- Business Planning

Business Plan Financial Projections

Written by Dave Lavinsky

Financial projections are forecasted analyses of your business’ future that include income statements, balance sheets and cash flow statements. We have found them to be an crucial part of your business plan for the following reasons:

- They can help prove or disprove the viability of your business idea. For example, if your initial projections show your company will never make a sizable profit, your venture might not be feasible. Or, in such a case, you might figure out ways to raise prices, enter new markets, or streamline operations to make it profitable.

- Financial projections give investors and lenders an idea of how well your business is likely to do in the future. They can give lenders the confidence that you’ll be able to comfortably repay their loan with interest. And for equity investors, your projections can give them faith that you’ll earn them a solid return on investment. In both cases, your projections can help you secure the funding you need to launch or grow your business.

- Financial projections help you track your progress over time and ensure your business is on track to meet its goals. For example, if your financial projections show you should generate $500,000 in sales during the year, but you are not on track to accomplish that, you’ll know you need to take corrective action to achieve your goal.

Below you’ll learn more about the key components of financial projections and how to complete and include them in your business plan.

What Are Business Plan Financial Projections?

Financial projections are an estimate of your company’s future financial performance through financial forecasting. They are typically used by businesses to secure funding, but can also be useful for internal decision-making and planning purposes. There are three main financial statements that you will need to include in your business plan financial projections:

1. Income Statement Projection

The income statement projection is a forecast of your company’s future revenues and expenses. It should include line items for each type of income and expense, as well as a total at the end.

There are a few key items you will need to include in your projection:

- Revenue: Your revenue projection should break down your expected sales by product or service, as well as by month. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

- Expenses: Your expense projection should include a breakdown of your expected costs by category, such as marketing, salaries, and rent. Again, it is important to be realistic in your estimates.

- Net Income: The net income projection is the difference between your revenue and expenses. This number tells you how much profit your company is expected to make.

Sample Income Statement

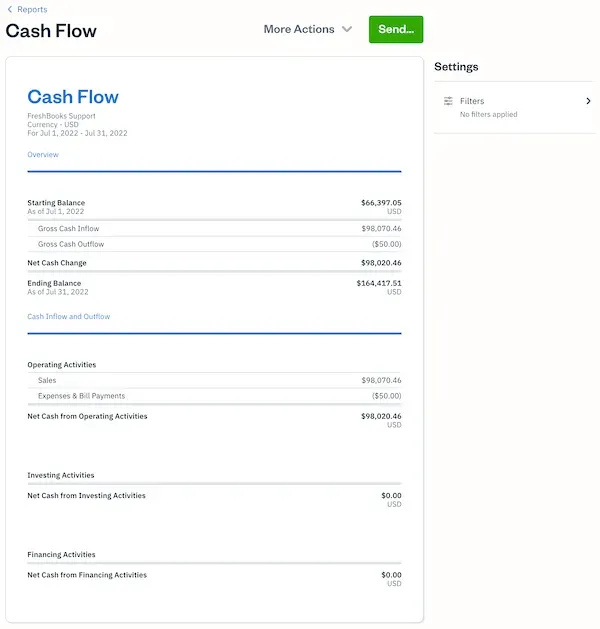

2. cash flow statement & projection.

The cash flow statement and projection are a forecast of your company’s future cash inflows and outflows. It is important to include a cash flow projection in your business plan, as it will give investors and lenders an idea of your company’s ability to generate cash.

There are a few key items you will need to include in your cash flow projection:

- The cash flow statement shows a breakdown of your expected cash inflows and outflows by month. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

- Cash inflows should include items such as sales revenue, interest income, and capital gains. Cash outflows should include items such as salaries, rent, and marketing expenses.

- It is important to track your company’s cash flow over time to ensure that it is healthy. A healthy cash flow is necessary for a successful business.

Sample Cash Flow Statements

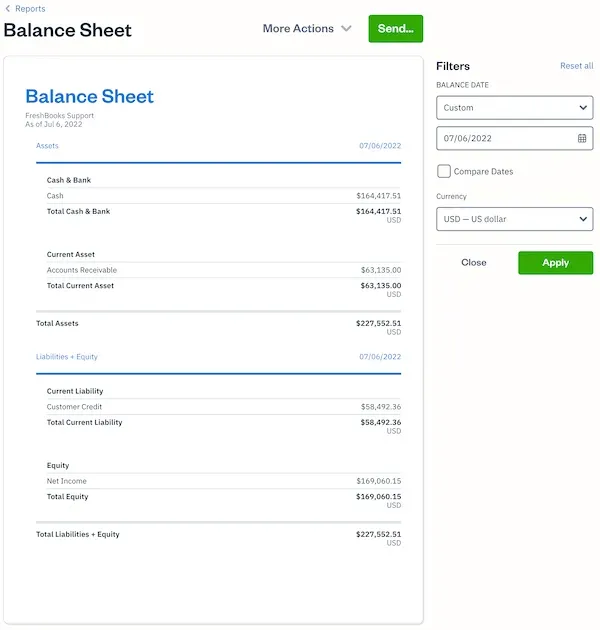

3. balance sheet projection.

The balance sheet projection is a forecast of your company’s future financial position. It should include line items for each type of asset and liability, as well as a total at the end.

A projection should include a breakdown of your company’s assets and liabilities by category. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

It is important to track your company’s financial position over time to ensure that it is healthy. A healthy balance is necessary for a successful business.

Sample Balance Sheet

How to create financial projections.

Creating financial projections for your business plan can be a daunting task, but it’s important to put together accurate and realistic financial projections in order to give your business the best chance for success.

Cost Assumptions

When you create financial projections, it is important to be realistic about the costs your business will incur, using historical financial data can help with this. You will need to make assumptions about the cost of goods sold, operational costs, and capital expenditures.

It is important to track your company’s expenses over time to ensure that it is staying within its budget. A healthy bottom line is necessary for a successful business.

Capital Expenditures, Funding, Tax, and Balance Sheet Items

You will also need to make assumptions about capital expenditures, funding, tax, and balance sheet items. These assumptions will help you to create a realistic financial picture of your business.

Capital Expenditures

When projecting your company’s capital expenditures, you will need to make a number of assumptions about the type of equipment or property your business will purchase. You will also need to estimate the cost of the purchase.

When projecting your company’s funding needs, you will need to make a number of assumptions about where the money will come from. This might include assumptions about bank loans, venture capital, or angel investors.

When projecting your company’s tax liability, you will need to make a number of assumptions about the tax rates that will apply to your business. You will also need to estimate the amount of taxes your company will owe.

Balance Sheet Items

When projecting your company’s balance, you will need to make a number of assumptions about the type and amount of debt your business will have. You will also need to estimate the value of your company’s assets and liabilities.

Financial Projection Scenarios

Write two financial scenarios when creating your financial projections, a best-case scenario, and a worst-case scenario. Use your list of assumptions to come up with realistic numbers for each scenario.

Presuming that you have already generated a list of assumptions, the creation of best and worst-case scenarios should be relatively simple. For each assumption, generate a high and low estimate. For example, if you are assuming that your company will have $100,000 in revenue, your high estimate might be $120,000 and your low estimate might be $80,000.

