Bookkeeping Business Plan Template

Written by Dave Lavinsky

Bookkeeping Business Plan

Over the past 20+ years, we have helped over 9,000 entrepreneurs create business plans to start and grow their bookkeeping companies. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through a bookkeeping business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is a Bookkeeping Business Plan?

A business plan provides a snapshot of your business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategy for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for a Bookkeeping Business

If you’re looking to start your own bookkeeping business or grow an established business, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your bookkeeping business in order to improve your chances of success. Your business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Bookkeeping Startups

With regards to funding, the main sources of funding for a bookkeeping business are personal savings, credit cards, bank loans, and angel investors. With regards to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to confirm that your financials are reasonable. But they will want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business.

The second most common form of funding for a bookkeeping company is angel investors. Angel investors are wealthy individuals who will write you a check. They will either take equity in return for their funding or, like a bank, they will give you a loan.

Finish Your Business Plan Today!

How to write a business plan for a bookkeeping company.

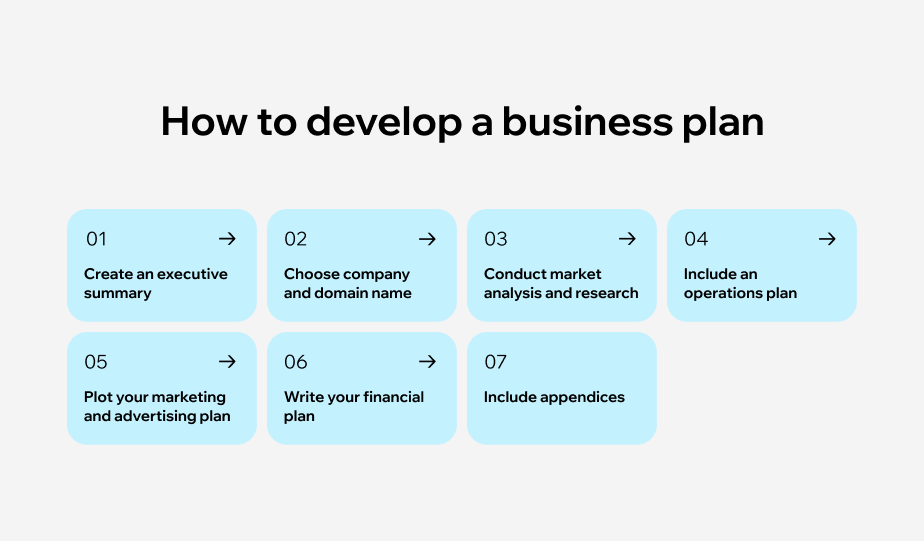

Your business plan should include 10 sections as follows:

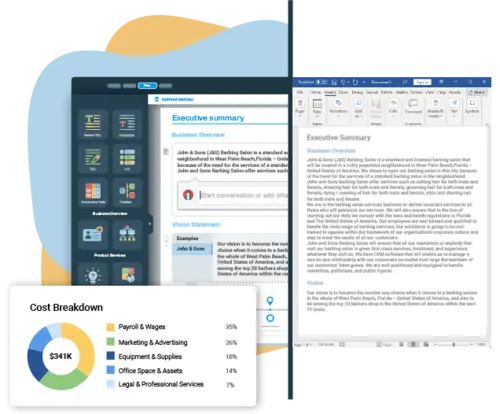

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of business you are operating and the status; for example, are you a startup, do you have a bookkeeping business that you would like to grow, or are you operating a chain of bookkeeping companies.

Next, provide an overview of each of the subsequent sections of your plan. For example, give a brief overview of the bookkeeping business industry. Discuss the type of business you are operating. Detail your direct competitors. Give an overview of your target market. Provide a snapshot of your marketing strategy. Identify the key members of your team. And offer an overview of your financial plan.

Company Analysis

In your company analysis, you will detail the type of bookkeeping business you are operating.

For example, you might operate one of the following types:

- Traditional Bookkeeping and Accounting Business : the traditional bookkeeping and accounting business can provide the entire range of bookkeeping services, including maintaining journals and ledgers, balancing and reconciling accounts, preparing payroll, preparing and filing taxes, and providing billing and collection services.

- Tax Preparation Services : this type of bookkeeping business primarily prepares, reviews, and/or files tax returns and supplementary documents.

- Payroll Services : this type of bookkeeping business typically collects payroll information, processes paychecks, processes withholdings, and files reports.

- Billing Services : this type of bookkeeping business deals with sending bills and collecting payments.

In addition to explaining the type of business you operate, the Company Analysis section of your business plan needs to provide background on the business.

Include answers to question such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include sales goals you’ve reached, new store openings, etc.

- Your legal structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry analysis, you need to provide an overview of the bookkeeping business.

While this may seem unnecessary, it serves multiple purposes.

First, researching the bookkeeping industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your strategy particularly if your research identifies market trends. For example, it would be helpful to ensure your plan takes into account the seasonal nature of certain services such as tax preparation.

The following questions should be answered in the industry analysis section:

- How big is the bookkeeping industry (in dollars)?

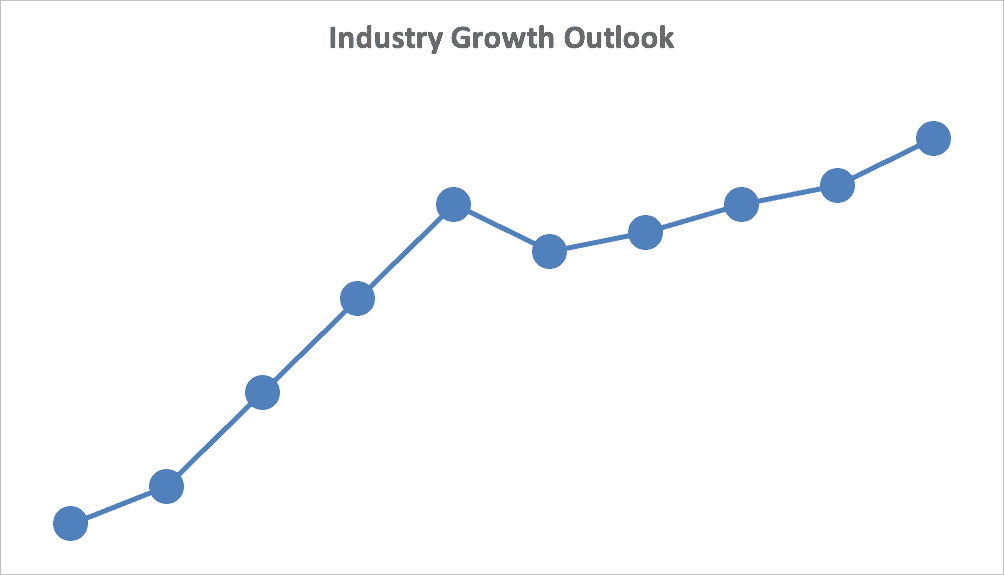

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential market for your bookkeeping business. You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section must detail the customers you serve and/or expect to serve.

The following are examples of customer segments : families, entrepreneurs, businesses, retirees, etc.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of bookkeeping business you operate. Clearly, families would want different pricing and product options and would respond to different marketing promotions than established businesses.

Try to break out your target market in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the customers you seek to serve. Because most bookkeeping companies primarily serve customers living in the same city or town, such demographic information is easy to find on government websites.

