- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Premium News

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Personal Loans

- Student Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Danske Bank announces its new Forward ‘28 strategy and financial targets for 2026

In recent years, Danske Bank has made fundamental changes to the bank, resulting in a more focused business with a reduced risk level and a strengthened organisation. Simultaneously we have focused on strengthening our commercial momentum, and Danske Bank is on a clear trajectory to exceed the original financial targets we set for 2023.

Today Danske Bank is a focused Nordic bank with a strong market presence in Denmark, Sweden, Finland, and Norway. With our new strategy, we set clear ambitions to continue our efforts to strengthen our position as a leading bank in the Nordic region and make significant investments in customer offerings. For business and institutional customers, we want to be a leading bank in Denmark, Sweden, Finland and Norway. For retail and private banking customers, we will with a sharpened focus in each market continue our strategic development to strengthen our relations with existing customers and attract new ones:

Denmark: We want to reaffirm our position as the bank of choice across customer segments.

Finland: We want to maintain our position, serving customer needs across a broad set of segments and focusing on customers with advanced needs in primarily urban areas.

Sweden: We want to become the premium retail and private banking bank for business owners and customers with advanced needs.

Norway: We have decided to exit the market for personal customers in Norway to focus our efforts, investments and capital on other parts of our portfolio (see Company Announcement no. 5 2023).

2026 financial targets and capital distribution We have set new financial targets for 2026, which reflect our ambition to deliver a solid return on equity, continue to simplify and raise efficiency, lower costs and to consistently generate and distribute capital to our shareholders based on low risk levels:

Return on equity: 13% with a CET1 ratio of above 16%

Cost/income ratio: around 45%

Our capital distribution policy of a dividend pay-out of 40-60% of net profit remains unchanged. From 2023-2026, we see a total dividend potential of at least DKK 50 billion, based on the upper end of our dividend policy range.

For 2023-2026, we have the ambition of making further capital distribution subject to our capital position and market conditions.

In accordance with the above, Danske Bank intends to restart dividend payments with the announcement of the interim report for the first half of 2023. The intended dividend payment will be based on the net profit for the first half of 2023, and we will be targeting the upper end of the 40-60% dividend policy range. The intended capital distribution is subject to a decision by the Board of Directors in accordance with the authorisation granted to the Board of Directors and will be based on a prudent assessment of Danske Bank’s capital position at the end of the first half of 2023.

Our financial targets are based on a prudent set of assumptions for the macroeconomic development and an expected growth in lending of approximately 3% and in deposits of less than 1%.

To support the execution of the strategy, we are significantly increasing our annual investments in our core capabilities within digital platforms, expert advisory services and sustainability from DKK 3 billion to DKK 4 billion. Combined with the reprioritisation of other investments, this means that we more than double our investments in the strategic development of the bank.

Carsten Egeriis, CEO of Danske Bank: “ Danske Bank has during recent years made fundamental changes to refocus the bank, reduce our risk exposure, develop our organisation and accelerate our commercial momentum. We can see that the changes work and we are on a clear trajectory to exceed the original financial targets we set for 2023 .”

“ W e are changing gear s and substantially increasing our strategic and financial ambitions. We continue to accelerate our commercial momentum in all parts of the business , underpinned by clear growth and profitability targets. At the same time, we have decided to significantly increase our investments in our digital platforms, expert advisory services and sustainability , focus ing on the areas where we see the best opportunities for profitable growth .”

“ With our new strategy, we set clear ambitions for Danske Bank to be a leading bank in a digital age . S erv ing a quarter of the personal customer s i n our home market , we w ill work hard to continue to earn their trust and to affirm our position as the bank of choice in Denmark . ”

Stephan Engels, CFO of Danske Bank: “ Danske Bank is determined to deliver shareholder value and with the good momentum we have in our business, we expect to have substantial future distribution potential for dividends. We intend to restart dividend payments w hen we announc e our results for the first half of 202 3 , and f rom 2023 to 2026 , we see a potential for a total dividend equivalent to the upper level of our dividend policy range , which remain s unchanged at 40-60% .”

Investor update Today, 7 June 2023 at 8.00am-12.00 noon CEST, Danske Bank’s Executive Leadership Team hosts an investor update and presents the new strategic direction and 2026 financial targets and host a Q&A session.

The investor update can be followed online, and all presentations will be recorded and made available on our website afterwards.

Danske Bank

Contact: Helga Heyn, Interim Head of Media Relations, tel. +45 45 14 14 00

Claus I. Jensen, Head of Investor Relations, tel. +45 25 42 43 70

Company announcement no 4 2023

Find relevant files here

- 02. feb 2024 Danske Bank - Annual Report 2023

- 02. feb 2024 Sustainability Fact Book 2023

- 02. feb 2024 Statement on Modern Slavery and Human Trafficking 2023

- 02. feb 2024 Statement on Carbon Neutralisation 2023

- 07. feb 2024 Sustainability approach and priorities - our strategic direction towards 2028

Log on to our self-service solutions

Sustainability.

