- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Technical Skills

- Accounting Articles

Financial Statements Examples – Amazon Case Study

Financial Statements are informational records detailing a company’s business activities over a period.

Austin has been working with Ernst & Young for over four years, starting as a senior consultant before being promoted to a manager. At EY, he focuses on strategy, process and operations improvement, and business transformation consulting services focused on health provider, payer, and public health organizations. Austin specializes in the health industry but supports clients across multiple industries.

Austin has a Bachelor of Science in Engineering and a Masters of Business Administration in Strategy, Management and Organization, both from the University of Michigan.

- What Are Financial Statements?

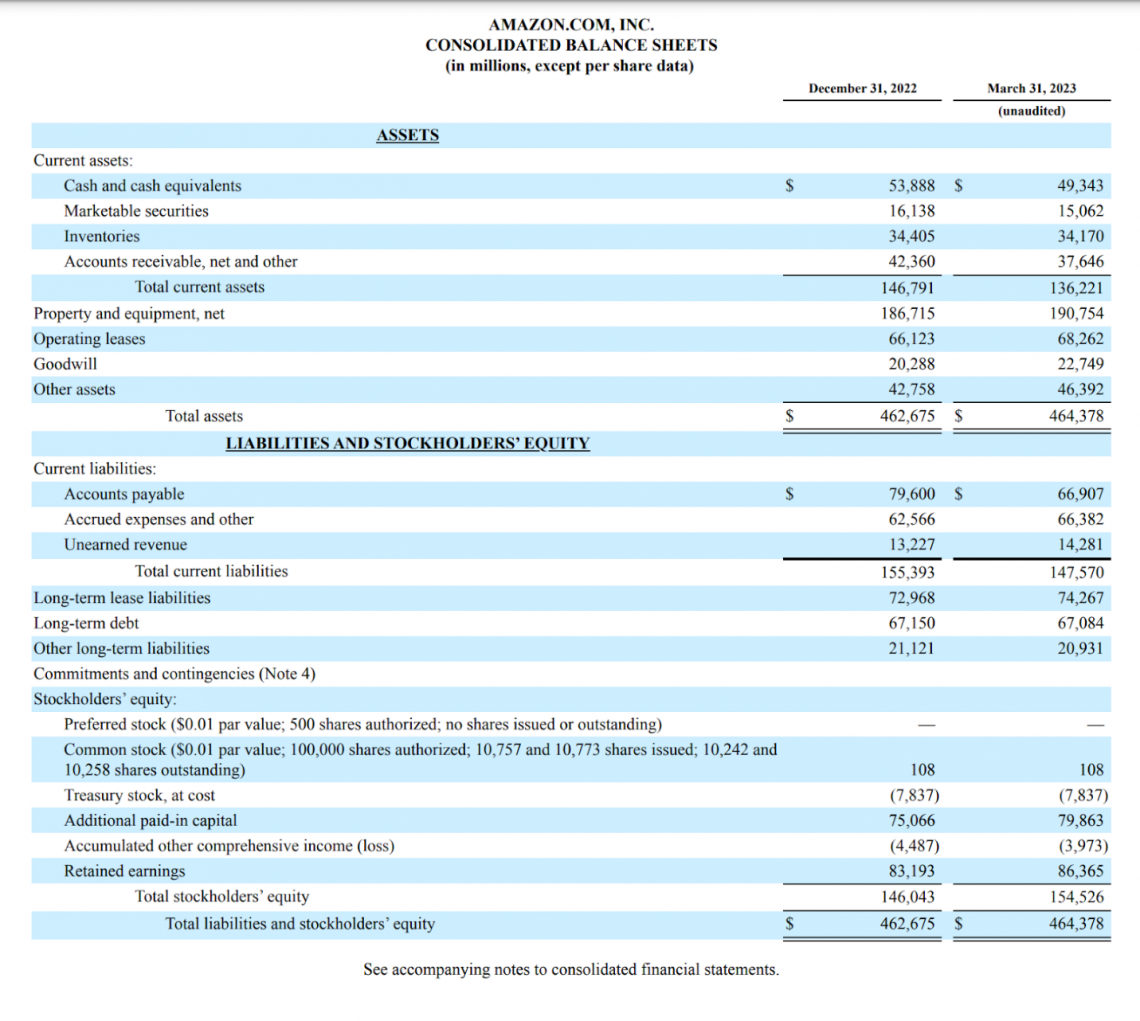

Amazon’s Balance Sheet

Amazon’s income statement, amazon’s cash flow statement, usage of financial statements, amazon case study faqs, what are financial statements.

Investors need financial statements to gain a full understanding of how a company operates in relation to competitors. In the case of Amazon , profitability metrics used to analyze most businesses cannot be used to compare the company to businesses in the same sector.

Amazon remains low in profitability continuously to reinvest in growing operations and new business opportunities. Instead, investors can point to the metrics signified in Amazon’s cash flow statement to demonstrate growth in revenue generation over the long term.

There are three main types of financial statements, all of which provide a current or potential investor with a different viewpoint of a company’s financials. These include the following below.

Balance Sheet

The balance sheet represents a company’s total assets, liabilities, and shareholder ’s equity at a certain time.

Assets are all items owned by a company with tangible or intangible value, while liabilities are all debts a company must repay in the future.

Shareholders' equity is simply calculated by subtracting total assets from total liabilities. This represents the book value of a business.

Income Statement

The income statement represents a company’s total generated income minus expenses over a specified range of time. This can be 3 months in a quarterly report or a year in an annual report .

Revenue includes the total money a company makes over a set time.

This includes operating revenue from business activities and non-operating revenue, such as interest from a company bank account.

Expenses include the total amount of money spent by a company over time. These can be grouped into two separate categories, Primary expenses occur from generating revenue, and secondary expenses appear from debt financing and selling off held assets.

Cash Flow Statement

The cash flow statement represents a company’s total cash inflows and outflows over a specified time range, similar to the income statement. Cash in a business can come from operating, investing, or financing activities.

Operating activities are events in which the business produces or spends money to sell its products or services. This would be income from the sales of goods or services or interest payments and expenses such as wages and rent payments for company facilities.

Investing activities include selling or purchasing assets, which can include investing in business equipment or purchasing short-term securities. Financing activities include the payment of loans and the issuance of dividends or stock repurchases.

Key Takeaways

- Financial statements have information relevant for investors to understand the operations and profitability of a business over a specified time.

- Fundamental analysis typically focuses on the main three financial statements: the balance sheet, income statement, and cash flow statement.

- Although analyzing business financials can provide an unaltered outlook into the operations of a business, the numbers don’t always demonstrate the full story, and investors should always conduct thorough due diligence beyond pure statistics.

- Investors must ensure all of a company's financial statements are analyzed before forming a thesis, as inconsistencies in one sheet may be caused by an unusual one-time expense or dictated by a global measure out of the company’s control (ex., COVID-19).

Now that we have a general understanding of the financial statements, we can begin to take a look at Amazon’s most recent quarterly filing.

Company filings can be found by using EDGAR (database of regulatory filings for investors by the SEC) or from Amazon’s investor relations website.

Before we begin analyzing this sheet, it is important to take note of the statement just below the title, indicating that the data is being displayed in millions.

This can throw off newcomers, who may be very confused upon seeing Amazon’s revenue is $53,888. Amazon’s quarterly revenue is indeed $53.8 billion as calculated in millions.

When looking at Amazon’s assets, it is important to note the difference between current and total assets. Current assets are categorized separately due to the expectation that they can be converted to cash within the fiscal year.

Current assets can be used in the current ratio to analyze Amazon’s ability to pay off its short-term obligations. The current ratio formula is:

Current Ratio = Current Assets / Current Liabilities

Amazon’s current ratio sits at 0.92, which is below the e-commerce industry average of 2.09 as of March 2023 (Source: Macrotrends ).

This could mean that Amazon is potentially overvalued compared to competitors, but this is only one metric and should ultimately be all of an investment decision, especially considering the capital-intensive nature of Amazon’s business model.

It is also important to understand all of the vocabulary used to detail items in Amazon’s balance sheet. Some of the major items’ definitions can be found below:

Assets are classified as follows.

- Cash and cash equivalents: Assets of high liquidity, such as certificates of deposit or treasury bonds.

- Marketable securities: Liquid securities can be sold in the public market, such as stock in another company or corporate bonds.

- Accounts receivable (A/R): Money owed to the company that has not been received yet, such as from items previously bought on credit.

- Inventories: Unsold finished or unfinished products from a company that has yet to be sold.

- Property and equipment (PP&E): Assets owned by a company that is used for business activities. It may include factory assets or other types of real estate.

- Operating leases: Assets rented by a business for operational purposes. Calculated as the net present value on the balance sheet.

- Goodwill: Calculates intangible assets that cannot be sold or directly measured, such as customer reputation and loyalty.

Liabilities are of the following types.

- Accounts payable (A/P): Obligations accrued through business activities that must be paid off shortly.

- Accrued expenses: Current liabilities for a business that must be paid in the next 12 months.

