Bank Business Plan Template

Written by Dave Lavinsky

Bank Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their banks.

If you’re unfamiliar with creating a bank business plan, you may think creating one will be a time-consuming and frustrating process. For most entrepreneurs it is, but for you, it won’t be since we’re here to help. We have the experience, resources, and knowledge to help you create a great business plan.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write a bank business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What Is a Business Plan?

A business plan provides a snapshot of your bank as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan

If you’re looking to start a bank or grow your existing bank, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your bank to improve your chances of success. Your bank business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Banks

With regards to funding, the main sources of funding for a bank are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for banks.

Finish Your Business Plan Today!

How to write a business plan for a bank.

If you want to start a bank or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your bank business plan.

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of bank you are running and the status. For example, are you a startup, do you have a bank that you would like to grow, or are you operating a chain of banks?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overview of the bank industry.

- Discuss the type of bank you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail the type of bank you are operating.

For example, you might specialize in one of the following types of banks:

- Commercial bank : this type of bank tends to concentrate on supporting businesses. Both large corporations and small businesses can turn to commercial banks if they need to open a checking or savings account, borrow money, obtain access to credit or transfer funds to companies in foreign markets.

- Credit union: this type of bank operates much like a traditional bank (issues loans, provides checking and savings accounts, etc.) but banks are for-profit whereas credit unions are not. Credit unions fall under the direction of their own members. They tend to serve people affiliated with a particular group, such as people living in the same area, low-income members of a community or armed service members. They also tend to charge lower fees and offer lower loan rates.

- Retail bank: retail banks can be traditional, brick-and-mortar brands that customers can access in-person, online, or through their mobile phones. They also offer general public financial products and services such as bank accounts, loans, credit cards, and insurance.

- Investment bank: this type of bank manages the trading of stocks, bonds, and other securities between companies and investors. They also advise individuals and corporations who need financial guidance, reorganize companies through mergers and acquisitions, manage investment portfolios or raise money for certain businesses and the federal government.

In addition to explaining the type of bank you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of clients served, the number of clients with positive reviews, reaching X number of clients served, etc.

- Your legal business Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the bank industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the bank industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your bank business plan:

- How big is the bank industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your bank? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your bank business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, small businesses, families, and corporations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of bank you operate. Clearly, corporations would respond to different marketing promotions than individuals, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Bank Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other banks.

Indirect competitors are other options that customers have to purchase from that aren’t directly competing with your product or service. This includes trust accounts, investment companies, or the stock market. You need to mention such competition as well.

For each such competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as

- What types of customers do they serve?

- What type of bank are they?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide loans and retirement savings accounts?

- Will you offer products or services that your competition doesn’t?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a bank business plan, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type of bank company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you provide savings accounts, auto loans, mortgage loans, or financial advice?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your plan, you are presenting the products and/or services you offer and their prices.

Place : Place refers to the site of your bank. Document where your company is situated and mention how the site will impact your success. For example, is your bank located in a busy retail district, a business district, a standalone office, or purely online? Discuss how your site might be the ideal location for your customers.

Promotions : The final part of your bank marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Reach out to websites

- Distribute flyers

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your bank, including reconciling accounts, customer service, accounting, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to sign up your Xth customer, or when you hope to reach $X in revenue. It could also be when you expect to expand your bank to a new city.

Management Team

To demonstrate your bank’s potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing banks. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing a bank or successfully running a small financial advisory firm.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you see 5 clients per day, and/or offer sign up bonuses? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your bank, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a bank:

- Cost of furniture and office supplies

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your bank location lease or a list of accounts and loans you plan to offer.

Writing a business plan for your bank is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will understand the bank industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful bank.

Bank Business Plan Template FAQs

What is the easiest way to complete my bank business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily write your bank business plan.

How Do You Start a Bank Business?

Starting a bank business is easy with these 14 steps:

- Choose the Name for Your Bank Business

- Create Your Bank Business Plan

- Choose the Legal Structure for Your Bank Business

- Secure Startup Funding for Your Bank Business (If Needed)

- Secure a Location for Your Business

- Register Your Bank Business with the IRS

- Open a Business Bank Account

- Get a Business Credit Card

- Get the Required Business Licenses and Permits

- Get Business Insurance for Your Bank Business

- Buy or Lease the Right Bank Business Equipment

- Develop Your Bank Business Marketing Materials

- Purchase and Setup the Software Needed to Run Your Bank Business

- Open for Business

Don’t you wish there was a faster, easier way to finish your Bank business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how a Growthink business plan consultant can create your business plan for you.

Other Helpful Business Plan Articles & Templates

- Business Plan for Investors

- Bank/SBA Business Plan

- Operational/Strategic Planning Services

- L1 Visa Business Plan

- E1 Treaty Trader Visa Business Plan

- E2 Treaty Investor Visa Business Plan

- EB-1 Business Plan

- EB-2 NIW Business Plan

- EB-5 Business Plan

- Innovator Founder Visa Business Plan

- Start-Up Visa Business Plan

- Expansion Worker Visa Business Plan

- Manitoba MPNP Visa Business Plan

- Nova Scotia NSNP Visa Business Plan

- British Columbia BC PNP Visa Business Plan

- Self-Employed Visa Business Plan

- OINP Entrepreneur Stream Business Plan

- LMIA Owner Operator Business Plan

- ICT Work Permit Business Plan

- LMIA Mobility Program – C11 Entrepreneur Business Plan

- USMCA (ex-NAFTA) Business Plan

- Franchise Business Plan

- Landlord business plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Cannabis business plan

- Ecommerce business plan

- Online boutique business plan

- Mobile application business plan

- Daycare business plan

- Restaurant business plan

- Food delivery business plan

- Real estate business plan

- Business Continuity Plan

- Pitch Deck Consulting Services

- Financial Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Examples

How to Write a Business Plan to Start a Bank

FEB.10, 2024

Bank Business Plan Checklist

A bank business plan is a document that describes the bank’s goals, strategies, operations, and financial projections. It communicates the bank’s vision and value proposition to potential investors, regulators, and stakeholders. A SBA business plan should be clear, concise, and realistic. It should also cover all the essential aspects of the bank’s business model.

Here is a checklist of the main sections that you should keep in mind while building a bank business plan:

- Executive summary

- Company description

- Industry analysis

- Competitive analysis

- Service or product list

- Marketing and sales plan

- Operations plan

- Management team

- Funding request

- Financial plan

Sample Business Plan for Bank

The following is a bank business plan template that operates in the USA. This bank business plan example is regarding ABC Bank, and it includes the following sections:

Executive Summary

ABC Bank is a new bank for California’s SMBs and individuals. We offer convenient banking services tailored to our customers’ needs and preferences. We have a large target market with over 500,000 SMBs spending billions on banking services annually. We have the licenses and approvals to operate our bank and raised $20 million in seed funding. We are looking for another $30 million in debt financing.

Our goal is to launch our bank by the end of 2024 and achieve the following objectives in the first five years of operation:

- Acquire 100,000 customers and 10% market share

- Generate $100 million in annual revenue and $20 million in net profit

- Achieve a return on equity (ROE) of 15% and a return on assets (ROA) of 1.5%

- Expand our network to 10 branches and 50 ATMs

- Increase our brand awareness and customer loyalty

Our bank has great potential to succeed and grow in the banking industry. We invite you to read the rest of our microfinance business plan to learn about how to set up a business plan for the bank and how we will achieve our goals.

Industry Analysis

California has one of the biggest and most active banking industries in the US and the world. According to the Federal Deposit Insurance Corp , California has 128 financial institutions, with total assets exceeding $560 billion.

The California banking industry is regulated and supervised by various federal and state authorities. However, they also face several risks and challenges, such as:

- High competition and consolidation

- Increasing regulation and compliance

- Rising customer demand for digital and mobile banking

- Cyberattacks and data breaches

- Environmental and social issues

The banking industry in California is highly competitive and fragmented. According to the FDIC, the top 10 banks and thrifts in California by total deposits as of June 30, 2023, were:

Customer Analysis

We serve SMBs who need local, easy, and cheap banking. We divide our customers into four segments by size, industry, location, and needs:

SMB Segment 1 – Tech SMBs in big cities of California. These are fast-growing, banking-intensive customers. They account for a fifth of our market share and a third of our revenue and are loyal and referable.

SMB Segment 2 – Entertainment SMBs in California’s entertainment hubs. These are high-profile, banking-heavy customers. They make up a sixth of our market and a fourth of our revenue and are loyal and influential.

SMB Segment 3 – Tourism SMBs in California’s tourist spots. These are seasonal, banking-dependent customers. They represent a quarter of our market and a fifth of our revenue and are loyal and satisfied.

SMB Segment 4 – Other SMBs in various regions of California. These are slow-growing, banking-light customers. They constitute two-fifths of our market and a quarter of our revenue and are loyal and stable.

Competitive Analysis

We compete with other banks and financial institutions that offer similar or substitute products and services to our target customers in our target market. We group our competitors into four categories based on their size and scope:

1. National Banks

- Key Players – Bank of America, Wells Fargo, JPMorgan Chase, Citibank, U.S. Bank

- Strengths – Large customer base, strong brand, extensive branch/ATM network, innovation, robust operations, solid financial performance

- Weaknesses – High competition, regulatory costs, low customer satisfaction, high attrition

- Strategies – Maintain dominance through customer acquisition/retention, revenue growth, efficiency

2. Regional Banks

- Key Players – MUFG Union Bank, Bank of the West, First Republic Bank, Silicon Valley Bank, East West Bank

- Strengths – Loyal customer base, brand recognition, convenient branch/ATM network, flexible operations

- Weaknesses – Moderate competition, regulatory costs, customer attrition

- Strategies – Grow market presence through customer acquisition/retention, revenue optimization, efficiency

3. Community Banks

- Key Players – Mechanics Bank, Bank of Marin, Pacific Premier Bank, Tri Counties Bank, Luther Burbank Savings

- Strengths – Small loyal customer base, reputation, convenient branches, ability to adapt

- Weaknesses – Low innovation and technology adoption

- Strategies – Maintain niche identity through customer loyalty, revenue optimization, efficiency

4. Online Banks

- Key Players – Ally Bank, Capital One 360, Discover Bank, Chime Bank, Varo Bank

- Strengths – Large growing customer base, strong brand, no branches, lean operations, high efficiency

- Weaknesses – High competition, regulatory costs, low customer satisfaction and trust, high attrition

- Strategies – Disrupt the industry by acquiring/retaining customers, optimizing revenue, improving efficiency

Market Research

Our market research shows that:

- California has a large, competitive, growing banking market with 128 banks and $560 billion in assets.

- Our target customers are the SMBs in California, which is 99.8% of the businesses and employ 7.2-7.4 million employees.

- Our main competitors are national and regional banks in California that offer similar banking products and services.

We conclude that:

- Based on the information provided in our loan officer business plan , there is a promising business opportunity for us to venture into and establish a presence in the banking market in California.

- We should focus on the SMBs in California, as they have various unmet banking needs, preferences, behavior, and a high potential for growth and profitability.

Operations Plan

Our operational structure and processes form the basis of our operations plan, and they are as follows:

- Location and Layout – We have a network of 10 branches and 50 ATMs across our target area in California. We strategically place our branches and ATMs in convenient and high-traffic locations.

- Equipment and Technology – We use modern equipment and technology to provide our products and services. We have c omputers and software for banking functions; security systems to protect branches and ATMs; communication systems to communicate with customers and staff; i nventory and supplies to operate branches and ATMs.

- Suppliers and Vendors – We work with reliable suppliers and vendors that provide our inventory and supplies like cash, cards, paper, etc. We have supplier management systems to evaluate performance.

- Staff and Management – Our branches have staff like branch managers, customer service representatives, tellers, and ATM technicians with suitable qualifications and experience.

- Policies and Procedures – We have policies for customer service, cash handling, card handling, and paper handling to ensure quality, minimize losses, and comply with regulations. We use various tools and systems to implement these policies.

Management Team

The following individuals make up our management team:

- Earl Yao, CEO and Founder – Earl is responsible for establishing and guiding the bank’s vision, mission, strategy, and overall operations. He brings with him over 20 years of banking experience.

- Paula Wells, CFO and Co-Founder – Paula oversees financial planning, reporting, analysis, compliance, and risk management.

- Mark Hans, CTO – Mark leads our technology strategy, infrastructure, innovation, and digital transformation.

- Emma Smith, CMO – Emma is responsible for designing and implementing our marketing strategy and campaigns.

- David O’kane, COO – David manages the daily operations and processes of the bank ensuring our products and services meet the highest standards of quality and efficiency.

Financial Projections

Our assumptions and drivers form the basis of our financial projections, which are as follows:

Assumptions: We have made the following assumptions for our collection agency business plan :

- Start with 10 branches, 50 ATMs in January 2024

- Grow branches and ATMs 10% annually

- 10,000 customers per branch, 2,000 per ATM

- 5% average loan rate, 2% average deposit rate

- 80% average loan-to-deposit ratio

- $10 average fee per customer monthly

- $100,000 average operating expense per branch monthly

- $10,000 average operating expense per ATM monthly

- 25% average tax rate

Our financial projections are as per our:

- Projected Income Statement

- Projected Cash Flow Statement

- Projected Balance Sheet

- Projected Financial Ratios and Indicators

Select the Legal Framework for Your Bank

Our legal structure and requirements form the basis of our legal framework, which are as follows:

Legal Structure and Entity – We have chosen to incorporate our bank as a limited liability company (LLC) under the laws of California.

Members – We have two members who own and control our bank: Earl Yao and Paula Wells, the founders and co-founders of our bank.

Manager – We have appointed Mark Hans as our manager who oversees our bank’s day-to-day operations and activities.

Name – We have registered our bank’s name as ABC Bank LLC with the California Secretary of State. We have also obtained a trademark registration for our name and logo.

Registered Agent – We have designated XYZ Registered Agent Services LLC as our registered agent authorized to receive and handle legal notices and documents on behalf of our bank.

Licenses and Approvals – We have obtained the necessary licenses and approvals to operate our bank in California, including:

- Federal Deposit Insurance Corporation (FDIC) Insurance

- Federal Reserve System Membership

- California Department of Financial Protection and Innovation (DFPI) License

- Business License

- Employer Identification Number (EIN)

- Zoning and Building Permits

Legal Documents and Agreements – We have prepared and signed the necessary legal documents and agreements to form and operate our bank, including:

- Certificate of Formation

- Operating Agreement

- Membership Agreement

- Loan Agreement

- Card Agreement

- Paper Agreement

Keys to Success

We analyze our market, customers, competitors, and industry to determine our keys to success. We have identified the following keys to success for our bank.

