Top 30 Questions and Answers- Budgeting [With PDF]

In management accounting, budgeting has significant importance. Today we will learn the top “30” questions and answers-budgeting.”

So let’s get started.

Questions and Answers- Budgeting

Question-01: What is the budget?

Answer: A budget is a comprehensive plan that is generally articulated in structured quantitative terms.

Question-02: What are the purposes of the budget?

Answer: Budgets are used for two different purposes:

- Planning and

- Controlling.

Question-03: What is planning?

Answer: Planning is the setting of goals and the preparation of budgets for achieving those goals.

Question-04: What is control?

Answer: Control is collecting feedback to ensure that a plan is implemented correctly or changed as situations change.

Question-05: What are the advantages of budgeting?

Answer: Some advantages of budgeting are as follows:

- Budgets express the strategies of the management around the enterprise.

- Budgets push executives to think about the future and prepare for it.

- Before they arise, the budgeting phase will reveal possible bottlenecks.

- Budgets identify targets and priorities that can act as indicators for subsequent performance assessment.

Question-06: What is responsibility accounting?

Answer: Responsibility accounting is an accountability system in which managers are held accountable for those sales and expense items and only those items they can exercise considerable influence.

Question-07: What is the continuous budget?

Answer: A 12-month budget is a continuous budget that rolls forward one month after the end of the current month.

Question-08: What is a self-imposed budget or participatory budget?

Answer: A self-imposed budget is a form of budget preparation in which executives plan their budgets. Higher-level administrators then review these budgets, and any conflicts are addressed by mutual consensus.

Question-09: What are the benefits of self-imposed budgeting?

Answer: There are a variety of benefits to self-imposed budgets:

- Individuals at all levels of the company are regarded as members of the team whose opinions and decisions are respected by top management.

- Front-line managers’ budget forecasts are often more detailed and accurate than estimates prepared by top managers with less comprehensive knowledge of markets and day-to-day operations.

Question-10: What is the limitation of self-imposed budgeting?

Answer: There are two significant drawbacks to self-imposed budgeting.

- If they lack the broad strategic perspective possessed by top executives, lower-level managers will make suboptimal budgeting recommendations.

- Self-imposed budgeting can allow the development of too much budgetary slack by lower-level managers.

Question-11: What is the master budget?

Answer: The master budget consists of various but interdependent budgets that formally set out the sales, production, and economic objectives of the organization.

Question-12: What budgets are included in the Master budget?

Answer: Master budget includes:

- Sales Budget

- Production Budget

- Direct Materials Budget

- Direct Labor Budget

- Production Overhead budget

- Ending Inventory Budget

- Selling and administrative expense budget

Question-13: What is the first step of master budgeting?

Answer: The preparation of the sales budget is the first step of the master budgeting.

Question-14: What’s the sales budget?

Answer: A comprehensive schedule indicating the expected sales for the budget duration is the sales budget.

Question-15: What is the second step of Master budgeting?

Answer: The preparation of the production budget is the second step of master budgeting.

Question-16: What is the production Budget?

Answer: The production budget is a detailed plan that lists the number of units that have to be produced to fulfill the needs of the sales and provide the inventory of finished goods required.

Question-17: How does it end in the master budget?

Answer: With the preparation of a cash budget, income statement, and balance sheet, the master budget ends.

Question-18: What is a Cash Budget?

Answer: A cash budget is a comprehensive plan that shows how cash resources will be collected and used.

Question-19: What are the four sections of the Cash Budget?

Answer: The four major sections of the cash budget are:

- The receipts section.

- The disbursements section.

- The cash excess or deficiency section.

- The financing section.

Question-20: What is the budgeted income statement?

Answer: An estimation of net income for the budget period is given in the budgeted income statement and relies on the sales budget, closing inventory budget, sales budget and operating expenditures budget, and the cash budget.

Question-21: What is the budgeted balance sheet?

Answer: At the end of a budget cycle, the budget balance sheet estimates the assets, liabilities, and stockholders’ equity of a corporation.

Question-22: How to calculate the required production units?

Answer: Required production in Units= (Budgeted sales units+ Desired ending finished goods inventory)-beginning finished goods inventory.

Question-23: What is the purchase budget?

Answer: The purchase budget is a detailed plan that indicates the number of products to be purchased during the period from suppliers.

Question-24: How to calculate the required Purchases?

Answer: Required Purchases = (Budgeted COGS+ Desired Closing merchandise Inventory) – Beginning Merchandise Inventory

Question-25: What is the direct materials budget?

Answer: The Direct Materials Budget is a structured plan showing the number of raw materials to be bought to meet the production budget and provide sufficient inventories.

Question-26: What is the direct labor budget?

Answer: A comprehensive plan demonstrating the direct labor hours needed to meet the production budget is the Direct Labor Budget.

Question-27: What is the production overhead budget?

Answer: The production overhead budget is a comprehensive plan that indicates the cost of production, other than direct materials and direct labor, that will be incurred over a given period.

Question-28: What is the ending finished goods inventory budget?

Answer: A budget reflecting the dollar amount of inventory of unsold finished products that will appear on the final balance sheet is the ending finished goods inventory budget.

Question-29: What are the reasons to prepare the ending finished goods inventory budget?

Answer: For two reasons, this budget is necessary:

- To aid in assessing the cost of products sold on the statement of budgeted income; and

- To value on the budgeted balance sheet ending inventories.

Question-30: What is the Selling and Administrative Expense Budget?

Answer: The selling and Administrative Expense budget is a detailed plan that lists the budgeted expenses as distinct from manufacturing.

I hope that you have a basic idea about budgeting at the end of the article. Read these “top 30 questions and answers-budgeting” regularly and improving your accounting skills.

You can also read:

- Top 25 Questions and Answers-Introduction to Management Accounting

- Top 25 questions and Answers- Cost Volume Profit (CVP) Analysis

- Top 15 Questions and Answers- Budgetary Control

- Top 20 Questions and Answers-Flexible Budget

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Budget Planning and Budgeting Lessons

Budgeting teaching budget lesson plans learning worksheet household family planning exercises classroom unit teacher resources activity free tutorial curriculum basics.

Lessons appropriate for: 1st 2nd 3rd 4th 5th 6th 7th 8th 9th 10th 11th 12th Graders.

First Grade - Second Grade - Third Grade - Fourth Grade - Fifth Grade - Sixth Grade - Seventh Grade - Eighth Grade - Ninth Grade - Tenth Grade - Eleventh Grade - Twelfth Grade - K12 - Middle School - High School Students - Adults - Special Education - Secondary Education - Teens - Teenagers - Kids - Children - Homeschool - Young People

Teaching Special Needs - Adult Education - Budgeting for Kids - Children - Young Adults

Our Budgeting section delivers an array of educational tools. Dive into our collection that comprises lesson plans, printable worksheets, instructive videos, detailed articles, and more. Our lesson plans and printable worksheets are crafted to guide educators in imparting knowledge about the principles of budgeting and the importance of financial planning. Tailored to fit various learning environments, these resources are adaptable for both group lessons and self-paced studies. Our instructive videos provide a vibrant approach to understanding budgeting, bringing to life the nuances of financial planning with compelling animations and lucid breakdowns of intricate topics. Meanwhile, our detailed articles delve into the finer points of budgeting, offering expert commentary and profound insights into managing personal finances effectively. Whether you're a visual learner, a reading enthusiast, or someone in search of structured lessons, the Budgeting section of Money Instructor is equipped with resources to ensure you grasp the essentials of financial planning and lead a financially sound life.

Lessons and worksheets, suggestions or need help.

Do you have a recommendation for an enhancement to this budgeting money lesson page, or do you have an idea for a new lesson? Then leave us a suggestion .

More Teaching Earning and Spending Money Worksheets and Lessons

To teach and learn money skills, personal finance, money management, business, careers, and life skills please go to the Money Instructor home page .

Teach and learn money skills, personal finance, money management, business, careers, real life skills, and more.... MoneyInstructor ®

- New Member Registration

- Teaching Lessons

© Copyright 2002-2024 Money Instructor® All Rights Reserved.

- Boards & Committees

- Event Management

- Financial Management

- Funding & Sponsorship

- Legal Issues

- Sport Industry

- Policy Development

- Service Delivery

- Risk Management

- Strategic Planning

- Computer Help

- What is budgeting?

- Purpose of a budget

- Budgeting principles

- Budgeting process

- Information for budgeting

- Developing a budget

- Presenting your budget

- Programs costing

- Example budget

- Cashflow forecasting

- Cashflow budget

- Break-even analysis

- Variance analysis

- Using a spreadsheet

- The budget interview

- Exercises and Quizzes

- Interactive quizzes

Answers to Budgeting Exercises

Immediate download of answers.

Answers to budgeting exercises are not individually purchased but are available for immediate download as a complete set in a ZIP file.

