- How It Works

- All Projects

- Write my essay

- Buy essay online

- Custom coursework

- Creative writing

- Custom admission essay

- College essay writers

- IB extended essays

- Buy speech online

- Pay for essays

- College papers

- Do my homework

- Write my paper

- Custom dissertation

- Buy research paper

- Buy dissertation

- Write my dissertation

- Essay for cheap

- Essays for sale

- Non-plagiarized essays

- Buy coursework

- Term paper help

- Buy assignment

- Custom thesis

- Custom research paper

- College paper

- Coursework writing

- Edit my essay

- Nurse essays

- Business essays

- Custom term paper

- Buy college essays

- Buy book report

- Cheap custom essay

- Argumentative essay

- Assignment writing

- Custom book report

- Custom case study

- Doctorate essay

- Finance essay

- Scholarship essays

- Essay topics

- Research paper topics

- Top queries link

Best Education Essay Examples

Financial management: reflection on the course.

622 words | 3 page(s)

Each course is a particular challenge, a new summit to conquer. For me, taking the course of financial management was another valuable contribution to personal development and a chance to cope with inner uncertainty in addressing challenging tasks. The best thing about this course is that it helped realize that any situation could be dealt with regardless of the initial fear and the belief that it would be too complicated to handle. Because the course was both fun and challenging, I do believe that the time and effort spent for taking it were not vain because they were a gigantic investment into the future career and personal life development. What I loved the most is the ability to develop in both individual and team-related aspects.

As a result, I not only obtained new knowledge but also acquired new skills that would undoubtedly be beneficial in my future life. Still, regardless of the value of new skills, knowledge is the main motivation for taking courses and making effort to complete them successfully. The financial management course helped become familiar with a lot of important and helpful concepts and topics. For me, the most challenging and interesting ones were the topics related to financial planning and estimating risks related to making investment decisions. I found them most interesting because they were the areas of the most significant knowledge attainment.

Use your promo and get a custom paper on "Financial Management: Reflection on the Course".

In particular, I have learned that, except for the interest and exchange rate risks that I was aware of, other types of risks should as well be considered. They are market, liquidity, inflationary, and reinvestment risks as well as those deriving from the changes of political, social, and legal environment (Pandey, 2015). Also, I have found out that financial planning goes beyond the mere assessment of an individual’s current financial condition (Billingsley, Gitman, & Joehnk, 2017). Instead, the evaluation of the future financial status and forecasting future income is as well taking into consideration when creating and controlling the financial planning process.

The two topics mentioned above – financial planning and investment-related risks – are those that were of interest to me. Nevertheless, other concepts were as well covered by the course. In particular, significant attention was paid to financial performance assessment, developing cost-effective working capital strategy and understanding capital expenditure, and evaluating securities. Still, regardless of the value of the knowledge related to these themes, I had some background in them, so they were less challenging. Summing up the experience obtained during the course, I realize that I would like to apply the knowledge connected to planning and assessing investment-related risks in my personal life.

They could be valuable for understanding how to achieve one of my life goals – financial independence. In particular, I am interested in the opportunity to depend on investment-generated income instead of having to hope for the increase of wages. For this reason, adequate knowledge of the investment process and risks would be critical for choosing the right asset to invest in as well as create the most effective investment portfolio (Billingsley et al., 2017). More than that, applying financial planning knowledge would be of use for adequately assessing my financial status and allocating enough sources in the investment activities as well as considering those actions that would contribute to becoming financially independent.

Regardless of the interest in these two topics, all concepts learned during the course would be helpful for developing career in any sphere of business activities because financial management is the core of success. Still, I would like to acquire more knowledge on the two topics of interest as well as the assessment of financial performance. The latter would be a perfect supplementation for understanding whether my financial decisions are correct and helpful for a more effective and comprehensive financial planning process.

Have a team of vetted experts take you to the top, with professionally written papers in every area of study.

Financial Management Reflection

Introduction.

Financial management (2010, para.1) defines financial management as planning for the future of a person or a business enterprise to ensure a positive cash flow. It captures the administration and proper management of financial assets. It also entails processes of identification and management of risks whereby reflective activity means integrating whatever has been learned in financial management into practice either where one is attached, in an internship or in gainful employment (Reuters, n.d,p.5). This essay is going to illuminate aspects of financial management and the reflective activities involved.

A financial manager is supposed to be having diverse knowledge relating to provision and interpretation of financial information, monitoring and interpreting cash flows and predicting future trends, managing budgets, efficient supervision of staff, conducting reviews and evaluation for cost reduction opportunities, analyzing competitors and market trends, and finally developing financial management mechanisms that minimize risks (Ray &Noreen, 1999, para 4).

Financial manager and management of budgets

Dosset (2004, p.1) posits that the drawing of good budgets is very central in the smooth running of any business venture. Good budgets are used for planning, coordinating and controlling the financial issues of an organization. In the budget, the financial managers address the fiscal integrity of an organization and the ongoing processes. The budget helps in formulation, presentation, and execution of planned activities by ensuring adjusting programs, review of reports, preparation of reports and controlling of funds (UNESCO,2006,p.6).

Managers and accounting

Financial manager’s work involves planning programs, adapting accounting systems, undertaking day-to-day maintenance of ledger, classification and recording of financial transactions, managing total accounting program, application of accounting concepts. (Prudential,2009, p.5).

Managers and managerial financial reporting

Managerial financial reporting encompasses recurring budget, accounting, financial reports, program operation evaluation, statistical reports and work performance reports. Involve provision of data to officials at different levels of management to come up with the most effective program (U.S. office of personnel management, 1963, p.5).

Financial managers and advice to managers

Financial managers offer advice to management from a financial perspective. They act as technical officers on matters pertaining to finances in any organization (U.S. office of personnel management, 1963, para.6).

Financial managers and paperwork management

They handle correspondence, control directives and disposition of records. They manage administrative control systems, services and processes (Debora, 2003, p.5).

Financial Managers and auditing

Auditing involves putting in place and modification of audit policies, programs, methods and procedures and attainment of high standards of auditing (Leacy, 2009, P.8).

The aspects of financial management that I have learned have been of great help to me especially when I was doing my internship in a renowned soft drinks processing company. I was able to use my statistical ability to collect and interpret quantified information relating to market trends. My knowledge of cost accounting enabled me to know how the beverage food company’s past performance was perceived by the competitors in the market. I was able to prepare reports that touched on the performance of different departments of the company. Some were updates on orders received by the company, sales and capacity utilization. I also prepared many analytical reports that touched on the profitability of different brands of beverages that we manufactured. I did reports that analyzed different developing opportunities in different locations of the country. When our company acquired a new production line and had to remove the line that there was there initially, some corporate organizations developed an interest in this old line. The services of an appraiser were then needed. I took the challenge and estimated the value of the old line appropriately. The appraisal process was accurate and all the parties were happy with whatever they got. My knowledge in auditing helped me to carry out basic and advance auditing techniques in different departments of the company. My knowledge of budget-making enabled me to draw budgets for different departments like the quality control department, production department, human resource department and marketing department. With the drawn budget, I was able to keep track of how different departments use the resources that were disbursed by creating a conducive environment for planning and controlling organizations’ funds. I was also in opposition to come up with the paperwork of the estimated income and expenditure of the organization. Most of the decision-making processes were made depending on the budget. The budgets I drew were used by the management of the beverage company to adjust, analyze and evaluate programs and activities. Future plans were made depending on the subsequent budgets drawn. At the beverage company, I did managerial financial reporting where I consolidated and reported on the company’s results. I prepared consolidated financial statements. I assisted in coming up with accounting policies and procedures. I oversaw the smooth operation and cost-effectiveness of operating procedures, programs and systems. When the external and internal auditors wanted assistance I was always willing to furnish them with the information they wanted.

