Clearing Universities & Courses

Clearing advice.

Recommended Clearing Universities

Popular Course Categories

Course Search & Discover

Start the search for your uni. Filter from hundreds of universities based on your preferences.

Search by Type

Search by region.

Recommended Universities

Ravensbourne University London

London (Greater) · 88% Recommended

University of Kent

South East England · 96% Recommended

Goldsmiths, University of London

London (Greater) · 92% Recommended

Search Open Days

What's new at Uni Compare

University of Surrey

Surrey has been ranked 4th for overall student satisfaction [NSS 2023].

University of Roehampton

See what London has to offer at Roehampton’s beautiful parkland campus.

Ranking Categories

Regional rankings.

More Rankings

Top 100 Universities

Taken from 65,000+ data points from students attending university to help future generations

About our Rankings

Discover university rankings devised from data collected from current students.

Guide Categories

Advice categories, recommended articles, popular statement examples, statement advice.

What to include in a Personal Statement

Personal Statement Tips

Personal statement example real estate personal statement.

Submitted by Phillip

Top 10% for Business graduate earnings (Longitudinal Education Outcomes 2022)

Gain real-world business skills and experience at University of Brighton in an AACSB-accredited business school. Explore Business degrees at Brighton.

Gain real world experience needed for success in Business

Prepare for your future with a Business Degree at Roehampton which includes practical learning, paid placements and employability events.

Real Estate Personal Statement

The catalyst of my desire to study Real Estate stems from a young age: when walking around the cobbled streets of Moray Place in Edinburgh's New Town, I was left with a simple question: "why was this street so different to the rest of the New Town?". A few years later, an answer appeared on a BBC programme 'The Secret History of Our Streets': it explained the social change in Edinburgh at the time and that the upper-middle classes wanted to move away from the highly polluted Old Town to the modern and cleaner New Town. The Earl of Moray decided to create the largest Georgian Terrace in Europe, Moray Place. For me, learning that there was so much more to this one street really stirred up a personal interest in the world of Property and Real Estate.

Following on from that, I started looking at property prices around Edinburgh by using Rightmove and subscribing to The Property Hub, receiving three issues a year since early 2016. This was not enough, however, and I wanted to see how a real estate agency operates away from my local city. I was lucky enough to secure a week of work experience at Wetherell's and Carter Jonas in Mayfair, London. In this week, I was taken aback by the complexity of it all, learning legal processes, seeing how changing political climates affect property, and more. During my time at Wetherell's, I was shown a legal process called 'Know Your Customer', which must be used before the purchasing of any property in the UK. This process is used to firstly identify the customer's legitimacy, to avoid money laundering schemes, and to make sure there has been no suspicious behaviour in the past. This Real Estate Law is a part of the course that I find particularly interesting. During my time in London, I independently organised a session with a real estate agent at Knight Frank. I had done some research prior to the session and asked if I could be given an introduction to LonRes, the property data network used by some of the most established real estate companies in the United Kingdom. I was shown how to use the data network, and even helped gather data for a client on the average price per square foot in the area where she was wishing to purchase property. I also learned that the sales process is often a collaborative process, and that many agencies in London and across the UK work together and share data to assist one another.

Taking Geography and Politics for A Level has given me a firm base to study my chosen degree: I have studied housing deprivation and the need for more housing development projects in deprived areas of the UK in Geography coursework, whilst in Government and Politics I have strengthened my knowledge on both the political framework and current political climate in the United Kingdom. Classical Civilisation has given me essential essay writing skills which will be invaluable at university. Outside of school, I had two part-time jobs over the summer: picking 'wild oats' on a farm and working in an engineering factory. Both jobs required good time keeping, enthusiasm and the ability to work in a team. I believe these skills are some of the qualities needed to be successful at university, and would certainly be applicable to my chosen career path. This academic year, I was appointed to the role of School Prefect, giving me responsibilities in supervising and guiding younger members of the school. I am also the anti-bullying representative for my house, a role which requires patience and pastoral skills. I am a keen sportsman and have represented the school at rugby and cricket. This has taught me to communicate well and work with a wide range of personalities.

I see this degree course as the start of a career that I have wished to pursue for a long time. I am ready for this next step in my education in Real Estate and university will help me enhance my knowledge of a subject I have a great passion for.

Recommended Course

Recommended Statements

Submitted by anonymous

Business and Management Personal Statement

I am applying to study a

Business and Management (Marketing) Personal Statement

Living in London, which is ranked as the number one city for bus...

International Business Personal Statement

Interaction with business professionals has led ...

Business Management Personal Statement

There are many events in a person’s life, but only a few of them are important and define a new start in t...

undergraduate Universities

Undergraduate uni's.

Ravensbourne

Uni of Kent

413 courses

Goldsmiths, UOL

273 courses

Swansea Uni

771 courses

Uni of Surrey

434 courses

238 courses

Middlesex Uni

470 courses

Uni of Sunderland

201 courses

Northeastern Uni

.jpg)

Uni of Hertfordshire

415 courses

Uni of East London

317 courses

Cardiff Met Uni

305 courses

Uni of Chester

398 courses

Uni of Winchester

154 courses

Uni of Leicester

267 courses

Uni for Creative Arts

457 courses

Uni of Suffolk

110 courses

Coventry Uni

444 courses

Leeds Beckett Uni

324 courses

Heriot-Watt Uni

208 courses

Staffordshire Uni

272 courses

Uni of Roehampton

268 courses

Uni of Westminster

338 courses

West London IoT

Uni of Bedfordshire

327 courses

Uni of Portsmouth

547 courses

,-Bristol.jpg)

UWE, Bristol

252 courses

Queen's Uni

411 courses

Leeds Arts University

Kingston Uni

373 courses

Anglia Ruskin Uni

464 courses

Escape Studios

Uni of Essex

801 courses

528 courses

Uni of Bradford

265 courses

ARU Writtle

104 courses

353 courses

Uni of Huddersfield

458 courses

Uni of C.Lancashire

531 courses

Wrexham Uni

171 courses

Uni of Brighton

257 courses

Bath Spa Uni

292 courses

Edge Hill Uni

243 courses

Uni of Hull

274 courses

Nottingham Trent

537 courses

Uni of Reading

391 courses

Edinburgh Napier

184 courses

246 courses

Find the latest from Uni Compare

University of South Wales

USW has been shortlisted as the Times Higher Education’s (THE) University of the Year! Click here to learn more.

University of Essex

Ranked in the top 30 in the Guardian University Guide 2024, click here to learn more!

Real Estate Finance and Economics Postgraduate Personal Statement

Example Real Estate Finance and Economics Postgraduate Personal Statement

The real estate crash was at the heart of the financial crisis. Had economists and bankers possessed a better understanding of the direction of the housing market, there might never have been the disastrous collapse of banks across the world that we witnessed night after night on the television and newspapers only a few years ago. I was studying Economics and the housing market at the height of the crisis and the increasingly obvious importance of the real estate market to the world economy’s fortunes combined with my evident aptitude for market analysis convinced me that I wish to become a real estate analyst or investor for a major investment management firm. The MSc in Real Estate Finance and Economics would equip me with the requisite knowledge to fulfil my ambition.

To prepare myself for the course and my career, I have taken modules in Accounting, Derivatives and various other courses relevant for developing an advanced understanding of the dynamics of real estate as part of my degree, for all of which I have received either a First or a high 2:1. Studying Economics has also equipped me with the requisite mathematical skills to analyse investments and markets, while the courses on economic theory have given me a thorough knowledge of how the overall economy works, an understanding which should stand me in good stead when I come to make forecasts about the real estate market.

The knowledge I gained at university built on what I had learned already at school, where I took A-Levels in Economics and Business, study which had already made me determined to work in finance. Outside of the classroom, I have tried to strengthen further my knowledge of finance and the real estate markets by reading regularly the Economist and the Financial Times, along with finance-related books such as Niall Ferguson’s The Ascent of Money, which indicates how housing bubbles always have been and always will be a part of the global economy.

