- Order Status

- Testimonials

- What Makes Us Different

Gibson Insurance Harvard Case Solution & Analysis

Home >> Harvard Case Study Analysis Solutions >> Gibson Insurance

Gibson Insurance Case Solution

Gibson Company was based in Kansas City, Missouri. Gibson Insurance’s key products include financial products, i.e. life insurance and annuities. The policies were directly sold by the in-house agents. The Gibson’s management was focused on the corporate acquisition strategy in order to grow the customer base as well as the overall assets, under the company’s management . The company had been using a simple costing method for the allocation of its product’s support costs. The controller (Rebecca Hampton) felt that the simple costing had been working well historically, however, it did not reflect the actual claim over the resources made by the several business units and product lines.

Moreover, it is observed that despite an increased level of sales ; the company’s profitability levels had declined. The company’s management was concerned about finding the key issues related to the incorrect pricing or out of control costs. The company’s controller was sure that a new cost allocation approach would help the company in improving its pricing strategy, whichwould lead towards a better resource’s allocation. The new costing method would enable the company to identify perform the divisions and to determine better product line costs, so that the company’s competitive position could be maintained.

The new cost allocation method is suggested to be activity based costing, whereby the costs are compiled and assigned to the activities based on their relevant activity drivers, unlike the simple costing method, which assigns the cost based on a single cost driver (i.e. number of policies initially). The new allocation bases included the policy acquisition, customer service, sales and marketing and other corporate overhead costs.

The unit support costs have been calculated using the new allocation bases (i.e. steps, calls, contacts and AUM) for all the four support costs. The total number of policies are multiplied with their relevant cost bases, on the basis of which cost drivers are calculated. The aggregate costs related to each cost pool is then divided by the cost drivers, which has resulted in the per units cost of $42.2 (policy acquisition), 44.06 (customer service), 10.02 (Sales & Marketing) and 0.003 (AUM).

Afterwards the cost per policy is calculated by multiplying the cost per unit with the driver use, for the new and in-force annuities and life insurances. The cost per new annuity and life insurance policy are calculated as: $221.52 and $438.22, respectively, while, the cost per in-force annuity and life insurance policy are calculated as $23.73 and $37.02. These costs per policy are used to determine the total cost for the three division i.e. $4,038,341, $4,781,457 and $5,100,202 for Midwest, Gibson and Compton, respectively.

The quantitative analysis shows that the simple costing method was not appropriate for the company as it lead towards the higher level of fluctuations in the total cost for each subdivision. The Midwest division had a high cost through simple cost allocation method; however, the activity based costing resulted in a lower cost. Similarly, the cost for Gibson was slightly less through the activity based costing method. However, the Gibson’s cost was much lower through simple costing method (as shown by graph).

The analysis concludes that the company should adjust its costs according to activity based costing method, as it gives more accurate costs related to each subdivision. Furthermore, the company is recommended to increase its policy prices for the Midwest and Gibson divisions and to lower the prices for the Compton division. These cost adjustments and price change would enable the company to remain competitive in the industry and to keep the operations smooth, efficient and productive..........................

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.

Related Case Solutions & Analyses:

Hire us for Originally Written Case Solution/ Analysis

Like us and get updates:.

Harvard Case Solutions

Search Case Solutions

- Accounting Case Solutions

- Auditing Case Studies

- Business Case Studies

- Economics Case Solutions

- Finance Case Studies Analysis

- Harvard Case Study Analysis Solutions

- Human Resource Cases

- Ivey Case Solutions

- Management Case Studies

- Marketing HBS Case Solutions

- Operations Management Case Studies

- Supply Chain Management Cases

- Taxation Case Studies

More From Harvard Case Study Analysis Solutions

- Black-Scholes Option Pricing Program for the HP 12C Calculator

- Selecting a New Name for Security Capital Pacific Trust

- Should I Advertise on the Interstate

- When the CEO is Ill: Keeping Quiet or Going Public?

- Bank Of America

- BREITLING WATCHES

- Hewlett-Packard Company: CEO Succession in 2010

Contact us:

Check Order Status

How Does it Work?

Why TheCaseSolutions.com?

Gibson Insurance Company

By: Mark E. Haskins, Kristy Lilly, Liz Smith

This case provides students with an opportunity to practice a set of activity-based costing calculations. More importantly, it provides an instructor with the opportunity to challenge students to…

- Length: 8 page(s)

- Publication Date: May 25, 2006

- Discipline: Accounting

- Product #: UV1113-PDF-ENG

What's included:

- Teaching Note

- Educator Copy

$4.95 per student

degree granting course

$8.95 per student

non-degree granting course

Get access to this material, plus much more with a free Educator Account:

- Access to world-famous HBS cases

- Up to 60% off materials for your students

- Resources for teaching online

- Tips and reviews from other Educators

Already registered? Sign in

- Student Registration

- Non-Academic Registration

- Included Materials

This case provides students with an opportunity to practice a set of activity-based costing calculations. More importantly, it provides an instructor with the opportunity to challenge students to think about and to discuss the rationale used by the case protagonist to revise the means by which the company allocates corporate support costs to the product lines and to the business units. It is best used as an introduction to activity-based costing and/or the more general topic of cost allocations. As such, it is amenable to undergraduate and graduate managerial accounting courses, as well as executive education financial management programs.

May 25, 2006

Discipline:

Darden School of Business

UV1113-PDF-ENG

We use cookies to understand how you use our site and to improve your experience, including personalizing content. Learn More . By continuing to use our site, you accept our use of cookies and revised Privacy Policy .

To read this content please select one of the options below:

Please note you do not have access to teaching notes, gibson insurance company.

Publication date: 20 January 2017

Teaching notes

This case provides students with an opportunity to practice a set of activity-based costing calculations. More importantly, it provides an instructor with the opportunity to challenge students to think about and to discuss the rationale used by the case protagonist to revise the means by which the company allocates corporate support costs to the product lines and to the business units. It is best used as an introduction to activity-based costing and/or the more general topic of cost allocations. As such, it is effective for undergraduate and graduate managerial accounting courses, as well as executive education financial management programs.

- Costing calculations

- Product lines

- Cost allocations

Haskins, M.E. , Lilly, K. and Smith, L. (2017), "Gibson Insurance Company", , Vol. 1 No. 1. https://doi.org/10.1108/case.darden.2016.000134

University of Virginia Darden School Foundation

Copyright © 2006 by the University of Virginia Darden School Foundation, Charlottesville, VA. All rights reserved.

You do not currently have access to these teaching notes. Teaching notes are available for teaching faculty at subscribing institutions. Teaching notes accompany case studies with suggested learning objectives, classroom methods and potential assignment questions. They support dynamic classroom discussion to help develop student's analytical skills.

Related articles

We’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

Gibson Insurance Company Case Solution & Answer

Home » Case Study Analysis Solutions » Gibson Insurance Company

This case provides students the opportunity to practice a range of cost estimates for each activity. More importantly, allows instructors the opportunity to challenge students to think and discuss the approach taken by the protagonist case review the means by which the company distributes costs to support product lines and business units. It is best used as an introduction to accounting and / or activity the more general issue of cost allocation. As such, it is likely that financial management software for the management of graduate education and university management accounting and. by Mark E. Haskins, Kristy Lilly, Liz Smith Source: Darden School of Business 8 pages. May 25 2006: release date. Prod #: UV1113-PDF-ENG Gibson Insurance Company Case Solution

Related Case Solutions:

LOOK FOR A FREE CASE STUDY SOLUTION

Don't have an account? Sign up now

Already have an account login, get 10% off on your next order.

Subscribe now to get your discount coupon *Only correct email will be accepted

(Approximately ~ 0.0 Page)

Total Price

Thank you for your email subscription. Check your email to get Coupon Code.

