To read this content please select one of the options below:

Please note you do not have access to teaching notes, the purpose of accounting education ☆.

A. C. Littleton’s Final Thoughts on Accounting: A Collection of Unpublished Essays

ISBN : 978-1-78635-390-0 , eISBN : 978-1-78635-389-4

Publication date: 15 October 2016

Accounting education can be considered as experience, as practice in learning to learn, and as part of education for business. Accounting techniques are important as parts of a data-processing apparatus, providing deeply significant data regarding enterprise prior experience. The objective of accounting is to provide insight into the results of management decisions. The aim of accounting education is to help students learn to learn to become professional accountants. The teacher should often mix theory with practice (the why and the how), and often indicate the contact of the course with non-accounting courses.

(2016), "The Purpose of Accounting Education ☆ ", A. C. Littleton’s Final Thoughts on Accounting: A Collection of Unpublished Essays ( Studies in the Development of Accounting Thought, Vol. 20 ), Emerald Group Publishing Limited, Leeds, pp. 47-55. https://doi.org/10.1108/S1479-350420160000020021

Emerald Group Publishing Limited

Copyright © 2016, The Estate of A.C. Littleton

We’re listening — tell us what you think

Something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

Discover the latest MyICAEW app for ACA students and members, available to download now. Find out more

- Benefits of membership

Gain access to world-leading information resources, guidance and local networks.

- Visit Benefits of membership

Becoming a member

98% of the best global brands rely on ICAEW Chartered Accountants.

- Visit Becoming a member

- Pay fees and subscriptions

Your membership subscription enables ICAEW to provide support to members.

Fees and subscriptions

Member rewards.

Take advantage of the range of value added or discounted member benefits.

- Member rewards – More from your membership

- Technical and ethics support

- Support throughout your career

Information and resources for every stage of your career.

Member Insights Survey

Let us know about the issues affecting you, your business and your clients.

- Complete the survey

From software start-ups to high-flying airlines and high street banks, 98% of the best global brands rely on ICAEW Chartered Accountants. A career as an ICAEW Chartered Accountant means the opportunity to work in any organisation, in any sector, whatever your ambitions.

Everything you need to know about ICAEW annual membership fees, community and faculty subscriptions, eligibility for reduced rates and details of how you can pay.

Membership administration

Welcome to the ICAEW members area: your portal to members'-only content, offers, discounts, regulations and membership information.

- Continuing Professional Development (CPD)

Continuing Professional Development (CPD) is an integral part of being a successful ICAEW Chartered Accountant.

The ICAEW Chartered Accountant qualification, the ACA, is one of the most advanced learning and professional development programmes available. It is valued around the world in business, practice and the public sector.

ACA for employers

Train the next generation of chartered accountants in your business or organisation. Discover how your organisation can attract, train and retain the best accountancy talent, how to become authorised to offer ACA training and the support and guidance on offer if you are already providing training.

Digital learning materials via BibliU

All ACA, ICAEW CFAB and Level 4 apprenticeship learning materials are now digital only. Read our guide on how to access your learning materials on the ICAEW Bookshelf using the BibliU app or through your browser.

- Find out more

Take a look at ICAEW training films

Focusing on professional scepticism, ethics and everyday business challenges, our training films are used by firms and companies around the world to support their in-house training and business development teams.

Attract and retain the next generation of accounting and finance professionals with our world-leading accountancy qualifications. Become authorised to offer ACA training and help your business stay ahead.

CPD guidance and help

Continuing Professional Development (CPD) is an integral part of being a successful ICAEW Chartered Accountant. Find support on ICAEW's CPD requirements and access resources to help your professional development.

Leadership Development Programmes

ICAEW Academy’s in-depth leadership development programmes take a holistic approach to combine insightful mentoring or coaching, to exclusive events, peer learning groups and workshops. Catering for those significant transitions in your career, these leadership development programmes are instrumental to achieving your ambitions or fulfilling your succession planning goals.

Specialist Finance Qualifications & Programmes

Whatever future path you choose, ICAEW will support the development and acceleration of your career at each stage to enhance your career.

Why a career in chartered accountancy?

If you think chartered accountants spend their lives confined to their desks, then think again. They are sitting on the boards of multinational companies, testifying in court and advising governments, as well as supporting charities and businesses from every industry all over the world.

- Why chartered accountancy?

Search for qualified ACA jobs

Matching highly skilled ICAEW members with attractive organisations seeking talented accountancy and finance professionals.

Volunteering roles

Helping skilled and in-demand chartered accountants give back and strengthen not-for-profit sector with currently over 2,300 organisations posting a variety of volunteering roles with ICAEW.

- Search for volunteer roles

- Get ahead by volunteering

Advertise with ICAEW

From as little as £495, access to a pool of highly qualified and ambitious ACA qualified members with searchable CVs.

Early careers and training

Start your ACA training with ICAEW. Find out why a career in chartered accountancy could be for you and how to become a chartered accountant.

Qualified ACA careers

Find Accountancy and Finance Jobs

Voluntary roles

Find Voluntary roles

While you pursue the most interesting and rewarding opportunities at every stage of your career, we’re here to offer you support whatever stage you are or wherever you are in the world and in whichever sector you have chosen to work.

ACA students

"how to guides" for aca students.

- ACA student guide

- How to book an exam

- How to apply for credit for prior learning (CPL)

Exam resources

Here are some resources you will find useful while you study for the ACA qualification.

- Certificate Level

- Professional Level

- Advanced Level

Digital learning materials

All ACA learning materials are now digital only. Read our guide on how to access your learning materials on the ICAEW Bookshelf via the BibliU app, or through your browser.

- Read the guide

My online training file

Once you are registered as an ACA student, you'll be able to access your training file to log your progress throughout ACA training.

- Access your training file

- Student Insights

Fresh insights, innovative ideas and an inside look at the lives and careers of our ICAEW students and members.

- Read the latest articles

System status checks

Getting started.

Welcome to ICAEW! We have pulled together a selection of resources to help you get started with your ACA training, including our popular 'How To' series, which offers step-by-step guidance on everything from registering as an ACA student and applying for CPL, to using your online training file.

Credit for prior learning (CPL)

Credit for prior learning or CPL is our term for exemptions. High quality learning and assessment in other relevant qualifications is appropriately recognised by the award of CPL.

Apply for exams

What you need to know in order to apply for the ACA exams.

The ACA qualification has 15 modules over three levels. They are designed to complement the practical experience you will be gaining in the workplace. They will also enable you to gain in-depth knowledge across a broad range of topics in accountancy, finance and business. Here are some useful resources while you study.

- Exam results

You will receive your results for all Certificate Level exams, the day after you take the exam and usually five weeks after a Professional and Advanced Level exam session has taken place. Access your latest and archived exam results here.

Training agreement

Putting your theory work into practice is essential to complete your ACA training.

Student support and benefits

We are here to support you throughout your ACA journey. We have a range of resources and services on offer for you to unwrap, from exam resources, to student events and discount cards. Make sure you take advantage of the wealth of exclusive benefits available to you, all year round.

- Applying for membership

The ACA will open doors to limitless opportunities in all areas of accountancy, business and finance anywhere in the world. ICAEW Chartered Accountants work at the highest levels as finance directors, CEOs and partners of some of the world’s largest organisations.

ACA training FAQs

Do you have a question about the ACA training? Then look no further. Here, you can find answers to frequently asked questions relating to the ACA qualification and training. Find out more about each of the integrated components of the ACA, as well as more information on the syllabus, your training agreement, ICAEW’s rules and regulations and much more.

- Anti-money laundering

Guidance and resources to help members comply with their legal and professional responsibilities around AML.

Technical releases

ICAEW Technical Releases are a source of good practice guidance on technical and practice issues relevant to ICAEW Chartered Accountants and other finance professionals.

