- Programming

- Admin & EIM

- BI & BW

- FICO & BPC

- CRM & Sales

- Introductions

- SAP PRESS Subscription

SAP Controlling: Assigning and Checking Cost Component Structures

In SAP Controlling, a company code determines which cost component structure the standard cost estimate uses, which ensures that the same cost component structure is used for all plants and costing variants in a company code.

If you use different cost component structures in different plants, the standard cost estimate in one plant cannot access the results of standard cost estimates in another plant. You cannot transfer costing data for materials transferred from one plant to another.

For other cost estimates, the cost component structure is determined through the combination of company code , plant, and costing variant.

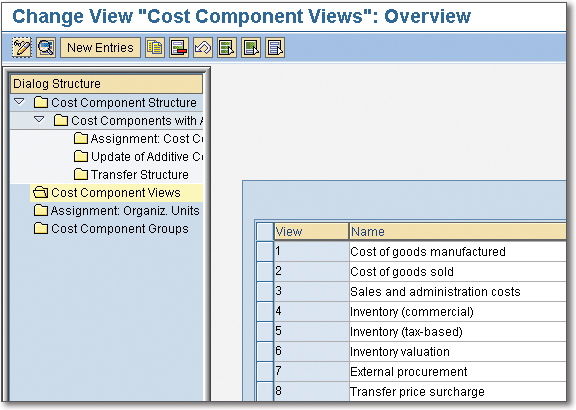

To access assignment of organizational units, double-click Assignment: Organiz. Units shown in the first figure below. Once selected, you should see the second figure display.

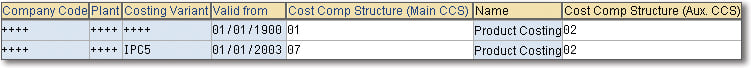

In this screen, you can assign cost component structures to organizational units such as Company Code , Plant , and Costing Variant . Some entries in this example employ masking. In the Plant column, both rows have the entry ++++ , which is a shorthand method of assigning cost component structures to all plants. You can employ the same technique of masking in many other screens throughout the system.

Specific entries always take priority over masked entries. Here’s an example:

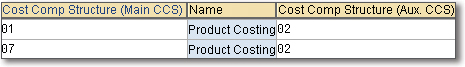

In the Costing Variant column shown above, the row with the specific IPC5 entry takes priority over rows with masked entries in the same column. When you create a cost estimate for any company code with costing variant IPC5, the system will use main cost component structure 07 and auxiliary cost component structure 02. All other cost estimates for these plants will use main cost component structure 01 and auxiliary cost component structure 02.

Now that we’ve discussed assigning organizational structures in general, let’s look first at assigning the cost component structure and then checking this assignment.

Assigning Organizational Units with Cost Component Structures in SAP

The main cost component split is the principal cost component split used by a standard cost estimate to update a standard price. The main cost component split can be for COGM or for a primary cost component split. You assign the main cost component structure in the above figure. You’ll need to widen the columns so you can see the entire text in the column headings as shown below.

You assign the main cost component structure in the first column and the auxiliary cost component structure in the last column. You don’t have to assign an auxiliary cost component structure, but you do need to assign a main cost component structure to each row you define in this screen.

You can use the auxiliary cost component structure in parallel to the main cost component structure to allow comparisons and analysis. You can use the auxiliary cost component structure to analyze costs in cost estimates and CO-PA. When viewing a cost estimate with an activated auxiliary cost component structure, you can switch between the main and auxiliary cost component structures.

You assign an auxiliary cost component structure to an organizational unit in the last column in the figure above. Follow these additional steps needed to activate the auxiliary cost component structure:

1. Create an auxiliary cost component structure.

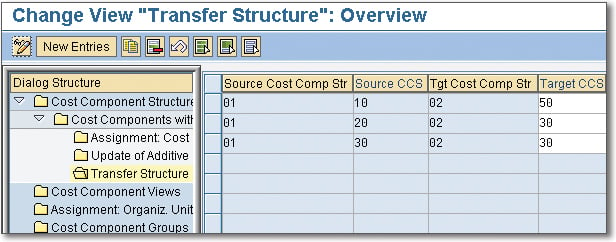

2. Create a transfer structure mapping the auxiliary cost components to the main cost components as shown below:

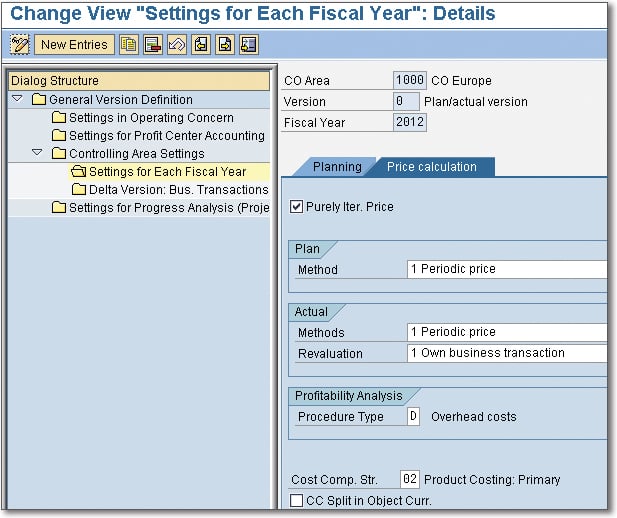

3. Assign the auxiliary cost component structure to the plan version per fiscal year in the Price calculation tab shown below.

4. Assign the auxiliary cost component structure to organizational units. See below.

5. Automatically calculate the plan activity price.

You don’t have to enter an auxiliary cost component structure. In most cases, the COGM cost component structure alone provides sufficient cost component reporting. The auxiliary cost component structure is available if you need additional reporting on primary costs, especially in some European implementations.

Next, we’ll look at a quick way to check assignment to organizational units.

Checking the Assignment to Organizational Units

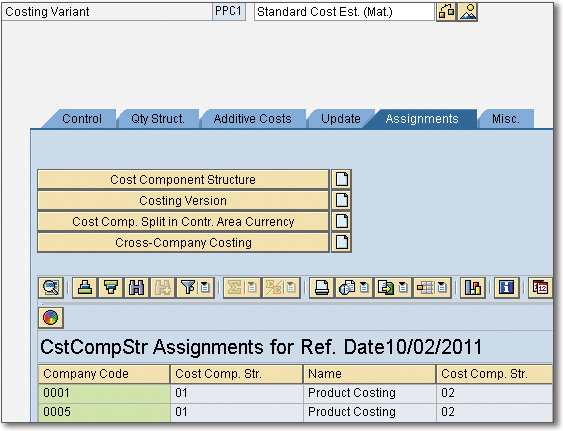

You can check the assignment of cost component structures to organizational units by inspecting the costing variant. Take costing variant PPC1 as an example. Display costing variant PPC1 with Transaction OKKN or double-click the costing variant in the Costing Data tab of a cost estimate.

Select the Assignments tab and click the Cost Component Structure button to display the screen shown below.

The main cost component structure assigned to company codes 0001 and 0005 is 01, and the auxiliary cost component structure assigned is 02.

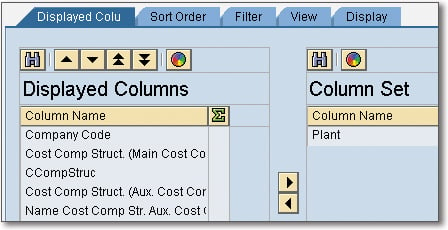

You can also assign a cost component structure to a plant. To add “Plant” as a column in the previous figure, click the down-pointing arrow to the right of the grid icon and select Change Layout to display this screen:

Double-click Plant to move it across to Displayed Columns and press (Enter) to display the screen shown below.

TIP : Click the Save icon before pressing (Enter) to save this layout.

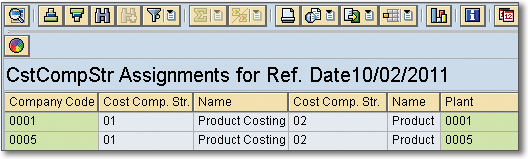

You can now see the Plant column in the cost component structure assignments for the costing variant.

Notice the SBO Explorer (circle) icon available with Enhancement Package (EHP) 5. This icon allows you direct access to SAP BusinessObjects Explorer.

This blog post summarized the process for assigning organizational units to cost component structures in SAP Controlling. After assigning these units, you learned how to check them. You also read a discussion of both the main cost component structure and the auxiliary cost component structure.

Editor’s note: This post has been adapted from a section of the book Product Cost Controlling with SAP by John Jordan.

Recommendation

Looking for a comprehensive guide to product costing in SAP (SAP CO-PC)? With this best-seller, you’ll begin with a breakdown of how to manage master data and configure settings in SAP CO. Next, you’ll learn the nitty-gritty details of integrated planning, from creating cost estimates to handling planned costs, actual costs, and final settlements. Contains coverage of SAP HANA, current trends in product cost controlling, and other new functionalities!

SAP PRESS is the world's leading SAP publisher, with books on ABAP, SAP S/4HANA, SAP CX, intelligent technologies, SAP Business Technology Platform, and more!