If a ZIP file is not convenient for you, please email [email protected] after making payment and I will send answers as separate attachments to emails as soon as I can.

Type of Files in Download

The complete set of budgeting answers includes professionally produced documents in Portable Document Format (.PDF) for all exercises plus a complete Microsoft Excel workbook file for all exercises except exercises 1 and 2.

High Quality Printouts

All Microsoft Excel workbook files have been formatted for professional presentation and each worksheet will produce a high quality printout of the recommended answer complete with headers and footers.

Cost of Purchase

For AUS $6 (6 Australian Dollars) you will receive one ZIP file that contains the complete set of 15 answers. If you are concerned that you may not be able to unzip the file, please continue with your purchase but then email me and I will send you the answers as attachments to an email.

How to Purchase

To begin your purchase, please click on the "Add to Cart" button below. The easiest way is to use PayPal. If you prefer to another method of payment, please email [email protected]

In Case of Difficulty

If you have any difficulty with the exercises or with the amswers, I would be pleased to assist. Please email [email protected]

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Budgeting 101: How to Budget Money

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

If I have take-home pay of, say, $3,000 a month, how can I pay for housing, food, insurance, health care, debt repayment and fun without running out of money? That’s a lot to cover with a limited amount, and this is a zero-sum game.

The answer is to make a budget.

What is a budget? A budget is a plan for every dollar you have. It’s not magic, but it represents more financial freedom and a life with much less stress. Here’s how to set up and then manage your budget.

Get a custom financial plan and unlimited access to a Certified Financial Planner™

NerdWallet Advisory LLC

How to budget money

Calculate your monthly income, pick a budgeting method and monitor your progress.

Try the 50/30/20 rule as a simple budgeting framework.

Allow up to 50% of your income for needs, including debt minimums.

Leave 30% of your income for wants.

Commit 20% of your income to savings and debt repayment beyond minimums.

Track and manage your budget through regular check-ins.

Understand the budgeting process

Figure out your after-tax income : If you get a regular paycheck, the amount you receive is probably it, but if you have automatic deductions for a 401(k), savings, and health and life insurance, add those back in to give yourself a true picture of your savings and expenditures. If you have other types of income — perhaps you make money from side gigs — subtract anything that reduces it, such as taxes and business expenses.

Choose a budgeting plan: Any budget must cover all of your needs, some of your wants and — this is key — savings for emergencies and the future. Budgeting plan examples include the envelope system and the zero-based budget.

Track your progress: Record your spending or use online budgeting and savings tools .

Automate your savings: Automate as much as possible so the money you’ve allocated for a specific purpose gets there with minimal effort on your part. An accountability partner or online support group can help, so that you're held accountable for choices that blow the budget.

Practice budget management: Your income, expenses and priorities will change over time, so actively manage your budget by revisiting it regularly, perhaps once a quarter. If you're struggling to stick with your plan, try these budgeting tips .

Start by determining your take-home (net) income, then take a pulse on your current spending. Finally, apply the 50/30/20 budget principles : 50% toward needs, 30% toward wants and 20% toward savings and debt repayment.

The key to keeping a budget is to track your spending on a regular basis so you can get an accurate picture of where your money is going and where you’d like it to go instead. Here’s how to get started: 1. Check your account statements. 2. Categorize your expenses. 3. Keep your tracking consistent. 4. Explore other options. 5. Identify room for change. Free online spreadsheets and templates can make budgeting easier.

Start with a financial self-assessment. Once you know where you stand and what you hope to accomplish, pick a budgeting system that works for you. We recommend the 50/30/20 system, which splits your income across three major categories: 50% goes to necessities, 30% to wants and 20% to savings and debt repayment.

Start by determining your take-home (net) income, then take a pulse on your current spending. Finally, apply the 50/30/20

budget principles

: 50% toward needs, 30% toward wants and 20% toward savings and debt repayment.

The key to keeping a budget is to

track your spending

on a regular basis so you can get an accurate picture of where your money is going and where you’d like it to go instead. Here’s how to get started: 1. Check your account statements. 2. Categorize your expenses. 3. Keep your tracking consistent. 4. Explore other options. 5. Identify room for change. Free

online spreadsheets and templates

can make budgeting easier.

Start with a financial self-assessment. Once you know where you stand and what you hope to accomplish, pick a

budgeting system

that works for you. We recommend the 50/30/20 system, which splits your income across three major categories: 50% goes to necessities, 30% to wants and 20% to savings and debt repayment.

Try a simple budgeting plan

We recommend the popular 50/30/20 budget to maximize your money . In it, you spend roughly 50% of your after-tax dollars on necessities, including debt minimum payments. No more than 30% goes to wants, and at least 20% goes to savings and additional debt payments beyond minimums.

We like the simplicity of this plan. Over the long term, someone who follows these guidelines will have manageable debt, room to indulge occasionally, and savings to pay irregular or unexpected expenses and retire comfortably.

The 50/30/20 budget

Find out how this budgeting approach applies to your money.

Your 50/30/20 numbers:

Necessities

Savings and debt repayment

Do you know your “want” categories?

Become a NerdWallet member to track your monthly spending trends, including how much you're allocating to needs and wants.

Allow up to 50% of your income for needs

Your needs — about 50% of your after-tax income — should include:

Basic utilities.

Transportation.

Minimum loan and credit card payments. Anything beyond the minimum goes into the savings and debt repayment category.

Child care or other expenses you need so you can work.

If your absolute essentials overshoot the 50% mark, you may need to dip into the “wants” portion of your budget for a while. It’s not the end of the world, but you'll have to adjust your spending.

Even if your necessities fall under the 50% cap, revisiting these fixed expenses occasionally is smart. You may find a better cell phone plan , an opportunity to refinance your mortgage or an opportunity for less expensive car insurance . That leaves you more to work with elsewhere.

Leave 30% of your income for wants

Separating wants from needs can be difficult. In general, though, needs are essential for you to live and work. Typical wants include dinners out, gifts, travel and entertainment.

It’s not always easy to decide. Are restorative spa visits (including tips for a massage ) a want or a need? How about organic groceries? Decisions vary from person to person.

If you're eager to get out of debt as fast as you can, you may decide your wants can wait until you have some savings or your debts are under control. But your budget shouldn't be so austere that you can never buy anything just for fun.

Every budget needs wiggle room — maybe you forgot about an expense or one was bigger than you anticipated — and some money to spend as you wish. If there's no money for fun, you'll be less likely to stick with your budget.

Commit 20% of your income to savings and debt paydown

Use 20% of your after-tax income to put something away for the unexpected, save for the future and pay off debt balances (paying more than minimums). Make sure you think of the bigger financial picture; that may mean two-stepping between savings and debt repayment to accomplish your most pressing goals.

Many experts recommend you try to build up several months of bare-bones living expenses. We suggest you start with an emergency fund of at least $500 — enough to cover small emergencies and repairs — and build from there.

You can’t get out of debt without a way to avoid more debt every time something unexpected happens. And you’ll sleep better knowing you have a financial cushion.

Get the easy money first. For most people, that means tax-advantaged accounts such as a 401(k). If your employer offers a match, contribute at least enough to grab the maximum. It's free money.

Why do we make capturing an employer match a higher priority than debts? Because you won’t get another chance this big at free money, tax breaks and compound interest. Ultimately, you have a better shot at building wealth by getting in the habit of regular long-term savings.

You don’t get a second chance at capturing the power of compound interest . Every $1,000 you don’t put away when you’re in your 20s could be $20,000 less you have at retirement .

Once you’ve snagged a match on a 401(k), if available, go after the toxic debt in your life: high-interest credit card debt, personal and payday loans, title loans and rent-to-own payments. All carry interest rates so high that you end up repaying two or three times what you borrowed.

If either of the following situations applies to you, investigate options for debt relief , which can include bankruptcy or debt management plans :

You can't repay your unsecured debt — credit cards, medical bills, personal loans — within five years, even with drastic spending cuts.

Your total unsecured debt equals half or more of your gross income.

Once you’ve knocked off any toxic debt, the next task is to get yourself on track for retirement. Aim to save 15% of your gross income; that includes your company match, if there is one.

If you’re young, consider funding a Roth individual retirement account after you capture the company match. Once you hit the contribution limit on the IRA, return to your 401(k) and maximize your contribution there.

Regular contributions can help you build up three to six months' worth of essential living expenses — not your full budget, just the must-pay basics. You shouldn’t expect steady progress because emergencies happen, and that's when you should pull money from this fund. Just focus on replacing what you use and building higher over time.

These are payments beyond the minimum required to pay off your remaining debt .

If you’ve already paid off your most toxic debt, what’s left is probably lower-rate, often tax-deductible debt (such as your mortgage). Tackle these when the more-basic goals listed above are covered.

Any wiggle room you have here comes from the money available for wants or from saving on your necessities, not your emergency fund and retirement savings.

