Federal ID: 91-6001537 ISSN: 0022-1090 (Print) | 1756-6916 (Online)

The Journal of Financial and Quantitative Analysis (JFQA) is published eight times a year (February, March, May, June, August, September, November, and December) by the Michael G. Foster School of Business at the University of Washington in cooperation with the Arizona State University W. P. Carey School of Business , Boston College Carroll School of Management , HEC Paris , University of Illinois at Urbana-Champaign G ies College of Busine ss , and the University of British Columbia Sauder School of Business .

The JFQA publishes theoretical and empirical research in financial economics. Topics include corporate finance, investments, capital and security markets, and quantitative methods of particular relevance to financial researchers.

Quick Stats 2022

Median Turnaround: 40 days

Acceptance Rate: 8%

Yearly Submissions: 1,308

Latest JFQA News

- 2023 Sharpe Award winners! March 22, 2024

Submit manuscripts online through JFQA’s Editorial Manager site | SUBMIT

Bank Market Value and Loan Supply

- Published: 13 May 2024

Cite this article

- Mattia Girotti ORCID: orcid.org/0000-0002-0468-0088 1 &

- Guillaume Horny ORCID: orcid.org/0000-0002-3506-208X 2

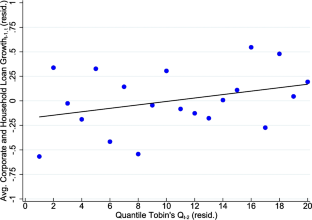

We study how the misvaluation of banks affects their loan supply by considering proprietary data on 83 banks from 11 euro-area countries from 2010Q1 to 2019Q4. We measure bank market value by the Tobin’s Q and identify the impact of nonfundamental changes in bank market value by saturating our specifications with observable bank fundamentals and analyst forecasts on future bank performance as well as several fixed effects. We show that nonfundamental rises in market value lead a bank to increase its loan supply to firms and households, even when the bank’s capital structure constraint is not binding. Our findings are consistent with a mechanism in which bank managers cater to the misperceptions of stock market investors.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

For a review of the literature, see Baker and Wurgler ( 2013 ).

These filters eliminate special institutions, whose business model departs from traditional banking. For instance, MFIs that raise funding only on the financial market and that mainly grant loans to other banks, or banks heavily specialized in consumer finance which are funded via other banks.

Specifically, Houston et al. ( 1997 ) document that the loan growth of subsidiary banks is more sensitive to the cash flow and capital position of their holding company than to their own cash flow and capital position. Campello ( 2002 ) finds that internal capital markets relax the funding constraints faced by smaller subsidiaries, while Ehrmann and Worms ( 2004 ) show that small German banks access the interbank market indirectly through their head of the group. Consequently, as shown by Ashcraft ( 2008 ), belonging to a banking group is a source of financial strength.

Note that the procedure does not concern the Tobin’s Q, for which we require to have always non-missing values.

Table A2 of the Online Appendix lists the banks in the sample and the banking group to which they belong.

Note that, ideally, we should consider as outcome variables seasoned equity offerings and share repurchases. The change in the log of capital and reserves is a coarse proxy for them, but has the advantage of being easily obtainable from the IBSI data set.

In the case of equity funding as a dependent variable, the estimated parameter on the Tobin’s Q at \(t-1\) loses its statistical significance but conserves the positive sign.

Aiyar S, Calomiris CW, Wieladek T (2014) Does macro-prudential regulation leak? Evidence from a UK policy experiment. J Money, Credit, Bank 46(s1):181–214

Article Google Scholar

Ashcraft AB (2008) Are bank holding companies a source of strength to their banking subsidiaries? J Money, Credit, Bank 40(2–3):273–294

Baker M, Wurgler J (2013) Behavioral corporate finance: An updated survey. In: Handbook of the Economics of Finance. Vol. 2, Elsevier, pp. 357–424

Baker M, Stein JC, Wurgler J (2003) When does the market matter? Stock prices and the investment of equity-dependent firms. Q J Econ 118(3):969–1005