Customer Satisfaction

Customer satisfaction is vital for any business, especially a bank relying on loyalty and referrals. It is the degree customers are happy with our products, services, and interactions. It is influenced by:

- Product and service quality – High-quality products and services that meet customer needs and preferences

- Customer service quality – Friendly, professional, and helpful customer service across channels

- Customer experience quality – Convenient, reliable, and secure customer access and transactions

We will measure satisfaction with surveys, feedback, mystery shopping, and net promoter scores. Our goal is a net promoter score of at least 8.

Operational Efficiency

Efficiency is key in a regulated, competitive environment. It is using resources and processes effectively to achieve goals and objectives. It is influenced by:

- Resource optimization – Effective and efficient use and control of capital, staff, and technology

- Process improvement – Streamlined, standardized processes measured for performance

- Performance management – Managing financial, operational, customer, and stakeholder performance

We will measure efficiency with KPIs, metrics, dashboards, and operational efficiency ratios. Our goal is an operational efficiency ratio below 50%.

Partner with OGSCapital for Your Bank Business Plan Success

Highly efficient service.

Highly Efficient Service! I am incredibly happy with the outcome; Alex and his team are highly efficient professionals with a diverse bank of knowledge.

Are you looking to hire business plan writers to start a bank business plan? At OGSCapital, we can help you create a customized and high-quality bank development business plan to meet your goals and exceed your expectations.

We have a team of senior business plan experts with extensive experience and expertise in various industries and markets. We will conduct thorough market research, develop a unique value proposition, design a compelling financial model, and craft a persuasive pitch deck for your business plan. We will also offer you strategic advice, guidance, and access to a network of investors and other crucial contacts.

We are not just a business plan writing service. We are a partner and a mentor who will support you throughout your entrepreneurial journey. We will help you achieve your business goals with smart solutions and professional advice. Contact us today and let us help you turn your business idea into a reality.

Frequently Asked Questions

How do I start a small bank business?

To start a small bank business in the US, you need to raise enough capital, understand how to make a business plan for the bank, apply for a federal or state charter, register your bank for taxes, open a business bank account, set up accounting, get the necessary permits and licenses, get bank insurance, define your brand, create your website, and set up your phone system.

Are banks profitable businesses?

Yes, banks are profitable businesses in the US. They earn money through interest on loans and fees for other services. The commercial banking industry in the US has grown 5.6% per year on average between 2018 and 2023.

Download Bank Business Plan Sample in pdf

OGSCapital’s team has assisted thousands of entrepreneurs with top-rate business plan development, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

Add comment

E-mail is already registered on the site. Please use the Login form or enter another .

You entered an incorrect username or password

Comments (0)

mentioned in the press:

Search the site:

OGScapital website is not supported for your current browser. Please use:

Researched by Consultants from Top-Tier Management Companies

Powerpoint Templates

Icon Bundle

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

How to Create a Fruitful Bank Business Plan- Free PDF Included

Tamana Gupta

A bank is a type of financial institution that accepts deposits and extracts money from customers' accounts. The banking industry, like other businesses, needed a large capital expenditure to get off the ground.

A business plan for the banking sector is essential for starting and growing banks. Financial institutions need a business plan for banks because their regulations are based on similar ones. So, it should be designed to grab the interest of lenders, stakeholders, and investors.

Business plans for the banking sector must include clear and attainable goals for the future, marketing strategies, timeliness, ways to use the investments and information about the organization. For the company to achieve its objectives, it must project the estimations of the commercial operations that have been planned during the previous three fiscal years and evaluate their viability.

Guidelines for Writing a Business Plan for the Banking Sector

Prepare a thorough banking business plan by going through all the relevant topics in depth. Provide the reasons for starting the firm and the goals that demonstrate the entrepreneur's skill and pique the interest of venture capitalists. Before creating a business plan for the banking industry, there are a few questions that should be adequately addressed. As follows:

What kind of market do you have, and where?

What is the likely range of your industrial expansion?

Who are your intended customers?

What types of regulations will you put in place to lure consumers?

How will you carry out your carefully thought-out policies and take the appropriate measures in response?

So, here are a few of the essential slides that you must incorporate into your business plan to make it stand out.

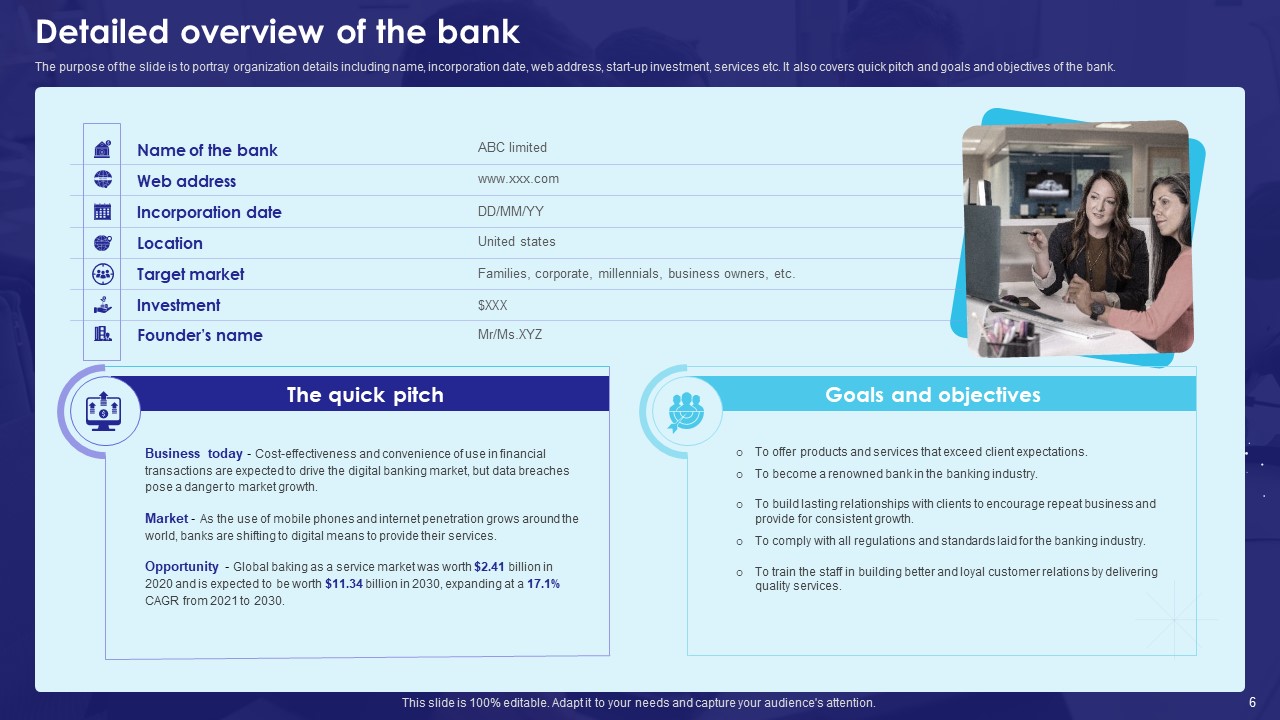

# Detailed overview of the bank

This slide is to portray organization details including name, incorporation date, web address, start-up investment, services, etc. It also covers the quick pitch and goals and objectives of the bank.

The company overview is part of your business plan that gives the basics and background of your business. It's the foundation on which you will build the rest of your business plan. You need the reader to be well-informed about your business to entice investors or future customers.

This slide is 100% editable, so download it right now.

Download this Template Now

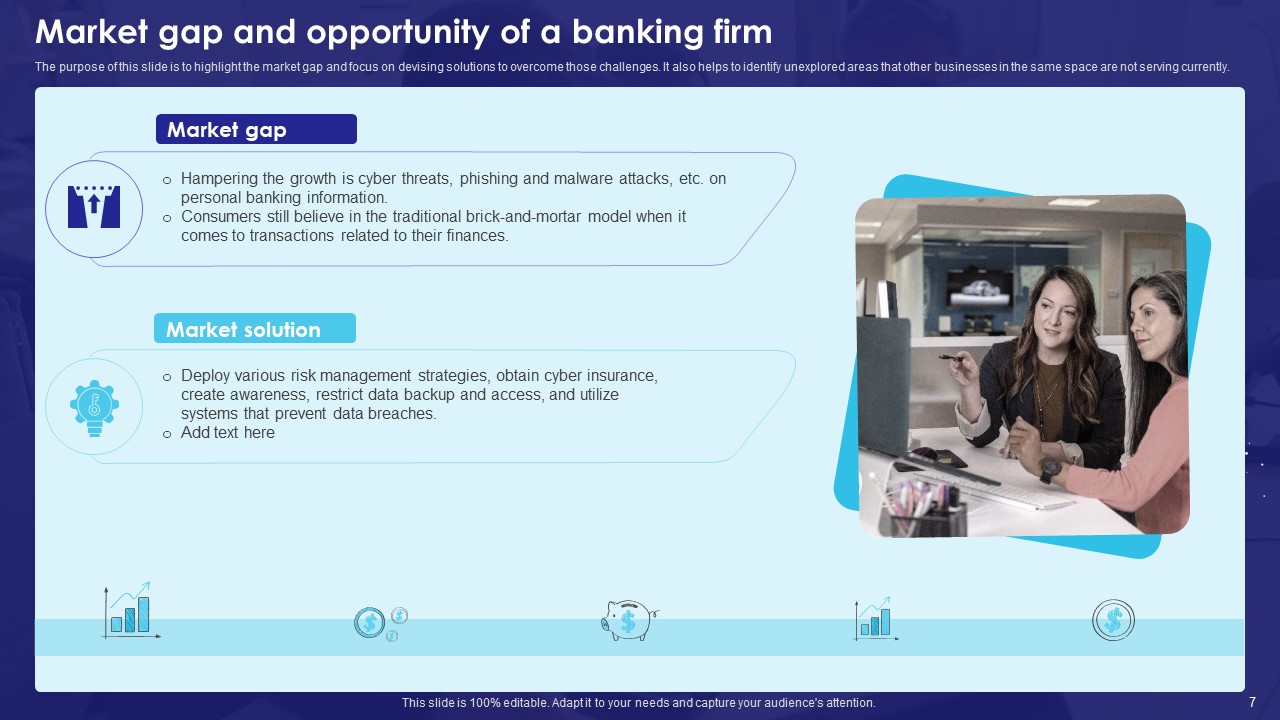

# Market gap and opportunity of a banking firm

The purpose of this slide is to highlight the market gap and focus on devising solutions to overcome those challenges. It also helps to identify unexplored areas that other businesses in the same space are not serving currently.

A market gap is an area where there is a need from customers but where businesses do not already fill the void. A market gap opportunity is a chance to create and offer something currently unavailable.

So, highlight the market gap along with its solution in the slide to give a glimpse to the investor.

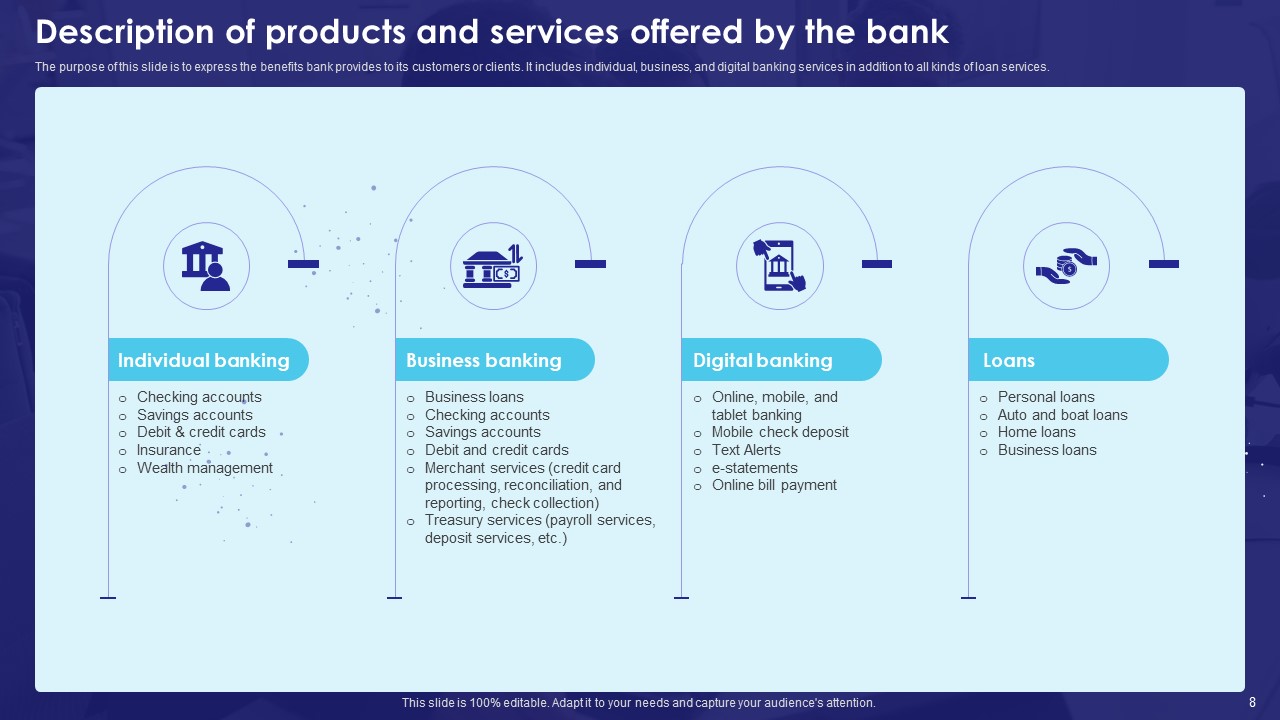

# Description of products and services offered by the bank

This slide is to express the benefits the bank provides to its customers or clients. It includes individual, business, and digital banking services in addition to all kinds of loan services.

Your business plan's section on products and services helps the reader understand why you're in business, what you sell, how you compete with existing options, or how you fill a market gap that no one else is filling.

So, highlight the different services your bank is offering to you.

