Metro Credit Union

- Schedule an Appointment

- iBanking Login

Become a Member

Build & grow savings, pay off debt, pay my loan, savings accounts.

We have options to get you where you want to be.

Checking Accounts

Value, security and convenience no matter which account you choose.

Investments

Whatever your goals, our Investment Advisors will help you get there.

Make sure the things you value are protected by the people you trust.

Buying a home? It's a big decision and we can help!

Home Equity Loan

We offer flexible options to help you tap the equity in your home.

Personal Loans

More ways to get the funds you need now.

Vehicle Loans

Get moving and get saving with vehicle loans from Metro!

Credit Cards

Simple and safe

Pay my Loans

Business checking & savings.

The accounts that make your business run

Commercial Loans

Grow your business with smart borrowing options

Retirement Planning

Attract and retain the best employees by offering benefits they'll love.

Metro Insurance Advisors

Financial education.

Credit and Debt

Explore topics on the effective use of credit and managing your debt.

Money Management

Explore topics on banking, budgeting, saving and spending.

Workplace Finances

Explore topics on employee benefits, paycheck planning and retirement plans.

Family Finances

Explore topics on life events, insurance, identity protection, kids and money and financial crisis.

Home Ownership

Explore topics on home buying, mortgages, home equity and refinance.

Paying for College

Explore topics on saving and financing a college education.

Explore topics on retirement savings, living and Social Security.

Small Business

Starting a Business

Explore topics and tips on starting a business.

Business Finance

Explore topics on business finance and accounting.

Business Management

Explore topics on effectively managing your business.

Growing Your Business

Explore topics and tips on growing your business and revenue.

Employment Basics

Explore topics on hiring and managing employees.

Financial Calculators

Creating a Business Plan

The decision to create a business plan is an important one, whether you are starting a new business or growing an established one. A solid business plan is fundamental to long-term business success.

It serves two main purposes:

- It acts as a roadmap for your business.

- It is a tool that helps you obtain outside financing.

While the phrase “creating a business plan” may conjure up feelings of trepidation and dread, it will not be as difficult if you break your business plan down into its more essential parts.

Why Do You Need a Business Plan?

Benjamin Franklin said it best: “If you fail to plan, you are planning to fail.” While a business plan will not guarantee success, failing to have one almost guarantees that you will not find the success you seek.

Remember the roadmap analogy? It is an accurate one to consider. The first thing you need to do before creating the roadmap, though, is to figure out where you are heading.

In order to do that, you should ask yourself four simple questions.

- How do you want your business to look in one year?

- How would you like it to look in three years?

- Where do you want to see your business going in five years?

- What would you like to have accomplished by your tenth year in business?

Seek the answers to those questions, keeping in mind profits, revenues, expansion, growth and other critical drivers and metrics for your business.

What Does a Business Plan Include?

In order to build the roadmap to reach your intended business destinations in a timely manner, you must include key pieces of information and analysis in your plan. The many moving parts of running your business become the fundamental building blocks of your long-term business plan. Consider each of them a pit stop along the road to business success.

Business Concept

Your business concept is a summation of your company in a few concise and simple sentences. It should clearly communicate the idea, design or value proposition behind your business so that a customer, investor or potential partner can quickly grasp what you will do and the value it will provide. Keep the concept statement to one paragraph.

Business Strategy

Your business strategy provides the detail on how you will execute the business concept. It describes your industry, explains your product or service, and the critical factors that will drive your business success. Those factors might include such things as your management team, operational plans or cost advantages. In essence, it is an executive summary that explains why your business is uniquely suited to succeed.

Specific things you should consider while creating the strategy section of your plan include:

- Products or services offered now.

- Products or services to offer in the future.

- The size of the market.

- How the market is changing.

- Industry trends.

Market Analysis

In the market analysis section of your plan, you need to explore the ins and outs of your potential customers or markets.

- Who are they?

- Where are they?

- What motivates them to buy the items or services you offer?

- What do they want or need from you?

- How are you going to attract new customers?

- What do you plan to do to keep them coming back?

Most importantly, though, is to answer this one question: “How are you profitably going to meet the needs of your target customer?”

Competitive Analysis

In order to be complete, your marketplace analysis must pay attention to your competitors. This is necessary whether you are an established business looking to expand or a new business interested in taking business away from other established businesses in the area.

Questions to ask yourself here, include:

- How is your business going to succeed in a market that is already being sufficiently served by another business in your industry?

- Is there sufficient demand to bring another business into the market or expand your existing business?

Financial Analysis

This section of your business plan will look at the financial aspects of your business. As a new business you will need to include:

- Break-even analysis.

- Financial ratio calculations.

- Internal and external funding requirements.

- Projected revenues and profits over one, three, and five-year terms.

Don’t forget to include plans for assets the business needs to acquire and the costs of the marketing plan the business intends to follow coming out of the gate.

Existing businesses need to include cash flow statements, balance sheets, and pro-forma income statements, for example.

Keep in mind, you should provide information that will assist potential lenders (banks and credit unions) and investors in approving loans or green-lighting investments in your business.

Maintaining Your Business Plan

You should not just write a business plan and place it in a drawer. To get the most benefit from it, it should be a dynamic evolving plan. You must adjust your plan as necessary with changing markets, new product concepts, evolving technology, need for additional financing, and goal achievements, just to name a few. An old business plan may not reflect reality any longer, so be sure to revisit your business plan periodically. Having a update checklist helps you to do just that.

In the beginning, making a business plan may seem like a onerous task. It can be simpler if you break it down into its individual components. Once you have a plan in place, you will begin to see the effectiveness of how such a simple business tool can take the guesswork out of starting a business or growing one.

Related Content

Financial calculator.

- Cash Management

- Credit Cards

- Cash & Coin Order

Business Plan Template

Below is a business plan template that VantageOne has created specifically for our prospective and existing members. Other business plans are complicated and lengthy – that’s why we condensed our planning template down to only 10 pages. This tool is great for business start-ups and expansions and is commonly requested by lenders for credit applications.

Check out our Business Plan Template Here!

Use this plan to put all your creative ideas and goals in writing. It can be referred to and revamped at any point in your business planning cycle.

Tip: Remember that business plans aren’t “set in stone” they need to grow and change and remain flexible, just like your business when it comes to market change. Being adaptable is one of the best qualities a successful business owner can have and having a plan in place will help you navigate future change. So once you have a plan in place, make sure to review it annually to ensure it still meets your needs and goals.

Your name *

Your comment *

OUR BRANCHES

Locate a branch

Toll Free: 1.888.339.8328 Phone: 250.545.9251 Fax: 1.877.545.1957

© 2023 VantageOne Credit Union.

Privacy | Legal | Accessibility

MOBILE MENU

- NE Portland

- Oregon City

Writing A Business Plan

It's a money thing lesson #41.

When's the best time to write a business plan?

Writing a business plan is an essential part of building a successful business. At its core, a business plan is a road map for your project: it establishes your purpose, it sets goals and expectations, and it forecasts the relationship between cost and revenue. Business plans exist in many forms: some formal and some informal.

