Have a language expert improve your writing

Run a free plagiarism check in 10 minutes, generate accurate citations for free.

- Knowledge Base

Methodology

- Survey Research | Definition, Examples & Methods

Survey Research | Definition, Examples & Methods

Published on August 20, 2019 by Shona McCombes . Revised on June 22, 2023.

Survey research means collecting information about a group of people by asking them questions and analyzing the results. To conduct an effective survey, follow these six steps:

- Determine who will participate in the survey

- Decide the type of survey (mail, online, or in-person)

- Design the survey questions and layout

- Distribute the survey

- Analyze the responses

- Write up the results

Surveys are a flexible method of data collection that can be used in many different types of research .

Table of contents

What are surveys used for, step 1: define the population and sample, step 2: decide on the type of survey, step 3: design the survey questions, step 4: distribute the survey and collect responses, step 5: analyze the survey results, step 6: write up the survey results, other interesting articles, frequently asked questions about surveys.

Surveys are used as a method of gathering data in many different fields. They are a good choice when you want to find out about the characteristics, preferences, opinions, or beliefs of a group of people.

Common uses of survey research include:

- Social research : investigating the experiences and characteristics of different social groups

- Market research : finding out what customers think about products, services, and companies

- Health research : collecting data from patients about symptoms and treatments

- Politics : measuring public opinion about parties and policies

- Psychology : researching personality traits, preferences and behaviours

Surveys can be used in both cross-sectional studies , where you collect data just once, and in longitudinal studies , where you survey the same sample several times over an extended period.

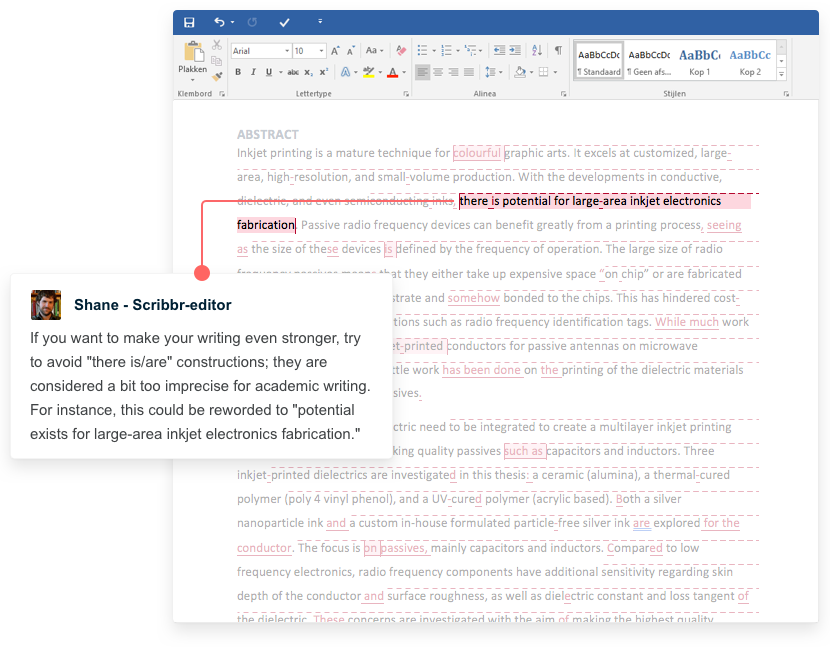

Receive feedback on language, structure, and formatting

Professional editors proofread and edit your paper by focusing on:

- Academic style

- Vague sentences

- Style consistency

See an example

Before you start conducting survey research, you should already have a clear research question that defines what you want to find out. Based on this question, you need to determine exactly who you will target to participate in the survey.

Populations

The target population is the specific group of people that you want to find out about. This group can be very broad or relatively narrow. For example:

- The population of Brazil

- US college students

- Second-generation immigrants in the Netherlands

- Customers of a specific company aged 18-24

- British transgender women over the age of 50

Your survey should aim to produce results that can be generalized to the whole population. That means you need to carefully define exactly who you want to draw conclusions about.

Several common research biases can arise if your survey is not generalizable, particularly sampling bias and selection bias . The presence of these biases have serious repercussions for the validity of your results.

It’s rarely possible to survey the entire population of your research – it would be very difficult to get a response from every person in Brazil or every college student in the US. Instead, you will usually survey a sample from the population.

The sample size depends on how big the population is. You can use an online sample calculator to work out how many responses you need.

There are many sampling methods that allow you to generalize to broad populations. In general, though, the sample should aim to be representative of the population as a whole. The larger and more representative your sample, the more valid your conclusions. Again, beware of various types of sampling bias as you design your sample, particularly self-selection bias , nonresponse bias , undercoverage bias , and survivorship bias .

There are two main types of survey:

- A questionnaire , where a list of questions is distributed by mail, online or in person, and respondents fill it out themselves.

- An interview , where the researcher asks a set of questions by phone or in person and records the responses.

Which type you choose depends on the sample size and location, as well as the focus of the research.

Questionnaires

Sending out a paper survey by mail is a common method of gathering demographic information (for example, in a government census of the population).

- You can easily access a large sample.

- You have some control over who is included in the sample (e.g. residents of a specific region).

- The response rate is often low, and at risk for biases like self-selection bias .

Online surveys are a popular choice for students doing dissertation research , due to the low cost and flexibility of this method. There are many online tools available for constructing surveys, such as SurveyMonkey and Google Forms .

- You can quickly access a large sample without constraints on time or location.

- The data is easy to process and analyze.

- The anonymity and accessibility of online surveys mean you have less control over who responds, which can lead to biases like self-selection bias .

If your research focuses on a specific location, you can distribute a written questionnaire to be completed by respondents on the spot. For example, you could approach the customers of a shopping mall or ask all students to complete a questionnaire at the end of a class.

- You can screen respondents to make sure only people in the target population are included in the sample.

- You can collect time- and location-specific data (e.g. the opinions of a store’s weekday customers).

- The sample size will be smaller, so this method is less suitable for collecting data on broad populations and is at risk for sampling bias .

Oral interviews are a useful method for smaller sample sizes. They allow you to gather more in-depth information on people’s opinions and preferences. You can conduct interviews by phone or in person.

- You have personal contact with respondents, so you know exactly who will be included in the sample in advance.

- You can clarify questions and ask for follow-up information when necessary.

- The lack of anonymity may cause respondents to answer less honestly, and there is more risk of researcher bias.

Like questionnaires, interviews can be used to collect quantitative data: the researcher records each response as a category or rating and statistically analyzes the results. But they are more commonly used to collect qualitative data : the interviewees’ full responses are transcribed and analyzed individually to gain a richer understanding of their opinions and feelings.

Next, you need to decide which questions you will ask and how you will ask them. It’s important to consider:

- The type of questions

- The content of the questions

- The phrasing of the questions

- The ordering and layout of the survey

Open-ended vs closed-ended questions

There are two main forms of survey questions: open-ended and closed-ended. Many surveys use a combination of both.

Closed-ended questions give the respondent a predetermined set of answers to choose from. A closed-ended question can include:

- A binary answer (e.g. yes/no or agree/disagree )

- A scale (e.g. a Likert scale with five points ranging from strongly agree to strongly disagree )

- A list of options with a single answer possible (e.g. age categories)

- A list of options with multiple answers possible (e.g. leisure interests)

Closed-ended questions are best for quantitative research . They provide you with numerical data that can be statistically analyzed to find patterns, trends, and correlations .

