- Search & Discover

- Get Involved

- Research Guides

Industries in Australia

- Market research

Find profiles, forecasts, statistics and other information on Australian industries & markets

- Get started

- Overviews & profiles

- Statistics & forecasts

- Organisations

About market research

Market research reports are usually produced by commercial organisations and publishers. They often include original research and they are often expensive.

A report will usually focus on a very specific industry segment or product group. However, it can also cover a very broad industry grouping like mining or retail.

Most publishers offer their reports for sale via their own websites. There are also online services that aggregate reports from numerous publishers and sell these reports. The biggest and best known of these aggregators is MarketResearch.com .

Australian market research

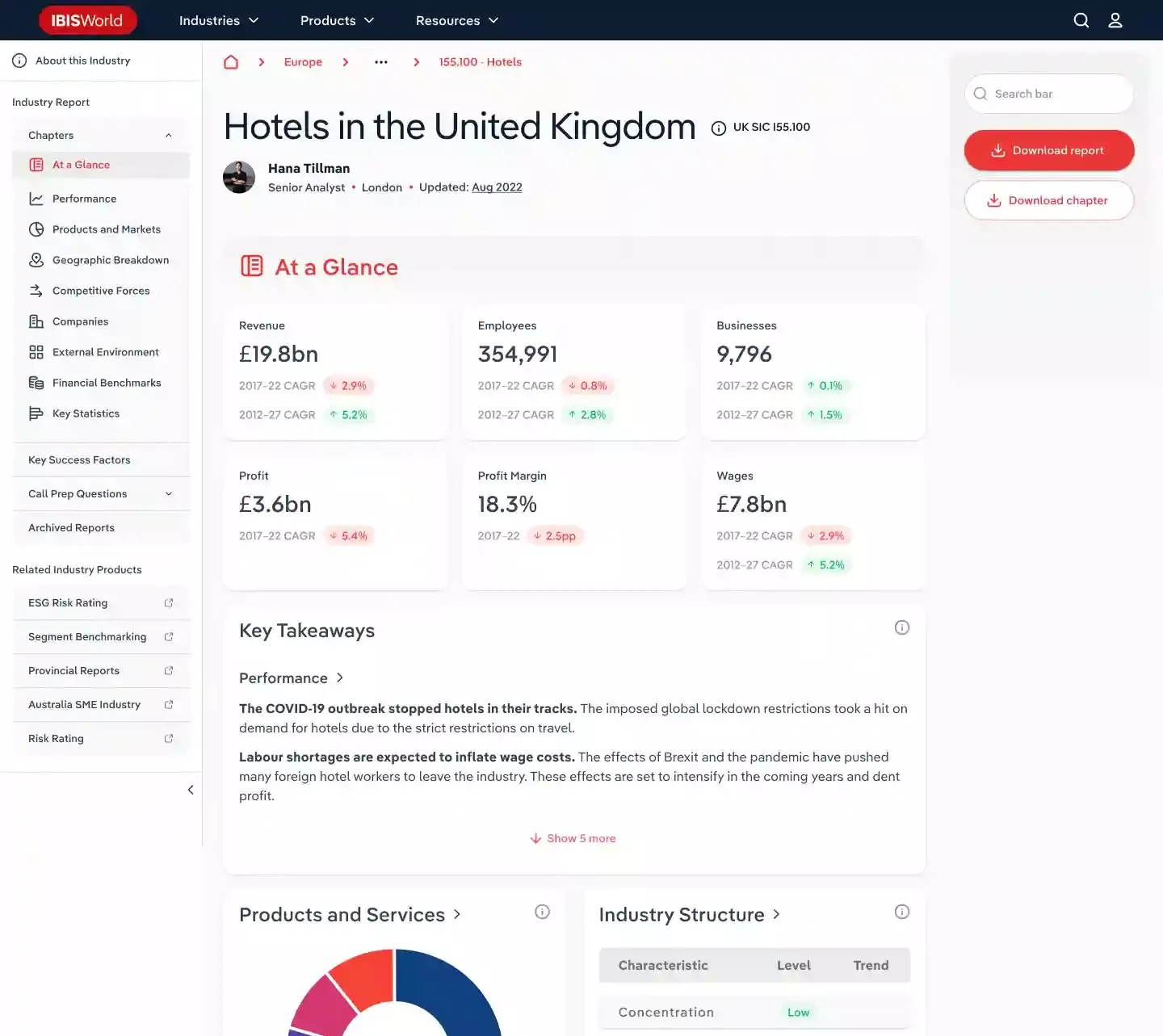

Access to IBISWorld Australia Industry Reports is provided for users' private research or study purposes only and not for users' business, commercial or work related purposes.

Discover a growing collection of research reports on niche and emerging Australian industries, including key statistics, current market analysis, major industry players, current and historical performance, and a five-year forecast.

Note that the State Library subscription covers Australian reports only. Downloads not available.

Access to IBISWorld Australia Specialized Industry Reports is provided for users' private research or study purposes only and not for users' business, commercial or work related purposes.

Find vital industry statistics and analysis for small-to-medium (SME) enterprises generating $10 million or less.

Access to IBISWorld Australia SME Industry Reports is provided for users' private research or study purposes only and not for users' business, commercial or work related purposes.

- AMSRS-- now The Research Society The Research Society Limited is a not-for-profit professional membership body of over 2,100 market research professionals. Its online directories are excellent tools to identify Australian market and social research companies and independent market research . Paid membership is required and ranges from "student" level to "full membership".

- BIS Oxford Economics BIS Oxford Economics - previously BIS Shrapnel - is a prominent global provider of industry research, analysis and forecasting services. It provides market size and segmentation data, market shares, consumer attitudes and supplier reputation information. It specialises in the following Australian industries: Building Forecasting; Residential Property; Commercial Property; Economics; Financial Services; Food & Beverages; Forestry; Household Appliances & Products; Infrastructure & Mining; Office Products; Paper & Packaging; Transport. Access to full reports are by subscription and content is geared towards industry participants.

- BuddeComm Based in Australia, BuddeComm is an independent global telecommunications research and consultancy company. Its research, covers 170 countries, 200 technologies and applications, 500 companies and explores developments in fixed and wireless telecommunications. Its research is currently focused on a range of telecoms and new media projects, including Digital Media, Fibre-to-the-Home, smart energy grids, e-health, interactive video and the convergence of telecommunications and IT. Its coverage of Australian markets is excellent. The State Library of Victoria holds many of Paul Budde publications. View the Budde Research page

Global market research

These market research vendors tend to be oriented to the USA. However, they also tend to focus on industries and markets that are global in nature. While coverage of Australian-specific markets will be minimal, they are always worth checking.

- ABI Research Founded in 1990 to assist manufacturers of wireless semiconductor components in understanding and entering new markets, ABI has since expanded its analytical coverage to a broader base of manufacturers and service companies in the technology industries.

- Clarivate Provides in-depth research on the trends, emerging developments, and market potential in various healthcare industry sectors: the biopharmaceutical, managed care, medical device, and financial markets. (previously called Decision Resources)

- Forrester Research A research company that focuses on the business implications of technology change. It provides proprietary research, consulting and executive programs aimed at IT, marketing, and technology professionals.

- Freedonia The Freedonia Group publishes more than 100 industry research studies annually. Its reports include product and market forecasts, industry trends, threats and opportunities, competitive strategies, market share determinations and company profiles.

- Frost & Sullivan With more than 1700 researchers and analysts, F&S specialises in: Aerospace; Transportation; Chemicals, Materials & Foods; Consumer Products; Electronics and Security; Power Systems; Environment & Building Technologies; Healthcare, ICT, etc.

- Gartner Founded in 1979, Gartner is the world’s most prominent information technology research and advisory company with analysts and consultants in 80 countries. In addition to market research, it offers executive programs and consulting services.

- Global Industry Analysts GIA is identified as a leading publisher of off-the-shelf market research. Reports address major geographic markets, serving companies across the world. GIA’s current searchable collection of market research consists of more than 900 Global Strategic Business Reports (large multi-client research programs); 45,000+ Market Trend Reports; 95 Global Industry Outlooks; and 114,000+ Market Data Capsules.

- IDC IDC is a provider of market intelligence and advisory services for the the IT, telecommunications and consumer technology markets. IDC provides global, regional, and local expertise on technology and industry trends in over 110 countries.

- Kalorama An established publisher of market research in medical markets, including the biotechnology, diagnostics, healthcare, medical device, and pharmaceutical industries.