Bakkar Y, De Jonghe O, Tarazi A (2023) Does banks’ systemic importance affect their capital structure and balance sheet adjustment processes? Journal of Banking & Finance 151:105518

Balduzzi P, Brancati E, Schiantarelli F (2018) Financial markets, banks’ cost of funding, and firms’ decisions: Lessons from two crises. Journal of Financial Intermediation 36:1–15

Barro RJ (1990) The Stock Market and Investment. The Review of Financial Studies 3(1):115–131

Berger AN, DeYoung R, Flannery MJ, Lee D, Öztekin Ö (2008) How do large banking organizations manage their capital ratios? Journal of Financial Services Research 34:123–149

Biswas S, Horváth BL, Zhai W (2022) Eliminating the tax shield through allowance for corporate equity: Cross-border credit supply effects. J Money, Credit, Bank 54(6):1803–1837

Blanchard O, Rhee C, Summers L (1993) The stock market, profit, and investment. Q J Econ 108(1):115–136

Campello M (2002) Internal capital markets in financial conglomerates: Evidence from small bank responses to monetary policy. J Financ 57(6):2773–2805

Campello M, Graham JR (2013) Do stock prices influence corporate decisions? Evidence from the technology bubble. J Financ Econ 107(1):89–110

Célérier C, Kick T, Ongena S (2020) Taxing bank leverage: The effects on bank portfolio allocation. Working Paper

De Jonghe O, Öztekin Ö (2015) Bank capital management: International evidence. Journal of Financial Intermediation 24(2):154–177

De Jonghe O, Dewachter H, Ongena S (2020) Bank capital (requirements) and credit supply: Evidence from pillar 2 decisions. J Corp Finan 60:101518

Ehrmann M, Worms A (2004) Bank networks and monetary policy transmission. J Eur Econ Assoc 2(6):1148–1171

Everett M, McQuade P, O’Grady M (2020) Bank business models as a driver of cross-border activities. J Int Money Financ 108:102164

Fischer S, Merton RC (1984) Macroeconomics and finance: The role of the stock market. Carn-Roch Conf Ser Public Policy 21:57–108

Google Scholar

Fraisse H, Lé M, Thesmar D (2020) The real effects of bank capital requirements. Manage Sci 66(1):5–23

Gropp R, Heider F (2010) The determinants of bank capital structure. Review of Finance 14(4):587–622

Gropp R, Mosk T, Ongena S, Wix C (2018) Banks response to higher capital requirements: Evidence from a quasi-natural experiment. The Review of Financial Studies 32(1):266–299

Houston J, James C, Marcus D (1997) Capital market frictions and the role of internal capital markets in banking. J Financ Econ 46(2):135–164

Koijen RSJ, Koulischer F, Nguyen B, Yogo M (2017) Euro-area quantitative easing and portfolio rebalancing. American Economic Review 107(5):621–627

Lepetit L, Saghi-Zedek N, Tarazi A (2015) Excess control rights, bank capital structure adjustments, and lending. J Financ Econ 115(3):574–591

Lou X, Wang AY (2018) Flow-induced trading pressure and corporate investment. Journal of Financial and Quantitative Analysis 53(1):171–201

Morck R, Shleifer A (1990) Vishny RW (1990) The stock market and investment: Is the market a sideshow? Brook Pap Econ Act 2:157–215

Polk C, Sapienza P (2009) The stock market and corporate investment: A test of catering theory. The Review of Financial Studies 22(1):187–217

Rostagno M, Altavilla C, Carboni G, Lemke W, Motto R, Saint-Guilhem A, Yiangou J (2019) A Tale of Two Decades: The ECB’s Monetary Policy at 20. Working Paper #2346, European Central Bank 2019

Sobiech AL, Chronopoulos DK, Wilson JOS (2021) The real effects of bank taxation: Evidence for corporate financing and investment. J Corp Finan 69:101989

Stein JC (1996) Rational capital budgeting in an irrational world. J Bus 69(4):429–455

Van den Heuvel SJ (2002) The bank capital channel of monetary policy. Working Paper

Warusawitharana M, Whited TM (2016) Equity market misvaluation, financing, and investment. The Review of Financial Studies 29(3):603–654

