Entrepreneurs! Want to earn

$75 by going outside? — Learn more

Free Agriculture Sample Business Plan PDF + How to Write

Elon Glucklich

6 min. read

Updated February 7, 2024

Free Download: Agriculture Business Plan Template

As a farmer, you’re in the business of putting food on the table. Agriculture is one of the world’s oldest professions.

Today it accounts for over 5% of U.S. Gross Domestic Product, and 1 in 10 American workers are in agriculture, food, and related industries.

But starting a new agriculture business requires intensive planning and upfront preparation. If you’re looking for a free, downloadable agriculture sample business plan PDF to help you create a business plan of your own, look no further.

Keep in mind that you don’t need to find a sample business plan that exactly matches your farm. Whether you’re launching a larger agricultural business outside a bustling city or a smaller organic operation, the details will be different, but the foundation of the plan will be the same.

Are you writing a business plan for your farm because you’re seeking a loan? Is your primary concern outlining a clear path for sales growth? Either way, you’re going to want to edit and customize it so it fits your particular farm.

No two agriculture farming businesses are alike.

For example, your strategy will be very different if you’re a dairy operation instead of a soybean farm. So take the time to create your own financial forecasts and do enough market research for your specific type of agriculture so you have a solid plan for success.

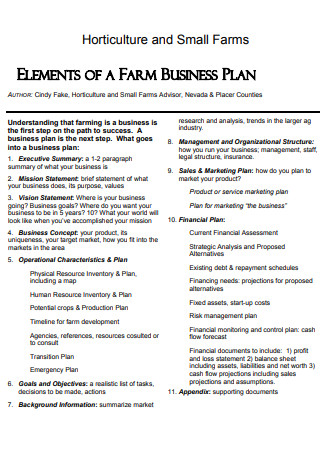

- What should you include in an agriculture farm business plan?

Your agriculture business plan doesn’t need to be hundreds of pages—keep it as short and focused as you can. You’ll probably want to include each of these sections:

1. Executive summary

An overview of your agriculture business, with a brief description of your products or services, your legal structure, and a snapshot of your future plans. While it’s the first part of the plan, it’s often easier to write your executive summary last.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

2. Business summary and funding needs

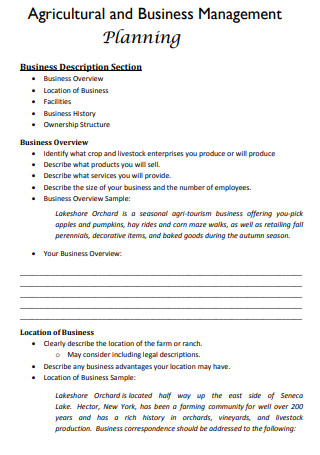

Details about your farming operation, including how much capital you will need and the types of funding you’re considering. Include your business history, your current state, and your future projections. It should also cover your business location, the equipment and facilities needed, and the kinds of crops or livestock you plan to raise.

3. Products and services

Provide details on the types of crops, farming methods, and any value-added products you plan to offer, such as finished goods or even agritourism offerings .

4. Marketing plan

Compile your market research findings, including the demand for your products or services, your target customers , and your competitors. It should also outline your marketing strategy—how you plan to attract and retain customers.

5. Financial plan

Your revenue projections, cost estimates, and break-even analysis. Your financial plan and forecasts should demonstrate that your business has a path to profitability.

- Building on your farm business plan sample

With a free agriculture business plan template as your starting point, you can start chipping away at the unique elements of your business plan.

As the business owner, only you can speak to aspects of your agriculture operation like your mission and core values.

You’re putting in the long hours to start a thriving farm business, so aspects of your mission – like a commitment to sustainable farming practices – will be best explained in your own words. Authenticity will help you connect with a growing market of consumers who value transparency and environmental stewardship in their food sources.

As for more conventional aspects of business planning , you will want to take on things like your marketing and financial plans one at a time. Here are a few specific areas to focus on when writing your business plan.

Invest time in market research

Starting an agriculture operation requires significant startup costs. When you throw in the unique land use considerations involved, it’s crucial to conduct thorough market research before investing hundreds of thousands – or even millions – of dollars into a farm business.

Start by researching the types of farms operating in your locality and wider region, and the specific crops or livestock they specialize in. You will need to understand seasonal trends, including crop yields and livestock productivity.

Note the demographics of the local community to understand their buying habits and preference for local produce. Also, be aware of the competitive landscape and how your farm can differentiate itself from others. All of this information will inform your service, pricing, marketing, and partnership strategy.

From there, you can outline how you plan to reach your target market and promote your farm’s offerings.

Craft your agriculture go-to-market strategy

One of the things that makes an agriculture farm business plan different from some service-based business plans is that you might decide to work only with one or two businesses that purchase your goods.

You may offer different tiers of products to different types of buyers, such as produce for an organic farmers market, and corn for another farm’s animal feed. If that’s the case, make sure you include ideas like setting aside land for organic growth and maintenance.

Discuss your advertising and promotional strategies, emphasizing channels relevant to your target market. Also, consider how partnerships with local businesses, farmers’ markets, and other industry stakeholders can enhance your visibility.

Include your pricing strategy and any special promotions or loyalty programs. Also, consider public relations and media outreach efforts that can raise awareness about your farm and its sustainable practices.

Prepare for unique farming challenges

Running an agricultural business comes with its own set of challenges, including weather-related disruptions and market volatility. Your business plan should identify these potential risks and present contingency plans to address them.

Include a plan to mitigate weather-related risks, such as crop diversification, employing weather-resistant farming practices, investing in appropriate infrastructure like greenhouses or drainage systems, or taking out insurance to cover weather-related losses.

Detail the operational aspects of your business , including land ownership, employee status, farm maintenance, and safety requirements. Also, illustrate your strategies for managing crop production, livestock care, land stewardship, and regulatory compliance.

Plan for the future

Contingency planning is important in all businesses.

But the unique challenges in agriculture of changing market dynamics, regulatory changes, and climate impacts make it especially necessary to plan for the future. Detail how you’ll measure success, and how you will be prepared to adapt your offerings if you need to change the focus of the business due to factors outside your control.

Also, be ready to discuss opportunities for scaling your business over time, such as introducing new crops, expanding farm operations, or opening additional locations.

- Get started with your farm business plan sample

There are obviously plenty of reasons farm owners can benefit from writing a business plan — for example, you’ll need one if you’re seeking a loan or investment. Even if you’re not seeking funding, the process of thinking through every aspect of your business will help you make sure you’re not overlooking anything critical as you grow.

Download this agriculture farm sample business plan PDF for free right now, or visit Bplans’ gallery of more than 550 sample business plans if you’re looking for more options.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Elon is a marketing specialist at Palo Alto Software, working with consultants, accountants, business instructors and others who use LivePlan at scale. He has a bachelor's degree in journalism and an MBA from the University of Oregon.