Open-ended questions are best for qualitative research. This type of question has no predetermined answers to choose from. Instead, the respondent answers in their own words.

Open questions are most common in interviews, but you can also use them in questionnaires. They are often useful as follow-up questions to ask for more detailed explanations of responses to the closed questions.

The content of the survey questions

To ensure the validity and reliability of your results, you need to carefully consider each question in the survey. All questions should be narrowly focused with enough context for the respondent to answer accurately. Avoid questions that are not directly relevant to the survey’s purpose.

When constructing closed-ended questions, ensure that the options cover all possibilities. If you include a list of options that isn’t exhaustive, you can add an “other” field.

Phrasing the survey questions

In terms of language, the survey questions should be as clear and precise as possible. Tailor the questions to your target population, keeping in mind their level of knowledge of the topic. Avoid jargon or industry-specific terminology.

Survey questions are at risk for biases like social desirability bias , the Hawthorne effect , or demand characteristics . It’s critical to use language that respondents will easily understand, and avoid words with vague or ambiguous meanings. Make sure your questions are phrased neutrally, with no indication that you’d prefer a particular answer or emotion.

Ordering the survey questions

The questions should be arranged in a logical order. Start with easy, non-sensitive, closed-ended questions that will encourage the respondent to continue.

If the survey covers several different topics or themes, group together related questions. You can divide a questionnaire into sections to help respondents understand what is being asked in each part.

If a question refers back to or depends on the answer to a previous question, they should be placed directly next to one another.

Before you start, create a clear plan for where, when, how, and with whom you will conduct the survey. Determine in advance how many responses you require and how you will gain access to the sample.

When you are satisfied that you have created a strong research design suitable for answering your research questions, you can conduct the survey through your method of choice – by mail, online, or in person.

There are many methods of analyzing the results of your survey. First you have to process the data, usually with the help of a computer program to sort all the responses. You should also clean the data by removing incomplete or incorrectly completed responses.

If you asked open-ended questions, you will have to code the responses by assigning labels to each response and organizing them into categories or themes. You can also use more qualitative methods, such as thematic analysis , which is especially suitable for analyzing interviews.

Statistical analysis is usually conducted using programs like SPSS or Stata. The same set of survey data can be subject to many analyses.

Finally, when you have collected and analyzed all the necessary data, you will write it up as part of your thesis, dissertation , or research paper .

In the methodology section, you describe exactly how you conducted the survey. You should explain the types of questions you used, the sampling method, when and where the survey took place, and the response rate. You can include the full questionnaire as an appendix and refer to it in the text if relevant.

Then introduce the analysis by describing how you prepared the data and the statistical methods you used to analyze it. In the results section, you summarize the key results from your analysis.

In the discussion and conclusion , you give your explanations and interpretations of these results, answer your research question, and reflect on the implications and limitations of the research.

If you want to know more about statistics , methodology , or research bias , make sure to check out some of our other articles with explanations and examples.

- Student’s t -distribution

- Normal distribution

- Null and Alternative Hypotheses

- Chi square tests

- Confidence interval

- Quartiles & Quantiles

- Cluster sampling

- Stratified sampling

- Data cleansing

- Reproducibility vs Replicability

- Peer review

- Prospective cohort study

Research bias

- Implicit bias

- Cognitive bias

- Placebo effect

- Hawthorne effect

- Hindsight bias

- Affect heuristic

- Social desirability bias

A questionnaire is a data collection tool or instrument, while a survey is an overarching research method that involves collecting and analyzing data from people using questionnaires.

A Likert scale is a rating scale that quantitatively assesses opinions, attitudes, or behaviors. It is made up of 4 or more questions that measure a single attitude or trait when response scores are combined.

To use a Likert scale in a survey , you present participants with Likert-type questions or statements, and a continuum of items, usually with 5 or 7 possible responses, to capture their degree of agreement.

Individual Likert-type questions are generally considered ordinal data , because the items have clear rank order, but don’t have an even distribution.

Overall Likert scale scores are sometimes treated as interval data. These scores are considered to have directionality and even spacing between them.

The type of data determines what statistical tests you should use to analyze your data.

The priorities of a research design can vary depending on the field, but you usually have to specify:

- Your research questions and/or hypotheses

- Your overall approach (e.g., qualitative or quantitative )

- The type of design you’re using (e.g., a survey , experiment , or case study )

- Your sampling methods or criteria for selecting subjects

- Your data collection methods (e.g., questionnaires , observations)

- Your data collection procedures (e.g., operationalization , timing and data management)

- Your data analysis methods (e.g., statistical tests or thematic analysis )

Cite this Scribbr article

If you want to cite this source, you can copy and paste the citation or click the “Cite this Scribbr article” button to automatically add the citation to our free Citation Generator.

McCombes, S. (2023, June 22). Survey Research | Definition, Examples & Methods. Scribbr. Retrieved April 2, 2024, from https://www.scribbr.com/methodology/survey-research/

Is this article helpful?

Shona McCombes

Other students also liked, qualitative vs. quantitative research | differences, examples & methods, questionnaire design | methods, question types & examples, what is a likert scale | guide & examples, "i thought ai proofreading was useless but..".

I've been using Scribbr for years now and I know it's a service that won't disappoint. It does a good job spotting mistakes”

Root out friction in every digital experience, super-charge conversion rates, and optimize digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re are saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Explore the platform powering Experience Management

- Free Account

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Employee Exit Interviews

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

- Market Research

- Artificial Intelligence

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results, live in Salt Lake City.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

- Experience Management

- What is a survey?

- Survey Research

Try Qualtrics for free

What is survey research.

15 min read Find out everything you need to know about survey research, from what it is and how it works to the different methods and tools you can use to ensure you’re successful.

Survey research is the process of collecting data from a predefined group (e.g. customers or potential customers) with the ultimate goal of uncovering insights about your products, services, or brand overall .

As a quantitative data collection method, survey research can provide you with a goldmine of information that can inform crucial business and product decisions. But survey research needs careful planning and execution to get the results you want.

So if you’re thinking about using surveys to carry out research, read on.