Once you have generated high and low estimates for all of your assumptions, you can create two scenarios: a best case scenario and a worst-case scenario. Simply plug the high estimates into your financial projections for the best-case scenario and the low estimates into your financial projections for the worst-case scenario.

Conduct a Ratio Analysis

A ratio analysis is a useful tool that can be used to evaluate a company’s financial health. Ratios can be used to compare a company’s performance to its industry average or to its own historical performance.

There are a number of different ratios that can be used in ratio analysis. Some of the more popular ones include the following:

- Gross margin ratio

- Operating margin ratio

- Return on assets (ROA)

- Return on equity (ROE)

To conduct a ratio analysis, you will need financial statements for your company and for its competitors. You will also need industry average ratios. These can be found in industry reports or on financial websites.

Once you have the necessary information, you can calculate the ratios for your company and compare them to the industry averages or to your own historical performance. If your company’s ratios are significantly different from the industry averages, it might be indicative of a problem.

Be Realistic

When creating your financial projections, it is important to be realistic. Your projections should be based on your list of assumptions and should reflect your best estimate of what your company’s future financial performance will be. This includes projected operating income, a projected income statement, and a profit and loss statement.

Your goal should be to create a realistic set of financial projections that can be used to guide your company’s future decision-making.

Sales Forecast

One of the most important aspects of your financial projections is your sales forecast. Your sales forecast should be based on your list of assumptions and should reflect your best estimate of what your company’s future sales will be.

Your sales forecast should be realistic and achievable. Do not try to “game” the system by creating an overly optimistic or pessimistic forecast. Your goal should be to create a realistic sales forecast that can be used to guide your company’s future decision-making.

Creating a sales forecast is not an exact science, but there are a number of methods that can be used to generate realistic estimates. Some common methods include market analysis, competitor analysis, and customer surveys.

Create Multi-Year Financial Projections

When creating financial projections, it is important to generate projections for multiple years. This will give you a better sense of how your company’s financial performance is likely to change over time.

It is also important to remember that your financial projections are just that: projections. They are based on a number of assumptions and are not guaranteed to be accurate. As such, you should review and update your projections on a regular basis to ensure that they remain relevant.

Creating financial projections is an important part of any business plan. However, it’s important to remember that these projections are just estimates. They are not guarantees of future success.

Business Plan Financial Projections FAQs

What is a business plan financial projection.

A business plan financial projection is a forecast of your company's future financial performance. It should include line items for each type of asset and liability, as well as a total at the end.

What are annual income statements?

The Annual income statement is a financial document and a financial model that summarize a company's revenues and expenses over the course of a fiscal year. They provide a snapshot of a company's financial health and performance and can be used to track trends and make comparisons with other businesses.

What are the necessary financial statements?

The necessary financial statements for a business plan are an income statement, cash flow statement, and balance sheet.

How do I create financial projections?

You can create financial projections by making a list of assumptions, creating two scenarios (best case and worst case), conducting a ratio analysis, and being realistic.

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

Writing a Business Plan—Financial Projections

Spell out your financial forecast in dollars and sense

Creating financial projections for your startup is both an art and a science. Although investors want to see cold, hard numbers, it can be difficult to predict your financial performance three years down the road, especially if you are still raising seed money. Regardless, short- and medium-term financial projections are a required part of your business plan if you want serious attention from investors.

The financial section of your business plan should include a sales forecast , expenses budget , cash flow statement , balance sheet , and a profit and loss statement . Be sure to follow the generally accepted accounting principles (GAAP) set forth by the Financial Accounting Standards Board , a private-sector organization responsible for setting financial accounting and reporting standards in the U.S. If financial reporting is new territory for you, have an accountant review your projections.

Sales Forecast

As a startup business, you do not have past results to review, which can make forecasting sales difficult. It can be done, though, if you have a good understanding of the market you are entering and industry trends as a whole. In fact, sales forecasts based on a solid understanding of industry and market trends will show potential investors that you've done your homework and your forecast is more than just guesswork.

In practical terms, your forecast should be broken down by monthly sales with entries showing which units are being sold, their price points, and how many you expect to sell. When getting into the second year of your business plan and beyond, it's acceptable to reduce the forecast to quarterly sales. In fact, that's the case for most items in your business plan.

Expenses Budget

What you're selling has to cost something, and this budget is where you need to show your expenses. These include the cost to your business of the units being sold in addition to overhead. It's a good idea to break down your expenses by fixed costs and variable costs. For example, certain expenses will be the same or close to the same every month, including rent, insurance, and others. Some costs likely will vary month by month such as advertising or seasonal sales help.

Cash Flow Statement

As with your sales forecast, cash flow statements for a startup require doing some homework since you do not have historical data to use as a reference. This statement, in short, breaks down how much cash is coming into your business on a monthly basis vs. how much is going out. By using your sales forecasts and your expenses budget, you can estimate your cash flow intelligently.

Keep in mind that revenue often will trail sales, depending on the type of business you are operating. For example, if you have contracts with clients, they may not be paying for items they purchase until the month following delivery. Some clients may carry balances 60 or 90 days beyond delivery. You need to account for this lag when calculating exactly when you expect to see your revenue.

Profit and Loss Statement

Your P&L statement should take the information from your sales projections, expenses budget, and cash flow statement to project how much you expect in profits or losses through the three years included in your business plan. You should have a figure for each individual year as well as a figure for the full three-year period.

Balance Sheet

You provide a breakdown of all of your assets and liabilities in the balances sheet. Many of these assets and liabilities are items that go beyond monthly sales and expenses. For example, any property, equipment, or unsold inventory you own is an asset with a value that can be assigned to it. The same goes for outstanding invoices owed to you that have not been paid. Even though you don't have the cash in hand, you can count those invoices as assets. The amount you owe on a business loan or the amount you owe others on invoices you've not paid would count as liabilities. The balance is the difference between the value of everything you own vs. the value of everything you owe.

Break-Even Projection

If you've done a good job projecting your sales and expenses and inputting the numbers into a spreadsheet, you should be able to identify a date when your business breaks even—in other words, the date when you become profitable, with more money coming in than going out. As a startup business, this is not expected to happen overnight, but potential investors want to see that you have a date in mind and that you can support that projection with the numbers you've supplied in the financial section of your business plan.

Additional Tips

When putting together your financial projections, keep some general tips in mind:

- Get comfortable with spreadsheet software if you aren't already. It is the starting point for all financial projections and offers flexibility, allowing you to quickly change assumptions or weigh alternative scenarios. Microsoft Excel is the most common, and chances are you already have it on your computer. You can also buy special software packages to help with financial projections.

- Prepare a five-year projection . Don’t include this one in the business plan, since the further into the future you project, the harder it is to predict. However, have the projection available in case an investor asks for it.

- Offer two scenarios only . Investors will want to see a best-case and worst-case scenario, but don’t inundate your business plan with myriad medium-case scenarios. They likely will just cause confusion.

