dVIDYA : e-learning | CA/CS/CMA Foundation | CBSE/ISCE/Boards- Class 11-12 | Competitive Exams

Practical Assignments : GST Accounts–Tally

The Practical Assignments-Tax Accounts- covers Basic tasks of Maintaining GST Accounts, from set up, Data Entry to GST Reports, in Tally Prime Rel 3.x.

This assignment is in continuation to Practical Assignments of Basic Financial Accounting & Basic Invoicing & Inventory Accounts. Maintain GST Accounts in the same Company in which Basic Financial Accounts and Basic Invoicing & Inventory Accounts Practical Assignments data were entered.

Perform the operations for each Assignment as explained. Capture the screenshots (Prtscr) and paste it in MS Word file in 1×1 cell. Write the number and Name of screen shot as indicated. Explain the options and operational step.

This way, capture the screenshots and place in MS Word file, in sequence. Don’t repeat same screenshot.

After completing all assignments, take Back up of the data files. Now email to [email protected], attaching the Data Back Up file and screenshot zip file.

GST Accounting – Practical Assignments

Continue in same Company after previous assignments

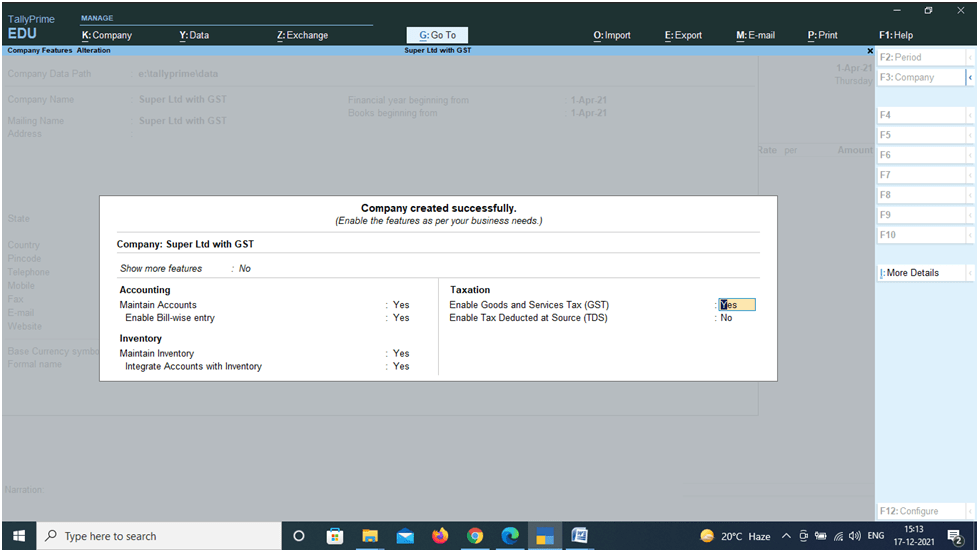

01-1 Company GST Features

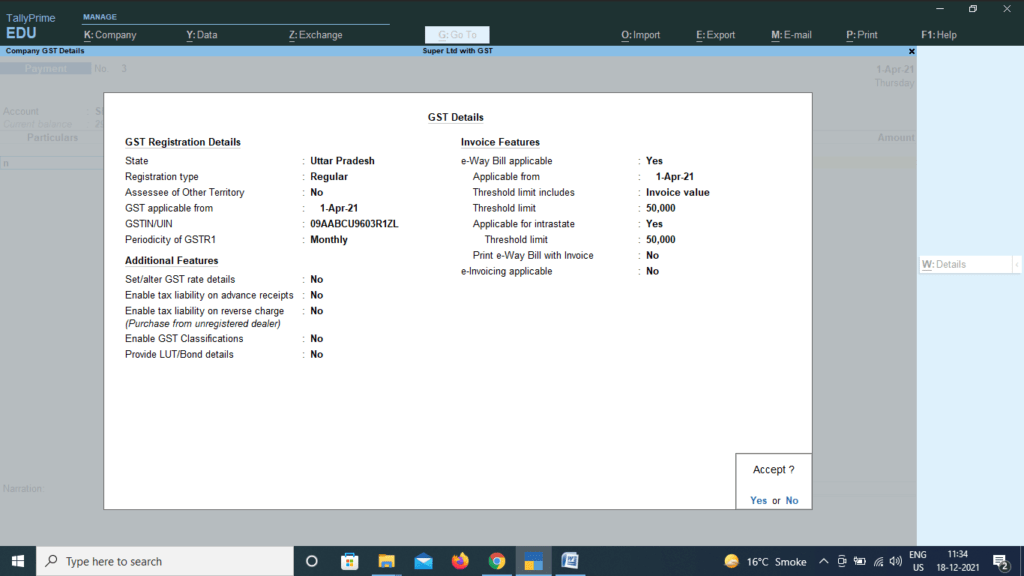

[At Company >Click F11. At Company Features , under section Taxation , set Yes at Enable Goods & Services Tax (GST) . Next, At GST Details screen , under GST Registration Details section, enter the relevant details.]

