- Open access

- Published: 12 March 2020

Current landscape and influence of big data on finance

- Md. Morshadul Hasan ORCID: orcid.org/0000-0001-9857-9265 1 ,

- József Popp ORCID: orcid.org/0000-0003-0848-4591 2 &

- Judit Oláh ORCID: orcid.org/0000-0003-2247-1711 2

Journal of Big Data volume 7 , Article number: 21 ( 2020 ) Cite this article

57k Accesses

86 Citations

32 Altmetric

Metrics details

Big data is one of the most recent business and technical issues in the age of technology. Hundreds of millions of events occur every day. The financial field is deeply involved in the calculation of big data events. As a result, hundreds of millions of financial transactions occur in the financial world each day. Therefore, financial practitioners and analysts consider it an emerging issue of the data management and analytics of different financial products and services. Also, big data has significant impacts on financial products and services. Therefore, identifying the financial issues where big data has a significant influence is also an important issue to explore with the influences. Based on these concepts, the objective of this paper was to show the current landscape of finance dealing with big data, and also to show how big data influences different financial sectors, more specifically, its impact on financial markets, financial institutions, and the relationship with internet finance, financial management, internet credit service companies, fraud detection, risk analysis, financial application management, and so on. The connection between big data and financial-related components will be revealed in an exploratory literature review of secondary data sources. Since big data in the financial field is an extremely new concept, future research directions will be pointed out at the end of this study.

Introduction

In the age of technological innovation, various types of data are available with the advance of information technologies, and data is seen as one of the most valuable commodities in managing automation systems [ 13 , 68 ]. In this sense, financial markets and technological evolution have become related to every human activity in the past few decades. Big data technology has become an integral part of the financial services industry and will continue to drive future innovation [ 12 ]. Financial innovations are also considered the fastest emerging issues in financial services. More specifically, they cover a variety of financial businesses such as online peer-to-peer lending, crowd-funding platforms, SME finance, wealth management and asset management platforms, trading management, crypto-currency, money/remittance transfer, mobile payments platforms, and so on. All of these services create thousands of pieces of data every day. Therefore, managing this data is also considered the most important factor in these services. Any damage to the data can cause serious problems for that specific financial industry. Nowadays, financial analysts use external and alternative data to make better investment decisions. In addition, financial industries use big data through different predictive analyses and monitor various spending patterns to develop large decision-making models. In this way, the industries can decide which financial products to offer [ 29 , 48 ]. Millions of data are transmitted among financial companies. That is why big data is receiving more attention in the financial services arena, where information affects important success and production factors. It has been playing increasingly important roles in consolidating our understanding of financial markets [ 71 ]. In any case, the financial industry is using trillions of pieces of data constantly in everyday decisions [ 22 ]. It plays an important role in changing the financial services sector, particularly in trade and investment, tax reform, fraud detection and investigation, risk analysis, and automation [ 37 ]. In addition, it has changed the financial industry by overcoming different challenges and gaining valuable insights to improve customer satisfaction and the overall banking experience [ 45 ]. Razin [ 65 ] pointed out that big data is also changing finance in five ways: creating transparency, analyzing risk, algorithmic trading, leveraging consumer data and transforming culture. Also, big data has a significant influence in economic analysis and economic modeling [ 16 , 21 ].

In this study, the views of different researchers, academics, and others related to big data and finance activities have been collected and analysed. This study not only attempts to test the existing theory but also to gain an in-depth understanding of the research from the qualitative data. However, research on big data in financial services is not as extensive as other financial areas. Few studies have precisely addressed big data in different financial research contexts. Though some studies have done these for some particular topics, the extensive views of big data in financial services haven’t done before with proper explanation of the influence and opportunity of big data on finance. Therefore, the need to identify the finance areas where big data has a significant influence is addressed. Also, the research related to big data and financial issues is extremely new. Therefore, this study presents the emerging issues of finance where big data has a significant influence, which has never been published yet by other researchers. That is why this research explores the influence of big data on financial services and this is the novelty of this study.

This paper seeks to explore the current landscape of big data in financial services. Particularly this study highlights the influence of big data on internet banking, financial markets, and financial service management. This study also presents a framework, which will facilitate the way how big data influence on finance. Some other services relating to finance are also highlighted here to specify the extended area of big data in financial services. These are the contribution of this study in the existing literatures.

This result of the study contribute to the existing literature which will help readers and researchers who are working on this topic and all target readers will obtain an integrated concept of big data in finance from this study. Furthermore, this research is also important for researchers who are working on this topic. The issue of big data has been explored here from different financing perspectives to provide a clear understanding for readers. Therefore, this study aims to outline the current state of big data technology in financial services. More importantly, an attempt has been made to focus on big data finance activities by concentrating on its impact on the finance sector from different dimensions.

Literature review

The concept of big data in finance has taken from the previous literatures, where some studies have been published by some good academic journals. At present, most of the areas of business are linked to big data. It has significant influence on various perspectives of business such as business process management, human resources management, R&D management [ 8 , 63 ], business analytics [ 19 , 26 , 42 , 59 , 63 ], B2B business process, marketing, and sales [ 30 , 39 , 53 , 58 ], industrial manufacturing process [ 7 , 15 , 40 ], enterprise’s operational performance measurement [ 20 , 69 , 81 ], policy making [ 2 ], supply chain management, decision, and performance [ 4 , 38 , 64 ], and so other business arenas.

Particularly, Rabhi et al. [ 63 ] mentioned big data as a significant factor of business process management& HR process to support the decision making. This study also talked about three sophisticated types of analytics techniques such as descriptive analytics, predictive analytics, and prescriptive analytics in order to improve the traditional data analytics process. Duan and Xiong [ 19 ], Grover and Kar [ 26 ], Ji et al. [ 42 ], and Pappas et al. [ 59 ] also explored the significance of big data in business analytics. Big data helps to solve business problems and data management through system infrastructure, which includes any technique to capture, store, transfer, and process data. Duan and Xiong [ 19 ] found that top-performing organizations use analytics as opposed to intuition almost five times more than do the lower performers. Business analytics and business strategy must be closely linked together to gain better analytics-driven insights. Grover and Kar [ 26 ] mentioned about firms, like Apple, Facebook, Google, Amazon, and eBay, that regularly use digitized transaction data such as storing the transaction time, purchase quantities, product prices, and customer credentials on regular basis to estimate the condition of their market for improving their business operations [ 61 , 76 ]. Holland et al. [ 39 ] showed the theoretical and empirical contributions of big data in business. This study inferred that B2B relationships from consumer search patterns, which used to evaluate and measure the online performance of competitors in the US airline market. Moreover, big data also help to foster B2B sales with customer data analytics. The use of customer’s big datasets significantly improve sales growth (monetary performance outcomes), and enhances the customer relationship performance (non-monetary performance outcomes) [ 30 ]. It also relates to market innovation with diversified opportunities.