- MarketResearch.com MarketResearch.com offers a large collection of industry reports based on market research updated daily. The reports compiled are geared towards businesses, specialists & individuals engaged in the various markets. Its coverage of Australian markets is good. Full reports are purchasable.

- Research and Markets This report aggregator offers market research reports and industry newsletters from leading publishers, specialist research firms and niche market analysts. Listed as a "Market Research Store", it offers a large range of reports for sale listed on its website.

- Yankee Group A technology research and consulting firm offering 15-to-20 page reports on global communications as it relates to networks, consumers and enterprises, as well as shorter pieces that address industry events, trends, case studies and market surveys. Requires subscription to log-in / access reports.

Mutual Acceptance Corp

Melbourne, Mutual Acceptance Corp. 30 Collins St. H98.252/ 744

State Library Victoria

- Search our Library catalogue

- Databases, eresources & ebooks

- Ask a librarian

- Become a Library member

- Library systems status

- << Previous: Statistics & forecasts

- Next: Companies >>

- Last updated: Mar 15, 2024 10:53 AM

- URL: https://guides.slv.vic.gov.au/industries

- Subjects: Business

- Tags: business , commerce , industries , markets , trade

- Login to LibApps

- Business and Finance /

- Advertising and Marketing /

- Market Research Service

Market Research in Australia

- October 2023

- Region: Australia

- Euromonitor International

- ID: 4658334

- Description

Table of Contents

Related topics, related reports.

- Purchase Options

- Ask a Question

- Recently Viewed Products

Why buy this report?

- Get a detailed picture of the Market Research market;

- Pinpoint growth sectors and identify factors driving change;

- Understand the competitive environment, the market’s major players and leading brands;

- Use five-year forecasts to assess how the market is predicted to develop.

- MARKET RESEARCH IN AUSTRALIA: ISIC 7413

- INDUSTRY OVERVIEW

- CHART 1 Key Industry's Indicators 2017-2027

- TURNOVER SCORECARD

- Summary 1 Scorecard of Turnover Pillar 2017-2027

- CHART 2 Turnover Developed Countries Comparison 2022

- Advertising And Marketing

Market Research in Indonesia: ISIC 7413

- Report

- November 2023

Market Research in Japan

Database of 527 Companies in Market Research and Public Opinion Polling in Singapore

- Database

- 527 Database Records

Global Market Research Services Market by Service Type (Marketing Research & Analysis Services, Public Opinion & Election Polling), End-User (FMCG, Healthcare, Media) - Cumulative Impact of High Inflation - Forecast 2023-2030

Market Research & Public Opinion Polling

About the market research service market.

Market research services are an integral part of the advertising and marketing industry. They provide businesses with the data and insights they need to make informed decisions about their products, services, and campaigns. Market research services can include surveys, focus groups, interviews, and other methods of collecting data. This data can be used to identify customer needs, preferences, and trends, as well as to measure the effectiveness of marketing campaigns. Market research services can also help businesses understand their target audience, develop effective strategies, and optimize their marketing efforts. By understanding their customers, businesses can create more effective campaigns and better target their messaging. Companies in the market research services market include Nielsen, Ipsos, Kantar, GfK, and Qualtrics. Show Less Read more

ASK A QUESTION

We request your telephone number so we can contact you in the event we have difficulty reaching you via email. We aim to respond to all questions on the same business day.

Request a Quote

YOUR ADDRESS

YOUR DETAILS

PRODUCT FORMAT

DOWNLOAD SAMPLE

Please fill in the information below to download the requested sample.

You are using an outdated browser. Please upgrade your browser to improve your experience.

Browse Research Oceania Australia All Categories Food & Beverage Food Service & Hospitality Restaurants Region: Australia Category : Restaurants

Australia Restaurants

Refine your search, acai bowl shops in australia - industry market research report.

Mar 05, 2024 | Published by: IBISWorld | USD 790

... fruits, like bananas and avocado, to create a thick and creamy acai bowl base that is then topped with fresh fruits, nuts, granola, yoghurt and other toppings. This report covers the scope, size, disposition and ... Read More

Australia Foodservice Market to 2028

Feb 27, 2024 | Published by: GlobalData | USD 3,275

... acts as a vital point of reference for operators or suppliers. Australia recorded annual nominal GDP per capita growth of 8.4% in 2023, a decline from 9.7% in 20221. The slowdown was due to the ... Read More

Australia Foodservice - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2017 - 2029

Feb 17, 2024 | Published by: Mordor Intelligence Inc | USD 4,750

... 101.68 billion by 2029, growing at a CAGR of 10.41% during the forecast period (2024-2029). The number if restaurant visits per month grew as a result of the national spread of fast food companies. The ... Read More

Full-Service Restaurants in Australia

Feb 08, 2024 | Published by: Euromonitor International | USD 990

... been the increase in the number of consumers dining out alone, rather than as a couple or in a group. Research by pricing platform, EatClub, has revealed an increase in the amount of restaurant bookings ... Read More

Consumer Foodservice By Location in Australia

... incomes to spend, there is not much incentive for consumers to visit retail stores more often. With lower footfall in shopping centres, the opportunity for sales at consumer foodservice outlets in these locations has been ... Read More

Consumer Foodservice in Australia

Feb 08, 2024 | Published by: Euromonitor International | USD 2,100

... budgets because of the rising cost of essential goods and services. During such a difficult economic period, dining outside or having food delivered can be perceived as a luxury by many consumers. It also results ... Read More

Limited-Service Restaurants in Australia

... a result, limited-service restaurants struggled to maintain the momentum of strong growth experienced the previous year. While limited-service restaurants are typically cheaper alternatives to full-service restaurants, many consumers have found themselves unable to afford takeaway ... Read More

Cafés/Bars in Australia

... challenging for cafés in particular, as it has resulted in reduced transaction sizes from their usual customers. The number of new customers visiting cafés has been on the decline, and even regular customers are no ... Read More

Self-Service Cafeterias in Australia

... is unsurprising to see Ikea Restaurant retain its dominance in terms of sales and transactions. With foodservice value of just under AUS70 million in 2023, Ikea Restaurant’s self-service cafeterias comprise 80% of the channel’s sales ... Read More

Australia Electric Kitchen Appliances Market, By Type (Small Electric Kitchen Appliances, Large Electric Kitchen Appliances); By Application (Household, Restaurant), Trend Analysis, Competitive Landscape & Forecast, 2019–2029

Dec 20, 2023 | Published by: BlueWeave Consulting | USD 2,950

... Physicians, Diagnostic Laboratories); By Region (North America, Europe, Asia Pacific (APAC), Latin America (LATAM), Middle East and Africa (MEA)) Australia Electric Kitchen Appliances Market Size Set to Grow at Steady CAGR of 4.21% between 2023 ... Read More

Restaurants in Australia - Industry Market Research Report

Dec 07, 2023 | Published by: IBISWorld | USD 805

... leisure and avoid spending time on food preparation. Increasing demand for food delivery platforms like Uber Eats has also supported industry revenue, allowing time-poor consumers to purchase home-delivered restaurant-quality food. The COVID-19 pandemic severely affected ... Read More

Australia Food Service Market Overview, 2028

Oct 06, 2023 | Published by: Bonafide Research & Marketing Pvt. Ltd. | USD 2,250

... meal options. Australia's food scene is incredibly diverse, influenced by multiculturalism and a rich blend of culinary traditions. The fusion of various cuisines, such as Asian, Mediterranean, and Middle Eastern, has led to an abundance ... Read More

Pizza Restaurants and Takeaway in Australia - Industry Market Research Report

Oct 05, 2023 | Published by: IBISWorld | USD 770

... have remained popular with Australians, consumer preferences have shifted towards gourmet and healthier options. The COVID-19 pandemic has had a modest effect on the industry, with social distancing measures restricting dining-in options and reducing foot ... Read More

Australia Foodservice Market Summary, Competitive Analysis and Forecast to 2027

Sep 22, 2023 | Published by: MarketLine | USD 350

... also contains descriptions of the leading players including key financial metrics and analysis of competitive pressures within the market. Key Highlights Foodservice is defined as the value of all food and drink, including on-trade drinks ... Read More

Chain Restaurants in Australia - Industry Market Research Report

Sep 15, 2023 | Published by: IBISWorld | USD 770

... The concept has been highly successful in Australia. However, industry operators have struggled over the past five years, due to strong external competition and difficult trading conditions following the COVID-19 pandemic. Industry revenue is expected ... Read More