Latest Blog Posts

Planning and Budgeting for Investment Controlling with SAP S/4HANA

How Has Controlling Changed with SAP S/4HANA?

The official sap press blog.

As the world’s leading SAP publisher, SAP PRESS’ goal is to create resources that will help you accelerate your SAP journey. The SAP PRESS Blog is designed to provide helpful, actionable information on a variety of SAP topics, from SAP ERP to SAP S/4HANA. Explore ABAP, FICO, SAP HANA, and more!

SAP Blog Topics

- Administration

- Business Intelligence

Blog curated by

- Legal Notes

- Privacy Policy

- Terms of Use

- Guest Posting

/support/notes/service/sap_logo.png)

1932623 - Expense Report show cost assignment of the employee, instead of Cost Assignment of receipts.

Expense report shows in the general tab the Cost Assignment of the employee, instead of Cost Assignment of receipts.

Reproducing the Issue

1. Go to Travel and Expenses Work Center. 2. Go to Expense Reports View. 3. Search for Expense report. 4. Click on Edit. 5. You will see the cost assignment as XXXX which is the same of employee that the expense report was created. 6. Go to Receipts tab. 7. In Details click on Deviating Cost Assignment. 8. You will see all the receipts with a different cost assignment as General Tab.

This is the system correct behavior.

The cost assignment shown in the General tab is for overall expense report and deviating cost assignment is entered in case you want a different one from the general for a specific receipt(s). The final cost assignment of different amounts are shown in the Review tab or by clicking on the number of expense report.

KBA , SRD-FIN-ERM , Travel and Expense Management , How To

Privacy | Terms of use | Legal Disclosure | Copyright | Trademark

Differentiating Between Distribution and Overhead Allocation

After completing this lesson, you will be able to:

- Introduce allocation cycles

Allocation Cycles

Within the management accounting team at Bike Company SE, Chris works closely with his dedicated teammate, Robert. Robert's expertise lies in refining management accounting processes, with a special emphasis on enhancing operations in the SAP S/4HANA environment and system configuration.

In a recent team meeting, the team manager noted that the company’s transition to SAP S/4HANA presents a prime opportunity to scrutinize the current management accounting procedures, particularly the cost allocation cycles throughout the company. Robert has been assigned to spearhead this project and is now tasked with improving the allocation processes. Always open to seeking advice and generating ideas, he brings this topic to his weekly coffee corner discussion with Chris. Here's how their conversation unfolded:

Having listened in to the conversation with Chris and Robert, it's now time to take a closer look at the tools available for overhead cost allocation and understand how they can provide a trustworthy source for analysis.

We'll focus on how to use templates to manage allocations and discuss the benefits of using tags for cycle administration.

In the following lesson, you'll delve deeper into a more sophisticated, cycle-related feature: the allocation structure. This can determine which G/L account to use for cost transfers based on the type of posting and the chosen receiver. Lastly, we'll explore additional allocation contexts.

Let's begin with a comparative overview of the two main types of period-end cycles.

General Allocation Cycle Approach

Allocation is a process in management accounting of distributing cost, revenue, or balance sheet values from specific sender accounts and objects (cost center, profit center, and so on) to specific receiver accounts and objects.

An example of cost allocation can be the initial posting of electricity expenses to a generic cost center, which should subsequently be spread over the cost centers of the respective departments that utilize these facilities and, thus, should bear part of the cost.

Cycles in Overhead Cost Controlling

The necessity to allocate data regularly arises during closure. SAP S/4HANA offers a solution, universal allocation , which is a comprehensive term covering all forms of allocations. The tool encompasses multiple capacities for both financial and managerial allocations, including cost center allocation, profit center allocation, top-down distribution, intercompany allocation, and also allocation to margin analysis.

An allocation cycle is used to transfer primary and/or secondary costs from senders to receiving controlling objects. The selected tool can be different, depending on the type of sender object, the type of G/L account used for the initial posting, and the G/L Account used for the allocation: It is the allocation context . It can spread actual and planned data.

In Overhead Cost Accounting, the possible cycles are overhead allocation and distribution . Depending on whether the original account/original cost element needs to be preserved with the allocation, the allocation type selected will be different.

Let’s compare the different types in a table:

Once the appropriate cycle type has been selected, it is time to create it. You can create a cycle with the following methods:

From scratch in the Manage Allocations app

Copying an existing cycle

By template-based upload

Log in to track your progress & complete quizzes

Blog about all things SAP

ERProof » SAP CO » SAP CO Training » SAP CO Account Assignment

SAP CO Account Assignment

Normally, when a financial document is entered in SAP FI module , user has the option of entering the cost center in the financial document. However, when documents are entered from different modules or a cross-module financial transaction occurs, such as from MM or SD , there is no option of entering the cost center in the document. In this situation, the SAP system will derive the cost center through automatic SAP CO account assignment, substitutions, or through default settings made in the primary cost element.