Big data and its analytics and applications work as indicators of organizations’ ability to innovate to respond to market opportunities [ 78 ]. Also, big data impact on industrial manufacturing process to gain competitive advantages. After analyzing a case study of two company, Belhadi et al. [ 7 ] stated ‘NAPC aims for a qualitative leap with digital and big - data analytics to enable industrial teams to develop or even duplicate models of turnkey factories in Africa’. This study also identified an Overall framework of BDA capabilities in manufacturing process , and mentioned some values of Big Data Analytics for manufacturing process, such as enhancing transparency, improving performance, supporting decision-making and increasing knowledge. Also, Cui et al. [ 15 ] mentioned four most frequently big data applications (Monitoring, prediction, ICT framework, and data analytics) used in manufacturing. These are essential to realize the smart manufacturing process. Shamim et al. [ 69 ] argued that employee ambidexterity is important because employees’ big data management capabilities and ambidexterity are crucial for EMMNEs to manage the demands of global users. Also big data appeared as a frontier of the opportunity in improving firm performance. Yadegaridehkordi et al. [ 81 ] hypothesized that big data adoption has positive effect on firm performance. That study also mentioned that the policy makers, governments, and businesses can take well-informed decisions in adopting big data. According to Hofmann [ 38 ], velocity, variety, and volume significantly influence on supply chain management. For example, at first, velocity offers the biggest opportunity to intensification the efficiency of the processes in the supply chain. Next to this, variety supports different types of data volume in the supply chains is mostly new. After that, the volume is also a bigger interest for the multistage supply chains than to two-staged supply chains. Raman et al. [ 64 ] provided a new model, Supply Chain Operations Reference (SCOR), by incorporating SCM with big data. This model exposes the adoption of big data technology adds significant value as well as creates financial gain for the industry. This model is apt for the evaluation of the financial performance of supply chains. Also it works as a practical decision support means for examining competing decision alternatives along the chain as well as environmental assessment. Lamba and Singh [ 50 ] focused on decision making aspect of supply chain process and mentioned that data-driven decision-making is gaining noteworthy importance in managing logistics activities, process improvement, cost optimization, and better inventory management. Sahal et al. [ 67 ] and Xu and Duan [ 80 ] showed the relation of cyber physical systems and stream processing platform for Industry 4.0. Big data and IoT are considering as much influential forces for the era of Industry 4.0. These are also helping to achieve the two most important goals of Industry 4.0 applications (to increase productivity while reducing production cost & to maximum uptime throughout the production chain). Belhadi et al. [ 7 ] identified manufacturing process challenges, such as quality & process control (Q&PC), energy & environment efficiency (E&EE), proactive diagnosis and maintenance (PD&M), and safety & risk analysis (S&RA). Hofmann [ 38 ] also mentioned that one of the greatest challenges in the field of big data is to find new ways for storing and processing the different types of data. In addition, Duan and Xiong [ 19 ] mentioned that big data encompass more unstructured data such as text, graph, and time-series data compared to structured data for both data storage techniques and data analytics techniques. Zhao et al. [ 86 ] identified two major challenges for integrating both internal and external data for big data analytics. These are connecting datasets across the data sources, and selecting relevant data for analysis. Huang et al. [ 40 ] raised four challenges, first, the accuracy and applicability of the small data-based PSM paradigms is one kind of challenge; second, the traditional static-oriented PSM paradigms difficult to adapt to the dynamic changes of complex production systems; third, it is urgent to carry out research that focuses on forecasting-based PSM paradigms; and fourth, the determining the causal relationship quickly, economically and effectively is difficult, which affects safety predictions and safety decision-making.

The above discussion based on different area of business. Whatever, some studies (such as [ 6 , 11 , 14 , 22 , 23 , 41 , 45 , 54 , 68 , 71 , 73 , 75 , 83 , 85 ] focused different perspectives of financial services. Still, the contribution on this area is not expanded. Based on those researches, the current trends of big data in finance have specified in finding section.

Methodology

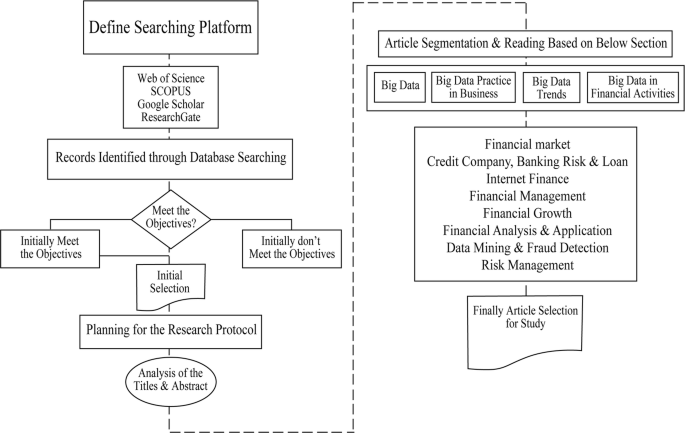

The purpose of this study is to locate academic research focusing on the related studies of big data and finance. To accomplish this research, secondary data sources were used to collect related data [ 31 , 32 , 34 ]. To collect secondary data, the study used the electronic database Scopus, the web of science, and Google scholar [ 33 ]. The keywords of this study are big data finance, finance and big data, big data and the stock market, big data in banking, big data management, and big data and FinTech. The search mainly focused only on academic and peer-reviewed journals, but in some cases, the researcher studied some articles on the Internet which were not published in academic and peer-reviewed journals. Sometimes, information from search engines helps understand the topic. The research area of big data has already been explored but data on big data in finance is not so extensive; this is why we did not limit the search to a certain time period because a time limitation may reduce the scope of the area of this research. Here, a structured and systematic data collection process was followed. Figure 1 presents the structured and systematic data collection process of this study. Certain renowned publishers, for example, Elsevier, Springer, Taylor & Francis, Wiley, Emerald, and Sage, among others, were prioritized when collecting the data for this study [ 35 , 36 ].

Systematic framework of the research structure. (Source: Author’s illustration)

The number of related articles collected from those databases is only 180. Following this, the collected articles were screened and a shortlist was created, featuring only 100 articles. Finally, data was used from 86 articles, of which 34 articles were directly related to ‘ Big data in Finance’ . Table 1 presents the list of those journals which will help to contribute to future research.

This literature study suggests that some major factors are related to big data and finance. In this context, it has been found that these specific factors also have a deep relationship with big data, such as financial markets, banking risk and lending, internet finance, financial management, financial growth, financial analysis and application, data mining and fraud detection, risk management, and other financial practices. Table 2 describes the focuses within the literature on the financial sector relating to big data.

Theoretical framework

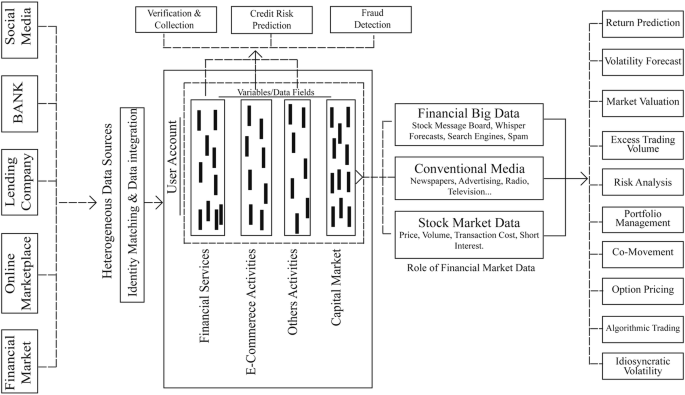

After studying the literature, this study has found that big data is mostly linked to financial market, Internet finance. Credit Service Company, financial service management, financial applications and so forth. Mainly data relates with four types of financial industry such as financial market, online marketplace, lending company, and bank. These companies produce billions of data each day from their daily transaction, user account, data updating, accounts modification, and so other activities. Those companies process the billions of data and take the help to predict the preference of each consumer given his/her previous activities, and the level of credit risk for each user. Based on those data, financial institutions help in taking decisions [ 84 ]. However, different financial companies processing big data and getting help for verification and collection, credit risk prediction, and fraud detection. As the billions of data are producing from heterogeneous sources, missing data is a big concern as well as data quality and data reliability is also significant matter. Whatever, the concept of role of financial big data has taken form [ 71 ], where that study mention the sources of financial market information include the information assembled from stock market data (e.g., stock prices, stock trading volume, interest rates, and so on), social media (e.g., Facebook, twitter, newspapers, advertising, television, and so on). These data has significant roles in financial market such as predicting the market return, forecasting market volatility, valuing market position, identifying excess trading volume, analyzing the market risk, movement of the stock, option pricing, algorithmic trading, idiosyncratic volatility, and so on. Based on these discussions, a theoretical framework is illustrated in Fig. 2 .

Theoretical framework of big data in financial services. Source: Author’s explanation. (This concept of this framework has been taken from Shen and Chen [ 71 ] and Zhang et al. [ 85 ])

Results and discussion

Massive data and increasingly sophisticated technologies are changing the way industries operate and compete. The financial world is also operating with these big data sets. It has not only influenced many fields of science and society, but has had an important impact on the finance industry [ 6 , 13 , 23 , 41 , 45 , 54 , 62 , 68 , 71 , 72 , 73 , 82 , 85 ]. After reviewing the literature, this study found some financial areas directly linked to big data, such as financial markets, internet credit service-companies and internet finance, financial management, analysis, and applications, credit banking risk analysis, risk management, and so forth. These areas are divided here into three groups; first, big data implications for financial markets and the financial growth of companies; second, big data implications for internet finance and value creation in internet credit-service companies; and third, big data in financial management, risk management, financial analysis, and applications. The discussion of big data in these specified financial areas is the contribution made by this study. Also, these are regarded as emerging landscape of big data in finance in this study.