Congratulations! You’re in a great position — a really great position — if you’ve built an emergency fund, paid off toxic debt and are socking away 15% toward a retirement nest egg. You’ve built a habit of saving that gives you immense financial flexibility. Don’t give up now.

Consider saving for irregular expenses that aren’t emergencies, such as a new roof or your next car. Those expenses will come no matter what, and it’s better to save for them than borrow.

WATCH TO LEARN MORE ABOUT BUDGETING

» LEARN: Tips for Canadians on how to budget

on Capitalize's website

Get a custom financial plan and unlimited access to a Certified Financial Planner™. Unbiased, expert financial advice for a low price.

12 Fun Budgeting Activities PDFs for Students (Kids & Teens)

By: Author Amanda L. Grossman

Posted on Last updated: March 27, 2023

Looking for fun budgeting activities PDFs? You'll love this collection of budgeting scenarios for high school students, and money management worksheets for students (PDFs).

Teaching students how to budget doesn't have to be a drag, especially if you do it through fun budgeting activities.

But, have you noticed how difficult it is to find GOOD, fun budgeting activities with PDFs?

After spending a few hours scouring the internet, searching for the best FREE options out there, I've now become aware of the problem.

Still, there are some good options you should know about (plus, I'm releasing my own — for free!).

Fun budgeting activities (with PDFs) and money management worksheets for students are two of the best ways to teach your kids and teens about money.

Article Content

Budgeting Scenarios for High School Students (PDFs to Print)

I'd like to start this list off with my own budgeting scenarios I created for high school students (parents, you can use these, too!).

This budgeting worksheet for students (pdf) was originally part of my Money Prodigy Online Summer Camp, but I'm carving it out for you to use, for free.

Here's how this works:

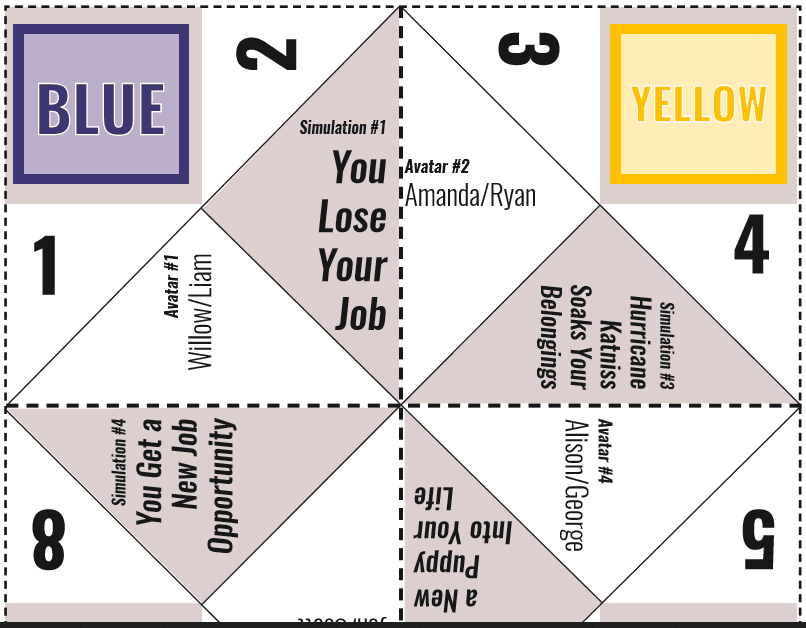

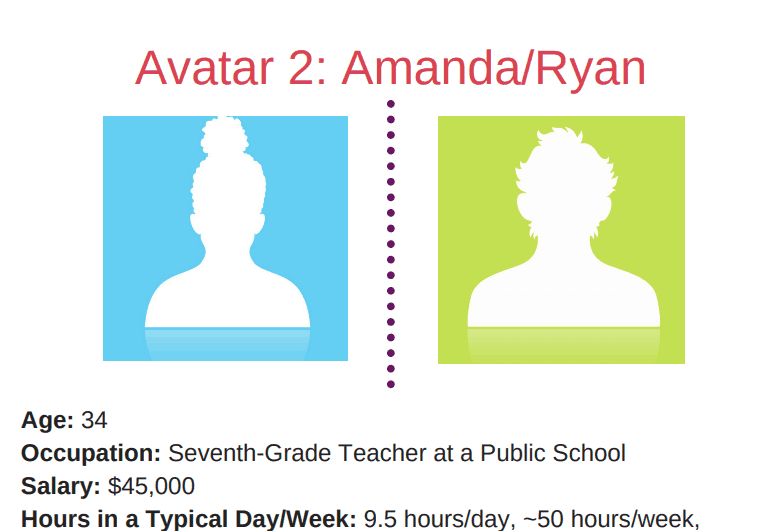

Your child uses a fortune teller (free printable) to determine which one of 4 Avatars they are. The avatars have both a female and a male name, but the information is the same — so it doesn't matter if a boy or a girl gets that avatar.

They read up on their salary information, budgeting information, and general financial information. Each avatar is at a different stage in their career, and in a different stage of life (so lots of possibilities to play several rounds of this).

They fill in a budgeting sheet based on the information they've been given.

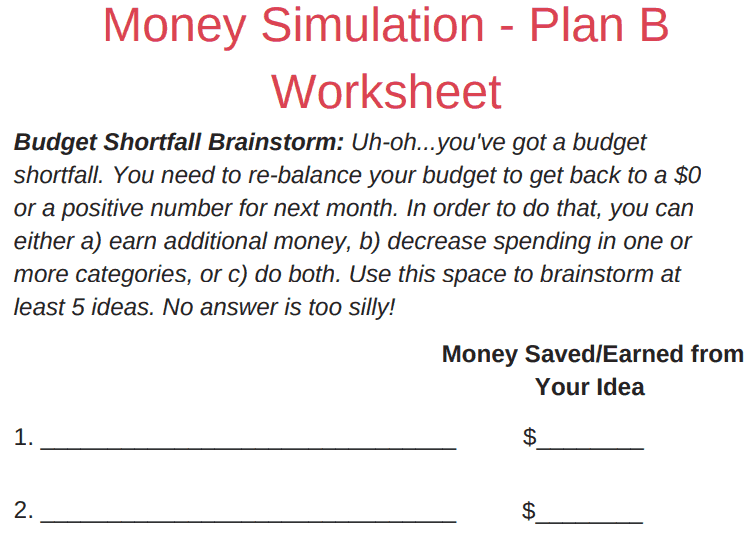

Then, the simulation really begins. They take a turn with the fortune teller again, which spits out a a real-life scenario. Once they figure out what their new situation is, they need to deal with it within their current budget constraints.

Your students then fill in follow-up questions and information about how things went for them.

Other resources for you:

- How to Teach Budgeting (from Beginner to Advanced Levels)

- 6 Budgeting Projects for Middle School Students

- 4 Budget Projects for High School Students

- 11 Teenage Budgeting Tips

- How a Teenager Can Improve their Budget

- Prom Budget Planner

Alright…let's move onto many more fun budgeting activities with PDFs and financial scenarios for students.

Fun Budgeting Activities (with PDFs)

Fun budgeting activities (PDFs you can print) will not only begin teaching your students and kids how to budget for specific events OR for life, in general, but it will make the process entertaining.

Heck, your kids might beg for more money activities after you introduce a few of these fun budgeting activities below.

Psst: you might want to check out my comprehensive article on budgeting for kids , and the best teen budget worksheets .

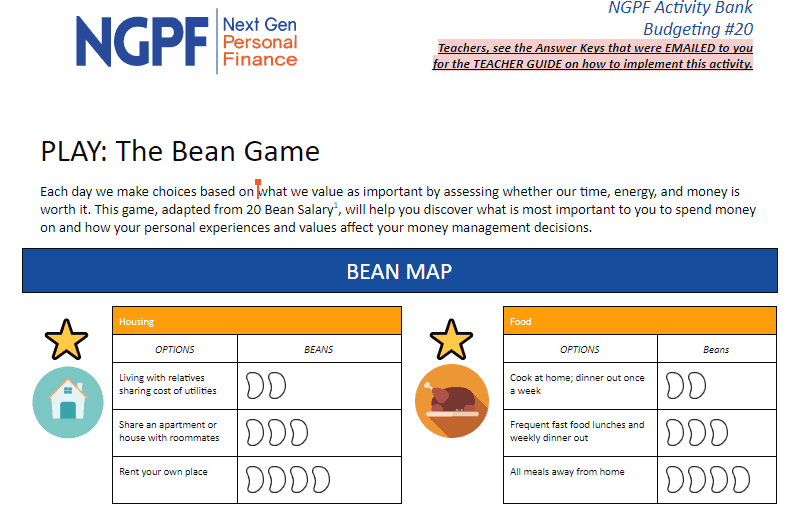

#1: Next Gen Personal Finance’s Bean Game

Suggested Age Range: Not given.