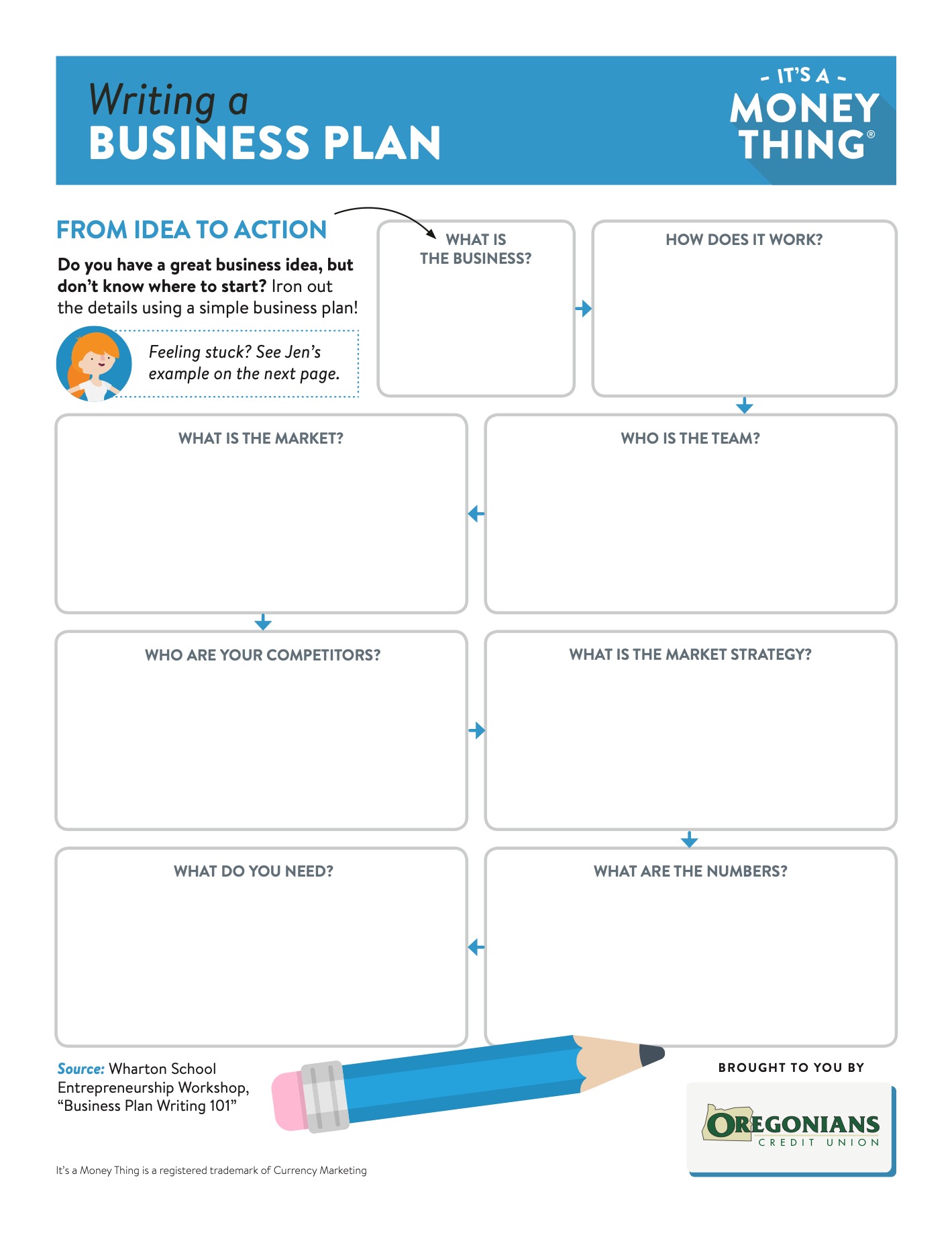

Business plan sample questions

- What is the business?

- How does it work?

- Who is the team?

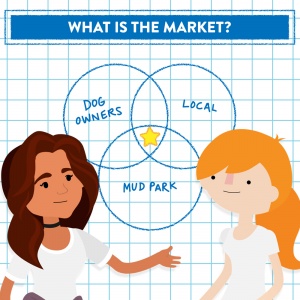

- What is the market?

- Who are your competitors?

- What is the market strategy?

- What are the numbers?

- What do you need?

A business plan doesn’t have to be formal in order to be effective. There are valuable insights to be gained whether you answer each of the questions above in a few sentences or with pages of in-depth research. Business plans are adaptable, and you will find that the level of detail you include will change depending on what stage of business development you’re in.

The best time to write a business plan

We often think that business plans are reserved for specific high-stakes situations—like pitching to a panel of investors on a reality TV show. In fact, the process of writing a business plan can be a helpful tool at multiple points along your entrepreneurial journey. The best time to write a business plan is any time you can benefit from more focus and direction. This might be when you’re in the early stages of exploring a new idea, when you’re ready to commit to your idea, when you’ve been running your business for years, or even a combination of all three. We’ve highlighted three different phases below to demonstrate the many ways a business plan can support your vision over time.

The idea phase

Writing a business plan in the idea phase:

- Solidifies your idea by filling in the major details

- Identifies strengths, weaknesses, opportunities and threats related to your business

- Helps you determine whether or not your idea makes sense to pursue

- Identifies the bare minimum of what you need in order to get started

The launch phase

Your initial idea has passed the test and you’re going all in—congratulations! During the launch phase, you will likely be communicating your business idea over and over again to others. You might be assembling a team, hiring employees, registering your business, or applying for grants or loans. In each of those situations, your idea will be challenged by others and you will find yourself having to answer all sorts of questions about your business. The launch phase is therefore the perfect time to develop a comprehensive business plan. Research your industry and learn about your potential customers. Forecast costs and revenues as realistically as possible. Explore different business models and determine a pricing strategy. The more you know about your business, the easier it will be to communicate your passion with others and get what you need in order to be successful.

- Determines what you need from others (like employees, vendors/suppliers or outside funding)

- Improves your expertise in the industry

- Enables you to speak confidently about your business to others

- Prepares you for questions about cash flow, profit and loss

- Identifies what makes you stand out from your competitors

The growth phase

A business plan can help you start your business, but did you know that it can still come in handy even if you’ve been successfully running your business for years? After some time, you may discover an opportunity to grow or expand your business. It’s an exciting prospect, but potentially overwhelming—that’s where your business plan can help. Rereading your business plan will remind you of the goals you established when you were first starting out. This information helps you make decisions that are in alignment with your original purpose. Revising and modifying your business plan allows you to grow in a strategic way and to include any areas that were missing from previous iterations. If your team is growing, sharing your business plan with your employees is an excellent way to connect them to your mission.

Writing a business plan in the growth phase:

- Reminds you of your goals and acknowledges the progress you’ve made

- Gives you perspective and eases decision-making

- Allows you to address new areas or concerns

- Helps you clearly communicate your vision to your team

- Realistically identifies what you need in order to grow

Whether your business is a fragment of an idea or already up and running, writing a business plan is a versatile and powerful tool that will help you run your business thoughtfully and successfully.

Do you have a great business idea, but don't know where to start? Iron out the details using a simple business plan! Click the image to open the PDF printable version that also includes Jen's example.