Psychographic profiles explain the wants and needs of your target customers. The more you can understand and define these needs, the better you will do in attracting and retaining your business clients.

Finish Your Bookkeeping Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other bookkeeping services and companies.

Indirect competitors are other options that customers have to purchase from that aren’t direct competitors. This includes accountants, companies’ internal accounting departments, professional employer organizations, and entrepreneurs/individuals doing their own bookkeeping. You need to mention such competition to show you understand that not everyone engages in bookkeeping services.

With regards to direct competition, you want to detail the other bookkeeping companies with which you compete. Most likely, your direct competitors will be bookkeeping companies located very close to your location.

For each such competitor, provide an overview of their businesses and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as:

- What types of customers do they serve?

- What services do they offer?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide superior bookkeeping services?

- Will you provide bookkeeping services that your competitors don’t offer?

- Will you make it easier or faster for customers to acquire your services?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

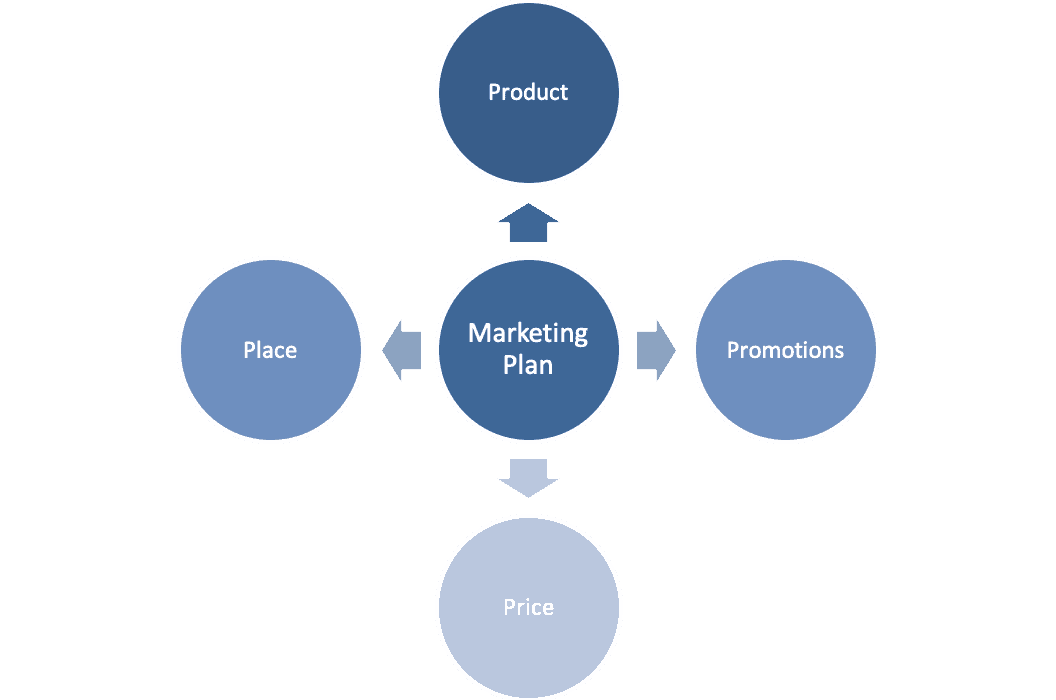

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a bookkeeping business plan, you should include the following:

Product : in the product section, you should reiterate the type of business that you documented in your Company Analysis. Then, detail the specific products you will be offering. For example, in addition to account reconciliation, will you offer services such as tax preparation?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections, you are presenting the services you offer and their prices.

Place : Place refers to the location of your business. Document your location and mention how the location will impact your success. Discuss how your location might provide a steady stream of customers.

Promotions : the final part is the promotions section. Here you will document how you will drive customers to your location(s). The following are some promotional methods you might consider:

- Email marketing to prospective clients

- Advertising in local papers and magazines

- Reaching out to local bloggers and websites

- Social media advertising

- Pay per click advertising

- Local radio advertising

- Banner ads at local venues

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your bookkeeping business such as serving customers, procuring supplies, keeping the office clean, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to serve your 1,000th customer, or when you hope to reach $X in sales. It could also be when you expect to hire your Xth employee or launch a new location.

Management Team

To demonstrate your bookkeeping business’s ability to succeed as a business, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in the bookkeeping or accounting business. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in bookkeeping businesses and/or successfully running small businesses.

Financial Plan

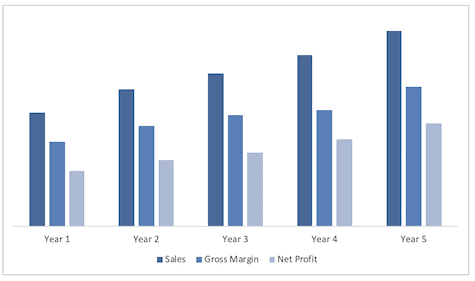

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet, and cash flow statements.

Income Statement An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenues and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you serve 10 customers per week or 20? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets While balance sheets include much information, to simplify them to the key items you need to know about, balance sheets show your assets and liabilities. For instance, if you spend $100,000 on building out your bookkeeping business, that will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a bank writes you a check for $100.000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement Your cash flow statement will help determine how much money you need to start or grow your business and make sure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

In developing your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a bookkeeping or accounting business:

- Location build-out including design fees, construction, etc.

- Cost of equipment like computers and software

- Cost of maintaining an adequate amount of office supplies

- Payroll or salaries paid to staff

- Business insurance

- Taxes and permits

- Legal expenses

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your office design blueprint or location lease.

Bookkeeping Business Plan Summary

Putting together a business plan for your bookkeeping business is a worthwhile endeavor. If you follow the template above, by the time you are done, you will have an expert bookkeeping business plan; download it to PDF to show banks and investors. You will really understand the bookkeeping business, your competition, and your customers. You will have developed a marketing plan and will really understand what it takes to launch and grow a successful bookkeeping business.

Bookkeeping Business Plan FAQs

What is the easiest way to complete my bookkeeping business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily complete your Bookkeeping Business Plan.

What is the Goal of a Business Plan's Executive Summary?

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of bookkeeping business you are operating and the status; for example, are you a startup, do you have a bookkeeping business that you would like to grow, or are you operating a chain of bookkeeping businesses.

Don’t you wish there was a faster, easier way to finish your Bookkeeping business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how a Growthink business plan consultant can create your business plan for you.

Other Helpful Business Plan Articles & Templates

Bookkeeping Business Plan Template

Written by Dave Lavinsky

Bookkeeping Business Plan

You’ve come to the right place to create your Bookkeeping business plan.

We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Bookkeeping companies.

Below is a template to help you create each section of your Bookkeeping business plan.

Executive Summary

Business overview.

Pacific Bookkeeping is a new bookkeeping firm located in Seattle, Washington. The firm will focus on providing expert bookkeeping services and exceptional customer service. We will help both small businesses and individuals and provide them with tax preparation, forecasting, budgeting, and other bookkeeping/accounting services.

Pacific Bookkeeping is led by Rebecca Stone, an experienced accountant who has been managing a large bookkeeping firm in Seattle, Washington for the past ten years. She graduated from Washington State University with an accounting degree and has been working at a large payroll firm since then, starting at an entry-level position and working her way up to a management-level role. Her experience and education have fully equipped her to run her own local bookkeeping firm.