I just love this – every student receives 20 beans, as well as a game board that shows a cost (in beans) for different spending and saving categories. Students must decide how to spend their 20 beans across all categories.

What might trip your students up? There are starred categories that are “musts”, so your student has to spend some beans in those.

In midway through, if you want to really shake things up, the creators of this game suggest telling your students that they’ve been demoted or downsized at work and now only have 13 beans – they must remove 7 beans from their boards.

This is an individual activity, but can easily be used in groups of 2 as well.

#2: ConsumerFinance.gov’s Bouncing Ball Budgets

Suggested Age Range: 13-19 years

What I like about this spending activity is it has a physical component. Meaning, kids get into a group and throw a ball to one another. The number that is closest to their right index finger (the ball has numbers on it) corresponds to a question about spending habits.

The student then has 30 seconds to answer the question, which will help them analyze their own spending habits.

Example questions include:

- Give an example of a big expense you’ve had to save money for.

- Give an example of why you might call yourself a saver or a spender.

- What do you find hard to resist spending money on?

#3: Design Mom's Teen Budgeting Game

Suggested Age Range: For teenagers.

In just an hour of play, your students and teens can go through 12 months on a budget. New challenges are thrown there way for each month, such as being fined for a traffic ticket, or earning an extra $5 in interest on savings.

Teens are given $300 each (remember, this is a game, not the real world!), and must satisfy 9 different budgeting categories ranging from rent to movies.

Free printables include:

- Budget Worksheet

- Banker’s Instructions

- Explanation of “Budget Options”

The goal of the game, or how to win? Is to end the game with $450 in savings PLUS a “Well Being” Factor of 96 or higher.

Psst: Here's more budget games for kids and teens to check out. Also, here's 19 free financial literacy games for high school students .

#4: Scholastic's Trip-Planning Simulation

Suggested Age Range: Grades 6-8

Take your students through a trip-planning simulation to teach them how to budget for something. Scholastic provides free printables, including:

- Project Outline: Going On Vacation printable

- Calculating Vacation Costs Worksheet

Part of your prep is coming up with a list of 6 different resorts they can choose from. Students then must come up with both distance and costs when planning a trip to one of those locations, all while staying within the $4,500 budget they have.

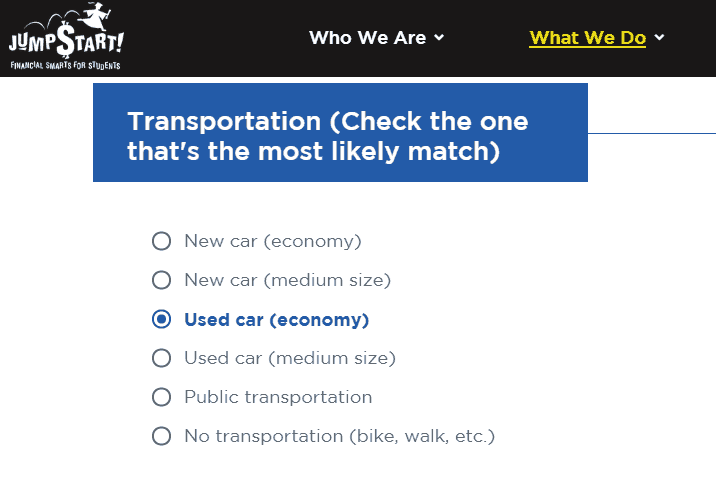

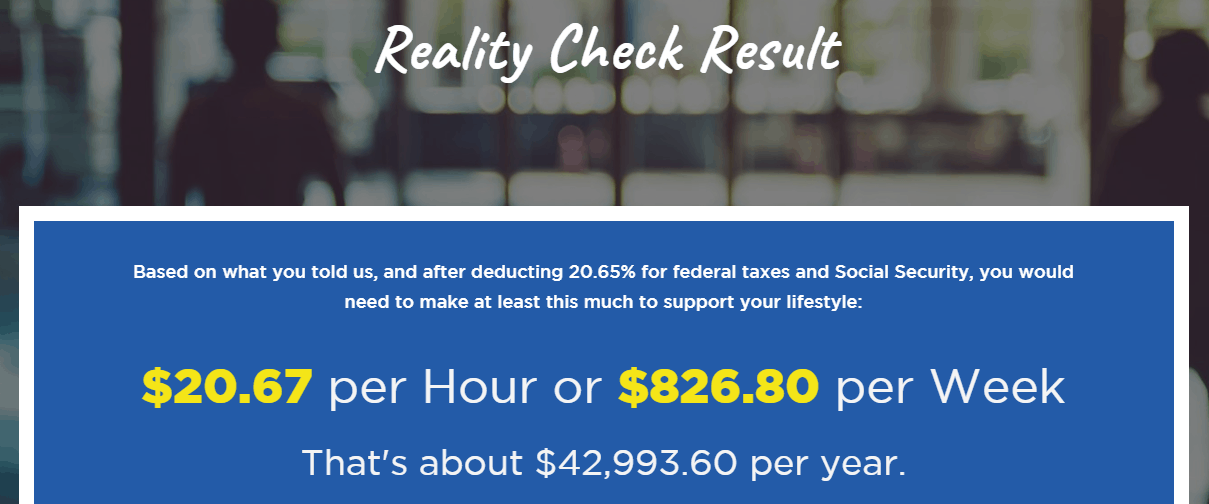

#5: Jump$tart’s Reality Check Activity

A fun activity to kick-off money lessons or a money unit would be to have your students go through this Reality Check calculator.

They get to answer various questions (there are only 10) about the type of lifestyle they want to live, and then fill out estimated amounts they think they’ll spend each month for specific budget categories.

Then the “reality” kicks in when they see what kind of income they’ll have to maintain in order to live that lifestyle.

Suggestion: perhaps you can set this reality check game up on computers as a transition activity for students, OR, as one of your various money centers for the day.

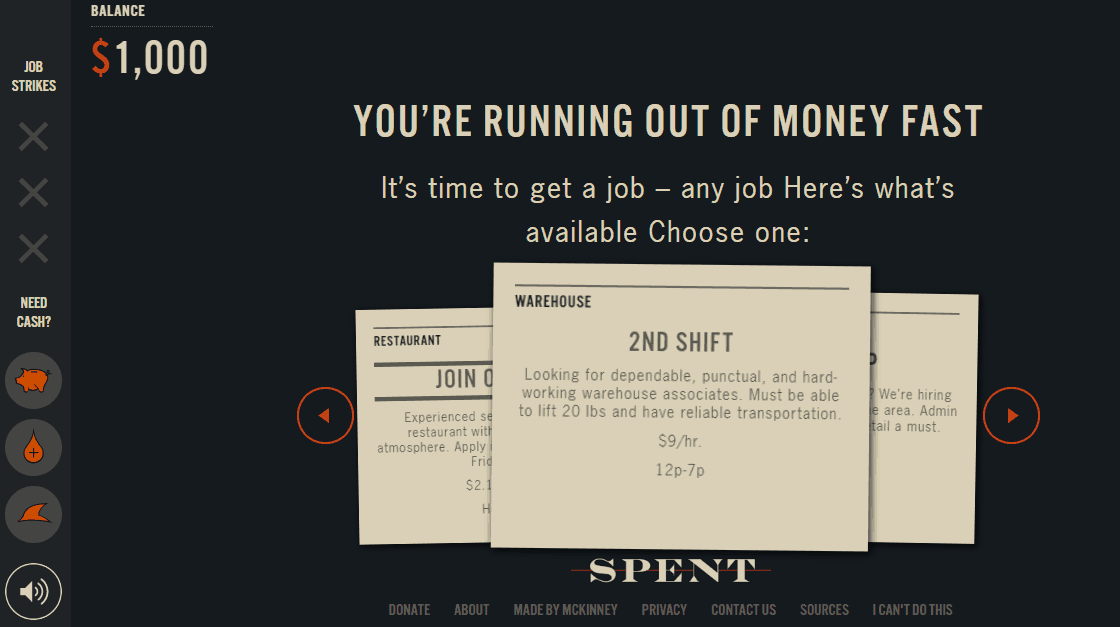

#6: McKinney’s PlaySpent.org

Here’s an interesting budgeting game for students to play, that will also increase their awareness of how hard it can be to survive without a job.

They are given the scenario that they are down to their last $1,000 since losing their job. The object of this game is to use that $1,000 as wisely as possible so that they can live with it over one month.

#7: FinanceintheClassroom.org’s Investigation of Regional Housing Costs

Suggested Age Range: Grades 10-12

What I love about this budgeting scenario is that they actually created it – I’ve been talking about how important it is to research cost of living before moving or accepting a job offer somewhere for years.

Mostly because, I’ve had personal experience from it! In my mid-20s, I took a job in Palm Beach Gardens, Florida. While I learned a lot at the job (I was eventually laid off from it), the fact is, I didn’t save any money (outside of retirement) during those almost two years because the cost of living was just too high.