.png?format=auto)

Table of Contents

Related Articles

6 Min. Read

How to Write a Yoga Studio Business Plan + Free Sample Plan PDF

How to Write an Ice Cream Shop Business Plan + Free Sample Plan PDF

13 Min. Read

How to Write an Online Fitness Business Plan

How to Write a Real Estate Business Plan + Example Templates

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Farm Business Plan Template

Written by Dave Lavinsky

Over the past 20+ years, we have helped over 3,500 farmers create business plans to start and grow their farm businesses. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through a farm business plan template step-by-step so you can create your plan today.

Download our Ultimate Farm Business Plan Template here >

What is a Farm Business Plan?

A business plan provides a snapshot of your farm business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategy for reaching them. It also includes market research to support your plans.

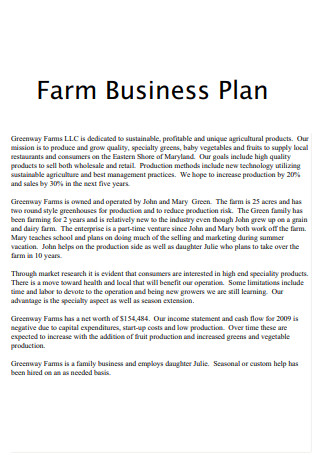

Why You Need a Business Plan for a Farm

If you’re looking to start a farm business or grow your existing farm business you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your farm business in order to improve your chances of success. Your farm business plan is a living document that should be updated annually as your company grows and changes. It can be used to create a vegetable farm business plan, or a dairy farm, produce farm, fruit farm, agriculture farm and more.

Source of Funding for Farm Businesses

With regards to funding, the main sources of funding for a farm business are personal savings, bank loans and angel investors. With regards to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to confirm that your financials are reasonable. But they will want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business.

The second most common form of funding for a farm business is angel investors. Angel investors are wealthy individuals who will write you a check. They will either take equity in return for their funding, or, like a bank, they will give you a loan.

Finish Your Business Plan Today!

Your business plan should include 10 sections as follows:

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of farm business you are operating and the status; for example, are you a startup, do you have a farm business that you would like to grow, or are you operating a chain of farm businesses.

Next, provide an overview of each of the subsequent sections of your plan. For example, give a brief overview of the farm business industry. Discuss the type of farm business you are operating. Detail your direct competitors. Give an overview of your target customers. Provide a snapshot of your marketing plan. Identify the key members of your team. And offer an overview of your financial plan.

Company Analysis

In your company analysis, you will detail the type of farm business you are operating.

For example, you might operate one of the following types among others:

- Vegetable Farm : this type of farm grows a wide variety of vegetables (but not grains or soybeans) and melons in open fields and in greenhouses.

- Dairy Farm : this type of farm primarily raises cattle for milk. Typically, this type of farm does not process the milk into cheeses or butter, etc.

- Fruit Farm : this type of farm primarily grows fruits.

- Hay and Crop Farm : More than half of these types of farms grow hay, while a small number grow sugar beets. A variety of other crops, such as hops and herbs, are included in the industry. Some operators also gather agave, spices, tea and maple sap.

- Industrial Hemp Farm : this type of farm grows and harvests cannabis plants with a tetrahydrocannabinol (THC) content of less than 0.3% by weight.

- Plant & Flower Farm : this type of farm grows nursery plants, such as trees and shrubs; flowering plants, such as foliage plants, cut flowers, flower seeds and ornamentals; and short rotation woody trees, such as Christmas trees and cottonwoods.

- Vertical Farming : This type of farm involves growing crops in vertically stacked layers, often using controlled environment agriculture (CEA) technologies. This method dramatically reduces the amount of land space needed for farming and can increase crop yields.

In addition to explaining the type of farm business you operate, the Company Analysis section of your business plan needs to provide background on the business.

Include answers to question such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include sales goals you’ve reached, acquisition of additional acreage, etc.

- Your legal structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry analysis, you need to provide an overview of the farm business.

While this may seem unnecessary, it serves multiple purposes.

First, researching the farm business industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your strategy particularly if your research identifies market trends. For example, if there was a trend towards decaffeinated farm business consumption, it would be helpful to ensure your plan calls for plenty of decaffeinated options.

The third reason for market research is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your farm business plan:

- How big is the farm business (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential market for your farm business. You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your farm business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: food manufacturers, grocery wholesalers, retail grocers, restaurants, individual consumers, etc.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of farm business you operate. Clearly food manufacturers would want different pricing and product options, and would respond to different marketing promotions than retail grocers.

Psychographic profiles explain the wants and needs of your target customers. The more you can understand and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Farm Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Farm Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other farm businesses.

Indirect competitors are other options that customers have to purchase from that aren’t direct competitors. This includes processed foods, imported goods, and growing produce themselves. You need to mention such competition to show you understand the true nature of the market.

With regards to direct competition, you want to detail the other farm businesses with which you compete. Most likely, your direct competitors will be farm businesses located very close to your location.

For each such competitor, provide an overview of their businesses and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as:

- What types of customers do they serve?

- What products do they offer?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide superior products?

- Will you provide products that your competitors don’t offer?

- Will you make it easier or faster for customers to acquire your products?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a farm business plan, your marketing plan should include the following:

Product : in the product section you should reiterate the type of farm business that you documented in your Company Analysis. Then, detail the specific products you will be offering. For example, in addition to wholesale crops, will you also offer subscriptions to individuals?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your marketing plan, you are presenting the products you offer and their prices.

Place : Place refers to the location of your farm. Document your location and mention how the location will impact your success. For example, is your farm centrally located near gourmet restaurants and specialty grocers, etc. Discuss how your location might provide a steady stream of customers. Also, if you operate or plan to operate farm stands, detail the locations where the stands will be placed.

Promotions : the final part of your farm business marketing plan is the promotions section. Here you will document how you will drive customers to your location(s). The following are some promotional methods you might consider:

- Making your farm stand extra appealing to attract passing customers

- Distributing produce samples from the farm stand or at farmers markets

- Advertising in local papers and magazines

- Reaching out to local bloggers and websites

- Local radio advertising

- Banner ads at local venues

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your farm business such as serving customers, delivering produce, harvesting, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to serve your 1,000th customer, or when you hope to reach $X in sales. It could also be when you expect to hire your Xth employee or acquire more arable land.

Management Team

To demonstrate your farm business’s ability to succeed as a business, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally you and/or your team members have direct experience in farming. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act like mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in farming and/or successfully running small businesses.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet and cash flow statements.

Income Statement : an income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenues and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you serve 100 customers per week or 200? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets : While balance sheets include much information, to simplify them to the key items you need to know about, balance sheets show your assets and liabilities. For instance, if you spend $100,000 on building out your farm, that will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a bank writes you a check for $100.000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement : Your cash flow statement will help determine how much money you need to start or grow your business, and make sure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt. For example, let’s say a company approached you with a massive $100,000 supplier contract, that would cost you $50,000 to fulfill. Well, in most cases, you would have to pay that $50,000 now for seed, equipment, employee salaries, etc. But let’s say the company didn’t pay you for 180 days. During that 180 day period, you could run out of money.