Get started with our free survey maker tool

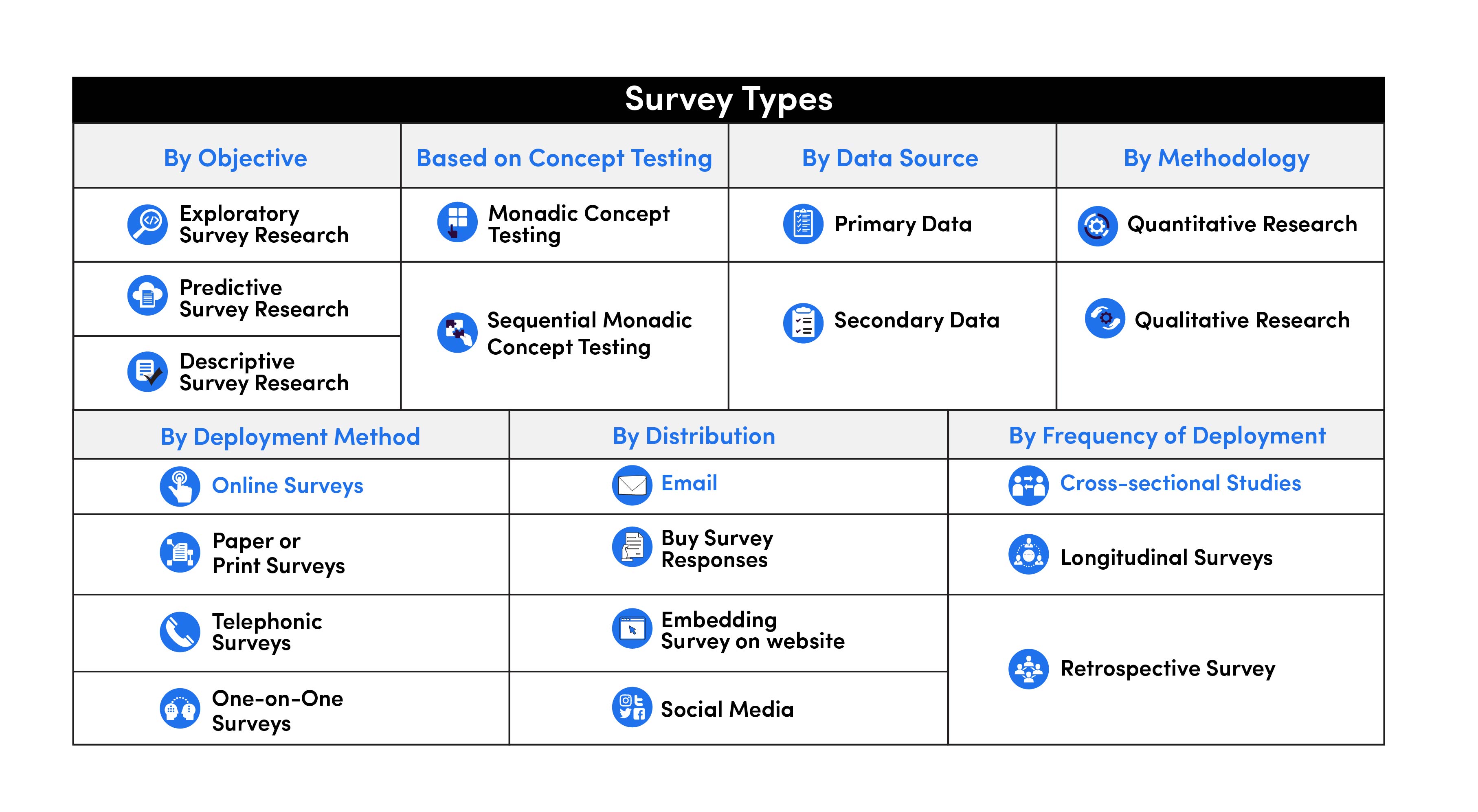

Types of survey research

Calling these methods ‘survey research’ slightly underplays the complexity of this type of information gathering. From the expertise required to carry out each activity to the analysis of the data and its eventual application, a considerable amount of effort is required.

As for how you can carry out your research, there are several options to choose from — face-to-face interviews, telephone surveys, focus groups (though more interviews than surveys), online surveys , and panel surveys.

Typically, the survey method you choose will largely be guided by who you want to survey, the size of your sample , your budget, and the type of information you’re hoping to gather.

Here are a few of the most-used survey types:

Face-to-face interviews

Before technology made it possible to conduct research using online surveys, telephone, and mail were the most popular methods for survey research. However face-to-face interviews were considered the gold standard — the only reason they weren’t as popular was due to their highly prohibitive costs.

When it came to face-to-face interviews, organizations would use highly trained researchers who knew when to probe or follow up on vague or problematic answers. They also knew when to offer assistance to respondents when they seemed to be struggling. The result was that these interviewers could get sample members to participate and engage in surveys in the most effective way possible, leading to higher response rates and better quality data.

Telephone surveys

While phone surveys have been popular in the past, particularly for measuring general consumer behavior or beliefs, response rates have been declining since the 1990s .

Phone surveys are usually conducted using a random dialing system and software that a researcher can use to record responses.

This method is beneficial when you want to survey a large population but don’t have the resources to conduct face-to-face research surveys or run focus groups, or want to ask multiple-choice and open-ended questions .

The downsides are they can: take a long time to complete depending on the response rate, and you may have to do a lot of cold-calling to get the information you need.

You also run the risk of respondents not being completely honest . Instead, they’ll answer your survey questions quickly just to get off the phone.

Focus groups (interviews — not surveys)

Focus groups are a separate qualitative methodology rather than surveys — even though they’re often bunched together. They’re normally used for survey pretesting and designing , but they’re also a great way to generate opinions and data from a diverse range of people.

Focus groups involve putting a cohort of demographically or socially diverse people in a room with a moderator and engaging them in a discussion on a particular topic, such as your product, brand, or service.

They remain a highly popular method for market research , but they’re expensive and require a lot of administration to conduct and analyze the data properly.

You also run the risk of more dominant members of the group taking over the discussion and swaying the opinions of other people — potentially providing you with unreliable data.

Online surveys

Online surveys have become one of the most popular survey methods due to being cost-effective, enabling researchers to accurately survey a large population quickly.

Online surveys can essentially be used by anyone for any research purpose – we’ve all seen the increasing popularity of polls on social media (although these are not scientific).

Using an online survey allows you to ask a series of different question types and collect data instantly that’s easy to analyze with the right software.

There are also several methods for running and distributing online surveys that allow you to get your questionnaire in front of a large population at a fraction of the cost of face-to-face interviews or focus groups.

This is particularly true when it comes to mobile surveys as most people with a smartphone can access them online.

However, you have to be aware of the potential dangers of using online surveys, particularly when it comes to the survey respondents. The biggest risk is because online surveys require access to a computer or mobile device to complete, they could exclude elderly members of the population who don’t have access to the technology — or don’t know how to use it.

It could also exclude those from poorer socio-economic backgrounds who can’t afford a computer or consistent internet access. This could mean the data collected is more biased towards a certain group and can lead to less accurate data when you’re looking for a representative population sample.

When it comes to surveys, every voice matters.

Find out how to create more inclusive and representative surveys for your research.

Panel surveys

A panel survey involves recruiting respondents who have specifically signed up to answer questionnaires and who are put on a list by a research company. This could be a workforce of a small company or a major subset of a national population. Usually, these groups are carefully selected so that they represent a sample of your target population — giving you balance across criteria such as age, gender, background, and so on.

Panel surveys give you access to the respondents you need and are usually provided by the research company in question. As a result, it’s much easier to get access to the right audiences as you just need to tell the research company your criteria. They’ll then determine the right panels to use to answer your questionnaire.

However, there are downsides. The main one being that if the research company offers its panels incentives, e.g. discounts, coupons, money — respondents may answer a lot of questionnaires just for the benefits.

This might mean they rush through your survey without providing considered and truthful answers. As a consequence, this can damage the credibility of your data and potentially ruin your analyses.

What are the benefits of using survey research?

Depending on the research method you use, there are lots of benefits to conducting survey research for data collection. Here, we cover a few:

1. They’re relatively easy to do

Most research surveys are easy to set up, administer and analyze. As long as the planning and survey design is thorough and you target the right audience , the data collection is usually straightforward regardless of which survey type you use.

2. They can be cost effective

Survey research can be relatively cheap depending on the type of survey you use.

Generally, qualitative research methods that require access to people in person or over the phone are more expensive and require more administration.

Online surveys or mobile surveys are often more cost-effective for market research and can give you access to the global population for a fraction of the cost.