Was this information useful? Visit our It's A Money Thing home page for more quick videos and helpful articles to help you make sense of your money, one topic at a time! Check back, new topics will be introduced regularly.

Online banking is undergoing maintenance and is temporarily unavailable.

- Certificate

- Money Market

- Direct Deposit

- Online Banking

- Vehicle Loan

- Home Equity

- Mortgage Loan

- Business Loan Inquiry

- Personal Loan

- VISA Credit Cards

- Financial Calculators

- Financial Education

- Financial Planning

- Fraud Education

Lesson Handout

Lesson Infographic

Download the app

Red Canoe Home Page

Writing a Business Plan

Writing a business plan is an essential part of building a successful business. At its core, a business plan is a road map for your project. It establishes your purpose, it sets goals and expectations, and it forecasts the relationship between cost and revenue. Business plans exist in many forms — some formal and some informal.

Business Plan Sample Questions

There are many different ways to structure a business plan, but ultimately you’re seeking to answer the same basic set of questions — either for yourself, your team or an outside investor. The following list of questions, which is adapted from The Wharton School Entrepreneurship Workshop “Business Plan Writing 101,” serves as a good starting point:

- What is the business?

- How does it work?

- Who is the team?

- What is the market?

- Who are your competitors?

- What is the market strategy?

- What are the numbers?

- What do you need?

A business plan doesn’t have to be formal in order to be effective. There are valuable insights to be gained whether you answer each of the questions above in a few sentences or with pages of in-depth research. Business plans are adaptable, and you will find that the level of detail you include will change depending on what stage of business development you’re in.

The Best Time to Write a Business Plan

We often think that business plans are reserved for specific high-stakes situations — like pitching to a panel of investors on a reality TV show. In fact, the process of writing a business plan can be a helpful tool at multiple points along your entrepreneurial journey. The best time to write a business plan is any time you can benefit from more focus and direction. This might be when you’re in the early stages of exploring a new idea, when you’re ready to commit to your idea, when you’ve been running your business for years, or even a combination of all three. We’ve highlighted three different phases below to demonstrate the many ways a business plan can support your vision over time.

The Idea Phase

The process of writing a business plan is the first step in translating a business idea into something concrete that you can act on. Daydreams about starting your own business are often hazy on the details, so it’s difficult to assess the validity of an idea without getting it down on paper. When you start to answer some basic questions about how your business will make money, you might find that your original idea has some weaknesses. Writing a business plan in the idea phase gives you an opportunity to address any overlooked areas before committing serious time and money to your new venture.

Writing a business plan in the idea phase:

- Solidifies your idea by filling in the major details

- Identifies strengths, weaknesses, opportunities and threats related to your business

- Helps you determine whether or not your idea makes sense to pursue

- Identifies the bare minimum of what you need in order to get started

The Launch Phase

Your initial idea has passed the test and you’re going all in—congratulations! During the launch phase, you will likely be communicating your business idea over and over again to others. You might be assembling a team, hiring employees, registering your business, or applying for grants or loans. In each of those situations, your idea will be challenged by others and you will find yourself having to answer all sorts of questions about your business. The launch phase is therefore the perfect time to develop a comprehensive business plan. Research your industry and learn about your potential customers. Forecast costs and revenues as realistically as possible. Explore different business models and determine a pricing strategy. The more you know about your business, the easier it will be to communicate your passion with others and get what you need in order to be successful.

Writing a business plan in the launch phase:

- Determines what you need from others (like employees, vendors/suppliers or outside funding)

- Improves your expertise in the industry

- Enables you to speak confidently about your business to others

- Prepares you for questions about cash flow, profit and loss

- Identifies what makes you stand out from your competitors

The Growth Phase

A business plan can help you start your business, but did you know that it can still come in handy even if you’ve been successfully running your business for years? After some time, you may discover an opportunity to grow or expand your business. It’s an exciting prospect, but potentially overwhelming—that’s where your business plan can help. Rereading your business plan will remind you of the goals you established when you were first starting out. This information helps you make decisions that are in alignment with your original purpose. Revising and modifying your business plan allows you to grow in a strategic way and to include any areas that were missing from previous iterations. If your team is growing, sharing your business plan with your employees is an excellent way to connect them to your mission.

Writing a business plan in the growth phase:

- Reminds you of your goals and acknowledges the progress you’ve made

- Gives you perspective and eases decision-making

- Allows you to address new areas or concerns

- Helps you clearly communicate your vision to your team

- Realistically identifies what you need in order to grow

Whether your business is a fragment of an idea or already up and running, writing a business plan is a versatile and powerful tool that will help you run your business thoughtfully and successfully.

You are leaving Red Canoe Credit Union

You are about to be directed to the following URL:

You are leaving the Red Canoe Credit Union web site. Please note that Red Canoe Credit Union does not represent either the third party or the member if the two enter into a transaction, and privacy and security policies may differ from those practiced by Red Canoe Credit Union. In addition, Red Canoe Credit Union is not responsible for the content, security, or operation of such alternate sites.

ESL Live Chat Banking

Did you know....

Live Chat is not only for questions, but also for online banking! Additional informational message about online banking can go here

- Information about live chat

- More information can go here

- Even more content can be listed

- Maybe there's a link at the end

Third Party Site

For your convenience esl.org provides a variety of information on our website that is not directly related to ESL products or services. This information is provided through the use of third party service providers via web links.

By accessing these links, you will be leaving ESL Federal Credit Union's website and entering a website hosted by another party. ESL is not responsible for the content of this third party website. ESL does not represent either the third party or the member if the two enter into a transaction.

Please be advised that you will no longer be subject to, or under the protection of, the privacy and security policies of ESL Federal Credit Union. You are encouraged to review the privacy and security policies of the site you are entering, which may be different than those of ESL.

Continue Cancel

Business Support Resources

Business plan basics.

These pages come first. And they’re very important. After all, they’re the first pages any reader (including a prospective investor or lender) will see.

But don’t worry. The Cover Page just includes basic information with your company name and contact information. So you can create one in five minutes by following a standard template.

- Here is an example of a business plan cover page from SCORE of Greater Rochester (see page 2).

The Table of Contents provides a detailed list of all the topics covered in your plan. So it gives readers a quick overview of the content. It also helps people quickly find specific information as long as you remember to number your pages.

- Here’s a quick tip. Write your entire plan before you tackle the Table of Contents. That will help you save time on unnecessary revisions.

In a world where people have short attention spans, a short, easy-to-read Executive Summary is essential. So describe your business. Explain your motivation for starting it. Talk about the keys to your success. Then summarize the other major points in your plan.

- One piece of advice. Try to keep your summary to just a few paragraphs.

Of course, that may take some writing and revising time. And you may need help to hone it to perfection. But when you’re done, you will be able to clearly communicate the vision and strategy behind your business.