Capture Screenshot 1-1A : Company Features . 1-1B : Company GST Details set up

For more details, visit

https://dvidya.com/goods-service-tax-gst/ https://dvidya.com/goods-services-tax-gst-set-up-composition-dealers-tally/ https://dvidya.com/goods-services-tax-gst-set-up-regular-dealers-tally/ https://youtu.be/STv3wbduT8A https://youtu.be/RwJJIYC6msE https://youtu.be/VSS48c_LZXY https://youtu.be/OjSvFYUJ_bI https://youtu.be/mLrLyOeDX78 https://youtu.be/7wlTsturfks

02 GST Masters

02-1 Create SGST Ledger Account Master

[Select GoT>Create> Ledger. At Ledger Account creation , at Name , enter SGST; at Under , select Duties & Taxes ; at Tax Type , select SGST/UTGST ; At Inventory Values are affected , set No .

Capture Screenshot 1-2 : SGST Ledger Account Creation.

https://dvidya.com/gst-set-up-accounts-inventory-masters-tally/ https://youtu.be/x8VZLjVEeug https://youtu.be/XVZbi0-ufDY https://youtu.be/Uzsise4yZXg

02-2 Create CGST Ledger Account Master

[Select GoT>Create> Ledger. At Ledger Account creation , at Name , enter CGST; at Under , select Duties & Taxes ; at Tax Type. At Inventory Values are affected , set No . Capture Screenshot 2-2 : CGST Ledger Account Creation.

02-3 Create IGST Ledger Account Master

[Select GoT>Create> Ledger. At Ledger Account creation , at Name , enter IGST; at Under , select Duties & Taxes ; at Tax Type select I GST ; At Inventory Values are affected , set No .

Capture Screenshot 2-3 : CGST Ledger Account Creation.

https://youtu.be/XVZbi0-ufDY

02-4 UQC set up in UoM Master

Set UQC in UoM – Kilograms [Select GoT>Alter> Unit. Select Kilogram. At Unit Alteration , at Unit Quantity Code (UQC) , select KGS-Kilograms from the UQC list. Press Ctrl+A to save].

Capture Screenshot 2-4 : UoM-UQC set up.

https://youtu.be/KAKto78n9fQ

02-5 GST details set up in Stock Item Master

Set GST details in Stock Item Wheat, Select GoT>Alter> Item. Select Wheat, At Stock Item Alteration, Under HSN/SAC & Related Details, at HSN/SAC Details , select Specify Details Here. At HSN Description – Food grains, HSN Code- 1234, At Description of Goods, select Specify Details Here , Under GST Rate and related Details, At GST Rate details, select Specify Details Here . At Taxability Type, select Taxable . At GST Rate, enter the GST Rate applicable for the Item. At Type of Supply, select Goods .

2-5 : Capture Screenshot UoM-UQC set up.

https://youtu.be/U7fuonC9dkI https://youtu.be/LK-df_Oh6Vk

02-6 Set GST details in Supplier Master

At Supplier Ledger Account, enter Tax related details [Select GoT>Alter>Ledger, select ABC & Co. At Ledger Alteration, click F12:Configure. At Ledger Master Configuration screen, under Party Tax Registration details , set Yes at Provide GST Registration details . At Tax Registration details of Ledger Account Master, Enter Registration Type- Regular, GSTIN 19AAAC1234K1ZV. At Set Alter Additional Details, set Yes and then Place of Supply, select the State of the Party.

Capture Screenshot : 2-6A: Ledger Account Master, 2-6B: Ledger Master Configuration screen,

https://youtu.be/1_jlZD8mXkI https://youtu.be/B6jEPMw26Tg

03 GST Invoicing

3-1 Create GST Sales Invoice .