As well as attempting to gain the requisite theoretical knowledge for my chosen career, I have also tried to gain day-to-day experience of the business world in order to develop the practical skills necessary to succeed in finance. In my last two summers at university, I have worked as a sales executive at two major retailers, where I have learned how to communicate clearly and confidently with customers and colleagues, answering queries and resolving difficulties. Working hard to achieve sales targets has shown me how to meet strict deadlines and demanding goals, which should prepare me well for the high-pressured world of international finance.

The summer after finishing my A-Levels I also was gifted the opportunity to work as a fraud analyst for Barclaycard where I was charged with identifying fraudulent transactions and notifying credit card holders when their accounts had been frozen. The experience gave me a taste for financial analysis and taught me how to deal calmly and patiently with customers whom I often would have to reassure when they feared their money had been stolen.

In my spare time, when not reading about the real estate and financial markets, I enjoy volunteering at schools and community centres, where I act as an interpreter for Bangladeshis new to Britain whom I try to help integrate into the society. I should like to volunteer for similar work on the Masters and help any other Bangladeshi students to integrate into the university’s community. I am also a fitness fanatic, regularly frequenting the gym as well as playing football and cricket competitively. I should like to try out for the university’s cricket team when I begin the Masters.

I want to become as deeply involved in university life as possible, for I hope to come away from the Masters not only with the requisite knowledge to analyse and forecast accurately the future of the housing markets but with close friends from whom I can learn and with whom I can collaborate in my future work.

We hope that this example Real Estate Finance and Economics Postgraduate Personal Statement will be a helpful reference when writing your own statement.

Personal Statement

- The Application Process

- UCAS Criteria

- Choosing a Degree

- Why is a Good Personal Statement Important?

- Your Personal Statement

- Example Personal Statements

- Personal Statement Help

- Personal Statement Format

- Points to Remember

- The UK Tuition Fees System

- Student Loans

- Student Finance

- Full Subjects List

- Disabled UCAS Applicants

- A-Level Results Day

- A Guide to Results Day

- Clearing & A Level Results Day

- A Guide to Clearing

- Visas to study in the UK

- Missed the January UCAS deadline?

- No University Offers…What Next?

- Interview Skills

- PGCE Interviews

- Applying to Oxbridge

- Before you go to University

- University Checklist

- Studying Abroad

- Applying to University Overseas

- Apply to study Internationally

- Preparing for Studying Abroad

- Benefits of Studying Abroad

- Taking a Gap Year

- Should You Take A Gap Year?

- Study Independently

- Choosing Accommodation

ADVERTISEMENTS

- Prices/Payment

- Standard Service US$199.00

- VIP/Rush Service US$299.00

- Masters Personal Statement Help

- Dr. Robert Edinger

- Autobiographical

- Cover Letter

- Disadvantaged Status

- Dual Degrees

- Letter of Appeal

- Letter of Recommendation

- Scholarship

- Summer School

- Undergraduate

- Mission/Service

- Privacy/Guarantee

#header_text h2#site_subheading a, #header_text h2#site_subheading{ color:#000000 } @media (min-width: 650px) { #header_text h2#site_subheading a, #header_text h2#site_subheading{ } }

Free Consults!

Dr. Robert Edinger Admission Writer and Editor

Samples of My Work in Real Estate

- Real Estate Master’s, Tibetan, New York City

- Master’s in Real Estate Development, Chinese

- Real Estate, International Development, Nigerian

- Masters Real Estate, Finance, Bangladeshi

- MS Real Estate Investment, Dubai, World Travel

- Masters International Real Estate & Planning UK

- MSc Real Estate UK, Malaysian Mom

- Masters Real Estate Development, Saudi Arabian

- MS, Masters Real Estate Development

Search by Discipline, Degree, Ethnicity, or Country of Origin

Statements of excellence for advanced studies in real estate sales and development.

Women in Real Estate.

- Accounting, MAcc, MSc

- Architecture MS, MSc

- Bacteriology MS

- Biology MS, MSc, PHD

- Chemical Engineering MS, MSc

- Chemistry MS, MSc

- Communications MA

- Computer Science MS, MSc, PHD

- Counseling MA

- Criminal Justice MA, MCJ

- Early Childhood Studies

- Economics Masters, PHD

- Education MA, MED, MS, EDM, EDD

- Engineering, MS, MSC, PHD

- English Language, Literature

- Finance MS, MSc

- Food Science MS

- Graphic Design MA

- Healthcare Management, Informatics

- Health Education MS

- HR Human Resources HRM

- International Relations, Affairs

- Information Systems MS, MSc

- Law, LLM, MA, MSc, JD

- Liberal Arts Masters, MA

- Linguistics

- Logistics MS, PHD

- Management MS, MBA

- Nuclear Energy

- Occupational Therapy

- Pathologist Assistant MS

- Pharmacy Masters, Doctorate

- Physician Assistant Studies BS, MS

- Physics MS, MSc

- Political Science MA

- Real Estate MS

- Regulatory Science, Affairs

- Rehabilitation Counseling MS

- Research, MS, MRes

- School Counselor MA

- Security Studies

- Sociology MA, PHD

- Statistics MS, PHD

- Supply Chain MS, MSc, PHD

- Translation MA

- Transportation MS, PHD

- Veterinary Medicine

Most Recently Edited Statement Samples

- MA Educational Counseling, Multiculturalism

- MS Computer Science, Info Security, Saudi

- General Practice Dental Residency, GPR, Egyptian

- HRM Human Resources Masters, Chinese Woman

- Real Estate Development, Employment Position

- International Affairs Masters, Diplomacy, Africa

- Masters Communications Management, Taiwanese

- Letter of Appeal, International Dentist Program

- Masters Material Science, Pollution, Chinese

- Masters Food Science, Development, African

- Endeavour Scholarship Australia, Filipina

- MBA, Accounting Background, Saudi Woman

- MSC Clinical Microbiology, London, Turkish

- Master's Degree Occupational Therapy, Pakistani

- MA Global Communication, Marketing, Latina

- MS in Business Analytics, Mgmt., Programming

- Masters, Information Systems, Chinese

- MS Project Management, Oil & Gas, Iranian

View older posts »

Premium Statement Service by Dr. Robert Edinger

Premium Service US$299.00

With maximum creativity, research, priority attention, and as many revisions as needed!

Dr Robert Edinger with Son David

1-812-675-4937

Sample 1st Paragraph MS Degree in Real Estate

Master’s Degree in Real Estate Finance Program, Sample Personal Statement of Purpose, Growing up in Bangladesh.

While I was born and raised in Bangladesh, I came to London for my undergraduate studies and am now working towards the completion of my LLB Degree from King’s College London. I have worked full time for the past three 3 summers with 5-6 months in total spent at each position. My first position was with an investment firm in Bangladesh (Date) performing Due Diligence Surveys for an Investment Analyst in the area of acquisitions of mostly commercial spaces and industrial land. I learned a great deal about real estate investment in this position that will serve me well as a graduate student in your program at XXXX, everything from finance to planning permissions and much in between.

My next ‘summer’ was spent in Lisbon, Portugal where I also served as an Investment Analyst. This time, my focus was primarily on residential properties, the full gambit, everything from run down sites for redevelopment through existing structures that were new or in excellent condition. I learned a lot about how the values of properties shift as a result of a broad variety of conditions and factors, with these differences being seen most graphically when examined comparatively across neighborhoods. In Portugal, I participated in a lot of forecasting analysis, looking at issues of risk/reward, depreciation, and return on investment.

This past summer I spent in Montreal Canada - again focused on analyzing investments in different parts of the country, including remote areas such as Newfoundland. This gave me great insight into the vast differences that can exist between real estate and investment climates in densely vs. sparsely populated areas, in Bangladesh as well as Canada. I have also learned a great deal about the impact of income disparities across countries and how this is related to real estate development.

I especially enjoyed studying the complex ways in which different parts of Canada can be characterized as having a particular investment climate. I have studied very closely the economic impact of population movements and shifting densities – comparing, for example, rapidly growing cities such as Vancouver and Toronto, with other cities that have more stable populations.

I have a great personal as well as professional passion for policies that protect the natural environment in sustainable ways with an emphasis on the integration and regeneration of urban areas. The area of London in which I currently live, Stratford, is an excellent example of successful regeneration that I have studied with special intensity. Before the 2012 Olympics the place was downtrodden and in most of it in very poor condition. Since the games, the area has been rejuvenated and the quality of life for those living here has greatly improved. Many new residency buildings have sprung up along with some of the world’s most exciting new shopping centers, new, cutting-edge universities are also being planned.