# Choosing an ideal business location for the bank

This slide portrays an ideal business location for the bank that minimizes the risk of failure. It covers gathering and analyzing data in order to select the optimal location in terms of feasibility, economy, and future sustainability.

Choosing an apt location for your business not only helps you in retaining employees but also makes you more accessible in attracting target customers.

So, highlight the few things you are considering while choosing the location to make the users of the business plan aware.

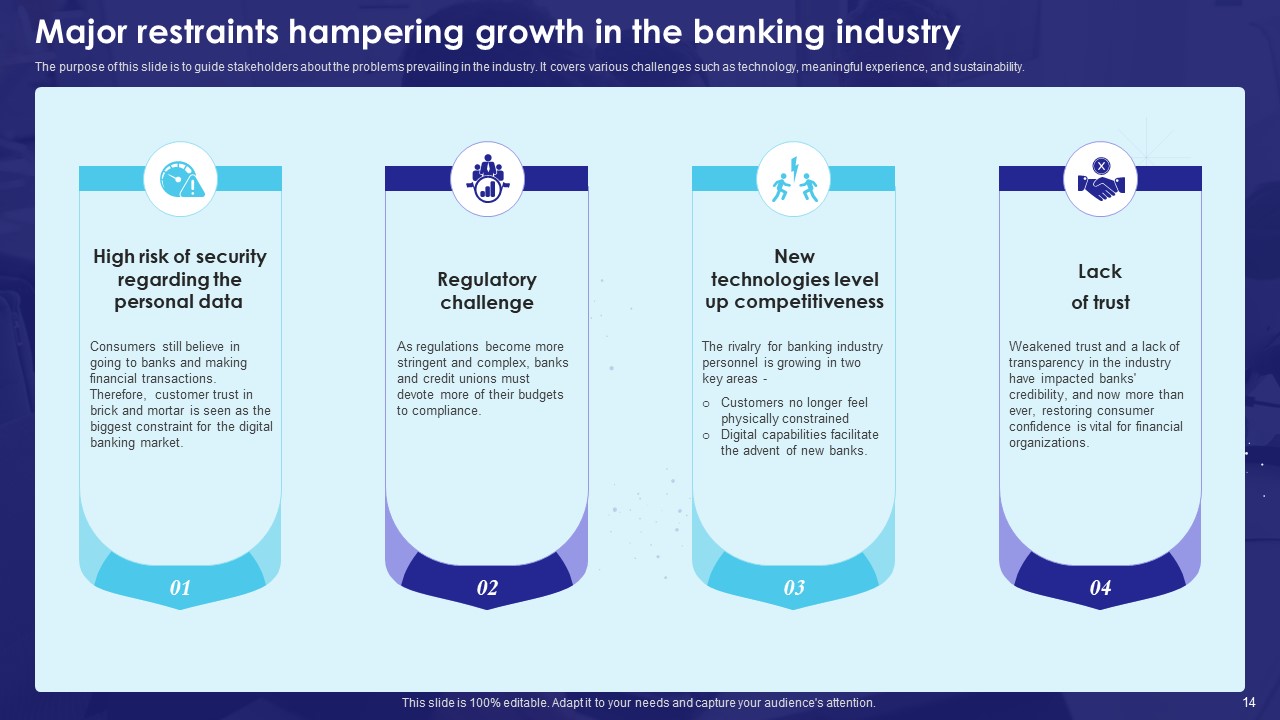

# Major restraints hampering growth in the banking industry

The idea behind this slide is to guide stakeholders about the problems prevailing in the industry. It covers various challenges such as technology, meaningful experience, and sustainability.

However, highlighting the major restraints in a business plan will make you understand the clear-cut challenges that they have to overcome.

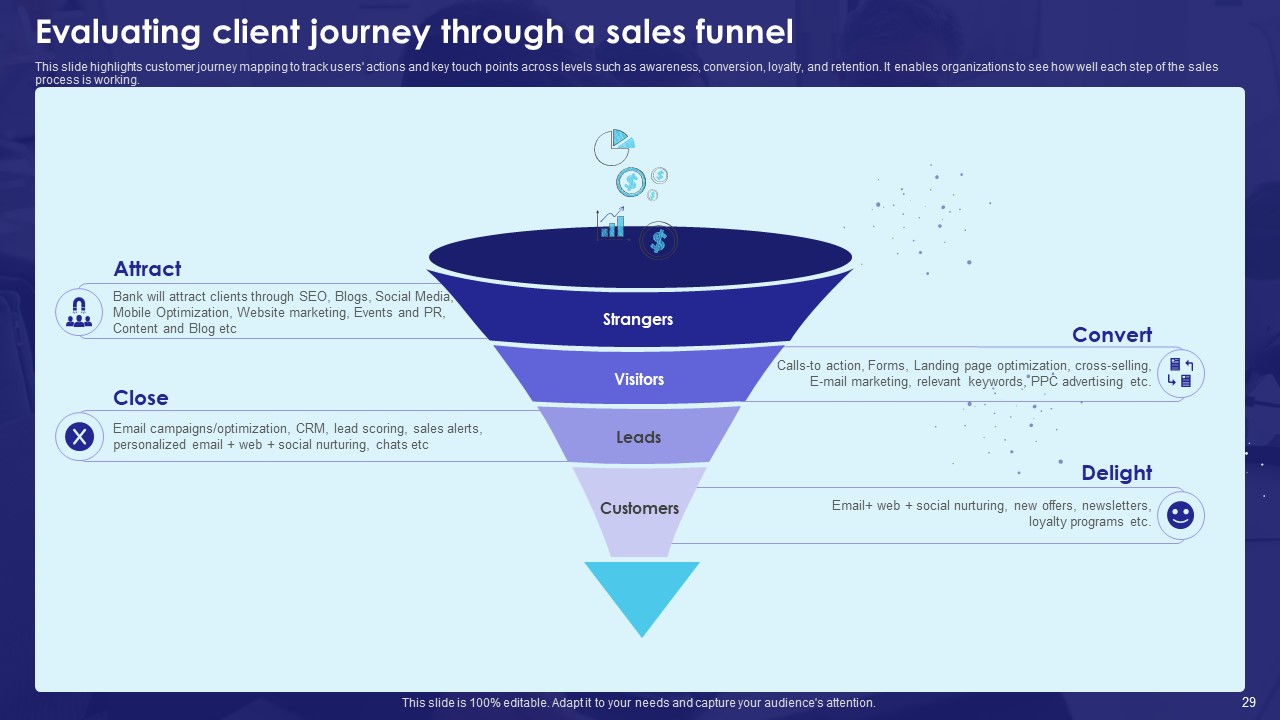

# Evaluating client journey through a sales funnel

This slide highlights customer journey mapping to track users' actions and key touch points across levels such as awareness, conversion, loyalty, and retention. It enables organizations to see how well each step of the sales process is working.

A sales funnel is a word used in marketing, to sum up and define the path taken by potential clients from prospecting to purchase.

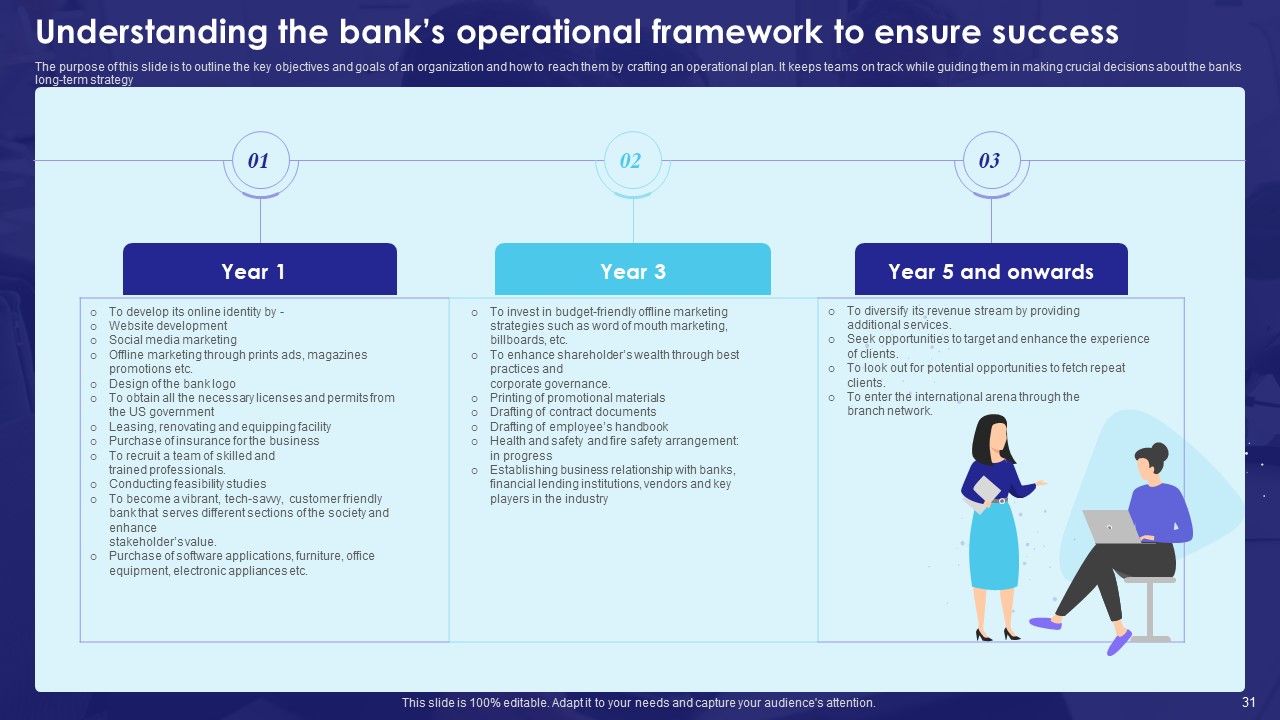

# Understanding the bank’s operational framework to ensure success

The purpose of this slide is to outline the key objectives and goals of an organization and how to reach them by crafting an operational plan. It keeps teams on track while guiding them in making crucial decisions about the banks’ long-term strategy.

In this slide, you can highlight the 1-YEAR plan, 3-YEAR plan, and 5-YEAR onwards plan to achieve the goals and objectives.

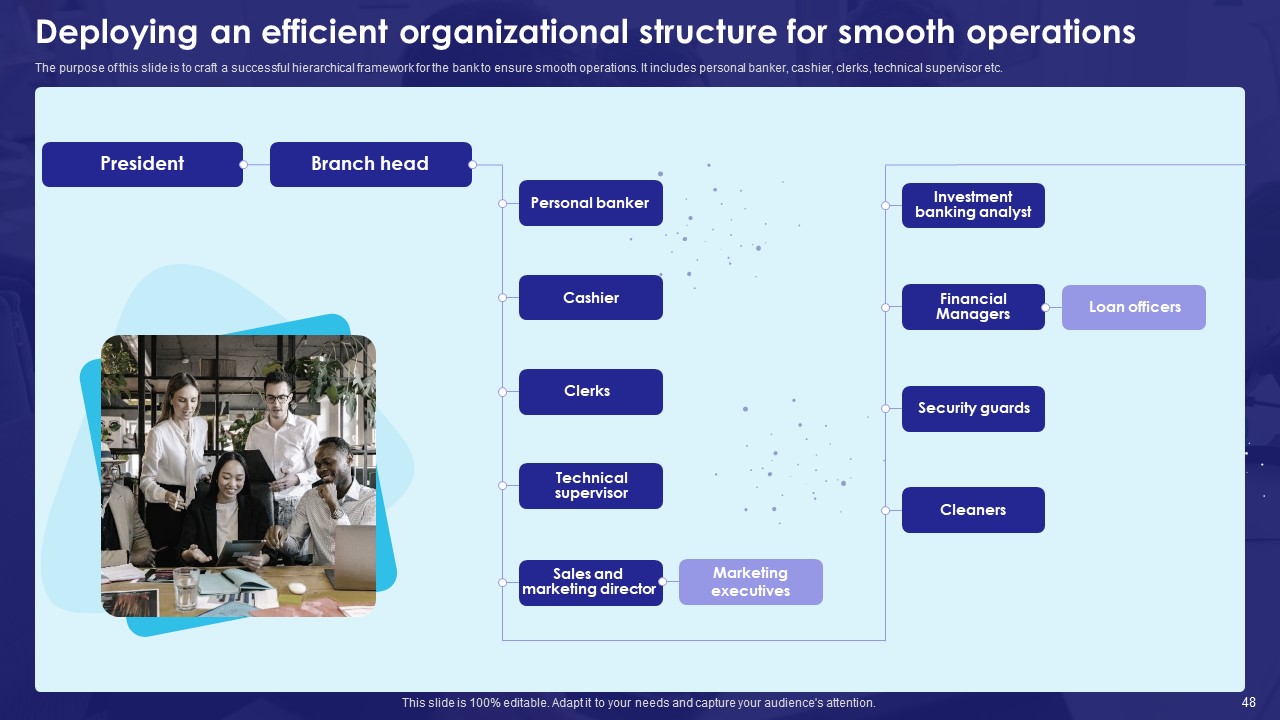

# Deploying an efficient organizational structure for smooth operations

The purpose of this slide is to craft a successful hierarchical framework for the bank to ensure smooth operations. It includes personal bankers, cashiers, clerks, technical supervisors, etc.

An organizational structure is a system that defines how specific tasks are directed in order to fulfill the goals of an organization.

So, highlight the organizational chart in the slide to make it clear to the audience, how the pattern is being followed in the organization.