Create Sales Invoice for 10 kg of Wheat @25 per kg sold to ABC & Co on 1-5-21. [Select GoT>Vouchers. Click F8:Sales (or press F8). Select Sales Voucher type from List. Click Ctrl+H and select Item Invoice . Enter Voucher Date 1-5-21 . At Party A/c Name , select ABC & Co . At Sales Ledger, select Sales . At Name of Item , select Wheat , At Quantity , enter 10 kg. at Rate , enter 25/kg. The amount 250 would be shown. In next line, select End of List . Next select SGST, the SGST amount (15.00) would be auto calculated. Next select CGST. the CGST amount (15.00) would be auto calculated. The total Invoice amount (250.00+15.00+15.00 = 280.00) is displayed. Press Ctrl+A to save the Voucher].

Capture Screenshot : 3-1 GST Sales Invoice Entry ,

https://youtu.be/L57aR4Zb7GM https://youtu.be/S0y56oS7r1U

3-2 Print the Sales Voucher

Voucher dated 1-5-23 on ABC Co [Select GoT>Day Book . At Day Book display, press F2 and Date 1-5-23. Select the Sales Voucher from the list to get the Voucher Alteration. Press Ctrl+P to get the Print screen. Click I:Preview to View the Print form of the Invoice on screen]

Capture Screenshot : 3-2 GST Sales Invoice in Print ,

https://youtu.be/L57aR4Zb7GM https://youtu.be/S0y56oS7r1U

03-03 GST Reports

- Display GSTR-1 for 1-4-23 to 31-7-23

[Select GoT>Display more reports>GST Reports>GSTR-1. Click F2:Period (or press F2) and enter Period from 1-4-23 to 31-7-23 to display GSTR-1 Report

Capture Screenshot : 3-3 GSTR-1 Display, https://dvidya.com/gsrt-1-return-filing-tally/

Dvidya: Hello Student, How can I help you!

Ask Question, Get Answer

This will close in 0 seconds

- Kindle Store

- Kindle eBooks

- Social Sciences

Promotions apply when you purchase

These promotions will be applied to this item:

Some promotions may be combined; others are not eligible to be combined with other offers. For details, please see the Terms & Conditions associated with these promotions.

Buy for others

Buying and sending kindle ebooks to others.

- Select quantity

- Buy and send Kindle eBooks

- Recipients can read on any device

These ebooks can only be redeemed by recipients in the India. Redemption links and eBooks cannot be resold.

Download the free Kindle app and start reading Kindle books instantly on your smartphone, tablet or computer – no Kindle device required .

Read instantly on your browser with Kindle for Web.

Using your mobile phone camera, scan the code below and download the Kindle app.

Image Unavailable

![tally prime practical assignment pdf TallyPrime Book (Advanced Usage)-with Practical Assignments: TallyPrime Book [ with Updated GST ] having 17 Chapters & 45 Practical Assignments.](https://m.media-amazon.com/images/I/41yQHTCO38L._SX342_SY445_.jpg)

- To view this video download Flash Player

Follow the author

TallyPrime Book (Advanced Usage)-with Practical Assignments: TallyPrime Book [ with Updated GST ] having 17 Chapters & 45 Practical Assignments. Kindle Edition

Learn TallyPrime [ with Updated GST ] having 17 Chapters & 45 Practical Assignments at Your Home !

Best Place to Learn & Implement TallyPrime with GST at Your Home & Business !

Best Suitable for Businessman, Students, Executives & Teachers.

More than 3000 copies has been sold.

Log on : https://tallyprimebook.com

To know more, Call me... 9437264738

- Print length 504 pages

- Language English

- Publication date 3 December 2020

- File size 83045 KB

- Page Flip Enabled

- Word Wise Enabled

- Enhanced typesetting Enabled

- See all details

Customers who read this book also read

Product details

- ASIN : B08PNQBX7Y

- Language : English

- File size : 83045 KB

- Text-to-Speech : Enabled

- Screen Reader : Supported

- Enhanced typesetting : Enabled

- X-Ray : Not Enabled

- Word Wise : Enabled

- Print length : 504 pages

- #9 in Finance & Accounting Exam eBooks

- #413 in Education (Kindle Store)

- #927 in Business & Investing eBooks

About the author

Sanjay satpathy.

Discover more of the author’s books, see similar authors, read author blogs and more

Tally Practical Questions and Answer PDF (Free Download)

Through today’s post, we are going to share Tally Practical Questions and Answer PDF with you, which you can download for free using direct download link given below in this post.

If you are studying Tally, then today’s notes can be very important for you, because in today’s notes, some important questions of Tally have been given along with their answers, with the help of which you can practice.

Tally Practical Questions and Answer PDF

Practical questions and answers of tally pdf.

If you are preparing for competitive exam of banking then study of tally becomes very important, because questions related to tally are also asked in the recruitment exam of banking.

Along with this, practical questions have also been given in this notes with their solutions, by solving which you can practice tally.

