Free Business Plan Excel Template [Excel Download]

Written by Dave Lavinsky

A business plan is a roadmap for growing your business. Not only does it help you plan out your venture, but it is required by funding sources like banks, venture capitalists and angel investors.

Download our Ultimate Business Plan Template here >

The body of your business plan describes your company and your strategies for growing it. The financial portion of your plan details the financial implications of your business: how much money you need, what you project your future sales and earnings to be, etc.

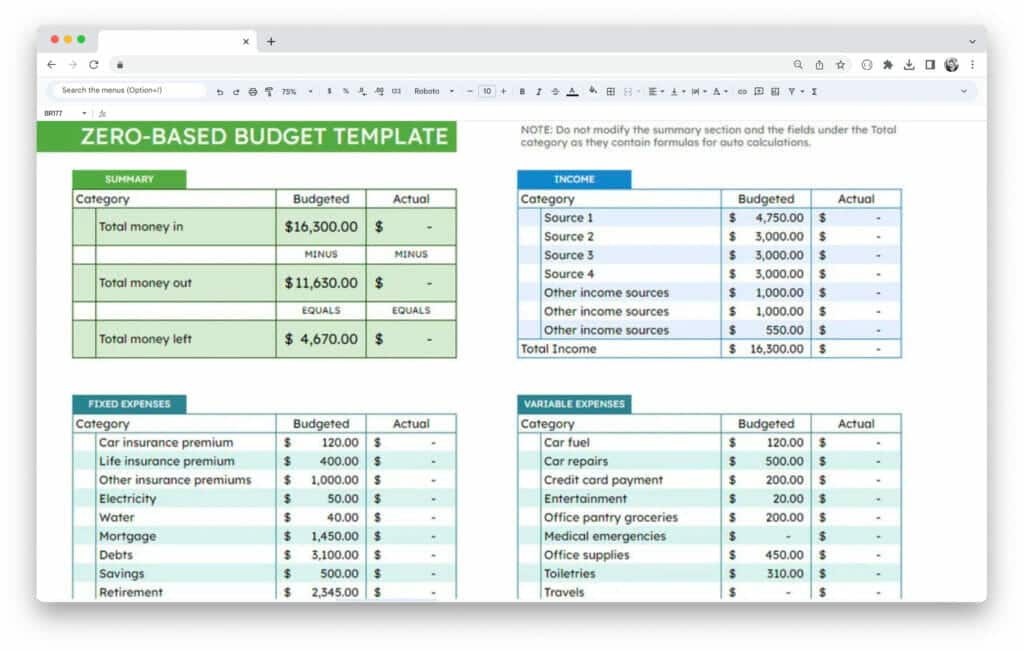

Below you will be able to download our free business plan excel template to help with the financial portion of your business plan. You will also learn about the importance of the financial model in your business plan.

Download the template here: Financial Plan Excel Template

How to Finish Your Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less! It includes a simple, plug-and-play financial model and a fill-in-the-blanks template for completing the body of your plan.

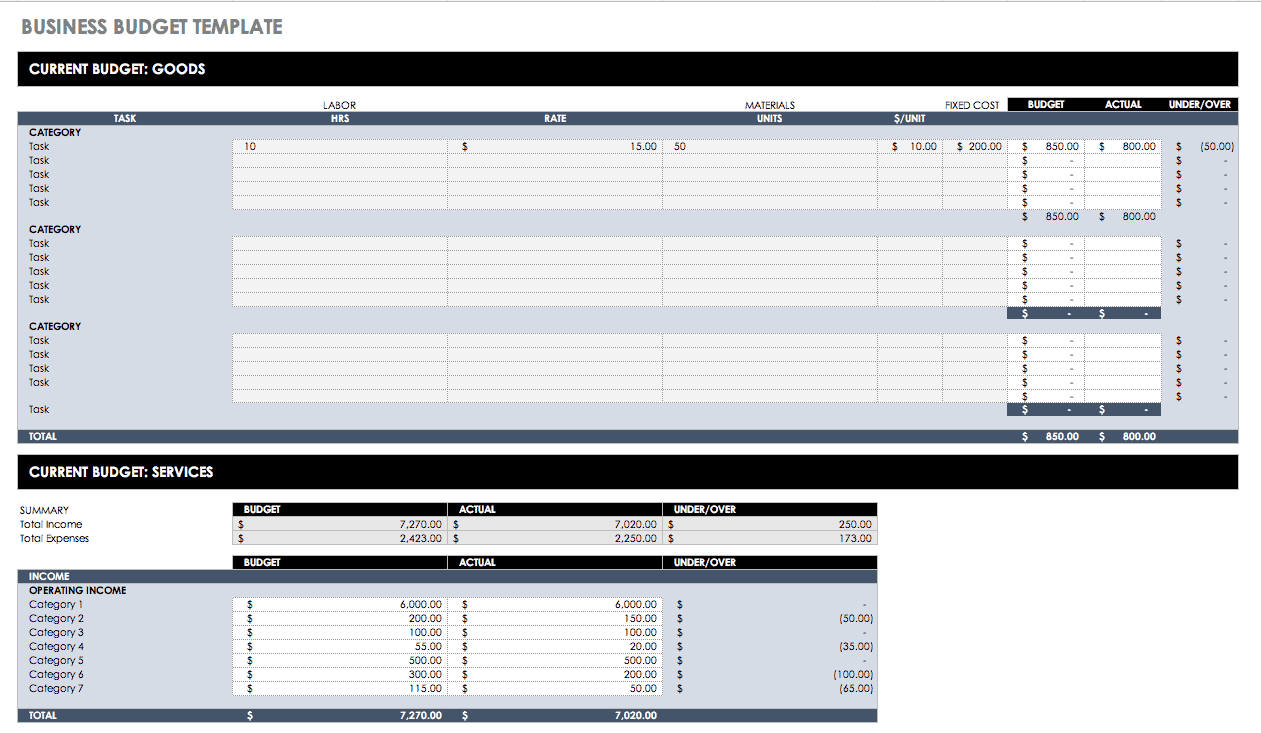

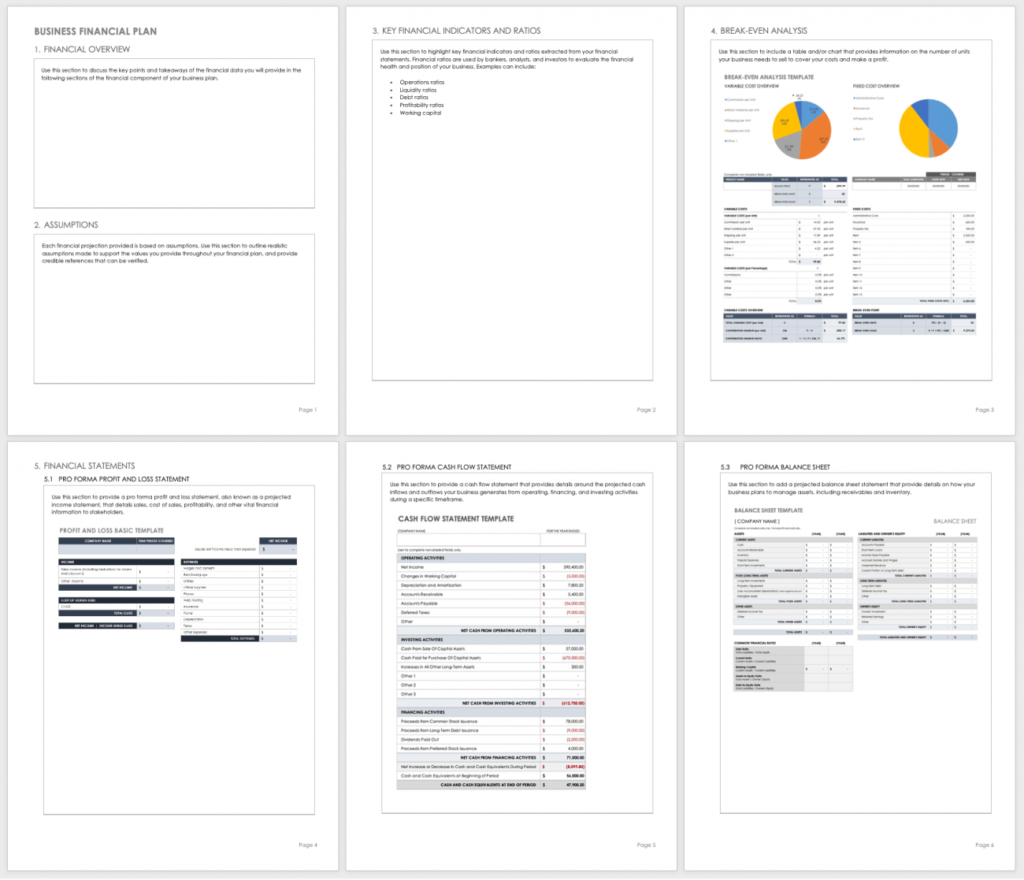

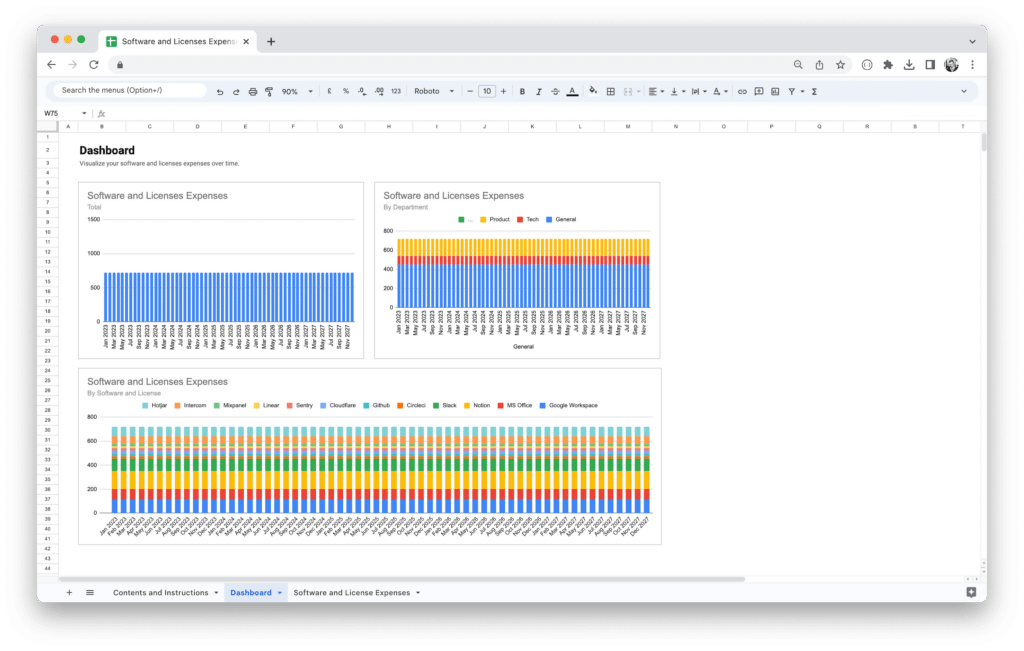

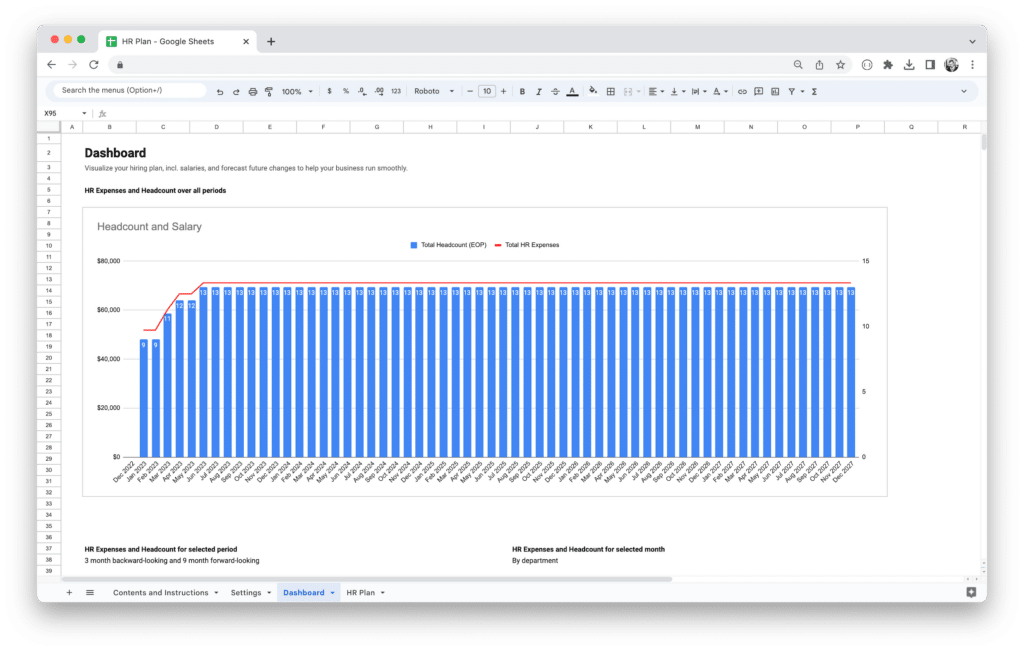

What’s Included in our Business Plan Excel Template

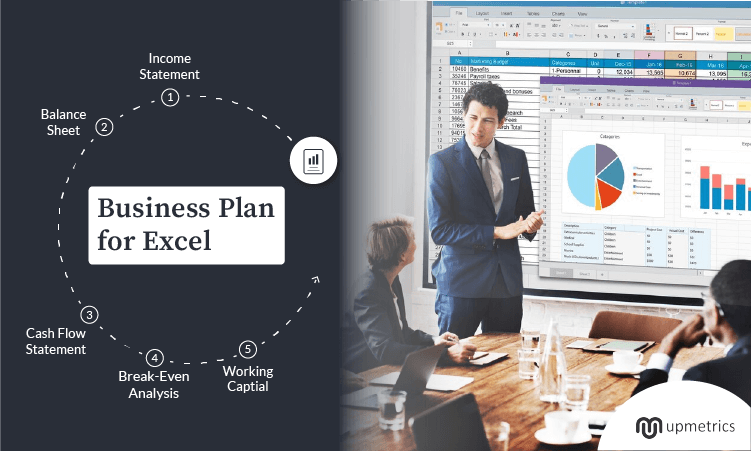

Our business plan excel template includes the following sections:

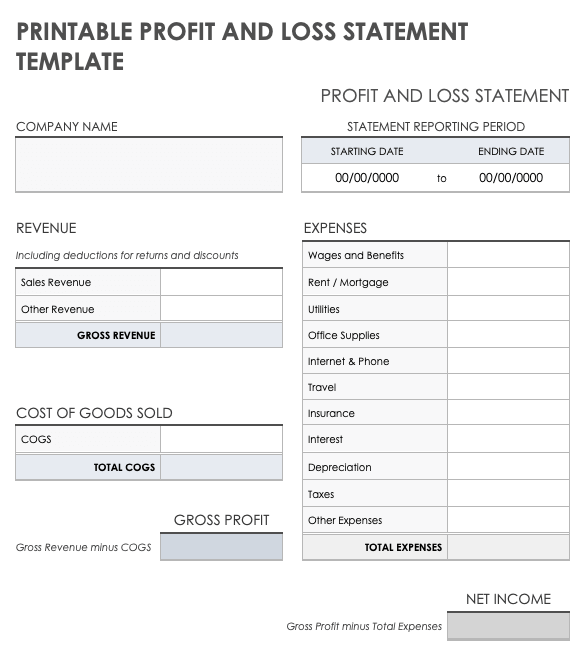

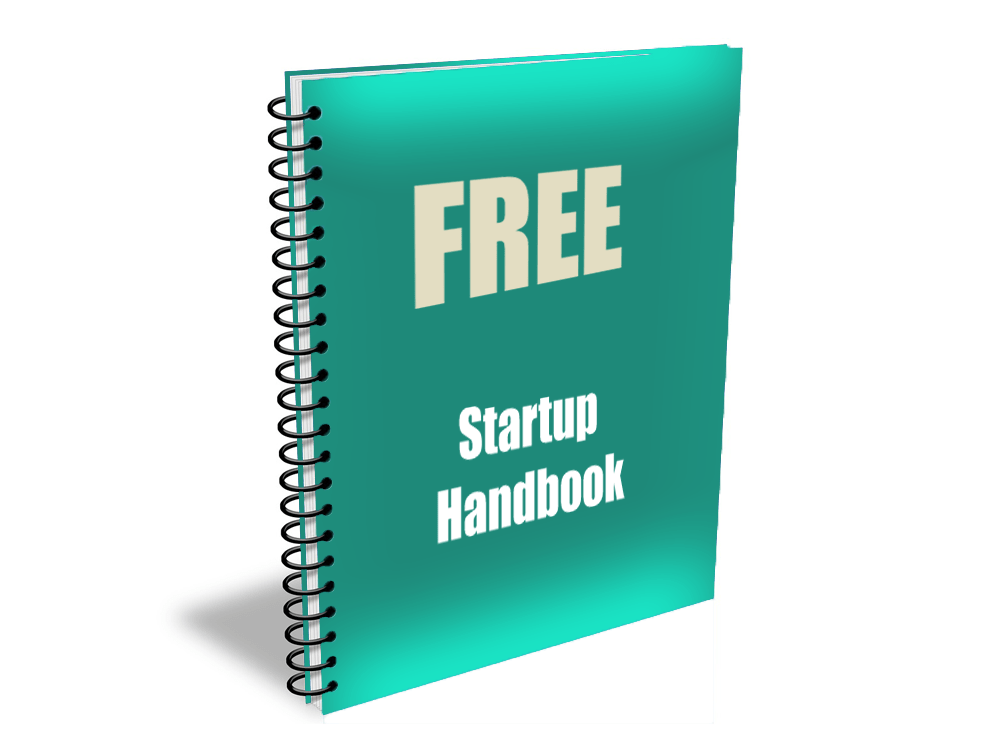

Income Statement : A projection of your business’ revenues, costs, and expenses over a specific period of time. Includes sections for sales revenue, cost of goods sold (COGS), operating expenses, and net profit or loss.