Product Offering

Pacific Bookkeeping will provide a full range of bookkeeping services for individuals and small businesses. Some of these services include:

- Recording invoices

- Tax filing and preparation

- Financial reporting

- Payroll processing

- Monitoring accounts receivable

- Documenting receipts

- Forecasting

- Customer analysis

Customer Focus

Pacific Bookkeeping will primarily serve individuals and small businesses in the Seattle, Washington area. The city is home to over four million residents and around 100,000 businesses and many of them have a need for professional bookkeeping services. We will offer a wide variety of bookkeeping services in order to serve as many customers as we can in this target market.

Management Team

Pacific Bookkeeping is led by Rebecca Stone, an experienced accountant who has been working at a large bookkeeping firm in Seattle, Washington for the past ten years. She graduated from Washington State University with an accounting degree and then began working at the firm, starting at an entry-level position and working her way up to a management-level role. Though she has never run an accounting firm of her own, her experience has given her an in-depth knowledge of the bookkeeping industry, including the operations side (e.g., running day-to-day operations) and the business management side (e.g., staffing, marketing, etc.).

Success Factors

Pacific Bookkeeping will be able to achieve success by offering the following competitive advantages:

- Location: Pacific Bookkeeping is centrally located in the community, which provides ease of access for clients. The firm’s office will be located between the retail and business districts, making it accessible to a larger customer base.

- Competitive pricing: Pacific Bookkeeping’s pricing is more affordable than its closest competitors.

- Management: The management team has years of accounting experience that allows the company to market to and serve clients in a much more sophisticated manner than competitors.

- Relationships: Having lived in the community for over 20 years, Rebecca Stone knows all of the local leaders, newspapers, and other influencers. As such, it will be relatively easy for Pacific Bookkeeping to build brand awareness and an initial customer base.

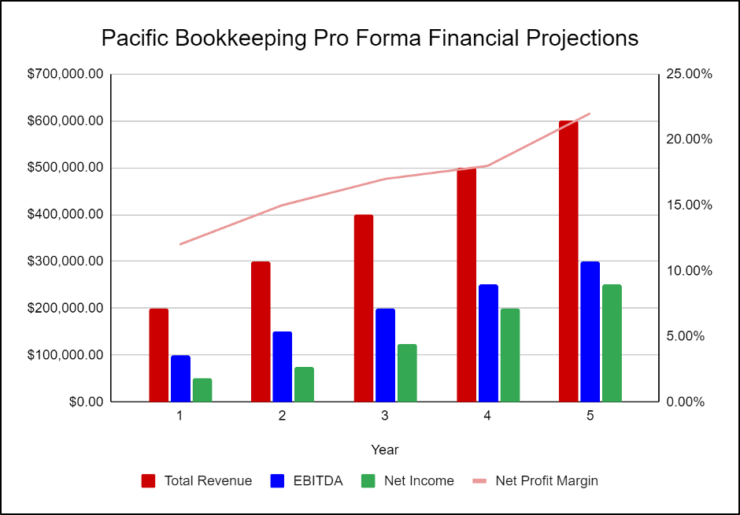

Financial Highlights

Pacific Bookkeeping is seeking a total funding of $200,000 of debt capital to open its bookkeeping firm. Funding will also be dedicated towards three months of overhead costs including the payroll of the staff, rent, and marketing costs. The breakout of the funding is below:

- Office space build-out: $20,000

- Office equipment, supplies, and materials: $10,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $10,000

- Working capital: $10,000

Company Overview

Who is pacific bookkeeping, pacific bookkeeping’s history.

Once her market analysis was complete, Rebecca Stone began surveying local office spaces for lease and identified an ideal location for the bookkeeping firm. Rebecca Stone incorporated Pacific Bookkeeping as a Limited Liability Corporation in January 2023.

Once the lease is finalized on the office space, interior design work can begin to make the office an appealing place to meet with clients.

Since incorporation, the company has achieved the following milestones:

- Located available office space for rent that is ideal for the bookkeeping firm

- Developed the company’s name, logo, and website

- Hired an interior decorating company to design and furnish the office

- Determined equipment and necessary supplies

- Began recruiting key employees

Pacific Bookkeeping’s Services

Industry analysis.

The United States Bookkeeping Industry is forecast to generate more than $66B this year. According to research reports, the largest bookkeeping firm in America generates approximately $9.5B annually. There are currently over 1.5M bookkeepers employed throughout the United States.

The top bookkeeping firms industry-wide are Automatic Data Processing (ADP) ($9.5B in annual revenue), Intuit ($7.8B in annual revenue), and Paychex ($4.0 in annual revenue). All other bookkeeping firms in the United States combined generate approximately $43.5B in annual revenue. An estimated 42% of industry revenue is generated through payroll services. Additional services such as billing, general accounting, tax preparation, and bookkeeping make up the remainder.

One of the biggest challenges for bookkeeping firms is the ability to keep up with changes in regulations. Additional hurdles include recruiting and retaining high-quality employees, keeping up with evolving technology, and acquiring new clients.

However, despite the challenges, the bookkeeping industry is expected to grow significantly throughout the rest of the decade. According to Data Intelo, the industry is expected to grow at a compound annual growth rate of 9.5% from now until 2030. This large growth shows that bookkeeping services are still in high demand, meaning that Pacific Bookkeeping has a solid chance of succeeding and maintaining a profit.

Customer Analysis

Demographic profile of target market.

Pacific Bookkeeping will serve individuals and small businesses in the community of Seattle, Washington, and its surrounding areas. Seattle has thousands of individuals and small businesses that would benefit from affordable bookkeeping services.

The precise demographics for Seattle, Washington are:

Customer Segmentation

Pacific Bookkeeping will primarily target the following customer profiles:

- Individuals

- Small businesses and nonprofits

- Government organizations

Competitive Analysis

Direct and indirect competitors.

Pacific Bookkeeping will face competition from other companies with similar business profiles. A description of each competitor company is below.

Young & Mitchell

Founded in the 1930s, Young & Mitchell has intentionally remained a small business so that the core group of professionals within the company could get to intimately know each one of their clients. The company is one of the leading tax firms in the Four State Region and offers financial guides and tax tools for individuals for free. Listed below is an outline of the services that the company offers according to its website:

- Tax Preparation and Planning Services

- Assurance and Advisory Services

- Estate and Trust Planning and Tax Preparation

- Bookkeeping/Write-up

- IRS Representation

- Accounting Services

- Audits, Reviews, and Compilation

- QuickBooks Accounting Help and Assistance

- Entity Selection and Restructuring

- Payroll Services

A Plus General Bookkeeping Services

A Plus General Bookkeeping Services is a bookkeeping firm that specializes in financial strategy and consulting for businesses of all sizes. The firm has been in business for over a decade and has acquired a loyal client base.

Clients may work with accountants in person, over the phone, through email, on video conferencing software, or completely through a new digital application. Although this firm has an excellent track record for service, it is also the most expensive bookkeeping company on the market.

Smith Brothers Accounting

Established in 1974, Smith Brothers Accounting is a privately held accountant practice that offers a wide variety of financial services including tax planning and preparation, payroll processing, financial planning, and small business accounting. Smith Brothers Accounting serves individuals and businesses.