This PDF Notes can be very beneficial for you to practice Tally, that’s why must download it for free.

Download Tally Practical Questions and Answer PDF

To download the practical questions and answers of tally in pdf format, just follow the below mentioned download button.

Through this post, we have shared Practical Questions and Answers of Tally PDF with you, I think, you liked the information shared in this post, if you liked, please do share with your friends as well.

Related Post-

- A to Z Shortcut Keys in MS Word PDF

- Internet Notes in Hindi PDF

- Generation of Computer Notes in Hindi PDF

- Computer Awareness in Hindi PDF

- Python Notes in Hindi PDF

Important Posts

RRB ALP Notification 2024 PDF Free Download

Kedareswara Vratham Vrat Katha Telugu PDF Free Download

Kalnirnay 2024 Marathi Calendar (कालनिर्णय मराठी कैलेंडर) PDF Free Download

Kalnirnay January 2024 Calendar Marathi PDF Free Download

UP Board Class 10 Exam Time Table 2024 PDF Download

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Tally Prime Course Notes : GST Ledger and Voucher Entry

Tally Prime with GST Course Notes with Example. Step by Step Guide for GST implementation, create CGST, SGST, IGST ledgers, Sample Purchase and Sales entry with GST. Computer Training Institute Notes with practice assignment PDF is very useful for learners.

GST (Goods and Service Tax)

CGST – Centre Goods and Service Tax SGST – State Goods and Service Tax IGST – Integrated Goods and Service Tax

GST Rates slab in India

Tally prime course notes with gst : step by step guide.

Open New Company : F3 Company >Create Company

Activate GST in Tally Prime

Taxation Enable Goods and Service Tax (GST): Yes

GST Details State : Uttar Pradesh Reg Type : Regular GSTIN : 09AABCU9603R1ZL Periodicity : Monthly

Accept GST details and Accept Statutory and Taxation

Create GST Ledgers in Tally Prime

Gateway of Tally > Create > Ledgers

CGST Name : CGST Under : Duties and Taxes Type of Tax : GST Tax Type : Central Tax

SGST Name :SGST Under : Duties and Taxes Type of Tax : GST Tax Type : State Tax

IGST Name :IGST Under : Duties and Taxes Type of Tax : GST Tax Type : Integrated Tax

Purchase Under : Purchase Account GST Details : Applicable Type of Supply : Goods

Sales Under :Sales Account GST Details : Applicable Type of Supply : Goods

SBI Bank Under : Bank Account

Ledger for Purchase Party

Super Computer Store

Under : Sundry Creditors State : Uttar Pradesh Reg Type : Regular GSTIN : 09AABCD1203R1ZL Set Alt GST details : No

Delhi Computer Traders

Under : Sundry Creditors State : Delhi Reg Type : Regular GSTIN : 09AABCD1203R1ZL Set Alt GST details : No

Ledger for Sales Party

Sudhir Saini Under : Sundry Debtors Set Alt GST details : No State : Uttar Pradesh

Sanju Rawat Under : Sundry Debtors Set Alt GST details : No State : Uttarakhand

Stock Group Creation : Gateway of Tally> Create > Stock Group

Computer Parts Under : Primary Set / Alt GST : No

Note: If all the items of a group have same GST rate, than GST rates can be set for groups. But for training purpose, we will set GST rate for each individual items.

Create Unit : Gateway of Tally> Create > Stock Units

Symbol : Pcs Name : Pieces

Create Stock Items with GST Rates in Tally Prime

Gateway of Tally> Create > Items

Keyboard –Dell Under : Computer Parts Unit : Pcs GST : Applicable Set/Alter GST : Yes Calculation Type : On Value Taxability : Taxable Tax Type : Integrated : 18% Type of Supply : Goods

Keyboard – HP Under : Computer Parts Unit : Pcs GST : Applicable Set/Alter GST : Yes Calculation Type : On Value Taxability : Taxable Tax Type : Integrated : 18% Type of Supply : Goods

Mouse (Normal) Under : Computer Parts Unit : Pcs GST : Applicable Set/Alter GST : Yes Calculation Type : On Value Taxability : Taxable Tax Type : Integrated : 18% Type of Supply : Goods

Mouse (Cordless) Under : Computer Parts Unit : Pcs GST : Applicable Set/Alter GST : Yes Calculation Type : On Value Taxability : Taxable Tax Type : Integrated : 18% Type of Supply : Goods

