- Advanced Search

- All new items

- Journal articles

- Manuscripts

- All Categories

- Metaphysics and Epistemology

- Epistemology

- Metaphilosophy

- Metaphysics

- Philosophy of Action

- Philosophy of Language

- Philosophy of Mind

- Philosophy of Religion

- Value Theory

- Applied Ethics

- Meta-Ethics

- Normative Ethics

- Philosophy of Gender, Race, and Sexuality

- Philosophy of Law

- Social and Political Philosophy

- Value Theory, Miscellaneous

- Science, Logic, and Mathematics

- Logic and Philosophy of Logic

- Philosophy of Biology

- Philosophy of Cognitive Science

- Philosophy of Computing and Information

- Philosophy of Mathematics

- Philosophy of Physical Science

- Philosophy of Social Science

- Philosophy of Probability

- General Philosophy of Science

- Philosophy of Science, Misc

- History of Western Philosophy

- Ancient Greek and Roman Philosophy

- Medieval and Renaissance Philosophy

- 17th/18th Century Philosophy

- 19th Century Philosophy

- 20th Century Philosophy

- History of Western Philosophy, Misc

- Philosophical Traditions

- African/Africana Philosophy

- Asian Philosophy

- Continental Philosophy

- European Philosophy

- Philosophy of the Americas

- Philosophical Traditions, Miscellaneous

- Philosophy, Misc

- Philosophy, Introductions and Anthologies

- Philosophy, General Works

- Teaching Philosophy

- Philosophy, Miscellaneous

- Other Academic Areas

- Natural Sciences

- Social Sciences

- Cognitive Sciences

- Formal Sciences

- Arts and Humanities

- Professional Areas

- Other Academic Areas, Misc

- Submit a book or article

- Upload a bibliography

- Personal page tracking

- Archives we track

- Information for publishers

- Introduction

- Submitting to PhilPapers

- Frequently Asked Questions

- Subscriptions

- Editor's Guide

- The Categorization Project

- For Publishers

- For Archive Admins

- PhilPapers Surveys

- Bargain Finder

- About PhilPapers

- Create an account

CEO International Assignment Experience and Corporate Social Performance

Reprint years, philarchive, external links.

- From the Publisher via CrossRef (no proxy)

- link.springer.com (no proxy)

- link.springer.com [2] (no proxy)

- jstor.org (no proxy)

Through your library

- Sign in / register and customize your OpenURL resolver

- Configure custom resolver

Similar books and articles

Citations of this work, references found in this work.

ORIGINAL RESEARCH article

The mechanisms of chief executive officer characteristics and corporate social responsibility reporting: evidence from chinese-listed firms.

- 1 School of Management and Economics, University of Electronic Science and Technology of China, Chengdu, China

- 2 Guangdong Institute of Electronic Information, University of Electronic Science and Technology of China, Chengdu, China

- 3 Institute of Finance and Public Administration, Anhui University of Finance and Economics, Bengbu, China

Corporate social responsibility (CSR) strategy hinges largely on the CEO characteristics in the context of an emerging market. Based on a sample of 16,144 firm-year observations obtained from 1,370 unique Chinese-listed firms, which whether voluntarily issue CSR reports over the period 2008–2019, this paper empirically examined the impact of CEO characteristics on the likelihood of issuing CSR reports. We find that CEO age, MBA education, international experience and political ideology consciousness are positively associated with the possibility of issuing CSR reports, while a newly appointed CEO will decrease the likelihood of issuing CSR reports. Moreover, we consider a contingent factor, namely CEO power over the board, can significantly enhance the relationship between CEO age, political ideology consciousness, and the likelihood of issuing CSR reports. Furthermore, there’s no significant evidence indicating that CEO power can moderate the relationship between MBA education, international experience, and the likelihood of issuing CSR reports. Nonetheless, CEO power moderates the negative relationship between a newly appointed CEO and CSR reporting initiatives. This study attaches understandings to the extant literature that how top management characteristics can shape firm CSR strategies.

Introduction

Corporate social responsibility (CSR) has attracted a great deal of attention over the past decade ( Jamali and Mirshak, 2007 ; Aguinis and Glavas, 2012 ). Various stakeholders such as customers, suppliers, employees, investors, non-government organizations, and social activists have kept asking firms to be more responsible and more transparent ( Porter and Kramer, 2006 ). In response to such stakeholders’ requests, voluntarily reporting CSR information has become a world-wide popular strategic action that firms engage in. On the one hand, studies suggest that the likelihood and quality of CSR report disclosure varies across firms, industries, and regions ( Jenkins and Yakovleva, 2006 ; Peng et al., 2015 ). On the other hand, some scholars start to recognize that managers might play an important role in explaining the heterogeneity of firms’ CSR participation ( Scherer et al., 2016 ; Nour et al., 2020 ). They point out that corporate executives are the reason that firms respond to the various stakeholders’ demands or not ( Lim and Greenwood, 2017 ; Clementino and Perkins, 2021 ). This argument is grounded on the upper echelon theory which posits that firm strategic decisions, including social performance policies, are significantly influenced by corporate executives, in particular, chief executive officers (CEOs) ( Tang et al., 2015 ). Combining current findings, we find that the majority of extant work has focused on the mechanism that CEO’s characteristics on CSR strategies in mature markets, there is lack of understanding of such mechanism on firms’ voluntary CSR reporting in emerging markets.

Therefore, the objective of this study is to examine how CEO characteristics influence firms’ voluntary CSR reporting in emerging markets. China provides us with an ideal research context in the following reasons: first, Chinese firms have witnessed a growing body of firms’ CSR reports in the past decades. Since 2006, China’s central government has issued a series of CSR reporting requirements for selected firms to improve their social and environmental initiatives ( Dong et al., 2014 ; Marquis and Qian, 2014 ). But many non-target firms started to issue CSR reports as of 2008.

Second, despite the fast growing body of firms’ CSR reports, CSR reporting in China is still its infancy. On the one hand, there is significant variation across listed firms in the quality of CSR reports ( Marquis and Qian, 2014 ). On the other hand, the weak institutional environment and the public CSR awareness lead to highly uncertain costs and benefits of CSR reporting ( Zhao et al., 2014 ). Under such conditions, decisions about firms’ CSR reporting may largely hinge on CEO’s interpretation of government signals. Therefore, CEO plays an important role in determining whether the disclosure of CSR information is perceived as an opportunities or a threat ( Jizi et al., 2014 ). Of course, CEO’s perception and interpretation depends on highly personalized lenses, which are formed by their experiences, personalities, and values ( Chin et al., 2013 ; Maak et al., 2016 ). Thus, we propose that CEO characteristics play an important role in explaining the variation of firms’ voluntary CSR reporting, especially in the emerging market.

Based on a sample of 16,144 firm-year observations that 1,370 unique Chinese-listed firms whether voluntarily issuing CSR reports from 2008 to 2019, this paper first explores how CEO characteristics, such as age, MBA education, tenure, international experience, and political ideology consciousness, impact the likelihood of issuing CSR reports. Our research findings indicate that the likelihood of voluntary CSR reporting is positively associated with CEO age, MBA education, international experience, and political ideology consciousness. Second, we examine the contingent factor, namely CEO power, that would influence the relationship between CEO characteristics and firm’s voluntary CSR reporting. The results suggest that the CEO’s power over the board can enhance the relationship between CEO age, political ideology consciousness, and the possibility of issuing CSR report. Nevertheless, our results provide evidence on the relationship between CEO tenure, power, and the likelihood of voluntary CSR report.

Our study makes several notable contributions. First, this study shed light on why firms exhibit heterogeneous CSR strategies even when they face similar institutional pressures by addressing CEO’s interpretational role between government signals and firms CSR strategies. Second, it enriches the CSR information disclosure literature by going beyond simply describing the variation of firms’ CSR reporting practices to linking upper echelons theory and providing a better understanding of why firms exhibit different CSR reporting practices.

The remainder of this paper is organized as follows: we reviewed the relevant literature in the next section, and then we proposed our research hypotheses in section “Hypotheses.” The data and methodology are elaborated in section “Data and Methodology.” Section “Results” displays our empirical findings. Finally, we conclude our paper and discussed limitation and future direction in section “Conclusion.”

Theoretical Background

Antecedents of corporate social responsibility reporting.

Corporate social responsibility is suggested to be positively related to firm competitive advantages ( Porter and Kramer, 2006 ). Extant literature has revealed the impact of CSR on firm performance in developed countries ( Hansen et al., 2011 ), while the impact of CSR on firm performance is somewhat ambiguous in emerging markets ( Bai and Chang, 2015 ; Ikram et al., 2019 ). For instance, Wang and Qian (2011) found that corporate philanthropy positively affects the Chinese firms’ financial performance, while Julian and Ofori-dankwa (2013) found that the firm’s long-term operating performance, such as return on sales, return on equity and net profitability, is negatively related to CSR expenditures. And this results in a lack of incentive for firms to implement CSR initiatives.

In China, regulation can be an important antecedent of CSR reporting ( Parsa et al., 2021 ). Since the implementation of reform and opening policy in 1978, the rapid economic growth of China leads to the awakening of people’s awareness of environmental protection ( Hart and Milstein, 2003 ). Subsequently, the central government issued guidelines and recommendations on reporting corporate social and environmental activities ( Marquis and Qian, 2014 ; Farag et al., 2015 ). Moreover, Shenzhen and Shanghai Stock Exchanges (SSEs) have targeted some specific firms to disclose their CSR practices along with their annual reports from 2008. Therefore, many scholars have concluded that the government is sending signals through many channels that CSR and CSR reporting are appropriate and desire activities ( Marquis and Qian, 2014 ).