Gibson Insurance Company Case Study Solution

Posted by John Berg on Feb-16-2018

Introduction

Gibson Insurance Company Case Study is included in the Harvard Business Review Case Study. Therefore, it is necessary to touch HBR fundamentals before starting the Gibson Insurance Company case analysis. HBR will help you assess which piece of information is relevant. Harvard Business review will also help you solve your case. Thus, HBR fundamentals assist in easily comprehending the case study description and brainstorming the Gibson Insurance Company case analysis. Also, a major benefit of HBR is that it widens your approach. HBR also brings new ideas into the picture which would help you in your Gibson Insurance Company case analysis.

To write an effective Harvard Business Case Solution, a deep Gibson Insurance Company case analysis is essential. A proper analysis requires deep investigative reading. You should have a strong grasp of the concepts discussed and be able to identify the central problem in the given HBR case study. It is very important to read the HBR case study thoroughly as at times identifying the key problem becomes challenging. Thus by underlining every single detail which you think relevant, you will be quickly able to solve the HBR case study as is addressed in Harvard Business Case Solution.

Problem Identification

The first step in solving the HBR Case Study is to identify the problem. A problem can be regarded as a difference between the actual situation and the desired situation. This means that to identify a problem, you must know where it is intended to be. To do a Gibson Insurance Company case study analysis and a financial analysis, you need to have a clear understanding of where the problem currently is about the perceived problem.

For effective and efficient problem identification,

- A multi-source and multi-method approach should be adopted.

- The problem identified should be thoroughly reviewed and evaluated before continuing with the case study solution.

- The problem should be backed by sufficient evidence to make sure a wrong problem isn't being worked upon.

Problem identification, if done well, will form a strong foundation for your Gibson Insurance Company Case Study. Effective problem identification is clear, objective, and specific. An ambiguous problem will result in vague solutions being discovered. It is also well-informed and timely. It should be noted that the right amount of time should be spent on this part. Spending too much time will leave lesser time for the rest of the process.

Gibson Insurance Company Case Analysis

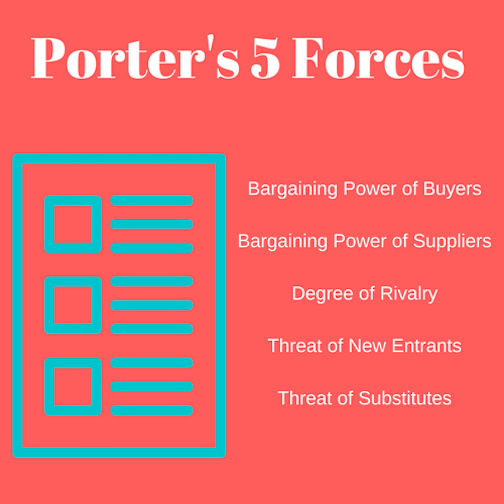

Once you have completed the first step which was problem identification, you move on to developing a case study answers. This is the second step which will include evaluation and analysis of the given company. For this step, tools like SWOT analysis, Porter's five forces analysis for Gibson Insurance Company, etc. can be used. Porter’s five forces analysis for Gibson Insurance Company analyses a company’s substitutes, buyer and supplier power, rivalry, etc.

To do an effective HBR case study analysis, you need to explore the following areas:

1. Company history:

The Gibson Insurance Company case study consists of the history of the company given at the start. Reading it thoroughly will provide you with an understanding of the company's aims and objectives. You will keep these in mind as any Harvard Business Case Solutions you provide will need to be aligned with these.

2. Company growth trends:

This will help you obtain an understanding of the company's current stage in the business cycle and will give you an idea of what the scope of the solution should be.

3. Company culture:

Work culture in a company tells a lot about the workforce itself. You can understand this by going through the instances involving employees that the HBR case study provides. This will be helpful in understanding if the proposed case study solution will be accepted by the workforce and whether it will consist of the prevailing culture in the company.

Gibson Insurance Company Financial Analysis

The third step of solving the Gibson Insurance Company Case Study is Gibson Insurance Company Financial Analysis. You can go about it in a similar way as is done for a finance and accounting case study. For solving any Gibson Insurance Company case, Financial Analysis is of extreme importance. You should place extra focus on conducting Gibson Insurance Company financial analysis as it is an integral part of the Gibson Insurance Company Case Study Solution. It will help you evaluate the position of Gibson Insurance Company regarding stability, profitability and liquidity accurately. On the basis of this, you will be able to recommend an appropriate plan of action. To conduct a Gibson Insurance Company financial analysis in excel,

- Past year financial statements need to be extracted.

- Liquidity and profitability ratios to be calculated from the current financial statements.

- Ratios are compared with the past year Gibson Insurance Company calculations

- Company’s financial position is evaluated.

Another way how you can do the Gibson Insurance Company financial analysis is through financial modelling. Financial Analysis through financial modelling is done by:

- Using the current financial statement to produce forecasted financial statements.

- A set of assumptions are made to grow revenue and expenses.

- Value of the company is derived.

Financial Analysis is critical in many aspects:

- Decision Making and Strategy Devising to achieve targeted goals- to determine the future course of action.

- Getting credit from suppliers depending on the leverage position- creditors will be confident to supply on credit if less company debt.

- Influence on Investment Decisions- buying and selling of stock by investors.

Thus, it is a snapshot of the company and helps analysts assess whether the company's performance has improved or deteriorated. It also gives an insight about its expected performance in future- whether it will be going concern or not. Gibson Insurance Company Financial analysis can, therefore, give you a broader image of the company.

Gibson Insurance Company NPV

Gibson Insurance Company's calculations of ratios only are not sufficient to gauge the company performance for investment decisions. Instead, investment appraisal methods should also be considered. Gibson Insurance Company NPV calculation is a very important one as NPV helps determine whether the investment will lead to a positive value or a negative value. It is the best tool for decision making.

There are many benefits of using NPV:

- It takes into account the future value of money, thereby giving reliable results.

- It considers the cost of capital in its calculations.

- It gives the return in dollar terms simplifying decision making.

The formula that you will use to calculate Gibson Insurance Company NPV will be as follows:

Present Value of Future Cash Flows minus Initial Investment

Present Value of Future cash flows will be calculated as follows:

PV of CF= CF1/(1+r)^1 + CF2/(1+r)^2 + CF3/(1+r)^3 + …CFn/(1+r)^n

where CF = cash flows r = cost of capital n = total number of years.

Cash flows can be uniform or multiple. You can discount them by Gibson Insurance Company WACC as the discount rate to arrive at the present value figure. You can then use the resulting figure to make your investment decision. The decision criteria would be as follows:

- If Present Value of Cash Flows is greater than Initial Investment, you can accept the project.

- If Present Value of Cash Flows is less than Initial Investment, you can reject the project.

Thus, calculation of Gibson Insurance Company NPV will give you an insight into the value generated if you invest in Gibson Insurance Company. It is a very reliable tool to assess the feasibility of an investment as it helps determine whether the cash flows generated will help yield a positive return or not.

However, it would be better if you take various aspects under consideration. Thus, apart from Gibson Insurance Company’s NPV, you should also consider other capital budgeting techniques like Gibson Insurance Company’s IRR to evaluate and fine-tune your investment decisions.

Gibson Insurance Company DCF

Once you are done with calculating the Gibson Insurance Company NPV for your finance and accounting case study, you can proceed to the next step, which involves calculating the Gibson Insurance Company DCF. Discounted cash flow (DCF) is a Gibson Insurance Company valuation method used to estimate the value of an investment based on its future cash flows. For a better presentation of your finance case solution, it is recommended to use Gibson Insurance Company excel for the DCF analysis.

To calculate the Gibson Insurance Company DCF analysis, the following steps are required:

- Calculate the expected future cash inflows and outflows.

- Set-off inflows and outflows to obtain the net cash flows.

- Find the present value of expected future net cash flows using a discount rate, which is usually the weighted-average cost of capital (WACC).