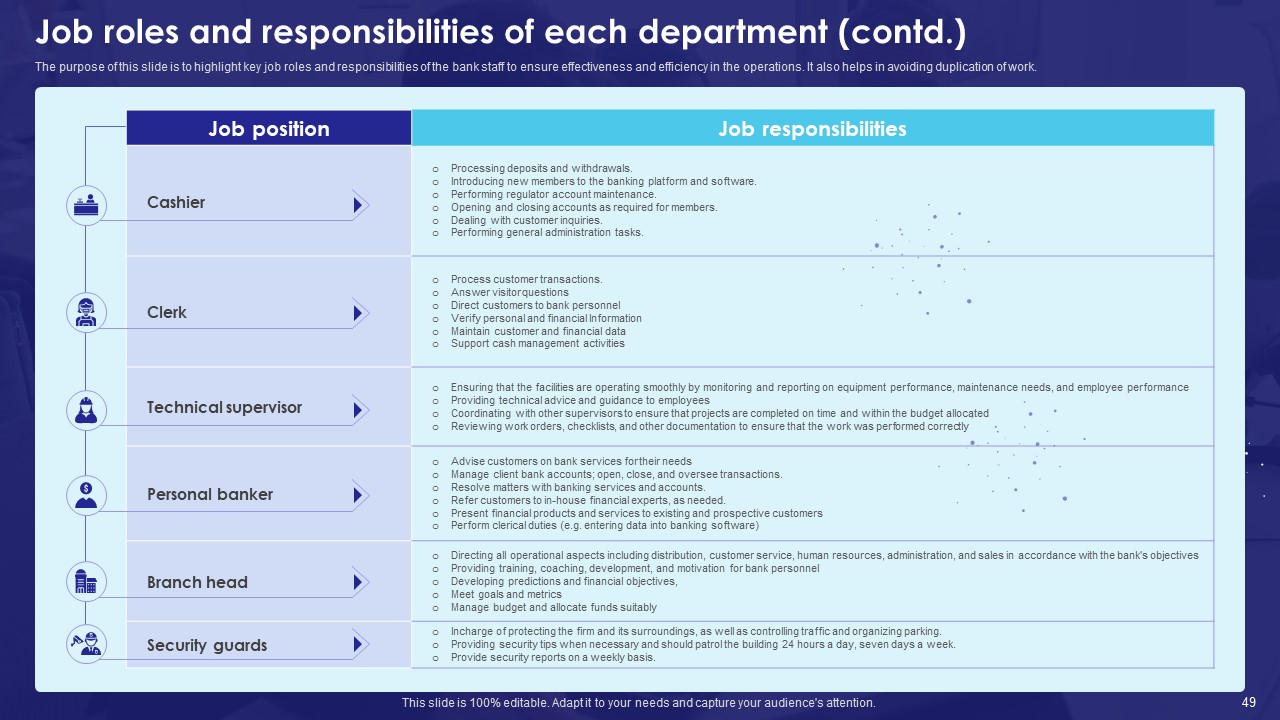

# Job roles and responsibilities of each department (contd.)

This slide aims to highlight key job roles and responsibilities of the bank staff to ensure effectiveness and efficiency in the operations. It also helps in avoiding duplication of work. Job responsibilities refer to the duties and tasks of their particular roles.

Companies that identify roles and responsibilities can streamline their hiring processes. It may encourage their employees to perform better and pay closer attention at work. It also helps enhance operational efficiency by removing confusion and redundancy.

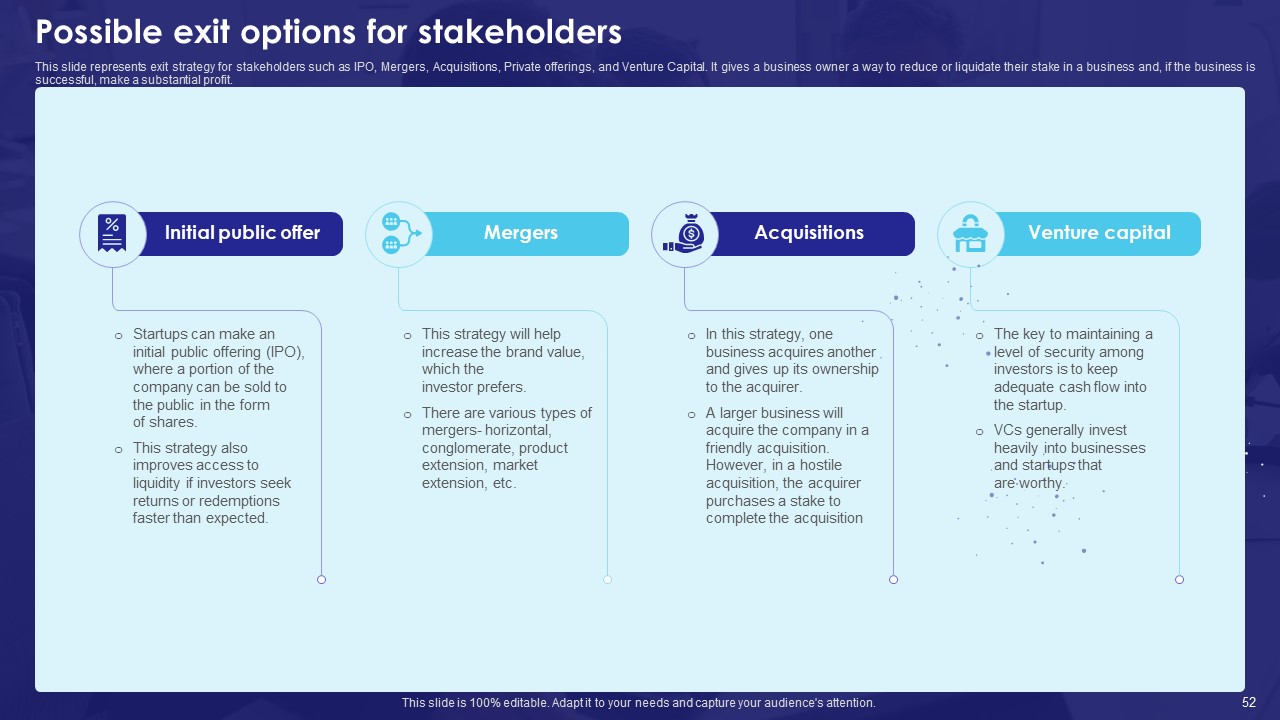

# Possible exit options for stakeholders

This bank business plan slide represents exit strategy for stakeholders such as IPO, Mergers, Acquisitions, Private offerings, and Venture Capital. It gives a business owner a way to reduce or liquidate their stake in a business and make a substantial profit if the business is successful.

An exit option is a clause in a business plan or project that enables a corporation to abandon the venture with only minor financial repercussions.

So download this ready-to-use PowerPoint presentation and edit the text as per your requirement.

Wrapping up

You can get all the information you need to understand the market, the industry, and both at once for the bank business plan in this PowerPoint.

At SlideTeam, a group of researchers and designers work together on projects to create material that satisfies customer requirements. You alter our business plan ppt to suit a person's unique professional needs.

What is the purpose of a business plan for a bank?

A business plan outlines your growth strategy for the next five years and gives a current picture of your bank. It outlines your company's objectives and your plans for achieving them. Market research is also included to help you with your plans.

Which three business models do banks typically use?

A commercial bank with retail funding, a commercial bank with wholesale funding, and a bank focused on the capital markets are the three business models we identify. While the third type stands out principally due to banks' growing involvement in trading activities, the first two models differ primarily in how banks choose to fund their operations.

Related posts:

- How to Design the Perfect Service Launch Presentation [Custom Launch Deck Included]

- Quarterly Business Review Presentation: All the Essential Slides You Need in Your Deck

- [Updated 2023] How to Design The Perfect Product Launch Presentation [Best Templates Included]

- 99% of the Pitches Fail! Find Out What Makes Any Startup a Success

Liked this blog? Please recommend us

2 thoughts on “How to Create a Fruitful Bank Business Plan- Free PDF Included”

This form is protected by reCAPTCHA - the Google Privacy Policy and Terms of Service apply.

Digital revolution powerpoint presentation slides

Sales funnel results presentation layouts

3d men joinning circular jigsaw puzzles ppt graphics icons

Business Strategic Planning Template For Organizations Powerpoint Presentation Slides

Future plan powerpoint template slide

Project Management Team Powerpoint Presentation Slides

Brand marketing powerpoint presentation slides

Launching a new service powerpoint presentation with slides go to market

Agenda powerpoint slide show

Four key metrics donut chart with percentage

Engineering and technology ppt inspiration example introduction continuous process improvement

Meet our team representing in circular format

Free PDF Business Plan Templates and Samples

By Joe Weller | September 9, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

We’ve gathered the most useful collection of business plan PDF templates and samples, including options for organizations of any size and type.

On this page, you’ll find free PDF templates for a simple business plan , small business plan , startup business plan , and more.

Simple Business Plan PDF Templates

These simple business plan PDF templates are ready to use and customizable to fit the needs of any organization.

Simple Business Plan Template PDF

This template contains a traditional business plan layout to help you map out each aspect, from a company overview to sales projections and a marketing strategy. This template includes a table of contents, as well as space for financing details that startups looking for funding may need to provide.

Download Simple Business Plan Template - PDF

Lean Business Plan Template PDF

This scannable business plan template allows you to easily identify the most important elements of your plan. Use this template to outline key details pertaining to your business and industry, product or service offerings, target customer segments (and channels to reach them), and to identify sources of revenue. There is also space to include key performance metrics and a timeline of activities.

Download Lean Business Plan Template - PDF

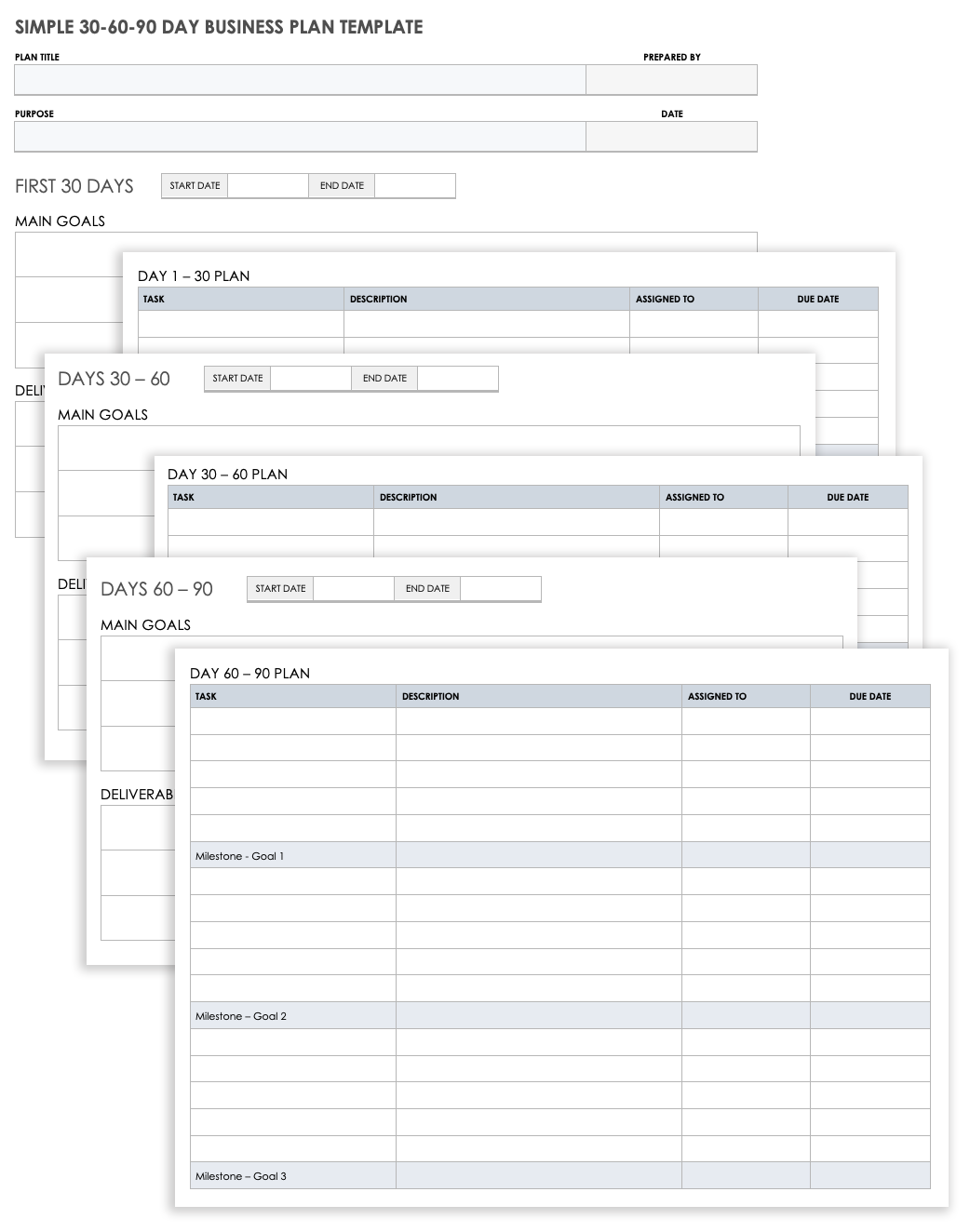

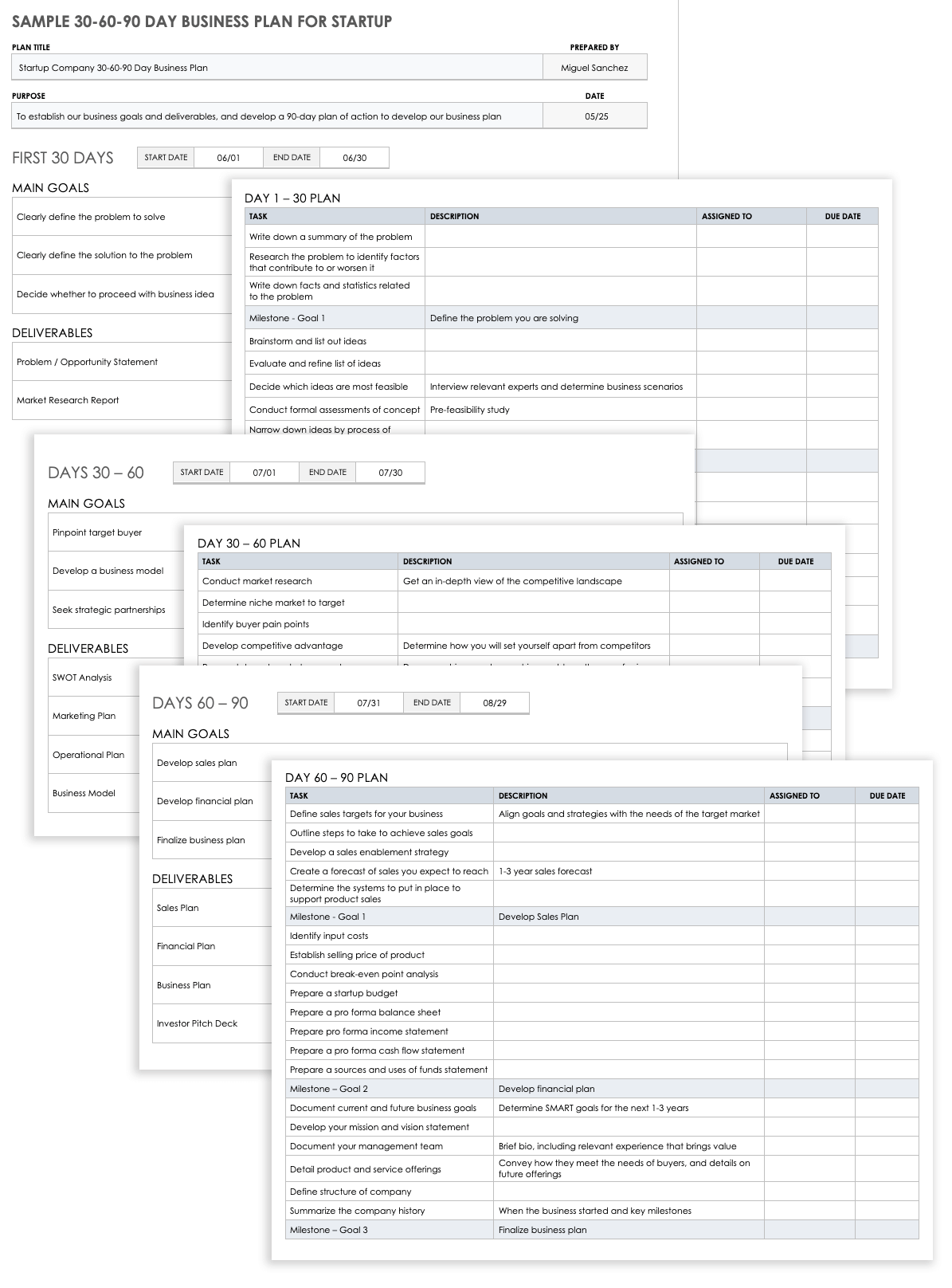

Simple 30-60-90 Day Business Plan Template PDF

This template is designed to help you develop and implement a 90-day business plan by breaking it down into manageable chunks of time. Use the space provided to detail your main goals and deliverables for each timeframe, and then add the steps necessary to achieve your objectives. Assign task ownership and enter deadlines to ensure your plan stays on track every step of the way.

