Timely news, information and advice concentrating on FHA, VA and USDA residential mortgage lending.

FHA Home Loan Rules For New Construction Appraisals

May 25, 2018

Borrowers who are interested in having a home built for them from the ground up using an FHA construction loan such as an FHA One-Time Close mortgage or any other type of FHA-guaranteed mortgage loan may wonder what the rules are for appraisals.

After all, existing construction appraisal processes are for a home that is ready to sell (although the process may vary if the borrower is applying for certain types of rehab loans).

While the appraisal requirements may be generally the same-the home must be safe, habitable, and have an economic life for the entire duration of the mortgage-there are procedural issues that affect new construction properties.

With that in mind, appraisals on new construction run a bit differently in some procedural ways than existing construction mortgages; with the construction loan the appraiser must perform their work within a specified set of parameters that may be affected by the progress of the construction.

From HUD 4000.1 we learn that some parameters of the FHA appraisal apply to both existing and new construction loans:

“The effective date of the appraisal cannot be before the FHA case number assignment date unless the Mortgagee certifies that the appraisal was ordered for conventional lending or government-guaranteed loan purposes and was performed pursuant to FHA guidelines.

New construction appraisal rules in HUD 4000.1 include guidelines for the appraiser to review the project’s documentation:

“When performing an appraisal for a sales transaction or on New Construction (emphasis ours) , the Appraiser must also review and analyze:

- the complete copy of the executed sales contract for the subject; and

- documents related to New Construction, including plans, specifications, and any exhibits provided that will assist the Appraiser in determining what is to be built, or, if now Under Construction, what will be built when finished; and report the results of that analysis in the appraisal report.”

But the construction phase for any FHA One-Time Close mortgage or other FHA construction loan options doesn’t always run to a standardized schedule; the appraiser may need to do her work before or after the construction reaches the 90% completion point. HUD 4000.1 addresses requirements depending on when the appraiser does the work:

“When New Construction is less than 90% complete at the time of the appraisal, the Appraiser must document the floor plan, plot plan, and exhibits necessary to determine the size and level of finish. When New Construction is 90% or more complete, the Appraiser must document a list of components to be installed or completed after the date of appraisal.”

What about contractor work to be performed on existing construction homes to be purchased with an FHA mortgage? HUD 4000.1 includes some guidance in this area, too:

“For labor on Existing Construction, the Mortgagee must also obtain an appraisal indicating the repairs or improvements to be performed. (Any work completed or materials provided before the appraisal are not eligible.)”

Want More Information About One-Time Close Loans?

One-Time Close Loans are available for FHA, VA and USDA Mortgages. These loans also go by the following names: 1 X Close, Single-Close Loan or OTC Loan. This type of loan allows for you to finance the purchase of the land along with the construction of the home. You can also use land that you own free and clear or has an existing mortgage.

We have done extensive research on the FHA (Federal Housing Administration), the VA (Department of Veterans Affairs) and the USDA (United States Department of Agriculture) One-Time Close Construction loan programs. We have spoken directly to licensed lenders that originate these residential loan types in most states and each company has supplied us the guidelines for their products. We can connect you with mortgage loan officers who work for lenders that know the product well and have consistently provided quality service. If you are interested in being contacted to one licensed construction lender in your area, please send responses to the questions below. All information is treated confidentially.

OneTimeClose.com provides information and connects consumers to qualified One-Time Close lenders in an effort to raise awareness about this loan product and to help consumers receive higher quality service. We are not paid for endorsing or recommending the lenders or loan originators and do not otherwise benefit from doing so. Consumers should shop for mortgage services and compare their options before agreeing to proceed.

Please note that investor guidelines for the FHA, VA and USDA One-Time Close Construction Program only allow s for single family dwellings (1 unit) – and NOT for multi-family units (no duplexes, triplexes or fourplexes). You CANNOT act as your own general contractor (Builder) / not available in all States.