Download references

Acknowledgements

This paper previously circulated under the title “Bank Equity Value and Loan Supply.” We thank Charles Calomiris, Ettore Croci, John Kandrac, Nikolaos Karagiannis and Joslem Ngambou for helpful comments. We also thank conference participants at the 5th EFiC Conference in Banking and Corporate Finance, 37th International Symposium on Money, Banking and Finance (GdRE) and 37th International Conference of the French Finance Association, and seminar participants at the University of Zurich and Central Bank of Ireland for valuable feedback. The views expressed herein are those of the authors and should under no circumstances be interpreted as reflecting those of the Banque de France or the Eurosystem.

No specific funding was received for this research.

Author information

Authors and affiliations.

Université Paris-Dauphine, Université PSL, CNRS, DRM, Finance, 75016, Paris, France

Mattia Girotti

Banque de France, 75049, Paris, France

Guillaume Horny

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Mattia Girotti .

Ethics declarations

Competing interests.

The authors confirm that there are no relevant financial or non-financial competing interests to report.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Supplementary file 1 (pdf 175 KB)

Rights and permissions.

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

Reprints and permissions

About this article

Girotti, M., Horny, G. Bank Market Value and Loan Supply. J Financ Serv Res (2024). https://doi.org/10.1007/s10693-024-00430-0

Download citation

Received : 03 February 2023

Revised : 08 December 2023

Accepted : 27 April 2024

Published : 13 May 2024

DOI : https://doi.org/10.1007/s10693-024-00430-0

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Market Value

- Market Misvaluation

- Loan Supply

JEL Classification

- Find a journal

- Publish with us

- Track your research

- Aims & Scope

- Abstracting & Indexing Information

- Associate Editors

- Past Editors

- History of the JFR

- Editorial Letters & Policies

- Membership and Subscriptions

- Sponsoring Organizations

- Statement of Professional Ethics

- Forthcoming Articles

- Current & Past Issues

- Review Process

- Submit a Manuscript

- Appeals Policy and Process

- Keynote Addresses from SFA & SWFA Meetings

- Editors’ Choice and Outstanding Article Awards

The Journal of Financial Research

The official journal of the southern finance association and the southwestern finance association, jfr editors tout decision turn-around time, give advice to reviewers and authors alike at swfa annual meeting.

The new co-editors of the Journal of Financial Research touted the journal’s current successes, revealed new changes, and fielded questions to prospective authors during a “Meet the Editors” panel session…

A welcome letter from JFR’s new editorial team

As the new editors of the Journal of Financial Research (JFR), we would like to thankthe Southern Finance Association and the Southwestern Finance Association for the honor ofbeing entrusted with…

JFR’s 2023 European Symposium

In conjunction with the BAFFI CAREFIN Center at Bocconi University, we are hosting a research symposium. The Symposium will take place at Bocconi University in Milan, Italy. We welcome general…

Learn more about The Journal of Financial Research, an SSCI listed journal.

Submit to JFR

More information on the electronic submission process can be found here.

With a median turnaround decision time of approximately 1 month, you will receive quick feedback on your submission.

The Journal of Financial Research publishes four issues per year.

CITATIONS RECEIVED IN 2022

2022 2-year impact factor, 2022 5-year impact factor, percent acceptance rate, submissions received in 2023.

© 2024 · The Journal of Financial Research

Type and press Enter to search

International Journal of Financial Research

Discontinued in Scopus as of 2020

Subject Area and Category

- Business and International Management

- Economics, Econometrics and Finance (miscellaneous)

Sciedu Press

Publication type

19234023, 19234031

The set of journals have been ranked according to their SJR and divided into four equal groups, four quartiles. Q1 (green) comprises the quarter of the journals with the highest values, Q2 (yellow) the second highest values, Q3 (orange) the third highest values and Q4 (red) the lowest values.

The SJR is a size-independent prestige indicator that ranks journals by their 'average prestige per article'. It is based on the idea that 'all citations are not created equal'. SJR is a measure of scientific influence of journals that accounts for both the number of citations received by a journal and the importance or prestige of the journals where such citations come from It measures the scientific influence of the average article in a journal, it expresses how central to the global scientific discussion an average article of the journal is.

