5 Steps To Setting Up Your Property Sourcing Business Legally and Properly

Setting up your property sourcing business to be compliant can be a lot of work. Read our Ultimate Guide to Property Sourcing & Deal Packaging first so you can avoid the unnecessary expense of going the compliant route.

If you’re thinking about setting up a property sourcing business, one of your biggest concerns should be how to set up your business legally and properly. If you don’t get this right, there could be consequences to your business and to you individually as the business owner. So before you start doing any business, make sure that you’ve gone through the appropriate legal steps.

To help you, I’ve listed the 5 most important factors in ensuring your property deal sourcing business is set up correctly:

1. Setting up as a property sourcing business

The first thing to think about is whether your business is in fact, a property sourcing business. If you’re purely sourcing properties for yourself, rather than packaging and selling on for a fee, you don’t have to set up a sourcing business. If you’re going to be a property sourcing business, you will need to have all of the relevant legal checks in place.

2. Registering with HMRC and Regulators

The property industry is highly regulated to protect all parties that are involved in property transactions. Property deal sourcing comes under the same category as estate agents in terms of governance, so we have to work by the same rules.

You must register your business with HMRC in the correct way, so select the relevant set up such as limited company, sole trader or limited liability partnership.

The property industry is governed by three separate ombudsman schemes, which offer independent bodies for customers to raise complaints through. This would happen if the customer wasn’t happy with the way that you dealt with their complaint, so the ombudsman is the next stage of escalation.

The three property ombudsman schemes are: Ombudsman Services, The Property Ombudsman (TPO) and the Property Redress Scheme (PRS). Property deal sourcers must be members of one of these schemes. Goliath Property Solutions are members of the PRS, which costs around £95 plus VAT each year.

3. Register for Anti Money Laundering Legislation

Criminals often use the property industry to launder money. If you’re not familiar with the term, money laundering basically means that they try to hide the money that they gained through criminal activity by using what looks to be legitimate methods.

Property sourcing businesses must be registered with HMRC for the Anti Money Laundering Legislation. This means that any suspicions of such activities must be reported and you can be subjected to fines if you are deemed to have not taken appropriate action.

4. Taking out Insurances

Setting up the correct types of insurance will protect you from potential issues such as being sued. In the property industry, where large sums of money are involved, this is more common than you might think. For example, you may find yourself in a situation where investors try to sue you for what they perceive to be giving incorrect information on a deal. If you take out the correct types of insurances, you will protect yourself from this.

The two types of insurances we have as brokers, are professional indemnity insurance and public liability insurance. It is really important that you get these set up, ours costs around £500 per year for the combined policy.

5. Register under Data Protection Act

We also have huge responsibilities in regards to data protection. We are holding lots of personal information about buyers, sellers, landlords etc. and we are responsible for protecting that information. Property sourcing businesses must register under the Data Protection Act with the Information Commission Officer. This only costs £35 per year and is really important.

We’re not trying to scare people but property is an industry where you must comply with all the regulations and register and set up correctly. Missing anything out could lead to huge consequences; look at what happened with PPI/miss-selling etc. You really do need to ensure that you dot all of the i’s and cross all the t’s when it comes to setting up a property sourcing business.

Ensure you’re set up correctly by downloading our free ‘Property Deal Sourcing Business Setup Checklist’ below.

FREE RESOURCES:

© All Rights Reserved Mark Dunsmore

PRIVACY POLICY | TERMS & CONDITIONS | DISCLAIMER

You are using an outdated browser. Please upgrade your browser to improve your experience.

- February 25, 2019

- — Property Market Insights

CASAFARI’s Property Sourcing: A How-To Guide

- Property Sourcing

Most countries in the world suffer from the same problem: chaos, a lack of access to public records when it comes to real estate, making navigating the property market a non-straightforward process. Not only are homebuyers, owners and rents lost, but it also means that the professionals of the sector operate without essential real estate data to help them streamline their work and advise their clients.

Which is why the Property Sourcing is one of the most central products of CASAFARI: it accomplishes our mission to solve chaos and bring transparency to the property market by aggregating millions of listings from thousands of sources every day.

See which features of our Property Sourcing allow you to have access to the largest real estate database in Europe.

Property Sourcing: an improved experience for your property search

What we’ve learnt from real estate professionals is that staying updated on daily market activity is a time-consuming process, involving multiple internet tabs open on dozens of online sources. Well, not anymore!

CASAFARI Property Sourcing is a centralised information on the entire property market. This application is designed for you to be able to quickly:

- source new properties and find market opportunities;

- track your own portfolio and identify exclusivity breaches;

- monitor the activity of competitor agencies;

- prepare for meetings with clients thanks to the access to all past information about a property;

- grow your portfolio with FSBO leads.

Improve your property sourcing and find the perfect place for your clients

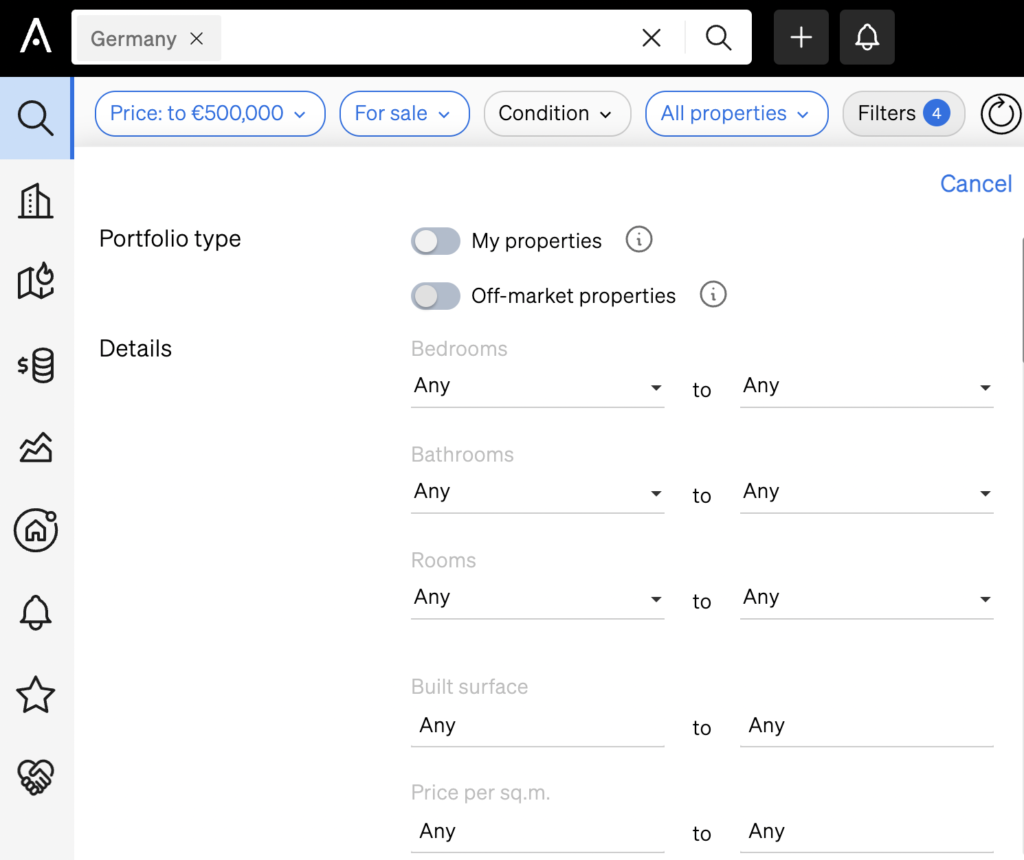

You can search by tenths of filters to find the property that matches the exact needs of your client or the market information needed for your daily tasks. Some of the filters offered on our Property Sourcing are:

- Price range and type of business (rent or sale);

- Condition of the property (new, very good, to refurbish, new);

- Amount of rooms;

- Year of construction, energy certificate, and built surface;

- Property type (house, apartment, studio, building, plot, office, etc.);

- Characteristics (balcony, elevator, garage, swimming pool, etc.);

- Who’s listing it.