In addition, this is a partial list of the following homes/building styles that are not allowed under these programs: Kit Homes, Barndominiums, Log Cabin or Bamboo Homes, Shipping Container Homes, Dome Homes, Bermed Earth-Sheltered Homes, Stilt Homes, Solar (only) or Wind Powered (only) Homes, Tiny Homes, Carriage Houses, Accessory Dwelling Units and A-Framed Homes.

Your email to info@ onetimeclose.com authorizes Onetimeclose.com to share your personal information with a mortgage construction lender licensed in your area to contact you.

- Send your first and last name, e-mail address, and contact telephone number.

- Tell us the city and state of the proposed property.

- Tell us your and/or the Co-borrower’s credit profile: Excellent – (680+), Good – (640-679), Fair – (620-639) or Poor- (Below 620). 620 is the minimum qualifying credit score for this product.

- Are you or your spouse (Co-borrower) eligible veterans? If either of you are eligible veteran’s, down payments as low as $0 may be available up to the maximum amount your debt-to-income ratio VA will allow – there are no maximum loan amounts as per VA guidelines. Most lenders will go up to $1,000,000 and review higher loan amounts on a case by case basis. If not an eligible veteran, the FHA down payment is 3.5% up to the maximum FHA lending limit for your county.

By Joe Wallace

Joe Wallace has been specializing in military and personal finance topics since 1995. His work has appeared on Air Force Television News, The Pentagon Channel, ABC and a variety of print and online publications. He is a 13-year Air Force veteran and a member of the Air Force Public Affairs Alumni Association. He was Managing editor for www.valoans.com for (8) years and is currently the Associate Editor for FHANewsblog.com.

Connect with Joe:

Browse by Date:

Posted in: FHA One-Time Close , HUD Regulations

Tagged with: Appraiser , FHA Appraisal Rules , FHA Appraisals , FHA One-Time Close Construction Loan , First-time Home Buyer

About FHANewsBlog.com FHANewsBlog.com was launched in 2010 by seasoned mortgage professionals wanting to educate homebuyers about the guidelines for FHA insured mortgage loans. Popular FHA topics include credit requirements, FHA loan limits, mortgage insurance premiums, closing costs and many more. The authors have written thousands of blogs specific to FHA mortgages and the site has substantially increased readership over the years and has become known for its “FHA News and Views”.

5850 San Felipe Suite #500, Houston, TX 77057 281-398-6111. FHANewsBlog.com is privately funded and is not a government agency.

- Print Friendly

Call or Text: (800) 900-8569

Email Us: [email protected]

What is an FHA Case Number on FHA Home Loans

This blog will cover and discuss the FHA case number on new FHA mortgage applications. We will also discuss transfers from one lender to a new lender. FHA loans are the most popular loan program in the U.S. Borrowers with lower prior bad credit scores can benefit from FHA loans compared to conventional loans. Not all lenders have the same lending guidelines. Mortgage lenders can have lender overlays.

Lenders will consider your debt-to-income ratio on your ability to repay your mortgage loan. HUD guidelines generally allow for a higher debt-to-income ratio than other loan programs.

HUD, the parent of FHA, created and launched FHA loans so first-time homebuyers and buyers with less than-perfect credit can qualify for a home loan. HUD’s mission is to promote homeownership to hard-working American families by making homeownership affordable. In the following paragraphs, we will cover what the FHA case number is and how the FHA case number process works.

Table of contents "Click Here"