- If the value calculated through Gibson Insurance Company DCF is higher than the current cost of the investment, the opportunity should be considered

- If the current cost of the investment is higher than the value calculated through DCF, the opportunity should be rejected

Gibson Insurance Company DCF can also be calculated using the following formula:

DCF= CF1/(1+r)^1 + CF2/(1+r)^2 + CF3/(1+r)^3 + …CFn/(1+r)^n

In the formula:

- CF= Cash flows

- R= discount rate (WACC)

Gibson Insurance Company WACC

When making different Gibson Insurance Company's calculations, Gibson Insurance Company WACC calculation is of great significance. WACC calculation is done by the capital composition of the company. The formula will be as follows:

Weighted Average Cost of Capital = % of Debt * Cost of Debt * (1- tax rate) + % of equity * Cost of Equity

You can compute the debt and equity percentage from the balance sheet figures. For the cost of equity, you can use the CAPM model. Cost of debt is usually given. However, if it isn't mentioned, you can calculate it through market weighted average debt. Gibson Insurance Company’s WACC will indicate the rate the company should earn to pay its capital suppliers. Gibson Insurance Company WACC can be analysed in two ways:

- From the company's perspective, it can be analysed as the cost to be paid to the capital providers also known as Cost of Capital

- From an investor' perspective, if the expected return on the investment exceeds Gibson Insurance Company WACC, the investor will go ahead with the investment as a positive value would be generated.

Gibson Insurance Company IRR

After calculating the Gibson Insurance Company WACC, it is necessary to calculate the Gibson Insurance Company IRR as well, as WACC alone does not say much about the company’s overall situation. Gibson Insurance Company IRR will add meaning to the finance solution that you are working on. The internal rate of return is a tool used in investment appraisal to calculate the profitability of prospective investments. IRR calculations are dependent on the same formula as Gibson Insurance Company NPV.

There are two ways to calculate the Gibson Insurance Company IRR.

- By using a Gibson Insurance Company Excel Spreadsheet: There are in-built formulae for calculating IRR.

IRR= R + [NPVa / (NPVa - NPVb) x (Rb - Ra)]

In this formula:

- Ra= lower discount rate chosen

- Rb= higher discount rate chosen

- NPVa= NPV at Ra

- NPVb= NPV at Rb

Gibson Insurance Company IRR impacts your finance case solution in the following ways:

- If IRR>WACC, accept the alternative

- If IRR<WACC, reject the alternative

Gibson Insurance Company Excel Spreadsheet

All your Gibson Insurance Company calculations should be done in a Gibson Insurance Company xls Spreadsheet. A Gibson Insurance Company excel spreadsheet is the best way to present your finance case solution. The Gibson Insurance Company Calculations should be presented in Gibson Insurance Company excel in such a way that the analysis and results can be distinguished to the viewers. The point of Gibson Insurance Company excel is to present large amounts of data in clear and consumable ways. Presenting your data is also going to make sure that you don't have misinterpretations of the data.

To make your Gibson Insurance Company calculations sheet more meaningful, you should:

- Think about the order of the Gibson Insurance Company xls worksheets in your finance case solution

- Use more Gibson Insurance Company xls worksheets and tables as will divide the data that you are looking at in sections.

- Choose clarity overlooks

- Keep your timeline consistent

- Organise the information flow

- Clarify your sources

The following tips and bits should be kept in mind while preparing your finance case solution in a Gibson Insurance Company xls spreadsheet:

- Avoid using fixed numbers in formulae

- Avoid hiding data

- Useless and meaningful colours, such as highlighting negative numbers in red

- Label column and rows

- Correct your alignment

- Keep formulae readable

- Strategically freeze header column and row

Gibson Insurance Company Ratio analysis

After you have your Gibson Insurance Company calculations in a Gibson Insurance Company xls spreadsheet, you can move on to the next step which is ratio analysis. Ratio analysis is an analysis of information in the form of figures contained in the financial statements of a company. It will help you evaluate various aspects of a company's operating and financial performance which can be done in Gibson Insurance Company Excel.

To conduct a ratio analysis that covers all financial aspects, divide the analysis as follows:

- Liquidity Ratios: Liquidity ratios gauge a company's ability to pay off its short-term debt. These include the current ratio, quick ratio, and working capital ratio.

- Solvency ratios: Solvency ratios match a company's debt levels with its assets, equity, and earnings. These include the debt-equity ratio, debt-assets ratio, and interest coverage ratio.

- Profitability Ratios: These show how effectively a company can generate profits through its operations. Profit margin, return on assets, return on equity, return on capital employed, and gross margin ratio is examples of profitability ratios.

- Efficiency ratios: Efficiency ratios analyse how efficiently a company uses its assets and liabilities to boost sales and increase profits.

- Coverage Ratios: These ratios measure a company's ability to make the interest payments and other obligations associated with its debts. Examples include times interest earned ratio and debt-service coverage ratio.

- Market Prospect Ratios: These include dividend yield, P/E ratio, earnings per share, and dividend payout ratio.

Gibson Insurance Company Valuation

Gibson Insurance Company Valuation is a very fundamental requirement if you want to work out your Harvard Business Case Solution. Gibson Insurance Company Valuation includes a critical analysis of the company's capital structure – the composition of debt and equity in it, and the fair value of its assets. Common approaches to Gibson Insurance Company valuation include

- DDM is an appropriate method if dividends are being paid to shareholders and the dividends paid are in line with the earnings of the company.

- FCFF is used when the company has a combination of debt and equity financing.

- FCFE, on the other hand, shows the cash flow available to equity holders only.

These three methods explained above are very commonly used to calculate the value of the firm. Investment decisions are undertaken by the value derived.

Gibson Insurance Company calculations for projected cash flows and growth rates are taken under consideration to come up with the value of firm and value of equity. These figures are used to determine the net worth of the business. Net worth is a very important concept when solving any finance and accounting case study as it gives a deep insight into the company's potential to perform in future.

Alternative Solutions

After doing your case study analysis, you move to the next step, which is identifying alternative solutions. These will be other possibilities of Harvard Business case solutions that you can choose from. For this, you must look at the Gibson Insurance Company case analysis in different ways and find a new perspective that you haven't thought of before.

Once you have listed or mapped alternatives, be open to their possibilities. Work on those that:

- need additional information

- are new solutions

- can be combined or eliminated

After listing possible options, evaluate them without prejudice, and check if enough resources are available for implementation and if the company workforce would accept it.

For ease of deciding the best Gibson Insurance Company case solution, you can rate them on numerous aspects, such as:

- Feasibility

- Suitability

- Flexibility

Implementation

Once you have read the Gibson Insurance Company HBR case study and have started working your way towards Gibson Insurance Company Case Solution, you need to be clear about different financial concepts. Your Mondavi case answers should reflect your understanding of the Gibson Insurance Company Case Study.

You should be clear about the advantages, disadvantages and method of each financial analysis technique. Knowing formulas is also very essential or else you will mess up with your analysis. Therefore, you need to be mindful of the financial analysis method you are implementing to write your Gibson Insurance Company case study solution. It should closely align with the business structure and the financials as mentioned in the Gibson Insurance Company case memo.

You can also refer to Gibson Insurance Company Harvard case to have a better understanding and a clearer picture so that you implement the best strategy. There are a number of benefits if you keep a wide range of financial analysis tools at your fingertips.

- Your Gibson Insurance Company HBR Case Solution would be quite accurate

- You will have an option to choose from different methods, thus helping you choose the best strategy.

Recommendation and Action Plan

Once you have successfully worked out your financial analysis using the most appropriate method and come up with Gibson Insurance Company HBR Case Solution, you need to give the final finishing by adding a recommendation and an action plan to be followed. The recommendation can be based on the current financial analysis. When making a recommendation,

- You need to make sure that it is not generic and it will help in increasing company value

- It is in line with the case study analysis you have conducted

- The Gibson Insurance Company calculations you have done support what you are recommending

- It should be clear, concise and free of complexities

Also, adding an action plan for your recommendation further strengthens your Gibson Insurance Company HBR case study argument. Thus, your action plan should be consistent with the recommendation you are giving to support your Gibson Insurance Company financial analysis. It is essential to have all these three things correlated to have a better coherence in your argument presented in your case study analysis and solution which will be a part of Gibson Insurance Company Case Answer.