- ICAEW Technical Releases

- Thought leadership

ICAEW's Thought Leadership reports provide clarity and insight on the current and future challenges to the accountancy profession. Our charitable trusts also provide funding for academic research into accountancy.

- Academic research funding

Technical Advisory Services helpsheets

Practical, technical and ethical guidance highlighting the most important issues for members, whether in practice or in business.

- ICAEW Technical Advisory Services helpsheets

Bloomsbury – free for eligible firms

In partnership with Bloomsbury Professional, ICAEW have provided eligible firms with free access to Bloomsbury’s comprehensive online library of around 80 titles from leading tax and accounting subject matter experts.

- Bloomsbury Accounting and Tax Service

Country resources

Our resources by country provide access to intelligence on over 170 countries and territories including economic forecasts, guides to doing business and information on the tax climate in each jurisdiction.

Industries and sectors

Thought leadership, technical resources and professional guidance to support the professional development of members working in specific industries and sectors.

Audit and Assurance

The audit, assurance and internal audit area has information and guidance on technical and practical matters in relation to these three areas of practice. There are links to events, publications, technical help and audit representations.

The most up-to-date thought leadership, insights, technical resources and professional guidance to support ICAEW members working in and with industry with their professional development.

- Corporate Finance

Companies, advisers and investors making decisions about creating, developing and acquiring businesses – and the wide range of advisory careers that require this specialist professional expertise.

- Corporate governance

Corporate governance is the system by which companies are directed and controlled. Find out more about corporate governance principles, codes and reports, Board subcommittees, roles and responsibilities and shareholder relations. Corporate governance involves balancing the interests of a company’s many stakeholders, such as shareholders, employees, management, customers, suppliers, financiers and the community. Getting governance right is essential to build public trust in companies.

Corporate reporting

View a range of practical resources on UK GAAP, IFRS, UK regulation for company accounts and non-financial reporting. Plus find out more about the ICAEW Corporate Reporting Faculty.

Expert analysis on the latest national and international economic issues and trends, and interviews with prominent voices across the finance industry, alongside data on the state of the economy.

- Financial Services

View articles and resources on the financial services sector.

- Practice resources

For ICAEW's members in practice, this area brings together the most up-to-date thought leadership, technical resources and professional guidance to help you in your professional life.

Public Sector

Many ICAEW members work in or with the public sector to deliver public priorities and strong public finances. ICAEW acts in the public interest to support strong financial leadership and better financial management across the public sector – featuring transparency, accountability, governance and ethics – to ensure that public money is spent wisely and that public finances are sustainable.

Sustainability and climate change

Sustainability describes a world that does not live by eating into its capital, whether natural, economic or social. Members in practice, in business and private individuals all have a role to play if sustainability goals are to be met. The work being undertaken by ICAEW in this area is to change behaviour to drive sustainable outcomes.

The Tax area has information and guidance on technical and practical tax matters. There are links to events, the latest tax news and the Tax Faculty’s publications, including helpsheets, webinars and Tax representations.

Keep up-to-date with tech issues and developments, including artificial intelligence (AI), blockchain, big data, and cyber security.

Trust & Ethics

Guidance and resources on key issues, including economic crime, business law, better regulation and ethics. Read through ICAEW’s Code of Ethics and supporting information.

- Communities

ICAEW Communities

Information, guidance and networking opportunities on industry sectors, professional specialisms and at various stages throughout your career. Free for ICAEW members and students.

- Discover a new community

ICAEW Faculties

The accountancy profession is facing change and uncertainty. The ICAEW Faculties can help by providing you with timely and relevant support.

- Choose to join any of the faculties

UK groups and societies

We have teams on the ground in: East of England, the Midlands, London and South East, Northern, South West, Yorkshire and Humberside, Wales and Scotland.

- Access your UK region

- Worldwide support and services

Support and services we offer our members in Africa, America, Canada, the Caribbean, Europe, Greater China, the Middle East, Oceania and South East Asia.

- Discover our services

ICAEW Faculties are 'centres of technical excellence', strongly committed to enhancing your professional development and helping you to meet your CPD requirements every year. They offer exclusive content, events and webinars, customised for your sector - which you should be able to easily record, when the time comes for the completion of your CPD declaration. Our offering isn't exclusive to Institute members. As a faculty member, the same resources are available to you to ensure you stay ahead of the competition.

Communities by industry / sector

Communities by life stage and workplace, communities by professional specialism, local groups and societies.

We aim to support you wherever in the world you work. Our regional offices and network of volunteers run events and provide access to local accounting updates in major finance centres around the globe.

- Ukraine crisis: central resource hub

Learn about the actions that ICAEW members are taking to ensure that their clients comply with sanctions imposed by different countries and jurisdictions, and read about the support available from ICAEW.

Insights pulls together the best opinion, analysis, interviews, videos and podcasts on the key issues affecting accountancy and business.

- See the latest insights

- Making COP count

This series looks at the role the accountancy profession can play in addressing the climate crisis and building a sustainable economy.

- Read more on COP28

Professional development and skills

With new requirements on ICAEW members for continuing professional development, we bring together resources to support you through the changes and look at the skills accountants need for the future.

- Visit the hub

When Chartered Accountants Save The World

Find out how chartered accountants are helping to tackle some of the most urgent social challenges within the UN Sustainable Development Goals, and explore how the profession could do even more.

- Read our major series

Insights specials

A listing of one-off Insights specials that focus on a particular subject, interviewing the key people, identifying developing trends and examining the underlying issues.

Top podcasts

Insights by topic.

ICAEW Regulation

- Regulatory News

View the latest regulatory updates and guidance and subscribe to our monthly newsletter, Regulatory & Conduct News.

- Regulatory Consultations

Strengthening trust in the profession

Our role as a world-leading improvement regulator is to strengthen trust and protect the public. We do this by enabling, evaluating and enforcing the highest standards in the profession.

Regulatory applications

Find out how you can become authorised by ICAEW as a regulated firm.

ICAEW codes and regulations

Professional conduct and complaints, statutory regulated services overseen by icaew, regulations for icaew practice members and firms, additional guidance and support, popular search results.

- Training File

- Practice Exam Software

- Ethics Cpd Course

- Routes to the ACA

- ACA students membership application

- Join as a member of another body

- How much are membership fees?

- How to pay your fees

- Receipts and invoices

- What if my circumstances have changed?

- Difficulties in making changes to your membership

- Faculty and community subscription fees

- Updating your details

- Complete annual return

- Promoting myself as an ICAEW member

- Verification of ICAEW membership

- Become a life member

- Become a fellow

- Request a new certificate

- Report the death of a member

- Membership regulations

- New members

- Career progression

- Career Breakers

- Volunteering at schools and universities

- ICAEW Member App

- Working internationally

- Self employment

- Support Members Scheme

- CPD is changing

- CPD learning resources

- Your guide to CPD

- Online CPD record

- How to become a chartered accountant

- Register as a student

- Train as a member of another body

- More about the ACA and chartered accountancy

- How ACA training works

- Become a training employer

- Access the training file

- Why choose the ACA

- Training routes

- Employer support hub

- Get in touch

- Apprenticeships with ICAEW

- A-Z of CPD courses by topic

- ICAEW Business and Finance Professional (BFP)

- ICAEW flagship events

- Financial Talent Executive Network (F-TEN®)

- Developing Leadership in Practice (DLiP™)

- Network of Finance Leaders (NFL)

- Women in Leadership (WiL)