Australia Foodservice Market Size and Trends by Profit and Cost Sector Channels, Consumers, Locations, Key Players and Forecast to 2027

Apr 18, 2023 | Published by: GlobalData | USD 3,275

... Locations, Key Players and Forecast to 2027” published by GlobalData provides extensive insight and analysis of the Indian Foodservice market over the next five years (2022-27) and acts as a vital point of reference for ... Read More

Fish and Chip Shops in Australia - Industry Market Research Report

Apr 12, 2023 | Published by: IBISWorld | USD 805

... sales from passing foot traffic. Consumers have access to an increasing range of takeaway options, with traditional takeaway establishments, such as fish and chip shops, losing market share to alternative fast food meal options, such ... Read More

Japanese Restaurants in Australia - Industry Market Research Report

Feb 01, 2023 | Published by: IBISWorld | USD 815

... other beverages with the food. The industry excludes shops that primarily offer takeaway food services. This report covers the scope, size, disposition and growth of the industry including the key sensitivities and success factors. Also ... Read More

Australia Foodservice Market - Growth, Trends, and Forecasts (2023 - 2028)

Jan 18, 2023 | Published by: Mordor Intelligence Inc | USD 4,750

... over the next five years. The Australian foodservice market is growing owing to the unique food preferences of people, tourism, and the working population in the region. Australian customers have a fast pace lifestyle and ... Read More

Australia Foodservice Market Summary, Competitive Analysis and Forecast, 2017-2026

Aug 23, 2022 | Published by: MarketLine | USD 350

... profile also contains descriptions of the leading players including key financial metrics and analysis of competitive pressures within the market. Key Highlights Foodservice is defined as the value of all food and drink, including on-trade ... Read More

Jul 08, 2022 | Published by: IBISWorld | USD 815

... excludes cafes and coffee shops, theatre restaurants, catering services and shops that primarily offer takeaway food services. This report covers the scope, size, disposition and growth of the industry including the key sensitivities and success ... Read More

Foodservice Market in Australia 2022-2026

May 11, 2022 | Published by: TechNavio | USD 2,500

... forecast period. Our report on the foodservice market in Australia provides a holistic analysis, market size and forecast, trends, growth drivers, and challenges, as well as vendor analysis covering around 25 vendors. The report offers ... Read More

Australia Foodservice Market Size and Trends by Profit and Cost Sector Channels, Consumers, Locations, Key Players, and Forecast, 2021-2026

May 10, 2022 | Published by: GlobalData | USD 4,995

... Key Players, and Forecast, 2021-2026” published by GlobalData provides extensive insight and analysis of the Australian Foodservice market over the next five years (2021-2026) and acts as a vital point of reference for operators or ... Read More

Australia Foodservice Market - Growth, Trends, COVID-19 Impact, and Forecasts (2022 - 2027)

Jan 17, 2022 | Published by: Mordor Intelligence Inc | USD 4,750

... during the forecast period, 2021 - 2026. The COVID-19 pandemic has altered the entire changing consumption habits of consumers, and this trend is not only pivoted to Australia but is a global transition to wary ... Read More

Luxury Foodservice in Australia

Dec 08, 2021 | Published by: Euromonitor International | USD 990

... improved in 2021. The operator rolled out multiple initiatives during the year to attract local tourists to its three restaurants, Vanitas, Il Barocco Restaurant and Le Jardin, as well as the hotel. These included special ... Read More

< prev 1 2 next >

Research Assistance

Join Alert Me Now!

- Market Research Blog

- Custom Research

Search form

Meat in Australia

Market Research Report Summary

Meat in Australia report is published on October 1, 2020 and has 32 pages in it. This market research report provides information about Meat & Poultry, Food, Food & Beverages industry. It covers Australia market data and forecasts. It is priced starting at USD 350.00 for Single User License (PDF) which allows one person to use this report.

Please read the description and table of contents of this research report given below to check whether it meets your research requirements. If not, then please do not hesitate to contact us using "Report Enquiry" form given below. We can customize this research report or suggest a new fully customized market research report to meet your research goals and data requirements.

Please choose the suitable license type from above. More details are given under tab "Report License Types" below.

Why to buy from us?

Pay By Invoice

Globally trusted brand, secure checkout, frequently asked questions.

Meat in Australia industry profile provides top-line qualitative and quantitative summary information including: market share, market size (value 2015-19, and forecast to 2024). The profile also contains descriptions of the leading players including key financial metrics and analysis of competitive pressures within the market.

Key Highlights

- The meat market consists of the retail sales of ambient meat, chilled raw packaged meat - processed, chilled raw packaged meat - whole cuts, cooked meats - counter, cooked meats - packaged, fresh meat (counter) and frozen meat. The market is valued according to retail selling price (RSP) and includes any applicable taxes. All currency conversions used in the creation of this report have been calculated using constant annual average 2019 exchange rates. - The Australian meat market had total revenues of $13.6bn in 2019, representing a compound annual growth rate (CAGR) of 2.2% between 2015 and 2019. - Market consumption volume increased with a CAGR of 1.6% between 2015 and 2019, to reach a total of 1,174.5 million kilograms in 2019. - Increasing purchasing power in the country is primarily supporting the market growth.

- Save time carrying out entry-level research by identifying the size, growth, major segments, and leading players in the meat market in Australia - Use the Five Forces analysis to determine the competitive intensity and therefore attractiveness of the meat market in Australia - Leading company profiles reveal details of key meat market players’ global operations and financial performance - Add weight to presentations and pitches by understanding the future growth prospects of the Australia meat market with five year forecasts

Reasons to Buy

- What was the size of the Australia meat market by value in 2019? - What will be the size of the Australia meat market in 2024? - What factors are affecting the strength of competition in the Australia meat market? - How has the market performed over the last five years? - Who are the top competitiors in Australia's meat market?

Table of Contents 1 Executive Summary 1.1. Market value 1.2. Market value forecast 1.3. Market volume 1.4. Market volume forecast 1.5. Category segmentation 1.6. Geography segmentation 1.7. Market share 1.8. Market rivalry 1.9. Competitive Landscape 2 Market Overview 2.1. Market definition 2.2. Market analysis 3 Market Data 3.1. Market value 3.2. Market volume 4 Market Segmentation 4.1. Category segmentation 4.2. Geography segmentation 4.3. Market distribution 5 Market Outlook 5.1. Market value forecast 5.2. Market volume forecast 6 Five Forces Analysis 6.1. Summary 6.2. Buyer power 6.3. Supplier power 6.4. New entrants 6.5. Threat of substitutes 6.6. Degree of rivalry 7 Competitive Landscape 7.1. Market share 7.2. Who are the leading players in the Australian meat market?? 7.3. Which companies have been most successful in increasing their market share in the last five years? 7.4. Which companies’ market shares have suffered in the last five years? 7.5. What are the most popular brands in the market? 8 Company Profiles 8.1. Hans Continental Smallgoods Pty Ltd 8.2. Inghams Group Ltd 9 Macroeconomic Indicators 9.1. Country data 10 Appendix 10.1. Methodology 10.2. Industry associations 10.3. Related MarketLine research 10.4. About MarketLine

List of Tables List of Tables Table 1: Australia meat market value: $ million, 2015-19 Table 2: Australia meat market volume: million kilograms, 2015-19 Table 3: Australia meat market category segmentation: $ million, 2019 Table 4: Australia meat market geography segmentation: $ million, 2019 Table 5: Australia meat market distribution: % share, by value, 2019 Table 6: Australia meat market value forecast: $ million, 2019-24 Table 7: Australia meat market volume forecast: million kilograms, 2019-24 Table 8: Australia meat market share: % share, by value, 2019 Table 9: Hans Continental Smallgoods Pty Ltd: key facts Table 10: Inghams Group Ltd: key facts Table 11: Inghams Group Ltd: Key Employees Table 12: Australia size of population (million), 2015-19 Table 13: Australia gdp (constant 2005 prices, $ billion), 2015-19 Table 14: Australia gdp (current prices, $ billion), 2015-19 Table 15: Australia inflation, 2015-19 Table 16: Australia consumer price index (absolute), 2015-19 Table 17: Australia exchange rate, 2015-19

List of Figures List of Figures Figure 1: Australia meat market value: $ million, 2015-19 Figure 2: Australia meat market volume: million kilograms, 2015-19 Figure 3: Australia meat market category segmentation: % share, by value, 2019 Figure 4: Australia meat market geography segmentation: % share, by value, 2019 Figure 5: Australia meat market distribution: % share, by value, 2019 Figure 6: Australia meat market value forecast: $ million, 2019-24 Figure 7: Australia meat market volume forecast: million kilograms, 2019-24 Figure 8: Forces driving competition in the meat market in Australia, 2019 Figure 9: Drivers of buyer power in the meat market in Australia, 2019 Figure 10: Drivers of supplier power in the meat market in Australia, 2019 Figure 11: Factors influencing the likelihood of new entrants in the meat market in Australia, 2019 Figure 12: Factors influencing the threat of substitutes in the meat market in Australia, 2019 Figure 13: Drivers of degree of rivalry in the meat market in Australia, 2019 Figure 14: Australia meat market share: % share, by value, 2019

Hans Continental Smallgoods Pty Ltd Inghams Group Ltd

Single User License (PDF)

- This license allows for use of a publication by one person.

