- Contact sales

Start free trial

How to Do a Project Audit: A Quick Guide

Conducting a project audit is an important aspect of managing projects, but often one that is neglected. Read on as we explain what a project management audit is and show you in a few simple steps how to do one yourself.

Let’s start with a definition of the word audit. In its general sense, audit is a verb that means to inspect, examine, check, assess, review or analyze. Now that is not so different from what a project manager does all the time.

What Is a Project Audit?

A project management audit is a bit different than the general definition of the audit. First off, in this context, it’s a noun that means an independent, structured assessment. The audit process is designed to determine the status of work performed on a project to ensure it complies with the statement of work, such as the scope, time and budget of the project, along with the maturity of the project management process.

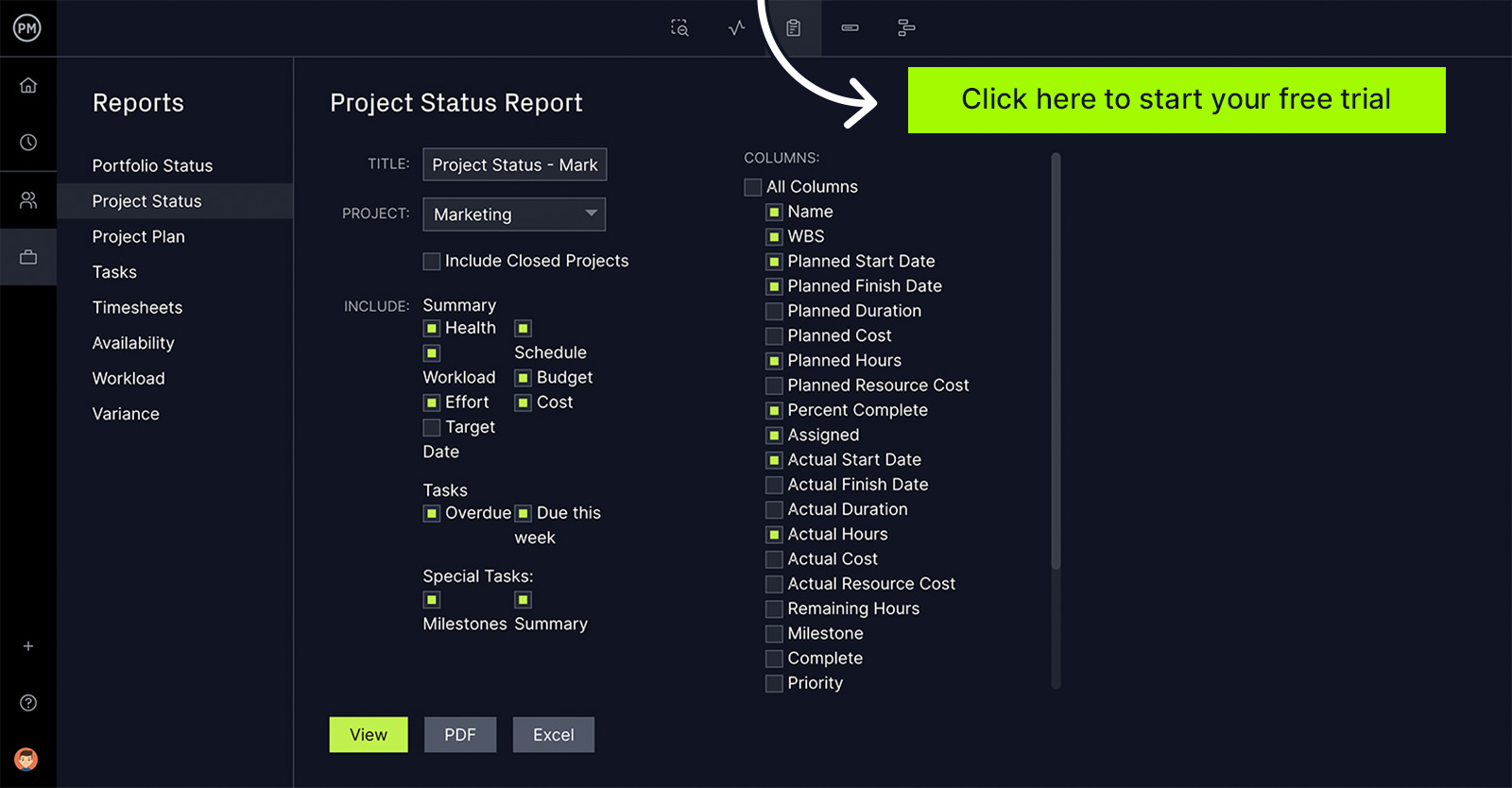

There are many ways to do a project management audit. Project management software can help gather important data. ProjectManager is online project management software that delivers real-time data to help you make more insightful audits. Use our one-click reporting tools to capture the large picture with project status reports or portfolio status reports. You can also focus on time, cost, workload, timesheets and more. All reports can be customized to focus on what you want to see and then easily shared with stakeholders. Get started with ProjectManager today for free.

What Should You Look for When Doing a Project Management Audit?

There are many things that’ll help inform your project management edit. Here’s a list of what you should be reviewing when auditing your project.

- Project scope: The project scope describes all the tasks and deliverables that should be completed. The project scope is defined in documents like the scope statement and a statement of work .

- Project schedule: This will help you determine if work was done as scheduled and if you met your deadlines and milestones.

- Project quality: Every project has quality expectations that must be met to satisfy the stakeholders and so these must be audited as well.

- Project costs: Here you can compare your actual costs to the budget to make sure you brought the project in without overspending.

- Project resources: Look over the resources that were used in the execution of the project to make sure they were used and used correctly.

- Project risks: Do all the project risks that were expected to occur show up as issues? Note which did and which did not.

Video: How to Plan a Project Audit

Need more tips for executing your project management audit? Watch Jennifer Bridges, PMP, as she walks you through the steps to auditing your next project.

Thanks for watching!

Pro tip: A project management audit is a critical method of making sure that you’re running the tightest project possible. However, there are other complementary ways to help with project efficiencies, such as hiring a project analyst to work with the project manager to help perform analytical tasks.

The Project Management Audit Process

- Plan the audit: You shouldn’t start anything without a plan. Let everyone involved in the audit and the project know about the audit, and stress that this isn’t anything scary. It’s a method to make things work better, not lay blame.

- Conduct the audit: Now do the audit and work through a thorough process to get all the data and proof. This includes interviewing the project sponsor, manager and team, either in person, in a group meeting or through a detailed questionnaire.

- Summarize the audit: At this point, you’ll have lots of data; so take these findings of improvements and faults, and put them in an executive summary to give a clear and broad overview. Be sure to point out and praise those who have done well.

- Present the results: Next, you want to present that summary of results to all parties that need to know about the audit, from your team to your stakeholders . At this point, you’ll want to identify opportunities that have been realized and implemented, as well as a list of all the problems that have and haven’t been resolved. Also, share recommendations.

- Determine the action plan: With this data, you can now develop a plan of action that’ll help improve efficiencies. Get people involved and set that course with assignments and due dates. Use all the records collected during the interviews, meetings or via questionnaire and define the solution. This will be submitted to senior management.

- Schedule follow-up: Don’t let this action plan go unattended. Go back to it and make sure the plan is progressing on schedule.

- Repeat: This is a list that should be designed in a circle because you can never sit back and become complacent. The more audits you do, the more efficiencies you’ll create.

How to Report the Findings of Your Project Audit

There’s a lot of information that goes into a project audit. Here are a few of the documents that deliver that data.

Project Status Report

A project status report captures a snapshot of the project over a period of time. It’s used to regularly track and communicate the progress and performance of the project.

Project Progress Report

The project progress report is also a record of the project over a specific range of time. But unlike the more expansive status report, this only focuses on progress.

Risk Register

The risk register summarizes the risks that might impact the project. This document will identify risks, but also determine what the priority should be in responding to them according to the likelihood of them occurring and the impact they might have on the project.

Cost Benefit Analysis

A cost-benefit analysis compares the costs and benefits of the project in terms of monetary units. This is usually done prior to starting the project to see if it’s worth the investment or not.