- Mentoring and coaching

- Partners in Learning

- Board Director's Programme e-learning

- Corporate Finance Qualification

- Diploma in Charity Accounting

- ICAEW Certificate in Insolvency

- ICAEW Data Analytics Certificate

- Financial Modeling Institute’s Advanced Financial Modeler Accreditation

- ICAEW Sustainability Certificate for Finance Professionals

- ICAEW Finance in a Digital World Programme

- All specialist qualifications

- Team training

- Start your training

- Improve your employability

- Search employers

- Find a role

- Role alerts

- Organisations

- Practice support – 11 ways ICAEW and CABA can help you

- News and advice

- ICAEW Volunteering Hub

- Support in becoming a chartered accountant

- Vacancies at ICAEW

- ICAEW boards and committees

- Exam system status

- ICAEW systems: status update

- Changes to our qualifications

- How-to guides for ACA students

- Apply for credits - Academic qualification

- Apply for credits - Professional qualification

- Credit for prior learning (CPL)/exemptions FAQs

- Applications for Professional and Advanced Level exams

- Applications for Certificate Level exams

- Tuition providers

- Latest exam results

- Archived exam results

- Getting your results

- Marks feedback service

- Exam admin check

- Training agreement: overview

- Professional development

- Ethics and professional scepticism

- Practical work experience

- Access your online training file

- How training works in your country

- Student rewards

- TOTUM PRO Card

- Student events and volunteering

- Xero cloud accounting certifications

- Student support

- Join a community

- Wellbeing support from caba

- Student mentoring programme

- Student conduct and behaviour

- Code of ethics

- Fit and proper

- Level 4 Accounting Technician Apprenticeship

- Level 7 Accountancy Professional Apprenticeship

- AAT-ACA Fast Track FAQs

- ACA rules and regulations FAQs

- ACA syllabus FAQs

- ACA training agreement FAQs

- Audit experience and the Audit Qualification FAQs

- Independent student FAQs

- Practical work experience FAQs

- Professional development FAQs

- Six-monthly reviews FAQs

- Ethics and professional scepticism FAQs

- Greater China

- Latin America

- Middle East

- North America

- Australasia

- Russia and Eurasia

- South East Asia

- Charity Community

- Construction & Real Estate

- Energy & Natural Resources Community

- Farming & Rural Business Community

- Forensic & Expert Witness

- Global Trade Community

- Healthcare Community

- Internal Audit Community

- Manufacturing Community

- Media & Leisure

- Portfolio Careers Community

- Small and Micro Business Community

- Small Practitioners Community

- Travel, Tourism & Hospitality Community

- Valuation Community

- Audit and corporate governance reform

- Audit & Assurance Faculty

- Professional judgement

- Regulation and working in audit

- Internal audit resource centre

- ICAEW acting on audit quality

- Everything business

- Latest Business news from Insights

- Strategy, risk and innovation

- Business performance management

- Financial management

- Finance transformation

- Economy and business environment

- Leadership, personal development and HR

- Webinars and publications

- Business restructuring

- The Business Finance Guide

- Capital markets and investment

- Corporate finance careers

- Corporate Finance Faculty

- Debt advisory and growth finance

- Mergers and acquisitions

- Private equity

- Start-ups, scale-ups and venture capital

- Transaction services

- Board committees and board effectiveness

- Corporate governance codes and reports

- Corporate Governance Community

- Principles of corporate governance

- Roles, duties and responsibilities of Board members

- Stewardship and stakeholder relations

- Corporate Governance thought leadership

- Corporate reporting resources

- Small and micro entity reporting

- UK Regulation for Company Accounts

- Non-financial reporting

- Improving Corporate Reporting

- Economy home

- ICAEW Business Confidence Monitor

- ICAEW Manifesto 2024

- Energy crisis

- Levelling up: rebalancing the UK’s economy

- Resilience and Renewal: Building an economy fit for the future

- Social mobility and inclusion

- Autumn Statement 2023

- Investment management

- Inspiring confidence

- Setting up in practice

- Running your practice

- Supporting your clients

- Practice technology

- TAS helpsheets

- Support for business advisers

- Join ICAEW BAS

- Public Sector hub

- Public Sector Audit and Assurance

- Public Sector Finances

- Public Sector Financial Management

- Public Sector Financial Reporting

- Public Sector Learning & Development

- Public Sector Community

- Latest public sector articles from Insights

- Climate hub

- Sustainable Development Goals

- Accountability

- Modern slavery

- Resources collection

- Sustainability Committee

- Sustainability & Climate Change community

- Sustainability and climate change home

- Tax Faculty

- Budgets and legislation

- Business tax

- Devolved taxes

- Employment taxes

- International taxes

- Making Tax Digital

- Personal tax

- Property tax

- Stamp duty land tax

- Tax administration

- Tax compliance and investigation

- UK tax rates, allowances and reliefs

- Artificial intelligence

- Blockchain and cryptoassets

- Cyber security

- Data Analytics Community

- Digital skills

- Excel community

- Finance in a Digital World

- IT management

- Technology and the profession

- Trust & Ethics home

- Better regulation

- Business Law

- UK company law

- Data protection and privacy

- Economic crime

- Help with ethical problems

- ICAEW Code of Ethics

- ICAEW Trust and Ethics team.....

- Solicitors Community

- Forensic & Expert Witness Community

- Latest articles on business law, trust and ethics

- Audit and Assurance Faculty

- Corporate Reporting Faculty

- Financial Services Faculty

- Academia & Education Community

- Construction & Real Estate Community

- Entertainment, Sport & Media Community

- Retail Community

- Career Breakers Community

- Black Members Community

- Diversity & Inclusion Community

- Women in Finance Community

- Personal Financial Planning Community

- Restructuring & Insolvency Community

- Sustainability and Climate Change Community

- London and East

- South Wales

- Yorkshire and Humberside

- European public policy activities

- ICAEW Middle East

- Latest news

- Access to finance special

- Attractiveness of the profession

- Audit and Fraud

- Audit and technology

- Adopting non-financial reporting standards

- Cost of doing business

- Mental health and wellbeing

- Pensions and Personal Finance

- Public sector financial and non-financial reporting

- More specials ...

- The economics of biodiversity

- How chartered accountants can help to safeguard trust in society

- Video: The financial controller who stole £20,000 from her company

- It’s time for chartered accountants to save the world

- Video: The CFO who tried to trick the market

- Video: Could invoice fraud affect your business?

- So you want to be a leader?

- A busy new tax year, plus progress on the Economic Crime Act

- Does Britain have a farming problem?

- Budget 2024: does it change anything?

- Will accountants save the world? With ICAEW CEO Michael Izza

- Crunch time: VAT (or not) on poppadoms

- Where next for audit and governance reform?

- A taxing year ahead?

- What can we expect from 2024?

- COP28: making the business case for nature

- COP28: what does transition planning mean for accountants?

- More podcasts...

- Top charts of the week

- EU and international trade

- CEO and President's insights

- Diversity and Inclusion

- Sponsored content

- Insights index

- Charter and Bye-laws

- Archive of complaints, disciplinary and fitness processes, statutory regulations and ICAEW regulations

- Qualifications regulations

- Training and education regulations

- How to make a complaint

- Guidance on your duty to report misconduct

- Public hearings

- What to do if you receive a complaint against you

- Anti-money laundering supervision

- Working in the regulated area of audit

- Local public audit in England

- Probate services

- Designated Professional Body (Investment Business) licence

- Consumer credit

- Quality Assurance monitoring: view from the firms

- The ICAEW Practice Assurance scheme

- Licensed Practice scheme

- Professional Indemnity Insurance (PII)

- Clients' Money Regulations

- Taxation (PCRT) Regulations

- ICAEW training films

- Helpsheets and guidance by topic

- ICAEW's regulatory expertise and history

Accounting education: the future is bright

Academia & Education Community

Author: Susan Smith, UCL School of Management, University College London & Jennifer Rose, Alliance Manchester Business School, University of Manchester

Published: 25 Jul 2023

SHARE THIS ARTICLE

The AI narrative is shifting and students continue to face multiple challenges. Accounting education must move with the times.

