IFRScommunity.com

IFRS Forums and IFRS Knowledge Base

Presentation of Financial Statements (IAS 1)

Last updated: 14 November 2023

IAS 1 serves as the main standard that outlines the general requirements for presenting financial statements. It is applicable to ‘general purpose financial statements’, which are designed to meet the informational needs of users who cannot demand customised reports from an entity. Documents like management commentary or sustainability reports, which are often included in annual reports, fall outside the scope of IFRS, as indicated in IAS 1.13-14. Similarly, financial statements submitted to a court registry are not considered general purpose financial statements (see IAS 1.BC11-13).

The standard primarily focuses on annual financial statements, but its guidelines in IAS 1.15-35 also extend to interim financial reports (IAS 1.4). These guidelines address key elements such as fair presentation, compliance with IFRS, the going concern principle, the accrual basis of accounting, offsetting, materiality, and aggregation. For comprehensive guidance on interim reporting, please refer to IAS 34 .

Note that IAS 1 will be superseded by the upcoming IFRS 18 Presentation and Disclosure in Financial Statements .

Now, let’s explore the general requirements for presenting financial statements in greater detail.

Financial statements

Components of a complete set of financial statements.

Paragraph IAS 1.10 outlines the elements that make up a complete set of financial statements. Companies have the flexibility to use different titles for these documents, but each statement must be presented with equal prominence (IAS 1.11). The terminology used in IAS 1 is tailored for profit-oriented entities. However, not-for-profit organisations or entities without equity (as defined in IAS 32), may use alternative terminology for specific items in their financial statements (IAS 1.5-6).

Are you tired of the constant stream of IFRS updates? I know it's tough! That's why I created Reporting Period – a once-a-month summary for professional accountants. It consolidates all essential IFRS developments and Big 4 insights into one readable email. I personally curate every issue to ensure it's packed with the most relevant information, delivered straight to your inbox. It's free, with no spam, and you can unsubscribe with just one click. Ready to give it a try?

Compliance with IFRS

Financial statements must include an explicit and unreserved statement of compliance with IFRS in the accompanying notes. This statement is only valid if the entity adheres to all the requirements of every IFRS standard (IAS 1.16). In many jurisdictions, such as the European Union, laws mandate compliance with a locally adopted version of IFRS.

IAS 1 does consider extremely rare situations where an entity might diverge from a specific IFRS requirement. Such a departure is permissible only if it prevents the presentation of misleading information that would conflict with the objectives of general-purpose financial reporting (IAS 1.20-22). Alternatively, entities can disclose the impact of such a departure in the notes, explaining how the statements would appear if the exception were made (IAS 1.23).

Identification of financial statements

The guidelines for identifying financial statements outlined in IAS 1.49-53 are straightforward and rarely cause issues in practice.

Going concern

The ‘going concern’ principle is a cornerstone of IFRS and other major GAAP. It assumes that an entity will continue to operate for the foreseeable future (at least 12 months). IAS 1 mandates management to assess whether the entity is a ‘going concern’. Should there be any material uncertainties regarding the entity’s future, these must be disclosed (IAS 1.25-26). IFRSs do not provide specific accounting principles for entities that are not going concerns, other than requiring disclosure of the accounting policies used. One of the possible approaches is to measure all assets and liabilities using their liquidation value.

See also this educational material at IFRS.org.

Materiality and aggregation

IAS 1.29-31 emphasise the importance of materiality in preparing user-friendly financial statements. While IFRS mandates numerous disclosures, entities should only include information that is material. This concept should be at the forefront when preparing financial statements, as reminders about materiality are seldom provided in other IFRS standards or publications.

Generally, entities should not offset assets against liabilities or income against expenses unless a specific IFRS standard allows or requires it. IAS 1.32-35 offer guidance on what can and cannot be offset. Offsetting of financial instruments is discussed further in IAS 32 .

Frequency of reporting

Entities are required to present a complete set of financial statements at least annually (IAS 1.36). However, some Public Interest Entities (PIEs) may be obliged to release financial statements more frequently, depending on local regulations. However, these are typically interim financial statements compiled under IAS 34 .

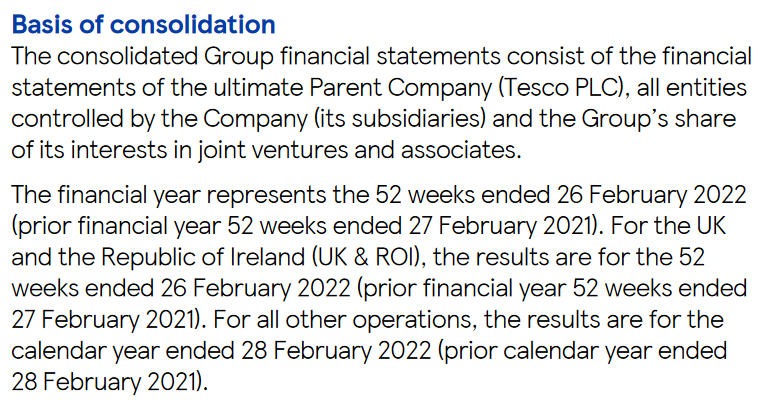

IAS 1 also allows for a 52-week reporting period instead of a calendar year (IAS 1.37). This excerpt from Tesco’s annual report serves to demonstrate this point, showing that the group uses 52-week periods for their financial year, even when some subsidiaries operate on a calendar-year basis:

If an entity changes its reporting period, it must clearly disclose this modification and provide the rationale for the change (IAS 1.36). It is advisable to include an explanatory note with comparative data that aligns with the new reporting period for clarity.

Comparative information

As a general guideline, entities should present comparative data for the prior period alongside all amounts reported for the current period, even when specific guidelines in a given IFRS do not require it. However, there’s no obligation to include narrative or descriptive information about the preceding period if it isn’t pertinent for understanding the current period (IAS 1.38).

If an entity opts to provide comparative data for more than the immediately preceding period, this additional information can be included in selected primary financial statements only. However, these additional comparative periods should also be detailed in the relevant accompanying notes (IAS 1.38C-38D).

IAS 1.40A-46 outlines how to present the statement of financial position when there are changes in accounting policies, retrospective restatements, or reclassifications. This entails producing a ‘third balance sheet’ at the start of the preceding period (which may differ from the earliest comparative period, if more than one is presented). Key points to note are:

- The third balance sheet is required only if there’s a material impact on the opening balance of the preceding period (IAS 1.40A(b)).

- If a third balance sheet is included, there’s no requirement to add a corresponding third column in the notes, although this could be useful where numbers have been altered by the change (IAS 1.40C).

- Interim financial statements do not require a third balance sheet (IAS 1.BC33).

IAS 8 also requires comprehensive disclosures concerning changes in accounting policies and corrections of errors .

Statement of financial position

IAS 1.54 enumerates the line items that must, at a minimum, appear in the statement of financial position. Entities should note that separate lines are not required for immaterial items (IAS 1.31). Additional line items can be added for entity-specific or industry-specific matters. IAS 1 permits the inclusion of subtotals, provided the criteria set out in IAS 1.55A are met.

Additional disclosure requirements are set out in IAS 1.77-80A. Of particular interest are the requirements pertaining to equity (IAS 1.79), which begin with the number of shares and extend to include details such as ‘rights, preferences, and restrictions relating to share capital, including restrictions on the distribution of dividends and the repayment of capital.’ While these kinds of limitations are common across various legal jurisdictions (for example, not all retained earnings can be distributed as dividends), many companies neglect to disclose such limitations in their financial statements.

For guidance on classifying assets and liabilities as either current or non-current, please refer to the separate page dedicated to this topic.