Evolution of the number of published documents. All types of documents are considered, including citable and non citable documents.

This indicator counts the number of citations received by documents from a journal and divides them by the total number of documents published in that journal. The chart shows the evolution of the average number of times documents published in a journal in the past two, three and four years have been cited in the current year. The two years line is equivalent to journal impact factor ™ (Thomson Reuters) metric.

Evolution of the total number of citations and journal's self-citations received by a journal's published documents during the three previous years. Journal Self-citation is defined as the number of citation from a journal citing article to articles published by the same journal.

Evolution of the number of total citation per document and external citation per document (i.e. journal self-citations removed) received by a journal's published documents during the three previous years. External citations are calculated by subtracting the number of self-citations from the total number of citations received by the journal’s documents.

International Collaboration accounts for the articles that have been produced by researchers from several countries. The chart shows the ratio of a journal's documents signed by researchers from more than one country; that is including more than one country address.

Not every article in a journal is considered primary research and therefore "citable", this chart shows the ratio of a journal's articles including substantial research (research articles, conference papers and reviews) in three year windows vs. those documents other than research articles, reviews and conference papers.

Ratio of a journal's items, grouped in three years windows, that have been cited at least once vs. those not cited during the following year.

Evolution of the percentage of female authors.

Evolution of the number of documents cited by public policy documents according to Overton database.

Evoution of the number of documents related to Sustainable Development Goals defined by United Nations. Available from 2018 onwards.

Leave a comment

Name * Required

Email (will not be published) * Required

* Required Cancel

The users of Scimago Journal & Country Rank have the possibility to dialogue through comments linked to a specific journal. The purpose is to have a forum in which general doubts about the processes of publication in the journal, experiences and other issues derived from the publication of papers are resolved. For topics on particular articles, maintain the dialogue through the usual channels with your editor.

Follow us on @ScimagoJR Scimago Lab , Copyright 2007-2024. Data Source: Scopus®

Cookie settings

Cookie Policy

Legal Notice

Privacy Policy

This website uses cookies.

By clicking the "Accept" button or continuing to browse our site, you agree to first-party and session-only cookies being stored on your device to enhance site navigation and analyze site performance and traffic. For more information on our use of cookies, please see our Privacy Policy .

- Journal of Economic Perspectives

- Spring 2024

The Financial Crisis Inquiry Commission and Economic Research

- Wendy Edelberg

- Greg Feldberg

- Article Information

- Comments ( 0 )

Additional Materials

- Author Disclosure Statement(s) (300.20 KB)

JEL Classification

- G20 Financial Institutions and Services: General

IMAGES

VIDEO

COMMENTS

The Journal of Financial Research is a quarterly academic journal devoted to publication of original scholarly research in investment and portfolio management, capital markets and institutions, and corporate finance, corporate governance, and capital investment. The JFR, as it is popularly known, has been in continuous publication since 1978 ...

Wiley Editing Services offers professional video, design, and writing services to create shareable video abstracts, infographics, conference posters, lay summaries, and research news stories for your research - so you can help your research get the attention it deserves. Wiley's Author Name Change Policy

The Journal of Finance publishes leading research across all the major fields of financial research. It is the most widely cited academic journal on finance and one of the most widely cited journals in economics as well.

Step 3. Payment of submission fees may be made by credit card, debit card, or PayPal. Submission fees are $250 for members of the Southern Finance Association or Southwestern Finance Association, or $300 for non-members (which includes a one-year subscription to the Journal of Financial Research ). Select the appropriate payment amount below ...

Journal of Financial Research, Volume 47, Issue 1, Page 89-121, Spring 2024. Capital gain overhang and risk-return trade‐off: An international study. by Dazhi Zheng, Huimin Li, Fengyun Li on March 14, 2024 at 6:13 am . Journal of Financial Research, Volume 47, Issue 1, Page 211-242, Spring 2024.

Scimago Journal Ranking provides information on the Journal of Financial Research, a quarterly academic journal of investment and portfolio management, capital markets and institutions, and corporate finance. See the journal's quartile, SJR, coverage, publication type, and similar journals options.