Still only 22 years old, it pleases me to think about the long professional lifetime that I have ahead of me and I feel most keen to engage with the cutting edge of theory and reality in real estate development, especially projects and strategies for developing nations like Bangladesh. I think of myself as a real estate development professional and also a volunteer, as I seek to make my humanitarian mark in this area as well. No greater gift can be given to people than dignified shelter and I have no desire to devote my efforts of a lifetime to the high end of real estate investment. I am more attracted to plans that benefit the common masses of ordinary people.

In addition to Hindi and Bengali, I am also fluent in French and I hope to make use of this language as well at some point in my career at the service of the developing world, the former colonies of European nations. Some of my highest moments in life so far have been while serving as a volunteer in Bangladesh working with a resilient housing project for 100's of families in Rangpur in rural Bangladesh. We sought, with a certain degree of success, to change to focus of residential construction to disaster risk reduction in areas subject to numerous water-related challenges. We enjoyed success at the implementation of earthen solutions along with the use of other natural materials such as bamboo in the construction of low cost yet sanitary and efficient dwellings for people of very limited resources.

I look forward to the fullest and most rigorous immersion experience possible in global property markets, especially commercial, with a focus on finance and development. I could not be more excited by the prospect of the fullest of exposure to the very latest concepts in risk management and financial engineering in particular.

I thank you for considering my application to your competitive Master’s Program in Real Estate Finance at XXXX University.

Women in Real Estate

Sample 1st Paragraph for the MPhil Degree Real Estate Finance, UK, Pakistani Applicant

Heroines of Real Estate

The real estate industry is chock full of talented, inspired and motivated women. Here are some of our favorites.

Marilyn Jordan Taylor

Marilyn Jordan Taylor is an American architect who has been a partner at Skidmore, Owings & Merrill since the early 1980s. She served as its first female chairman. Taylor specializes in urban architectural projects and designed the master plan for the Manhattanville expansion, the Consolidated Edison East River Greenway as well as airports from the John F. Kennedy International Airport terminal 4 expansion to the SkyCity at the Hong Kong International Airport .

Since 2008, she has been the Dean of the University of Pennsylvania School of Design .

Ivanka Trump

Ivanka Trump is executive vice president of the Trump Organization (and member of Fortune’s just-released, 2014 40 under 40 list ). She is an American businesswoman and former fashion model .

Trump is the daughter of real estate developer and the President of the United States , Donald Trump ; and the Executive Vice President of Development & Acquisitions at her father's company, the Trump Organization , where her work is focused on the company's real estate and hotel management initiatives.

Maryanne Gilmartin

Maryanne Gilmartin is President and CEO of Forest City Ratner Companies. She is president and chief executive officer of Forest City Ratner Companies, the New York office of Forest City Realty Trust, Inc.

Gilmartin has been point person in the development of some of the most high-profile real estate projects in New York City. They include Pacific Park Brooklyn, The New York Times Building and New York by Gehry.

In addition to these projects, Gilmartin managed the commercial portfolio at MetroTech Center in Downtown Brooklyn.

Gilmartin graduated summa cum laude, Phi Beta Kappa from Fordham University, where she also studied for a master’s degree.

She proudly served for more than seven years on the New York City Ballet Advisory Board. Currently, she is a board trustee for the Brooklyn Academy of Music, a member of the executive committee and board of governors of the Real Estate Board of New York, and as a member of the Industry Advisory Board of the MS Real Estate Development Program at Columbia University.

She was named co-chair of the Downtown Brooklyn Partnership, a member of the board of directors of the Jefferies Group LLC, a global investment banking firm, and a member of the board of trustees of New York Public Radio.

Gilmartin has been recognized as a top professional in her field with a number of awards. She earned the Woman of the Year honor in 2007 from WX New York Women Executives in Real Estate.

She has made multiple appearances on Crain’s New York Business’s annual list of New York’s 50 Most Powerful Women.

Barbara Corcoran

Barbara Ann Corcoran is an American businesswoman, investor, speaker, consultant, syndicated columnist, author, and television personality.

She graduated from St. Thomas Aquinas College with a degree in education in 1971, and then she taught school for a year. She soon moved on working various jobs including a side job renting apartments in New York City. Corcoran wanted to be her own boss.

In 1973 co-founded a real estate business called The Corcoran Group with her boyfriend, who fronted a $1,000 loan (approximately $5,420 now).

In the mid-1970s, she also began publishing The Corcoran Report, which detailed the real estate data trends in New York City.

In 2001, Corcoran sold her business to NRT Incorporated for $66 million. She is an investor herself, and is invested in more than twenty businesses to date.

Corocan is a columnist for More Magazine , The Daily Review , and Redbook , has written several books. She has been featured in various shows, include Larry King Live .

Corocan has been a guest business speaker at various real estate events and is a business consultant via her consulting and television production business, Barbara Corcoran Inc.

She is also the real estate contributor to NBC's Today show and hosts The Millionaire Broker with Barbara Corcoran on CNBC .

Dolly Lenz is a real estate agent in New York City . It is estimated that in 2007, she sold $7 billion in real estate. She sold $748 million the year before.

Lenz, whose birth name is Idaliz Camino, was born in the Bronx to a Spanish immigrant father, and bought her first apartment at age 18 on Park Avenue in the Murray Hill neighborhood.

Lenz was an accountant at United Artists , where she struck up a friendship with Barbra Streisand and began selling real estate in various agencies, including Sotheby's before moving to Prudential 's Douglas Elliman agency in 1999. She became vice chairman of the division in 2003.

Lenz left Douglas Elliman to start her own firm in June 2013. “She is probably pursuing an opportunity where she can leverage her brand, but this is just an outsider’s opinion,” said Town Residential CEO Andrew Heiberger when she left.

She has been used frequently by Donald Trump , and in 2005, sold the Burnt Point mansion in Wainscott, New York to billionaire Stewart Rahr for $45 million.

Mary Ann Tighe

On the commercial side of real estate is Mary Ann Tighe, CEO of CBRE, Tristate Area, Laura Pomerantz, vice chairman of Cushman and Wakefield, and Faith Hope Consolo, chairman of the retail group of Douglas Elliman.

Tighe is an American commercial real estate broker and CEO of the New York Tri-State Region of CBRE , the world’s largest commercial real estate services firm.

She has made commercial transactions for over 93 million square feet and has been cited as a groundbreaker in a traditionally male-dominated industry.

Tighe’s deals have anchored more than 13.7 million square feet of new construction in the New York region , a total believed to be a record in commercial brokerage. She has been named to Crain’s New York Business Most Powerful Women in New York since the listing was inaugurated in 2007, ranking #1 in 2011 across all New York City industries.

Elizabeth Plater-Zyberk

Elizabeth Plater-Zyberk is an American architect and urban planner of Polish - Livonian aristocratic roots based in Miami, Florida .

Plater-Zyberk received her undergraduate degree in architecture and urban planning from Princeton and her master's degree in architecture from the Yale School of Architecture .

She is a representative of New Urbanism and New Classical Architecture .

Janette Sadik-Khan

Janette Sadik-Khan is a former commissioner of the New York City Department of Transportation (2007-2013) and an advisor on transportation and urban issues.

Khan currently serves as a principal at Bloomberg Associates, a philanthropic consultancy established by former Mayor Michael R. Bloomberg that advises mayors around the world to improve the quality of life for their residents.

She is the author of the book "Streetfight: Handbook for an Urban Revolution," which is based on her experience as commissioner and her new role as global transportation advisor.

Khan also serves as chairperson for the National Association of City Transportation Officials (NACTO), a coalition of the transportation departments of 40 large cities nationwide.

Other Women Worth a Mention

Other women worth mentioning are architect Zaha Hadid; Marianne Cusato, the author and urban designer who created the Katrina Cottages; and Sarah Susanka, pioneer of the Not So Big House movement.

In the tech/Silcon Valley realm, Amy Bohutinsky, CMO of Zillow, and Sarah Leary, cofounder of the social-networking-for-neighborhoods site Nextdoor are doing great things.