In developing your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a farm business:

- Location build-out including barn construction, land preparation, etc.

- Cost of equipment like tractors and attachments, silos, barns, etc.

- Cost of nutrients and maintaining machinery

- Payroll or salaries paid to staff

- Business insurance

- Taxes and permits

- Legal expenses

Your new farm’s business plan must include a detailed financial plan based on reasonable assumptions of your costs and revenues. To determine if the results you show in this plan will be attractive to investors, look at industry standard financial metrics to see how you measure up against the farming industry, or your sector of the industry, on average. These are some basic measures and ratios to study.

Value of Production

The value of production is equal to your farm’s cash receipts plus the changes in value of product inventory and accounts receivable, less your livestock purchases. This is a measure of the value of the commodities you have produced in the period.

Net Farm Income

The NFI or net farm income, represents the value of production less direct and capital costs in the time period. This is a dollar figure, and not a ratio relating the income to the investment made, so it cannot be used to compare the farm against other farms.

Gross Margin

This represents the NFI less depreciation. The gross margin shows how much money is available in the year to cover the unallocated fixed costs, and dividends to owners and unpaid operators.

Return on Farm Assets

This is a ratio that can be used to compare the farm with others. This is calculated as NFI plus interest expense less unpaid operator labor, all divided by the total assets of the farm.

Asset Turnover Ratio

This ratio is equal to the value or production over the total farm assets. Combined with the operating profit margin ratio, this shows the efficiency of the farm in generating revenues.

Operating Profit Margin Ratio

This ratio is similar to Return on Farm Assets, but divides the same numerator (NFI plus interest expense less unpaid operator labor) by the value of production figure. This shows the percentage of each revenue dollar that becomes profit. If it is low, a higher turnover can compensate, and if it is high, a lower turnover ratio is required.

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your store design blueprint or location lease.

Farm Business Plan Summary

Putting together a business plan for your farm business is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. It can be used for a small farm business plan template or any other type of farm. You will really understand the farm business, your competition and your customers. You will have developed a marketing plan and will really understand what it takes to launch and grow a successful farm business.

Download Our Farm Business Plan PDF

You can download our farm business plan PDF here . This is a small farm business plan example pdf you can use in PDF format.

Farm Business Plan FAQs

What is the easiest way to complete my farm business plan.

Growthink's Ultimate Farm Business Plan Template allows you to quickly and easily complete your Farm Business Plan.

Where Can I Download a Free Farm Business Plan Example PDF?

You can download our farm business plan PDF template here . This is an example business plan template you can use in PDF format.

Don’t you wish there was a faster, easier way to finish your Farm business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success.

Click here to see how Growthink’s professional business plan consulting services can create your business plan for you.

Other Helpful Business Plan Articles & Templates

Agricultural Business Plan Template

Written by Dave Lavinsky

Agricultural Business Plan

You’ve come to the right place to create your Agricultural business plan.

We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Agricultural companies.

Below is a template to help you create each section of your Agricultural business plan.

Executive Summary

Business overview.

Schrute’s Roots is a startup agricultural business that produces crops for Scranton, Pennsylvania and the surrounding area. Schrute’s Roots will specifically grow root vegetables, including potatoes, onions, and beets. The company’s mission statement is to work hard to grow these vegetables organically and without any chemicals. We will sell our produce at local farmer’s markets as well as to local restaurants and other establishments that would like to use or sell our produce.

Schrute’s Roots is owned and led by Dwight Schrute. Dwight has been a farm operations manager for the past twenty years, bringing a plethora of knowledge and skills that will prove to be invaluable to all aspects of the business. After working as a farm operations manager, Dwight desired to run his own agricultural farm business that grows organic produce and benefits the local community. He will utilize his prior knowledge and experience to manage crop production, operations, and other aspects of the business.

Product Offering

Schrute’s Roots grows a variety of root vegetables for Scranton, Pennsylvania and the local community. All produce will be organically grown. We alternate our crops, so the exact crops that are grown will be dependent on the season and current crop cycle. Some crops that we plan to grow include the following:

Customer Focus

Schrute’s Roots will primarily serve the residents and businesses of Scranton, Pennsylvania and the surrounding areas. Any individual or establishment that is interested in purchasing our crops is welcome to partner with us. We will sell our crops to individuals at local farmer’s markets and directly to wholesalers, grocery stores, and restaurants.

Management Team

Schrute’s Roots’ most valuable asset is the expertise and experience of its founder, Dwight Schrute. Dwight has been a farm operations manager for the past twenty years, bringing a plethora of knowledge and skills that will prove to be invaluable to all aspects of the business. After working as a farm operations manager, Dwight desired to run his own agricultural business that grows organic produce and benefits the local community. He will utilize his prior knowledge and experience to manage crop production, operations, and other aspects of the business.

Success Factors

Schrute’s Roots will be able to achieve success by offering the following competitive advantages:

- Management: Schrute’s Roots’ management team has years of experience in agricultural operations, which will prove invaluable to all aspects of the business.

- Relationships: Having lived in the community for twenty years, Dwight Schrute knows all of the local leaders, media, and other influencers. As such, it will be relatively easy for Schrute’s Roots to build brand awareness and an initial customer base.

- Quality products at affordable pricing: Schrute’s Roots will provide quality products at affordable pricing, as it has high-quality equipment and uses the latest techniques.

Financial Highlights

Schrute’s Roots is currently seeking $750,000 to start the company. The funding will be dedicated towards securing the land and purchasing equipment and supplies. Funding will also be dedicated towards three months of overhead costs and marketing costs. Specifically, these funds will be used as follows:

- Land: $200,000

- Equipment: $200,000

- Three Months of Overhead Expenses (payroll, utilities): $150,000

- Marketing Costs: $100,000

- Working Capital: $100,000

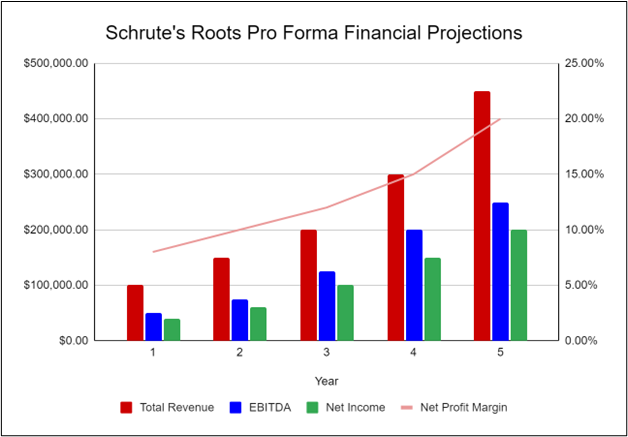

The following graph below outlines the pro forma financial projections for Schrute’s Roots.