- Be reasonable and clear . As mentioned before, financial forecasting is as much art as science. You’ll have to assume certain things, such as your revenue growth, how your raw material and administrative costs will grow, and how effective you’ll be at collecting on accounts receivable. It’s best to be realistic in your projections as you try to recruit investors. If your industry is going through a contraction period and you’re projecting revenue growth of 20 percent a month, expect investors to see red flags.

Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books.

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Run » finance, how to create a financial forecast for a startup business plan.

Financial forecasting allows you to measure the progress of your new business by benchmarking performance against anticipated sales and costs.

When starting a new business, a financial forecast is an important tool for recruiting investors as well as for budgeting for your first months of operating. A financial forecast is used to predict the cash flow necessary to operate the company day-to-day and cover financial liabilities.

Many lenders and investors ask for a financial forecast as part of a business plan; however, with no sales under your belt, it can be tricky to estimate how much money you will need to cover your expenses. Here’s how to begin creating a financial forecast for a new business.

[Read more: Startup 2021: Business Plan Financials ]

Start with a sales forecast

A sales forecast attempts to predict what your monthly sales will be for up to 18 months after launching your business. Creating a sales forecast without any past results is a little difficult. In this case, many entrepreneurs make their predictions using industry trends, market analysis demonstrating the population of potential customers and consumer trends. A sales forecast shows investors and lenders that you have a solid understanding of your target market and a clear vision of who will buy your product or service.

A sales forecast typically breaks down monthly sales by unit and price point. Beyond year two of being in business, the sales forecast can be shown quarterly, instead of monthly. Most financial lenders and investors like to see a three-year sales forecast as part of your startup business plan.

Lower fixed costs mean less risk, which might be theoretical in business schools but are very concrete when you have rent and payroll checks to sign.

Tim Berry, president and founder of Palo Alto Software

Create an expenses budget

An expenses budget forecasts how much you anticipate spending during the first years of operating. This includes both your overhead costs and operating expenses — any financial spending that you anticipate during the course of running your business.

Most experts recommend breaking down your expenses forecast by fixed and variable costs. Fixed costs are things such as rent and payroll, while variable costs change depending on demand and sales — advertising and promotional expenses, for instance. Breaking down costs into these two categories can help you better budget and improve your profitability.

"Lower fixed costs mean less risk, which might be theoretical in business schools but are very concrete when you have rent and payroll checks to sign," Tim Berry, president and founder of Palo Alto Software, told Inc . "Most of your variable costs are in those direct costs that belong in your sales forecast, but there are also some variable expenses, like ads and rebates and such."

Project your break-even point

Together, your expenses budget and sales forecast paints a picture of your profitability. Your break-even projection is the date at which you believe your business will become profitable — when more money is earned than spent. Very few businesses are profitable overnight or even in their first year. Most businesses take two to three years to be profitable, but others take far longer: Tesla , for instance, took 18 years to see its first full-year profit.

Lenders and investors will be interested in your break-even point as a projection of when they can begin to recoup their investment. Likewise, your CFO or operations manager can make better decisions after measuring the company’s results against its forecasts.

[Read more: Startup 2021: Writing a Business Plan? Here’s How to Do It, Step by Step ]

Develop a cash flow projection

A cash flow statement (or projection, for a new business) shows the flow of dollars moving in and out of the business. This is based on the sales forecast, your balance sheet and other assumptions you’ve used to create your expenses projection.

“If you are starting a new business and do not have these historical financial statements, you start by projecting a cash-flow statement broken down into 12 months,” wrote Inc . The cash flow statement will include projected cash flows from operating, investing and financing your business activities.

Keep in mind that most business plans involve developing specific financial documents: income statements, pro formas and a balance sheet, for instance. These documents may be required by investors or lenders; financial projections can help inform the development of those statements and guide your business as it grows.

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Follow us on Instagram for more expert tips & business owners’ stories.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

For more finance tips

What is enterprise resource planning, choosing an enterprise resource planning tool for your small business, 10 benefits of erp systems for small businesses.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

How to Create Financial Projections for Your Business Plan

Written by Dave Lavinsky

Financial projections, also known as financial models, are forecasts of your company’s expected financial performance, typically over the next 5 years.

Over the past 25+ years, we’ve created financial projections for thousands of startups and existing businesses. In doing so, we’ve found 3 key reasons why financial projections are important:

- They help you determine the viability of your new business ideas and/or your need to make modifications to them. For instance, if your initial financial projections show your business idea isn’t profitable, you’ll know that changes are needed (e.g., raising prices, serving new markets, figuring out how to reduce costs, etc.) to make it viable.

- They are crucial for raising funding. Lenders will always review your financial projections to ensure you can comfortably repay any loans they issue you. Equity investors will nearly always review your projections in determining whether they can achieve their desired return on their investment in your business.

- They help keep your business financially on track by giving you goals. For instance, if your financial projections state your company should generate 100 new clients this year, and the year is halfway done and you’re only at 30 clients, you’ll know you need to readjust your strategy to achieve your goals.

In the remainder of this article, you’ll learn more about financial projections, how to complete them, and how to incorporate them in your business plan.

Download our Ultimate Business Plan Template Here to Quickly & Easily Complete Your Business Plan & Financial Projections

What are Financial Projections?

Financial projections are forecasts or estimations of your company’s future revenues and expenses, serving as a crucial part of business planning. To complete them you must develop multiple assumptions with regards to items like future sales volumes, employee headcount and the cost of supplies and other expenses. Financial projections help you create better strategies to grow your business.

Your financial projections will be the most analyzed part of your business plan by investors and/or banks. While never a precise prediction of future performance, an excellent financial model outlines the core assumptions of your business and helps you and others evaluate capital requirements, risks involved, and rewards that successful execution will deliver.

Having a solid framework in place also will help you compare your performance to the financial projections and evaluate how your business is progressing. If your performance is behind your projections, you will have a framework in place to assess the effects of lowering costs, increasing prices, or even reimagining your model. In the happy case that you exceed your business projections, you can use your framework to plan for accelerated growth, new hires, or additional expansion investments.

Hence, the use of financial projections is multi-fold and crucial for the success of any business. Your financial projections should include three core financial statements – the income statement, the cash flow statement, and the balance sheet. The following section explains each statement in detail.

Necessary Financial Statements

The three financial statements are the income statement, the cash flow statement, and the balance sheet. You will learn how to create each one in detail below.

Income Statement Projection

The projected income statement is also referred to as a profit and loss statement and showcases your business’s revenues and expenses for a specific period.

To create an income statement, you first will need to chart out a sales forecast by taking realistic estimates of units sold and multiplying them by price per unit to arrive at a total sales number. Then, estimate the cost of these units and multiply them by the number of units to get the cost of sales. Finally, calculate your gross margin by subtracting the cost of sales from your sales.

Once you have calculated your gross margin, deduct items like wages, rent, marketing costs, and other expenses that you plan to pay to facilitate your business’s operations. The resulting total represents your projected operating income, which is a critical business metric.

Plan to create an income statement monthly until your projected break-even, or the point at which future revenues outpace total expenses, and you reflect operating profit. From there, annual income statements will suffice.