- This person may print out a single copy of the publication.

- This person can include information given in the publication in presentations and internal reports by providing full copyright credit to the publisher.

- This person cannot share the publication (or any information contained therein) with any other person or persons.

- Unless a Enterprise License is purchased, a Single User License must be purchased for every person that wishes to use the publication within the same organization.

- Customers who infringe these license terms are liable for a Global license fee.

Site License (PDF)*

- This license allows for use of a publication by all users within one corporate location, e.g. a regional office.

- These users may print out a single copy of the publication.

- These users can include information given in the publication in presentations and internal reports by providing full copyright credit to the publisher.

- These users cannot share the publication (or any information contained therein) with any other person or persons outside the corporate location for which the publication is purchased.

- Unless a Enterprise License is purchased, a Site User License must be purchased for every corporate location by an organization that wishes to use the publication within the same organization.

Global License (PDF)*

- This license allows for use of a publication by unlimited users within the purchasing organization e.g. all employees of a single company.

- Each of these people may use the publication on any computer, and may print out the report, but may not share the publication (or any information contained therein) with any other person or persons outside of the organization.

- These employees of purchasing organization can include information given in the publication in presentations and internal reports by providing full copyright credit to the publisher.

*If Applicable.

Report Inquiry

Do you have more questions related to this market research report after going through the description and table of contents?

We are here to help. Please use the form given below to let us know your questions related to this report.

Kindly use your official email address and contact number to ensure speedy response.

*Please note that the report cover image shown above is for representation purpose only. Actual report cover may vary.

Related Market Research Reports

Clients who trust us, need tailor made market research solution we can help you with that too..

At Market Research Reports, Inc. we aim to make it easier for decision makers to find relevant information and locate right market research reports which can save their time and assist in what they do best, i.e. take time-critical decisions.

We work with our associate Global market research firms who are known leaders in their respective domains to obtain right market research solution for our customer’s needs, be it custom research or syndicated research reports.

Market Research Reports, Inc 16192 Coastal Hwy Lewes , DE 19958 , USA

USA: +1-302-703-9904

India: +91-8762746600

marketresearchreports

- Create new account

- Request new password

Latest Blog Posts

- SiC Power Semiconductors: The Next Big Wave in Advanced Electronics

- Global MEMS Devices Sector on the Rise: Expected to Surpass $1.8 Billion by 2030

Stay Connected

Research industries.

- Banking & Finance

- Business & Government

- Computing & Electronics

- Consumer & Retail

- Energy & Utilities

- Food & Beverages

- Industry & Manufacturing

- Marketing & Advertising

- Pharma & Healthcare

- Travel & Leisure

Our Company

- Become Publisher

- Publications By Country

- Research Subscription

- Privacy Policy

- Terms & Conditions

- Trade Trends

Our Services

- Syndicated Market Research

- Custom Market Research

- Market Research Consulting

- Industry Market Research

- Market Research For Startups

- B2B Market Research

- Market Research Resources

- Market Research Learning

© Copyright 2010-24 Market Research Reports, Inc. . All Rights Reserved. M Market Research Reports and the M Market Research Reports Logo are registered trademarks of Market Research Reports, Inc.

Disclaimer: Market Research Reports, Inc. has no affiliation to, and is not associated with any other website(s) or organization(s). We offer syndicated research reports (like country analysis, SWOT analysis, competitive intelligence, industry reports, company reports and market analysis & trends reports) and custom market research from our website MarketResearchReports.com only.

If you are looking for a market research solution for your research requirements, please begin your search using the search box on top of this page or use our chat system to speak to our market research consultants or directly write to us .

- New Zealand

- United Kingdom

- United States

Popular Searches

Recommended topics.

News & Research

Population density: where is it the highest and what does it mean for housing trends

In today's Pulse, CoreLogic research director Tim Lawless reveals the impact of population density on the housing market.

With Australia’s population moving through the fastest rate of growth since the 1950’s, our cities and towns are naturally densifying. At a national level, the population density of 3.5 people per square kilometer (sq. km) is among the lowest in the world, highlighting our highly urbanised population where half the populace live in the three largest cities. In fact, 75% of Australia’s population resides on just 2.6% of the land mass.

The density of the population, which is simply the number of residents divided by the land area, becomes more relevant at a city level and even more interesting across smaller areas.

Below is a snapshot of key findings from this analysis.

1. Melbourne has the highest population density across the capital cities (521 people per sq.km), followed by Adelaide (444 ppl per sq. km) and Sydney (441 ppl per sq. km). Despite Sydney having a larger portion of medium to high density housing stock and generally smaller blocks of land, the larger land area of the Sydney metro region contributes to its lower population density.

2. Every capital city is recording a rise in population density, however the way this is occurring is quite different from region to region.

3. At the SA2 level, inner city precincts of Melbourne and Sydney dominate the highest density locations nationally, however the density rankings have changed remarkably over the past 20 years. Outside of Sydney and Melbourne, the SA2 regions with highest population density nationally were in Brisbane (Fortitude Valley), the Gold Coast (Surfers Paradise – North was ranked 97th) and the ACT’s Kingston (107th).

4. The relationship between population density and rental growth is weak. For units, areas with a high population density have shown slightly stronger rental appreciation relative to lower population density areas, but slightly weaker growth over the past decade. For house rents it's the opposite, where higher population densities have been associated with slightly weaker rental appreciation than areas with a lower population density over the past 12 months, but slight stronger over the past decade.

5. Of the 20 highest density SA2 locations nationally, only two recorded a larger rise in rents over the past 12 months than the capital city benchmark, Chippendale (+9.4%) and Hurstville-Central (+11.7%).

6. The relationship between unit values and population density is more significant, with high density unit markets generally showing a lower level of value growth over both the past 12 months, and past 10 years – although the longer- term relationship is more significant, potentially reflecting periods of higher unit supply that weighted on value appreciation. Sixteen of the top 20 have recorded a lower annual rate of unit value growth over the past decade relative to the broader capital city trend. Over the past 12 months, nine of the of the top 20 have underperformed.

7. High population densities provide virtually no explanatory power for house values with the coefficient of determination just .001 over the past 12 months and over the past decade.

Download the complete article

Meet Tim Lawless

Executive, Research Director, Asia-Pacific

Contact LinkedIn

Tim is executive research director of CoreLogic’s Asia–Pacific research division, managing a team of economic and data specialists across Australia and New Zealand. He brings more than 20 years’ experience to the role, providing deep insights and analysis on national housing trends.

Subscribe to our newsletter

Receive a weekly email with the latest housing market information, news and updates.

We use cookies on this site to enhance your user experience

We use cookies to improve and customise your browsing experience, provide tailored content and advertising, and for analytics and metrics regarding visitor usage. We may also share this information with third parties for the above purposes. By using our website, we assume you're ok with cookies being used as described in our Privacy Policy .

Check your browser settings and network. This website requires JavaScript for some content and functionality.

Bulletin – April 2024 Australian Economy The Private Equity Market in Australia

18 April 2024

Jacob Harris and Emma Chow [*]

- Download 623 KB

The Australian private equity market has grown significantly for a number of years, particularly as the economy recovered from pandemic-related disruptions. Consistent with this growth, private equity deals involving Australian companies have increased in value, and private equity funds have raised larger amounts of capital from investors. Recently, however, private equity activity has declined substantially as borrowing costs increased. Over recent years, international private equity firms and investors have also increased their presence in the Australian market. This article discusses these developments in the Australian private equity market and considers the implications that a robust private equity market may have on Australian businesses and public capital markets.