3. You can collect data from a large sample

Again, depending on the type of survey, you can obtain survey results from an entire population at a relatively low price. You can also administer a large variety of survey types to fit the project you’re running.

4. You can use survey software to analyze results immediately

Using survey software, you can use advanced statistical analysis techniques to gain insights into your responses immediately.

Analysis can be conducted using a variety of parameters to determine the validity and reliability of your survey data at scale.

5. Surveys can collect any type of data

While most people view surveys as a quantitative research method, they can just as easily be adapted to gain qualitative information by simply including open-ended questions or conducting interviews face to face.

How to measure concepts with survey questions

While surveys are a great way to obtain data, that data on its own is useless unless it can be analyzed and developed into actionable insights.

The easiest, and most effective way to measure survey results, is to use a dedicated research tool that puts all of your survey results into one place.

When it comes to survey measurement, there are four measurement types to be aware of that will determine how you treat your different survey results:

Nominal scale

With a nominal scale , you can only keep track of how many respondents chose each option from a question, and which response generated the most selections.

An example of this would be simply asking a responder to choose a product or brand from a list.

You could find out which brand was chosen the most but have no insight as to why.

Ordinal scale

Ordinal scales are used to judge an order of preference. They do provide some level of quantitative value because you’re asking responders to choose a preference of one option over another.

Ratio scale

Ratio scales can be used to judge the order and difference between responses. For example, asking respondents how much they spend on their weekly shopping on average.

Interval scale

In an interval scale, values are lined up in order with a meaningful difference between the two values — for example, measuring temperature or measuring a credit score between one value and another.

Step by step: How to conduct surveys and collect data

Conducting a survey and collecting data is relatively straightforward, but it does require some careful planning and design to ensure it results in reliable data.

Step 1 – Define your objectives

What do you want to learn from the survey? How is the data going to help you? Having a hypothesis or series of assumptions about survey responses will allow you to create the right questions to test them.

Step 2 – Create your survey questions

Once you’ve got your hypotheses or assumptions, write out the questions you need answering to test your theories or beliefs. Be wary about framing questions that could lead respondents or inadvertently create biased responses .

Step 3 – Choose your question types

Your survey should include a variety of question types and should aim to obtain quantitative data with some qualitative responses from open-ended questions. Using a mix of questions (simple Yes/ No, multiple-choice, rank in order, etc) not only increases the reliability of your data but also reduces survey fatigue and respondents simply answering questions quickly without thinking.

Find out how to create a survey that’s easy to engage with

Step 4 – Test your questions

Before sending your questionnaire out, you should test it (e.g. have a random internal group do the survey) and carry out A/B tests to ensure you’ll gain accurate responses.

Step 5 – Choose your target and send out the survey

Depending on your objectives, you might want to target the general population with your survey or a specific segment of the population. Once you’ve narrowed down who you want to target, it’s time to send out the survey.

After you’ve deployed the survey, keep an eye on the response rate to ensure you’re getting the number you expected. If your response rate is low, you might need to send the survey out to a second group to obtain a large enough sample — or do some troubleshooting to work out why your response rates are so low. This could be down to your questions, delivery method, selected sample, or otherwise.

Step 6 – Analyze results and draw conclusions

Once you’ve got your results back, it’s time for the fun part.

Break down your survey responses using the parameters you’ve set in your objectives and analyze the data to compare to your original assumptions. At this stage, a research tool or software can make the analysis a lot easier — and that’s somewhere Qualtrics can help.

Get reliable insights with survey software from Qualtrics

Gaining feedback from customers and leads is critical for any business, data gathered from surveys can prove invaluable for understanding your products and your market position, and with survey software from Qualtrics, it couldn’t be easier.

Used by more than 13,000 brands and supporting more than 1 billion surveys a year, Qualtrics empowers everyone in your organization to gather insights and take action. No coding required — and your data is housed in one system.

Get feedback from more than 125 sources on a single platform and view and measure your data in one place to create actionable insights and gain a deeper understanding of your target customers .

Automatically run complex text and statistical analysis to uncover exactly what your survey data is telling you, so you can react in real-time and make smarter decisions.

We can help you with survey management, too. From designing your survey and finding your target respondents to getting your survey in the field and reporting back on the results, we can help you every step of the way.

And for expert market researchers and survey designers, Qualtrics features custom programming to give you total flexibility over question types, survey design, embedded data, and other variables.

No matter what type of survey you want to run, what target audience you want to reach, or what assumptions you want to test or answers you want to uncover, we’ll help you design, deploy and analyze your survey with our team of experts.

Ready to find out more about Qualtrics CoreXM?

Get started with our free survey maker tool today

Related resources

Survey bias types 24 min read, post event survey questions 10 min read, best survey software 16 min read, close-ended questions 7 min read, survey vs questionnaire 12 min read, response bias 13 min read, double barreled question 11 min read, request demo.

Ready to learn more about Qualtrics?

An official website of the United States government

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

- Publications

- Account settings

Preview improvements coming to the PMC website in October 2024. Learn More or Try it out now .

- Advanced Search

- Journal List

- Ann R Coll Surg Engl

- v.95(1); 2013 Jan

A quick guide to survey research

1 University of Cambridge,, UK

2 Cambridge University Hospitals NHS Foundation Trust,, UK

Questionnaires are a very useful survey tool that allow large populations to be assessed with relative ease. Despite a widespread perception that surveys are easy to conduct, in order to yield meaningful results, a survey needs extensive planning, time and effort. In this article, we aim to cover the main aspects of designing, implementing and analysing a survey as well as focusing on techniques that would improve response rates.

Medical research questionnaires or surveys are vital tools used to gather information on individual perspectives in a large cohort. Within the medical realm, there are three main types of survey: epidemiological surveys, surveys on attitudes to a health service or intervention and questionnaires assessing knowledge on a particular issue or topic. 1

Despite a widespread perception that surveys are easy to conduct, in order to yield meaningful results, a survey needs extensive planning, time and effort. In this article, we aim to cover the main aspects of designing, implementing and analysing a survey as well as focusing on techniques that would improve response rates.

Clear research goal

The first and most important step in designing a survey is to have a clear idea of what you are looking for. It will always be tempting to take a blanket approach and ask as many questions as possible in the hope of getting as much information as possible. This type of approach does not work as asking too many irrelevant or incoherent questions reduces the response rate 2 and therefore reduces the power of the study. This is especially important when surveying physicians as they often have a lower response rate than the rest of the population. 3 Instead, you must carefully consider the important data you will be using and work on a ‘need to know’ rather than a ‘would be nice to know’ model. 4

After considering the question you are trying to answer, deciding whom you are going to ask is the next step. With small populations, attempting to survey them all is manageable but as your population gets bigger, a sample must be taken. The size of this sample is more important than you might expect. After lost questionnaires, non-responders and improper answers are taken into account, this sample must still be big enough to be representative of the entire population. If it is not big enough, the power of your statistics will drop and you may not get any meaningful answers at all. It is for this reason that getting a statistician involved in your study early on is absolutely crucial. Data should not be collected until you know what you are going to do with them.

Directed questions

After settling on your research goal and beginning to design a questionnaire, the main considerations are the method of data collection, the survey instrument and the type of question you are going to ask. Methods of data collection include personal interviews, telephone, postal or electronic ( Table 1 ).