Sample Income Statement

Consider a sample income statement for a retail store below:

Cash Flow Projection

As the name indicates, a cash flow statement shows the cash flowing in and out of your business. The cash flow statement incorporates cash from business operations and includes cash inflows and outflows from investment and financing activities to deliver a holistic cash picture of your company.

Investment activities include purchasing land or equipment or research & development activities that aren’t necessarily part of daily operations. Cash movements due to financing activities include cash flowing in a business through investors and/or banks and cash flowing out due to debt repayment or distributions made to shareholders.

You should total all these three components of a cash flow projection for any specified period to arrive at a total ending cash balance. Constructing solid cash flow projections will ensure you anticipate capital needs to carry the business to a place of sustainable operations.

Sample Cash Flow Statement

Below is a simple cash flow statement for the same retail store:

Balance Sheet Projection

A balance sheet shows your company’s assets, liabilities, and owner’s equity for a certain period and provides a snapshot in time of your business performance. Assets include things of value that the business owns, such as inventory, capital, and land. Liabilities, on the other hand, are legally bound commitments like payables for goods or services rendered and debt. Finally, owner’s equity refers to the amount that is remaining once liabilities are paid off. Assets must total – or balance – liabilities and equity.

Your startup financial documents should include annual balance sheets that show the changing balance of assets, liabilities, and equity as the business progresses. Ideally, that progression shows a reduction in liabilities and an increase in equity over time.

While constructing these varied business projections, remember to be flexible. You likely will need to go back and forth between the different financial statements since working on one will necessitate changes to the others.

Sample Balance Sheet

Below is a simple balance sheet for the retail store:

How to Finish Your Business Plan and Financial Projections in 1 Day!

Don’t you wish there was a faster, easier way to finish your plan and financial projections?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

How to Create Financial Projections

When it comes to financial forecasting, simplicity is key. Your financial projections do not have to be overly sophisticated and complicated to impress, and convoluted projections likely will have the opposite effect on potential investors. Keep your tables and graphs simple and fill them with credible data that inspires confidence in your plan and vision. The below tips will help bolster your financial projections.

Create a List of Assumptions

Your financial projections should be tied to a list of assumptions. For example, one assumption will be the initial monthly cash sales you achieve. Another assumption will be your monthly growth rate. As you can imagine, changing either of these assumptions will significantly impact your financial projections.

As a result, tie your income statement, balance sheet, and cash flow statements to your assumptions. That way, if you change your assumptions, all of your financial projections automatically update.

Below are the key assumptions to include in your financial model:

For EACH essential product or service you offer:

- What is the number of units you expect to sell each month?

- What is your expected monthly sales growth rate?

- What is the average price that you will charge per product or service unit sold?

- How much do you expect to raise your prices each year?

- How much does it cost you to produce or deliver each unit sold?

- How much (if at all) do you expect your direct product costs to grow each year?

For EACH subscription/membership, you offer:

- What is the monthly/quarterly/annual price of your membership?

- How many members do you have now, or how many members do you expect to gain in the first month/quarter/year?

- What is your projected monthly/quarterly/annual growth rate in the number of members?

- What is your projected monthly/quarterly/annual member churn (the percentage of members that will cancel each month/quarter/year)?

- What is the average monthly/quarterly/annual direct cost to serve each member (if applicable)?

Cost Assumptions

- What is your monthly salary? What is the annual growth rate in your salary?

- What is your monthly salary for the rest of your team? What is the expected annual growth rate in your team’s salaries?

- What is your initial monthly marketing expense? What is the expected annual growth rate in your marketing expense?

- What is your initial monthly rent + utility expense? What is the expected annual growth rate in your rent + utility expense?

- What is your initial monthly insurance expense? What is the expected annual growth rate in your insurance expense?

- What is your initial monthly office supplies expense? What is the expected annual growth rate in your office supplies expense?

- What is your initial monthly cost for “other” expenses? What is the expected annual growth rate in your “other” expenses?

Capital Expenditures, Funding, Tax, and Balance Sheet Items

- How much money do you need for Capital Expenditures in your first year (to buy computers, desks, equipment, space build-out, etc.)?

- How much other funding do you need right now?

- What percent of the funding will be financed by Debt (versus equity)?

- What Corporate Tax Rate would you like to apply to company profits?

- What is your Current Liabilities Turnover (in the number of days)?

- What are your Current Assets, excluding cash (in the number of days)?

- What is your Depreciation rate?

- What is your Amortization number of Years?

- What is the number of years in which your debt (loan) must be paid back?

- What is your Debt Payback interest rate?

Create Two Financial Projection Scenarios

It would be best if you used your assumptions to create two sets of financial projections that exhibit two very different scenarios. One is your best-case scenario, and the other is your worst-case. Investors are usually very interested in how a business plan will play out in both these scenarios, allowing them to better analyze the robustness and potential profitability of a business.

Conduct a Ratio Analysis

Gain an understanding of average industry financial ratios, including operating ratios, profitability ratios, return on investment ratios, and the like. You can then compare your own estimates with these existing ratios to evaluate costs you may have overlooked or find historical financial data to support your projected performance. This ratio analysis helps ensure your financial projections are neither excessively optimistic nor excessively pessimistic.

Be Realistic

It is easy to get carried away when dealing with estimates and you end up with very optimistic financial projections that will feel untenable to an objective audience. Investors are quick to notice and question inflated figures. Rather than excite investors, such scenarios will compromise your legitimacy.

Create Multi-Year Financial Projections

The first year of your financial projections should be presented on a granular, monthly basis. For subsequent years, annual projections will suffice. It is advised to have three- or five-year projections ready when you start courting investors. Since your plan needs to be succinct, you can add yearly projections as appendices to your main plan.

You should now know how to create financial projections for your business plan. In addition to creating your full projections as their own document, you will need to insert your financial projections into your plan. In your executive summary, Insert your topline projections, that is, just your sales, gross margins, recurring expenses, EBITDA (earnings before interest, taxes, depreciation, and amortization), and net income). In the financial plan section of your plan, insert your key assumptions and a little more detail than your topline projections. Include your full financial model in the appendix of your plan.

Other Helpful Business Plan Articles & Templates

Revenue Projection: How to Plan and Track Growth

A revenue projection is an indispensable task that is the backbone of financial planning for small business owners and entrepreneurs eager to secure their business trajectory.

In this comprehensive blog post, we'll navigate through the art of projecting your revenue, paving the pathway for decision-making and growth tracking.

The Role of Revenue Projections in Financial Planning

Beyond the financial jargon, revenue projection is a visionary exercise businesses undertake to map out their finances over a specified period. But it's not merely a set of numbers; it's a dynamic map that helps you navigate challenging economic terrains.

A revenue projection typically requires estimating units sold, selling prices, growth rates across multiple customer segments, and customer churn. These factors combine to estimate your level of sales and inform what you can spend in all areas of your business.

Let's delve deeper into why understanding these projections is not a luxury but a necessity.