The 2022/23 academic year has challenged the academic and education community once more. The release of ChatGPT 3 in late 2022 led to a rush of activity as the sector sought to understand the risks and opportunities that it, and other generative AI tools offer, not to mention the ethical implications of using them. Also, during 2022/23 both students and academics continue to face mental health challenges and burnout as they continue working through the ongoing cost of living crisis. Now academics are preparing for the next round of the Research Excellence Framework (with different rules of course) and are currently awaiting the results from the most recent round of the Teaching Excellence Framework. This is against the backdrop of a challenging regulatory and funding situation for the UK universities sector. That said, students are now mostly back in classrooms, with the benefits of many lecturers leveraging the digital skills built up through the pandemic to create more flexible learning environments where they can flourish.

What then does 2023/24 and beyond hold for accounting education?

The narrative surrounding generative AI has shifted noticeably in recent months from one predominantly concerned with academic integrity implications to considering the opportunities that it presents. For academic research, generative AI can yield significant productivity gains in the form of literature searching and writing support. In the classroom it can help with the development of lesson plans, the creation of scenarios and case studies, as well as writing check-up questions. For students it can support the review process, acting as a coach, a Socratic opponent or offer self-test capabilities. It is important that accounting academics maintain a dialogue with the profession to understand how such tools are being used in practice so that they can prepare students for the changing workplace.

We are hopeful that we will see a change in what authentic assessment looks like, perhaps with more portfolio work and reflection, including more optionality in assessment to support our diverse student population demonstrate their developing knowledge and skills. As accounting lecturers, we need to be aware of the constraints of professional accreditation but need to continue to challenge our students to develop and demonstrate the skills they need for the future.

All of this brings us to a juncture for accounting education. Too often accounting is conceptualised as a narrow technical subject and students focus on ‘the right answer’. This ignores the important enabling role that accounting plays in society in shaping behaviours, making inequalities visible and also the implications of its darker side, including matters of power and control. Given the power of accounting in society, a strong ethical foundation and the ability to make sound judgements are critical to underpin responsible behaviours. The rapidly developing sustainability reporting area is a fantastic opportunity to draw these themes together and engage with how accountants can work on societal challenges.

Accounting education has a responsibility to embrace and engage with the uncertainties of the subject, ensuring students are equipped with critical thinking skills that enable them to recognise and engage with the complex issues facing contemporary society.

In the words of Garry Carnegie and Jenni Rose ‘ How should we redefine accounting? ’. The article, from earlier this year, draws on the following definition of accounting:

'A technical, social and moral practice concerned with the sustainable utilisation of resources and proper accountability to stakeholders to enable the flourishing of organisations, people and nature.' (Carnegie, Parker & Tsahuridu, 2021)

Of course, students will still need to be able to perform technical calculations in order to understand the construction of the accounts but the emphasis is likely to shift to engage them further with the uncertainties and areas of judgement at the outset rather than in the more advanced options of their degree.

The question is, are we bold enough to lead these changes?

*The views expressed are the author’s and not ICAEW’s.

Carnegie, G., Parker, L., & Tsahuridu, E. (2021). It's 2020: what is accounting today? Australian Accounting Review , 31(1), 65-73.

- Read the latest articles from the Community

- Upcoming events and webinars

- Watch our on-demand webinars

Previous Article

A rich, full and meaningful life

Next Article

Are universities and artificial intelligence tools worthy adversaries in the quest for academic integrity?

Read out this code to the operator.

The AAA has educational resources for all members of the academy, whether you are at the beginning of your journey, a senior faculty member, or somewhere in between. Become a Member of the AAA to gain access to hundreds of hours of free CPE-granting content, upskill with our free-to-members webinars, advance your career with access to our Career Center, access our 17 scholarly journals, and more.

To learn more about membership, visit our Membership Page

AAA Career Center

The AAA Career Center is your trusted resource for career connections for job candidates and employers. Search and apply to the best jobs at institutions that value your credentials. Post your jobs where the most qualified professionals will find and apply to them.

AAA Webinars

The AAA offers many webinars as a benefit of membership. Topics vary widely, with the weARE series focusing on accounting education and research, the Pipeline Webinar Series addressing the accounting pipeline, and sponsored webinars. You can earn more than 35 FREE CPE CREDITS per year by attending AAA webinars.

AAA Meetings are a great time to learn more about the latest research and teaching trends, network with other accounting students and professionals, present your research, and earn CPE credits. AAA Members receive a discount on meeting registrations. Each year, the AAA hosts several meetings that are entirely teaching-focused, including the Intensive Data and Analytics Workshop, Audit Educator's and Accounting Information Systems Bootcamps, and Strategies for Success in the Classroom.

Pipeline Webinar Series

The AAA recently launched a new series of webinars, focusing on increasing the pipeline of accounting students. We are pleased to announce this is being offered – with free CPE – as an exclusive benefit to AAA Members. Recordings of prior webinars are available on the Pipeline Webinar Series page.

weARE Webinar Series - Free to Members

The AAA's weARE Webinar Series is free to members . Earn CPE credits and upskill your classroom while you hear from accounting educators on a wide range of topics. Webinar recordings are also available to AAA members, with over 70 already available and more being scheduled regularly.

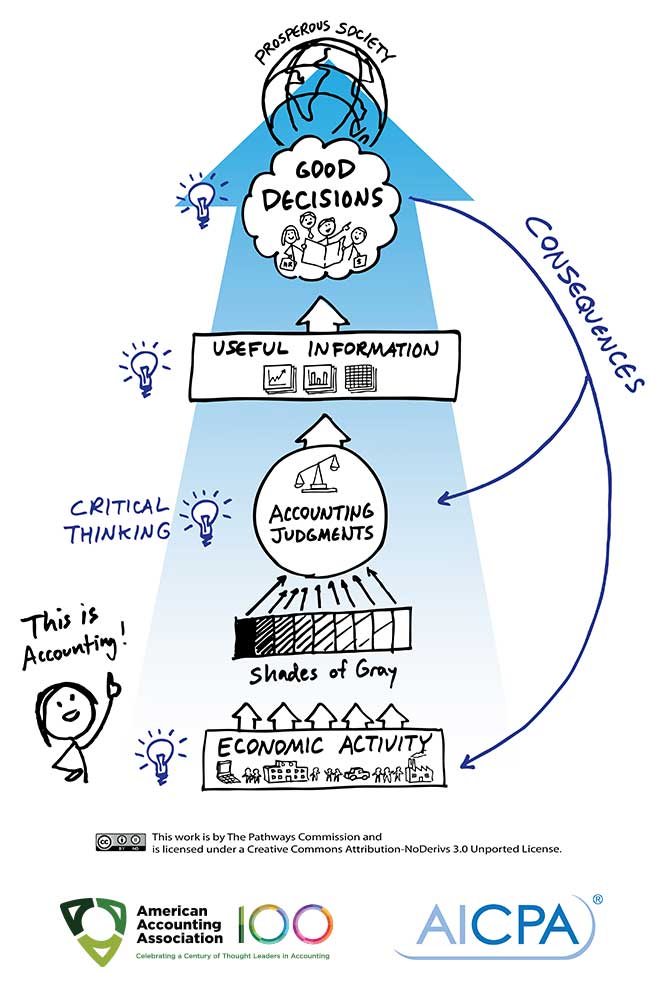

Pathways Continues

Implementation of the recommendations from the Pathways Commission report, Charting a National Strategy of the Next Generation of Accountants continues through Pathways Inspired activities . Success will ultimately be measured by ongoing efforts to continuously identify challenges and develop innovative actions to address these challenges.