Conclusions

Aspects of financial management like accounting, budgeting, managerial financial reporting, management analysis, auditing and statistics if substantially reflected in various government departments can help curb the loss of resources (University of Waterloo School of Accounting and Financial Management, n.d, p.6)

Debora, N. (2003). What is an Appraisal? Wise GEEK . Spark: Conjecture Corporation. Web.

Dosset, J.C. (2004). Budgets and Financial Management in Special Libraries. Web.

Financial management. (2010). Economy Watch. Stanley: Stanley St Labs. Web.

Leacy, A. (2009). Financial manager . Prospects. Manchester: Manchester. Web.

Prudential. (2009). Manager Financial Reporting . New Jersey: Newark. Web.

Ray, H., Noreen, E. (1999). Introduction to Managerial Accounting. Accounting for management.com. Web.

Reuters, T. (n.d.). Internal Auditing and Financial Management Package . New York: Web.

UNESCO. (2006). Budget and Financial Management . Paris: International Institute for Educational Planning. Web.

University of Waterloo School of Accounting and Financial Management. (n.d) Work term/ Professional reflection requirements . Waterloo: Ontario. Web.

U.S. office of personnel management. (1963). Position Classification Standards for Financial management Series. Web.

Cite this paper

- Chicago (A-D)

- Chicago (N-B)

- Turabian (A-D)

- Turabian (N-B)

EduRaven. (2021, December 13). Financial Management Reflection. https://eduraven.com/financial-management-reflection/

"Financial Management Reflection." EduRaven , 13 Dec. 2021, eduraven.com/financial-management-reflection/.

EduRaven . (2021) 'Financial Management Reflection'. 13 December.

EduRaven . 2021. "Financial Management Reflection." December 13, 2021. https://eduraven.com/financial-management-reflection/.

1. EduRaven . "Financial Management Reflection." December 13, 2021. https://eduraven.com/financial-management-reflection/.

Bibliography

EduRaven . "Financial Management Reflection." December 13, 2021. https://eduraven.com/financial-management-reflection/.

Essay on Financial Management

After reading this essay you will learn about:- 1. Introduction to Financial Management 2. Definition of Financial Management 3. Scope 4. Role in a Business 5. Financial Goals and Objectives 6. Functions.

Essay Contents:

- Essay on the Functions of Financial Management

Essay # 1. Introduction to Financial Management:

A business organisation seek to achieve their objectives by obtaining funds from various sources and then investing them in different types of assets, such as plant, buildings, machinery, vehicles etc. Financial management is managing the finances through scientific decision-making.

For making right decisions, financial management needs to understand financial environment within which these decisions operate. Financial management will then be able to analyse these financial information’s to predict likely future results and to plan more carefully their proposed course of action.

ADVERTISEMENTS:

Financial management is concerned with the acquisition (investment), financing (arranging funds), and management of assets with some overall goal in mind. Investment decisions begin with a determination of the total amount of assets required by the firm and to determine the money value of the same. Assets that cannot be economically justified, may be reduced, eliminated or replaced.

Financing decisions include decisions regarding mix of financing, type of financing employed, dividend policy and method of acquiring funds i.e., getting a short term loan, or a long term lease arrangement, sale of bonds or stock.

Asset management decisions means managing the assets efficiently after their acquisition.

Success of a firm depends on the ability to raise funds, invest in assets and manage wisely.

Essay # 2. Definition of Financial Management:

Financial management is an internal part of overall management and not a staff function of the organization. It is not only restricted to fund raising process but also covers utilization of funds and monitoring its uses. The finance function is concerned with the process of acquiring an efficient utilization of funds of a business system, in order to maximize the value of the enterprise.

Financial management involves the application of principles of general management to the finance function. These functions influence the operations of other crucial functional areas of the enterprise or firm such as marketing production and personnel. Thus the overall survival of the firm is effected by it financial operations.

“The financial management deals with how the corporation obtains the funds and how it uses them.” —Hoagland

“The financial management refers to the application of skills in the manipulation, use and control of funds.” —Mock, Schultz and Schuckectat

Financial management can also be defined as that part of management, which is related mainly with raising or acquiring the funds for the enterprise or firm in the most economical way, utilizing those funds as profitably as possible, for a given risk level, planning the future investment of those funds and controlling the current performance plus future development by adopting budgeting, cost accounting and financial accounting.

Essay # 3. Scope and Functions of Financial Management :

The main objectives of financial management are to arrange the sufficient funds for meeting short term long term requirements of the enterprise. These finances are procured at minimum cost in order to maximize the profitability.

In view of these factors the financial management scope concentrates on the following areas of finance function.

(i) Estimating the Financial Requirements :

The first job of the finance manager of an enterprise is to estimate short term and long term financial requirements of his business. He will prepare a financial plan for present as well as future for this purpose.

The finance required for procuring fixed assets as well as the working capital needs will have to be ascertained. The estimations should be based on sound financial principles so that funds available with the firm are neither inadequate nor excess.

(ii) Determining the Capital Structure :

After estimating the financial requirements, the finance executives have to decide about the composition of capital. The capital structure refers to the type and proportion of different securities for raising funds. After deciding the quantum of funds needed it should be decided which type of securities should be raised.

The finance executives have to determine the relative proportions of owner’s risk capital and borrowed capital along with short term and long term debt equity ratio.

A decision regarding various sources of funds should be linked with the cost of raising funds. A decision about the kind of securities to be employed and the proportion in which these should be utilized is an important decision which affects the short term and long term financial planning of an enterprise.

(iii) Choice of Sources of Finance :

After preparing a capital structure an appropriate source of finance is chosen. Various sources from which finance may be raised include: shareholders’ debenture holders, banks and other financial institutions and public deposits etc. Finance executive has to evaluate each source or method of finance and select the best source keeping in view the various factors.

The need, purpose, objective, cost involved may be the factors affecting the selection of a suitable source of financing, for instance, if the finances are required for short periods then banks, public deposits and financial institutions may be appropriate, and for long term financial requirements, the share capital and debentures may be useful.

(iv) Investment Decisions :

When the funds have been poured then a decision regarding pattern of investment has to be taken. The funds raised are to be intelligently invested in various assets so as to optimize the returns on investment. The funds will have to be used first for the purchase of fixed assets and then an appropriate part will be retained as working capital.

The utilisation of long term funds requires a proper assessment of different alternatives through capital budgeting and opportunity cost analysis. While spending on various assets, management should be guided by three important principles of safety, liquidity and profitability. A balance should be struck even in these principles for the purpose of optimum returns on investment.

(v) Management of Profits :

The utilisation of surpluses or earnings is also an important factor in financial management. A judicious utilisation of earnings is essential for expansion and diversification plans of the enterprise.

A certain amount out of the total profit may be kept as reserve voluntarily, a portion of surplus may be distributed among the ordinary and preference shareholders, yet another portion may be reinvested. The finance executive must take into consideration the merits and demerits of the alternative scheme of utilizing the funds generated from the enterprise’s own earnings.

(vi) Management of Cash Flow :

Cash flow management is also an important task of finance executive. He has to assess the various cash requirements at different times and then make arrangements for cash needed. Cash may be required to (i) make payments to creditors (ii) for purchase of materials (iii) to meet wage bill (iv) to meet everyday expenses.