Big data implications on financial markets

Financial markets always seek technological innovation for different activities, especially technological innovations that are always positively accepted, and which have a great impact on financial markets, and which have truly transforming effects on them. Shen and Chen [ 71 ] explain that the efficiency of financial markets is mostly attributed to the amount of information and its diffusion process. In this sense, social media undoubtedly plays a crucial role in financial markets. In this sense, it is considered one of the most influential forces acting on them. It generates millions of pieces of information every day in financial markets globally [ 9 ]. Big data mainly influences financial markets through return predictions, volatility forecasts, market valuations, excess trading volumes, risk analyses, portfolio management, index performance, co-movement, option pricing, idiosyncratic volatility, and algorithmic trading.

Shen and Chen [ 71 ] focus on the medium effect of big data on the financial market. This effect has two elements, effects on the efficient market hypothesis, and effects on market dynamics. The effect on the efficient market hypothesis refers to the number of times certain stock names are mentioned, the extracted sentiment from the content, and the search frequency of different keywords. Yahoo Finance is a common example of the effect on the efficient market hypothesis. On the other hand, the effect of financial big data usually relies on certain financial theories. Bollen et al. [ 9 ] emphasize that it also helps in sentiment analysis in financial markets, which represents the familiar machine learning technique with big datasets.

In another prospect, Begenau et al. [ 6 ] explore the assumption that big data strangely benefits big firms because of their extended economic activity and longer firm history. Even large firms typically produce more data compared to small firms. Big data also relates corporate finance in different ways such as attracting more financial analysis, as well as reducing equity uncertainty, cutting a firm’s cost of capital, and the costs of investors forecasting related to a financial decision. It cuts the cost of capital as investors process more data to enable large firms to grow larger. In pervasive and transformative information technology, financial markets can process more data, earnings statements, macro announcements, export market demand data, competitors’ performance metrics, and predictions of future returns. By predicting future returns, investors can reduce uncertainty about investment outcomes. In this sense Begenau et al. [ 6 ] stated that “More data processing lowers uncertainty, which reduces risk premia and the cost of capital, making investments more attractive.”.

Big data implications on internet finance and value creation at an internet credit service company

Technological advancements have caused a revolutionary transformation in financial services; especially the way banks and FinTech enterprises provide their services. Thinking about the influence of big data on the financial sector and its services, the process can be highlighted as a modern upgrade to financial access. In particular, online transactions, banking applications, and internet banking produce millions of pieces of data in a single day. Therefore, managing these millions of data is a subject to important [ 46 ]. Because managing these internet financing services has major impacts on financial markets [ 57 ]. Here, Zhang et al. [ 85 ] and Xie et al. [ 79 ] focus on data volume, service variety, information protection, and predictive correctness to show the relationship between information technologies and e-commerce and finance. Big data improves the efficiency of risk-based pricing and risk management while significantly alleviating information asymmetry problems. Also, it helps to verify and collect the data, predict credit risk status, and detect fraud [ 24 , 25 , 56 ]. Jin et al. [ 44 ], [ 47 ], Peji [ 60 ], and Hajizadeh et al. [ 28 ] identified that data mining technology plays vital roles in risk managing and fraud detection.

Big data also has a significant impact on Internet credit service companies. The first impact is to be able to assess more borrowers, even those without a good financial status. Big data also plays a vital role in credit rating bureaus. For example, the two public credit bureaus in China only have 0.3 billion individual’s ‘financial records. For other people, they at most have identity and demographic information (such as ID, name, age, marriage status, and education level), and it is not plausible to obtain reliable credit risk predictions using traditional models. This situation significantly limits financial institutions from approaching new consumers [ 85 ]. In this case, big data benefits by giving the opportunity for unlimited data access. In order to deal with credit risk effectively, financial systems take advantage of transparent information mechanisms. Big data can influence the market-based credit system of both enterprises and individuals by integrating the advantages of cloud computing and information technology. Cloud computing is another motivating factor; by using this cloud computing and big data services, mobile internet technology has opened a crystal price formation process in non-internet-based traditional financial transactions. Besides providing information to both the lenders and borrowers, it creates a positive relationship between the regulatory bodies of both banking and securities sectors. If a company has a large data set from different sources, it leads to multi-dimensional variables. However, managing these big datasets is difficult; sometimes if these datasets are not managed appropriately they may even seem a burden rather than an advantage. In this sense, the concept of data mining technology described in Hajizadeh et al. [ 28 ] to manage a huge volume of data regarding financial markets can contribute to reducing these difficulties. Managing the huge sets of data, the FinTech companies can process their information reliably, efficiently, effectively, and at a comparatively lower cost than the traditional financial institutions. They can analyze and provide services to more customers at greater depth. In addition, they can benefit from the analysis and prediction of systemic financial risks [ 82 ]. However, one critical issue is that individuals or small companies may not be able to afford to access big data directly. In this case, they can take advantage of big data through different information companies such as professional consulting companies, relevant government agencies, relevant private agencies, and so forth.

Big data in managing financial services

Big data is an emerging issue in almost all areas of business. Especially in finance, it effects with a variety of facility, such as financial management, risk management, financial analysis, and managing the data of financial applications. Big data is expressively changing the business models of financial companies and financial management. Also, it is considered a fascinating area nowadays. In this fascinating area, scientists and experts are trying to propose novel finance business models by considering big data methods, particularly, methods for risk control, financial market analysis, creating new finance sentiment indexes from social networks, and setting up information-based tools in different creative ways [ 58 ]. Sun et al. [ 73 ] mentioned the 4 V features of big data. These are volume (large data scale), variety (different data formats), velocity (real-time data streaming), and veracity (data uncertainty). These characteristics comprise different challenges for management, analytics, finance, and different applications. These challenges consist of organizing and managing the financial sector in effective and efficient ways, finding novel business models and handling traditional financial issues. The traditional financial issues are defined as high-frequency trading, credit risk, sentiments, financial analysis, financial regulation, risk management, and so on [ 73 ].

Every financial company receives billions of pieces of data every day but they do not use all of them in one moment. The data helps firms analyze their risk, which is considered the most influential factor affecting their profit maximization. Cerchiello and Giudici [ 11 ] specified systemic risk modelling as one of the most important areas of financial risk management. It mainly, emphasizes the estimation of the interrelationships between financial institutions. It also helps to control both the operational and integrated risk. Choi and Lambert [ 13 ] stated that ‘Big data are becoming more important for risk analysis’. It influences risk management by enhancing the quality of models, especially using the application and behavior scorecards. It also elaborates and interprets the risk analysis information comparatively faster than traditional systems. In addition, it also helps in detecting fraud [ 25 , 56 ] by reducing manual efforts by relating internal as well as external data in issues such as money laundering, credit card fraud, and so on. It also helps in enhancing computational efficiency, handling data storage, creating a visualization toolbox, and developing a sanity-check toolbox by enabling risk analysts to make initial data checks and develop a market-risk-specific remediation plan. Campbell-verduyn et al. [ 10 ] state “Finance is a technology of control, a point illustrated by the use of financial documents, data, models and measures in management, ownership claims, planning, accountability, and resource allocation” .

Moreover, big data techniques help to measure credit banking risk in home equity loans. Every day millions of financial operations lead to growth in companies’ databases. Managing these big databases sometimes creates problems. To resolve those problems, an automatic evaluation of credit status and risk measurements is necessary within a reasonable period of time [ 62 ]. Nowadays, bankers are facing problems in measuring the risks of credit and managing their financial databases. Big data practices are applied to manage financial databases in order to segment different risk groups. Also big data is very helpful for banks to comply with both the legal and the regulatory requirements in the credit risk and integrity risk domains [ 12 ]. A large dataset always needs to be managed with big data techniques to provide faster and unbiased estimators. Financial institutions benefit from improved and accurate credit risk evaluation. This helps to reduce the risks for financial companies in predicting a client’s loan repayment ability. In this way, more and more people get access to credit loans and at the same time banks reduce their credit risks [ 62 ].