Introduction

Australian companies benefit from deep, high-quality capital markets in which they can raise funds to support their operations and expand their business. A key component of this is the Australian equity market, in which companies raise money from investors in return for part-ownership of the company’s profits and assets. Companies listed on the Australian Securities Exchange (ASX) are some of the most visible businesses in Australia. Listed companies tend to be large, mature businesses that benefit from having their shares trade in a liquid and transparent public market.

Issuing shares on a public exchange, however, may not be the best way to raise capital for all companies. Some companies prefer to raise private equity capital, which generally involves a smaller number of investors, who therefore obtain more control over the company. This can be a particularly important source of funding for smaller or riskier businesses that may face greater costs and other challenges in raising capital in public markets.

While it remains much smaller than the public market, the Australian private equity market has grown significantly over recent years. Assets under management in Australian-focused private equity funds – an important component of the private equity market – have nearly tripled in size since 2010 to $66 billion (for comparison, the combined market capitalisation of companies listed on the ASX is $2.7 trillion). [1] This has occurred alongside substantial growth in private equity fund raisings and deals with Australian companies.

What is private equity?

Private equity is ownership or interest in a company that is not transacted in a public market. These companies are often small, new, or otherwise riskier businesses. [2] They may not have enough collateral or a track record of profits to qualify for bank financing, and other forms of debt funding may be prohibitively expensive. While internal equity financing through retained profits is often the cheapest source of funds, this can be impractical for companies with negative cashflows or businesses trying to grow quickly. [3] As such, private equity financing is an important source of funding for some companies’ operations and growth. While companies can obtain private equity financing from a variety of non-institutional sources – such as friends, family members, and angel investors – the most prominent investors are private equity firms. [4]

Private equity firms may raise capital for their investments through a combination of equity and debt. The equity component is typically raised from a range of external investors (limited partners) – such as superannuation funds, wealth managers and high net-worth individuals – as well as from the private equity firm itself (general partner) (Figure 1). This equity component may be supplemented with debt financing to increase the total amount of capital available for investment. Private equity firms generally invest in a portfolio of companies and distribute the returns on these investments, after costs, to the investors. The main external investors in Australian private equity funds are institutional investors, particularly superannuation funds and foreign institutions. The prevalence of institutional investors reflects, in part, the fact that private equity funds require a relatively high minimum contribution (subscription) from investors; these investments are also relatively illiquid, with investors typically required to lock their money away for a number of years. Retail investors in Australia nonetheless have some indirect exposure to private equity funds through the funds management industry and listed private equity investment companies.

Private equity firms invest the capital for each fund into a portfolio of companies that satisfies the fund’s mandate, such as indicators of growth potential. Investment decisions are normally managed and executed by the general partner of the fund (the private equity firm), with the limited partners (fund investors) paying management and performance fees to the private equity firm for these services. Private equity investments range from a minority stake in a business to buying out an entire company, and can be grouped into three broad categories:

- Venture capital. This involves investment in early-stage or growing companies with strong long-term growth potential.

- Buyouts. These involve the purchase of at least a controlling interest of an established (and often listed) company, often with the intention of improving operations and/or financials before selling the company for a profit. The largest of these transactions are generally leveraged buyouts, which tend to be financed with some equity and a significant amount of debt.

- Other private equity. This involves raising new equity capital to fund further growth opportunities, such as acquisitions, or to improve the company’s capital structure.

The objective of a private equity firm is to generate a return on their investments, potentially through selling their equity ownership at some point in the future at a profit. Private equity firms often take some degree of control in the management of a company, with the aim of improving its growth prospects and profitability. Changes may be made to operations and capital structure, staff and management, or the level of investment in research and development to improve a company’s products. Upon selling their investments, the firm will distribute net returns to the investors in its fund.

Size of and trends in the Australian private equity market

The Australian private equity market has seen significant growth in recent years, particularly as the economy recovered from pandemic-related disruptions. [5] As an indication of market size, private equity funds (both domestic and foreign) with a focus on investing in Australian companies had around $66 billion in assets under management as at June 2023, representing 2.6 per cent of GDP (Preqin and AIC 2024). [6] This comprised around $44 billion in funds already invested in Australian companies, and $22 billion in funds yet to be invested. Nominal assets under management for these funds grew by around 75 per cent from December 2019 to June 2023, with notable growth in venture capital funds (Graph 1, top panel).

While some of this growth stemmed from the returns on the investment portfolios, fund raising has also been a driver in recent years. Aggregate capital raised by private equity funds that have an Australian focus was a record $11.7 billion (0.5 per cent of GDP) in 2022 (Graph 1, bottom panel). This is significantly higher than the $4.1 billion annual average (inflation-adjusted to 2022) over the prior decade. It also greatly exceeded the amount of capital raised on the public equity market through initial public offerings, which, at roughly $1 billion in 2022, was well below the $9.8 billion annual average (inflation-adjusted to 2022) over the prior decade.

Consistent with the growth in private equity funds with a focus on investing in Australian companies, the value of private equity deals involving Australian companies has increased to a record high in recent years. The total value of private equity deals was $57 billion (2.3 per cent of GDP) in 2022 (Graph 2). This growth was primarily driven by a small number of large leveraged buyouts, in which private equity firms take on more debt to purchase a controlling stake in an established Australian company. Since 2023, however, private equity activity has declined, partly due to higher debt servicing costs.

The earlier strength and most recent decline in the Australian private equity market has mirrored private equity activity in other developed equity markets (Graph 3). Earlier strength occurred against a backdrop of rapid economic expansion during the pandemic recovery, low interest rates and strong company balance sheets, including elevated cash assets. Despite this growth, the Australian private equity market remains smaller than some other developed markets. Like Australia, international markets have also seen a decline in private equity activity from heightened levels during the pandemic recovery (Bain and Company 2024).

Recent private equity firm investments in Australian companies

In previous episodes of rapid growth in Australian private equity, investments were mostly concentrated in the information technology (IT) sector. [7] While the IT sector has recently attracted the greatest number of private equity deals (primarily driven by investments from venture capital firms), these deals only account for 8 per cent of the total value of private equity activity since 2020 (Graph 4). By contrast, private equity investment in other sectors have been driven by a small number of large buyouts.

Since the start of 2020, the value of private equity buyouts has been highest in the industrials and utilities sectors, with a relatively small value in IT companies. Industrial and utility companies often have stable cash flows and lower risk profiles. This makes them attractive targets for leveraged buyouts from private equity firms as the less volatile cash flows of the acquired company can be used to service debt. Significant deals in industrials include the approximately $25 billion acquisition of Sydney Airport and a large investment in DP World Australia ($6 billion), a prominent shipping terminal and supply chain operator. The utilities sector has also had several significant buyouts, notably AusNet ($10 billion) and Spark Infrastructure ($5 billion), both of which own and manage electrical infrastructure assets. Other notable recent buyouts include the $9 billion acquisition of Crown Resorts – the dominant transaction in the consumer discretionary sector – and the $3.5 billion deal to take telecommunications company Vocus Group private.

Unlike buyouts, the majority of recent venture capital activity in Australia has been concentrated in the IT sector. This is consistent with international venture capital investment, as developing IT companies typically have potentially strong but uncertain growth prospects that rely on high levels of initial research and development – that is, they are relatively risky investments. These companies may also remain unprofitable or generate negative cashflows for some time. To mitigate risk, venture capital firms often diversify their investments across a range of developing companies.

Since 2020, there have been nearly 500 venture capital deals worth a collective $8.5 billion in the Australian IT sector. This includes several later-stage funding deals for companies seeking further growth or to develop new products, such as software company Simpro ($500 million) and Canva ($450 million). The industrials sector has also seen some interest from venture capital firms, resulting in over 100 deals since 2020. The largest among these deals were concentrated on funding for companies providing technical services to support business logistics and operations.

The composition of Australian private equity fund raisings

Private equity funds based in Australia have raised significant capital in recent years (Graph 5). These funds can receive capital from both domestic and foreign investors and can invest in both domestic and foreign companies. While buyout funds generally raise the most capital, there has been a growing interest recently in venture capital and other private equity funds.

The share of capital committed to Australian private equity funds from foreign investors rose steadily to 45 per cent in 2019, compared with less than 10 per cent in 2010 (Graph 6). Most of this foreign capital is likely to have come from North America, though Asian investors are an increasingly large source of non-resident funding (Preqin and AIC 2024). Over this period, the Australian superannuation industry has gone from being the dominant investor class in Australian private equity to accounting for one-third of capital committed. Further, superannuation funds have reduced their exposure to unlisted equity over recent years from around 12 per cent of total assets in 2013 to 5 per cent in 2023 (APRA 2023).