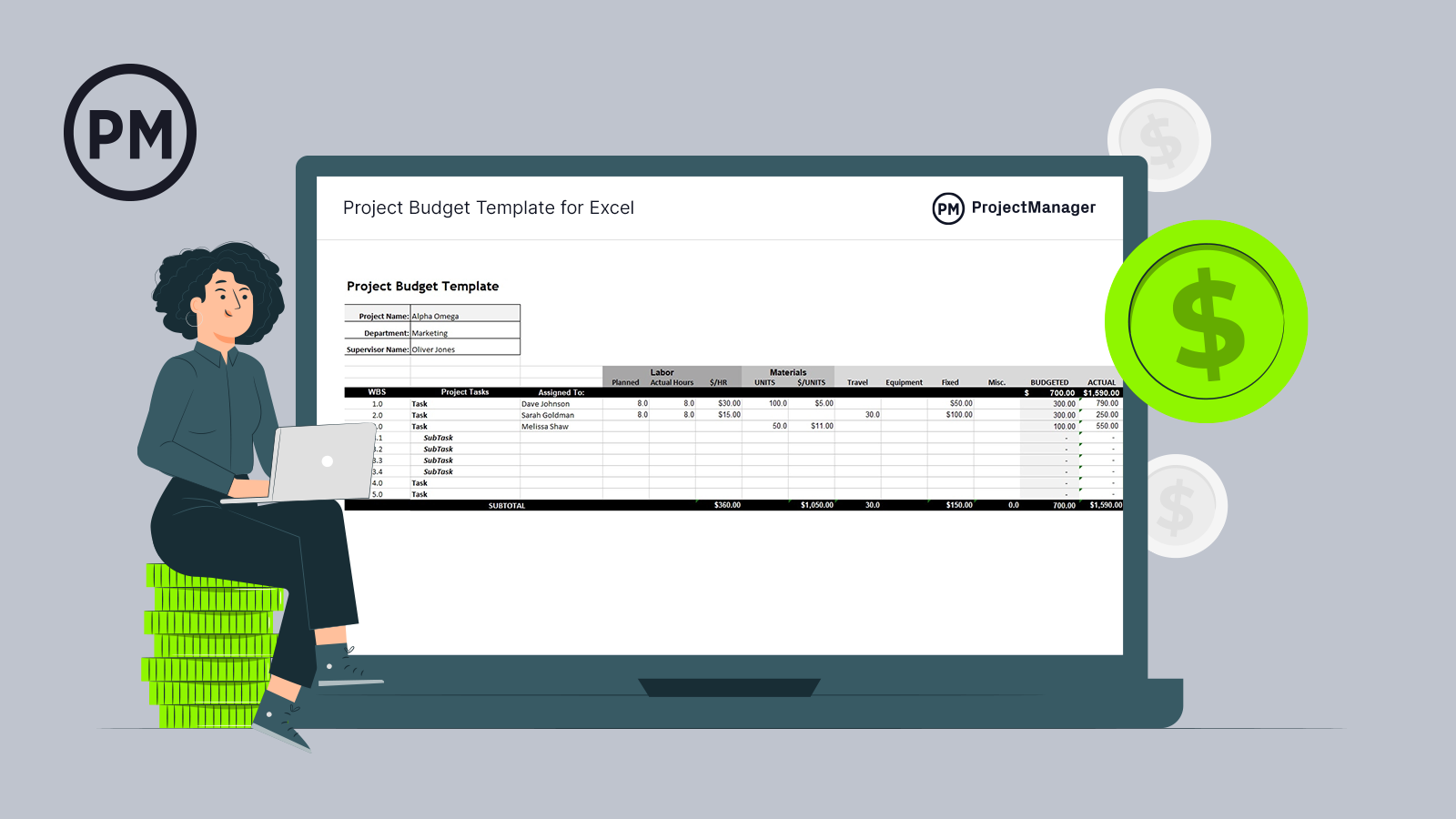

Get your free

Project Budget Template

Use this free Project Budget Template for Excel to manage your projects better.

Project Variance Report

Project variance is the difference between what was planned and what actually occurred. This can be applied to the schedule and budget to see if you’re keeping to both. And, if not, then you can set in place actions to right those wrongs.

Why Should You Do a Project Audit?

We’re constantly auditing the health of our project, its financial well-being, the schedule and our timeliness in completing it, as well as the equipment and tools we’re using in the project.

Why do we do this? Well, for many reasons. One, it helps to understand where we are compared to where we should be in the project. Auditing lets us know if things are okay and are performing as planned. It also tells us if we’re safe to go on and if things are improving.

Who’s Involved In a Project Management Audit?

Every organization is different and therefore every project management audit is going to have differences depending on the project-related processes they use. For example, there’s the budget, which will include those managers involved in this process, depending on the size of the organization.

Regardless of the size of your organization, a project management audit is likely to be led by the project manager and include all project team members. It can also include anyone who interfaced with the project, no matter in what capacity, such as vendors and stakeholders . This provides different perspectives, which gives a fuller, more accurate picture.

The discipline of a project management audit is not the same as managing a project. Though it’s a project, too, sometimes it is better to leave it in the hands of a dispassionate third party. An outside contractor can run through the process with more authority due to their experience and not be prejudiced by closeness to the project.

Benefits of Project Management Audit

One of the main reasons to do a project management audit is to ensure that you’re compliant with whatever governing regulations your project is subject to, depending on the industry, such as HIPAA, GDR, FAA, FTC, etc.

It also helps to find gaps or reasons for any project failures or errors. On the flip side of this, it will also discover any areas for efficiencies concerning time, money and effort.

But you must know your specific objectives, as they are not necessarily the same from project to project and organization to organization. There are many questions to consider during an audit, such as why are you engaged in the project, and what results are you seeking?

The project management audit at the top level asks, who does what, when and where, and how can it be improved. Well, improvement always comes through the process. By going through each task and auditing it, you can begin a thorough audit of the entire project.

How ProjectManager Can Help with Project Audits

ProjectManager is online project management software that helps you plan, execute and track your project through every phase, and it can be a valuable tool for your project management audit, too.