Smith Brothers Accounting Services:

- Business Services

- Tax Services

- Individual Services

- Notary Services

Competitive Advantage

Pacific Bookkeeping will be able to offer the following advantages over the competition:

Marketing Plan

Brand & value proposition.

Pacific Bookkeeping will offer a unique value proposition to its clientele:

- Client-focused bookkeeping services

- Service built on long-term relationships

- Thorough knowledge of the latest regulations

- Big-firm expertise in a small-firm environment

Promotions Strategy

The promotions strategy for Pacific Bookkeeping is as follows:

Pacific Bookkeeping understands that the best promotion comes from satisfied customers. The company will encourage its clients to refer others by providing economic or financial incentives for every new client produced. This strategy will increase in effectiveness after the business has already been established.

Website/SEO

Pacific Bookkeeping will invest heavily in developing a professional website that displays all of the features and benefits of the bookkeeping company. It will also invest heavily in SEO so that the brand’s website will appear at the top of search engine results.

Social Media Marketing

Social media is one of the most cost-effective and practical marketing methods for improving brand visibility. The company will use social media to develop engaging content and post customer reviews that will increase audience awareness and loyalty.

Special Offers

Offers and incentives are an excellent approach to assisting businesses in replenishing the churn in their customer base that they lose each year. The company will introduce special offers to attract new clients and encourage repeat business.

Pacific Bookkeeping’s pricing will be moderate so consumers feel they receive great value when purchasing the bookkeeping services. The client can expect to receive quality bookkeeping services at a more affordable price than what they pay at other accounting firms.

Operations Plan

The following will be the operations plan for Pacific Bookkeeping.

Operation Functions:

- Rebecca Stone is the Owner and CEO of Pacific Bookkeeping. She will be in charge of the executive and operations aspects of the business. She will also provide bookkeeping services for her initial clients until she hires a full staff of accountants, bookkeepers, and tax preparation professionals.

- Rebecca is joined by Rhonda Wolfe who will be the company’s Administrative Assistant. She will help Rebecca with the administrative functions of the business.

- Rebecca is also joined by Samual Wright. He will act as the Marketing Manager and manage all the marketing and advertising functions for Pacific Bookkeeping.

- As the firm grows and takes on more clients, Rebecca will hire a team of experienced accountants, bookkeepers, and tax preparation professionals to help with the company’s service functions.

Milestones:

Pacific Bookkeeping will have the following milestones completed in the next six months.

- 3/202X Finalize lease agreement

- 4/202X Design and build out Pacific Bookkeeping

- 5/202X Hire and train initial staff

- 6/202X Kickoff of promotional campaign

- 7/202X Launch Pacific Bookkeeping

- 8/202X Reach break-even

Financial Plan

Key revenue & costs.

Pacific Bookkeeping’s revenues will come primarily from its bookkeeping services. The major costs for the company will include the salaries of the staff, marketing spending, and the rent for a prime location in Seattle.

Funding Requirements and Use of Funds

Key assumptions.

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and pay off the startup business loan.

- Annual rent: $50,000

- Year 3: 100

- Year 4: 125

- Year 5: 150

Financial Projections

Income statement, balance sheet, cash flow statement, bookkeeping business plan faqs, what is a bookkeeping business plan.

A bookkeeping business plan is a plan to start and/or grow your bookkeeping business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Bookkeeping business plan using our Bookkeeping Business Plan Template here .

What are the Main Types of Bookkeeping Businesses?

There are a number of different kinds of bookkeeping businesses , some examples include: Traditional Bookkeeping and Accounting Business, Tax Preparation Services, Payroll Services, and Billing Services.

How Do You Get Funding for Your Bookkeeping Business Plan?

Bookkeeping businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start a Bookkeeping Business?

Starting a bookkeeping business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Bookkeeping Business Plan - The first step in starting a business is to create a detailed bookkeeping business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your bookkeeping business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your bookkeeping business is in compliance with local laws.

3. Register Your Bookkeeping Business - Once you have chosen a legal structure, the next step is to register your bookkeeping business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your bookkeeping business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Bookkeeping Equipment & Supplies - In order to start your bookkeeping business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your bookkeeping business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful bookkeeping business:

- How to Start a Bookkeeping Business

Creating your business plan

It’s time to get things down on paper. Your business plan is vital to reality checking all those ideas you have.

What to do on day zero

If you already know what you want to be called, lock down the name and register the URL. Now take some time to see what’s working for other bookkeepers. Find the ones in your area and check out their websites – plus their LinkedIn and Facebook profiles – to see what makes them tick. How do they speak to the market? What services do they offer? How much do they charge? Use this research to help start the plan for your bookkeeping business.

But what if I already know the plan?

It’s great if you already know how you’re going to get started, but it’s still important to write everything down. For one thing, you’ll want to record all your golden ideas before they’re forgotten. Plus the writing process will help you interrogate those ideas.

Putting them on a timeline, costing them out, and fitting them around each other might reveal a thing or two. Perhaps some assumptions will need to be rethought, or some ideas will have to be skipped in favor of others. It’s a great way to organize your thinking.

Start with a working one-pager

The key to a business plan is to start out simple, and build on it as you go. Begin with a few headings and bullet points that map out your vision, goals, milestones and predictions.

Don’t let it get out of hand or bog you down. That’s not what a business plan is for. It’s supposed to help you get started. So set yourself a target of producing a one page plan to start.

Choose your words carefully

Decide how you’re going to talk about your business, and which words you’ll use. It’ll be helpful in settling on a value proposition and relating to clients. You can use your chosen terms in your elevator pitch, on your website, in blurbs about your business – and in your business plan.

Sections for a one-page business plan

1. Value proposition: Explain why clients will be better off with you.

2. The problem you’re solving: Describe the status quo and say why it’s not ideal.

3. Target market and competition: Profile the clients you want, and the bookkeeping solutions they use now.

4. Sales and marketing: Show how you’ll reach your target market, and what you’ll say to them.

5. Budget and sales: Work out your costs and predict how much you can earn over the first couple of years.

6. Milestones: Identify all the things that need to happen and map them against a timeline.

7. The team: Identify the people that will be involved (including consultants) and outline their roles.

8. Funding: Show how you’ll bankroll the business, especially as you wait for fees to start rolling in.

9. Contingency plan: What will you do if your cash flow isn’t what you budgeted?

You may eventually draw up a longer business plan, or you may stick with a short one. It depends on your working style, and the level of risk you’re taking on. Your plan will probably be more detailed if you’re taking on a lot of debt.

You can download a copy of our one-page or multi-page business plan template .

Staying alive

Once you’ve got your plan nailed down, remember you really don’t. You should treat your plan as a living document and keep tweaking it as things evolve. That’s another reason why it’s good to have a short plan, which you’re much more likely to update as you go. Try to be agile and open to change.

The discipline of maintaining your business plan will help you:

- discover and solve problems – putting things in black and white will show up holes in your thinking.

- get feedback from others – you can share your plan to get feedback from trusted advisors.

- go for more finance – an up-to-date business plan (and budget) means you’re always ready to apply for loans.

- guide growth – regular focus on the big picture will help you make strategic decisions rather than instinctive ones.

Have a succession plan

You will also need a succession plan. What will happen when you step away from the business? Will you sell it? Who to? A family member, a staff member, or someone on the open market?

A good succession plan will make sure the business can survive and thrive without you. That it will perform for its clients and its new owners. And it should give you the flexibility to step away from the business at short notice, if required or desired.