The cash management should be such that neither there is shortage of it and nor it is idle. Any shortage of cash will damage the credit worthiness of the firm. The idle cash with the enterprise will mean that it is not properly utilized. In order to know the cash requirements during different periods, the management should arrange for the preparation of cash flow statement in advance.

(vii) Implementation of Financial Controls :

An efficient system of financial management needs the use of various control of devices. Financial control devices generally adopted are (i) Return on Investment (ii) Budgetrary Control (iii) Cost control (iv) Break Even analysis (v) Ratio analysis. The use of various control techniques by the Finance Manager will help him in evaluating the performance in different areas and take corrective action whenever needed.

Essay # 4. Role of Financial Management in a Business:

An effective financial management plays a dynamic role in a modern company’s development.

In earlier days, financial managers were primarily engaged in:

(a) Raising funds, and

(b) Managing the firms cash flow.

But now-a-days with the developments and increasing complexities in the business, responsibility of the financial managers have increased and they are now concerned with the decision-making process involving finance, i.e., capital investment.

Today external factors, like competition, technological change, economic uncertainty, inflation problem etc., create financial managers problem more complicated. He must have flexibility to adopt to the changing external environment for the survival of his firm.

Thus in addition to the job of acquisition, financing and managing the assets, the financial manager is supposed to contribute to the fortunes of the firm and to the optimal growth of the economy as a whole.

He is required to take decisions on:

(i) Investing funds in assets, and

(ii) Obtaining best mix of financing and dividends.

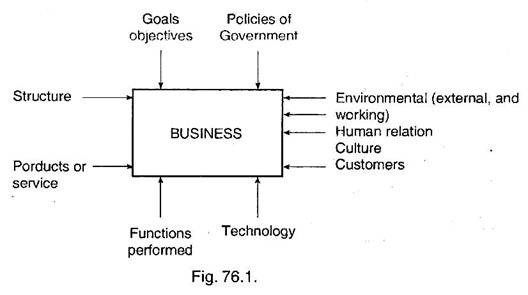

In order to understand the environment in which a finance manager is required to take decision, a sketch indicating business system is given hereunder:

The Financial Management’s main role is therefore to create profit on the capital invested (fixed as well as working capital). Each and every decision related to finance/economy must be optimal. Every business enterprise is set up to earn profit, and no one is interested in taking risk unless he is assured of fair return on the investment. However government organisations have no profit motive but are created to serve the public.

The profit earned by a firm is used for:

(a) Future expansion.

(b) Distributing profit as rewards to owners/shareholders.

Profit earned also serves as an indicator of efficiency and performance of the firm. So as to enable to perform the role of financial management, financial managers must be given proper authority, autonomy, freedom of actions, supporting staff, system for providing necessary information. He should be accountable also for his role.

Essay # 5. Financial Goals and Objectives :

There may be various objectives of a firm, but the goal of a firm is to maximise the wealth of the firm’s owners. Thus we can say that, “the improvement of shareholders value is the one mission that continually guides all corporate decisions and actions” or “the goal of a firm is maximizing the shareholders’ value”. This maximisation of value should be achieved from long term point of view.

The financial goal can be expressed as:

(a) Required profit levels,

(b) Earnings per shares, and

(c) Required rate of return on investment.

For a large firm, where shareholders do not have direct say and the firm is managed by the management, an ordinary shareholder can judge the performance by the market price of the firm’s share. Market price serves as a gauge for business performance, it indicates how well management is doing on behalf of its shareholders.

Management is the agents of the owners or shareholders, and financial management acts for achieving the goal of profit maximization in the shareholders’ best interests.

Social Goals :

While profit maximisation is the primary goal for any business organisation, social responsibility is also important for them. In case of Government organisations and public sector organisations, social responsibility is the primary goal and profit is secondary.

Social responsibility includes service to the people, protecting the consumer, paying fare wages to the employees, upliftment of the weaker sections, welfare facilities like medical education, environment improvement programmes etc.

Financial Objectives :

In making financial decisions, it is important to set out clear objectives.

Following are the basic financial objectives:

(a) Profit maximisation.

(b) Maximisation of shareholders’ owners’ wealth.

(c) Reduction in cost.

(d) Minimising risks.

(e) Sustained increase in the value of firm

(f) Wealth maximisation.

Essay # 6. Functions of Financial Management :

Financial manager is concerned with the following aspects:

1. Identifying the present strengths and weaknesses of the organisation, and the scope for improvement, by conducting the financial analysis.

2. Planning the financial strategies. This involves the consideration of methods and levels of funds raising, profitability and the financing of expansion plan of the organisation.

3. Arranging the funds when required, in the form needed in the most economical way.

4. Conducting financial appraisal of the possible courses of action. The appraisals are needed in respect of possible take overs and mergers, analysis of capital projects, or alternative methods of funding.

5. Advising about capital structure.

6. Consideration of an appropriate level for drawings by dividends to the owners/ shareholders.

7. Ensuring that assets are controlled and used in an efficient manner.

8. Cash management. Preparation of detailed cash budgets and/or forecast funds flow statement so that future problems can be foreseen and remedial measures taken in advance. These take care of both shortage and excess of cash. Finance managers must find ways of raising more funds needed, or investing excess funds for an appropriate length of time.

9. Finance managers are likely to draw attention on other disciplines also, like accounting and budgeting.

In order to enable financial managers to perform above functions satisfactorily, he must have good knowledge of accounting, economics, mathematics, statistics, law especially taxation, financial market etc.

The functions of finance thus involve three major decisions the firm must make:

(a) The investment decisions,

(b) The financing decisions, and

(c) The dividend decisions.

Each of these decisions are taken in relation to the objective of the firm, an optimal combination of these three will maximise the value of the firm to its shareholders. Since the decisions are interrelated, their joint impact on the market price of the firm’s stock must be considered.

(a) Investment Decisions:

This is the most important decision. Capital investment, i.e., allocation of capital to investment proposals is the most important aspect, whose benefits are to be realised in future. As future benefits are not known with certainty, the investment proposals involve risk.

These should, therefore, be evaluated in relation to expected return and risk. Considerable attention is paid to determine the appropriate required rate of return on the investment.

In addition to taking capital investment decisions, finance managers are concerned with the management of current assets efficiently in order to maximise profitability relative to the amount of funds tied up in asset. Investment decisions also include the decisions about mergers and acquisition of another company.

(b) Financing Decisions:

Finance manager is required to determine the best financing mix or capital structure. An optimal financing mix is one in which market price per share could be maximised. Financing decision are taken in relation to the overall valuation of the firm.

Various methods of obtaining short, intermediate, and long term financing are also explored, examined, analysed and a decision is taken. While taking financing decisions, the influence of inflammation on financial markets and on the cost of funds to the firm is also considered.

(c) Dividend Decision:

The dividend decision includes the percentage of earnings paid to stockholders in cash dividends, stock dividends and splits, and the repurchase of stock.

To Meet Funds Requirement of a Firm :

Funds requirement is assessed for different purposes, namely for feasibility study of a project, detailed planning of a project, and for operation and expansion of the business.

For feasibility study, only broad estimates are sufficient and are generally obtained from the past experience of the similar works by interpolating the present trends and the condition of the proposed project in comparison to the one whose figures are being adopted. While during detailed planning, estimated requirement is comparatively more realistic, and prepared after going into details more thoroughly.