Historically, most private equity investments in Australian companies were by Australian private equity funds investing domestic institutional money. However, offshore private equity funds have increased their Australian presence in recent years. In 2023, offshore private equity funds accounted for around 50 per cent of the total number of investments over the year, compared with around 35 per cent in 2010 (Graph 7). [8] This was primarily driven by investments from private equity funds based in the United States. Indeed, most of the largest deals in recent years (such as the acquisitions of Sydney Airport, AusNet and Crown Resorts) have had significant – if not sole – contributions from foreign private equity funds based in the United States or Canada.

The implications of a larger private equity market

There are both benefits to, and costs of, a larger private equity market. In particular, there are upside and downside risks to economic growth and capital efficiency. [9] In Australia, the private equity market remains primarily focused on smaller companies. This is despite some sizeable deals in recent years, with the level of assets under management in Australian-focused private equity funds being less than 3 per cent of listed equity market capitalisation. Further, some of the recent growth in private equity may eventually be absorbed into the public equity market.

The private equity market plays an important role in supporting the efficient allocation of capital to companies. [10] New, innovative businesses and products often seek external capital investments at a time when their growth prospects and earnings potential are highly uncertain. Venture capital firms are among the private equity firms specialised in assessing early-stage funding. Underperforming companies may also be targeted by private equity investment, which can bring expertise and experience to help maximise growth. The threat of takeover, including through buyout by private equity firms, can also discipline existing management to improve company performance. [11]

Some research, however, also indicates that the public equity market is more efficient at allocating capital than the private equity market – partly because unlisted firms are generally subject to less stringent public reporting and governance obligations. [12] Removing companies from public listing lowers transparency and may make it more difficult for investors to compare company and management performance to make informed investment decisions. Heightened levels of private equity buyout activity may reduce the diversification of the public equity market. Private buyouts of large companies have removed equity capital from the Australian public equity market at a time when there were limited inflows of new listings and initial public offerings. This has contributed to a greater concentration of the biggest companies in the public equity market, although only to around the average of the past 14 years (Graph 8).

The private equity market is an important source of funding for many Australian companies, particularly for smaller or riskier businesses that have difficulty raising capital in public markets. The Australian private equity market grew over several years to 2022 before declining in 2023, mirroring a heightened period of private equity activity in other developed markets. Growth was supported by broad-based economic expansion during the pandemic recovery, historic low interest rates (which makes leveraged private equity more attractive) and other accommodative policy measures. International private equity firms and investors increased their participation in deals involving Australian companies, and Australian private equity firms sourced around half of their capital from foreign investors.

A large, competitive private equity market can contribute to promoting an innovative, efficient and dynamic business sector in Australia. This is true for both companies that receive private equity investment, and for peer companies where the possibility of a takeover can provide more discipline on existing management. However, greater private equity market size and activity could also reduce the size and diversification of the public equity market. Despite some larger deals in recent years, the Australian private equity market remains small compared with international markets. It is also much smaller than the public equity market.

The authors completed this work in Domestic Markets Department. They would like to thank Ed Tellez and Iris Chan for their help with preparing this article. While every effort has been made to ensure the quality of the data used in this article, different data vendors may use inconsistent methodologies and some details about specific private equity transactions are undisclosed. As such, the values reported in this article should be treated as estimates. [*]

Assets under management in Australian-focused private equity funds represent only a portion of the total stock of private equity financing for Australian businesses. The value of private equity financing from other sources, such as friends, family members, and angel investors, is often undisclosed. [1]

Though some private equity investments may be in large, mature companies that are seen to be underperforming, poorly managed or undervalued. [2]

For further discussion on internal and external business finance in Australia, see Connolly and Jackman (2017). [3]

In this article, ‘private equity’ is used as an umbrella term that includes venture capital. [4]

The Australian private equity market encompasses both domestic and foreign private equity investments in Australian companies. Private equity firms based in Australia are discussed separately below. [5]

The scope of assets under management and fund raising data as shown in Graph 1 includes only private closed-end funds that predominantly focus on Australia, regardless of manager headquarters. [6]

For discussions on previous episodes of Australian private equity market growth, see Connolly and Tan (2002) and RBA (2007). [7]

Individual private equity deals often involve multiple private equity funds, with the value of each fund’s differing contributions often undisclosed. As such, it is difficult to precisely measure the proportion of aggregate private equity deal value that is sourced from foreign private equity funds. [8]

For a broad review of academic research on the effects of private and public equity markets, see Bernstein (2022). [9]

For further discussion on the positive influence of private equity investment on economic growth and innovation, see Samila and Sorenson (2011). [10]

For more information on the positive spillover effects of private equity investments on peer companies, see Aldatmaz and Brown (2019). [11]

For further discussion on the capital allocation efficiency gap between public and private equity markets, see Sanati and Spyridopoulos (2024). [12]

Aldatmaz S and GW Brown (2019), ‘Private Equity in the Global Economy: Evidence on Industry’, Journal of Corporate Finance , 60, Art No 101524.

APRA (Australian Prudential Regulation Authority) (2023), ‘Quarterly Superannuation Performance Statistics’, December.

Bain and Company (2024), ‘Global Private Equity Report 2024’, Report.

Bernstein S (2022), ‘The Effects of Public and Private Equity Markets on Firm Behavior’, Annual Review of Financial Economics , 14, pp 295–318.

Connolly E and B Jackman (2017), ‘ The Availability of Business Finance ’, RBA Bulletin , December.

Connolly E and A Tan (2002), ‘ The Private Equity Market in Australia ’, RBA Bulletin , June.

Preqin and AIC (Australian Investment Council) (2024), ‘Australian Private Capital Market Overview: A Preqin and Australian Investment Council Yearbook 2024’, Report.

RBA (Reserve Bank of Australia) (2007), ‘ Private Equity in Australia ’, Financial Stability Review , March.

Samila S and O Sorenson (2011), ‘Venture Capital, Entrepreneurship, and Economic Growth’, The Review of Economics and Statistics , 93(1), pp 338–349.

Sanati A and I Spyridopoulos (2024), ‘Comparing Capital Allocation Efficiency in Public and Private Equity Markets’, 30 January.

Market Research and Statistical Services in Australia - Market Size, Industry Analysis, Trends and Forecasts (2024-2029)

Instant access to hundreds of data points and trends.

- Market estimates from

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

100% money back guarantee

Industry statistics and trends.

Access all data and statistics with purchase. View purchase options.

Market Research and Statistical Services in Australia

Industry Revenue

Total value and annual change from . Includes 5-year outlook.

Access the 5-year outlook with purchase. View purchase options

Trends and Insights

Market size is projected to over the next five years.

Market share concentration for the Market Research and Statistical Services industry in Australia is , which means the top four companies generate of industry revenue.

The average concentration in the sector in Australia is .

Products & Services Segmentation

Industry revenue broken down by key product and services lines.

Ready to keep reading?

Unlock the full report for instant access to 30+ charts and tables paired with detailed analysis..

Or contact us for multi-user and corporate license options

Table of Contents

About this industry, industry definition, what's included in this industry, industry code, related industries, domestic industries, competitors, complementors, international industries, performance, key takeaways, revenue highlights, employment highlights, business highlights, profit highlights, current performance.

What's driving current industry performance in the Market Research and Statistical Services in Australia industry?

What's driving the Market Research and Statistical Services in Australia industry outlook?

What influences volatility in the Market Research and Statistical Services in Australia industry?

- Industry Volatility vs. Revenue Growth Matrix

What determines the industry life cycle stage in the Market Research and Statistical Services in Australia industry?

- Industry Life Cycle Matrix

Products and Markets

Products and services.

- Products and Services Segmentation

How are the Market Research and Statistical Services in Australia industry's products and services performing?

What are innovations in the Market Research and Statistical Services in Australia industry's products and services?

Major Markets

- Major Market Segmentation

What influences demand in the Market Research and Statistical Services in Australia industry?

International Trade

- Industry Concentration of Imports by Country

- Industry Concentration of Exports by Country

- Industry Trade Balance by Country

What are the import trends in the Market Research and Statistical Services in Australia industry?

What are the export trends in the Market Research and Statistical Services in Australia industry?

Geographic Breakdown

Business locations.