Example 5 Year Annual Income Statement

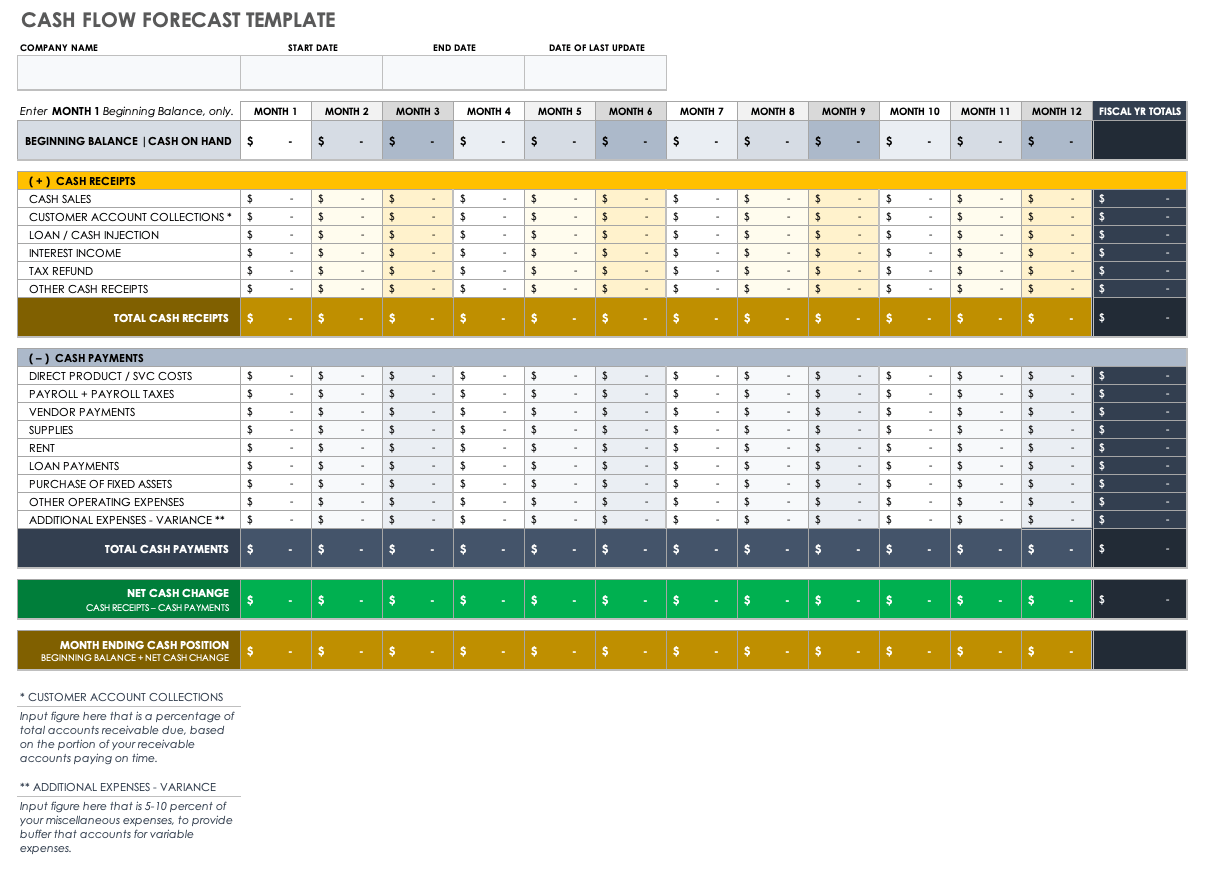

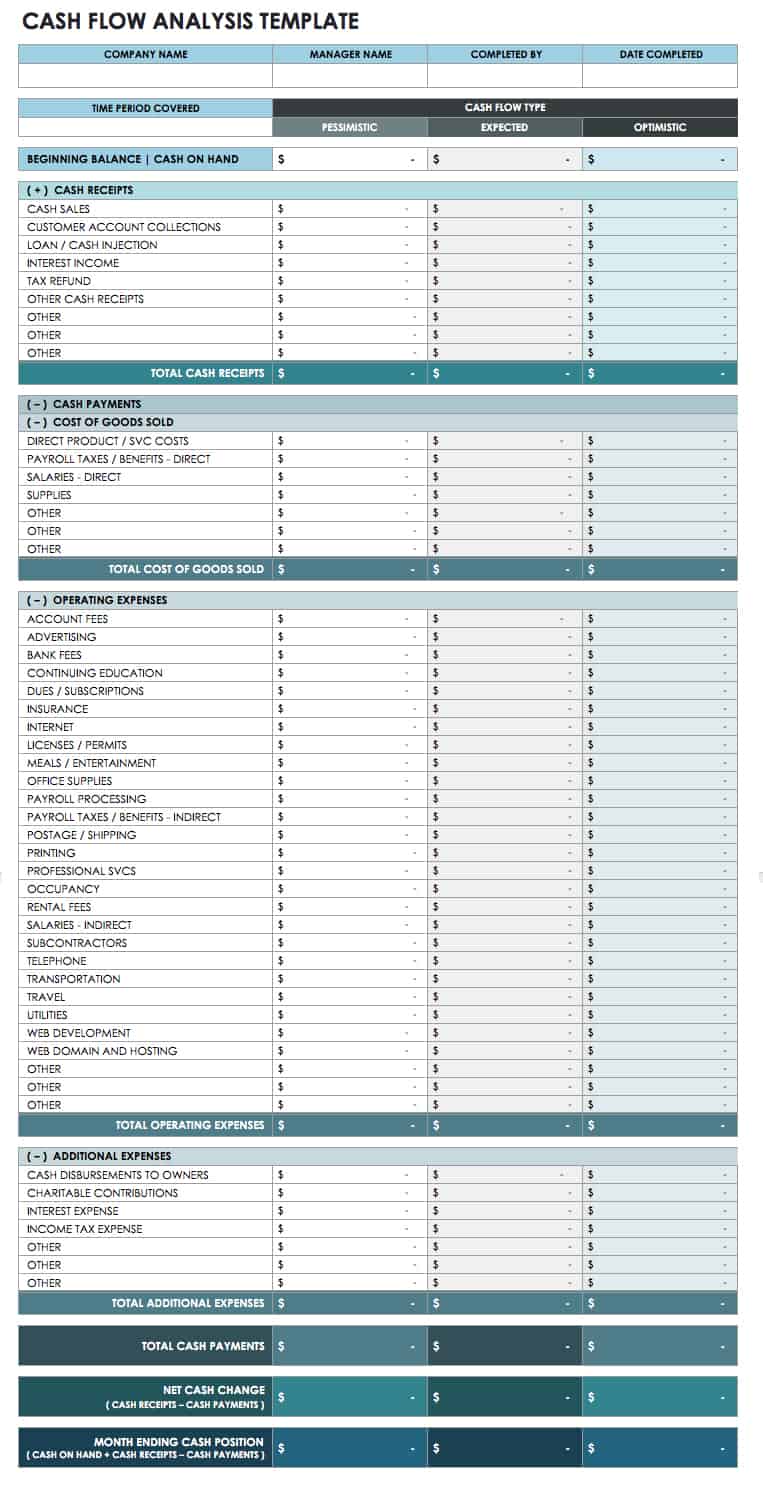

Cash Flow Statement : A projection of your business’ cash inflows and outflows over a specific period of time. Includes sections for cash inflows (such as sales receipts, loans, and investments), cash outflows (such as expenses, salaries, and loan repayments), and net cash flow.

Example 5 Year Annual Cash Flow Statement

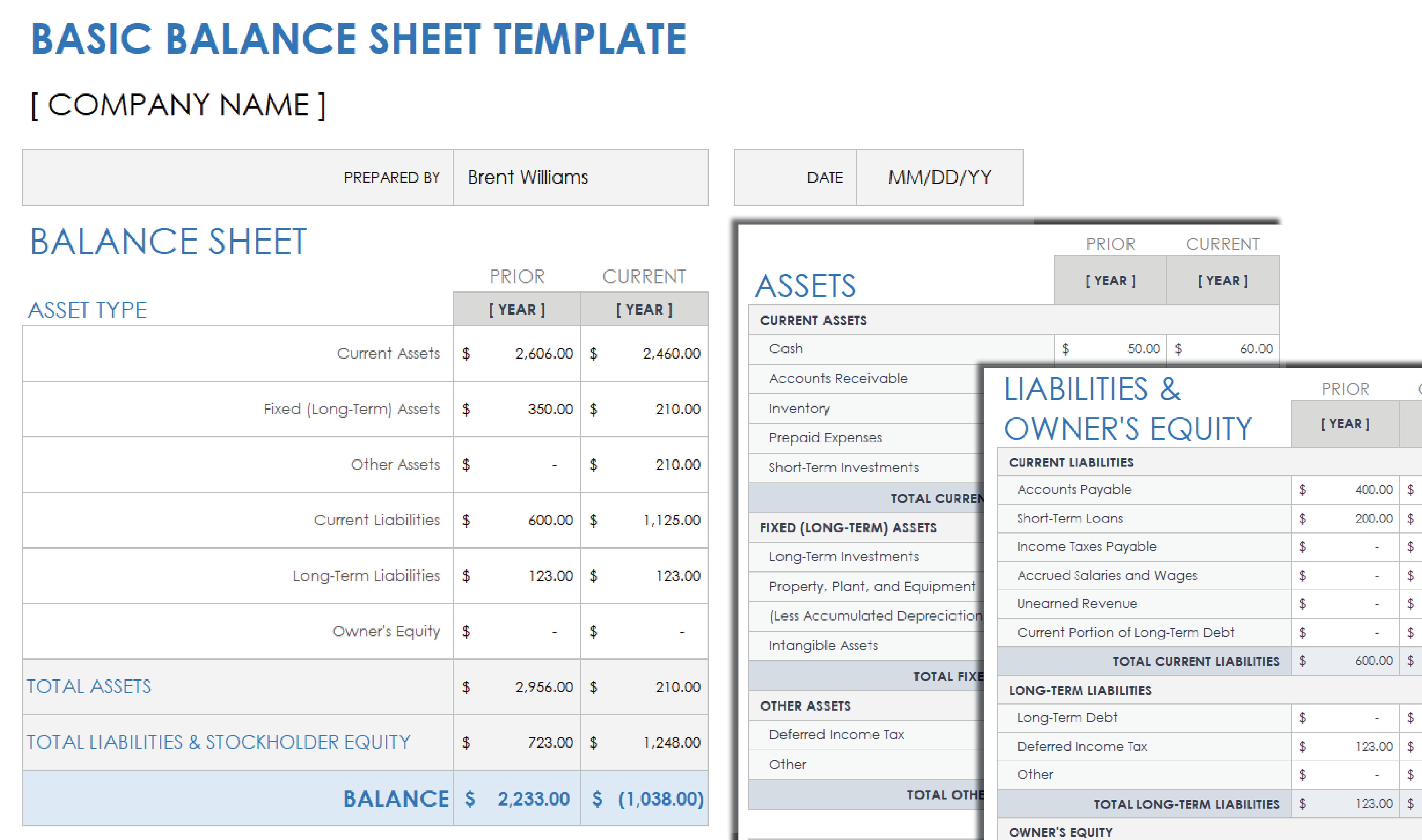

Balance Sheet : A snapshot of your business’ financial position at a specific point in time. Includes sections for assets (such as cash, inventory, equipment, and property), liabilities (such as loans, accounts payable, and salaries payable), and owner’s equity (such as retained earnings and capital contributions).

Example 5 Year Annual Balance Sheet

Download the template here: Business Plan Excel Template

The template is easy to customize according to your specific business needs. Simply input your own financial data and projections, and use it as a guide to create a comprehensive financial plan for your business. Remember to review and update your financial plan regularly to track your progress and make informed financial decisions.

Finish Your Business Plan Today!

The importance of the financial model in your business plan.

A solid financial model is a critical component of any well-prepared business plan. It provides a comprehensive and detailed projection of your business’ financial performance, including revenue, expenses, cash flow, and profitability. The financial model is not just a mere set of numbers, but a strategic tool that helps you understand the financial health of your business, make informed decisions, and communicate your business’ financial viability to potential investors, lenders, and other stakeholders. In this article, we will delve into the importance of the financial model in your business plan.

- Provides a roadmap for financial success : A well-structured financial model serves as a roadmap for your business’ financial success. It outlines your revenue streams, cost structure, and cash flow projections, helping you understand the financial implications of your business strategies and decisions. It allows you to forecast your future financial performance, set financial goals, and measure your progress over time. A comprehensive financial model helps you identify potential risks, opportunities, and areas that may require adjustments to achieve your financial objectives.

- Demonstrates financial viability to stakeholders : Investors, lenders, and other stakeholders want to see that your business is financially viable and has a plan to generate revenue, manage expenses, and generate profits. A robust financial model in your business plan demonstrates that you have a solid understanding of your business’ financials and have a plan to achieve profitability. It provides evidence of the market opportunity, pricing strategy, sales projections, and financial sustainability. A well-prepared financial model increases your credibility and instills confidence in your business among potential investors and lenders.

- Helps with financial decision-making : Your financial model is a valuable tool for making informed financial decisions. It helps you analyze different scenarios, evaluate the financial impact of your decisions, and choose the best course of action for your business. For example, you can use your financial model to assess the feasibility of a new product launch, determine the optimal pricing strategy, or evaluate the impact of changing market conditions on your cash flow. A well-structured financial model helps you make data-driven decisions that are aligned with your business goals and financial objectives.

- Assists in securing funding : If you are seeking funding from investors or lenders, a robust financial model is essential. It provides a clear picture of your business’ financials and shows how the funds will be used to generate revenue and profits. It includes projections for revenue, expenses, cash flow, and profitability, along with a breakdown of assumptions and methodology used. It also provides a realistic assessment of the risks and challenges associated with your business and outlines the strategies to mitigate them. A well-prepared financial model in your business plan can significantly increase your chances of securing funding as it demonstrates your business’ financial viability and growth potential.

- Facilitates financial management and monitoring : A financial model is not just for external stakeholders; it is also a valuable tool for internal financial management and monitoring. It helps you track your actual financial performance against your projections, identify any deviations, and take corrective actions if needed. It provides a clear overview of your business’ cash flow, profitability, and financial health, allowing you to proactively manage your finances and make informed decisions to achieve your financial goals. A well-structured financial model helps you stay on top of your business’ financials and enables you to take timely actions to ensure your business’ financial success.

- Enhances business valuation : If you are planning to sell your business or seek investors for an exit strategy, a robust financial model is crucial. It provides a solid foundation for business valuation as it outlines your historical financial performance, future projections, and the assumptions behind them. It helps potential buyers or investors understand the financial potential of your business and assess its value. A well-prepared financial model can significantly impact the valuation of your business, and a higher valuation can lead to better negotiation terms and higher returns on your investment.

- Supports strategic planning : Your financial model is an integral part of your strategic planning process. It helps you align your financial goals with your overall business strategy and provides insights into the financial feasibility of your strategic initiatives. For example, if you are planning to expand your business, enter new markets, or invest in new technologies, your financial model can help you assess the financial impact of these initiatives, including the investment required, the expected return on investment, and the timeline for achieving profitability. It enables you to make informed decisions about the strategic direction of your business and ensures that your financial goals are aligned with your overall business objectives.

- Enhances accountability and transparency : A robust financial model promotes accountability and transparency in your business. It provides a clear framework for setting financial targets, measuring performance, and holding yourself and your team accountable for achieving financial results. It helps you monitor your progress towards your financial goals and enables you to take corrective actions if needed. A well-structured financial model also enhances transparency by providing a clear overview of your business’ financials, assumptions, and methodologies used in your projections. It ensures that all stakeholders, including investors, lenders, employees, and partners, have a clear understanding of your business’ financial performance and prospects.

In conclusion, a well-prepared financial model is a crucial component of your business plan. It provides a roadmap for financial success, demonstrates financial viability to stakeholders, helps with financial decision-making, assists in securing funding, facilitates financial management and monitoring, enhances business valuation, supports strategic planning, and enhances accountability and transparency in your business. It is not just a set of numbers, but a strategic tool that helps you understand, analyze, and optimize your business’ financial performance. Investing time and effort in creating a comprehensive and robust financial model in your business plan is vital for the success of your business and can significantly increase your chances of achieving your financial goals.

Filter by Keywords

10 Free Business Plan Templates in Word, Excel, & ClickUp

Praburam Srinivasan

Growth Marketing Manager

February 13, 2024

Turning your vision into a clear and coherent business plan can be confusing and tough.

Hours of brainstorming and facing an intimidating blank page can raise more questions than answers. Are you covering everything? What should go where? How do you keep each section thorough but brief?

If these questions have kept you up at night and slowed your progress, know you’re not alone. That’s why we’ve put together the top 10 business plan templates in Word, Excel, and ClickUp—to provide answers, clarity, and a structured framework to work with. This way, you’re sure to capture all the relevant information without wasting time.

And the best part? Business planning becomes a little less “ugh!” and a lot more “aha!” 🤩

What is a Business Plan Template?

What makes a good business plan template, 1. clickup business plan template, 2. clickup sales plan template, 3. clickup business development action plan template, 4. clickup business roadmap template, 5. clickup business continuity plan template, 6. clickup lean business plan template, 7. clickup small business action plan template, 8. clickup strategic business roadmap template , 9. microsoft word business plan template by microsoft, 10. excel business plan template by vertex42.

A business plan template is a structured framework for entrepreneurs and business executives who want to create business plans. It comes with pre-arranged sections and headings that cover key elements like the executive summary , business overview, target customers, unique value proposition, marketing plans, and financial statements.

A good business plan template helps with thorough planning, clear documentation, and practical implementation. Here’s what to look for:

- Comprehensive structure: A good template comes with all the relevant sections to outline a business strategy, such as executive summary, market research and analysis, and financial projections

- Clarity and guidance: A good template is easy to follow. It has brief instructions or prompts for each section, guiding you to think deeply about your business and ensuring you don’t skip important details

- Clean design: Aesthetics matter. Choose a template that’s not just functional but also professionally designed. This ensures your plan is presentable to stakeholders, partners, and potential investors

- Flexibility : Your template should easily accommodate changes without hassle, like adding or removing sections, changing content and style, and rearranging parts 🛠️

While a template provides the structure, it’s the information you feed it that brings it to life. These pointers will help you pick a template that aligns with your business needs and clearly showcases your vision.

10 Business Plan Templates to Use in 2024

Preparing for business success in 2024 (and beyond) requires a comprehensive and organized business plan. We’ve handpicked the best templates to help you guide your team, attract investors, and secure funding. Let’s check them out.

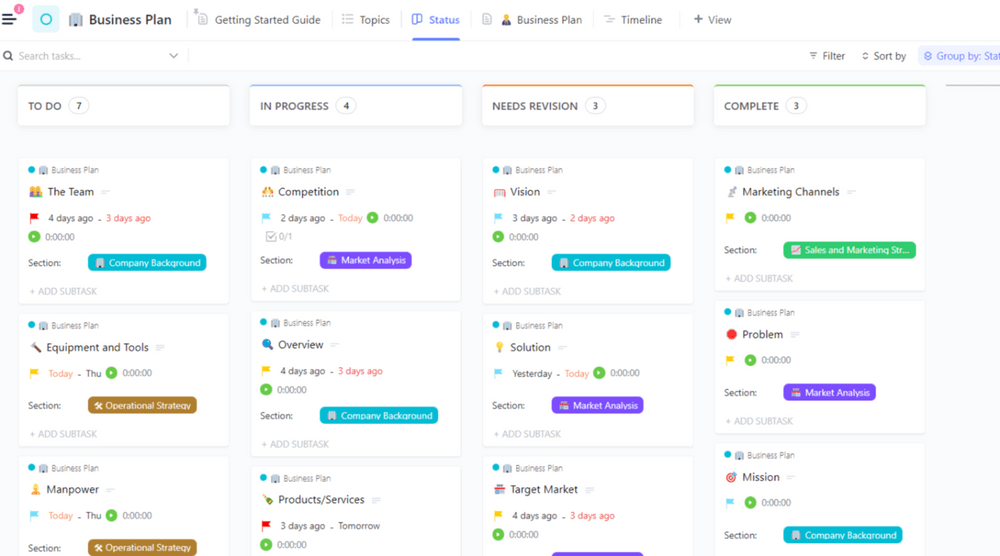

If you’re looking to replace a traditional business plan document, then ClickUp’s Business Plan Template is for you!

This one-page business plan template, designed in ClickUp Docs , is neatly broken down into the following sections:

- Company description : Overview, mission, vision, and team

- Market analysis : Problem, solution, target market, competition, and competitive advantage

- Sales and marketing strategy : Products/services and marketing channels

- Operational plan : Location and facilities, equipment and tools, manpower, and financial forecasts

- Milestones and metrics: Targets and KPIs

Customize the template with your company logo and contact details, and easily navigate to different sections using the collapsible table of contents. The mini prompts under each section guide you on what to include—with suggestions on how to present the data (e.g., bullet lists, pictures, charts, and tables).