- Unearned revenue: This represents revenue earned by a business that has not yet received. Prevents profits from being overstated for a specific period.

- Long-term debt: Debts in which payments are required over 12 months.

- Lease liabilities: Payment obligations of a lease taken out by a company.

- Stockholders’ equity: Net worth of a business/asset value to shareholders.

- Retained earnings: Net profit remaining for a company after all liabilities are paid.

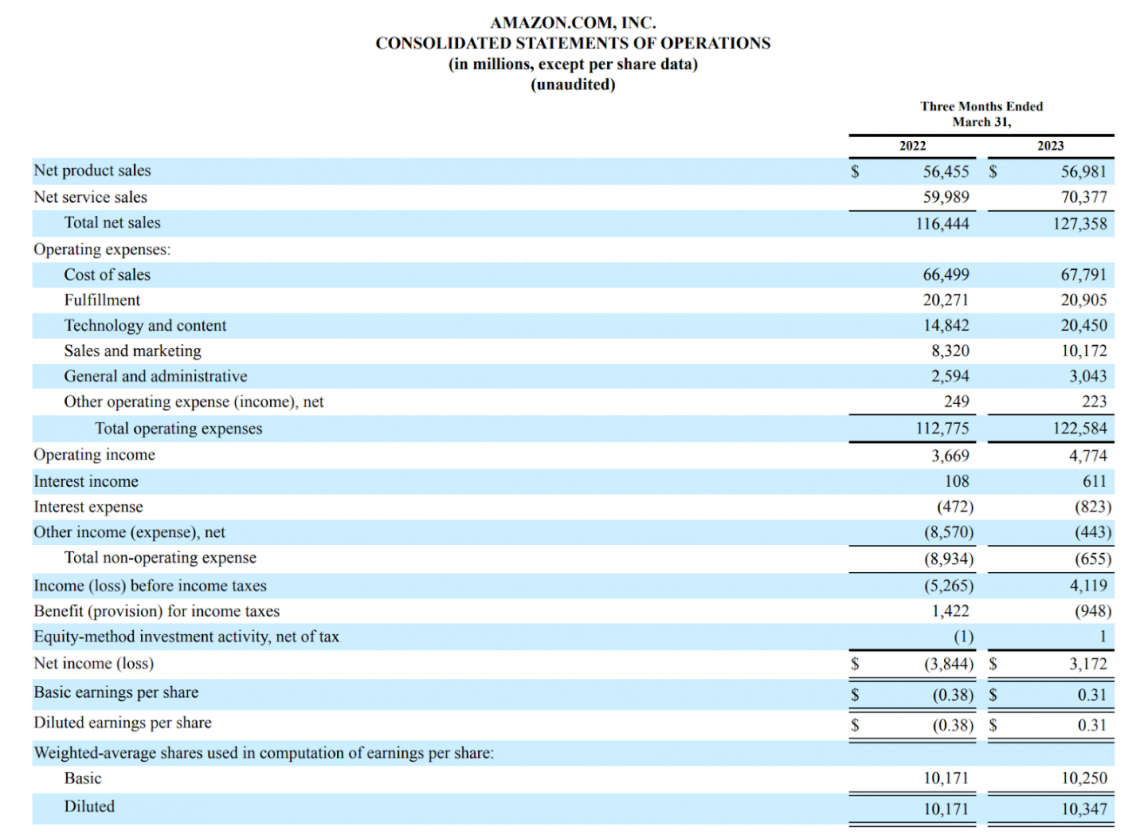

Amazon’s next statement in its quarterly filing is the income statement. The income statement is useful for comparing a company’s growth over time and matching it up against competitors in the same or different sectors.

An essential factor to note when looking at a company’s income statement is whether its revenue and net income are consistently growing year over year. Investors should also be aware of Wall Street expectations, as they can heavily influence the business’s share price.

Many important ratios are used when analyzing a company’s income statement. Some of the most notable ones include:

- EV/EBITDA = (Market Capitalization + Debt - Cash) / (Revenue - Cost of Goods Sold - Operating Expenses)

- Gross Margin = (Revenue - Cost of Goods Sold) / Revenue

- Operating Margin = Operating Income / Revenue

- Net Margin = Net Income / Revenue

- Return on Equity (ROE) = Net Income / Average Shareholder Equity (End Value + Beginning Value / 2)

- Earnings Per Share = Net Income / Shares Outstanding

Let’s use these ratios to conduct a comparables analysis between Amazon and eBay, a company at a much lower valuation relative to the e-commerce giant. Here are their ratios side-by-side, as of Amazon’s Q1 2023 and eBay’s Q1 2023 filings:

* = EV/EBITDA ratios sourced from finbox.com , March 2023 trailing twelve months (TTM)

Looking at these statistics on paper, it is clear to see that Amazon seems overvalued compared to eBay due to lower margins, negative earnings per share, and an EV/EBITDA multiple over three times as high as the business.

However, pure stats on an income statement cannot fully justify purchasing one company or another. The statement merely shows what a company is doing without a corporate spin.

One thing to note that is unique about Amazon’s business model is how the company invests huge amounts of capital into R&D and technology to expand its operations continuously.

Their numbers don’t account for the massive cash flows and growth opportunities that the business takes advantage of.

When conducting fundamental analysis, an investor must consider all aspects of a business beyond the financial statements, including comparing business models to competitors and setting benchmarks encompassing the overall sector.

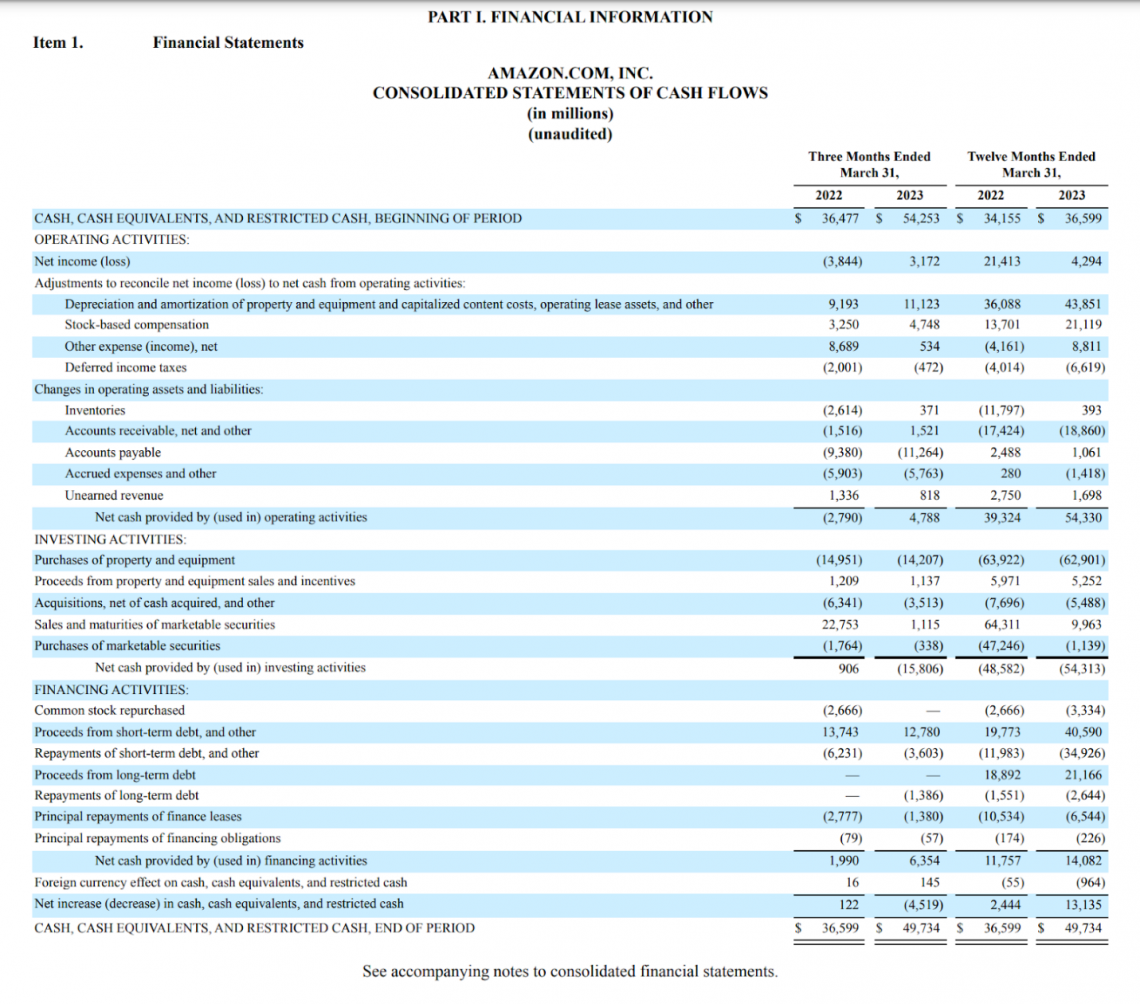

Amazon’s cash flow statement is where the company begins to shine compared to its competitors in the online commerce sector. The company has consistently increased cash flow from operating activities and constantly returns value to shareholders in the form of capital appreciation.