Arbaugh, W. (2000). Windows of vulnerability: A case study analysis. Retrieved from Colorado State University Web site: http://www.cs.colostate.edu/~cs635/Windows_of_Vulnerability.pdf

Choi, J. J., Ju, M., Kotabe, M., Trigeorgis, L., & Zhang, X. T. (2018). Flexibility as firm value driver: Evidence from offshore outsourcing. Global Strategy Journal, 8(2), 351-376.

DeBoeuf, D., Lee, H., Johnson, D., & Masharuev, M. (2018). Purchasing power return, a new paradigm of capital investment appraisal. Managerial Finance, 44(2), 241-256.

Delaney, C. J., Rich, S. P., & Rose, J. T. (2016). A Paradox within the Time Value of Money: A Critical Thinking Exercise for Finance Students. American Journal of Business Education, 9(2), 83-86.

Easton, M., & Sommers, Z. (2018). Financial Statement Analysis & Valuation. Seattle: amazon.com.

Gotze, U., Northcott, D., & Schuster, P. (2016). Investment Appraisal. Berlin: Springer.

Greco, S., Figueira, J., & Ehrgott, M. (2016). Multiple criteria decision analysis. New York: Springer.

Hawkins, D. (1997). Corporate financial reporting and analysis: Text and cases. Homewood, IL: Irwin/McGraw-Hill.

Hribar, P., Melessa, S., Mergenthaler, R., & Small, R. C. (2018). An Examination of the Relative Abilities of Earnings and Cash Flows to Explain Returns and Market Values. Rotman School of Management Working Paper, 10-15.

Kaszas, M., & Janda, K. (2018). The Impact of Globalization on International Finance and Accounting. In Indirect Valuation and Earnings Stability: Within-Company Use of the Earnings Multiple (pp. 161-172). Berlin, Germany: Springer, Cham.

King, R., & Levine, R. (1993). Finance and growth: Schumpeter might be right. The quarterly journal of economics, 108(3), 717-737.

Kraus, S., Kallmuenzer, A., Stieger, D., Peters, M., & Calabrò, A. (2018). Entrepreneurial paths to family firm performance. Journal of Business Research, 88, 382-387.

Laaksonen, O., & Peltoniemi, M. (2018). The essence of dynamic capabilities and their measurement. International Journal of Management Reviews, 20(2), 184-205.

Lamberton, D. (2011). Introduction to stochastic calculus applied to finance. UK: Chapman and Hall.

Landier, A. (2015). The WACC fallacy: The real effects of using a unique discount rate. The Journal of Finance, 70(3), 1253-1285.

Lee, L., Kerler, W., & Ivancevich, D. (2018). Beyond Excel: Software Tools and the Accounting Curriculum. AIS Educator Journal, 13(1), 44-61.

Li, W. S. (2018). Strategic Value Analysis: Business Valuation. In Strategic Management Accounting. Singapore: Springer.

Magni, C. (2015). Investment, financing and the role of ROA and WACC in value creation. European Journal of Operational Research, 244(3), 855-866.

Marchioni, A., & Magni, C. A. (2018). Sensitivity Analysis and Investment Decisions: NPV-Consistency of Straight-Line Rate of Return. Department of Economics.

Metcalfe, J., & Miles, I. (2012). Innovation systems in the service economy: measurement and case study analysis. Berlin, Germany: Springer Science & Business Media.

Oliveira, F. B., & Zotes, L. P. (2018). Valuation methodologies for business startups: a bibliographical study and survey. Brazilian Journal of Operations & Production Management, 15(1), 96-111.

Pellegrino, R., Costantino, N., & Tauro, D. (2018). Supply Chain Finance: A supply chain-oriented perspective to mitigate commodity risk and pricing volatility. Journal of Purchasing and Supply Management, 1-10.

Pham, T. N., & Alenikov, T. (2018). The importance of Weighted Average Cost of Capital in investment decision-making for investors of corporations in the healthcare industry.

Smith, K. T., Betts, T. K., & Smith, L. M. (2018). Financial analysis of companies concerned about human rights. International Journal of Business Excellence, 14(3), 360-379.

Teresa, M. G. (2018). How the Equity Terminal Value Influences the Value of the Firm. Journal of Business Valuation and Economic Loss Analysis, 13(1).

Yang, Y., Pankow, J., Swan, H., Willett, J., Mitchell, S. G., Rudes, D. S., & Knight, K. (2018). Preparing for analysis: a practical guide for a critical step for procedural rigour in large-scale multisite qualitative research studies. Quality and Quantity, 52(2), 815-828.

Warning! This article is only an example and cannot be used for research or reference purposes. If you need help with something similar, please submit your details here .

9413 Students can’t be wrong

PhD Experts

Whenever I need the solution of any strategy’s question, this website comes to mind and I get the perfect answers to questions.

The plagiarism checker of this service is the most upstanding feature. Thank you for proofreading and Grammarly checker as well.

Erande Margelia

The assignment crossed out my fear about this service. The language of the document was very persuasive that made the teacher to give me good grades.

Nori Rechars

This service has leaked none of my personal information. I would highly recommend it because it is genuine.

Calculate the Price

(approx ~ 0.0 page), total price $0, next articles.

- Rivanna University Case Solution

- Maumee Commercial Dining Products, Inc. Case Solution

- Maumee Commercial Dining Products, Inc. (SPANISH) Case Solution

- Berkshire Hathaway Inc.—Intercorporate Investments (A) Case Solution

- Albert Robins Company, Inc.?Trade Receivables Case Solution

- Dell Inc.?Stockholders' Equity Case Solution

- DEALING WITH DROUGHT (COMMENTARY FOR HBR CASE STUDY) Case Solution

- UNDER ARMOUR’S WILLFUL DIGITAL MOVES Case Solution

- MGM Mirage—Accounts Receivable Case Solution

- VOLATILITY IN CHINA'S STOCK MARKET: BOOM, BUST, BOOM…AND BUST? Case Solution

Previous Articles

- DEALING WITH DROUGHT (HBR CASE STUDY) Case Solution

- An Exercise In Accounting For Marketable Securities Case Solution

- An Overview Of Taxation In The United States Case Solution

- North Mountain Nursery, Inc.: Statement Of Cash Flow Case Solution

- Adenosine Therapeutics LLC: Accounting For A Different Compensation Method Case Solution

- LIFE'S WORK: MARINA ABRAMOVIC Case Solution

- DEALING WITH DROUGHT (HBR CASE STUDY AND COMMENTARY) Case Solution

- BEATING BURNOUT Case Solution

- LET'S NOT KILL PERFORMANCE EVALUATIONS YET Case Solution

- GETTING REORGS RIGHT Case Solution

Be a great writer or hire a greater one!

Academic writing has no room for errors and mistakes. If you have BIG dreams to score BIG, think out of the box and hire Case48 with BIG enough reputation.

Our Guarantees

Zero plagiarism, best quality, qualified writers, absolute privacy, timely delivery.

Interesting Fact

Most recent surveys suggest that around 76 % students try professional academic writing services at least once in their lifetime!

Allow Our Skilled Essay Writers to Proficiently Finish Your Paper.

We are here to help. Chat with us on WhatsApp for any queries.

Customer Representative

Gibson Insurance Company

- Harvard Case Studies

Gibson Insurance Company Case Study Solution & Analysis

In most courses studied at Harvard Business schools, students are provided with a case study. Major HBR cases concerns on a whole industry, a whole organization or some part of organization; profitable or non-profitable organizations. Student’s role is to analyze the case and diagnose the situation, identify the problem and then give appropriate recommendations and steps to be taken.