Here we are discussing the funds requirement for a running business including its long term planning for expansion.

The main function of financial management is to ensure that the firm must have sufficient funds to meet financial obligations when they are needed and to take advantage of investment opportunities. To achieve this objective, a thorough study is conducted about ‘flow of funds’ i.e., statement of funds requirement indicating the amount of fund needed and at what time.

This ‘statement of funds’ is a summary of a firm’s changes in financial position from one period to another. This indicates that how the funds will be used and how it will be financed over specific period of time. This includes the cash as well as non-cash transactions.

Forecast, financial statements are prepared for selected future dates, generally for middle term and long term plans of the firm. Budgets are used for one year, and are prepared only to fulfill the firms’ objectives envisaged in the forecast for that particular year.

These forecast financial statements are based on the sales forecast and future strategies for expanding the business, and includes, forecast income statements, forecast assets, liabilities, shareholders, equity etc.

Related Articles:

- Essay on Financial Management: Objectives, Scope and Functions

- Essay on Financial Management: Top 5 Essays | Branches | Management

- Top 3 Types of Financial Decisions

- Shareholder Value Analysis (SVA) | Firm | Financial Management

We use cookies

Privacy overview.

Financial Management Essay Examples and Topics

Mcdonald’s operation management & supply chain.

- Words: 2479

Apple Strategic Management: Planning and Management Process — Apple Company Essay

- Words: 5021

Strategic Management: The Case of Coca-Cola

Walmart balanced scorecard – a case study.

- Words: 1117

Samsung Company’s Financial Performance

- Words: 2498

Apple Company’s Financial Management

- Words: 1250

The Five Forces Analysis of the Low-Cost Airline Industry in Europe

Apple inc.’s financial performance analysis in 2020.

- Words: 1437

Financial Analysis: ADNOC vs. ENOC

- Words: 5008

Relationship Between Average Cost and Marginal Cost

- Words: 1366

Morgan and Sunderland’s Management Styles

- Words: 1611

Tesco and Sainsbury Companies’ Capital Structure

- Words: 5810

Rule and Principle-Based Accounting: Apple and Samsung

- Words: 1960

The Ethical Issues in Financial Management

Factors that shape the relationship between the buyer and the suppliers.

- Words: 1479

The Body Shop: Financial Strategies

Starbucks audit: the largest coffeehouse chain in the world.

- Words: 2243

Porter Forces Model on Dell Company

- Words: 1142

Financial Management Practices and Their Impacts

- Words: 1373

Strategic Management: Movie Industry

- Words: 2090

A Strong Link Between Age and Salary

Christine dior: financial strategy.

- Words: 2420

Lincoln Sports Equipment: Capital Budgeting

- Words: 5118

Tesco: Effects of Recession on Marketing Activities

Financial risks of the walmart customers, accounting and finance: new hair care product.

- Words: 3700

Intel Strategic Management

- Words: 1346

Nestlé Group Ratio Analysis Results

- Words: 1503

Dove Company’s Pricing Strategy

Apple inc.’s capital projects and funding sources, decision-making processes in the london olympics 2012.

- Words: 2713

McDonald’s and Yum! Brands, Inc.: Financial Performance

Adidas ag: functional currency of the company, budgeting and its importance in business, discussion of effective budgetary control, organisational change at tesco revised.

- Words: 7018

The Meaning and Importance of Credit Rating

Chevron company’s financial management.

- Words: 3725

Methods of Business Valuation

- Words: 3142

Price of Football Players

- Words: 1125

Budgeting as an Instrument of Internal Control

- Words: 4101

Price Elasticity of Demand: Definition

- Words: 1429

The Importance of Financial Forecasting

Linear technology corporation’s dividend policy.

- Words: 2965

Distribution Channel in Business

Hp inc.’s risk factors and financial performance indicators, job aid: financial analyst responsibilities, bre-x minerals company: management and company’s relationship.

- Words: 1108

The Sources Available for Funding a New Venture

Shopping networks: pricing strategy, j sainsbury plc’s financial management policies.

- Words: 4161

Financial Management of Hj Heinz

- Words: 1112

Key Aspects of Buyer and Supplier Relationship

- Words: 1383

Tesco PLC: Increased Audit Risk

- Words: 1374

Babycakes Bakery’s Budget Planning and Control

- Words: 1010

Strategic financial management

- Words: 1140

Selecting a Forecasting Method for Volkswagen AG

Cost management for a bakery business.

- Words: 1164

Walmart POS System Implementation

- Words: 1221

Risk Tolerance and Business Ethics

- Words: 1110

Financial Management in Medical Laboratory

- Words: 1200

Financial Management in the Marine Industry

Starbucks corporation’s balance sheet analysis, normative ethics: utilitarianism and deontology.

- Words: 1095

Internal Control Assessment Sox 404

- Words: 2376

Starbucks Company’s Pay Model Implementation

Finance of the agco corp.

- Words: 3940

Gross vs. Taxable Income: What’s the Difference?

Iteos therapeutics: bottom-up valuation, ford dealers’ financial performance analysis, apple inc.: stock price valuation, performance evaluation of an organization: commonwealth bank of australia.

- Words: 1490

Netflix Inc.: Financial Options

The materiality concept in auditing, lawn king: creating a sales forecast.

- Words: 1181

The Relevance of Financial Performance Measures and Targets

- Words: 2576

Almarai Company and Effective Budgeting

- Words: 1764

Chester, Inc. Financial Analysis

- Words: 1482

Negative Effect of Earning Disparity

Lease agreements: option for security devices inc., body shop financial and marketing.

- Words: 1466

The Problem of Approving a Loan Extension

Analysis and viability of ids budget proposal: a strategic approach, reaction to “fundraising” article by gelatt, designing a pay structure for a premier supplier of rubber floor mats.

- Words: 2247

Comcast Corporation’s Financial Management

- Words: 1403

Minimizing Working Capital: Benefits and Challenges

The role of financial planning in business, details of the financial management, common stock and its key characteristics, ethical questions and promotion assignment.

- Words: 1314

Different Purposes of Keeping Financial Records by Business

- Words: 1667

Bluevine: The Loan Repayment Issue

Apple inc.’s financial performance in 2018-2019, abc manufacturing: financial management, impairment losses of finances in company, the cash flow-based financial strategy in china, injury control and safety promotion: linear regression models, donovan enterprises: case study, home depot vs. lowe firms’ financial positions, budget estimate for the town hall program, cinematography and animation startup financial analysis.

- Words: 2542

The Chef Robot: Revenue Streams and Cost Structure

Diffusion of innovation as exemplified by bitcoin, understanding a company’s financial statements, aspects of interest from a retirement account, financial ratios and trend analysis: budget decisions in business, netflix: commercial loan and the line of credit, bluescope: the production data.

- Words: 2200

The College Dreams Organization’s Budget Plan

Bgc ltd.’s financial performance in 2020-2021.

- Words: 1761

Cost and Revenue Management Challenges

Financial statements in business, airlines’ ancillary services: revenues analysis, financial change management styles.

- Words: 2329

The Issue of Financial Fraud in Public

Endeavor’s growth strategy and financial performance.

- Words: 1590

An Elemental Cost Plan for the Student Residential Building

Whole life costing vs. life cycle cost in construction, finances of pearl retail website in switzerland.

- Words: 4133

116 Financial Management Essay Topics

🏆 best essay topics on financial management, ✍️ financial management essay topics for college, 👍 good financial management research topics & essay examples, 🎓 most interesting financial management research titles, 💡 simple financial management essay ideas.