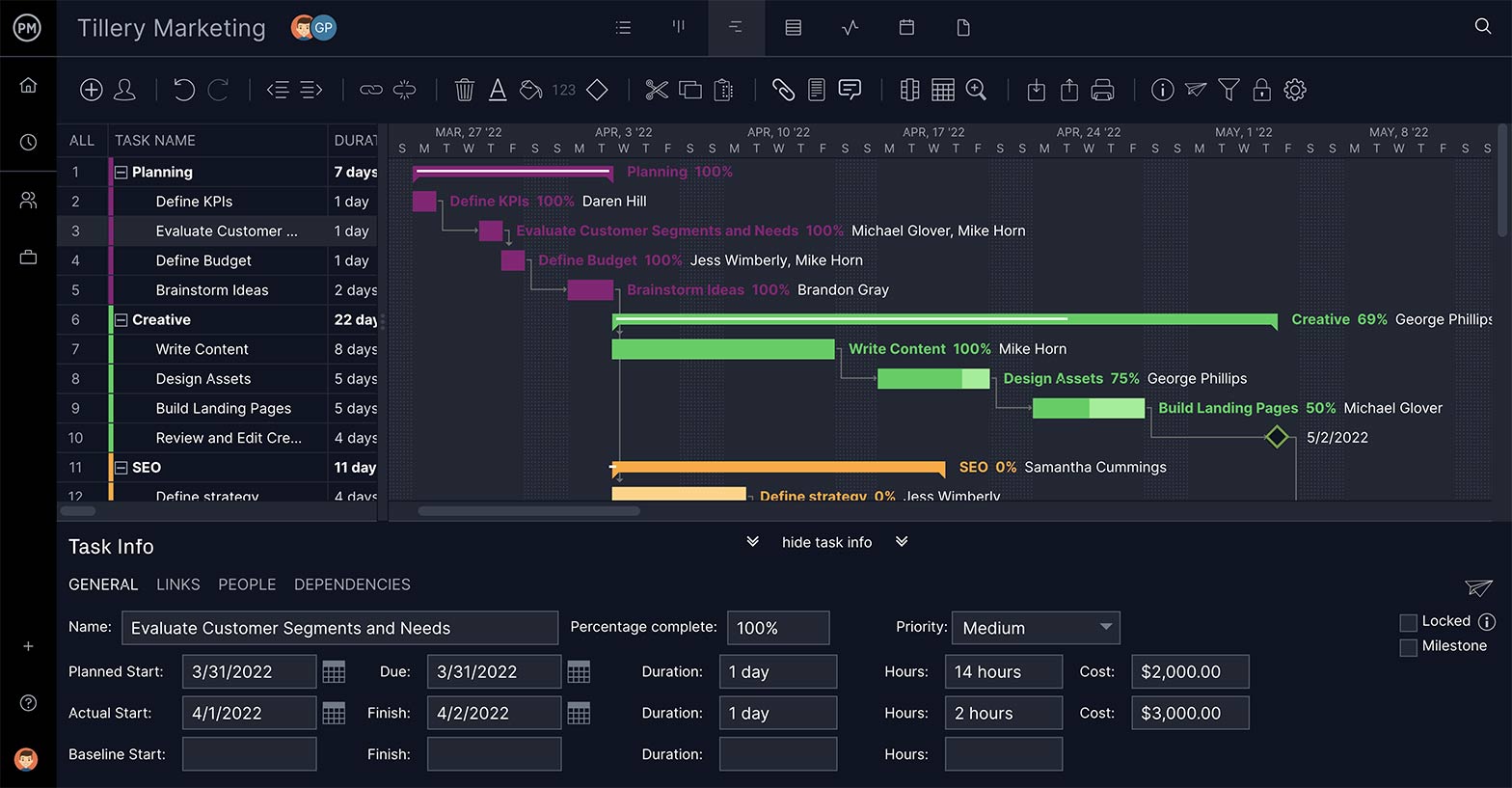

One-click reports provide a detailed picture of your project and how it adhered to or diverted from your plan. Reports can be filtered to show just the data you want and then easily shared among management. Our real-time dashboard not only tracks progress during the project but also provides color graphs and charts that make it easy to digest project metrics.

When you’re done gathering and reporting data and ready to start an action plan, our online Gantt chart takes your tasks and sets them across a timeline. You can now set duration, assign team members who can collaborate at the task level, add documents and comment.

ProjectManager has you covered before, during and after the project. See how it can help you deliver your next project more productively by taking this free 30-day trial .

So if you need a tool that can help you with your project management audit, then sign up for our software now at ProjectManager .

Deliver your projects on time and under budget

Start planning your projects.

Things to know about audits

What is an audit, why is an audit useful, what types of audits are there, what is audit planning.

- What does audit time mean ?

What is the job of a Lead Auditor?

What is an audit report, what is an audit finding.

In the broadest sense, an audit is an objective analysis for the improvement of a company's organization - based on observations, examinations, questioning, and insight into the relevant documents. An audit always serves to compare a target and the actual situation, a target and its fulfillment. Audits thus provide clarity. They serve as a performance assessment or diagnosis to identify strengths and potential for improvement, and provide important feedback on changes and the effectiveness of measures introduced.

In the auditing of management systems the guideline is ISO 19011 is authoritative. In chapter 3.1, it defines the audit as a "systematic, independent and documented process for obtaining objective evidence and evaluating it objectively to determine the extent to which audit criteria have been met ".

The term audit comes from the Latin word "audire " - to listen or hear. Listening, in the sense of "listening to the interlocutor," is an essential task of an auditor , but by no means the only one. For the auditor asks questions, observes and analyzes in an audit. Ultimately, the aim is to find out and evaluate whether, and to what extent, the organization to be audited has succeeded in implementing the specifications and requirements set out, e.g. in a management system standard. To this end, the auditor also examines the interaction of processes, among others.

A characteristic feature of all our audits is that an independent industry expert takes a look at your management system and processes . Our standards always begin where audit checklists end. Take us at our word.

DQS. Simply leveraging Quality.

A characteristic feature of all our audits is that an independent industry expert takes a look at your management system and processes . Our claim always begins where audit checklists end.

Regular audits provide your company with information on whether measures and processes are effective, appropriate and suitable for meeting specifications and requirements. In addition, potential for improvement and risks can be identified. The documented results provide your top management with important findings for control measures.

Audits serve to:

- Further develop your organization in a way that adds value

- Obtain a comprehensive target/actual comparison

- Identify strengths and improvement potential for your company

- Uncover risks and errors and derive measures to avoid them

- Provide executives with a well-founded basis for decision-making

- Uncover blind spots and weak points in the company

- Learn from proven working methods and processes

- Proceed systematically and consistently

- Provide objective evidence of your performance

First, a distinction is made between internal and external audits.

An internal audit (also called self-audit or first party audit) is planned within the company. As a rule, a specially trained employee, i.e. an internal auditor such as the quality management representative, carries out the audit. Internal audits are also a regular part of the company's own management system.

An audit by an external third party can be carried out, for example, by customers (second party audit) or by an accredited certification body such as DQS (third party audit). Then the company decides which areas it wants to look at. Is it about certain standards, as in a management system audit, or about certain processes , products, innovations, or compliance topics? If it is a question of suppliers , second party audits by the customer's quality rep are just as feasible as placing an order with DQS.

Or maybe the company aims at a full certification audit of its management system by external auditors from a certification company? Or perhaps partial aspects are to be the focus of a gap or delta audit ? And then there is the question of what form the audit will take: an on-site audit or a remote audit ?

ISO/IEC 17021-1:2015 - Conformity assessment — Requirements for bodies providing audit and certification of management systems — Part 1: Requirements

The standard is available from the ISO website.

Audit planning includes the definition of the audit objectives, the scope of the audit, the audit criteria (requirements to be met) and, if necessary, significant changes that have an impact on your management system. Apart from the audit objectives, the definitions are made in close consultation with you as the client. ISO 17021 sets specific requirements for these definitions, which must be taken into account during audit planning.

An essential part of audit planning is the selection of a team of auditors (audit team) and the assignment of roles by the appointed lead auditor in their function as "audit team leader". The selection of auditors follows a process defined by DQS. The planning includes the number of auditors, their composition or competence (required technical expertise) and their specific assignment. Audit planning must be based primarily on the audit objectives, the scope of the audit, the audit criteria, the estimated audit duration, and a number of other aspects.

Audit planning also includes the preparation of an audit schedule by the lead auditor, which contains concrete data for the audit conduct. This includes which organizational or functional units and processes are to be audited, when, where, how long and by whom. The audit schedule is coordinated with the client before the audit begins.

Audits are not carried out at random. Careful planning is always a prerequisite for the success of an audit. This is especially true for audits within the scope of external certification . Certification audits are carefully planned, especially when it comes to accredited procedures . The ISO 17021 standard describes what needs to be taken into account in chapter "9.2 Planning audits" as well as requirements specific to the rules and regulations. Planning is the responsibility of the lead auditor appointed by the certification body.

What does audit time mean?

Since the 2015 edition of ISO 17021, the old term audit duration has been referred to as audit time . This is defined as the " time needed to plan and accomplish a complete and effective audit of the client organization's management system ."

As an accredited certification body, DQS determines audit time according to the requirements set by the respective international standard(s). A whole range of aspects have to be taken into account, such as i.a.:

- Standard whose requirements are to be audited

- Complexity of your business activities and your management system

- Number of employees

- Size, number and location of sites

- Risks associated with products, activities or processes etc.

The way an audit is conducted - on-site or as a so-called remote audit, can also have an impact on audit time and must be taken into account.

A lead auditor is an auditor who is appointed to this position by the certification body on the basis of their special qualifications according to a defined process. They are responsible for the proper execution of the audit assignment, i.e. the audit planning and the audit itself. If a team of several auditors is auditing, they have - in their function as audit team leader - the task of forming, scheduling, and instructing the audit team. They must also manage the audit program and the audit process, including time management.

The lead auditor usually moderates the opening meeting, and is the primary contact person for the client. They exchange information with the team members, evaluates the progress of the audit at regular intervals, and inform the client of the current status. This may include, for example, any non-conformities discovered or a need to change the scope of the audit. In this context, the audit manager may also have to look for solutions to conflicts.

Finally, together with the audit team, the lead auditor draws conclusions from the audit results, discusses them in the final meeting, and prepares the audit report.

An audit report is a written summary of the audit findings made by the lead auditor during their audit. This includes conclusions based on evaluation of the audit evidence, in view of the audit criteria (i.e. requirements to be met). The audit report of an external certification audit is the basis for the decision to issue a certificate.

The audit report focuses on statements about the extent to which the audit criteria have been met, whether or which non-conformities have been identified, and how serious these are. In detail, it deals with the documentation of identified strengths, weaknesses, risks and opportunities, but also whether immediate measures or a follow-up audit may be necessary. The audit report is also the basis for implementing improvement measures. Information on the implementation of corrective actions for non-conformities identified in previous audits may also need to be provided. In addition, any deviation from the audit plan must be documented.