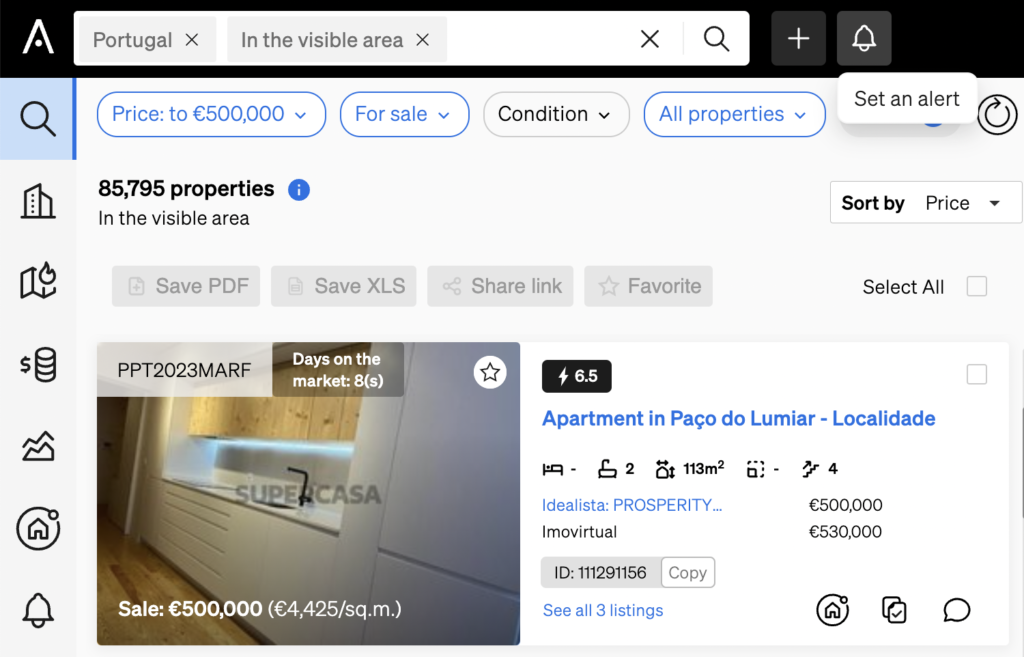

Setting Alerts for recurring property searches

But let’s say you’re on the look for a specific type of property for a client, something that’s not that easy to find. You certainly wouldn’t want to run the same search everyday, right?

Worry not, we’ve got you covered! Inside Property Sourcing you can set Alerts and get notified every time a new property that matches your criteria is put on the market. You only need to click on the bell icon beside the search engine.

Gather more property leads with CASAFARI: get to know Alerts

Search by reference

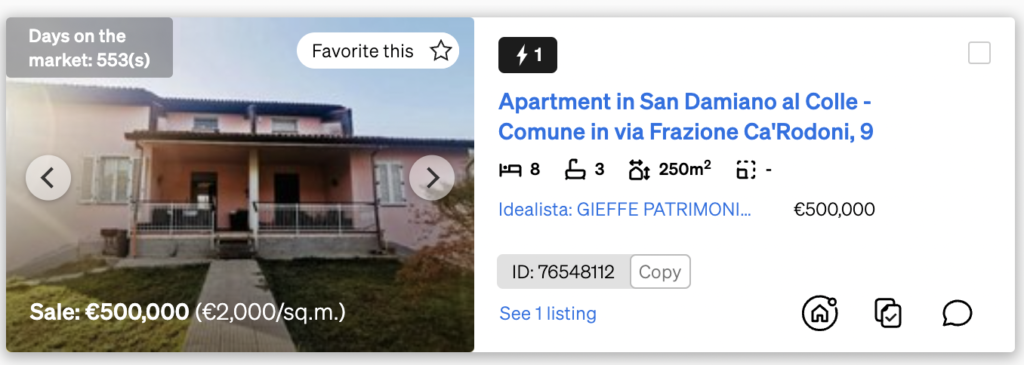

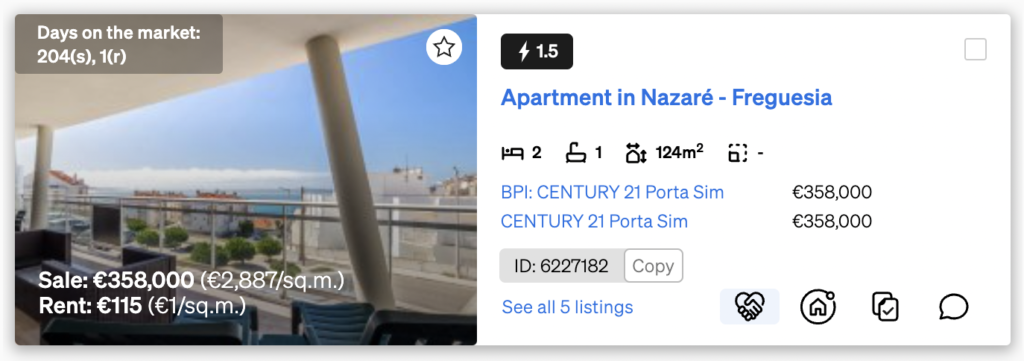

Every real estate listed online has a unique reference number that you can input in the search engine of CASAFARI Property Sourcing. The property will appear instantly and, if you want to stay updated with it, you simply have to add it to your Favourites (more on that later!).

This feature is useful to keep track of what’s in your portfolio and your competitor’s without having to manually scroll through all that’s available on the market.

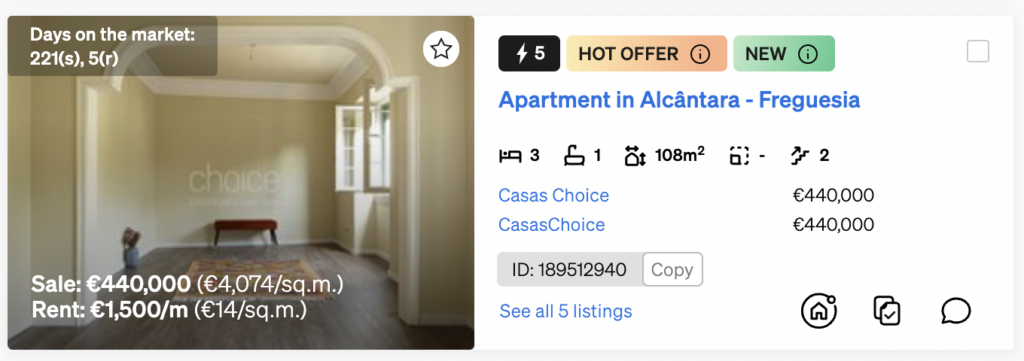

HOT OFFER and NEW labels

Inside CASAFARI’s Property Sourcing you can see labels that help you identify new properties put on the market and hot opportunities that are available for buyers.

These labels are meant to give you a competitive edge, whether it’s helping you act fast on competitive markets or making your property

Ratings for properties

The properties shown inside our search engine also go through our scoring system, in order to help you select the most interesting properties available and quickly evaluate their desirability . Take a look and see which factors are taken into account to provide these ratings!