Download Simple 30-60-90 Day Business Plan Template

PDF | Smartsheet

One-Page Business Plan PDF Templates

The following single page business plan templates are designed to help you download your key ideas on paper, and can be used to create a pitch document to gain buy-in from partners, investors, and stakeholders.

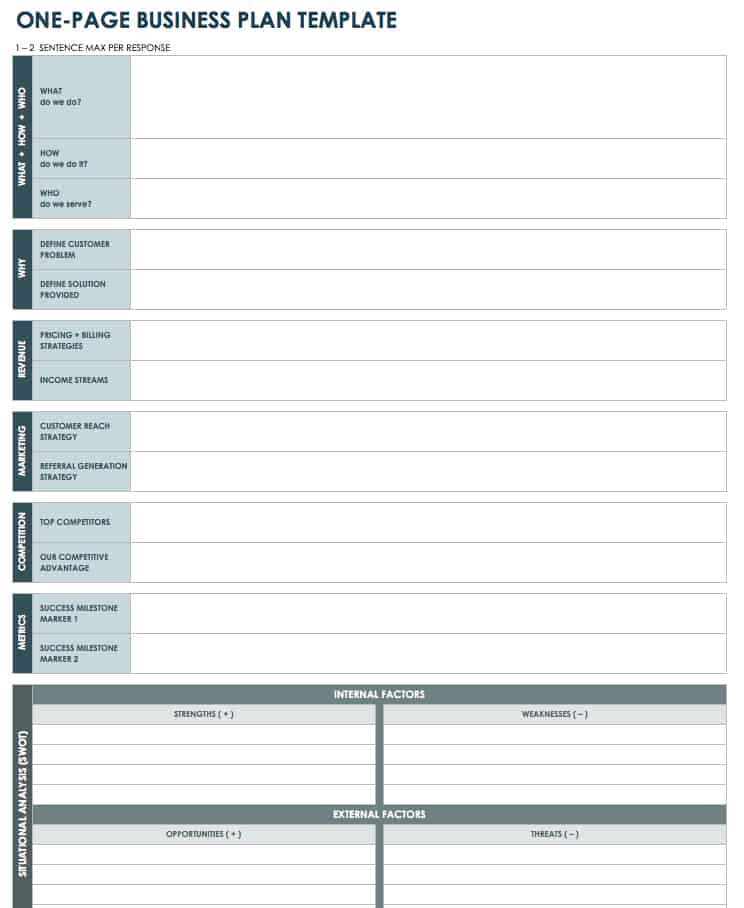

One-Page Business Plan Template PDF

Use this one-page template to summarize each aspect of your business concept in a clear and concise manner. Define the who, what, why, and how of your idea, and use the space at the bottom to create a SWOT analysis (strengths, weaknesses, opportunities, and threats) for your business.

Download One-Page Business Plan Template

If you’re looking for a specific type of analysis, check out our collection of SWOT templates .

One-Page Lean Business Plan PDF

This one-page business plan template employs the Lean management concept, and encourages you to focus on the key assumptions of your business idea. A Lean plan is not stagnant, so update it as goals and objectives change — the visual timeline at the bottom is ideal for detailing milestones.

Download One-Page Lean Business Plan Template - PDF

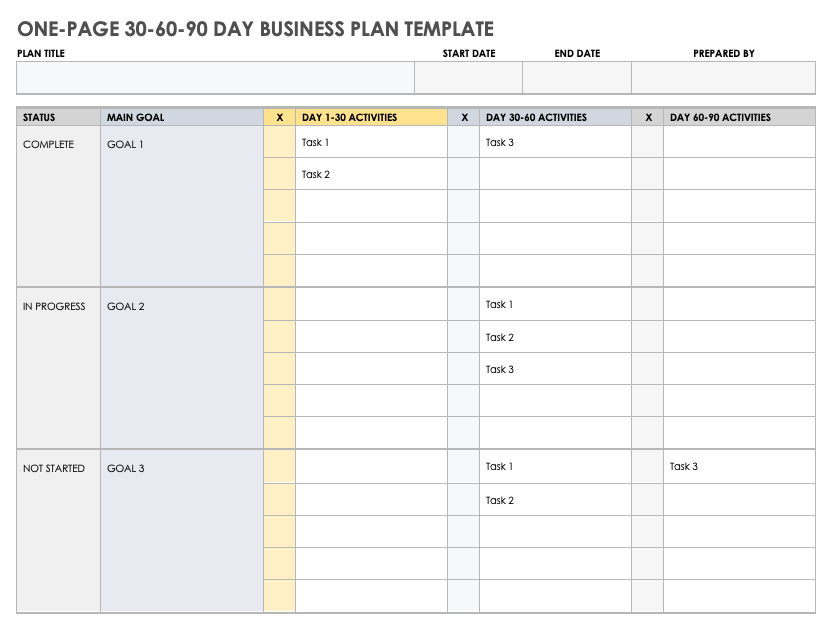

One-Page 30-60-90 Day Business Plan Template

Use this business plan template to identify main goals and outline the necessary activities to achieve those goals in 30, 60, and 90-day increments. Easily customize this template to fit your needs while you track the status of each task and goal to keep your business plan on target.

Download One-Page 30-60-90 Day Business Plan Template

For additional single page plans, including an example of a one-page business plan , visit " One-Page Business Plan Templates with a Quick How-To Guide ."

Small Business Plan PDF Templates

These business plan templates are useful for small businesses that want to map out a way to meet organizational objectives, including how to structure, operate, and expand their business.

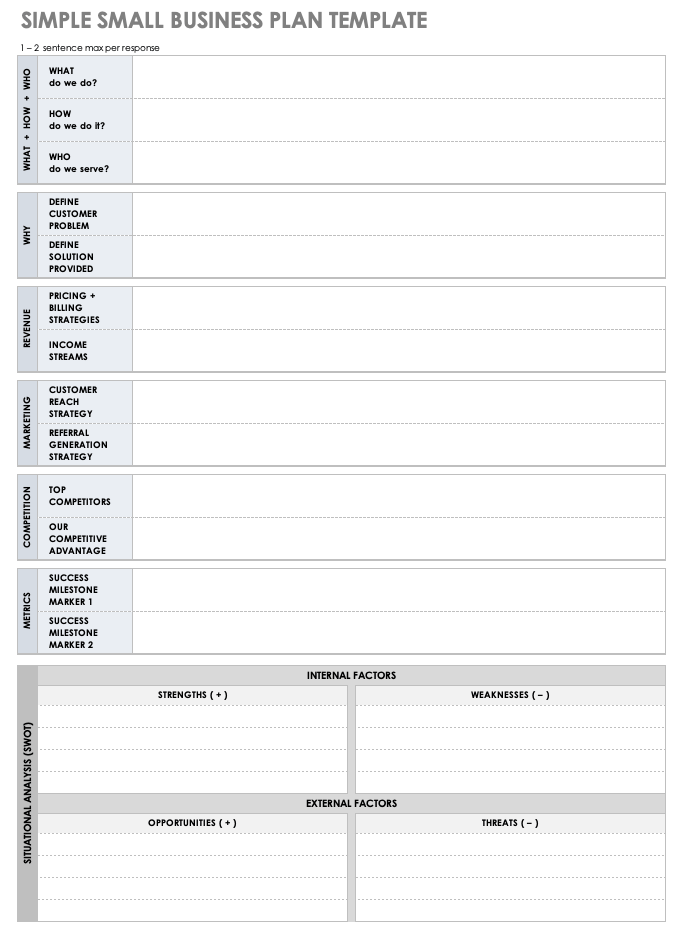

Simple Small Business Plan Template PDF

A small business can use this template to outline each critical component of a business plan. There is space to provide details about product or service offerings, target audience, customer reach strategy, competitive advantage, and more. Plus, there is space at the bottom of the document to include a SWOT analysis. Once complete, you can use the template as a basis to build out a more elaborate plan.

Download Simple Small Business Plan Template

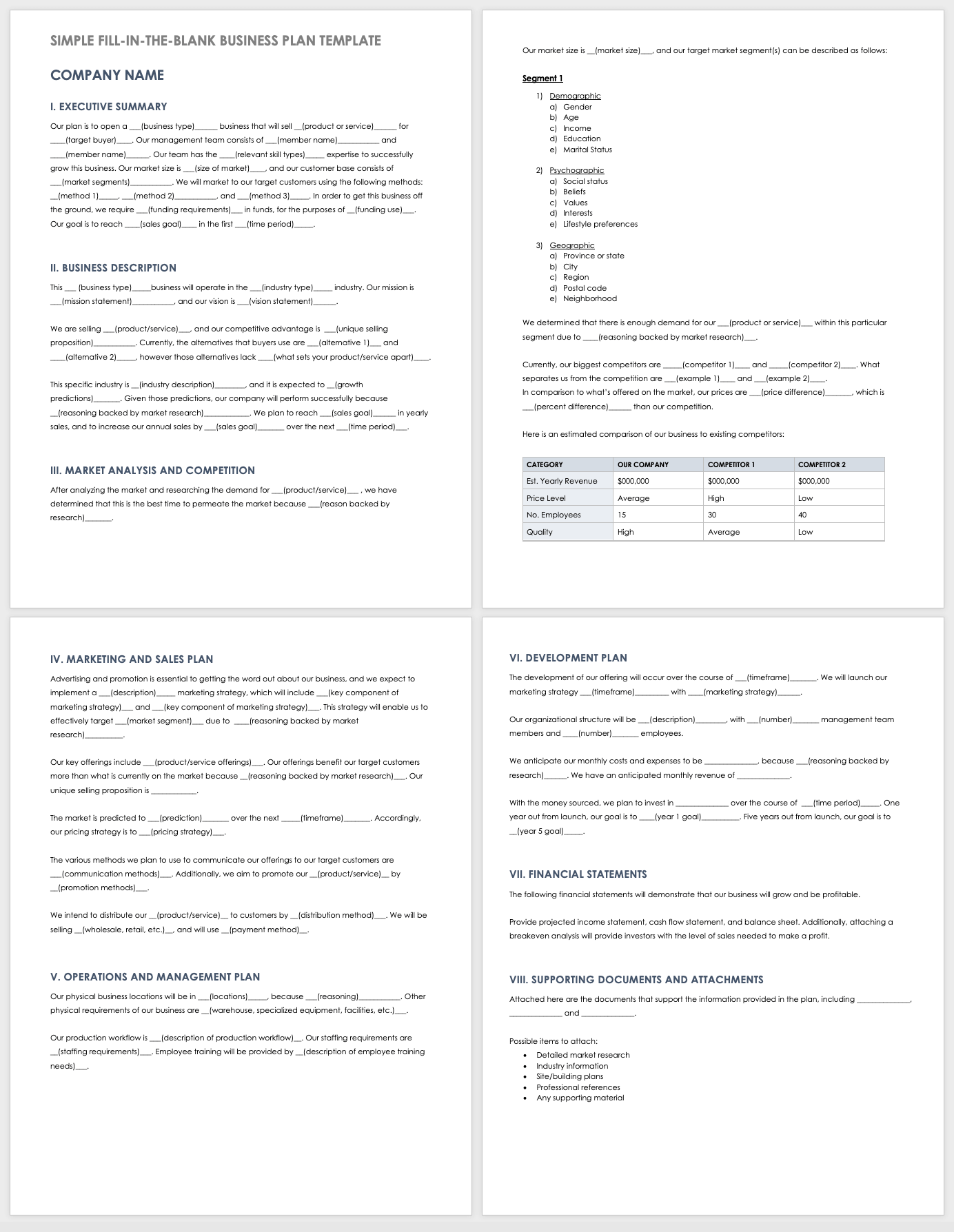

Fill-In-the-Blank Small Business Plan Template PDF

This fill-in-the-blank template walks you through each section of a business plan. Build upon the fill-in-the-blank content provided in each section to add information about your company, business idea, market analysis, implementation plan, timeline of milestones, and much more.

Download Fill-In-the-Blank Small Business Plan Template - PDF

One-Page Small Business Plan Template PDF

Use this one-page template to create a scannable business plan that highlights the most essential parts of your organization’s strategy. Provide your business overview and management team details at the top, and then outline the target market, market size, competitive offerings, key objectives and success metrics, financial plan, and more.