- Amazon Company: Financial Management

- Financial Operation Exposure Management Principles

- Strategic Financial Management: The Link Between Valuation and Financial Decisions

- BP and Royal Dutch Shell Companies’ Financial Management

- Coca-Cola Company’s International Financial Management

- Financial Management of Aldar Properties UAE

- BMW: Global Financial Management and Summary

- IBM’s Management Accounting & Financial Practices The financial tradition at IBM is that those who are charged with the responsibility to handle finances do that. Accounting is an important part of IBM as a corporation.

- Euroland Foods S.A. Strategic Financial Management In the Euroland Foods S.A. company, there are many constraints, among them is capital rationing where the budget for all projects is Euro 120 million.

- Puma SE: Financial Management The paper examines Puma’s outlook as it will grow through sustainability-based initiatives, profitability options, and potential risks such as the uncertain economic situation.

- JD Sports and Sports Direct Companies Financial Management This paper focuses on the financial analysis of two companies, JD Sports Fashion PLC and Sports Direct International PLC. Both are based in the UK but have a presence in other parts of the world.

- Financial Management of Marks & Spencer vs. Next Marks and Spencer demonstrates higher profit and liquidity than Next does. However, Next has more capability to pay off its debts judging by its interest cover ratio.

- Financial Planning. Money Management Skill Financial literacy can be defined as knowledge about financial planning and management that allows making reasonable choices about money spending and saving.

- Alibaba Corporation’s Financial Management This report offers an examination of Alibaba’s major financial ratios and performance indicators, assessing the firm’s cash flow, liquidity, solvency, and profitability ratios.

- Financial Management Role in Healthcare With the introduction of the Affordable Care Act, electronic health records, and the Medicare billing system, the financial aspect of healthcare requires extra attention.

- Nokia Company’s Financial Analysis and Management Nokia is part of the mobile communications industry which is now one of the most rapidly growing industries in the world. The industry includes multinational companies.

- British Airways Group: Financial Management In this report, a critical analysis is made of the financial statements of the British Airways Group for the period February 28, 2008 to March 31, 2009.

- Expo2020 Dubai’s Accounting and Financial Management This paper compares costs and revenues at two levels: state and organizational. Moreover, a comparison with other exhibitions that have been held in the last decade is presented.

- Financial Management in Nokia Nokia is part of the mobile communications industry which is now one of the most rapidly growing industries in the world.

- Project Cost and Finance Management Challenges The cost management functions are complex as projects come with different complexities. Many emerging projects pose different challenges in terms of their characteristics.

- Strategic Financial Management: Diageo plc and SAB Miller plc Both Diageo and SAB Miller have strategic financial management that helps make complex decisions that increase their competitive advantages and eventually increase revenue.

- Southwest Airlines’ Financial Management This paper analyzes the financial and trend ratios of Southwest Airlines, predicts future financial performance, and determines the return on equity.

- EasyJet: Financial Management To ensure its survival during lockdowns and travel bans, EasyJet could take every step necessary to reduce costs, conserve cash burn, and enhance liquidity.

- Personal Financial Management and Financial Literacy By understanding the basic principles and minor aspects of money management such as the compound interest method, people can avoid bankruptcy and enhance their chances for the side income.

- Financial Management: Annual Savings for Retirement The paper will focus on estimating the annual savings that the client needs to make in order to achieve the retirement plan.

- Financial Management of Healthcare Organizations Healthcare is one of the salient aspects of human beings since it determines their ability to do their daily activities. Sick people cannot perform their roles.

- Financial Management in the Healthcare Industry In this essay, the author focuses on the significance of financial management and the most crucial data for overall management.

- International Finance and Responsible Financial Management COVID-19 has a variety of ramifications for businesses in the future. Due diligence processes should focus on the target industry and the risks.

- The Neqi Firm’s Financial Management Due to the face mask sales during COVID-19, the Neqi firm, which creates and markets face masks, rose to the top of the list of profitable businesses.

- ABC Manufacturing: Financial Management In this research paper, it is required to evaluate the effectiveness of the financial management of ABC Manufacturing.

- Ramsay Health Care: Financial Management The results of this analysis reveal that Ramsay Health Care is engaging in desirable efforts and strategies that have led to considerable financial gains.

- Capital Investment and Financial Management A company’s capital investment is the money it spends on fixed assets like land, machinery, and buildings. Cash, assets, or loans may be used to fund the project.

- Rules of Financial Accounting: Economics and Management It is vital to describe control methods to show how an organization works to stop and curtail dishonest behavior and needless mistakes in its accounting records and data.

- Data Management and Financial Strategies By adopting comprehensive supply chain management, businesses can maximize the three main streams in the supply chain— information flow, product flow, and money flow.

- Possum Inc.’s Multinational Financial Management While Possum Inc. wants to become a multinational corporation, it is expected to know the nature of the local currency of the host currency and its conversion rates.

- Anne Arundel County: Public Finance and Management Analysis of revenue sources is extremely important to understand how the financial health of the county can be improved.

- Children’s Programs: Financing and Management This research paper will examine the domains specific to the financial management and planning of children’s programs.

- Accounting and Financial Management for Expo 2020 Dubai The use of technology is a fundamental aspect of the organizational development adopted in every aspect of the innovation exhibitions hosted by the association in Dubai.

- Financial Management: Growth Financing Growth financing is an important topic of consideration for managers to continue the development of a business.

- Financial Management: Where Does the Money Go It is increasingly possible to hear about the importance of financial literacy in the modern world, which largely boils down to thoughtful money management.

- Jim’s Auto Body: Financial Management This paper examines the financial management of Jim’s Auto Body. Profitability is among the core elements considered in evaluating financial performance.

- Importance of Financial Management The implementation of non-monetary policies is proven to be useful as governments were able to overcome the financial recession.

- Valero Energy and Chevron Corporations’ Financial Management Valero Energy and Chevron Corporations faced a drastic decline in total revenues in 2020, mainly due to economic upheaval and uncertainty caused by COVID-19.

- Financial Management During the Recession This paper shall set out to establish whether the recent financial crisis was in any way affected by global financial management or by other economic factors.

- Financial Management and Quality of Healthcare It is important for managers to understand how these facts are used to improve the financial position of the organisation.

- Sarbanes-Oxley Act and Financial Management The main concern regarding the Sarbanes-Oxley Act is whether it offers effective frameworks for preventing the falsification of a firm’s financial statements or not.

- Financial Management. Some Important Generalizations The article identifies several financial management approaches and perspectives, which when put in place are likely to hamper financial performance.

- Financial Management Competencies Discussion This article is about financial management: the author considers the most important competencies of a financial manager, liquidity risk, risk, and return scenarios.

- Healthcare Financial Management Association (HFMA) Healthcare Financial Management Association (HFMA) provides learning, analysis, and direction to its affiliates on the subjects relating to healthcare finance.

- Financial Management: Evaluation of the New Machine This report evaluates the viability of new trucks that are to be purchased by Southern Suburbs Transport by calculating the net present value.

- Stock Ticker Symbol: Financial Management of the Company The analysis of the company shows that the company has hardships with financial sustainability and adequate management of its assets and liabilities.

- Medical Centers Financial Management Factors that affect the financial performance of these hospitals include the indigent care load, case mix, payer mix, which also includes different levels of self-pay.

- Cyberchamp Inc.’s Ethics and Financial Management This paper aims at discussing the factors to consider while resolving ethical issues and making recommendations for the assistant finance manager in the Cyberchamp Inc. scenario.