The audit report contains formal details of the audit, such as the name of the certification body and the auditors of the audit team. Also, the name and address of your company, date, location, audit type, audit criteria, audit objectives and scope, audit time spent, and more. Important to know: The contents of an audit report are generally confidential, and ownership of the report remains with the certification body.

Audit findings are relevant findings from the analysis of information and evidence obtained by the audit team during the audit. They are an integral part of the audit report. The audit findings are evaluated by the audit team, which draws appropriate audit conclusions. In an external certification audit , the conclusions are decisive for the certification decision. In the opening meeting for the audit, the audit manager must already explain the criteria according to which the audit findings will be categorized.

Audit findings are documented. They include both the concise presentation of conformities (compliance with the underlying standard) and the comprehensive presentation and classification of non-conformities. A highly beneficial variant of the audit findings for your company is the targeted uncovering of improvement potential. The ISO 17021 standard does not require this, but it is considered beneficial. This procedure is a sign of special professional competence. However, the discovery of improvement potential may not include a solution. Improvement potential may not be evaluated and recorded as a non-conformity. Conversely, a non-conformity cannot be treated as improvement potential.

DQS. Because not all audits are created equal.

Do you have questions about the certification of your quality management system according to ISO 9001 ? Find out more. Without obligation and free of charge.

Any Questions?

- Search Search Please fill out this field.

What Is an Internal Audit?

- How It Works

- Internal vs. External Audit

- The Process

- Internal Audit Reports: The 5 C's

Importance of Internal Audits

- Internal Audit FAQs

The Bottom Line

- Corporate Finance

Internal Audit: What It Is, Different Types, and the 5 Cs

Pete Rathburn is a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom.

:max_bytes(150000):strip_icc():format(webp)/E7F37E3D-4C78-4BDA-9393-6F3C581602EB-2c2c94499d514e079e915307db536454.jpeg)

Investopedia / Paige McLaughlin

Internal audits evaluate a company’s internal controls , including its corporate governance and accounting processes. These types of audits ensure compliance with laws and regulations and help to maintain accurate and timely financial reporting and data collection. Internal auditors are hired by companies who work on behalf of their management teams. These audits also provide management with the tools necessary to attain operational efficiency by identifying problems and correcting lapses before they are discovered in an external audit .

Key Takeaways

- An internal audit offers risk management and evaluates the effectiveness of many different aspects of the company.

- Types of internal audits include financial, operational, compliance, environmental, IT, or for a very specific purpose.

- Internal audits provide management and the board of directors with a value-added service where flaws in a process may be caught and corrected prior to external audits.

- Similar to external audits, internal audits are conducted through planning, auditing, reporting, and monitoring steps.

- Internal audits may enhance the efficiency of operations, motivate employees to adhere to company policy, and allow management to explore specific areas of its operations.

Understanding Internal Audits

Internal audits play a critical role in a company’s operations and corporate governance, especially now that the Sarbanes-Oxley Act of 2002 holds managers legally responsible for the accuracy of their company's financial statements. SOX also required that a company's internal controls be documented and reviewed as part of its external audit.

In addition to ensuring that a company complies with laws and regulations, internal audits also provide a degree of risk management and safeguard against potential fraud, waste, or abuse. The results of internal audits provide management with suggestions for improvements to current processes not functioning as intended, which may include information technology systems as well as supply-chain management.

Internal audits may take place on a daily, weekly, monthly, or annual basis. Some departments may be audited more frequently than others. For example, a manufacturing process may be audited on a daily basis for quality control , while the human resources department might only be audited once a year.

Audits may be scheduled, to give managers time to gather and prepare the required documents and information, or they may be a surprise, especially if unethical or illegal activity is suspected.

Types of Internal Audits

Compliance audit.

A company may be required to adhere to local laws, compliance needs, government regulations , external policies, or other restrictions. To demonstrate compliance with these rules, a company may task an internal audit committee to review, compile appropriate information, and provide an overall opinion on the status of the compliance requirement.

Internal Financial Audit

Public companies are required to perform certain levels of external financial auditing where a completely independent third party provides an opinion on the company's financial records. Companies may want to dive further into audit findings or perform an internal financial audit in preparation for an external audit. Many of the tests between an internal or external auditor may be similar; the nature of independence separates the two types of audits for financial audits.

Environmental Audit

As companies become continually more environmentally conscious, some take the steps of reviewing the business' impact on the planet. This results in an internal audit covering how a company safely sources raw materials, minimizes greenhouse gases during production, utilizes eco-friendly distribution methods, and reduces energy consumption. Companies leveraging triple bottom line reporting may perform internal environmental audits as part of annual reporting.

Technology/IT Audit

An IT audit may have different objectives. The internal audit may be the result of an external lawsuit, a company complaint, or a target to become more efficient. An internal audit focused on technology reviews the controls, hardware, software, security, documentation, and backup/recovery of systems. The goal is likely to assess general IT accuracy and processing capabilities.

Performance Audit

An internal audit focused on performance pays less attention to the processes and more on the final result. The company will have likely have set performance objectives or metrics that may be tied to performance bonuses or other incentives. As a result, an internal auditor assesses the outcome of an objective that may not be easily quantifiable.

For example, a company may wish to have expanded its use of diverse suppliers ; the internal auditor, independent of any purchasing process, will be tasked with analyzing how the company's spending patterns have changed since this goal was set.

Operational Audit

An operational audit is most likely to occur when key personnel leaves or when new management takes over an entity. The company may want to assess how things are done and whether resources are being used more efficiently. During an operational internal audit, the auditor will review whether current staff and processes fulfil the mission statement , value, and objectives of a company.

Construction Audit

Development, operating, real estate , or construction companies may perform construction audits to ensure not only appropriate physical development of a building but appropriate project billing along the life of the project. This mostly includes adherence to contract terms with the general contractor, sub-contractors, or standalone vendors as necessary.

This may also include ensuring the company has remit the appropriate payments, collected the appropriate payments, and internal project reports regarding project completion are correct.

Special Investigations

Many of the audits above may be recurring and performed each year. In some cases, it might make sense for an internal audit committee to evaluate a special circumstance that will occur only once. This may entail gathering a report on the efficiency on a recent merger, the hiring of a key employee, or a complaint from staff. When selecting the individuals for the special investigation audit, a company must be especially mindful to select members with appropriate expertise and independence.

Depending on the structure of the organization, the internal audit may be prepared by the board of directors of by upper management.

Internal Audit vs. External Audit

Internal and external audits have the same objective. Both types of audits analyze an aspect of a company to determine a specific opinion. However, there are many differences between the two types of audits.

In an internal audit, the company is often able to select its own audit team. As such, the team represents the interests of the company's management team. This may be advantageous to specifically place certain employees with very niche experience on the team. In an external audit, the company can often select the external audit firm; however, the company often does not have a say in the specific employees put on their external audit.

There may be some requirements regarding the external audit staff depending on the audit. For example, in an external financial audit, a Certified Public Accountant (CPA) must certify the financial statements. In an internal audit, there is no requirement that any member of the audit team must be a CPA.

The end goal of either audit is an audit report; however, audit reports are used for very different reasons. An internal audit report is usually used by internal management to improve the operations, processes, or policies of the company. An external audit report is often required for an outside reason and is more often used by members outside of the company.

Finally, the nature of the engagement will be very different. During an internal audit, the employees of a company may often freely give advice, discuss unrelated matters with the company, or may have a very fluid consulting agreement. During an external audit, a very defined scope is often set, and the external auditor will often take great care to ensure they do not exceed their audit boundaries.

A company is usually able to select its own internal audit lead and team members

Members of the audit team often do not need to have specific titles or licenses

Audit reports are primarily used by internal management to improve company operations

Internal audits may be less formal with blurred structure as the auditor provides casual guidance

A company or board can usually pick the audit firm but not audit team members

Members of the audit team may be required to hold specific titles or license as part of the audit agreement

Audit reports are primarily used by external parties to satisfy a reporting requirement

External audits are often more formal with defined boundaries and disallowed services

Internal Audit Process

Internal auditors generally identify a department, gather an understanding of the current internal control process, conduct fieldwork testing, follow up with department staff about identified issues, prepare an official audit report, review the audit report with management, and follow up with management and the board of directors as needed to ensure recommendations have been implemented.