Download One-Page Business Plan for Small Business - PDF

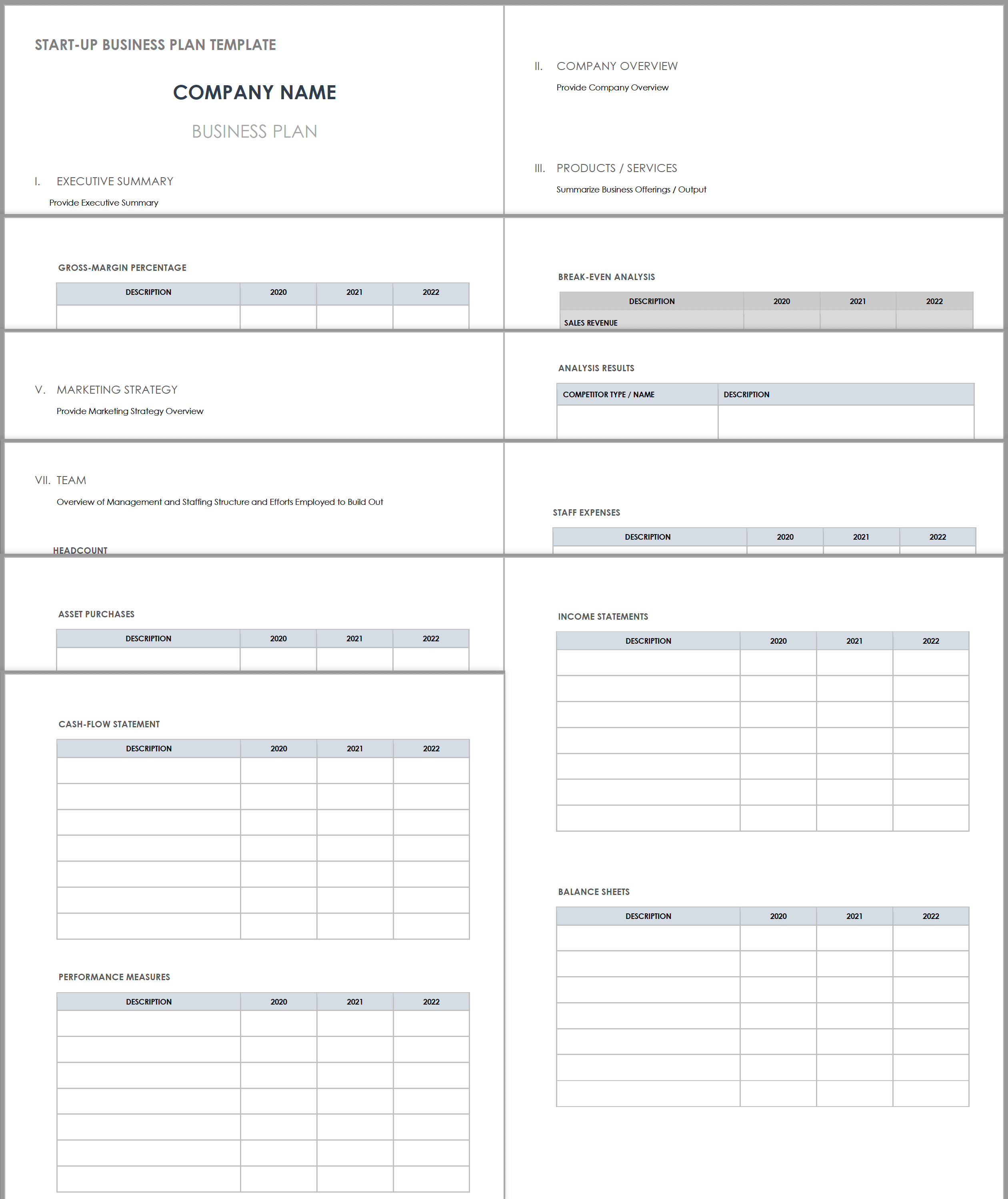

Startup Business Plan PDF Templates

Startups can use these business plan templates to check the feasibility of their idea, and articulate their vision to potential investors.

Startup Business Plan Template

Use this business plan template to organize and prepare each essential component of your startup plan. Outline key details relevant to your concept and organization, including your mission and vision statement, product or services offered, pricing structure, marketing strategy, financial plan, and more.

Download Startup Business Plan Template

Sample 30-60-90 Day Business Plan for Startup

Startups can use this sample 30-60-90 day plan to establish main goals and deliverables spanning a 90-day period. Customize the sample goals, deliverables, and activities provided on this template according to the needs of your business. Then, assign task owners and set due dates to help ensure your 90-day plan stays on track.

Download Sample 30-60-90 Day Business Plan for Startup Template

For additional resources to create your plan, visit “ Free Startup Business Plan Templates and Examples .”

Nonprofit Business Plan PDF Templates

Use these business plan PDF templates to outline your organization’s mission, your plan to make a positive impact in your community, and the steps you will take to achieve your nonprofit’s goals.

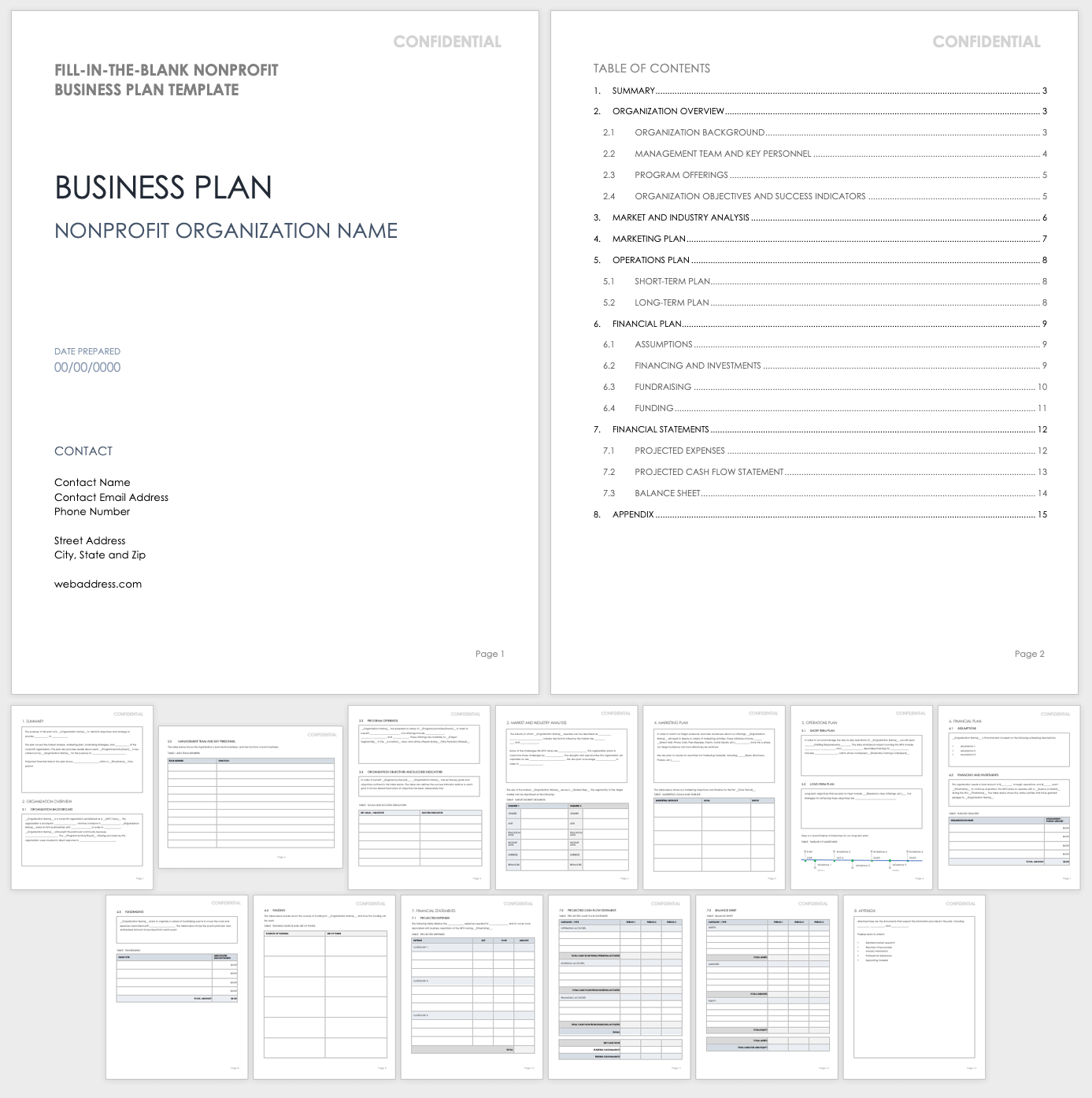

Nonprofit Business Plan Template PDF

Use this customizable PDF template to develop a plan that details your organization’s purpose, objectives, and strategy. This template features a table of contents, with room to include your nonprofit’s mission and vision, key team and board members, program offerings, a market and industry analysis, promotional plan, financial plan, and more. This template also contains a visual timeline to display historic and future milestones.

Download Nonprofit Business Plan Template - PDF

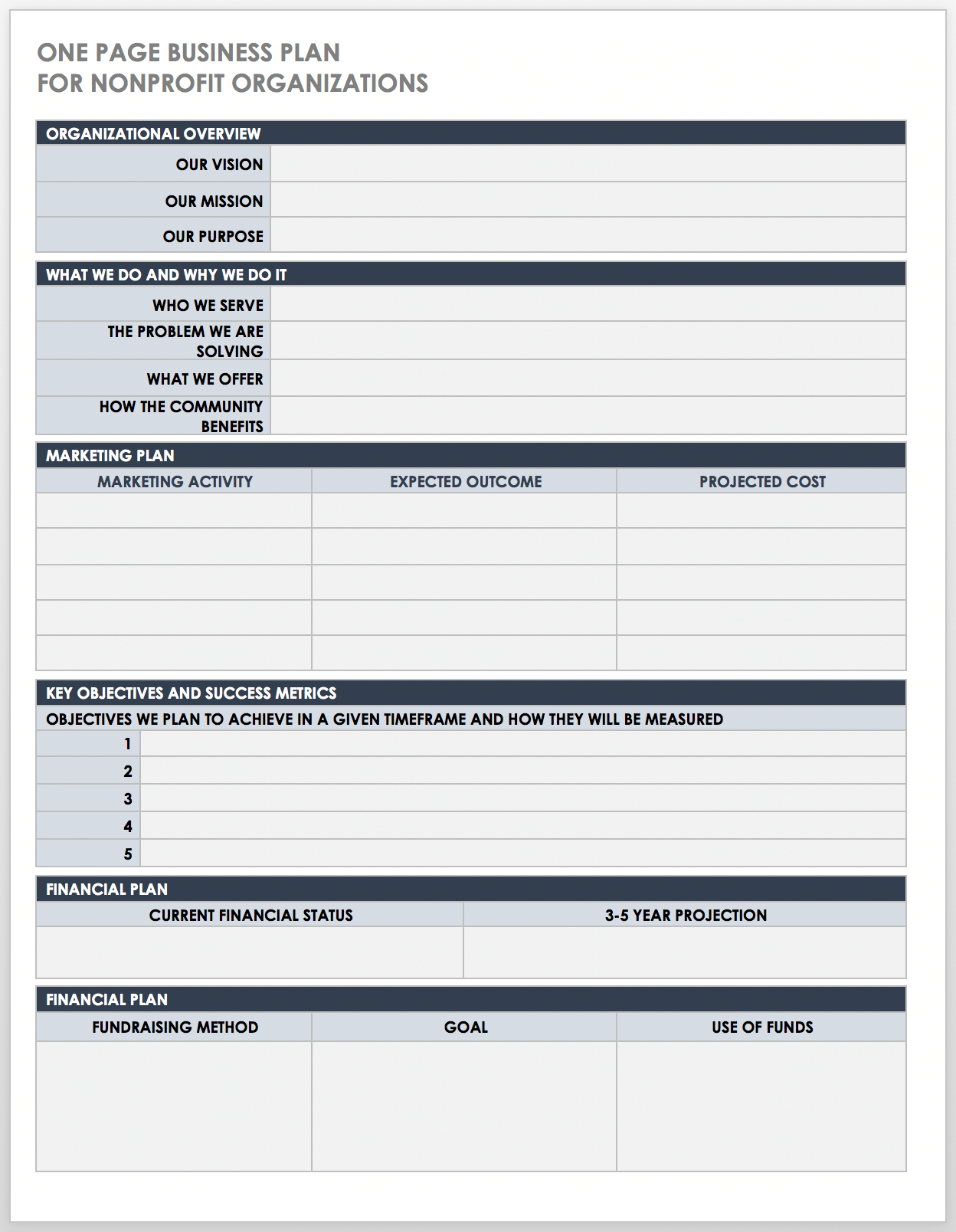

One-Page Business Plan for Nonprofit Organization PDF

This one-page plan serves as a good starting point for established and startup nonprofit organizations to jot down their fundamental goals and objectives. This template contains all the essential aspects of a business plan in a concise and scannable format, including the organizational overview, purpose, promotional plan, key objectives and success metrics, fundraising goals, and more.

Download One-Page Business Plan for Nonprofit Organization Template - PDF

Fill-In-the-Blank Business Plan PDF Templates

Use these fill-in-the-blank templates as a foundation for creating a comprehensive roadmap that aligns your business strategy with your marketing, sales, and financial goals.

Simple Fill-In-the-Blank Business Plan PDF

The fill-in-the-blank template contains all the vital parts of a business plan, with sample content that you can customize to fit your needs. There is room to include an executive summary, business description, market analysis, marketing plan, operations plan, financial statements, and more.