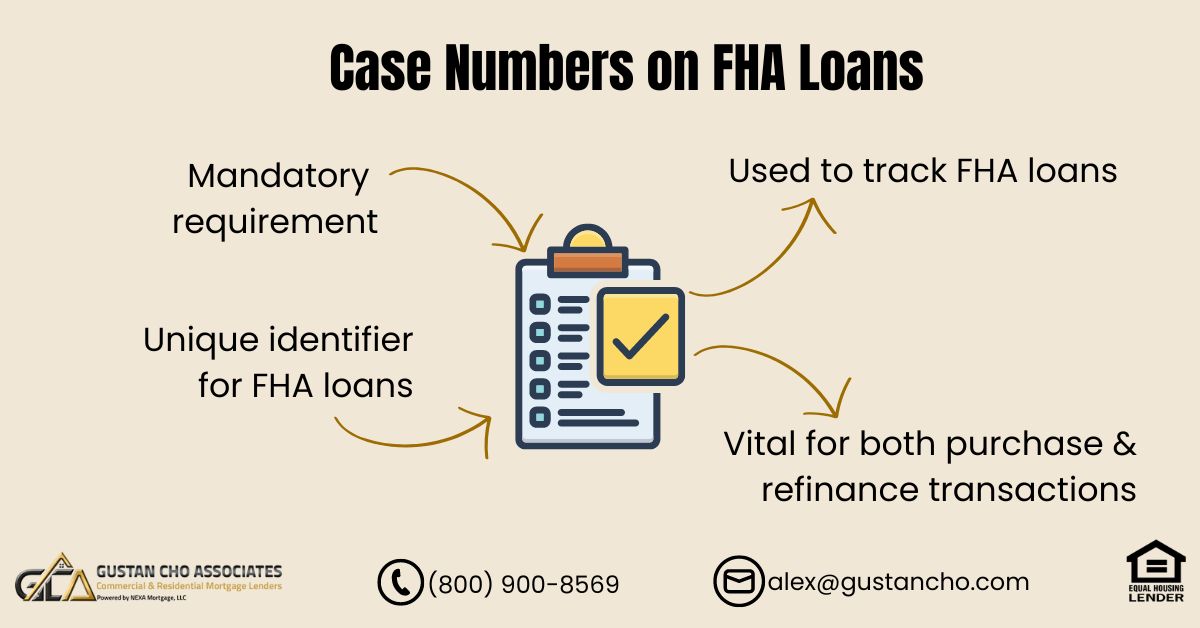

What is the Definition of an FHA Case Number

An FHA case number is a unique identifier assigned to a specific FHA-insured mortgage loan. The Federal Housing Administration (FHA) uses case numbers to track and manage the various loans it insures. When a borrower applies for an FHA-insured home loan, the lender initiates the loan process by obtaining an FHA case number. The FHA case number is crucial for tracking and managing the loan. It is used in various documents and systems related to the FHA-insured loan, including endorsements, claims, and other administrative processes.

Speak With Our Loan Officer for Getting Mortgage Loans

How Does the FHA Case Number Process Work

Here’s how the FHA case number process generally works: The borrower applies for an FHA-insured mortgage loan through a HUD-approved lender. The lender submits the necessary information of the borrower and the loan to the FHA for approval. This includes details such as borrower information, property details, and terms.

Once HUD receives the loan information, it assigns a unique case number to that specific loan application. HUS reviews the loan application and, if everything meets its requirements, provides approval for the loan.

With FHA approval, the lender can proceed with processing and underwriting the loan. If the loan is approved and closes, it becomes an FHA-insured loan, and the FHA case number remains associated with that loan throughout its life. Borrowers and lenders use the FHA case number for reference when communicating with the FHA or accessing loan information. It helps ensure that all parties can easily identify and track the specific FHA-insured loan.

Importance of Case Numbers on FHA Loans

A mandatory requirement for all FHA loans is the inclusion of Case Numbers. The FHA Case Number, a distinctive 10-digit identifier, is allocated to each borrower’s loan file. The assignment of the Case Number is carried out through the case number assignment on FHA Connection . The term “case” refers to the specific FHA loan to which this number is assigned. Irrespective of whether it is a purchase or refinance, the Case Number is obligatory for every FHA loan and is assigned when a borrower applies for such loans.

How To Read FHA Case Number

The initial three digits of an FHA case number indicate the geographical area, including the county and state. The concluding three digits correspond to the ACT sections where FHA Insurance was issued for each property.