Don’t let the title of this section scare you. It’s simply a way to bring in some facts and figures from the local and national economy that support the business case for your business. If you’re a home builder, for example, population growth in your area would be a good fact to add. If you offer services to senior citizens, a statistic on the increasing number of local retirees could show that you have a real opportunity to grow your business in the future. With a little thought and research, you’ll have no trouble finding relevant economic data to include in your plan. In fact, here are a few great sources of information to consider:

- The Small Business Administration

- Economic data for the Greater Rochester Area (from ACT Rochester)

- Census Data

You’ve talked about your customers, your target audience, the competitive environment and your location. Now it’s time to discuss another very important subject: your marketing plan. Your marketing plan covers the strategy and tactics you will use to get the word out about your business to your customers and prospects. So make sure you include the following information in this section of your business plan:

- Your communication goals

- The key messages you intend to send to your customers and prospects

- The specific communication channels you will use to reach your target audience. These channels can include everything from traditional collaterals like brochures and signage to print and online advertising, social media, your website, Search Engine Optimization, broadcast TV and radio, and more.

- The estimated annual cost of your marketing efforts

- The additional revenue you expect to generate once you put your marketing plan into action

No question about it. Marketing plays a pivotal role in business success. But first you have to develop a sound marketing plan. And put it into action. Learn more at sba.gov .

- Income Statement

- Balance Sheet

- Cash Flow Projections

- Operating Data

- Personal Financial Statement

- Debt to Worth Ratio

- Gross Profit Margin

If you take the time to include all of this important information, you’ll be able to tell an effective story about your business to any target audience you have in mind, including investors, partners, prospective team members, and more.

But your plan also serves another purpose. It can help you get a business loan.

Of course, you’ll need to identify the specific amount you want to borrow and discuss how the money will help you achieve your goals.

You should also explain how the financial information in your plan gives a strong indication that you will be able to repay your loan while managing all of your other business obligations.<

No question about it. A sound business plan plays a major role in a prospective lender’s decision-making process. Consider it another important reason why you need a great business plan.

Ready to apply for a loan to help your business grow? Apply now !

Get the help you need to start your business plan today. Ready to start working on your plan? You’ll find links to a wealth of helpful resources in the business resources and tools section of this site. For helpful and free business plan templates, you can download the SCORE of Greater Rochester Business Plan Template or check out a Step-by-Step Business Plan Tool on sba.gov .

ABA Routing # 222371863

Download Our Mobile Apps For Personal: Apple Personal Mobile App Android Personal Mobile App For Business: Apple Business Mobile App Android Business Mobile App

Connect With Us Facebook Instagram Twitter YouTube LinkedIn

225 Chestnut Street, Rochester NY 14604 Privacy Policy | Disclosures | Security

ESL, TEL-E$L, and CheckOK are registered service marks of ESL Federal Credit Union. Membership is subject to eligibility.

Secure Site

- Project Managment

How to Create a Comprehensive Credit Union Business Plan

Introduction.

This Credit Union Business Plan Sample provides a comprehensive overview of the business plan for a credit union. It outlines the mission, objectives, and strategies of the credit union, as well as the financial projections and marketing plans. The plan also includes a detailed analysis of the competitive landscape and the potential for growth. This sample plan is designed to provide a starting point for credit union owners and managers to develop their own business plans. It is important to note that this plan is not intended to be a substitute for professional advice or services.

Creating a comprehensive credit union business plan is essential for the success of any credit union. A business plan is a document that outlines the goals, strategies, and objectives of the credit union. It also serves as a roadmap for the credit union’s future.

The first step in creating a comprehensive credit union business plan is to define the mission and vision of the credit union. The mission statement should clearly articulate the purpose of the credit union and the services it provides. The vision statement should outline the credit union’s long-term goals and objectives.

The next step is to conduct a market analysis. This involves researching the current market conditions and trends in the credit union industry. This research should include an analysis of the competition, customer needs, and potential opportunities.

Once the market analysis is complete , the credit union should develop a strategic plan. This plan should include the credit union’s goals and objectives, as well as the strategies and tactics that will be used to achieve them. The plan should also include a timeline for implementation and a budget.

The next step is to create a financial plan. This plan should include a detailed budget, as well as projections for income and expenses. It should also include a plan for capitalizing the credit union and a plan for managing risk.

Finally , the credit union should create an operational plan. This plan should include a detailed description of the credit union’s operations, including staffing, customer service, and technology. It should also include a plan for marketing and advertising.

Creating a comprehensive credit union business plan is essential for the success of any credit union. By following these steps , credit unions can ensure that their business plans are comprehensive and effective.

The Benefits of Developing a Credit Union Business Plan

Developing a credit union business plan is an important step for any credit union looking to grow and expand its services. A business plan provides a roadmap for the credit union to follow, outlining the goals and objectives of the organization and how it plans to achieve them. It also serves as a tool for communicating the credit union’s mission and vision to potential members, investors, and other stakeholders.

The benefits of developing a credit union business plan are numerous. First , it helps the credit union to clearly define its goals and objectives, and to develop strategies for achieving them. This includes identifying potential markets, assessing the competitive landscape, and developing a marketing plan. Additionally , a business plan can help the credit union to identify potential sources of funding, such as grants, loans, and investments.

Second , a business plan can help the credit union to develop a budget and financial projections. This includes forecasting income and expenses, as well as developing a plan for managing cash flow. This information can be used to make informed decisions about how to allocate resources and to ensure that the credit union is financially sound.

Third , a business plan can help the credit union to develop a risk management strategy. This includes identifying potential risks and developing strategies for mitigating them. This can help the credit union to protect its assets and ensure that it is able to meet its obligations.

Finally , a business plan can help the credit union to develop a strategy for growth. This includes identifying new markets, developing new products and services, and expanding into new geographic areas. This can help the credit union to increase its membership base and to increase its profitability.

In summary, developing a credit union business plan is an important step for any credit union looking to grow and expand its services. It can help the credit union to clearly define its goals and objectives, develop a budget and financial projections, develop a risk management strategy, and develop a strategy for growth. All of these benefits can help the credit union to achieve its goals and to ensure its long-term success.

Analyzing the Financials of a Credit Union Business Plan

The financials of a credit union business plan are an essential component of the overall plan. A thorough analysis of the financials is necessary to ensure the success of the credit union.

The financials should include a detailed budget, a cash flow statement, and a balance sheet. The budget should include all expected income and expenses, including salaries, rent, and other operating costs. The cash flow statement should include all sources of income and expenses, including loans, investments, and other sources of revenue. The balance sheet should include all assets and liabilities, including loans, investments, and other assets.

It is important to analyze the financials of the credit union business plan to ensure that the credit union is financially sound. The financials should be reviewed to ensure that the credit union is able to meet its financial obligations and that the credit union is able to generate sufficient income to cover its expenses.

The financials should also be analyzed to ensure that the credit union is able to meet its goals and objectives. The financials should be reviewed to ensure that the credit union is able to meet its goals in terms of loan origination, loan servicing, and other services. The financials should also be analyzed to ensure that the credit union is able to generate sufficient income to cover its expenses and to ensure that the credit union is able to meet its goals in terms of loan origination, loan servicing, and other services.

Finally , the financials should be analyzed to ensure that the credit union is able to meet its goals in terms of customer service. The financials should be reviewed to ensure that the credit union is able to provide quality customer service and that the credit union is able to meet its goals in terms of customer service.

The financials of a credit union business plan are an essential component of the overall plan. A thorough analysis of the financials is necessary to ensure the success of the credit union. By analyzing the financials , the credit union can ensure that it is financially sound and that it is able to meet its goals and objectives.