NEW: Labels and scores for the best market opportunities

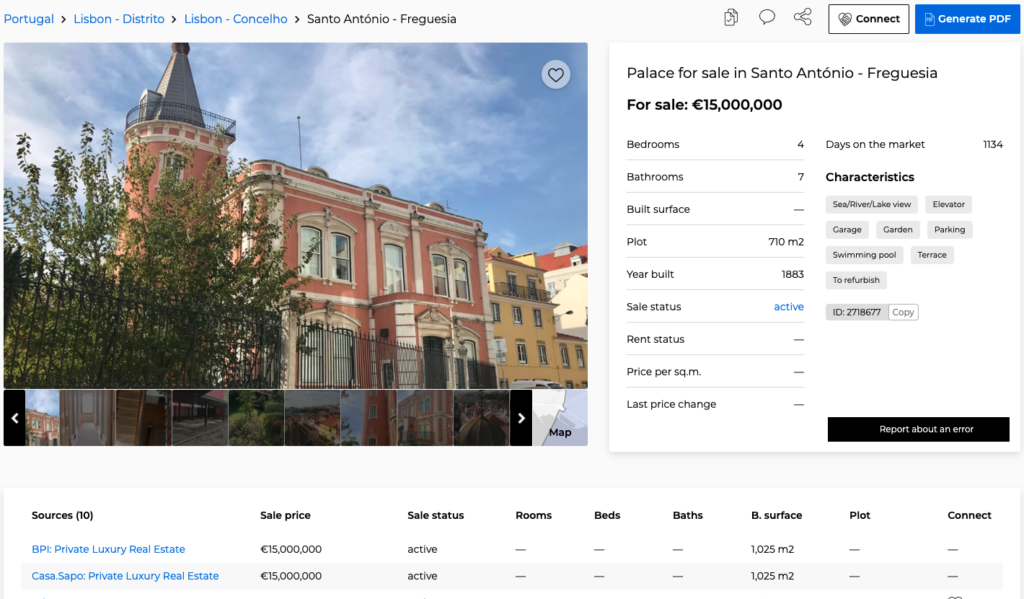

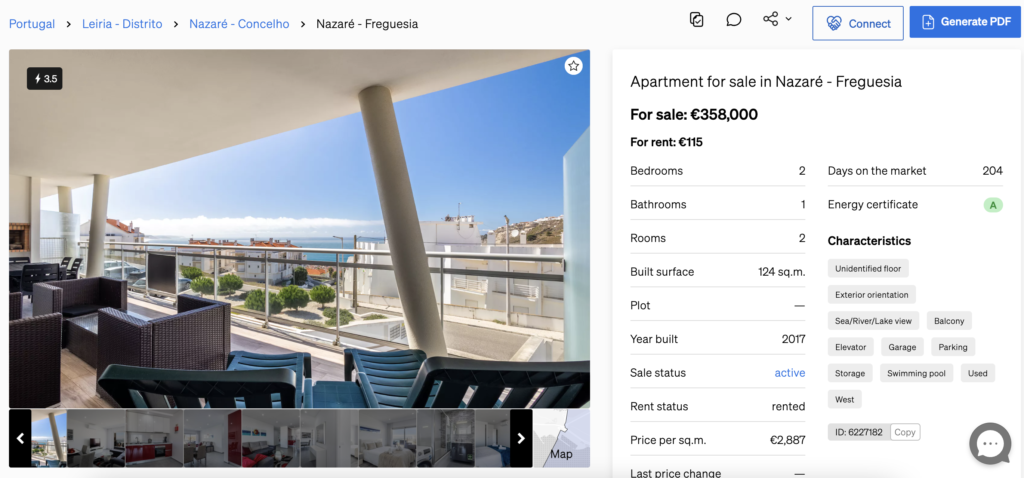

Property page: detailed information about each property

You can click in each real estate found inside CASAFARI Property Sourcing to see detailed information about it. Here’s a list of what you can find inside a property page:

- All the characteristics of the property (amount of rooms, size, energy certificate, etc.);

- Photos of it;

- See graphs about how’s the market for properties such as this one;

- How long it’s been on the market, for how much and who’s listing it;

- Recent price changes;

- All the property history since it was first put online.

Property history: why is this data priceless to real estate professionals

You can also add comments for you or your colleagues, share the property through a message, email or generating a PDF, run a property valuation for it and propose a shared deal with a seller agent.

With this data on your hands, it’s your move! You’re able to:

- Identify exclusivity breaches;

- Understand how the property is positioned in relation to its competitors;

- Strategise how to approach a seller or how to sell the real estate;

- Reach out to other estate agents shared deals.

After all, closing deals is all about keeping your market knowledge updated, right?

Favourites: keep a close eye on what interests you

And since we spoke about the Favourites, you should know that you can check all changes that go on with properties that are interesting to you or your clients . This is useful to:

- Monitor interesting assets that decrease in price as a buying agent or property investor;

- Make informed decisions about selling real estate assets by keeping track of their competitors;

- Monitoring your portfolio as an estate agent or broker, identifying exclusivity breaches or competitive disadvantages.

How to benefit from CASAFARI’s Favourites folders

The process of adding a property to your Favourites is very simple: you simply need to click on a star icon found on the photo of a property inside Property Sourcing. Easy, right? You even get to choose in which folder you wish to add said property, for organisation purposes.

And, finally, in the Favourites section of your CASAFARI real estate software, you can see all the changes that happened to the properties you saved in the last day, 3 days, week or month. You will be able to see:

- Which properties increased or decreased in prices;

- Which were reserved, delisted or sold.

This helps you keep track of potential opportunities or changes that might be useful to you.

CASAFARI Connect: partner with other estate agents to close deals faster

CASAFARI Connect is a platform that allows estate agents to collaborate in shared deals, splitting commissions in an easy, safe, and transparent way. With CASAFARI Connect, you can:

- Easily manage your requests for shared deals, sent or received;

- Establish flexible rules for commission splitting;

- Gain more visibility to your property portfolio;

- Increase your lead generation and seal deals faster.

How CASAFARI Connect boosts property deals and who is it for

Inside CASAFARI Property Sourcing, you can identify the properties that are available for a shared deal with the handshake icon.

You can opt to click on the handshake icon directly on your property search, which will allow you to check which commission sharing rules apply to this real estate, or you can do it with the “Connect” button, on the top right corner of the property page.

Interested in knowing more about CASAFARI Connect and how you can benefit from it as a buyer or seller estate agent? Here’s all the information you need!

Step-by-step: how to use the new CASAFARI Connect

Real estate commission sharing: build flexible rules in CASAFARI Connect

Are you ready to have all the market data you need in your hands? CASAFARI boosts your deals with up-do-date and thorough information that will put you one step ahead of the competition. Waste no time and subscribe!

We track daily over 310M listings across Europe

The work of JamesEdition in the luxury real estate market

Perlin Gentil, the Head of Sales of JamesEdition, talked to CASAFARI about how the luxury real estate market is since 2020 and what the luxury customer looks

The buyer’s agent work and how to qualify a buyer

Since buyer’s agents work in a commission-based business, it’s crucial to quickly identify which leads show the potential to become a real client so you prioritize them

DoveVivo: capillarity of data and their choice for CASAFARI

When the DoveVivo Group was looking for a partner to power their lead generation for real estate across all countries they work in, a shared investor presented

Engel & Völkers Costa Adeje: data-driven advices for clients with CASAFARI

A tool that allows estate agents to access in-depth and matter-of-fact analyses of the property market. It could be the description of CASAFARI, but it’s actually what

How can climate change affect the property market

Severe floods across Europe causing damages in 10 different countries including Germany and the UK in 2021, wildfires getting increasingly common in Spain, Portugal and France, the

Real estate brokerage: 4 ways in which Market Analytics boosts your business

Sell more properties, challenge the competition, expand the business and improve the credibility of your brand: brokers are always looking for new and better ways to enhance

How to Create Property Management Business Plan [Free Template]

Shannon Hurlman

Sales Manager - Second Nature

There are as many different perspectives on property management business plans as there are different PM businesses. But one thing holds true – in the classic adage usually attributed to Dwight D. Eisenhower – it’s not the plan that matters so much as the planning .

Outlining a detailed business plan isn’t just important for defining your own goals, it’s key to communicating those to potential clients and investors. It also requires deep insight into what residents want and are willing to pay for.

Whether you’re new to property management, have been managing properties for years and are ready to start your own business, or own property management business but are looking for greater investment, we’ll cover important topics to address business plan creation.

We’ll explain why business planning can be so important, as well as who to target with your plan. We’ll also share a free template to get you started.

Key Learning Objectives:

- How to identify and find your ideal clients

- How to articulate your value proposition

- What to include in your business plan

- How to outline your business plan

- A free property management business plan template

Meet the Expert: Peter Lohmann , CEO RL Property Management

What to Know before Creating a Property Management Business Plan

Not to get too deep down the rabbit hole, but the first step to creating a high-quality business plan is – you guessed it – to make a plan for the plan. For entrepreneurs, planning is the key to success.

Going through the following steps first will make the process much easier and more effective in the long run. Here’s what you need to get clear at the outset.

State Laws governing property management business

As you know, each property management company’s approach is very dependent on regional or state regulations. Before taking any steps to either start or change your business, you need to have a clear understanding of the local laws governing your business venture.

We highly recommend hiring an attorney who can help you navigate those laws and regulations.

Who are your ideal clients

Lohmann lays out three critical steps to crystalizing a successful business plan:

- Identify your ideal clients.

- Articulate your unique value proposition for those clients.

- Go out and find leads.

So, first: Who are your ideal new clients?

“Get really clear on who your ideal customer is,” Lohmann says. “Are you managing associations, office buildings, big apartments, single-family rentals, etc.? The narrower and more specific you can be, the better your life is going to be and the more money you’re going to make.”

In other words, anything outside of this target market is going to be a waste of your time. That’s why this is the first step.

“The more narrow and specific you can be here, the more directly you can speak to your prospects in a way that’s compelling,” Lohmann says. “Everything becomes easier – content strategy, sales conversations, even operations become easier – if you know who you want to manage for and what types of properties you want to manage.”

What type of property management company you are

The next step is to identify your unique value proposition. There are tons of property management companies out there. Why should your ideal client choose you?

In Lohmann’s words: “Your second step is to ask, ‘Why should anyone care?’ Property management isn’t a new concept; there are tons of property managers. So, identify what your unique value proposition is.”

This is key to figuring out not just who to pitch to but how to pitch to them.

“What are you going to talk about?” Lohmann says. “You can’t just say, ‘Oh, hire us, we’re the best!’ You need clear examples that say, ‘Our company does something a little different.’”

For RL Property Management, that started as a promise that they would never charge a leasing fee.