Company Overview

Who is schrute’s roots.

Schrute’s Roots is a startup agricultural business that produces crops for Scranton, Pennsylvania and the surrounding area. Schrute’s Roots will specifically grow root vegetables, including potatoes, onions, and beets. The company’s mission is to grow vegetables organically and without any chemicals. We will sell our produce at local farmer’s markets as well as to local restaurants and other establishments that would like to use or sell our produce.

Schrute’s Roots is owned and led by Dwight Schrute. Dwight has been a farm operations manager for the past twenty years, bringing a plethora of knowledge and skills that will prove to be invaluable to all aspects of the business. After working as a farm operations manager, Dwight desired to run his own agricultural business that grows organic produce and benefits the local community. He will utilize his prior knowledge and experience to manage crop production, operations, and other aspects of the business.

Schrute’s Roots’ History

Dwight Schrute incorporated Schrute’s Roots as an S-corporation on May 1st, 2023. The operations aspects of the business will be run from Dwight’s home, while the agricultural aspects will be run from the land purchased for crop production.

Since incorporation, the company has achieved the following milestones:

- Found land to grow the crops and wrote a letter of intent to purchase it

- Developed the company’s name, logo, and website

- Determined agricultural equipment and inventory requirements

- Began recruiting key employees

Schrute’s Roots’ Services

Industry analysis.

The agricultural industry is vital to all communities. The crops and products grown by local farmers and crop production companies are essential to the health of local communities. They provide jobs to the locals and result in locally grown food that the nearby residents can purchase. Larger agriculture businesses do not offer these benefits to smaller communities. Because of this, there has been a greater demand and emphasis on the sustainability of local agricultural companies that can directly benefit the local community.

Furthermore, market research shows that local communities are demanding that crop production and other agricultural companies grow their products organically. Organic foods are much healthier for individuals to eat because they provide more nutrition and aren’t laced with chemicals. Improved technology and research into organic methods are making this form of crop production more profitable and sustainable.

Therefore, with the increasing demand for local organic farms, we are confident that Schrute’s Roots will succeed in the local market and benefit the residents of the Scranton area.

Customer Analysis

Demographic profile of target market.

Schrute’s Roots will serve the industries and community residents of Scranton, Pennsylvania and its surrounding areas. We will sell our produce at farmer’s markets to individuals and directly to establishments that wish to partner with us.

The demographics of Scranton, Pennsylvania are as follows:

Customer Segmentation

Schrute’s target audience segments include:

- Individuals

- Restaurants

- Grocery Stores

Competitive Analysis

Direct and indirect competitors.

Schrute’s Roots will face competition from other agriculture businesses. A description of each competitor company is below.

AgraFarm is one of the largest raw food manufacturers in the U.S., owning a 15,000-acre farm for agriculture. It has well-established connections with big FMCG companies and has been thriving in the agricultural industry for 12 years. It also has automated equipment and machines, which helps in improving its operations and reducing costs. AgraFarm is also known for delivering large orders at the right time without delay.

BDA Farms was established in 1998. BDA Farms is a very well-known company that provides good quality organic produce to companies. It also has a very good brand value, and its product packaging is second to none. BDA Farms is located in Scranton, Pennsylvania, and it has a very effective distribution and supply chain network.

BeetFarms was initially a beets producer company and then branched out to other vegetables. BeetFarms is now one of the ten largest vegetable producers in the state. The Company’s packaging and processing units are located in Scranton, Pennsylvania. It has recently acquired other local vegetable producers, expanding its operations as well as limiting the variety of farms producing vegetables for the community.

Competitive Advantage

Schrute’s Roots will be able to offer the following advantages over their competition:

Marketing Plan

Brand & value proposition.

Schrute’s Roots will offer the unique value proposition to its clientele:

- Production of high-quality organic produce

- Affordable pricing

- Providing excellent customer service and customer experiences

Promotions Strategy

The promotions strategy for Schrute’s Roots is as follows:

Social Media Marketing

Social media is one of the most cost-effective and practical marketing methods for improving brand visibility. The company will use social media to develop engaging content in terms of various forms and technologies of commercial cultivation and post customer reviews that will increase audience awareness and loyalty.

Website/SEO

Schrute’s Roots will develop a professional website that showcases pictures of the farm and the products we will grow. It will also invest in SEO so that the company’s website will appear at the top of search engine results.

Industry Events

By attending regional farming conferences, association meetings, and symposia, Schrute’s Roots will network with agricultural industry leaders and seek referrals to potential customers.

Direct Mail

The company will use a direct mail campaign to promote its brand and draw customers, as well. The campaign will blanket specific neighborhoods with simple, effective mail advertisements that highlight the credentials and credibility of Schrute’s Roots as a high-quality crop production agriculture business.

Schrute’s Roots’ pricing will be competitive. Pricing will be about 50% lower than retail prices to allow wholesalers and retailers to earn their margins.

Operations Plan

Operation Functions: The following will be the operations plan for Schrute’s Roots.

- Dwight Schrute will be the Owner and President of the company. He will oversee all staff and manage client relations. He will help with the produce cultivation until he has hired a full staff of farmhands. Dwight has spent the past year recruiting the following staff:

- Meredith Grant – will oversee all administrative aspects of running the farm. This will include bookkeeping, tax payments, and payroll of the staff.

- Kevin Baird – Head Farmhand who will oversee the farming staff and day to day operations.

- Oscar Smith– Assistant Farmhand who will assist Kevin.

Milestones:

Schrute’s Roots will have the following milestones completed in the next six months.

- 07/202X Finalize land purchase

- 08/202X Design and build out Schrute’s Roots

- 09/202X Hire and train initial staff

- 10/202X Kickoff of promotional campaign

- 11/202X Launch Schrute’s Roots

- 12/202X Reach break-even

Financial Plan

Key revenue & costs.

Schrute’s Roots’ revenues will come from the sales of root vegetables to its customers and local food establishments.

The major cost drivers for Schrute’s Roots will be labor expenses, land purchase, equipment purchases and maintenance, and marketing plan expenses.

Funding Requirements and Use of Funds

- Three months of overhead expenses (payroll, utilities): $150,000

- Marketing costs: $100,000

- Working capital: $100,000

Key Assumptions

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and pay off the startup business loan.

- Number of customers per month:

- Annual equipment maintenance costs: $20,000

Financial Projections

Income statement, balance sheet, cash flow statement, agricultural business plan faqs, what is an agricultural business plan.

An agricultural business plan is a plan to start and/or grow your agricultural business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Agricultural business plan using our Agricultural Business Plan Template here .

What are the Main Types of Agricultural Businesses?

There are a number of different kinds of agricultural businesses , some examples include: Animal feed manufacturing, Agrichemical and seed manufacturing, Agricultural engineering, Biofuel manufacturing, and Crop production.

How Do You Get Funding for Your Agricultural Business Plan?