Member Benefit

The AAA's new Learning Management System (LMS) is now offering two courses, available free to members with purchase options for non-members. The first course, created in collaboration with KPMG, titled "The Architecture of Inclusion", includes 8 insightful 1-hour modules with resources, tools, and techniques to improve your cultural intelligence (CQ). The newest series, titled "The Inclusive Classroom" features discussions with educators and offers strategies and resources to foster inclusivity in your classroom for all students. Bulk registration pricing is also available for organizations.

Thinking of a PhD?

PhD Students can take advantage of the reduced student membership rates offered by AAA and its sections. AAA Meetings are a great opportunity for PhD students to present their research , be exposed to new ideas, and network with other students and professionals . Each year, the AAA hosts the Accounting PhD Rookie Recruiting and Research Camp. This conference is a two-day forum for recruiters to meet and network with PhD Candidates. Student members also receive a 10% discount on Author Services via Editage

AAA Journals

AAA Members have access to all 17 of our journals, including The Accounting Review , Accounting Horizons , and Issues in Accounting Education . These journals are a great educational resource to learn more about trending topics in accounting, and stay up to date on the latest research. Full members receive access to teaching notes!

COSO Frameworks for Teaching and Research

The AAA in a joint initiative with The Committee of Sponsoring Organizations of the Treadway Commission (COSO), provides online academic access to COSO’s two frameworks. With this project, COSO is investing in education with the long-term goals of improving organizational performance, enhancing governance, and reducing the extent of fraud in organizations.

Online Students

For All Online Programs

International Students

On Campus, need or have Visa

Campus Students

For All Campus Programs

Is an Accounting Degree Worth It?

Understanding the Numbers When reviewing job growth and salary information, it’s important to remember that actual numbers can vary due to many different factors — like years of experience in the role, industry of employment, geographic location, worker skill and economic conditions. Cited projections do not guarantee actual salary or job growth.

If you're thinking about a bachelor’s degree in accounting, you might have questions about what the degree program is like and what you can do with it.

Choosing your major or degree program is a big decision, but doing your research can help you make a choice that works for you, your interests and your goals.

First Things First: Is Accounting a Hard Major?

Some accounting degree courses do fall into the category of what you probably think of as typical “math” classes. For example, you can expect to take a course in statistics. But many classes in your accounting degree will focus on the theories, documentation and laws that inform accounting practices, like microeconomics or federal taxation.

“In accounting, the math involved is manageable, with resources readily available to assist in understanding,” Regis said, “but the focus should be on problem-solving and logical thinking rather than complex mathematical computations.”

Regis has been an instructor and administrator at SNHU for 10 years. As a senior associate dean, she currently oversees accounting, finance and business administration programs and courses, among others. During this time, she’s seen the challenges students face in an accounting program , but also the skills that can help them succeed.

So, What Makes Someone a Good Accountant?

According to Regis, you may be a good fit for a degree in accounting if you have:

- A keen eye for detail: Details matter in accounting, and being detail-oriented ensures accuracy in your financial reporting.

- Strong analytical skills: Accountants have to make sense of complex financial data to help inform business strategies.

- A strong sense of integrity: Financial information often has a sensitive nature. “Integrity and ethical conduct are non-negotiable,” Regis said.

Every major comes with its own set of challenges, and they will be different for every student. Regis encourages students who are facing challenges or difficulty to share their concerns with an instructor or advisor and to take advantage of academic support services .

Find Your Program

How valuable is a bachelor’s degree in accounting.

If you are interested in becoming an accountant , getting your bachelor's degree in accounting or a related field (like business administration) is a good first step. While there are some jobs you can do without a bachelor's degree, like becoming an accounting clerk, auditing clerk or bookkeeper , your earning potential will see a significant increase if you have a bachelor's degree.*

According to the U.S. Bureau of Labor Statistics (BLS), in 2023, accountants and auditors with a bachelor’s degree made a median salary of $79,880 compared to the median salary of $47,440 for accounting clerks, auditing clerks or bookkeepers.*

In addition to increasing your earning potential and career options, an accounting degree can also lay the groundwork for further certifications, like becoming a Certified Public Accountant (CPA).*

Accounting Degree Career Outlook and Outcomes

Your bachelor’s degree in accounting can be the gateway to multiple career opportunities — and the career outlook for accountants is good.* According to the BLS, there will be an expected 126,500 job openings for auditors and accountants each year between 2022 and 2032, which is a growth rate of 4%.* This is slightly higher than the projected 3% growth rate across all careers in the U.S.*

“An accounting degree offers flexibility, allowing graduates to explore various sectors within the business world,” said Regis. She also noted that some career paths you may choose to pursue with an accounting degree include:

- Auditing: Auditors make sure that an organization’s financial statements are accurate and compliant with relevant laws.

- Financial analysis: Financial analysts guide businesses in decision-making based on data and financial insights. Find out how you can become a financial analyst .

- Forensic accounting: Forensic accountants and fraud examiners investigate financial transactions and crimes. If this interests you, explore how to become a forensic accountant .

- Public accounting: Public accountants advise individuals and businesses on tax matters.

To increase your skills and help boost your employability after graduation, Regis said it’s beneficial to look for internships that will give you practical experience — and you can often get course credit for them during your degree as well. She also suggests looking into professional certifications, student organizations, competitions and conferences to develop your leadership skills and professional networks .

Is an Accounting Degree a Good Fit for Me?

If you’re thinking about a bachelor's degree in accounting, take the time to look at your options and your goals. To aid your research and reflection, Regis encourages students to check out industry websites sites like AICPA & CIMA or the New Hampshire Society of Certified Public Accountants to learn more about the career path.

“Prospective students should assess their interest in accounting, understand the commitment required for a rigorous academic journey and explore the various specializations within accounting to find their niche,” said Regis.

Discover more about SNHU's online bachelor's in accounting : Find out what courses you'll take, skills you'll learn and how to request information about the program.

Explore more content like this article

Should I Get an HR Certificate Before a Degree in Human Resources?

Is a Business Degree Worth It?

What is Public Administration?

About southern new hampshire university.

SNHU is a nonprofit, accredited university with a mission to make high-quality education more accessible and affordable for everyone.

Founded in 1932, and online since 1995, we’ve helped countless students reach their goals with flexible, career-focused programs . Our 300-acre campus in Manchester, NH is home to over 3,000 students, and we serve over 135,000 students online. Visit our about SNHU page to learn more about our mission, accreditations, leadership team, national recognitions and awards.

- Corporate Finance

Accounting Explained With Brief History and Modern Job Requirements

- Search Search Please fill out this field.

What Is Accounting?

What is the purpose of accounting, history of accounting, what types of careers are in the accounting field.

- Requirements

What Are Major Accounting Software Platforms?

Why accounting is important.

- Accounting FAQs

:max_bytes(150000):strip_icc():format(webp)/jason_mugshot__jason_fernando-5bfc261946e0fb00260a1cea.jpg)

Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics. Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit.

Accounting is the process of recording financial transactions pertaining to a business. The accounting process includes summarizing, analyzing, and reporting these transactions to oversight agencies, regulators, and tax collection entities. The financial statements used in accounting are a concise summary of financial transactions over an accounting period, summarizing a company's operations, financial position, and cash flows .

Key Takeaways

- Regardless of the size of a business, accounting is a necessary function for decision making, cost planning, and measurement of economic performance.

- A bookkeeper can handle basic accounting needs, but a Certified Public Accountant (CPA) should be utilized for larger or more advanced accounting tasks.

- Two important types of accounting for businesses are managerial accounting and cost accounting. Managerial accounting helps management teams make business decisions, while cost accounting helps business owners decide how much a product should cost.