On the investment side, Robyn Sorid, cofounder of G4 Capital Partners is a pioneer that we appreciate.

As most people in real estate know, women are still underrepresented in the top ranks, but as they are in all industries, women are starting to take more prominent roles.

Let's Get Started!

- Alternative Investments

- Real Estate Investing

A Beginner's Guide to Real Estate Investing

Different ways to invest in real estate

- Search Search Please fill out this field.

Historical Prices

Rental properties.

- Flipping House

Real Estate Investment Groups

Real estate limited partnerships, real estate mutual funds, why invest in real estate, the bottom line.

:max_bytes(150000):strip_icc():format(webp)/Group1805-3b9f749674f0434184ef75020339bd35.jpg)

When you think about real estate investing, the first thing that probably comes to mind is your home. Of course, real estate investors have lots of other options when it comes to choosing investments, and they're not all physical properties.

Real estate has become a popular investment vehicle over the last 50 years or so. Here's a look at some of the leading options for individual investors, along with the reasons to invest.

Key Takeaways

- Real estate is considered to be its own asset class and one that should be at least a part of a well-diversified portfolio.

- One of the key ways investors can make money in real estate is to become a landlord of a rental property.

- Flippers try to buy undervalued real estate, fix it up, and sell it for a profit.

- Real estate investment trusts (REITs) provide indirect real estate exposure without the need to own, operate, or finance properties.

Real estate has long been considered a sound investment, and for good reason. Before 2007, historical housing data made it seem like prices could continue to climb indefinitely. With few exceptions, the average sale price of homes in the U.S. increased each year between 1963 and 2007—the start of the Great Recession. Home prices did take a small hit at the onset of the COVID-19 pandemic in the Spring of 2020. However, as vaccines were rolled out and pandemic concerns waned, home prices accelerated to reach all-time highs by 2022.

This chart from the Federal Reserve Bank of St. Louis shows average sales prices between 1963 and Q1 2022 (the most recent data available). The areas that are shaded in light grey indicate U.S. recessions.

The most significant downturn in the real estate market before the COVID-19 pandemic coincided with the Great Recession. The long-term results of the coronavirus crisis have yet to be seen.

If you invest in rental properties , you become a landlord—so you need to consider if you'll be comfortable in that role. As the landlord, you'll be responsible for things like paying the mortgage, property taxes, and insurance , maintaining the property, finding tenants, and dealing with any problems.

Unless you hire a property manager to handle the details, being a landlord is a hands-on investment. Depending on your situation, taking care of the property and the tenants can be a 24/7 job—and one that's not always pleasant. If you choose your properties and tenants carefully, however, you can lower the risk of having major problems.

One way landlords make money is by collecting rent. How much rent you can charge depends on where the rental is located. Still, it can be difficult to determine the best rent because if you charge too much you'll chase tenants away, and if you charge too little you'll leave money on the table. A common strategy is to charge enough rent to cover expenses until the mortgage has been paid, at which time the majority of the rent becomes profit.

The other primary way that landlords make money is through appreciation. If your property appreciates in value, you may be able to sell it at a profit (when the time comes) or borrow against the equity to make your next investment. While real estate does tend to appreciate, there are no guarantees.

This is particularly true during periods of intense volatility in the real estate market, including most recently throughout the duration of the COVID-19 pandemic. From February 2020 to March 2022, median real estate prices in the U.S. rose by an astonishing 38%. The dramatic growth has left many wondering whether prices are due to crash.

Read about Investopedia's 10 Rules of Investing by picking up a copy of our special issue print edition.

Flipping Houses

Like the day traders who are leagues away from buy-and-hold investors, real estate flippers are an entirely different breed from buy-and-rent landlords. Flippers buy properties with the intention of holding them for a short period—often no more than three to four months—and quickly selling them for a profit.

The are two primary approaches to flipping a property:

- Repair and update. With this approach, you buy a property that you think will increase in value with certain repairs and updates. Ideally, you complete the work as quickly as possible and then sell at a price that exceeds your total investment (including the renovations).

- Hold and resell. This type of flipping works differently. Instead of buying a property and fixing it up, you buy in a rapidly rising market, hold for a few months, and then sell at a profit.

With either type of flipping, you run the risk that you won't be able to unload the property at a price that will turn a profit. This can present a challenge because flippers don’t generally keep enough ready cash to pay mortgages on properties for the long term. Still, flipping can be a lucrative way to invest in real estate if it's done the right way .

A real estate investment trust (REIT) is created when a corporation (or trust) is formed to use investors’ money to purchase, operate, and sell income-producing properties. REITs are bought and sold on major exchanges , just like stocks and exchange-traded funds (ETFs).

To qualify as a REIT, the entity must pay out 90% of its taxable profits in the form of dividends to shareholders. By doing this, REITs avoid paying corporate income tax, whereas a regular company would be taxed on its profits, thus eating into the returns it could distribute to its shareholders.

Much like regular dividend-paying stocks, REITs are appropriate for investors who want regular income, though they offer the opportunity for appreciation, too. REITs invest in a variety of properties such as malls (about a quarter of all REITs specialize in these), healthcare facilities, mortgages, and office buildings. In comparison to other types of real estate investments, REITs have the benefit of being highly liquid .

Real estate investment groups (REIGs) are sort of like small mutual funds for rental properties. If you want to own a rental property but don’t want the hassle of being a landlord, a real estate investment group may be the solution for you.

A company will buy or build a set of buildings, often apartments, then allow investors to buy them through the company, thus joining the group. A single investor can own one or multiple units of self-contained living space. But the company that operates the investment group manages all the units and takes care of maintenance, advertising, and finding tenants. In exchange for this management, the company takes a percentage of the monthly rent.

There are several versions of investment groups. In the standard version, the lease is in the investor’s name, and all of the units pool a portion of the rent to guard against occasional vacancies. This means you will receive enough to pay the mortgage even if your unit is empty.

The quality of an investment group depends entirely on the company that offers it. In theory, it is a safe way to get into real estate investment, but groups may charge the kind of high fees that haunt the mutual fund industry. As with all investments, research is key.

A real estate limited partnership (RELP) is similar to a real estate investment group. It is an entity formed to buy and hold a portfolio of properties, or sometimes just one property. However, RELPs exist for a finite number of years.

An experienced property manager or real estate development firm serves as the general partner . Outside investors are then sought to provide financing for the real estate project, in exchange for a share of ownership as limited partners . The partners may receive periodic distributions from income generated by the RELP’s properties, but the real payoff comes when the properties are sold—with luck, at a sizable profit—and the RELP dissolves down the road.

Real estate mutual funds invest primarily in REITs and real estate operating companies. They provide the ability to gain diversified exposure to real estate with a relatively small amount of capital. Depending on their strategy and diversification goals, they provide investors with much broader asset selection than can be achieved through buying individual REITs.

Like REITs, these funds are pretty liquid. Another significant advantage to retail investors is the analytical and research information provided by the fund. This can include details on acquired assets and management’s perspective on the viability and performance of specific real estate investments and as an asset class. More speculative investors can invest in a family of real estate mutual funds, tactically overweighting certain property types or regions to maximize return.

Real estate can enhance the risk-and-return profile of an investor’s portfolio, offering competitive risk-adjusted returns . In general, the real estate market is one of low volatility , especially compared to equities and bonds.

Real estate is also attractive when compared with more traditional sources of income return. This asset class typically trades at a yield premium to U.S. Treasuries and is especially attractive in an environment where Treasury rates are low.

Diversification and Protection

Another benefit of investing in real estate is its diversification potential. Real estate has a low and, in some cases, negative, correlation with other major asset classes—meaning, when stocks are down, real estate is often up. This means the addition of real estate to a portfolio can lower its volatility and provide a higher return per unit of risk. The more direct the real estate investment, the better the hedge: Less direct, publicly traded vehicles, such as REITs, are going to reflect the overall stock market’s performance.

Because it is backed by brick and mortar, direct real estate also carries less principal-agent conflict , or the extent to which the interest of the investor is dependent on the integrity and competence of managers and debtors. Even the more indirect forms of investment carry some protection. REITs, for example, mandate that a minimum percentage of profits (90%) be paid out as dividends.