Nonetheless, it cannot fully explain firms’ voluntary CSR reporting behaviors. It is important to note that for non-targeted listed firms, these government guidelines and expectations are not mandatory laws ( Bown and Crowley, 2013 ). The government did not specify standards of compliance or penalties for non-compliance. So the CSR reporting of non-targeted firms is done on a voluntarily basis. Previous studies have stressed the importance of corporate characteristics, such as firm size, industry classification, etc. ( Cowen et al., 1987 ; Giannarakis, 2014 ). Recently, corporate governance has become a growing force to explain voluntary CSR reporting behaviors ( Giannarakis, 2014 ; Jizi et al., 2014 ). This provides a new lens to study the impact of corporate governance in addition to firm performance ( Khatib and Nour, 2021 ).

Chief Executive Officer Characteristics and Firms’ Voluntary Corporate Social Responsibility Reporting

Voluntary issuing CSR report is often viewed as a response to market competition, social norms, government regulation, and various stakeholder demands ( Tschopp and Nastanski, 2014 ). Many studies have pointed out the likelihood and quality of CSR report disclosure vastly varies across firms, industries, and regions ( Luo et al., 2017 ; Mani et al., 2018 ). However, the prior studies fail at the micro-level in explaining how two similar companies facing the same set of environmental constraints can have vastly different levels of CSR reporting.

Some studies have noted that the heterogeneity in corporate’ CSR activities is due to differences among company top leaders ( Lockett et al., 2006 ; Brammer et al., 2012 ; Wang et al., 2016 ). For instance, a few studies have examined how CEO’s personal backgrounds and experiences influence corporate CSR participation. Manner (2010) found that firms with female CEOs who have a bachelor’s degree in humanities and a breadth of career experience were more likely to achieve higher CSR performance. Slater and Dixon-Fowler (2009) showed that CEOs with international assignment experience are more likely to lead firms to participate in socially responsible activities. In addition, some recent studies have found the influence of CEOs’ cognitive factors on corporate CSR engagement. For example, Chin et al. (2013) found that CEOs’ political ideologies influenced their firms’ CSR practices: Compared with conservative CEOs, liberal CEOs exhibited greater participation in socially responsible activities.

The above evidence clearly points out the influence of CEO demographic attributes, personalities, and values on firm’s social initiatives. Comparing with mature studies in the western context, there’s still a lack of literature in the merging context ( Farag and Mallin, 2018 ). We bring this line of research into CSR information disclosure research by arguing that CEO characteristics play a significant role on firms issuing CSR reports in the emerging markets. CEO, as a critical member of top management, has discretion on whether to report CSR of the firm. So, CEOs are likely to judge by their own perception and interpretation when deciding upon a CSR information disclosure strategy ( Khan et al., 2013 ). Upper echelon theory indicates that executives’ perception and interpretation of external institutional pressures are influenced by their experiences, capabilities, values, and personalities ( Hambrick and Mason, 1984 ). Therefore, consistent with upper echelon theory, we make hypotheses about how CEO characteristics influence the likelihood of voluntarily issuing CSR reports.

Chief Executive Officer Age

In explaining how CEO age influences CSR initiatives, Donaldson (1999) argued that with increasing age comes the preference for established routine, hesitation to challenge the system of formal rules, and a more deliberate approach to decision making. It seems reasonable to expect that maturity is associated with moral development and firms with older CEOs are more likely to engage in corporate social activities. Outside of moral explanations, older CEOs may be more likely to issue CSR report because older CEOs are more willing to and good at interpreting government signals than younger CEOs. First, aged CEOs have more experience to deal with uncertain and complex institutional environment than younger CEOs ( Laufs et al., 2016 ). So, aged CEOs are able to diagnose the value of government signals more accurately, deeply understand the important role that government plays in firms’ survival and development process, and balance various stakeholder demands. Second, aged CEOs are a little bit more conservative and risk adverse than younger CEOs ( Serfling, 2014 ). Under the conditions of difficultly calculating the cost and the benefits of CSR disclosure, younger CEOs may choose to ignore government signals and lead firms to not issue CSR report. Thus, we hypothesize the following:

Hypothesis 1 : Firms led by aged CEOs are more likely to voluntarily issue CSR report than that led by younger CEOs.

Chief Executive Officer Education Background

A significant body of research suggests that MBA-educated executives behave differently from executives without MBA degrees ( Cannella et al., 2009 ). It appears that executives with MBA degrees tend to follow more aggressive and innovative strategies and respond to clear-cut and unambiguous environmental changes ( Bertrand and Schoar, 2003 ). Left unanswered in all this is whether the shareholder maximization ethic of MBA-educated executives affects the firm’s attention to other stakeholders, such as customers, employees, communities and governments.

Some scholars point out that executives with MBA degrees are more skilled in strategic decision making and poses a greater capacity to recognize and take advantage of opportunities that would increase firms’ value ( Barney et al., 2001 ). So they can get rich information from many channels use sophisticated techniques and skills to evaluate these information ( Graham and Harvey, 2001 ). So, CEOs with elite MBA degrees might be more likely to perceive government signals on CSR reporting as a strategic opportunity and they want to take this opportunity to enhance firm’s reputation and legitimacy ( Carroll and Shabana, 2010 ). Therefore, the following arguments lead us to offer the following hypothesis:

Hypothesis 2 : Firms led by CEOs with MBA education experiences are more likely to voluntarily issue CSR report than that without MBA education experiences.

Chief Executive Officer Tenure

A large body of prior study suggests that executives’ tenure in the position, the organization or the industry is highly positively related to strategic persistence, or inversely related to organizational change ( Lant et al., 1992 ; Boeker, 1997 ; Chowhan et al., 2017 ). A well-known finding from several studies is that executives tend to make more and bigger strategic changes early in their tenures than they do later on ( Cannella et al., 2009 ). Organizational tenure is thought to be associated with rigidity and commitment to established policies and practices ( Lewis et al., 2014 ). However, newly appointed CEOs have been shown to have fresh and diverse information and are willing to experiment, take risks, and pursue innovative strategies ( Shimizu and Hitt, 2004 ; You et al., 2020 ).

Based on the above findings, it seems reasonable for us to believe that CEO’s tenure in the organization might influence the firms’ social strategies such as corporate social activities and CSR information disclosure. Lewis et al. (2014) found that newly appointed CEOs (tenure < 3) are more likely to respond to the Carbon Disclosure Project by disclosing their environmental information because newly appointed CEOs are more open-minded and less ingrained in the existing norms of the firm than CEOs with longer tenures. Similarly, we argue that newly appointed CEOs in Chinese-listed firm also have incentives to respond to government signals by leading firms to issue CSR report. First, newly appointed CEOs are like to take risk and adopt innovative practices or strategies, so they are more likely to perceive government signals on CSR reporting as a strategic opportunity which may enhance firms’ reputation or legitimacy. Moreover, long-tenured CEOs have more power over the organization, which allows them to resist pressures from various stakeholders. Therefore, we conclude that newly appointed CEOs are more likely to respond to government signals by leading firms to issue CSR reports.

Hypothesis 3 : Firms led by newly appointed CEOs are more likely to voluntarily issue CSR report than that led by long-tenured CEOs.

Chief Executive Officer International Experience

The growing body of research has shown that executives’ international experience has been related to higher salaries ( Carpenter et al., 2001 ), greater firm internationalization ( Athanassiou and Nigh, 2000 ) and increased firm financial performance ( Daily et al., 2000 ). Moreover, some studies have found that international experience have largely influenced personal values ( Talavera et al., 2018 ) and provides the CEO with scarce and valuable resources ( Collins, 2021 ). Recently, scholars started to investigate how executives’ international experience influences corporate social activities. For instance, using a sample of 393, CEOs of S&P 500, Slater and Dixon-Fowler (2009) found that CEO international assignment experience is positively related to corporate social performance. We argue that CEOs with international experience is also positively related with the possibility of issuing CSR report in the Chinese context. First, international experience leads to the changes of personal values ( Serfling, 2014 ). Such open-minded and empathic value makes CEOs more care about other stakeholders’ demands, thereby issuing CSR report to connect with various stakeholders. Second, although CSR is still in its infancy in China, CSR in western countries has become a social norm that companies would comply with. Thus, international experience will increase CEOs’ awareness of the importance of sustainable development, CSR, and CSR information disclosure ( Slater and Dixon-Fowler, 2009 ). Therefore, based on the above arguments, we predict that CEOs with international experience are more likely to issue CSR report.

Hypothesis 4 : Firms led by CEOs with international experiences are more likely to voluntarily issue CSR report than that without international experiences.

Chief Executive Officer Political Ideology Consciousness

Political changes are examined to be strongly related to market change ( Jabarin et al., 2019 ), while political activities are often conducted by firms to shape the government rule-making process ( Hillman, 2003 ). Recently, some researchers have become interested in the political orientations of business leaders as individuals ( Maak et al., 2016 ; Saleh et al., 2020 ). They argued that executives’ political ideologies is a centrally important construct for considering individuals’ core beliefs and values, can, therefore, be expected to shape organizational outcomes ( Hambrick and Mason, 1984 ). By defining political ideologies as CEOs stance on the conservatism–liberalism dimension, Chin et al. (2013) provide the evidence that liberal CEOs will emphasize CSR more than will conservative CEOs. So it is important to examine whether CEOs’ political ideology or orientation influence firms’ volunteer CSR reporting practices.

However, China only has a party named China Communist party, so we define the concept of CEOs’ political ideology consciousness as to what extent CEOs will recognize and support government. Given that volunteer CSR reporting in China is mainly driven by state guidelines and signals, it seems reasonable to predict that CEOs with higher political ideology consciousness will more likely to respond to government signals. CEOs need to interpret government signals based on their own values and experience. CEOs with higher political ideology consciousness are more likely to trust and support government regulations or expectations. Thus, CEOs with higher political ideology consciousness will more likely to interpret government signals on CSR reporting as strategic opportunities which might provide firms with critical resources and legitimacy than other CEOs. Therefore, based on the above arguments, we predict the following hypothesis.