Advantages and disadvantages of survey methods

Collected data are only useful if they convey information accurately and consistently about the topic in which you are interested. This is where a validated survey instrument comes in to the questionnaire design. Validated instruments are those that have been extensively tested and are correctly calibrated to their target. They can therefore be assumed to be accurate. 1 It may be possible to modify a previously validated instrument but you should seek specialist advice as this is likely to reduce its power. Examples of validated models are the Beck Hopelessness Scale 5 or the Addenbrooke’s Cognitive Examination. 6

The next step is choosing the type of question you are going to ask. The questionnaire should be designed to answer the question you want answered. Each question should be clear, concise and without bias. Normalising statements should be included and the language level targeted towards those at the lowest educational level in your cohort. 1 You should avoid open, double barrelled questions and those questions that include negative items and assign causality. 1 The questions you use may elicit either an open (free text answer) or closed response. Open responses are more flexible but require more time and effort to analyse, whereas closed responses require more initial input in order to exhaust all possible options but are easier to analyse and present.

Questionnaire

Two more aspects come into questionnaire design: aesthetics and question order. While this is not relevant to telephone or personal questionnaires, in self-administered surveys the aesthetics of the questionnaire are crucial. Having spent a large amount of time fine-tuning your questions, presenting them in such a way as to maximise response rates is pivotal to obtaining good results. Visual elements to think of include smooth, simple and symmetrical shapes, soft colours and repetition of visual elements. 7

Once you have attracted your subject’s attention and willingness with a well designed and attractive survey, the order in which you put your questions is critical. To do this you should focus on what you need to know; start by placing easier, important questions at the beginning, group common themes in the middle and keep questions on demographics to near the end. The questions should be arrayed in a logical order, questions on the same topic close together and with sensible sections if long enough to warrant them. Introductory and summary questions to mark the start and end of the survey are also helpful.

Pilot study

Once a completed survey has been compiled, it needs to be tested. The ideal next step should highlight spelling errors, ambiguous questions and anything else that impairs completion of the questionnaire. 8 A pilot study, in which you apply your work to a small sample of your target population in a controlled setting, may highlight areas in which work still needs to be done. Where possible, being present while the pilot is going on will allow a focus group-type atmosphere in which you can discuss aspects of the survey with those who are going to be filling it in. This step may seem non-essential but detecting previously unconsidered difficulties needs to happen as early as possible and it is important to use your participants’ time wisely as they are unlikely to give it again.

Distribution and collection

While it should be considered quite early on, we will now discuss routes of survey administration and ways to maximise results. Questionnaires can be self-administered electronically or by post, or administered by a researcher by telephone or in person. The advantages and disadvantages of each method are summarised in Table 1 . Telephone and personal surveys are very time and resource consuming whereas postal and electronic surveys suffer from low response rates and response bias. Your route should be chosen with care.

Methods for maximising response rates for self-administered surveys are listed in Table 2 , taken from a Cochrane review.2 The differences between methods of maximising responses to postal or e-surveys are considerable but common elements include keeping the questionnaire short and logical as well as including incentives.

Methods for improving response rates in postal and electronic questionnaires 2

- – Involve a statistician early on.

- – Run a pilot study to uncover problems.

- – Consider using a validated instrument.

- – Only ask what you ‘need to know’.

- – Consider guidelines on improving response rates.

The collected data will come in a number of forms depending on the method of collection. Data from telephone or personal interviews can be directly entered into a computer database whereas postal data can be entered at a later stage. Electronic questionnaires can allow responses to go directly into a computer database. Problems arise from errors in data entry and when questionnaires are returned with missing data fields. As mentioned earlier, it is essential to have a statistician involved from the beginning for help with data analysis. He or she will have helped to determine the sample size required to ensure your study has enough power. The statistician can also suggest tests of significance appropriate to your survey, such as Student’s t-test or the chi-square test.

Conclusions

Survey research is a unique way of gathering information from a large cohort. Advantages of surveys include having a large population and therefore a greater statistical power, the ability to gather large amounts of information and having the availability of validated models. However, surveys are costly, there is sometimes discrepancy in recall accuracy and the validity of a survey depends on the response rate. Proper design is vital to enable analysis of results and pilot studies are critical to this process.

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case NPS+ Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Home Market Research

Survey Research: Definition, Examples and Methods

Survey Research is a quantitative research method used for collecting data from a set of respondents. It has been perhaps one of the most used methodologies in the industry for several years due to the multiple benefits and advantages that it has when collecting and analyzing data.

LEARN ABOUT: Behavioral Research

In this article, you will learn everything about survey research, such as types, methods, and examples.

Survey Research Definition

Survey Research is defined as the process of conducting research using surveys that researchers send to survey respondents. The data collected from surveys is then statistically analyzed to draw meaningful research conclusions. In the 21st century, every organization’s eager to understand what their customers think about their products or services and make better business decisions. Researchers can conduct research in multiple ways, but surveys are proven to be one of the most effective and trustworthy research methods. An online survey is a method for extracting information about a significant business matter from an individual or a group of individuals. It consists of structured survey questions that motivate the participants to respond. Creditable survey research can give these businesses access to a vast information bank. Organizations in media, other companies, and even governments rely on survey research to obtain accurate data.

The traditional definition of survey research is a quantitative method for collecting information from a pool of respondents by asking multiple survey questions. This research type includes the recruitment of individuals collection, and analysis of data. It’s useful for researchers who aim to communicate new features or trends to their respondents.

LEARN ABOUT: Level of Analysis Generally, it’s the primary step towards obtaining quick information about mainstream topics and conducting more rigorous and detailed quantitative research methods like surveys/polls or qualitative research methods like focus groups/on-call interviews can follow. There are many situations where researchers can conduct research using a blend of both qualitative and quantitative strategies.

LEARN ABOUT: Survey Sampling

Survey Research Methods

Survey research methods can be derived based on two critical factors: Survey research tool and time involved in conducting research. There are three main survey research methods, divided based on the medium of conducting survey research:

- Online/ Email: Online survey research is one of the most popular survey research methods today. The survey cost involved in online survey research is extremely minimal, and the responses gathered are highly accurate.

- Phone: Survey research conducted over the telephone ( CATI survey ) can be useful in collecting data from a more extensive section of the target population. There are chances that the money invested in phone surveys will be higher than other mediums, and the time required will be higher.

- Face-to-face: Researchers conduct face-to-face in-depth interviews in situations where there is a complicated problem to solve. The response rate for this method is the highest, but it can be costly.

Further, based on the time taken, survey research can be classified into two methods:

- Longitudinal survey research: Longitudinal survey research involves conducting survey research over a continuum of time and spread across years and decades. The data collected using this survey research method from one time period to another is qualitative or quantitative. Respondent behavior, preferences, and attitudes are continuously observed over time to analyze reasons for a change in behavior or preferences. For example, suppose a researcher intends to learn about the eating habits of teenagers. In that case, he/she will follow a sample of teenagers over a considerable period to ensure that the collected information is reliable. Often, cross-sectional survey research follows a longitudinal study .

- Cross-sectional survey research: Researchers conduct a cross-sectional survey to collect insights from a target audience at a particular time interval. This survey research method is implemented in various sectors such as retail, education, healthcare, SME businesses, etc. Cross-sectional studies can either be descriptive or analytical. It is quick and helps researchers collect information in a brief period. Researchers rely on the cross-sectional survey research method in situations where descriptive analysis of a subject is required.