Statement of profit or loss and other comprehensive income

IAS 1 provides two methods for presenting profit or loss (P/L) and other comprehensive income (OCI). Entities can either combine both P/L and OCI into a single statement or present them in separate statements (IAS 1.81A-B). Additionally, the P/L and total comprehensive income for a given period should be allocated between the owners of the parent company and non-controlling interests (IAS 1.81B).

Minimum contents in P/L and OCI

IAS 1.82-82A specifies the minimum items that must appear in the P/L and OCI statements. These items are required only if they materially impact the financial statements (IAS 1.31).

Entities are permitted to add subtotals to the P/L statement if they meet the criteria specified in IAS 1.85A. Operating income is often the most commonly used subtotal in P/L. This practice may be attributed to the 1997 version of IAS 1, which mandated the inclusion of this subtotal—although this is no longer the case. IAS 1.BC56 clarifies that an operating profit subtotal should not exclude items commonly considered operational, such as inventory write-downs, restructuring costs, or depreciation/amortisation expenses.

Profit or loss (P/L)

All items of income and expense must be recognised in P/L (or OCI). This means that no income or expenses should be recognised directly in the statement of changes in equity, unless another IFRS specifically mandates it (IAS 1.88). Direct recognition in equity may also result from intra-group transactions . IAS 1.97-98 require separate disclosure of material items of income and expense, either directly in the income statement or in the notes.

Expenses in P/L can be presented in one of two ways (IAS 1.99-105):

- By their nature (e.g., depreciation, employee benefits); or

- By their function within the entity (e.g., cost of sales, distribution costs, administrative expenses).

When opting for the latter, entities must provide additional details on the nature of the expenses in the accompanying notes (IAS 1.104).

Other comprehensive income (OCI)

OCI encompasses income and expenses that other IFRS specifically exclude from P/L. There is no conceptual basis for deciding which items should appear in OCI rather than in P/L. Most companies present P/L and OCI as separate statements, partly because OCI is generally overlooked by investors and those outside of accounting and financial reporting circles. The concern is that combining the two could reduce net profit to merely a subtotal within total comprehensive income.

All elements that constitute OCI are specifically outlined in IAS 1.7, as part of its definitions.

Reclassification adjustments

A reclassification adjustment refers to the amount reclassified to P/L in the current period that was recognised in OCI in the current or previous periods (IAS 1.7). All items in OCI must be grouped into one of two categories: those that will or will not be subsequently reclassified to P/L (IAS 1.82A). Reclassification adjustments must be disclosed either within the OCI statement or in the accompanying notes (IAS 1.92-96).

To illustrate, foreign exchange differences arising on translation of foreign operations and gains or losses from certain cash flow hedges are examples of items that will be reclassified to P/L. In contrast, remeasurement gains and losses on defined benefit employee plans or revaluation gains on properties will not be reclassified to P/L.

The practice of transferring items from OCI to P/L, commonly known as ‘recycling’, lacks a concrete conceptual basis and the criteria for allowing such transfers in IFRS are often considered arbitrary.

Tax effects

OCI items can be presented either net of tax effects or before tax, with the overall tax impact disclosed separately. In either case, entities must specify the tax amount related to each item in OCI, including any reclassification adjustments (IAS 1.90-91). Interestingly, there is no such requirement to disclose tax effects for individual items in the income statement.

Statement of changes in equity

IAS 1.106 outlines the minimum line items that must be included in the statement of changes in equity. Subsequent paragraphs specify the disclosure requirements, which can be addressed either within the statement itself or in the accompanying notes. It’s crucial to note that changes in equity during a reporting period can arise either from income and expense items or from transactions involving owners acting in their capacity as owners (IAS 1.109). This means that entities cannot adjust equity directly based on changes in assets or liabilities unless these adjustments result from transactions with owners, such as capital contributions or dividend payments, or are otherwise mandated by other IFRSs.

Statement of cash flows

The statement of cash flows is governed by IAS 7 .

- Explanatory notes

Structure of explanatory notes

The structure for explanatory notes is detailed in IAS 1.112-116. In practice, there are several commonly adopted approaches to organising these notes:

Approach #1:

- Primary financial statements (P/L, OCI, etc.)

- Statement of compliance and basis of preparation

- Accounting policies

Approach #1 is logically coherent, as understanding accounting policies is crucial before delving into the financial data. However, in reality, few people read the accounting policies in their entirety. Consequently, users often have to navigate past several pages of accounting policies to reach the explanatory notes.

Approach #2:

- Primary financial statements (P/L, OCI, etc)

In Approach #2, accounting policies are treated as an appendix and positioned at the end of the financial statements. The advantage here is that all numerical data is clustered together, uninterrupted by extensive descriptions of accounting policies.

Approach #3:

- Explanatory notes integrated with relevant accounting policies

Approach #3 pairs accounting policies directly with the associated explanatory notes. For example, accounting policies relating to inventory would appear alongside the explanatory note that breaks down inventory components.

Management of capital

IAS 1.134-136 outline the disclosures related to capital management. These provisions apply to all entities, whether or not they are subject to external capital requirements. An important note here is that entities are not obligated to disclose specific values or ratios concerning capital objectives or requirements.

IAS 1.137 mandates disclosure of dividends proposed or declared before the financial statements were authorised for issue but not recognised as a distribution to owners during the period. Furthermore, entities are required to disclose the amount of any cumulative preference dividends not recognised.

Disclosure of accounting policies

IAS 1 specifies the requirements for disclosing accounting policy information which are discussed here .

Disclosing judgements and sources of estimation uncertainty

IAS 1 mandates disclosing judgements and sources of estimation uncertainty .

Other disclosures

Additional miscellaneous disclosure requirements are detailed in paragraphs IAS 1.138.

IFRS 18 Presentation and Disclosure in Financial Statements

The upcoming IFRS 18 Presentation and Disclosure in Financial Statements , which will supersede IAS 1, aims to enhance the comparability and transparency of financial reporting, focusing on the statement of profit or loss. Key changes include:

- The introduction of two new subtotals in the P/L statement: ‘operating profit’ and ‘profit before financing and income taxes’.

- A requirement for the reconciliation of management-defined performance measures (also known as ‘non-GAAP’ measures) with those specified by IFRS.

- Refined guidelines for the aggregation and disaggregation of information within the primary financial statements.

- Limited changes to the statement of cash flows, establishing operating profit as a starting point for the indirect method and eliminating options for the classification of interest and dividend cash flows.

Learn more in this BDO’s publication .

The release of IFRS 18 is expected in Q2 2024. This new IFRS will be effective from 1 January 2027 with early application permitted.

© 2018-2024 Marek Muc

The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Excerpts from IFRS Standards come from the Official Journal of the European Union (© European Union, https://eur-lex.europa.eu). You can access full versions of IFRS Standards at shop.ifrs.org. IFRScommunity.com is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org.

Questions or comments? Join our Forums

Discover the latest MyICAEW app for ACA students and members, available to download now. Find out more

- Benefits of membership

Gain access to world-leading information resources, guidance and local networks.

- Visit Benefits of membership

Becoming a member

98% of the best global brands rely on ICAEW Chartered Accountants.

- Visit Becoming a member

- Pay fees and subscriptions

Your membership subscription enables ICAEW to provide support to members.

Fees and subscriptions

Member rewards.

Take advantage of the range of value added or discounted member benefits.

- Member rewards – More from your membership

- Technical and ethics support

- Support throughout your career

Information and resources for every stage of your career.

Member Insights Survey

Let us know about the issues affecting you, your business and your clients.

- Complete the survey

From software start-ups to high-flying airlines and high street banks, 98% of the best global brands rely on ICAEW Chartered Accountants. A career as an ICAEW Chartered Accountant means the opportunity to work in any organisation, in any sector, whatever your ambitions.