You can share the document with anyone via URL and collaborate in real time. And when the business plan is ready, you have the option to print it or export it to PDF, HTML, or Markdown.

But that’s not all. This template is equipped with basic and enterprise project management features to streamline the business plan creation process . The Topics List view has a list of all the different sections and subsections of the template and allows you to assign it to a team member, set a due date, and attach relevant documents and references.

Switch from List to Board view to track and update task statuses according to the following: To Do, In Progress, Needs Revision, and Complete.

This template is a comprehensive toolkit for documenting the different sections of your business plan and streamlining the creation process to ensure it’s completed on time. 🗓️

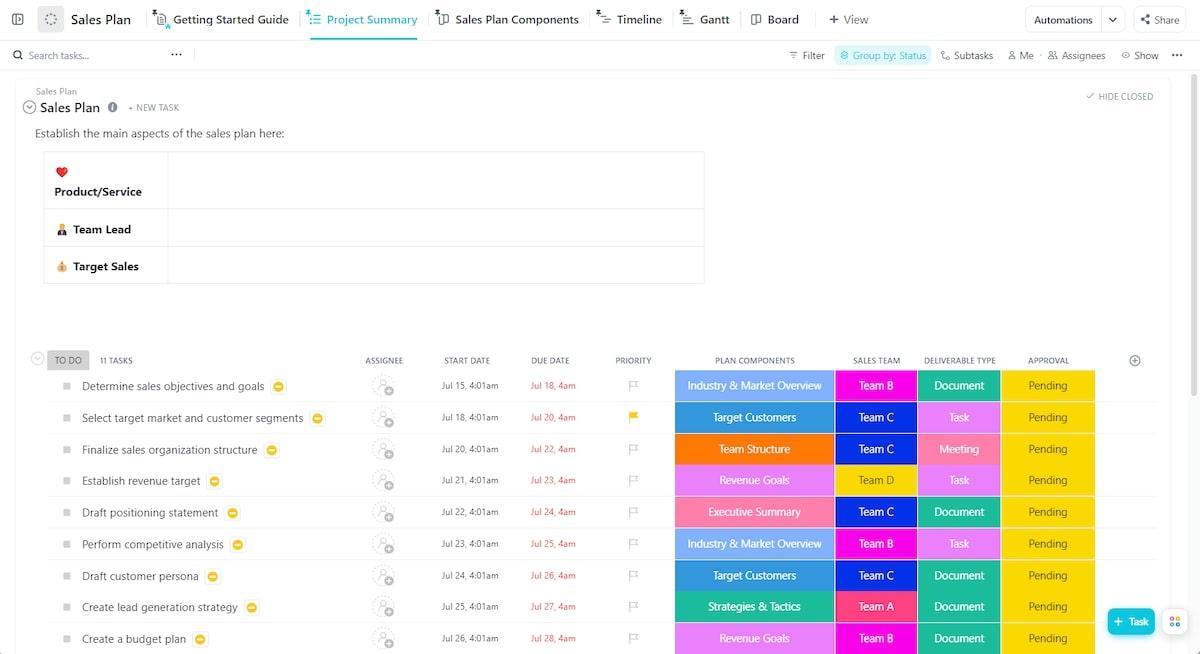

If you’re looking for a tool to kickstart or update your sales plan, ClickUp’s Sales Plan Template has got you covered. This sales plan template features a project summary list with tasks to help you craft a comprehensive and effective sales strategy. Some of these tasks include:

- Determine sales objectives and goals

- Draft positioning statement

- Perform competitive analysis

- Draft ideal customer persona

- Create a lead generation strategy

Assign each task to a specific individual or team, set priority levels , and add due dates. Specify what section of the sales plan each task belongs to (e.g., executive summary, revenue goals, team structure, etc.), deliverable type (such as document, task, or meeting), and approval state (like pending, needs revisions, and approved).

And in ClickUp style, you can switch to multiple views: List for a list of all tasks, Board for visual task management, Timeline for an overview of task durations, and Gantt to get a view of task dependencies.

This simple business plan template is perfect for any type of business looking to create a winning sales strategy while clarifying team roles and keeping tasks organized. ✨

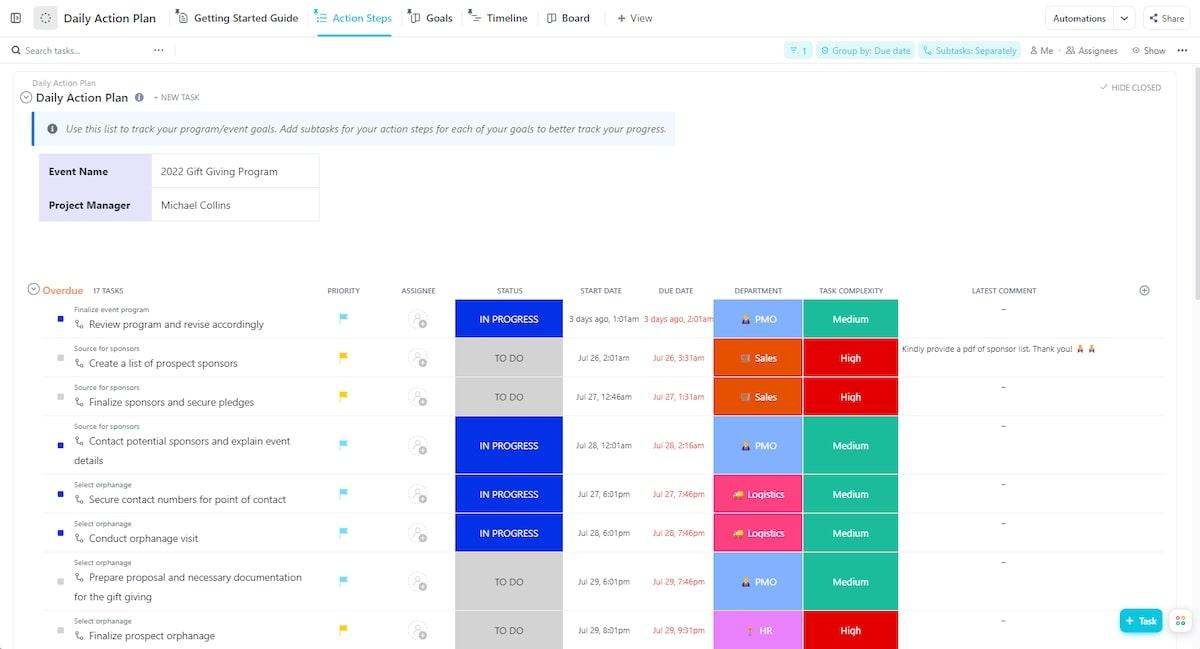

Thinking about scaling your business’s reach and operations but unsure where or how to start? It can be overwhelming, no doubt—you need a clear vision, measurable goals, and an actionable plan that every member of your team can rally behind.

Thankfully, ClickUp’s Business Development Action Plan Template is designed to use automations to simplify this process so every step toward your business growth is clear, trackable, and actionable.

Start by assessing your current situation and deciding on your main growth goal. Are you aiming to increase revenue, tap into new markets, or introduce new products or services? With ClickUp Whiteboards or Docs, brainstorm and collaborate with your team on this decision.

Set and track your short- and long-term growth goals with ClickUp’s Goals , break them down into smaller targets, and assign these targets to team members, complete with due dates. Add these targets to a new ClickUp Dashboard to track real-time progress and celebrate small wins. 🎉

Whether you’re a startup or small business owner looking to hit your next major milestone or an established business exploring new avenues, this template keeps your team aligned, engaged, and informed every step of the way.

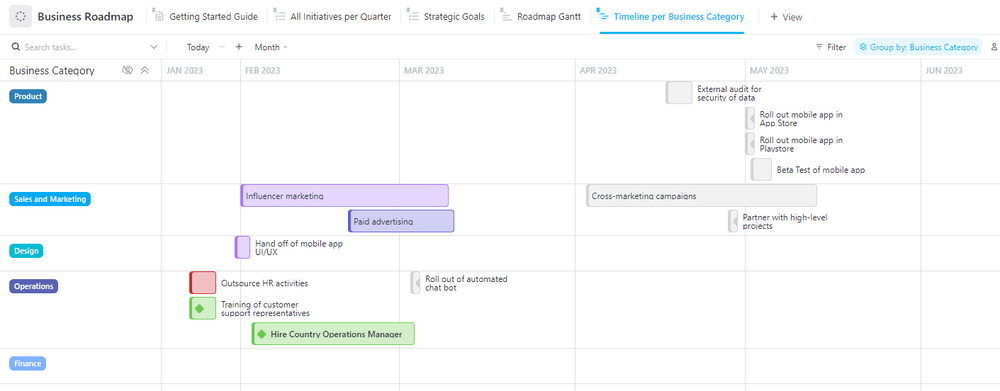

ClickUp’s Business Roadmap Template is your go-to for mapping out major strategies and initiatives in areas like revenue growth, brand awareness, community engagement, and customer satisfaction.

Use the List view to populate tasks under each initiative. With Custom Fields, you can capture which business category (e.g., Product, Operations, Sales & Marketing, etc.) tasks fall under and which quarter they’re slated for. You can also link to relevant documents and resources and evaluate tasks by effort and impact to ensure the most critical tasks get the attention they deserve. 👀

Depending on your focus, this template provides different views to show just what you need. For example, the All Initiatives per Quarter view lets you focus on what’s ahead by seeing tasks that need completion within a specific quarter. This ensures timely execution and helps in aligning resources effectively for the short term.

This template is ideal for business executives and management teams who need to coordinate multiple short- and long-term initiatives and business strategies.

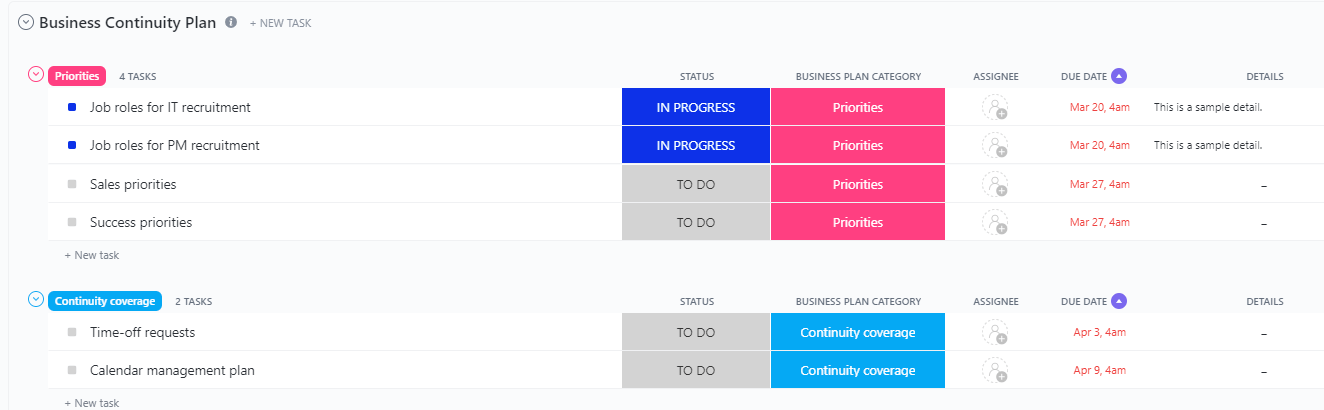

In business, unexpected threats to operations can arise at any moment. Whether it’s economic turbulence, a global health crisis, or supply chain interruptions, every company needs to be ready. ClickUp’s Business Continuity Plan Template lets you prepare proactively for these unforeseen challenges.

The template organizes tasks into three main categories:

- Priorities: Tasks that need immediate attention

- Continuity coverage: Tasks that must continue despite challenges

- Guiding principles: Resources and protocols to ensure smooth operations

The Board view makes it easy to visualize all the tasks under each of these categories. And the Priorities List sorts tasks by those that are overdue, the upcoming ones, and then the ones due later.

In times of uncertainty, being prepared is your best strategy. This template helps your business not just survive but thrive in challenging situations, keeping your customers, employees, and investors satisfied. 🤝

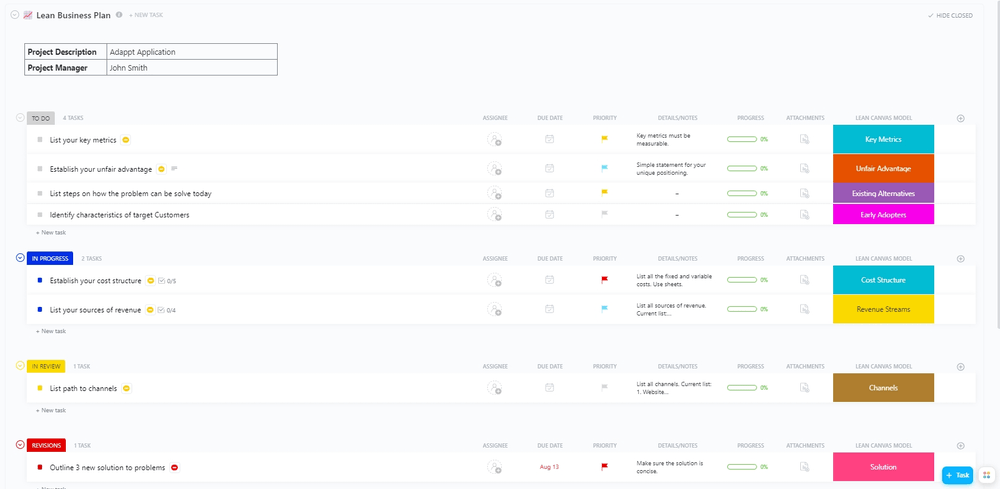

Looking to execute your business plan the “lean” way? Use ClickUp’s Lean Business Plan Template . It’s designed to help you optimize resource usage and cut unnecessary steps—giving you better results with less effort.

In the Plan Summary List view, list all the tasks that need to get done. Add specific details like who’s doing each task, when it’s due, and which part of the Business Model Canvas (BMC) it falls under. The By Priority view sorts this list based on priorities like Urgent, High, Normal, and Low. This makes it easy to spot the most important tasks and tackle them first.

Additionally, the Board view gives you an overview of task progression from start to finish. And the BMC view rearranges these tasks based on the various BMC components.

Each task can further be broken down into subtasks and multiple checklists to ensure all related action items are executed. ✔️

This template is an invaluable resource for startups and large enterprises looking to maximize process efficiencies and results in a streamlined and cost-effective way.

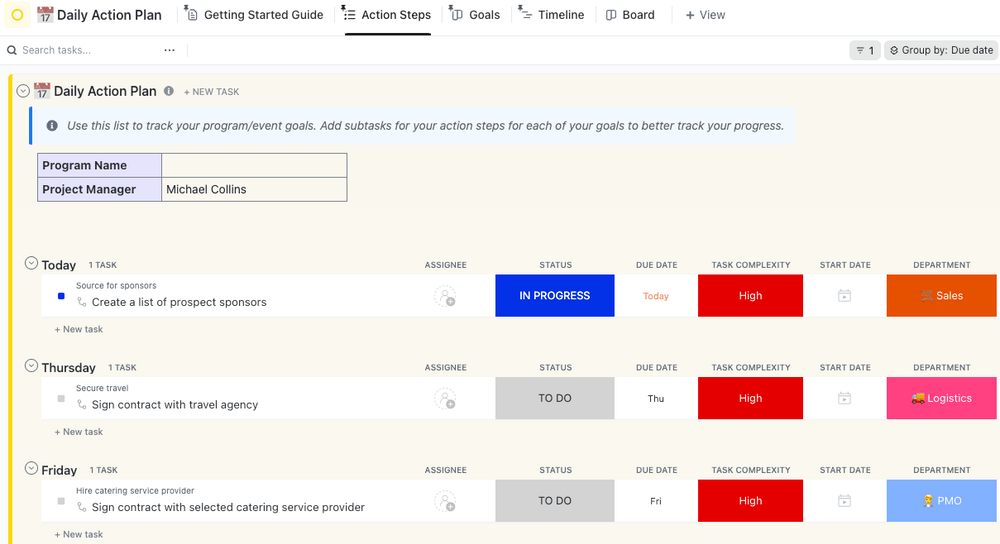

The Small Business Action Plan Template by ClickUp is tailor-made for small businesses looking to transform their business ideas and goals into actionable steps and, eventually, into reality.

It provides a simple and organized framework for creating, assigning, prioritizing, and tracking tasks. And in effect, it ensures that goals are not just set but achieved. Through the native dashboard and goal-setting features, you can monitor task progress and how they move you closer to achieving your goals.

Thanks to ClickUp’s robust communication features like chat, comments, and @mentions, it’s easy to get every team member on the same page and quickly address questions or concerns.

Use this action plan template to hit your business goals by streamlining your internal processes and aligning team efforts.

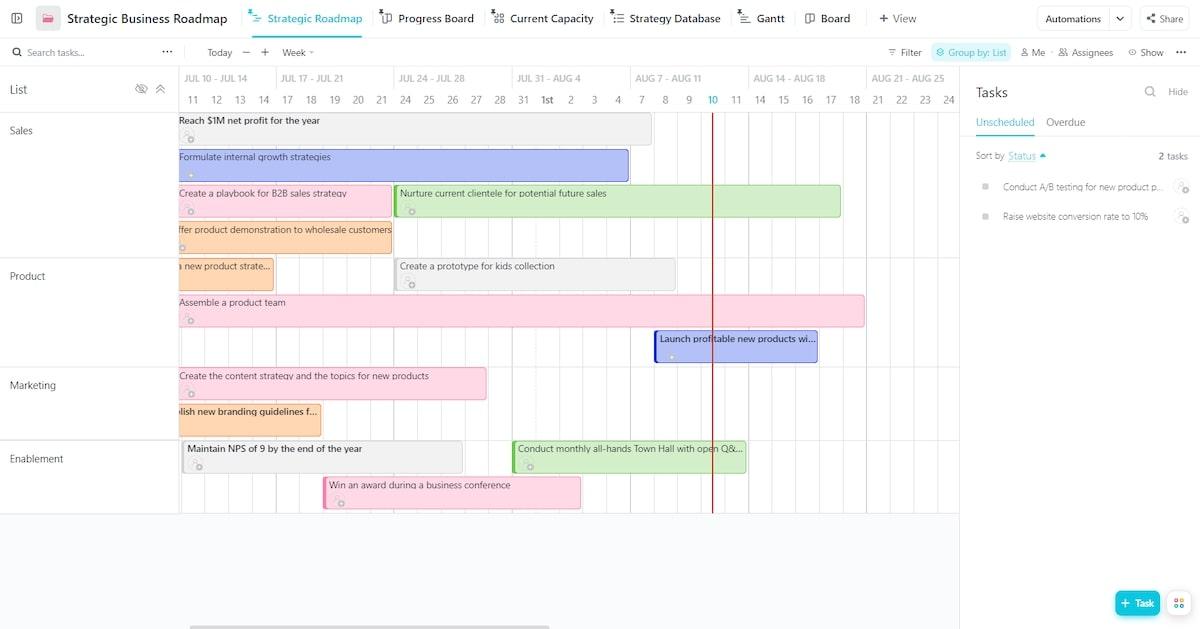

For larger businesses and scaling enterprises, getting different departments to work together toward a big goal can be challenging. The ClickUp Strategic Business Roadmap Template makes it easier by giving you a clear plan to follow.

This template is packaged in a folder and split into different lists for each department in your business, like Sales, Product, Marketing, and Enablement. This way, every team can focus on their tasks while collectively contributing to the bigger goal.