You can find the case number at the top of each page in a completed FHA home appraisal.

When a borrower utilizes an FHA loan to purchase a home, the assigned case number pertains to the purchased property. While case numbers can be transferred from one borrower to another, they cannot be transferred from one property to another.

How HUD Case Number Connections Work

Once a home buyer, pre-approved for an FHA loan, initiates the FHA loan process, the lender must acquire a Case Number for the property specified in the buyer’s contract. Nevertheless, the Case Number becomes null and void if the buyer opts not to proceed with the home purchase.

Getting a New FHA Case Number

If a borrower opts to acquire an additional property, obtaining a new Case Number for the second property becomes necessary. In the given scenario, should a different homebuyer wish to buy the initial property previously canceled by the initial borrower, the only requirement is for the new homebuyer to have the Case Number for the initially canceled property transferred to them. In cases where multiple lenders are involved, it can lead to delays in the mortgage process. Lenders holding the original case numbers must facilitate the release of the case Numbers to the new lender.

Qualify For FHA Loans, Click Here

How Long Is The FHA Case Number Valid

If an FHA loan with an assigned case number does not close within six months, the initial FHA case number will be voided. In the scenario where FHA modifies the HUD 4000.1 FHA Handbook, replacing it with a revised HUD Handbook that includes changes such as an increase in FHA MIP.

The changes on the updated revised HUD 4000.1 FHA Handbook, the alterations become effective for case numbers assigned on or after the date of the updated FHA programs and guidelines.

FHA case numbers assigned before this date will continue to be underwritten based on the guidelines before the changes as long as the FHA Loan closes within six months.

Benefits of FHA Loans

HUD established mortgage guidelines that are accommodating in terms of down payments and credit requirements. As the overseeing entity of the FHA, HUD aims to enable diligent Americans to achieve homeownership. FHA loans prove advantageous for those with limited funds for a down payment, lower credit scores, higher debt-to-income ratios, bankruptcy or a prior housing event.

Thanks to the government guarantee, lenders have the flexibility to provide FHA loans for home purchases with a minimal 3.5% down payment.

Homebuyers need a credit score as low as 580, all while offering attractive mortgage rates. FHA loans are popular among homebuyers, especially those with less-than-perfect credit and lower credit scores. Remember that guidelines may be subject to change, so it’s essential to verify the latest update on the HUD 4000.1 FHA Handbook with a mortgage professional.

HUD Down Payment Requirements on FHA Loans

The down payment requirement on FHA loans differs depending on the credit score. If you have at least a 580 credit score, the down payment required is 3.5% of the purchase price. If your credit scores fall under 580 and down to 500, a 10% down payment is required on FHA loans. The low down payment requirement makes it possible for renters with a small down payment to become homeowners.

HUD Mortgage Insurance Premium (MIP)

FHA loans require borrowers to pay an upfront mortgage insurance premium (UFMIP) at closing and an annual mortgage insurance premium (MIP) throughout the life of the loan. This is to protect the lender in case of default. FHA loan limits vary by county and are adjusted annually. There are limits on the maximum loan amount you can borrow based on the property’s location.

FHA 203(k) Rehabilitation Loans

HUD offers acquisition and renovation loans for one to four units of owner-occupant homers. HUD offers a 203(k) program that allows borrowers to finance a home’s purchase and rehabilitation costs in one loan. FHA loans do not have prepayment penalties, allowing borrowers to pay off the mortgage early without incurring additional fees.

We highly recommend you contact multiple lenders to compare their requirements and terms is recommended if you’re considering an FHA loan.

It’s crucial to note that individual lenders may have additional requirements or overlays beyond the basic HUD guidelines. You should check the official HUD website or consult a mortgage professional familiar with FHA loan guidelines for the most current and accurate information. Remember that these guidelines may have been updated or changed without notice.

HUD Agency Guidelines on FHA Loans

Borrowers applying for an FHA loan will be assigned an FHA Case Number. Borrowers will need to meet the minimum agency mortgage guidelines on FHA loans. HUD allows homebuyers to purchase a home with a 3.5% down payment and a 580 credit score.