Some analysts think that REITs and the stock market will become more correlated, now that REIT stocks are represented on the S&P 500.

Inflation Hedging

The inflation-hedging capability of real estate stems from the positive relationship between gross domestic product (GDP) growth and demand for real estate. As economies expand, the demand for real estate drives rents higher, and this, in turn, translates into higher capital values. Therefore, real estate tends to maintain the purchasing power of capital by passing some of the inflationary pressure onto tenants and by incorporating some of the inflationary pressure, in the form of capital appreciation .

The Power of Leverage

With the exception of REITs, investing in real estate gives an investor one tool that is not available to stock market investors: leverage . Leverage means to use debt to finance a larger purchase than you have the available cash for. If you want to buy a stock, you have to pay the full value of the stock at the time you place the buy order—unless you are buying on margin . And even then, the percentage you can borrow is still much less than with real estate, thanks to that magical financing method, the mortgage.

Most conventional mortgages require a 20% down payment. However, depending on where the property you invest in is located, you might find a mortgage that requires as little as 5%. This means that you can control the whole property and the equity it holds by only paying a fraction of the total value. Of course, the size of your mortgage affects the amount of ownership you actually have in the property, but you control it the minute the papers are signed.

This is what emboldens real estate flippers and landlords alike. They can take out a second mortgage on their homes and put down payments on two or three other properties. Whether they rent these out so that tenants pay the mortgage or wait for an opportunity to sell for a profit, they control these assets despite having only paid for a small part of the total value.

How Can I Add Real Estate to My Portfolio?

Aside from buying properties directly, ordinary investors can purchase REITs or funds that invest in REITs. REITs are pooled investments that own and/or manage properties or which own their mortgages.

Why Is Real Estate Considered to Be an Inflation Hedge?

Home prices tend to rise along with inflation. This is because homebuilders' costs rise with inflation, which must be passed on to buyers of new homes. Existing homes, too, rise with inflation though. If you hold a fixed-rate mortgage, as inflation rises, your fixed monthly payments become effectively more affordable. Moreover, if you are a landlord, you can increase the rent to keep up with inflation.

Why Are Home Prices Impacted by Interest Rates?

Because real estate is such a large and costly asset, loans must often be taken out to finance their purchase. Because of this, interest rate hikes make mortgage payments more costly for new loans (or on existing adjustable-rate loans like ARMs). This can discourage buyers, who must factor in the cost to carry the property month-to-month.

Real estate can be a sound investment and one that has the potential to provide a steady income and build wealth. Still, one drawback of investing in real estate is illiquidity : the relative difficulty in converting an asset into cash and cash into an asset.

Unlike a stock or bond transaction, which can be completed in seconds, a real estate transaction can take months to close. Even with the help of a broker , simply finding the right counterparty can be a few weeks of work. Of course, REITs and real estate mutual funds offer better liquidity and market pricing. But they come at the price of higher volatility and lower diversification benefits, as they have a much higher correlation to the overall stock market than direct real estate investments.

As with any investment, keep your expectations realistic, and be sure to do your homework and research before making any decisions.

Mortgage lending discrimination is illegal. If you think you've been discriminated against based on race, religion, sex, marital status, use of public assistance, national origin, disability, or age, there are steps you can take. One such step is to file a report to the Consumer Financial Protection Bureau (CFPB) or with the U.S. Department of Housing and Urban Development (HUD) .

Federal Reserve Bank of St. Louis. FRED Economic Data. " Average Sales Price of Houses Sold for the United States (ASPUS) ."

U.S. Bureau of Labor Statistics. " Property, Real Estate, and Community Association Managers: What They Do ."

Federal Trade Commission. " The Real Estate Marketplace Glossary: How to Talk the Talk ," Page 1.

Federal Reserve Bank of St. Louis. FRED Economic Data. " S&P/Case-Shiller U.S. National Home Price Index (CSUSHPINSA) ."

U.S. Securities and Exchange Commission. " Investor Bulletin: Publicly Traded REITs ."

Realty Capital Partners, LLC. " Building an Investment Partnership ."

U.S. Securities and Exchange Commission. " Mutual Funds ."

Morningstar. " Why I'm Lukewarm on Real Estate ."

Consumer Financial Protection Bureau. " Determine Your Down Payment ."

The White House, Council of Economic Advisers. " Housing Prices and Inflation ."

Federal Trade Commission. " Mortgage Discrimination ."

- A Beginner's Guide to Real Estate Investing 1 of 34

- Real Estate: Definition, Types, How to Invest in It 2 of 34

- 5 Simple Ways to Invest in Real Estate 3 of 34

- How to Make Money in Real Estate 4 of 34

- The Most Important Factors for Real Estate Investing 5 of 34

- How to Find Your Return on Investment (ROI) in Real Estate 6 of 34

- REIT: What It Is and How to Invest 7 of 34

- 5 Types of REITs and How to Invest in Them 8 of 34

- Direct Real Estate Investing vs. REITs 9 of 34

- REIT vs. Real Estate Fund: What’s the Difference? 10 of 34

- Equity REIT vs. Mortgage REIT 11 of 34

- How to Assess REITs Using Funds from Operations (FFO/AFFO) 12 of 34

- What Are the Risks of Real Estate Investment Trusts (REITs)? 13 of 34

- Capital Real Estate Investment Trust: What It is, How It Works 14 of 34

- How to Analyze REITs (Real Estate Investment Trusts) 15 of 34

- How to Invest in Rental Property 16 of 34

- 10 Factors to Consider When Buying an Income Property 17 of 34

- Should You Buy and Hold Real Estate or Flip Properties? 18 of 34

- How to Calculate ROI on a Rental Property 19 of 34

- How to Calculate Rental Property Depreciation 20 of 34

- Add Some Real Estate to Your Portfolio 21 of 34

- Alternative Real Estate Investments 22 of 34

- Best Real Estate Crowdfunding Platforms for May 2024 23 of 34

- 10 Habits of Successful Real Estate Investors 24 of 34

- 8 Mistakes That Real Estate Investors Should Avoid 25 of 34

- How to Value Real Estate Investment Property 26 of 34

- Investing in Luxury Real Estate 27 of 34

- Avoid Capital Gains Tax on Your Investment Property Sale 28 of 34

- How to Prevent a Tax Hit When Selling a Rental Property 29 of 34

- What Is a 1031 Exchange? Know the Rules 30 of 34

- Avoiding a Big Tax Bill on Real Estate Gains 31 of 34

- Key Reasons to Invest in Real Estate 32 of 34

- Reasons to Invest in Real Estate vs. Stocks 33 of 34

- Is Real Estate Investing Safe? 34 of 34

:max_bytes(150000):strip_icc():format(webp)/156416606-5bfc2b8b46e0fb00517bdff7.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Where Financial Planning Meets Real Estate

Real Life Planning offers unbiased personal financial planning for real estate investors - and those who dream of it.

Get the House Hacking Guide 2.0

DOWNLOAD THE GUIDE

Financial Mentorship For The Real (Estate) Life

Are you a busy professional who owns rental property, or are you thinking about getting started as a real estate investor? Whether you're a current landlord or aspire to own your first rental, you've got a different perspective. You look at your income as a tool for building financial independence from a paycheck, not just for spending on your lifestyle.

If this sounds like you, we can help.

The real estate life can be rewarding, but it's not nearly as simple as it looks on TV. How do you know if you're financially prepared? What type of real estate investment fits your life stage and finances? What's involved in being a landlord? Are you ready to buy your next rental property? How do you know if you're taking too much risk? Will you use leverage? Where should you invest? We'll help you figure it all out so that you're pursuing a real estate life that fits you.

Realize Your Financial Potential

Whether you're adding to your properties, listing your place on Airbnb or looking for your first rental, we'll help you create a realistic plan for your financial life goals.

Fee-Only CFP ® Professionals

As a Fee-Only fiduciary firm and CERTIFIED FINANCIAL PLANNER™ (CFP®), we work for you, not for Wall Street. We help you design a realistic financial life plan.

We're Real Estate Investors, Too

We walk our talk. We're rental property owners, financial planners and investors. Because we speak both real estate and financial planning, we can help you put it all together.