With this budgeting scenario, students are asked to look at the finances and situation of Trish and Scott who want to move from Annapolis, MD to somewhere else for a job offer.

Students then must analyze the housing costs for one of their new job offers and see if they can or cannot afford to accept the job and move there.

Such a valuable financial lesson to learn young (especially since because young adults are least able to afford high-cost-of-living areas).

#8: Sarah and Jessica's Jelly Bean Game

Group students together in sizes of 2-4, and hand them 20 jelly beans in total (tell them not to eat them!). The group then collectively decides how they'd like to spend those 20 jelly beans, based on money values, spending needs vs. wants , etc.

For each round they go through, they'll deal with different scenarios, such as someone's leg breaking (did they choose to spend on insurance?), or getting a raise at work.

Now, let's move onto money management worksheets.

#9: Budgeting a Trip in Rural Setting Vs. City Setting

ConsumerFinance.gov has these two lesson plans that are exactly the same…except where the students plan a trip to: rural or a city location.

I say, why not take this a step further and show your students one aspect of cost-of-living by having them budget out BOTH a trip to a rural setting AND a trip to a city setting ?

Then, they can compare the costs of each and discuss why one is (most likely) costlier than the other.

Money Management Worksheets for Students (with PDFs)

I love that you're looking for money management worksheets for your students — it means you care about their money future!

After hours of research, I've curated a list of free printable money management worksheets (available in PDF format, so you can easily print them out), that, in my opinion, are the best available.

#1: Practical Money Skill’s The Art of Budgeting

Suggested Age Range: 14-18 years

What I specifically like about this lesson is the “Rework a Budget” section, found on Page 11.

Students are given the chance to budget for a girl named Gabrielle. And then, they’re asked to rework the budget once her month actually played out – which is such a great lesson because, let’s face it, planned budgets and planned spending is often not what happens in real life.

Yet, you want to teach students to learn early on that just because your planned spending and your actual spending aren’t the same, doesn’t mean you should give up on budgeting.

Instead, rework it! They’ll get better and better with doing that, the more they budget.

#2: Second Harvest Food Bank’s Shopping on a Budget Activity

I don’t know that I would call this budgeting activity fun , but eye-opening? For sure.

This budgeting activity for students attempts to bring awareness to how difficult it can be to feed your family nutritious food on a low budget.

#3: ConsumerFinance.gov’s Create a Savings First Aid Kit

One of the most valuable parts of this activity is having students complete the simple acts of:

- Brainstorming possible unexpected expenses that pop up in life

- Determine if those expenses are an emergency, or not

Simple, but effective.

I hope you've found some awesome fun budgeting activities, budgeting worksheets for students, and budget scenario activities you're going to give a try with your own students and kids. Let me know how it goes in the comments below!

- Latest Posts

Amanda L. Grossman

Latest posts by amanda l. grossman ( see all ).

- 50 Banking Activities for Kids (Student Financial Literacy) - February 14, 2024

- 14 Christmas Activities for High School Students (they’ll Actually Find Cool) - December 1, 2023

- 3 Fun Selfie Scavenger Hunts for Teens (Christmas, Fin Lit, etc.) - November 27, 2023

Criticism of Budgeting Assignment Answer

Introduction

“A budget is a plan, expressed in financial and or more general quantitative terms, which extends forward for a period into the future.” (Gowthorpe, 2003, p 457). “A budget may be defined as a financial or quantitative statement, prepared and approved prior to a defined period of time of the policy to be pursued during that period for the purpose of attaining a given objective. It may include income, expenditure and employment of capital.” (The chartered Institute of Management Accountants of England and Wales).

Traditional budgets

It is a long time practise to prepare budgets; every organization wants to succeed, attain competitive advantage, earn high revenues, incur low costs, and achieve high EPS, long term loyalty of customers and finally high market value. To achieve the above objectives, the business must plan out its activities in the most optimum manner by taking in to consideration planning tools, such as budgets. Budgets are prepared for future after taking into account the changes that are expected to occur in future times. The motive behind the preparation of budget is the optimum use of capital, labour and better utilization of other resources. The actual figures are expected to match the budget unless something contrary happens; in fact it is the constant duty of the management to see that the actual figures do correspond with that of the budgetary figures. Budgets are prepared by the managers for their departments along with his subordinates to manage the processes taken care of by them. Thus the manager's subordinates will each bear an individual responsibility to ensure that a specific area of activity complies with the values and expectations expressed within the overall budget. Budgets are prepared for internal use and do not accompany the annual financial statements published by the company. According to, Richard Barrett, of ALG software, “the preparation of annual budgets is still the most widely used tool of controlling expenditure and setting up of related performance targets.”

Traditionally the budget serves the functions of planning, coordination, communication authorising and delegating, and motivation, control and performance evaluation. Let's discuss these functions separately (Drury C. 2003):

- Planning: as seen above, planning is the first and foremost function of budgeting, planning requires quantifying the resources to be used in the budgeting period like, materials and labour etc. budget is a planning techniques because it involve planning for future.

- Coordination: budgeting is also coordination, because activities are to be coordinated in such as manner in which there is achievement of organizational goals. For example, coordination is required between the operating activities such as, sales, production, consumption inventory etc.

- Communication: budgeting is a communication tool as well, as the results attained by the various part of the organization helps the organization in prioritization of activities.

- Motivation: it is also an important aspect of budgeting as when the managers achieve their targets, they are motivated to work harder.

- Controlling: whenever, any activity is going out of track, through budgeting as a controlling technique, we can get it back to track by either changing it completely or stopping it temporarily.

- Performance evaluation: budgeting helps in performance evaluation because the performance of the managers is evaluated on the basis of the targets achieved, if they achieve the targets, they get promotions and bonuses etc.

Short comings of Traditional budgets

Traditional budgeting have been criticised on the basis of planning problems and performance evaluation problems. There has been widespread dissatisfaction with traditional budgets in recent times. (e.g., Schmidt 1992; Hope and Fraser 1997, 2000, 2003; Ekholm and Wallin 2000; Marcino 2000; Jensen 2001). Budgets lack behind in meeting the demands of the business; they fail in identifying waste, do not support continuous improvement, do not involve activities based costing, do not identify the cost pools and cost drivers, and a general lack of ownership and buy in is observed in traditional budgeting, (Cassell. M, 2003). As said by Lester (2000), “it may invite micro –management by administrators and governing boards as they attempt to manage operations with little or no performance information”, moreover they are very lengthy and time consuming. They are also criticised by investors as budgets do not provide any information to investors about the operations and activities going on in the organization, they are prepared on calendar year and not to match the schedules of product. Traditional budgets are therefore regarded too slow, backward looking and one-dimensional. Budgets are criticised of their long established and oft researched susceptibility to induce budget games or dysfunctional behaviours, (Hofstede 1967; Onsi 1973; Merchant 1985b; Lukka 1988).

The major drawbacks can be summarized as below:

- Lack concentration of strategy and contradicts them.

- Lengthy i.e. takes a lot of time and costly to prepare

- Rigid, lacks flexibility

- Do not allow change

- No value additions when compared with the efforts and time put in

- Main focus of budgets are on cost reduction rather than adding value to the business

- Gives importance to vertical control

Inspite of the drawbacks above, in a survey by David Dugdale and Stephen Lyne, nearly 40 companies are still willing to use budgets, they agreed only on two areas. They said that, yes budgeting is time consuming and the actions may get delayed due to some constrains. They disagreed to abandon budgets because of the following reasons:

- Viewing Budgets as a framework to control, budgets are still regarded as helpful tool in coordination and control

- Organizations culture to prepare budgets, budgets is indispensible part of an organization. (Scapens and Roberts, 1999)

- The need of decentralization.