Borrowers with under 580 down to 500 credit scores can qualify for FHA loans. However, any borrower with under 580 credit scores will need a 10% versus 3.5% down payment.

Borrowers can qualify for an FHA loan with a prior bankruptcy or foreclosure if they meet the minimum waiting period requirements. Outstanding collections and charged-off accounts do not have to be paid to qualify for FHA loans. HUD’s role is to promote homeownership for homebuyers of all types. All FHA borrowers will need an FHA case number. You can only have one FHA case number.

Speak With Our Loan Officer for FHA Loans

Qualifying For FHA Loans

FHA loans are the most popular loan program in the U.S. FHA loans are popular with first-time home buyers, home buyers with outstanding collections and charge-offs, buyers with higher debt-to-income ratios, and homebuyers with little to no credit. Here are the basic HUD guidelines on FHA loans:

- 580 FICO credit score

- 3.5% down payment

- 46.9% front end and 56.9% back end DTI

- Non-Occupant Co-Borrowers allowed

- 100% of the down payment can be gifted

- No Closing Costs: Closing Costs can be covered with seller concessions or lender credit

HUD requires that the property meets HUD agency standards and will be habitable to be eligible for an FHA loan. The HUD appraiser will assess the property to ensure it meets HUD’s minimum property requirements. To qualify for an FHA loan, don’t hesitate to contact us at Gustan Cho Associates at 1-800-900-8569 or text us for a faster response. Or email us at [email protected] . The Gustan Cho Associates Mortgage Group team is available 7 days a week, evenings, weekends, and holidays.

FAQs: What is an FHA Case Number on FHA Home Loans

What is an FHA Case Number, and why is it important? An FHA Case Number is a unique identifier assigned to a specific FHA-insured mortgage loan. It is crucial for tracking and managing the loan throughout its life. The case number is used in various documents and systems related to FHA-insured loans, including endorsements, claims, and administrative processes.

How does the FHA Case Number process work? The borrower applies for an FHA-insured mortgage through a HUD-approved lender. The lender submits necessary information to the FHA for approval, and a unique case number is assigned upon approval. This number remains associated with the loan, helping parties easily identify and track the specific FHA-insured loan.

What are the benefits of FHA loans? FHA loans are advantageous for those with limited funds for a down payment, lower credit scores, and higher debt-to-income ratios. They offer a minimal 3.5% down payment requirement, lower credit score thresholds, and flexibility for borrowers with past financial challenges.

What are the down payment requirements for FHA loans? The down payment requirement on FHA loans varies based on credit score. A credit score of at least 580 requires a 3.5% down payment, while scores below 580 to 500 require a 10% down payment. The low down payment makes homeownership accessible for those with limited funds.

What is the HUD Mortgage Insurance Premium (MIP)? FHA loans require borrowers to pay an upfront mortgage insurance premium (UFMIP) at closing and an annual mortgage insurance premium (MIP) throughout the loan’s life. This insurance protects lenders in case of default.

How are FHA Case Numbers connected to property purchases? The assigned case number pertains to the property purchased using an FHA loan. While case numbers can be transferred from one borrower to another, they cannot be transferred from one property to another.

How long is an FHA Case Number valid? If an FHA loan with an assigned case number does not close within six months, the initial case number becomes void. Changes in FHA guidelines or programs after the case number assignment date will only apply to loans closing after six months.

What are the basic HUD guidelines for qualifying for FHA loans? Basic HUD guidelines for FHA loans include a minimum FICO credit score of 580, a 3.5% down payment, front-end DTI of 46.9%, back-end DTI of 56.9%, allowance for non-occupant co-borrowers, and the option for 100% gifted down payment.

Can FHA loans be used for property rehabilitation? Yes, FHA offers a 203(k) rehabilitation program that allows borrowers to finance a home’s purchase and renovation costs in one loan.