Automatic SAP CO Account Assignment

The automatic account assignment has to be configured in the transaction code OKB9 . For posting made in external accounting, such as for price differences, exchange rate differences, etc., the SAP system automatically checks entries in the OKB9 settings and derives the cost center.

If you do not enter a CO object (order, cost center, or project) in external accounting postings made in FI, MM or SD modules and the posting is cost relevant, then the automatic account assignment checks the relevant cost center and makes the posting.

Here are examples of automatic account assignments:

- Banking fees, exchange rate differences and discounts in FI

- Minor differences and price differences in MM

The account assignment objects that can be maintained in the transaction OKB9 are:

- Cost center

- Profit center (profitability segment)

Normally, the automatic account assignment runs on the company code level along with the CO object. However, if the user wants to make the posting on the business area level, valuation area level or profit center level, it is also available in OKB9 settings. So basically it includes the following levels:

- Company code level

- Business area level

- Valuation area level

- Profit center level

The above 3 excluding the company code level are used in cases when the account assignment is needed below the company code level.

Prerequisites

Here are the prerequisites of activating automatic SAP CO account assignment:

- Activation of the cost center accounting

- Creation of cost centers

- Maintenance of cost elements

Additionally, you can also create orders and profit centers as per the business requirements.

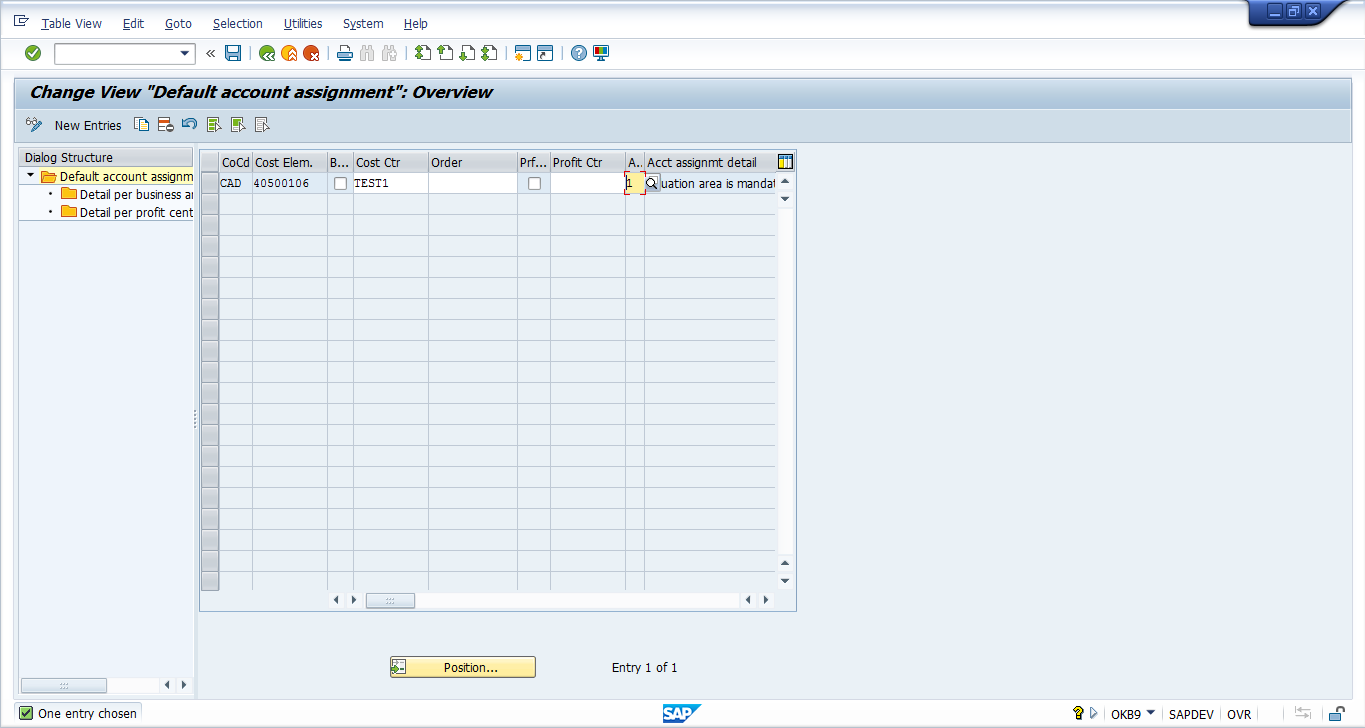

Settings in Transaction OKB9

Let’s discuss settings that are possible for automatic SAP CO account assignment in OKB9 transaction.