Advanced developments in the Budgeting Process

After classifying traditional budgeting as “Bane of corporate America” and “tools of repression”, companies worldwide are using Activity Based Budgeting, rolling Budgeting, Zero base Budgeting and 4P based budgeting (PBB), which is Paradigm –Based Budgeting, Process-Based Budgeting, Priority based budgeting and Performance based budgeting. As suggested by Anthony, Hawkins and Merchant (2003), a change in the practise and methodology used can make a huge difference in the processes and systems that underline business performance management . The definitions of the new budgeting alternatives to traditional budgets are discussed below: In the words of Peter a Pyhm, zero base baudegting (ZBB) is “an operating planning and budgeting process which requires each manger to justify his entire budget requests in detail from scratch (hence zero base). Each manager has to justify why he should spend any money at all. This approach requires that all activities be identified as decision on packages which would be evaluated by systematic analysis and ranked on order of importance.” Thus “ZBB is a management tool which provides a systematic method for evaluating all operations and programme, current or new, allows for budget reductions and expansions in a rational manner and allows reallocation of resources from low to high priority programmes.” (David Heminger). Performance budgeting is described as a technique, “the process of analysing, identifying, simplifying and crystallising specific performance objectives of a job to be achieved over a period, within the frame work of organizational objectives, the purpose and objectives of the job. The technique is characterised by its specific direction towards the business objectives of the organization,” The National Institute of bank Management, Mumbai. Performance budgeting is based in the achievement of specific goals in a period of time. Rolling budget can be defined as Method in which a budget established at the beginning of an accounting period is continually amended to reflect variances that arise due to changing circumstances. “Activity based budgeting is the allocation of resources to individual activities. Activity based budgeting involves determining which activities incur costs within an organization, establishing the relationships between them, and then deciding how much of the total budget should be allocated to each activity.” Cost Dictionary. Balanced score card is a part of ABB; it is a set of financial and non financial measure relating to company’s critical success factors. It is an approach which provides information to the management to assist in strategic policy formulation and achievement. It emphasizes the need to provide the user with a set of information which addresses all relevant areas of performance in an objective and unbiased manner. As a management tool it helps companies to assess overall performance, improves operational processes and enables management to develop better plans for improvements. It offers managers a balanced view of their organization upon which they can base real change. (Kalpan and Norton 1992) They say that abolishment of budgets open up new financial as well as non financial measures of performance. The company’s after abandoning budgets need to identify the Key Performance Indicators (KPI) for example, profit, return on capital, cash flows, quality and customer satisfaction. Such KPI’s are continuously reviewed and changed according to the changing world thus allowing the company to adapt according to the shift in market conditions.

Beyond Budgeting (BB)

Hope and Robin Fraser achieved prominence in criticising budgeting in their book, Beyond Budgeting: How Managers Can Break Free from the Annual Performance Trap (2003). The authors urged that, “Budgeting, as most corporations practice it, should be abolished”. According to Hope and Fraser, "abandoning the annual budgeting process opens up two opportunities; one is to enable a more adaptive state of management processes, and the other is to enable a radically decentralized organization." The authors are of the view that if the company wants to adapt to changing economy it should abolish using budgets, once it stops preparing budgets, the companies will make their employees more creative, motivated, willing to work hard and ready to share information, which are the most necessary requisitions for any company’s’ long life. The authors suggested Beyond Budgeting is the result of the Beyond Budgeting Round table (BBRT), which is an independent industry led research consortium. Hope and Fraser (2003) is the founder of “Beyond budgeting: how managers can break free from the annual performance trap.” Beyond budgeting, p212 says, “A set of guiding principles that, if followed, will enable an organization to manage its performance and decentralise its decision making process without the need for traditional budgets. Its purpose is to enable the organization to meet the success factors of the information economy (e.g being adaptive in unpredictable conditions.” Beyond budgeting have two advantages:

- It make the organization adaptable to the changing market conditions

- It is not like traditional budgeting process, it is a decentralized process where organization is taken care of by the leaders centrally. BB by the word “budgeting” means the entire performance management.

The Six Adaptive Process Principles of ‘Beyond Budgeting’ given by Hope and Fraser are as follows:

- Set stretch goals aimed at relative improvement

- Base evaluation and rewards on relative improvement contracts with hindsight

- Make action planning a continuous and inclusive process

- Make resources available as required

- Coordinate cross-company actions according to prevailing customer demand

- Base controls on effective governance and on a range of relative performance indicators

Source: Beyond Budgeting, pp. 69-89.

References:

- CIMA, “Beyond Budgeting” beyond budgeting oct 07

- “Who needs Budgets” https://www.ncbi.nlm.nih.gov/pubmed/12577658

- “Who needs Budgets” https://hbr.org/2003/02/who-needs-budgets

- MassiveMark Playground

- Transliteration Playground

- Professional Practice Test

- Assignmenthelp Services

- Custom Writing help

- Free Assignment Samples

- Free Homework Help Samples

- Terms of Use

- Refund Policy

Budgeting Activities

New to ngpf.

Save time, increase student engagement, and help your students build life-changing financial skills with NGPF's free curriculum and PD.

Start with a FREE Teacher Account to unlock NGPF's teachers-only materials!

Become an ngpf pro in 4 easy steps:.

1. Sign up for your Teacher Account

2. Explore a unit page

3. Join NGPF Academy

4. Become an NGPF Pro!

Want to see some of our best stuff?

Spin the wheel and discover an engaging activity for your class, your result:.

INTERACTIVE: Shady Sam

Sending form...

One more thing.

Before your subscription to our newsletter is active, you need to confirm your email address by clicking the link in the email we just sent you. It may take a couple minutes to arrive, and we suggest checking your spam folders just in case!

Great! Success message here

Teacher Account Log In

Not a member? Sign Up

Forgot Password?

Thank you for registering for an NGPF Teacher Account!

Your new account will provide you with access to NGPF Assessments and Answer Keys. It may take up to 1 business day for your Teacher Account to be activated; we will notify you once the process is complete.

Thanks for joining our community!

The NGPF Team

Want a daily question of the day?

Subscribe to our blog and have one delivered to your inbox each morning, create a free teacher account.

Complete the form below to access exclusive resources for teachers. Our team will review your account and send you a follow up email within 24 hours.

Your Information

School lookup, add your school information.

To speed up your verification process, please submit proof of status to gain access to answer keys & assessments.

Acceptable information includes:

- a picture of you (think selfie!) holding your teacher/employee badge

- screenshots of your online learning portal or grade book

- screenshots to a staff directory page that lists your e-mail address

- any other means that can prove you are not a student attempting to gain access to the answer keys and assessments.

Acceptable file types: .png, .jpg, .pdf.

Create a Username & Password

Once you submit this form, our team will review your account and send you a follow up email within 24 hours. We may need additional information to verify your teacher status before you have full access to NGPF.

Already a member? Log In

Welcome to NGPF!

Take the quiz to quickly find the best resources for you!

ANSWER KEY ACCESS

- Managing Resources in an International Business Environment

- Unit 35 Developing Individuals Teams and Organisations

- Teaching in a Specialist Area

- Just Baked Inventory Management Exercise Solutions

- Orientation for Success in Higher Education

- Leading and Managing Change Assignment

- Business Management Assignment Sample

- Download Free Samples

- Budgeting Assignment Samples

- Plagiarism & Error Free Assignments By Subject Experts

- Affordable prices and discounts for students

- On-time delivery before the expected deadline

No AI Generated Content

62000+ Projects Delivered

500+ Experts

- Select Services Assignment / Coursework / Homework Essay Dissertation / Thesis / Proposal Question and Answers SOP Editing / Proofreading PPT Resume / CV Others (Custom order) Select subject Redirecting... Free Assistance

- Assignment Help

Introduction

Master budget, benefits of making budgets-, traditional approaches to budgeting, beyond budgeting model.

Get free samples written by our Top-Notch subject experts for taking online assignment help services

The report has been prepared to determine the effects of implementation of budgets n an organization. These are prepared to establish benchmarks and to allocate resources according to that. The approaches to traditional budgeting are highlighted and a reason for non suitability in changing business environment is also presented in the study. The beyond budgeting techniques of budgets are also identified in the report and its relevance in business environment is highlighted.

The budgets are used by the company so that forecasts can be made on the basis of actual performance; production has been undertaken in a company. There are several kind of budgets prepared in an organization. Capital budgets are useful for the determination of the investments made in the large projects for long term and assess the cash flow from the project throughout its life in order to gather information related to the possible returns generated as per the set standards. The purpose for which investment has been made is justified and used in order to secure effective measures in a company (Elias et al., 2017). It has been used to allocate appropriate resources in an organization. Huge amount of investment is required for long term purpose that has been used to allocate resources in a company. Poor formation of budgets can lead to significant losses (Ostaev et al., 2019).

The master budget entails the information regarding all the activities carried out in the business in which there is an incurrence of cost or generation of the income such as sales and expenses to formulate the business objectives. The budgets are performed for the purpose of ascertaining benefits in long term. This has been used to calculate effective controls in an organization. The company uses the same to determine well defined combination of assets and liabilities (Ostaev et al., 2019).

There are several disadvantages of master budget that it brings inaccuracy in a company. These are based on financial figures and historical costs of companies that leads to having an effective control in an organization (Aksom et al., 2017). The cash flow budget provides the forecasts of the cash inflows and outflows which in turn help in doing the prudence management of cash by the business. The cash inflows and outflows are maintained in order to achieve effective measures in an organization. The cash generated has been used to develop appropriate responses in an organization (Ostaev et al., 2019).

The accurate results cannot be predicted with this help. The realization of cash has been undertaken to make better presentation of cash inflows and outflows (Miller et al., 2018).