Everything you need to know about ICAEW annual membership fees, community and faculty subscriptions, eligibility for reduced rates and details of how you can pay.

Membership administration

Welcome to the ICAEW members area: your portal to members'-only content, offers, discounts, regulations and membership information.

- Continuing Professional Development (CPD)

Continuing Professional Development (CPD) is an integral part of being a successful ICAEW Chartered Accountant.

The ICAEW Chartered Accountant qualification, the ACA, is one of the most advanced learning and professional development programmes available. It is valued around the world in business, practice and the public sector.

ACA for employers

Train the next generation of chartered accountants in your business or organisation. Discover how your organisation can attract, train and retain the best accountancy talent, how to become authorised to offer ACA training and the support and guidance on offer if you are already providing training.

Digital learning materials via BibliU

All ACA, ICAEW CFAB and Level 4 apprenticeship learning materials are now digital only. Read our guide on how to access your learning materials on the ICAEW Bookshelf using the BibliU app or through your browser.

- Find out more

Take a look at ICAEW training films

Focusing on professional scepticism, ethics and everyday business challenges, our training films are used by firms and companies around the world to support their in-house training and business development teams.

Attract and retain the next generation of accounting and finance professionals with our world-leading accountancy qualifications. Become authorised to offer ACA training and help your business stay ahead.

CPD guidance and help

Continuing Professional Development (CPD) is an integral part of being a successful ICAEW Chartered Accountant. Find support on ICAEW's CPD requirements and access resources to help your professional development.

Leadership Development Programmes

ICAEW Academy’s in-depth leadership development programmes take a holistic approach to combine insightful mentoring or coaching, to exclusive events, peer learning groups and workshops. Catering for those significant transitions in your career, these leadership development programmes are instrumental to achieving your ambitions or fulfilling your succession planning goals.

Specialist Finance Qualifications & Programmes

Whatever future path you choose, ICAEW will support the development and acceleration of your career at each stage to enhance your career.

Why a career in chartered accountancy?

If you think chartered accountants spend their lives confined to their desks, then think again. They are sitting on the boards of multinational companies, testifying in court and advising governments, as well as supporting charities and businesses from every industry all over the world.

- Why chartered accountancy?

Search for qualified ACA jobs

Matching highly skilled ICAEW members with attractive organisations seeking talented accountancy and finance professionals.

Volunteering roles

Helping skilled and in-demand chartered accountants give back and strengthen not-for-profit sector with currently over 2,300 organisations posting a variety of volunteering roles with ICAEW.

- Search for volunteer roles

- Get ahead by volunteering

Advertise with ICAEW

From as little as £495, access to a pool of highly qualified and ambitious ACA qualified members with searchable CVs.

Early careers and training

Start your ACA training with ICAEW. Find out why a career in chartered accountancy could be for you and how to become a chartered accountant.

Qualified ACA careers

Find Accountancy and Finance Jobs

Voluntary roles

Find Voluntary roles

While you pursue the most interesting and rewarding opportunities at every stage of your career, we’re here to offer you support whatever stage you are or wherever you are in the world and in whichever sector you have chosen to work.

ACA students

"how to guides" for aca students.

- ACA student guide

- How to book an exam

- How to apply for credit for prior learning (CPL)

Exam resources

Here are some resources you will find useful while you study for the ACA qualification.

- Certificate Level

- Professional Level

- Advanced Level

Digital learning materials

All ACA learning materials are now digital only. Read our guide on how to access your learning materials on the ICAEW Bookshelf via the BibliU app, or through your browser.

- Read the guide

My online training file

Once you are registered as an ACA student, you'll be able to access your training file to log your progress throughout ACA training.

- Access your training file

- Student Insights

Fresh insights, innovative ideas and an inside look at the lives and careers of our ICAEW students and members.

- Read the latest articles

System status checks

Getting started.

Welcome to ICAEW! We have pulled together a selection of resources to help you get started with your ACA training, including our popular 'How To' series, which offers step-by-step guidance on everything from registering as an ACA student and applying for CPL, to using your online training file.

Credit for prior learning (CPL)

Credit for prior learning or CPL is our term for exemptions. High quality learning and assessment in other relevant qualifications is appropriately recognised by the award of CPL.

Apply for exams

What you need to know in order to apply for the ACA exams.

The ACA qualification has 15 modules over three levels. They are designed to complement the practical experience you will be gaining in the workplace. They will also enable you to gain in-depth knowledge across a broad range of topics in accountancy, finance and business. Here are some useful resources while you study.

- Exam results

You will receive your results for all Certificate Level exams, the day after you take the exam and usually five weeks after a Professional and Advanced Level exam session has taken place. Access your latest and archived exam results here.

Training agreement

Putting your theory work into practice is essential to complete your ACA training.

Student support and benefits

We are here to support you throughout your ACA journey. We have a range of resources and services on offer for you to unwrap, from exam resources, to student events and discount cards. Make sure you take advantage of the wealth of exclusive benefits available to you, all year round.

- Applying for membership

The ACA will open doors to limitless opportunities in all areas of accountancy, business and finance anywhere in the world. ICAEW Chartered Accountants work at the highest levels as finance directors, CEOs and partners of some of the world’s largest organisations.

ACA training FAQs

Do you have a question about the ACA training? Then look no further. Here, you can find answers to frequently asked questions relating to the ACA qualification and training. Find out more about each of the integrated components of the ACA, as well as more information on the syllabus, your training agreement, ICAEW’s rules and regulations and much more.

- Anti-money laundering

Guidance and resources to help members comply with their legal and professional responsibilities around AML.

Technical releases

ICAEW Technical Releases are a source of good practice guidance on technical and practice issues relevant to ICAEW Chartered Accountants and other finance professionals.

- ICAEW Technical Releases

- Thought leadership

ICAEW's Thought Leadership reports provide clarity and insight on the current and future challenges to the accountancy profession. Our charitable trusts also provide funding for academic research into accountancy.

- Academic research funding

Technical Advisory Services helpsheets

Practical, technical and ethical guidance highlighting the most important issues for members, whether in practice or in business.

- ICAEW Technical Advisory Services helpsheets

Bloomsbury – free for eligible firms

In partnership with Bloomsbury Professional, ICAEW have provided eligible firms with free access to Bloomsbury’s comprehensive online library of around 80 titles from leading tax and accounting subject matter experts.

- Bloomsbury Accounting and Tax Service

Country resources

Our resources by country provide access to intelligence on over 170 countries and territories including economic forecasts, guides to doing business and information on the tax climate in each jurisdiction.

Industries and sectors

Thought leadership, technical resources and professional guidance to support the professional development of members working in specific industries and sectors.

Audit and Assurance

The audit, assurance and internal audit area has information and guidance on technical and practical matters in relation to these three areas of practice. There are links to events, publications, technical help and audit representations.

The most up-to-date thought leadership, insights, technical resources and professional guidance to support ICAEW members working in and with industry with their professional development.

- Corporate Finance

Companies, advisers and investors making decisions about creating, developing and acquiring businesses – and the wide range of advisory careers that require this specialist professional expertise.

- Corporate governance

Corporate governance is the system by which companies are directed and controlled. Find out more about corporate governance principles, codes and reports, Board subcommittees, roles and responsibilities and shareholder relations. Corporate governance involves balancing the interests of a company’s many stakeholders, such as shareholders, employees, management, customers, suppliers, financiers and the community. Getting governance right is essential to build public trust in companies.

- Corporate reporting

View a range of practical resources on UK GAAP, IFRS, UK regulation for company accounts and non-financial reporting. Plus find out more about the ICAEW Corporate Reporting Faculty.