Learn more in our guide to succession planning.

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Starting a bookkeeping business

Work through the big decisions around accreditation, services to offer, fees to charge, and how to find clients.

You’ll need some training and certification to become a professional bookkeeper. Find out where this is available.

With a foundation of knowledge, skills and experience, take the next steps in setting up as a bookkeeper.

You need to nail down what services you’ll offer, who to, and how. Don’t promise more than you’re able to deliver.

Designing your bookkeeping business around a specific type of client or your strengths can be a successful way to go.

How do you walk the line between profitable for you and affordable for your clients? And help clients budget?

You might deliver an awesome service at a great price, but what if no one knows? Let’s look at marketing your services.

Download the bookkeeping business guide

A guide to help you work through the big decisions around starting a bookkeeping business. Fill out the form to receive the guide as a PDF.

Privacy notice .

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.

- Included Safe and secure

- Included Cancel any time

- Included 24/7 online support

Or compare all plans

Free Download

Accounting & Bookkeeping Business Plan Template

Download this free accounting & bookkeeping business plan template, with pre-filled examples, to create your own plan..

Or plan with professional support in LivePlan. Save 50% today

Available formats:

What you get with this template

A complete business plan.

Text and financials are already filled out and ready for you to update.

- SBA-lender approved format

Your plan is formatted the way lenders and investors expect.

Edit to your needs

Download as a Word document and edit your business plan right away.

- Detailed instructions

Features clear and simple instructions from expert business plan writers.

All 100% free. We're here to help you succeed in business, no strings attached.

Get the most out of your business plan example

Follow these tips to quickly develop a working business plan from this sample.

1. Don't worry about finding an exact match

We have over 550 sample business plan templates . So, make sure the plan is a close match, but don't get hung up on the details.

Your business is unique and will differ from any example or template you come across. So, use this example as a starting point and customize it to your needs.

2. Remember it's just an example

Our sample business plans are examples of what one business owner did. That doesn't make them perfect or require you to cram your business idea to fit the plan structure.

Use the information, financials, and formatting for inspiration. It will speed up and guide the plan writing process.

3. Know why you're writing a business plan

To create a plan that fits your needs , you need to know what you intend to do with it.

Are you planning to use your plan to apply for a loan or pitch to investors? Then it's worth following the format from your chosen sample plan to ensure you cover all necessary information.

But, if you don't plan to share your plan with anyone outside of your business—you likely don't need everything.

More business planning resources

How to Create a Business Plan Presentation

Simple Business Plan Outline

10 Qualities of a Good Business Plan

How to Write a Business Plan for Investors

Industry Business Planning Guides

Business Plan Template

How to Write a Business Plan

How to Start a Business With No Money

Download your template now

Need to validate your idea, secure funding, or grow your business this template is for you..

- Fill-in-the-blank simplicity

- Expert tips & tricks

We care about your privacy. See our privacy policy .

Not ready to download right now? We'll email you the link so you can download it whenever you're ready.

Download as Docx

Download as PDF

Finish your business plan with confidence

Step-by-step guidance and world-class support from the #1 business planning software

From template to plan in 30 minutes

- Step-by-step guidance

- Crystal clear financials

- Expert advice at your fingertips

- Funding & lender ready formats

- PLUS all the tools to manage & grow

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

BUSINESS STRATEGIES

How to create a bookkeeping business plan

- Jeremy Greenbaum

- Sep 7, 2023

Starting a business in the field of bookkeeping requires more than just number-crunching skills. It demands a well-crafted business plan that keeps you on track towards your goals.

More specifically, a bookkeeping business plan is a strategic document that outlines the objectives, strategies and financial projections for your business. It serves as a roadmap, helping you stay organized both now and in the future. Keep reading for tips on creating a strong business plan when starting your bookkeeping business .

Looking to get your business online? Try Wix’s website builder today.

As you’re building out your bookkeeping business plan, here are the six primary sections to keep in mind:

Executive summary

Business and domain names

Market analysis and research

Operations plan, marketing and advertising plan, financial plan.

Not sure how to begin planning your business? Check out how to start a service business .

01. Executive summary

The executive summary is a concise overview of your bookkeeping business plan, providing a snapshot of its key elements. For a clear executive summary, focus on highlighting the unique value that your services bring to clients and how your business aims to meet their needs efficiently and accurately.

Example of an executive summary for a bookkeeping business plan: “Our bookkeeping business, PreciseLedger Solutions, aims to provide meticulous financial record-keeping services to small and medium-sized businesses. With a commitment to accuracy, reliability and technology-driven solutions, we intend to streamline our clients' financial processes, enabling them to focus on core business activities. With a team of experienced and certified professionals, PreciseLedger Solutions seeks to establish long-term partnerships with clients, ensuring their financial success through organized and compliant bookkeeping practices.”

02. Business and domain names

Selecting the right business name for your bookkeeping business is pivotal for brand identity and recognition. It should reflect professionalism, trustworthiness and the services you offer. Once you have a business name, ensure the corresponding domain name is available for your bookkeeping website . You can use a business name generator to brainstorm consulting business names that align with your services and values.

Be inspired: Bookkeeping business name ideas

When choosing a domain name , keep it short, memorable and relevant to your bookkeeping services. Avoid using hyphens or complex spellings. Check its availability, and secure it promptly. For instance, if your business name is "AccuBooks Consultants," consider a domain like "AccuBooksConsultants.com" for consistency and easy online discovery.

Remember to also register your business once you’ve landed on a name and legal structure for your business.

03. Market analysis and research

Your business plan should include a comprehensive market analysis. Research your target market, competitors and industry trends. Understand the pain points that your potential clients face and how your services can address those needs effectively. Utilize this information to craft a robust marketing strategy that positions your bookkeeping business uniquely in the market.

04. Operations plan

Detail the operational aspects of your bookkeeping business. Specify the location—whether physical or virtual—and explain the rationale behind it. Outline the premises layout, necessary equipment and technology infrastructure. And, define your staffing requirements, highlighting the skills and certifications that your team will bring to the table.

05. Marketing and advertising plan

In this section, outline the marketing and advertising strategies you intend to employ to promote your bookkeeping services. This could involve a combination of a business website , digital marketing, content creation and networking with local businesses. Highlight the benefits of your services, and start thinking about how you will brand your business.

Note: You can use a logo maker to think of logo ideas for your business. Keep in mind that your visual identity is just one half of the branding formula—the other half involves knowing your company mission, vision, values and messaging.

06. Financial plan

The financial plan is the heart of your bookkeeping business plan. It should include startup costs, revenue projections and expense estimates. Specify how you plan to fund your business initially and provide a realistic timeline for reaching profitability. Detail your pricing structure, considering factors like industry standards, services offered and value provided.

Incorporating these six main parts into your bookkeeping business plan ensures a comprehensive and well-structured document that guides your entrepreneurial journey. From setting a strong foundation to strategically marketing your services and achieving financial success, each section plays a crucial role in your business's growth and sustainability.

Sample bookkeeping business plan: AccuLedger Bookkeeping Services

AccuLedger Bookkeeping Services aims to revolutionize financial record-keeping for small and medium-sized businesses. We specialize in providing accurate, streamlined and technologically advanced bookkeeping solutions. Our team of experienced professionals is committed to enabling our clients to focus on their core operations while we manage their financial records with precision and compliance.