It is notable for focusing on what the company is doing inside of its cash flow statements to get a better picture of why its income or stock price is trending a certain way.

For example, an explosive drop in net income in an otherwise stable company could be due to mismanagement or hampered growth but is most likely due to M&A activity charged in a quarter that may be skewing the numbers. The cash flow statement clears this up.

Compared to 2022, Amazon has increased its annual cash from operating activities by over 38% from the previous year based on a 12-month rolling basis.

This increase has also resulted in an 11.7% increase in investment expenditures, which should allow Amazon to continue growing faster than similar companies.

In comparison, according to eBay’s most recent 10-K filing , the company generated an 82% growth in operating cash flow (OCF), however, this stat can be very misleading due to the company’s lack of investment in processes such as R&D and SG&A.

In 2022, the company reported $92M in investing activities, representing only 26% of operating cash flows. Amazon reported over $37.6B in investing activities representing approximately 88% of its OCF.

The income statement can misrepresent how well a company is doing, as while eBay has a higher net income, Amazon strategically reinvests its cash flows into R&D and other expenses to produce more over time continuously.

What makes the cash flow statement so essential to fundamental analysis is the fact that it is tough to manipulate its numbers through financial engineering or clever accounting.

The statement purely shows precisely where all of the money a company makes is being used. Many investors use the cash flow statement to tell the true financial health of a business, as profits can often not be indicative of a growth company's value.

The stock price of a company can easily be swayed by sentiment or the market cycle , and the income statement can be skewed through large one-time transactions or large amounts of financed revenue. The amount of money in the possession of a company is very hard to adjust.

Amazon currently has much better growth prospects than eBay and thus sells at a higher premium in the open market , but you wouldn’t understand why unless you took in the full picture of the company.

Everything You Need To Master Valuation Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

Financial statements are excellent tools to learn more about a business in terms of an overall market or sector of operation. Using financial statements to determine the current value of a business is essential for understanding a company’s stock price.

Along with the ratios mentioned, analysts often form their methodologies over time to focus on companies that are strong in specific financial circumstances.

Tools such as stock screeners can sort millions of companies by certain factors. For instance, some investors may seek defensive companies with consistent dividend growth over long periods, while others may seek growth companies with the most innovative new technology.

Investors should keep all of this information in mind, as well as pay attention to the reports of analysts with varied performance outlooks. It is essential to seek out the opinions of multiple sources before establishing an opinion on a business.

Looking at reports from analysts specializing in the industry can also ensure that your expectations are reasonable compared to industry experts.

If your thesis results in Amazon growing its revenues by 20% a year while analysts across the country are only expecting growth in the range of 5-7%, it could be a sign that you may have overlooked a key factor in your due diligence .

The overall goal of using financial statements is to fully understand the company you are investing in to justify a position. Although your views may slightly differ from experts, quality due diligence can result in somewhat varied outcomes based on an investor’s outlook for the future.

Using EBITDA instead of net income strips away the capital structure and taxation of a business to analyze the pure earnings potential of a business. This is more practical for investors to see the general trajectory of a company’s income over time.

For example, companies may decide on completing a merger or acquiring another company. This will require a company to report its current and acquired assets on its balance sheet .

Over time, these assets must be recorded as expenses through the use of depreciation, which is the process of deducting from gross revenue to account for the decreasing value of company plant assets.

If these assets increase in value over time, this could decrease revenues over time not due to company performance but because of increased prices for equipment outside of the company’s control.

Without looking at EBITDA, company financials may paint a completely different picture with the use of net income that may or may not be justified at all.

ROE is an important metric to distinguish how good a company is at generating profits with investor capital compared to its share price and competitors. It is yet another indicator used to analyze the trajectory of a business over time.

Using ROE can also demonstrate how much financing a company requires to generate its revenue and if investors are really getting a great return for the amount of money shareholders contribute.

A startup that has recently gone public on the stock exchange may have a very low to negative ROE compared to an established company. Still, the startup may have the margins and growth to justify its valuation .

Much like every financial ratio, ROE doesn’t demonstrate the entire story of a business, and the full picture of a business must be considered to decide on an equity investment.

To proliferate and take market share from competitors, Amazon undercuts prices on many products to decrease competition and remain the top player in the industry.

Amazon, like many other companies recently since the pandemic, has also faced significant increases in operating expenses , thus lowering operating and net margins in the short term. Once Amazon begins to slow expansion, these margins are expected to rise.

Amazon’s net income is very low for many of the same reasons. The company is profitable yet is constantly reinvesting into new businesses and products to further grow cash flows for future expenditures.

Amazon investors are not focused on income but rather on its ability to continuously grow in the long term. Growth companies like Amazon do not issue dividends because they believe that the money is better reinvested in business operations.

Everything You Need To Master Financial Statement Modeling

To Help you Thrive in the Most Prestigious Jobs on Wall Street.

Researched and Authored by Tanner Hertz | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

- Accounting Conservatism

- Accounting Equation

- Accounting Ratios

- Three Financial Statements in FP&A

- Working Capital Cycle

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

or Want to Sign up with your social account?

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Financial statements

- Finance and investing

When Senior Managers Won't Collaborate

- Heidi K. Gardner

- From the March 2015 Issue

Reduce the Risk of Failed Financial Judgments

- Robert G. Eccles

- Edward J. Riedl

- From the July–August 2008 Issue

Why Good Accountants Do Bad Audits (HBR OnPoint Enhanced Edition)

- Max H. Bazerman

- George Loewenstein

- Don A. Moore

- November 01, 2002

What's Your Project's Real Price Tag?

- Quentin W Fleming

- Joel M Koppelman

- September 01, 2003

Why Are Companies Sitting on Cash Right Now?

- Vijay Govindarajan

- Anup Srivastava

- Chandrani Chatterjee

- February 05, 2024

Decoding CEO Pay*

- Robert C. Pozen

- S.P. Kothari

- From the July–August 2017 Issue

How to Attract the Right Shareholders

- Mark DesJardine

- August 08, 2023

The Greening of the Balance Sheet

- Anthony White

- From the March 2006 Issue

Countering the Biggest Risk of All

- Adrian J. Slywotzky

- John Drizik

- April 01, 2005

Earnings Game: Everyone Plays, Nobody Wins

- Harris Collingwood

- From the June 2001 Issue

How Managers Should Read Financial Statements

- February 19, 2013

Inside Microsoft: Balancing Creativity and Discipline

- Robert J. Herbold

- From the January 2002 Issue

- January 29, 2013

Foreign Corrupt Practices Act

- Hurd Baruch

- From the January 1979 Issue

Giving After Disasters

- Harvard Business Review

- From the January–February 2019 Issue

From Niche to Mainstream (HBR Case Study and Commentary)

- Tetsuya Fujisaki

- Carlos Canals

- From the July–August 2018 Issue

Tread Lightly Through These Accounting Minefields

- H. David Sherman

- S. David Young

- From the July–August 2001 Issue

U.S. Financial Reporting Is Stuck in the 20th Century

- Shivaram Rajgopal

- Luminita Enache

- December 16, 2020

Customer Loyalty Isn't Enough. Grow Your Share of Wallet

- Timothy L. Keiningham

- Lerzan Aksoy

- Alexander Buoye

- Bruce Cooil

- From the October 2011 Issue

Research: Simple Writing Pays Off (Literally)

- Bill Birchard

- October 11, 2022

Juliette's Lemonade Stands

- Mark Potter

- February 01, 2018

VP Group: Vegpro Grows Beyond Kenya

- Jose B. Alvarez

- Natalie Kindred

- December 16, 2013

Analog Devices, Inc.: The Half-Life System

- Robert S. Kaplan

- March 16, 1990

The Farm Winery

- Madhav V. Rajan

- Jaclyn C. Foroughi

- October 15, 2014

Revenue and Expense Recognition at NetSuite Inc.

- Graeme Rankine

- August 01, 2016

Merger of NOVA Corporation and TransCanada Pipelines Ltd.

- Claude P. Lanfranconi

- Jacque Murphy

- April 06, 1999

Intercorporate Investment and Consolidated Statements

- David F. Hawkins

- January 14, 1994

Butler Lumber Co.

- Thomas R. Piper

- October 31, 1991

Darby's Investment in Sirma: Professionalizing an Entrepreneurial Firm

- Suraj Srinivasan

- Eren Kuzucu

- November 13, 2016

Revenue Recognition

- Paul M. Healy

- August 15, 2000

New Century Financial Corporation (Abridged)

- Krishna G. Palepu

- Ian Cornell

- July 20, 2012

Superior Clamps, Inc.

- July 20, 1995

Depreciation at Delta and Pan Am

- William J. Bruns Jr.