There are multiple viewing options available for team members. These include:

- Progress Board: Visualize tasks that are on track, those at risk, and those behind

- Gantt view: Get an overview of project timelines and dependencies

- Team view: See what each team member is working on so you can balance workloads for maximum productivity

While this template may feel overwhelming at first, the getting started guide offers a step-by-step breakdown to help you navigate it with ease. And like all ClickUp templates, you can easily customize it to suit your business needs and preferences.

Microsoft’s 20-page traditional business plan template simplifies the process of drafting comprehensive business plans. It’s made up of different sections, including:

- Executive summary : Highlights, objectives, mission statement, and keys to success

- Description of business: Company ownership and legal structure, hours of operation, products and services, suppliers, financial plans, etc.

- Marketing: Market analysis, market segmentation, competition, and pricing

- Appendix: Start-up expenses, cash flow statements, income statements, sales forecast, milestones, break-even analysis, etc.

The table of contents makes it easy to move to different sections of the document. And the text placeholders under each section provide clarity on the specific details required—making the process easier for users who may not be familiar with certain business terminology.

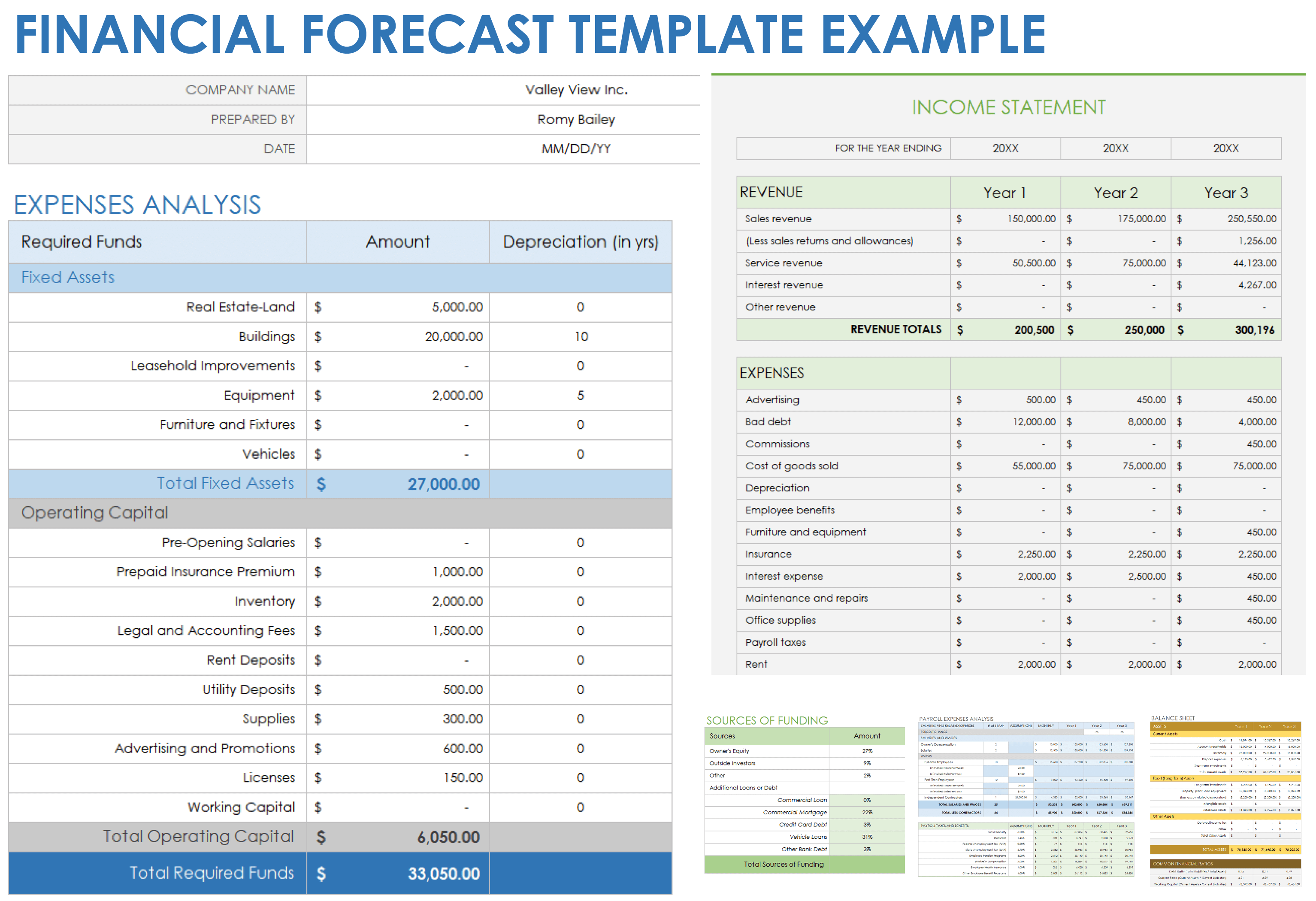

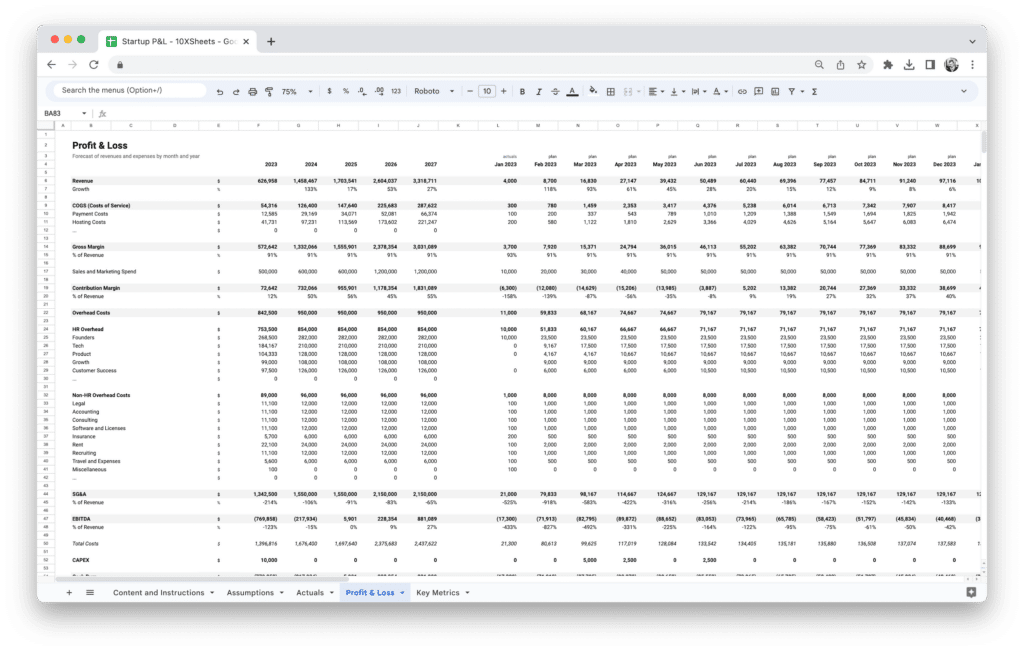

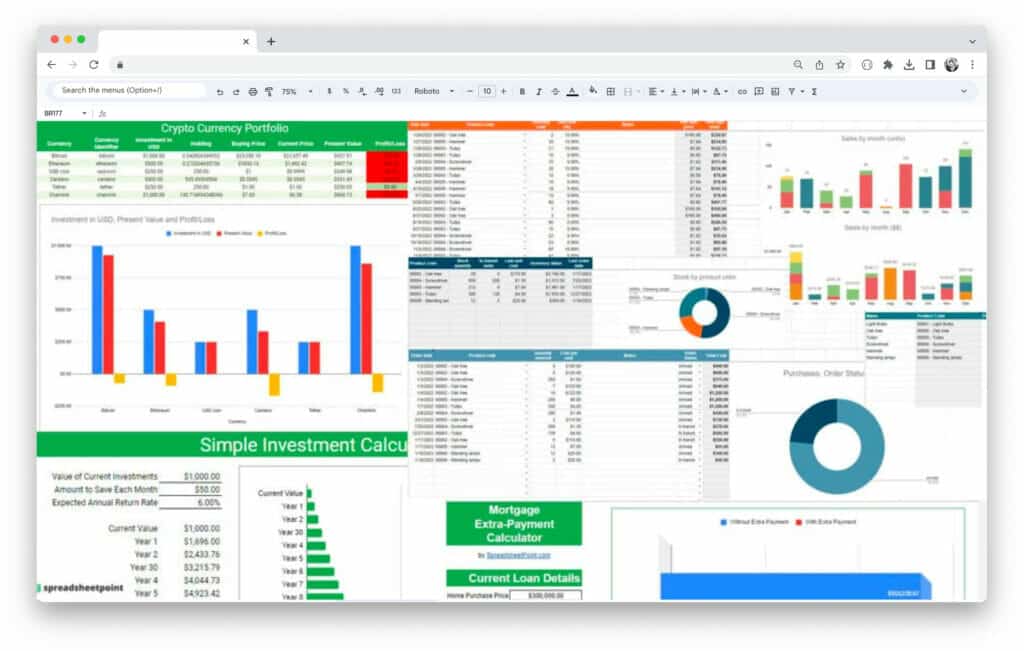

No business template roundup is complete without an Excel template. This business plan template lets you work on your business financials in Excel. It comes with customizable tables, formulas, and charts to help you look at the following areas:

- Highlight charts

- Market analysis

- Start-up assets and expenses

- Sales forecasts

- Profit and loss

- Balance sheet

- Cash flow projections

- Break-even analysis

This Excel template is especially useful when you want to create a clear and visual financial section for your business plan document—an essential element for attracting investors and lenders. However, there might be a steep learning curve to using this template if you’re not familiar with business financial planning and using Excel.

Try a Free Business Plan Template in ClickUp

Launching and running a successful business requires a well-thought-out and carefully crafted business plan. However, the business planning process doesn’t have to be complicated, boring, or take up too much time. Use any of the above 10 free business plan formats to simplify and speed up the process.

ClickUp templates go beyond offering a solid foundation to build your business plans. They come with extensive project management features to turn your vision into reality. And that’s not all— ClickUp’s template library offers over 1,000 additional templates to help manage various aspects of your business, from decision-making to product development to resource management .

Sign up for ClickUp’s Free Forever Plan today to fast-track your business’s growth! 🏆

Questions? Comments? Visit our Help Center for support.

Receive the latest WriteClick Newsletter updates.

Thanks for subscribing to our blog!

Please enter a valid email

- Free training & 24-hour support

- Serious about security & privacy

- 99.99% uptime the last 12 months

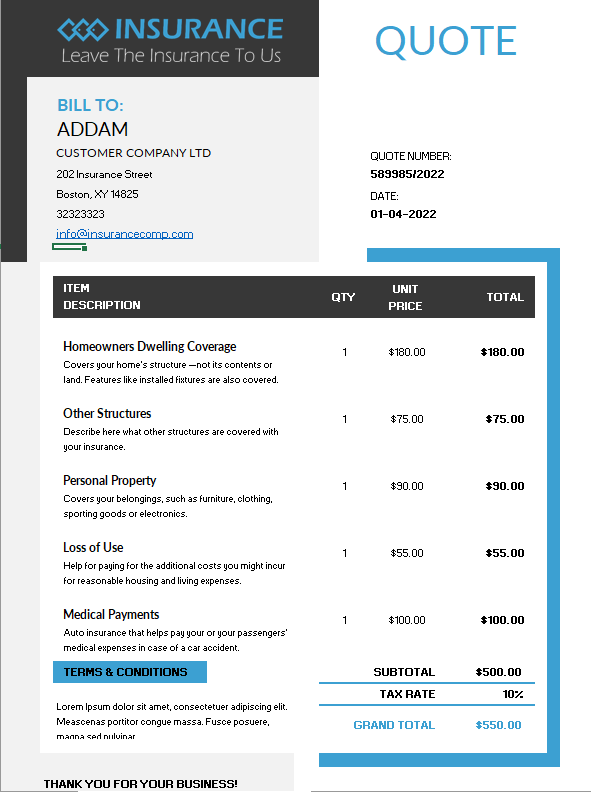

Free Financial Projection and Forecasting Templates

By Andy Marker | January 3, 2024

- Share on Facebook

- Share on LinkedIn

Link copied

We’ve collected the top free financial projection and forecasting templates. These templates enable business owners, CFOs, accountants, and financial analysts to plan future growth, manage cash flow, attract investors, and make informed decisions. On this page, you'll find many helpful, free, customizable financial projection and forecasting templates, including a 1 2-month financial projection template , a startup financial projection template , a 3-year financial projection template , and a small business financial forecast template , among others. You’ll also find details on the elements in a financial projection template , types of financial projection and forecasting templates , and related financial templates .

Simple Financial Projection Template

Download a Sample Simple Financial Projection Template for

Excel | Google Sheets

Download a Blank Simple Financial Projection Template for

Excel | Google Sheets

Small business owners and new entrepreneurs are the ideal users for this simple financial projection template. Just input your expected revenues and expenses. This template stands out due to its ease of use and focus on basic, straightforward financial planning, making it perfect for small-scale or early-stage businesses. Available with or without sample text, this tool offers clear financial oversight, better budget management, and informed decision-making regarding future business growth.

Looking for help with your business plan? Check out these free financial templates for a business plan to streamline the process of organizing your business's financial information and presenting it effectively to stakeholders.

Financial Forecast Template

Download a Sample Financial Forecast Template for

Download a Blank Financial Forecast Template for

This template is perfect for businesses that require a detailed and all-encompassing forecast. Users can input various financial data, such as projected revenues, costs, and market trends, to generate a complete financial outlook. Available with or without example text, this template gives you a deeper understanding of your business's financial trajectory, aiding in strategic decision-making and long-term financial stability.

These free cash-flow forecast templates help you predict your business’s future cash inflows and outflows, allowing you to manage liquidity and optimize financial planning.

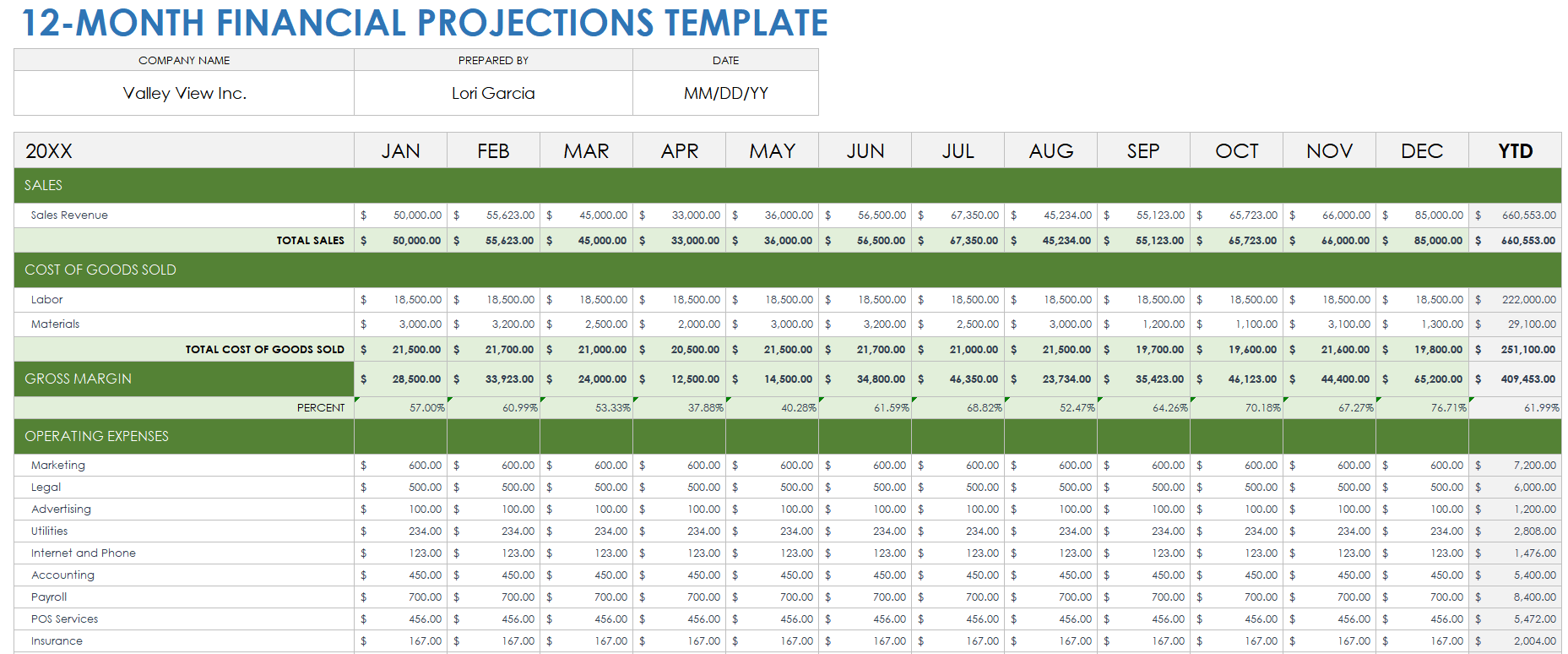

12-Month Financial Projection Template

Download a Sample 12-Month Financial Projection Template for

Download a Blank 12-Month Financial Projection Template for

Use this 12-month financial projection template for better cash-flow management, more accurate budgeting, and enhanced readiness for short-term financial challenges and opportunities. Input estimated monthly revenues and expenses, tracking financial performance over the course of a year. Available with or without sample text, this template is ideal for business owners who need to focus on short-term financial planning. This tool allows you to respond quickly to market shifts and plan effectively for the business's crucial first year.

Download free sales forecasting templates to help your business predict future sales, enabling better inventory management, resource planning, and decision-making.