We Work Weekends, Click Here For Contact Us

This blog about What is an FHA Case Number on FHA Home Loans was updated on January 25th, 2024.

Gustan Cho NMLS 873293 is the National Managing Director of NEXA Mortgage, LLC dba as Gustan Cho Associates NMLS 1657322. Gustan Cho and his team of loan officers are licensed in multiple states. Over 75% of the borrowers of Gustan Cho Associates (Gustan Cho Associates) are folks who could not qualify at other lenders due their lender overlays on government and conventional loans. Many mortgage borrowers and real estate professionals do not realize a mortgage company like Gustan Cho Associates exists. We have a national reputation of being a one-stop mortgage company due to not just being a mortgage company with no lender overlays but also offering dozens of non-QM and alternative financing loan programs. Any non-QM mortgage loan program available in the market will be offered by the team at Gustan Cho Associates. Our team of support and licensed personnel is available 7 days a week, evenings, weekends, and holidays.

Similar Posts

Steps of the Home Mortgage Process

Share on X (Twitter) Share on Facebook Share on Pinterest Share on LinkedIn Share on Email Share on Reddit This…

Unemployment Rate Falls To 50-Year Low For The United States

Share on X (Twitter) Share on Facebook Share on Pinterest Share on LinkedIn Share on Email Share on RedditThis Breaking…

Delegated Versus Nondelegated Mortgage Underwriting

Moving To Another Owner-Occupied Home Without Selling

Share on X (Twitter) Share on Facebook Share on Pinterest Share on LinkedIn Share on Email Share on Reddit In…

Mortgage Approval Conditions and Clearing For a CTC

The initial loan approval from the mortgage loan approval lists a set of conditions from the mortgage loan underwriter. Once the loan conditions are satisfied, the mortgage underwriter will issue will issue a clear to close.

10-Year Treasury Yield Surges To A 12-Month High Rising Rates

Case number 091 4211637 what the status my mom passed away 03 03 2021 i submit all information to novad 04 2020 i have heras from them. I m her son contact aulkien mcgriff

Please contact us with your contact information at [email protected] . Or call us at 262-716-8151 or text us for a faster response.

My mother passed away in SEP 15-2021, my brother is the trustee to the trust of MARY L. GAY estate, he has kept me out of the loop such as reverse mortgage monthly statement. this is the case #044-4319571-952-34526, 37371807 second deed of trust. my Email is [email protected]

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

IMAGES

VIDEO

COMMENTS

Updated: 12/2023 Case Number Assignment - 5 Single Family FHA Single Family Origination > Case Processing > Case Number Assignment meantime, case processing can continue; you can enter the case information and obtain a case number (see Establish a New Case: Case Number Assignment). Loan Application Certification. For case numbers assigned on or ...

Administration (FHA) New Construction financing in alignment with the regulatory amendments announced in the 2018 Final Rules that streamlined inspection and warranty requirements. Effective Date This guidance may be used immediately for existing cases and must be used for FHA case numbers assigned on or after January 4, 2021.

Case Detail, available on the Single Family Servicing (Monthly Premiums) menu, provides current information for all FHA cases, both endorsed and non-endorsed, based on the status of the requested case. If the case has not been insured, case information is retrieved from CHUMS, and CHUMS Last Action is displayed as the key status field.

additional requirements for requesting a case number, see HUD 4155.2 1.D.3.e cancellation of case numbers, see HUD 4155.2 1.D.4, and FHAC, see the FHA Connection Guide. 4155.2 1.D.3.b Requesting Case Number Before Appraiser Assignment Lenders may request a case number in FHAC without first having to select an appraiser from the FHA Appraiser ...

of case assignment. All forbearance plans, for all properties, must be terminated prior to closing. Foreclosure: New case number assignment must be dated at least 3 years + 1 day. * Deed in Lieu: New case number assignment must be dated at least 3 years + 1 day Short Sale: New case number assignment

The Case Processing menu allows online processing of a mortgage from initial request for a case number through the endorsement of the mortgage for FHA insurance. Listed below are descriptions of the options on the Case Processing menu. See also the FHA Connection Guide for more detailed information on Case Processing [PDF], Case Number Assignment [PDF], HECM Financial Assessment [PDF], Holds ...