Agricultural businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start an Agricultural Business?

Starting an agricultural business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop An Agricultural Business Plan - The first step in starting a business is to create a detailed agricultural business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your agricultural business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your agricultural business is in compliance with local laws.

3. Register Your Agricultural Business - Once you have chosen a legal structure, the next step is to register your agricultural business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your agricultural business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Agricultural Equipment & Supplies - In order to start your agricultural business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your agricultural business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

How to Create an Agricultural Business Plan

Blog > how to create an agricultural business plan, table of content, introduction, executive summary, company description, market analysis, product/service description, marketing and sales strategies, operational plan, swot analysis, financial projections, funding and investment, risk management, sustainability and environmental impact, legal and regulatory compliance, timeline and milestones, our other categories.

- Company Valuation

- Pitch Deck Essentials

- Raising Capital

- Startup Guide

- Uncategorized

Reading Time : 16 Min

Business plan 101.

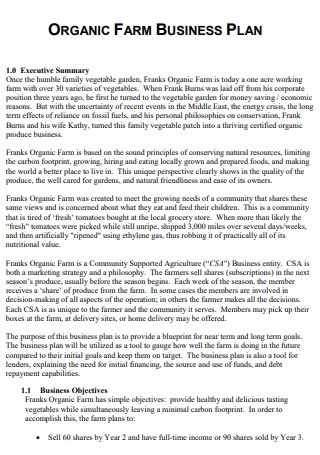

Starting an agricultural venture is an exciting and rewarding journey, but it requires careful planning and a well-crafted agricultural business plan. This document serves as a roadmap for your agricultural business, outlining your goals, strategies, and financial projections. In this comprehensive guide, we will walk you through each step of creating a robust agricultural business plan to set your venture up for success. Whether you’re planning to start a small family farm or a large-scale agricultural operation, this guide will help you make informed decisions and navigate the challenges of the agricultural industry.

The executive summary is the first section of your agricultural business plan, but it is typically written last. This section provides a concise overview of your entire plan and should capture the reader’s attention. Include the following elements in your executive summary:

- Example: ABC Farms is a sustainable agriculture venture committed to providing organic, locally sourced produce to health-conscious consumers in the region. Our mission is to promote eco-friendly farming practices and support local communities while delivering premium-quality products.

Stellar Business Tips: Keep your executive summary clear, compelling, and focused. Highlight the unique selling points of your agricultural business and how it addresses market demands.

In this section, provide a comprehensive description of your agricultural business. Include the following details:

- Example: ABC Farms was founded in 2010 by John and Jane Smith, who have a combined experience of over 20 years in sustainable agriculture. The business started as a small family farm and has since expanded to a 50-acre organic farm with a diverse range of crops, including vegetables, fruits, and herbs.

Stellar Business Tips: Share your business’s background, founders’ expertise, and growth trajectory. Emphasize your passion for agriculture and commitment to environmental and social responsibility.

Conduct a thorough market analysis to gain insights into the agricultural industry, market trends, and potential opportunities. Consider the following factors:

- Example: The organic produce market has been steadily growing at a rate of 10% per year, driven by increasing consumer awareness of health benefits and environmental concerns. Local restaurants and grocery stores are eager to source fresh, organic produce from nearby farms.

Stellar Business Tips: Use data and statistics to support your market analysis. Identify target customers and potential gaps in the market that your agricultural business can address.

Detail the agricultural products or services your business offers. If you are into crop farming, describe the crops you plan to grow, their varieties, and their uses. If you are into livestock rearing, specify the types of animals and breeds you’ll raise. If you offer agricultural services, describe them in detail.

- Example: ABC Farms specializes in heirloom vegetables, such as tomatoes, peppers, and cucumbers, renowned for their exceptional flavor and nutritional value. We also raise heritage-breed livestock, including free-range chickens and pasture-raised pigs, to provide ethically sourced meat products.

Stellar Business Tips: Highlight the uniqueness and quality of your agricultural products or services. Emphasize your commitment to sustainability and responsible animal husbandry if applicable.

Outline your marketing and sales strategies to reach and attract your target customers. Consider the following aspects:

- Example: ABC Farms utilizes social media platforms to showcase our farm-to-table journey and engage with customers. We actively participate in farmers’ markets and local food events to promote our brand and build personal connections with consumers.

Stellar Business Tips: Utilize digital marketing tools, such as social media and email marketing, to create brand awareness and engage with customers directly. Explore partnerships with local businesses to expand your reach.

The operational plan outlines how your agricultural business will function on a day-to-day basis. It includes the following details:

- Example: ABC Farms employs a team of experienced farmers who follow sustainable farming practices, including crop rotation and integrated pest management, to ensure soil health and minimize environmental impact. We have invested in modern irrigation systems and machinery to optimize productivity and reduce labor costs.

Stellar Business Tips: Detail the specific practices and technologies you’ll use to enhance efficiency and sustainability. Showcase your commitment to ethical and responsible farm management.

Conduct a SWOT analysis to evaluate your agricultural business’s internal strengths and weaknesses, as well as external opportunities and threats. Use this analysis to make informed decisions and develop effective strategies.

- Example: Strengths: ABC Farms has established a strong reputation for premium-quality produce, garnering repeat customers and positive reviews. Weaknesses: We currently face limited storage facilities for harvested crops, which may affect our ability to meet peak demands.

Stellar Business Tips: Be honest about your agricultural business’s strengths and weaknesses. Address how you plan to capitalize on opportunities and mitigate potential risks.

The financial projections section provides a detailed forecast of your agricultural business’s financial performance over the next 3-5 years. Include the following financial statements:

- Example: Sales Forecast: We anticipate steady growth in sales, with a projected increase of 15% annually due to expanding customer base and diversified product offerings.

Stellar Business Tips: Use realistic and data-driven estimates for your financial projections. Include contingency plans for unforeseen financial challenges.

If your agricultural business requires funding or investment, outline your funding requirements and sources of financing. This section should include:

- Example: Funding Requirements: ABC Farms seeks a capital investment of $200,000 to expand farmland, install greenhouses, and upgrade equipment to meet the growing demand for our organic products.

Stellar Business Tips: Clearly explain how the investment will be used to drive the growth and success of your agricultural business.

Identify potential risks and challenges that your agricultural business may face and develop risk management strategies to mitigate their impact. Consider the following risk categories:

- Example: Market Risks: Fluctuations in commodity prices and changes in consumer preferences may impact our sales revenue. To address this, we will diversify our product offerings and explore new markets.

Stellar Business Tips: Demonstrate your proactive approach to risk management. Provide solutions for handling potential challenges to reassure stakeholders.

As the importance of sustainable farming practices grows, customers and investors increasingly value agricultural businesses that prioritize environmental stewardship and social responsibility. In this section, highlight your commitment to sustainability:

- Example: ABC Farms is committed to regenerative agriculture practices, including cover cropping and no-till farming, to enhance soil health and sequester carbon. We actively participate in local conservation programs to protect natural habitats and biodiversity.