Our Financial Planning Philosophy For Real Estate Investors

What is Fee-Only Financial Planning?

Fiduciary financial planning & fee-only registered investment adviser.

As Fee-Only financial planners, we work for you. Our fiduciary obligation is to work solely in your best interests. We offer wisdom and guidance – with no commissions or sales pitch – for a transparent monthly fee.

We'll make sure all the pieces of your financial life fit together.

PROFESSIONAL CERTIFICATIONS & AFFILIATIONS

Planning expertise featured in:.

OUR SOLUTIONS

First, we listen. Then we help you develop a realistic financial plan to get where you want to go, whether that's growing your rental business, becoming a first-time landlord or including real estate in your investment strategy in other ways. Our process will help you feel ready, confident and financially prepared to pursue your real estate goals.

LET'S COLLABORATE

We'll be alongside you – with wisdom, guidance and coaching – so you can realize your financial potential.

Who are our clients?

- Rental property investors looking for a comprehensive financial plan

- Investors considering adding real estate to their portfolios

- Professionals considering a real estate side hustle

- People with inherited rental property

- Homeowners maximizing opportunities for income

- Married couples who want to make the most of their economic partnership

Our Core Services

Realize your financial potential with unbiased financial planning for all the important pieces (and people) of real life.

- LIFT: Comprehensive Financial Planning

- LAUNCH: Financial Coaching

- AIM: Project-Based Planning

- LIVE: Live Workshops And Events

- LEARN: DIY Online Education

All this for an affordable, transparent fee which fits your life stage and situation .

Tell me more, join our community.

Get the latest wisdom and guidance from Real Life Planning.

Email Address *

Fee-Only and Fiduciary

LIFT your financial life to a higher level with ongoing, comprehensive financial planning and investment management – our core solution.

Why Choose LIFT?

You’ll collaborate with us to build a financial life plan and cohesive investment strategy to make sure all your finances – including your real estate , your income, your retirement and other investments – work together to help you realize your ambitious goals.

Comprehensive Financial Life Planning

Comprehensive financial planning that looks at all aspects of your financial life.

Custom Investment Strategy

Custom investment Strategy that includes your real estate, your retirement and other investments. We'll design an investment policy statement that acts like a constitution for all your investments.

Optional Low-Fee Investment Management

Optional Low-Fee Investment Management for all your non-real estate investments that are optimized to your goals and risk tolerance, and automatically rebalanced. Socially responsible portfolios are available.

WHAT TO EXPECT & OUR FEES

LAUNCH your financial journey with financial coaching to get off to an excellent start.

Why Choose LAUNCH?

Master the basics of money management and develop powerful financial habits that will last.

AIM high with a short term consultation with a CFP® to tackle a specific financial planning project or investment analysis.

Why Choose AIM?

Short-term engagement for project-based financial planning. We'll run all the important numbers, and help you work through your choices then give you a clear action plan to take the next step in confidence.

Plan For One-Time Decisions:

- Should I buy or sell this property?

- What should I do with my employee stock/stock options?

- How to evaluate an employment offer or exit package?

- How can I tackle my student loans or credit card debt?

- What to do with my 401k when I leave my job?

CRUSH YOUR FINANCIAL GOALS with live workshops and and coaching groups.

Why Choose LIVE?

Empower yourself with practical, hands-on group learning and coaching on essential financial topics.

Workshops can be customized to your company's needs, employee benefits and demographics.

- Enroll in a live workshop or boot camp to boost your real estate knowledge.

- Join a financial coaching group to boost your financial confidence and get inspired by peers with similar goals.

- Engage your employees by bringing LIVE workshops, webinars and one-to-one financial consultations to your company.

Improve your financial skills and LEARN at your own pace.

Why Choose LEARN?

Gain new skills, boost your confidence and knowledge and get inspired.

DIY learning resources:

The Real Life Blog

Free intro workshops and webinars on real estate investing, home buying and other financial planning topics.

Real Life Guides™ with checklists and worksheets to dive deeper

Coming in 2020

DIY courses – learn online on your own time

Our podcast – get inspired by people living the real (estate) life

76% of active real estate investors are younger than 55 years old - GenX and Millennial

- Source: Bigger Pockets

From The Real Life Blog

Loading Posts...

TAKE ME TO THE REAL LIFE PLANNING BLOG FOR MORE IDEAS ON CREATING INCOME

20 Impressive Examples of Realtor Bios That Win Clients [Template & Examples]

Published: April 04, 2024

Your realtor bio sets the stage for success. A great bio can help capture new clients, while a poorly written one can send buyers to your competition.

Why is a realtor bio so important? The National Association of Realtors (NAR) found that 52% of home buyers found their homes online. Before reaching out, those home buyers read realtor bios to understand agents’ backgrounds and experiences.

In this post, you’ll learn how to write a strong realtor bio that makes a great first impression.

![real estate investment personal statement → Download Now: 80 Professional Bio Examples [Free Templates]](https://no-cache.hubspot.com/cta/default/53/4eb63650-d315-42e5-9ac7-8d0fcba29324.png)

Table of Contents

Why Real Estate Agent Bios Are Important

How to write a real estate agent bio, excellent real estate agent bio examples, real estate agent bio templates, new real estate agent bio examples, real estate bios when you have no experience, realtor bio tips to keep your readers interested.

Like a business card or website, your real estate bio is crucial to your professional branding. But if you’re stumped on where to start, it helps to know why you’re writing one in the first place. Here are several key reasons why real estate agent bios are important.

1. It describes who you are and why you’re different.

Think of a real estate bio as your first impression, and use it as a vehicle to share your education, experience, and personality (that is, why you’re the person for the job). But remember, a real estate agent bio isn’t a condensed summary of your LinkedIn profile.

In your writing, describe who you are and why it matters. For example, you could write that you were born and raised in [X] area, but why does it matter? Because you have extensive knowledge of the local market. Including the “why” is attractive to potential clients.

2. It builds credibility.

Most clients seek an agent with experience, a great reputation, and sharp negotiation skills. The list goes on. Use your real estate bio to showcase any awards, recognitions, or impressive stats that support these skills.

Of course, there’s a fine line between tooting your own horn and bragging, so tread lightly here. Stick to one or two relevant or impressive accomplishments.

3. It establishes your connection to the community.

Real estate is a local business. Someone looking to sell their property in Texas wouldn’t hire an agent in Hawaii. Instead, they want someone local who knows the ins and outs of the local market.

Now, this doesn’t mean you need deep roots in a particular community to succeed. However, you should position yourself as an enthusiastic advocate for the area by explaining why you chose to move there (or stay, if you’re a native).

Let’s take a look at the steps needed to create an excellent realtor profile and look at bio examples from realtors.

- Use a professional bio prompt template.

- State your real estate experience.

- Convey your connection to the area you sell in.

- Emphasize the value you provide clients.

- Include any of your special designations (if applicable).

- Provide any past sales statistics (if applicable).

- Include any awards you've won (if applicable).

- Tell a story or include personal information about yourself.

1. Use a professional bio prompt template.

Why start from scratch? Writing a real estate agent bio can be difficult, given the pressure you’re facing to impress clients before meeting them in person.

We’ve compiled over 80 professional bio templates and examples for you to use when writing your real estate agent bio. Whether you want to write in the first person or third person, share it on Twitter or LinkedIn, or make it long or short, we’ve got you covered with prompts and real examples.

.webp)

4. Why You’re in Real Estate

Do you have a passion for selling? A penchant for buying? Are you most interested in acreage-type properties? New homes? Historical buildings?

Whatever attracted you to real estate, make it clear in your bio. Clients want a professional on their side, but they also want a human being who has a passion for the work they do and the people they help. This is your chance to stand out from the more typical bios of other real estate agents, which often highlight their experience but don’t give a sense of the agent as a person or help customers understand why realtors are in the business.

Samples of Realtor Bios With No Experience

So, what does this look like in practice? Here are three sample bios that I’ve written to help you get started.