“Sure, it’s kind of crazy, and I don’t know anyone else who doesn’t charge that, but it worked,” Lohmann says. “We were trying to figure out why everyone hated their property manager. And we decided that it might be an incentive problem where the property manager’s incentive is to fill the unit as quickly as possible so they can get that big leasing fee, and that was creating bad outcomes for property owners. So we decided that we weren't going to charge a leasing fee, and we've stuck with it ever since.”

How to find your ideal clients

The third and final step of preparation is to identify where you need to go out and find leads and engage property management marketing .

“Given what you know about how you defined your ideal prospect and your company and what they offer, the next question is where you go and get these leads,” Lohmann says.

“A lot of property managers start with this third step. They just say, ‘How can I get more leads?’ But that’s the wrong question. Why do you deserve those leads? Answer that first. Downstream of that is ‘Where are those people hanging out, and how can I get this to them?’”

Getting this step right involves researching property management and real estate property in your area and getting familiar with industry news, conferences, and listings.

What should a property management business plan include?

Now, let’s talk about the actual outline of your PM business plan. If you’re starting a new business and aiming to present a business plan to investors, or even business partners, you should outline each section below as a presentation deck. The information presented in this section needs to read like it is designed for investors and should highlight key terms and concepts they care about.

Here’s a sample property management business plan outline, followed by a detailed explanation:

Executive Summary

Company overview, market analysis (industry, customer, and competitive analysis).

- Marketing Plan & Sales Strategy

Operations Management

Management team, financial plan .

- Growth Opportunities

This is a high-level overview of your entire presentation. As such, it should be the last section that you write. You want to be concise but interesting and hook the reader quickly. Outline the following in broad strokes:

- The type of property management company you are operating

- Your target market

- Your objectives

- Your plan for meeting these objectives

The company overview will dive deeper into your property management niche and business model. Explain what types of properties you manage and how you operate. Options include single-family residential property management (SFR), multi-family property management (MFR) or residential apartments, HOA management, and commercial property management.

Give a brief history of your company and your legal business structure. Other important information might include:

- Your key competitive differentiators and core competencies

- Your metrics for success

- Your management team

- Financial details

- Mission and vision statements

This section benefits you almost as much as it does your audience. Researching for this section will help you more deeply understand the industry, customers, and competition.

- Industry analysis should include details on the trajectory of the market, its size, and key trends, along with challenges and opportunities.

- Customer analysis should include details about your target customers, their wants and needs, etc.

- Competitive analysis should outline direct competitors (PMCs in your area) and indirect competitors like in-house managers, automated tools, etc. Explain why your value proposition is unique. Ideally, present a thorough SWOT (strengths, weaknesses, opportunities, threats) analysis.

This section should describe the property management services the company plans to offer, such as leasing, maintenance, and rent collection. Depending on the jurisdiction, legal compliance and documentation services may be relevant as well. This section should also discuss the pricing strategy for these services.

This section should describe the company's marketing plan and sales strategy, including how it plans to attract and retain clients. It should also discuss any advertising or promotional campaigns the company plans to undertake. Promotions could include paid advertising in print and on websites, social media marketing, radio advertising, SEO marketing, and more.

Here, it’s important to document your marketing channels (organic online, targeted online, print advertising, professional networking) as well as ongoing sales and marketing programs.

Outline your short-term processes and long-term business goals, as well as estimate day-to-day operations. What property management software are you using in the business? What bottlenecks slow down work that’s moving through the organization? How will you structure your company and your teams?

It may also be helpful to include details on critical process workflows, risk mitigation strategies, and technology integrations and updates.

Outline your management structure and the skills and experience of your management team. You’ll particularly want to highlight property management and real estate experience. This is a key moment for you to consider who you have in the company, who is a right fit, and who needs to be looked at as not a great fit.

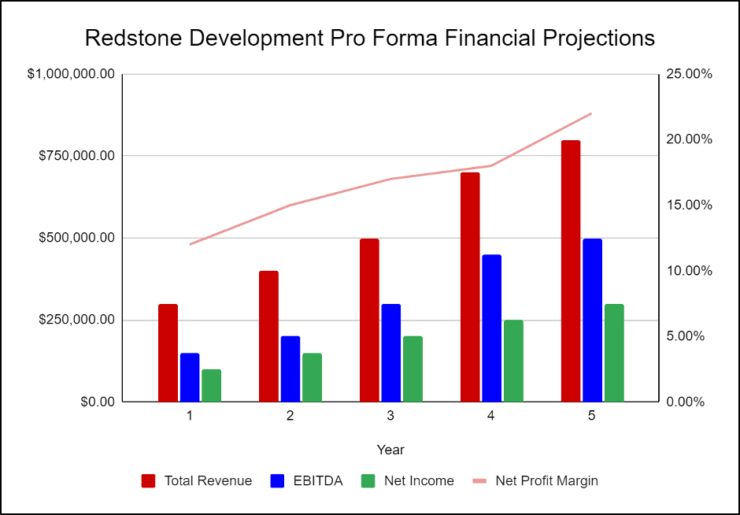

This is where you give your financial projections and approach. Outline your major cost centers and revenue drivers. What management fees are you going to charge? You should include a profit and loss statement, balance sheets, and a cash flow statement.

Growth Opportunities

Identify and outline the most targeted growth opportunities for your business right now and over the next five and ten years. Knowing your long-term goals requires you to gain a deep understanding of the real estate and property management market in your area and to understand clearly where you fit in and how you can generate growth and value for years to come.

Typically, in this section you might include:

- Expansion plans

- Strategic alliances

- Technology upgrades

- Emerging market trends

Property Management Business Plan Free Template

Although you may prefer to draft your own property management business plan from scratch, there are a couple of options for short-cutting the process.

You can use the checklist below to organize your plan, or else simply download our free PMC business plan template to customize as you see fit.

- Your property management niche and business model

- How you operate

- Company history

- Your legal business structure

- Financial overview

Market Analysis

- Industry assessment

- Customer analysis

- Competitive analysis

- Outline of sales and marketing plans

- Marketing channels

- Ongoing sales and marketing programs

- Long-term business goals

- Current processes

- Critical process workflows

- Risk mitigation strategies

- Technology integrations and updates

- Management structure

- Skills and experience

- Financial projections

- Cost centers and revenue drivers

- P&L statement

- Balance sheet

- Cash flow statement

- Targeted growth opportunities

Get your free PMC business plan template here.

Beyond the business plan: Focus on retention with the Second Nature RBP

At Second Nature, we work with property managers around the country to develop better resident experiences that will generate more value for their clients and more profit for their companies.

The product we have found most helpful to property managers at every stage of their company’s growth is a fully managed resident benefits package or RBP. Each product in this package aims to deliver something residents want or need and a service that helps set your PMC apart. We want to help make running your business as easy as second nature.