Big data and other financial issues

One of the largest data platforms is the Internet, which is clearly playing ever-increasing roles in both the financial markets and personal finance. Information from the Internet always matters. Tumarkin and Whitelaw [ 77 ] examine the relationship between Internet message board activity and abnormal stock returns and trading volume. The study found that abnormal message activity of the stock of the Internet sector changes investors’ opinions in correlation with abnormal industry-adjusted returns, as well as causing trading volume to become abnormally high, since the Internet is the most common channel for information dissemination to investors. As a result, investors are always seeking information from the Internet and other sources. This information is mostly obtained by searching on different search engines. Drake et al. [ 18 ] found that abnormal information searches on search engines increase about two weeks prior to the earnings announcement. This study also suggests that information diffusion is not instantaneous with the release of the earnings information, but rather is spread over a period surrounding the announcement. One more significant correlation identified in this study is that information demand is positively associated with media attention and news, but negatively associated with investor distraction. Dimpfl and Jank [ 17 ] specified that search queries help predict future volatility, and their volatility will exceed the information contained in the lag volatility itself, and the volatility of the search volume will have an impact on volatility, which will last a considerable period of time. Jin et al. [ 43 ] identified that micro blogging also has a significant influence on changing the information environment, which in turn influences changes in stock market behavior.

Conclusions

Big data, machine learning, AI, and the cloud computing are fueling the finance industry toward digitalization. Large companies are embracing these technologies to implement digital transformation, bolster profit and loss, and meet consumer demand. While most companies are storing new and valuable data, the question is the implication and influence of these stored data in finance industry. In this prospect, every financial service is technologically innovative and treats data as blood circulation. Therefore, the findings of this study are reasonable to conclude that big data has revolutionized finance industry mainly with the real time stock market insights by changing trade and investments, fraud detection and prevention, and accurate risk analysis by machine learning process. These services are influencing by increasing revenue and customer satisfaction, speeding up manual processes, improving path to purchase, streamlined workflow and reliable system processing, analyze financial performance, and control growth. Despite these revolutionary service transmissions, several critical issues of big data exist in the finance world. Privacy and protection of data is one the biggest critical issue of big data services. As well as data quality of data and regulatory requirements also considered as significant issues. Even though every financial products and services are fully dependent on data and producing data in every second, still the research on big data and finance hasn’t reached its peak stage. In this perspectives, the discussion of this study reasonable to settle the future research directions. In future, varied research efforts will be important for financial data management systems to address technical challenges in order to realize the promised benefits of big data; in particular, the challenges of managing large data sets should be explored by researchers and financial analysts in order to drive transformative solutions. The common problem is that the larger the industry, the larger the database; therefore, it is important to emphasize the importance of managing large data sets for large companies compared to small firms. Managing such large data sets is expensive, and in some cases very difficult to access. In most cases, individuals or small companies do not have direct access to big data. Therefore, future research may focus on the creation of smooth access for small firms to large data sets. Also, the focus should be on exploring the impact of big data on financial products and services, and financial markets. Research is also essential into the security risks of big data in financial services. In addition, there is a need to expand the formal and integrated process of implementing big data strategies in financial institutions. In particular, the impact of big data on the stock market should continue to be explored. Finally, the emerging issues of big data in finance discussed in this study should be empirically emphasized in future research.

Availability of data and materials

Our data will be available on request.

Abbreviations

Small and medium enterprise

Research & Development

Human resource

Business to Business

Big data analytics

Supply chain management

Internet of things

Production safety management

Financial Technology

Andreasen MM, Christensen JHE, Rudebusch GD. Term structure analysis with big data: one-step estimation using bond prices. J Econom. 2019;212(1):26–46. https://doi.org/10.1016/j.jeconom.2019.04.019 .

Article MathSciNet MATH Google Scholar

Aragona B, Rosa R De. Big data in policy making. Math Popul Stud. 2018;00(00):1–7. https://doi.org/10.1080/08898480.2017.1418113 .

Article Google Scholar

Baak MA, van Hensbergen S. How big data can strengthen banking risk surveillance. Compact, 15–19. https://www.compact.nl/en/articles/how-big-data-can-strengthen-banking-risk-surveillance/ (2015).

Bag S, Wood LC, Xu L, Dhamija P, Kayikci Y. Big data analytics as an operational excellence approach to enhance sustainable supply chain performance. Resour Conserv Recycl. 2020;153:104559. https://doi.org/10.1016/j.resconrec.2019.104559 .

Barr MS, Koziara B, Flood MD, Hero A, Jagadish HV. Big data in finance: highlights from the big data in finance conference hosted at the University of Michigan October 27–28, 2016. SSRN Electron J. 2018. https://doi.org/10.2139/ssrn.3131226 .

Begenau J, Farboodi M, Veldkamp L. Big data in finance and the growth of large firms. J Monet Econ. 2018;97:71–87. https://doi.org/10.1016/j.jmoneco.2018.05.013 .

Belhadi A, Zkik K, Cherrafi A, Yusof SM, El fezazi S. Understanding big data analytics for manufacturing processes: insights from literature review and multiple case studies. Comput Ind Eng. 2019;137:106099. https://doi.org/10.1016/j.cie.2019.106099 .

Blackburn M, Alexander J, Legan JD, Klabjan D. Big data and the future of R&D management: the rise of big data and big data analytics will have significant implications for R&D and innovation management in the next decade. Res Technol Manag. 2017;60(5):43–51. https://doi.org/10.1080/08956308.2017.1348135 .

Bollen J, Mao H, Zeng X. Twitter mood predicts the stock market. J Comput Sci. 2011;2(1):1–8. https://doi.org/10.1016/j.jocs.2010.12.007 .

Campbell-verduyn M, Goguen M, Porter T. Big data and algorithmic governance: the case of financial practices. New Polit Econ. 2017;22(2):1–18. https://doi.org/10.1080/13563467.2016.1216533 .

Cerchiello P, Giudici P. Big data analysis for financial risk management. J Big Data. 2016;3(1):18. https://doi.org/10.1186/s40537-016-0053-4 .

Chen M. How the financial services industry is winning with big data. https://mapr.com/blog/how-financial-services-industry-is-winning-with-big-data/ (2018).

Choi T, Lambert JH. Advances in risk analysis with big data. Risk Anal 2017; 37(8). https://doi.org/10.1111/risa.12859 .

Corporation O. Big data in financial services and banking (Oracle Enterprise Architecture White Paper, Issue February). http://www.oracle.com/us/technologies/big-data/big-data-in-financial-services-wp-2415760.pdf (2015).

Cui Y, Kara S, Chan KC. Manufacturing big data ecosystem: a systematic literature review. Robot Comput Integr Manuf. 2020;62:101861. https://doi.org/10.1016/j.rcim.2019.101861 .

Diebold FX, Ghysels E, Mykland P, Zhang L. Big data in dynamic predictive econometric modeling. J Econ. 2019;212:1–3. https://doi.org/10.1016/j.jeconom.2019.04.017 .

Dimpfl T, Jank S. Can internet search queries help to predict stock market volatility? Eur Financ Manag. 2016;22(2):171–92. https://doi.org/10.1111/eufm.12058 .

Drake MS, Roulstone DT, Thornock JR. Investor information demand: evidence from Google Searches around earnings announcements. J Account Res. 2012;50(4):1001–40. https://doi.org/10.1111/j.1475-679X.2012.00443.x .

Duan L, Xiong Y. Big data analytics and business analytics. J Manag Anal. 2015;2(1):1–21. https://doi.org/10.1080/23270012.2015.1020891 .

Dubey R, Gunasekaran A, Childe SJ, Bryde DJ, Giannakis M, Foropon C, Roubaud D, Hazen BT. Big data analytics and artificial intelligence pathway to operational performance under the effects of entrepreneurial orientation and environmental dynamism: a study of manufacturing organisations. Int J Prod Econ. 2019. https://doi.org/10.1016/j.ijpe.2019.107599 .

Einav L, Levin J. The data revolution and economic analysis. Innov Policy Econ. 2014;14(1):1–24. https://doi.org/10.1086/674019 .

Ewen J. How big data is changing the finance industry. https://www.tamoco.com/blog/big-data-finance-industry-analytics/ (2019).

Fanning K, Grant R. Big data: implications for financial managers. J Corp Account Finance. 2013. https://doi.org/10.1002/jcaf.21872 .

Glancy FH, Yadav SB. A computational model for fi nancial reporting fraud detection. Decis Support Syst. 2011;50(3):595–601. https://doi.org/10.1016/j.dss.2010.08.010 .

Gray GL, Debreceny RS. A taxonomy to guide research on the application of data mining to fraud detection in financial statement audits. Int J Account Inform Sys. 2014. https://doi.org/10.1016/j.accinf.2014.05.006 .