Company and domain names

Company name: AccuLedger Bookkeeping Services

Domain name: www.acculedgerbookkeeping.com

We have conducted extensive research on the bookkeeping industry and identified a growing demand for reliable and efficient financial management among businesses. Our target market comprises local businesses, startups and entrepreneurs who seek trustworthy and cost-effective bookkeeping services.

Location: We will operate from a centralized office in the heart of the business district, ensuring accessibility for clients.

Premises: Our office layout will include private meeting spaces for consultations, a dedicated area for bookkeeping operations and advanced technology infrastructure for data security.

Equipment: We will invest in state-of-the-art bookkeeping software, high-speed computers and security measures to safeguard client data.

Staffing: Our team will consist of certified bookkeepers and financial experts with a strong commitment to accuracy and client satisfaction.

Digital presence: Establish a professional website (AccuLedgerBookkeeping.com) showcasing our services, team and success stories. Optimize for search engines to increase online visibility.

Social media: Leverage platforms like LinkedIn, Facebook and Instagram to engage with potential clients, share educational content and build a community around financial management.

Content strategy: Develop informative blog posts, ebooks and video tutorials on bookkeeping best practices, demonstrating our expertise and value to clients.

Networking: Attend local business events, workshops and seminars to connect with potential clients and establish our brand as a trustworthy bookkeeping partner.

Startup costs

Office setup: $15,000

Software licenses: $5,000

Marketing initiatives: $7,000

Staff training: $3,000

Miscellaneous: $2,000

Total startup costs: $32,000

Revenue projections (Year 1)

Monthly clients: 10

Average monthly revenue per client: $800

Total monthly revenue: $8,000

Total annual revenue: $96,000

Expenses (monthly)

Salaries and wages: $4,000

Marketing expenses: $500

Office utilities: $300

Software maintenance: $200

Miscellaneous: $100

Total monthly expenses: $5,100

We will initially fund the business through personal savings and a small business loan of $20,000.

Profitability timeline

We project to achieve profitability within the first year of operation, driven by a steadily growing client base and effective cost management.

Benefits of creating a bookkeeping business plan

A well-structured business plan will help you define your scope of services, target market, competitive landscape and pricing strategies. By outlining these aspects, the business plan acts as a blueprint that guides decision-making and resource allocation.

Secondly, a business plan aids in raising money for your business . Whether you’re seeking a loan, investment or other contributions, potential stakeholders will want to see a well-thought-out plan. It demonstrates your commitment and understanding of your business's potential for success. Financial projections within the plan illustrate the expected profitability and return on investment, offering a clear picture of the business's viability.

Moreover, a business plan assists in setting achievable goals and measuring progress. By establishing milestones and performance indicators, you can assess whether your bookkeeping business is on track and make necessary adjustments if not. This aspect is crucial when starting a business, as it ensures that the initial steps are strategic and effective.

Got another business idea in mind?

Not exactly sure what type of business to pursue? Check out the guides below and explore your options with service business ideas and service business examples .

How to start an online business

How to start a consulting business

How to start a fitness business

How to start a fitness clothing line

How to start a makeup line

How to start a candle business

How to start a clothing business

How to start an online boutique

How to start a T-shirt business

How to start a jewelry business

How to start a subscription box business

How to start a beauty business

How to start a landscaping business

How to start a food business

How to start a vending machine business

How to start a coaching business

How to start a construction business

How to start a trucking business

How to start a flower business

How to start a car wash business

How to start a food prep business

How to start a DJ business

How to start a pool cleaning business

How to start a baking business

Looking to start a business in a specific state?

How to start a business in Arizona

How to start a business in South Carolina

How to start a business in Virginia

How to start a business in Michigan

How to start a business in California

How to start a business in Florida

How to start a business in Texas

How to start a business in Wisconsin

Want to create another type of business plan?

How to create a real estate business plan

How to create a flower business plan

How to create a medical supply business plan

How to create a car wash business plan

How to create a contractor business plan

How to create a DJ business plan

How to create a dog walking business plan

How to create a clothing line business plan

How to create a construction business plan

How to create a painting business plan

How to create a plumbing business plan

How to create a rental property business plan

How to create a bar business plan

How to create a photographer business plan

How to create a cleaning business plan

How to create a restaurant business plan

How to create a coffee shop business plan

Related Posts

How to create a catering business plan

Was this article helpful?

Need a business plan? Call now:

Talk to our experts:

- Business Plan for Investors

- Bank/SBA Business Plan

- Operational/Strategic Planning

- L1 Visa Business Plan

- E1 Treaty Trader Visa Business Plan

- E2 Treaty Investor Visa Business Plan

- EB1 Business Plan

- EB2 Visa Business Plan

- EB5 Business Plan

- Innovator Founder Visa Business Plan

- UK Start-Up Visa Business Plan

- UK Expansion Worker Visa Business Plan

- Manitoba MPNP Visa Business Plan

- Start-Up Visa Business Plan

- Nova Scotia NSNP Visa Business Plan

- British Columbia BC PNP Visa Business Plan

- Self-Employed Visa Business Plan

- OINP Entrepreneur Stream Business Plan

- LMIA Owner Operator Business Plan

- ICT Work Permit Business Plan

- LMIA Mobility Program – C11 Entrepreneur Business Plan

- USMCA (ex-NAFTA) Business Plan

Franchise Business Planning

- Landlord Business Plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Cannabis business plan

- eCommerce business plan

- Online Boutique Business Plan

- Mobile Application Business Plan

- Daycare business plan

- Restaurant business plan

- Food Delivery Business Plan

- Real Estate Business Plan

- Business Continuity Plan

- Buy Side Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Examples

Bookkeeping Business Plan Sample

Mar.28, 2019

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

Table of Content

Do you want to start accounting and bookkeeping business plan?

A bookkeeping business requires you to manage your expenses and income, prepare tax returns for clients and process payrolls. You should learn how to approach clients and create a bookkeeping business plan template to get your business up and running. One thing you should not overlook is looking for an ideal banking partner. You should write a business plan before starting your business.

When a business plan is needed to acquire funding, the value it provides is all about the overall process. You need considering every aspect, like services and products, you are going to sell, the way you will market your offerings, and your competition. Here are some of the major items you should include in your business plan –

Executive Summary

When writing a bookkeeping services business plan template, the executive summary is a very important part. You need writing the overall review of your company business. You need describing your services to your clients. It will need investment in staff and marketing for the overall growth of your business to include the complementary range of your business. This segment of the business plan helps you in starting your own bookkeeping business . You need to do an in-depth and detailed analysis of your business strengths and weaknesses and ensure it has great odds of success.

- What services do you offer?

This way, your company can definitely provide bookkeeping services to your clients along with management accounting, tax accounting, as well as QuickBooks installation and services. You can also further expand to offer bookkeeping services for small businesses. You may want to offer quality and reliable services like Accounts Payable/Receivable, General Ledger, Billing & Collections, Payroll Management, Tax Preparation and Filling State, Federal and Local Forms.

- Who buys your product?

As a licensed and standard bookkeeping firm, you can offer a huge range of consulting solutions to a huge range of clients’ base. Your target market may be ranging from different industries and sizes. This way, you may want to target NGOs, Mom and Pop stores, Blue Chip companies, Hotels and Restaurants, Religious Organizations, Sports Organizations, Schools and others.