- Clayton County Library’s Financial Management Study Limited funding has created financial constraints for Clayton County Library, Georgia. American Libraries experience the greatest threat to their financial stability.

- Terms Used in Financial Management It is important to be aware of some of the general terms the organization uses in its financial management system: a balance sheet, an income statement and the operating cash flow.

- Financial Management and the Secondary Market for Common Stocks This paper will focus on the changes that the secondary market for common stocks in the USA has faced since the 1960s as the reflections of the financial situation in the country.

- Financial Management and Investment Banking This paper will focus on the primary markets, analyze the functions that investment bankers perform in the traditional process for issuing new securities.

- Thai-Lay Fashion Company Ltd.’s Financial Management There are several methods that will help managers make capital investment decisions. These will be discussed here with reference to the Thai-Lay Fashion Company Ltd.

- Public Budgeting Leadership and Financial Management To control the field of public budgeting correctly, one should have ideas about the practical methods of work and the theoretical aspects of this practice.

- Carnival Corporation’s Financial Management This paper details an account of the cost behavior of Carnival Corporation Inc. – a large multi-vessel cruise operator.

- A Company’s Value: Financial Management The current paper is aimed to discuss the aspects of financial management of an organization and its stakeholders.

- Financial Ratios: Management and Analysis A high price to earnings ratio suggests that the investors are expecting an enhanced earnings growth in the future as compared to other companies having a lower price to earnings ratio.

- Financial Institutions Management and Sources of Finance Finance is important to any business as it serves different functions which allow the business to run effectively. A company may need additional funds to expand its business operations or expenses.

- Management in Organizations: Financial Issues Creating the environment in which the staff delivers the performance of the finest quality is a necessity for managers in the contemporary business environment.

- Healthcare Organizations Financial Management The suggested paper describes the central components of the healthcare finance and lists phenomena that might impact decision-making regarding particular scenarios.

- Government Budgeting and Financial Management The public budgeting leaders have the responsibility of fulfilling various roles including planning, reforming, and budgeting.

- What Is Financial Management and How to Do It Effectively

- The Role of Financial Management in Elaborating and Implementing Organization’s Strategies

- Effective and Ineffective Financial Management Practices in Health Care

- Innovation in Financial Management: The Impact of Technology

- Building Financial Management Capacity in Fragile and Conflict-Affected States

- Debt Elimination Through Financial Management

- How Financial Management and Corporate Strategy Affect a Firm’s Performance

- Profit vs. Wealth Maximization: A Financial Management Perspective

- Financial Statement and Ratio Analysis: Key Tools to Successful Financial Management

- Hierarchical Clustering Algorithms and Data Security in Financial Management

- Public Financial Management Intervention and Its Impact on Corruption

- Financial Management and Forecasting Using Business Intelligence and Big Data Analytics

- Economic Performance and Corporate Financial Management of Shipping Firms

- Microsoft’s International Financial Management: An Analysis

- Financial Management Practices and Their Impact on Organizational Performance

- Computer Applications for Financial Management

- Antecedent Factors of Financial Management Behavior Among Young Adults

- Financial Management Information Systems and Open Budget Data

- Household Financial Management: The Connection Between Knowledge and Behavior

- Modern System of International Financial Management in Multinational Corporations

- International Financial Management: Exchange Rate Exposure

- Fiscal Decentralization and Public Subnational Financial Management

- Best Practices for Non-Profit Financial Management

- Public Financial Management, Health Financing, and Under-Five Mortality: A Comparative Empirical Analysis

- Entrepreneurial Finance: Fundamentals of Financial Planning and Management for Small Business

- How Technological Evolution in Financial Management Implies a Company’s Success

- Challenges Facing Financial Management in Schools

- Time to Reboot: Rethinking Public Financial Management and Budgeting in Greece

- Financial Management of a Non- vs. For-Profit: Which Is Harder?

- Examining Financial Management in Promoting Sustainable Business Practices & Development

- Banking, Finance, and Financial Management: What’s the Difference

- Improving Public Financial Management in India: Opportunities to Move Forward

- Essential Instruments in the Financial Management of the Companies

- Short-Term Financial and Working Capital Management

- Examining Financial Management Practices in the Context of Smart ICT Use

- Family Financial Management: A Real-World Perspective

- Reforming Public Financial Management Systems in Developing Countries as a Contribution to the Improvement of Governance

- Accounting Use & Abuse in the Australian Public Sector Financial Management Reform Program

- Financial Management Explained: Scope, Objectives, and Importance

- Regional Financial Management Strategies to Improve the Community Welfare

- Financial Management for Public, Health, and Not-for-Profit Organizations

- Technical Efficiency and Financial Management in the Agriculture Industry

- Poor Financial Management Behavior as a Factor Why Students Are Facing Financial Difficulties

- Strengthening Public Financial Management: Exploring Drivers & Effects

- Balancing Long- and Short-Term Financial Management

- Financial Management and Control Procedures for the EU Structural Funds Programs

- The Environment of Public Financial Management: An Economic Perspective

- Introducing Financial Management Information Systems in Developing Countries

- Managing Post-Disaster Reconstruction Finance: International Experience in Public Financial Management

- Lessons From Australian and British Reforms in Results-Oriented Financial Management

Cite this post

- Chicago (N-B)

- Chicago (A-D)

StudyCorgi. (2023, May 7). 116 Financial Management Essay Topics. https://studycorgi.com/ideas/financial-management-essay-topics/

"116 Financial Management Essay Topics." StudyCorgi , 7 May 2023, studycorgi.com/ideas/financial-management-essay-topics/.

StudyCorgi . (2023) '116 Financial Management Essay Topics'. 7 May.

1. StudyCorgi . "116 Financial Management Essay Topics." May 7, 2023. https://studycorgi.com/ideas/financial-management-essay-topics/.

Bibliography

StudyCorgi . "116 Financial Management Essay Topics." May 7, 2023. https://studycorgi.com/ideas/financial-management-essay-topics/.

StudyCorgi . 2023. "116 Financial Management Essay Topics." May 7, 2023. https://studycorgi.com/ideas/financial-management-essay-topics/.

These essay examples and topics on Financial Management were carefully selected by the StudyCorgi editorial team. They meet our highest standards in terms of grammar, punctuation, style, and fact accuracy. Please ensure you properly reference the materials if you’re using them to write your assignment.

This essay topic collection was updated on January 8, 2024 .

- How It Works

- Topic Generator

- United States

- View all categories

Reflective Essay on Financial Management

Introduction.

Growing up, I was not concerned about matters related to financial management since my parents often intervened in situations that involved finances. However, at adolescent stage, the desire to be independent changed my perspective on financial management. As such, I began to save in order to take care of my financial needs instead of depending solely on my parents and older siblings (Xiao et al. 398). Saving money necessary to attend to my needs was a challenging process as I was a spendthrift. For a long time, it was almost impossible to stay afloat as I kept engaging in impulse buying and I was constantly broke. As a result, I kept seeking financial help from significant others even though I desired for financial independence. My struggle in terms of managing my finances got worse when I joined college, which was far from home and had to relocate.

Is your time best spent reading someone else’s essay? Get a 100% original essay FROM A CERTIFIED WRITER!