Grover P, Kar AK. Big data analytics: a review on theoretical contributions and tools used in literature. Global J Flex Sys Manag. 2017;18(3):203–29. https://doi.org/10.1007/s40171-017-0159-3 .

Hagenau M, Liebmann M, Neumann D. Automated news reading: stock price prediction based on financial news using context-capturing features. Decis Support Syst. 2013;55(3):685–97. https://doi.org/10.1016/j.dss.2013.02.006 .

Hajizadeh E, Ardakani HD, Shahrabi J. Application of data mining techniques in stock markets: a survey. J Econ Int Finance. 2010;2(7):109–18.

Google Scholar

Hale G, Lopez JA. Monitoring banking system connectedness with big data. J Econ. 2019;212(1):203–20. https://doi.org/10.1016/j.jeconom.2019.04.027 .

Article MATH Google Scholar

Hallikainen H, Savimäki E, Laukkanen T. Fostering B2B sales with customer big data analytics. Ind Mark Manage. 2019. https://doi.org/10.1016/j.indmarman.2019.12.005 .

Hasan MM, Mahmud A. Risks management of ready-made garments industry in Bangladesh. Int Res J Bus Stud. 2017;10(1):1–13. https://doi.org/10.21632/irjbs.10.1.1-13 .

Hasan MM, Mahmud A, Islam MS. Deadly incidents in Bangladeshi apparel industry and illustrating the causes and effects of these incidents. J Finance Account. 2017;5(5):193–9. https://doi.org/10.11648/j.jfa.20170505.13 .

Hasan MM, Nekmahmud M, Yajuan L, Patwary MA. Green business value chain: a systematic review. Sustain Prod Consum. 2019;20:326–39. https://doi.org/10.1016/J.SPC.2019.08.003 .

Hasan MM, Parven T, Khan S, Mahmud A, Yajuan L. Trends and impacts of different barriers on Bangladeshi RMG Industry’s sustainable development. Int Res J Bus Stud. 2018;11(3):245–60. https://doi.org/10.21632/irjbs.11.3.245-260 .

Hasan MM, Yajuan L, Khan S. Promoting China’s inclusive finance through digital financial services. Global Bus Rev. 2020. https://doi.org/10.1177/0972150919895348 .

Hasan MM, Yajuan L, Mahmud A. Regional development of China’s inclusive finance through financial technology. SAGE Open. 2020. https://doi.org/10.1177/2158244019901252 .

Hill C. Where big data is taking the financial industry: trends in 2018. Big data made simple. https://bigdata-madesimple.com/where-big-data-is-taking-the-financial-industry-trends-in-2018/ (2018).

Hofmann E. Big data and supply chain decisions: the impact of volume, variety and velocity properties on the bullwhip effect. Int J Prod Res. 2017;55(17):5108–26. https://doi.org/10.1080/00207543.2015.1061222 .

Holland CP, Thornton SC, Naudé P. B2B analytics in the airline market: harnessing the power of consumer big data. Ind Mark Manage. 2019. https://doi.org/10.1016/j.indmarman.2019.11.002 .

Huang L, Wu C, Wang B. Challenges, opportunities and paradigm of applying big data to production safety management: from a theoretical perspective. J Clean Prod. 2019;231:592–9. https://doi.org/10.1016/j.jclepro.2019.05.245 .

Hussain K, Prieto E. Big data in the finance and insurance sectors. In: Cavanillas JM, Curry E, Wahlster W, editors. New horizons for a data-driven economy: a roadmap for usage and exploitation of big data in Europe. SpringerOpen: Cham; 2016. p. 2019–223. https://doi.org/10.1007/978-3-319-21569-3 .

Chapter Google Scholar

Ji W, Yin S, Wang L. A big data analytics based machining optimisation approach. J Intell Manuf. 2019;30(3):1483–95. https://doi.org/10.1007/s10845-018-1440-9 .

Jin X, Shen D, Zhang W. Has microblogging changed stock market behavior? Evidence from China. Physica A. 2016;452:151–6. https://doi.org/10.1016/j.physa.2016.02.052 .

Jin M, Wang Y, Zeng Y. Application of data mining technology in financial risk. Wireless Pers Commun. 2018. https://doi.org/10.1007/s11277-018-5402-5 .

Joshi N. How big data can transform the finance industry. BBN Times. https://www.bbntimes.com/en/technology/big-data-is-transforming-the-finance-industry .

Kh R. How big data can play an essential role in Fintech Evolutionno title. Smart Dala Collective. https://www.smartdatacollective.com/fintech-big-data-play-role-financial-evolution/ (2018).

Khadjeh Nassirtoussi A, Aghabozorgi S, Ying Wah T, Ngo DCL. Text mining for market prediction: a systematic review. Expert Syst Appl. 2014;41(16):7653–70. https://doi.org/10.1016/j.eswa.2014.06.009 .

Khan F. Big data in financial services. https://medium.com/datadriveninvestor/big-data-in-financial-services-d62fd130d1f6 (2018).

Kshetri N. Big data’s role in expanding access to financial services in China. Int J Inf Manage. 2016;36(3):297–308. https://doi.org/10.1016/j.ijinfomgt.2015.11.014 .

Lamba K, Singh SP. Big data in operations and supply chain management: current trends and future perspectives. Prod Plan Control. 2017;28(11–12):877–90. https://doi.org/10.1080/09537287.2017.1336787 .

Lien D. Business Finance and Enterprise Management in the era of big data: an introduction. North Am J Econ Finance. 2017;39:143–4. https://doi.org/10.1016/j.najef.2016.10.002 .

Liu S, Shao B, Gao Y, Hu S, Li Y, Zhou W. Game theoretic approach of a novel decision policy for customers based on big data. Electron Commer Res. 2018;18(2):225–40. https://doi.org/10.1007/s10660-017-9259-6 .

Liu Y, Soroka A, Han L, Jian J, Tang M. Cloud-based big data analytics for customer insight-driven design innovation in SMEs. Int J Inf Manage. 2019. https://doi.org/10.1016/j.ijinfomgt.2019.11.002 .

Mohamed TS. How big data does impact finance. Aksaray: Aksaray University; 2019.

Mulla J, Van Vliet B. FinQL: a query language for big data in finance. SSRN Electron J. 2015. https://doi.org/10.2139/ssrn.2685769 .

Ngai EWT, Hu Y, Wong YH, Chen Y, Sun X. The application of data mining techniques in financial fraud detection: a classification framework and an academic review of literature. Decis Support Syst. 2011;50(3):559–69. https://doi.org/10.1016/j.dss.2010.08.006 .

Niu S. Prevention and supervision of internet financial risk in the context of big data. Revista de La Facultad de Ingeniería. 2017;32(11):721–6.

Oracle. (2012) Financial services data management: big Data technology in financial services (Issue June).

Pappas IO, Mikalef P, Giannakos MN, Krogstie J, Lekakos G. Big data and business analytics ecosystems: paving the way towards digital transformation and sustainable societies. IseB. 2018;16(3):479–91. https://doi.org/10.1007/s10257-018-0377-z .

Peji M. Text mining for big data analysis in financial sector: a literature review. Sustainability. 2019. https://doi.org/10.3390/su11051277 .

Pousttchi K, Hufenbach Y. Engineering the value network of the customer interface and marketing in the data-Rich retail environment. Int J Electron Commer. 2015. https://doi.org/10.2753/JEC1086-4415180401 .

Pérez-Martín A, Pérez-Torregrosa A, Vaca M. Big Data techniques to measure credit banking risk in home equity loans. J Bus Res. 2018. https://doi.org/10.1016/j.jbusres.2018.02.008 .

Rabhi L, Falih N, Afraites A, Bouikhalene B. Big data approach and its applications in various fields: review. Proc Comput Sci. 2019;155(2018):599–605. https://doi.org/10.1016/j.procs.2019.08.084 .

Raman S, Patwa N, Niranjan I, Ranjan U, Moorthy K, Mehta A. Impact of big data on supply chain management. Int J Logist Res App. 2018;21(6):579–96. https://doi.org/10.1080/13675567.2018.1459523 .

Razin E. Big buzz about big data: 5 ways big data is changing finance. Forbes. https://www.forbes.com/sites/elyrazin/2015/12/03/big-buzz-about-big-data-5-ways-big-data-is-changing-finance/#1d055654376a (2019).