Journal of Financial Research. 2020, 477 (3): 134-151. Abstract ( 1430) PDF (556KB) (1202 ) China's P2P (peer-to-peer) online lending industry has experienced numerous twists and turns in its development process, during which there have been several serious platform crises that have hindered the healthy development of the industry. ...

Journal of Financial Research. 2023, 515 (5): 58-76. Can Autonomous Debt Issuance by Local Governments Improve the Quality of Economic Development?. A Quasi-Natural Experiment Based on the "Self-Repayment" Reform of Local Debt Collect. Journal of Financial Research. 2023, 515 (5): 77-95.

General Guidelines. We strongly recommend that submitting authors 1) peruse past issues of the journal in order to become familiar with the quality and composition of articles appearing in the journal, 2) motivate the main idea clearly and early in the paper, and 3) avoid submitting papers that have not been well vetted and/or professionally ...

Journal of Financial Research. 2021, 498 (12): 189-206. Abstract ( 726) PDF (572KB) (1034 ) In Recent years, China's bond market has achieved rapid development.However, since China's first default case of "11 Chaori Bond" in 2014, the rigid bond repayment rule has been violated and bond default has occurred frequently.This has caused ...

A hybrid journal that publishes empirical and theoretical research on financial services industries and policies. Topics include banking, risk management, capital markets, insurance, FinTech, and macro-financial issues.

The JFQA publishes theoretical and empirical research in financial economics. Topics include corporate finance, investments, capital and security markets, and quantitative methods of particular relevance to financial researchers. ... Journal of Financial and Quantitative Analysis Foster School of Business +1 (206) 543-4598 [email protected] 109 ...

The Journal of Financial and Quantitative Analysis ( JFQA) publishes theoretical and empirical research in financial economics. Topics include corporate finance, investments, capital and security markets, and quantitative methods of particular relevance to financial researchers. With a circulation of 3000 libraries, firms, and individuals in 70 ...

Bank Risk and Firm Investment: Evidence from Firm-Level Data. The Journal of Financial Services Research publishes high quality empirical and theoretical research on the demand, supply, regulation, and pricing of ...

An important question in financial economics is whether capital market imperfections trigger real effects. In a seminal article, Fischer and Merton suggest that deviations of stock market prices from fundamental values can ultimately affect firms' investment decisions.According to them, when the stock market values a company more than what fundamentals imply, firm managers should profit from ...

The official journal of the Southern Finance Association. and the Southwestern Finance Association. 04Apr. JFR editors tout decision turn-around time, give advice to reviewers and authors alike at SWFA annual meeting. The new co-editors of the Journal of Financial Research touted the journal's current successes, revealed new changes, and ...

The Journal of Financial Economics (JFE) is a leading peer-reviewed academic journal covering theoretical and empirical topics in financial economics.It provides a specialized forum for the publication of research in the area of financial economics and the theory of the firm, placing primary emphasis on the highest quality analytical, empirical, and clinical contributions in the following ...

Journal of Financial Research. 2016, 436 (10): 159-173. Abstract ( 1029) PDF (1514KB) (641 ) In this paper, we put the risk dependence, consistency risk measurement and portfolio into an analytical framework, combined with Coupla-CVaR model and Mean-var portfolio theory to construct the investment portfolio model of Mean-Copula-CVaR, and ...

International Journal of Financial Research . Discontinued in Scopus as of 2020 ... SJR is a measure of scientific influence of journals that accounts for both the number of citations received by a journal and the importance or prestige of the journals where such citations come from It measures the scientific influence of the average article in ...

The Financial Crisis Inquiry Commission and Economic Research by Wendy Edelberg and Greg Feldberg. Published in volume 38, issue 2, pages 43-62 of Journal of Economic Perspectives, Spring 2024, Abstract: Researchers and economic research were essential to the success of the Financial Crisis Inquiry...

Photo: Allison Dinner for The Wall Street Journal. Liquid metal battery developer Ambri, which is backed by Microsoft co-founder Bill Gates, has filed for bankruptcy, ...