Financial Challenges I Have Overcome in My Life

As a common norm, when one approaches adulthood, there is a desire for financial independence from significant others such as parents or older siblings (Shim et al. 716). Subsequently, one is bound to start contemplating how to lead his or her life, separate from significant others. Important issues to consider in achieving such a goal is financial stability that can sustain one away from home and avoid depending on parents' financial support. In this regard, the first agenda that often comes to a young adult's thought process is how to secure a job to improve his or her income status as an individual (Shim et al. 721). However, the challenge that often grapples a young adult trying to save money to make life-changing goals is impulsiveness (Xu 39).

Youthful life is characterized by a desire to explore new things as one search for a sense of identity. Consequently, some of the financial decisions that a youthful person may make are often irrational without the consideration of eventual outcomes. In this respect, one seldom make the right decision regarding appropriate management of his or her finances and may struggle without financial assistance especially in situations where one has left home and supporting himself or herself financially. In a scenario where a young adult has left home and is trying to make a living on his or her own, lack of experience on how to save hard earned money can cause numerous financial problems. For instance, the youth are accustomed to impulse buying and most products and services today are increasingly targeting the youth due to their buying behavior such as willingness to spend on new and popular products and services in the marketplace. As a result, spendthrift behavior often leaves a significant number of young adults without money to cater for their basic needs and are constantly forced to seek for financial assistance from family members and friends (Xu 41).

Myself, I have struggled with impulse buying and been unable to save money on numerous occasions. Consequently, I have often found myself in situations where I cannot meet my financial obligations as an individual. Having left home when I joined college, I decided to rent an apartment and was successful to secure a job that I thought could make me financially independent and avoid seeking financial help from significant others. However, due to my spendthrift habit, I struggled to pay for my expenses such as rent, buying food and medical costs. Even though student loan covered my tuition fee, I still struggled to pay for meager expenses because I could not manage to save money that I earned from my side jobs while attending college.

Eventually, life became unbearable away from home and I ended up transferring my credits to a college near my parents' home since I resorted to depending on them for my financial needs. While at home, I still had financial needs that I was not comfortable burdening my parents. As such, I secured another job, hoping to save and avoid depending solely on my parents for all my financial needs. Still, I could not manage to contain my overspending habit and was often broke despite having a job and not obligated to pay most of my expenses since my parents often stepped in to lend a hand. As things got worse for my financial life, I decide to seek help from my elder brother who is leaving independently without assistance from our parents. I shared with him the spending habit that often leaves me without any coin and thus being unable to manage my own financial needs. Through his advice, I learned the necessity of having a budget to avoid overspending (Gutter and Zeynep 708). In most of the occasions that I spent all the money I earned from my side jobs, I never prepared a budget for my expenses. Further, my elder brother also enlightened me on the need to align my savings with lifelong goals (Shim et al. 722). He also shared with me the necessity of opening a bank account such as savings account where I could only withdraw occasionally compared to having all the money in my wallet. In our conversation, my brother also shared various ways on how I could invest the money that I earned from my side jobs to give me some level of financial stability (Babiarz and Cliff 43). In essence, major financial hurdles that I had to overcome were overspending and compulsive buying.

The Lessons that Overspending and Impulse Buying Taught Me

Overspending makes it hard for one to save because being a spendthrift often leaves an individual without a coin to save. A spender also tends to ignore factors such as considering costs against the benefits of spending on a particular product or service. As a result, one may end up spending his or her hard-earned money on a product or service that may not add value to his or her life. On the other hand, impulse buying as I have learned is mostly influenced by lack of a proper budget on what to buy. As such, one may end up making purchases that he or she had no prior plans thus compromising plans to save for other important financial needs (Babiarz and Cliff 45).

Overall, I have learnt that in order to avoid being caught in a financial quagmire, it is important to have a plan on how to spend money in tandem with well-defined lifelong goals. Similarly, preparing a budget on how to use money gives one a clue on the expected amount to spend on daily expenses as well as save from receivable income. In addition, one should consider the available methods of saving offered by financial institutions that range from opening savings account to investing in assets, shares and bonds as a way to improve future financial status necessary to manage constantly changing financial demands over the duration of an individual's lifetime.

Works Cited

Babiarz, Patryk., and Cliff A. Robb. "Financial literacy and emergency saving." Journal of Family and Economic Issues, vol. 35, no.1, 2014, pp. 40-50.

Gutter, Michael., and Zeynep, Copur. "Financial behaviors and financial well-being of college students: Evidence from a national survey." Journal of Family and Economic Issues, vol. 32, no.4, 2011, pp. 699-714.

Shim, Soyeon., Jing J. Xiao., Bonnie L. Barber., and Angela C. Lyons. "Pathways to life success: A conceptual model of financial well-being for young adults." Journal of Applied Developmental Psychology, vol. 30, no. 6, 2009, pp.708-723.

Xiao, Jing Jian, Swarn Chatterjee, and Jinhee Kim. "Factors associated with financial independence of young adults." International Journal of Consumer Studies, vol. 38, no.4, 2014, pp. 394-403.

Xu, Yingjiao. "The influence of public self-consciousness and materialism on young consumers' compulsive buying." Young Consumers, vol. 9, no.1, 2008, pp. 37-48.

What are some common financial challenges faced by young adults?

Young adults often face difficulty when it comes to managing their financial independence and expenses effectively. Impulse buying and overspending can become serious obstacles to saving money and meeting obligations on time.

How can overspending and impulse buying affect one's financial stability?

Overspending and impulse purchasing can make saving money and reaching financial goals challenging for individuals. They could spend their hard-earned funds on non-essential products or services instead, leaving no funds for meeting essential needs or saving for the future.

What strategies can help overcome overspending and impulse buying habits?

Planning ahead by creating a budget that aligns expenses with long-term goals can help individuals avoid overspending and impulse buys. Establishing plans for spending and saving, opening savings accounts and exploring investment options can promote financial security while helping individuals manage changing demands in life.

Cite this page

Reflective Essay on Financial Management. (2022, Apr 14). Retrieved from https://proessays.net/essays/reflective-essay-on-financial-management

so we do not vouch for their quality

If you are the original author of this essay and no longer wish to have it published on the ProEssays website, please click below to request its removal:

- Emergency Management of "Deep Horizon" Event

- Institutional Entrepreneurship, Service Innovation and Operation Management of Service-Oriented Government in China

- Understanding Risk Assessment Methodology Essay Example

- Essay Sample on Everest Team Decision-Making: Enhancing Project Accomplishment

- Paper Sample on Maximizing Profit with Budgeting: A Guide for Establishments

- Essay Sample on Invictus: Uniting a Nation Through Leadership and Equality

- Strategic Risk Management for Database Migration: A Comprehensive Approach

Liked this essay sample but need an original one?

Hire a professional with VAST experience and 25% off!

24/7 online support

NO plagiarism

Submit your request

Sorry, but it's not possible to copy the text due to security reasons.

Would you like to get this essay by email?

Interested in this essay?

Get it now!

Unfortunately, you can’t copy samples. Solve your problem differently! Provide your email for sample delivery

You agree to receive our emails and consent to our Terms & Conditions

Sample is in your inbox

Avoid editing or writing from scratch! Order original essay online with 25% off. Delivery in 6+ hours!

Financial Management Explained: Scope, Objectives & Importance

In business, financial management is the practice of handling a company’s finances in a way that allows it to be successful and compliant with regulations. That takes both a high-level plan and boots-on-the-ground execution.

What Is Financial Management?

At its core, financial management is the practice of making a business plan and then ensuring all departments stay on track. Solid financial management enables the CFO or VP of finance to provide data that supports creation of a long-range vision, informs decisions on where to invest, and yields insights on how to fund those investments, liquidity, profitability, cash runway and more.