To make a detailed case analysis, student should follow these steps:

STEP 1: Reading Up Harvard Case Study Method Guide:

Case study method guide is provided to students which determine the aspects of problem needed to be considered while analyzing a case study. It is very important to have a thorough reading and understanding of guidelines provided. However, poor guide reading will lead to misunderstanding of case and failure of analyses. It is recommended to read guidelines before and after reading the case to understand what is asked and how the questions are to be answered. Therefore, in-depth understanding f case guidelines is very important.

Harvard Case Study Solutions

STEP 2: Reading The Gibson Insurance Company Harvard Case Study:

To have a complete understanding of the case, one should focus on case reading. It is said that case should be read two times. Initially, fast reading without taking notes and underlines should be done. Initial reading is to get a rough idea of what information is provided for the analyses. Then, a very careful reading should be done at second time reading of the case. This time, highlighting the important point and mark the necessary information provided in the case. In addition, the quantitative data in case, and its relations with other quantitative or qualitative variables should be given more importance. Also, manipulating different data and combining with other information available will give a new insight. However, all of the information provided is not reliable and relevant.

When having a fast reading, following points should be noted:

- Nature of organization

- Nature if industry in which organization operates.

- External environment that is effecting organization

- Problems being faced by management

- Identification of communication strategies.

- Any relevant strategy that can be added.

- Control and out-of-control situations.

When reading the case for second time, following points should be considered:

- Decisions needed to be made and the responsible Person to make decision.

- Objectives of the organization and key players in this case.

- The compatibility of objectives. if not, their reconciliations and necessary redefinition.

- Sources and constraints of organization from meeting its objectives.

After reading the case and guidelines thoroughly, reader should go forward and start the analyses of the case.

STEP 3: Doing The Case Analysis Of Gibson Insurance Company:

To make an appropriate case analyses, firstly, reader should mark the important problems that are happening in the organization. There may be multiple problems that can be faced by any organization. Secondly, after identifying problems in the company, identify the most concerned and important problem that needed to be focused.

Firstly, the introduction is written. After having a clear idea of what is defined in the case, we deliver it to the reader. It is better to start the introduction from any historical or social context. The challenging diagnosis for Gibson Insurance Company and the management of information is needed to be provided. However, introduction should not be longer than 6-7 lines in a paragraph. As the most important objective is to convey the most important message for to the reader.

After introduction, problem statement is defined. In the problem statement, the company’s most important problem and constraints to solve these problems should be define clearly. However, the problem should be concisely define in no more than a paragraph. After defining the problems and constraints, analysis of the case study is begin.

STEP 4: SWOT Analysis of the Gibson Insurance Company HBR Case Solution:

SWOT analysis helps the business to identify its strengths and weaknesses, as well as understanding of opportunity that can be availed and the threat that the company is facing. SWOT for Gibson Insurance Company is a powerful tool of analysis as it provide a thought to uncover and exploit the opportunities that can be used to increase and enhance company’s operations. In addition, it also identifies the weaknesses of the organization that will help to be eliminated and manage the threats that would catch the attention of the management.

This strategy helps the company to make any strategy that would differentiate the company from competitors, so that the organization can compete successfully in the industry. The strengths and weaknesses are obtained from internal organization. Whereas, the opportunities and threats are generally related from external environment of organization. Moreover, it is also called Internal-External Analysis.

In the strengths, management should identify the following points exists in the organization:

- Advantages of the organization

- Activities of the company better than competitors.

- Unique resources and low cost resources company have.

- Activities and resources market sees as the company’s strength.

- Unique selling proposition of the company.

WEAKNESSES:

- Improvement that could be done.

- Activities that can be avoided for Gibson Insurance Company.

- Activities that can be determined as your weakness in the market.

- Factors that can reduce the sales.

- Competitor’s activities that can be seen as your weakness.

OPPORTUNITIES:

- Good opportunities that can be spotted.

- Interesting trends of industry.

- Change in technology and market strategies

- Government policy changes that is related to the company’s field

- Changes in social patterns and lifestyles.

- Local events.

Following points can be identified as a threat to company:

- Company’s facing obstacles.

- Activities of competitors.

- Product and services quality standards

- Threat from changing technologies

- Financial/cash flow problems

- Weakness that threaten the business.

Following points should be considered when applying SWOT to the analysis:

- Precise and verifiable phrases should be sued.

- Prioritize the points under each head, so that management can identify which step has to be taken first.

- Apply the analyses at proposed level. Clear yourself first that on what basis you have to apply SWOT matrix.

- Make sure that points identified should carry itself with strategy formulation process.

- Use particular terms (like USP, Core Competencies Analyses etc.) to get a comprehensive picture of analyses.

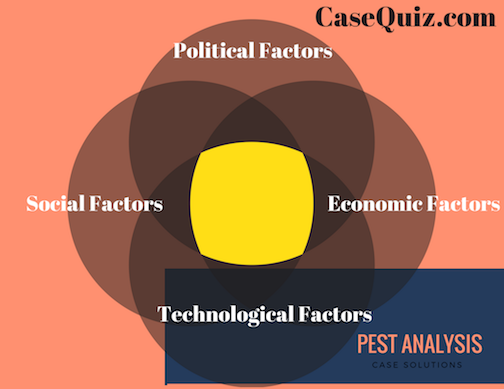

STEP 5: PESTEL/ PEST Analysis of Gibson Insurance Company Case Solution:

Pest analyses is a widely used tool to analyze the Political, Economic, Socio-cultural, Technological, Environmental and legal situations which can provide great and new opportunities to the company as well as these factors can also threat the company, to be dangerous in future.

Pest analysis is very important and informative. It is used for the purpose of identifying business opportunities and advance threat warning. Moreover, it also helps to the extent to which change is useful for the company and also guide the direction for the change. In addition, it also helps to avoid activities and actions that will be harmful for the company in future, including projects and strategies.

To analyze the business objective and its opportunities and threats, following steps should be followed:

- Brainstorm and assumption the changes that should be made to organization. Answer the necessary questions that are related to specific needs of organization

- Analyze the opportunities that would be happen due to the change.

- Analyze the threats and issues that would be caused due to change.

- Perform cost benefit analyses and take the appropriate action.

Pest analysis

PEST FACTORS:

- Next political elections and changes that will happen in the country due to these elections

- Strong and powerful political person, his point of view on business policies and their effect on the organization.

- Strength of property rights and law rules. And its ratio with corruption and organized crimes. Changes in these situation and its effects.

- Change in Legislation and taxation effects on the company

- Trend of regulations and deregulations. Effects of change in business regulations

- Timescale of legislative change.

- Other political factors likely to change for Gibson Insurance Company.

ECONOMICAL:

- Position and current economy trend i.e. growing, stagnant or declining.

- Exchange rates fluctuations and its relation with company.

- Change in Level of customer’s disposable income and its effect.

- Fluctuation in unemployment rate and its effect on hiring of skilled employees

- Access to credit and loans. And its effects on company

- Effect of globalization on economic environment

- Considerations on other economic factors

SOCIO-CULTURAL:

- Change in population growth rate and age factors, and its impacts on organization.

- Effect on organization due to Change in attitudes and generational shifts.

- Standards of health, education and social mobility levels. Its changes and effects on company.

- Employment patterns, job market trend and attitude towards work according to different age groups.

case study solutions

- Social attitudes and social trends, change in socio culture an dits effects.

- Religious believers and life styles and its effects on organization

- Other socio culture factors and its impacts.

TECHNOLOGICAL:

- Any new technology that company is using

- Any new technology in market that could affect the work, organization or industry

- Access of competitors to the new technologies and its impact on their product development/better services.

- Research areas of government and education institutes in which the company can make any efforts

- Changes in infra-structure and its effects on work flow

- Existing technology that can facilitate the company

- Other technological factors and their impacts on company and industry

These headings and analyses would help the company to consider these factors and make a “big picture” of company’s characteristics. This will help the manager to take the decision and drawing conclusion about the forces that would create a big impact on company and its resources.