Hypothesis 5 : Firms led by CEOs with higher political ideology consciousness are more likely to voluntarily issue CSR report than that whit lower political ideology consciousness.

The Moderating Role of Chief Executive Officer Power Over the Board

So far, we have talked about how different CEOs characteristics affect firm’s volunteer CSR reporting by viewing CEOs as relatively unconstrained in inject their values and preferences into firms’ business decisions. However, the extent how much CEOs exercising their values and preferences into firms’ business decisions is influenced by one important factor-CEO power over the board. It is widely recognized that CEO vary in how much power they possess ( Gomez-Mejia et al., 2001 ; Farag and Mallin, 2016 ). For instance, many scholars have acknowledged the differences in CEO’s power relative to that of their boards ( Lewis et al., 2014 ). Such differences in CEOs’ power have been found as an important moderator in the relationship between CEOs’ inclinations and firms’ strategic outcomes. For example, using a sample of 249 CEOs, Chin et al. (2013) have found that CEO’s power positively moderates the relationship between CEO’s political ideology and firms’ CSR participation. They argued that CEOs’ power will influence “the degree to which their inclinations are reflected in firms’ decisions.”

Accordingly, we also expect that CEOs will manifest their values and preferences depend on how much power they possess relative to their boards. Specifically, when CEOs have little power, CEO’s inclinations might be only faintly reflected in their companies’ volunteer CSR reporting. However, when CEOs have substantial power, they will hold great power in firms’ decision-making process, and their personal inclinations will be more vividly reflected in firms’ volunteer CSR reporting practice. Therefore, we provide the following hypothesis.

Hypothesis 6 : The relationship between CEO’s characteristics and the likelihood of issuing CSR report is enhanced by the CEO’s power. Specifically, the greater a CEO’s power over the board, the stronger the relationship between CEO characteristics and the likelihood of firms’ volunteer CSR reporting.

Data and Methodology

Data and sample.

To construct our sample, we first collected all the firms that are listed on the Shenzhen (SZE) and SSE from 2008 to 2019. As the main goal of this study is to examine the impact of CEO characteristics on voluntary CSR reporting, we marked all the firms whether they have issued the CSR reports. Additionally, to determine whether the firm voluntarily issues its CSR report, we dropped the firms whose CSR reports are mandatorily required by either the SZE or SSE. More specifically, SZE asks the constituent companies of the SZE 100 index to mandatorily disclose CSR reports. SSE asks following three types of firms to disclose CSR information: Companies in the SSE Corporate Governance Section, companies that issue overseas listed foreign shares and financial companies. We dropped these firms and retain only other firms with voluntary CSR reports or no CSR reports. The CSR reporting information is acquired from the China Stock Market and Accounting Research Database (CSMAR), which is a primary source for the financial statements of Chinese-listed firms and is widely used in prior research ( Li et al., 2020 ; Sarfraz et al., 2020 ).

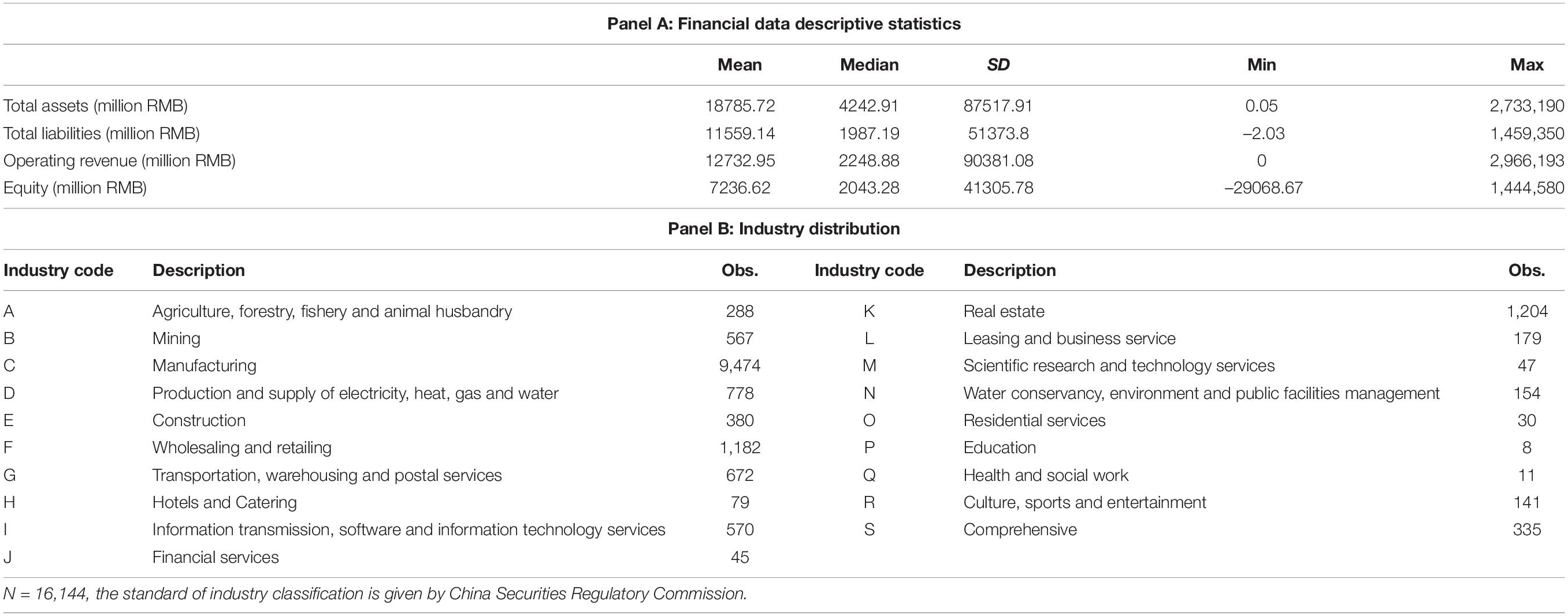

Next, we downloaded the financial data and CEO characteristics of these public firms from CSMAR as well. We removed the firms that missing the key variables. Finally, we have a sample of 1,370 unique listed firms and 16,144 firm-year observations. As depicted in Table 1 , the financial descriptive statistics and industry distribution are in panel A and panel B, respectively. Panel A of Table 1 indicates that the sample firms are different in size and revenue. According to China Securities Regulatory Commission, Panel B of Table 1 suggests that most of the sample firms are from manufacturing industry.

Table 1. Sample descriptive statistics.

Dependent Variables

This study mainly focuses on how CEO characteristics influence their decisions to voluntarily issue the CSR report. Thus, the dependent variable is the voluntary CSR reporting , which is a dummy variable that takes the value of 1 if a firm issued a CSR report in a given year, and 0 otherwise.

Independent Variables

All of the CEO characteristics are collected from the CSMAR database. AGE is the age of the CEO in the fiscal year-end. MBA is a binary variable that is used to capture the effect of business education. It takes the value of 1 if the CEO has an EMBA or MBA degree and 0 otherwise. NEW is also a binary variable. Following Lewis et al. (2014) , a new CEO takes the value of 1 if the CEO had been in duty for less than 3 years and 0 otherwise. OVERSEA equals to 1 if the CEO has education or working experience aboard and 0 otherwise.

POLITICAL is a dichotomous variable to capture CEO’s political ideology consciousness, which is coded as 1 when CEO has the experience of “(vice) Secretary of the Party Committee,” and 0 otherwise. The reasons that CEOs’ experience of “(vice) Secretary of the Party Committee” reflects CEOs’ political ideology consciousness are the following. First, the aim of the Party Committee in firms is to earnestly implement the Communist Party’s guidelines and policies, disseminate the instructions from the various levels of governments, and make sure the firms keep the same pace with the government. Thus, only those who show their faith and loyalty to government can be chosen to be (vice) Secretary of the Party Committee. Second, the working experience of being (vice) Secretary of the Party Committee allows CEOs to gain more understandings about the government and to cultivate the habit to follow and support governments’ policies and expectations. Therefore, CEOs with the experience of “(vice) Secretary of the Party Committee” might have higher political ideology consciousness.

Moderating Variables

The moderator in this study is the CEO’s power over the board. POWER is a dummy variable that takes the value of 1 if the CEO is the chairman of the board, 0 otherwise.

Control Variables

The control variables included in this study are the Firm Size , Firm Age , SOE , ROA , and Stock Exchange . Firm Size is measured as the natural logarithm of the total assets of the firm. Firm Age is the monthly age of the firm that is calculated using the difference between the date of the fiscal year-end and the date of the establishment of the firm. We control firm age since older firms may be more inert and less responsive to new policies ( Hannan and Freeman, 1984 ). SOE is a dummy variable that reflects the firm’s ownership. It takes the value of 1 if the firm is a state-owned enterprise, and 0 otherwise. ROA is the abbreviation for return on assets, which controls for the firm’s financial status. It is calculated using the operating revenue before depreciation divided by the total assets of the firm in the fiscal year end. Stock Exchange equals to 1 if the firm is listed on the SSE and 0 for Shenzhen Stock Exchange. Additionally, we include year dummies to absorb the potential time effects. Moreover, after the Chairman Xi came to power in early 2013, the Chinese government proposed lots of environmentally friendly policies to regulate firm behaviors. We use another alternative year dummy which equals to 1 if the year is between 2013 and 2019, and 0 if the year is between 2008 and 2012. Furthermore, we include industry dummies to control for unobservable industry-wide effects, and the industries categories are classified by the China Security Regulatory Commission.