Operational Efficiency

Keep learning

Resident Benefits Package: How to Increase Revenue and Reduce Costs

You might not be surprised to hear that at Second Nature we get asked this a lot: "Exactly what is a resident benefit package?" Or "What is a tenant benefit package?" Simply put, a resident benefits package (RBP) is a suite of services provided by the property manager to make life easier for residents. In today’s marketplace, residents and property investors expect a certain level of ease, convenience, and support. Property managers have noticed that beyond reacting quickly to requests, residents want their needs proactively anticipated. And they're willing to pay and stay for it. (Ready to get started now? Build your Resident Benefits Package today!) In this article, we’ll explore what a resident benefit package is, how it can generate revenue, and how to implement a resident benefits package (RBP) to give your residents, investors, and business a win. What is a resident benefits package (RBP)? The Resident Benefits Package (RBP) is designed to transform the resident's living experience. Sometimes called a "tenant benefits package," the RBP proactively meets residents' wants and needs by providing benefits to make their lives easier. At Second Nature, we pioneered the only fully managed resident benefits package. We chose the term "resident" because the tenant benefit package sounded too impersonal for the value we're driving. Resident benefit packages include an array of services and supports for residents, from filter delivery to credit building to maintenance. Stay tuned for our next suite of services for property managers and investors: the Investor Benefits Package (IBP). What are the benefits of a resident benefits package? The resident benefits package adds value to residents by anticipating their needs and providing them with services that make life easier and better. It adds value to investors by preventing maintenance, vacancy, and delinquency. And, of course, it adds value to property managers because it differentiates them from the competition. Let’s take a deeper look at how the RBP creates a Triple Win – for residents, for investors, and for you, the property manager. Attracting and retaining residents through better experiences Offering a comprehensive benefits package can make a property more appealing to potential residents. By providing desirable perks such as exclusive discounts, concierge services, or access to credit reporting and other financial benefits, the property management company can attract a larger pool of prospective residents and increase occupancy rates. Retaining residents is also crucial for profitability, as turnover costs can be significant. A benefits package can enhance resident satisfaction and loyalty, reducing turnover and associated expenses. Higher rental rates for higher value A well-curated tenant benefit package makes properties more valuable. When residents perceive additional value in the form of amenities, services, or discounts, they are often willing to pay more for their living experience. This allows the property management company to command premium prices for their units, leading to increased revenue and improved profitability. Differentiation and competitive advantage In a crowded real estate market, a distinct resident benefits package can set a property apart from competitors. It becomes a unique selling proposition that highlights the property management company's commitment to providing an exceptional living experience. By offering a package that exceeds what other properties in the area provide, the company gains a competitive advantage and attracts residents who value the added benefits. Ancillary revenue opportunities A tenant benefits package can create opportunities for generating additional revenue streams tied to specific benefits in the package. Resident benefit fee: How much does a resident benefit package cost? Most resident benefits packages cost between $20 and $100, which is often included in the lease and added as a monthly fee for the resident. Prices vary depending on a few key factors, chief among them being the mix of benefits selected by the property manager. What does a resident benefits package include? Here’s what the Second Nature Resident Benefit Package includes. Filter delivery service Air filter delivery was the first service Second Nature offered to scattered-site and single-family property managers. It is a cornerstone of the RBP, and over 1M residents have shown that a physical, tangible product is key to their ongoing perception of value. One of the most common causes of HVAC maintenance requests is a failure to change the home’s air filters on time. Air filter delivery from Second Nature solves the problem by delivering the correct-sized high-quality HVAC filters directly to each home’s front door on a predetermined schedule. The delivery serves as a reminder for the resident to change the filter, and voila – problem solved. The resident breathes clean air, the PM has fewer HVAC tickets to deal with, and the investor has their asset protected. That’s a triple win. Our message to residents: “Changing filters is as easy as opening the front door.” Phil Owen, founder of OnSight PROS, says of the delivery system: “Last year OnSight PROS performed third-party property condition reports at almost 18k single-family rental properties on behalf of property managers. The number of filters that we have to replace or mark as ‘needs attention’ becomes almost zero when a PM implements the Second Nature program. I cannot imagine how a property manager could justify not protecting their landlords with this program. The difference between those using the program and those who simply hope that their tenants go to the store to purchase and install a new filter is staggering.” Our filter delivery service has proven to reduce total HVAC maintenance requests by 38% and save up to $250 per year per property. $1 million identity protection One in four Americans will be victims of identity theft. In 2021, digital theft incidence surpassed home burglary incidents for the first time – and is rapidly rising. With identity protection as part of your RBP, every adult on the lease automatically gets the peace of mind you can expect from professional-level identity protection. Backed by AIG and monitored through IBM’s Watson, Aura Identity Guard works proactively on behalf of the resident to identify fraudulent use of their identity and alert them. In the event of an actual identity theft case, the resident receives a dedicated case manager and is covered up to $1,000,000 for most resulting damages. This protects the resident's ability to pay rent, which makes it a win for the investor. And it keeps property managers out of the middle of another difficult situation and decision. Credit building With RBP’s credit building service, on-time rental payments improve the credit score of your residents. It may seem crazy that people are building credit by paying for Netflix and other small subscriptions, but not their largest monthly payment... rent! But that's the truth for most residents. We asked, how is it even possible that someone's largest monthly expense is the only one they aren't getting credit or rewards for? This credit reporting program reports positive-impact, on-time rent payments automatically to all three credit bureaus, helping residents build their credit simply for paying their rent on time. Residents also get an immediate boost with 24 months of back reporting included. This service directly impacts rates on credit cards, auto loans, and future mortgages, incentivizing residents to get rent in on time and helping set them up for home buying in the future. The property manager and the investor both reap the benefit of the extra incentive to get rent on time and the resident gets to see their credit score rise as a result of something they have to do anyway. It’s a big-time triple win here. Resident rewards program Rental rewards are a favorite among residents and another powerful and positive incentive for on-time rent payments. Rental rewards programs deliver automatic benefits at move-in. Then, residents can unlock even more rewards by paying rent on the day it's due. At Second Nature, all on-time payment tracking is done through the app. Like other services in your RBP, it’s managed for you. Gifts include: $30 gift card for national and local brands $25 restaurant card $40 rewards cash on rent day each month rent is paid on time And more The value of rewards is covered in the cost of the RBP, so the property manager isn’t seeing any additional liabilities. The PM and investor only see a benefit, which is the increase in on-time rent payments. For the resident, rent day is now rewards day. Another triple win. Move-in Concierge Setting up utilities can be a massive headache for a new resident. Residents aren’t sure who to call and who provides utilities and home services like internet and TV for their new address. More, the research for discounts/promotions/coupons available takes more time. Most times, the process is clunky, with lots of friction that gets in the way of it getting 100% done. And it is too easy to overlook fine print in the lease about installing satellite dishes. Move-in Concierge changes all of that for professional property managers. In one phone call, residents find out what their best options are and can even get help simplifying setup. An experienced concierge confidently guides multiple people every day to properly setup their utilities. Renters Insurance Program Nearly all property managers require a renters insurance policy in their lease agreements. As part of our RBP, Second Nature offers price-competitive insurance coverage options through a Renters Insurance Program that property managers can apply to all their residents locked in with one group rate. Residents who have their own renters insurance can receive a waiver on RBP's insurance program, but the current list of enrolled residents is tracked for you by Second Nature, and any resident who drops off of their own insurance is automatically enrolled. No more hassle for you, quality asset coverage for the investor, and immediate and comprehensive liability coverage for the resident – another triple win you can create with your Resident Benefits Package. Additional benefits At Second Nature, we help property managers deliver all their services to residents. If you’re already offering perks and are ready to level up to a resident benefits package, we can help you bundle the above benefits with other services. We’ve worked with PMs to bundle in their existing property management services, including: 24/7 Maintenance Coordination: A huge benefit to residents and PMs is a service that provides after-hours support without dragging the property manager out of bed. This type of program makes reporting pesky maintenance issues easy and fast for the resident. It also helps prioritize emergency maintenance. Online Portal: With a simplified online resident portal, residents can access all of their documents, messages, and more through an app. Residents can also pay rent and receive reminders to pay rent online. Home Buying Assistance: For residents who are building up toward home ownership, some PMs offer assistance in building credit and savings. We help them get there. Vetted Vendor Network: A vetted network ensures that vendors who service your properties are screened to exceed your standards for insurance, licensing, and professionalism on the job. Property