Expert analysis on the latest national and international economic issues and trends, and interviews with prominent voices across the finance industry, alongside data on the state of the economy.

- Financial Services

View articles and resources on the financial services sector.

- Practice resources

For ICAEW's members in practice, this area brings together the most up-to-date thought leadership, technical resources and professional guidance to help you in your professional life.

Public Sector

Many ICAEW members work in or with the public sector to deliver public priorities and strong public finances. ICAEW acts in the public interest to support strong financial leadership and better financial management across the public sector – featuring transparency, accountability, governance and ethics – to ensure that public money is spent wisely and that public finances are sustainable.

Sustainability and climate change

Sustainability describes a world that does not live by eating into its capital, whether natural, economic or social. Members in practice, in business and private individuals all have a role to play if sustainability goals are to be met. The work being undertaken by ICAEW in this area is to change behaviour to drive sustainable outcomes.

The Tax area has information and guidance on technical and practical tax matters. There are links to events, the latest tax news and the Tax Faculty’s publications, including helpsheets, webinars and Tax representations.

Keep up-to-date with tech issues and developments, including artificial intelligence (AI), blockchain, big data, and cyber security.

Trust & Ethics

Guidance and resources on key issues, including economic crime, business law, better regulation and ethics. Read through ICAEW’s Code of Ethics and supporting information.

Communities

ICAEW Communities

Information, guidance and networking opportunities on industry sectors, professional specialisms and at various stages throughout your career. Free for ICAEW members and students.

- Discover a new community

ICAEW Faculties

The accountancy profession is facing change and uncertainty. The ICAEW Faculties can help by providing you with timely and relevant support.

- Choose to join any of the faculties

UK groups and societies

We have teams on the ground in: East of England, the Midlands, London and South East, Northern, South West, Yorkshire and Humberside, Wales and Scotland.

- Access your UK region

- Worldwide support and services

Support and services we offer our members in Africa, America, Canada, the Caribbean, Europe, Greater China, the Middle East, Oceania and South East Asia.

- Discover our services

ICAEW Faculties are 'centres of technical excellence', strongly committed to enhancing your professional development and helping you to meet your CPD requirements every year. They offer exclusive content, events and webinars, customised for your sector - which you should be able to easily record, when the time comes for the completion of your CPD declaration. Our offering isn't exclusive to Institute members. As a faculty member, the same resources are available to you to ensure you stay ahead of the competition.

Communities by industry / sector

Communities by life stage and workplace, communities by professional specialism, local groups and societies.

We aim to support you wherever in the world you work. Our regional offices and network of volunteers run events and provide access to local accounting updates in major finance centres around the globe.

- Ukraine crisis: central resource hub

Learn about the actions that ICAEW members are taking to ensure that their clients comply with sanctions imposed by different countries and jurisdictions, and read about the support available from ICAEW.

Insights pulls together the best opinion, analysis, interviews, videos and podcasts on the key issues affecting accountancy and business.

- See the latest insights

- Making COP count

This series looks at the role the accountancy profession can play in addressing the climate crisis and building a sustainable economy.

- Read more on COP28

Professional development and skills

With new requirements on ICAEW members for continuing professional development, we bring together resources to support you through the changes and look at the skills accountants need for the future.

- Visit the hub

When Chartered Accountants Save The World

Find out how chartered accountants are helping to tackle some of the most urgent social challenges within the UN Sustainable Development Goals, and explore how the profession could do even more.

- Read our major series

Insights specials

A listing of one-off Insights specials that focus on a particular subject, interviewing the key people, identifying developing trends and examining the underlying issues.

Top podcasts

Insights by topic.

ICAEW Regulation

- Regulatory News

View the latest regulatory updates and guidance and subscribe to our monthly newsletter, Regulatory & Conduct News.

- Regulatory Consultations

Strengthening trust in the profession

Our role as a world-leading improvement regulator is to strengthen trust and protect the public. We do this by enabling, evaluating and enforcing the highest standards in the profession.

Regulatory applications

Find out how you can become authorised by ICAEW as a regulated firm.

ICAEW codes and regulations

Professional conduct and complaints, statutory regulated services overseen by icaew, regulations for icaew practice members and firms, additional guidance and support, popular search results.

- Training File

- Practice Exam Software

- Ethics Cpd Course

- Routes to the ACA

- ACA students membership application

- Join as a member of another body

- How much are membership fees?

- How to pay your fees

- Receipts and invoices

- What if my circumstances have changed?

- Difficulties in making changes to your membership

- Faculty and community subscription fees

- Updating your details

- Complete annual return

- Promoting myself as an ICAEW member

- Verification of ICAEW membership

- Become a life member

- Become a fellow

- Request a new certificate

- Report the death of a member

- Membership regulations

- New members

- Career progression

- Career Breakers

- Volunteering at schools and universities

- ICAEW Member App

- Working internationally

- Self employment

- Support Members Scheme

- CPD is changing

- CPD learning resources

- Your guide to CPD

- Online CPD record

- How to become a chartered accountant

- Register as a student

- Train as a member of another body

- More about the ACA and chartered accountancy

- How ACA training works

- Become a training employer

- Access the training file

- Why choose the ACA

- Training routes

- Employer support hub

- Get in touch

- Apprenticeships with ICAEW

- A-Z of CPD courses by topic

- ICAEW Business and Finance Professional (BFP)

- ICAEW flagship events

- Financial Talent Executive Network (F-TEN®)

- Developing Leadership in Practice (DLiP™)

- Network of Finance Leaders (NFL)

- Women in Leadership (WiL)