Model Specification

We used a logistic regression model to estimate how the CEO characteristics impact the likelihood of a firm voluntarily issuing a CSR report. To determine whether this unbalanced panel is suitable for fixed-effect regression, we run the BP-LM test and the Hausman test; the results indicate that the panel data are suitable for pooled regress model. To account for the potential heteroscedasticity and correlation in the error term, we adopted the robust standard errors in the regression analysis. CEO characteristics data were based on the current year, but some control variables including firm financial performance were lagged by 1 year.

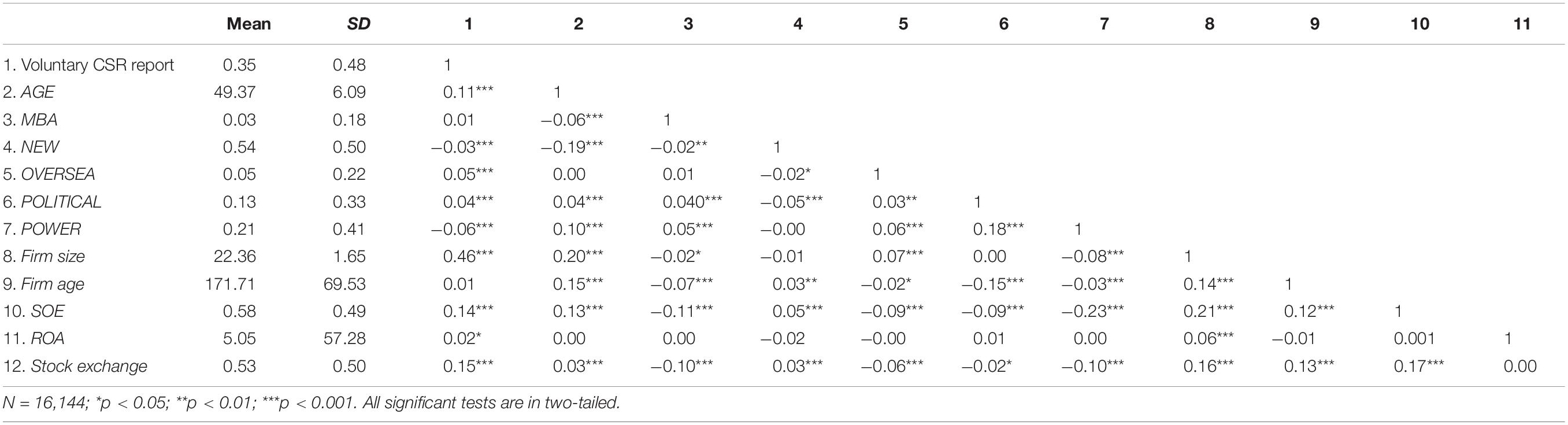

Table 2 presents the descriptive statistics and correlations for all variables. To investigate whether there is potential multicollinearity, we calculated the variance inflation factors (VIFs). The result shows that the maximum VIF is 2.6; the mean VIF is 1.32, far below the rule-of-thumb cutoff of 10. Therefore, the multicollinearity seems not to exist in our model. Table 3 presents the estimates of the likelihood of a firm voluntarily issuing a CSR report.

Table 2. Variable descriptive statistics and correlations.

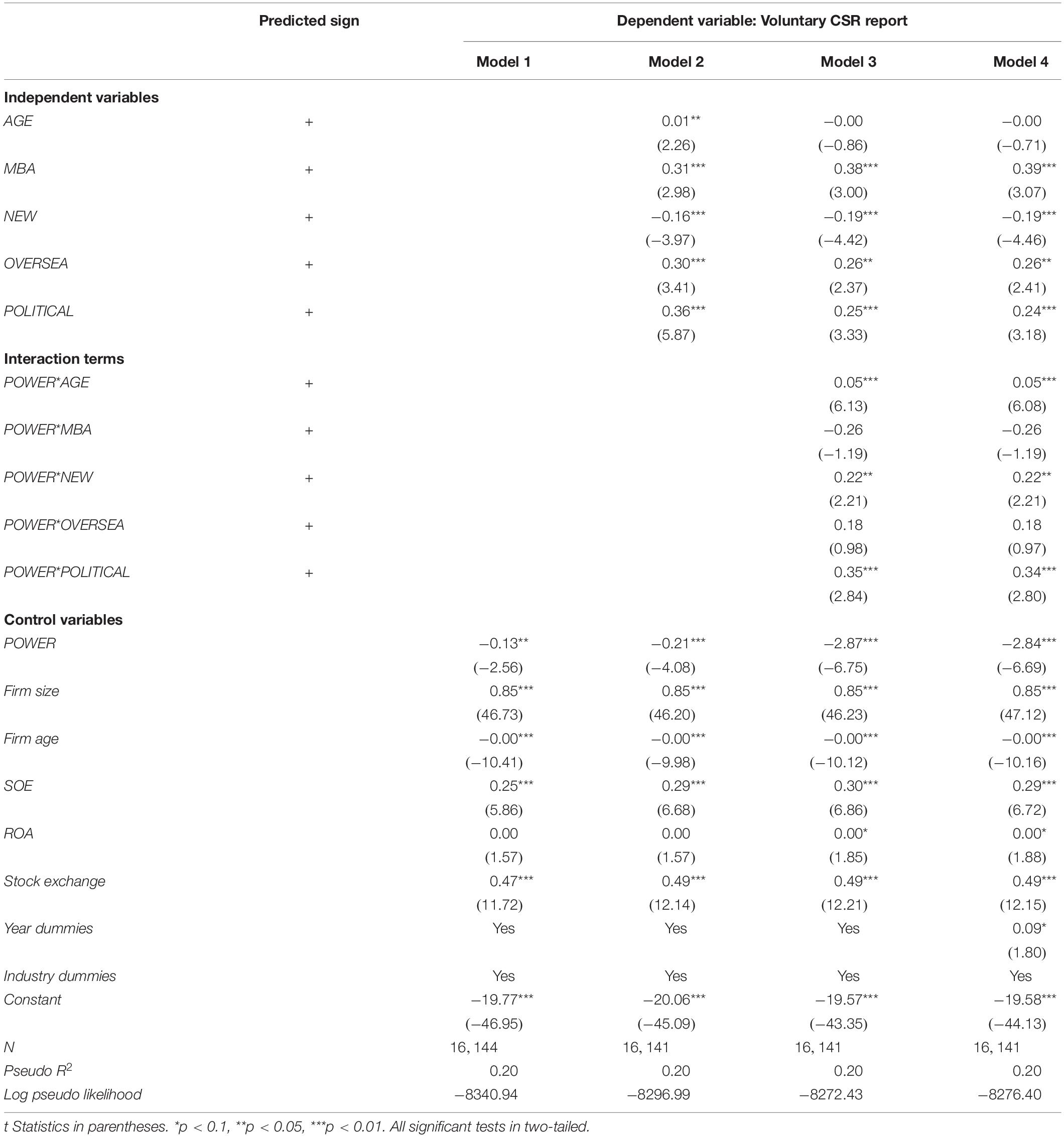

Table 3. Logit regression models predicting the likelihood of volunteer corporate social responsibility (CSR) reporting for Chinese-listed firms.

In addition to the moderating variable POWER , Model 1 also includes all control variables: Firm Size, Firm Age, SOE, ROA, Stock Exchange, Year dummies , and Industry dummies. Model 2 test the hypotheses H1–H5 so that the Model 2 includes all independent variables. To investigate hypothesis H6, the model 3 includes all the interaction terms. To determine whether Chairman Xi’s new policies will drive firms to voluntarily issue CSR reports, Model 4 uses the alternative year dummy.

In Model 2, all the coefficients of CEOs’ demographic characteristics are significantly different from zero at least at the 5% level. More specifically, the coefficients of CEO age, MBA education, international experience, and political ideology consciousness are aligned well with our expectation and all of these four coefficients are positively significantly different from zero. These results indicate that an aged CEO, CEOs with MBA education background or with international working or education experience and CEO’s political ideology consciousness are all positively related to the likelihood of voluntary CSR reporting. Therefore, these results provide support to our H1, H2, H4, and H5. However, the coefficient of newly appointed CEO is negative, which is opposite to our prediction, suggesting that a newly appointed CEO is less likely to voluntarily issue CSR reports. Thus our H3 is not supported.

Model 3 and Model 4 use different year dummies but the results are basically the same. In both models, we added the interaction terms and only the coefficients of POWER * AGE , POWER * NEW , and POWER * POLITICAL are significantly different from zero at least at the 5% level. First, the coefficient of interaction term between CEO power and CEO age is positive, which is consistent with our prediction, indicating that the CEO’s power over the board can enhance its relationship between CEO age and the likelihood of CSR reporting. Second, the coefficient of interaction term between CEO power and CEO’s political ideology consciousness is positive, which is consistent with our expectation, also indicating that CEO power can strengthen the relationship between CEO’s political ideology consciousness and the likelihood of issuing CSR reports. Third, there’s no evidence suggesting that CEO power can enhance the relationship between either CEO’s MBA education or CEO’s international experience and the likelihood of issuing CSR reports.

Interestingly, in Model 3 and Model 4, given the positive and significant coefficient of interaction term between CEO power and a newly appointed CEO, the result indicates that a newly appointed CEO, meanwhile a chairman of the board will increase the likelihood of voluntarily issuing the CSR reports. Whereas the coefficient of NEW is negative and significant. These contradictory results motivate a plausible explanation: As we hypothesized, a newly appointed CEO indeed can be more risk tolerable and wants to make a difference in their tenure, but this CEO is not powerful enough to fight against the board. This situation gets better until she becomes the chairman of the board, and then CEO can exert their influence on the social strategies of the firm as she wants.