The Ins and Outs of Successful Revenue Projection

Although every business differs, successful revenue projections typically include a few core elements.

Setting Realistic Revenue Goals

Striking a balance between ambitious and achievable is the cornerstone of establishing realistic revenue goals.

Of course, you'd love to grow your company to extraordinary heights. However, benchmarks that align with your company's size, market potential, and growth stage can inform your expectations while maintaining the vigor necessary for expansion.

Before defining short and long-term revenue targets, gauge the current market pulse. Understand the demand-supply dynamics, consumer behavior shifts, and emerging industry trends that could be the wind behind your sales or the ominous herald demanding strategic shifts.

For future-proof assumptions, it's vital to incorporate growth factors while remaining vigilant about potential roadblocks. There are massive benefits to a proactive and pragmatic approach to challenges, ensuring your projections aren't just romantic dreams but adaptable structures.

Develop a Revenue Projection Strategy

Your past financial data isn't just history; it's a compass that indicates future performance when appropriately interpreted. Historical data analysis highlights your current trajectory and its crucial role in your projection strategies.

In a world of choices and opportunities, navigating the strategic waters of diversified revenue streams can feel intimidating. Know which products or services are your golden geese and which offer growth potential yet require nurturing. Revenue forecasting also allows for exploring new products, markets, and customer segments.

Ignoring your competitors may lead you to unrest. Instead, map them. Understand their plays, strategize, and let this informed approach impact your revenue projection strategy. Monitoring their behavior and performance can ensure your competitive advantage is well-maintained.

Implement Tools and Systems for Revenue Tracking

There are a million software tools available on the market. Choosing the software or system that best aligns with your business needs and size can simplify your startup's financial life. Find one that works well with your business model to generate actionable insights.

Forecasting tools that integrate seamlessly with your financial and CRM systems allow easy data collection and analysis.

Tools that decode the patterns, trends, and anomalies in your revenue data can help you readily transform your raw data into actionable intelligence that propels strategic business decisions.

Integrating your revenue tracking system with other financial management tools is necessary to understand your business's overall economic health. A seamless integration ensures you're not just looking but seeing the bigger fiscal picture.

Review and Adjust Revenue Projections

Reviewing your business's financial performance against your projected revenue is similar to tuning a musical instrument. It's a never-ending, iterative process that keeps your business in harmony with its financial notes.

Variances are common and occur for many reasons. Expect to find gaps when reviewing your projected versus actual revenue. Pay attention to them, understand their root causes, and transform them into learning opportunities for future projections.

Numbers speak truth; it's your analysis that adds color and context. Learn to differentiate between variances that warrant adjustments to your projections and those that indicate something in your business that needs adjustment.

When making data-driven decisions, you can confidently react to real-world influences on your business's finances.

Best Practices for Effective Revenue Projection

Revenue projections are more than just a one-person show. Multiple perspectives from a cross-functional team ensure that your forecast reflects what's happening in the market and your business.

Because your revenue projection will rarely be spot on, documenting the assumptions and methodologies you used adds credibility to your projections.

Documentation also makes it easy to improve your accuracy consistently. You'll see where your assumptions were correct and where you need to adjust your projections. Practice makes perfect, and regular forecasts allow you to continuously refine and enhance your revenue projection models based on feedback and results.

It's not just about what you project but the story you tell behind those numbers.

Leveraging Revenue Projections is Tied to Business Growth

There's an unbreakable link between revenue projections and your business's growth. Data-driven assumptions allow a glimpse into the future and enable you to adjust to pricing, target markets, and customer acquisition strategies. Remember that projection is not a constraint; it's liberation, providing the security and foresight required to achieve your long-term business goals.

Although getting started can feel challenging, you don't need to go it alone. The experts at Founder's CPA can help you implement tools and processes to make consistent, accurate revenue projections that guide your business AND improve over time.

Contact us today to see how a robust revenue projection can help you plan and track business growth.

What You Need to Know About Startup Cap Tables

What Should Be in Your Financial Tech Stack?

KPIs You Need to Scale Your Saas Company

Cash vs Accrual: What Should Your Startup Use?

Just in Time for Spring 🌻 50% Off for 3 Months. BUY NOW & SAVE

50% Off for 3 Months Buy Now & Save

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

Automatically track your mileage and never miss a mileage deduction again

Time-saving all-in-one bookkeeping that your business can count on

Track project status and collaborate with clients and team members

Organized and professional, helping you stand out and win new clients

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

Pay your employees and keep accurate books with Payroll software integrations

- Team Management

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Freelancers

- Self-Employed Professionals

- Businesses With Employees

- Businesses With Contractors

- Marketing & Agencies

- Construction & Trades

- IT & Technology

- Business & Prof. Services

- Accounting Partner Program

- Collaborative Accounting™

- Accountant Hub

- Reports Library

- FreshBooks vs QuickBooks

- FreshBooks vs HoneyBook

- FreshBooks vs Harvest

- FreshBooks vs Wave

- FreshBooks vs Xero

- Free Invoice Generator

- Invoice Templates

- Accounting Templates

- Business Name Generator

- Estimate Templates

- Help Center

- Business Loan Calculator

- Mark Up Calculator

Call Toll Free: 1.866.303.6061

1-888-674-3175

- All Articles

- Productivity

- Project Management

- Bookkeeping

Resources for Your Growing Business

How to make financial projections for business.

Writing a solid business plan should be the first step for any business owner looking to create a successful business.

As a small business owner, you will want to get the attention of investors, partners, or potential highly skilled employees. It is, therefore, important to have a realistic financial forecast incorporated into your business plan.

We’ll break down a financial projection and how to utilize it to give your business the best start possible.

Key Takeaways

Accurate financial projections are essential for businesses to succeed. In this article, we’ll explain everything you need to know about creating financial projections for your business. Here’s what you need to know about financial projections:

- A financial projection is a group of financial statements that are used to forecast future performance

- Creating financial projections can break down into 5 simple steps: sales projections, expense projections, balance sheet projections, income statement projections, and cash flow projections

- Financial projections can offer huge benefits to your business, including helping with forecasting future performance, ensuring steady cash flow, and planning key moves around the growth of the business

Here’s What We’ll Cover:

What Is a Financial Projection?

How to Create a Financial Projection

What goes into a financial projection, what are financial projections used for.

Financial Projections Advantages

Frequently Asked Questions

What Is Financial Projection?

A financial projection is essentially a set of financial statements . These statements will forecast future revenues and expenses.

Any projection includes your cash inflows and outlays, your general income, and your balance sheet.

They are perfect for showing bankers and investors how you plan to repay business loans. They also show what you intend to do with your money and how you expect your business to grow.

Most projections are for the first 3-5 years of business, but some include a 10-year forecast too.

Either way, you will need to develop a short and mid-term projection broken down month by month.

As you are just starting out with your business, you won’t be expected to provide exact details. Most financial projections are rough guesses. But they should also be educated guesses based on market trends, research, and looking at similar businesses.

It’s incredibly important for financial statements to be realistic. Most investors will be able to spot a fanciful projection from a mile away.

In general, most people would prefer to be given realistic projections, even if they’re not as impressive.