Step 1: Planning

Before any audit procedures are performed, the internal auditors often start by developing the audit plan . This sets the audit requirements, objectives, timeline, schedule, and responsibilities across audit team members. The audits may review prior audits to understand management expectations for presentation and data collection.

The audit plan often has a checklist to ensure members of the team adhere to broad expectations. The internal audit team may also preemptively plan to meet with management throughout the audit to communicate the status and any struggles of the audit. The planning stage often ends with a kick-off meeting that launches the audit and communicates the initial information needed.

Step 2: Auditing

Many of the auditing procedures used by internal audits are the same as external auditors. Some companies might use continuous audits to ensure ongoing oversight of company practices. Assessment techniques ensure an internal auditor gathers a full understanding of the internal control procedures and whether employees are complying with internal control directives.

To avoid disrupting the daily workflow, auditors begin with indirect assessment techniques, such as reviewing flowcharts, manuals, departmental control policies, or other existing documentation.

Auditing fieldwork procedures can include transaction matching, physical inventory count, audit trail calculations, and account reconciliation as is required by law. Analysis techniques may test random data or target specific data if an auditor believes an internal control process needs to be improved.

The internal audit may have started with a defined scope; but as the internal audit team gathers and analyzes information, it may become necessary to redefine the purpose and extent of the audit. This includes re-evaluating the original timeline or resources allocated to the audit.

Step 3: Reporting

Internal audit reporting includes a formal report and may include a preliminary or memo-style interim report. An interim report typically includes sensitive or significant results the auditor thinks the board of directors needs to know right away. Similar to an interim financial statement , an interim audit communicates a partial set of information useful for laying the road for the remaining portion.

Often, a company may deliver a draft copy of the final audit report and host a pre-close internal audit meeting with management. This may allow management to provide rebuttals, additional information that may change findings, or provide commentary on their feedback regarding the audit findings.

The final report includes a summary of the procedures and techniques used for completing the audit, a description of audit findings, and suggestions for improvements to internal controls and control procedures. The final report may also communicate next steps in terms of changes to be implemented, future monitoring processes, and what future reviews will entail.

Step 4: Monitoring

After a designated amount of time, an internal audit may call for follow-up steps to make sure the appropriate post-close audit changes were implemented. The details and process for these monitoring and review steps is often agreed to at the delivery of the final audit.

For example, an internal financial audit may find severe internal control deficiencies that an internal auditor believes will not pass an external financial audit. Management agreed to implement changes within the next six weeks. After six weeks, the internal auditor may be tasked with implementing a small-scope or limited review of the deficiency to see if the issue still persists.

The monitoring step of an internal audit is technically not required. Management or the board may decide to disregard internal audit findings and not implement the changes the audit report suggests.

Internal Audit Reports: The 5 C's

Internal audit reports are often known for adhering to the 5 C's reporting requirement. A complete, sufficient internal audit often ends with a summary report that communicates answers to the following questions:

- Criteria: What particular issue was identified, and why was the internal audit necessary? Is the internal audit in preparation for a future external audit? Who requested the audit, and why did this party request the audit?

- Condition: How as the issue in relation to a company target or expectation? Does the company have a policy that was broken, a benchmark that was not met, or other condition that was not satisfied? Is the company confident no issue exists, or do they believe an issue is at hand?

- Cause: Why did the issue arise? Who was involved, what processes were broken, and how could the issue have been avoided?

- Consequence: What is the outcome of the problem? Are issues limited to internal matters, or are there risks of external consequences? What is the financial implications of the issue?

- Corrective Action: What can the company do fix the problem? What specific steps will management take to resolve the issue, and what type of monitoring or review will occur after solutions have been put in place to ensure a fix has been implemented?

Some may think internal audits are not as valuable as external audits. After all, a company may hand-pick its own internal audits who do not have full independence from the company. However, there are many ways internal audits provide value to the company and external parties:

- Management can be more efficient about what to explore. For example, while external financial audits must test an entire financial system, a company may be concerned about whether the cash management process is being fraudulently managed; therefore, management can elect to have all audit procedures analyze cash processes.

- Internal audits may save companies money. If a company's processes are very strong, the external audit process may not be as long as intensive, thereby reducing the external audit fee and time spent supporting external auditors.

- The company enhances its control environment. Even if the internal audit yields no findings, employees may be aware that their work gets analyzed and reported on, thereby motivating adherence to company policy.

- Internal audits may make companies more efficient. External audits often are not intended to make processes better; they are meant to review whether processes are accurate. This distinction is important because a company may be "just getting by" with inefficient processes that meet very minimum requirements.

- Internal audit reports give management a head start to make corrections. Instead of having to scramble when an external audit finds a deficiency, management can take longer to think through solutions, implement the solution with care, and review whether the solution worked.

- Certain departments may need enhanced oversight. Whether it is lack of expertise, staffing shortages, or problem with current personnel, a company may benefit from targeting a specific area and formally reviewing its workflow and processes.

What Are the Types of Internal Audits?

A company can choose to perform an internal audit for almost any reason. This may lead to an internal financial audit, operational audit, compliance audit, environmental audit, IT audit, or a special one-time circumstance.

What Is the Role of Internal Audit?

The role of an internal audit is to identify a deficiency or substantiate a proficiency. For example, a company may issue an internal financial audit to make sure its internal controls over accounts payable adhere to company policy. Alternatively, the company may launch an internal environmental audit to explore how environmental impact its eco-friendly changes had on the planet last year.

What Is the Internal Audit Process?

The internal audit process entails planning the audit, performing the audit procedures, compiling the audit report, and monitoring post-audit changes. Management may choose to expand the scope of an audit at any point of the audit if findings during the audit cause the scope to shift a different direction.

What Are the 5 C's of Internal Audit?

Internal audit reports often outline the criteria, condition, cause, consequence, and corrective action. These five areas report why the audit was performed, what caused the reason for the audit, how the audit will be performed, what the auditor aims to achieve, and what steps will be taken after the audit findings are presented.

An internal audit is a process that allows a company to self-select an audit team to carry out the review of its operations. The company can often define the scope of the internal audit. In addition, the company can often choose almost any reason to conduct an internal audit. Though internal audits are less useful for meeting external reporting requirements, they hold tremendous value for improving internal operations as well as informing management ways the company can get better.

Cornell University, Legal Information Institute. " Sarbanes-Oxley Act ."

Congressional Research Service. " Corporate Responsibility: Sarbanes-Oxley Act of 2002 ." Pages 5-8.

U.S. Securities and Exchange Commission. " All About Auditors: What Investors Need to Know ."

:max_bytes(150000):strip_icc():format(webp)/93975514-5bfc388946e0fb00260eb6ca.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Types of Audits: 14 Types of Audits and Level of Assurance (2022)

The audit is an art of systematic and independent review and investigation on a certain subject matter, including financial statements, management accounts, management reports, accounting records, operational reports, revenues reports, expenses reports, etc.

The result of reviewing and investigation will be reported to shareholders and other key internal stakeholders of the entity for their decision-making or other purposes.

Audit reports sometimes submit to other stakeholders like the government, banks, creditors, or the public.

For example, the statutory audit report is submitted to the regulator or authority like the tax department, the central bank, or the security authority.

The audit is classified into many different types and levels of assurance according to the objectives, scopes, purposes, and procedures of auditing.

The execution of financial statements auditing normally follows International Standards on Auditing (ISA) and other local auditing standards.

There are many types of audits including financial audits, operational audits, statutory audits, compliance audits, and so on.

In this article, we will explain the main 14 types of audits being performed in the current audit industry or practices.

Here is the list of 14 Types of Audits and Levels of Assurance:

1) External Audit:

The external audit refers to the audit firms that offer certain auditing services, including Assurance Services, Consultant Services, Tax Consultant Services, Legal Services, Financial Advisory, and Risk Management Advisory.

The best example of external auditing services is the services these big four audit firms provide, including KPMG, PWC, EY, and Deloitte.

External auditors are normally referred to as audit staff who are working in audit firms. The positions are ranked from audit associate, and senior auditors to audit partners, and managing partners.

These kinds of firms are sometimes called CPA firms as they are required by law to hold a CPA qualification/certificate to run an audit firm and issue audit reports .

This type of audit requires maintaining the professional code of ethics and strictly following International Standards on Auditing and local standards as required by local law.