The first step in establishing a new case using the FHA Connection is to click the Establish a New Case link on the Case Number Assignment menu. This takes you to the Validate Borrower/Address for Case Number Assignment page where you enter: property address, that is validated against the U.S. Postal Service database.

The case number assigned is used in subsequent transactions and inquiries in the FHA Connection. The lender should gather required information before beginning this process. (1) The FHA Approval Lists menu provides one way to look up some information with its lists of appraisers, inspectors, underwriters, and other relevant information. (2) To ...

"The effective date of the appraisal cannot be before the FHA case number assignment date unless the Mortgagee certifies that the appraisal was ordered for conventional lending or government-guaranteed loan purposes and was performed pursuant to FHA guidelines. New construction appraisal rules in HUD 4000.1 include guidelines for the ...

FHA Case Number is a unique 10-digit number assigned to a loan through Case Number Assignment on FHA Connection. The loan # is a case. Skip to content. Call or Text: (800) 900-8569. Search. Email Us: [email protected]. About Us. Contact Us; ... This blog will cover and discuss the FHA case number on new FHA mortgage applications. We will also ...

FHA Case Number/ Appraiser Additional File Number. Reminder that this is to be formatted as numeric ... Property/Assignment Type Acceptable Reporting Form Compliance or Final Inspection for New Construction or Manufactured Housing Form HUD-92051, Compliance Inspection Report, in Portable Document Format (PDF)

FHA CASE NUMBER ASSIGNMENT FORM ... (Month required for New Construction or Less than one year old) Please send to [email protected] Note: There must be a loan # established in the system in order to upload the FHA Case Number. Rev 04/2022 . Author: Deanna Slicker

HUD Mortgagee Letter 2019-13 provides instructions for obtaining an FHA case number for a unit in a Condominium Project that is not FHA-approved and will be processed as a Single-Unit Approval. This new policy/process went into effect for FHA back on October 15, 2019. It is a five-step process to receive FHA Condo Single-Unit Approval.

The Housing Finance Agency (FHFA) increased the conforming loan limit values (CLLs) for mortgages Fannie Mae and Freddie Mac will acquire in 2024. In most of the United States, the 2024 CLL value for one-unit properties will be $766,550, an increase of $40,350 from 2023. Read More →. Nov 21, 2023.

The password format for the file should be FHA + the first five digits of the requestor lender ID (i.e., FHA12345). Encrypted documents that cannot be opened using the lender ID on file will be returned. If you have any questions regarding these procedures, email the FHA Resource Center at [email protected] or call 1-800-CALLFHA (225-5342).

FHA Case Number Request 01/14/20 Page 1 of 1 Version 2020-2 Order an FHA Case Number using the instructions below: 1. Complete the form below in its entirety. Incomplete requests will delay the FHA Case Number from being ordered. 2. E-mail completed form to [email protected] In e-mail subject line, please include NewRez

This option cannot be selected for cases assigned an FHA case number on or after February 1, 2010 (per Mortgagee Letter 2009-46A). Single-Unit Approval: Condominium unit is not located in an FHA-approved condominium project at the time of case number assignment.

Here's the short answer: FHA appraisals typically remain valid for 120 days. But they can be extended in certain cases. If the initial home appraisal is updated, it could be valid for a total period of up to 240 days. Let's go to the official handbook and see what it says on this subject. The first mention of a 120-day rule occurs in Part ...

The field descriptions for the Case Number Assignment page are listed below in the order they appear on the page under their section headings: ... New Construction ... This option cannot be selected for cases assigned an FHA case number on or after February 1, 2010 (per Mortgagee Letter 2009-46A). ...