- Mentoring and coaching

- Partners in Learning

- Board Director's Programme e-learning

- Corporate Finance Qualification

- Diploma in Charity Accounting

- ICAEW Certificate in Insolvency

- ICAEW Data Analytics Certificate

- Financial Modeling Institute’s Advanced Financial Modeler Accreditation

- ICAEW Sustainability Certificate for Finance Professionals

- ICAEW Finance in a Digital World Programme

- All specialist qualifications

- Team training

- Start your training

- Improve your employability

- Search employers

- Find a role

- Role alerts

- Organisations

- Practice support – 11 ways ICAEW and CABA can help you

- News and advice

- ICAEW Volunteering Hub

- Support in becoming a chartered accountant

- Vacancies at ICAEW

- ICAEW boards and committees

- Exam system status

- ICAEW systems: status update

- Changes to our qualifications

- How-to guides for ACA students

- Apply for credits - Academic qualification

- Apply for credits - Professional qualification

- Credit for prior learning (CPL)/exemptions FAQs

- Applications for Professional and Advanced Level exams

- Applications for Certificate Level exams

- Tuition providers

- Latest exam results

- Archived exam results

- Getting your results

- Marks feedback service

- Exam admin check

- Training agreement: overview

- Professional development

- Ethics and professional scepticism

- Practical work experience

- Access your online training file

- How training works in your country

- Student rewards

- TOTUM PRO Card

- Student events and volunteering

- Xero cloud accounting certifications

- Student support

- Join a community

- Wellbeing support from caba

- Student conduct and behaviour

- Code of ethics

- Fit and proper

- Level 4 Accounting Technician Apprenticeship

- Level 7 Accountancy Professional Apprenticeship

- AAT-ACA Fast Track FAQs

- ACA rules and regulations FAQs

- ACA syllabus FAQs

- ACA training agreement FAQs

- Audit experience and the Audit Qualification FAQs

- Independent student FAQs

- Practical work experience FAQs

- Professional development FAQs

- Six-monthly reviews FAQs

- Ethics and professional scepticism FAQs

- Greater China

- Latin America

- Middle East

- North America

- Australasia

- Russia and Eurasia

- South East Asia

- Charity Community

- Construction & Real Estate

- Energy & Natural Resources Community

- Farming & Rural Business Community

- Forensic & Expert Witness

- Global Trade Community

- Healthcare Community

- Internal Audit Community

- Manufacturing Community

- Media & Leisure

- Portfolio Careers Community

- Small and Micro Business Community

- Small Practitioners Community

- Travel, Tourism & Hospitality Community

- Valuation Community

- Audit and corporate governance reform

- Audit & Assurance Faculty

- Professional judgement

- Regulation and working in audit

- Internal audit resource centre

- ICAEW acting on audit quality

- Everything business

- Latest Business news from Insights

- Strategy, risk and innovation

- Business performance management

- Financial management

- Finance transformation

- Economy and business environment

- Leadership, personal development and HR

- Webinars and publications

- Business restructuring

- The Business Finance Guide

- Capital markets and investment

- Corporate finance careers

- Corporate Finance Faculty

- Debt advisory and growth finance

- Mergers and acquisitions

- Private equity

- Start-ups, scale-ups and venture capital

- Transaction services

- Board committees

- Corporate governance codes and reports

- Corporate Governance Community

- Principles of corporate governance

- Roles, duties and responsibilities of Board members

- Stewardship and stakeholder relations

- Corporate Governance thought leadership

Corporate reporting resources

- Small and micro entity reporting

- UK Regulation for Company Accounts

- Non-financial reporting

- Improving Corporate Reporting

- Economy home

- ICAEW Business Confidence Monitor

- ICAEW Manifesto 2024

- Energy crisis

- Levelling up: rebalancing the UK’s economy

- Resilience and Renewal: Building an economy fit for the future

- Social mobility and inclusion

- Autumn Statement 2023

- Investment management

- Inspiring confidence

- Setting up in practice

- Running your practice

- Supporting your clients

- Practice technology

- TAS helpsheets

- Support for business advisers

- Join ICAEW BAS

- Public Sector hub

- Public Sector Audit and Assurance

- Public Sector Finances

- Public Sector Financial Management

- Public Sector Financial Reporting

- Public Sector Learning & Development

- Public Sector Community

- Latest public sector articles from Insights

- Climate hub

- Sustainable Development Goals

- Accountability

- Modern slavery

- Resources collection

- Sustainability Committee

- Sustainability & Climate Change community

- Sustainability and climate change home

- Tax Faculty

- Budgets and legislation

- Business tax

- Devolved taxes

- Employment taxes

- International taxes

- Making Tax Digital

- Personal tax

- Property tax

- Stamp duty land tax

- Tax administration

- Tax compliance and investigation

- UK tax rates, allowances and reliefs

- Artificial intelligence

- Blockchain and cryptoassets

- Cyber security

- Data Analytics Community

- Digital skills

- Excel community

- Finance in a Digital World

- IT management

- Technology and the profession

- Trust & Ethics home

- Better regulation

- Business Law

- UK company law

- Data protection and privacy

- Economic crime

- Help with ethical problems

- ICAEW Code of Ethics

- ICAEW Trust and Ethics team.....

- Solicitors Community

- Forensic & Expert Witness Community

- Latest articles on business law, trust and ethics

- Audit and Assurance Faculty

- Corporate Reporting Faculty

- Financial Services Faculty

- Academia & Education Community

- Construction & Real Estate Community

- Entertainment, Sport & Media Community

- Retail Community

- Career Breakers Community

- Black Members Community

- Diversity & Inclusion Community

- Women in Finance Community

- Personal Financial Planning Community

- Restructuring & Insolvency Community

- Sustainability and Climate Change Community

- London and East

- South Wales

- Yorkshire and Humberside

- European public policy activities

- ICAEW Middle East

- Latest news

- Access to finance special

- Attractiveness of the profession

- Audit and Fraud

- Audit and technology

- Adopting non-financial reporting standards

- Cost of doing business

- Mental health and wellbeing

- Pensions and Personal Finance

- Public sector financial and non-financial reporting

- More specials ...

- The economics of biodiversity

- How chartered accountants can help to safeguard trust in society

- Video: The financial controller who stole £20,000 from her company

- It’s time for chartered accountants to save the world

- Video: The CFO who tried to trick the market

- Video: Could invoice fraud affect your business?

- So you want to be a leader?

- A busy new tax year, plus progress on the Economic Crime Act

- Does Britain have a farming problem?

- Budget 2024: does it change anything?

- Will accountants save the world? With ICAEW CEO Michael Izza

- Crunch time: VAT (or not) on poppadoms

- Where next for audit and governance reform?

- A taxing year ahead?

- What can we expect from 2024?

- COP28: making the business case for nature

- COP28: what does transition planning mean for accountants?

- More podcasts...

- Top charts of the week

- EU and international trade

- CEO and President's insights

- Diversity and Inclusion

- Sponsored content

- Insights index

- Charter and Bye-laws

- Archive of complaints, disciplinary and fitness processes, statutory regulations and ICAEW regulations

- Qualifications regulations

- Training and education regulations

- How to make a complaint

- Guidance on your duty to report misconduct

- Public hearings

- What to do if you receive a complaint against you

- Anti-money laundering supervision

- Working in the regulated area of audit

- Local public audit in England

- Probate services

- Designated Professional Body (Investment Business) licence

- Consumer credit

- Quality Assurance monitoring: view from the firms

- The ICAEW Practice Assurance scheme

- Licensed Practice scheme

- Professional Indemnity Insurance (PII)

- Clients' Money Regulations

- Taxation (PCRT) Regulations

- ICAEW training films

- Helpsheets and guidance by topic

- ICAEW's regulatory expertise and history

- IFRS accounting standards

IAS 1 Presentation of Financial Statements

Presentation of financial statements sets out the overall requirements for the presentation of financial statements, guidelines for their structure, and minimum requirements for their content., access the standard, current proposals, recent amendments, related ifric interpretations, uk reduced disclosures – frs 101, icaew factsheets and guides, icaew articles, other resources.

- 2023 Issued Standard – IAS 1 The 2023 Issued Standards include all amendments issued up to and including 1 January 2023.

Registration is required to access the free version of the Issued Standards, which do not include additional documents that accompany the full standard (such as illustrative examples, implementation guidance and basis for conclusions).

A complete set of financial statements includes:

- A statement of financial position (balance sheet) at the end of the period

- A statement of profit or loss and other comprehensive income (income statement) for the period

- A statement of changes in equity for the period

- A statement of cash flows (cash flow statement) for the period

- Notes to the accounts.

The names of the main statements are not mandatory.

IAS 1 Revised also requires a statement of financial position at the start of the earliest comparative period where there has been a retrospective adjustment to the accounts or reclassification of items.

The statement of profit or loss and other comprehensive income, as the name suggests, presents profit and loss for the period as well as other comprehensive income. Other comprehensive income includes income and expenses not recognised in profit or loss such as revaluation surpluses. The statement of profit or loss and other comprehensive income may be presented either as one statement or a separate statement of profit or loss and statement showing other comprehensive income.

The standard provides guidance on the form and content of the financial statements and the underlying accounting concepts. It also requires financial statements to present fairly the position, performance and cash flows of an entity. This is normally achieved by the application of IFRS.

ED/2019/7 General Presentation and Disclosures was issued in December 2019. This is the exposure draft of a proposed new standard that would replace IAS 1. The standard would carry forward most of the current requirements of IAS 1 and add supplementary requirements, including:

- Categorising items in profit or loss as operating, investing or financing

- Requiring additional profit subtotals

- Distinguishing between integral and non-integral associates and joint ventures

- Removing the choice of how to present cash flows from dividends and interest

- Requiring additional disclosure about unusual items

- Providing disclosure of management performance measures.