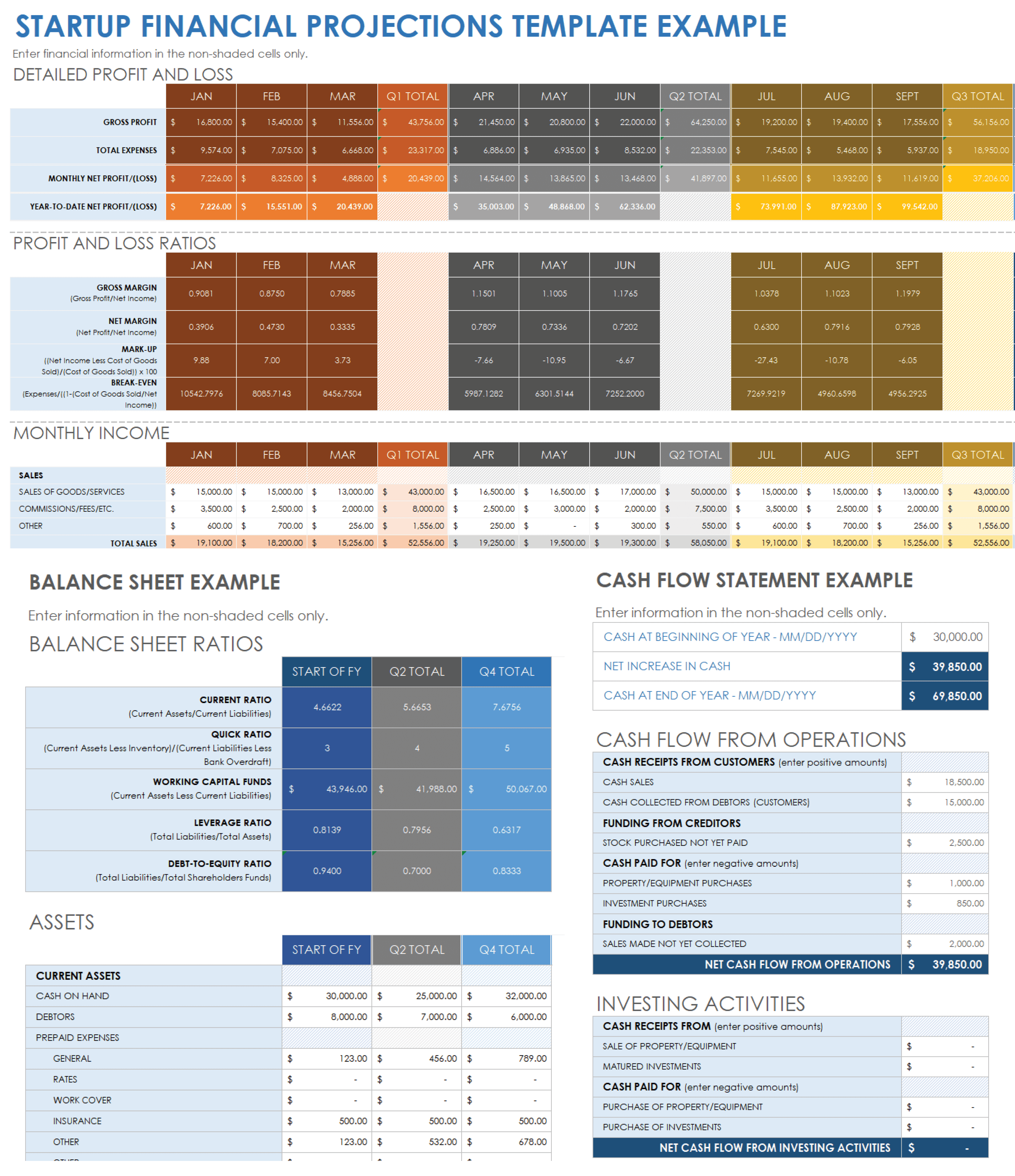

Startup Financial Projection Template

Download a Sample Startup Financial Projection Template for

Download a Blank Startup Financial Projection Template for

This dynamic startup financial projection template is ideal for startup founders and entrepreneurs, as it's designed specifically for the unique needs of startups. Available with or without example text, this template focuses on clearly outlining a startup's initial financial trajectory, an essential component for attracting investors. Users can input projected revenues, startup costs, and funding sources to create a comprehensive financial forecast.

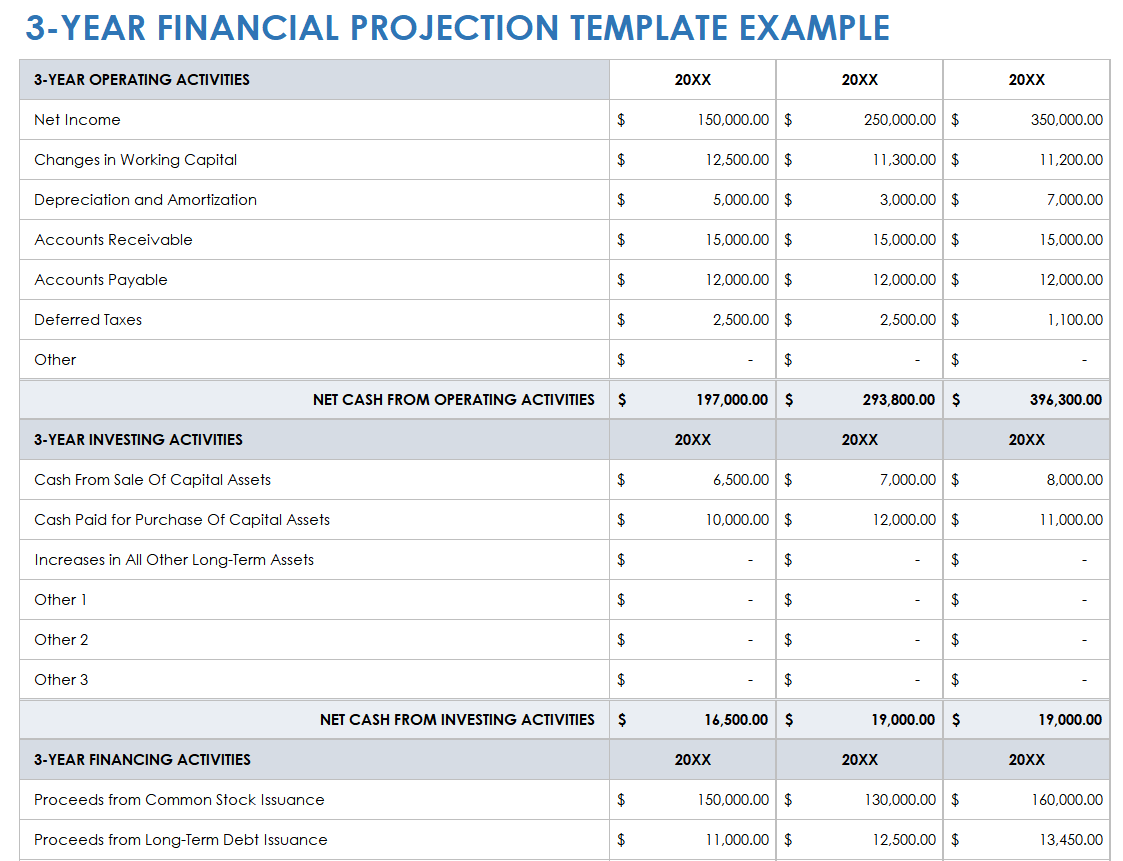

3-Year Financial Projection Template

Download a Sample 3-Year Financial Projection Template for

Download a Blank 3-Year Financial Projection Template for

This three-year financial projection template is particularly useful for business strategists and financial planners who are looking for a medium-term financial planning tool. Input data such as projected revenues, expenses, and growth rates for the next three years. Available with or without sample text, this template lets you anticipate financial challenges and opportunities in the medium term, aiding in strategic decision-making and ensuring sustained business growth.

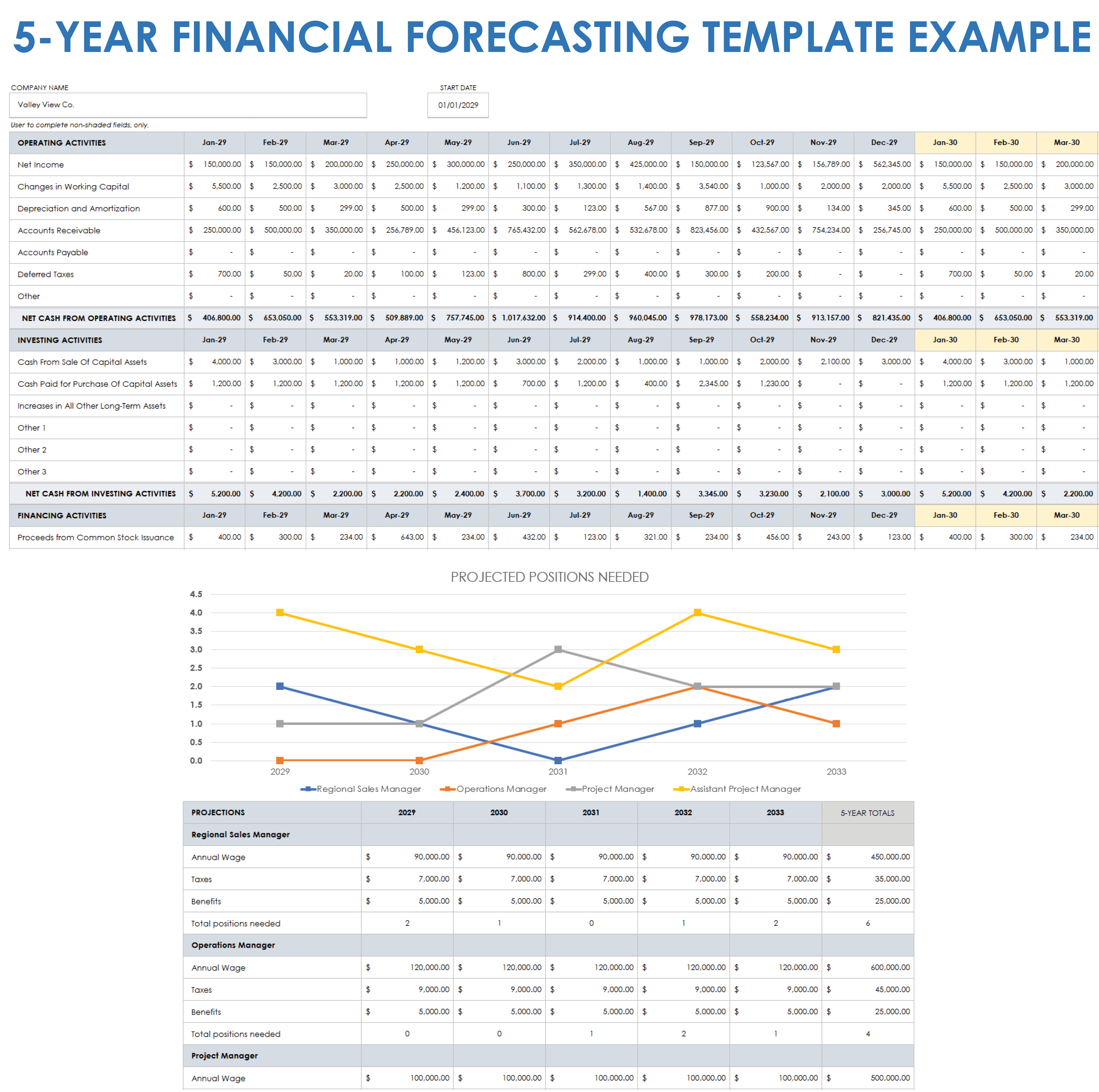

5-Year Financial Forecasting Template

Download a Sample 5-Year Financial Forecasting Template for

Download a Blank 5-Year Financial Forecasting Template for

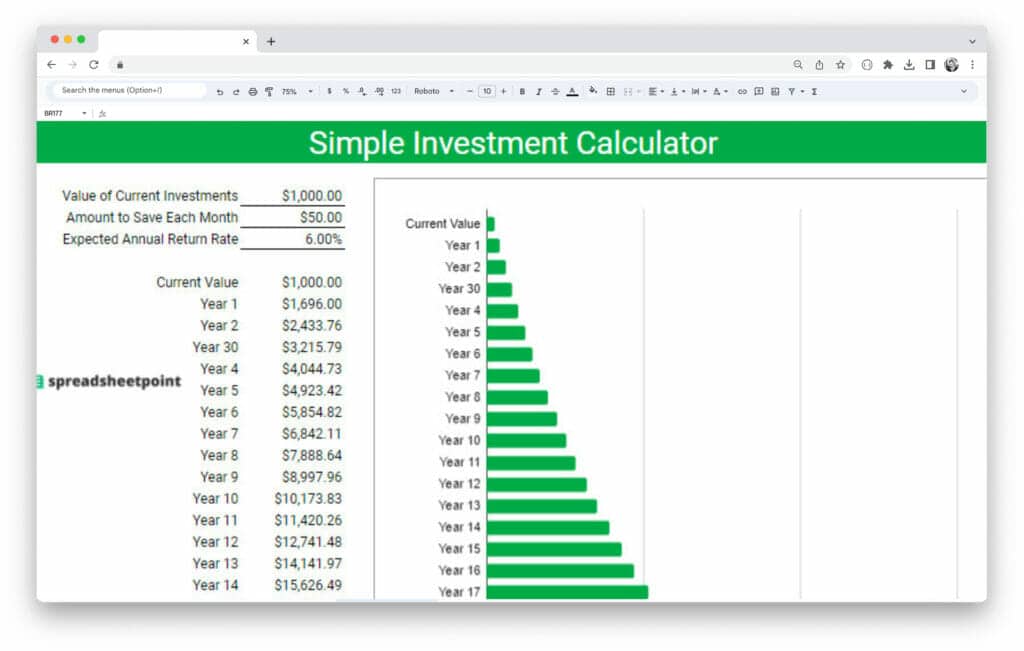

CFOs and long-term business planners can use this five-year financial forecasting template to get a clear, long-range financial vision. Available with or without example text, this template allows you to plan strategically and invest wisely, preparing your business for future market developments and opportunities. This unique tool offers an extensive outlook for your business’s financial strategy. Simply input detailed financial data spanning five years, including revenue projections, investment plans, and expected market growth. Visually engaging bar charts of key metrics help turn data into engaging narratives.

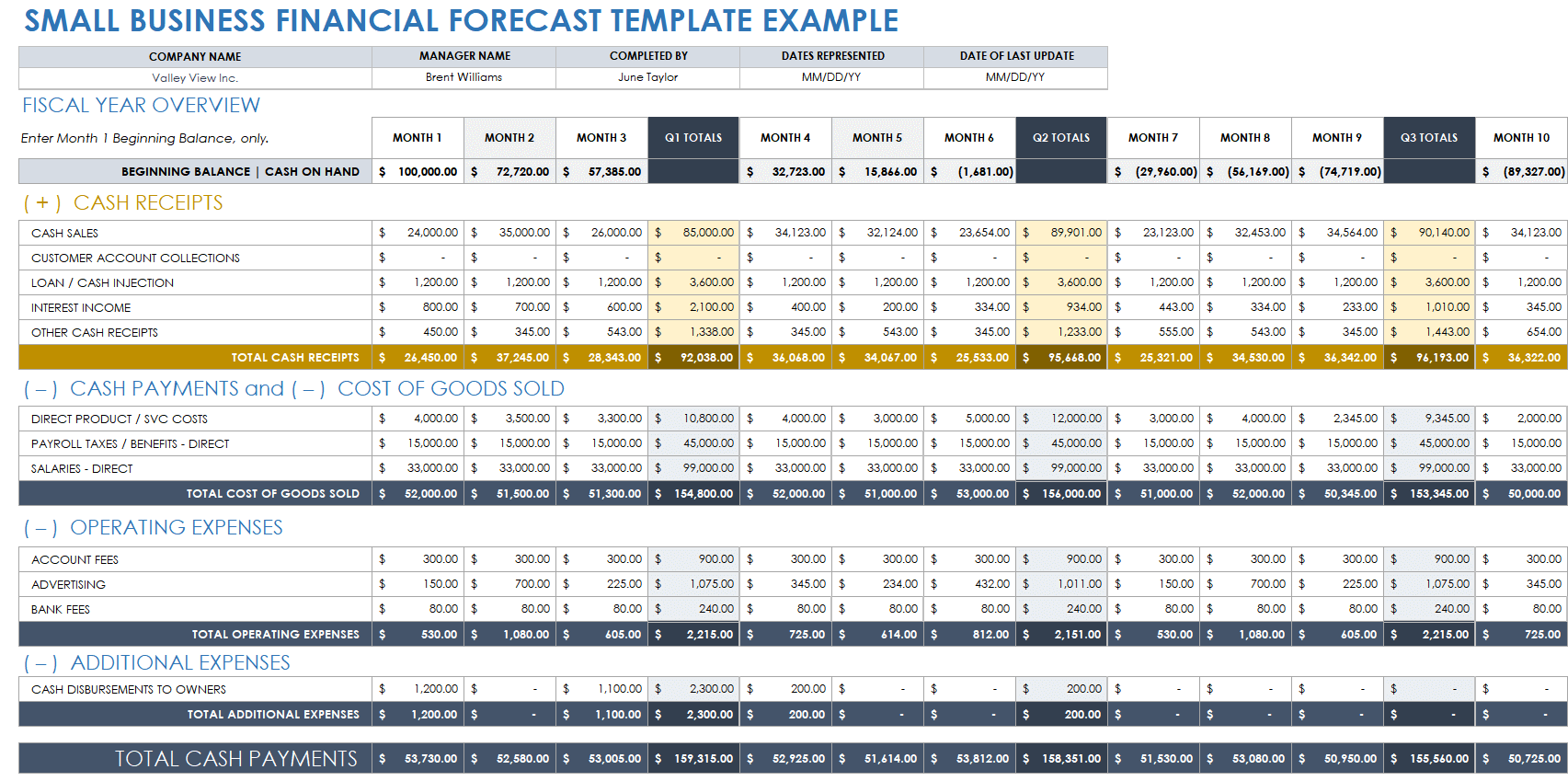

Small Business Financial Forecast Template

Download a Sample Small Business Financial Forecast Template for

Download a Blank Small Business Financial Forecast Template for

Excel | Google Sheets

The small business financial forecast template is tailored specifically for the scale and specific requirements of small enterprises. Business owners and financial managers can simply input data such as projected sales or expenses. Available with or without sample text, this tool offers the ability to do the following: envision straightforward financial planning; anticipate future financial needs and challenges; make informed decisions; and steer the business toward steady growth.

Elements in a Financial Projection Template

The elements in a financial projection template include future sales, costs, profits, and cash flow. This template illustrates expected receivables, payables, and break-even dates. This tool helps you plan for your business's financial future and growth.

Here are the standard elements in a financial projection template:

- Revenue Projection: This estimates future income from various sources over a specific period.

- Expense Forecast: This predicts future costs, including both fixed and variable expenses.

- Profit and Loss Forecast: This projects the profit or loss by subtracting projected expenses from projected revenues.

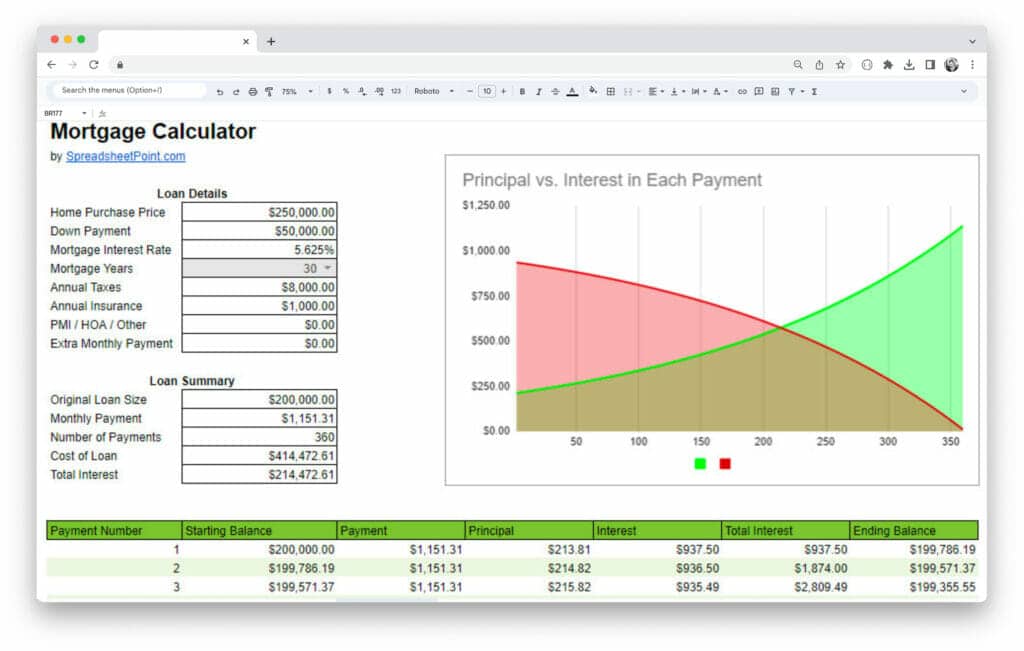

- Cash-Flow Projection: This assesses the inflows and outflows of cash, indicating liquidity over time.

- Balance Sheet Projection: This predicts the future financial position, showing assets, liabilities, and equity.

- Break-Even Analysis: This calculates the point at which total revenues equal total costs.