Financial projections are created to help business owners gain insight into the future of their company’s financials.

The question is, how to create financial projections? For business plan purposes, it’s important that you follow the best practices of financial projection closely. This will ensure you get accurate insight, which is vital for existing businesses and new business startups alike.

Here are the steps for creating accurate financial projections for your business.

1. Start With A Sales Projection

For starters, you’ll need to project how much your business will make in sales. If you’re creating a sales forecast for an existing business, you’ll have past performance records to project your next period. Past data can provide useful information for your financial projection, such as if your sales do better in one season than another.

Be sure also to consider external factors, such as the economy at large, the potential for added tariffs and taxes in the future, supply chain issues, or industry downturns.

The process is almost the same for new businesses, only without past data to refer to. Business startups will need to do more research on their industry to gain insight into potential future sales.

2. Create Your Expense Projection

Next, create an expense projection for your business. In a sense, this is an easier task than a sales projection since it seems simpler to predict your own behaviors than your customers. However, it’s vital that you expect the unexpected.

Optimism is great, but the worst-case scenario must be considered and accounted for in your expense projection. From accidents in the workplace to natural disasters, rising trade prices, to unexpected supply disruptions, you need to consider these large expenses in your projection.

Something always comes up, so we suggest you add a 10-15% margin on your expense projection.

3. Create Your Balance Sheet Projection

A balance sheet projection is used to get a clear look at your business’s financial position related to assets, liabilities , and equity, giving you a more holistic view of the company’s overall financial health.

For startup businesses, this can prove to be a lot of work since you won’t have existing records of past performance to pull from. This will need to be factored into your industry research to create an accurate financial projection.

For existing businesses, it will be more straightforward. Use your past and current balance sheets to predict your business’s position in the next 1-3 years. If you use a cloud-based, online accounting software with the feature to generate balance sheets, such as the one offered by FreshBooks, you’ll be able to quickly create balance sheets for your financial projection within the app.

Click here to learn more about the features of FreshBooks accounting software.

4. Make Your Income Statement Projection

Next up, create an income statement projection. An income statement is used to declare the net income of a business after all expenses have been made. In other words, it states the profits of a business.

For currently operating businesses, you can use your past income statements and the changes between them to create accurate predictions for the next 1-3 years. You can also use accounting software to generate your income statements automatically.

You’ll need to work on rough estimates for new businesses or those still in the planning phase. It’s vital that you stay realistic and do your utmost to create an accurate, good-faith projection of future income.

5. Finally, Create Your Cash Flow Projection

Last but not least is to generate your projected cash flow statement. A cash flow projection forecasts the movement of all money to and from your business. It’s intertwined with a business’s balance sheet and income statement, which is no different when creating projections.

If your business has been operating for six months or more, you can create a fairly accurate cash flow projection with your past cash flow financial statements. For new businesses, you’ll need to factor in this step of creating a financial forecast when doing your industry research.

It needs to include five elements to ensure an accurate, useful financial forecast for your business. These financial statements come together to provide greater insight into the projected future of a business’s financial health. These include:

Income Statement

A standard income statement summarizes your company’s revenues and expenses over a period. This is normally done either quarterly or annually.

The income statement is where you will do the bulk of your forecasting.

On any income statement, you’re likely to find the following:

- Revenue: Your revenue earned through sales.

- Expenses: The amount you’ve spent, including your product costs and your overheads.

- Pre-Tax Earnings: This is your income before you’ve paid tax.

- Net Income: The total revenues minus your total expenses.

Net income is the most important number. If the number is positive, then you’re earning a profit, if it’s negative, it means your expenses outweigh your revenue and you’re making a loss.

Cash Flow Statement

Your cash flow statement will show any potential investor whether you are a good credit risk. It also shows them if you can successfully repay any loans you are granted.

You can break a cash flow statement into three parts:

- Cash Revenues: An overview of your calculated cash sales for a given time period.

- Cash Disbursements: You list all the cash expenditures you expect to pay.

- Net Cash Revenue: Take the cash revenues minus your cash disbursements.

Balance Sheet

Your balance sheet will show your business’s net worth at a given time.

A balance sheet is split up into three different sections:

- Assets: An asset is a tangible object of value that your company owns. It could be things like stock or property such as warehouses or offices.

- Liabilities: These are any debts your business owes.

- Equity: Your equity is the summary of your assets minus your liabilities.

Looking for an easy-to-use yet capable online accounting software? FreshBooks accounting software is a cloud-based solution that makes financial projections simple. With countless financial reporting features and detailed guides on creating accurate financial forecasts, FreshBooks can help you gain the insight you need to let your business thrive. Click here to give FreshBooks a try for free.

Financial projections have many uses for current business owners and startup entrepreneurs. Provided your financial forecasting follows the best practices for an accurate projection, your data will be used for:

- Internal planning and budgeting – Your finances will be the main factor in whether or not you’ll be able to execute your business plan to completion. Financial projections allow you to make it happen.

- Attracting investors and securing funding – Whether you’re receiving financing from bank loans, investors, or both, an accurate projection will be essential in receiving the funds you need.

- Evaluating business performance and identifying areas for improvement – Financial projections help you keep track of your business’s financial health, allowing you to plan ahead and avoid unwelcome surprises.

- Making strategic business decisions – Timing is important in business, especially when it comes to major expenditures (new product rollouts, large-scale marketing, expansion, etc.). Financial projections allow you to make an informed strategy for these big decisions.

Financial Projections Advantages

Creating clear financial projections for your business startup or existing company has countless benefits. Focusing on creating (and maintaining) good financial forecasting for your business will:

- Help you make vital financial decisions for the business in the future

- Help you plan and strategize for growth and expansion

- Demonstrate to bankers how you will repay your loans

- Demonstrate to investors how you will repay financing

- Identify your most essential financing needs in the future

- Assist in fine-tuning your pricing

- Be helpful when strategizing your production plan

- Be a useful tool for planning your major expenditures strategically

- Help you keep an eye on your cash flow for the future

Your financial forecast is an essential part of your business plan, whether you’re still in the early startup phases or already running an established business. However, it’s vital that you follow the best practices laid out above to ensure you receive the full benefits of comprehensive financial forecasting.

If you’re looking for a useful tool to save time on the administrative tasks of financial forecasting, FreshBooks can help. With the ability to instantly generate the reports you need and get a birds-eye-view of your business’s past performance and overall financial help, it will be easier to create useful financial projections that provide insight into your financial future.

FAQs on Financial Projections

More questions about financial forecasting, projections, and how these processes fit into your business plan? Here are some frequently asked questions by business owners.

Why are financial projections important?

Financial projections allow you to gain insight into your business’s economic trajectory. This helps business owners make financial decisions, secure funding, and more. Additionally, financial projections provide early warning of roadblocks and challenges that may lay ahead for the company, making it easier to plan for a clear course of action.

What is an example of a financial projection?

A projection is an overall look at a business’s forecasted performance. It’s made up of several different statements and reports, such as a cash flow statement, income statement, profit and loss statement, and sales statement. You can find free templates and examples of many of these reports via FreshBooks. Click here to view our selection of accounting templates.