Stellar Business Tips: Showcase your efforts to contribute positively to the environment and local community. Share success stories of how your sustainable practices have made a difference.

The agricultural industry is subject to various laws and regulations, such as agricultural zoning laws, environmental regulations, labor laws, and food safety standards. In this section, address the legal and regulatory aspects of your agricultural business:

- Example: ABC Farms complies with all local, state, and federal regulations for organic certification and food safety. We conduct regular inspections and maintain accurate records to ensure full compliance.

Stellar Business Tips: Emphasize your commitment to adhering to legal requirements and ensuring transparency in your agricultural operations.

Develop a timeline for your agricultural business’s key milestones and achievements. This section should include:

- Example: Milestone Timeline: Year 1 – Acquire additional farmland; Year 2 – Expand greenhouse production; Year 3 – Launch an online farm-to-table store.

Stellar Business Tips: Set realistic timelines for achieving your milestones. This will help you track progress and stay on course.

In conclusion, creating a well-structured and comprehensive agricultural business plan is crucial for your venture’s success. It provides a roadmap to guide your agricultural business towards its goals, while also attracting investors and other stakeholders. Remember that the agricultural industry is dynamic and continually evolving, so your business plan should be flexible enough to adapt to changing market conditions and opportunities.

By following the steps outlined in this guide and incorporating sustainable practices, your agricultural business can thrive in an increasingly competitive landscape. At Stellar Business Plans , we are dedicated to supporting the success of agricultural entrepreneurs like you. Our team of experts can assist you in crafting a tailored business plan that aligns with your vision and values. Let’s cultivate growth together and create a sustainable future for agriculture!

Remember, agricultural business success is not only about financial gains but also about nurturing the land, supporting local communities, and providing consumers with nutritious and ethically sourced products. Let your passion for agriculture and dedication to sustainability shine through every aspect of your business. Together, we can sow the seeds of a thriving agricultural future.

Start Your Journey With Us

To know us more.

Updated On : September 2, 2023

Total shares:, average rating :, related posts.

How to Write a Business Plan for a Loan

How to create an airline business plan, how to create an effective amazon fba business plan, how to create an advertising agency business plan, how to create an accounting business plan, how to create 3d printing business plan, how to create mcdonalds restaurant business plan, how to create a bbq restaurant business plan, how to create airbnb business plan, how to create a gym business plan: complete guide.

How to Write a Strong Executive Summary?

13 Reasons why you need a Solid Business Plan

How useful was this post?

Click on a star to rate it!

Average rating 4.2 / 5. Vote count: 33

No votes so far! Be the first to rate this post.

WhatsApp us

An official website of the United States government Here’s how you know

- Translations |

- Service Centers |

- Local Dashboard

Farmers.gov is not optimized for this browser. Please use the latest versions of Chrome, Edge, or Safari for the best experience. Dismiss

Find your state/county's agriculture data and USDA resources on your farmers.gov Local Dashboard !

How to Start a Farm: Plan Your Operation

Think about your operation from the ground up and start planning for your business. A good farm business plan is your roadmap to start-up, profitability, and growth, and provides the foundation for your conversation with USDA about how our programs can complement your operation.

Keep reading about planning your business below, get an overview of the beginning farmer's journey , or jump to a different section of the farmer's journey.

On This Page

Why you need a farm business plan.

A comprehensive business plan is an important first step for any size business, no matter how simple or complex. You should create a strong business plan because it:

- Will help you get organized . It will help you to remember all of the details and make sure you are taking all of the necessary steps.

- Will act as your guide . It will help you to think carefully about why you want to farm or ranch and what you want to achieve in the future. Over time, you can look back at your business plan and determine whether you are achieving your goals.

- Is required to get a loan . In order to get an FSA loan, a guarantee on a loan made by a commercial lender, or a land contract, you need to create a detailed business plan . Lenders look closely at business plans to determine if you can afford to repay the loan.

How USDA Can Help

Whether you need a good get-started guide, have a plan that you would like to verify, or have a plan you’re looking to update for your next growth phase, USDA can help connect you to resources to help your decisions.

Your state's beginning farmer and rancher coordinator can connect you to local resources in your community to help you establish a successful business plan. Reach out to your state's coordinator for one-on-one technical assistance and guidance. They can also connect you with organizations that specifically serve beginning farmers and ranchers.

It is important to know that no single solution fits everyone, and you should research, seek guidance, and make the best decision for your operation according to your own individual priorities.

Build a Farm Business Plan

There are many different styles of business plans. Some are written documents; others may be a set of worksheets that you complete. No matter what format you choose, several key aspects of your operation are important to consider.

Use the guidelines below to draft your business plan. Answering these kinds of questions in detail will help you create and develop your final business plan. Once you have a business plan for your operation, prepare for your visit to a USDA service center. During your visit, we can help you with the necessary steps to register your business and get access to key USDA programs.

Business History

Are you starting a new farm or ranch, or are you already in business? If you are already in business:

- What products do you produce?

- What is the size of your operation?

- What agricultural production and financial management training or experience do you, your family members, or your business partners have?

- How long have you been in business?

Mission, Vision, and Goals

This is your business. Defining your mission, vision and goals is crucial to the success of your business. These questions will help provide a basis for developing other aspects of your business plan.

- What values are important to you and the operation as a whole?

- What short- and long-term goals do you have for your operation?

- How do you plan to start, expand, or change your operation?

- What plans do you have to make your operation efficient or more profitable ?

- What type of farm or ranch model (conventional, sustainable, organic, or alternative agricultural practices) do you plan to use?

Organization and Management

Starting your own business is no small feat. You will need to determine how your business will be structured and organized, and who will manage (or help manage) your business. You will need to be able to convey this to others who are involved as well.

- What is the legal structure of your business? Will it be a sole proprietorship, partnership, corporation, trust, limited liability company, or other type of entity?

- What help will you need in operating and managing your farm or ranch?

- What other resources, such as a mentor or community-based organization , do you plan to use?

Marketing is a valuable tool for businesses. It can help your businesses increase brand awareness, engagement and sales. It is important to narrow down your target audience and think about what you are providing that others cannot.

- What are you going to produce ?

- Who is your target consumer ?

- Is there demand for what you are planning to produce?

- What is the cost of production?

- How much will you sell it for and when do you expect to see profit ?

- How will you get your product to consumers ? What are the transportation costs and requirements?

- How will you market your products?

- Do you know the relevant federal, state, and local food safety regulations? What licensing do you need for your operation?

Today there are many types of land, tools, and resources to choose from. You will need to think about what you currently have and what you will need to obtain to achieve your goals.

- What resources do you have or will you need for your business?

- Do you already have access to farmland ? If not, do you plan to lease, rent, or purchase land?

- What equipment do you need?

- Is the equipment and real estate that you own or rent adequate to conduct your operation? If not, how do you plan to address those needs?