As for control variables, we observed that firm size, firm age, ownership, and stock exchange can strongly impact the firm’s likelihood of issuing CSR repots across four models. In particular, a larger sized firm is more likely to disclose CSR information, a plausible explanation is that large firms are subject to more regulation. Similarly, state-owned firms are generally assumed to bear more social responsibilities, and our result confirms this assumption. Firms listed in the SSE are more likely to issue CSR reports than those listed in the SZE. A plausible explanation is that SSE attaches more importance on mandatory CSR activities and sets higher requirements, while this can positively affect other firms that are listed in SSE. Nonetheless, firm age is negatively associated with the likelihood of CSR reporting, indicating that long-established firms are less willing to issue CSR reports. This phenomenon is strange, especially since Table 2 has depicted a positive correlation between firm age and firm size, ownership, and stock exchange. A plausible explanation is that the long-established firms tend to be old slickers and less likely to be regulated.

In summary, our hypotheses H1, H2, H4, and H5 are supported, H3 is conditionally supported, and H6 is partially supported.

Drawing from the upper echelons perspective, this paper aims to examine how CEOs’ characteristics are manifested in firms CSR reporting practices. Using the 16,144 firm-year observations from 1,370 unique listed firms during 2008–2019 in China, our results suggest that: (1) CEOs’ demographic characteristics such as age, MBA degrees, international experience, and political ideology consciousness are positively associated with the likelihood of voluntarily issuing CSR reports; (2) a newly appointed CEO is less likely to voluntarily issue CSR reports, but this possibility gets higher when she gets power over the board; (3) CEO’s power over the board will also strongly enhance the relationship between age, political ideology consciousness, and the likelihood of voluntarily issuing CSR reports. We believe these findings offer broader contributions to research on CSR reporting, upper echelons theory, and institutional theory.

First, by examining how CEO characteristics affect firm response to government signals, our study extends the recent research that aims to explain why firms respond differently even when they face similar institutional pressures ( Crilly et al., 2012 ). While a significant body of research has shown that organizational attributes shape the firm’s response to external institutional pressures ( Marquis and Qian, 2014 ). Our results suggest that CEO’s perception and interpretation of institutional pressures play a critical role in explaining various firms’ response strategies. Specifically, the extent to which institutional pressures will exert influence on firms and how firms respond to these institutional pressures depends on how executives especially CEOs perceive and interpret institutional pressures ( Lewis et al., 2014 ). Furthermore, our study particularly highlights the critical role that CEO characteristics play an important role in explaining the variation of firm response strategy to government signals. Although China has gradually transformed from central-planned economy to market economy, the government still remains a critical source of resources and legitimacy. An appropriate response to governmental signals becomes a critical way of acquiring legitimacy from government ( Manner, 2010 ). However, the lack of rule of law and governmental transparency obscures governmental decision processes and priorities ( Clementino and Perkins, 2021 ). Moreover, governmental signals are not specific laws or regulations and there is great uncertainty about the implementation of these government signals ( Luo et al., 2017 ). Thus, firm CEOs have to interpret governmental signals and decide how to respond based on their own knowledge, experiences, and values too.

Second, our study also provides new insights into the antecedents of CSR reporting practices by bringing upper echelons theory into CSR information disclosure research. In demonstrating that a CEO’s characteristics manifested in a company’s CSR profiles and that a CEO’s power amplifies this relationship, the study highlights the broader importance of focusing on within-firm, especially managerial explanations of CSR reporting. A significant body of prior study has examined organizational attributes and institutional drivers of CSR information disclosure, yielding substantial but incomplete insights ( Hillman, 2003 ; Marquis and Qian, 2014 ). Recently, some scholars have begun to consider that CSR is a subject to managerial discretion that some CEOs pursue, while others-even those facing the same institutional pressures do not ( Chin et al., 2013 ). Our study addresses this call and highlights the important role that CEOs might play in explaining the variation of firms’ CSR reporting practices.

Limitations and Future Directions

To overcome some limitations that existed in this study, we offer some directions for future research. First, we only examined how CEOs’ demographic characteristics influence firms’ CSR reporting practices. However, upper echelons theory points that top managers’ psychological characteristics are important determinants of firm behavior and outcomes ( Hambrick and Mason, 1984 ; Hambrick, 2007 ). Future studies should examine how CEOs’ psychological characteristics such as values or personalities affect firms’ CSR reporting practices. The second limitation is this study only focuses on CEOs. Hambrick and Mason (1984) argue that corporate decision-making is a shared activity and studying top management teams rather than CEOs alone, provides better predictions of organizational outcomes. So future studies could consider how the background, experiences, and values of entire top management teams, as well as those of boards of directors, influence firms’ CSR reporting practices, and other CSR activities. Moreover, although the methods in this paper alleviate the endogenous problem to some extent, there may be more suitable methods to deal with the concerns. Future research should continue to find more appropriate tool variables and adopt 2SLS method to deal with this problem. Finally, the conclusions discovered in the study only verified in the Chinese context, we encourage future researches to explore a wider range of research scenarios to broader the theories.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author Contributions

YL conceived and designed the research. XxZ wrote and revised the manuscript. MW provided the data and revised the manuscript. XrZ revised the manuscript. XrZ and YL gave guidance throughout the whole research process. All authors contributed to the article and approved the submitted version.

This study was supported by National Natural Science Foundation of China (No. 71772027); Key Projects of Humanities and Social Sciences in Colleges and Universities of Anhui Province (No. SK2021A0241); and Natural Science Foundation of Guangdong Province (No. 2020A1010020008).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Aguinis, H., and Glavas, A. (2012). What we know and don’t know about corporate social responsibility: a review and research agenda. J. Manag. 38, 932–968.

Google Scholar

Athanassiou, N., and Nigh, D. (2000). Internationalization, tacit knowledge and the top management teams of MNCs. J. Int. Bus. Stud. 31, 471–487.

Bai, X., and Chang, J. (2015). Corporate social responsibility and firm performance: the mediating role of marketing competence and the moderating role of market environment. Asia Pac. J. Manag. 32, 505–530.

Barney, J., Wright, M., and Ketchen, D. J. Jr. (2001). The resource-based view of the firm: ten years after 1991. J. Manag. 27, 625–641.

Bertrand, M., and Schoar, A. (2003). Managing with style: the effect of managers on firm policies. Q. J. Econ. 118, 1169–1208. doi: 10.1162/003355303322552775

PubMed Abstract | CrossRef Full Text | Google Scholar

Boeker, W. (1997). Strategic change: the influence of managerial characteristics and organizational growth. Acad. Manag. J. 40, 152–170.

Bown, C. P., and Crowley, M. A. (2013). Import protection, business cycles, and exchange rates: evidence from the Great Recession. J. Int. Econ. 90, 50–64. doi: 10.1016/j.jinteco.2012.12.001

CrossRef Full Text | Google Scholar

Brammer, S., Hoejmose, S., and Marchant, K. (2012). Environmental management in SME s in the UK: practices, pressures and perceived benefits. Bus. Strategy Environ. 21, 423–434. doi: 10.1002/bse.717

Cannella, S. F. B., Hambrick, D. C., Finkelstein, S., and Cannella, A. A. (2009). Strategic Leadership: Theory and Research on Executives, Top Management Teams, and Boards. Oxford: Strategic Management.

Carpenter, M. A., Sanders, W. G., and Gregersen, H. B. (2001). Bundling human capital with organizational context: the impact of international assignment experience on multinational firm performance and CEO pay. Acad. Manag. J. 44, 493–511. doi: 10.2307/3069366

Carroll, A. B., and Shabana, K. M. (2010). The business case for corporate social responsibility: a review of concepts, research and practice. Int. J. Manag. Rev. 12, 85–105. doi: 10.1111/j.1468-2370.2009.00275.x

Chin, M. K., Hambrick, D. C., and Treviño, L. K. (2013). Political ideologies of CEOs: the influence of executives’ values on corporate social responsibility. Admin. Sci. Q. 58, 197–232. doi: 10.1177/0001839213486984

Chowhan, J., Pries, F., and Mann, S. (2017). Persistent innovation and the role of human resource management practices, work organization, and strategy. J. Manag. Organ. 23, 456–471. doi: 10.1017/jmo.2016.8

Clementino, E., and Perkins, R. (2021). How do companies respond to environmental, social and governance (ESG) ratings? Evidence from Italy. J. Bus. Ethics 171, 379–397.

Collins, C. J. (2021). Expanding the resource based view model of strategic human resource management. Int. J. Hum. Resour. Manag. 32, 331–358. doi: 10.1080/09585192.2019.1711442

Cowen, S. S., Ferreri, L. B., and Parker, L. D. (1987). The impact of corporate characteristics on social responsibility disclosure: a typology and frequency-based analysis. Account. Organ. Soc. 12, 111–122.

Crilly, D., Zollo, M., and Hansen, M. T. (2012). Faking it or muddling through? Understanding decoupling in response to stakeholder pressures. Acad. Manag. J. 55, 1429–1448. doi: 10.5465/amj.2010.0697

Daily, C. M., Certo, S. T., and Dalton, D. R. (2000). International experience in the executive suite: the path to prosperity? Strateg. Manag. J. 21, 515–523. doi: 10.1002/(sici)1097-0266(200004)21:4<515::aid-smj92>3.0.co;2-1

Donaldson, T. (1999). Making stakeholder theory whole. Acad. Manag. Rev. 24, 237–241. doi: 10.5465/amr.1999.1893933

Dong, S., Burritt, R., and Qian, W. (2014). Salient stakeholders in corporate social responsibility reporting by Chinese mining and minerals companies. J. Clean. Prod. 84, 59–69.