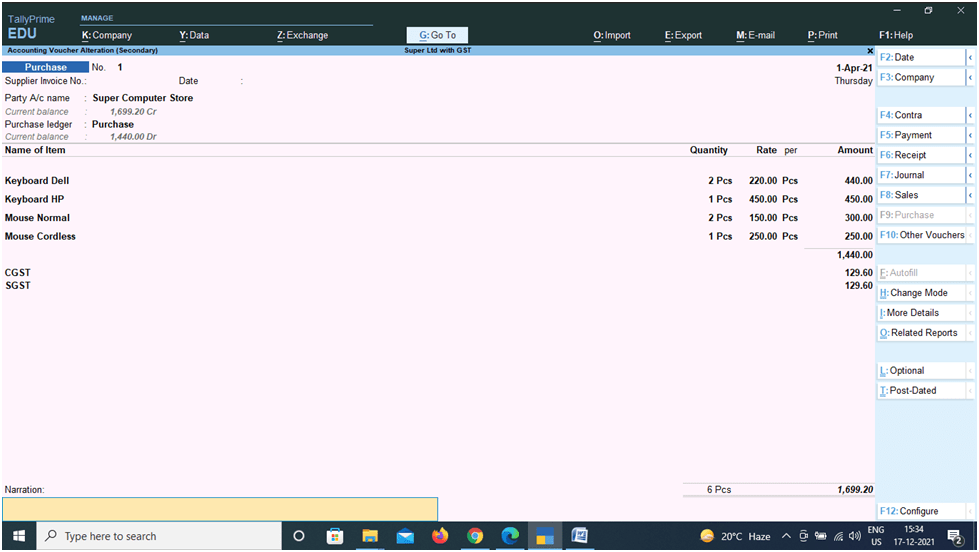

Purchase the Items with GST in Tally Prime

Purchase with in state: cgst and sgst applicable.

Gateway of Tally > Voucher > F9 (Purchase) Party Account : Super Computer Store

Enter and Accept : Our company is Registered in Uttar Pradesh and supplier Super Computer Store is also from Uttar Pradesh (Same State). Therefore, CGST and SGST are applicable. Screen Shot is shown below:

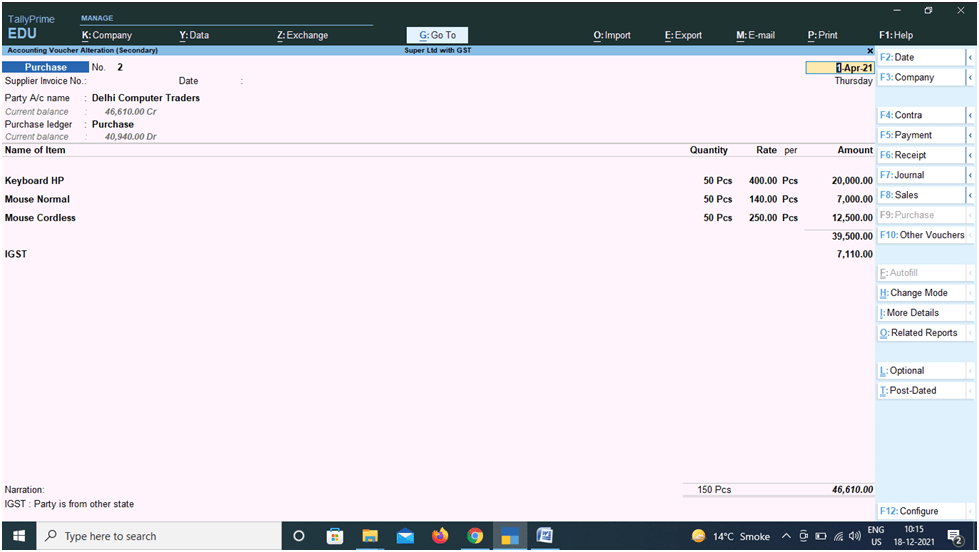

Purchase from Other State : IGST Applicable

Gateway of Tally > Voucher > F9 (Purchase) Party Account : Delhi Computer Traders

Our company is Registered in Uttar Pradesh and supplier Delhi Computer Trader is from Delhi (Other State). Therefore, IGST are applicable, in place of SGST and CGST. Screen Shot is given below:

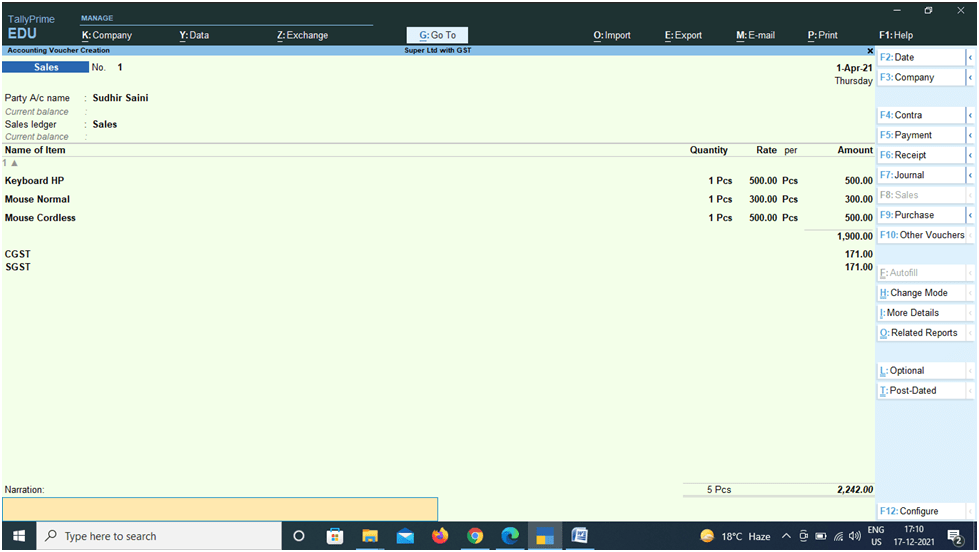

Sales the Items: with in State : CGST and SGST Applicable

GOT > Account Voucher > F8 (Sales) Party Account : Sudhir Saini

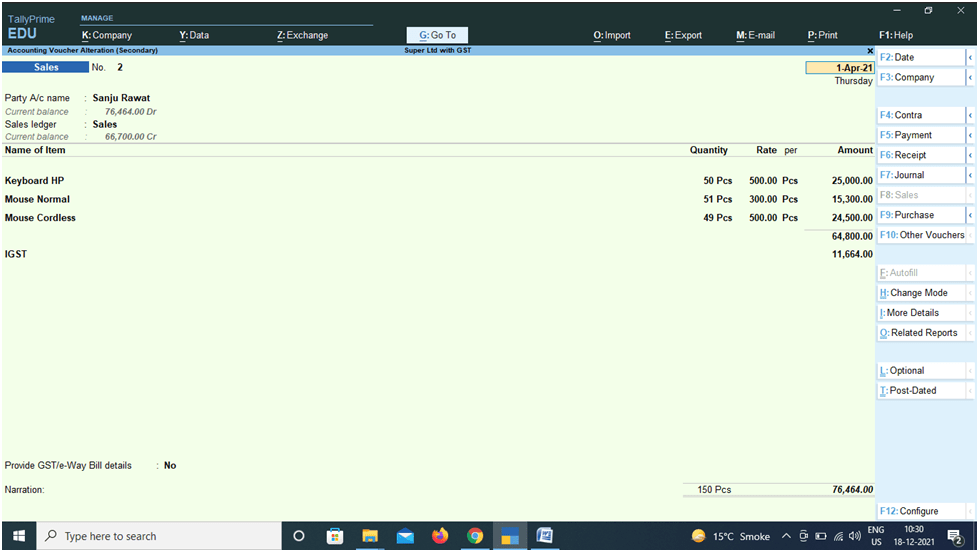

Sales the Items: Other State : CGST and SGST Applicable

GOT > Account Voucher > F8 (Sales) Party Account : Sanju Rawat ( Uttarakhand) Sales Ledger : Sales

Check Reports

Display More Report > Statement of Accounts > Outstanding > Receivable/ Payables Balance Sheet

Receive Amount against Sale

Gateway of Tally > Voucher > F6 (Receipt) Account : Cash Cr Sudhir Saini : 2242 Accept

Account : SBI Bank Cr Sanju Rawat : 76464 Accept

Make Payment to Supplier

Gateway of Tally > Voucher > F5 (Payment) Account : Cash Super Computer Store (Dr): 1699.20 Accept