- Professional accountants follow a set of standards known as the Generally Accepted Accounting Principles (GAAP) when preparing financial statements.

- Accounting is an important function of strategic planning, external compliance, fundraising, and operations management.

Investopedia / Jiaqi Zhou

Accounting is one of the key functions of almost any business. A bookkeeper or an accountant may handle it at a small firm. At larger companies, there might be sizable finance departments guided by a unified accounting manual with dozens of employees. The reports generated by various streams of accounting, such as cost accounting and managerial accounting, are invaluable in helping management make informed business decisions.

The financial statements that summarize a large company's operations, financial position, and cash flows over a particular period are concise and consolidated reports based on thousands of individual financial transactions. As a result, all professional accounting designations are the culmination of years of study and rigorous examinations combined with a minimum number of years of practical accounting experience.

The history of accounting has been around almost as long as money itself. Accounting history dates back to ancient civilizations in Mesopotamia, Egypt, and Babylon. For example, during the Roman Empire, the government had detailed records of its finances. However, modern accounting as a profession has only been around since the early 19th century.

Luca Pacioli is considered "The Father of Accounting and Bookkeeping" due to his contributions to the development of accounting as a profession. An Italian mathematician and friend of Leonardo da Vinci, Pacioli published a book on the double-entry system of bookkeeping in 1494.

By 1880, the modern profession of accounting was fully formed and recognized by the Institute of Chartered Accountants in England and Wales . This institute created many of the systems by which accountants practice today. The formation of the institute occurred in large part due to the Industrial Revolution. Merchants not only needed to track their records but sought to avoid bankruptcy as well.

The Alliance for Responsible Professional Licensing (ARPL) was formed in August 2019 in response to a series of state deregulatory proposals making the requirements to become a CPA more lenient. The ARPL is a coalition of various advanced professional groups including engineers, accountants, and architects.

What Are the Different Types of Accounting?

Accountants may be tasked with recording specific transactions or working with specific sets of information. For this reason, there are several broad groups that most accountants can be grouped into.

Financial Accounting

Financial accounting refers to the processes used to generate interim and annual financial statements. The results of all financial transactions that occur during an accounting period are summarized in the balance sheet, income statement, and cash flow statement. The financial statements of most companies are audited annually by an external CPA firm.

For some, such as publicly-traded companies, audits are a legal requirement. However, lenders also typically require the results of an external audit annually as part of their debt covenants. Therefore, most companies will have annual audits for one reason or another.

Managerial Accounting

Managerial accounting uses much of the same data as financial accounting, but it organizes and utilizes information in different ways . Namely, in managerial accounting, an accountant generates monthly or quarterly reports that a business's management team can use to make decisions about how the business operates. Managerial accounting also encompasses many other facets of accounting, including budgeting, forecasting, and various financial analysis tools. Essentially, any information that may be useful to management falls underneath this umbrella.

Cost Accounting

Just as managerial accounting helps businesses make decisions about management, cost accounting helps businesses make decisions about costing. Essentially, cost accounting considers all of the costs related to producing a product. Analysts, managers, business owners, and accountants use this information to determine what their products should cost . In cost accounting, money is cast as an economic factor in production, whereas in financial accounting, money is considered to be a measure of a company's economic performance.

Tax Accounting

While financial accountants often use one set of rules to report the financial position of a company, tax accountants often use a different set of rules. These rules are set at the federal, state, or local level based on what return is being filed. Tax accounts balance compliance with reporting rules while also attempting to minimize a company's tax liability through thoughtful strategic decision-making. A tax accountant often oversees the entire tax process of a company: the strategic creation of the organization chart , the operations, the compliance, the reporting, and the remittance of tax liability.

While basic accounting functions can be handled by a bookkeeper, advanced accounting is typically handled by qualified accountants who possess designations such as Certified Public Accountant (CPA) or Certified Management Accountant (CMA) in the United States.

In Canada, the three legacy designations—the Chartered Accountant (CA), Certified General Accountant (CGA), and Certified Management Accountant (CMA)—have been unified under the Chartered Professional Accountant (CPA) designation.

A major component of the accounting professional is the "Big Four". These four largest accounting firms conduct audit, consulting, tax advisory, and other services. These firms, along with many other smaller firms, comprise the public accounting realm that generally advises financial and tax accounting.

Careers in accounting may vastly difference by industry, department, and niche. Some relevant job titles may include:

- Auditor (internal or external): ensures compliance with reporting requirements and safeguarding of company assets.

- Forensic Accountant : monitors internal or external activity to investigate the transactions of an individual or business.

- Tax Accountant: strategically plans the optimal business composition to minimize tax liabilities as well as ensures compliance with tax reporting.

- Managerial Accountant: analyzes financial transactions to make thoughtful, strategic recommendations often related to the manufacturing of goods.

- Information and Technology Analyst/Accountant: maintains the system and software in which accounting records are processed and stored.

- Controller : oversees the accounting functions of financial reporting, accounts payable, accounts receivable, and procurement.

As of May 2023, the average Certified Public Accountant in the United States made $113,095 per year.

What Are Accounting Standards?

In most cases, accountants use generally accepted accounting principles (GAAP) when preparing financial statements in the U.S. GAAP is a set of standards and principles designed to improve the comparability and consistency of financial reporting across industries. Its standards are based on double-entry accounting, a method in which every accounting transaction is entered as both a debit and credit in two separate general ledger accounts that will roll up into the balance sheet and income statement.

In most other countries , a set of standards governed by the International Accounting Standards Board named the International Financial Reporting Standards (IFRS) is used.

Tax accountants overseeing returns in the United States rely on guidance from the Internal Revenue Service. Federal tax returns must comply with tax guidance outlined by the Internal Revenue Code (IRC). Tax accounts may also lean in on state or county taxes as outlined by the jurisdiction in which the business conducts business. Foreign companies must comply with tax guidance in the countries in which it must file a return.

Accountants often leverage software to aid in their work. Some accounting software is considered better for small businesses such as QuickBooks, Quicken, FreshBooks, Xero, SlickPie, or Sage 50. Larger companies often have much more complex solutions to integrate with their specific reporting needs. This includes add-on modules or in-home software solutions. Large accounting solutions include Oracle, NetSuite, or Sage products.

What Is the Accounting Cycle?

Financial accountants typically operate in a cyclical environment with the same steps happening in order and repeating every reporting period. These steps are often referred to as the accounting cycle, the process of taking raw transaction information, entering it into an accounting system, and running relevant and accurate financial reports. The steps of the accounting cycle are:

- Collect transaction information such as invoices , bank statements , receipts, payment requests, uncashed checks, credit card statements, or other mediums that may contain business transactions.

- Post journal entries to the general ledger for the items in Step 1, reconciling to external documents whenever possible.

- Prepare an unadjusted trial balance to ensure all debits and credits balance and material general ledger accounts look correct.

- Post adjusting journal entries at the end of the period to reflect any changes to be made to the trial balance run in Step 3.

- Prepare the adjusted trial balance to ensure these financial balances are materially correct and reasonable.

- Prepare the financial statements to summarize all transactions for a given reporting period.

Cash Method vs. Accrual Method of Accounting

Financial accounts have two different sets of rules they can choose to follow. The first, the accrual basis method of accounting, has been discussed above. These rules are outlined by GAAP and IFRS, are required by public companies, and are mainly used by larger companies.

The second set of rules follow the cash basis method of accounting. Instead of recording a transaction when it occurs, the cash method stipulates a transaction should be recorded only when cash has exchanged. Because of the simplified manner of accounting, the cash method is often used by small businesses or entities that are not required to use the accrual method of accounting.

Imagine a company buys $1,000 of inventory on credit. Payment is due for the inventory in 30 days.