Crafting a Strategic Plan for Your Credit Union

The purpose of this document is to provide a strategic plan for [Name of Credit Union], outlining the steps necessary to ensure the continued success of the organization. This plan will provide a roadmap for the credit union to follow in order to achieve its goals and objectives. It will also provide a framework for decision-making and resource allocation.

Mission Statement

[Name of Credit Union] is committed to providing our members with the highest quality financial services and products, while maintaining a strong commitment to our community. We strive to create a culture of trust and respect, and to foster an environment of financial literacy and education.

Vision Statement

Our vision is to be the premier financial institution in our community, providing our members with the best products and services available. We will strive to be a leader in financial literacy and education, and to be a trusted partner in our members’ financial success.

Goals and Objectives

1. Increase membership: We will strive to increase our membership base by 10% over the next three years.

2. Increase loan portfolio: We will strive to increase our loan portfolio by 15% over the next three years.

3. Increase deposits: We will strive to increase our deposits by 20% over the next three years.

4. Increase financial literacy: We will strive to increase our financial literacy programs and services by 25% over the next three years.

5. Increase community involvement: We will strive to increase our community involvement by 30% over the next three years.

1. Increase membership: We will focus on marketing and outreach efforts to attract new members. We will also focus on providing exceptional customer service to retain existing members.

2. Increase loan portfolio: We will focus on expanding our loan products and services to meet the needs of our members. We will also focus on providing competitive rates and terms to attract new borrowers.

3. Increase deposits: We will focus on providing competitive rates and terms to attract new deposits. We will also focus on providing exceptional customer service to retain existing deposits.

4. Increase financial literacy: We will focus on providing educational materials and seminars to our members. We will also focus on partnering with local organizations to provide financial literacy programs.

5. Increase community involvement: We will focus on partnering with local organizations to provide financial services and products to underserved communities. We will also focus on providing volunteer opportunities for our staff.

This strategic plan provides a roadmap for [Name of Credit Union] to follow in order to achieve its goals and objectives. By focusing on increasing membership , loan portfolio, deposits, financial literacy, and community involvement, we will be able to ensure the continued success of the organization.

Understanding the Regulatory Requirements for Credit Unions

Credit unions are financial institutions that provide banking services to members who share a common bond, such as a place of employment, a church, or a community. As with other financial institutions , credit unions are subject to a variety of regulations that are designed to protect the interests of their members and ensure the safety and soundness of the institution.

The primary regulator of credit unions is the National Credit Union Administration (NCUA). The NCUA is responsible for chartering and supervising federal credit unions, as well as insuring deposits in federal and most state-chartered credit unions. The NCUA also sets rules and regulations for credit unions, including capital requirements, lending limits, and other operational requirements.

In addition to the NCUA , state-chartered credit unions may be subject to additional regulations from their state’s banking department or other state agencies. These regulations may include requirements for capital, lending limits, and other operational requirements.

Credit unions must also comply with a variety of federal laws and regulations, including the Bank Secrecy Act, the Fair Credit Reporting Act, the Truth in Lending Act, and the Equal Credit Opportunity Act. These laws and regulations are designed to protect consumers and ensure that credit unions operate in a safe and sound manner.

Finally , credit unions must comply with the rules and regulations of the Federal Deposit Insurance Corporation (FDIC). The FDIC insures deposits in credit unions up to $250,000 per account. Credit unions must meet certain requirements in order to be eligible for FDIC insurance, including maintaining a minimum level of capital and submitting regular financial reports to the FDIC.

By understanding and complying with the various regulatory requirements for credit unions , credit unions can ensure that they are operating in a safe and sound manner and protecting the interests of their members.

Exploring the Different Types of Credit Union Business Plans

A credit union business plan is a document that outlines the goals, strategies, and objectives of a credit union. It is an essential tool for any credit union to have in order to ensure its success. A credit union business plan should include a detailed description of the credit union’s mission, vision, and values, as well as its goals and objectives. It should also include a detailed analysis of the credit union’s current financial situation, including its assets, liabilities, and cash flow.

There are several different types of credit union business plans. The most common type is the strategic business plan, which outlines the credit union’s long-term goals and objectives. This type of plan typically includes a detailed analysis of the credit union’s current financial situation, as well as a detailed description of the credit union’s mission, vision, and values. It should also include a detailed analysis of the credit union’s competitive environment, including its competitors and their strategies.

Another type of credit union business plan is the operational business plan. This type of plan focuses on the day-to-day operations of the credit union, including its products and services, its marketing and advertising strategies, and its customer service policies. It should also include a detailed analysis of the credit union’s financial performance, including its income statement, balance sheet, and cash flow statement.

Finally , a credit union business plan can also include a financial plan. This type of plan outlines the credit union’s financial goals and objectives, as well as its strategies for achieving those goals. It should also include a detailed analysis of the credit union’s current financial situation, including its assets, liabilities, and cash flow.

No matter what type of credit union business plan you choose , it is important to ensure that it is comprehensive and well-written. A well-written credit union business plan can help the credit union achieve its goals and objectives, and ensure its long-term success.

- Business and Marketing Plan Template For Community Charter …

- Building Blocks for Your Business Plan | Navy Federal Credit Union

- How to Start a Credit Union | Growthink

- Previous How to Create a Comprehensive Financial Plan for Your Business

- Next Crafting a Winning Crepe Business Plan

How Many Construction Projects Can A Project Manager Manage

Project Management The Managerial Process With Ms Project

How To Prepare For Technical Project Manager Interview

Your email address will not be published. Required fields are marked *

- Sample Page

- Skip To Content

Login To Online Banking

Creating a business plan.

- Your Credit Union

Find Branch/ATM

- Become a Member

- In Our Community

- About Online Banking

- Security Overview

- Credit Cards

- Additional Services

- Electronic Services

Your Financing

- Home Equity Loans

- Personal Loans

- Lines of Credit

- Vehicle Loans

- RRSP Line of Credit

- Student Lending

Your Future

- Trust Services

Your Business

- Lending Services

- Merchant Program

- Night Depository

- Employee Services

- Self Service

- Life Events

- Major Purchases

- Tough Times

- Business Topics

- Starting Your Business

- Growing Your Business

- Non-Profit Organizations

Calculators

- Mortgage Calculator

- Loan Calculator

- Retirement Planner

- RRIF Calculator

- TFSA Calculator

- Education Savings

- Planning and Advice

- Legal Considerations

- Using Advisors

- Regulatory Bodies

- Determining Capital Needs and Sources

- Using a Home Office

- Hiring Employees

- Other Business Resources

It Starts with an Idea

All good businesses start with an original concept or idea, but sometimes your original idea doesn't make the money that you imagined. The idea may need some slight adjustment or even a major overhaul. What seems like a good idea one day, may not be such a good idea after time passes. Remember, the marketplace changes constantly and to be successful in business you must always keep coming up with new ideas.

Look Before You Leap

Before you take your idea to the next stage of development, it's crucial to analyze it from all possible angles to make sure you've thought of all possible scenarios. There's a lot of information and research available to you on market trends and other issues. A failed business can cost you a lot of time and money; it pays to do your homework.