The firms are working independently from auditing clients that they are auditing. If a conflict of interest has occurred, proper procedures must be taken to minimize the conflicts.

The firm should consider withdrawing from the audit engagement if the impairment cannot minimize to an acceptable level.

Some external audit firms are also offering internal audit services. The popular services offered by external audit firms are an audit of financial statements, tax consultant, and advisory services.

2) Internal Audit:

Internal Auditing is an independent and objective consulting service designed to add value to the business and improve the entity’s operation.

It provides a systematic and disciplined approach to evaluating and assessing risk management, internal control, and corporate governance.

The audit committee generally determines the scope of the internal audit , the board of directors, or directors with equivalence authorization. And if there is no audit committee and board of directors, an internal audit normally reports to the entity owner.

Internal audit activities normally cover internal control reviewing, operational reviewing, fraud investigation, compliant reviewing, and other special tasks assigned by the audit committee or BOD.

3) Forensic Audit:

The forensic audit is normally performed by a forensic accountant who has the skill in both accounting and investigation.

Forensic Accounting is the type of engagement undertaking the financial investigation in response to a particular subject matter. The findings of the investigation normally are used as evidence in court or conflict resolution among the shareholders.

The investigation covers several areas: fraud investigation, crime investigation, insurance claims, and disputes among shareholders.

A forensic audit is also needed to have a proper plan, procedure, and report like other audit engagements.

Forensic audit also needs to follow ethical guidelines like an audit of financial statements . This kind of engagement is not so popular as an audit of financial statements or statutory auditing .

4) Statutory Audit:

Statutory audit refers to an audit of financial statements for the specific type of entities required by law or local authority.

For example, all banking sectors require their financial statements to be audited by qualified audit firms authorized by their central bank.

The statutory audit might be different from financial statements auditing as the financial audit refers to the audit of all types of entity’s financial statements, including whether both meeting or not meet the government’s requirements.

However, statutory audit refers to only auditing the entity’s financial statements required by local law.

External audit firms normally perform the statutory audit, and the audit report will be issued by the auditor and submitted to the government body by the entity. Not by the auditor.

The best example of firms that offer statutory auditing is KPMG, PWC, EY, …. etc.

The common criteria set by law that require entities to have their financial statements by qualified audit firms are annual turnover, the value of assets, and the number of staff the entity employed.

Some countries may require companies in specific industries like banks, minerals, and others based on their decision to have those companies’ financial statements audited.

Companies listed on the stock exchange are generally required and enforced by the stock exchange authority to have a qualified audit form audit their financial statements.

5) Financial Audit:

Financial audit refers to the audit of the entity’s financial statements by an independent auditor where audit opinion will be provided on those financial statements after auditing works are done.

A financial audit is normally performed by an external audit firm that holds a CPA and is normally performed annually and at the end of the accounting period. This type of audit is also known as financial statements auditing.

But, sometimes, as required by management, bank, security exchange, regulation, or else, the financial audit is also performed quarterly.

Most entities prepare their financial statements based on IFRS, and some financial statements are prepared based on local GAAP.

For example, financial statements are prepared based on US GAAP for the entity registered in the US. If the financial statements are prepared based on IFRS, the financial audit needs to be audited against IFRS.

However, if the financial statements are prepared based on local GAAP, then the audit needs to be performed against those local GAAP.

The audit standards used by the auditor to conduct financial audits need to adopt international standards and local law requirements.

Some country requires an audit firm to follow its audit standards while others have adopted international standards and transformed them into local ones.

6) Tax Audit:

A tax audit is a type of audit that performing by the government’s tax department or tax authority.

A tax audit could be performed as the result of in-compliant found by a government agency or the schedule set by the government tax department.

An entity needs not to invite or engage with the tax authority to come to perform a tax audit. They will come by themselves. An entity just needs to file its tax obligation properly and timely based on the country’s tax law.

To minimize the penalty as the result of the tax audit, the entity is recommended to follow all the requirements set by tax law and for those areas that they are not sure about, the entity should engage with a tax consulting firm for advice. As mentioned above, the big four firms also offer such a service.

7) Information System Audit or Information Technology Audit (IT Audit)

An information system audit is sometimes called an IT audit. This type of audit assesses and checks the reliability of the security system, information security structure, and integrity of the system so that the system’s output is reliable.

Sometimes, financial auditing also requires IT auditing as now technology is increasing and most of the client’s financial reports are recorded by complex accounting software.

The audit approach also changed due to the changing of management’s approach in recording and reporting their entity’s financial information.

Normally, before relying on information systems (software) that are used for producing financial statements, auditors must have IT and audit teams test and review that information system first.

Especially, when an entity uses an ERP system where the operational reportings are also integrated with the accounting system. For example, a banking system normally links operational reporting with the accounting system.

IT audit is also offered and requested separately from the financial audit.

As you know, most big firms have this kind of service. They do not only provide IT audits but also offer consultants in the information system areas.

8) Compliance Audit

A compliance audit is a type of audit that checks against the internal policies and procedures of the entity as well as the laws and regulations where the entity operates. Law and regulation here refer to the government’s law where the business is operating.

For example, in the banking sector, there are many regulations required for bankers to follow and comply with.

Most of the central banks require commercial banks to set up a complaint review (assessment) or compliance audit to ensure that they comply with those laws and regulations.

The entity may also assign its internal audit function to review whether the entity’s internal policies and procedures are complying and effectively followed.

A compliance audit is part of the system used by the entity’s management to enforce the effectiveness of the implementation of the government’s laws and regulations, and the entity’s internal policies and procedures.

9) Value For Money Audit

Value for money audit refers to activities that assess and evaluate three main difference factors: Economy, Efficiency, and Effectiveness of entity operation.

Economically, the auditor assesses and evaluates whether the resources that the entity purchases are at a low cost with acceptable quality whereas efficiency audit, the auditor checks whether the resources that the entity use have a better conversion ratio.

Effectiveness, by the way, looks at the big picture of the objective whether the entity using the resources meets its objective or not.

The auditor might review the entity’s purchasing system to assess and evaluate whether it is helping the entity to purchase materials or services at low costs or not.

Value for money audit is really important for the entity since it helps the entity improve resource efficiency usage and make sure that the entity obtains good quality material at a low cost.

10) Review Financial Statements

Reviewing financial statements is a type of negative engagement where auditors review the entity’s financial statements.

At the end of the review, the audit is not going to express whether financial statements are a true and fair view and free from material.

But, the auditor will issue the opinion to say that nothing is coming to their attention that financial statements are not prepared with a true and fair view and free from material.

This kind of service is normally required when an entity borrows money from the bank. And the banks, as part of their policy require the entity to provide financial statements reviewed by an external auditor .

Or sometimes it is requested by management to have their financial statements before asking for the auditor to audit the financial statements . Or sometimes it is required by management for internal use.

11) Agreed Upon Procedures (AUP)

The agreed-upon procedure is the type of negative engagement where auditors review the procedures agreed upon with the client. This type of engagement is called limited assurance.

Even though the client’s procedures are set, auditors must also ensure that the firm has enough resources to perform the job and the fee is not low-balling.

Auditors will also need to ensure no conflict of interest between the audit and client management teams.

If the auditor finds a conflict of interest, the safe guide needs to be checked and introduced to reduce the conflict.

Once auditors complete their review or perform all the procedures required by management, they will issue the factual finding report by listing down all the findings they found during the audit.

12) Integrated Audit

Integrate audit happens when there are two different areas of audit requirements. For example, there is a financial audit and a social audit, or some areas need to be confirmed with the financial audit.

For example, NGOs require their financial statements to be audited, and the technical areas that those NGOs are spending the money on need to be audited by a specialist auditor.

For example, NGOs are working on public health and most of the money spent is related to public health.

Besides the expense reports that present the expenses that NGOs paid for and need to be audited by the financial auditor, there are many technical reports like health reports that need to be verified by technical auditors that have experience in assessing health reports.

This is called an integrated audit. The integrated audit also happens when the entity operates in many different countries, and the financial statements are audited by different audit firms.

13) Special Audit

A special audit is a type of audit assignment that is normally done by the internal auditor.

This happens when a problem/case occurs in the organization, like fraud, business case, or other special cases.

For example, fraud occurred in the payroll department, and this concern was raised to the audit committee or board of directors, or sometimes there is a request from the CEO to have a special audit on these areas.

The special audit is a bit different from the forensic audit as a special audit is done by the internal staff of the entity.