All amendments issued up to and including the publication date of 1 January 2022 are included within the IFRS Foundation’s latest version of the issued standard: 2022 Issued Standard – IAS 1 . Issued amendments may, therefore, have a mandatory effective date that is later than 1 January 2022 – see below for details.

Any amendments issued after 1 January 2022 will not be included in the IFRS Foundation’s 2022 Issued Standards but will be listed below and identified as such.

See the Corporate Reporting Faculty’s annual IFRS factsheets for a more detailed discussion of recent IFRS amendments.

Mandatory date: Annual periods beginning on or after 1 January 2024. Earlier application is permitted.

Issue date: October 2022 (not included within the IFRS Foundation’s 2022 Issued Standards).

The amendments specify that the classification of a liability as current or non-current is only affected by covenants that an entity must comply with on or before the end of the reporting period. They also require disclosure of information that allows users of financial statements to understand the risk that non-current liabilities with covenants could become repayable within 12 months.

This amendment has been endorsed for use in the UK. It is not yet endorsed for use in the EU as at 25 July 2023. Read more on UK endorsement and EU endorsement of IFRS standards.

For a more detailed discussion of the amendment, read the faculty’s factsheet:

- 2022 IFRS Accounts

Mandatory date: Annual periods beginning on or after 1 January 2024 (deferred from 2023). Earlier application is permitted.

IAS 1 is amended to clarify that the classification of liabilities as current or non-current should be based on rights that exist at the end of the reporting period. Expectations about whether an entity will exercise a right to defer settlement of a liability do not affect its classification. The amendments also clarify that settlement is the transfer of cash, equity instruments, other assets or services.

The deferral of the effective date to 2024 is included in the Non-current Liabilities with Covenants amendment to IAS 1.

Mandatory date: Annual periods beginning on or after 1 January 2023. Earlier application is permitted.

The amendments to IAS 1:

- Require an entity to disclose material accounting policy information rather than significant accounting policies.

- Explain that accounting policy information is material if, together with other information in the financial statements, it can reasonably be expected to influence decisions that primary users make.

- Provide examples of material accounting policies.

- Clarify that accounting policy information relating to immaterial transactions need not be disclosed.

IAS 1 is amended to:

- Add finance income and expenses to the list of components of other comprehensive income;

- Require line items to be presented in the statement of financial position in respect of contracts that are within the scope of IFRS 17;

- Require line items to be presented in the statement of profit or loss in respect of amounts related to contracts within the scope of IFRS 17.

IAS 1 is amended to refer to portfolios of contracts rather than groups of contracts within the scope of IFRS 17.

Mandatory date: Annual periods beginning on or after 1 January 2020. Earlier application is permitted.

The definition of material is amended to be as follows:

Information is material if omitting, misstating or obscuring it could reasonably be expected to influence decisions that the primary users of general purpose financial statements make on the basis of those financial statements, which provide financial information about a specific reporting entity.

Examples of circumstances that may result in material information being obscured are added to the standard as a result of the amendment, as is guidance on users of financial statements.

- 2020 IFRS Accounts

Mandatory date: Annual periods beginning on or after 1 January 2020. Earlier application is permitted if an entity also applies the amendments to other IFRS Accounting Standards at the same time.

IAS 1 is updated to refer to the 2018 Conceptual Framework rather than the Framework for the Preparation and Presentation of Financial Statements when referring to materiality, definitions of elements and their recognition criteria and the objective of financial statements.

- IFRIC 1 Existing Decommissioning, Restoration and Similar Liabilities Addresses accounting for a change in a provision that is included in the carrying amount of an item of PPE.

- IFRIC 14 IAS 19 – The Limit on a Defined Benefit Asset, Minimum Funding Requirements and their Interaction Provides general guidance on how to assess the limit in IAS 19 on the amount of the surplus that can be recognised as an asset. Explains how the pensions asset or liability may be affected when there is a statutory or contractual minimum funding requirement.

- IFRIC 17 Distribution of Non-cash Assets to Owners Addresses the accounting for dividends of non-cash assets, including those where there is a cash alternative.

- IFRIC 19 Extinguishing Financial Liabilities with Equity Instruments Addresses the accounting by an entity which issues equity instruments in order to settle, in full or part, a financial liability.

- IFRIC 20 Stripping Costs in the Production Phase of a Surface Mine Addresses the accounting treatment of mine waste materials, which are the materials removed by mining entities in order to gain access to mineral ore deposits.

- IFRIC 21 Levies Provides guidance on when to recognise liability for a levy imposed by a government.

- IFRIC 23 Uncertainty over Income Tax Treatments Clarifies how to apply the recognition and measurement requirements of IAS 12 when there is uncertainty over income tax treatments.

- SIC 7 Introduction of the Euro The effective start of the EMU after the reporting date does not alter the requirements of IAS 21 at the reporting date.

- SIC 25 Income Taxes – Changes in the Tax Status of an Enterprise or its Shareholders Addresses the deferred tax consequences of changes in tax status of an enterprise or its shareholders.

- SIC 29 Disclosure – Service Concession Arrangements Prescribes disclosures required by a concession operator and concession provider joined by a service concession arrangement.

- SIC 32 Intangible Assets – Website Costs Addresses accounting for costs associated with the development of a website.

UK qualifying parents and subsidiaries can take advantage of FRS 101 Reduced Disclosure Framework. Our FRS 101 page gives more information on which entities qualify and the criteria to be met.

The following amendments must be made to IAS 1 in order to achieve compliance with the Companies Act and related Regulations:

- The statement of financial position must comply with the balance sheet format requirements of the Companies Act.

- The statement of profit or loss and other comprehensive income must comply with the profit and loss account format requirements of the Companies Act.

- Ordinary activities of an entity are defined and extraordinary items are described as highly abnormal material items arising from events falling outside an entity’s ordinary activities.

- It is clarified that items of income or expense are not recognised in profit or loss where such recognition is prohibited by the Companies Act.

FRS 101 paragraph 8(f) states that a qualifying entity is exempt from the IAS 1 requirement to present the following within a set of financial statements:

- A statement of cash flows for the period;

- A third statement of financial position when a retrospective adjustment or reclassification is made;

- A statement of compliance with IFRS;

- A reconciliation of property, plant and equipment, intangible assets, investment properties, biological assets and the number of shares outstanding at the beginning and end of the comparative period;

- Capital management disclosures (this exemption is not available to a financial institution);

- All remaining IAS 1 disclosures must be applied.

IAS 1 paragraphs for which exemption is available: 10(d), 10(f), 16, 38A-D, 40A-D, 111, 134-6.

The Corporate Reporting Faculty's annual IFRS factsheets provide a more detailed discussion of recent IFRS amendments.

- Helpsheets and support

- 16 Feb 2024

- 08 Aug 2023

- PDF (398kb)

- PDF (415kb)

- 16 Aug 2021

- PDF (414kb)

- 10 Apr 2024

- 14 Nov 2022

- 30 Dec 2020

- 11 Jun 2020

The ICAEW Library & Information Service provides full text access to a selection of key business and reference eBooks from leading publishers. eBooks are available to logged-in ICAEW members, ACA students and other entitled users. If you are unable to access an eBook, please see our Help and support advice or contact [email protected] .

- eBook chapter

- PKF International Ltd

- Wiley Interpretation and Application of IFRS Standards

- Ernst & Young LLP

- International GAAP - Generally Accepted Accounting Practice under International Financial Reporting Standards

Terms of use

You are permitted to access, download, copy, or print out content from eBooks for your own research or study only, subject to the terms of use set by our suppliers and any restrictions imposed by individual publishers. Please see individual supplier pages for full terms of use.