Farag, H., and Mallin, C. (2016). The impact of the dual board structure and board diversity: evidence from Chinese initial public offerings (IPOs). J. Bus. Ethics 139, 333–349. doi: 10.1007/s10551-015-2649-6

Farag, H., and Mallin, C. (2018). The influence of CEO demographic characteristics on corporate risk-taking: evidence from Chinese IPOs. Eur. J. Finance 24, 1528–1551. doi: 10.1080/1351847x.2016.1151454

Farag, H., Meng, Q., and Mallin, C. (2015). The social, environmental and ethical performance of Chinese companies: evidence from the Shanghai Stock Exchange. Int. Rev. Financ. Anal. 42, 53–63. doi: 10.1016/j.irfa.2014.12.002

Giannarakis, G. (2014). The determinants influencing the extent of CSR disclosure. Int. J. Law Manag. 56, 393–416.

Gomez-Mejia, L. R., Nunez-Nickel, M., and Gutierrez, I. (2001). The role of family ties in agency contracts. Acad. Manag. J. 44, 81–95.

Graham, J. R., and Harvey, C. R. (2001). The theory and practice of corporate finance: evidence from the field. J. Financ. Econ. 60, 187–243.

Hambrick, D. C. (2007). Upper echelons theory: an update. Acad. Manag. Rev. 32, 334–343.

Hambrick, D. C., and Mason, P. A. (1984). Upper echelons: the organization as a reflection of its top managers. Acad. Manag. Rev. 9, 193–206. doi: 10.2307/258434

Hannan, M. T., and Freeman, J. (1984). Structural inertia and organizational change. Am. Sociol. Rev. 149–164. doi: 10.2307/2095567

Hansen, S. D., Dunford, B. B., Boss, A. D., Boss, R. W., and Angermeier, I. (2011). Corporate social responsibility and the benefits of employee trust: a cross-disciplinary perspective. J. Bus. Ethics 102, 29–45. doi: 10.1007/s10551-011-0903-0

Hart, S. L., and Milstein, M. B. (2003). Creating sustainable value. Acad. Manag. Perspect. 17, 56–67.

Hillman, A. J. (2003). Determinants of political strategies in US multinationals. Bus. Soc. 42, 455–484. doi: 10.1177/0007650303260351

Ikram, M., Sroufe, R., Mohsin, M., Solangi, Y. A., Shah, S. Z. A., and Shahzad, F. (2019). Does CSR influence firm performance? A longitudinal study of SME sectors of Pakistan. J. Glob. Respons. 11, 27–53. doi: 10.1108/jgr-12-2018-0088

Jabarin, M., Nour, A.-N. I., and Atout, S. (2019). Impact of macroeconomic factors and political events on the market index returns at Palestine and Amman Stock Markets (2011–2017). Invest. Manag. Financ. Innovat. 16, 156–167. doi: 10.21511/imfi.16(4).2019.14

Jamali, D., and Mirshak, R. (2007). Corporate social responsibility (CSR): theory and practice in a developing country context. J. Bus. Ethics 72, 243–262.

Jenkins, H., and Yakovleva, N. (2006). Corporate social responsibility in the mining industry: exploring trends in social and environmental disclosure. J. Clean. Prod. 14, 271–284.

Jizi, M. I., Salama, A., Dixon, R., and Stratling, R. (2014). Corporate governance and corporate social responsibility disclosure: evidence from the US banking sector. J. Bus. Ethics 125, 601–615. doi: 10.1007/s10551-013-1929-2

Julian, S. D., and Ofori-dankwa, J. C. (2013). Financial resource availability and corporate social responsibility expenditures in a sub-Saharan economy: the institutional difference hypothesis. Strateg. Manag. J. 34, 1314–1330.

Khan, A., Muttakin, M. B., and Siddiqui, J. (2013). Corporate governance and corporate social responsibility disclosures: evidence from an emerging economy. J. Bus. Ethics 114, 207–223.

Khatib, S. F., and Nour, A.-N. I. (2021). The impact of corporate governance on firm performance during the COVID-19 pandemic: evidence from Malaysia. J. Asian Finance Econ. Bus. 8, 943–952.

Lant, T. K., Milliken, F. J., and Batra, B. (1992). The role of managerial learning and interpretation in strategic persistence and reorientation: an empirical exploration. Strateg. Manag. J. 13, 585–608.

Laufs, K., Bembom, M., and Schwens, C. (2016). CEO characteristics and SME foreign market entry mode choice: the moderating effect of firm’s geographic experience and host-country political risk. Int. Market. Rev. 33, 246–275. doi: 10.1108/imr-08-2014-0288

Lewis, B. W., Walls, J. L., and Dowell, G. W. (2014). Difference in degrees: CEO characteristics and firm environmental disclosure. Strateg. Manag. J. 35, 712–722.

Li, H., Hang, Y., Shah, S. G. M., Akram, A., and Ozturk, I. (2020). Demonstrating the impact of cognitive CEO on firms’ performance and CSR activity. Front. Psychol. 11:278. doi: 10.3389/fpsyg.2020.00278

Lim, J. S., and Greenwood, C. A. (2017). Communicating corporate social responsibility (CSR): stakeholder responsiveness and engagement strategy to achieve CSR goals. Public Relat. Rev. 43, 768–776.

Lockett, A., Moon, J., and Visser, W. (2006). Corporate social responsibility in management research: focus, nature, salience and sources of influence. J. Manag. Stud. 43, 115–136.

Luo, X. R., Wang, D., and Zhang, J. (2017). Whose call to answer: institutional complexity and firms’ CSR reporting. Acad. Manag. J. 60, 321–344.

Maak, T., Pless, N. M., and Voegtlin, C. (2016). Business statesman or shareholder advocate? CEO responsible leadership styles and the micro-foundations of political CSR. J. Manag. Stud0 53, 463–493.

Mani, V., Gunasekaran, A., and Delgado, C. (2018). Supply chain social sustainability: standard adoption practices in Portuguese manufacturing firms. Int. J. Prod. Econ. 198, 149–164.

Manner, M. H. (2010). The impact of CEO characteristics on corporate social performance. J. Bus. Ethics 93, 53–72. doi: 10.1007/s10551-010-0626-7

Marquis, C., and Qian, C. (2014). Corporate social responsibility reporting in China: symbol or substance? Organ. Sci. 25, 127–148.

Nour, A. I., Sharabati, A.-A. A., and Hammad, K. M. (2020). Corporate governance and corporate social responsibility disclosure. Int. J. Sustain. Entrep. Corp. Soc. Respons. (IJSECSR) 5, 20–41.

Parsa, S., Dai, N., Belal, A., Li, T., and Tang, G. (2021). Corporate social responsibility reporting in China: political, social and corporate influences. Account. Bus. Res. 51, 36–64. doi: 10.3389/fpsyg.2021.796470

Peng, J., Sun, J., and Luo, R. (2015). Corporate voluntary carbon information disclosure: evidence from China’s listed companies. World Econ. 38, 91–109. doi: 10.1111/twec.12187

Porter, M. E., and Kramer, M. R. (2006). Strategy and society: the link between competitive advantage and corporate social responsibility. Harv. Bus. Rev. 84, 78–92, 163.

Saleh, M. W., Shurafa, R., Shukeri, S. N., Nour, A. I., and Maigosh, Z. S. (2020). The effect of board multiple directorships and CEO characteristics on firm performance: evidence from Palestine. J. Account. Emerg. Econ. 10, 637–654.

Sarfraz, M., Ozturk, I., Shah, S. G. M., and Maqbool, A. (2020). Contemplating the impact of the moderators agency cost and number of supervisors on corporate sustainability under the aegis of a cognitive CEO. Front. Psychol. 11:965. doi: 10.3389/fpsyg.2020.00965

Scherer, A. G., Rasche, A., Palazzo, G., and Spicer, A. (2016). Managing for political corporate social responsibility: new challenges and directions for PCSR 2.0. J. Manag. Stud. 53, 273–298.

Serfling, M. A. (2014). CEO age and the riskiness of corporate policies. J. Corp. Finance 25, 251–273. doi: 10.1016/j.jcorpfin.2013.12.013

Shimizu, K., and Hitt, M. A. (2004). Strategic flexibility: organizational preparedness to reverse ineffective strategic decisions. Acad. Manag. Perspect. 18, 44–59. doi: 10.5465/ame.2004.15268683

Slater, D. J., and Dixon-Fowler, H. R. (2009). CEO international assignment experience and corporate social performance. J. Bus. Ethics 89, 473–489. doi: 10.1136/bjsports-2019-101961

Talavera, O., Yin, S., and Zhang, M. (2018). Age diversity, directors’ personal values, and bank performance. Int. Rev. Financ. Anal. 55, 60–79. doi: 10.1016/j.irfa.2017.10.007

Tang, Y., Qian, C., Chen, G., and Shen, R. (2015). How CEO hubris affects corporate social (ir) responsibility. Strateg. Manag. J. 36, 1338–1357. doi: 10.1002/smj.2286

Tschopp, D., and Nastanski, M. (2014). The harmonization and convergence of corporate social responsibility reporting standards. J. Bus. Ethics 125, 147–162. doi: 10.1007/s10551-013-1906-9

Wang, H., and Qian, C. (2011). Corporate philanthropy and corporate financial performance: the roles of stakeholder response and political access. Acad. Manag. J. 54, 1159–1181. doi: 10.5465/amj.2009.0548

Wang, Q., Dou, J., and Jia, S. (2016). A meta-analytic review of corporate social responsibility and corporate financial performance: the moderating effect of contextual factors. Bus. Soc. 55, 1083–1121.