managers, residents, and investors can rest easy knowing that they have the best vendors working on their assets. Washer/Dryer Rental: Some properties may have these appliances installed or the residents come with their own, but we’ve seen the impact on prospective applicants choosing homes due the convenience of having the washer/dryer available. Security deposit alternatives: Security deposit alternatives come in different packages, but all serve to provide residents ways to be financially liable for damages without having to pay a significant lump sum up front. Pure insurance, surety bonds, and ACH authorization programs are all versions of deposit alternatives that seek to lower the barriers to rental, which in turn keeps days-on-market low and turnover costs down. Pest control services: Property managers can partner with pest control companies to provide routine or on-demand pest control services to the homes they manage. Bugs are one of the most common complaints from renters, and having services available to prevent infestation issues is a big win for resident experience. When implementing a full-service, fully managed resident benefits package, you don’t have to lose the benefits you already offer. A great service can integrate all of these benefits together – delivering more impact to residents, investors, and property managers. How much revenue can I create per unit with a Resident Benefits Package? The amount of ROI on a resident benefits package will vary depending on the property class type, market, and number and type of services offered. Generally speaking, resident benefits packages are often in the $25-75/mo range for residents, but could be more or less. It depends primarily on the amount and type of products and services. To go back to our concept of the experience economy: a resident benefits package gives residents the kind of incredible experience that they will pay and stay for. In short, keeping residents happy can reduce turnover and lead to lower costs and higher ROI for you and your investor. According to Eric Wetherington, VP of Strategic Initiatives at PURE Property Management, “Revenue is all about providing a service. The younger generations we’re dealing with in property management – they want convenience, they want experiences, and they want things to be simple, and they’re willing to pay to have things taken care of for them.” A fully managed resident benefits package can generate revenue in two key ways: Increasing services to improve resident retention Decreasing costs by increasing efficiency A resident benefits package can help to accomplish both. Routine filter delivery cuts down on HVAC and maintenance costs. A move-in concierge helps cut down time and cost as residents get settled in their new home. Credit building services keep residents invested in paying on time, sending online payments, and deliver incredible value. The list goes on. A resident benefits program creates a huge win for you as a property manager, and your investor, by driving higher ROI over time. How can property managers implement a Resident Benefits Package? If a resident benefits package is new to your company, you may wonder how best to implement it. Should you roll out a mandatory resident benefit package – ensuring the maximum benefits for your investor – or allow residents to choose? What is legal or not? We do recommend mandatory rollouts to create the most ease for you, your investor, and your residents. Having a choice may give residents a short-term positive experience, but in the long term won’t be much of a benefit. Mandatory resident benefits packages tend to go much smoother and eventually have higher benefits for everyone involved. According to Second Natures Head of Sales, Bob Hansen, “You have to look at the value that a resident benefits package brings to the investor and the resident, not just you as the property manager.” At Second Nature, we’ve seen incredibly low pushback from residents when an RBP was introduced. After all, it benefits residents, and most are delighted to have the extra service. How can property managers reduce costs with a resident benefits package? The answer is: in several ways! Implementing a comprehensive residential benefits package can provide property managers with opportunities to reduce costs and increase operational efficiency. Let’s look at examples from the product above. By including air filter delivery as part of the package, property managers can ensure that residents have regular access to clean air filters, reducing the need for costly maintenance and repairs caused by poor air quality. Offering identity protection and credit building services can help mitigate the financial risks associated with identity theft and delinquent payments, potentially reducing costs related to collections and legal procedures. They also improve retention and encourage on-time payments. Including a resident rewards program can also incentivize desirable behaviors such as timely rent payments or positive referrals, fostering resident satisfaction and reducing turnover costs. By partnering with a renter's insurance program, property managers can transfer potential liability and property damage expenses to the insurance provider, minimizing their own financial risks. A move-in concierge service can streamline the onboarding process for new residents, reducing administrative costs and improving operational efficiency. By providing these benefits, property managers can enhance resident satisfaction and retention, ultimately reducing expenses associated with turnover, repairs, and legal issues. Common mistakes property managers make implementing resident benefits packages In our experience helping property managers implement RBPs, we’ve heard our share of concerns or even horror stories from PMs who had bad implementations with other products. Here are some of the most common mistakes in RBP implementations – and how to avoid them! Overpromising and underdelivering Property managers may advertise extravagant benefits that they cannot consistently provide or fulfill, leading to disappointment and resident or investor dissatisfaction. Property managers should accurately represent the benefits package, ensuring that the offered perks are realistically achievable and consistently provided to residents. Lack of communication Failing to effectively communicate the details and availability of the benefits package to residents can result in confusion and missed opportunities for using the offered perks. Property managers should effectively communicate the details, availability, and utilization process of the benefits package to residents through multiple channels, such as newsletters and online platforms. Inadequate research and selection Property managers may choose benefits that do not align with the residents' preferences or needs, leading to a lack of interest and underutilization of the package. Property managers should conduct thorough market research and engage with residents to understand their preferences and needs, ensuring that the benefits selected align with their expectations. Failure to evaluate cost-effectiveness Neglecting to assess the costs and benefits of the package can result in offering benefits that are financially unsustainable or fail to provide a satisfactory return on investment. Property managers should regularly assess the costs and benefits of the package, considering factors such as resident utilization, return on investment, and overall financial sustainability to make informed adjustments as needed. Lack of flexibility and adaptability Not regularly reviewing and updating the benefits package based on resident feedback and changing market trends can make it less competitive and less appealing over time. Property managers should actively seek resident feedback, monitor market trends, and periodically review and update the benefits package to ensure it remains competitive and relevant to residents' changing needs. Insufficient staff training Failing to train property management staff on the benefits package and its administration can lead to ineffective communication, missed opportunities, and difficulty addressing resident inquiries or issues. Property managers should provide comprehensive training to their staff on the benefits package, including its features, administration processes, and effective communication strategies, enabling them to effectively support and engage with residents. Neglecting legal and regulatory considerations Property managers must ensure that the benefits package complies with all relevant laws and regulations, such as data protection requirements or fair housing laws, to avoid legal repercussions. Property managers should consult legal experts or advisors to ensure that the benefits package complies with all applicable laws and regulations, protecting both the company and residents. Ineffective marketing and promotion Inadequate marketing efforts to promote the benefits package can result in low resident awareness and limited participation, reducing the overall effectiveness of the package. Property managers should develop a strategic marketing plan that utilizes various channels to promote the benefits package, highlighting its value proposition and actively engaging residents in participating and utilizing the offered perks. Ignoring resident feedback Neglecting to seek and incorporate resident feedback can hinder the improvement and optimization of the benefits package, missing opportunities for enhancing resident satisfaction and retention. Property managers should establish channels for residents to provide feedback on the benefits package, actively listen to their suggestions and concerns, and make necessary adjustments to enhance resident satisfaction. Lack of coordination with vendors Failing to establish clear communication and expectations with vendors offering benefits can lead to subpar service delivery, difficulty resolving issues, or missed opportunities for cost savings. Property managers should establish clear expectations, contracts, and regular communication channels with vendors offering benefits, ensuring a seamless and satisfactory service delivery process for residents and promptly resolving any issues that may arise. This is A LOT to keep in mind, and avoiding these mistakes might feel like it will cost too much or simply take too much work. But that’s why opting for a fully managed RBP is a solution so many PMCs are turning to. You can rely on a partner to manage all aspects of your RBP, and ensure its delivering on its promises to your residents. More on that in the next section. How 1,000+ property managers are creating Triple Wins with a resident benefits package Rolling out a resident benefits package is a powerful way for property managers to create a Triple Win – for residents, investors, and themselves. An RBP like Second Nature’s is designed to be simple to use and easy to implement. All the services included within it are managed externally by Second Nature, meaning there is no day-do-day upkeep required from the manager. You plug it in and Second Nature keeps it running. The value creation an RBP generates – with such little work required from the PM – is an incredibly easy way to grow your business and create great experiences that residents will pay and stay for. Don't get left behind in the evolving world of resident experience. Learn more about our fully-managed Resident Benefits Package and how we can build ease for you, your investors, and your residents. Learn More About RBP from Second Nature