- Will you be implementing any conservation practices to sustain your operation?

- What types of workers will you need to operate the farm?

- What additional resources do you need?

Now that you have an idea of what you are going to provide and what you will need to run your operation you will need to consider the finances of your operation.

- How will you finance the business?

- What are your current assets (property or investments you own) and liabilities (debts, loans, or payments you owe)?

- Will the income you generate be sufficient to pay your operating expenses, living expenses, and loan payments?

- What other sources of income are available to supplement your business income?

- What business expenses will you incur?

- What family living expenses do you pay?

- What are some potential risks or challenges you foresee for your operation? How will you manage those risks?

- How will you measure the success of your business?

Farm Business Plan Worksheets

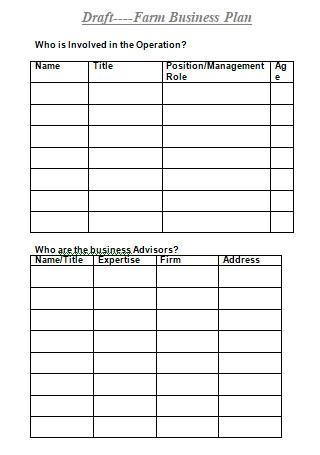

The Farm Business Plan Balance Sheet can help gather information for the financial and operational aspects of your plan.

Form FSA-2037 is a template that gathers information on your assets and liabilities like farm equipment, vehicles and existing loans.

- FSA-2037 - Farm Business Plan - Balance Sheet

- FSA-2037 Instructions

Planning for Conservation and Risk Management

Another key tool is a conservation plan, which determines how you want to improve the health of your land. A conservation plan can help you lay out your plan to address resource needs, costs and schedules.

USDA’s Natural Resources Conservation Service (NRCS) staff are available at your local USDA Service Center to help you develop a conservation plan for your land based on your goals. NRCS staff can also help you explore conservation programs and initiatives, such as the Environmental Quality Incentives Program (EQIP) .

Conservation in Agriculture

Crop insurance, whole farm revenue protection and other resources can help you prepare for unforeseen challenges like natural disasters.

Disaster Recovery

Special Considerations

Special considerations for businesses.

There are different types of farm businesses each with their own unique considerations. Determine what applies to your operation.

- Organic Farming has unique considerations. Learn about organic agriculture , organic certification , and the Organic Certification Cost Share Program to see if an organic business is an option for you. NRCS also has resources for organic producers and offers assistance to develop a conservation plan.

- Urban Farming has special opportunities and restrictions. Learn how USDA can help farmers in urban spaces .

- Value-Added Products . The Agricultural Marketing Resource Center (AgMRC) is a national virtual resource center for value-added agricultural groups.

- Cooperative. If you are interested in starting a cooperative, USDA’s Rural Development Agency (RD) has helpful resources to help you begin . State-based Cooperative Development Centers , partially funded by RD, provide technical assistance and education on starting a cooperative.

Special Considerations for Individuals

Historically Underserved Farmers and Ranchers: We offer help for the unique concerns of producers who meet the USDA definition of "historically underserved," which includes farmers who are:

- socially disadvantaged

- limited resource

- military veterans

Women: Learn about specific incentives, priorities, and set asides for women in agriculture within USDA programs.

Heirs' Property Landowners: If you inherited land without a clear title or documented legal ownership, learn how USDA can help Heirs’ Property Landowners gain access to a variety of programs and services

Business Planning

Creating a good business plan takes time and effort. The following are some key resources for planning your business.

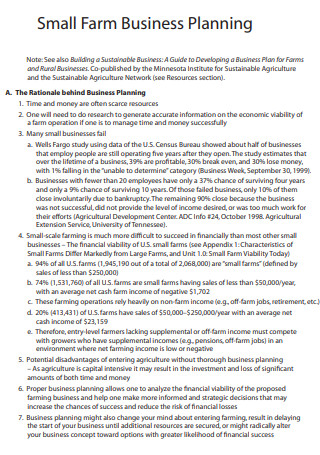

- Farm Answers from the University of Minnesota features a library of how-to resources and guidance, a directory of beginning farmer training programs, and other sources of information in agriculture. The library includes business planning guides such as a Guide to Developing a Business Plan for Farms and Rural Businesses and an Example Business Plan .

- The Small Business Administration (SBA) offers information about starting, managing, and transitioning a business.

SCORE is a nonprofit organization with a network of volunteers who have experience in running and managing businesses. The Score Mentorship Program partners with USDA to provide:

- Free, local support and resources, including business planning help, financial guidance, growth strategies.

- Mentorship through one-on-one business coaching -- in-person, online, and by phone.

- Training from subject matter experts with agribusiness experience.

- Online resources and step-by-step outlines for business strategies.

- Learn more about the program through the Score FAQ .

Training Opportunities

Attend field days, workshops, courses, or formal education programs to build necessary skills to ensure you can successfully produce your selected farm products and/or services. Many local and regional agricultural organizations, including USDA and Cooperative Extension, offer training to beginning farmers.

- Cooperative Extension offices address common issues faced by agricultural producers, and conduct workshops and educational events for the agricultural community.

- extension.org is an online community for the Cooperative Extension program where you can find publications and ask experts for advice.

Now that you have a basic plan for your farm operation, prepare for your visit to a USDA service center.

2. Visit Your USDA Service Center

How to Start a Farm with USDA

Get an overview of the beginning farmer's journey or jump to a specific page below.

Find Your Local Service Center

USDA Service Centers are locations where you can connect with Farm Service Agency, Natural Resources Conservation Service, or Rural Development employees for your business needs. Enter your state and county below to find your local service center and agency offices. If this locator does not work in your browser, please visit offices.usda.gov.

Learn more about our Urban Service Centers . Visit the Risk Management Agency website to find a regional or compliance office or to find an insurance agent near you.

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai Pitch Deck Generator

Strategic Planning

See How Upmetrics Works →

- Sample Plans

- WHY UPMETRICS?

Customer Success Stories

Business Plan Course

Small Business Tools

Strategic Planning Templates

E-books, Guides & More

Agriculture, Farm & Food Production Business Plans

- IT, Staffing & Customer Service

- Construction, Architecture & Engineering

- Food, Beverage & Restaurant

- Real Estate & Rentals

- Mobile Apps & Software

- Education & Training

- Beauty Salon & Fitness

- Medical & Health Care

- Retail, Consumers & E-commerce

- Entertainment & Media

- Transportation, Logistics & Travel

- Agriculture, Farm & Food Production

- Nonprofit & Community

- Manufacturing & Wholesale

- Clothing & Fashion

- Children & Pets

- Fine Art & Crafts

- Cleaning, Maintenance & Repair

- Hotel & Lodging

- Finance & Investing

- Consulting, Advertising & Marketing

- Accounting, Insurance & Compliance

Agritourism Business Plan

Beekeeping Business Plan

Farming Business Plan

Hydroponics Business Plan

Fishing Farming Business Plan

Food Distribution Business Plan

Dairy Farm Business Plan

Small Farming Business Plan

Cannabis Cultivation Business Plan

Organic Farm Business Plan

How to Write a Cannabis Business Plan + Free Template

Cattle Farm Business Plan

Poultry Farming Business Plan

Lawn Care Business Plan

Horse Boarding Business plan

Solar Farm Business Plan

Plant Nursery Business Plan

Microgreens Business Plan Template & Guide [Updated]

Did you find what you are looking for.