Survey research also is bifurcated according to the sampling methods used to form samples for research: Probability and Non-probability sampling. Every individual in a population should be considered equally to be a part of the survey research sample. Probability sampling is a sampling method in which the researcher chooses the elements based on probability theory. The are various probability research methods, such as simple random sampling , systematic sampling, cluster sampling, stratified random sampling, etc. Non-probability sampling is a sampling method where the researcher uses his/her knowledge and experience to form samples.

LEARN ABOUT: Survey Sample Sizes

The various non-probability sampling techniques are :

- Convenience sampling

- Snowball sampling

- Consecutive sampling

- Judgemental sampling

- Quota sampling

Process of implementing survey research methods:

- Decide survey questions: Brainstorm and put together valid survey questions that are grammatically and logically appropriate. Understanding the objective and expected outcomes of the survey helps a lot. There are many surveys where details of responses are not as important as gaining insights about what customers prefer from the provided options. In such situations, a researcher can include multiple-choice questions or closed-ended questions . Whereas, if researchers need to obtain details about specific issues, they can consist of open-ended questions in the questionnaire. Ideally, the surveys should include a smart balance of open-ended and closed-ended questions. Use survey questions like Likert Scale , Semantic Scale, Net Promoter Score question, etc., to avoid fence-sitting.

LEARN ABOUT: System Usability Scale

- Finalize a target audience: Send out relevant surveys as per the target audience and filter out irrelevant questions as per the requirement. The survey research will be instrumental in case the target population decides on a sample. This way, results can be according to the desired market and be generalized to the entire population.

LEARN ABOUT: Testimonial Questions

- Send out surveys via decided mediums: Distribute the surveys to the target audience and patiently wait for the feedback and comments- this is the most crucial step of the survey research. The survey needs to be scheduled, keeping in mind the nature of the target audience and its regions. Surveys can be conducted via email, embedded in a website, shared via social media, etc., to gain maximum responses.

- Analyze survey results: Analyze the feedback in real-time and identify patterns in the responses which might lead to a much-needed breakthrough for your organization. GAP, TURF Analysis , Conjoint analysis, Cross tabulation, and many such survey feedback analysis methods can be used to spot and shed light on respondent behavior. Researchers can use the results to implement corrective measures to improve customer/employee satisfaction.

Reasons to conduct survey research

The most crucial and integral reason for conducting market research using surveys is that you can collect answers regarding specific, essential questions. You can ask these questions in multiple survey formats as per the target audience and the intent of the survey. Before designing a study, every organization must figure out the objective of carrying this out so that the study can be structured, planned, and executed to perfection.

LEARN ABOUT: Research Process Steps

Questions that need to be on your mind while designing a survey are:

- What is the primary aim of conducting the survey?

- How do you plan to utilize the collected survey data?

- What type of decisions do you plan to take based on the points mentioned above?

There are three critical reasons why an organization must conduct survey research.

- Understand respondent behavior to get solutions to your queries: If you’ve carefully curated a survey, the respondents will provide insights about what they like about your organization as well as suggestions for improvement. To motivate them to respond, you must be very vocal about how secure their responses will be and how you will utilize the answers. This will push them to be 100% honest about their feedback, opinions, and comments. Online surveys or mobile surveys have proved their privacy, and due to this, more and more respondents feel free to put forth their feedback through these mediums.

- Present a medium for discussion: A survey can be the perfect platform for respondents to provide criticism or applause for an organization. Important topics like product quality or quality of customer service etc., can be put on the table for discussion. A way you can do it is by including open-ended questions where the respondents can write their thoughts. This will make it easy for you to correlate your survey to what you intend to do with your product or service.

- Strategy for never-ending improvements: An organization can establish the target audience’s attributes from the pilot phase of survey research . Researchers can use the criticism and feedback received from this survey to improve the product/services. Once the company successfully makes the improvements, it can send out another survey to measure the change in feedback keeping the pilot phase the benchmark. By doing this activity, the organization can track what was effectively improved and what still needs improvement.

Survey Research Scales

There are four main scales for the measurement of variables:

- Nominal Scale: A nominal scale associates numbers with variables for mere naming or labeling, and the numbers usually have no other relevance. It is the most basic of the four levels of measurement.

- Ordinal Scale: The ordinal scale has an innate order within the variables along with labels. It establishes the rank between the variables of a scale but not the difference value between the variables.

- Interval Scale: The interval scale is a step ahead in comparison to the other two scales. Along with establishing a rank and name of variables, the scale also makes known the difference between the two variables. The only drawback is that there is no fixed start point of the scale, i.e., the actual zero value is absent.

- Ratio Scale: The ratio scale is the most advanced measurement scale, which has variables that are labeled in order and have a calculated difference between variables. In addition to what interval scale orders, this scale has a fixed starting point, i.e., the actual zero value is present.

Benefits of survey research

In case survey research is used for all the right purposes and is implemented properly, marketers can benefit by gaining useful, trustworthy data that they can use to better the ROI of the organization.

Other benefits of survey research are:

- Minimum investment: Mobile surveys and online surveys have minimal finance invested per respondent. Even with the gifts and other incentives provided to the people who participate in the study, online surveys are extremely economical compared to paper-based surveys.

- Versatile sources for response collection: You can conduct surveys via various mediums like online and mobile surveys. You can further classify them into qualitative mediums like focus groups , and interviews and quantitative mediums like customer-centric surveys. Due to the offline survey response collection option, researchers can conduct surveys in remote areas with limited internet connectivity. This can make data collection and analysis more convenient and extensive.

- Reliable for respondents: Surveys are extremely secure as the respondent details and responses are kept safeguarded. This anonymity makes respondents answer the survey questions candidly and with absolute honesty. An organization seeking to receive explicit responses for its survey research must mention that it will be confidential.

Survey research design

Researchers implement a survey research design in cases where there is a limited cost involved and there is a need to access details easily. This method is often used by small and large organizations to understand and analyze new trends, market demands, and opinions. Collecting information through tactfully designed survey research can be much more effective and productive than a casually conducted survey.

There are five stages of survey research design:

- Decide an aim of the research: There can be multiple reasons for a researcher to conduct a survey, but they need to decide a purpose for the research. This is the primary stage of survey research as it can mold the entire path of a survey, impacting its results.

- Filter the sample from target population: Who to target? is an essential question that a researcher should answer and keep in mind while conducting research. The precision of the results is driven by who the members of a sample are and how useful their opinions are. The quality of respondents in a sample is essential for the results received for research and not the quantity. If a researcher seeks to understand whether a product feature will work well with their target market, he/she can conduct survey research with a group of market experts for that product or technology.

- Zero-in on a survey method: Many qualitative and quantitative research methods can be discussed and decided. Focus groups, online interviews, surveys, polls, questionnaires, etc. can be carried out with a pre-decided sample of individuals.

- Design the questionnaire: What will the content of the survey be? A researcher is required to answer this question to be able to design it effectively. What will the content of the cover letter be? Or what are the survey questions of this questionnaire? Understand the target market thoroughly to create a questionnaire that targets a sample to gain insights about a survey research topic.

- Send out surveys and analyze results: Once the researcher decides on which questions to include in a study, they can send it across to the selected sample . Answers obtained from this survey can be analyzed to make product-related or marketing-related decisions.

Survey examples: 10 tips to design the perfect research survey

Picking the right survey design can be the key to gaining the information you need to make crucial decisions for all your research. It is essential to choose the right topic, choose the right question types, and pick a corresponding design. If this is your first time creating a survey, it can seem like an intimidating task. But with QuestionPro, each step of the process is made simple and easy.