Start SPRO transaction and navigate to the following path:

Controlling – Cost Center Accounting – Actual Postings – Manual Actual Postings – Edit Automatic Account Assignment (OKB9)

Alternatively, you can start OKB9 transaction directly from the command bar.

- If you want to have the setting on the company code level only, then enter the company code and the cost element along with the corresponding CO object, i.e. a cost center, an order or a profit center.

- If you want to have the settings on the valuation area level, then enter the company code and the cost element and chose the ‘valuation area’ option in the account assignment detail as ‘1’.

- Similarly, if you want to have the settings on the business area or profit center level, then choose the option ‘2’ or ‘3’ respectively.

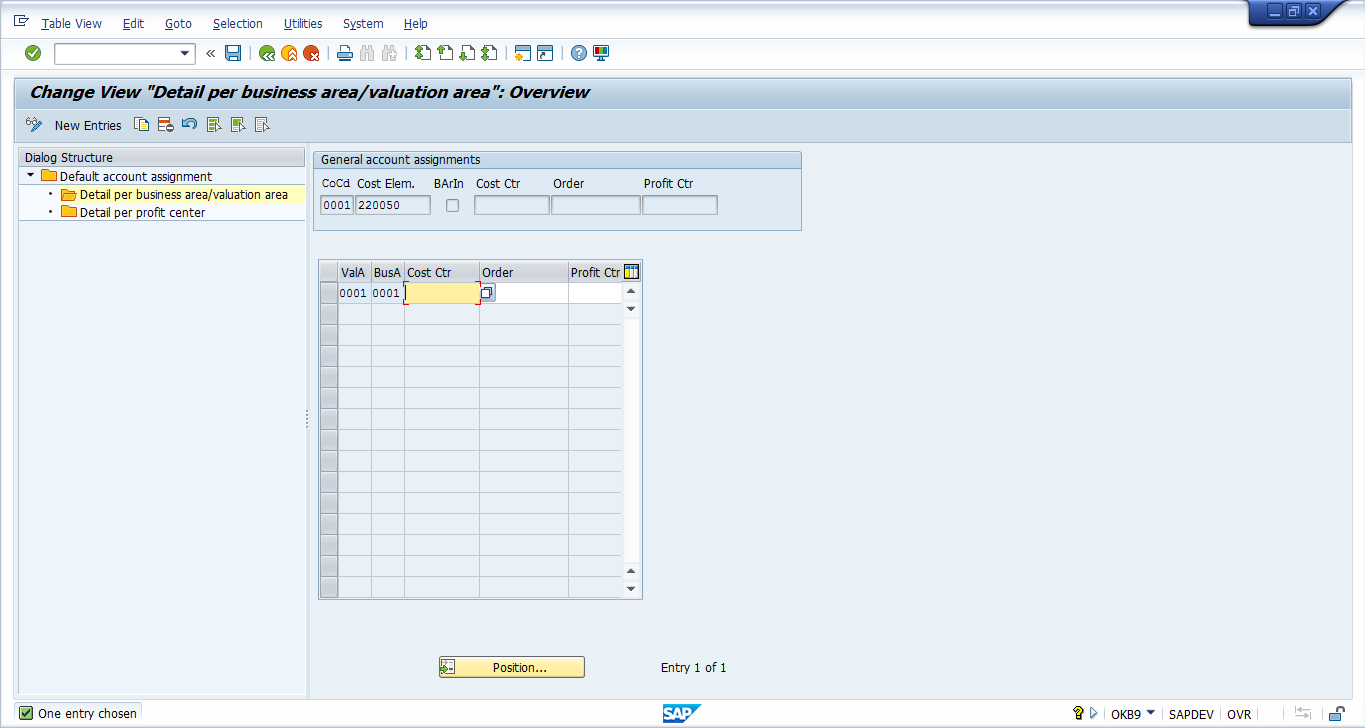

If you have chosen account assignment detail ‘1’ or ‘2’, then click on ‘Detail per business area/valuation area’ on the left sidebar.