- Eric J. Petro

- September 08, 1989

Colorado & Utah Canyons Tour Company

- Mark E. Haskins

- July 29, 2015

ITC LTD.: Toward a Triple Bottom Line Performance

- January 01, 2010

Drugstore.com

- Richard L. Nolan

- September 15, 1999

- Paul A. Gompers

- March 08, 2001

The Game of Financial Ratios

- Pooja Gupta

- Madhvi Sethi

- Darroch A. Robertson

- January 16, 2017

- Francois Brochet

- March 18, 2009

Sack It & Pack It, Inc.: 12 Combinations of GAAP and How They Differ

- September 16, 2009

Major League Baseball Advanced Media: America's Pastime Goes Digital, Teaching Note

- Anita Elberse

- July 12, 2010

Project Management for Profit: 6: The Critical Number: Gross Profit per Hour

- June 26, 2012

Popular Topics

Partner center.

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- *New* Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

The Beginner’s Guide to Reading & Understanding Financial Statements

- 10 Jun 2020

An ability to understand the financial health of a company is one of the most vital skills for aspiring investors, entrepreneurs, and managers to develop. Armed with this knowledge, investors can better identify promising opportunities while avoiding undue risk, and professionals of all levels can make more strategic business decisions.

Financial statements offer a window into the health of a company, which can be difficult to gauge using other means. While accountants and finance specialists are trained to read and understand these documents, many business professionals are not. The effect is an obfuscation of critical information.

If you’re new to the world of financial statements, this guide can help you read and understand the information contained in them.

Access your free e-book today.

Understanding Financial Statements

To understand a company’s financial position—both on its own and within its industry—you need to review and analyze several financial statements: balance sheets, income statements, cash flow statements, and annual reports. The value of these documents lies in the story they tell when reviewed together.

1. How to Read a Balance Sheet

A balance sheet conveys the “book value” of a company. It allows you to see what resources it has available and how they were financed as of a specific date. It shows its assets, liabilities, and owners’ equity (essentially, what it owes, owns, and the amount invested by shareholders).

The balance sheet also provides information that can be leveraged to compute rates of return and evaluate capital structure, using the accounting equation: Assets = Liabilities + Owners’ Equity.

Assets are anything a company owns with quantifiable value.

Liabilities refer to money a company owes to a debtor, such as outstanding payroll expenses, debt payments, rent and utility, bonds payable, and taxes.

Owners’ equity refers to the net worth of a company. It’s the amount of money that would be left if all assets were sold and all liabilities paid. This money belongs to the shareholders, who may be private owners or public investors.

Alone, the balance sheet doesn’t provide information on trends, which is why you need to examine other financial statements, including income and cash flow statements, to fully comprehend a company’s financial position.

This article will teach you more about how to read a balance sheet .

2. How to Read an Income Statement

An income statement , also known as a profit and loss (P&L) statement, summarizes the cumulative impact of revenue, gain, expense, and loss transactions for a given period. The document is often shared as part of quarterly and annual reports, and shows financial trends, business activities (revenue and expenses), and comparisons over set periods.

Income statements typically include the following information:

- Revenue: The amount of money a business takes in

- Expenses: The amount of money a business spends

- Costs of goods sold (COGS): The cost of component parts of what it takes to make whatever a business sells

- Gross profit: Total revenue less COGS

- Operating income: Gross profit less operating expenses

- Income before taxes: Operating income less non-operating expenses

- Net income: Income before taxes less taxes

- Earnings per share (EPS): Division of net income by the total number of outstanding shares

- Depreciation: The extent to which assets (for example, aging equipment) have lost value over time

- EBITDA: Earnings before interest, taxes, depreciation, and amortization

Accountants, investors, and other business professionals regularly review income statements:

- To understand how well their company is doing: Is it profitable? How much money is spent to produce a product? Is there cash to invest back into the business?

- To determine financial trends: When are costs highest? When are they lowest?

This article will teach you more about how to read an income statement .

Related: Financial Terminology: 20 Financial Terms to Know

3. How to Read a Cash Flow Statement

The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified duration of time, known as the accounting period. It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of it.

Cash flow statements are broken into three sections: Cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

Operating activities detail cash flow that’s generated once the company delivers its regular goods or services, and includes both revenue and expenses. Investing activity is cash flow from purchasing or selling assets—usually in the form of physical property, such as real estate or vehicles, and non-physical property, like patents—using free cash, not debt. Financing activities detail cash flow from both debt and equity financing.

It’s important to note there’s a difference between cash flow and profit . While cash flow refers to the cash that's flowing into and out of a company, profit refers to what remains after all of a company’s expenses have been deducted from its revenues. Both are important numbers to know.

With a cash flow statement, you can see the types of activities that generate cash and use that information to make financial decisions .

Ideally, cash from operating income should routinely exceed net income, because a positive cash flow speaks to a company’s financial stability and ability to grow its operations. However, having positive cash flow doesn’t necessarily mean a company is profitable, which is why you also need to analyze balance sheets and income statements.

This article will teach you more about how to read a cash flow statement .

4. How to Read an Annual Report

An annual report is a publication that public corporations are required to publish annually to shareholders to describe their operational and financial conditions.

Annual reports often incorporate editorial and storytelling in the form of images, infographics, and a letter from the CEO to describe corporate activities, benchmarks, and achievements. They provide investors, shareholders, and employees with greater insight into a company’s mission and goals, compared to individual financial statements.

Beyond the editorial, an annual report summarizes financial data and includes a company's income statement, balance sheet, and cash flow statement. It also provides industry insights, management’s discussion and analysis (MD&A), accounting policies, and additional investor information.

In addition to an annual report, the US Securities and Exchange Commission (SEC) requires public companies to produce a longer, more detailed 10-K report, which informs investors of a business’s financial status before they buy or sell shares.

10-K reports are organized per SEC guidelines and include full descriptions of a company’s fiscal activity, corporate agreements, risks, opportunities, current operations, executive compensation, and market activity. You can also find detailed discussions of operations for the year, and a full analysis of the industry and marketplace.

Both an annual and 10-K report can help you understand the financial health, status, and goals of a company. While the annual report offers something of a narrative element, including management’s vision for the company, the 10-K report reinforces and expands upon that narrative with more detail.

This article will teach you more about how to read an annual report .

A Critical Skill

Reviewing and understanding these financial documents can provide you with valuable insights about a company, including:

- Its debts and ability to repay them

- Profits and/or losses for a given quarter or year

- Whether profit has increased or decreased compared to similar past accounting periods

- The level of investment required to maintain or grow the business

- Operational expenses, especially compared to the revenue generated from those expenses

Accountants, investors, shareholders, and company leadership need to be keenly aware of the financial health of an organization, but employees can also benefit from understanding balance sheets, income statements, cash flow statements, and annual reports.

If you don’t have a financial background, the good news is that there are steps you can take to learn about finance and jumpstart your career . Building your financial literacy and skills doesn’t need to be difficult.

Are you interested in gaining a toolkit for making smarter financial decisions and communicating decisions to key stakeholders? Explore our online finance and accounting courses , and download our free course flowchart to determine which best aligns with your goals.

About the Author

- Browse All Articles

- Newsletter Sign-Up

FinancialMarkets →

No results found in working knowledge.

- Were any results found in one of the other content buckets on the left?

- Try removing some search filters.

- Use different search filters.

- Study Guides

- Homework Questions

FIN600M1TamerH Case Study Report

- < Previous

Home > Honors College > Honors Theses > 250

Honors Theses

Financial reporting: a case study analysis.

Darby Mills , University of Mississippi. Sally McDonnell Barksdale Honors College

Date of Award

Document type.

Undergraduate Thesis

Accountancy

First Advisor

Victoria Dickinson

Relational Format

Dissertation/Thesis

This paper looks at accountancy following the application of the U.S. Generally Accepted Accounting Principles (GAAP) through case study analysis. Within this paper, there are twelve case studies that cover areas of financial accounting, financial statement analysis, and research. The financial accounting cases cover several topics, such as stockholder's equity, inventory, leases, and deferred tax assets and liabilities. The financial statement analysis cases use ratios, creation of financial reports, and commentary to discuss in further detail the financial statements. The FASB Codification is used as a basis for research in many cases. Dr. Vicki Dickinson facilitated each case within this paper through the instruction of the Accountancy 420 course.

Recommended Citation

Mills, Darby, "Financial Reporting: A Case Study Analysis" (2018). Honors Theses . 250. https://egrove.olemiss.edu/hon_thesis/250

Accessibility Status

Searchable text

Since August 31, 2019

Included in

Accounting Commons

To view the content in your browser, please download Adobe Reader or, alternately, you may Download the file to your hard drive.

NOTE: The latest versions of Adobe Reader do not support viewing PDF files within Firefox on Mac OS and if you are using a modern (Intel) Mac, there is no official plugin for viewing PDF files within the browser window.

- Collections

- Disciplines

Advanced Search

- Notify me via email or RSS

Author Corner

- Submit Thesis

Additional Information

- Request an Accessible Copy

Home | About | FAQ | My Account | Accessibility Statement

Privacy Copyright

Read our research on: Abortion | Podcasts | Election 2024

Regions & Countries

What the data says about abortion in the u.s..