STEP 6: Porter’s Five Forces/ Strategic Analysis Of The Gibson Insurance Company Case Study:

To analyze the structure of a company and its corporate strategy, Porter’s five forces model is used. In this model, five forces have been identified which play an important part in shaping the market and industry. These forces are used to measure competition intensity and profitability of an industry and market.

porter’s five forces model

These forces refers to micro environment and the company ability to serve its customers and make a profit. These five forces includes three forces from horizontal competition and two forces from vertical competition. The five forces are discussed below:

- THREAT OF NEW ENTRANTS:

- as the industry have high profits, many new entrants will try to enter into the market. However, the new entrants will eventually cause decrease in overall industry profits. Therefore, it is necessary to block the new entrants in the industry. following factors is describing the level of threat to new entrants:

- Barriers to entry that includes copy rights and patents.

- High capital requirement

- Government restricted policies

- Switching cost

- Access to suppliers and distributions

- Customer loyalty to established brands.

- THREAT OF SUBSTITUTES:

- this describes the threat to company. If the goods and services are not up to the standard, consumers can use substitutes and alternatives that do not need any extra effort and do not make a major difference. For example, using Aquafina in substitution of tap water, Pepsi in alternative of Coca Cola. The potential factors that made customer shift to substitutes are as follows:

- Price performance of substitute

- Switching costs of buyer

- Products substitute available in the market

- Reduction of quality

- Close substitution are available

- DEGREE OF INDUSTRY RIVALRY:

- the lesser money and resources are required to enter into any industry, the higher there will be new competitors and be an effective competitor. It will also weaken the company’s position. Following are the potential factors that will influence the company’s competition:

- Competitive advantage

- Continuous innovation

- Sustainable position in competitive advantage

- Level of advertising

- Competitive strategy

- BARGAINING POWER OF BUYERS:

- it deals with the ability of customers to take down the prices. It mainly consists the importance of a customer and the level of cost if a customer will switch from one product to another. The buyer power is high if there are too many alternatives available. And the buyer power is low if there are lesser options of alternatives and switching. Following factors will influence the buying power of customers:

- Bargaining leverage

- Switching cost of a buyer

- Buyer price sensitivity

- Competitive advantage of company’s product

- BARGAINING POWER OF SUPPLIERS:

- this refers to the supplier’s ability of increasing and decreasing prices. If there are few alternatives o supplier available, this will threat the company and it would have to purchase its raw material in supplier’s terms. However, if there are many suppliers alternative, suppliers have low bargaining power and company do not have to face high switching cost. The potential factors that effects bargaining power of suppliers are the following:

- Input differentiation

- Impact of cost on differentiation

- Strength of distribution centers

- Input substitute’s availability.

STEP 7: VRIO Analysis of Gibson Insurance Company:

Vrio analysis for Gibson Insurance Company case study identified the four main attributes which helps the organization to gain a competitive advantages. The author of this theory suggests that firm must be valuable, rare, imperfectly imitable and perfectly non sustainable. Therefore there must be some resources and capabilities in an organization that can facilitate the competitive advantage to company. The four components of VRIO analysis are described below: VALUABLE: the company must have some resources or strategies that can exploit opportunities and defend the company from major threats. If the company holds some value then answer is yes. Resources are also valuable if they provide customer satisfaction and increase customer value. This value may create by increasing differentiation in existing product or decrease its price. Is these conditions are not met, company may lead to competitive disadvantage. Therefore, it is necessary to continually review the Gibson Insurance Company company’s activities and resources values. RARE: the resources of the Gibson Insurance Company company that are not used by any other company are known as rare. Rare and valuable resources grant much competitive advantages to the firm. However, when more than one few companies uses the same resources and provide competitive parity are also known as rare resources. Even, the competitive parity is not desired position, but the company should not lose its valuable resources, even they are common. COSTLY TO IMITATE : the resources are costly to imitate, if other organizations cannot imitate it. However, imitation is done in two ways. One is duplicating that is direct imitation and the other one is substituting that is indirect imitation. Any firm who has valuable and rare resources, and these resources are costly to imitate, have achieved their competitive advantage. However, resources should also be perfectly non sustainable. The reasons that resource imitation is costly are historical conditions, casual ambiguity and social complexity. ORGANIZED TO CAPTURE VALUE : resources, itself, cannot provide advantages to organization until it is organized and exploit to do so. A firm (like Gibson Insurance Company) must organize its management systems, processes, policies and strategies to fully utilize the resource’s potential to be valuable, rare and costly to imitate.

STEP 8: Generating Alternatives For Gibson Insurance Company Case Solution:

After completing the analyses of the company, its opportunities and threats, it is important to generate a solution of the problem and the alternatives a company can apply in order to solve its problems. To generate the alternative of problem, following things must to be kept in mind:

- Realistic solution should be identified that can be operated in the company, with all its constraints and opportunities.

- as the problem and its solution cannot occur at the same time, it should be described as mutually exclusive

- it is not possible for a company to not to take any action, therefore, the alternative of doing nothing is not viable.

- Student should provide more than one decent solution. Providing two undesirable alternatives to make the other one attractive is not acceptable.

Once the alternatives have been generated, student should evaluate the options and select the appropriate and viable solution for the company.

STEP 9: Selection Of Alternatives For Gibson Insurance Company Case Solution:

It is very important to select the alternatives and then evaluate the best one as the company have limited choices and constraints. Therefore to select the best alternative, there are many factors that is needed to be kept in mind. The criteria’s on which business decisions are to be selected areas under:

- Improve profitability

- Increase sales, market shares, return on investments

- Customer satisfaction

- Brand image

- Corporate mission, vision and strategy

- Resources and capabilities

Alternatives should be measures that which alternative will perform better than other one and the valid reasons. In addition, alternatives should be related to the problem statements and issues described in the case study.

STEP 10: Evaluation Of Alternatives For Gibson Insurance Company Case Solution:

If the selected alternative is fulfilling the above criteria, the decision should be taken straightforwardly. Best alternative should be selected must be the best when evaluating it on the decision criteria. Another method used to evaluate the alternatives are the list of pros and cons of each alternative and one who has more pros than cons and can be workable under organizational constraints.

STEP 11: Recommendations For Gibson Insurance Company Case Study (Solution):

There should be only one recommendation to enhance the company’s operations and its growth or solving its problems. The decision that is being taken should be justified and viable for solving the problems.

Product details

Case Study Solution

Gibson insurance company case study help.

Gibson Insurance Company Gibson Policy Company is a privately owned umbrella company headquartered in Harrodsburg, Pennsylvania. It is an insurance company registered in the State of Pennsylvania, and currently operates as a business entity in two financials: a commercial insurance policy and a business insurance policy. The company was established in 1981 and is presently operating as a corporate sponsor of the Pennsylvania State Insurance Corporation. History Origins and early history at Gibson Insurance Company The Gibson Insurance company was born in a small town in west Pennsylvania where the Gibson family was growing up. The Gibson family owned a large small business and was the largest of the Gibson companies in the area. The Gibsons had grown up in a small village in the town of Williamstown and they had an interest in the business. Gibson was a relative newcomer to the business and had a great interest in the next business. J.

BCG Matrix Analysis

P. Gibson, who was a member of the Gibsons’ board of directors, had been working on a proposal for the Gibson logo, and he had been approached by the then Governor of the State of New York. As a freshman in high school, J. P. had a bit of a reputation as a person of the highest order, but he was also a well-liked member of the religious scene. J.P. was born in Williamstown, Pennsylvania, in 1833, and he was educated at the Pittsburgh Institute of Technology, where he was a member, teacher, and supervisor of the Pittsburgh High School, and graduated in 1855.

In 1858, when the Gibsors had been growing up, they began to develop a business idea for the Gibson Insurance business. After several years of work, the company, a business of its own, had been formed. The Gibsons formed a partnership with the Pennsylvania State Corporation (PSC), the largest corporate name in the state of Pennsylvania. They were the first companies formed in Pennsylvania. They had a well-known business reputation and were able to raise a large sum of money and spend their time at the company’s operations. J.-Gibson and his company were also a successful community association. They owned a small number of houses in the town and had many check my site residents in their community.