Below are 10 Tips To Design The Perfect Research Survey:

- Set your SMART goals: Before conducting any market research or creating a particular plan, set your SMART Goals . What is that you want to achieve with the survey? How will you measure it promptly, and what are the results you are expecting?

- Choose the right questions: Designing a survey can be a tricky task. Asking the right questions may help you get the answers you are looking for and ease the task of analyzing. So, always choose those specific questions – relevant to your research.

- Begin your survey with a generalized question: Preferably, start your survey with a general question to understand whether the respondent uses the product or not. That also provides an excellent base and intro for your survey.

- Enhance your survey: Choose the best, most relevant, 15-20 questions. Frame each question as a different question type based on the kind of answer you would like to gather from each. Create a survey using different types of questions such as multiple-choice, rating scale, open-ended, etc. Look at more survey examples and four measurement scales every researcher should remember.

- Prepare yes/no questions: You may also want to use yes/no questions to separate people or branch them into groups of those who “have purchased” and those who “have not yet purchased” your products or services. Once you separate them, you can ask them different questions.

- Test all electronic devices: It becomes effortless to distribute your surveys if respondents can answer them on different electronic devices like mobiles, tablets, etc. Once you have created your survey, it’s time to TEST. You can also make any corrections if needed at this stage.

- Distribute your survey: Once your survey is ready, it is time to share and distribute it to the right audience. You can share handouts and share them via email, social media, and other industry-related offline/online communities.

- Collect and analyze responses: After distributing your survey, it is time to gather all responses. Make sure you store your results in a particular document or an Excel sheet with all the necessary categories mentioned so that you don’t lose your data. Remember, this is the most crucial stage. Segregate your responses based on demographics, psychographics, and behavior. This is because, as a researcher, you must know where your responses are coming from. It will help you to analyze, predict decisions, and help write the summary report.

- Prepare your summary report: Now is the time to share your analysis. At this stage, you should mention all the responses gathered from a survey in a fixed format. Also, the reader/customer must get clarity about your goal, which you were trying to gain from the study. Questions such as – whether the product or service has been used/preferred or not. Do respondents prefer some other product to another? Any recommendations?

Having a tool that helps you carry out all the necessary steps to carry out this type of study is a vital part of any project. At QuestionPro, we have helped more than 10,000 clients around the world to carry out data collection in a simple and effective way, in addition to offering a wide range of solutions to take advantage of this data in the best possible way.

From dashboards, advanced analysis tools, automation, and dedicated functions, in QuestionPro, you will find everything you need to execute your research projects effectively. Uncover insights that matter the most!

MORE LIKE THIS

Customer Experience Automation: Benefits and Best Tools

Apr 1, 2024

7 Best Market Segmentation Tools in 2024

In-App Feedback Tools: How to Collect, Uses & 14 Best Tools

Mar 29, 2024

11 Best Customer Journey Analytics Software in 2024

Other categories.

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Uncategorized

- Video Learning Series

- What’s Coming Up

- Workforce Intelligence

- Search Menu

- Advance articles

- Editor's Choice

- Supplements

- French Abstracts

- Portuguese Abstracts

- Spanish Abstracts

- Author Guidelines

- Submission Site

- Open Access

- About International Journal for Quality in Health Care

- About the International Society for Quality in Health Care

- Editorial Board

- Advertising and Corporate Services

- Journals Career Network

- Self-Archiving Policy

- Dispatch Dates

- Contact ISQua

- Journals on Oxford Academic

- Books on Oxford Academic

Article Contents

What is survey research, advantages and disadvantages of survey research, essential steps in survey research, research methods, designing the research tool, sample and sampling, data collection, data analysis.

- < Previous

Good practice in the conduct and reporting of survey research

- Article contents

- Figures & tables

- Supplementary Data

KATE KELLEY, BELINDA CLARK, VIVIENNE BROWN, JOHN SITZIA, Good practice in the conduct and reporting of survey research, International Journal for Quality in Health Care , Volume 15, Issue 3, May 2003, Pages 261–266, https://doi.org/10.1093/intqhc/mzg031

- Permissions Icon Permissions

Survey research is sometimes regarded as an easy research approach. However, as with any other research approach and method, it is easy to conduct a survey of poor quality rather than one of high quality and real value. This paper provides a checklist of good practice in the conduct and reporting of survey research. Its purpose is to assist the novice researcher to produce survey work to a high standard, meaning a standard at which the results will be regarded as credible. The paper first provides an overview of the approach and then guides the reader step-by-step through the processes of data collection, data analysis, and reporting. It is not intended to provide a manual of how to conduct a survey, but rather to identify common pitfalls and oversights to be avoided by researchers if their work is to be valid and credible.

Survey research is common in studies of health and health services, although its roots lie in the social surveys conducted in Victorian Britain by social reformers to collect information on poverty and working class life (e.g. Charles Booth [ 1 ] and Joseph Rowntree [ 2 ]), and indeed survey research remains most used in applied social research. The term ‘survey’ is used in a variety of ways, but generally refers to the selection of a relatively large sample of people from a pre-determined population (the ‘population of interest’; this is the wider group of people in whom the researcher is interested in a particular study), followed by the collection of a relatively small amount of data from those individuals. The researcher therefore uses information from a sample of individuals to make some inference about the wider population.

Data are collected in a standardized form. This is usually, but not necessarily, done by means of a questionnaire or interview. Surveys are designed to provide a ‘snapshot of how things are at a specific time’ [ 3 ]. There is no attempt to control conditions or manipulate variables; surveys do not allocate participants into groups or vary the treatment they receive. Surveys are well suited to descriptive studies, but can also be used to explore aspects of a situation, or to seek explanation and provide data for testing hypotheses. It is important to recognize that ‘the survey approach is a research strategy, not a research method’ [ 3 ]. As with any research approach, a choice of methods is available and the one most appropriate to the individual project should be used. This paper will discuss the most popular methods employed in survey research, with an emphasis upon difficulties commonly encountered when using these methods.

Descriptive research

Descriptive research is a most basic type of enquiry that aims to observe (gather information on) certain phenomena, typically at a single point in time: the ‘cross-sectional’ survey. The aim is to examine a situation by describing important factors associated with that situation, such as demographic, socio-economic, and health characteristics, events, behaviours, attitudes, experiences, and knowledge. Descriptive studies are used to estimate specific parameters in a population (e.g. the prevalence of infant breast feeding) and to describe associations (e.g. the association between infant breast feeding and maternal age).

Analytical studies

Analytical studies go beyond simple description; their intention is to illuminate a specific problem through focused data analysis, typically by looking at the effect of one set of variables upon another set. These are longitudinal studies, in which data are collected at more than one point in time with the aim of illuminating the direction of observed associations. Data may be collected from the same sample on each occasion (cohort or panel studies) or from a different sample at each point in time (trend studies).

Evaluation research

This form of research collects data to ascertain the effects of a planned change.

Advantages:

The research produces data based on real-world observations (empirical data).

The breadth of coverage of many people or events means that it is more likely than some other approaches to obtain data based on a representative sample, and can therefore be generalizable to a population.

Surveys can produce a large amount of data in a short time for a fairly low cost. Researchers can therefore set a finite time-span for a project, which can assist in planning and delivering end results.