As a large financial institution with activities across all economic sectors, our aim is to support our more than 3.2 million customers in their sustainability transitions. By providing finance when and where it is needed most, we can promote economic growth, jobs and prosperity while also enabling societies to transition to a more sustainable economy. Our three strategic focus areas provide the framework for how we aim to create lasting value for our customers, for our business and for society:

Support our customers in their transition

Ensure a robust and resilient bank, manage our societal impact.

Strategic direction

We want to take responsibility for making a real difference in enabling this massive transition.

Customer offerings

We are committed to supporting our more than 3.2 million customers in navigating the transition toward a sustainable future by providing a range of sustainable finance advisory, products and services.

Danske Bank to make climate reporting easier for its business customers

Danske Bank has entered into a partnership with software firm, EIVEE, who specialise in calculating a business’s carbon footprint. With the partnership, Danske Bank aims to help its customers with their green transition and to support CO2-reducing initiatives with financing.

Sustain Tomorrow: Danske Bank opens conversation on global challenges

Climate Action Plan Progress Report 2023

Danske Bank integrates sustainability disclosures into the Annual Report 2023

Danske Bank maps potential impacts on nature and biodiversity

Publications & policies.

In our Annual Report, you can find our statutory sustainability statement, which provides information on our sustainability performance. In addition, you can find detailed and segmented data in our Sustainability Fact Book. We continuously strive to develop and expand our reporting and disclosures, noting the growing importance of sustainability related data and information to our stakeholders.

- 02. feb 2024 Climate Action Plan Progress Report 2023

- 02. feb 2024 Danske Bank PRB self-assessment 2023

- 20. jan 2023 Climate Action Plan

- 31. maj 2023 Human Rights Report

Get in touch with us

We welcome any comments, suggestions or questions you may have regarding our work with sustainability.

Danske Bank’s use of cookies and processing of personal data

Popular pages

How can we help.

You’ll find help here for many of the business banking questions you may have, from logging on to District to exchange rates or managing account mandates and card holders.

Browse our list of help topics below to help find the answers you need, or contact us via phone or by sending us a secure message through District.

Most common topics

Fraud and Scams

Adding a mandate to a business account

What is District?

How to log on for the first time

Logging on to District

Your password

eSafeID (blue fob)

Your User ID

Adding or amending users

District Mobile & Tablet App

District customer support

Document upload facility

Upload your documents

Account information

Business account T&Cs & important information

How to open an account

How to switch an account

Fees, Service Charges & Interest Rates (PDF)

Payments, transfers & lodgements

How to make a payment

Tracing a payment

Cancelling a payment

Card disputes

Automated Deposit Service

Check an IBAN

Using the Post Office®

Cards & cheques

Adding another card holder

How to block your card

Lost or stolen cards

Re-order cards

Expiring cards

Create or reset your card password to shop online

Keeping you safe

Keep it safe

Strong Customer Authentication

Business online security

Report fraud

Currency & exchange rates

Currency Converter

Exchange Rates

Change order request

Change Order Form

Updating customer details

Update your Business Details

Business insights, tools & templates

Advantage business podcast & webinar series

Business planning templates

Support for customers

Supporting the needs of all our customers

Bereavement Guide

Useful numbers

Feedback, Compliments and Complaints

Business Banking Resolution Service

Coronavirus customer support hub

Branch Finder & ATM Locator

Automated Deposit Locator

Branch accessibility services

Bank holidays

Saturday opening

Post Office lodgements & withdrawals

Want to get in touch?

Use our mobile business app.

Log on using District

Danske bank’s use of cookies and processing of personal data.

Danske Bank

When 3 employees change the behavior of 1500 colleagues.

Danske Bank was founded back in 1871 in Copenhagen and is today the second largest bank in the Nordic region. They have offices in 8 countries and in total they have around 21.800 employees. The business unit in this case serving corporate clients in Danske Bank is a unit consisting of 1500 employees with an annual turnover of 2 billion DKK.

The financial crisis back in 2008, caused massive changes, customer defections, and several other challenges that made Danske Bank have to reorganize a lot. With the changes, the team called 'Aim High', consisting of three employees was born. They are kind of internal 'pioneers' of the change process that started now, many years ago.

Before Learningbank came into the picture, the challenge Danske Banks 'Aim High'- team needed to address was how to ensure a coherent strategic change process and make sure that 4 different countries all followed the same principles to create one consistent Nordic Customer Experience .

Strong negotiating skills and ‘soft skills ’ was Danske Bank’s learning goal. Employees working with corporate clients in Danske Bank are expected to strengthen their skills in ‘strategic customer dialogue’ , where the ability to negotiate plays an important role. How do you, for example, negotiate with a competitive person, if you are a bit ‘soft’ yourself? This is exactly what they want to help their employees do.

As ‘ life is busy’ on the front line , this was also something that needed to be taken into account when creating the new digital training.