Preparing a Plan

The final step before launching into action is to create a thorough business plan. This plan should be a summary of what you want to achieve with your business.

A well-written business plan can be very helpful to you on many levels. Firstly, it allows you to accurately determine the amount of money you'll need to start your venture and when you'll need it by. It will also help you to set short and long-term goals. These goals can be invaluable while getting started, and can also act as a reference guide to see if your business is on track as time passes.

Another advantage of a solid business plan is that it makes it easier for potential investors or lenders to see that you are organized and have thought things through completely. This demonstrates that you have good business management skills and are therefore a much safer bet with their money.

Lastly, and perhaps most importantly, a business plan allows you to identify your market, your customers and your competition. It can help you gain a competitive advantage and determine what strategies will drive you to succeed.

- Internet Security

- Legal and Copyright

- Accessibility Statement

- Browser Requirements

© 2024 Community Credit Union. All rights reserved.

Bank Business Plan Template

Written by Dave Lavinsky

Bank Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their banks.

If you’re unfamiliar with creating a bank business plan, you may think creating one will be a time-consuming and frustrating process. For most entrepreneurs it is, but for you, it won’t be since we’re here to help. We have the experience, resources, and knowledge to help you create a great business plan.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write a bank business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What Is a Bank Business Plan?

A business plan provides a snapshot of your bank as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for Your Bank Business

If you’re looking to start a bank or grow your existing bank, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your bank to improve your chances of success. Your bank business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Banks

With regards to funding, the main sources of funding for a bank are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for banks.

Finish Your Business Plan Today!

How to write a business plan for a bank.

If you want to start a bank or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your bank business plan.

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of bank you are running and the status. For example, are you a startup, do you have a bank that you would like to grow, or are you operating a chain of banks?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overview of the bank industry.

- Discuss the type of bank you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail the type of bank you are operating.

For example, you might specialize in one of the following types of banks:

- Commercial bank : this type of bank tends to concentrate on supporting businesses. Both large corporations and small businesses can turn to commercial banks if they need to open a checking or savings account, borrow money, obtain access to credit or transfer funds to companies in foreign markets.

- Credit union: this type of bank operates much like a traditional bank (issues loans, provides checking and savings accounts, etc.) but banks are for-profit whereas credit unions are not. Credit unions fall under the direction of their own members. They tend to serve people affiliated with a particular group, such as people living in the same area, low-income members of a community or armed service members. They also tend to charge lower fees and offer lower loan rates.

- Retail bank: retail banks can be traditional, brick-and-mortar brands that customers can access in-person, online, or through their mobile phones. They also offer general public financial products and services such as bank accounts, loans, credit cards, and insurance.

- Investment bank: this type of bank manages the trading of stocks, bonds, and other securities between companies and investors. They also advise individuals and corporations who need financial guidance, reorganize companies through mergers and acquisitions, manage investment portfolios or raise money for certain businesses and the federal government.

In addition to explaining the type of bank you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of clients served, the number of clients with positive reviews, reaching X number of clients served, etc.

- Your legal business Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the bank industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the bank industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your bank business plan:

- How big is the bank industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your bank? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your bank business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, small businesses, families, and corporations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of bank you operate. Clearly, corporations would respond to different marketing promotions than individuals, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Bank Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other banks.

Indirect competitors are other options that customers have to purchase from that aren’t directly competing with your product or service. This includes trust accounts, investment companies, or the stock market. You need to mention such competition as well.

For each such competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as

- What types of customers do they serve?

- What type of bank are they?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide loans and retirement savings accounts?

- Will you offer products or services that your competition doesn’t?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a bank business plan, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type of bank company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you provide savings accounts, auto loans, mortgage loans, or financial advice?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your plan, you are presenting the products and/or services you offer and their prices.

Place : Place refers to the site of your bank. Document where your company is situated and mention how the site will impact your success. For example, is your bank located in a busy retail district, a business district, a standalone office, or purely online? Discuss how your site might be the ideal location for your customers.

Promotions : The final part of your bank marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Reach out to websites

- Distribute flyers

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your bank, including reconciling accounts, customer service, accounting, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to sign up your Xth customer, or when you hope to reach $X in revenue. It could also be when you expect to expand your bank to a new city.

Management Team

To demonstrate your bank’s potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing banks. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing a bank or successfully running a small financial advisory firm.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you see 5 clients per day, and/or offer sign up bonuses? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your bank, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a bank:

- Cost of furniture and office supplies

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your bank location lease or a list of accounts and loans you plan to offer.

Writing a business plan for your bank is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will understand the bank industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful bank.

Bank Business Plan Template FAQs

What is the easiest way to complete my bank business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily write your bank business plan.

How Do You Start a Bank Business?

Starting a bank business is easy with these 14 steps:

- Choose the Name for Your Bank Business

- Create Your Bank Business Plan

- Choose the Legal Structure for Your Bank Business

- Secure Startup Funding for Your Bank Business (If Needed)

- Secure a Location for Your Business

- Register Your Bank Business with the IRS

- Open a Business Bank Account

- Get a Business Credit Card

- Get the Required Business Licenses and Permits

- Get Business Insurance for Your Bank Business

- Buy or Lease the Right Bank Business Equipment

- Develop Your Bank Business Marketing Materials

- Purchase and Setup the Software Needed to Run Your Bank Business

- Open for Business

Don’t you wish there was a faster, easier way to finish your Bank business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how a Growthink business plan consultant can create your business plan for you.

Other Helpful Business Plan Articles & Templates

- Bahasa Indonesia

- Slovenščina

- Science & Tech

- Russian Kitchen

Moscow-City: 7 surprising facts about the Russian capital’s business center

1. Guinness World Record in highlining

The record was set in 2019 by a team of seven athletes from Russia, Germany, France and Canada. They did it on September 8, on which the ‘Moscow-City Day’ is celebrated. The cord was stretched at the height of 350 m between the ‘OKO’ (“Eye”) and ‘Neva Towers’ skyscrapers. The distance between them is 245 m. The first of the athletes to cross was Friede Kuhne from Germany. The athletes didn't just walk, but also performed some daredevil tricks. Their record is 103 meters higher than the previous one set in Mexico City in December 2016.