- How he implement business management?

Proper planning needs well-trained staff and efficient management team enough to run your business. You need describing the efficiency of your business partners and staff.

- What target of this business?

Here, you need describing your measurable goals. You should have a well-defined target and measurable elements to ensure the success of your business.

Company Summary

Financial services are quite a large industry and bookkeeping is one of the active segments of the businesses, which includes recording financial transactions in business. It is a kind of financial accounting process. The payroll and bookkeeping services industry has plenty of small business operators which serve many clients from start-ups to well-established ones.

Bookkeeping industry is a mature stage of growth. If you are wondering how to start a bookkeeping service business plan , it is very helpful to know how to outsource your human resource functions like payroll etc. to focus your attention on core business operations. The bookkeeping is a large and active industry especially in developed countries like USA, Canada, UK, France, Italy, Japan, China, etc. There are around 285,212 licensed and registered bookkeeping companies in the US alone.

- Who is owner of this company?

You need telling the ownership of your company, like a sole proprietorship, partnership, etc.

- Why you have started Bookkeeping business plan?

Bookkeepers usually keep transactions like sales, purchases, payments, and receipts by the organization or person. Your purpose to start this business may be related to one of these things.

- How you have to start the Bookkeeping business plan?

For doing this, you can partner with smaller companies also engaged in financial services, such as auditing firms, tax consulting firms, and others.

Here is the data in table containing the costs-

Services for customers

When creating an accounting business plan template , you need to describe what services you have on offer. Establishing the clientele of the accounting business takes time. It takes words of mouth, referrals, and recommendations for new clients to select your services. You may look at the advertisements or Yellow Pages to figure out the services your business can offer. Then you can add further information and pricing.

You should be prepared well to make profits from your industry. As a general overview of <strong>how to start a business plan template for home bookkeeping</strong>, you may offer the following services.

- Tax services like Tax Planning, Tax Preparation, addressing tax issues (IRS issues, payroll problems, bankruptcy, audit representation etc.)

- Cost Accountant/Management services like Cost and Margin analysis, Audits, Credit Card Processing setup, and Financial Projection

- QuickBooks training, QuickBooks setup, etc.

Along with these, your accountants may add these bookkeeping solutions –

- Sales tax processing

- Payroll processing

- Accounts receivable (invoicing, entry, collection, deposits etc.)

- Accounts payable (bill payments, entry)

- Bank Reconciliations

- Financial statement preparation

- Inventory Management

To add further value to your offerings, your accountant or bookkeeping manager may audit and supervise the work of bookkeepers, answer their queries, and provide quality service. They will also review QuickBooks reports and files to ensure they follow the formats properly and are prepared well.

Marketing Analysis of Accounting and Bookkeeping Business Plan

The market for small accounting business consists of almost every small business in the US. As businesses grow larger than a sole proprietorship, they usually need an expert solution with tax preparation and additional bookkeeping and accounting solutions. Even most of the non-employer proprietorships need accounting services at least once. When most small businesses have CEOs or bookkeepers for full time, some even outsource these services. When making home based bookkeeping business plan template, you need to consider the following questions –

- Who is the targeted audience of accounting and bookkeeping business?

Promotion activities in your business also vary according to your target market. When it comes to choosing an accountant, there is a great importance of referrals and words of mouth among all market segments. There are certain efforts you need to take to stimulate business when starting your own bookkeeping business plan home . You need creating a cost-effective business campaign, based on publicity, direct marketing, advertising, and customer reward program.

- What business target should company achieve?

Your business target clarifies what you want to achieve in your specific goals. You need to have a well-defined target with measurable elements to make an effective goal. There are different types of goals, and your plan should have a variety of goals. There are two different categories of goals for many businesses – marketing and financial targets. You need to tailor your objectives to cover the overall bookkeeping business.

- How much will be the average price of the product?

Here, you need to describe how much you are going to charge for your services. You should consider fee structure for your business clients according to their unique needs. On average, you may charge $55 on an hourly basis for businesses for accounting services. There is a base fee range of $50 to $125 for personal/housing tax preparation. There are also charges for filing in the schedules and forms involved. The personal consulting is also priced at an hourly rate of $25.

Referrals are the effective and most important parts of your business. Therefore, you need to be more aggressive in attracting new clients in the first few years, which will pass on the words and your business, can start experiencing natural growth. Useful and constructive planning needs a broad and detailed understanding of changes, which take place in the market where your company has competition, or want to compete.

SALES FORECAST

You also have to consider the ever-changing and thriving financial markets when starting your own bookkeeping business home . You need considering detailed technical skills in different disciplines like financial analysis, tax, sales, managing growth, and marketing, which are the important components to assess the risks and opportunities in a company.

- Who are your competitors?

When writing a business plan tamplate for bookkeeping business , you need to explain how you are going to stand out in competition. You may want to have detailed technical skills in different disciplines like financial analysis, tax, sales, managing growth, and marketing. These are the important components to assess the risks and opportunities for the company. Your management should develop disciplined planning and methodology to anticipate your economic needs and other important information.

- What is your sales strategy?

It is a strategy for business plan to sell your services to your existing clients, especially before your marketing efforts pay off with upcoming inquiries. You need to inform about the services to all the clients by phone. You may approach the clients through regular sales calls.

- What about your sales forecast?

When writing a business plan template for a bookkeeping business , describe the average cost of a project like tax services ($750), QuickBooks services ($300), and cost accounting ($1000). Bookkeeping services are charged on an hourly basis, i.e. $30 per hour.

Personnel Plan

When creating a business plan for accounting services , you might want to have a bookkeeping manager who will keep track of the work of bookkeepers. He will be in MS or MBA accounting program with years of bookkeeping and professional work experience, especially at the beginning of their graduate school program so they can work through two years of the program and be considered for a move to a full-time position in the third year.

The manager will also move from part-time to a full-time position in a few years to come. In the personnel plan, you need to explain about the staff you are going to hire and the team you have already.

- What staff would be needed for accounting and bookkeeping company?

In this part of the bookkeeping business plan template, explain what staff you would need for your company. You have to explain the key business members of your business. You need to explain whether you would hire full time or part-time staff. Will you need additional support staff to further expand your business? You need to explain key members of your business.

- What will be the average salary of your staff?

You will also have to explain the salary of your staff on average, along with office and other expenses during the first year. You can describe this part in detailed form.

Very professional

Had a great experience with OGS, especial ly Alex. Understood exactly what I wanted and did the job when promised. I was little skeptical about them at first but they definitely were amazing. Very happy with the work. I highly recommend them!

Financial Plan

This section of your bookkeeping company business plan consists of growth with positive cash flows with operations. It is unimportant to add owner investment or outside investment for business plan . The new line of business is not capital based and it will improve the fixed costs of business. Additional revenues from sales should cover it quickly. At least five clients use service without any problem, as they are all set to use bookkeeper or outsource their bookkeeping. Here are some of the assumptions of financial plan –

Important Assumptions

You need to describe your assumptions on the growth of your business over the next 2 to 3 years. You need to explain the working hours of your bookkeepers before reaching the capacity.

Break-even Analysis

It should be based on fixed costs behind running the business with old lines of your business. It is a significant rise from the breakeven point. You can describe your payroll, capacity, marketing activity, expenses of new bookkeeper, insurance, cost of sales etc.