You, Y., Srinivasan, S., Pauwels, K., and Joshi, A. (2020). How CEO/CMO characteristics affect innovation and stock returns: findings and future directions. J. Acad. Mark. Sci. 48, 1229–1253. doi: 10.1007/s11747-020-00732-4

Zhao, M., Tan, J., and Park, S. H. (2014). From voids to sophistication: institutional environment and MNC CSR crisis in emerging markets. J. Bus. Ethics 122, 655–674. doi: 10.1007/s10551-013-1751-x

Keywords : CEO characteristics, CSR report, upper echelons theory, institutional theory, CEO power

Citation: Zhao X, Wang M, Zhan X and Liu Y (2022) The Mechanisms of Chief Executive Officer Characteristics and Corporate Social Responsibility Reporting: Evidence From Chinese-Listed Firms. Front. Psychol. 13:794258. doi: 10.3389/fpsyg.2022.794258

Received: 13 October 2021; Accepted: 02 February 2022; Published: 24 March 2022.

Reviewed by:

Copyright © 2022 Zhao, Wang, Zhan and Liu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY) . The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yunqing Liu, [email protected]

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

To read this content please select one of the options below:

Please note you do not have access to teaching notes, ceo international experience and firm performance revisited: what’s culture got to do with it.

Journal of Global Mobility

ISSN : 2049-8799

Article publication date: 5 July 2023

Issue publication date: 7 November 2023

This paper examines the relationship between chief executive officer (CEO) international experience (IE) and firm performance. The authors also examine the symmetry of this relationship, whereby home and host countries would be interchangeable without any significant change in the impact of each cultural dimension on firm performance.

Design/methodology/approach

For a sample of CEOs from Fortune's list of Global 500 companies, firm performance was measured as average net margin for the first four years of CEO tenure. IE was the difference between home country culture and that where CEO experience was gained, based on the GLOBE cultural dimensions. Regression then tested the IE/firm performance relationship. For symmetry, distance direction was coded as either positive or negative, depending on whether home country score on a given dimension was higher or lower than that of the host. Moderator regression then tested for whether distance direction impacted the relationship between IE and firm performance.

Results show that overall distance between home and host cultures in aggregate does not have a significant effect on firm performance. However, for specific dimensions, greater distances between the CEO's countries of experience and that of the parent company on in-group collectiveness and performance orientation are associated with higher firm performance, and greater distances on power distance and assertiveness are associated with lower performance. The authors further find asymmetric patterns in the IE–performance relationship, attributable primarily to the fact that, when scores on performance orientation are greater for the home than host country, organizational performance is significantly enhanced.

Originality/value

This study's hypotheses are grounded in theory, combining the human capital perspective with cultural paradox theory. In addition, the authors offer a unique approach for measuring the dimensional distance of culture.

- CEO experience

- International experience

- Human capital

- Expatriate assignments

- National culture

- Cultural paradox

- Organizational performance

Downes, M. and Barelka, A.J. (2023), "CEO international experience and firm performance revisited: What’s culture got to do with it?", Journal of Global Mobility , Vol. 11 No. 4, pp. 554-573. https://doi.org/10.1108/JGM-01-2023-0005

Emerald Publishing Limited

Copyright © 2023, Emerald Publishing Limited

Related articles

We’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

Marketing experience of CEOs and corporate social performance

- Original Empirical Research

- Published: 05 January 2022

- Volume 50 , pages 460–481, ( 2022 )

Cite this article

- Saeed Janani 1 ,

- Ranjit M. Christopher 2 ,

- Atanas Nik Nikolov 3 &

- Michael A. Wiles ORCID: orcid.org/0000-0003-3680-9912 4

3796 Accesses

19 Citations

4 Altmetric

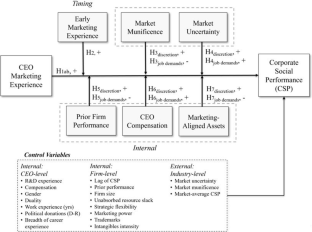

Explore all metrics

Corporate social performance (CSP) is increasingly becoming an important firm performance dimension in its own right. Since the CEO plays a pivotal role in setting the firm’s strategic actions, the examination of CSP’s antecedents has often focused on how CEO characteristics may impact CSP. According to upper echelons theory, one such key characteristic is the CEO’s functional background. As CEO experience in marketing may instill a CSP-supportive mindset in line with stakeholder theory, we examine how such CEO marketing experience may promote CSP and how situational factors may moderate this. Analyses of 3,569 CEOs from 1,999 firms from 2001 to 2016 reveal that CEO prior experience in marketing positively relates to CSP. This finding is robust to multiple analytical methods and endogeneity checks. Further, marketing experience’s effect is stronger than that of other functional experiences. Moderation results indicate this effect is associated more with executive discretion than job demands.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Research in marketing strategy

Neil A. Morgan, Kimberly A. Whitler, … Simos Chari

The customer value proposition: evolution, development, and application in marketing

Adrian Payne, Pennie Frow & Andreas Eggert

Meta-analyses on Corporate Social Responsibility (CSR): a literature review

Patrick Velte

The term CSR is often used to describe the conceptual social responsibilities of companies, the programs and initiatives the firm engages in, and the measurement or assessment of the organization’s visible performance related to CSR (Manner, 2010 ). Similar to others, we refer to this latter aspect as corporate social performance (CSP) (Brower & Mahajan, 2013 ; Luo & Bhattacharya, 2009 ; Manner, 2010 ; Wood, 1991 ). As we are interested in explaining the variations in socially responsible behaviors across firms, we utilize CSP to refer to such behavior (e.g., Brower & Mahajan, 2013 ; Manner, 2010 ; Waddock & Graves, 1997 ).

This is due to the hierarchical governance mechanisms in existence which place CEOs on top of the corporate structure (e.g., Kashmiri et al., 2017 ) and because CEOs influence what information others in the firm attend and respond to (Yadav et al., 2007 ).

For readability, we use the term ‘CEO marketing experience’ interchangeably with CEO prior functional experience in marketing (i.e., gained in a marketing position, degree, or role before assuming the CEO role).

Managerial discretion, as used in the strategic management literature, refers to latitude of action, and we follow this conceptualization. In economics, managerial discretion describes the extent to which managers are free to pursue their own interests over shareholders (i.e., latitude of objectives).

Thus, for market munificence (H3), prior performance (H5), and marketing-aligned assets (H7), a positive moderating effect indicates support for the discretion pathway, while a negative moderating effect indicates support for the job demands pathway (see also Fig. 1 ). For market uncertainty (H4) and CEO compensation (H6), the job demands and discretion perspectives do not offer competing predictions.

This database has been widely used in the marketing and management literature (e.g., Chin et al., 2013 ; Mishra & Modi, 2016 ). There are several advantages to using KLD scores over other rank order ratings like Fortune 1,000 or primary survey-based ratings to assess firm CSP. First, the ratings align well with the theoretical stakeholder perspective of CSP considered in this paper. Second, the ratings are widely used by both the investor community and academic researchers. Third, despite a few weaknesses owing to the inherent subjectivity of raters and the masking of industry effects, KLD’s advantages over other available metrics are well-documented (Harrison & Freeman, 1999 ).

We also use these keywords to identify the percentage of board members with finance and operations experience.

Further, we use short-term and long-term compensation (Manner, 2010 ) but did not find any difference in results. We also use the relative total compensation to the average compensation of the board as well as to the compensation of the CFO, and we find consistent interaction results. However, due to significant number of missing values, we do not use those in our main analysis.

Similar to marketing power, we calculate finance and operations power as the percentage of board members with finance and operations experience, excluding the CEO, as this captures their influence at the strategic levels of the firm (McNulty & Pettigrew, 1999 ; Whitler et al., 2018 ).

The lag of the dependent variable is not included in the first three models because it is correlated with the error term and thereby leads to inconsistent results.

By excluding general management CEOs who also have marketing experience from the DID analysis, the effect for general management is smaller (treatment effect = .104; p < .001).

We also considered the possibility of lagged effects. Looking at the effect of marketing CEO appointments within the three years after the appointment, we find similar results (treatment effect = .109; p = .000). Further, as we expand (limit) our analysis to more (fewer) number of years after CEO appointment, we notice that the effect strengthens (weakens). This finding suggests that CEOs with marketing experience become increasingly more effective in enhancing CSP as time goes by. When we look at the effect of CEO appointments with general management and legal experience within the three years after the appointment, we also find a similar pattern of results as what we observe for marketing CEOs (general management treatment effect = .030; p = .034; legal experience treatment effect = -.159; p = .027). We thank a reviewer for this insightful suggestion.

Alternate specifications of the first-stage model with different controls provide similar results.

The effect size is calculated as the coefficient of marketing experience intensity times its standard deviation, divided by the mean of CSP.

Abadie, A., & Imbens, G. W. (2006). Large sample properties of matching estimators for average treatment effects. Econometrica, 74 , 235–267.

Article Google Scholar

Agle, B. R., Mitchell, R. K., & Sonnenfeld, J. A. (1999). Who matters to CEOs? An investigation of stakeholder attributes and salience, corporate performance and CEO values. Academy of Management Journal, 42 , 507–525.

Aiken, L. S., West, S. G., & Reno, R. R. (1991). Multiple Regression: Testing and Interpreting Interactions . Sage Publications Inc.

Google Scholar

Alba, J. W., & Hasher, L. (1983). Is memory schematic? Psychological Bulletin, 93 , 203–231.

Angrist, J. (2014). The perils of peer effects. Labor Economics, 30 , 98–108.

Basu, K., & Palazzo, G. (2008). Corporate social responsibility: A process model of sense making. Academy of Management Review, 33 , 122–136.