Once the auditor completes the audit, then the report is prepared by the audit team and then submitted to the audit committee or board of directors. It is sometimes also reported to the CEO of the entity.

14) Operational audit

An operational audit is a type of audit service that mainly focuses on key processes, procedures, systems, and internal control. The main objective is to improve the operation’s productivity, efficiency, and effectiveness.

Operation audit has also targeted the leak of key control and processes that cause waste of resources and then recommended improvement.

Operational audit is part of the internal audit and their main aim is to add value to the business and their professional services.

Systematic and highly disciplined is also the part that helps to make sure the operational audit adds value to the organization. Written by Sinra

Related Posts

How to prepare an internal audit program tips and guidance, review engagement (limited assurance): definition and example, 5 types of due diligence services, benefits, and limitations, what is internal audit department (responsibilities and more).

- Popular Courses

- GST Live Course

- More classes

- More Courses

Planning of Internal Audit Assignments

Rule 13(2) of Companies Act, 2013 requires the Audit Committee or its Board to formulate the overall internal audit plan of the company. In consultation with the Internal Auditor, they are required to formulate the scope, functioning, periodicity, and methodology for conducting the internal audit.

Why Planning?

It ensures that the audit is in line with its objective and align the organization's risk assessment with the effectiveness of the risk mitigation implemented through various internal controls. Also, it confirms and agrees with those charged with governance the broad scope, methodology and depth of coverage of the internal audit work to be undertaken in the defined time period.

How Planning?

Engagement partner undertakes audit plan prior to the beginning of the financial year with a comprehensive nature covering the entire entity. It is directional in nature and considers all locations, functions, business units and legal entities including third parties along with periodicity of the assignments to be undertaken during the plan period by ensuring that overall resources are adequate, skilled and deployed with focus in areas of importance, complexity and sensitivity. In order to understand the intricacies of each auditable unit subject to audit internal auditor shall obtain Knowledge of the entity, its business and operating environment. The Internal Auditor shall undertake an independent risk assessment exercise to prioritize and focus the audit work on high risk areas, with due attention to matters of importance, complexity and sensitivity

There is a need to connect the financial aspects of the business with other business elements, such as industry dynamics, company's business model, operational intricacies, legal and regulatory environment, and the system and processes in place to run its operations since it has a significant effect on the organization's financials. It requires Internal auditor to use his professional judgment for the process to be followed in completing all essential planning activities.

This planning shall be documented and contain all the essential elements required to help achieve the objectives of the plan including technology deployment & resource allocation.

Technology deployment

Auditor shall understand the IT deployed in business, operations and transaction processing, and plan accordingly IT tools, data mining and analytic procedures, and the expertise required for conducting the audit activities and testing procedures.

Resource allocation

Auditor shall document detailed work schedule to estimate the time required for each audit area depending on the audit attention it deserves (based on risk assessment) & maps this with the competencies (knowledge, experience, expertise, etc.) of the staff

The highest governing body responsible for internal audits , normally, the Board of Directors, or the Audit Committee shall reviewed and approve it.

In addition, the Internal Auditor shall exchange relevant information with the Statutory Auditor to coordinate the audit work and procedures, as per Standard on Auditing (SA) 610, “Using the Work of Internal Auditors'.

Ref: STANDARD ON INTERNAL AUDIT (SIA) 220 "Conducting overall internal audit planning"

Published by

CA. Heet Shah (Tax Consultant & Practitioner) Category Audit Report

Related Articles

Popular articles.

- Making SME Payments by 31st March 2024 for compliance u/s 43B(h) of Income Tax Act

- 20-Point Checklist for GST & Income Tax for Trade & Industry at FY 23-24 Year-End

- Applicable for FY 2023-24 (AY 2024-25)

- GST on Flat Purchase for FY 2023-24

- Points to remember while filing ITR for FY 2023-24

- Important Financial Tasks To Complete Before 31st March 2024

- ICAI Announced Revised Schedule of CA May 2024 Exams

- 10 Things to Remember before 31st March 2024

Trending Online Classes

Live Course on 2nd Batch - Scrutiny of Returns

Live Course on Unlock the Secrets of Statutory Bank Branch Audits

GST Live Certification Course (39th Batch) (With Certificate)

CCI Articles

You can also submit your article by sending to [email protected]

Browse by Category

- Corporate Law

- Info Technology

- Shares & Stock

- Professional Resource

- Union Budget

- Miscellaneous

Whatsapp Groups

Login at caclubindia, caclubindia.

India's largest network for finance professionals

Alternatively, you can log in using:

- Meaning and Definitions of Audit

Once we complete preparing the final statements and accounts for the year the accounting process is over. However, we still cannot be completely certain of the accuracy of these accounts. This is when the concept of auditing comes in. Let us see the audit meaning and features of an audit.

Suggested Videos

Audit meaning.

The word “audit” is a very generic word, it essentially means to examine something thoroughly. But we will be learning about auditing as it relates to accounting and the finance world. So audit meaning is the thorough inspection of the books of accounts of the organization .

This involves the examination of vouchers and the verification of various assets of the organization. And the person who carries out such an audit is known as the auditor.

The International Federation of Accountants has given the following definition of an audit, “audit is an independent inspection of the financial information of any organization, whether profit-oriented or not profit-oriented, irrespective of its legal form, status or size when such examination is conducted with a view to express an opinion thereof”.

The one important thing to remember is that an audit is a close inspection of the books of accounts, but it does not absolutely guarantee error-free books. The auditor only expresses his opinion on the accuracy of the books, he does not give his opinion on the financial status of the company or predict its future.

If he is satisfied with the examination then he will state that the financial accounts are true and fair, which means they are absent of any material misstatement. But this is not an opinion about the financial status of the company.

(source – ipleaders)

Browse more Topics under Concept Of Auditing

- Basic Principles Governing an Audit

- Principle aspects covered by auditing

- Advantages and Limitations of Audit

- Investigation vs Auditing

Features of an Audit

- Auditing is a systematic process. It is a logical and scientific procedure to examine the accounts of an organization for their accuracy. There are rules and procedures to follow.

- The audit is always done by an independent authority or a body of persons with the necessary qualifications. They have to be independent so their views and opinions can be totally unbiased.

- Once again, an audit is the examination of all the books of accounts and financial information of the company. So it is essentially a verification of the final accounts of the organization, i.e. the profit and loss statement and the balance sheet at the end of the financial year.

- Auditing is not only the review of the books of accounts but also the internal systems and internal control of the organization.

- To conduct the audit we need the help of various sources of information. This includes vouchers, documents, certificates, questionnaires, explanations etc. He may scrutinize any other documents he sees fit like Memorandum of Association , Articles of Associations , vouchers, minute books, shareholders register etc.

- The auditor must completely satisfy himself with the accuracy and authenticity of the financial statements. Only then can he give the opinion that they are true and fair statements.

Solved Question for You

Q: What are the main types of functional audits?

Ans: The main types of functional audits are,

- Propriety Auditing

- Efficiency Auditing

- Operational Auditing

- Voucher Auditing

- Statutory Auditing

- Social Auditing

- Cost Auditing

Customize your course in 30 seconds

Which class are you in.

Concept of Auditing

- Advantages and Limitations of Auditing

- Principle Aspects Covered by Auditing

One response to “Principle Aspects Covered by Auditing”

You have well explained about financial auditing, when it comes to IS auditing it necessary to check all the application and related to the organization which includes third party accessibility and their data base too. Information system auding includes checking of every department’s software application system to provide utmost security to the data in an entity or organization.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Download the App

The global body for professional accountants

- Search jobs

- Find an accountant

- Technical activities

- Help & support

Can't find your location/region listed? Please visit our global website instead

- Middle East

- Cayman Islands

- Trinidad & Tobago

- Virgin Islands (British)

- United Kingdom

- Czech Republic

- United Arab Emirates

- Saudi Arabia

- State of Palestine

- Syrian Arab Republic

- South Africa

- Africa (other)

- Hong Kong SAR of China

- New Zealand

- Apply to become an ACCA student

- Why choose to study ACCA?

- ACCA accountancy qualifications

- Getting started with ACCA

- ACCA Learning

- Register your interest in ACCA

- Learn why you should hire ACCA members

- Why train your staff with ACCA?