- Share of Total Industry Establishments by Region ( )

Data Tables

- Number of Establishments by Region ( )

- Share of Establishments vs. Population of Each Region

What regions are businesses in the Market Research and Statistical Services in Australia industry located?

Competitive Forces

Concentration.

- Combined Market Share of the Four Largest Companies in This Industry ( )

- Share of Total Enterprises by Employment Size

What impacts market share in the Market Research and Statistical Services in Australia industry?

Barriers to Entry

What challenges do potential entrants in the Market Research and Statistical Services in Australia industry?

Substitutes

What are substitutes in the Market Research and Statistical Services in Australia industry?

Buyer and Supplier Power

- Upstream Buyers and Downstream Suppliers in the Market Research and Statistical Services in Australia industry

What power do buyers and suppliers have over the Market Research and Statistical Services industry in Australia?

Market Share

Top companies by market share:

- Market share

- Profit Margin

Company Snapshots

Company details, summary, charts and analysis available for

Company Details

- Total revenue

- Total operating income

- Total employees

- Industry market share

Company Summary

- Description

- Brands and trading names

- Other industries

What's influencing the company's performance?

External Environment

External drivers.

What demographic and macroeconomic factors impact the Market Research and Statistical Services in Australia industry?

Regulation and Policy

What regulations impact the Market Research and Statistical Services in Australia industry?

What assistance is available to the Market Research and Statistical Services in Australia industry?

Financial Benchmarks

Cost structure.

- Share of Economy vs. Investment Matrix

- Depreciation

What trends impact cost in the Market Research and Statistical Services in Australia industry?

Financial Ratios

- 3-4 Industry Multiples (2018-2023)

- 15-20 Income Statement Line Items (2018-2023)

- 20-30 Balance Sheet Line Items (2018-2023)

- 7-10 Liquidity Ratios (2018-2023)

- 1-5 Coverage Ratios (2018-2023)

- 3-4 Leverage Ratios (2018-2023)

- 3-5 Operating Ratios (2018-2023)

- 5 Cash Flow and Debt Service Ratios (2018-2023)

- 1 Tax Structure Ratio (2018-2023)

Data tables

- IVA/Revenue ( )

- Imports/Demand ( )

- Exports/Revenue ( )

- Revenue per Employee ( )

- Wages/Revenue ( )

- Employees per Establishment ( )

- Average Wage ( )

Key Statistics

Industry data.

Including values and annual change:

- Revenue ( )

- Establishments ( )

- Enterprises ( )

- Employment ( )

- Exports ( )

- Imports ( )

Frequently Asked Questions

What is the market size of the market research and statistical services industry in australia.

The market size of the Market Research and Statistical Services industry in Australia is measured at in .

How fast is the Market Research and Statistical Services in Australia market projected to grow in the future?

Over the next five years, the Market Research and Statistical Services in Australia market is expected to . See purchase options to view the full report and get access to IBISWorld's forecast for the Market Research and Statistical Services in Australia from up to .

What factors are influencing the Market Research and Statistical Services industry in Australia market trends?

Key drivers of the Market Research and Statistical Services in Australia market include .

What are the main product lines for the Market Research and Statistical Services in Australia market?

The Market Research and Statistical Services in Australia market offers products and services including .

Which companies are the largest players in the Market Research and Statistical Services industry in Australia?

Top companies in the Market Research and Statistical Services industry in Australia, based on the revenue generated within the industry, includes .

How many people are employed in the Market Research and Statistical Services industry in Australia?

The Market Research and Statistical Services industry in Australia has employees in Australia in .

How concentrated is the Market Research and Statistical Services market in Australia?

Market share concentration is for the Market Research and Statistical Services industry in Australia, with the top four companies generating of market revenue in Australia in . The level of competition is overall, but is highest among smaller industry players.

Methodology

Where does ibisworld source its data.

IBISWorld is a world-leading provider of business information, with reports on 5,000+ industries in Australia, New Zealand, North America, Europe and China. Our expert industry analysts start with official, verified and publicly available sources of data to build an accurate picture of each industry.

Each industry report incorporates data and research from government databases, industry-specific sources, industry contacts, and IBISWorld's proprietary database of statistics and analysis to provide balanced, independent and accurate insights.

IBISWorld prides itself on being a trusted, independent source of data, with over 50 years of experience building and maintaining rich datasets and forecasting tools.

To learn more about specific data sources used by IBISWorld's analysts globally, including how industry data forecasts are produced, visit our Help Center.

Deeper industry insights drive better business outcomes. See for yourself with your report or membership purchase.

Discover how 30+ pages of industry data and analysis can give you the edge you need..

- Consumer Goods and Services

- Consumer Services

Australia Mobile Cranes Rental Market

Australia Mobile Cranes Rental Market Size, Analysis: By Product Type: All Terrain Crane, Floating Crane, Truck Crane, Others; By Capacity: Up to 30 Ton, 30 - 50 Ton, 50 - 75 Ton, 75 – 100 Ton, Above 100 Ton; By Application: Construction, Mining & Excavation, Marine & Offshore, Industrial; Regional Analysis; Competitive Landscape; 2024-2032

- Report Summary

- Table of Contents

- Pricing Detail

- Request Sample

Australia Mobile Cranes Rental Market Outlook

The Australia mobile cranes rental market size reached USD 185.70 million in 2023. The market is expected to grow at a CAGR of 3.98% between 2024 and 2032, reaching USD 262.27 million by 2032.

Key Takeaways:

- The Australian construction sector, per the International Trade Administration, achieves over $162 billion annually in building activities.

- Mineral exploration expenditure rose by 0.9% in recent quarterly data on Australia's mineral and petroleum exploration in January 2024.

- The marine sector, per The Australian Institute of Marine Science, added $105.3 billion to GDP and supported 462,000 full-time jobs in 2020-21.

Construction activities drive the Australia mobile crane rental market growth due to their versatility, enabling navigation through construction sites, access to confined areas, and operation across various landscapes

In construction, mobile cranes provide adaptability in confined areas and various landscapes, precisely lifting heavy materials. They improve productivity, safety with load indicators, and cost-effectiveness through easy setup and access to remote sites.

In July 2023, JDM Diesel Services, a TRT TIDD Crane Dealer in Victoria, sold a TIDD PC28-2 to Colac Mobile Cranes, known for rigging, heavy lifting, and safety-focused services. The TIDD PC28-2 enhances their fleet with top-notch safety features.

In mining and excavation, mobile cranes efficiently lift heavy loads, minimizing downtime with swift material handling. They adjust to site alterations, enhance safety through maintenance services, and offer cost-effective solutions through rental choices.

Market Segmentation

Australia Mobile Cranes Rental Market Report and Forecast 2024-2032 offers a detailed analysis of the market based on the following segments:

Market Breakup by Product Type

- All Terrain Crane

- Floating Crane

- Truck Crane

Market Breakup by Capacity

- Up to 30 Ton

- 30 - 50 Ton

- 50 - 75 Ton

- 75 – 100 Ton

- Above 100 Ton

Market Breakup by Application

- Construction

- Mining & Excavation

- Marine & Offshore

Market Breakup by Region

- New South Wales

- Australian Capital Territory

- Western Australia

The Australia mobile cranes rental market key players Rex Constructions PTY LTD, Altec, Inc., Titan Cranes Pty Ltd, Freo Group Pty Ltd, Borger Crane Hire and Rigging Services Pty Ltd., Pakenham Crane Trucks, Cranecorp Australia and Joyce Krane Australia among others.

Key Highlights of the Report

*At Expert Market Research, we strive to always give you current and accurate information. The numbers depicted in the description are indicative and may differ from the actual numbers in the final EMR report.