Agriculture or farming is the only industry consistently performing well, regardless of economic climate changes.

Whether you plan to start farming, cannabis cultivation, a cattle farm, or nursery business, you’ll do great as long as you do things right and have a solid business plan.

This library of farm business plan examples here can inspire and guide you as you begin to plan your business. So, don’t worry; we got you covered on that part.

Let’s learn more about these agriculture business plan samples, starting with their benefits.

Benefits of using an industry-specific business plan example

Believe it or not, using an industry-specific business plan example is the best and probably the quickest way of writing a business plan.

Doubt it? Hold, this may change your perception; an extended list of the benefits of using an industry-specific business plan template.

- Inspiration : Reading a business-specific template can be incredibly helpful in getting content inspiration. Furthermore, it helps you gain insights into how to present your business idea, products, vision, and mission.

- Risk-free method : You are taking a reference from a real-life, let’s say, plant nursery business plan—so you know this plan has worked in the past or uses a method subscribed by experts.

- Deep market understanding : Analyzing and reading such examples can provide clarity and develop a deeper market understanding of complex industry trends and issues you may not know but relate directly to the realities of your business landscape.

- Increased credibility : A business plan developed using an example follows a standard business plan format, wisely presents your business, and provides invaluable insights into your business. There’s no question it establishes you as a credible business owner, demonstrating your deep business and market understanding.

- Realistic financial projections : Financial forecasting being a critical aspect of your plan, this real-life example can help you better understand how they project their financials—ultimately helping you set realistic projections for your business.

These were the benefits; let’s briefly discuss choosing an agriculture or food production plan example that best suits your business niche.

Choosing an Agriculture or Farming Business Plan

This category has business plan templates for various farming or agricultural businesses. With many similar business types and templates, you may not find the most suitable one through manual scrolling.

Here are the steps to consider while choosing the most suitable business plan template.

Identify your business type

Are you planning to start cannabis cultivation? Or thinking of doing organic farming? Thinking of taking care of horses through horse boarding?

Asking yourself these questions will help you identify your business type, which will help in choosing a niche-specific business plan template.

Once you identify your business type, you can choose between templates for different business segments.

Search for the template

We have an in-built search feature, so you can easily search for a business-specific template using your business type as a key term. Once you have the search results, choose the most suitable one. Simple as that.

Review the example

Look closely at the content of the sample business plan you are considering. Analyze its sections and components to identify relevant as well as unnecessary areas.

Since all the Upmetrics templates are tailored to specific business needs, there won’t be many fundamental customizations. However, a hybrid business model targeting multiple customer segments may require adjustments.

For instance, if you plan to start a cannabis cultivation business and also produce and sell CBD, you may need to adjust some of your business plan sections accordingly.

No big deal—you can view and copy sections from other business plan examples or write using AI while customizing a template.

That’s how you find and select the most suitable business plan for your farming business. Still haven’t found the perfect business plan example? Here’s the next step for you.

Explore 400+ business plan examples

Check out Upmetrics’ library of 400+ sample plans and get your free business plan template now. Upmetrics is a modern and intuitive business planning software that streamlines business planning with its free templates and AI-powered features. So what are you waiting for? Download your example and draft a perfect business plan.

From simple template to full finished business plan

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

Agriculture Business Plan: Step-by-Step Guide to Start Agri-Business

- May 24, 2023

- Business Loan , Finance

Agriculture has long been the foundation of economies all across the world, supplying communities with food, resources, and income. With the agricultural sector employing more than 80% of the world’s labour force, it is obvious that this sector is crucial to the prosperity of any nation’s economy.

For an entrepreneur, there are numerous opportunities in this sector. Whether you want to start a successful farm business, or you are looking for government assistance in the form of loans and subsidies. In this article, we’ll cover all the topics.

Let’s understand what are different factors to consider in Agriculture business plans.

The Importance of Agriculture in India

- Over 60% to 70% of the Indian population relies on agriculture and related industries.

- Almost 52% of the labour force in the nation is employed in the agriculture industry.

- About 18.3% of India’s GDP (2022-23) (Gross Domestic Product) is attributed to agriculture. ( PIB )

- India’s GDP from agriculture increased to 6934.75 INR billion in the 4th quarter of 2022 from 4297.55 INR billion in the 3rd quarter.

- The Indian agriculture industry is projected to grow by 3.5% during the fiscal year 2022-2023.[ Source ]

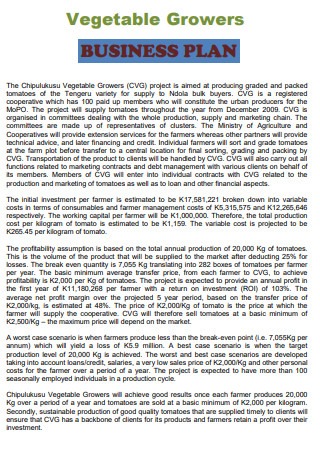

Agriculture Business Plan

A solid plan may make your agriculture business successful. Therefore when writing one, consider all the elements that constitute an excellent agriculture business plan. Also, take inspiration and incorporate key elements from already existing businesses.

Purpose of Agriculture Business Plan

- A strong agriculture business plan helps you understand the teams and make key business decisions to accomplish desired goals.

- It also helps you get investors for your business. Investors could be bankers or any other venture capitalists who would be willing to raise funds for your agribusiness.

- It helps determine if you can get the business going in a set direction and also allows you to estimate the costs required for founding the business.

- A good business plan clearly defines your corporate objectives.

Elements of an Agriculture Business Plan

While creating a strategy for your agriculture business, use a step-by-step procedure and include a comprehensive list of all the necessary components. Of course, your business strategy will determine whether you are a startup or an established firm. In any case, you must ensure that your business plan is inclusive, succinct, detailed, and grounded in reality.

Planning to create an Agriculture Business plan? Here’s what you should include:

1. Purpose and Objectives

The goal of the company is expressed in its objective statement. It dictates why you want to start the business and what you hope to achieve. Also, it identifies the other companies or entities your business will work with.

Thus, your company’s mission statement must incorporate information about your brand and core values.

2. Business Details

Illustrate every important component of your business, including its location, the size of its property, the date it began operations, its current status, and the sector it operates in. This section could also address other subjects, like marketing and sustainability.

3. Market Analysis

The majority of businesses begin by researching their industry. So, it would be great to implement the same idea in your agricultural business.