- Under the accrual method of accounting, a journal entry is recorded when the order is placed. The entry records a debit to inventory (asset) for $1,000 and a credit to accounts payable (liability) for $1,000. When 30 days has passed and the inventory is actually paid for, the company posts a second journal entry: a debit to accounts payable (liability) for $1,000 and a credit to cash (asset) for $1,000.

- Under the cash method of accounting, a journal entry is only recorded when cash has been exchanged for inventory. There is no entry when the order is placed; instead, the company enters only one journal entry at the time the inventory is paid for. The entry is a debit to inventory (asset) for $1,000 and a credit to cash (asset) for $1,000.

The difference between these two accounting methods is the treatment of accruals. Naturally, under the accrual method of accounting, accruals are required. Under the cash method, accruals are not required and not recorded.

The Securities and Exchange Commission has an entire financial reporting manual outlining reporting requirements of public companies.

Accounting is a back-office function where employees may not directly interface with customers, product developers, or manufacturing. However, accounting plays a key role in the strategic planning, growth, and compliance requirements of a company.

- Accounting is necessary for company growth. Without insight into how a business is performing, it is impossible for a company to make smart financial decisions through forecasting . Without accounting, a company wouldn't be able to tell which products are its best sellers, how much profit is made in each department, and what overhead costs are holding back profits.

- Accounting is necessary for funding. External investors want confidence that they know what they are investing in. Prior to private funding, investors will usually require financial statements (often audited) to gauge the overall health of a company. The same rules pertain to debt financing. Banks and other lending institutions will often require financial statements in compliance with accounting rules as part of the underwriting and review process for issuing a loan.

- Accounting is necessary for owner exit. Small companies that may be looking to be acquired often need to present financial statements as part of acquisition or merger efforts. Instead of simply closing a business, a business owner may attempt to "cash-out" of their position and receive compensation for building a company. The basis for valuing a company is to use its accounting records.

- Accounting is necessary to make payments. A company naturally incurs debt, and part of the responsibility of managing that debt is to make payments on time to the appropriate parties. Without positively fostering these business relationships, a company may find itself with a key supplier or vendor. Through accounting, a company can always know who it has debts to and when those debts are coming due.

- Accounting is necessary to collect payments. A company may agree to extend credit to its customers. Instead of collecting cash at the time of an agreement, it may give a customer trade credit terms such as net 30. Without accounting, a company may have a hard time keeping track of who owes it money and when that money is to be received.

- Accounting may be required. Public companies are required to issue periodic financial statements in compliance with GAAP or IFRS. Without these financial statements, a company may be de-listed from an exchange. Without proper tax accounting compliance, a company may receive fines or penalties.

Example of Accounting

To illustrate double-entry accounting, imagine a business sends an invoice to one of its clients. An accountant using the double-entry method records a debit to accounts receivables, which flows through to the balance sheet, and a credit to sales revenue, which flows through to the income statement.

When the client pays the invoice, the accountant credits accounts receivables and debits cash. Double-entry accounting is also called balancing the books, as all of the accounting entries are balanced against each other. If the entries aren't balanced, the accountant knows there must be a mistake somewhere in the general ledger.

What Are the Responsibilities of an Accountant?

Accountants help businesses maintain accurate and timely records of their finances. Accountants are responsible for maintaining records of a company’s daily transactions and compiling those transactions into financial statements such as the balance sheet, income statement, and statement of cash flows. Accountants also provide other services, such as performing periodic audits or preparing ad-hoc management reports.

What Skills Are Required for Accounting?

Accountants hail from a wide variety of backgrounds. Generally speaking, however, attention to detail is a key component in accountancy, since accountants must be able to diagnose and correct subtle errors or discrepancies in a company’s accounts. The ability to think logically is also essential, to help with problem-solving. Mathematical skills are helpful but are less important than in previous generations due to the wide availability of computers and calculators.

Why Is Accounting Important for Investors?

The work performed by accountants is at the heart of modern financial markets. Without accounting, investors would be unable to rely on timely or accurate financial information, and companies’ executives would lack the transparency needed to manage risks or plan projects. Regulators also rely on accountants for critical functions such as providing auditors’ opinions on companies’ annual 10-K filings . In short, although accounting is sometimes overlooked, it is absolutely critical for the smooth functioning of modern finance.

American Institute of Certified Public Accountants. " CPA Licensure ."

Gary J. Previts, Peter Walton, and Peter Wolnizer. "Global History of Accounting, Financial Reporting and Public Policy: Eurasia, Middle East and Africa," Pages 1-29. Emerald Group Publishing, 2012.

Jane Gleeson-White. "Double Entry: How the Merchants of Venice Created Modern Finance," Pages 28, 47 and 91. W. W. Norton & Company, 2012.

The Institute of Chartered Accountants in England and Wales. " Timeline: 1853-1880 ."

Alliance for Responsible Professional Licensing. " AICPA, NASBA Help Launch New Coalition to Protect Professional Licensing ."

U.S. Securities and Exchange Commission. " All About Auditors: What Investors Need to Know ."

American Institute of Certified Public Accountants. " Frequently Asked Questions FAQs - Become a CPA ."

Institute of Management Accountants. " CMA Certification ."

Chartered Professional Accountants Canada. " The CPA Profession ."

Glassdoor. " CPA Salaries ."

Financial Accounting Foundation. " About GAAP ."

International Financial Reporting Standards Foundation. " Who Uses IFRS Standards? "

Internal Revenue Service. " Tax Code, Regulations, and Official Guidance ."

U.S. Securities and Exchange Commission. " Financial Reporting Manual ."

- Accounting Explained With Brief History and Modern Job Requirements 1 of 51

- What Is the Accounting Equation, and How Do You Calculate It? 2 of 51

- What Is an Asset? Definition, Types, and Examples 3 of 51

- Liability: Definition, Types, Example, and Assets vs. Liabilities 4 of 51

- Equity Meaning: How It Works and How to Calculate It 5 of 51

- Revenue Definition, Formula, Calculation, and Examples 6 of 51

- Expense: Definition, Types, and How Expenses Are Recorded 7 of 51

- Current Assets vs. Noncurrent Assets: What's the Difference? 8 of 51

- What Is Accounting Theory in Financial Reporting? 9 of 51

- Accounting Principles Explained: How They Work, GAAP, IFRS 10 of 51

- Accounting Standard Definition: How It Works 11 of 51

- Accounting Convention: Definition, Methods, and Applications 12 of 51

- What Are Accounting Policies and How Are They Used? With Examples 13 of 51

- How Are Principles-Based and Rules-Based Accounting Different? 14 of 51

- What Are Accounting Methods? Definition, Types, and Example 15 of 51

- What Is Accrual Accounting, and How Does It Work? 16 of 51

- Cash Accounting Definition, Example & Limitations 17 of 51

- Accrual Accounting vs. Cash Basis Accounting: What's the Difference? 18 of 51

- Financial Accounting Standards Board (FASB): Definition and How It Works 19 of 51

- Generally Accepted Accounting Principles (GAAP): Definition, Standards and Rules 20 of 51