Disadvantages:

The significance of the data can become neglected if the researcher focuses too much on the range of coverage to the exclusion of an adequate account of the implications of those data for relevant issues, problems, or theories.

The data that are produced are likely to lack details or depth on the topic being investigated.

Securing a high response rate to a survey can be hard to control, particularly when it is carried out by post, but is also difficult when the survey is carried out face-to-face or over the telephone.

Research question

Good research has the characteristic that its purpose is to address a single clear and explicit research question; conversely, the end product of a study that aims to answer a number of diverse questions is often weak. Weakest of all, however, are those studies that have no research question at all and whose design simply is to collect a wide range of data and then to ‘trawl’ the data looking for ‘interesting’ or ‘significant’ associations. This is a trap novice researchers in particular fall into. Therefore, in developing a research question, the following aspects should be considered [ 4 ]:

Be knowledgeable about the area you wish to research.

Widen the base of your experience, explore related areas, and talk to other researchers and practitioners in the field you are surveying.

Consider using techniques for enhancing creativity, for example brainstorming ideas.

Avoid the pitfalls of: allowing a decision regarding methods to decide the questions to be asked; posing research questions that cannot be answered; asking questions that have already been answered satisfactorily.

The survey approach can employ a range of methods to answer the research question. Common survey methods include postal questionnaires, face-to-face interviews, and telephone interviews.

Postal questionnaires

This method involves sending questionnaires to a large sample of people covering a wide geographical area. Postal questionnaires are usually received ‘cold’, without any previous contact between researcher and respondent. The response rate for this type of method is usually low, ∼20%, depending on the content and length of the questionnaire. As response rates are low, a large sample is required when using postal questionnaires, for two main reasons: first, to ensure that the demographic profile of survey respondents reflects that of the survey population; and secondly, to provide a sufficiently large data set for analysis.

Face-to-face interviews

Face-to-face interviews involve the researcher approaching respondents personally, either in the street or by calling at people’s homes. The researcher then asks the respondent a series of questions and notes their responses. The response rate is often higher than that of postal questionnaires as the researcher has the opportunity to sell the research to a potential respondent. Face-to-face interviewing is a more costly and time-consuming method than the postal survey, however the researcher can select the sample of respondents in order to balance the demographic profile of the sample.

Telephone interviews

Telephone surveys, like face-to-face interviews, allow a two-way interaction between researcher and respondent. Telephone surveys are quicker and cheaper than face-to-face interviewing. Whilst resulting in a higher response rate than postal surveys, telephone surveys often attract a higher level of refusals than face-to-face interviews as people feel less inhibited about refusing to take part when approached over the telephone.

Whether using a postal questionnaire or interview method, the questions asked have to be carefully planned and piloted. The design, wording, form, and order of questions can affect the type of responses obtained, and careful design is needed to minimize bias in results. When designing a questionnaire or question route for interviewing, the following issues should be considered: (1) planning the content of a research tool; (2) questionnaire layout; (3) interview questions; (4) piloting; and (5) covering letter.

Planning the content of a research tool

The topics of interest should be carefully planned and relate clearly to the research question. It is often useful to involve experts in the field, colleagues, and members of the target population in question design in order to ensure the validity of the coverage of questions included in the tool (content validity).

Researchers should conduct a literature search to identify existing, psychometrically tested questionnaires. A well designed research tool is simple, appropriate for the intended use, acceptable to respondents, and should include a clear and interpretable scoring system. A research tool must also demonstrate the psychometric properties of reliability (consistency from one measurement to the next), validity (accurate measurement of the concept), and, if a longitudinal study, responsiveness to change [ 5 ]. The development of research tools, such as attitude scales, is a lengthy and costly process. It is important that researchers recognize that the development of the research tool is equal in importance—and deserves equal attention—to data collection. If a research instrument has not undergone a robust process of development and testing, the credibility of the research findings themselves may legitimately be called into question and may even be completely disregarded. Surveys of patient satisfaction and similar are commonly weak in this respect; one review found that only 6% of patient satisfaction studies used an instrument that had undergone even rudimentary testing [ 6 ]. Researchers who are unable or unwilling to undertake this process are strongly advised to consider adopting an existing, robust research tool.

Questionnaire layout

Questionnaires used in survey research should be clear and well presented. The use of capital (upper case) letters only should be avoided, as this format is hard to read. Questions should be numbered and clearly grouped by subject. Clear instructions should be given and headings included to make the questionnaire easier to follow.

The researcher must think about the form of the questions, avoiding ‘double-barrelled’ questions (two or more questions in one, e.g. ‘How satisfied were you with your personal nurse and the nurses in general?’), questions containing double negatives, and leading or ambiguous questions. Questions may be open (where the respondent composes the reply) or closed (where pre-coded response options are available, e.g. multiple-choice questions). Closed questions with pre-coded response options are most suitable for topics where the possible responses are known. Closed questions are quick to administer and can be easily coded and analysed. Open questions should be used where possible replies are unknown or too numerous to pre-code. Open questions are more demanding for respondents but if well answered can provide useful insight into a topic. Open questions, however, can be time consuming to administer and difficult to analyse. Whether using open or closed questions, researchers should plan clearly how answers will be analysed.

Interview questions

Open questions are used more frequently in unstructured interviews, whereas closed questions typically appear in structured interview schedules. A structured interview is like a questionnaire that is administered face to face with the respondent. When designing the questions for a structured interview, the researcher should consider the points highlighted above regarding questionnaires. The interviewer should have a standardized list of questions, each respondent being asked the same questions in the same order. If closed questions are used the interviewer should also have a range of pre-coded responses available.

If carrying out a semi-structured interview, the researcher should have a clear, well thought out set of questions; however, the questions may take an open form and the researcher may vary the order in which topics are considered.

A research tool should be tested on a pilot sample of members of the target population. This process will allow the researcher to identify whether respondents understand the questions and instructions, and whether the meaning of questions is the same for all respondents. Where closed questions are used, piloting will highlight whether sufficient response categories are available, and whether any questions are systematically missed by respondents.

When conducting a pilot, the same procedure as as that to be used in the main survey should be followed; this will highlight potential problems such as poor response.

Covering letter

All participants should be given a covering letter including information such as the organization behind the study, including the contact name and address of the researcher, details of how and why the respondent was selected, the aims of the study, any potential benefits or harm resulting from the study, and what will happen to the information provided. The covering letter should both encourage the respondent to participate in the study and also meet the requirements of informed consent (see below).

The concept of sample is intrinsic to survey research. Usually, it is impractical and uneconomical to collect data from every single person in a given population; a sample of the population has to be selected [ 7 ]. This is illustrated in the following hypothetical example. A hospital wants to conduct a satisfaction survey of the 1000 patients discharged in the previous month; however, as it is too costly to survey each patient, a sample has to be selected. In this example, the researcher will have a list of the population members to be surveyed (sampling frame). It is important to ensure that this list is both up-to date and has been obtained from a reliable source.

The method by which the sample is selected from a sampling frame is integral to the external validity of a survey: the sample has to be representative of the larger population to obtain a composite profile of that population [ 8 ].

There are methodological factors to consider when deciding who will be in a sample: How will the sample be selected? What is the optimal sample size to minimize sampling error? How can response rates be maximized?

The survey methods discussed below influence how a sample is selected and the size of the sample. There are two categories of sampling: random and non-random sampling, with a number of sampling selection techniques contained within the two categories. The principal techniques are described here [ 9 ].

Random sampling