Retail banks and big data: big data as the key to better risk management. In: The Economist Intelligence Unit. https://eiuperspectives.economist.com/sites/default/files/RetailBanksandBigData.pdf (2014).

Sahal R, Breslin JG, Ali MI. Big data and stream processing platforms for Industry 4.0 requirements mapping for a predictive maintenance use case. J Manuf Sys. 2020;54:138–51. https://doi.org/10.1016/j.jmsy.2019.11.004 .

Schiff A, McCaffrey M. Redesigning digital finance for big data. SSRN Electron J. 2017. https://doi.org/10.2139/ssrn.2967122 .

Shamim S, Zeng J, Shafi Choksy U, Shariq SM. Connecting big data management capabilities with employee ambidexterity in Chinese multinational enterprises through the mediation of big data value creation at the employee level. Int Bus Rev. 2019. https://doi.org/10.1016/j.ibusrev.2019.101604 .

Shen Y (n.d.). Study on internet financial risk early warning based on big data analysis. 1919–1922.

Shen D, Chen S. Big data finance and financial markets. In: Computational social sciences (pp. 235–248). https://doi.org/10.1007/978-3-319-95465-3_12235 (2018).

Shen Y, Shen M, Chen Q. Measurement of the new economy in China: big data approach. China Econ J. 2016;9(3):304–16. https://doi.org/10.1080/17538963.2016.1211384 .

Sun Y, Shi Y, Zhang Z. Finance big data: management, analysis, and applications. Int J Electron Commer. 2019;23(1):9–11. https://doi.org/10.1080/10864415.2018.1512270 .

Sun W, Zhao Y, Sun L. Big data analytics for venture capital application: towards innovation performance improvement. Int J Inf Manage. 2018. https://doi.org/10.1016/j.ijinfomgt.2018.11.017 .

Tang Y, Xiong JJ, Luo Y, Zhang Y, Tang Y. How do the global stock markets Influence one another? Evidence from finance big data and granger causality directed network. Int J Electron Commer. 2019;23(1):85–109. https://doi.org/10.1080/10864415.2018.1512283 .

Thackeray R, Neiger BL, Hanson CL, Mckenzie JF. Enhancing promotional strategies within social marketing programs: use of Web 2.0 social media. Health Promot Pract. 2008. https://doi.org/10.1177/1524839908325335 .

Tumarkin R, Whitelaw RF. News or noise? Internet postings and stock prices. Financ Anal J. 2001;57(3):41–51. https://doi.org/10.2469/faj.v57.n3.2449 .

Wright LT, Robin R, Stone M, Aravopoulou DE. Adoption of big data technology for innovation in B2B marketing. J Business-to-Business Mark. 2019;00(00):1–13. https://doi.org/10.1080/1051712X.2019.1611082 .

Xie P, Zou C, Liu H. The fundamentals of internet finance and its policy implications in China. China Econ J. 2016;9(3):240–52. https://doi.org/10.1080/17538963.2016.1210366 .

Xu L Da, Duan L. Big data for cyber physical systems in industry 4.0: a survey. Enterp Inf Syst. 2019;13(2):148–69. https://doi.org/10.1080/17517575.2018.1442934 .

Article MathSciNet Google Scholar

Yadegaridehkordi E, Nilashi M, Shuib L, Nasir MH, Asadi M, Samad S, Awang NF. The impact of big data on firm performance in hotel industry. Electron Commer Res Appl. 2020;40:100921. https://doi.org/10.1016/j.elerap.2019.100921 .

Yang D, Chen P, Shi F, Wen C. Internet finance: its uncertain legal foundations and the role of big data in its development. Emerg Mark Finance Trade. 2017. https://doi.org/10.1080/1540496X.2016.1278528 .

Yu S, Guo S. Big data in finance. Big data concepts, theories, and application. Cham: Springer International Publishing; 2016. p. 391–412. https://doi.org/10.1007/978-3-319-27763-9 .

Yu ZH, Zhao CL, Guo SX(2017). Research on enterprise credit system under the background of big data. In: 3rd International conference on education and social development (ICESD 2017), ICESD, 903–906. https://doi.org/10.2991/wrarm-17.2017.77 .

Zhang S, Xiong W, Ni W, Li X. Value of big data to finance: observations on an internet credit Service Company in China. Financial Innov. 2015. https://doi.org/10.1186/s40854-015-0017-2 .

Zhao JL, Fan S, Hu D. Business challenges and research directions of management analytics in the big data era. J Manag Anal. 2014;1(3):169–74. https://doi.org/10.1080/23270012.2014.968643 .

Download references

Acknowledgements

All the authors are acknowledged to the reviewers who made significant comments on the review stage.

The project is funded under the program of the Minister of Science and Higher Education titled “Regional Initiative of Excellence in 2019-2022, project number 018/RID/2018/19, the amount of funding PLN 10 788 423 16”.

Author information

Authors and affiliations.

School of Finance, Nanjing Audit University, Nanjing, 211815, China

Md. Morshadul Hasan

WSB University, Cieplaka 1c, 41-300, Dabrowa Górnicza, Poland

József Popp & Judit Oláh

You can also search for this author in PubMed Google Scholar

Contributions

All the authors have the equal contribution on this paper. All authors read and approved the final manuscript.

Corresponding author

Correspondence to József Popp .

Ethics declarations

Competing interests.

There is no competing interests.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/ .

Reprints and permissions

About this article

Cite this article.

Hasan, M.M., Popp, J. & Oláh, J. Current landscape and influence of big data on finance. J Big Data 7 , 21 (2020). https://doi.org/10.1186/s40537-020-00291-z

Download citation

Received : 31 August 2019

Accepted : 17 February 2020

Published : 12 March 2020

DOI : https://doi.org/10.1186/s40537-020-00291-z

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Big data finance

- Big data in financial services

- Big data in risk management

- Data management

Help | Advanced Search

Computer Science > Distributed, Parallel, and Cluster Computing

Title: analysis of distributed algorithms for big-data.

Abstract: The parallel and distributed processing are becoming de facto industry standard, and a large part of the current research is targeted on how to make computing scalable and distributed, dynamically, without allocating the resources on permanent basis. The present article focuses on the study and performance of distributed and parallel algorithms their file systems, to achieve scalability at local level (OpenMP platform), and at global level where computing and file systems are distributed. Various applications, algorithms,file systems have been used to demonstrate the areas, and their performance studies have been presented. The systems and applications chosen here are of open-source nature, due to their wider applicability.

Submission history

Access paper:.

- HTML (experimental)

- Other Formats

References & Citations

- Google Scholar

- Semantic Scholar

BibTeX formatted citation

Bibliographic and Citation Tools

Code, data and media associated with this article, recommenders and search tools.

- Institution

arXivLabs: experimental projects with community collaborators

arXivLabs is a framework that allows collaborators to develop and share new arXiv features directly on our website.

Both individuals and organizations that work with arXivLabs have embraced and accepted our values of openness, community, excellence, and user data privacy. arXiv is committed to these values and only works with partners that adhere to them.

Have an idea for a project that will add value for arXiv's community? Learn more about arXivLabs .

Big Data: Current Challenges and Future Scope

Ieee account.

- Change Username/Password

- Update Address

Purchase Details

- Payment Options

- Order History

- View Purchased Documents

Profile Information

- Communications Preferences

- Profession and Education

- Technical Interests

- US & Canada: +1 800 678 4333

- Worldwide: +1 732 981 0060

- Contact & Support

- About IEEE Xplore

- Accessibility

- Terms of Use

- Nondiscrimination Policy

- Privacy & Opting Out of Cookies

A not-for-profit organization, IEEE is the world's largest technical professional organization dedicated to advancing technology for the benefit of humanity. © Copyright 2024 IEEE - All rights reserved. Use of this web site signifies your agreement to the terms and conditions.

Doctoral Symposium on Intelligence Enabled Research

DoSIER 2022: Recent Trends in Intelligence Enabled Research pp 221–233 Cite as

Applications of Big Data in Various Fields: A Survey

- Sukhendu S. Mondal 18 ,

- Somen Mondal 18 &

- Sudip Kumar Adhikari ORCID: orcid.org/0000-0001-5174-397X 18

- Conference paper

- First Online: 23 June 2023

83 Accesses

Part of the book series: Advances in Intelligent Systems and Computing ((AISC,volume 1446))

A large volume of data is produced from the digital transformation with the extensive use of Internet and global communication system. Big data denotes this extensive heave of data which cannot be managed by traditional data handling methods and techniques. This data is generated in every few milliseconds in the form of structured, semi-structured, and unstructured data. Big data analytics are extensively used in enterprise which plays an important role in various fields of application. This paper presents applications of big data in various fields such as healthcare systems, social media data, e-commerce applications, agriculture application, smart city application, and intelligent transport system. The paper also tries to focus on the characteristics, storage technology of using big data in these applications. This survey provides a clear view of the state-of-the-art research areas on big data technologies and its applications in recent past.