- What Are International Financial Reporting Standards (IFRS)? 21 of 51

- IFRS vs. GAAP: What's the Difference? 22 of 51

- How Does US Accounting Differ From International Accounting? 23 of 51

- Cash Flow Statement: What It Is and Examples 24 of 51

- Breaking Down The Balance Sheet 25 of 51

- Income Statement: How to Read and Use It 26 of 51

- What Does an Accountant Do? 27 of 51

- Financial Accounting Meaning, Principles, and Why It Matters 28 of 51

- How Does Financial Accounting Help Decision-Making? 29 of 51

- Corporate Finance Definition and Activities 30 of 51

- How Financial Accounting Differs From Managerial Accounting 31 of 51

- Cost Accounting: Definition and Types With Examples 32 of 51

- Certified Public Accountant: What the CPA Credential Means 33 of 51

- What Is a Chartered Accountant (CA) and What Do They Do? 34 of 51

- Accountant vs. Financial Planner: What's the Difference? 35 of 51

- Auditor: What It Is, 4 Types, and Qualifications 36 of 51

- Audit: What It Means in Finance and Accounting, and 3 Main Types 37 of 51

- Tax Accounting: Definition, Types, vs. Financial Accounting 38 of 51

- Forensic Accounting: What It Is, How It's Used 39 of 51

- Chart of Accounts (COA) Definition, How It Works, and Example 40 of 51

- What Is a Journal in Accounting, Investing, and Trading? 41 of 51

- Double Entry: What It Means in Accounting and How It's Used 42 of 51

- Debit: Definition and Relationship to Credit 43 of 51

- Credit: What It Is and How It Works 44 of 51

- Closing Entry 45 of 51

- What Is an Invoice? It's Parts and Why They Are Important 46 of 51

- 6 Components of an Accounting Information System (AIS) 47 of 51

- Inventory Accounting: Definition, How It Works, Advantages 48 of 51

- Last In, First Out (LIFO): The Inventory Cost Method Explained 49 of 51

- The FIFO Method: First In, First Out 50 of 51

- Average Cost Method: Definition and Formula with Example 51 of 51

:max_bytes(150000):strip_icc():format(webp)/General-ledger-b821d06e18904b86b246c191d0adc447.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- More from M-W

- To save this word, you'll need to log in. Log In

Definition of accounting

- explanation

Examples of accounting in a Sentence

These examples are programmatically compiled from various online sources to illustrate current usage of the word 'accounting.' Any opinions expressed in the examples do not represent those of Merriam-Webster or its editors. Send us feedback about these examples.

Word History

Middle English acountynge "reckoning, calculation," from gerund of accounten "to account entry 2 "

circa 1676, in the meaning defined at sense 2b

Phrases Containing accounting

- cost accounting

- there's no accounting for taste

Dictionary Entries Near accounting

account for (something)

accounting equation

Cite this Entry

“Accounting.” Merriam-Webster.com Dictionary , Merriam-Webster, https://www.merriam-webster.com/dictionary/accounting. Accessed 1 May. 2024.

Kids Definition

Kids definition of accounting, legal definition, legal definition of accounting, more from merriam-webster on accounting.

Nglish: Translation of accounting for Spanish Speakers

Britannica English: Translation of accounting for Arabic Speakers

Britannica.com: Encyclopedia article about accounting

Subscribe to America's largest dictionary and get thousands more definitions and advanced search—ad free!

Can you solve 4 words at once?

Word of the day.

See Definitions and Examples »

Get Word of the Day daily email!

Popular in Grammar & Usage

More commonly misspelled words, commonly misspelled words, how to use em dashes (—), en dashes (–) , and hyphens (-), absent letters that are heard anyway, how to use accents and diacritical marks, popular in wordplay, the words of the week - apr. 26, 9 superb owl words, 'gaslighting,' 'woke,' 'democracy,' and other top lookups, 10 words for lesser-known games and sports, your favorite band is in the dictionary, games & quizzes.

IMAGES

VIDEO

COMMENTS

A comprehensive definition of accounting education is surprisingly sparse in the accounting academic literature. The phrase in most instances is mentioned without explanation and its meaning is assumed lacking elaboration beyond its literal or intuitive understanding or description. This could be because 'accounting education' is a socially ...

Accounting techniques are important as parts of a data-processing apparatus, providing deeply significant data regarding enterprise prior experience. The objective of accounting is to provide insight into the results of management decisions. The aim of accounting education is to help students learn to learn to become professional accountants.

According to NASBA, 2016 candidates from AACSB-accredited accounting programs had a pass rate of 55.1%, compared to the overall pass rate of 48.7%. In addition, first-time candidates from schools with an AACSB accounting accreditation had a pass rate of 61.9%, compared to an overall first-time pass rate of 54.4%.

The sub-discipline of accounting education is often traced back to the advent of accounting as a modern profession during the mid-nineteenth century, with education being a key part of the accountancy professionalisation project (Willmott, 1986).Yet, before the words 'accounting' and 'accountancy' became widely used, earlier forms of accounting, sometimes called 'reckoning' and ...

meaning is assumed lacking elaboration beyond its literal or intuitive understanding or description. This could be because 'accounting education' is a socially constructed concept ... Accounting education reinforces the assumptions of capitalism and shareholder discourse

This Special Edition of Accounting History can act as a catalyst for more historical studies of accounting education that puts accounting education today into perspective, and may well allow us to draw on the data bank of the past to provide solutions to the problems of the present (Carnegie and Napier, 1996). 1.

Degrees in accounting, or accountancy degrees, are the culminating degree of an accounting or finance program that prepares the holder for a career in the field. An accountancy degree prepares you for a number of jobs. For example, as an accounting degree holder, it's possible to open your own business as a CPA or work on a freelance basis ...

International accounting education standards convergence is an important issue as it enhances the global accountancy profession's competency and public trust to the profession.

The AI narrative is shifting and students continue to face multiple challenges. Accounting education must move with the times. The 2022/23 academic year has challenged the academic and education community once more. The release of ChatGPT 3 in late 2022 led to a rush of activity as the sector sought to understand the risks and opportunities ...

The Journal of Accounting Education (JAEd) is a refereed journal dedicated to promoting and publishing research on accounting education issues and to improving the quality of accounting education worldwide. The Journal provides a vehicle for making results of empirical studies available to educators and for exchanging ideas, instructional resources, and best practices that help improve ...

Projected bachelor's, master's, and PhD accounting enrollments were down 4%, 6%, and 23% in 2018 compared with 2016, respectively, and the number of new CPA exam candidates hit a 10-year low. The declining trends in accounting program enrollments should be of interest and concern to the PCAOB, SEC, FASB, GASB, and other leading authorities.

A bachelor's degree in accounting meets the educational requirement for careers like accountant and auditor. Earning a bachelor's degree takes four years of full-time study, though some institutions offer accelerated programs. Accounting majors complete a minimum of 120 credits to graduate.

The accounting education has criteria that discipline the educational process and achieve high quality for the educational process as well as preparing a new generation qualified technically and ...

A certified public accountant (CPA) is an accounting professional who has met certain education, exam, and experience requirements for licensure by a state board of accountancy. To become a CPA, you'll need to pass an exam that demonstrates you have mastered the technical skills necessary to provide services for financial accounting ...

Get an accounting education. Look into accounting degree programs to find one that best suits your needs. Compare their costs, application processes, and reputations. In addition, obtain the certifications and/or licensures required by your specific area of accounting. Gain accounting experience.

Education. The AAA has educational resources for all members of the academy, whether you are at the beginning of your journey, a senior faculty member, or somewhere in between. Become a Member of the AAA to gain access to hundreds of hours of free CPE-granting content, upskill with our free-to-members webinars, advance your career with access ...

(a) Accounting Perspectives was included in the 1991-1997 review; excluded thereafter because its focus shifted away from education-related articles. (b) Not reviewed prior to 1997. (c) Known as Accounting Education: A Journal of Theory, Practice, and Research for the 1991-1997 review. (d) No issue published in 2006. (e) No issues published. (f) Volumes 11, 12, 13, and 14 (1999-2002) not ...

(a) Accounting Perspectives was included in the 1991-1997 review; excluded thereafter because its focus shifted away from education-related articles. (b) Not reviewed prior to 1997. (c) Known as Accounting Education: A Journal of Theory, Practice, and Research for the 1991-1997 review. (d) No issue published. (e) Volumes 11, 12, 13, and 14 (1999-2002) were not reviewed in this series.