1 Preface 2 Report Coverage – Key Segmentation and Scope 3 Report Description 3.1 Market Definition and Outlook 3.2 Properties and Applications 3.3 Market Analysis 3.4 Key Players 4 Key Assumptions 5 Executive Summary 5.1 Overview 5.2 Key Drivers 5.3 Key Developments 5.4 Competitive Structure 5.5 Key Industrial Trends 6 Market Snapshot Australia Mobile Cranes Rental market 7 Opportunities and Challenges in the Market 8 Australia Mobile Cranes Rental Market Overview 8.1 Key Industry Highlights 8.2 Australia Mobile Cranes Rental Historical Market (2018-2023) 8.3 Australia Mobile Cranes Rental Market Forecast (2024-2032) 9 Australia Mobile Cranes Rental Market by Product Type 9.1 All Terrain Crane 9.1.1 Historical Trend (2018-2023) 9.1.2 Forecast Trend (2024-2032) 9.2 Floating Crane 9.2.1 Historical Trend (2018-2023) 9.2.2 Forecast Trend (2024-2032) 9.3 Truck Crane 9.3.1 Historical Trend (2018-2023) 9.3.2 Forecast Trend (2024-2032) 9.4 Others 10 Australia Mobile Cranes Rental Market by Capacity 10.1 Up to 30 Ton 10.1.1 Historical Trend (2018-2023) 10.1.2 Forecast Trend (2024-2032) 10.2 30 - 50 Ton 10.2.1 Historical Trend (2018-2023) 10.2.2 Forecast Trend (2024-2032) 10.3 50 - 75 Ton 10.3.1 Historical Trend (2018-2023) 10.3.2 Forecast Trend (2024-2032) 10.4 75 – 100 Ton 10.4.1 Historical Trend (2018-2023) 10.4.2 Forecast Trend (2024-2032) 10.5 Above 100 Ton 10.5.1 Historical Trend (2018-2023) 10.5.2 Forecast Trend (2024-2032) 11 Australia Mobile Cranes Rental Market by Application 11.1 Construction 11.1.1 Historical Trend (2018-2023) 11.1.2 Forecast Trend (2024-2032) 11.2 Mining & Excavation 11.2.1 Historical Trend (2018-2023) 11.2.2 Forecast Trend (2024-2032) 11.3 Marine & Offshore 11.3.1 Historical Trend (2018-2023) 11.3.2 Forecast Trend (2024-2032) 11.4 Industrial 11.4.1 Historical Trend (2018-2023) 11.4.2 Forecast Trend (2024-2032) 12 Australia Mobile Cranes Rental Market by Region 12.1 New South Wales 12.1.1 Historical Trend (2018-2023) 12.1.2 Forecast Trend (2024-2032) 12.2 Victoria 12.2.1 Historical Trend (2018-2023) 12.2.2 Forecast Trend (2024-2032) 12.3 Queensland 12.3.1 Historical Trend (2018-2023) 12.3.2 Forecast Trend (2024-2032) 12.4 Australian Capital Territory 12.4.1 Historical Trend (2018-2023) 12.4.2 Forecast Trend (2024-2032) 12.5 Western Australia 12.5.1 Historical Trend (2018-2023) 12.5.2 Forecast Trend (2024-2032) 12.6 Others 13 Market Dynamics 13.1 SWOT Analysis 13.1.1 Strengths 13.1.2 Weaknesses 13.1.3 Opportunities 13.1.4 Threats 13.2 Porter’s Five Forces Analysis 13.2.1 Supplier’s Power 13.2.2 Buyer’s Power 13.2.3 Threat of New Entrants 13.2.4 Degree of Rivalry 13.2.5 Threat of Substitutes 13.3 Key Indicator for Demand 13.4 Key Indicator for Price 14 Competitive Landscape 14.1 Market Structure 14.2 Company Profiles 14.2.1 Rex Constructions PTY LTD 14.2.1.1 Company Overview 14.2.1.2 Product Portfolio 14.2.1.3 Demographic Reach and Achievements 14.2.1.4 Certifications 14.2.2 Altec, Inc. 14.2.2.1 Company Overview 14.2.2.2 Product Portfolio 14.2.2.3 Demographic Reach and Achievements 14.2.2.4 Certifications 14.2.3 Titan Cranes Pty Ltd 14.2.3.1 Company Overview 14.2.3.2 Product Portfolio 14.2.3.3 Demographic Reach and Achievements 14.2.3.4 Certifications 14.2.4 Freo Group Pty Ltd 14.2.4.1 Company Overview 14.2.4.2 Product Portfolio 14.2.4.3 Demographic Reach and Achievements 14.2.4.4 Certifications 14.2.5 Borger Crane Hire and Rigging Services Pty Ltd. 14.2.5.1 Company Overview 14.2.5.2 Product Portfolio 14.2.5.3 Demographic Reach and Achievements 14.2.5.4 Certifications 14.2.6 Pakenham Crane Trucks 14.2.6.1 Company Overview 14.2.6.2 Product Portfolio 14.2.6.3 Demographic Reach and Achievements 14.2.6.4 Certifications 14.2.7 Cranecorp Australia 14.2.7.1 Company Overview 14.2.7.2 Product Portfolio 14.2.7.3 Demographic Reach and Achievements 14.2.7.4 Certifications 14.2.8 Joyce Krane Australia 14.2.8.1 Company Overview 14.2.8.2 Product Portfolio 14.2.8.3 Demographic Reach and Achievements 14.2.8.4 Certifications 15 Key Trends and Developments in the Market

16 List of Key Figures and Tables

1. Australia Mobile Cranes Rental Market: Key Industry Highlights, 2018 and 2032 2. Australia Mobile Cranes Rental Historical Market: Breakup by Product Type (USD Million), 2018-2023 3. Australia Mobile Cranes Rental Market Forecast: Breakup by Product Type (USD Million), 2024-2032 4. Australia Mobile Cranes Rental Historical Market: Breakup by Capacity (USD Million), 2018-2023 5. Australia Mobile Cranes Rental Market Forecast: Breakup by Capacity (USD Million), 2024-2032 6. Australia Mobile Cranes Rental Historical Market: Breakup by Application (USD Million), 2018-2023 7. Australia Mobile Cranes Rental Market Forecast: Breakup by Application (USD Million), 2024-2032 8. Australia Mobile Cranes Rental Historical Market: Breakup by Region (USD Million), 2018-2023 9. Australia Mobile Cranes Rental Market Forecast: Breakup by Region (USD Million), 2024-2032 10. Australia Mobile Cranes Rental Market Structure

What was the market value in 2023?

The market was valued at USD 185.70 million in 2023.

What is the growth rate of the Australia mobile cranes rental market?

The market is projected to grow at a CAGR of 3.98% between 2024 and 2032.

What is the market forecast for 2024-2032?

The revenue generated from the market is expected to reach USD 262.27 million in 2032.

What is the breakup of the market based on the product type?

The mobile cranes rental market is categorised according to product type, which includes all terrain cranes, floating cranes, truck cranes, and others.

Who are the key players in the Australia mobile cranes rental industry, according to the report?

The key players are Rex Constructions PTY LTD, Altec, Inc., Titan Cranes Pty Ltd, Freo Group Pty Ltd, Borger Crane Hire and Rigging Services Pty Ltd., Pakenham Crane Trucks, Cranecorp Australia and Joyce Krane Australia among others.

What is the breakup of the market according to the application?

Based on the application, the market is divided into construction, mining & excavation, marine & offshore and industrial.

What is the market breakup by region?

The market is broken down into New South Wales, Victoria, Queensland, Australian Capital Territory, Western Australia, and others.

Purchase Options 10% off

Methodology

Request Customisation

Report Sample

Request Brochure

Ask an Analyst

( USA & Canada ) +1-415-325-5166 [email protected]

( United Kingdom ) +44-702-402-5790 [email protected]

Mini Report

- Selected Sections, One User

- Printing Not Allowed

- Email Delivery in PDF

- Free Limited Customisation

- Post Sales Analyst Support

- 50% Discount on Next Update

Single User License

- All Sections, One User

- One Print Allowed

Five User License

- All Sections, Five Users

- Five Prints Allowed

Corporate License

- All Sections, Unlimited Users

- Unlimited Prints Allowed

- Email Delivery in PDF + Excel

Any Question? Speak With An Analyst

View A Sample

Did You Miss Anything, Ask Now

Right People

We are technically excellent, strategic, practical, experienced and efficient; our analysts are hand-picked based on having the right attributes to work successfully and execute projects based on your expectations.

Right Methodology

We leverage our cutting-edge technology, our access to trusted databases, and our knowledge of the current models used in the market to deliver you research solutions that are tailored to your needs and put you ahead of the curve.

Right Price

We deliver in-depth and superior quality research in prices that are reasonable, unmatchable, and shows our understanding of your resource structure. We, additionally, offer attractive discounts on our upcoming reports.

Right Support

Our team of expert analysts are at your beck and call to deliver you optimum results that are customised to meet your precise needs within the specified timeframe and help you form a better understanding of the industry.

Stay informed with our free industry updates.

We use cookies, just to track visits to our website, we store no personal details. Privacy Policy X

Press Release

Industry Statistics