Download Simple Fill-In-the-Blank Business Plan Template - PDF

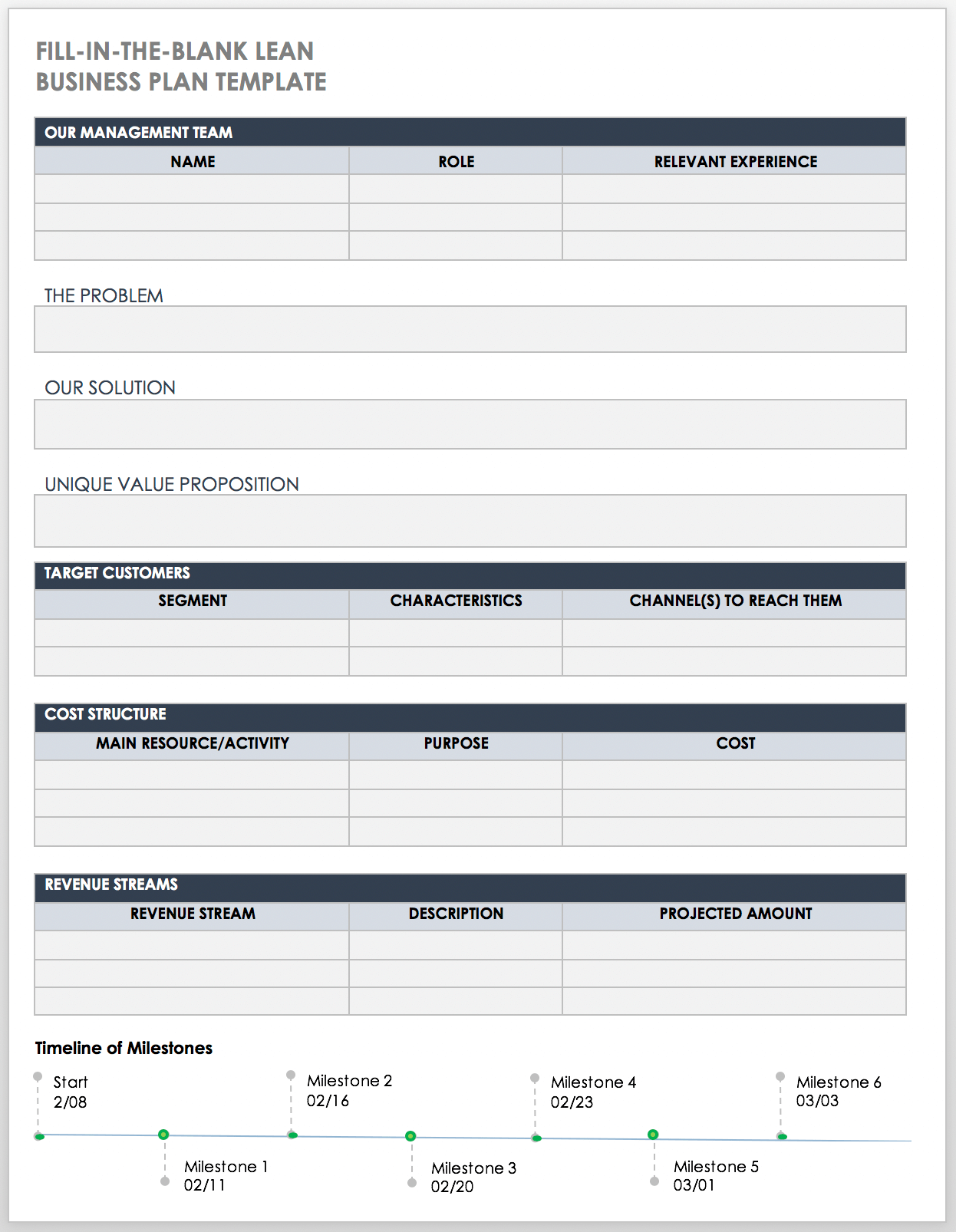

Lean Fill-In-the-Blank Business Plan PDF

This business plan is designed with a Lean approach that encourages you to clarify and communicate your business idea in a clear and concise manner. This single page fill-in-the-blank template includes space to provide details about your management team, the problem you're solving, the solution, target customers, cost structure, and revenue streams. Use the timeline at the bottom to produce a visual illustration of key milestones.

Download Fill-In-the-Blank Lean Business Plan Template - PDF

For additional resources, take a look at " Free Fill-In-the-Blank Business Plan Templates ."

Sample Business Plan PDF Templates

These sample business plan PDF templates can help you to develop an organized, thorough, and professional business plan.

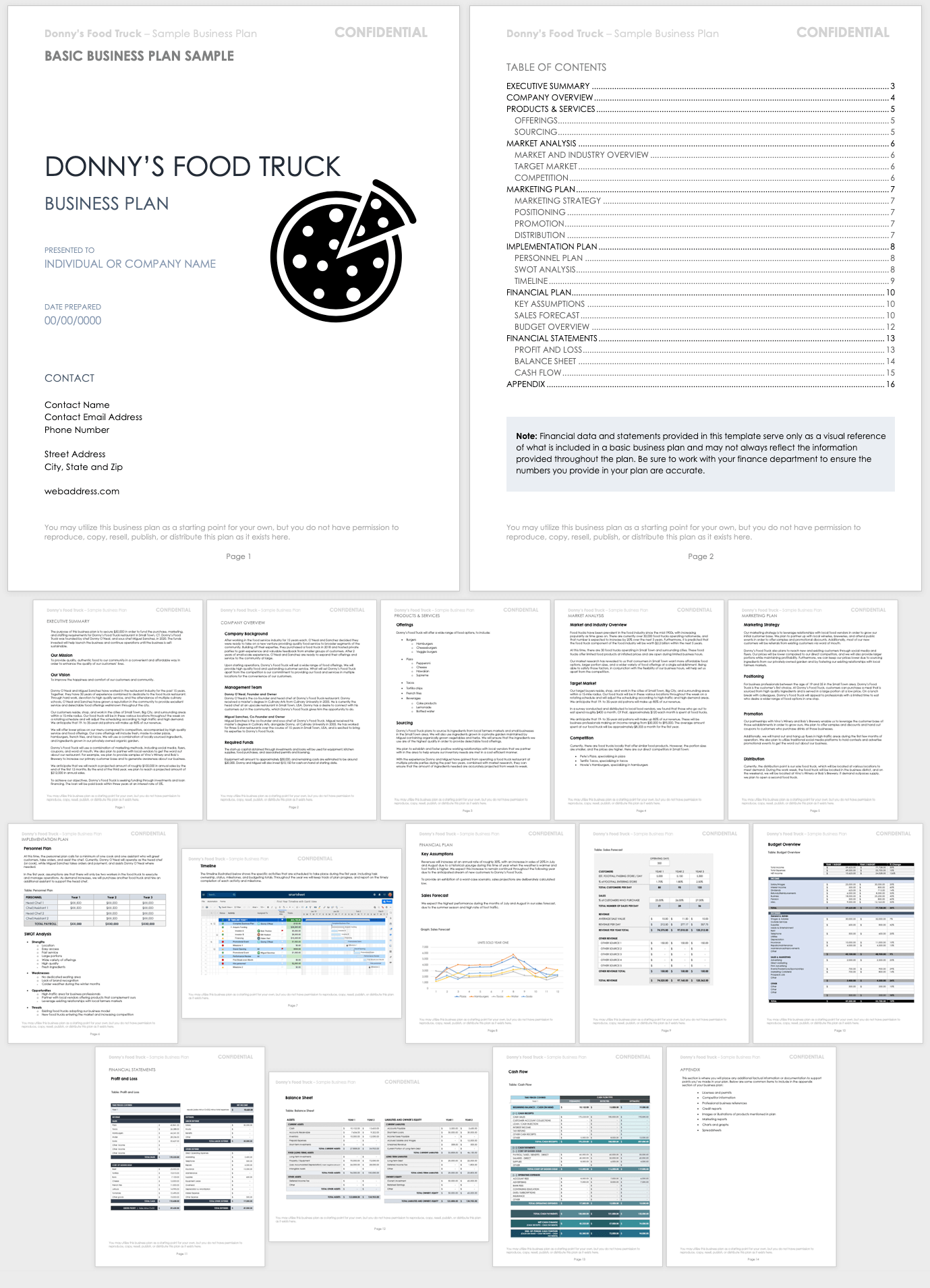

Business Plan Sample

This business plan example demonstrates a plan for a fictional food truck company. The sample includes all of the elements in a traditional business plan, which makes it a useful starting point for developing a plan specific to your business needs.

Download Basic Business Plan Sample - PDF

Sample Business Plan Outline Template

Use this sample outline as a starting point for your business plan. Shorten or expand the outline depending on your organization’s needs, and use it to develop a table of contents for your finalized plan.

Download Sample Business Plan Outline Template - PDF

Sample Business Financial Plan Template

Use this sample template to develop the financial portion of your business plan. The template provides space to include a financial overview, key assumptions, financial indicators, and business ratios. Complete the break-even analysis and add your financial statements to help prove the viability of your organization’s business plan.

Download Business Financial Plan Template

PDF | Smartsheet

For more free, downloadable templates for all aspects of your business, check out “ Free Business Templates for Organizations of All Sizes .”

Improve Business Planning with Real-Time Work Management in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

Internet-Banking

Bank business plan

- Bank Business Plan

pdf (958 Kb)

pdf (197 Kb)

pdf (182 Kb)

doc (55 Kb)

How to use a screen reader

Firstly, enable a screen reader mode. Then highlight necessary text and click on the emerging icon. * The screen reader isn't compatible with Windows Vista and other older versions of Windows.

Which version of Internet Banking do you want to use?

- current affairs

- daily current affairs 10 april 2024

Daily Current Affairs 10 April 2024 | Latest News | Download Free PDF

Apr 10 2024

Dear Readers, get to know the daily current affairs today covering all the National & International Events provided here in this article. Current Affairs is an important topic in various competitive exams like IBPS/SBI/PO/Clerk and other competitive exams. To score better in this section, be updated with the daily happenings. Check the Daily Current Affairs February 2024 updates here. Revision is very important in remembering current affairs. Candidates after learning the Daily current affairs April 10 2024, can test their knowledge by attempting Current Affairs Quiz provided with answers. Daily current affairs 10 April 2024 covers current affairs from International & National news, Important Days, State News, Banking & Economy, Business News, Appointments & Resignation, Awards & Honour, Books & Authors, Sports News, etc.,

Daily Current Affairs PDF of 10th April 2024

Get more: static gk pdfs, current affairs: banking & finance.

Mudra Loans Reach Record High, Exceeding ₹5 lakh-crore Mark in FY24

- According to the latest Government data, Small business loans under the Pradhan Mantri Mudra Yojana (PMMY) witnessed record growth in disbursals in FY24 and also crossed the milestone of ₹5 lakh crore .

- Loans sanctioned in the last financial year were higher at ₹5.28 lakh crore.

- The total disbursals stood at ₹5.20 lakh in the year ended March 2024, as against ₹4.40 lakh crore in the previous financial year.

- Nearly 70% of the beneficiaries of these loans are women.

Key Highlights :

- With this, approximately ₹46 lakh crore has been disbursed in Mudra loans since the introduction of the scheme in 2015 , if we include the provisional figures for FY24,.

- There is also an institutional framework that encourages lenders to push disbursal of Mudra loans further, such as the guarantee provided by the National Credit Guarantee Trustee Company Limited. (NCGTC) against the eligible micro units under PMMY.

- Notably, the gross non-performing assets (NPAs) in PMMY have declined from 3.17% in March 2022 to 2.68% in June 2023.

- NPA data for 2023-24 is yet to be released.

About Pradhan Mantri MUDRA Yojana (PMMY) :

- The PMMY is a scheme launched by the Hon’ble Prime Minister on April 8, 2015 for providing loans up to 10 lakh to the non-corporate, non-farm small/micro enterprises.

- These loans are classified as MUDRA loans under PMMY.

- Types of Lenders: MUDRA loans are offered by Commercial Banks, Regional Rural Banks (RRBs), Small Finance Banks, Microfinance Institutions (MFIs), and Non-Banking Financial Companies (NBFCs).

- Application Process: Borrowers can approach any of the mentioned lending institutions directly or apply online through the portaludyami mitra.in.

- Loan Categories:

- Three products under PMMY: Shishu (up to ₹50,000), Kishor (above ₹50,000 and up to ₹5 lakh), and Tarun (above ₹5 lakh and up to ₹10 lakh).

- These categories signify the stage of growth/development and funding needs of the micro unit/entrepreneur.

- Graduation/Growth:

- The categorization into Shishu, Kishor, and Tarun also serves as a reference point for the next phase of graduation or growth for the beneficiary micro unit/entrepreneur.

Recent News :

- In Jan 2024, Small businesses received a boost as loans granted through the Pradhan Mantri Mudra Yojana (PMMY) reached an all-time high of ₹3 trillion in December 2023, demonstrating an impressive 16% increase compared to the previous year.

Securities and Exchange Board of India Approves ₹5,000 Crore IPO for Aadhar Housing Finance, Backed by Blackstone

- Aadhar Housing Finance Limited (AHFL), focused on low-income housing in India, has received final observations from the Securities and Exchange Board of India (SEBI) for its proposed Initial Public Offering (IPO).

- The company aims to raise approximately ₹5,000 crore through the IPO.

Background :

- AHFL had previously submitted draft papers in February 2024.

- However, in January 2021, it had submitted draft papers to SEBI, receiving approval in May 2022 for an IPO of slightly over ₹7,000 crore, which it decided not to proceed with.

- The new issue plan includes a new equity offering totaling ₹1,000 crore alongside a ₹4,000 crore offer for sale.

- Within the offer for sale (OFS), promoter BCP Topco VII Pte will divest its stake.

- BCP Topco, an affiliate of funds managed by Blackstone, currently holds 98.7% of the pre-offer issued, subscribed, and paid-up equity share capital.AHFL targets economically weaker and low-to-middle income customers, providing small-ticket mortgage loans, with an average ticket size of ₹0.9 million and average loan-to-value ratios of 57.6% and 58.1% as of September 30, 2022, and September 30, 2023, respectively.

- According to Crisil, AHFL had the highest Assets Under Management (AUM) and net worth among its peers in the six months ending September, reflecting its market position.

- AHFL offers various mortgage-related loan products, including residential property purchase and construction loans, home improvement and extension loans, and loans for commercial property construction and acquisition.

- The company operates through a network of 471 branches, including 91 sales offices.

- Book Running Lead Managers for the IPO include ICICI Securities, Citigroup Global Markets India, Kotak Mahindra Capital, Nomura Financial Advisory and Securities, and SBI Capital Markets.

What is an initial public offering?

- An IPO or initial public offering is the process by which a privately held company, or a company owned by the government such as LIC, raises funds by offering shares to the public or new investors.

- Following the IPO, the company is listed on the stock exchange.

Tata Mutual Fund Introduces 6 Sectoral and Thematic Index Funds

- Tata Mutual Fund has launched 6 thematic index funds focused on various sectors including infrastructure, healthcare, realty, financial services, automobile, and manufacturing.