- Capital Expenditure Forecast: This estimates future spending on fixed assets such as equipment or property.

- Debt Repayment Plan: This outlines the schedule for paying back any borrowed funds.

- Sales Forecast: This predicts future sales volume, often broken down by product or service.

- Gross Margin Analysis: This looks at the difference between revenue and cost of goods sold.

Types of Financial Projection and Forecasting Templates

There are many types of financial projection and forecasting templates: basic templates for small businesses; detailed ones for big companies; special ones for startup businesses; and others. There are also sales forecasts, cash-flow estimates, and profit and loss projections.

In addition, financial projection and forecasting templates include long-term planning templates, break-even analyses, budget forecasts, and templates made for specific industries such as retail or manufacturing.

Each template serves different financial planning needs. Determine which one best suits your requirements based on the scale of your business, the complexity of its financial structure, and the specific department that you want to analyze.

Here's a list of the top types of financial projection and forecasting templates:

- Basic Financial Projection Template: Ideal for small businesses or startups, this template provides a straightforward approach to forecasting revenue, expenses, and cash flow.

- Detailed Financial Projection Template: Best for larger businesses or those with complex financial structures, this template offers in-depth projections, including balance sheets, income statements, and cash-flow statements.

- Startup Financial Projection Template: Tailored for startups, this template focuses on funding requirements and early-stage revenue forecasts, both crucial for attracting investors and planning initial operations.

- Sales Forecasting Template: Used by sales and marketing teams to predict future sales, this template helps you set targets and plan marketing strategies.

- Cash-Flow Forecast Template: Essential for financial managers who need to monitor the liquidity of the business, this template projects cash inflows and outflows over a period.

- Profit and Loss Forecast Template (P&L): Useful for business owners and financial officers who need to anticipate profit margins, this template enables you to forecast revenues and expenses.

- Three-Year / Five-Year Financial Projection Template: Suitable for long-term business planning, these templates provide a broader view of your company’s financial future, improving your development strategy and investor presentations.

- Break-Even Analysis Template: Used by business strategists and financial analysts, this template helps you determine when your business will become profitable.

- Budget Forecasting Template: Designed for budget managers, this template uses historical financial data to help you plan your future spending.

- Sector-Specific Financial Projection Template: Designed for specific industries (such as retail or manufacturing), these templates take into account industry-specific factors and benchmarks.

Related Financial Templates

Check out this list of free financial templates related to financial projections and forecasting. You'll find templates for budgeting, tracking profits and losses, planning your finances, and more. These tools help keep your company’s money matters organized and clear.

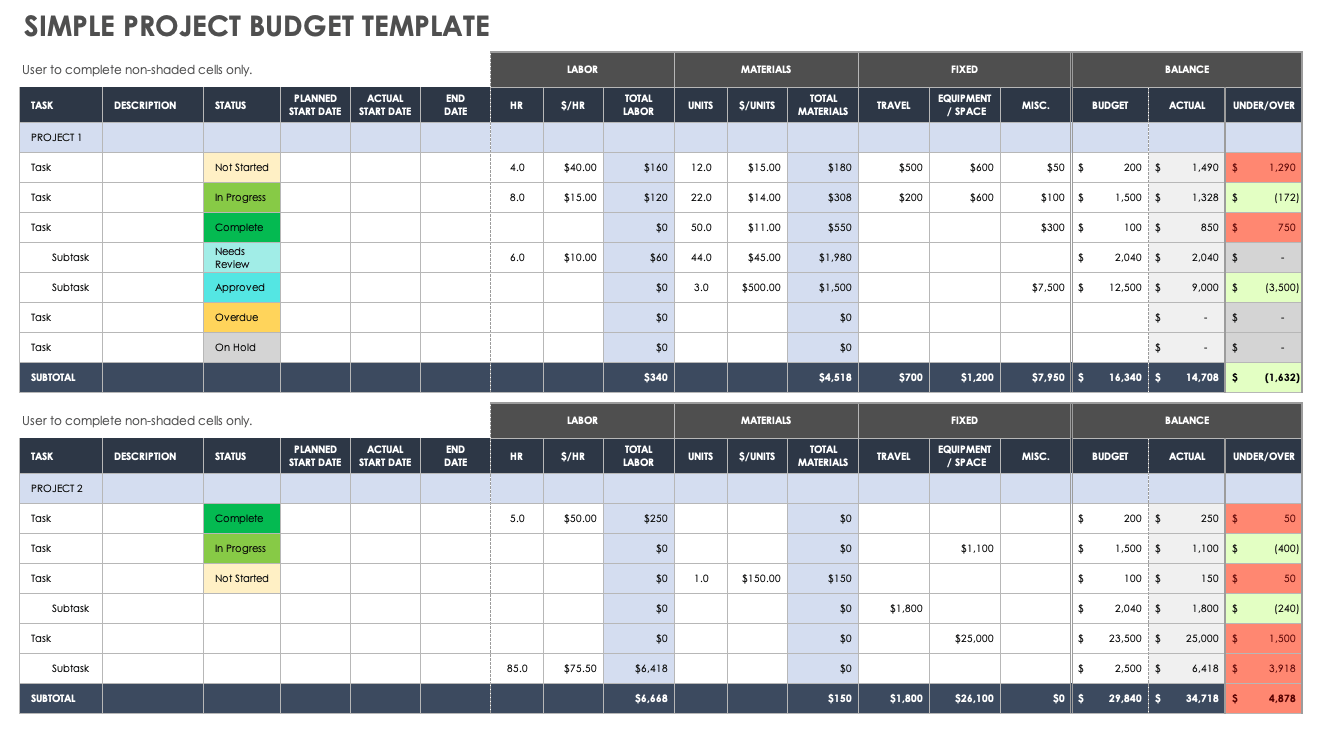

Free Project Budget Templates

Use one of these project budget templates to maintain control over project finances, ensuring costs stay aligned with the allocated budget and improving overall financial management.

Free Monthly Budget Templates

Use one of these monthly budget templates to effectively track and manage your business’s income and expenses, helping you plan financially and save money.

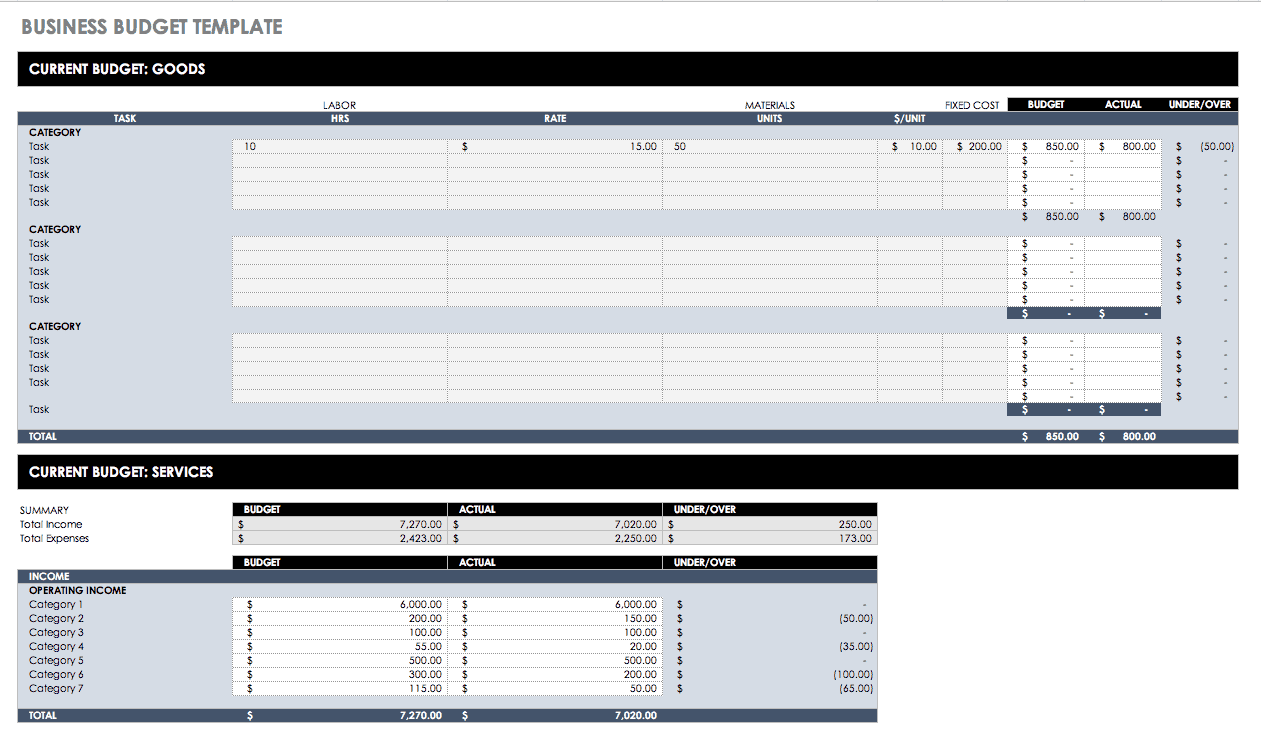

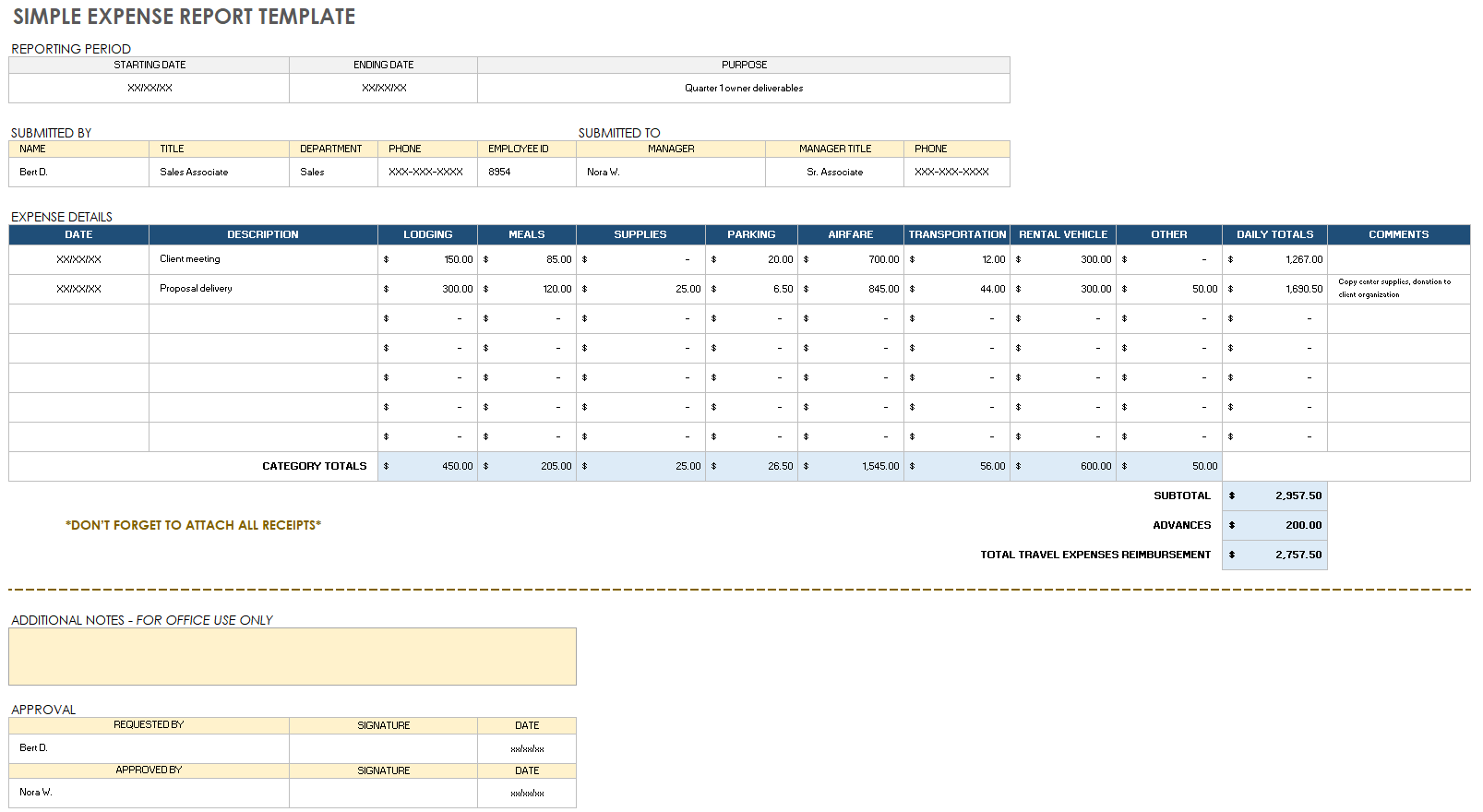

Free Expense Report Templates

Use one of these expense report templates to systematically track and document all business-related expenditures, ensuring accurate reimbursement and efficient financial record-keeping.

Free Balance Sheet Templates

Use one of these balance sheet templates to summarize your company's financial position at a given time.

Free Cash-Flow Forecast Templates

Use one of these cash-flow forecast templates to predict future cash inflows and outflows, helping you manage liquidity and make informed financial decisions.

Free Cash-Flow Statement Templates

Use one of these cash-flow statement templates to track the movement of cash in and out of your business, so you can assess your company’s level of liquidity and financial stability.

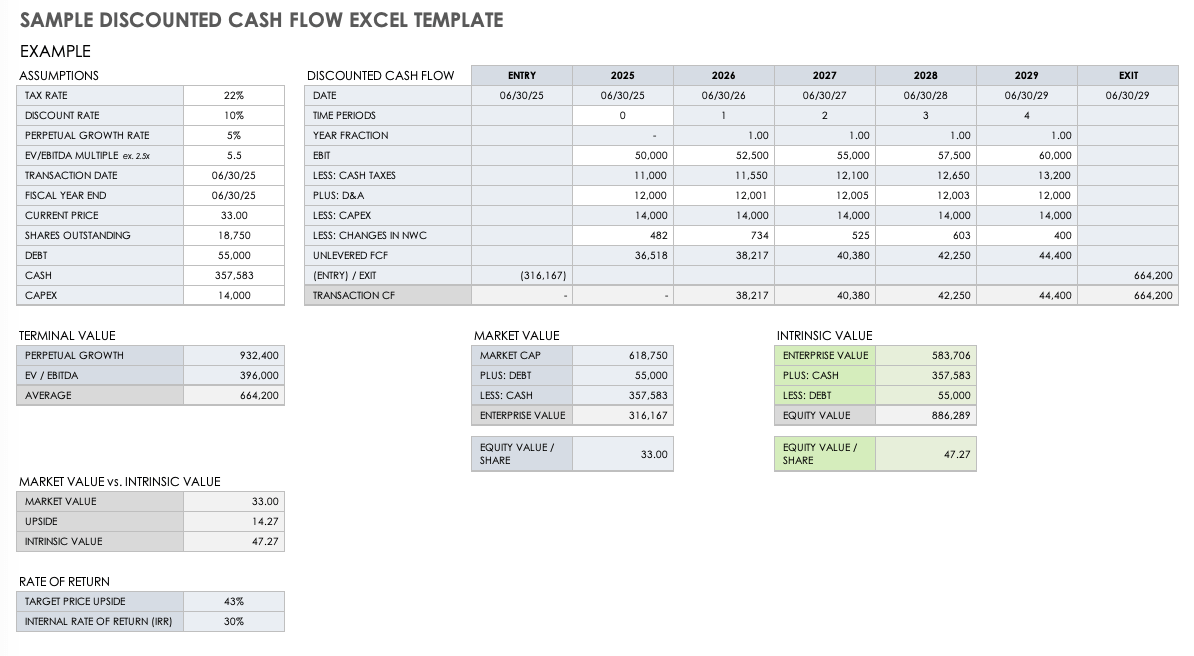

Free Discounted Cash-Flow (DCF) Templates

Use one of these discounted cash-flow (DCF) templates to evaluate the profitability of investments or projects by calculating their present value based on future cash flows.

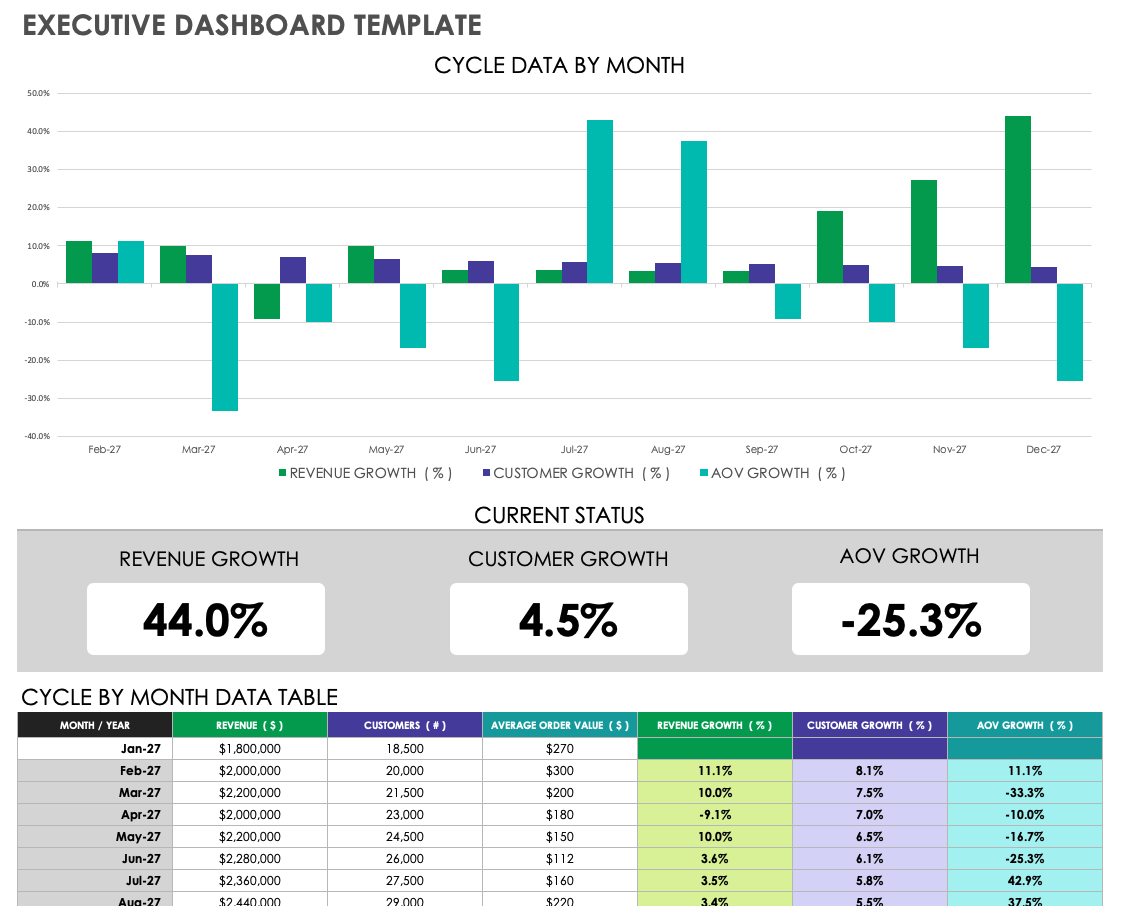

Free Financial Dashboard Templates

Use one of these financial dashboard templates to get an at-a-glance view of key financial metrics, so you can make decisions quickly and manage finances effectively.

Related Customer Stories

Free financial planning templates.

Use one of these financial planning templates to strategically organize and forecast future finances, helping you set realistic financial goals and ensure long-term business growth.