Pew Research Center has conducted many surveys about abortion over the years, providing a lens into Americans’ views on whether the procedure should be legal, among a host of other questions.

In a Center survey conducted nearly a year after the Supreme Court’s June 2022 decision that ended the constitutional right to abortion , 62% of U.S. adults said the practice should be legal in all or most cases, while 36% said it should be illegal in all or most cases. Another survey conducted a few months before the decision showed that relatively few Americans take an absolutist view on the issue .

Find answers to common questions about abortion in America, based on data from the Centers for Disease Control and Prevention (CDC) and the Guttmacher Institute, which have tracked these patterns for several decades:

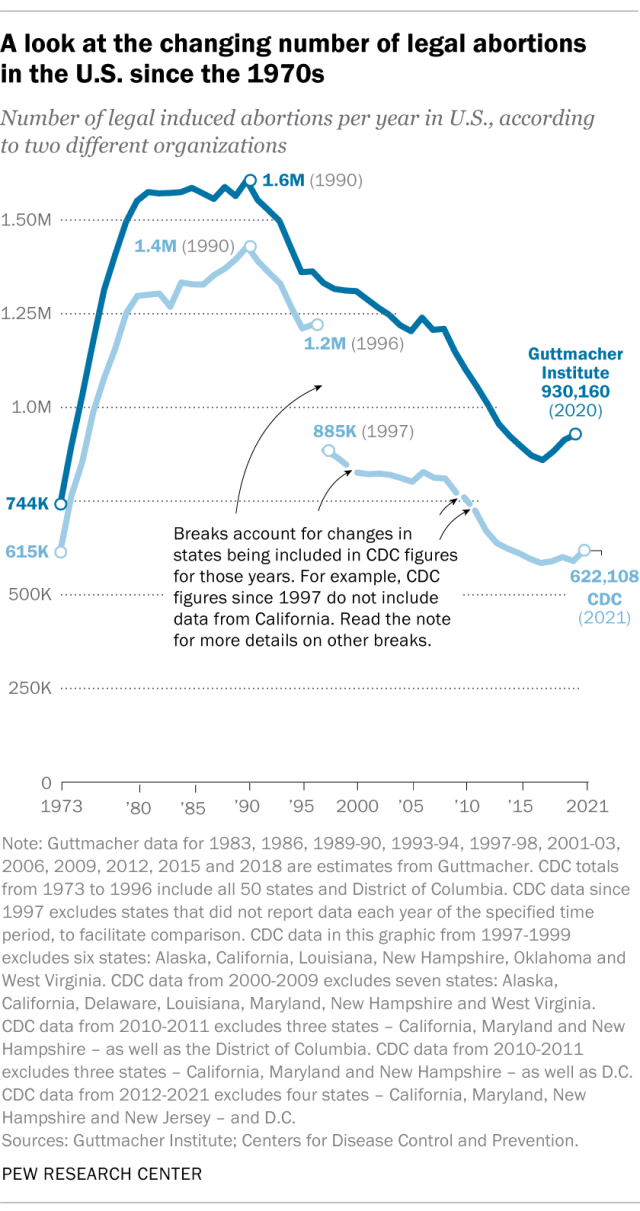

How many abortions are there in the U.S. each year?

How has the number of abortions in the u.s. changed over time, what is the abortion rate among women in the u.s. how has it changed over time, what are the most common types of abortion, how many abortion providers are there in the u.s., and how has that number changed, what percentage of abortions are for women who live in a different state from the abortion provider, what are the demographics of women who have had abortions, when during pregnancy do most abortions occur, how often are there medical complications from abortion.

This compilation of data on abortion in the United States draws mainly from two sources: the Centers for Disease Control and Prevention (CDC) and the Guttmacher Institute, both of which have regularly compiled national abortion data for approximately half a century, and which collect their data in different ways.

The CDC data that is highlighted in this post comes from the agency’s “abortion surveillance” reports, which have been published annually since 1974 (and which have included data from 1969). Its figures from 1973 through 1996 include data from all 50 states, the District of Columbia and New York City – 52 “reporting areas” in all. Since 1997, the CDC’s totals have lacked data from some states (most notably California) for the years that those states did not report data to the agency. The four reporting areas that did not submit data to the CDC in 2021 – California, Maryland, New Hampshire and New Jersey – accounted for approximately 25% of all legal induced abortions in the U.S. in 2020, according to Guttmacher’s data. Most states, though, do have data in the reports, and the figures for the vast majority of them came from each state’s central health agency, while for some states, the figures came from hospitals and other medical facilities.

Discussion of CDC abortion data involving women’s state of residence, marital status, race, ethnicity, age, abortion history and the number of previous live births excludes the low share of abortions where that information was not supplied. Read the methodology for the CDC’s latest abortion surveillance report , which includes data from 2021, for more details. Previous reports can be found at stacks.cdc.gov by entering “abortion surveillance” into the search box.

For the numbers of deaths caused by induced abortions in 1963 and 1965, this analysis looks at reports by the then-U.S. Department of Health, Education and Welfare, a precursor to the Department of Health and Human Services. In computing those figures, we excluded abortions listed in the report under the categories “spontaneous or unspecified” or as “other.” (“Spontaneous abortion” is another way of referring to miscarriages.)

Guttmacher data in this post comes from national surveys of abortion providers that Guttmacher has conducted 19 times since 1973. Guttmacher compiles its figures after contacting every known provider of abortions – clinics, hospitals and physicians’ offices – in the country. It uses questionnaires and health department data, and it provides estimates for abortion providers that don’t respond to its inquiries. (In 2020, the last year for which it has released data on the number of abortions in the U.S., it used estimates for 12% of abortions.) For most of the 2000s, Guttmacher has conducted these national surveys every three years, each time getting abortion data for the prior two years. For each interim year, Guttmacher has calculated estimates based on trends from its own figures and from other data.

The latest full summary of Guttmacher data came in the institute’s report titled “Abortion Incidence and Service Availability in the United States, 2020.” It includes figures for 2020 and 2019 and estimates for 2018. The report includes a methods section.

In addition, this post uses data from StatPearls, an online health care resource, on complications from abortion.

An exact answer is hard to come by. The CDC and the Guttmacher Institute have each tried to measure this for around half a century, but they use different methods and publish different figures.

The last year for which the CDC reported a yearly national total for abortions is 2021. It found there were 625,978 abortions in the District of Columbia and the 46 states with available data that year, up from 597,355 in those states and D.C. in 2020. The corresponding figure for 2019 was 607,720.

The last year for which Guttmacher reported a yearly national total was 2020. It said there were 930,160 abortions that year in all 50 states and the District of Columbia, compared with 916,460 in 2019.

- How the CDC gets its data: It compiles figures that are voluntarily reported by states’ central health agencies, including separate figures for New York City and the District of Columbia. Its latest totals do not include figures from California, Maryland, New Hampshire or New Jersey, which did not report data to the CDC. ( Read the methodology from the latest CDC report .)

- How Guttmacher gets its data: It compiles its figures after contacting every known abortion provider – clinics, hospitals and physicians’ offices – in the country. It uses questionnaires and health department data, then provides estimates for abortion providers that don’t respond. Guttmacher’s figures are higher than the CDC’s in part because they include data (and in some instances, estimates) from all 50 states. ( Read the institute’s latest full report and methodology .)

While the Guttmacher Institute supports abortion rights, its empirical data on abortions in the U.S. has been widely cited by groups and publications across the political spectrum, including by a number of those that disagree with its positions .

These estimates from Guttmacher and the CDC are results of multiyear efforts to collect data on abortion across the U.S. Last year, Guttmacher also began publishing less precise estimates every few months , based on a much smaller sample of providers.

The figures reported by these organizations include only legal induced abortions conducted by clinics, hospitals or physicians’ offices, or those that make use of abortion pills dispensed from certified facilities such as clinics or physicians’ offices. They do not account for the use of abortion pills that were obtained outside of clinical settings .

(Back to top)

The annual number of U.S. abortions rose for years after Roe v. Wade legalized the procedure in 1973, reaching its highest levels around the late 1980s and early 1990s, according to both the CDC and Guttmacher. Since then, abortions have generally decreased at what a CDC analysis called “a slow yet steady pace.”

Guttmacher says the number of abortions occurring in the U.S. in 2020 was 40% lower than it was in 1991. According to the CDC, the number was 36% lower in 2021 than in 1991, looking just at the District of Columbia and the 46 states that reported both of those years.

(The corresponding line graph shows the long-term trend in the number of legal abortions reported by both organizations. To allow for consistent comparisons over time, the CDC figures in the chart have been adjusted to ensure that the same states are counted from one year to the next. Using that approach, the CDC figure for 2021 is 622,108 legal abortions.)

There have been occasional breaks in this long-term pattern of decline – during the middle of the first decade of the 2000s, and then again in the late 2010s. The CDC reported modest 1% and 2% increases in abortions in 2018 and 2019, and then, after a 2% decrease in 2020, a 5% increase in 2021. Guttmacher reported an 8% increase over the three-year period from 2017 to 2020.

As noted above, these figures do not include abortions that use pills obtained outside of clinical settings.