This is a preview of subscription content, log in via an institution .

Buying options

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

Tax calculation will be finalised at checkout

Purchases are for personal use only

Singh, N., Lai, K.H., Vejvar, M., Cheng, T.C.E.: Big data technology: challenges, prospects, and realities. IEEE Eng. Manage. Rev. 47 (1), 58–66 (2019)

Article Google Scholar

Imran, S., Mahmood, T., Morshed, A., Sellis T.: Big data analytics in healthcare-a systematic literature review and roadmap for practical implementation, IEEE/CAA J. Automatica Sinica 8 (1), (2021)

Google Scholar

Tsai, C.W., Lai, C.F., Chao, H.C., Vasilakos, A.V.: Big data analytics: a survey. J. Big Data 21 (2015)

Rabhi, L., Falih, N., Afraites, A., Bouikhalene, B: Big data approach and its applications in various fields: review. Procedia Comput. Sci. 155 , 599–605 (2019)

Diebold, F.X.: Big data’ dynamic factor models for macroeconomic measurement and forecasting. In: Advances in Economics and Econometrics, Eighth World Congress of the Econometric Society, pp. 115–122 (2000)

Laney, D.: 3D data management: Controlling data volume, velocity, and variety, META Group, Tech. Rep., Feb. (2001)

Demchenko, Y., Ngo, C., Membrey, P.: Architecture framework and components for the big data ecosystem Draft Version 0.2, System and Network Engineering, SNE technical report SNE-UVA-2013–02, Sept (2013)

Harrison, G: Next Generation Databases: NoSQL, NewSQL, and Big Data. Apress (2015)

Wu, X., Kadambi, S., Kandhare, D., Ploetz, A.: Seven NoSQL Databases in a Week: Get Up and Running with the Fundamentals and Functionalities of Seven of the Most Popular NoSQL Databases Kindle. Packt Publishing, USA (2018)

Marz, N., Warren, J.: Big Data: Principles and Best Practices of Scalable Realtime Data Systems, USA. Manning Publications, Greenwich (2015)

Tudorica, B. G. and Bucur, C.: A comparison between several NoSQL databases with comments and notes. In: Proceeding RoEduNet International Conference 10th Edition: Networking in Education and Research. Iasi, Romania (2011)

Thusoo, A., Sarma, J.S., Jain, N., Shao, Z., Chakka, P., Zhang, N., Antony, S., Liu, H., Murthy, R.: Hive—A petabyte scale data warehouse using Hadoop. In: Proceeding of the IEEE 26th International Conference Data Engineering, pp. 996–1005. Long Beach, USA (2010)

Ercan, M. and Lane, M.: An evaluation of the suitability of NoSQL databases for distributed EHR systems. In: Proceeding 25th Australasian Conferences Information Systems. Auckland, New Zealand (2014)

Lee, B., Jeong, E.: A design of a patient-customized healthcare system based on the Hadoop with text mining (PHSHT) for an efficient disease management and prediction. Int. J. Softw. Eng. Appl. 8 (8), 131–150 (2014)

Yang, C.T., Liu, J.C., Hsu, W.H., Lu, H.W., Chu, W.C.C.: Implementation of data transform method into NoSQL database for healthcare data. In: Proceeding International Conference Parallel and Distributed Computing, pp. 198–205. Applications and Technologies, Taipei, China (2013)

Park, Y., Shankar, M, Park, B.H., Ghosh, J.: Graph databases for large-scale healthcare systems: a framework for efficient data management and data services. In: Proceeding of the IEEE 30th International Conference Data Engineering Workshops. Chicago, USA, (2014)

Štufi, M., Bacic, B., Stoimenov, L.: Big data analytics and processing platform in Czech republic healthcare. Appl. Sci. 10 (5), 1705 (2020)

Gopinath, M. P., Tamilzharasi, G.S., Aarthy, S. L. and Mohanasundram, R: An analysis and performance evaluation of NoSQL databases for efficient data management in e-health clouds. Int. J. Pure Appl. Math. 117 (21), 177–197 (2017)

Chen, K.L., Lee, H.: The impact of big data on the healthcare information systems, in transactions of the. In: International Conference Health Information Technology Advancement (2013)

Thorlby, R., Jorgensen, S., Siegel, B., Ayanian, J.Z.: How health care organizations are using data on patients’ race and ethnicity to improve quality of care. Milbank Quart. 89 (2), 226–255 (2011)

Zillner, S., Lasierra, N., Faix, W., Neururer, S.: User needs and requirements analysis for big data healthcare applications. Stud. Health Technol. Inform. 205 , 657–661 (2014)

Boinepelli, H.: Applications of big data, in Big Data. In: Primer, A. (Ed.) Springer, New Delhi, India, pp. 161–179 (2015)

Hood, L., Lovejoy, J.C., Price, N.D.: Integrating big data and actionable health coaching to optimize wellness. BMC Med. 13 (1), 4 (2015)

Rahman, M.S., Reza, H.: A systematic review towards big data analytics in social media. Big Data Min. Anal. 5 (3), 228–244 (2022)

Hou, Q., Han, M., Cai, Z.: Survey on data analysis in social media: a practical application aspect. Big Data Min. Anal. 3 (4), 259–279 (2020)

Dhawan, V., Zanini, N.: Big data and social media analytics. Res. Matt. Cambridge Assess. Publ. 18 , 36–41 (2014)

Ghani, N.A., Hamid, S., Targio Hashem, I.A, Ahmed, E.: Social media big data analytics: a survey. Comput. Hum. Behav. 101 , 417–428 (2019)

Ayele, W.Y., Juell-Skielse, G.: Social media analytics and internet of things: Survey. In: Proceeding 1st International Conference on Internet of Things and Machine Learning, pp. 1–11. Liverpool, UK (2017)

Alrumiah, S.S., Hadwan, M.: Implementing big data analytics in E-commerce: vendor and customer view. IEEE Access 9 , 37281–37286 (2021)

Akter, S., Wamba, S.F.: Big data analytics in E-commerce: a systematic review and agenda for future research. Electron. Market. 26 (2), 173–194 (2016)

Moorthi, K., Srihari, K., Karthik, S.: A survey on impact of big data in E-commerce. Int. J. Pure Appl. Math. 116 (21), 183–188 (2017)

Feng, P.: Big data analysis of E-commerce based on the internet of things. In: 2019 International Conference on Intelligent Transportation, Big Data and Smart City (ICITBS), pp. 345–347 (2019)

Bhat, S.A., Huang, N.F.: Big data and AI revolution in precision agriculture: survey and challenges. IEEE Access 9 , 110209–110222 (2021)

Bermeo-Almeida, O., Cardenas-Rodriguez, M., Samaniego-Cobo, T., Ferruzola-Gómez, E., Cabezas-Cabezas, R., Bazán-Vera, W.: Blockchain in agriculture: a systematic literature review. In: Proceeding International Conference Technology Innovations, pp. 44–56. Springer, Cham, Switzerland (2018)

Lokhande, S.A.: Effective use of big data in precision agriculture. In: 2021 International Conference on Emerging Smart Computing and Informatics (ESCI), pp. 312–316 (2021)

Jedlička, K., Charvát, K.: Visualisation of Big Data in Agriculture and Rural Development, 2018 IST-Africa Week Conference (IST-Africa), pp. 1–8 (2018)

Spandana Vaishnavi, A, Ashish, A, Sai-Pranavi, N., Amulya, S.: Big Data Analytics Based Smart Agriculture. In: 2021 6th International Conference on Communication and Electronics Systems (ICCES), pp. 534–537 (2021)

Kumar, M., Nagar, M.: Big data analytics in agriculture and distribution channel. In: 2017 International Conference on Computing Methodologies and Communication (ICCMC), pp. 384–387 (2017)