Account : SBI Bank Dr Delhi Computer Traders : 76464 Accept

Report Balance Sheet > Current Liabilities

Duties and Taxes : 4636.80 CGST : 41.40 IGST : 4554.00 SGST : 41.40

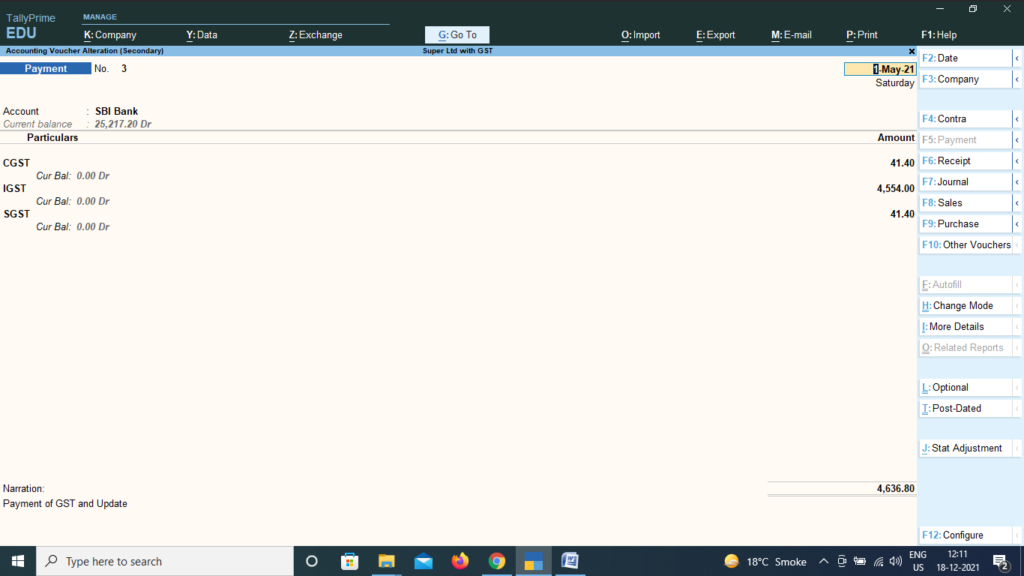

Pay GST and Update in Tally Prime

Gateway of Tally > Vouchers >Payment (F5) Change Date F2 – 1.5.2021 ( For Tally training version)

Account -SBI Bank CGST : 41.40 SGST : 41.40 IGST : 4554.00 Total : 4636.80 Mode of Payment : Net banking / Name of Bank : SBI

Check Balance Sheet > Current Liabilities > Duties and Taxes – NIL

Tally Prime Course Notes PDF Download

Download Tally Computer Course Notes and Practice Assignment Bill Book PDF :

Tally Prime Notes : All Topic

Related Posts

Payroll tally notes with assignment, gst implementation in tally notes, fundamental of accounting and tally prime notes, introduction of tally prime notes, leave a comment.

Your email address will not be published. Required fields are marked *

IMAGES

VIDEO

COMMENTS

A Self-Study Practical Assignment on TallyPrime-Rel.4 TallyPrime-4 [Practical Assignment] Page: 3 Visit us: www.tallyprimebook.com Instruction : All are requested to attempt all Practical Assignment given after every Chapter with the help of your own TallyPrime Software, otherwise you will not able to display your Reports and Statements. After

Our e-Book, "Practical Assignment on TallyPrime 4.1," is a comprehensive guide that will help you master this powerful accounting software. Whether you are a beginner or an experienced user, this guide will take you through the various features and functionalities of TallyPrime 4.1, helping you become proficient in its usage.

The visitors may visit www.tallysolutions.com, the web site of Tally Solutions Pvt. Ltd. for resolving their doubts or for clarifications Trademark: TallyPrime, Tally, Tally9, Tally.ERP 9, Tally.Server9, Tally.NET & 'Power of Simplicity' are either ... Practical Assignment - 22 CHAPTER-6 GST REPORTS TO FILE GST RETURNS IN TallyPRIME-3.*

Complete Step by Step Training Guide, with practice assignment for Tally computer course. Notes PDF are very useful to learn Tally for self business and work as Tally operator. About the Tally Prime Book PDF. There are total 11 parts PDF parts of this Tally Prime book. 9 Pars PDF cover all the relevant topics and 2 Annexure of Bill books.

The Practical Assignments-Tax Accounts- covers Basic tasks of Maintaining GST Accounts, from set up, Data Entry to GST Reports, in Tally Prime Rel 3.x. This assignment is in continuation to Practical Assignments of Basic Financial Accounting & Basic Invoicing & Inventory Accounts. Maintain GST Accounts in the same Company in which Basic ...

But, there is no such requirement, any one who are willing to learn, can easily work on tally Prime. We are going to share Tally computer Course Training Notes with Practice Example and Assignment PDF. One can easily learn Tally Prime with in one month with the help of Notes. The Topic wise notes are given below.

Reading information. Learn TallyPrime with practical examples - Ebook written by Bimlendu Shekhar. Read this book using Google Play Books app on your PC, android, iOS devices. Download for offline reading, highlight, bookmark or take notes while you read Learn TallyPrime with practical examples.