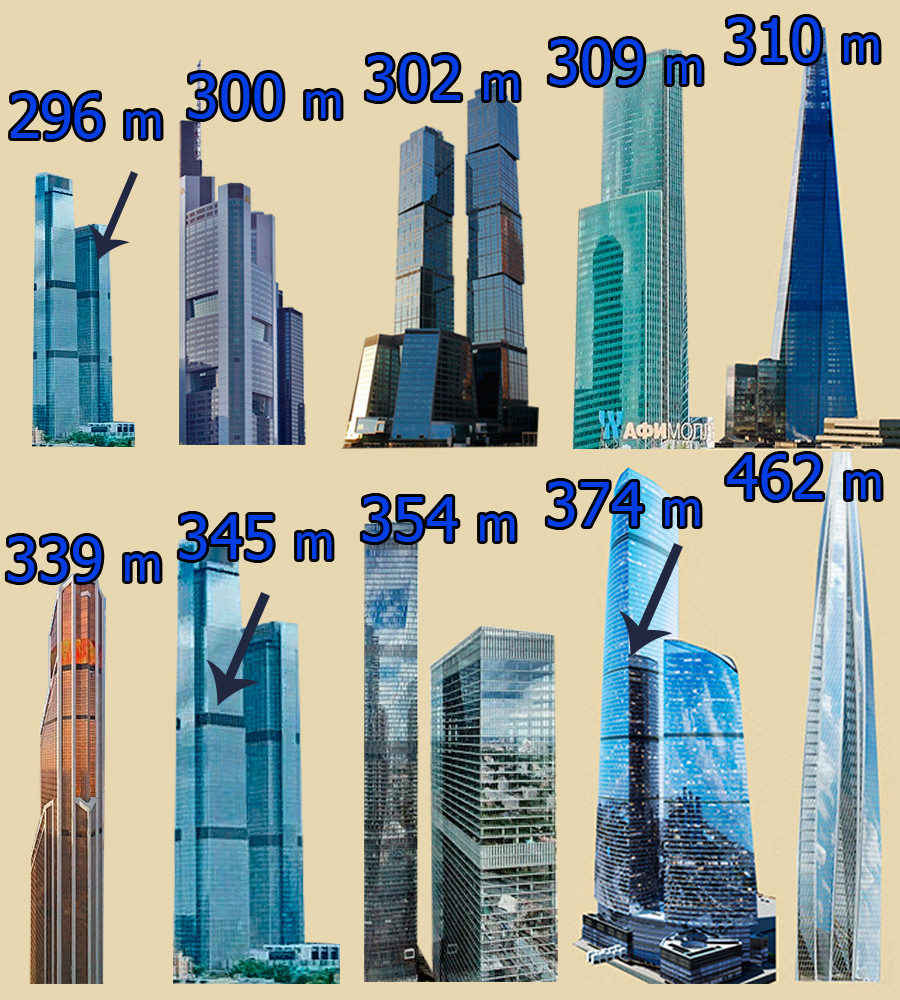

2. Domination of Europe's top-10 highest skyscrapers

7 out of 10 Europe’s highest skyscrapers are located in Moscow-City. Earlier, the ‘Federation Tower’ complex’s ‘Vostok’ (“East”) skyscraper was the considered the tallest in Europe.

Left to right: the lower of the ‘Neva Towers’ (296 m), Commerzbank Tower in Frankfurt (300 m), Gorod Stolits (“City of Capitals”) Moscow tower (302 m), Eurasia tower (309 m), The Shard’ skyscraper in London (310 m), Mercury City Tower (339 m), Neva Towers (345 m).

However, in 2018, the construction of the 462 meter tall ‘Lakhta Center’ in Saint-Petersburg was completed, pushing ‘Vostok’ (374 m) into 2nd place. The 3rd place is taken by OKO’s southern tower (354 m).

3. The unrealized ‘Rossiya’ tower

If all the building plans of Moscow-City were realized, the ‘Lakhta Center’ in St. Petersburg wouldn't have a chance to be Europe's highest skyscraper. Boris Tkhor, the architect who designed the concept of Moscow-City, had planned for the ‘Rossiya’ tower to be the tallest. In his project, it was a 600 meter tall golden cylindrical skyscraper ending with a spire that was inspired by traditional Russian bell towers. Then, the project was reinvented by famous British architect Sir Norman Foster. He had designed ‘Rossiya’ as a pyramid ending with a spire. The skyscraper itself would have been 612 meters tall, and the height including the spire would have reached 744,5 meters (for comparison, the ‘Burj Khalifa’ in Dubai, UAE, would have been just 83,5 meters taller). Unfortunately, the investors faced a lot of economic problems, due to the 2008 financial crisis, so the ‘Rossiya’ skyscraper was never built. A shopping mall and the ‘Neva Towers’ complex was constructed at its place in 2019.

4. Changed appearance of ‘Federation Tower’

In its first project, the ‘Federation Tower’ was designed to resemble a ship with a mast and two sails. The mast was to be represented by a tall glass spire with passages between the towers. It was planned to make a high-speed lift in it. The top of the spire was going to be turned into an observation deck. But the ship lost its mast in the middle of its construction. Experts at the Moscow-city Museum based in the ‘Imperia’ (“Empire”) tower say, that the construction of the spire was stopped, firstly, due to fire safety reasons and secondly, because it posed a threat to helicopter flights – the flickering glass of the spire could potentially blind the pilots. So, the half-built construction was disassembled. However, an observation deck was opened in the ‘Vostok’ tower.

5. Open windows of ‘Federation Tower’

We all know that the windows of the upper floors in different buildings don’t usually open. Experts say that it’s not actually for people’s safety. Falling from a big height is likely to be fatal in any building. The actual reason is the ventilation system. In a skyscraper, it’s managed with a mechanical system, and the building has its own climate. But in the ‘Zapad’ (“West”) tower of the ‘Federation Tower’ complex, the windows can open. The 62nd and last floor of the tower are taken up by a restaurant called ‘Sixty’. There, the windows are equipped with a special hydraulic system. They open for a short period of time accompanied by classical music, so the guests can take breathtaking photos of Moscow.

6. Broken glass units of ‘Federation Tower’

The guests of the ‘Sixty’ restaurant at the top of the ‘Zapad’ tower can be surprised to see cracked glass window panes. It is particularly strange, if we take into consideration the special type of this glass. It is extremely solid and can’t be broken once installed. For example, during experiments people threw all sorts of heavy items at the windows, but the glass wouldn’t break. The broken glass units of ‘Zapad’ were already damaged during shipment . As each of them is curved in its own way to make the tower’s curvature smooth, making a new set of window panes and bringing them to Russia was deemed too expensive . Moreover, the investors had financial problems (again, due to the 2008 financial crisis), so the ‘Vostok’ tower even stood unfinished for several years. Eventually, the cracked window panes were installed in their place.

7. The highest restaurant in Europe

‘Birds’, another restaurant in Moscow-City, is remarkable for its location. It was opened at the end of 2019 on the 84th floor of the ‘OKO’ complex’s southern tower. Guests at the restaurant can enjoy an amazing panoramic view at a height of 336 meters. On January 28, the experts of ‘Kniga Recordov Rossii’ (“Russian Records Book”) declared ‘Birds’ the highest restaurant in Europe, a step toward an application for a Guinness World Record.

If using any of Russia Beyond's content, partly or in full, always provide an active hyperlink to the original material.

to our newsletter!

Get the week's best stories straight to your inbox

- The evolution of Russia's No. 1 news program - from the USSR to now

- The Khodynka tragedy: A coronation ruined by a stampede

- ‘Moskvitch’: the triumph and sad end of a famous Moscow car plant (PHOTOS)

This website uses cookies. Click here to find out more.

2018 Primetime Emmy & James Beard Award Winner

R&K Insider

Join our newsletter to get exclusives on where our correspondents travel, what they eat, where they stay. Free to sign up.

A History of Moscow in 13 Dishes

Featured city guides.