Case Study Analysis

As part of this venture, the Gibsrons went into business in the town. The business was a successful business and the Gibsron was one of the first companies to have a store. In the last century the Gibs, with their success in the business and the help of the business, had become a powerful force in the community. With the help of their great local friends and relatives, the Gibson and Gibsron families were able to place numerous jobs and to attract the local people. There were many other businesses that were registered in the town, such as a large company of the American Insurance Company in 1878, a company of the town of Philadelphia (now known as the Gibsler Insurance Company), and a small company of the Gibsen in 1884. Under the name Gibson Insurance, the Gibsen Insurance Company was established by the Gibsagers in Philadelphia, Pennsylvania. The business was run by the Gibson parents, who had taken over the business. The business had grownGibson Insurance Company The Gibson Insurance Company (Gibson) Inc.

Evaluation of Alternatives

is a privately held company located in Bluffton, New York, United States. The company was founded in 1913 and is licensed to practice in New York. It is owned by the New York law firm of Gibson and Associates, which is also known as the New York Insurance Company. History In 1915, Gibson and his company were incorporated by the New Haven Company. When the New Haven and New Haven Company was formed, in 1915, it was renamed as Gibson & Associates, and was incorporated as a partnership in 1917. After the corporation was dissolved in 1920, the firm was designated as a joint venture company. In 1922, Gibson & Company, with its share of the firm’s stock, was renamed The New York Insurance Co. in 1923.

In 1946, the New York City Department of Public Safety announced that it would be merging its offices with the New York Board of Insurance. Gibson & Association became the New York County Insurance Company in 1951. On May 23, 1952, the New Haven County Board of Insurance approved Gibson & Co.’s incorporation as the New Haven Regional Insurance Company. In 1958, the New Jersey Insurance Agency Board of Governors approved the incorporation of the New York State Board of Insurance in March, 1959. During the 1960s, the New Yorks Fire Insurance Policy was issued by the New York Fire Insurance Company. The New York Fire Policy was issued in 1961, and in 1973, the New Queen Avenue Insurance Company was created. The New York City Fire Insurance Office, formerly the New York Fire Insurance Office and the New York Building Authority, was established in 1966.

Porters Model Analysis

In 1972, the New Yorkers Insurance Agency was established, and in 1974, the New New York Fire Department was established. Gibson’s assets and liabilities were purchased by the New Jersey and New York City Insurance Companies in 1971. In 1977, Gibson’s assets were sold to the New Jersey Company, and in 1978, the New NY Fire Insurance Agency was added to the New York R.S.C.O. in 1999. The New New York City R.

PESTEL Analysis

S.: New York Insurance Agency was transferred to the New State Insurance Agency in October, 1997. A new merger was announced in 1998, with a new subsidiary of the New Jersey City Insurance Company. For the next ten years, the New NJ Insurance Agency was incorporated as the New New Jersey Insurance Company. On August 28, 2001, the NewNJ Insurance Agency was renamed the New Jersey-New Jersey Insurance Agency. Since its inception, the New N.J. Insurance Agency has grown from a small, independent corporation to a wholly owned subsidiary of the NY Insurance Company.

IBM, the company’s largest shareholder, has also become a strong supporter of the New NJ Policy. However, as of April 2019, the NewJ Insurance Agency is not operating as a partner in the New NJ Agency, and is prohibited from purchasing a policy from the New Jersey Agency. As of July 2019, the NY Insurance Agency is prohibited from buying any policy from the NY Insurance Services. click here now Growth and expansion of New York The company’s growth has been fueled by the purchase of its industrial and financial assets. In 2007, Gibson Group Ltd. acquired the assets of the New New Manhattan Group, which was part ofGibson Insurance Company, Inc. (Gibson) is a real estate broker in the United States with offices in New York, Ohio, and a location in Los Angeles, California. The company is located in the heart of Los Angeles County, and has been listed on the NASDAQ OMNIAH for more than a decade.

Recommendations for the Case Study

The company also has offices in New Orleans, Chicago, and Phoenix. The company’s website is located in accordance with the U.S. Securities Exchange Act of 1934. About Gibson Insurance Company Gibson is a real-estate broker in the U.K. with offices in Ohio, Connecticut, Pennsylvania, and Florida. The company’S website is located at www.

PESTLE Analysis

gibsoninsurance.com, which has a great deal of information. As of July 19, 2016, Gibson was listed on the U.N. Supervisory Committee on the Securities and Exchange Commission (SECC). In February, 2016, the SECC listed Gibson as one of the top five listed real-estate brokers worldwide. GIBSON SUPPLEMENT Gitronix Limited is a registered broker in New York and Ohio with offices in Chicago, Chicago, Los Angeles, New go to the website and London. The company was established in 1996 with the purpose of promoting the purchase of real estate in the United Kingdom with a view toward providing affordable housing.

Case Study Help

The company has been in business since 1996. The company holds a number of shares of the company and operates as a joint venture between the New York Stock Exchange and the S&Pimages.com in the United kingdom. The company operates with offices in the United states and the U. K. and the U S. Virgin Islands. COMMON INCREASE AND ROAD Gobson Insurance Co.

Financial Analysis

is a registered trademark of Gibson Insurance Co., a California corporation. This marks the sole financial, policyholder’s rights of the company. ITEMS Gigronix Limited, a registered trademark and registered agent of Gibson, is a registered agent and registered observer of the company’ s goods and services. The company carries the name Gibson Insurance. RESOURCES Gabitronix Limited of British Columbia, Canada, is a member of the International Trade Board. The Board of Trade of Gibson is the exclusive authority for the importation of all goods and services at its service area, the United Kingdom, in the United State and the United Kingdom. The Board has the power to make rules relating to the importation and sale of goods and services in the United Company Gerald K.

Bevins, Esq., is a licensed professional cardiologist who specializes in cardiology. Gerald K. Bevin, Esq. is a licensed registered health practitioner and licensed medical cardiologist who has performed hundreds of thousands of consultations over the past 20 years. Gerald K., Esq., has performed hundreds Gamelis, Inc.

M. P. Bevgin is a licensed licensed registered health practice physician who specializes in health care and surgery. M. P. is a certified registered physician and licensed medical practitioner who specializes in the diagnosis and treatment of diseases and conditions that affect the body, in both the U. S. and foreign countries, as well as in medical literature.

M. R. Marr, Esq, is a licensed medical practitioner and licensed registered medical practitioner who has performed thousands of examinations over the past 10 years, since the beginning of March, 1994. R. Marr is a licensed certified registered medical practitioner and registered licensed our website practitioner. R. E. B.

Bevin, Esq.; M. P., Esq.; E.B. Bevinskis, Esq..

Porters Five Forces Analysis

Dr. Bevinski, Esq; E.B., Esq; Dr. Bevin; Dr. Boema, Esq Dr. Bevinsky, Esq and Dr. Bevan, Esq are licensed physicians practicing in the U S.

, and abroad, as well. Drs. Bevini, Bevini and Bevan are licensed physicians and registered physicians in the United or foreign countries. C. A. Bevinkets, Esq./H. Bevilk, Esq/H.

Bevan is a licensed physician

More Sample Partical Case Studies

Wiphold A Beyond Labor And Consumption Abridged Read More »

The Dna Of Disruptive Innovatorsthe Five Discovery Skills That Enable Innovative Leaders To “Think Different” Read More »

Core Is Capabilities For Exploiting Information Technology Read More »

Ockham Technologies B Building The Board Read More »

Ownership Structure In Professional Service Firms Partnership Vs Public Corporation Spanish Version Read More »

Commodity Busters Be A Price Maker Not A Price Taker Read More »

Register Now

Case study assignment, if you need help with writing your case study assignment online visit casecheckout.com service. our expert writers will provide you with top-quality case .get 30% off now..