Talebkhah, M., Sali, A., Marjani, M., Gordan, M., Hashim, S.J., Rokhani, F.Z.: IoT and big data applications in smart cities: recent advances challenges, and critical issues. IEEE Access 9 , 55465–55484 (2021)

Alshawish, R.A., Alfagih, S.A.M., Musbah, M.S.: Big data applications in smart cities. 2016 International Conference on Engineering & MIS (ICEMIS), pp. 1–7 (2016)

Ismail, A.: Utilizing big data analytics as a solution for smart cities. In: 2016 3rd MEC International Conference on Big Data and Smart City (ICBDSC), pp. 1–5 (2016)

Costa, C., Santos, M.Y.: BASIS: A big data architecture for smart cities. 2016 SAI Comput. Conf. (SAI), pp. 1247–1256 (2016)

Manjunatha, Annappa, B.: Real time big data analytics in smart city applications. In: 2018 International Conference on Communication, Computing and Internet of Things (IC3IoT), pp. 279–284 (2018)

Rathore, M.M., Ahmad, A. Paul, A.: IoT-based smart city development using big data analytical approach. In: 2016 IEEE International Conference on Automatica (ICA-ACCA), pp. 1–8 (2016)

Zhu, L., Yu, F.R., Wang, Y., Ning, B., Tang, T.: Big data analytics in intelligent transportation systems: a survey. In: IEEE Transactions on Intelligent Transportation Systems, vol. 20, no. 1, pp. 383–398 (2019)

Guido, G., Rogano, D., Vitale, A., Astarita, V. and Festa, D.: Big data for public transportation: A DSS framework. In: 2017 5th IEEE International Conference on Models and Technologies for Intelligent Transportation Systems (MT-ITS) (2017)

Download references

Author information

Authors and affiliations.

Cooch Behar Government Engineering College, Cooch Behar, West Bengal, India

Sukhendu S. Mondal, Somen Mondal & Sudip Kumar Adhikari

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Sudip Kumar Adhikari .

Editor information

Editors and affiliations.

Rajnagar Mahavidyalaya, Birbhum, India

Siddhartha Bhattacharyya

Cooch Behar Government Engineering College, Cooch Behar, India

Algebra University College, Zagreb, Croatia

Rights and permissions

Reprints and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this paper

Cite this paper.

Mondal, S.S., Mondal, S., Adhikari, S.K. (2023). Applications of Big Data in Various Fields: A Survey. In: Bhattacharyya, S., Das, G., De, S., Mrsic, L. (eds) Recent Trends in Intelligence Enabled Research. DoSIER 2022. Advances in Intelligent Systems and Computing, vol 1446. Springer, Singapore. https://doi.org/10.1007/978-981-99-1472-2_19

Download citation

DOI : https://doi.org/10.1007/978-981-99-1472-2_19

Published : 23 June 2023

Publisher Name : Springer, Singapore

Print ISBN : 978-981-99-1471-5

Online ISBN : 978-981-99-1472-2

eBook Packages : Intelligent Technologies and Robotics Intelligent Technologies and Robotics (R0)

Share this paper

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

An official website of the United States government

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

- Publications

- Account settings

Preview improvements coming to the PMC website in October 2024. Learn More or Try it out now .

- Advanced Search

- Journal List

- Springer Nature - PMC COVID-19 Collection

The use of Big Data Analytics in healthcare

Kornelia batko.

1 Department of Business Informatics, University of Economics in Katowice, Katowice, Poland

Andrzej Ślęzak

2 Department of Biomedical Processes and Systems, Institute of Health and Nutrition Sciences, Częstochowa University of Technology, Częstochowa, Poland

Associated Data

The datasets for this study are available on request to the corresponding author.

The introduction of Big Data Analytics (BDA) in healthcare will allow to use new technologies both in treatment of patients and health management. The paper aims at analyzing the possibilities of using Big Data Analytics in healthcare. The research is based on a critical analysis of the literature, as well as the presentation of selected results of direct research on the use of Big Data Analytics in medical facilities. The direct research was carried out based on research questionnaire and conducted on a sample of 217 medical facilities in Poland. Literature studies have shown that the use of Big Data Analytics can bring many benefits to medical facilities, while direct research has shown that medical facilities in Poland are moving towards data-based healthcare because they use structured and unstructured data, reach for analytics in the administrative, business and clinical area. The research positively confirmed that medical facilities are working on both structural data and unstructured data. The following kinds and sources of data can be distinguished: from databases, transaction data, unstructured content of emails and documents, data from devices and sensors. However, the use of data from social media is lower as in their activity they reach for analytics, not only in the administrative and business but also in the clinical area. It clearly shows that the decisions made in medical facilities are highly data-driven. The results of the study confirm what has been analyzed in the literature that medical facilities are moving towards data-based healthcare, together with its benefits.

Introduction

The main contribution of this paper is to present an analytical overview of using structured and unstructured data (Big Data) analytics in medical facilities in Poland. Medical facilities use both structured and unstructured data in their practice. Structured data has a predetermined schema, it is extensive, freeform, and comes in variety of forms [ 27 ]. In contrast, unstructured data, referred to as Big Data (BD), does not fit into the typical data processing format. Big Data is a massive amount of data sets that cannot be stored, processed, or analyzed using traditional tools. It remains stored but not analyzed. Due to the lack of a well-defined schema, it is difficult to search and analyze such data and, therefore, it requires a specific technology and method to transform it into value [ 20 , 68 ]. Integrating data stored in both structured and unstructured formats can add significant value to an organization [ 27 ]. Organizations must approach unstructured data in a different way. Therefore, the potential is seen in Big Data Analytics (BDA). Big Data Analytics are techniques and tools used to analyze and extract information from Big Data. The results of Big Data analysis can be used to predict the future. They also help in creating trends about the past. When it comes to healthcare, it allows to analyze large datasets from thousands of patients, identifying clusters and correlation between datasets, as well as developing predictive models using data mining techniques [ 60 ].

This paper is the first study to consolidate and characterize the use of Big Data from different perspectives. The first part consists of a brief literature review of studies on Big Data (BD) and Big Data Analytics (BDA), while the second part presents results of direct research aimed at diagnosing the use of big data analyses in medical facilities in Poland.

Healthcare is a complex system with varied stakeholders: patients, doctors, hospitals, pharmaceutical companies and healthcare decision-makers. This sector is also limited by strict rules and regulations. However, worldwide one may observe a departure from the traditional doctor-patient approach. The doctor becomes a partner and the patient is involved in the therapeutic process [ 14 ]. Healthcare is no longer focused solely on the treatment of patients. The priority for decision-makers should be to promote proper health attitudes and prevent diseases that can be avoided [ 81 ]. This became visible and important especially during the Covid-19 pandemic [ 44 ].

The next challenges that healthcare will have to face is the growing number of elderly people and a decline in fertility. Fertility rates in the country are found below the reproductive minimum necessary to keep the population stable [ 10 ]. The reflection of both effects, namely the increase in age and lower fertility rates, are demographic load indicators, which is constantly growing. Forecasts show that providing healthcare in the form it is provided today will become impossible in the next 20 years [ 70 ]. It is especially visible now during the Covid-19 pandemic when healthcare faced quite a challenge related to the analysis of huge data amounts and the need to identify trends and predict the spread of the coronavirus. The pandemic showed it even more that patients should have access to information about their health condition, the possibility of digital analysis of this data and access to reliable medical support online. Health monitoring and cooperation with doctors in order to prevent diseases can actually revolutionize the healthcare system. One of the most important aspects of the change necessary in healthcare is putting the patient in the center of the system.

Technology is not enough to achieve these goals. Therefore, changes should be made not only at the technological level but also in the management and design of complete healthcare processes and what is more, they should affect the business models of service providers. The use of Big Data Analytics is becoming more and more common in enterprises [ 17 , 54 ]. However, medical enterprises still cannot keep up with the information needs of patients, clinicians, administrators and the creator’s policy. The adoption of a Big Data approach would allow the implementation of personalized and precise medicine based on personalized information, delivered in real time and tailored to individual patients.

To achieve this goal, it is necessary to implement systems that will be able to learn quickly about the data generated by people within clinical care and everyday life. This will enable data-driven decision making, receiving better personalized predictions about prognosis and responses to treatments; a deeper understanding of the complex factors and their interactions that influence health at the patient level, the health system and society, enhanced approaches to detecting safety problems with drugs and devices, as well as more effective methods of comparing prevention, diagnostic, and treatment options [ 40 ].