Guttmacher says that in 2020 there were 14.4 abortions in the U.S. per 1,000 women ages 15 to 44. Its data shows that the rate of abortions among women has generally been declining in the U.S. since 1981, when it reported there were 29.3 abortions per 1,000 women in that age range.

The CDC says that in 2021, there were 11.6 abortions in the U.S. per 1,000 women ages 15 to 44. (That figure excludes data from California, the District of Columbia, Maryland, New Hampshire and New Jersey.) Like Guttmacher’s data, the CDC’s figures also suggest a general decline in the abortion rate over time. In 1980, when the CDC reported on all 50 states and D.C., it said there were 25 abortions per 1,000 women ages 15 to 44.

That said, both Guttmacher and the CDC say there were slight increases in the rate of abortions during the late 2010s and early 2020s. Guttmacher says the abortion rate per 1,000 women ages 15 to 44 rose from 13.5 in 2017 to 14.4 in 2020. The CDC says it rose from 11.2 per 1,000 in 2017 to 11.4 in 2019, before falling back to 11.1 in 2020 and then rising again to 11.6 in 2021. (The CDC’s figures for those years exclude data from California, D.C., Maryland, New Hampshire and New Jersey.)

The CDC broadly divides abortions into two categories: surgical abortions and medication abortions, which involve pills. Since the Food and Drug Administration first approved abortion pills in 2000, their use has increased over time as a share of abortions nationally, according to both the CDC and Guttmacher.

The majority of abortions in the U.S. now involve pills, according to both the CDC and Guttmacher. The CDC says 56% of U.S. abortions in 2021 involved pills, up from 53% in 2020 and 44% in 2019. Its figures for 2021 include the District of Columbia and 44 states that provided this data; its figures for 2020 include D.C. and 44 states (though not all of the same states as in 2021), and its figures for 2019 include D.C. and 45 states.

Guttmacher, which measures this every three years, says 53% of U.S. abortions involved pills in 2020, up from 39% in 2017.

Two pills commonly used together for medication abortions are mifepristone, which, taken first, blocks hormones that support a pregnancy, and misoprostol, which then causes the uterus to empty. According to the FDA, medication abortions are safe until 10 weeks into pregnancy.

Surgical abortions conducted during the first trimester of pregnancy typically use a suction process, while the relatively few surgical abortions that occur during the second trimester of a pregnancy typically use a process called dilation and evacuation, according to the UCLA School of Medicine.

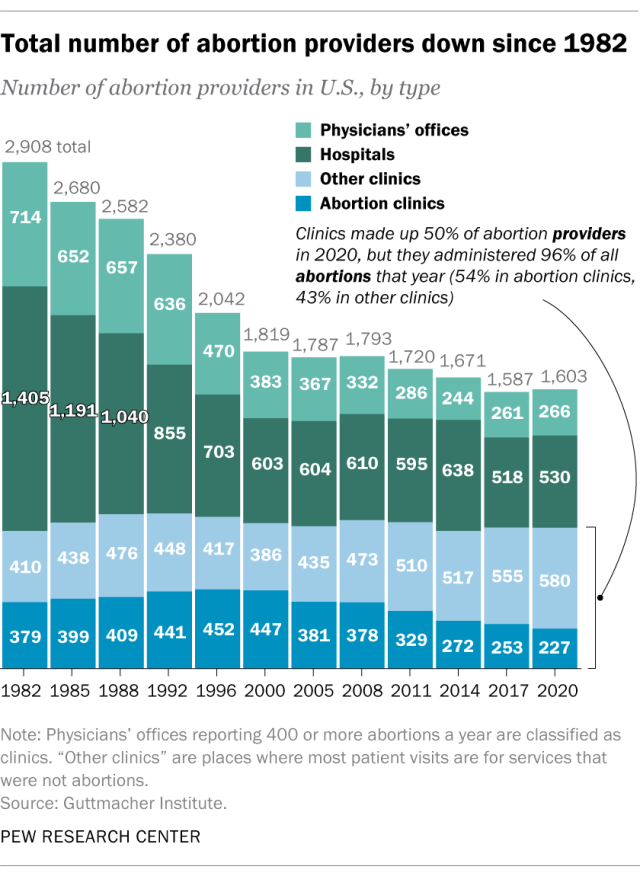

In 2020, there were 1,603 facilities in the U.S. that provided abortions, according to Guttmacher . This included 807 clinics, 530 hospitals and 266 physicians’ offices.

While clinics make up half of the facilities that provide abortions, they are the sites where the vast majority (96%) of abortions are administered, either through procedures or the distribution of pills, according to Guttmacher’s 2020 data. (This includes 54% of abortions that are administered at specialized abortion clinics and 43% at nonspecialized clinics.) Hospitals made up 33% of the facilities that provided abortions in 2020 but accounted for only 3% of abortions that year, while just 1% of abortions were conducted by physicians’ offices.

Looking just at clinics – that is, the total number of specialized abortion clinics and nonspecialized clinics in the U.S. – Guttmacher found the total virtually unchanged between 2017 (808 clinics) and 2020 (807 clinics). However, there were regional differences. In the Midwest, the number of clinics that provide abortions increased by 11% during those years, and in the West by 6%. The number of clinics decreased during those years by 9% in the Northeast and 3% in the South.

The total number of abortion providers has declined dramatically since the 1980s. In 1982, according to Guttmacher, there were 2,908 facilities providing abortions in the U.S., including 789 clinics, 1,405 hospitals and 714 physicians’ offices.

The CDC does not track the number of abortion providers.

In the District of Columbia and the 46 states that provided abortion and residency information to the CDC in 2021, 10.9% of all abortions were performed on women known to live outside the state where the abortion occurred – slightly higher than the percentage in 2020 (9.7%). That year, D.C. and 46 states (though not the same ones as in 2021) reported abortion and residency data. (The total number of abortions used in these calculations included figures for women with both known and unknown residential status.)

The share of reported abortions performed on women outside their state of residence was much higher before the 1973 Roe decision that stopped states from banning abortion. In 1972, 41% of all abortions in D.C. and the 20 states that provided this information to the CDC that year were performed on women outside their state of residence. In 1973, the corresponding figure was 21% in the District of Columbia and the 41 states that provided this information, and in 1974 it was 11% in D.C. and the 43 states that provided data.

In the District of Columbia and the 46 states that reported age data to the CDC in 2021, the majority of women who had abortions (57%) were in their 20s, while about three-in-ten (31%) were in their 30s. Teens ages 13 to 19 accounted for 8% of those who had abortions, while women ages 40 to 44 accounted for about 4%.

The vast majority of women who had abortions in 2021 were unmarried (87%), while married women accounted for 13%, according to the CDC , which had data on this from 37 states.

In the District of Columbia, New York City (but not the rest of New York) and the 31 states that reported racial and ethnic data on abortion to the CDC , 42% of all women who had abortions in 2021 were non-Hispanic Black, while 30% were non-Hispanic White, 22% were Hispanic and 6% were of other races.

Looking at abortion rates among those ages 15 to 44, there were 28.6 abortions per 1,000 non-Hispanic Black women in 2021; 12.3 abortions per 1,000 Hispanic women; 6.4 abortions per 1,000 non-Hispanic White women; and 9.2 abortions per 1,000 women of other races, the CDC reported from those same 31 states, D.C. and New York City.

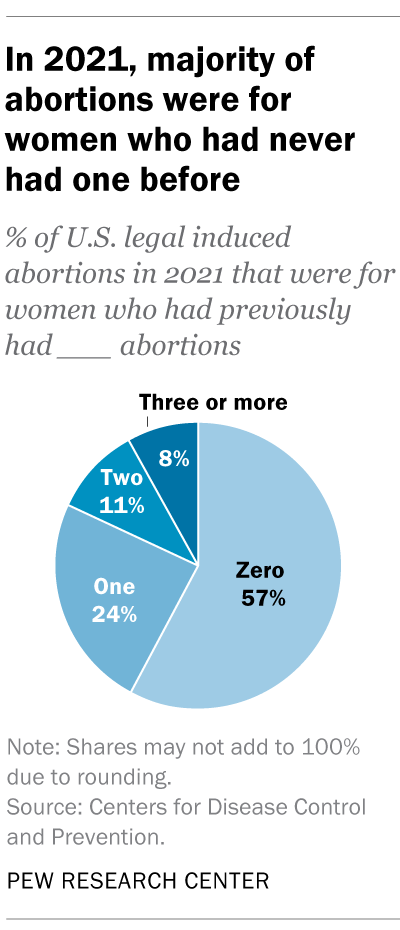

For 57% of U.S. women who had induced abortions in 2021, it was the first time they had ever had one, according to the CDC. For nearly a quarter (24%), it was their second abortion. For 11% of women who had an abortion that year, it was their third, and for 8% it was their fourth or more. These CDC figures include data from 41 states and New York City, but not the rest of New York.