Are financial forecasts and financial projections the same?

Technically, there is a difference between forecasting and projections, though many use the terms interchangeably. Financial forecasting often refers to shorter-term (<1 year) predictions of financial performance, while financial projections usually focus on a larger time scale (2-3 years).

What is the most widely used method for financial forecasting?

The most common method of accurate forecasting is the straight-line forecasting method. It’s most often used for projecting the growth of a business’s revenue growth over a set period. If you notice that your records indicate a 4% growth of revenue per year for five years running, it would be reasonable to assume that this will continue year-over-year.

What is the purpose of a financial projection?

Projection aims to get deeper, more nuanced insight into a business’s financial health and viability. It allows business owners to anticipate expenses and profit growth, giving them the tools to secure funding and loans and strategize major business decisions. It’s an essential accounting process that all business owners should prioritize in their business plans.

Michelle Alexander, CPA

About the author

Michelle Alexander is a CPA and implementation consultant for Artificial Intelligence-powered financial risk discovery technology. She has a Master's of Professional Accounting from the University of Saskatchewan, and has worked in external audit compliance and various finance roles for Government and Big 4. In her spare time you’ll find her traveling the world, shopping for antique jewelry, and painting watercolour floral arrangements.

RELATED ARTICLES

Save Time Billing and Get Paid 2x Faster With FreshBooks

Want More Helpful Articles About Running a Business?

Get more great content in your Inbox.

By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBook’s Privacy Policy . You can unsubscribe at any time by contacting us at [email protected].

👋 Welcome to FreshBooks

To see our product designed specifically for your country, please visit the United States site.

What's Planergy?

Modern Spend Management and Accounts Payable software.

Helping organizations spend smarter and more efficiently by automating purchasing and invoice processing.

We saved more than $1 million on our spend in the first year and just recently identified an opportunity to save about $10,000 every month on recurring expenses with Planergy.

Cristian Maradiaga

Download a free copy of "preparing your ap department for the future", to learn:.

- How to transition from paper and excel to eInvoicing.

- How AP can improve relationships with your key suppliers.

- How to capture early payment discounts and avoid late payment penalties.

- How better management in AP can give you better flexibility for cash flow management.

Business Plan Financial Projections: How To Create Accurate Targets

- Written by Keith Murphy

- 16 min read

Small businesses and startups have a lot riding on their ability to create effective and accurate financial projections as part of their business plan. Solid financials are a strong enticement for investors, after all, and can help new businesses chart a course that will take them beyond the legendendarily difficult first year and into a productive and profitable future.

But the need for business owners to look ahead in order to secure funding, increase profits, and make intelligent financial decisions doesn’t end when startups become full-fledged businesses—and business plan financial projections aren’t just for startups. Existing businesses can also put them to good use by harvesting insights from their existing financial statements and creating sales projections and other financial forecasts that guide and improve their ongoing business planning.

What Are Business Plan Financial Projections?

Successful companies plan ahead, looking as best they can into the near and distant future to chart a course to growth, innovation, and competitive strength. Financial projections, both as part of an initial business plan and as part of ongoing business planning, use a company’s financial statements to help business owners forecast their upcoming expenses and revenue in a strategically useful way.

Most businesses use two types of financial projections:

- Short-term projections are broken down by month and generally cover the coming 12 months. They provide a guide companies can use to monitor and adjust their financial activity to set and hit targets for the financial year. In the first year, short-term projections will be entirely estimated, but in subsequent years, historical data can be used to help fine-tune them for greater accuracy and strategic utility.

- Long-term projections are focused on the coming three to five years and are generally used to secure investment (both initial and ongoing), provide a strategic roadmap for the company’s growth, or both.

For startups, creating financial projections is part of their initial business plan. Providing financial forecasts banks and potential investors can use to determine the financial viability of a business is key to obtaining financing and investments needed to get the business off the ground.

For existing businesses—for whom an initial business plan has evolved into business planning—financial projections are useful in attracting investors who want to see clear estimates for upcoming revenue, expenses, and potential growth. They’re also helpful in securing loans and lines of credit from financial institutions for the same reason. And even if you’re not trying to get funding or investments, financial projections provide a useful framework for building budgets focused on growth and competitive advantage.

So whether you’re a small business owner, an aspiring tycoon starting a new business, or part of the financial team at a well-established corporation, what matters most is viewing financial projections as a living, breathing reference tool that can help you plan and budget for growth in a realistic way while still setting aspirational goals for your business.

Financial projections, both as part of an initial business plan and as part of ongoing business planning, use a company’s financial statements to help business owners forecast their upcoming expenses and revenue in a strategically useful way.

Financial Projections: Core Components

Whether you’re preparing them as part of your business plan or to enhance your business planning, you’ll need the same financial statements to prepare financial projections: an income statement, a cash-flow statement, and a balance sheet.

- Income statements , sometimes called profit and loss statements , provide detailed information on your company’s revenue and expenses for a given period (e.g., a quarter, year, or multi-year period).

- Cash flow statements provide a comprehensive view of cash flowing into and out of a business. They record all cash flow from operations, investment, and financing activities.

- Balance sheets are used to showcase a company’s assets, liabilities, and owner’s equity for a specific period.

How to Create Financial Projections

The process of creating financial projections is the same whether you’re drafting a business plan or creating forecasts for an existing business. The primary difference is whether you’ll draw on your own research and expertise (a new business or startup business) or use historical data (existing businesses).

Keep in mind that while you’ll create the necessary documents separately, you’ll most likely finish them by consulting each of them as needed. For example, your sales forecast might change once you prepare your cash-flow statement. The best approach is to view each document as both its own piece of the financial projection puzzle and a reference for the others; this will help ensure you can assemble comprehensive and clear financial projections.

1. Start with a Sales Projection

A sales forecast is the first step in creating your income statement. You can start with a one, three, or five-year projection, but keep in mind that, without historical financial data, accuracy may decrease over time. It’s best to start with monthly income statements until you reach your projected break-even , which is the point at which revenue exceeds total operating expenses and you show a profit. Once you hit the break-even, you can transition to annual income statements.

Also, keep in mind factors outside of sales; market conditions, global environmental, political, and health concerns, sourcing challenges (including pricing changes and increased variable costs) and other business disruptors can put the kibosh on your carefully constructed forecasts if you leave them out of your considerations.

Start with a reasonable estimate of the units sold for the forecast period, and multiply them by the price per unit. This value is your total sales for the period.

Next, estimate the total cost of producing these units (i.e., the cost of goods sold , or COGS; sometimes called cost of sales ) by multiplying the per-unit cost by the number of units produced.

Deducting your COGS from your estimated sales yields your gross profit margin.

From the gross margin, subtract expenses such as wages, marketing costs, rent, and other operating expenses. The result is your projected operating income , or net income .

Using these figures, you can create an income statement:

2. Cash Flow Statement

Tracking your estimated cash inflows and outflows from investment and financing, combined with the cash generated by business operations, is the purpose of a cash flow projection .