There are several benefits associated with the process of budgeting. It outlines the planning of business and suggest plans to ensure and manage tasks effectively. There are several benefits associated with budgets of the company-

- Planning for success of business success –the success of business can only be achieved if all the departments work in collaboration towards the achievement of specific goals of the company. It is important to determine growth and expansion of the company. For that it is important to plan the success in a definite way (Miller et al., 2018).

- Ability to make continuous improvements –budgets increases the capability of the business to take several decisions in an organization. The improvements in the changing environment can be easily implemented through budgets that will increase the working capability of the company (Elias et al., 2017).

- Helps in anticipating problems –the problems of the company are anticipated in order to maintain appropriate balance in a company. It is important to organize various resources so that organizational development can be there (Miller et al., 2018).

- Sound financial information –the financial performance of the company can be improved by maintaining sound financial information in a company. The year end results can be surprising on determining appropriate concern in a company. It will also give an opportunity to stand back in tough circumstances (Elias et al., 2017).

- Improvements in clarity and focus –there is great improvements in clarity and focus of the company. The same can be prepared by maintaining appropriate decisions in an organization (Miller et al., 2018).

- Confidence in decision making –the decision making can also be ascertained with projections for the future. It is required to maintain appropriate relations in an organization. It is important to maintain efficiency and reliability in a company. The confidence could be established in order to maintain efficiency in an organization.

The budget is planned to control finances of the company. It is important to organize efficient and relative course of action in a company. It is used to ensure that current commitments can be achieved and objectives could be reached in an organization. It enables us to be confident for the financial decisions that could meet the objectives of the company. It is used to ensure money for future projects of the company.

The budgets are prepared to maintain the money effectively. It is used to allocate appropriate resources in an organization. It is used to monitor the performance of the company. It is used to meet objectives of the company in order to develop positive scenario of the organization. The problems are identified and finance can be raised to reduce the cash flow difficulties of the company. The planning for the future can be made effectively. The staff motivation can also be increased so that it is possible to recognize long term efficiency in an organization (Ouassini, 2018).

The budgets can be fixed or variable depending upon the requirements of the company. The fixed budget overheads include cost of premises, cost of equipment, promotion and advertising, expenses of vehicle, subsistence and travel expenses, cost of staff. It is important to ascertain effectiveness and efficiency with the establishment of proper budgets in an organization (Miller et al., 2018).

The budgets must be prepared keeping the plans that are realistic to be achieved in long run. It will be easy to perform business operations in an organization. This could be developed using last year budget as a base figure. It would also required involvement of right people so that essential tasks are fulfilled and conducted using these. The estimate of the figures is determined and appropriate resources could be collected with this (Ostaev et al., 2019).

Traditional budgets are prepared taken previous year budget as base to prepare budgets for the next year. It is used to be preparing specific time budget for a particular period and it is required to make changes in that. The benefit for adopting this type of budget is simplicity and ease in making such budgets. It is not important to rethink over the previous year budget. This is important to do changes in the previous budget to implement changes in the business department. Many people sit with the data they have and plan budget for the year.

The usefulness of traditional budgeting has been faded away in the current business situations. The business situations nowadays are challenging and required regular up gradation in order to sustain its position in the market. It is important to prepare budge that will suit the requirements of the current business. The traditional form of budget is based on the incremental value of the previous budgets and no other change. The method is simple to apply but not practically suitable to be implemented in the organization (Weigel et al., 2018).

The traditional approach must be changed in order to develop long term efficiency in an organization. It is important to maintain long term efficiency and benefits in an organization. The same has to be prepared by adding on more requirements on the basis of what organization demands with relation to the moves of the rivalry firms of the company (O’Grady et al., 2017).

The budgets are not strategically prepared and are more prone to errors of the company. It is important to maintain efficacy in a business. The budget prepared on traditional approach is strategically focused and are contradictory in nature. It places responsiveness and flexibility in an organization. It is a barrier to change that would not let the business expand its operations to the full capacity (Weigel et al., 2018).

Also traditional budgets are costly to be prepared are really time consuming in context of putting these together. These are prepared and updated annually and infrequently that would not help in measuring realistic targets of the company. The approach is required to be changed since the business environment is dynamic in nature. It is required to prepare the same for changing business needs of the company.

The traditional budget approach undervalues the needs and requirements of the company (Weigel et al., 2018). It is important to maintain and prepared balance in a company. It does not reflect the change in the current working environment that would make inefficient work force. The targets set for them are not proper. These are required in order to ascertain better efficiency and relational base in a company. It does not reflect the emerging network structures that are adopted by the organizations (Nikulina, 2019).

There are several benefits of traditional budgeting-

- Provides solid framework –it provides a framework and benchmarks that are required to be handle in an organization. It is important to maintain essential and effective controls in an organization.

- Encourages decentralization –it is used to process decentralization of tasks that would make easy to fix responsibility and accountability in an organization. The emphasis is on long term tasks that are required in an organization (Ho, 2018).

- Traditional budgeting is the part of organizational structure –various related consequences can be derived using these. It is important to maintain efficient controls in order to organize efficiency in a company (Nikulina, 2019).

With various benefits it has seen that traditional budgeting do not fit in changing environment of the company. There are certain disadvantages to this that can be seen in the traditional form of budgeting. These are as follows-

- Chances of human errors are higher –the chances of errors and mistakes are higher as these are prone to certain human errors. This is the main cause why traditional form of budgeting is avoided.

- Time consuming –the process is time consuming as it involves dependency on lots of spreadsheets that are required to be open. The previous data has been used for this purpose so that it becomes important to manage various tasks of the company (Weigel et al., 2018).

- Do not encourage expected behavior –the behavior could not be identified and expected that would not fix the accountability and responsibility on the employees of the company (Ho, 2018).

- There is no alignment between strategy and spending –the strategy to every business must be different as the economic, political, technological consequences are different every year so there must be balance in an organization (Weigel et al., 2018).

- Inaccurate predictions –the predictions are inaccurate that will lead to inefficient controls on the organization. The prediction for the future cannot be made and futuristic plans cannot be developed with the traditional form of budgeting (May, 2017).

Beyond Budgeting Model is prepared to cover the limitations of traditional budgeting that are generally used to set contracts of the company. The range of techniques, forecasts and market related activities and feature are all involved and included in the budget. It is the way to abolish the process of traditional budgeting over an organization. The company aims to establish highly decentralized organizational system and adaptive to the set management process of the company (Nikulina, 2019).

The traditional budgeting carries lots of flaws that need to be removed to make the efficient move of the business. The objective of traditional budgeting is not fulfilled in the current business situations. To cover this beyond budgeting is considered (Ho, 2018).

There is a rationale behind preparation of beyond budgeting. This is based on as below-

- The time consuming and costly preparation of the budgets.

- The budgets are not prepared on strategy of the company

- The value creation is seen on the basis of determining budgets of the company (Nikulina, 2019).

- The obstacles for the changes are created in order to implement changes in the company.

- The centralization of power within an organization is created in an organization (May, 2017).

The idea of beyond budgeting is based on agility, and is primarily used in software development companies. It is more prevalent to quickly adjust and adapt to the changing environment of the company. Nowadays business across various departments is using the technique to adapt to achieve its goals and targets of long run (Ho, 2018).

There are various techniques in beyond budgeting that are implemented while making forecasts. These are as follows-

- Rolling forecasts are required be created every monthly and every quarterly and not annually (Ho, 2018).

- The targets of the company are based on key performance indicators.

- The performance of the company is based on external benchmarks rather than the past performance.

- Operational managers are empowered to react to the changes in the business environment and can dynamically coordinate their actions (Ho, 2018).

There are different principles on which beyond budgeting is based-

- Purpose –initiate long term goals of the company and not focus on short term objectives,.

- Values –it is govern through sound judgment and shared values and not to the rules and regulations of the company.

- Transparency –this is more open to innovation, self regulation, controls and learning.

- Organization –it cultivate a strong sense of organizing all the resources in a company. It avoids hierarchical control and bureaucracy (Nikulina, 2019).

- Autonomy –the people are trusted with freedom to act efficiently.

- Customers –the conflicts of interest are avoided and needs of customer are avoided.

- Rhythm –the management processes are dynamically around business events.

- Targets –the relative goals are recognized in the company (Nikulina, 2019).

- Plan and forecasts –the unbiased and lean processed are simplified in the process.

- Resource allocation –the cost conscious mind set and resources are made available to political and rigid processes.

- Performance evaluation –the learning and development is not based on the measurement only and not for the rewards (May, 2017).

- Rewards –the success against competition is the rewards shared.

There are certain barriers to the beyond budgeting. These are as follows-

- The composition of budgets takes up lots of time and money –it is required to cover each and every area of the organization that would take up most of the time in preparation for the same (Nikulina, 2019).

- The budgets are prepared lead to an emphasis on internal areas rather than external area –it is more required to take efforts to set higher performance standards in a company.

- The budget makes the people feel in the organization that these are set up to fulfill short term goals instead of long term. The sense of insecurity is created in the minds of people.