ERP software can help finance teams achieve these goals: A financial management system combines several financial functions, such as accounting, fixed-asset management, revenue recognition and payment processing. By integrating these key components, a financial management system ensures real-time visibility into the financial state of a company while facilitating day-to-day operations, like period-end close processes.

Video: What Is Financial Management?

Objectives of Financial Management

Building on those pillars, financial managers help their companies in a variety of ways, including but not limited to:

- Maximizing profits: Provide insights on, for example, rising costs of raw materials that might trigger an increase in the cost of goods sold.

- Tracking liquidity and cash flow: Ensure the company has enough money on hand to meet its obligations.

- Ensuring compliance: Keep up with state, federal and industry-specific regulations.

- Developing financial scenarios: These are based on the business’ current state and forecasts that assume a wide range of outcomes based on possible market conditions.

- Manage relationships: Dealing effectively with investors and the boards of directors .

Ultimately, it’s about applying effective management principles to the company’s financial structure.

Scope of Financial Management

Financial management encompasses four major areas:

The financial manager projects how much money the company will need in order to maintain positive cash flow, allocate funds to grow or add new products or services and cope with unexpected events, and shares that information with business colleagues.

Planning may be broken down into categories including capital expenses, T&E and workforce and indirect and operational expenses.

The financial manager allocates the company’s available funds to meet costs, such as mortgages or rents, salaries, raw materials, employee T&E and other obligations. Ideally there will be some left to put aside for emergencies and to fund new business opportunities.

Companies generally have a master budget and may have separate sub documents covering, for example, cash flow and operations; budgets may be static or flexible .

Static vs. Flexible Budgeting

Managing and assessing risk.

Line-of-business executives look to their financial managers to assess and provide compensating controls for a variety of risks, including:

Affects the business’ investments as well as, for public companies, reporting and stock performance. May also reflect financial risk particular to the industry, such as a pandemic affecting restaurants or the shift of retail to a direct-to-consumer model .

The effects of, for example, customers not paying their invoices on time and thus the business not having funds to meet obligations, which may adversely affect creditworthiness and valuation, which dictates ability to borrow at favorable rates .

Finance teams must track current cash flow, estimate future cash needs and be prepared to free up working capital as needed.

This is a catch-all category, and one new to some finance teams. It may include, for example, the risk of a cyber-attack and whether to purchase cybersecurity insurance , what disaster recovery and business continuity plans are in place and what crisis management practices are triggered if a senior executive is accused of fraud or misconduct.

The financial manager sets procedures regarding how the finance team will process and distribute financial data, like invoices, payments and reports, with security and accuracy. These written procedures also outline who is responsible for making financial decisions at the company — and who signs off on those decisions.

Companies don’t need to start from scratch; there are policy and procedure templates available for a variety of organization types, such as this one for nonprofits.

Functions of Financial Management

More practically, a financial manager’s activities in the above areas revolve around planning and forecasting and controlling expenditures.

The FP&A function includes issuing P&L statements, analyzing which product lines or services have the highest profit margin or contribute the most to net profitability, maintaining the budget and forecasting the company’s future financial performance and scenario planning.

Managing cash flow is also key. The financial manager must make sure there’s enough cash on hand for day-to-day operations, like paying workers and purchasing raw materials for production. This involves overseeing cash as it flows both in and out of the business, a practice called cash management.

Along with cash management, financial management includes revenue recognition, or reporting the company’s revenue according to standard accounting principles. Balancing accounts receivable turnover ratios is a key part of strategic cash conservation and management. This may sound simple, but it isn’t always: At some companies, customers might pay months after receiving your service. At what point do you consider that money “yours” — and report the good news to investors?

Finally, managing financial controls involves analyzing how the company is performing financially compared with its plans and budgets. Methods for doing this include financial ratio analysis, in which the financial manager compares line items on the company’s financial statements.

Strategic vs. Tactical Financial Management

On a tactical level, financial management procedures govern how you process daily transactions, perform the monthly financial close, compare actual spending to what’s budgeted and ensure you meet auditor and tax requirements.

On a more strategic level, financial management feeds into vital FP&A (financial planning and analysis) and visioning activities, where finance leaders use data to help line-of-business colleagues plan future investments, spot opportunities and build resilient companies.

Importance of Financial Management

Solid financial management provides the foundation for three pillars of sound fiscal governance:

Strategizing

Identifying what needs to happen financially for the company to achieve its short- and long-term goals. Leaders need insights into current performance for scenario planning , for example.

Decision-making

Helping business leaders decide the best way to execute on plans by providing up-to-date financial reports and data on relevant KPIs.

Controlling

Ensuring each department is contributing to the vision and operating within budget and in alignment with strategy.

With effective financial management, all employees know where the company is headed, and they have visibility into progress.

What Are the Three Types of Financial Management?

The functions above can be grouped into three broader types of financial management:

Capital budgeting

Relates to identifying what needs to happen financially for the company to achieve its short- and long-term goals. Where should capital funds be expended to support growth ?

Capital structure

Determine how to pay for operations and/or growth. If interest rates are low, taking on debt might be the best answer. A company might also seek funding from a private equity firm , consider selling assets like real estate or, where applicable, selling equity.

Working capital management

As discussed above, is making sure there’s enough cash on hand for day-to-day operations, like paying workers and purchasing raw materials for production.

#1 Cloud ERP Software

What Is an Example of Financial Management?

We’ve covered some examples of financial management in the “functions” section above. Now, let’s cover how they all work together:

Say the CEO of a toothpaste company wants to introduce a new product: toothbrushes. She’ll call on her team to estimate the cost of producing the toothbrushes and the financial manager to determine where those funds should come from — for example, a bank loan.

The financial manager will acquire those funds and ensure they’re allocated to manufacture toothbrushes in the most cost-effective way possible. Assuming the toothbrushes sell well, the financial manager will gather data to help the management team decide whether to put the profits toward producing more toothbrushes, start a line of mouthwashes, pay a dividend to shareholders or take some other action.

Throughout the process, the financial manager will ensure the company has enough cash on hand to pay the new workers producing the toothbrushes. She’ll also analyze whether the company is spending and generating as much money as she estimated when she budgeted for the project.

NetSuite: Financial Management for Startups and Beyond

At the outset, financial management responsibilities within a startup include making and sticking to a budget that aligns with the business plan, evaluating what to do with profits and making sure your bills get paid and that customers pay you.

Financial management gets more complicated as the company grows and adds finance and accounting contractors or staffers. You must ensure your employees get paid with accurate deductions, properly file taxes and financial statements, and watch for errors and fraud.

This all circles back to our opening discussion of balancing strategic and tactical. By building a plan, you can answer the big questions: Are our goods and services profitable? Can we afford to launch a new product or make that hire? What might the coming 12 to 18 months bring for the business? Solid financial management provides the systems and processes to answer those questions.

Financial management challenges can be daunting for both startups and growing businesses. This is where NetSuite's financial management software comes into play. With its comprehensive, cloud-based solutions, NetSuite ensures that your financial data is accurate, up-to-date, and accessible anytime, anywhere.

From automating complex financial processes to offering real-time visibility into performance, NetSuite is the go-to solution for businesses aiming for seamless integration and efficient financial operations. As your company expands, NetSuite scales with you, ensuring you have the right tools to make informed strategic decisions at every stage. Make the smart choice for your business's financial future with NetSuite.

Financial Management