Free Profit and Loss (P&L) Templates

Use one of these profit and loss (P&L) templates to systematically track income and expenses, giving you a clear picture of your company's profitability over a specific period.

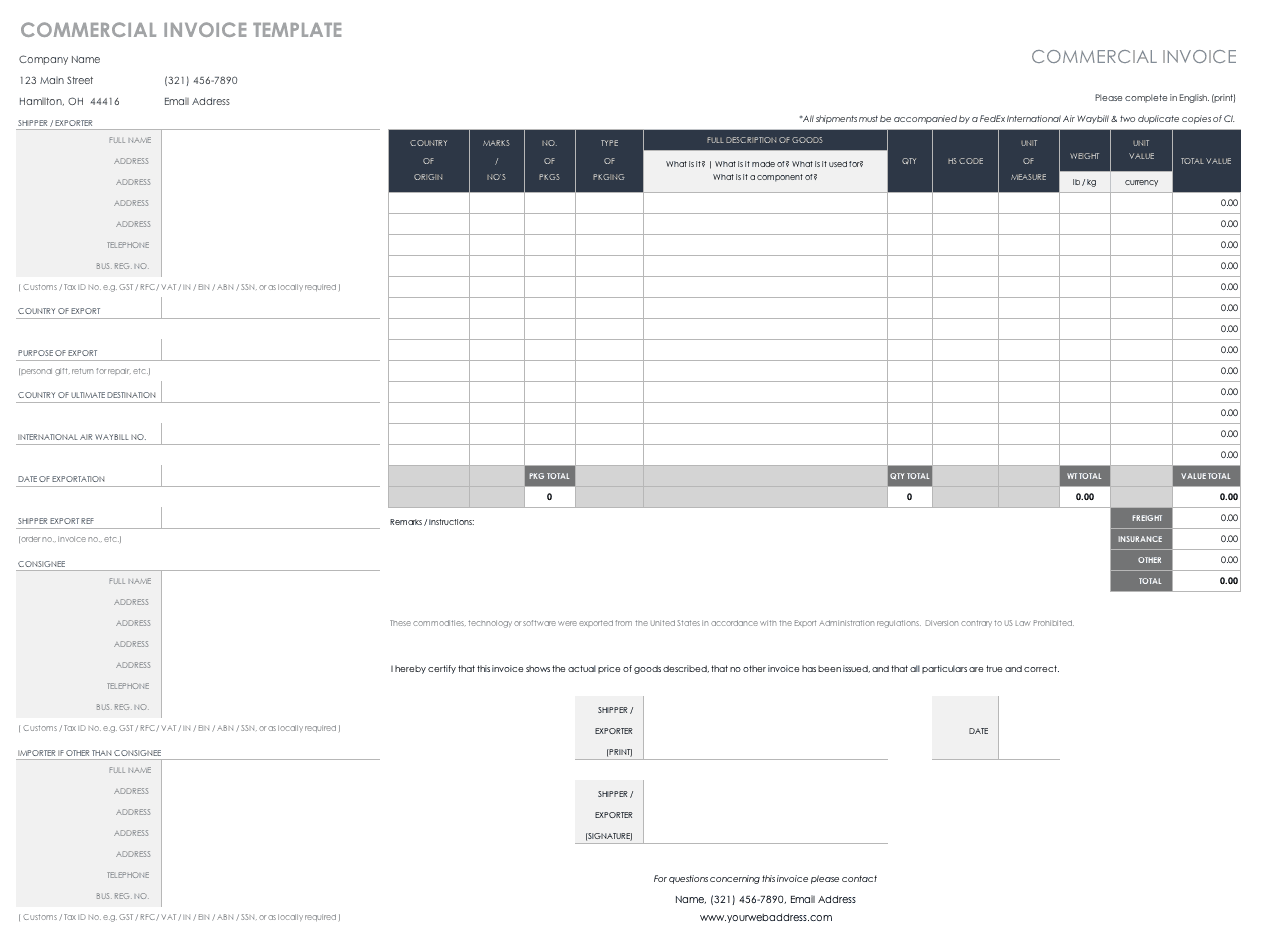

Free Billing and Invoice Templates

Use one of these billing and invoice templates to streamline the invoicing process and ensure that you bill clients accurately and professionally for services or products.

Plan and Manage Your Company’s Financial Future with Financial Projection and Forecasting Templates from Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

FinModelsLab

Industry-Specific Financial Model Templates in Excel

Food & Beverage Financial Models

Healthcare Financial Models

Agriculture Financial Models

Marketplace Financial Models

Hospitality Financial Models

E-Commerce Financial Models

Beauty & Sport Financial Models

Subscription Box Financial Models

Real Estate Financial Models

Services Financial Models

Retail Financial Models

Software as a Service Financial Models

- Financial Models

- Business Plans

Restaurant Financial Model

Boutique hotel financial model, clinic financial model, saas financial model, grocery marketplace financial model, medical practice financial model, hotel financial model, dropshipping financial model, massage therapy financial model, solar panel financial model, clothing manufacturing financial model, brewery financial model, medical equipment manufacturing financial model, fintech financial model, frozen food financial model, e-commerce financial model, cannabis financial model, juice production financial model, mobile application financial model, daycare financial model, meat processing plant financial model, coffee roasting financial model, consulting agency financial model, digital marketing agency financial model, financial model for 3 statements, 3 statement projection tool, three-way financial analysis model, three statement financial plan, vegetables farming financial model, our happy customers.

I have been doing capital raising in a wide variety of industries and have been involved on 4 Private Equity Funds. Financial models tend to be either too simplistic or too complicated and useless. But this model is the perfect mix of simplistic and intuitive with enough detail for large project funding analysis. It could even be used as a budgeting tool for smaller mining companies. Well Done! And Thank You very much!

Great financial model template with the most complete set of charts that will ever need! Monthly breakdowns for all the financial statements and a cash valuation. Summary tabs with all the main information you need for a business plan! Could be improved with the addition of financial ratios.

What an incredible find in FinModelsLab! The ASC model is perfect for modeling our healthcare practice… enthusiastically recommend!!!

The spear sheet is just what I needed. I am able to plug in my numbers and the video shows you where to place all information. I can now send the pro-forma to investors. Love it thank you

Henry was a life-saver. If you have a very difficult financial modeling project that you need delivered fast, go with Henry. He will get it done.

Henry is very good at forecasting and business modelling. His communication and responsiveness are excellent.

Henry was the best financial expert for us when it came to financial analysis and building financial complex models for our start-up.

Excellent CFO I have ever come across. He has an eye to detail and is an expert when to comes to financial modeling & planning.

A complete and easy to use Restaurant financial model that gives you clear view and guide when preparing business plan numbers

I really feel there is no finance challenge Henry can't overcome, and I look forward to working with him on many more projects and entrepreneurial initiatives.

Henry is incredibly talented and hard working. He is one of the top-notch players in his niche, He pushed out a rock solid deliverable.

Industry-specific Financial Model Templates in Excel, Business Plan Templates, Excel Dashboards and Pitch Decks

FinModelsLab provides a wide range of industry-specific financial model templates in Excel as well as Excel dashboards, Business Plan Templates, and Pitch Deck Templates. Creating a business plan with detailed financial projections and pitch deck presentation or Excel dashboard is time-consuming. That is why we created a web repository with 1500+ business templates for a wide range of usage cases. We spent 10 000+ hours creating industry-specific financial forecasting model templates in Excel which offers a well-structured as well as best practice financial modeling know-how to users such as c-level executives, entrepreneurs, investors, startup founders, and many more, who are looking for assistance in creating financial projections template.

In today's fast-paced business landscape, effective financial modeling and planning are crucial for the success and growth of any organization. With accurate financial projections, businesses can make informed decisions, secure funding, and navigate potential challenges with confidence. At FinModelsLab, we understand the significance of financial modeling, which is why we offer a comprehensive collection of industry-specific financial model templates in Excel.

The Importance of Financial Modeling

Financial modeling serves as the foundation for strategic decision-making, providing insights into the financial health and performance of a business. It allows organizations to forecast revenue, project expenses, assess profitability, and evaluate potential risks and opportunities. By modeling different scenarios, businesses can optimize their resources, identify growth strategies, and plan for the future.

Addressing the Need for Industry-Specific Templates

Generic financial templates may not capture the unique requirements and dynamics of specific industries. That's where industry-specific financial model templates become invaluable. At FinModelsLab, we recognize the importance of tailoring financial models to the nuances of different sectors. Our extensive collection includes a wide range of industry-specific templates, ensuring that businesses have the tools they need to accurately project revenues, analyze costs, and plan for success in their respective sectors.

- Comprehensive financial model templates designed for specific industries.

- Templates catering to diverse sectors such as manufacturing, e-commerce, healthcare, and more.

- Industry-specific financial model templates for startups, small businesses, and established enterprises.

By providing industry-specific financial model templates, we empower businesses to make informed decisions based on reliable and relevant data, ultimately increasing their chances of success in the marketplace.

About FinModelsLab

At FinModelsLab, we pride ourselves on being a trusted and reliable source for financial model templates. With our commitment to excellence and a comprehensive collection of over 3500+ business templates, we empower entrepreneurs, startups, investors, and professionals to create accurate and detailed financial projections.

Reliable Financial Projections Templates

Our platform offers a vast selection of financial projections templates that cater to various industries and business models. Each template is designed by our team of financial experts, ensuring that they meet industry standards and best practices. Whether you are starting a new venture or seeking to optimize your existing business, our templates provide a solid foundation for projecting revenues, estimating costs, and analyzing profitability.

A Wide Range of Business Templates

With a collection of 3500+ business templates, we cover a diverse range of industries, including manufacturing, e-commerce, SaaS, healthcare, and more. Our templates address different aspects of financial modeling, such as cash flow analysis, income statements, balance sheets, and valuation models. This comprehensive assortment enables users to find the templates that best align with their specific business needs.

- 3500+ business templates available for different industries and usage cases.

- Templates for startups, small businesses, investors, and c-level executives.

- Templates covering various financial aspects, including cash flow, income statements, and valuation models.

With FinModelsLab, you can access a wide range of financial projections templates and find the resources necessary to make informed financial decisions for your business.

Expertise and Dedication

At FinModelsLab, we have invested over 10,000 hours of meticulous effort and dedication into creating our financial model templates. This extensive investment of time and expertise reflects our commitment to providing high-quality resources for financial modeling and planning.

Well-Structured Financial Model Templates

Our financial model templates are designed with a well-structured framework that follows industry best practices. Each template encompasses a comprehensive set of financial projections, ensuring that businesses can accurately forecast revenues, expenses, and cash flows. By leveraging our well-structured templates, users can save time and effort, focusing on analyzing the data rather than building models from scratch.

Best Practice Financial Modeling Knowledge

Our team of financial experts brings in-depth knowledge and expertise in financial modeling. We follow best practices and incorporate industry standards into our templates, ensuring that users have access to reliable and accurate financial projections. Whether you are a c-level executive, entrepreneur, investor, or professional seeking robust financial models, our templates provide the necessary guidance and insights to support your decision-making process.

Serving a Diverse Audience

Our financial model templates cater to a diverse audience, including c-level executives, entrepreneurs, investors, and professionals from various industries. We understand the unique needs and challenges faced by different stakeholders, and our templates are tailored to address those requirements. By serving a wide range of users, we aim to empower businesses of all types and sizes to make informed financial decisions and achieve their goals.

- Financial model templates for c-level executives, entrepreneurs, and investors.

- Templates designed to meet the diverse needs of different industries and usage cases.

- Best practice financial modeling knowledge incorporated into every template.

With our expertise and dedication, FinModelsLab strives to provide users with the necessary tools and knowledge to excel in financial modeling and planning.

Benefits of Using Financial Model Templates

Utilizing financial model templates offers significant advantages when it comes to creating accurate financial projections for your business. At FinModelsLab, we understand the importance of these benefits and strive to provide users with the resources they need to succeed.

Accurate Financial Projections Made Easy

Our financial model templates are specifically designed to assist users in creating accurate financial projections. By leveraging these templates, businesses can input their data and variables, which are then automatically calculated to generate comprehensive projections. This process reduces the risk of errors and ensures that the resulting financial projections are reliable and precise.

Time-Saving Pre-Built Templates

Time is a valuable resource for any business, and our pre-built financial model templates help save significant time and effort. Instead of starting from scratch, users can access ready-to-use templates that already include the necessary formulas, calculations, and structure. This allows users to focus on analyzing the projections and making informed decisions, rather than spending excessive time building complex financial models.

Convenience and Ease of Excel for Financial Modeling

Excel has long been recognized as a powerful tool for financial modeling, and our templates capitalize on this convenience. With Excel as the foundation, users can benefit from a familiar and user-friendly interface, making it easier to work with the templates and customize them according to their specific needs. Excel also provides flexibility for users to adapt the templates as their business evolves, ensuring the models remain relevant over time.

- Templates designed to assist in creating accurate financial projections.

- Pre-built templates save time and effort by eliminating the need to start from scratch.

- Excel-based templates provide a convenient and user-friendly platform for financial modeling.

By utilizing our financial model templates, businesses can leverage the benefits of accuracy, time-saving efficiency, and the convenience of working with Excel, ultimately aiding in their financial planning and decision-making processes.

Wide Range of Templates

At FinModelsLab, we offer a diverse selection of financial model templates to cater to various industries and specific business needs. Our extensive range ensures that businesses can find templates tailored to their industry, whether they are a startup, small business, or established enterprise.

Diverse Selection of Industry-Specific Templates

We understand that different industries have unique financial considerations. That's why we provide a wide range of industry-specific financial model templates. From manufacturing to e-commerce, healthcare to SaaS, our templates cover various sectors, ensuring that businesses can create accurate financial projections that align with the dynamics of their industry. These industry-specific templates include revenue forecasts, expense breakdowns, and other relevant financial data, allowing businesses to gain valuable insights and make informed decisions.

Relevance for Startups and Financial Planning

Startups face unique challenges and financial planning is crucial for their success. Our templates include startup-specific financial model templates designed to assist entrepreneurs in their financial planning journey. These templates consider the specific needs of startups, including revenue drivers, cost structures, and funding requirements. By utilizing our startup financial model templates, entrepreneurs can create comprehensive financial projections, pitch to investors, and develop a solid financial strategy for their business.

- A wide range of industry-specific financial model templates.

- Templates catering to startups with startup-specific financial projections.

- Templates covering various industries, including manufacturing, e-commerce, healthcare, SaaS, and more.

Whether you are starting a new venture or operating an established business, our diverse selection of financial model templates ensures that you have the resources needed to create accurate financial projections and drive your business forward.

Importance of Financial Statements

Financial statements play a vital role in business plans, providing a comprehensive view of a company's financial health and performance. At FinModelsLab, we understand the significance of financial statements and offer templates that facilitate the creation of robust and accurate financial statements for your business plan.

Significance of Financial Statements in Business Plans

Financial statements are essential components of any business plan as they present a clear picture of a company's financial position. These statements, including the income statement, balance sheet, and cash flow statement, allow stakeholders to assess the company's profitability, liquidity, and overall financial stability. Financial statements provide crucial information for investors, lenders, and potential partners, aiding in informed decision-making and demonstrating the viability and potential of the business.

Creating Comprehensive Financial Statements with Templates

Our templates are specifically designed to assist users in creating comprehensive financial statements for their business plans. These templates offer a structured framework and predefined formulas that simplify the process of compiling financial data and generating accurate statements. By utilizing our templates, users can input their financial information, and the templates automatically calculate key metrics and generate professional-looking financial statements. This ensures that your business plan is well-supported with accurate and visually appealing financial information.

- The significance of financial statements in business plans for assessing financial health and performance.

- Templates designed to aid in the creation of comprehensive financial statements.

- Financial statements as crucial components for investors, lenders, and potential partners.

With our financial statement templates, you can confidently present a clear and compelling financial snapshot of your business, showcasing its potential and strengthening your business plan.

Excel-Based Financial Templates

At FinModelsLab, we provide a wide range of financial templates that are specifically designed in Excel format, offering users easy customization and flexibility. Our Excel-based templates empower businesses to create accurate and tailored financial models, enabling effective financial planning and decision-making.

Easy Customization and Flexibility

All our financial templates are available in Excel format, which provides users with the ability to easily customize and adapt the templates to suit their specific needs. Excel's intuitive interface allows users to input their own data, adjust formulas, and make modifications as required. Whether it's adding new variables, changing assumptions, or incorporating specific industry metrics, Excel enables users to tailor the templates to their unique requirements, ensuring that the resulting financial models are precise and relevant to their business.

Advantages of Using Excel for Financial Modeling

Excel has long been recognized as a powerful tool for financial modeling, and there are several advantages to utilizing it for your financial planning needs. Excel offers a wide range of built-in functions and formulas, making complex calculations and projections more accessible. Its spreadsheet format provides a structured and organized way to present and analyze financial data, allowing for easy data entry, manipulation, and visualization. Excel's widespread familiarity among professionals also ensures that users can collaborate, share, and present their financial models seamlessly.

- Templates provided in Excel format for easy customization and adaptability.

- Excel's flexibility allows users to tailor templates to their specific needs.

- Advantages of using Excel include built-in functions, structured presentation, and widespread familiarity.

By leveraging our Excel-based financial templates, businesses can benefit from the ease of customization, flexibility, and the robust capabilities of Excel, ultimately enabling them to create accurate and dynamic financial models that drive better financial planning and decision-making.

Financial Forecasting and Planning

Financial forecasting plays a crucial role in effective business planning and decision-making. At FinModelsLab, we recognize the significance of financial forecasting, and we offer a wide range of forecast templates in Excel format to assist businesses in their financial planning endeavors.

The Role of Financial Forecasting in Business Planning

Financial forecasting is a vital component of business planning as it allows organizations to anticipate future financial outcomes based on historical data, market trends, and key assumptions. By creating comprehensive financial forecasts, businesses can gain valuable insights into revenue projections, expense management, and cash flow dynamics. These forecasts help in identifying potential risks, setting realistic targets, and making informed strategic decisions to drive business growth.

Availability of Forecast Templates in Excel

Our forecast templates, available in Excel format, provide businesses with a convenient and efficient way to create accurate financial forecasts. These templates are designed to simplify the forecasting process by incorporating pre-built formulas and intuitive interfaces. Users can input their data, adjust variables, and instantly generate forecasts based on different scenarios. The flexibility of Excel allows for easy customization of the templates to align with specific business needs, ensuring that the resulting forecasts are tailored and reliable.

- The importance of financial forecasting in business planning and decision-making.

- Forecast templates available in Excel format for convenient and accurate financial forecasting.

- Financial forecasts as valuable tools for identifying risks, setting targets, and making strategic decisions.

By utilizing our forecast templates in Excel, businesses can streamline their financial forecasting processes, gain valuable insights, and enhance their overall planning capabilities.

Tailored for Startups

At FinModelsLab, we understand the unique financial planning needs of startups, and we offer a range of templates specifically tailored to meet those needs. Our startup-specific financial projections templates provide startups with a solid foundation for their financial planning and enable them to make informed decisions to drive growth and success.

Relevance of the Templates for Startups' Financial Planning

Startups face distinctive challenges and requirements when it comes to financial planning. Our templates address these specific needs by providing startup founders and entrepreneurs with a comprehensive framework to forecast revenue, estimate expenses, and project cash flow. These templates incorporate startup-specific assumptions and variables, allowing startups to create accurate financial projections that align with their business models, growth strategies, and funding requirements.