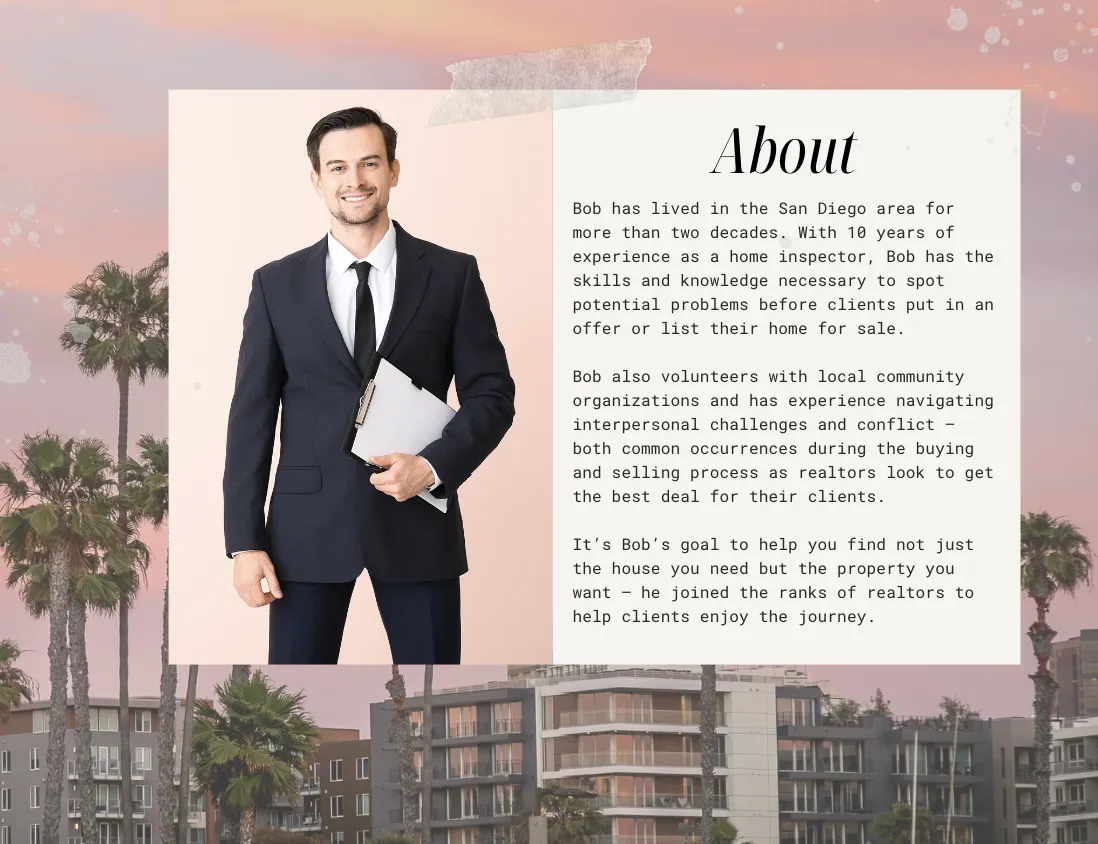

1. Bob Property ( Location: San Diego, California)

Don't forget to share this post!

Related articles.

25 Real Estate Marketing Ideas to Bring in Qualified Buyers

How to Plan, Start, & Grow a Real Estate Business: 27 Essential Tips

45 Real Estate Stats Agents Should Know in 2024

The Ultimate Guide to Real Estate

The 8 Best Real Estate Designations for Prestige and Expertise

The 18 Best Real Estate Apps Every Agent Needs

The 15 Best Real Estate Websites for Selling a Home in 2020

A Beginner's Guide to Running a Comparative Market Analysis

70 Motivational, Relatable, & Funny Real Estate Quotes Every Agent Should Read

How the Procuring Cause Works in Real Estate

Create a compelling professional narrative for your summary, bio, or introduction.

Powerful and easy-to-use sales software that drives productivity, enables customer connection, and supports growing sales orgs

- Blog , Funding Deals / Financing

Understanding the Personal Financial Statement

Understanding the personal financial statement .

Real Estate investing is a team sport and it’s important to leverage the collective power of the deal team to get a deal done. Whether the team is looking to finance a multifamily deal or to market themselves to potential brokers and sellers, it’s necessa ry to provide a thorough and accurate accounting of their individual and collective financial condition. The easiest way to do this is through the creation of a Personal Financial Statement (PFS) .

Personal Financial Statement – Defined

A Personal Financi al Statement is a document that contains a detailed accounting of an investor’s assets, liabilities, and income and it’s used to provide evidence of financial strength and/or ability to close on a deal. In a multifamily transaction, providing a Personal F inancial Statement serves two purposes:

1. It demonstrates the ability to support a loan if necessary : In multifamily lending, there are two types of debt, Recourse and Non-Recourse . If a lender requires that a deal have “recourse” it means that they requi re the personal guarantee of the principal(s) in the loan transaction. Providing a guarantee gives the lender the legal means to pursue the personal assets of the loan “ guarantor(s)” should a deal go bad. In a non-recourse deal, there are no personal gu arantees.

To ensure that the guarantors have the personal capability to repay a loan, the lender will ask them to provide a Personal Financial Statement. As a general rule of thumb, a lender wants to see post transaction liquidity of at least 10% of t he loan amount 2 and post transaction net worth of 100% of the loan amount. If there are multiple guarantors, these rules apply to them collectively.

2. It inspires Broker/Seller Confidence : The other purpose of a Personal Financial Statement is to inspire confidence in brokers and sellers that an investor has the financial wherewithal to close on a deal.

Protect Your Deals, Your Team And Your Reputation.

Access Your Free Copy Of The MF Property Checklist Now And Gain The Guidelines To Securing Your Safest And Most Profitable Real Estate Opportunities.

- First Name *

- Email Address *

- By providing your number, you consent to receive marketing call or texts

- Name This field is for validation purposes and should be left unchanged.

Popular Articles

How do you find inspiration – rod khleif, 3 reasons cash flow beats value as a better investment strategy, how to succeed – the 7 steps to success by rod khleif, why you should invest in multifamily by rod khleif, related posts.

What Are Cap Rates and Why You Should Use Them

Capitalization rates, commonly called cap rates, are a crucial metric for evaluating potential investment opportunities. By understanding them, investors can decide which properties to pursue

How to Invest in Multifamily Properties During Economic Cycles

Multifamily real estate has historically demonstrated stability during economic downturns. This is due to its fundamental nature of providing essential housing, a necessity that people

Navigating the Multifamily Investing Landscape: A Guide for Beginners: INSCMagazine

The article covers the fundamentals of multifamily investing, highlights the key benefits of this investment approach, and provides valuable advice and tactics for individuals new

Let’s Get Started

If you hold interest in multifamily property investing, then we have numerous multi-family real estate investing courses for you under which we offer the best multifamily investing coaching. All you need to do is to enroll yourself in one or more programs and we will provide the best apartment investing coaching as we connect you with apartment investors network. So, what are you waiting for? Enroll today!

- © All Rights Reserved

- Terms of Service / Privacy Policy

- Disclaimers

242 S. Washington Blvd Suite 319 Sarasota, FL 34236 +1-941-225-8477

- Work With Rod

- Real Estate Presentations

- Keynote Speaking

- How to Achieve Massive Success in Business & in Life

- How to Recover From Any Failure or Setback

- How to Create Any Level of Success you Want

- Raving Fans

- The Lifetime CashFlow Through Real Estate Podcast

- Student Success

- Become an Affiliate

As one of America’s top real estate professionals Rod mentors business leaders and entrepreneurs through world-class speaking events, books, and training courses online and around the world.

K L Promotions, LLC

242 S. Washington Blvd Suite 319 Sarasota, FL 34236

Privacy Policy and Terms of Service

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

14 Examples of a Great Real Estate Mission Statement

Published by Brian E Adams on March 18, 2024 March 18, 2024

Start With Why .

Your brand, your customer avatar, your prospecting methods, everything originates from your business mission.

Figuring out who you are, and who you are not , is an important first step in giving your real estate business a purposeful direction .

Once you have a mission statement, you can then begin building your business, value propositions , and personal brand from those core values.

Table of Contents

- Mission vs Strategy vs Value Proposition vs USP

Examples (Written)

Examples (video).