Overviews of each international accounting standard, with a history and timeline of key events and amendments.

Detailed guide on interpreting and implementing IFRS, with illustrative examples and extracts from financial statements. The manual is available online (free registration required) as part of EY Atlas Client Edition.

Further support

Practical resources including factsheets, online guides, helpsheets, webinars, eBooks and articles.

Technical Advisory Services

Our experienced advisors can help you with technical questions.

Library and Information Service

Expert help with research and access to trustworthy, professional sources.

- +44 (0)20 7920 8620

- [email protected]

Some of the content on this web page was provided by the Chartered Accountants’ Trust for Education and Research, a registered charity, which owns the library and operates it for ICAEW.

Read out this code to the operator.

Annual Reporting

Knowledge base for IFRS Reporting

IFRS Standard: IAS 1 Presentation of Financial Statements

Ias 1 objective scope definitions, ias 1 presentation of financial statements, ias 1 objective ias 1 objective scope definitions.

1 This Standard prescribes the basis for presentation of general purpose financial statements to ensure comparability both with the entity’s financial statements of previous periods and with the financial statements of other entities. It sets out overall requirements for the presentation of financial statements, guidelines for their structure and minimum requirements for their content.

IAS 1 Scope

2 An entity shall apply this Standard in preparing and presenting general purpose financial statements in accordance with International Financial Reporting Standards (IFRSs).

3 Other IFRSs set out the recognition, measurement and disclosure requirements for specific transactions and other events.

4 This Standard does … Read more

IAS 1 Financial statements

Purpose of financial statements ia s 1 financial statements.

9. Financial statements are a structured representation of the financial position and financial performance of an entity. The objective of financial statements is to provide information about the financial position, financial performance and cash flows of an entity that is useful to a wide range of users in making economic decisions. Financial statements also show the results of the management’s stewardship of the resources entrusted to it. To meet this objective, financial statements provide information about an entity’s:

- liabilities;

- income and expenses, including gains and losses;

- contributions by and distributions to owners in their capacity as owners; and

IAS 1 Structure and content

Introduction ias 1 structure and content.

47 This Standard requires particular disclosures in the statement of financial position or the statement(s) of profit or loss and other comprehensive income, or in the statement of changes in equity and requires disclosure of other line items either in those statements or in the notes. IAS 7 Statement of Cash Flows sets out requirements for the presentation of cash flow information.

48 This Standard sometimes uses the term ‘disclosure’ in a broad sense, encompassing items presented in the financial statements. Disclosures are also required by other IFRSs. Unless specified to the contrary elsewhere in this Standard or in another IFRS, such disclosures … Read more

IAS 1 Statement of financial position

Information to be presented in the statement of financial position.

54 The statement of financial position shall include line items that present the following amounts:

- property, plant and equipment;

- investment property;

- intangible assets;

- financial assets (excluding amounts shown under (e), (h) and (i)); (da) portfolio of contracts within the scope of IFRS 17 that are assets, disaggregated as required by paragraph 78 of IFRS 17 ;

- investments accounted for using the equity method;

- biological assets within the scope of IAS 41 Agriculture ;

- inventories;

- trade and other receivables;

- cash and cash equivalents;

- the total of assets classified as held for sale and assets included in disposal groups classified

IAS 1 Statement of profit or loss and other comprehensive income

81 [ Deleted]

81A The statement of profit or loss and other comprehensive income (statement of comprehensive income) shall present, in addition to the profit or loss and other comprehensive income sections:

- profit or loss;

- total other comprehensive income;

- comprehensive income for the period, being the total of profit or loss and other comprehensive income.

If an entity presents a separate statement of profit or loss it does not present the profit or loss section in the statement presenting comprehensive income.

81B An entity shall present the following items, in addition to the profit or loss and other comprehensive income sections, as … Read more

IAS 1 Statement of changes in equity

Information to be presented in the statement of changes in equity ias 1 statement of changes in equity.

106 An entity shall present a statement of changes in equity as required by paragraph 10. The statement of changes in equity includes the following information:

- total comprehensive income for the period, showing separately the total amounts attributable to owners of the parent and to non-controlling interests;

- for each component of equity, the effects of retrospective application or retrospective restatement recognised in accordance with IAS 8; and

- for each component of equity, a reconciliation between the carrying amount at the beginning and the end of the period, separately

IAS 1 Statement of cash flows

111 Cash flow information provides users of financial statements with a basis to assess the ability of the entity to generate cash and cash equivalents and the needs of the entity to utilise those cash flows. IAS 7 sets out requirements for the presentation and disclosure of cash flow information.

Previous: IAS 1 Statement of changes in equity

Next: IAS 1 Notes

Source EU rules on financial information disclosed by companies

IAS 1 Statement of cash flows IAS 1 Statement of cash flows IAS 1 Statement of cash flows IAS 1 Statement of cash flows IAS 1 Statement of cash flows IAS 1 Statement of … Read more

IAS 1 Notes

112 The notes shall:

- present information about the basis of preparation of the financial statements and the specific accounting policies used in accordance with paragraphs 117–124;

- disclose the information required by IFRSs that is not presented elsewhere in the financial statements; and

- provide information that is not presented elsewhere in the financial statements, but is relevant to an understanding of any of them.

113 An entity shall, as far as practicable, present notes in a systematic manner. In determining a systematic manner, the entity shall consider the effect on the understandability and comparability of its financial statements. An entity shall cross-reference each item in the statements of financial position and … Read more

- Conceptual Framework

- IFRS Accounting Standards

IAS Standards

- IFRIC Interpretations

IAS 1 Presentation of Financial Statements

Learn the key accounting principles to be applied to financial statements, including fair presentation and compliance with IFRS Standards.

- Terms of use

- Deloitte Accounting Research Tool

© 2024 For information, contact Deloitte Global.

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms, and their related entities (collectively, the “Deloitte organization”). DTTL (also referred to as “Deloitte Global”) and each of its member firms and related entities are legally separate and independent entities, which cannot obligate or bind each other in respect of third parties. DTTL and each DTTL member firm and related entity is liable only for its own acts and omissions, and not those of each other. DTTL does not provide services to clients. Please see Deloitte website to learn more. Consult our content information page for more information about the content of this website.

The IFRS Foundation is a not-for-profit, public interest organisation established to develop high-quality, understandable, enforceable and globally accepted accounting and sustainability disclosure standards.

Our Standards are developed by our two standard-setting boards, the International Accounting Standards Board (IASB) and International Sustainability Standards Board (ISSB).

About the IFRS Foundation

Ifrs foundation governance, stay updated.

IFRS Accounting Standards are developed by the International Accounting Standards Board (IASB). The IASB is an independent standard-setting body within the IFRS Foundation.

IFRS Accounting Standards are, in effect, a global accounting language—companies in more than 140 jurisdictions are required to use them when reporting on their financial health. The IASB is supported by technical staff and a range of advisory bodies.

IFRS Accounting

Standards and frameworks, using the standards, project work, products and services.

IFRS Sustainability Disclosure Standards are developed by the International Sustainability Standards Board (ISSB). The ISSB is an independent standard-setting body within the IFRS Foundation.

IFRS Sustainability Standards are developed to enhance investor-company dialogue so that investors receive decision-useful, globally comparable sustainability-related disclosures that meet their information needs. The ISSB is supported by technical staff and a range of advisory bodies.

IFRS Sustainability

Education, membership and licensing.

IAS 1 Presentation of Financial Statements

You need to Sign in to use this feature

IAS 1 sets out overall requirements for the presentation of financial statements, guidelines for their structure and minimum requirements for their content. It requires an entity to present a complete set of financial statements at least annually, with comparative amounts for the preceding year (including comparative amounts in the notes). A complete set of financial statements comprises:

- a statement of financial position as at the end of the period;

- a statement of profit and loss and other comprehensive income for the period. Other comprehensive income is those items of income and expense that are not recognised in profit or loss in accordance with IFRS Standards. IAS 1 allows an entity to present a single combined statement of profit and loss and other comprehensive income or two separate statements;

- a statement of changes in equity for the period;

- a statement of cash flows for the period;

- notes, comprising a summary of significant accounting policies and other explanatory information; and

- a statement of financial position as at the beginning of the preceding comparative period when an entity applies an accounting policy retrospectively or makes a retrospective restatement of items in its financial statements, or when it reclassifies items in its financial statements.

An entity whose financial statements comply with IFRS Standards must make an explicit and unreserved statement of such compliance in the notes. An entity must not describe financial statements as complying with IFRS Standards unless they comply with all the requirements of the Standards. The application of IFRS Standards, with additional disclosure when necessary, is presumed to result in financial statements that achieve a fair presentation. IAS 1 also deals with going concern issues, offsetting and changes in presentation or classification.

Standard history

In April 2001 the International Accounting Standards Board (IASB) adopted IAS 1 Presentation of Financial Statements , which had originally been issued by the International Accounting Standards Committee in September 1997. IAS 1 Presentation of Financial Statements replaced IAS 1 Disclosure of Accounting Policies (issued in 1975), IAS 5 Information to be Disclosed in Financial Statements (originally approved in 1977) and IAS 13 Presentation of Current Assets and Current Liabilities (approved in 1979).

In December 2003 the IASB issued a revised IAS 1 as part of its initial agenda of technical projects. The IASB issued an amended IAS 1 in September 2007, which included an amendment to the presentation of owner changes in equity and comprehensive income and a change in terminology in the titles of financial statements. In June 2011 the IASB amended IAS 1 to improve how items of other income comprehensive income should be presented.

In December 2014 IAS 1 was amended by Disclosure Initiative (Amendments to IAS 1), which addressed concerns expressed about some of the existing presentation and disclosure requirements in IAS 1 and ensured that entities are able to use judgement when applying those requirements. In addition, the amendments clarified the requirements in paragraph 82A of IAS 1.

In October 2018 the IASB issued Definition of Material (Amendments to IAS 1 and IAS 8). This amendment clarified the definition of material and how it should be applied by (a) including in the definition guidance that until now has featured elsewhere in IFRS Standards; (b) improving the explanations accompanying the definition; and (c) ensuring that the definition of material is consistent across all IFRS Standards.

In February 2021 the IASB issued Disclosure of Accounting Policies which amended IAS 1 and IFRS Practice Statement 2 Making Materiality Judgements . The amendment amended IAS 1 to replace the requirement for entities to disclose their significant accounting policies with the requirement to disclose their material accounting policy information.

In October 2022, the IASB issued Non-current Liabilities with Covenants . The amendments improved the information an entity provides when its right to defer settlement of a liability for at least twelve months is subject to compliance with covenants. The amendments also responded to stakeholders’ concerns about the classification of such a liability as current or non-current.

Other Standards have made minor consequential amendments to IAS 1. They include Improvement to IFRSs (issued April 2009), Improvement to IFRSs (issued May 2010), IFRS 10 Consolidated Financial Statements (issued May 2011), IFRS 12 Disclosures of Interests in Other Entities (issued May 2011), IFRS 13 Fair Value Measurement (issued May 2011), IAS 19 Employee Benefits (issued June 2011), Annual Improvements to IFRSs 2009–2011 Cycle (issued May 2012), IFRS 9 Financial Instruments (Hedge Accounting and amendments to IFRS 9, IFRS 7 and IAS 39) (issued November 2013), IFRS 15 Revenue from Contracts with Customers (issued May 2014), Agriculture: Bearer Plants (Amendments to IAS 16 and IAS 41) (issued June 2014), IFRS 9 Financial Instruments (issued July 2014), IFRS 16 Leases (issued January 2016), Disclosure Initiative (Amendments to IAS 7) (issued January 2016), IFRS 17 Insurance Contracts (issued May 2017), Amendments to References to the Conceptual Framework in IFRS Standards (issued March 2018) and Amendments to IFRS 17 (issued June 2020).

Related active projects

IFRS Accounting Taxonomy Update—Primary Financial Statements

Related completed projects

Clarification of the Requirements for Comparative Information (Amendments to IAS 1)

Classification of Liabilities as Current or Non-current (Amendments to IAS 1)

Definition of Accounting Estimates (Amendments to IAS 8)

Disclosure Initiative (Amendments to IAS 1)

Disclosure Initiative (Amendments to IAS 7)

Disclosure Initiative—Accounting Policies

Disclosure Initiative—Definition of Material (Amendments to IAS 1 and IAS 8)

Disclosure Initiative—Principles of Disclosure

Disclosure Initiative—Targeted Standards-level Review of Disclosures

IFRS Accounting Taxonomy Update—Amendments to IAS 1, IAS 8 and IFRS Practice Statement 2

IFRS Accounting Taxonomy Update—Amendments to IFRS 16 and IAS 1

Joint Financial Statement Presentation (Replacement of IAS 1)

Non-current Liabilities with Covenants (Amendments to IAS 1)

Presentation of Items of Other Comprehensive Income (Amendments to IAS 1)

Presentation of Liabilities or Assets Related to Uncertain Tax Treatments (IAS 1)

Presentation of interest revenue for particular financial instruments (IFRS 9 and IAS 1)

Puttable Financial Instruments and Obligations Arising on Liquidation (Amendments to IAS 32 and IAS 1)

Revised IAS 1 Presentation of Financial Statements: Phase A

Supply Chain Financing Arrangements—Reverse Factoring

Related IFRS Standards

Related ifric interpretations.

IFRIC 1 Changes in Existing Decommissioning, Restoration and Similar Liabilities

Unconsolidated amendments

Implementation support, your privacy.

IFRS Foundation cookies

We use cookies on ifrs.org to ensure the best user experience possible. For example, cookies allow us to manage registrations, meaning you can watch meetings and submit comment letters. Cookies that tell us how often certain content is accessed help us create better, more informative content for users.

We do not use cookies for advertising, and do not pass any individual data to third parties.

Some cookies are essential to the functioning of the site. Other cookies are optional. If you accept all cookies now you can always revisit your choice on our privacy policy page.

Cookie preferences

Essential cookies, always active.

Essential cookies are required for the website to function, and therefore cannot be switched off. They include managing registrations.

Analytics cookies

We use analytics cookies to generate aggregated information about the usage of our website. This helps guide our content strategy to provide better, more informative content for our users. It also helps us ensure that the website is functioning correctly and that it is available as widely as possible. None of this information can be tracked to individual users.

Preference cookies

Preference cookies allow us to offer additional functionality to improve the user experience on the site. Examples include choosing to stay logged in for longer than one session, or following specific content.

Share this page

IAS 1 Presentation of Financial Statements

International accounting standard 1.

Overview of IAS 1

- Issued: in 1975; re-issued in 2007, followed by amendments

- Effective date: 1 January 2009

- Statement of financial position;

- Statement of profit or loss and other comprehensive income;

- Statement of changes in equity;

- Statement of cash flows;

- Notes with summary of significant accounting policies and other explanatory information

- fair presentation and compliance with IFRS;

- going concern;

- accrual basis of accounting;

- materiality and aggregation;

- offsetting;

- frequency of reporting;

- comparative information; and

- consistency of presentation.

- It sets the minimum requirements for the content of financial statements; their identification and structure.

Articles about IAS 1

- Summary of IAS 1 Presentation of Financial Statements