- Recruit finance staff

- Train and develop finance talent

- Approved Employer programme

- Employer support

- Resources to help your organisation stay one step ahead

- Support for Approved Learning Partners

- Becoming an ACCA Approved Learning Partner

- Tutor support

- Computer-Based Exam (CBE) centres

- Content providers

- Registered Learning Partner

- Exemption accreditation

- University partnerships

- Find tuition

- Virtual classroom support for learning partners

- It’s renewal time for your students!

- Find CPD resources

- Your membership

- Member networks

- AB magazine

- Sectors and industries

- Regulation and standards

- Advocacy and mentoring

- Council, elections and AGM

- Tuition and study options

- Study support resources

- Practical experience

- Our ethics modules

- Student Accountant

- Regulation and standards for students

- Your 2024 subscription

- Completing your EPSM

- Completing your PER

- Apply for membership

- Skills webinars

- Finding a great supervisor

- Choosing the right objectives for you

- Regularly recording your PER

- The next phase of your journey

- Your future once qualified

- Mentoring and networks

- Advance e-magazine

- An introduction to professional insights

- Meet the team

- Global economics

- Professional accountants - the future

- Supporting the global profession

- Download the insights app

Can't find your location listed? Please visit our global website instead

- Acceptance decisions for audit and assurance engagements

- Study resources

- Advanced Audit and Assurance (AAA)

- Technical articles and topic explainers

- Back to Advanced Audit and Assurance (AAA)

- How to approach Advanced Audit and Assurance

Relevant to ACCA Qualification Paper P7 The syllabus for Paper P7, Advanced Audit and Assurance includes Professional Appointments (syllabus reference C4). The learning outcomes include the explanation of matters that should be considered and procedures that should be followed by a firm before accepting a new client, a new engagement for an existing client, or agreeing the terms of any new engagement. The engagement may be an audit, or it may be a non-audit or assurance engagement. Acceptance decisions are crucially important, because new clients and/or engagements can pose threats to objectivity, or create risk exposure to the firm, which must be carefully evaluated. One of the current issues being debated in the profession is whether there should be an outright ban on the provision of non-audit services to audit clients. In addition, new International Standard on Auditing (ISA) requirements compel the firm to establish whether preconditions for an audit are present when faced with a potential new audit engagement. All of these factors mean that acceptance decisions must be taken with care.

Accepting new audit clients

IFAC’s Code of Ethics for Professional Accountants states: ‘Before accepting a new client relationship, a professional accountant in public practice shall determine whether acceptance would create any threats to compliance with the fundamental principles. Potential threats to integrity or professional behaviour may be created from, for example, questionable issues associated with the client (its owners, management or activities).’ This means that when approached to take on a new client, the firm should investigate the potential client, its owners and business activities in order to evaluate whether there are any questions over the integrity of the potential client which create unacceptable risk. These investigative actions are usually performed as ‘know your client/customer’ or ‘customer due diligence’ procedures, which are also carried out in order to comply with anti-money laundering regulations. Once a client has been accepted, the firm should consider the suitability of the specific engagement it has been asked to perform. In particular there may be ethical threats which mean that the engagement should not be accepted, in particular whether there are any threats to objectivity. Potential threats could arise for example, if members of the audit firm hold shares in the client or there are family relationships. If threats are discovered, it may not mean that the client must be turned down, as safeguards could potentially reduce the threats to an acceptable level. There may be other ethical matters to evaluate in relation to a potential new engagement, for example, whether any conflict of interest or confidentiality issues could arise, and if so, whether appropriate safeguards can be put in place. Also, the firm’s competence to perform the potential work should be evaluated, especially if the potential client operates in a specialised industry, or if the client has a complex structure. A self-interest threat to professional competence and due care is created if the engagement team does not possess, or cannot acquire, the competencies necessary to properly carry out the engagement. Practical matters such as the resources needed to perform the work, the deadline for completion, and logistics like locations and geographical spread will have to be looked into as well. Obviously, these matters need to be evaluated in the specific context of the potential engagement, and should be fully documented. Different types of potential engagement will give rise to different matters that should be evaluated. For example, if the firm is asked to perform the audit of a large group of companies with operations in many countries, then resourcing the audit may be the most significant issue. The fee may be large, leading to a self-interest threat of fee dependence. On the other hand, if asked to perform the audit of a small owner-managed company, fee dependence is less likely to be an issue, but threats potentially created by the auditor appearing to make management decisions could be significant. In answering requirements on client and engagement acceptance, candidates are warned that their comments must be made specific to the scenario presented to them in order to pass the requirement. Commercially, an engagement should be profitable to make it worthwhile for the firm. But the firm must take care that commercial considerations do not outweigh other matters to be considered. IFAC’s Code makes it clear that acceptance decisions are not to be treated as a one-off matter. The Code states: ‘It is recommended that a professional accountant in public practice periodically review acceptance decisions for recurring client engagements.’ Changes in the circumstances of either the client, or the audit firm may mean that an engagement ceases to be ethically or professionally acceptable or creates a heightened level of risk exposure. Therefore, client continuance assessments are important and should be fully documented.

Preconditions for an audit

Once a firm has decided to go ahead with an audit engagement, it must comply with the requirements of ISA 210, Agreeing the Terms of Audit Engagements . ISA 210 was revised as part of the International Auditing and Assurance Standards Board’s Clarity Project, with new requirements to perform specific procedures in order to establish whether the preconditions for an audit are present. ISA 210 defines preconditions for an audit as follows: ‘The use by management of an acceptable financial reporting framework in the preparation of the financial statements and the agreement of management and, where appropriate, those charged with governance to the premise on which an audit is conducted’. This means that the auditor must do two things. First, the auditor must determine the acceptability of the financial reporting framework to be applied in the preparation of the financial statements. This includes evaluating whether law or regulation prescribes the applicable financial reporting framework, considering the purpose of the financial statements, and the nature of the reporting entity (for example, whether a listed company or a public sector entity). In most cases this will simply be a matter of confirming with the client that the financial statements will be prepared under International Financial Reporting Standards, or other national reporting framework. Second, the auditor must obtain the agreement of management that it acknowledges and understands its responsibility:

- For the preparation of the financial statements in accordance with the applicable financial reporting framework.

- For internal controls to enable the preparation of financial statements which are free from material misstatement, whether due to fraud or error.

- To provide the auditor with access to all information necessary for the purpose of the audit.

In relation to the final bullet point, if management impose a limitation on the scope of the auditor’s work in the terms of a proposed audit engagement, the auditor should decline the audit engagement if the limitation could result in the auditor having to disclaim the opinion on the financial statements. The engagement should also be declined if the financial reporting framework is unacceptable, or if management fail to provide the agreement outlined above. (ISA 580, Written Representations also requires that management provide written representations regarding its responsibilities in relation to the preparation of financial statements.)

Accepting non-audit assignments

It is very common for audit clients to approach their auditor for the provision of additional services, ranging from audit related services such as tax planning and bookkeeping, to other engagements such as due diligence and forensic investigations. The audit firm must again carefully consider whether it is ethically and professionally acceptable to take on the additional service. The main ethical threat created by the provision of non-audit services is the threat to objectivity. The threats created are most often self-review, self-interest and advocacy threats and if a threat is created that cannot be reduced to an acceptable level by the application of safeguards, the non-audit service shall not be provided. The UK Auditing Practices Board’s (APB) Ethical Standard 5, Non-audit services provided to audit clients contains similar principles, and emphasises the ‘management threat’ which exists when the audit firm makes decisions and judgments that are properly the responsibility of management. Both the Code and ES 5 outline a principles-based approach to determining the acceptability of a non-audit service to an audit client. With a few exceptions, if safeguards can reduce threats to an acceptable level then the service may be provided. Safeguards could include using separate teams to provide the various services to the client, and the use of second partner review or Engagement Quality Control Review. ES 5 specifies that it is the audit engagement partner who should evaluate the level of threat, the effectiveness of safeguards, and is ultimately responsible for the documentation of the acceptance decision. The provision of non-audit services to audit clients continues to be debated by the profession. Many argue in favour of outright prohibition as being the only measure which can totally safeguard auditor’s objectivity. However, it is accepted that audit firms are best placed to provide audit clients with additional services due to the knowledge of the business which they already possess, leading to a lower cost and higher quality service than that would be provided by a different firm. In 2010 the APB issued a feedback and consultation paper The provision of non-audit services by auditors , which prompted continued discussion of these issues and recommended a number of measures to:

- Increase the rigour with which auditors assess threats to their independence