Property Management Outsourcing Services: Example Tasks & Best Providers

Virtual assistants are becoming increasingly important in the property management industry for a number of reasons. First are the associated efficiencies. Property managers often wear many hats, juggling tasks like resident communication, lease agreements, maintenance requests, and advertising. A virtual assistant can handle many of these administrative and repetitive tasks, freeing up the property manager's time to focus on more strategic initiatives. Virtual assistants can also act as a communication "hub" between residents, property management companies, and service providers. They can field calls and emails, schedule appointments, and ensure everyone is on the same page. In the same vein, virtual assistants can help with tasks related to online advertising for vacancies, managing a social media presence to attract potential residents, and even creating basic property videos or photos for listings. It’s important to note that virtual assistants are not a replacement for in-house staff. Instead, they allow staff to focus on important tasks that add value, as opposed to time-consuming manual operations. In today's post, we'll provide concrete examples of how virtual assistants can help property managers, the pros and cons of using these services, and a brief directory of property management virtual assistant service providers. Note on language: In the interest of clear communication, particularly regarding legal matters, this blog post may occasionally use the term "tenant" in reference to residents. While "resident" reflects the valued community we aim to support, service provider agreements and other legal documents today typically use the term "tenant." For the majority of this post, however, we'll utilize the term "resident" to best represent the positive and collaborative atmosphere we aim to cultivate. What is outsourced property management? Outsourced property management refers to the practice of paying for a third-party company or product to handle certain tasks or operations for your property management company. This could include tasks such as tenant screening, resident benefits, renters insurance programs, rent collection, maintenance and repair coordination, lease enforcement, financial reporting, and more. Property management is in itself an outsourced service for real estate investors/property owners. Just as property owners often choose to outsource their property management to save time, reduce stress, and ensure they stay profitable – property management companies may outsource several of their services for the same reasons. Property management outsourcing services, whether PropTech products or fully managed solutions, allow property management companies to build efficiencies and focus on quality and growth. Outsourcing certain services can give residents more of what they need and investors more value for their dollar. Example property management tasks you can outsource to virtual assistants The number of tasks property managers can outsource has increased over time, as companies have become more comfortable with geographically dispersed teams, and as virtual assistants themselves have become more sophisticated (better communication skills, task automation capabilities, and access to information). Given that the benefits of outsourcing to virtual assistants are on the rise, here is a sampling of tasks that can currently be outsourced to virtual assistants. Outreach to homeowners for management Virtual assistants can be a property management company's secret weapon for improving homeowner outreach in a few key ways. Given that property managers often manage a large number of properties and homeowners, virtual assistants can handle sending personalized emails, texts, or even making phone calls to homeowners. As indicated above, they can also help manage the property management company's social media presence, posting updates, building trust, and boosting its brand presence to property owners. Property assessments While virtual assistants can't directly conduct rental property assessments, which typically involve a qualified professional inspecting the property's condition, they can provide valuable support throughout the assessment process by gathering and organizing property information crucial for the assessment (for example, details such as square footage, number of bedrooms/bathrooms, year built, major renovations, and past maintenance upkeep records). They can also compile relevant data from property management software or online real estate industry resources. Virtual assistants can also manage the scheduling of property assessors and ensure clear communication between the property owner, property manager, and the assessor. This involves sending appointment reminders, handling any cancellations or rescheduling needs, and keeping everyone informed throughout the process. Once any given assessment is complete, a virtual assistant can help process and organize the assessor's report. This might involve formatting the report, creating digital copies, and ensuring it's easily accessible to the property manager and owner. Creating and presenting management proposals Virtual assistants can be a highly cost-effective asset to property management companies when it comes to creating and presenting management proposals. For instance, virtual assistants can save a lot of time by gathering data on comparable properties in the area, including rental rates, vacancy rates, and recent sales. They can pull this data from industry reports, rental listing websites, or public property records. They can also compile details about specific rental properties under management such as square footage, amenities, maintenance history, and any unique features. This ensures the proposal accurately reflects the property's value and the services offered. In addition, virtual assistants can alleviate the hassle of creating or maintaining templates for management proposals, ensuring consistency in branding and formatting. This saves time and ensures a professional presentation. As far as actual proposal presentation is concerned, virtual assistants can handle the electronic delivery of the proposal to the client and schedule follow-up calls or meetings to discuss the proposal details and answer any questions. If the property manager is competing against other companies, a virtual assistant can help research competitor offerings and identify areas where your proposal can stand out. Determining property rent In addition to the market research capabilities mentioned above, virtual assistants can gather data on rental trends in the target area. This includes vacancy rates, as well as recent rental listings for comparable properties (similar size, bedrooms, amenities) and their advertised rent prices. They can find this information on rental listing websites, property management software, or public rental databases. Virtual assistants can also handle initial communication with investors to understand their rental expectations and any specific goals they might have (e.g., maximizing rent vs. filling the vacancy quickly). Creating and organizing property photos and marketing material Virtual assistants can be a game-changer for property management businesses when it comes to creating and organizing property photos and marketing materials. If professional photography is required, a virtual assistant can schedule appointments with photographers, and even perform basic photo editing tasks like cropping, and adjusting brightness and contrast. This ensures a clean and polished presentation of the property. They can also create file-naming conventions for these photos, in order to make them easily searchable for future use in marketing materials or listings. As far as marketing materials are concerned, virtual assistants can create or maintain templates for various materials, ensuring consistent branding and design across all platforms. This saves time and creates a professional look while delivering cost savings. Advertising the property Virtual assistants can be highly beneficial for property management companies when it comes to advertising their properties. For instance, virtual assistants can create and manage listings on various online rental platforms, ensuring accurate and up-to-date property information reaches a wide audience of potential tenants. They can also optimize listings with relevant keywords to improve search ranking. On the social media channel, virtual assistants can help create targeted ads with eye-catching visuals and compelling descriptions highlighting the property's best features. They can also schedule ad posts and track their performance to optimize future campaigns. In general, virtual assistants can create and manage a content calendar for property promotions. This can include scheduling social media posts, email blasts to potential residents, or even blog posts showcasing the property and surrounding neighborhood. Responding to inquiries Virtual assistants can be the first point of contact for prospective tenants who inquire about a property through listings, social media, or the company website. They can answer basic questions, schedule viewings, and qualify leads to ensure they are a good fit for the property. Likewise, when it comes to responding to inquiries from potential investors, they can assess the lead quality and guide the initial conversation. Vetting resident applications Virtual assistants can be a valuable asset in the vetting process for property management companies. For starters, they can handle the initial processing of rental applications, collecting and organizing applicant information, as well as lease agreements and supporting documents. This frees up property managers to focus on reviewing qualified applications. They can also manage initial communication with applicants. This might involve sending automated emails with application instructions, answering basic questions about the property or application process, and scheduling appointments for viewings. Many property management companies use tenant screening software that virtual assistants can be trained to utilize, ordering credit reports, background checks, and eviction history reports efficiently. Approving a tenant application after review Virtual assistants can play a crucial role in streamlining the post-review approval process for property management companies. Once the property manager approves an applicant, they can handle initial communication with the new resident. This might sending a lease agreement electronically, explaining signing procedures, and collecting e-signatures. Virtual assistants can also coordinate move-in logistics, such as scheduling move-in property inspections, providing information on utility activation, and sending welcome packages with important building information and resident resources. Lease preparation Virtual assistants can help to streamline the process of lease preparation while minimizing the potential for errors. At a minimum, they can gather essential information from the approved application and property details to populate lease templates. This might include resident names, contact details, leasing terms, rent amounts, and security deposit details. Many property management companies use pre-defined lease templates with standard clauses outlining They can then handle initial communication with the approved resident about lease signing. This might involve sending the lease electronically, explaining signing procedures, and answering basic questions about lease terms and conditions. resident responsibilities, maintenance procedures, and lease termination processes. Virtual assistants can ensure these clauses are included in the lease agreement. They can also review completed lease agreements for any typos, inconsistencies, or missing information before sending them to the resident for review and signature. Lease renewals Virtual assistants can also help streamline the process of lease renewal, thereby helping to increase resident retention. For example, virtual assistants can monitor lease agreements and identify upcoming lease expirations. They can then create a timeline for initiating communication with residents about potential renewals, via personalized emails or letters to residents approaching the end of their lease term. These messages can express appreciation for their residency, highlight the benefits of renewing, and outline the renewal process. Virtual assistants can also track resident responses to renewal offers, flagging those requiring further discussion with the property manager. They can also generate reports on renewal rates, providing valuable data for analyzing resident retention strategies. Running tenant background checks While virtual assistants can't legally conduct background checks themselves, they can be a valuable asset in streamlining the process for property management companies. This might include managing the initial steps of collecting and organizing applicant information crucial for background checks. This includes details like full names, Social Security numbers (with applicant consent), and previous addresses. They can also help maintain standardized forms with clear instructions for applicants regarding background check consent. This ensures applicants understand the process and provide the necessary authorization for releasing information to background check companies. Organizing tenant records Virtual assistants can be instrumental in bringing order to record-keeping processes, from data entry and management to record-keeping and accessibility. They can handle the initial data entry of resident information from applications, including names, contact details, emergency contacts, lease details, and pet information. This ensures all crucial information is captured and readily accessible. Virtual assistants can upload and organize various tenant documents electronically. This might include lease agreements, signed addendums, rental history verifications, and maintenance request records. They can also create a filing system for easy retrieval of documents when needed. Note that virtual assistants should be trained on data security and privacy regulations to ensure the confidentiality of resident information – while virtual assistants can manage record-keeping tasks, the property manager should maintain oversight and ensure compliance with data protection laws. Invoicing and accounting Virtual assistants can handle a range of tasks related to recording rent payments, managing maintenance expenses, and categorizing various property management costs For example, virtual assistants can help set up secure online payment portals for residents to easily submit rent payments electronically. On the tracking side, virtual assistants can track incoming payments, reconcile bank statements, and ensure accurate records are maintained. Virtual assistants can then generate basic financial reports for the property manager, summarizing expenses and overall property income. This allows for better financial tracking and informed decision-making. Many property management companies utilize accounting software. Virtual assistants can be trained to use these platforms, automating tasks like data entry and simplifying record-keeping. Best property management virtual assistant services providers Identifying the "best" virtual assistant service provider will of course depend on your specific needs and budget. First, we'd recommend that you determine the specific tasks you want your virtual assistant to handle (e.g., advertising, resident communication, bookkeeping), then conduct research on different providers, and compare their services offered, pricing structures, and experience with property management. Also look to online reviews and ask potential providers questions about their screening processes, and data security measures. We're highlighting a couple of providers below that focus exclusively on property management, as well as a short list of solutions that include property management in their overall focus. Virtual Property Management Solutions VPM Solutions is a platform designed specifically to connect property management and real estate businesses with virtual assistants. Learn more Purple Powered Virtual Assistant Purple Powered Virtual Assistant (PPVA) specializes in providing virtual assistants specifically catered to the property management industry. They focus on connecting property management companies with qualified VAs as well as ensuring those VAs have the necessary skills to excel in the role. Learn more Honorable mentions Virtudesk Virtudesk specializes in virtual assistants for various industries, including property management. They offer a proven track record and a focus on quality service. Learn more MyOutDesk Known for their expertise in real estate and property management, MyOutDesk offers virtual assistants with experience in tasks relevant to the field. Learn more Wishup This company boasts a user-friendly platform, offers flexible pricing plans, and has a quick onboarding process for virtual assistants. Learn more Pros and cons of using property management virtual assistants Overall, virtual assistants can be a valuable asset for property management companies, boosting profitability, resident satisfaction, and business growth. However, careful vetting, clear communication, and training are necessary to mitigate potential downsides related to quality control, local regulations, legal issues, and retention. Pros of using virtual assistants in property management Increased profitability Virtual assistants can handle tasks like advertising and resident communication, freeing up property managers to focus on maximizing rental income and minimizing vacancies. Improved tenant satisfaction Virtual assistants can ensure timely responses to new tenant inquiries and manage resident portals, leading to a more responsive and efficient experience for residents. Streamlined bookkeeping and reporting Virtual assistants can assist with bookkeeping tasks and help generate accurate financial reports, allowing for better financial management. Support for business growth Virtual assistants can handle administrative tasks and marketing efforts, reducing the overhead costs of executing this work, and freeing up property managers to focus on growing their business and taking on new clients. Cons of using virtual assistants in property management Quality control challenges Ensuring the quality of services provided by virtual assistants can be tricky, especially for complex tasks like legal compliance or resident screening. Potential legal issues Data security and privacy become a concern when sharing property information with virtual assistants. Clear contracts and data security measures are crucial. Retention challenges Finding and retaining qualified virtual assistants can be difficult, especially for specialized tasks within property management. Maintaining resident satisfaction Reliance on virtual assistants for initial communication with residents might lead to impersonal interactions, potentially impacting satisfaction. Limited expertise Virtual assistants may not have in-depth knowledge of property management regulations or local real estate market nuances compared to experienced property managers. How PMCs are outsourcing services for better resident experiences Property management companies are always looking for new ways to generate value for themselves, their residents, and their investors. One of the quickest ways to scale and increase return on investment can be through property management service outsourcing. At Second Nature, we’ve pioneered the first-ever fully managed Resident Benefits Package. The goal is to make property management easier for PMs, residents, and investors – and drive value that benefits all three. We call it the Triple Win. Our RBP provides services that residents are proven to pay and stay for – and our team manages every part of the process so property managers can focus on what's important to them.