- The new fund offer (NFO) of these schemes is available for subscription till April 22, 2024 .

- The minimum investment during the NFO period is ₹5,000.

- Industry Firsts : Among the 6 schemes, 3 are industry firsts : Nifty 500 Multicap India Manufacturing 50:30:20 Index Fund, Nifty 500 Multicap 50:30:20 Infrastructure Index Fund and Nifty MidSmall Healthcare Index Fund — are a first in the industry.

- Other Schemes: The remaining 3 schemes are Nifty Realty Index Fund, Nifty Financial Services Index Fund, and Nifty Auto Index Fund.

About 6 thematic index funds:

- Investment Framework: The infrastructure and manufacturing index funds follow a multicap framework with fixed allocations across largecap, midcap, and smallcap companies in the proportion of 50:30:20.

- Market Trends and Drivers: The decision to introduce these index funds is driven by rising income levels and compelling consumer trends, indicating market demand and potential growth opportunities in these sectors.

- Passive Investing Trend: With passive investing gaining traction, fund houses are exploring opportunities in this space through index funds and exchange-traded funds (ETFs).

- This approach offers greater flexibility to fund houses to create innovative products and cater to investor preferences.

- Regulatory Filings:In March 2024 , fund houses filed papers with the Securities and Exchange Board of India (SEBI) for three passive funds, indicating ongoing developments and regulatory compliance in the mutual fund industry.

What Are Index Funds?

- Index funds passively track the performance of a specific index and provide exposure to a diversified basket of stocks, mostly in a specific theme.

- They operate passively, eliminating the need for active stock selection, resulting in transparency and cost-efficiency compared to actively managed funds.

Kotak Alternate Asset Managers Secures Rs 2,000 Crore for Equity Investments

- Kotak Mahindra Bank's asset management arm Kotak Alternate Asset Managers Limited has raised Rs 2,000 crore to invest in equities.

- Kotak Alternate Asset Managers' 'Iconic Fund' is a Sebi-registered category III Alternative Investment Fund (AIF) and an open-ended platform conceptualised as an equity multi-advisor portfolio solution.

- Aim of the fund : To solve the challenge of building and maintaining equity portfolios amid the difficulties faced by investors due to the market volatilities.

- Additionally, Kotak Iconic Fund is capable of accepting investments from five offshore jurisdictions, including the United States (US), United Kingdom (UK), Singapore, DIFC, and Hong Kong, offering a convenient platform for non-resident investors to access the Indian equity markets.

- Kotak Alt under Kotak Optimus and Kotak Iconic offer multi-asset and equity discretionary portfolio solutions to both resident and non-resident investors having varying investment objectives.

- In Nov 2023, Kotak Alternate Asset Managers Limited raised about ₹1,000 crore ($120 million) for its open-ended fund to invest in Indian equities.

Reserve Bank of India and National Payments Corporation of India Recommend Strategies to Reduce Cross-Border Remittance Expenses to 3%

- The Reserve Bank of India (RBI) and the National Payments Corporation of India (NPCI) have collaborated to propose measures to the World Trade Organisation (WTO) aimed at reducing the cost of cross-border remittances.

- The current costs of cross-border remittances can be as high as 8%, prompting the need for measures to reduce these expenses.

Key Highlights :

- Presentation to WTO: A presentation outlining strategies to lower cross-border remittance costs was delivered by RBI and NPCI during a seminar conducted by the WTO's Committee on Trade in Financial Services on March 25, 2024.

- International Cooperation : The seminar was organized following a proposal from India, Philippines, and South Africa , indicating international cooperation in addressing this issue.

- Sustainable Development Goal (SDG) Target: India aims to bring the cost of remittances below 3% and eliminate remittance channels costing more than 5% by 2030, aligning with the UN Sustainable Development Goal (SDG) target.

- Discussion at WTO Conference: The issue of reducing remittance costs was also discussed at the 13th Ministerial Conference of the WTO in Abu Dhabi, indicating its significance at the international level.

- Current Remittance Costs: On average, remittance services currently represent 6.2% of the transferred amount, with 3% charged at the sending point and 3% at the receiving point.

- Importance of Remittance Flows: Remittance flows into low- and middle-income economies totalled $669 billion in 2023 and are anticipated to increase in the future.

- India stands as the largest recipient of remittances globally, receiving Rs 125 billion in 2023.

- Comparison with Other Countries: India's significant position as a remittance receiver is highlighted by the fact that it surpassed other countries, with Mexico receiving $67 billion and China receiving $50 billion in 2023.

Recent News :

- In Feb 2024, The Reserve Bank of India (RBI) advised the National Payments Corporation of India (NPCI) to examine Paytm’s request to become a third-party application provider for unified payments interface (UPI) payments.

About RBI :

- Established : 1 April 1935

- Headquarters : Mumbai, Maharashtra, India

- Governor : Shaktikanta Das

About NPCI :

- Founded : 2008

- MD & CEO : Dilip Asbe

- The NPCI is an umbrella organization for operating retail payments and settlement systems in India.

- It is an initiative of the Reserve Bank of India (RBI) and Indian Banks’ Association (IBA) under the provisions of the Payment and Settlement Systems Act, 2007, for creating a robust Payment & Settlement Infrastructure in India.

Draft Guidelines for Academic Bank of Credits Establishment Notified by Ministry of Skills Development and Entrepreneurship

- The Ministry of Skills Development and Entrepreneurship has notified draft guidelines for setting up the Academic Bank of Credit (ABC) , paving way for implementation and operationalization of the National Credit Framework as envisaged under the National Education Policy 2020.

- Purpose of ABC : The Academic Bank of Credit is a digital repository that stores credit information earned by students or learners throughout their educational journey.

- Registration Requirement: Recognized awarding bodies are mandated to register both their credentials and the students or learners under the ABC framework.

- Individual Accounts: Under ABC, every student or learner will have an academic bank of credit account, which will be opened and operated by a student/learner, through an unique Automated Permanent Academic Account Registry (APAAR) ID.

- Credit Assignment: Students or learners will be allocated credits upon successful completion of a qualification, job role, or learning course aligned with National Occupational Standards (NOS), MicroCredentials (MC), or qualifications.

- Recognition Basis : Recognition of credits is contingent upon predefined outcomes at a specified level of the National Credit Framework (NCrF) or National Skill Qualification Framework (NSQF), subject to successful assessment of achieved learning outcomes.

What is APAAR?

- APAAR, which stands for Automated Permanent Academic Account Registry, is a specialised identification system designed for all students in India.

- This initiative is part of the 'One Nation, One Student ID' program launched by the Union government, aligning with the new National Education Policy of 2020.

ICICI Bank Extends Rs 2675 Crore Debt Facility to Tata Steel: Report

- ICICI Bank has provided a ₹2,675 crore debt facility to Tata Steel for a term of 3 years to repay its existing debt.

- It added that documents filed with the National Securities Depository showed that Tata Steel has raised Rs 2,700 crore through unsecured fixed-rate bonds at 7.79%.

- The documents showed that Tata Steel will make a bullet payment to both investors on March 27, 2027.

- Tata Steel is among the top three steel producers in India with 21.6 million tonnes per annum of crude steel capacity on a standalone basis.

- The company targets to expand its total capacity to 40 mtpa by FY30.

About ICICI Bank :

- Founded : 5 January 1994

- Headquarters : Mumbai , Maharashtra, India

- MD & CEO : Sandeep Bakhshi

CURRENT AFFAIRS: NATIONAL NEWS

Eci holds ‘conference on low voter turnout’ to increase voter turnout in ls elections.

- In a first-of-its-kind initiative, the Election Commission of India (ECI) held a ‘ Conference on Low Voter Turnout’ with Municipal Commissioners and District Education Officers (DEO) from select districts to increase voter turnout in the ensuing Lok Sabha Elections .

- Ahead of the polling in the ongoing general elections in 2024, the poll body has accelerated efforts to enhance voter turnout in parliamentary constituencies (PCs) with a history of low poll participation in previous general elections.

- According to an official release from the ECI, “In a day-long ‘ Conference on Low Voter Turnout’ held at Nirvachan Sadan, New Delhi, Municipal Commissioners from major cities and select District Election Officers (DEOs) from Bihar and Uttar Pradesh deliberated together to chart a path towards enhancing voter engagement and participation in identified urban and rural PCs.”

- The conference was chaired by Chief Election Commissioner Rajiv Kumar, along with Election Commissioners Gyanesh Kumar and Sukhbir Singh Sandhu.

- A booklet on “ Voter’s Apathy” was also unveiled by the Chief Election Commissioner on the occasion.

Central & state GST officials to conduct joint audits of firms

- In a move that is expected to help businesses as well as reduce litigation , a Model All India GST Audit Manual 2023 has been finalised for use by the Centre and state tax

- The manual lays out standard principles for the selection of audit cases, preparation and conduct of audit as well as post-audit follow-up, which is expected to help both the Central and state GST officials to carry out the process in a uniform manner, sources said.

- The norms, which were placed before the GST Council in February , are likely to be taken up for audit cases from this fiscal.

- Among other measures, it has suggested a common platform for sharing important audit findings and other sources of relevant information to improve the quality and efficiency of audit .

- In recent months, audits have also gained traction with both the Centre and state GST departments, sending out several notices to taxpayers for this.

- Audit is expected to be a key tool for tax officials this fiscal given the focus on increasing the GST taxpayer base and cutting down on tax evasion.

- As part of the exercise, an All-India Coordination Committee’ of Officers is also being set up with officers from the Centre and states who will choose themes for conducting audit , constitute a Committee of Officers for selecting taxpayers in a state for conducting a thematic audit, coordinate among various audit authorities for evolving a common minimum audit plan for a given theme.

- It will also monitor actual audits by the field formations and disseminate audit outcomes to appropriate stakeholders and perform other functions as per the Model All India GST Audit Manual.

- Experts noted that the audit manual acts as a guide to both the taxpayers and the team conducting the audits.

- Recommending a uniform process for the selection of audit cases, the manual has suggested weightage-based criteria under which taxpayers filing Form GSTR- 3B and Form GSTR-1 are selected.

- Secondary data sources such as data from other indirect levies or income tax can be considered.

- The final selection of taxpayers to be audited may be done based on the descending order of the final score thus calculated.

- Further, a selection committee should be constituted to identify various risk parameters for selection for audit and some cases can be taken on a random basis or based on local parameters such as intelligence inputs and past behaviour.

- For follow-up audits, if the tax, interest, penalty or any other amount payable by the registered taxpayer as have been ascertained as short paid or not paid, is not deposited within 30 days after the issuance of the final audit report, the case is required to be referred to the respective jurisdiction and the case may be taken up for initiation of demand and recovery proceedings.

Tata's military-grade satellite successfully placed into orbit

- India's first military-grade geospatial satellite manufactured in the private sector has been successfully launched and placed in orbit, with full functionality expected to be achieved within a few months.

- Built by Tata Advanced Systems Ltd ( TASL ) at its Vemagal facility in Karnataka , the TSAT-1A was onboard the Bandwagon-1 mission launched by SpaceX's Falcon 9 rocket in Florida .

- The sub-metre resolution imaging satellite has given a signal that it is in the right orbit and tests will be run on it for the next few weeks before it is fully functional , TASL officials stated.

- The satellite will provide military-grade imagery with a high resolution of less than one metre per pixel that will be downloaded and processed at a ground centre in India that is being built by

- While India has a few military spy satellites built by ISRO , this is the first such initiative in the private sector.

- The company plans to put up a constellation of such satellites in the future and its manufacturing facility is geared to produce up to 25 low earth orbit (LEO) satellites

- The satellites are being manufactured in collaboration with Satellogic Inc , a leader in sub-metre resolution earth observation satellites.

India's fuel demand up by 5% y-o-y in FY24, a new financial year record

- India's fuel consumption declined by 0.6 percent year-on-year (y-o-y) in March .

- However, demand for the 2024 financial year increased by about five percent , primarily due to higher sales of automotive fuel and naphtha.

- Preliminary data from the Petroleum Planning and Analysis Cell (PPAC ) of the oil ministry showed that the total consumption, a proxy for oil demand, stood at 21.09 million metric tonnes (4.99 million barrels per day) in March.

- This was a slight decrease from 21.22 million tonnes (5.02 mbpd) recorded in the same period last year.

- However, fuel demand for the financial year ending in March 2024 reached a record high of 276 million tonnes (4.67 mbpd), up from 223.021 million tonnes (4.48 mbpd) the previous year.

- Diesel sales, primarily used by trucks and commercial passenger vehicles, increased by 3.1 percent y-o-y to 8.04 million tonnes in March and was up 4.4 percent for the previous fiscal year.

- Meanwhile, sales of gasoline in March grew by 6.9 percent y-o-y to 3.32 million tonnes and were up 6.4 percent for the fiscal year.

- Sales of Bitumen , crucial for road construction, remained largely stable in March but saw a 9.9 percent rise for the fiscal year.

- Sales of liquefied petroleum gas (LPG), commonly known as cooking gas, increased by 8.6 percent to reach 2.61 million tonnes, and naphtha sales saw a significant rise of 5.5 percent to about 1.19 million tonnes, compared to the same period last March.

- The usage of fuel oil, on the other hand, experienced a decline of 9.7 percent y-o-y in March and declined by 6.3 percent for the fiscal year.

CURRENT AFFAIRS : APPOINTMENTS & RESIGNATIONS

Manoj Panda Appointed as Member of the 16th Finance Commission by the Central Government

- Manoj Panda, formerly the director at the Institute of Economic Growth, has been appointed as a full-time member of the 16th Finance Commission by the Government of India (GoI).

- The 16th Finance Commission is responsible for formulating recommendations on the revenue-sharing formula between the central government and states for the 5-year period starting from April 2026.

- Panda's tenure as a member of the Commission will last from the date of assuming office until either the submission of the Commission's report or October 31, 2025 , whichever comes earlier.

- He replaces Niranjan Rajadhyaksha, Executive Director at Artha Global, who resigned from his position as a member of the Commission due to unforeseen personal circumstances.

About Manoj Panda :

- Manoj Panda has an extensive background in economics, having served as the Director of the Centre for Economic and Social Studies (CESS) in Hyderabad, as well as holding positions as a Professor and Associate Professor at the Indira Gandhi Institute of Development Research (IGIDR) in Mumbai.

- He has also contributed to economic research as an economist and senior economist at the National Council of Applied Economic Research in New Delhi.