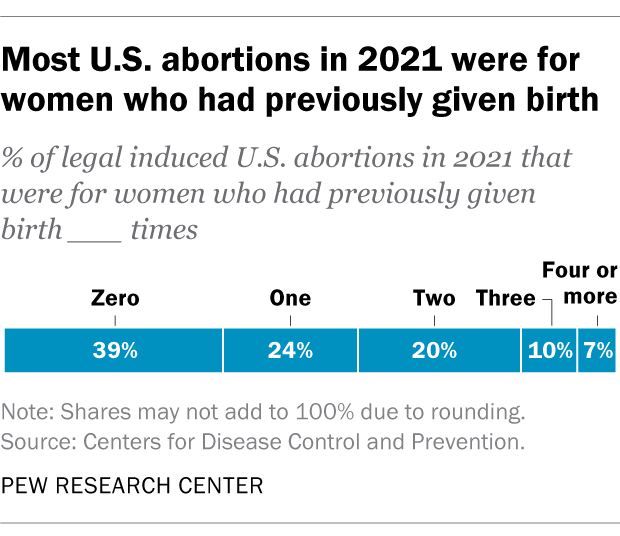

Nearly four-in-ten women who had abortions in 2021 (39%) had no previous live births at the time they had an abortion, according to the CDC . Almost a quarter (24%) of women who had abortions in 2021 had one previous live birth, 20% had two previous live births, 10% had three, and 7% had four or more previous live births. These CDC figures include data from 41 states and New York City, but not the rest of New York.

The vast majority of abortions occur during the first trimester of a pregnancy. In 2021, 93% of abortions occurred during the first trimester – that is, at or before 13 weeks of gestation, according to the CDC . An additional 6% occurred between 14 and 20 weeks of pregnancy, and about 1% were performed at 21 weeks or more of gestation. These CDC figures include data from 40 states and New York City, but not the rest of New York.

About 2% of all abortions in the U.S. involve some type of complication for the woman , according to an article in StatPearls, an online health care resource. “Most complications are considered minor such as pain, bleeding, infection and post-anesthesia complications,” according to the article.

The CDC calculates case-fatality rates for women from induced abortions – that is, how many women die from abortion-related complications, for every 100,000 legal abortions that occur in the U.S . The rate was lowest during the most recent period examined by the agency (2013 to 2020), when there were 0.45 deaths to women per 100,000 legal induced abortions. The case-fatality rate reported by the CDC was highest during the first period examined by the agency (1973 to 1977), when it was 2.09 deaths to women per 100,000 legal induced abortions. During the five-year periods in between, the figure ranged from 0.52 (from 1993 to 1997) to 0.78 (from 1978 to 1982).

The CDC calculates death rates by five-year and seven-year periods because of year-to-year fluctuation in the numbers and due to the relatively low number of women who die from legal induced abortions.

In 2020, the last year for which the CDC has information , six women in the U.S. died due to complications from induced abortions. Four women died in this way in 2019, two in 2018, and three in 2017. (These deaths all followed legal abortions.) Since 1990, the annual number of deaths among women due to legal induced abortion has ranged from two to 12.

The annual number of reported deaths from induced abortions (legal and illegal) tended to be higher in the 1980s, when it ranged from nine to 16, and from 1972 to 1979, when it ranged from 13 to 63. One driver of the decline was the drop in deaths from illegal abortions. There were 39 deaths from illegal abortions in 1972, the last full year before Roe v. Wade. The total fell to 19 in 1973 and to single digits or zero every year after that. (The number of deaths from legal abortions has also declined since then, though with some slight variation over time.)

The number of deaths from induced abortions was considerably higher in the 1960s than afterward. For instance, there were 119 deaths from induced abortions in 1963 and 99 in 1965 , according to reports by the then-U.S. Department of Health, Education and Welfare, a precursor to the Department of Health and Human Services. The CDC is a division of Health and Human Services.

Note: This is an update of a post originally published May 27, 2022, and first updated June 24, 2022.

Sign up for our weekly newsletter

Fresh data delivered Saturday mornings

Key facts about the abortion debate in America

Public opinion on abortion, three-in-ten or more democrats and republicans don’t agree with their party on abortion, partisanship a bigger factor than geography in views of abortion access locally, do state laws on abortion reflect public opinion, most popular.

About Pew Research Center Pew Research Center is a nonpartisan fact tank that informs the public about the issues, attitudes and trends shaping the world. It conducts public opinion polling, demographic research, media content analysis and other empirical social science research. Pew Research Center does not take policy positions. It is a subsidiary of The Pew Charitable Trusts .

Technology Strategy

Get the flexibility and value you need from technology

Why technology strategy matters.

the revenue growth when leaders double down on investments in technology and innovation

of CIO/CTOs are primarily focusing investment on revenue growth as opposed to cutting costs

of CIOs are focusing on an overall business transformation, versus a single function, in 2024

of enterprise transformation projects fail to meet expectations

Start with technology, then reinvent

Use everything technology offers to build a better business.

What you need to do

Get out of tech debt and into tech value.

Curb your tech debt and focus your tech spending on the activities that will power your business growth. Give your management team a shared understanding of how tech can deliver more value.

Design an enterprise architecture that allows your business to soar

Make the most of digital core technologies and techniques to improve business continuity and reduce your risk. Reinvent every aspect of your IT using generative AI.

Build an operating model that’s as innovative as your team

Respond to changing market demands by being nimbler. Design and implement an intelligent operating model built for business agility, resiliency and growth.

Have a clear vision for your tech transformation

Prioritize what you want to achieve, set the success criteria, and establish a transformation office to deliver it.

What you’ll achieve

A tech strategy everyone supports

Create a coalition for change with a plan that also fires up your business, tech and finance teams.

Total transparency on where your tech spend is going

With a clear view, you can decide where to reduce, redistribute and expand your tech investments.

A vision for your future architecture

Get the outcomes your business needs while continuously transforming your organization at scale.

An operating model that is your competitive edge

Get an intelligent operating model that moves at the same pace as your customers.

A transformation that meets expectations

Track and communicate the value of your enterprise transformation and get insights to help you make better decisions.

What’s trending in technology strategy

This is a singular moment for CIOs: here is how they can take advantage to unlock true business value across their enterprise.

How do you simplify a complex enterprise transformation; Accenture’s Jason Sain recommends starting with a clear vision and value creation story.

By focusing on new opportunities provided by cloud, data and AI, CSPs can accelerate their legacy technology transformation to resolve tech debt and position themselves for new product and service growth.

CIOs can bring the greatest value to transformation. Accenture’s Greg Douglass explains how CIOs address new challenges in today’s business.

If Agile is challenging, meet multi-speed; a model combining the best of both worlds to gain agility.

Accenture’s Kit Friend explains what’s at risk when CIOs mistake a hybrid solution for Agile, and why multi-speed isn’t always the answer.

Five imperatives the C-suite must address to reinvent in the age of generative AI.

Greg Douglass from Accenture advises how to boost a tech-savvy board as embracing digital transformation requires tech expertise across enterprises.

Accelerate your journey

myDiagnostic

Assess your business, talent, and IT maturity to understand your strengths and gaps. Unlock opportunities over a data-driven path to hastened growth and value.

Accenture Momentum

Orchestrate large-scale business transformations from start to finish, focusing on vision, value, speed, talent and technology.

Partners in change

Our leaders

Koenraad Schelfaut

Lead – Technology Strategy & Advisory

Keith Boone

Lead – Technology Strategy & Advisory, North America

Frédéric Brunier

Lead – Technology Strategy & Advisory, EMEA

Tejas R. Patel

Lead – Technology Strategy & Advisory, Growth Markets

- health care

Texas has the 5th highest health care costs in the nation, Forbes says

A new Forbes Advisor study shedding light on Americans' top financial worries has revealed Texas has the fifth highest health care costs in the nation.

The video above is from a previous report: Millions of uninsured Texans have health coverage options and they may not know it

Forbes Advisor's annual report compared all 50 states and Washington, D.C., across nine different metrics to determine which states have the most and least expensive health care costs in 2024.

Factors include the average annual deductibles and premiums for employees using single and family coverage through employer-provided health insurance and the percentage of adults who chose not to see a healthcare provider due to costs within the last year, among others. Each state was ranked based on its score out of a total of 100 possible points.

Continue reading this article from our ABC13 partners at Houston CultureMap .

SEE ALSO: Study shows disparities in access to affordable health care for Black and brown Texans

Related Topics

- HEALTH & FITNESS

- HEALTH CARE

- PERSONAL FINANCE

- HEALTH INSURANCE

- HOUSTON CULTUREMAP

Health Care

$13M mental health center coming to Galveston County

- 3 hours ago

Man who can walk again shows potential benefit of stem cell therapy

1st human case of bird flu in Texas linked to exposure to sick cattle

President Biden, Vice President Harris speak in Raleigh on health care

Top stories.