Investment activities might include, for example, purchasing real estate or investing in research and development outside of daily operations.

Financing activities include cash inflows from investor funding or business loans, as well as cash outflows to repay debts or pay dividends to shareholders.

A reliable and accurate cash flow projection is essential to managing your working capital effectively and ensuring you have all the cash you need to cover your ongoing obligations while still having enough left to invest in growth and innovation or cover emergencies.

Drawing from our income statement, we can create a basic cash flow statement:

3. The Balance Sheet

Providing a “snapshot” of your businesses’ financial performance for a given period of time, the balance sheet contains your company’s assets, liabilities, and owner’s equity.

Assets include inventory, real estate, and capital, while liabilities represent financial obligations and include accounts payable, bank loans, and other debt.

Owner’s equity represents the amount remaining once liabilities have been paid.

Ideally, over time your company’s balance sheet will reflect your growth through a reduction of liabilities and an increase in owner’s equity.

We can complete our triumvirate of financial statements with a basic balance sheet:

Best Practices for Effective Financial Projections

Like a lot of other business processes, financial planning can be complex, time-consuming, and even frustrating if you’re still using manual workflows and paper documents or basic spreadsheet-style applications such as Microsoft Excel. You can get free templates for basic financial projections from the Service Corps of Retired Executives (SCORE), but even templates can only take you so far.

Without a doubt, the best advantage you can give yourself in creating effective and accurate financial projections—whether they’re for the financial section of your business plan or simply part of your ongoing business planning—is to invest in comprehensive procure-to-pay (P2P) software such as Planergy.

In addition to helpful templates, best-in-class P2P software also provides a rich array of real-time data analysis, reporting, and forecasting tools that make it easy to transform historical data (or market research) into accurate forecasts. In addition, artificial intelligence and process automation make it easy to collect, organize, manage and share your data with all internal stakeholders, so everyone has the information they need to create the most useful and complete forecasts and projections possible.

Beyond investing in P2P software, you can also improve the quality and accuracy of your financial projections by:

- Doing your homework. Invest in financial statement analysis and ratio analysis, with a focus not just on your own company, but your industry and the market in general. Learn the current ratios used for liquidity analysis, profitability, and debt and compare them to your own to get a more nuanced and useful understanding of how your company performs internally and within the context of the marketplace.

- Keeping it real. It can be all too easy to get carried away with pie-in-the-sky optimism when forecasting the future of your business. Rose-colored glasses aren’t exclusive to startups and small businesses; over-inflated estimates can hobble even veteran organizations if they don’t practice good data discipline and temper their hopes with practical considerations. Focus on creating realistic, but positive, projections, and you won’t have to worry about investors or lenders glancing askance at your hard work.

- Hoping for the best, but planning for the worst. Run two scenarios when performing your financial projections: the best-case scenario where everything goes perfectly to plan, and a worse-case scenario where Murphy’s Law holds sway. While actual performance will undoubtedly fall somewhere in between the two, having an upper and lower boundary appeals to investors and lenders who are assessing your company’s financial viability.

Financial Projections Help You Reach Your Goals for Growth

From startups to global corporations, every business needs reliable tools for financial forecasting. Take the time to create well-researched, data-driven financial projections, and you’ll be well-equipped to attract investors, secure funding, and chart a course for greater profits, growth, and performance in today’s competitive marketplace.

What’s your goal today?

1. use planergy to manage purchasing and accounts payable.

- Read our case studies, client success stories, and testimonials.

- Visit our “Solutions” page to see the areas of your business we can help improve to see if we’re a good fit for each other.

- Learn about us, and our long history of helping companies just like yours.

2. Download our guide “Preparing Your AP Department For The Future”

3. learn best practices for purchasing, finance, and more.

Browse hundreds of articles , containing an amazing number of useful tools, techniques, and best practices. Many readers tell us they would have paid consultants for the advice in these articles.

Related Posts

The Future of FP&A: How The Role Is Evolving With The Use Of Real-Time Data

- 17 min read

Days Sales Outstanding: What Is It and How To Calculate It

- 19 min read

Budgeting In UK Schools: MAT, Academy Budgeting Challenges and Best Practices

Procurement.

- Purchasing Software

- Purchase Order Software

- Procurement Solutions

- Procure-to-Pay Software

- E-Procurement Software

- PO System For Small Business

- Spend Analysis Software

- Vendor Management Software

- Inventory Management Software

AP & FINANCE

- Accounts Payable Software

- AP Automation Software

- Compliance Management Software

- Business Budgeting Software

- Workflow Automation Software

- Integrations

- Reseller Partner Program

Business is Our Business

Stay up-to-date with news sent straight to your inbox

Sign up with your email to receive updates from our blog

This website uses cookies

We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our social media, advertising and analytics partners who may combine it with other information that you’ve provided to them or that they’ve collected from your use of their services.

Read our privacy statement here .

Business Plan

- Our Services

- Our Process

WhatsApp: +92 345 5384026

E-mail: [email protected]

A Comprehensive Guide: How to Forecast Revenues for Your Business Plan

Introduction:.

Forecasting revenues is a crucial aspect of developing a business plan. Accurate revenue projections not only attract investors but also provide a roadmap for sustainable growth and financial success. This article will provide you with a step-by-step guide to help you forecast revenues effectively. By following these strategies and best practices, you can make informed decisions, set realistic goals, and build a solid foundation for your business.

I. Understand Your Market and Customers:

Before you can forecast revenues, it's essential to gain a deep understanding of your target market and customers. Conduct market research to analyze trends, demand, and competition. Identify your target audience's needs, preferences, and purchasing behavior. This information will help you estimate the potential market size and assess the revenue potential for your products or services.

II. Break Down Revenue Streams:

Next, break down your revenue streams into specific categories. For example, if you have multiple products or services, create separate revenue streams for each. Consider the pricing structure, sales volume, and average transaction value for each category. This breakdown enables you to analyze and forecast revenues with greater accuracy.

III. Utilize Historical Data:

If you have been in business for some time, historical data can serve as a valuable resource for revenue forecasting. Analyze past financial records, sales data, and customer trends. Identify patterns, seasonal variations, and growth rates. Use this information as a baseline to project future revenues, accounting for any market changes or new product launches.

IV. Determine Key Assumptions:

Forecasting revenues involves making certain assumptions about your business and the market. Identify the key factors that will impact your revenue projections, such as market growth rates, pricing changes, or shifts in consumer behavior. Document these assumptions clearly, ensuring they are realistic and supported by data and market trends.

V. Use Multiple Forecasting Methods:

To enhance the accuracy of your revenue projections, employ various forecasting methods. Here are a few commonly used techniques:

a) Top-Down Approach:

Start with the overall market size, estimate your market share, and calculate revenues based on this share.

b) Bottom-Up Approach:

Begin with individual product or service sales projections and aggregate them to obtain total revenue estimates.

c) Time-Series Analysis:

Analyze historical sales data to identify patterns, trends, and seasonality. Apply statistical methods like moving averages or exponential smoothing to project future revenues.

d) Market Research and Surveys: