- Search Search Please fill out this field.

- Corporate Finance

- Corporate Debt

Assignment of Accounts Receivable: Meaning, Considerations

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

:max_bytes(150000):strip_icc():format(webp)/CharleneRhinehartHeadshot-CharleneRhinehart-ca4b769506e94a92bc29e4acc6f0f9a5.jpg)

Investopedia / Jiaqi Zhou

What Is Assignment of Accounts Receivable?

Assignment of accounts receivable is a lending agreement whereby the borrower assigns accounts receivable to the lending institution. In exchange for this assignment of accounts receivable, the borrower receives a loan for a percentage, which could be as high as 100%, of the accounts receivable.

The borrower pays interest, a service charge on the loan, and the assigned receivables serve as collateral. If the borrower fails to repay the loan, the agreement allows the lender to collect the assigned receivables.

Key Takeaways

- Assignment of accounts receivable is a method of debt financing whereby the lender takes over the borrowing company's receivables.

- This form of alternative financing is often seen as less desirable, as it can be quite costly to the borrower, with APRs as high as 100% annualized.

- Usually, new and rapidly growing firms or those that cannot find traditional financing elsewhere will seek this method.

- Accounts receivable are considered to be liquid assets.

- If a borrower doesn't repay their loan, the assignment of accounts agreement protects the lender.

Understanding Assignment of Accounts Receivable

With an assignment of accounts receivable, the borrower retains ownership of the assigned receivables and therefore retains the risk that some accounts receivable will not be repaid. In this case, the lending institution may demand payment directly from the borrower. This arrangement is called an "assignment of accounts receivable with recourse." Assignment of accounts receivable should not be confused with pledging or with accounts receivable financing .

An assignment of accounts receivable has been typically more expensive than other forms of borrowing. Often, companies that use it are unable to obtain less costly options. Sometimes it is used by companies that are growing rapidly or otherwise have too little cash on hand to fund their operations.

New startups in Fintech, like C2FO, are addressing this segment of the supply chain finance by creating marketplaces for account receivables. Liduidx is another Fintech company providing solutions through digitization of this process and connecting funding providers.

Financiers may be willing to structure accounts receivable financing agreements in different ways with various potential provisions.

Special Considerations

Accounts receivable (AR, or simply "receivables") refer to a firm's outstanding balances of invoices billed to customers that haven't been paid yet. Accounts receivables are reported on a company’s balance sheet as an asset, usually a current asset with invoice payments due within one year.

Accounts receivable are considered to be a relatively liquid asset . As such, these funds due are of potential value for lenders and financiers. Some companies may see their accounts receivable as a burden since they are expected to be paid but require collections and cannot be converted to cash immediately. As such, accounts receivable assignment may be attractive to certain firms.

The process of assignment of accounts receivable, along with other forms of financing, is often known as factoring, and the companies that focus on it may be called factoring companies. Factoring companies will usually focus substantially on the business of accounts receivable financing, but factoring, in general, a product of any financier.

:max_bytes(150000):strip_icc():format(webp)/Accounts_Recievable_Financing_Final_3-2-9d907a15511b455f94a1f064a1cc5ae8.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Please update your browser.

We don't support this browser version anymore. Using an updated version will help protect your accounts and provide a better experience.

Update your browser

We don't support this browser version anymore. Using an updated version will help protect your accounts and provide a better experience.

We’ve signed you out of your account.

You’ve successfully signed out

We’ve enhanced our platform for chase.com. For a better experience, download the Chase app for your iPhone or Android. Or, go to System Requirements from your laptop or desktop.

Access & Security Manager: Add users and assign rights

Please turn on javascript in your browser.

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

- Personal Banking

- Credit Cards

- Mobile & Online

- Home Lending

- Investments

- Business Banking

Access & Security Manager: Add users and assign rights

You can set up multiple authorized users with their own unique ID and password – which gives them access only to the accounts and services you set. Here’s how:

Do more with the Chase Mobile ® app

Scan the QR code to download the app to experience convenience and security on the go.

Chase Survey

Your feedback is important to us. Will you take a few moments to answer some quick questions?

You're now leaving Chase

Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. Chase isn’t responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name.

- Python Basics

- Interview Questions

- Python Quiz

- Popular Packages

- Python Projects

- Practice Python

- AI With Python

- Learn Python3

- Python Automation

- Python Web Dev

- DSA with Python

- Python OOPs

- Dictionaries

Python program to create Bankaccount class with deposit, withdraw function

- How to create an empty class in Python?

- Python program to build flashcard using class in Python

- Create a GUI to search bank information with IFSC Code using Python

- Python program to print current year, month and day

- Python program to convert any base to decimal by using int() method

- Python Program to calculate Profit Or Loss

- How to create a list of object in Python class

- Python program to convert exponential to float

- Python Program to Calculate Gross Salary of a Person

- Essential Python Tips And Tricks For Programmers

- Python Program to Convert Celsius To Fahrenheit

- How to Call a Method on a Class Without Instantiating it in Python?

- How to write an empty function in Python - pass statement?

- How to Create a Programming Language using Python?

- Accessing Python Function Variable Outside the Function

- Python program to add two Octal numbers

- How to write memory efficient classes in Python?

- Python program to draw a bar chart using turtle

- Python - Create or Redefine SQLite Functions

- Python Program to Convert Temperatures using Classes

- How to use Function Decorators in Python ?

- How to create a simple drawing board in Processing with Python Mode?

- Python Program to Find and Print Address of Variable

- Using a Class with Input in Python

- First Class functions in Python

- Python program to find number of local variables in a function

- How to Call a C function in Python

- Program to create grade calculator in Python

- Python Tips and Tricks for Competitive Programming

Prerequisite: Object Oriented Programming in Python Let’s write a simple Python program using OOP concept to perform some simple bank operations like deposit and withdrawal of money. First of all, define class Bankacccount. This step is followed by defining a function using __init__. It is run as soon as an object of a class is instantiated. This __init__ method is useful to do any initialization you want to do with object, then we have the default argument self.

This step is followed by declaring that balance is 0 using self argument then we simply print a statement welcoming to Machine. In function deposit and withdraw , amount is taken as input(in float) and is then added/subtracted to the balance. Thus resultant balance is printed in next line.

Use an if condition to check whether there is a sufficient amount of money available in the account to process a fund withdrawal.

Next, we use a display function to display the remaining balance in the account. Then we create a object and call it to get the program executed.

Below is the implementation:

Output:

Please Login to comment...

Similar reads.

- Technical Scripter 2018

- Technical Scripter

Improve your Coding Skills with Practice

What kind of Experience do you want to share?

Properly Executed Assignment of Deposit Account

Answered by: Andy Zavoina

We can't be specific as to state laws. For that we'd refer you to your state peers in a state forum in the BOL threads. Notices to deposit holders would be a state law issue and not under a federal regulation. Generally the deposits securing your loan will be with you and you have control. CDs under Article 9 of the UCC and deposited elsewhere differ, but those don't appear to be your question.

First published on 09/29/2014

Report a problem with this page

Related Q&As

Curbing mortgage fraud, cra data collection for new businesses, what is the definition of a manufactured home, related tools view all, hmda refi cheat sheet, cra codes for small business loans, red flag (found) worksheet, ofac updates view all, sanctions list search, specially designated nationals list (sdn), sanctions programs and information, search topics.

Learn about our FREE Briefings.

Banking, Bank Accounts, and Earning Interest Lessons

Banking teaching banking lesson plans personal finance money management worksheet skills education 101 syllabus tutorial exercises classroom unit teacher resources activity free curriculum basics.

Lessons appropriate for: 4th 5th 6th 7th 8th 9th 10th 11th 12th Graders College Adults

Fourth Grade - Fifth Grade - Sixth Grade - Seventh Grade - Eighth Grade - Ninth Grade - Tenth Grade - Eleventh Grade - Twelfth Grade - K12 - Middle School - High School Students - Adults - Teens - Teenagers - Young People - Special Education

Welcome to our Savings and Banking section, where you can find a variety of educational resources to help you master the fundamentals of bank savings accounts and interest rates. Our lesson plans, worksheets, exercises, and activities are designed to teach learners of all levels about savings, banks, bank accounts, and interest rates. These resources are customizable and can be used in a classroom setting or for independent study. In addition, our online bank simulator provides a dynamic way to learn about modern online banking and ATM usage. The simulator features interactive exercises that allow you to practice transactions such as deposits, withdrawals, transfers, and more. Whether you're a beginner looking to learn the basics or an experienced saver looking to enhance your knowledge, our Savings and Banking section has everything you need to manage your finances with confidence. So, start exploring our resources today and take the first step towards financial literacy. See below for Lessons and Worksheets

Savings accounts overview.

When saving your money, you will be placing money in many different types of savings instruments, including very safe and stable investments vehicles. This is especially true for money that you are going to need in the short-term (as compared to long-term investments, such as buying a house). This category includes bank savings accounts and money market mutual funds, some of the safest short term investments. When placing your money with a bank or money market fund, you earn interest, or yield, which fluctuates, depending on general rates of interest.

TYPES OF SAVINGS ACCOUNTS

Bank Savings Accounts When you are beginning to save, you should place your money in investments that are as safe as possible. In addition, you will likely always have at least some of your money in short-term investments. Bank savings accounts are such an investment. The federal government backs these accounts with what is known as Federal Deposit insurance Corporation (FDIC) Insurance.

Money Market Account These are accounts offered by banks. However, in these accounts the bank typically pays you a higher rate of interest than a savings account.

CD or Certificate of Deposit The bank holds your money for a set period of time. Usually one to six months, or one to five years. Unlike a normal savings account, you may not withdraw your money at any time. If you do, you will be subject to withdrawal fees.

Money Market Funds Similar to bank savings accounts are money market funds. Money market accounts are available from mutual fund companies. They are similar, but you usually get a better return with money market funds. Also, since these funds are not held with a bank, they are not FDIC insured. However, they are invested in very short-term bonds, which tend to be less risky than longer-term bonds and invest in safe government investments, corporate commercial paper, and other related investments. In addition, they are regulated by the U.S. Securities and Exchange commission. Money market mutual funds that invest exclusively in U.S. government securities have very little risk, while giving you better rates of return then typical bank savings accounts.

Lessons and Worksheets

More Saving and Investing Money Lessons

To teach and learn money skills, personal finance, money management, business, careers, and life skills please go to the Money Instructor home page .

Teach and learn money skills, personal finance, money management, business, careers, real life skills, and more.... MoneyInstructor ®

- New Member Registration

- Teaching Lessons

© Copyright 2002-2024 Money Instructor® All Rights Reserved.

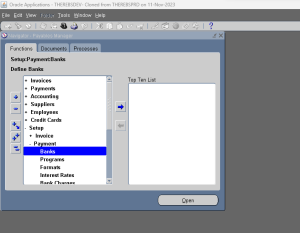

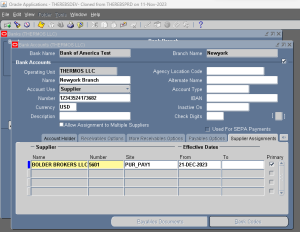

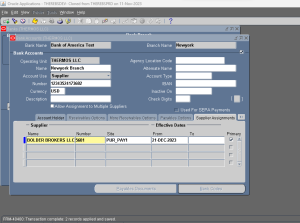

Bank Account

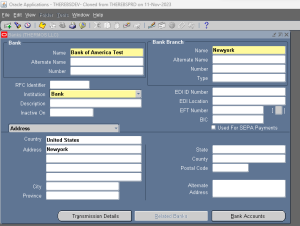

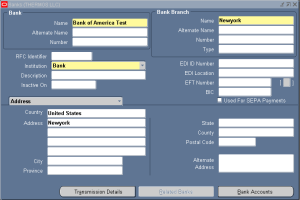

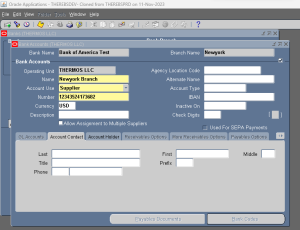

Create and Assigning the Bank Account to the Supplier in Oracle Apps 11i

This Document will explain the steps to create Supplier Bank account and assign the supplier to the Bank account in Oracle Apps 11i.

In Payables, you can define external banks where your suppliers are the account holders.

To enter a basic bank:

- In the Banks window, enter all basic bank information: bank name, branch name, bank number, branch number, and address.

Note: If this is a U.S.-based bank, enter the American Banking Association nine-digit transit routing number in the Bank Branch Number field. The bank branch number must be included on both internal and supplier banks referenced by the NACHA (National Automated Clearing House Association) electronic payment format.

- Select Bank as the Institution.

- Optionally enter the EFT (electronic funds transfer) Number.

- Optionally enter names and information for your bank contacts in the Contact region.

- Save your work.

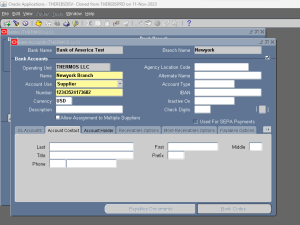

Defining Supplier Bank Accounts

If you use Payables, you can enter bank information for bank accounts for which your supplier is the account holder. You then assign these accounts to the supplier and its sites. Payables uses this bank information when you create electronic payments for your suppliers.

You can either define the supplier first and then when you define the bank account you can associate it with the supplier in the Supplier Assignments region (as described below). Or you can define the bank account first and then assign it to the supplier when you enter the supplier in the Suppliers window.

The primary supplier bank account defaults from the supplier site to the scheduled payments on an invoice. When you make a supplier bank account inactive, Payables displays a message to automatically replace that account on any unpaid or partially paid scheduled payments with the supplier’s primary bank account. Payables ensures that a payment cannot be made to an inactive supplier remittance account. Payables notifies you if you attempt such payment.

To define a supplier bank account:

- In the Banks window query an existing Bank.

- Choose the Bank Accounts button. Enter the Bank Account Name and Bank Account Number.

Suggestion: Use the supplier name or supplier number in the bank account name and description to make it easy to identify later.

- Enter the EDI ID number only if you have installed Oracle Energy. Optionally enter an Account Type and Description.

- Optionally change the account currency, which defaults from your functional currency. Leave the account currency blank if you want the account to receive payments in multiple currencies.

- If you want to use Bank Account validation, enter Check Digits.

- Select Supplier as the Account Use.

- To enable this bank account to receive payments for multiple suppliers, enable the Allow Assignment to Multiple Suppliers option. See: Factoring Arrangements .

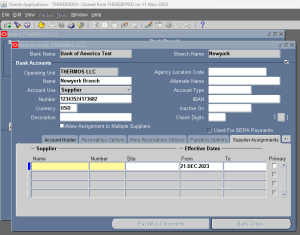

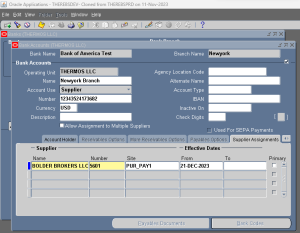

- In the Supplier Assignments region list the supplier, and optionally list supplier sites, that use the account to receive electronic payments.

- Optionally enter account holder information in the Account Holder region.

Note: If you are processing NACHA-formatted electronic payments, in the Alternate Account Holder field, enter the exact name of the tax reporting entity that should be referenced by the NACHA payment format.

- Optionally enter contact information in the Account Contact region.

- In the Bank Accounts region of the Suppliers and Supplier Sites windows, verify for each supplier and site that all appropriate bank accounts are listed. For suppliers and supplier sites with multiple bank accounts, designate as the primary bank account one bank account per period and per currency.

Step1: Login to the Oracle Instance and Navigate to Payables Responsibility:

Step2: Bank Creation Navigation: Payables –> Setup –> Payment–>Banks

Step3: Enter Bank Name, Branch Name, Bank Address and Institution as Bank.

Step4: Click Bank Account

Step5: Enter Bank Account Details and Select Account use as Supplier.

Step6: Select Account Use as Supplier

Step7: Click the Highlighted Arrow Mark

Step8: Click Supplier Assignment’s

Step9: A new Tap will appear to assign the Supplier details to the Bank

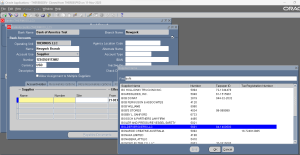

Step10: Select Supplier from the List of Values

Step11: Select Supplier Site if required, It is an optional filed.

Step12: Enable to Primary Check Box

Step13: Save the Work

Bank Accounts Region of the Suppliers and Supplier Sites Windows

Use this region to record the supplier bank accounts that your suppliers and supplier sites use for electronic payment transactions.

Bank accounts you have already assigned to the supplier or supplier site in the Bank Accounts window will appear here. Information you enter in this region of the Supplier and Supplier Sites windows will appear in the Supplier Assignments region of the Bank Accounts window. The Bank Accounts region appears for new supplier sites after you save the supplier site. When you enter bank accounts for a supplier site, Payables defaults all of the supplier’s active bank accounts. At any time you can add bank accounts for a supplier or supplier site. You can also change the effective dates at any time to make a bank assignment inactive. Updating bank accounts for a supplier will not affect bank accounts for existing supplier sites.

If you want to view detailed information or update a bank account listed in this window, you can double click on the current record indicator to navigate to the Banks window.

Name: Name of the bank account that this supplier or supplier site uses. The list of values includes only active supplier bank accounts that are either not yet assigned to a different supplier or site within a different supplier, or have the Allow Assignment to Multiple Suppliers option enabled on the account, such as factor company accounts.

Number: Bank account number of the supplier’s remittance account.

Primary: Enable this check box to have Payables use this bank account as a default when you pay this supplier electronically. For each supplier and supplier site that has bank account assignments, you must designate as the primary bank account exactly one bank account per currency. For all periods during which a supplier or site has active bank accounts, you must specify a primary bank account. When you enter an invoice, the supplier site primary bank account for the invoice currency defaults to each scheduled payment. If no primary bank account is selected for the supplier site, then the system uses the supplier’s primary bank account. The Remit-To Bank Account for the scheduled payment then defaults to the payment.

If you enable the Allow Remit-To Account Override Payables option, you can override the Remit-To Bank Account value in the Scheduled Payments tab, the Payments tab, and the Modify Payment Batch window with any other remit-to bank with the same currency and for the same supplier.

Effective Dates From/To: Enter dates if you want to limit the time during which a supplier site uses this bank account as the primary bank account for receiving electronic payments in the bank account currency.

Start typing and press Enter to search

- Commercial Lending

- Community Banking

- Compliance and Risk

- Cybersecurity

- Human Resources

- Mutual Funds

- Retail and Marketing

- Tax and Accounting

- Wealth Management

- Magazine Archive

- Newsletter Archive

- Sponsored Archive

- Podcast Archive

Digital Account Opening Best Practices That Will Boost Your Deposit Game

There’s no one-size-fits-all approach when it comes to new deposit account opening.

As you face deposit challenges, a volatile workforce, and time limitations, it’s impossible to meet every accountholder’s expectation. Instead, you can understand what matters most to your current and potential accountholders to better serve and attract deposit relationships across all digital channels.

Without the right technology, you won’t be able to serve your accountholders in their moments of need.

As you look to increase your deposits and reimagine your account opening process, use this checklist as a guide. Does your digital solution:

- Provide a list of the information needed at the beginning of the process

- Set expectations upfront so applicants understand how long the process will take

- Offer omnichannel integrations and allow applicants to save and resume their applications at any point in the account opening process

- Capture and auto-fill basic personal identity information

- Provide a method to compare different account types

- Empower easy direct deposit set-up

- Provide notifications regarding the progress of the application process

- Allow the simplicity of digital account funding in real-time

- Qualify applicants against risk and fraud threats

- Verify applicant identity (often with third-party data sources)

- Integrate with your core banking system

- Enable electronic signature capture

- Easily capture photo or file uploads of supporting documents (identification, agreements, etc.)

- Include specific functionality and form fields for business accountholders

- Deliver a seamless user experience from account opening to digital banking

Opening an account with a neobank takes less than five minutes. If your account opening platform isn’t providing every feature on this list, connect with a Jack Henry™ expert today and discover how you can effectively compete for new deposits.

Related Posts

Why It May Be Time for Your Bank to Expand into Dealer Commercial Lending

SPONSORED CONTENT PRESENTED BY DATASCAN Your community bank is the financial heart of the region. Businesses and families count on...

LEGAL NOTICE

SPONSORED CONTENT PRESENTED BY ANALYTICS CONSULTING LLC If your financial institution issued one or more payment cards identified as having...

ERM Model Risk and AI

SPONSORED CONTENT PRESENTED BY PROTECHT GROUP By Jared Siddle Director of Risk, North America, Protecht Group Building a Robust Model...

The Federal Reserve’s Nick Stanescu shares what’s next for the FedNow® Service

SPONSORED CONTENT PRESENTED BY FEDERAL RESERVE FINANCIAL SERVICES The FedNow Service launched in July 2023 with 35 financial institutions live...

AI Compliance and Regulation: What Financial Institutions Need to Know

SPONSORED CONTENT PRESENTED BY ALKAMI TECHNOLOGY While generative AI (GenAI) stands poised to improve everything from risk management to profit...

Gain Efficiencies and Other Timely Benefits with Data Analytics

SPONSORED CONTENT PRESENTED BY JACK HENRY Understanding data intelligence and analytics is increasingly critical to being able to serve today’s...

Unlocking the potential of marketing automation

Four ways stonier changes bankers’ careers, preparing for the departure of an information security officer, artificial intelligence for banks: learning benefits, mitigating risk, how technology is changing for bank marketers, podcast: how a georgia community bank engaged employees at 3x the national rate, sponsored content.

CFPB claims ‘complex’ pricing drives up cost of financial products

Aba files coalition amicus brief urging third circuit to reject cfpb’s expansive fcra interpretation, fifth third bank sued over return deposit item fees, new york federal court denies coinbase motion for judgment over sec enforcement actions, michigan federal court dismisses overdraft fee maximization lawsuit against flagstar bank, minnesota federal court dismisses minnesota bankers association’s nsf fees lawsuit.

American Bankers Association 1333 New Hampshire Ave NW Washington, DC 20036 1-800-BANKERS (800-226-5377) www.aba.com About ABA Privacy Policy Contact ABA

© 2024 American Bankers Association. All rights reserved.

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best Personal Loans

Auto Insurance

Best Auto Insurance

Best High-Yields Savings Accounts

CREDIT CARDS

Best Credit Cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Today’s top savings account rate roundup: Take home 5.84% with today’s best rates — April 30, 2024

Taylor Tepper

Megan Horner

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Published 9:25 a.m. UTC April 30, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

Getty Images

Over the past week, average savings account rates have inched up all while banks try to figure out if the Federal Reserve’s pause in interest rate hikes is permanent.

More broadly, savers are enjoying a favorable situation that offers an excellent chance to strengthen your emergency fund or save for a major purchase. Regardless of your goal, strive to find a savings account that features a competitive interest rate, minimal fees and exceptional customer service, along with a seamless digital user experience.

Savings accounts provided subatomic yields following the Great Recession thanks to the Fed keeping borrowing costs low in order to cajole economic growth.

This low-rate environment was abandoned, however, following the government’s extensive spending during the pandemic, which caused the Fed to significantly boost interest rates to offset soaring inflation. That then prompted banks and credit unions to raise rates for savers.

Savings account rates — $2,500 minimum deposit

The highest interest rate on a standard savings account today is 5.84%, per Curinos, the same as a week ago. Meanwhile, the average APY (annual percentage yield) for a traditional savings account, as reported by Curinos, is 0.24%, up slightly from last week.

APY represents the return your account will generate in a year, taking into account compound interest—the interest earned on both the principal and previously accumulated interest in your account.

For instance, if you were to invest $2,500 at a 5.84% rate (the current high) for one year, you would earn roughly $150 in interest, assuming daily compounding and no additional contributions.

Savings account rates — $10,000 minimum deposit

The average APY for savings accounts requiring a minimum deposit of $10,000 is 0.24%, unmoved over the past week. But remember that many banks offer substantially higher rates.

Some of the top high-yield savings accounts , for instance, currently feature rates of 4.00% or higher.

Per Curinos, the highest interest rate today on a savings account requiring a minimum deposit of $10,000 is 5.35%. If you were to invest $10,000 at a 5.35% rate (the current high) for one year, you would earn more than $550 in interest, assuming daily compounding and no additional contributions.

Methodology

To establish average savings account rates, Curinos focused on savings accounts intended for personal use. Savings accounts that fall into specific categories are excluded, including promotional offers, relationship-based accounts, private, youth, senior and student/minor. The average savings rates quoted above are based on a $2,500 or $10,000 minimum deposit amount.

Frequently asked questions (FAQs)

A high-yield savings account is essentially a standard savings account that offers a higher interest rate on deposits. (It’s more of a description than a technical definition.) This rate can fluctuate based on the broader financial market and the specific bank or credit union’s business requirements.

Like most savings accounts, you can’t access your funds by writing checks and your withdrawals are typically limited.

A high-yield savings account is ideal for those who require a readily accessible option for funds that won’t be touched more than once a week. It’s a recommended choice for most people.

However, if you already have a well-balanced investment portfolio with high earning potential and a convenient savings account with a trusted bank, you might not need or want a high-yield savings account. In this situation, managing an additional account could be an unnecessary hassle.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Taylor Tepper is the lead banking editor for USA TODAY Blueprint. Prior to that he was a senior writer at Forbes Advisor, Wirecutter, Bankrate and Money Magazine. He has also been published in the New York Times, NPR, Bloomberg and the Tampa Bay Times. His work has been recognized by his peers, winning a Loeb, Deadline Club and SABEW award. He has completed the education requirement from the University of Texas to qualify for a Certified Financial Planner certification, and earned a M.A. from the Craig Newmark Graduate School of Journalism at the City University of New York where he focused on business reporting and was awarded the Frederic Wiegold Prize for Business Journalism. He earned his undergraduate degree from New York University, and married his college sweetheart with whom he raises three kids in Dripping Springs, TX.

Megan Horner is editorial director at USA TODAY Blueprint. She has over 10 years of experience in online publishing, mostly focused on credit cards and banking. Previously, she was the head of publishing at Finder.com where she led the team to publish personal finance content on credit cards, banking, loans, mortgages and more. Prior to that, she was an editor at Credit Karma. Megan has been featured in CreditCards.com, American Banker, Lifehacker and news broadcasts across the country. She has a bachelor’s degree in English and editing.

Best national banks of April 2024

Banking Dori Zinn

Capital One bonuses and promotions of April 2024

Banking Emily Batdorf

How to make a budget

Banking Jacqueline DeMarco

Best bank bonuses & promotions of April 2024

Best credit unions of April 2024

The 7 best budgeting apps of April 2024

Betterment cash management account review 2024

No-penalty CD vs. savings account: Which should you choose?

Banking Bob Haegele

Alliant Credit Union review of 2024

Banking Cassidy Horton

Wells Fargo vs. Bank Of America: Which is best for you?

KeyBank review of 2024

YNAB budgeting app review

Banking John Egan

PNC Bank promotions of April 2024

Best compound interest accounts

Banking Lauren Ward

Discover Bank promotions of April 2024

An official website of the United States government

Here's how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- The Attorney General

- Organizational Chart

- Budget & Performance

- Privacy Program

- Press Releases

- Photo Galleries

- Guidance Documents

- Publications

- Information for Victims in Large Cases

- Justice Manual

- Business and Contracts

- Why Justice ?

- DOJ Vacancies

- Legal Careers at DOJ

Former Bank Employee Charged With Stealing and Selling Customer Account and Identity Information

PHILADELPHIA – United States Attorney Jacqueline C. Romero announced that Kalien Frazier, 29, of Oakland, California, was charged today by indictment with six counts of wire fraud and one count of aggravated identity theft for a bank insider scheme, in which he used his position as a bank employee to access, misappropriate, and sell bank customer account and identity information.

As alleged in the indictment, from on or about March 30, 2022, until on or about August 30, 2023, Frazier used his position as a customer service representative at a Federal Deposit Insurance Corporation (FDIC)-insured bank to obtain the account details, debit card details, card verification value (CVV), and personal identifying information of customers. Frazier would ask for this information from customers, even if not required to complete the customer service request, while on recorded customer service calls. After Frazier had obtained this information, he advertised in group chats that he had bank account information for sale due to his position at a financial institution. When advertising the information for sale, Frazier warned potential customers that they would have to stay under certain monetary thresholds to avoid detection.

As alleged in the indictment, Frazier sold or transferred information on hundreds of bank accounts to third parties. As a result of Frazier’s scheme, unauthorized electronic payments and transfers were made from hundreds of bank accounts.

If convicted on all counts, Frazier faces a possible maximum sentence of 120 years in prison for the wire fraud, plus a mandatory minimum sentence of two years for aggravated identity theft.

This case was investigated by the Federal Deposit Insurance Corporation (FDIC) – Office of Inspector General. The case is being prosecuted by Assistant United States Attorney Timothy Lanni.

[email protected] 215-861-8300

Related Content

What do you need to cash a check?

Retail stores and supermarkets, prepaid debit cards, issuing bank, check-cashing services, how to cash a check without a bank account.

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate banking products to write unbiased product reviews.

- Many brick-and-mortar banks will still allow you to cash a check even if you don't bank with them.

- Grocery stores and big-box retailers may also offer check-cashing services, for a fee.

- Avoid check-cashing stores if you can, as they typically charge a higher fee.

- See Business Insider's picks for the best checking accounts .

When you receive a check from another person, you usually don't want to keep it as a check for long. However, if you don't have a bank account or aren't near your bank due to travel, your situation becomes a bit trickier.

Banks aren't required to cash checks from people who aren't customers. That being said, many brick-and-mortar banks will still cash your check even if you don't bank with them. However, there might be some additional rules you'll have to follow.

Before you visit any bank branch or check-cashing store, make sure to bring at least one form of government-issued identification.

If you don't have a U.S. ID, such as a driver's license, you'll need to go to a bank or credit union that lets you use an alternative form of ID, like a foreign passport. Otherwise, a bank could turn you away since it can't determine whether the check belongs to you.

Make sure your check isn't expired before you cash it. Many checks expire within 90 days of being written.

Many popular grocery and retail chains offer check-cashing services. These stores might be closer to your home and more convenient than a bank, but they still charge a fee for processing your check.

For example, Walmart charges a maximum of $4 for checks up to $1,000 and a maximum of $8 for checks over $1,000 and up to $5,000. Kroger charges $4.50 ($4 if you have a Kroger rewards card) for checks under $3,000; $7.50 ($7 with a card) for checks between $3,000 and $5,000.

A prepaid debit card is loaded with money and works much like a debit card, except it's not connected to a checking account .

Prepaid debit cards sometimes come with mobile app access, which allows you to load money easily, including by taking a photo of your check. Keep in mind that there may be a fee.

Several financial institutions have policies that allow you to cash a check even if you don't have an account with the bank or credit union. Usually you will need to take the check to the issuing institution, not just your bank of choice.

Be prepared to show a government-issued ID and pay a fee. Contact the bank's customer service before your visit to make sure you're aware of any additional requirements or policies.

Cashing check policies at different banks

Below, you'll get an overview of how ten national banks cash checks from non-customers:

- Bank of America: Bank of America permits checks written by Bank of America customers. Checks with a value greater than $50 will be charged $8 per check.

- Chase: Chase will cash any checks issued by the bank. Fees vary depending on the amount written on the check. For instance, a $100 check would require a $10 fee.

- Wells Fargo: Wells Fargo will let you cash a check for a $7.50 fee if the person who wrote the check is a Wells Fargo account owner.

- Citibank: Citibank allows non-customers to cash a check for a $7 fee.

- Capital One: Capital One will let you cash a check if the person who wrote it has a Capital One account. Fees will vary depending on where you live, so you'll have to contact the nearest bank.

- Truist Bank: Truist will cash any Truist checks. There's no fee if the value of the check is less than $50. If it's greater than $50, you'll pay $8. These fees do not apply if you live in New Jersey.

- PNC Bank: You won't be charged fees if the check is $25 or less. However, for checks greater than $25, you'll be charged 2% of the check amount.

- KeyBank : KeyBank permits checks under $5,000 and written by someone who has a KeyBank account. Checks under $15 will not require any fees, but if your check exceeds that amount, you'll have to pay a fee. Fees vary by state, but if you go to a KeyBank Plus branch, you'll be charged 1.5% of your check's total amount.

- Citizens Bank : There's a $7 fee to cash a check if you're not a client.

- Regions Bank: Regions Bank has a check-cashing service that doesn't require an account with the bank. If you're cashing a Regions check, the fee will vary from $0 to $20, excluding two-party checks. If you're cashing a payroll or government check, you'll pay 1.5% of the check amount. If you cash any other check, you'll have to pay 4% of the value of your check amount.

You don't have to visit a bank to cash a check. Check-cashing stores process your check and immediately give you cash.

Often, check-cashing services are available at places that also offer payday loans . These companies have a reputation for charging exorbitant or unnecessary fees, however, so consider this a last resort.

Banks typically allow non-customers to cash a check written by one of their customers. Be prepared to pay a fee and show your government-issued identification.

Fees depend on the service provider and may be a flat dollar amount of a percentage of the deposit amount. Always ask about fees up front.

Many grocery stores and big-box retailers, such as Walmart, offer check-cashing services for a fee.

Some prepaid debit cards will allow you to set up an account via a mobile app and take a photo of your check to load the deposit onto an existing card.

The cheapest way to cash a check without a bank account depends on the deposit amount and where you go. In general, a retailer or the issuing bank will likely be cheaper than a check-cashing service.

- Are banks open today? Here's a list of US bank holidays for 2023

- Best CD rates

- Best High-yield savings accounts

- Four reasons why your debit card might be denied even when you have money

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

Advertisement

Who Is Gary Farro, the Banker Testifying in Trump’s Trial?

Donald J. Trump’s lawyer has said he arranged a hush-money payment through First Republic Bank, where Gary Farro worked.

- Share full article

By Michael Rothfeld

- April 26, 2024

The third witness in the criminal trial of Donald J. Trump is Gary Farro, a banker who is testifying on Friday about his work with Mr. Trump’s former lawyer and fixer on a $130,000 hush-money deal in 2016.

Mr. Farro spent 15 years at First Republic Bank, where he was a senior managing director, according to his LinkedIn profile. That is the now-defunct institution where the lawyer, Michael D. Cohen, established an account for Essential Consultants L.L.C. Mr. Cohen had created Essential Consultants to pay a porn star, Stormy Daniels, as part of a nondisclosure agreement to bury her claim that she and Mr. Trump had sex in 2006.

Mr. Cohen set up the account in October 2016 and funded it from his home equity line of credit at First Republic. He has previously said he did so to ensure his wife would not know about the transaction. About two weeks before the 2016 presidential election, he wired the payment to Keith Davidson, a lawyer for Ms. Daniels.

After the hush-money payment became public, Ms. Daniels’s lawyer at the time, Michael Avenatti, provided NBC News with an email from an assistant to Mr. Farro confirming the transfer. Mr. Cohen had used his Trump Organization email address in the communications, but said at the time that company funds were not used.

According to NBC, the email, from Oct. 26, 2016, had the subject line, “First Republic Bank Transfer” and confirmed that “the funds have been deposited into your checking account.”

Mr. Trump has denied having had sex with Ms. Daniels.

Michael Rothfeld is an investigative reporter in New York, writing in-depth stories focused on the city’s government, business and personalities. More about Michael Rothfeld

Our Coverage of the Trump Hush-Money Trial

News and Analysis

The judge overseeing Donald Trump’s hush-money trial held him in contempt and fined him $9,000 , punishing Trump for repeatedly violating a gag order that bars him from attacking witnesses, prosecutors and jurors.

Todd Blanche upended his career to represent Trump and has been the former president’s favorite lawyer. But Trump has also made him a focus of his episodic wrath .

At his trial, Trump demands praise and concedes no faults, robbing his lawyers of time-honored defense tactics .

More on Trump’s Legal Troubles

Key Inquiries: Trump faces several investigations at both the state and the federal levels, into matters related to his business and political careers.

Case Tracker: Keep track of the developments in the criminal cases involving the former president.

What if Trump Is Convicted?: Could he go to prison ? And will any of the proceedings hinder Trump’s presidential campaign? Here is what we know , and what we don’t know .

Trump on Trial Newsletter: Sign up here to get the latest news and analysis on the cases in New York, Florida, Georgia and Washington, D.C.

- Using Procurement

Set Up a Supplier's Bank Account

To pay suppliers electronically, a bank account is required in the supplier profile.

If a request to promote a supplier to spend authorized is submitted without a bank account, it slows the approval process and requires manual intervention by approvers.

With the ability to require that a supplier profile has a valid bank account before a spend authorization request can be submitted, approval processing will be smoother and you can transact with the supplier sooner.

When you promote a prospective supplier who doesn't have any active bank account or bank account assignment, an error will be displayed to prevent you from proceeding with the promotion.

You can set up a supplier bank account at these levels:

Supplier level

Supplier address level

Supplier site level

Each bank account assignment is comprised of the following entities:

Bank account

Bank account assignment

You can set up a bank account by doing the following:

Find your existing supplier.

Set up a bank account at the supplier, supplier address, or supplier site level.

Upload supporting documents as proof for the bank account.

Provide additional information that's relevant to the bank account.

Optionally, add joint bank account owners.

Optionally, specify intermediary accounts.

Optionally, assign a joint bank account to a supplier.

Find Your Existing Supplier

On the Manage Suppliers page, you can search for an existing supplier.

On the Manage Suppliers page, in the Search region, enter your supplier name or supplier number in the Supplier or Supplier Number field and click the Search button. Supplier details appear in the Search Results region.

In the Search Results region, select the supplier name and click the Edit icon. The Edit Supplier: <Supplier Name> page appears.

Set Up a Bank Account at the Supplier, Supplier Address, or Supplier Site Level

You can set up a supplier's bank account at the supplier, supplier address, or supplier site level.

To set up a bank account at the supplier level, on the Edit Supplier: <Supplier Name> page, select the Profile tab. Select the Payments tab. Select the Bank Accounts subtab. Go to step 8 and continue.

To set up a bank account at the supplier address level, on the Edit Supplier: <Supplier Name> page, select the Addresses tab. Click a specific address name link. On the Edit Address: <Location> page, select the Payments tab. Select the Bank Accounts subtab. Go to step 8 and continue.

To set up a bank account at the supplier site level, on the Edit Supplier: <Supplier Name> page, go to step 4 and continue.

Select the Sites tab. The supplier's various sites display.

Click a specific site link. The Edit Site: <Supplier Site Name> page appears.

Select the Payments tab.

Select the Bank Accounts subtab.

On the Bank Accounts subtab, click the Create icon. The Create Bank Account page appears. On the Create Bank Account page in the Bank Account region, you set up basic information about the bank account.

Quickly search for bank and branch when adding bank accounts. You can also search and select the branch first which will automatically populate the bank information.

In the Account Number field, enter the bank account number.

From the bank account, search and select a bank.

From the Branch lookup, select the branch where the bank account will reside. You can also search and select the branch before selecting the bank.

The bank to which the selected branch belongs is automatically populated.

To make international payments to a supplier's bank account, select the Allow international payments check box.

If you're setting up a supplier's bank account in a European country, enter the International Bank Account Number (IBAN) in the IBAN field.

From the Currency choice list, select the currency in which payments are made.

Upload the documents to support the bank account being created.

Provide Additional Information That's Relevant to the Bank Account

On the Create Bank Account page, in the Additional Information region, you can enter additional information that's relevant to the bank account you're setting up.

In the Account Suffix field, enter the value that appears at the end of the bank account number, if applicable.

From the Conversion Rate Agreement Type choice list, select the type of conversion rate agreement you have with the supplier.

In the Conversion Rate field, enter the conversion rate for which one currency can be exchanged for another at a specific point in time.

In the Conversion Rate Agreement Number field, enter the number of the conversion rate agreement with the supplier that specifies the currency in which payments are made.

In the Check Digits field, enter one or multiple digits used to validate a bank account number.

In the Secondary Account Reference field, you can optionally enter additional account information.

In the Agency Location Code field, enter the eight-digit value that identifies a Federal agency as the supplier.

Select the Factor account check box if the purpose of the bank account is to receive funds that are owed to the supplier, but are being collected on behalf of the supplier by the bank or a third party. The supplier receives payments from the funds collected, minus a commission.

Optionally, Add Joint Bank Account Owners

On the Create Bank Account page, in the Account Owners region, you can optionally add other suppliers to the supplier's bank account as joint bank account owners.

In the Account Owner field, select a joint bank account owner from the list.

In the From Date field, select a starting date for the joint bank account owner.

To specify the primary bank account owner among multiple owners, click the check mark icon and then click the Primary field in the applicable bank account row. The check mark icon appears in the row you selected.

To add a row from which to select another joint bank account owner, click the Create icon.

Optionally, Specify Intermediary Accounts

On the Create Bank Account page in the Intermediary Accounts region, you specify intermediary bank accounts for this supplier. If there are restrictions on the transfer of funds between two countries, you can specify an intermediary bank account. An intermediary account is used to transfer funds between the originator's bank and the beneficiary's bank.

Optionally, Assign a Joint Bank Account to a Supplier

From the Bank Accounts subtab at the supplier, supplier address, or supplier site level, you can optionally assign a joint bank account to a supplier.

On the Bank Accounts subtab, select the Create icon. The Search and Select: Bank Account dialog box appears.

In the Search and Select: Bank Account dialog box, select the applicable joint bank account you want to assign to your supplier and click the OK button. The bank account you selected now appears in the Bank Accounts subtab.

Navigation Menu

Search code, repositories, users, issues, pull requests..., provide feedback.

We read every piece of feedback, and take your input very seriously.

Saved searches

Use saved searches to filter your results more quickly.

To see all available qualifiers, see our documentation .

- Notifications

Python tutorial for absolute beginner

psamuels00/python-tutorial-bank-account

Folders and files, repository files navigation, python tutorial - bank account.

This tutorial was designed for an absolute beginner to learn about programming using Python. In addition to teaching the basics of Python, there is a heavy emphasis on factoring and refactoring as is common in the real world. The first lesson starts off very simple. With each subsequent lesson, we add a feature or improve the code one step at a time so that by the end, we have a small Bank Account program with the following features:

- Initial account balance can be set on startup

- Interactive user input

- Deposit into account

- Withdraw from account

- List all transactions

A simple transaction list might look like this:

Requirements

- A text editor or IDE (Integrated Development Environment)

- A shell to execute your scripts from

PyCharm is an excellent choice of an IDE to use. The Community Edition is free. It has a built in shell and debugger for running your scripts, as well as many other features.

This tutorial is not complete as-is. You will need an experienced programmer to explain the concepts that are to be learned for each lesson.

Bank Account

The bank_account.py file contains all the lessons in its revision history. It is the same as lesson-26.py except that it is missing the comments at top. Since this file was updated incrementally to reflect the latest lesson as it was added to the repository, you can easily see what has changed by looking at the commit differences for this file.

Lessons Summary

For each lesson, there is an essential enhancement to be made, as well as a set of Python features or programming concepts to be learned. To follow the tutorial, read the lesson summary below and then study the corresponding .py file. Better yet, try to implement the enhancement on your own and use the provided .py file as a guide when you get stuck.

Print hello world.

- shebang line

- single-line comments

- string literal

- print statement

- function and function call

Welcome to the bank and show account balance.

- integer and string literals

- assignment operator

- format operator

- format integer field

Show a $10 withdrawal and a $20 deposit.

- print empty line

- function call with no arguments

- compound assignment operators

Show a $30 withdrawal and a $15 deposit.

- the tedium of repetition

Factor both withdrawals and factor both deposits.

- function definition

- function calling

- code factoring

- global variables

- indentation

Factor show balance.

- more factoring

- function definition with no arguments

Reorder code to group functions.

- code reorg: functions first

Create function for main code.

- code reorg: more function grouping

Allow user to supply transaction amounts.

- string conversion to integer

Have only 1 transaction, but allow user to determine which type.

- string input and equality comparison

- conditional statement with else clause (branching)

Allow unlimited transactions.

- break out of a loop

- Boolean literal

- single-branch conditional statement

Add error checking for each prompt.

- error checking

- syntax errors

- exception handling

- continue statement to skip rest of loop

- inequality comparison

- "and" logical operator

Add semantic error checking for transaction.

- semantic errors

- ordering comparison

- single-quotes vs double-quotes

Flatten the logic in main().

- code reorg: reduce nesting

Refactor again and simplify main().

- None object

- is operator

- pass statement

- else-if clause of conditional statement

- "not" logical operator

- the importance of initializing reused variables sometimes

- why testing is important

Rename 'type' to 'op' for operator.

- the importance of naming

- identifiers sometimes need to change as code evolves

Lesson 16.5 - List Operations

Summary of basic list operations. This lesson was hacked in after the tutorial was completed to address the big jump to lists and lists of lists in Lesson 17.

- create a list of simple elements

- display a list

- create an empty list

- append an element to a list

- display number of elements in a list

- display specific elements of a list

- display last element of a list

- iterate over a list

- create a list of mixed element types

- create a list of lists

- display specific elements of a list of lists

- display number of elements in a list inside a list

- display specific elements of a list inside a list

- iterate over a list of lists

Keep a log of all transactions and list them using 't' op.

- list data structure and list of lists

- empty list literal

- append to a list

- get size of list

- format field width

Show starting and running balance with transactions.

- list assignment to variables (spread?)

- format string field

- format field left alignment

- tuple as operand for format operator

- use of second variable to save initial value

Get starting account balance from command line argument, including error handling.

- module import and the sys module

- access to program arguments

Eliminate global variable by passing around balance.

- avoid globals by passing variables

- keep global space unpolluted

Create Account class with static balance member instead of passing around.

- class definition

- static (class) members and access to them

- variable and method members

- another way to avoid globals

Make balance an instance member and instantiate the class.

- class instantiation

- objects and object-oriented programming

- the class constructor

- instance members and access to them

- the self reference

- passing objects as parameters

Use float for amounts instead of int; update error checking and output format.

- float literal

- string conversion to float

- format float field

- format field precision

- prevent accumulation error

- the regular expression module and re pattern matching

- raise an exception

- distinguish different types of exception (ValueError, Exception)

- how diligent you must be with floats

Clean up and refactor more.

- more refactoring

- re-raise an exception

Add name to account, create multiple instances of account and test transactions.

- instrumenting code to assist with testing

- multiple instantiation of a class

- default parameter value

- program startup flag

- program exit code

automate from the command line, for example:

- printf "w\n.02\nd\n125.32\nw\n100\nd\n1\nt\nq\n" | ./lesson-25.py 100.01; echo

Use set to validate op.

- set data structure and set inclusion

- string expansion

Floating Point Calculations

The file float_error/test.py is included to demonstrate the challenges of floating point calculations. The file float_error/output.txt contains the output of running this.

Lessons Summary Generation

This works for all the lessons except the hacky 16.5 (List Operations) for which the summary must be generated manually.

Commit and Tag All Lessons

- Python 100.0%

David Trone Flexes His Bank Account in Maryland Primary

April 30, 2024 at 7:28 am EDT By Taegan Goddard Leave a Comment

Politico : “With the contest two weeks away, Trone is explicitly making his bank account a selling point, testing whether it’s more important for Democrats to diversify the overwhelmingly white and male Senate — or to have the resources to save their deeply endangered incumbents.”

“A Trone victory would mean an unbroken string of white senators from a state where nearly one in three residents is Black, and raise questions about the stated values of a party that calls Black women its backbone.”

Recent Posts

Right-wing pastor claims jesus told her to run.

Drenda Keesee (R), a right-wing pastor and broadcaster, said that she’s running for office because Jesus personally told her to. Said Keesee: “He was holding my cheeks, and I was…

Trump Justice Department Lawyer Faces Disbarment

“The District of Columbia’s Office of Disciplinary Counsel issued a recommendation this week battering the credibility of former Donald Trump Justice Department attorney Jeffrey Clark, saying Clark’s ‘dishonest attempt to…

Former Ohio Treasurer Ordered to Jail

“Josh Mandel (R), the former Ohio state treasurer and multiple-time U.S. Senate candidate, is facing a threat of jail time due to his years-old and increasingly contentious divorce case,” the…

Louisiana GOP Punts on Rape Exceptions to Abortion Ban

Louisiana Republicans pushed back votes on several bills that would have added exceptions to the state’s near-total abortion ban, the New Orleans Times-Picayune reports. Save to Favorites

Bonus Quote of the Day

“This gag order is totally unconstitutional. I’m the Republican candidate for president of the United States. I received this honor in record time. Nobody has ever gone faster… And I’m…

Appeals Court Denies Trump Bid to Have Judge Recused

“An appellate court has denied former President Trump’s bid to have Judge Juan Merchan recused from his hush money trial,” ABC News reports. Save to Favorites

Elon Musk Convenes Anti-Biden Dinner

Puck: “On a brisk Friday evening earlier this month, David Sacks and Elon Musk convened a dozen or so of America’s most powerful business leaders for dinner at Sacks’ $23…

Republicans Face Little Backlash Over Ukraine Vote

New York Times: “The reactions suggested that even as Republicans are waging an internal war over aiding Ukraine — one that is continuing even after the funding package cleared Congress…

Trump Appears to Fall Asleep at Trial

Donald Trump “appears to have fallen asleep while listening to testimony — at times appearing to stir and then falling back to sleep,” NBC News reports. “Trump’s eyes were closed…

Trump Removes Posts Cited in Gag Order Ruling

Donald Trump has begun to remove the social media posts cited by Judge Juan Merchan in today’s gag order ruling, ABC News reports. Save to Favorites

Biden and Democrats Seize on Trump’s Striking Interview

“The Biden campaign is mounting a concerted push to attack former President Donald J. Trump over statements he made to Time magazine in a wide-ranging interview published Tuesday morning, particularly…

Trump to Hold Rally In Wisconsin

“Donald Trump will make another stop in Wisconsin this week for a campaign rally as his criminal hush money trial continues in New York,” USA Today reports. Save to Favorites

Rishi Sunak Seeks ‘Greatest Comeback’ Ever

“Rishi Sunak urged Conservative Party faithful in a pre-election speech to take part in ‘the greatest comeback in political history,’ a tacit admission of the long odds the prime minister…

Fox News Quietly Takes Down Hunter Biden Videos

“Fox News appears to be taking Hunter Biden’s lawsuit threat quite seriously,” the Daily Beast reports. “The network has quietly pulled down its six-part ‘mock trial’ series from its digital…

Marijuana to Be Classified as Less Dangerous

“The U.S. Drug Enforcement Administration will move to reclassify marijuana as a less dangerous drug, a historic shift to generations of American drug policy that could have wide ripple effects…

Trump Wants Presidential Immunity — But Not for Biden

“When a lawyer for former President Donald Trump argued before the Supreme Court last week that his client should be immune from charges of plotting to subvert the last election,…

Trump Would Not Rule Out Violence After the Election

Donald Trump in an interview did not shut down the potential for political violence after November’s election if he doesn’t win, saying “it depends” on the fairness of the vote,…

Trump Would Consider Blanket Pardon for Capitol Rioters

“Donald Trump, who is currently facing felony criminal charges in connection with Jan. 6, said that, if elected, he’d ‘absolutely’ consider pardoning every single one of the hundreds of criminals…

Trump Quickly Fundraises Off Contempt Citation

“Donald Trump’s campaign immediately sought to capitalize after the judge in his New York criminal trial ruled him in contempt of court — the latest example of how the former…

Trump’s Eyes Closed During Testimony

Donald Trump “has been sitting with his eyes closed for significant portions of testimony this morning,” the New York Times reports. “It is unclear how the jurors, who have to…

About Political Wire

Goddard spent more than a decade as managing director and chief operating officer of a prominent investment firm in New York City. Previously, he was a policy adviser to a U.S. Senator and Governor.

Goddard is also co-author of You Won - Now What? (Scribner, 1998), a political management book hailed by prominent journalists and politicians from both parties. In addition, Goddard's essays on politics and public policy have appeared in dozens of newspapers across the country.

Goddard earned degrees from Vassar College and Harvard University. He lives in New York with his wife and three sons.

Goddard is the owner of Goddard Media LLC .

Praise for Political Wire

“There are a lot of blogs and news sites claiming to understand politics, but only a few actually do. Political Wire is one of them.”

— Chuck Todd, host of “Meet the Press”

“Concise. Relevant. To the point. Political Wire is the first site I check when I’m looking for the latest political nugget. That pretty much says it all.”

— Stuart Rothenberg, editor of the Rothenberg Political Report

“Political Wire is one of only four or five sites that I check every day and sometimes several times a day, for the latest political news and developments.”

— Charlie Cook, editor of the Cook Political Report

“The big news, delicious tidbits, pearls of wisdom — nicely packaged, constantly updated… What political junkie could ask for more?”

— Larry Sabato, Center for Politics, University of Virginia

“Political Wire is a great, great site.”

— Joe Scarborough, host of MSNBC’s “Morning Joe”

“Taegan Goddard has a knack for digging out political gems that too often get passed over by the mainstream press, and for delivering the latest electoral developments in a sharp, no frills style that makes his Political Wire an addictive blog habit you don’t want to kick.”

— Arianna Huffington, founder of The Huffington Post

“Political Wire is one of the absolute must-read sites in the blogosphere.”

— Glenn Reynolds, founder of Instapundit

“I rely on Taegan Goddard’s Political Wire for straight, fair political news, he gets right to the point. It’s an eagerly anticipated part of my news reading.”

— Craig Newmark, founder of Craigslist.

IMAGES

VIDEO

COMMENTS

Assignment_Users_With_Bank_Accounts. Add a make_deposit method to the User class that calls on it's bank account's instance methods. Add a make_withdrawal method to the User class that calls on it's bank account's instance methods. SENPAI BONUS: Add a transfer_money (self, amount, other_user) method to the user class that takes an amount and a ...

Assignment: Users with Bank Accounts. Objectives: Practice writing classes with associations Update your existing User class to have an association with the BankAccount class. You should not have to change anything in the BankAccount class. The method signatures of the User class (the first line of the method with the def keyword) should also ...

Assignment: Users with Bank Accounts. Welcome to another Core assignment! Some students like to explore the assignments before they're finished reading through the lessons, and that's okay! It can be good for your brain to have a preview of what your future challenges might be. However, before you begin this assignment, it's important that you ...

1. You need to create an array of 'Account' objects and allocate each account to new customer and accordingly call the required methods of that specific account. Also use 'switch' statement rather than nested if then else statement. You are still mixing the procedural programming with object oriented programming.

Assignment of accounts receivable is a lending agreement, often long term , between a borrowing company and a lending institution whereby the borrower assigns specific customer accounts that owe ...

Make purchases with your debit card, and bank from almost anywhere by phone, tablet or computer and more than 15,000 ATMs and more than 4,700 branches. Savings Accounts & CDs It's never too early to begin saving.

Python3. class Bankaccount: def __init__(self): This step is followed by declaring that balance is 0 using self argument then we simply print a statement welcoming to Machine. In function deposit and withdraw , amount is taken as input (in float) and is then added/subtracted to the balance. Thus resultant balance is printed in next line.

Answer: We can't be specific as to state laws. For that we'd refer you to your state peers in a state forum in the BOL threads. Notices to deposit holders would be a state law issue and not under a federal regulation. Generally the deposits securing your loan will be with you and you have control. CDs under Article 9 of the UCC and deposited ...