- The budgets do not lead to reduction in costs of the company (Ostaev et al., 2019).

From the above discussions it has been cleared that method of beyond budgeting help organization to be more specific to the problems and that would radically change more specific problems. The challenging fundamental beliefs are required to be implemented in an organization. The industries are involved in the megatrends of globalization, mobility and digitalization in a company. The same been implemented to be implemented in non-profit organization. It also fosters sharing of experiences and information by adopting principles in a company.

Aksom, H., 2017. Infused with value? Trajectories, discourses and institutional constructions in Beyond Budgeting diffusion. International Journal of Management Concepts and Philosophy , 10 (2), pp.199-225.

Elias, I. and Etim, O., 2017. Traditional Budgeting in Today’ s Business Environment. Journal of Applied Finance & Banking , 7 (3), pp.1-7.

Ho, A.T.K., 2018. From performance budgeting to performance budget management: theory and practice. Public Administration Review , 78 (5), pp.748-758.

May, A.U., 2017. Traditional budgeting in today’s business environment. Journal of Applied Finance & Banking , 7 (3), pp.111-120.

Miller, G.J., Hildreth, W.B. and Rabin, J., 2018. Performance-based budgeting: An ASPA classic. In Performance based budgeting (pp. 1-504). Taylor and Francis.

Nikulina, S.N., 2019. Innovative Direction of the Budgeting System Development. In Paper Materials of the 1st China and CIS Countries Scientific Readings" Urbaniza-tion Level, Rural Labor Transfer and Economic Growth in the XXI-st Century: Economic Models, New Technologies, Management & Marketing Practices and Mutual Collaboration" (pp. 404-418).

O’Grady, W., Akroyd, C. and Scott, I., 2017. Beyond budgeting: distinguishing modes of adaptive performance management. In Advances in management accounting . Emerald Publishing Limited.

Ostaev, G.Y., Gogolev, I.M., Kondratiev, D.V., Markovina, E.V., Mironova, M.V., Kravchenko, N.A. and Aleksandrova, E.V., 2019. Strategic budgeting in the accounting and management system of agricultural enterprises. Indo American Journal of Pharmaceutical Sciences , 6 (4), pp.8180-8186.

Ouassini, I., 2018. An introduction to the concept of Incremental Budgeting and Beyond Budgeting. Available at SSRN 3140059 .

Weigel, C. and Hiebl, M.R., 2018. Beyond budgeting: review and research agenda. Journal of

From Every Subject To Improve Your Grades

Orders Delivered

5 Star Rating

- Understanding Business Environment Assignment Sample

- The Impact Of Digital Transformation On Business Operations Assignment Sample

- Dynamic Capabilities Assessment

- Examine business theories and analytical framework Assignmnet Sample

- Lead innovative thinking and practice Assignment Sample

Title and bibliography page Free

Formatting Free

Preferred writer Free

Order tracking Free

Unlimited revisions Free

24/7 support Free

Quality Check Free

Order Assignments at Reasonable Prices

Introduction - Financial Analysis Get free samples written by our... Read more

Introduction A critical review of the chosen article: “Half of social... Read more

Get free samples written by our Top-Notch subject experts for taking online... Read more

Financial Management And Economics In Health Care Get Free Samples Written by... Read more

1. Assessment policies and procedures based on political, social and cultural... Read more

Introduction: How Effective Was The Global Public Health Response To The... Read more

Get your doubts & queries resolved anytime, anywhere.

Receive your order within the given deadline.

Get original assignments written from scratch.

Highly-qualified writers with unmatched writing skills.

Get instant access to student account

Don't have an account? Sign Up

Already have an account? Sign In

- 62000+ Project Delivered

- 500+ Experts 24*7 Online Help

offer valid for limited time only*

someone in has bought

© Copyright 2024 | New Assignment Help | All rights reserved

Hi! We're here to answer your questions! Send us message, and we'll reply via WhatsApp

Pleae enter your phone number and we'll contact you shortly via Whatsapp

We will contact with you as soon as possible on whatsapp.

IMAGES

VIDEO

COMMENTS

Answer: A 12-month budget is a continuous budget that rolls forward one month after the end of the current month. Question-08: What is a self-imposed budget or participatory budget? Answer: A self-imposed budget is a form of budget preparation in which executives plan their budgets.Higher-level administrators then review these budgets, and any conflicts are addressed by mutual consensus.

budget. an estimate of income and expenditure for a set period of time. microeconomics. is the part of economics concerned with singe factors and the effects on individual decisions. macroeconomic. the part of economics concerned with large-scale or general economic factors, such as interest rates, national productivity.

Betty Lou's Budget:Introductory Spreadsheet Training for Budgeting and Financial Management (A) Part ABetty Lou is a recently admitted HKS MPA student facing the challenge of financial planning for the next twoyears. The assignment in this case is for you to prepare Betty Lou's budget for graduate school.This case walks through the ...

budgeting year monthly pay 3,255.31 housing percent chosen 30 976.59 percent chosen 15 savings percent chosen 227.87 transportation percent

You can set monthly savings goals to help you work towards your end goal over time. Budgeting Apps Consider looking into free budgeting apps, which allow you to link your bank account and separate your expenses into different categories like rent, loans, groceries and entertainment costs. You can set a budget for each category to keep your expenses

Budgeting exercises for students to download. Includes event and program budgets, break-even analysis, cost-benefit analysis and cashflow budgets. Contact Us; ... You should endeavour to use Microsoft Excel to prepare your answers to these exercises as Excel is the tool of choice for most people in budgeting. For assistance ...

Economics 1.09 Buget FLVS budget worksheet for this assignment, you will submit yearly budget based on the specific salary from the career path activity earlier. Skip to document. University; High School. ... Budgeting will help me prioritize my spending and it will help me make sure that money goes for the things that are mainly important and ...

Our Budgeting section delivers an array of educational tools. Dive into our collection that comprises lesson plans, printable worksheets, instructive videos, detailed articles, and more. Our lesson plans and printable worksheets are crafted to guide educators in imparting knowledge about the principles of budgeting and the importance of ...

Answers to Budgeting Exercises Immediate Download of Answers. Answers to budgeting exercises are not individually purchased but are available for immediate download as a complete set in a ZIP file.. If a ZIP file is not convenient for you, please email [email protected] after making payment and I will send answers as separate attachments to emails as soon as I can.

Find step-by-step solutions and answers to Personal Finance - 9781264101597, as well as thousands of textbooks so you can move forward with confidence. ... DIGITAL FINANCIAL LITERACY: Budgeting Apps. Page 109: Financial Planning Problems. Page 110: FINANCIAL PLANNING CASE - Questions. Page 111: CONTINUING CASE - Questions. Page 112: DAILY ...

form. Students calculate the differences and answer questions to re-work a budget. Outline steps for balancing income and expenses. Have students set up their own personal budget. Students focus on their own spending patterns using information from their Spending Summary and integrate it onto a budget form (activity 3-4b).

budgeting assignment 2104afe trimester 2019 due date: 13 may at 08:00. weighted (20 marks) guidance to complete the assignment: there are two steps to complete. Skip to document. University; High School. ... budget. The answer to each question of the test w ill be one figure of your master budget.

Calculate your monthly income, pick a budgeting method and monitor your progress. Try the 50/30/20 rule as a simple budgeting framework. Allow up to 50% of your income for needs, including debt ...

Suggested Age Range: For teenagers. In just an hour of play, your students and teens can go through 12 months on a budget. New challenges are thrown there way for each month, such as being fined for a traffic ticket, or earning an extra $5 in interest on savings.

Criticism of Budgeting Assignment Answer. Introduction. "A budget is a plan, expressed in financial and or more general quantitative terms, which extends forward for a period into the future." (Gowthorpe, 2003, p 457). "A budget may be defined as a financial or quantitative statement, prepared and approved prior to a defined period of ...

Free Classroom Activities from the NGPF Curriculum on Budgeting. Budgeting worksheets, explainers and more. Math; Arcade; Curriculum . Units. Resources & answer keys: ... and help your students build life-changing financial skills with NGPF's free curriculum and PD. Start with a FREE Teacher Account to unlock NGPF's teachers-only materials! GET ...

A key term to understand in creating a budget is net income, which is the amount of money you receive in your paycheck after taxes and other deductions are taken out; this is also called take-home pay. ... roommate to share the costs of living will help keep her expenses low. Kenza earns $11.77 an hour and works 40 hours per week. Her annual ...

2104AFE Management Accounting T3 2021 Master Budget Case Study 1 Griffith Business School Department of Accounting, Finance and Economics BUDGETING ASSIGNMENT Due date: 24 January 2022 at 08:00 Weighting: 30% (30 marks) of total marks to be awarded for the course GUIDANCE TO COMPLETE THE ASSIGNMENT: This assignment is an individual assignment. It consists of the following two parts: 1.