Default SAP CO Account Assignment

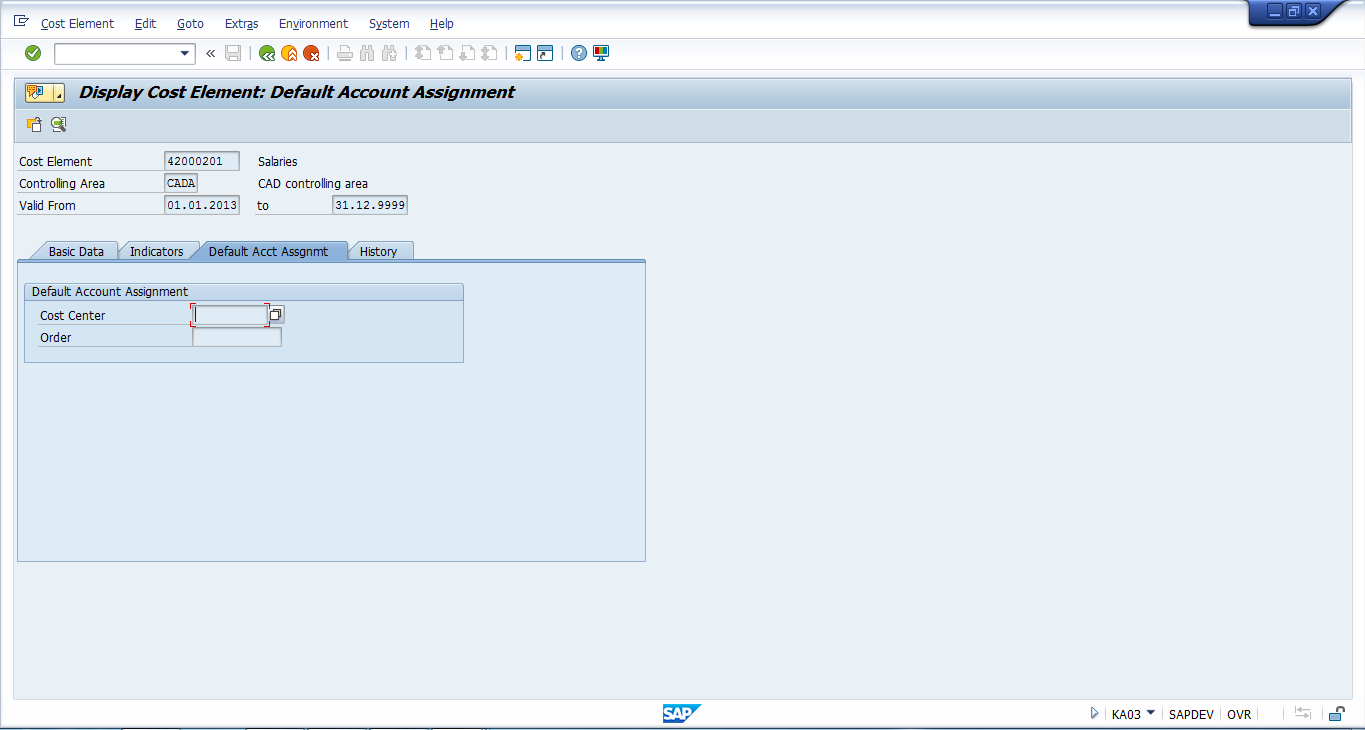

In order to determine the correct CO account assignment, the SAP system performs several checks in the following sequence. First it checks the document which a user is posting. If the cost center is empty in the document, then the system checks if any substitutions are maintained for the particular G/L account . Next, if the substitution is also missing, then the system moves on to the OKB9 settings for automatic SAP CO account assignments. Finally, if these settings are also missing, the SAP system checks master data of the primary cost element (G/L Account) under the tab of Default Account Assignment . You can display this master data using the transaction KA03 .

You can maintain the cost center and the order in the master data of the primary cost element.

So, basically the order of checks the system makes is:

- Financial document – Cost center

- Substitutions – transaction OKC9

- Automatic account assignments – transaction OKB9

- Default account assignments – transaction KA03 / KA02

Lastly, if any of the above is not maintained, then the SAP system throws an error ‘Account X requires an assignment to a CO Object’ and doesn’t allow posting of a document.