Crews battling fire engulfing vacant building in southeast Houston

HPD chief learned of suspended cases the day before Astroworld tragedy

SB 4 possibly resulted in decrease of migrant arrests in Texas

Uvalde Mayor Cody Smith resigns from office, citing health issues

- 15 minutes ago

Montgomery Co. man who was sentenced to life dies by suicide in prison

Officials identify man shot, killed while walking dog near The Heights

Would you sip water from the Gulf? New study explores possibility

ITC settles for $6.6M with state, feds over 3-day-long plant fire

- 2 hours ago

Baltimore bridge collapse: What happened and what is the death toll?

What is the death toll, when did the baltimore bridge collapse, why did the bridge collapse, who will pay for the damage and how much will the bridge cost.

HOW LONG WILL IT TAKE TO REBUILD THE BRIDGE?

What ship hit the baltimore bridge, what do we know about the bridge that collapsed.

HOW WILL THE BRIDGE COLLAPSE IMPACT THE BALTIMORE PORT?

Get weekly news and analysis on the U.S. elections and how it matters to the world with the newsletter On the Campaign Trail. Sign up here.

Writing by Lisa Shumaker; Editing by Daniel Wallis and Bill Berkrot

Our Standards: The Thomson Reuters Trust Principles. , opens new tab

Thomson Reuters

Lisa's journalism career spans two decades, and she currently serves as the Americas Day Editor for the Global News Desk. She played a pivotal role in tracking the COVID pandemic and leading initiatives in speed, headline writing and multimedia. She has worked closely with the finance and company news teams on major stories, such as the departures of Twitter CEO Jack Dorsey and Amazon’s Jeff Bezos and significant developments at Apple, Alphabet, Facebook and Tesla. Her dedication and hard work have been recognized with the 2010 Desk Editor of the Year award and a Journalist of the Year nomination in 2020. Lisa is passionate about visual and long-form storytelling. She holds a degree in both psychology and journalism from Penn State University.

Taiwan hit by strongest quake in 25 years, buildings damaged

A 7.2 magnitude earthquake rocked Taiwan on Wednesday, the strongest tremor to hit the island in at least 25 years, shaking buildings from their foundations and sparking a tsunami warning for the islands of southern Japan and the Philippines.

The White House held a scaled-down iftar dinner on Tuesday to celebrate Islam's holy month of Ramadan, after some invitees turned the president down over frustrations in the Muslim community over his policy toward the Israel-Gaza war.

Japan issued an evacuation advisory for the coastal areas of the southern prefecture of Okinawa after a powerful earthquake triggered a tsunami warning.

IMAGES

VIDEO

COMMENTS

Financial Statements Examples - Amazon Case Study. An in-depth look at Amazon's financial statements. Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets.

contract with the student when the customer orders a beer and the bartender says. it will cost $5. Step 2: Identify the performance obligations in the contract: The performance. obligation in the contract is for the bartender to give the student a beer. Step 3: Determine the contract price: The contract price is $5.

Introduction. Financial analysis is the process of examining a company's performance in the context of its industry and economic environment in order to arrive at a decision or recommendation. Often, the decisions and recommendations addressed by financial analysts pertain to providing capital to companies—specifically, whether to invest in ...

Financial analysis Magazine Article. John J. Scanlon. This article presents the research findings of a leading U.S. corporation, AT&T, on a series of important economic questions and issues, with ...

Summary. This chapter presents four case studies which provide examples of financial information upon which liquidity, leverage, profitability, and causal calculations may be performed. The first two case studies also contain example ratio summary and analysis. Two discussion cases are also provided, followed by questions related to the ...

In financial accounting, a balance sheet or statement of financial position is a summary of the financial balances of a sole proprietorship, a business partnership, a corporation or other business organization, such as an LLC

In this free guide, we will break down the most important types and techniques of financial statement analysis. This guide is designed to be useful for both beginners and advanced finance professionals, with the main topics covering: (1) the income statement, (2) the balance sheet, (3) the cash flow statement, and (4) rates of return. 1.

Financial Statements are informational records detailing a company's business activities over a period. Investors need financial statements to gain a full understanding of how a company operates in relation to competitors. In the case of Amazon, profitability metrics used to analyze most businesses cannot be used to compare the company to ...

The financial statement analysis cases use ratios, creation of financial reports, and commentary to discuss in further detail the financial statements. The FASB Codification is used as a basis for research in many cases. Dr. Vicki Dickinson facilitated each case within this paper through the instruction of the Accountancy 420 course.

Finance & Accounting Magazine Article. Carolyn B. Levine. Yuji Ijiri. By definition, forecasted numbers in a financial statement involve educated guesses. But that's not always clear in the ...

A SERIES OF CASE STUDIES IN FINANCIAL REPORTING by Nicholas Fenske A thesis submitted to the faculty of The University of Mississippi in partial fulfillment of

The study used a secondary sourced data extracted from the annual report and financial statements of the selected consumer goods manufacturing firms in Nigeria. It covered the period from 2000 ...

case study of four firms. 3Dataset of Financial Reports Our case study focuses on 10-K annual reports of four firms from two industries in a period of ten years (2005-2014). From the automotive industry we chose Ford Motor Company (F) and General Motors Company (GM), and from the IT industry we selected Google - Alphabet Inc. (GOOAV) and ...

Objective and task. • The objective of this case study is to provide evidence to the Board about whether it is possible to define operating profit. • IAS 1 Presentation of Financial Statements does not require entities to present an operating profit subtotal. However, it requires entities to present additional subtotals when such ...

1. How to Read a Balance Sheet. A balance sheet conveys the "book value" of a company. It allows you to see what resources it has available and how they were financed as of a specific date. It shows its assets, liabilities, and owners' equity (essentially, what it owes, owns, and the amount invested by shareholders).

Looking at 10-K annual reports for a large sample of banks in the 2000-2014 period, 52 public bank holding companies that were associated with bank failures during the global financial crisis ...

by Kasandra Brabaw. One in 10 people in America lack health insurance, resulting in $40 billion of care that goes unpaid each year. Amitabh Chandra and colleagues say ensuring basic coverage for all residents, as other wealthy nations do, could address the most acute needs and unlock efficiency. 23 Mar 2023.

Studies on the frequency of financial reporting find that an increase in frequency is associated with real earnings management (Ernstberger et al. Citation 2017) and a decline in investment (Kraft et al. Citation 2018). While at first glance it would seem that an increase in disclosure has the potential to further reduce information asymmetry ...

2 . I. Introduction . The purpose of Case Study #1: Data Analytics is to provide an in-depth examination of the programs available to accountants to improve the efficiency with which financial data is processed and analyzed,

by Carolin E. Pflueger, Emil Siriwardane, and Adi Sunderam. This paper sheds new light on connections between financial markets and the macroeconomy. It shows that investors' appetite for risk—revealed by common movements in the pricing of volatile securities—helps determine economic outcomes and real interest rates.

Hani Tamer - A00056418 FIN600 T3 2021 Case Study Report - Orica Limited 3- Ratio Analysis In general, our study aims to assess the financial situation of Orica through a financial analysis in order to examine the activity, the profitability and the structure of the company. In the following report we adapted the horizontal analysis methodology that is based on the main financial statements ...

Meaning of Financial Statement Analysis:-Financial. statement refers to which contains financial information about an enterprise. They report profitability and financial positions of the firm business at the end of accounting period. The team financial statement include of two statements which the accountant prepare at the end of an accounting ...

Case Studies in Financial Education* A report prepared by the Global Financial Literacy Excellence Center February 29, 2016 Abstract This report provides a review of case studies of financial education programs, primarily throughout Europe and the United States, in order to examine what makes such programs effective. We focus

Financial statements are crucial to understanding a company's financial health and performance. Beyond the balance sheet, income statement, and cash flow statement, the Notes to Financial Statements provide important context and detail that can significantly impact the interpretation of the numbers.

The financial statement analysis cases use ratios, creation of financial reports, and commentary to discuss in further detail the financial statements. The FASB Codification is used as a basis for research in many cases. Dr. Vicki Dickinson facilitated each case within this paper through the instruction of the Accountancy 420 course.

The case-fatality rate reported by the CDC was highest during the first period examined by the agency (1973 to 1977), when it was 2.09 deaths to women per 100,000 legal induced abortions. During the five-year periods in between, the figure ranged from 0.52 (from 1993 to 1997) to 0.78 (from 1978 to 1982).

Research Report From survive to thrive: Achieving tech transformation for CSPs' future By focusing on new opportunities provided by cloud, data and AI, CSPs can accelerate their legacy technology transformation to resolve tech debt and position themselves for new product and service growth. Expand. Close ...

Forbes Advisor's annual report compared all 50 states and Washington, D.C., across nine different metrics to determine which states have the most and least expensive health care costs in 2024.

We present a rare case of myeloid sarcoma in the stomach of an elderly woman initially diagnosed with anaemia. Myeloid sarcoma, an unusual extramedullary manifestation of acute myeloid leukaemia (AML), primarily affects lymph nodes, bones, spine and skin, with gastrointestinal involvement being infrequent. Despite normal results from the initial endoscopy, a follow-up examination after 4 ...

Work is underway to begin clearing the wreckage of Baltimore's Francis Scott Key Bridge a week after a cargo ship crashed into it, sending the span crashing into the harbor and killing six ...