Receive articles straight to your inbox

Deliver the ultimate resident experience

Our Resident Benefits Package gives residents everything they want without all the work.

One moment please...

- Multifamily

- Property Manager

How to start a property management company

- May 1, 2024

The property management industry is more competitive today than ever. As of September 2023, there were 296,000 property management firms in the US alone.

As a prospective property manager, it’s important to prepare yourself with the right tools and knowledge to succeed. Otherwise, you won’t be able to handle the various challenges this field can bring, from difficult residents to periods of particularly high competition.

Keep reading to learn how to start a successful property management company in 2024 and beyond.

What to know about becoming a property manager

You’ll need a firm grasp of the real estate industry to become a successful property manager . This includes learning how to get residents to renew, familiarizing yourself with landlord-tenant laws , and knowing how to budget.

One way to gain all this knowledge is to obtain a certification such as one of the following (or something similar):

- Residential Management Professional , offered by the National Association of Residential Property Managers

- Real Estate Management , provided by Harvard Business School

- Certified Apartment Leasing Professional , which you can study for locally at several accredited associations

While you don’t need a college degree, studying sound management and business principles helps you master a property management company’s operational and financial aspects—which you’ll need for sustained profitability.

National and international associations, such as the Institute of Real Estate Management , the National Association of Residential Property Managers , and the National Apartment Association , can also help you network.

To enhance your skills in this field, consider exploring Realtor.com’s Virtual Learning Academy. It hosts weekly webinars, so you can easily book a session and expand your knowledge of specific topics.

Setting up your property management company

Here are the general steps to setting up a property management company:

1. Develop your business plan and entity strategically

A business plan details your company’s objectives and the actions needed to achieve them. It usually includes a market analysis, business structure information, a list of your services, and more. Without a comprehensive plan, you risk financial or operational difficulties because you won’t know how to allocate resources effectively .

Keep the following in mind when creating your business plan:

- Be clear about your target residents since they’ll impact your marketing strategies, your operations, and the property types you’ll focus on.

- Develop resident retention and lease renewal strategies , such as community building or cash bonuses, to show how you plan to increase occupancy and profit.

- Research the latest property management trends to ensure your strategies are based on facts. Always include relevant research to show real estate investors that you know the industry and that they can trust you with their money.

- Register for an Employment Identification Number (EIN) to open a business bank account and for tax purposes.

- Apply for a state license before beginning any operations.

- To avoid confusion, it’s recommended that you trademark your business name to ensure no one else can use it or your logo.

It’s also important to highlight your company’s entity type within your business plan. There are four primary types of legal entities for property management companies:

- Limited liability companies (LLCs) protect business owners from being personally responsible for debts. Your liability is limited to the amount of your investment in the company, and company profits pass through your tax returns.

- S-corporations are similar to LLCs with limited liability protection, and company income also passes through shareholders’ tax returns. However, this type of entity has more restrictions on ownership and is limited to a maximum of 100 shareholders.

- C-corporations have no restrictions on the number of shareholders. Owners are also not responsible for the company’s debts and liabilities. But, unlike LLCs, C-corporations have double taxation, meaning they are taxed on their profits, and shareholders are taxed again on the proceeds they receive.

- Real Estate Investment Trusts (REITs) own, operate, and finance income-producing real estate. Unlike other entities, REITs primarily develop properties not to sell them but to use them in their property portfolios.

If you’re stuck on where to begin with your business plan, the National Association of Realtors offers free business plan templates .

2. Organize your business finances

Understanding all your financial obligations is essential to ensure you don’t run out of money before your business takes off.

There are startup costs that’ll require considerable money upfront, such as the following:

- Licenses and permits

- Business insurance

- Business formation fees

- Office setup

- Marketing and advertising

- Software and technology

- Staff training

- Membership fees

- Legal and professional services

Create a system for monitoring your income and expenses to keep your finances organized. This will help you track rent payments and operational costs, such as bills and mortgages. It’ll also help you create accurate budgets and financial plans for ongoing expenses, such as repairs and staff salaries, so you always have enough funds to cover your costs.

Note that proper income and expense tracking is also vital for tax compliance.

3. Forecast your property management company’s revenue

Calculate your ongoing expenses and compare them against your predicted income to forecast your company’s revenue.

Here’s how to determine your costs and pricing:

- Perform a cost analysis to determine your operating costs, including maintenance, repairs, staff salaries, marketing, and software subscriptions.

- Conduct market research to determine what other companies are charging for similar services. The most recent Realtor.com rental report can help you determine rent prices in your area. Remember to consider your property type, level of service, and ongoing management fees.

- Determine your unique value proposition, such as excellent customer service or unique technology solutions. Offering something distinctive could enable you to increase your rent price.

- Compare this number to broader economic factors, such as rising interest rates, employment trends, and legislative changes. After determining your pricing and costs, compare these numbers to determine your potential revenue.

Pro tip: Be careful not to overprice your services, especially if you’re new to the market. To make your prices more accessible, consider offering flexible payment options to accommodate different types of residents.

4. Identify and hire your team

There are three structural models you can adopt when building your team:

- The portfolio framework: Each property manager is assigned a rental property.

- The departmental framework: Employees manage specific aspects of the business, such as inspections and resident relations.

- The hybrid framework: You combine the portfolio and departmental frameworks.

No matter which framework you choose, eventually, you’ll need a team consisting of:

- On-site managers

- Leasing agent(s)

- Maintenance manager(s)

- Accounting staff

- Admin staff

- Legal and compliance specialist(s)

- Marketing specialists

- Customer service representative(s)

- Facilities manager(s)

- Property inspector(s)

Building a reputation for having a trustworthy team can help you stand out among competitors. Here are some tips for hiring an expert team:

- Implement a robust screening process to help you find reliable candidates with the qualifications and experience needed for their roles.

- Offer attractive compensation packages that include health insurance, good salaries, and other perks to attract higher-quality talent.

- Invest in training and development to help new employees learn the company’s policies and systems faster and expand their skills.

5. Identify property management software your company could use

Property management software is a smart investment, as it helps automate operations. It can help your company start out on the right path and avoid future issues.

With Avail , for example, you can create the proper application forms and conduct background checks to find reliable residents. You can also use it to help you scale your property management company by making the rental process more enjoyable for your residents since they’ll get to:

- Pay their rent online

- Submit maintenance issues and requests from their phones

- Communicate with you directly

6. Acquire your first property

Acquiring your first property is a significant milestone. Make sure to conduct adequate market research to find a property that aligns with your goals and investment criteria.