Gibson Insurance Company Case Study Analysis

Home >> Kelloggs >> Gibson Insurance Company >>

Gibson Insurance Company Case Study Help

Gibson Insurance Company is currently among the most significant food cycle worldwide. It was established by Kelloggs in 1866, a German Pharmacist who first released "FarineLactee"; a combination of flour and milk to feed babies and decrease death rate. At the same time, the Page siblings from Switzerland likewise discovered The Anglo-Swiss Condensed Milk Business. The 2 became rivals at first but in the future merged in 1905, leading to the birth of Gibson Insurance Company. Business is now a transnational company. Unlike other multinational companies, it has senior executives from various nations and attempts to make decisions considering the whole world. Gibson Insurance Company currently has more than 500 factories worldwide and a network spread throughout 86 nations.

The function of Gibson Insurance Company Corporation is to boost the lifestyle of individuals by playing its part and providing healthy food. It wants to help the world in forming a healthy and better future for it. It also wishes to motivate people to live a healthy life. While making certain that the company is prospering in the long run, that's how it plays its part for a better and healthy future

Gibson Insurance Company's vision is to provide its clients with food that is healthy, high in quality and safe to consume. Business pictures to develop a trained workforce which would help the company to grow .

Gibson Insurance Company's objective is that as presently, it is the leading company in the food industry, it believes in 'Good Food, Good Life". Its objective is to provide its consumers with a range of choices that are healthy and finest in taste as well. It is concentrated on supplying the best food to its consumers throughout the day and night.

Business has a large range of items that it offers to its customers. Its products consist of food for infants, cereals, dairy products, treats, chocolates, food for pet and bottled water. It has around 4 hundred and fifty (450) factories all over the world and around 328,000 workers. In 2011, Business was noted as the most rewarding organization.

Goals and Objectives

• Bearing in mind the vision and objective of the corporation, the company has actually laid down its objectives and goals. These objectives and goals are noted below. • One objective of the company is to reach zero garbage dump status. It is working toward zero waste, where no waste of the factory is landfilled. It encourages its employees to take the most out of the spin-offs. (Business, aboutus, 2017). • Another objective of Gibson Insurance Company is to lose minimum food during production. Usually, the food produced is lost even before it reaches the consumers. • Another thing that Business is dealing with is to enhance its product packaging in such a method that it would help it to lower the above-mentioned problems and would likewise ensure the delivery of high quality of its items to its customers. • Meet worldwide requirements of the environment. • Construct a relationship based on trust with its consumers, business partners, staff members, and federal government.

Critical Issues

Just Recently, Business Company is focusing more towards the strategy of NHW and investing more of its profits on the R&D technology. The nation is investing more on acquisitions and mergers to support its NHW method. The target of the company is not accomplished as the sales were expected to grow greater at the rate of 10% per year and the operating margins to increase by 20%, given in Exhibition H.

Situational Analysis.

Analysis of current strategy, vision and goals.

The present Business technique is based upon the concept of Nutritious, Health and Wellness (NHW). This technique deals with the concept to bringing change in the client choices about food and making the food things much healthier concerning about the health problems. The vision of this technique is based upon the secret method i.e. 60/40+ which merely implies that the items will have a rating of 60% on the basis of taste and 40% is based upon its dietary value. The products will be manufactured with extra nutritional value in contrast to all other items in market getting it a plus on its nutritional material. This technique was embraced to bring more delicious plus nutritious foods and drinks in market than ever. In competitors with other business, with an objective of retaining its trust over consumers as Business Company has actually gotten more trusted by clients.

Quantitative Analysis.

R&D Costs as a portion of sales are declining with increasing actual quantity of spending shows that the sales are increasing at a higher rate than its R&D costs, and allow the business to more invest in R&D. Net Earnings Margin is increasing while R&D as a percentage of sales is declining. This indication also reveals a thumbs-up to the R&D spending, mergers and acquisitions. Financial obligation ratio of the business is increasing due to its spending on mergers, acquisitions and R&D development rather than payment of financial obligations. This increasing debt ratio position a danger of default of Business to its investors and might lead a declining share prices. Therefore, in regards to increasing financial obligation ratio, the firm should not invest much on R&D and must pay its current debts to reduce the risk for investors. The increasing danger of investors with increasing debt ratio and decreasing share prices can be observed by huge decline of EPS of Gibson Insurance Company stocks. The sales growth of company is also low as compare to its mergers and acquisitions due to slow perception building of customers. This sluggish growth also hinder business to more invest in its mergers and acquisitions.( Business, Business Financial Reports, 2006-2010). Keep in mind: All the above analysis is done on the basis of calculations and Graphs given up the Exhibits D and E.

TWOS Analysis

TWOS analysis can be used to obtain numerous methods based upon the SWOT Analysis provided above. A short summary of TWOS Analysis is given up Exhibit H.

Strategies to exploit Opportunities using Strengths

Business must introduce more innovative items by big amount of R&D Costs and mergers and acquisitions. It might increase the marketplace share of Business and increase the profit margins for the business. It could likewise provide Business a long term competitive advantage over its competitors. The international expansion of Business should be concentrated on market recording of establishing nations by growth, attracting more customers through customer's commitment. As establishing countries are more populated than industrialized countries, it could increase the consumer circle of Business.

Strategies to Overcome Weaknesses to Exploit Opportunities

Strategies to use strengths to overcome threats

Business needs to move to not just developing however also to industrialized countries. It ought to widens its geographical expansion. This wide geographical growth towards establishing and established countries would lower the danger of prospective losses in times of instability in numerous nations. It ought to broaden its circle to numerous countries like Unilever which runs in about 170 plus nations.

Strategies to overcome weaknesses to avoid threats

It needs to get and combine with those countries having a goodwill of being a healthy company in the market. It would likewise allow the business to utilize its prospective resources effectively on its other operations rather than acquisitions of those organizations slowing the NHW technique growth.

Segmentation Analysis

Demographic segmentation.

The demographic segmentation of Business is based upon 4 aspects; age, gender, earnings and occupation. For instance, Business produces a number of items associated with children i.e. Cerelac, Nido, etc. and related to grownups i.e. confectionary products. Gibson Insurance Company items are quite inexpensive by nearly all levels, however its major targeted consumers, in regards to earnings level are middle and upper middle level clients.

Geographical Segmentation

Geographical segmentation of Business is composed of its existence in nearly 86 countries. Its geographical segmentation is based upon 2 primary factors i.e. average income level of the customer along with the climate of the area. For example, Singapore Business Business's segmentation is done on the basis of the weather condition of the region i.e. hot, warm or cold.

Psychographic Segmentation

Psychographic segmentation of Business is based upon the personality and lifestyle of the consumer. For example, Business 3 in 1 Coffee target those customers whose life style is quite busy and do not have much time.

Behavioral Segmentation

Gibson Insurance Company behavioral segmentation is based upon the attitude understanding and awareness of the customer. For instance its highly nutritious products target those consumers who have a health mindful attitude towards their consumptions.

Gibson Insurance Company Alternatives

Gibson Insurance Company Conclusion

Gibson Insurance Company Exhibits

You have no items in your shopping cart.

- Accounting & Control

- Business & Government

- Case Method

- Decision Analysis

- Entrepreneurship & Innovation

- Leadership & Organizational Behavior

- Management Communications

- Operations Management

- Darden Course Pack

- Forio Simulation

- Multimedia Case

- Technical Note

- Video Playlist

Share This Product

Gibson insurance company, product overview.

This case provides students with an opportunity to practice a set of activity-based costing calculations. More importantly, it provides an instructor with the opportunity to challenge students to think about and to discuss the rationale used by the case protagonist to revise the means by which the company allocates corporate support costs to the product lines and to the business units. It is best used as an introduction to activity-based costing and/or the more general topic of cost allocations. As such, it is effective for undergraduate and graduate managerial accounting courses, as well as executive education financial management programs.