Baum, C. F., Schaffer, M. E., & Stillman, S. (2003). Instrumental variables and GMM: Estimation and testing. The Stata Journal, 3 (1), 1–31.

Black, J. S., & Gregersen, H. (2002). Leading Strategic Change: Breaking through the Brain Barrier . FT Press.

Brickson, S. L. (2007). Organizational identity orientation: The genesis of the role of the firm and distinct forms of social value. Academy of Management Review, 32 , 864–888.

Brower, J., & Dacin, P. A. (2020). An institutional theory approach to the evolution of the corporate social performance-corporate financial performance relationship. Journal of Management Studies, 57 , 805–836.

Brower, J., & Mahajan, V. (2013). Driven to be good: A stakeholder theory perspective on the drivers of corporate social performance. Journal of Business Ethics, 117 , 313–331.

Business Roundtable. (2019). Business roundtable redefines the purpose of a corporation to promote ‘An economy that serves all Americans’ . Retrieved May 19, 2020 from https://www.businessroundtable.org/business-roundtable-redefines-the-purpose-of-a-corporation-to-promote-an-economy-that-serves-all-americans .

Cha, W., Abede, M., & Dadanlar, H. (2019). The effect of CEO civic engagement on corporate social and environmental performance. Social Responsibility Journal, 15 , 1054–1107.

Chabowski, B. R., Mena, J. A., & Gonzalez-Padron, T. L. (2011). The structure of sustainability research in marketing, 1958–2008: A basis for future research opportunities. Journal of the Academy of Marketing Science, 39 , 55–57.

Chernev, A., & Blair, S. (2015). Doing well by doing good: The benevolent halo of corporate social responsibility. Journal of Consumer Research, 41 , 1412–1425.

Chin, M. K., Hambrick, D. C., & Treviño, L. K. (2013). Political ideologies of CEOs: The influence of executives’ values on corporate social responsibility. Administrative Science Quarterly, 58 , 197–232.

Clarkson, M. E. (1995). A stakeholder framework for analyzing and evaluating corporate social performance. Academy of Management Review, 20 , 92–117.

Cohn, M. (2020). Big four firms release ESG reporting metrics with World Economic Forum. Accounting Today (Sepember 23, accessed at https://www.accountingtoday.com/news/big-four-firms-release-esg-reporting-metrics-with-world-economic-forum .

Connelly, B. L., Ketchen, D. L., Jr., & Slater, S. F. (2011). Toward a “theoretical toolbox” for sustainability research in marketing. Journal of the Academy of Marketing Science, 39 , 86–10.

Crittenden, V. L., Crittenden, W. F., Ferrell, L. K., Ferrell, O. C., & Pinney, C. C. (2011). Market-oriented sustainability: A conceptual framework and propositions. Journal of the Academy of Marketing Science, 39 , 71–85.

Cron, W. L. (1984). Industrial salesperson development: A career stages perspective. Journal of Marketing, 48 , 41–52.

Cyert, R. M., & March, J. G. (1963). A Behavioral Theory of the Firm . Prentice Hall.

David, P., Bloom, M., & Hillman, A. J. (2007). Investor activism, managerial responsiveness, and corporate social performance. Strategic Management Journal, 28, 91–100.

Day, G. S., & Nedungadi, P. (1994). Managerial representations of competitive advantage. Journal of Marketing, 58 , 31–44.

Dearborn, D. C., & Simon, H. A. (1958). Selective perception: A note on the departmental identifications of executives. Sociometry, 21 , 140–144.

Deckop, J. R., Merriman, K. K., & Gupta, S. (2006). The effects of CEO pay structure on corporate social performance. Journal of Management, 32 , 329–342.

Dess, G. G., & Beard, D. W. (1984). Dimensions of organizational task environments. Administrative Science Quarterly, 29 , 52–73.

Dunham, L., Freeman, R. E., & Liedtka, J. (2006). Enhancing stakeholder practice: A particularized exploration of community. Business Ethics Quarterly, 16 , 23–42.

Feng, H., Morgan, N. A., & Rego, L. L. (2015). Marketing department power and firm performance. Journal of Marketing, 79 , 1–20.

Feng, H., Morgan, N. A., & Rego, L. L. (2017). Firm capabilities and growth: The moderating role of market conditions. Journal of the Academy of Marketing Science, 45 , 76–92.

Finkelstein, S., & Hambrick, D. C. (1990). Top management team tenure and organizational outcomes: The moderating role of managerial discretion. Administrative Science Quarterly, 35 , 484–503.

Finkelstein, S., Hambrick, D. C., & Cannella, A. A., Jr. (2009). Strategic Leadership: Theory and Research on Executives, Top Management Teams, and Boards . Oxford University Press.

Fombrun, C. J., Van Riel, C. B., & Van Riel, C. (2004). Fame & fortune: How successful companies build winning reputations . FT press.

Freeman, R. E. (1984). Strategic Management: A Stakeholder Approach . Pitman.

Germann, F., Ebbes, P., & Grewal, R. (2015). The chief marketing officer matters! Journal of Marketing, 79 , 1–22.

Graham, J. R., Harvey, C. R., & Puri, M. (2013). Managerial attitudes and corporate actions. Journal of Financial Economics, 109 , 103–121.

Greve, H. R. (2003). A behavioral theory of R&D expenditures and innovations: Evidence from shipbuilding. Academy of Management Journal, 46 , 685–702.

Grayson, K., Johnson, D., & Chen, D.-F.R. (2008). Is firm trust essential in a trusted environment? How trust in the business context influences customers. Journal of Marketing Research, 45 , 241–256.

Groening, C., & Kanuri, V. K. (2018). Investor reactions to concurrent positive and negative stakeholder news. Journal of Business Ethics, 149 , 833–856.

Guadalupe, M., Li, H., & Wulf, J. (2014). Who lives in the C-Suite? Organizational structure and the division of labor in top management. Management Science, 60 , 824–844.

Hambrick, D. C. (1982). Environmental scanning and organizational strategy. Strategic Management Journal, 3 , 159–174.

Hambrick, D. C. (2007). Upper echelons theory: An update. Academy of Management Review, 32 , 334–343.

Hambrick, D. C., & Finkelstein, S. (1987). Managerial discretion: A bridge between polar views of organizational outcomes. Research in Organizational Behavior, 9 , 369–406.

Hambrick, D. C., Finkelstein, S., & Mooney, A. C. (2005). Executive job demands: New insights for explaining strategic decisions and leader behaviors. Academy of Management Review, 30 , 472–491.

Hambrick, D. C., Geletkanycz, M. A., & Fredrickson, J. W. (1993). Top executive commitment to the status quo: Some tests of its determinants. Strategic Management Journal, 14 , 401–418.

Hambrick, D. C., & Mason, P. A. (1984). Upper echelons: The organization as a reflection of its top managers. Academy of Management Review, 9 , 193–206.

Harrison, J. S., & Freeman, R. E. (1999). Stakeholders, social responsibility, and performance: Empirical evidence and theoretical perspectives. Academy of Management Journal, 42 , 479–485.

Hillebrand, B., Driessen, P. H., & Koll, O. (2015). Stakeholder marketing: Theoretical foundations and required capabilities. Journal of the Academy of Marketing Science, 43 , 411–428.

Hitt, M. A., & Tyler, B. B. (1991). Strategic decision models: Integrating different perspectives. Strategic Management Journal, 12 , 327–351.

Hoeffler, S., Bloom, P. N., & Keller, K. L. (2010). Understanding stakeholder response to corporate citizenship initiatives: Managerial guidelines and research directions. Journal of Public Policy and Marketing, 29 , 78–88.

Hult, G. T. M., Mena, J. A., Ferrell, O. C., & Ferrell, L. (2011). Stakeholder marketing: A definition and conceptual framework. AMS Review, 1 , 44–65.

Ikram, A., Li, Z. F., & Minor, D. (2019). CSR-contingent executive compensation contracts. Journal of Banking & Finance, 105655.

Ioannou, I., & Serafeim, G. (2015). The impact of corporate social responsibility on investment recommendations: Analysts’ perceptions and shifting institutional logics. Strategic Management Journal, 36 , 1053–1081.

Kang, C., Germann, F., & Grewal, R. (2016). Washing away your sins? Corporate social responsibility, corporate social irresponsibility, and firm performance. Journal of Marketing, 80 , 59–79.

Kahneman, D., Fredrickson, B. L., Schreiber, C. A., & Redelmeier, D. A. (1993). When more pain is preferred to less: Adding a better end. Psychological Science, 4 , 401–405.

Kashmiri, S., Nicol, C. D., & Arora, S. (2017). Me, myself, and I: Influence of CEO narcissism on firms’ innovation strategy and the likelihood of product-harm crises. Journal of the Academy of Marketing Science, 45 , 633–656.

Keats, B. W., & Hitt, M. A. (1988). A causal model of linkages among environmental dimensions, macro organizational characteristics, and performance. Academy of Management Journal, 31 , 570–598.

Kim, M., Boyd, D. E., Kim, N., & Yi, C. H. (2016). CMO equity incentive and shareholder value: Moderating role of CMO managerial discretion. International Journal of Research in Marketing, 33 , 725–738.

Kotchen, M., & Moon, J. J. (2012). Corporate social responsibility for irresponsibility. The BE Journal of Economic Analysis & Policy, 12 , 1–21.

Krasnikov, A., Mishra, S., & Orozco, D. (2009). Evaluating the financial impact of branding using trademarks: A framework and empirical evidence. Journal of Marketing, 73 , 154–166.

Kurt, D., & Hulland, J. (2013). Aggressive marketing strategy following equity offerings and firm value: The role of relative strategic flexibility. Journal of Marketing, 77 , 57–74.