Projected Profit and Loss

Here, you need to explain the proposed income and expenses of your business as well as the overall profit and loss. Also, explain how you are going to balance them.

Projected Cash Flow

You will need to explain the overall cost requirement in the first year and how you will balance out and get back to the positive cash flow in the next few years to come.

Projected Balance Sheet

If your new business succeeds as you expect, the net worth can improve in your business. Explain the debt of the business as well as external financing.

Business Ratios

You will need to explain the overall ratio of your assets with net worth. Explain how gross margins can be higher than averages.

Download Bookkeeping Business Plan Sample in pdf

OGS capital writers specialize in business plan themes such as credit repair business plan , finance business plan , business plan for a financial advisor , holding company business plan , insurance agency business plan , insurance business plan and many other business plans.

OGSCapital’s team has assisted thousands of entrepreneurs with top-rate business plan development, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

Vegetable Farming Business Plan

Trading Business Plan

How To Write A Textile Manufacturing Business Plan

Start a Vending Machine Business in 2024: A Detailed Guide

Oil and Gas Business Plan

What Is Strategic Planning: Definition and Process

Any questions? Get in Touch!

We have been mentioned in the press:

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search the site:

Bookkeeping Business Plan

Many business owners don’t enjoy bookkeeping. Even if someone feels okay about it, they might not have enough time. Mistakes can happen easily when owners try to do the books by themselves. Small mistakes or not keeping track of payments can lead to problems which cost a lot of money.

Recognizing the challenges that business owners face in maintaining accurate financial records, our team of Fresno business plan writers have crafted this bookkeeping business plan sample to address these specific concerns. While bookkeeping may appear straightforward, the reality is that it’s surprisingly easy to make mistakes. Therefore, entrusting this responsibility to a small business book keeper is essential for effective financial management. Professional bookkeeping firm in Fresno, California plays a pivotal role in supporting business owners by ensuring the careful and thorough recording of transactions. Beyond the immediate challenge of avoiding errors, these services contribute to the creation of a reliable financial foundation.

At the end of the day, good bookkeeping businesses give companies reliable financial information, which is really important for making decisions. This article will explain what is a bookkeeping business, why businesses need it, and what kind of services they might get.

What are Bookkeeping Services

Bookkeeping services involve the recording and tracking of a business’s financial transactions. Periodically, bookkeepers are required to prepare financial reports that summarize the performance of the business.

What Services Does a Bookkeeper Provide

Basic business bookkeeping services encompass the management of various financial statements, including:

- Income Statement: Income statement details revenue and expenses over a specific period, providing a comprehensive overview of the company’s financial performance.

- Balance Sheet: Bookkeeping for small business offers insight into the current financial state of the business, the balance sheet outlines assets, liabilities, and equity.

- Cash Flow Statement: The cash flow statement serves as a record of cash and cash-like equivalents entering and leaving the organization. The business bookkeeping service provides clarity on the business’s cash position.

- Statement of Owner’s Equity: Detailing changes in your share of capital, reserves, and retained earnings during a reporting period, this statement offers a snapshot of the company’s financial health.

Why do Businesses Need Bookkeeping

With the list of booming bookkeeping business in the US, ever wondered why your business could benefit from their business bookeeping services? Why bother with bookeeping services? Well, starting how to book keep your business isn’t as simple as it seems.

Bookkeeping is a challenging task. Unless you hold a degree in accounting, the basics of bookkeeping may not come naturally. It’s a learning curve. Often, bookkeeping can be dull. It’s all about numbers. It can be disheartening to see your business expenses go up while revenue takes a dip.

Primarily for starters, book keeping for beginners can eat up a lot of time. And here’s the kicker – bookkeeping is prone to mistakes, and those mistakes can cost you.

Having a professional bookkeeper for business ensures that your books are well-organized, and your deductions are legitimate. The right bookkeeping service can make navigating through any audit a breeze.

Why Choose Bookkeeping Services

For businesses opting to outsource bookkeeping and accounting services, the decision often translates to saving resources, gaining access to high-quality financial services, and receiving proactive advice. This bookkeeping business from home helps business owners in many ways such as:

- Better Budgeting: Gain a clear understanding of where every dollar is spent.

- Easy Tax Filing: Ensure compliance with tax regulations for a stress-free filing experience.

- Audit-Proof Business: Maintain IRS-required documents to make your business audit-proof.

- Understanding Seasonal Changes: Analyze and comprehend your company’s seasonal fluctuations.

- Insight into Financial Metrics: Know your revenue, costs, and overall profitability.

- More Time for Operations: Free up time to focus on core business operations .

How to Start a Bookkeeping Business

If you have a strong background in accounting doing your own bookkeeping and aspire to turn your bookkeeping skills into a bookkeeper small business, you are about to embark on a unique opportunity in the US. Numerous small businesses require assistance in filing taxes and maintaining accurate financial records, making the establishment of a bookkeeper business both profitable and rewarding.

Starting a bookkeeping business doesn’t necessarily require professional training or certifications, but having a good understanding of the costs, along with knowing how to set up a bookkeeping business, can significantly contribute to the success of your bookkeeping startup. If you are searching, “what do i need to start a bookkeeping business” on the web, below is a checklist for starting a bookkeeping business:

Choose Your Market

As you plan to open a bookkeeping business, think about what kind of business you want to help. Maybe you want to focus on a specific type of business or offer catch-up services for those who are behind.

Create a Business Plan

Every new business needs a plan. In your accounting firm business plan, include key points, what services you will offer, why you’re better than others, research about your market and how you’ll tell people about your business. Also, pick a bookkeeping business name that is easy for customers to remember and check if it is not already taken.

Get Certified

You don’t need a lot of education, but having a certification like a certified public bookkeeper can show you’re good at what you do. If you are starting a bookkeeping business with Quickbooks, all you need to do is complete the accounting fundamentals course and pass the bookkeeping certification exam online.

Register and Get Insured

Decide how your business will be set up. If you’re working alone, you’re a sole proprietor. You might also be a partnership, bookkeeping for LLC , or a corporation. Get insurance to protect yourself if you make a mistake in someone’s books and consider other insurance if you hire employees.

Choose Software

Pick the right software to help with your bookkeeping for business. You might also need other software to help with payments and bills.

Set Up Your Business

Your bookkeeper checklist must include how to set up a bookkeeping business. In starting a bookkeeping and tax preparation business, you will need a website and a CRM system to keep track of your clients.

Decide on Prices

When you’re just starting your small business bookkeeping service, it’s important to determine how much to charge for your services. As a beginner small business basic bookkeeping, you need to consider your experience. Look at what other bookkeepers in your area charge for small business bookkeeper services.

Find Customers

Now, let’s focus on getting clients for your bookkeeping business. Marketing bookkeeping business through different social media platforms. Building a strong social media presence for your bookkeeping business requires consistency in publishing informative content, and staying engaged with your audience.

Research Funding Options

If you need funding in starting your own bookkeeping business, research different ways to get it.

Check with your local bank for small business loans. Having a good business plan can increase your chances of approval.

- Business Credit Card

Consider getting a business credit card for initial expenses. Use it responsibly to build positive credit for your business.

Explore loan programs from the U.S. Small Business Administration (SBA). They provide support for small businesses at different stages of development.

Let's Get Started!

- Your Name *

- Email Address *

- Phone Number

How Much does it Cost to Start a Bookkeeping Business