Startup-Specific Financial Projections Template

Our startup-specific financial projections template is a valuable resource for startups seeking to create robust financial forecasts. This template encompasses key startup metrics, such as customer acquisition costs, customer lifetime value, and funding rounds, to accurately project revenue, expenses, and funding needs over a defined period. By leveraging this template, startups can effectively communicate their financial projections to potential investors, demonstrate their growth potential, and secure the funding necessary to fuel their development.

- Templates specifically tailored to meet the unique financial planning needs of startups.

- Importance of accurate financial projections for startups to make informed decisions.

- Startup-specific financial projections template incorporating key startup metrics.

Our startup-focused templates empower entrepreneurs and startup founders to navigate the financial landscape with confidence, ensuring that their financial planning aligns with their business goals and positions them for long-term success.

Excel-Based Financial Modeling

Excel is a powerful tool for financial modeling, and at FinModelsLab, we leverage the capabilities of Excel to provide comprehensive and effective financial model templates. Our Excel-based financial models offer numerous benefits for businesses, empowering them to make informed financial decisions and drive success.

Benefits of Using Excel for Financial Modeling

Excel provides a range of benefits that make it an ideal platform for financial modeling. Its built-in functions and formulas allow for complex calculations, enabling accurate financial projections and analysis. The spreadsheet format of Excel provides a structured and organized way to present and manipulate financial data, making it easier to input and track variables, assumptions, and key metrics. Excel's flexibility also allows for scenario analysis, sensitivity testing, and the creation of dynamic charts and graphs, enhancing the visibility and understanding of financial models.

Availability of Excel Financial Model Templates

Our Excel financial model templates provide businesses with ready-to-use frameworks for various financial modeling purposes. These templates are designed to streamline the financial modeling process, incorporating best practices and industry-specific assumptions. By leveraging our Excel financial model templates, businesses can save valuable time and effort in building their own models from scratch, while still having the flexibility to customize and adapt the templates to their specific needs.

- Excel's capabilities for complex calculations, accurate projections, and analysis.

- The structured format of Excel for organized financial data management.

- Excel's flexibility for scenario analysis, sensitivity testing, and visual representation.

- Availability of ready-to-use Excel financial model templates for streamlined financial modeling.

By utilizing our Excel-based financial model templates, businesses can harness the power of Excel and benefit from its robust features to create accurate, dynamic, and customizable financial models that drive better financial decision-making and planning.

In today's competitive business landscape, financial modeling is essential for informed decision-making and successful planning. At FinModelsLab, our industry-specific financial model templates in Excel offer a range of benefits to empower businesses and individuals in their financial projections and planning endeavors.

Reaping the Benefits of Industry-Specific Financial Model Templates

Our industry-specific financial model templates provide users with a host of advantages. By utilizing these templates, businesses can save valuable time and effort, as our templates are pre-built with best practices and industry-specific assumptions. This enables users to create accurate and reliable financial projections that align with their unique needs and goals. Whether you are a c-level executive, entrepreneur, investor, or startup founder, our templates offer a well-structured and comprehensive financial modeling know-how, supporting your financial planning and decision-making processes.

Explore Our Wide Range of Templates

We invite you to explore our extensive collection of 3500+ business templates, including financial modeling Excel templates and financial projections template Excel. Our diverse selection ensures that you will find the right template for your industry and specific use case. Whether you are starting a new venture, seeking funding, or managing an existing business, our templates provide the foundation you need for accurate financial projections and comprehensive planning.

- The benefits of using industry-specific financial model templates for informed decision-making and successful planning.

- Time-saving advantages through pre-built templates with best practices and industry-specific assumptions.

- Wide range of 3500+ business templates, including financial modeling Excel templates and financial projections template Excel.

Begin your journey towards effective financial modeling and planning by exploring our wide range of templates. Empower your business with accurate financial projections and make confident decisions to drive growth and success.

Why is a Financial Plan Important to Your Small Business?

A well-put-together financial plan can help you achieve greater confidence in your business while generating a better understanding of how to allocate resources. It shows your business is committed to spending wisely and its ability to meet financial obligations. A financial forecasting model helps you determine if choices will impact revenue and which occasions call for dipping into reserve funds.

It’s also an important tool when asking investors to consider your business. Your startup financial plan shows how your organization manages expenses and generates revenue. It shows where your business stands and how much it needs from sales and investors to meet important financial benchmarks.

Used by Professionals from 300+ Companies Including

Frequently Asked Questions

Of course! Yes. All our templates are fully editable . All formulas, cells and sheets are completely unlocked, so you can edit anything to your liking. Each row on every sheet has a note about what that row’s calculations are trying to do, and many of the components are explained in the help files, so that you can see how I did it - and help you figure out how to change it to your liking.

This financial model is perfect for entrepreneurs to quickly build financial projections for fundraising decks or business modeling.

With this all-in-1 model, you’ll be able to forecast your sales, profits, and cash flow in seconds. Plus, you’ll have all the data, metrics and reports you’ll need to effectively present your business plan to investors & prospects. This financial model was crafted in Excel by expert analysts with 15-years consulting background to assist entrepreneurs with forecasting efforts.

Take advantage of this Excel model to effortlessly forecast your financials, create investor-friendly reports, and build a better business!

You don’t have to be an expert to model your Profit and Loss Statement (P&L) with this straightforward financial model excel template. Our financial projection makes that easy for even the most novice finance background. Just enter your financials and our sophisticated financial model will do all the work, giving you a clear view of your company’s current state, predictions for future performance, and an action plan for scaling revenue. With financial projections that can be easily updated as assumptions change, you’ll have all the information you need to project your company’s future & pitch investors!

Yes. Our financial model excel templates are fully editable, you can change many assumptions including the currency of your business.

You may change currency inputs and currency outputs by applying the exchange rate.

All our financial model templates are Microsoft Excel™ files, and they are available for download immediately after purchase. Can be imported into the Google Sheets™ for editing and customizations. I recommend using Excel or Google Sheets™ for financial modeling, both in general and for our templates specifically. In practice, I use Excel to build and edit models, and Google Sheets to share or collaborate with users. Excel is usually a faster platform for building models, but Google Sheets can be easier for sharing models with people. My models can be used in both Excel and Google Sheets interchangeably; simply upload the Microsoft Excel model template from FinancialModelExcel.com into Google Sheets, and everything will work fine.

Unfortunately no. Unlike a physical product where you can send it back to the seller, because it is a digital product you can still use it after refund. This makes it quite difficult for us to manage honest refund requests. If you have any questions about the financial model excel templates, please contact us so we can guide you and answer any questions you have.

Yes. We accept all major credit cards, debit cards and PayPal. Payments are powered by Stripe and PayPal via our payment processing provider. All transactions are secured and your card payment information encrypted and sent directly to Stripe and PayPal, no payment details are stored on our website.

Yes. Of course! Every financial model excel template has a button to download immediately a DEMO version of the particular template. With the Demo version you will get the read-only financial model template.

By purchasing the template on our website, you will receive an email from us including the link to download your template. Additionally, you should see the download links right after the payment at the checkout page.

Yes, we provide free email support via email at [email protected] . We are in the Europe time zone hence please bear with us and we will catch up as soon as we are back online!

Professor Excel

Let's excel in Excel

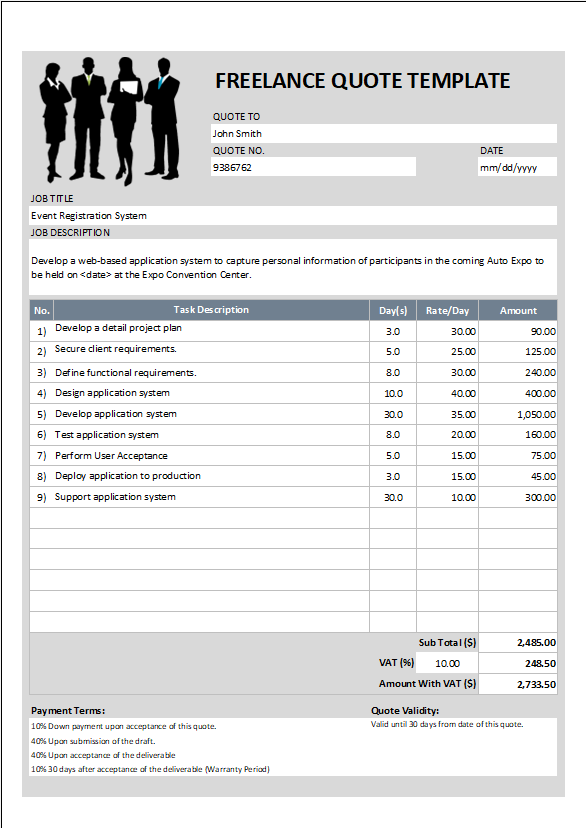

Business Plan: How to Create Great Financial Plans in Excel

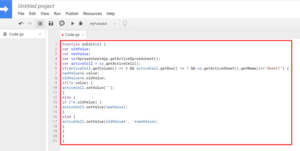

I guess, you are about to write a business plan and that is why you have come to this page. Very good – because in this article I am going to write down my experience with business plans and what I have learned creating them with Microsoft Excel. As I will point out again further down, I will only concentrate on the financial part of business plans. Specifically, how to set it up in Excel. Of course, you can also download an Excel template .

Parts of business plans

As you reached this page I suppose you already have a rough idea of what a business plan is. So, we will skip this part here.

A business plan is a formal written document containing the goals of a business, the methods for attaining those goals, and the time-frame for the achievement of the goals.” https://en.wikipedia.org/wiki/Business_plan

But one comment concerning the scope of this article: The formal business plan has usually many different parts, in which you describe the business idea and product, the market, competition, legal construct and so on. But typically, investors are most interested in the financial part. They want to know first, what they can get out of it. Of course, the other parts are also very important, but the financial topics usually put everything described in the other sections into numbers.

I’m not going further into the details of all the other parts than then financial section here. Specifically, we will dive into the basics of the financial part and how to model it in Excel.

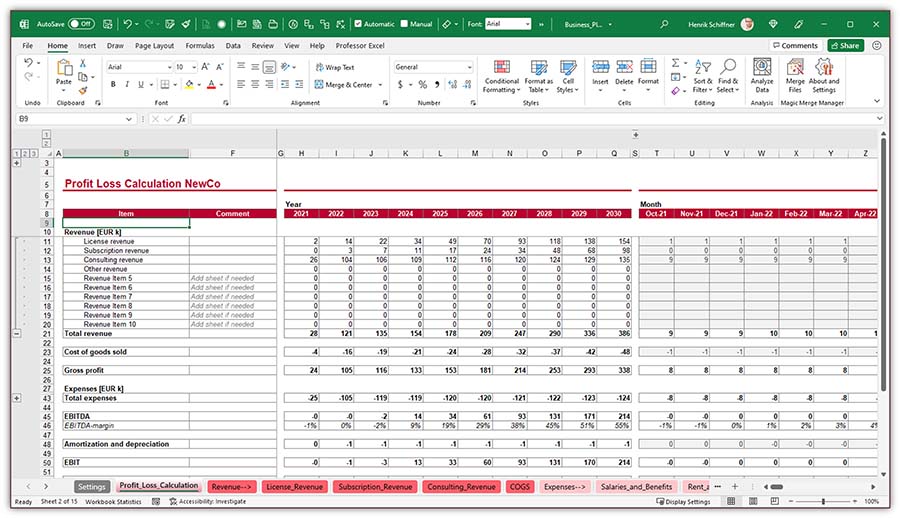

Please scroll down to download the business plan template. We are going to explore all the following advice with this template.

How to create a business plan in Excel

Advice 1: be clear about the purpose and the recipient of the business plan.

Before you start opening Excel, make sure that you are 100% clear of the purpose this business plan. Is the business plan just for you? Or do you create it for someone else, for example an investor or bank? Although the next steps might still be the same, the focus might be different. For example: Maybe you have a very good understanding of the major assumptions because you have been working in this field for some time. But for someone external you still need to validate them. Of course, in both cases the assumptions should be realistic and goals should be achievable. But maybe for your own peace of mind you would choose more pessimistic assumptions if the plan was only for you.

Advice 2: Go top-down in terms of line items

Now, let’s start in Excel. But how do we start?

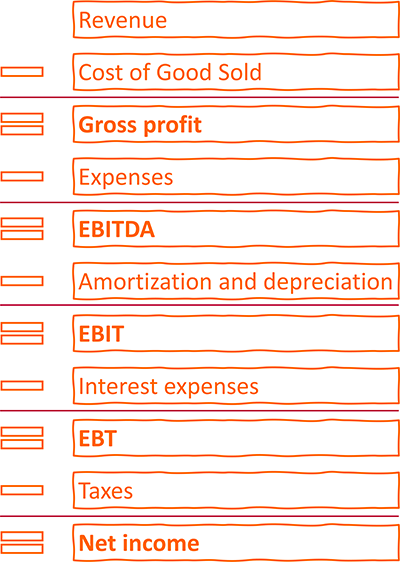

My approach is to go top-down. I usually use a basic P&L (“Profit- and loss” calculation) structure to start with, having some placeholders for revenue and costs.

Specifically, I go through the following parts (also shown on the right-hand side).

Let’s assume that you develop and sell Excel add-ins: 50 EUR per license – once-off. You would now start with assumptions of how many you can sell per month and the price. This is your first revenue item. At this point in time, I would leave it like this. We can later drill further down as much as we need (for example modeling discounts, the connection between marketing spending and number of units sold, price changes, etc.).

If we have multiple products, we calculate them in a similar manner.

Cost of goods sold

Cost of goods sold – or COGS – refers to the direct costs of producing the goods sold. Depending on the complexity you could also summarize cost of sales here or keep it separately.

Often, the COGS are directly linked to the number of units produced so you could refer to the numbers already calculated for the revenues.

In our example from above, we don’t have any direct costs for producing the Excel add-ins because we develop them ourselves and our salary will be regarded under “Salaries and Benefits”.

All other expenses

The structure of the expenses highly depends on your business. I usually start with these:

- Salaries and Benefits

- Rent and Overhead

- Marketing and Advertising

- Other expenses

Again, these items might look completely different for you. Example: if you travel a lot for your business, you might plan travel costs separately.

Subtracting costs from the revenue leads to the EBITDA (earnings before interest, taxes, depreciation, and amortization). This is one of the important financial performance indicators.

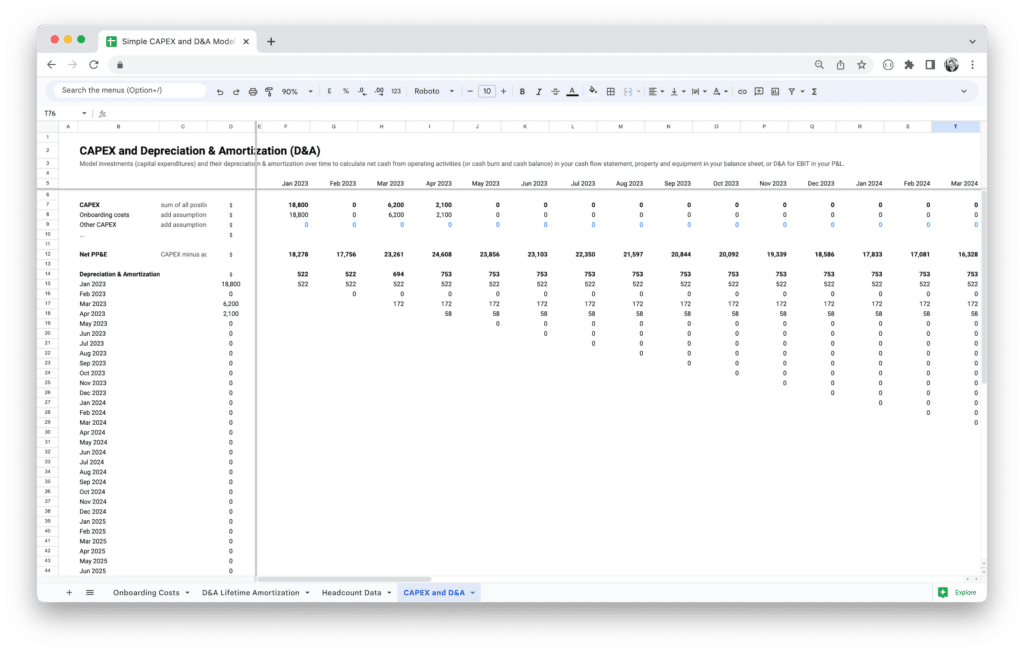

Amortization and depreciation

If you buy any assets for your business (for example machines, computers, even cars), you usually plan to use them over a certain period. When you first buy them, let’s say for 1,000 USD, you basically just exchange money for assets in the same amount. The problem: The assets will decrease in value the longer you use them. Within the cost items above, you don’t regard the acquisition value. So, how to regard them in your business plan?

You only regard the annual decrease of value. If you plan to use your 1,000 USD item for 5 years, you could (plainly speaking), each year regard 200 USD as depreciation.

Please note: If you later plan your cash, you have to make sure that you fully regard the initial sales price and not the depreciation.

The key difference between amortization and depreciation is that amortization is used for intangible assets, while depreciation is used for tangible assets. https://www.fool.com/knowledge-center/whats-the-difference-between-amortization-deprecia.aspx

Subtracting the amortization and depreciation from the EBITDA leads to the second key performance indicator, the EBIT (earnings before interest and tax).

Interest and taxes

Eventually, you have to prognose your interest costs (for example what you have to pay for bank loans) and your taxes, which is typically just a percentage of the EBT (the earning before taxes).

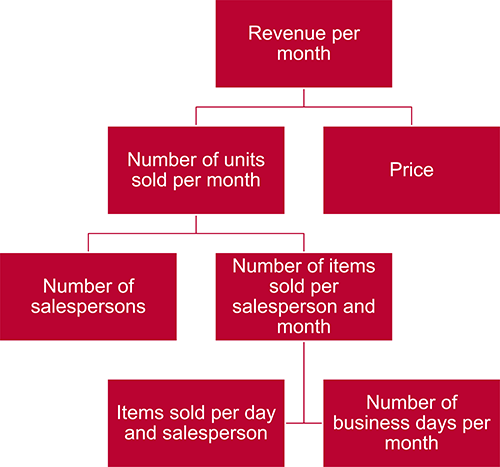

Advice 3: Think about the business drivers carefully

Good business plans are driver based.

Business drivers are the key inputs and activities that drive the operational and financial results of a business. Common examples of business drivers are salespeople, number of stores, website traffic, number and price of products sold, units of production, etc. https://corporatefinanceinstitute.com/resources/knowledge/modeling/business-drivers/

Let me explain with an example: You want to plan the revenues. You have two different options:

- Revenue per month is split into number of units sold times price per unit.

- Number of units sold is further split into number of salespersons and number of items sold per salesperson and month, and so on.

- Or you could just write a number and every following year you assume a growth in percentage (e.g. +2% per year).

Let’s finish this section with some final comments:

- Choose drivers that are measurable. You will most probably later on compare the drivers to reality and therefore make sure that they are not impossible to measure.

- Figure out, which driver has most impact. You should focus on those first. Driver with no or very limited impact can be skipped initially.

- Are drivers depending on each other? If yes, it should be modeled accordingly.

Advice 4: Choose the smallest period from the beginning in your business plan

So far, we have been focusing on the line items, for example costs, revenue, or drivers. Now, let’s talk about the time frame.

The question is: Should you plan on annual, monthly or any other basis? Or a mix?

I have seen many business plans doing it something like this:

- Plan on monthly basis for the first 24 to 36 months.

- Switch to annual planning for the years 3/4 to 5.

Most business plans are not going beyond 5 years planning period.

My recommendation: Plan on monthly basis for the full period. There will be a point in time when you need to break it down into months. And it is always easier to sum up 12 months for annual values than to drill down from years to months.