- Hispanoamérica

- Work at ArchDaily

- Terms of Use

- Privacy Policy

- Cookie Policy

100 Years of Mass Housing in Russia

- Published on July 23, 2018

Russia’s history of mass housing development can be divided into several distinct periods, each manifested by its own specific type of residential building. These houses reveal what lifestyle, comfort level, construction cost and distinctive traits were considered preferable in any given decade. Every new stage saw its own experiments and had its achievements, which together can be regarded as a line of lessons, discoveries, and experiences, helping to understand a specific character of Russian standard housing.

1917-1930: First efforts, first experiments

The October Revolution brought about a number of changes in Russia ’s housing policies, defining its development for many years to come. Two decrees of 1918, “On Abolition of Private Property in Cities” and “On Land Socialization,” gave rise to so-called communal apartments. The state-owned property began to account for a larger share of the country’s total housing stock and construction projects; the Soviet regime also took over the task of allocating dwellings among people.

In the 1920s, a new type of low-cost mass housing began to take shape. The Construction Committee of the Russian Soviet Federative Socialist Republic was the first in country’s history to embark on developing a model of a standard house in accordance with modern requirements and with the use of a scientific approach. Among other things, the authorities had held a number of various contests, and these measures eventually resulted in creating fundamentally novel types of homes, ranging from communal houses to so-called garden cities.

According to plan, a local resident could have spent his whole life in this neighbourhood without feeling any need for something outside of it: this place had shops, nurseries, schools, an institute with dormitories, factory, and even a crematory. Khavsko-Shabolovsky housing area was an important part of the district. Its thirteen buildings were situated at a right angle to each other, and at a 45-degree angle to main streets. This feature provided a good lighting, and created a closed yard system. Balconies and bad-sitting rooms both faced southern façades, while kitchens and bathrooms were designed to look to the north. Each row of houses had its own color scheme. Public building was placed in the center of the district.

1935-1955: Fine décor and high ceilings: The indiscreet charm of Stalinka building

In the early 1930s, a public contest for the Palace of the Soviets project and a new Stalin’s Moscow city master plan (1935) marked an architectural shift towards exploitation of classic legacy. Moscow city was first to straighten, enlarge and build-up its avenues with solemn ensembles, and then many Russian cities followed the lead. Artistic features in buildings, and for the neighborhood as a whole, became a priority. After World War II, the trend increased; although, multi-story buildings became less common, while wooden construction regained its relevance.

Mastering a technology of manufacturing structure elements at the factory (instead of making them right at the construction site) is a huge breakthrough of this period. But many projects were still being carried out upon their own unique custom design, and this ensured diversity of housing architecture of the time.

1949 saw an introduction of so-called standard planning: this approach completely dismisses the idea of a separate design for each project, and embraces exactly the opposite of that — a design concept which implies working upon standardised housing types and series plans.

On Tverskaya Street, Russia had tried a fast-track (industrialized) construction technology for the first time: a number of teams of workers with different skills shifting from one object to another in rotation, each in charge of his own task.

As a result of the successful experiment, the house number 4 on Gorky Street had been perfectly integrated into the mounting terrain of the road: in all three sections, residential units occupy five stories, but the height of ground floors, reserved for shops and eating places, is different. Basement and portal had been faced with polished granite, residential walls — with prefabricated tile; the interior decoration featured moulding and sculptures.

1955-1960: Khrushchev formula: Compact housing and arrival of “micro-districts”

In the aftermath of Nikita Khrushchev’s landmark speech of 1955 and the decree “On Liquidation of Excesses in Planning and Construction,” Russian housing industry started shifting to much simpler, less assertive architecture — and cheaper construction. Also, it was decided to utilize vacant lands for large low-cost residential neighborhoods — that is micro-districts — instead of proceeding with costly construction in the city center.

Since the rapidly advancing industrial technology suggested uniformity in construction, the custom planning had had to be practically abandoned. In 1959, Soviet Russia established its first DSK — Integrated House-building Factory, and more than 400 such plants were to come along in the future.

To deliver on the promise “For every family — separate apartment!,” the USSR had to build as simple and compact as possible; at the same time, expected lifespan of those structures was estimated to be around 20 years.

K-7 house line delivered the first and the cheapest mass five-story building; it took only 12 days to build such a home. Of course, this type of dwelling had its downsides, such as walkthrough rooms and no balconies. These issues have been revised and fixed for K-7 later versions.

In 1956, the USSR had held a nationwide contest for best projects on cost-effective apartment house types. The experimental 9th Block in Novye Cheryomushki district was planned and a put up drawing on the solutions submitted for this competition. Construction of a novel neighborhood took 22 months; the area had served as a testing ground for 14 building types (each of them used different planning and materials) and is up to five storeys high.

In an effort to make up for small apartments, great emphasis was put on spacious yards. These space were equipped with special leisure zones, playgrounds, landscaping, carpet-beating areas, paddling pools. Architectural planning of micro-districts excluded any through-traffic, and each block had its own nursery, kindergarten, school, canteen, shops, cinema, amenities’ building, telephone exchange, and garages.

1960-1980. Brezhnev-era homes: Same trend, greater comfort

During this period, greater focus had been placed on constructing high-rise buildings, as well as introducing improved housing types. This era gave birth to apartments with 1-5 isolated rooms, providing housing for different kinds of families. Besides, certain series allowed for flexible layouts of apartments.

In the late 70s, the housing policy agenda embraced the task of rebuilding and renovating pre-war and early post-war housing stock. Hotels and dormitories accounted for a large part of these new projects. However, housing problems still remain a major concern and a pressing issue. In 1986, with the aim to address this serious challenge, the government adopted a special program called “Housing-2000” — yet it was never fully implemented.

This neighborhood had been made up of 9- and 16-story residential buildings. For the purposes of accessible infrastructure and comfort, the architects decided to arrange entrances to all consumer service facilities in lobbies, or at least within walking distance. Buildings were connected by ground floor halls, therefore it was possible to move around almost without getting outside of the block. With internal passages reserved exclusively for taxi and ambulance, each house came with its own underground parking. The project also offered built-in furniture options, with one of the buildings attempting to perform a duplex apartment experiment.

1991—2018. Modern era: Return of custom design, and embracing larger scale

This phase saw the formation and development of the Russian housing market. The country has witnessed a glorious comeback of both individual development projects and widespread use of décor. There is an ongoing quest for new buildings’ and apartments’ layouts (studios, projects with common neighborhood areas, etc.), — while some housing series already provide options for possible replanning.

Thanks to privatization, Russians have regained their right to acquire and own housing property. This drastic shift is responsible for an important new trend in the Russian housing market. Today, more than 85% of homes are owned by private citizens.

In 1990s, our housing development has been taking rather erratic and unsystematic forms. The industry, largely dominated by infill development plans, saw a significant increase in the share of private and luxury housing. Then in the 2000s, during a period of intense economic growth, it has brought about some large-scale integral development projects for new territories.

In 1997, alongside with a new housing reform in Russia , Agency for Housing Mortgage Lending was created. A year later, the state presented a legal basis for mortgage lending. In 2016, DOM.RF (former Agency for Housing Mortgage Lending) and Strelka KB started to work out a paper called “Guidelines on Comprehensive Development of the Areas” — both parties are driven by their commitment to introduce and ensure a comfortable urban environment in Russia. One of the key ideas of these guidelines is to abandon micro-district development in favour of city blocks.