Case Study 1 Tally Prime Exercise - Free download as PDF File (.pdf), Text File (.txt) or read online for free.

TALLY PRIME STUDY GUIDE - Free ebook download as PDF File (.pdf), Text File (.txt) or read book online for free. Tally prime

Tally prime with GST Practicals purchas invoice with gst (local 32bsmpk7018m1zf bills no party names item names gst rate quantity rate mouse nos 850 keyboard 10 ... Assignment - Tally prime with GST Practicals. Tally prime with GST Practicals. Course. MCQs on GST. 28 Documents. ... Practice materials. 100% (1) 2. GST Mcq 15 - MCQs on GST. MCQs ...

TallyPrime - Practical Assignment: Learn & Practice Tally Prime Accounting Software with Practical Assignment at your Home & Office. Sanjay Kumar Satapathy. Kindle Edition. 1 offer from ₹150.00. Tally Prime 2.0 with GST: Tally Prime Beta version. V Mishra.

TallyPrime, Tally, Tally9, Tally.ERP 9, Tally.Server9, Tally.NET & 'Power of Simplicity' are either registered ... All are requested to attempt all Practical Assignment given after every Chapter with the help of your own TallyPrime Software, otherwise you will not able to display your Reports and Statements. After going through all

We found that student face problem to find the practice assignment of Tally. The Training Faculty of Super Success Institute compiled the practice task in this PDF for self study of students. Our Tally Coaching Class Assignment / task includes following:-. Purchase Invoice Bills Sundry Creditors. Sales Invoice Bills Sundry Debtors.

Get In Touch 011-43522158 More about Right Button Bar is given below. Let us explore a little more about the buttons on the right button bar. • -F2, F3, F12 options remain constant on all screens, transactions, masters and reports. • -F4 to F10 each one has a preset but different action in transactions, masters, and reports. • Ctrl+B/H/J -has present actions only in reports.

This article provides a comprehensive guide to the Tally Prime Practical Assignment With Solutions Pdf, with step-by-step solutions and helpful illustrations. Tally Prime is an accounting software…

Check Pages 1-50 of Tally_Assignment in the flip PDF version. Tally_Assignment was published by bhimgautam345 on 2020-02-18. Find more similar flip PDFs like Tally_Assignment. Download Tally_Assignment PDF for free.

[34-Practical Assignment-TallyPrime] Press Ctrl + A to save. Note - Create only one ledger for Purchase i.e. Purchase Account and One Ledger for Sale i.e. Sale Account for both within State and Outside State Transactions. [Practical Assignment] Create the following Purchase & Sales Ledgers:

Premium Notes. Join Telegram. Through today's post, we are going to share Tally Practical Questions and Answer PDF with you, which you can download for free using direct download link given below in this post. If you are studying Tally, then today's notes can be very important for you, because in today's notes, some important questions of ...

Tally Prime with GST Course Notes with Example. Step by Step Guide for GST implementation, create CGST, SGST, IGST ledgers, Sample Purchase and Sales entry with GST. Computer Training Institute Notes with practice assignment PDF is very useful for learners. GST (Goods and Service Tax) CGST - Centre Goods and Service Tax

assignment for tally prime - Free download as PDF File (.pdf), Text File (.txt) or read online for free. 1) The document provides instructions for setting up a new company called "Jindal Electronics, Metro Market, Mathura" in TallyPrime accounting software. It includes steps for creating the company, setting features and GST details, recording initial transactions, creating ledgers, stock ...

The visitors may visit www.tallysolutions.com, the web site of Tally Solutions Pvt. Ltd. for resolving their doubts or for clarifications Trademark: TallyPrime, Tally, Tally9, Tally.ERP 9, Tally.Server9, Tally.NET & 'Power of Simplicity' are either ... Practical Assignment-22 CHAPTER-6 GST REPORTS TO FILE GST RETURNS 6.1. GSTR -1 Report in ...

Tally Payroll Notes in PDF. Download. Tally Practice Set in PDF. Download. Tally Practice Set 2 in PDF. Download. Tally Practical Assignment in PDF Download. See Also:- " Click Here ". Tally Practical Assignment in PDF Download.

Sale of Goods and Services in a Single Invoice with multiple GST Rate. 5.3.5. GST Sale of a Composite Supply (Sale of Items & Goods with Expenses Apportioning) 5.3.6. Sale of 'Nil-Rated' , 'Exempted', Supplies using TallyPrime. 5.3.7. Ledger to Round-off the Invoice Value Automatically in Sale Invoice. 5.3.8.