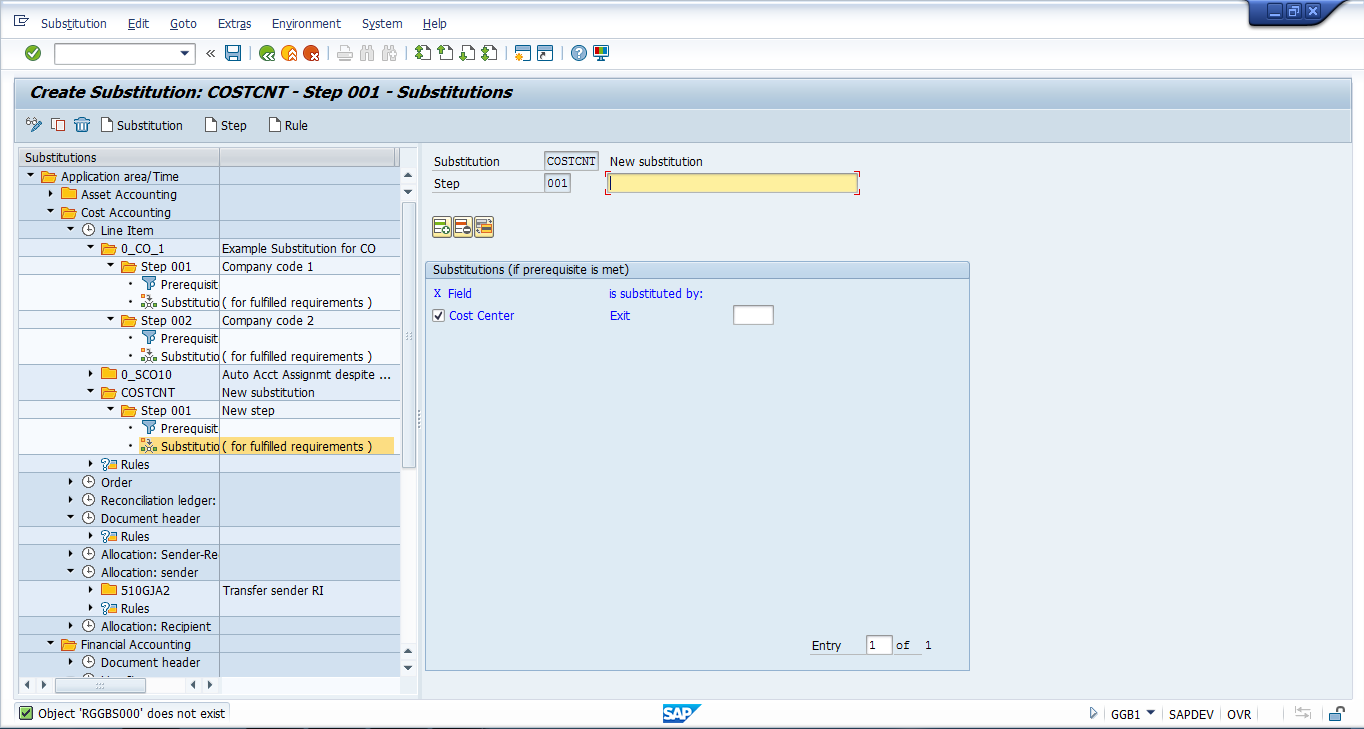

SAP CO Account Assignment using Substitution

In cases where you don’t need OKB9 or default account assignment, the user can go for user exits where a specific G/L account is mentioned under the company and the value in the cost center is substituted by the cost center given in the substitution.

The transaction for maintaining the substitution is GGB1 .

Usage of substitutions for SAP CO account assignment is justified by the business requirement and usually SAP CO account assignment requirements are fulfilled by OKB9 or default account assignments.

Did you like this tutorial? Have any questions or comments? We would love to hear your feedback in the comments section below. It’d be a big help for us, and hopefully it’s something we can address for you in improvement of our free SAP CO tutorials.

Navigation Links

Go to next lesson: SAP Adjustment Postings

Go to previous lesson: SAP Profit Center

Go to overview of the course: Free SAP CO Training

4 thoughts on “SAP CO Account Assignment”

it is helpful material i ask for more clear details for using substitution method for Account Assignment. thanks in advance

Sir, I am not receiving the training mails from yesterday 7/1/2019. I have completed my training till here(SAP CO Account Assignment) please do send the rest of the training emails for SAP CO. Hope you will do the needful.

I am getting the same error “Account 500911 requires an assignment to a CO object”. In OKB9, we have given company code, Cost element and ticked the check box ‘Indicator: Find profitability segment using substitution’ (V_TKA3A-BSSUBST) and not filled anything like cost center, order and profit center. in OKC9 we have created substitution. All the process happening through Idoc Message Type SINGLESETTRQS_CREATE and inside BAPI BAPI_SINGLESETTREQS_CREATEMULT triggering and raising this error. Cost center is not maintained in 1. Financial document – Cost center 2. Automatic account assignments – transaction OKB9 and 3. Default account assignments – transaction KA03/KA02 But we have substitution in transaction OKC9 to determine cost centre.

Where woulbe be the issue?

good explanation

Leave a Reply Cancel reply

Do you have a question and want it to be answered ASAP? Post it on our FORUM here --> SAP FORUM !