- Steps to a Great Mission Statment

Mission v Strategy v Value Proposition v Unique Selling Proposition

It’s easy to confuse missions, value propositions, and strategies. But don’t!

It is important that your mission be a short and concise statement that you can memorize. If you have a team, everyone on your team should be able to recite it from memory.

It does no good to have a mission statement saved in a Word document somewhere. If you and your team cannot remember your mission from memory, then you do not have a mission.

- EXAMPLE: Hood Homes Blog is the most trusted authority on Killeen, TX single-family real estate investing.

- EXAMPLE: Knowledgeable, Local Expert, and Investor Savvy.

- EXAMPLE: Hood Homes Blog creates blog content on all topics Killeen, TX as well as real estate in order to earn trust in local knowledge and expertise. Posts regularly in Bigger Pockets to establish oneself as a local investor expert. Attend local auctions.

- EXAMPLE: Hood Homes Blog performs commercial grade underwriting on SFR assets for investors.

- EXAMPLE: Hood Homes Blog offers discounted commissions for repeat customers like investors.

Remember, your mission is not “to make money”.

Yes, real estate is a business, the purpose of which is to be profitable and provide income for yourself and your employees. But you earn income when you trade something of value. Clients hire you and pay you because you are giving them value.

What is the value you are selling? That is how you should think about your mission, and money comes later.

Halton Pardee + Partners

- Knowledgeable . We strive to understand our markets and our clients’ needs.

- Connected . Relationships are everything to us; we connect people to their homes and to their communities.

- Passionate . We love what we do. We believe that working with “all heart” can change the world.

- Playful . We never take ourselves too seriously. Real estate can be, dare we say, fun!

- Upstanding . Our clients’ needs and best interests are at the heart of everything we do.

- Effective . We set a high bar and move mountains to exceed expectations.

We work as a team.

Our concierge brokerage model made up of specialized departments provides our clients with an unparalleled experience in buying, selling, or leasing a home.

DeLeon Team

DeLeon Realty values teamwork and interdisciplinary collaboration as a path to insight and excellence in our work. Our company’s team of committed professionals embrace the following core values:

- Quality : We deliver only excellence and aim to exceed expectations in everything we do.

- Integrity : We conduct ourselves in the highest ethical standards, demonstrating honesty and fairness in every decision and action.

- Agility : We execute expeditiously to address our clients’ needs.

- Courage : We make decisions and act in the best interests of our clients, even in the face of personal or professional adversity.

- Respect and Trust : We treat our clients and each other with dignity and respect at all times.

- Fun : We believe in having fun at work and with each other.

Ben Kinney Companies

The Ben Kinney Team strives to perfect the systems and strategies that get more homes sold for the most amount of money in the least amount of time.

We tap into our team’s unparalleled knowledge of the local real estate market, real estate tech tools, and aggressive marketing and search engine strategies to help sellers achieve the best possible success in pricing, showing and marketing their properties.

What Sets Us Apart

At Ben Kinney Companies, we have a defining culture of doing much more than just selling real estate. As a Keller Willams affiliated organization, we share the KW culture of serving each other, our communities and our planet. Our mission, vision, values and culture differentiate us as industry innovators and leaders.

Delivering the dream of home ownership everywhere. All branches of the Ben Kinney Companies have this same goal, because owning real estate provides security, safety and opportunity for individuals. The technology we build helps real estate agents become more efficient at their job and find more customers to deliver on that mission. Our training prepares agents to be even better by utilizing exceptional techniques and systems, and the Ben Kinney Teams constantly help families find and sell homes.

Win, Make, Give, and Do Good.

We want to win at what we do, and we do all we can to help our customers, agents and employees build wealth. We love to work with people who are passionate about working hard and also giving back to their communities in a big way.

H.E.A.L.T.H.

Our values are what everyone who works at Ben Kinney Companies strives for each day, and they are applicable to any companies we work with. These values are also the metric we use to decide to invest or get in business with others. We believe our team’s success is determined by our ability to maintain our HEALTH, which is defined by our core values:

- Extraordinary results

- Accountable in all things

- Leaders only

The Loken Group

Mission Statement

Our mission is to inspire a positive, lasting impact.

- HUMBLE. We never forget that we owe everything to the efforts of each team member, our families, and our clients.

- GRIT. We persevere in our efforts no matter the obstacle with a high sense of urgency and always keeping our team and clients top of mind.

- INTEGRITY. We promise to always do the right thing for our team, our business, and our clients, resulting in mutual success.

- SERVANT LEADERSHIP. We are passionate about giving back in the communities we serve.

- ACCOUNTABLE. We operate with a high level of accountability, taking full ownership in delivering on our commitment to excellence.

- INNOVATIVE. We pursue excellence by pushing each other to be better every day and seeing possibility instead of limitation.

- SOLUTION-BASED. We are resourceful, always seeking to discover a solution and providing options for any concerns that arise.

Chantel Ray Real Estate

To glorify God by putting our clients’ interests above our own.

Vision Statement

To change the lives of the communities we serve through abundant giving.

Our Core Values

- Think win/win

- Be a go getter

- Follow up and follow through

- Address issues head on

- Do the right thing

- Let your yes be yes and your no be no

- Drive the bus, land the plane

We hold all of our team members accountable to embrace the following core values:

- CRUSH IT: We are committed to excellence and embrace change

- COMMUNICATION: We seek to understand and communicate clearly

- RESPECT: We respect the thoughts and time of those around us

- INTEGRITY: We always choose to do the right thing and operate professionally

- LEADERSHIP: We seek to edify, motivate and inspire others

- HUMBLE: We are grateful and check our ego’s at the door

- OWN IT: We are accountable and are accountable for our actions

- WELL BALANCED: With our commitments and our temperaments

- PROACTIVE: We innovate and constantly improve

- UNITY: We have fun, encourage and celebrate the journey TOGETHER!

To redefine the method in which real estate is sold.

To empower our team to deliver the best service and to empower our clients to reach their real estate goals.

The BREL Team

We think that you should expect more from your real estate experience.

- More services and inclusions

- More experience and expertise

- More marketing power and exposure

- More expert guidance and truth

As a team, we’ve pooled our talents and resources and invested in specialized in-house experts focused on staging, marketing and administration. Which means our agents are left to….service our clients.

How does that benefit the Buyers and Sellers who work with BREL?

- More attention

- More competent agents

- More communication

Our agents sell homes. They build relationships. They problem-solve. They negotiate. They go into scary basements. They discover neighbourhoods. They obsess over prices, market values and the newest, hottest listings. They make sure our clients don’t buy the wrong home. Meanwhile, the rest of the BREL team does what they do best: Next-level staging. Killer photography. Powerful marketing. Rock-solid paperwork. Concierge services for our clients.

It’s Win/Win. And it’s all included in our commission: Solid Experience. Real Results. Full Transparency. Communication Guaranteed.

We Believe In:

- Embracing fresh ideas and bold thinking

- Being real and transparent

- Being responsive and available

- Obsessing about the details

- Doing the right thing for the long term

- Doing what we love and outsourcing everything else

- Being ourselves

Ryan Smith Home Selling Team

OUR CORE VALUES

As our team has grown, it’s become more and more important to identify and outline the core values that guide everything we do. Our core values develop and define our culture, our brand, our business strategies and who we are as professionals in today’s corporate world. It is our goal to consistently live these core values out in our lives on a daily basis and we encourage both our teammates and our clients to hold us accountable to these values.

- Innovate and lead

- Embrace accountability

- Focus on solutions

- Build relationships and have fun

- Be great and never settle

OUR MISSION STATEMENT

In addition to our core values, our mission statement more clearly defines our true purpose as an organization and further enhances our team culture. We are unified in consistently living out our core values and performing our professions in direct alignment with our mission statement.

We are dedicated to providing world-class service and market-leading expertise to our clients. We are passionate about providing the extra value that others simply will not. Fanatical integrity and consistently impressive results will be the signature of our service. Our collaborative spirit and desire to grow will help us achieve the goals we set. We will make the families we serve feel special, creating raving fans, and help them truly win. We will succeed because we will not let our clients fail.

McKinnies Realty

Realty Austin

Movementum Realty

Stovall Realtors

Real Estate Heaven