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

IMAGES

VIDEO

COMMENTS

Employees are assigned to a master cost center in Personnel Administration in the Organizational Assignment infotype (0001). The total employee costs determined in Payroll are distributed as a percentage over several cost centers. This process is recommended in situations where an employee performs various tasks for different cost centers.

The allocation of costs to a party or location. Cost Assignment in SAP - Everything you need to know about Cost Assignment; definition, explanation, tcodes, tables, wiki, relevant SAP documents, PDFs, and useful links.

Select the Assignments tab and click the Cost Component Structure button to display the screen shown below. The main cost component structure assigned to company codes 0001 and 0005 is 01, and the auxiliary cost component structure assigned is 02. You can also assign a cost component structure to a plant.

In SAP S/4HANA Cloud, private edition, the costing functionality of simple projects can also be covered with internal orders - a controlling account assignment that is not available in SAP S/4HANA Cloud, public edition systems. You now know that WBS elements represent discrete parts of the work linked to a project.

4. Click on Edit. 5. You will see the cost assignment as XXXX which is the same of employee that the expense report was created. 6. Go to Receipts tab. 7. In Details click on Deviating Cost Assignment. 8. You will see all the receipts with a different cost assignment as General Tab.

Assignment of Cost Objects | SAP Help Portal. 6.0 SP31. English. This document. Favorite. Download PDF. Share. Preparations for Consolidation (FI) Accounts Payable (FI-AP)

In S/4HANA public cloud edition, CO account assignments are updated automatically for the processes described above. On premise customers can still go on using cost element type 90 accounts, if they already did so. For AP/AR postings no CO account assignment will be derived.

1. You can find all the profit center assigned to cost centers in T. Code KS13, select cost centers --> Execute ---> select profit center from layout. 2. for Balance sheet you can use T.Code F.01 or S_ALR_87012284. Regards, JA. Show replies. Former Member.

The necessity to allocate data regularly arises during closure. SAP S/4HANA offers a solution, universal allocation, which is a comprehensive term covering all forms of allocations.The tool encompasses multiple capacities for both financial and managerial allocations, including cost center allocation, profit center allocation, top-down distribution, intercompany allocation, and also allocation ...

SAP Community is moving in January 2024! Hereâ s what you need to know to prepare. Home; Community; Ask a Question; ... Sep 14, 2011 at 03:01 AM Cost Assignment. 55 Views. Follow RSS Feed Hi, I haveconfigured a cost assignment for "finance and funds" i.e. Cost Center (W/GR) in both ecc and srm..but when i try to create a shopping cart for this ...

Changing the Cost Assignment to diff. Cost Objects at Trip & Receipt levels - SAP Q&A Relevancy Factor: 1.0 We have Four Cost Objects .....Internal Order, Cost Center, WBS Element and Network.

This tutorial is part of our free SAP CO training. You will learn how account assignment works in SAP ERP and what are different sources of information about account assignment that the SAP system uses. Normally, when a financial document is entered in SAP FI module, user has the option of entering the cost center in the financial document.

This Blog Post will give the overview on what is Account Assignment Category in SAP MM and How to configure it within SAP system. I will explain configuration step by step in SAP configuration. ... For now, lets consider K- Cost Center So, for "K" only GL Account, Cost Center needs to be mandatory i.e. user need to specify the respective value ...

We have assigned the Account Assignment Category u2013 K to the Item category of the shipment cost type which is below and the setting inside The settings in the fields are standard settings 6.3 : Automatic G/L Account Determination:

Assignment Fields in Cost Center Master Data; Controlling (CO) 2023 Latest. Available Versions: 2023 Latest ; 2023 (Oct 2023) 2022 Latest ; 2022 FPS02 (May 2023) 2022 FPS01 (Feb 2023) ... If you do not have an SAP ID, you can create one for free from the login page. Log on

Accepted Solutions (1) Hi, Please take a look at the following link from SAP Help: You can also extend the batch number creation function to specify the internal number range or suppress internally generated batch numbers, and you can implement your own logic to create batch numbers based on your data. Please take a look at the following link ...

72. PTDW_COST_DB. Time Data Extract (Account Assgnmnt Objects/ cost assignment ) PT - Personnel Time Management. Transparent Table. 73. PTP81. Trip Statistics - cost assignment. FI - Travel Expenses.

By the end of the year, Preh plans to leverage SAP Product Lifecycle Costing to calculate more than a hundred projects with up to 10 different product variants - and many more later. "The choice of SAP Product Lifecycle Costing was the right decision," Bayer says. "We were able to increase quality and accuracy in our processes and take ...