"It is very convenient that the training has become digital and thus scalable via Learningbank,“ explains Senior Business Consultant & Project Manager, Marianne Lykke Nielsen.

Training modules are kept in a short and simple format between 5 and 20 minutes , making it possible to fit them into a busy schedule . The content is designed in a visually engaging format – in the form of a digital learning game based on a fictional story of an employee, who is faced with the challenge of having to climb a mountain. The mountain metaphor is chosen in order to resemble a change process , which can be so demanding that it resembles the life of a mountain climber fighting his way to the top.

Danske Bank uses Learningbank’s Learning Lifecycle Platform and ready-made learning content , including video, learning games , and quizzes, In addition, the 'Aim High' team created customized learning modules in Learningbank’s authoring tool, which is basically a kind ‘DIY’ module.

”Normally it is very difficult to follow up on behavioral changes. But now we are able to follow up closely because we can see who trains, and we can see how much they train. We can address the needs of the local country managers by saying: ‘Okay, if you really want this change, then your team needs to use the training programs actively.’ This is a huge advantage, ” explains Marianne.

“Aim High was established in 2013. Today our training programs have become scalable in a whole new way . And my small team is well on its way to getting new internal customers since other departments in the bank are also getting curious and want to try something similar,” says Marianne.

“Previously we used a ‘cascading method’ preparing a lot of slides for our SIA (Strategy Implementation Agents). But no matter how carefully you prepare the communication, important knowledge can get lost along the way. Our SIA’s were anything but thrilled by the thought of having to act as experts in ‘negotiation techniques’. So now we have created premium quality content instead. Via Learningbank we are able to deliver this content in four languages reaching even the most remote parts of the organization ,“ says Marianne.

Danske Bank has launched the Aim High Learning solution in collaboration with Learningbank as part of the overall strategy leading up to 2020.

Key takeaways

- Empower employees and enable them to negotiate solutions

- Generates value for the bank and corporate clients

- Easy to follow-up

- Creates premium quality learning content

- Hitting targets has become easier

- Uses both ready-made content as well as customizing content themselves

Download the case here

Quick links til hjælp

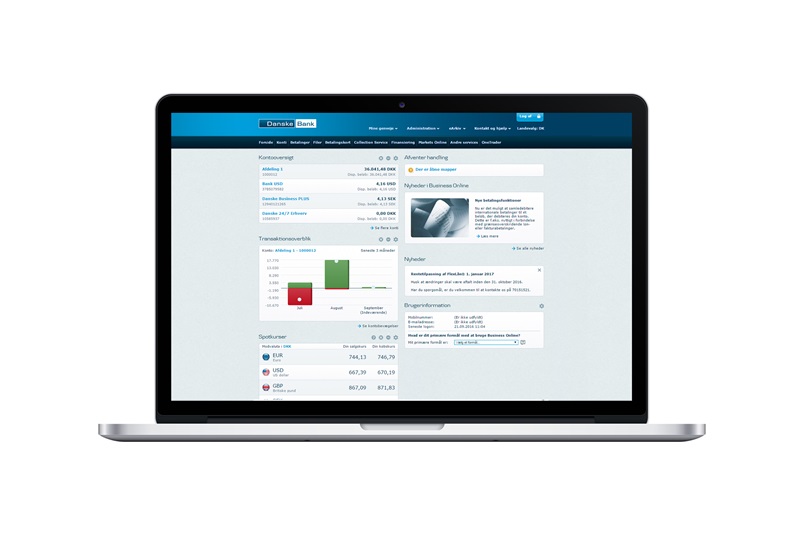

Business online.

Optimér driften med vores professionelle onlineløsning

Business Online giver dig fuldt overblik og kontrol over virksomhedens økonomi i realtid, uanset om du er på dit kontor eller på farten. Du kan skræddersy løsningen til dine behov, og sikkerheden er i top. Det har aldrig været nemmere at styre virksomhedens økonomi.

Bliv kunde og få Business Online Allerede kunde, hent app'en her

Nem at bruge

Overblik i realtid

Skræddersyet til dine behov

Likviditetsstyring i verdensklasse

Vores kunder fortæller os, at Business Online giver dem markedets bedste værktøj til at styre likviditeten. Et specialiseret Cash management-modul er en fast del af løsningen, og det gør det muligt for dig nemt og enkelt at optimere virksomhedens likviditet i realtid – også på tværs af landegrænser.

Sikkerheden er i top i Business Online. Du kan selv styre forskellige brugeres adgangsrettigheder, og som et ekstra værn mod svindel kan du bruge to-trins-godkendelse på alle overførsler. Det er også muligt at opsætte skræddersyede adviseringer, så du automatisk får en besked, når en overførsel er over en bestemt størrelse.

Overblik og kontrol

Kortadministration

Få nemt overblik over virksomhedens brug af corporate cards

Trade Finance

Styr risikoen ved handel med udlandet - nemt og enkelt

Adgang og integration med Danske Banks valutahandelsplatform

Betalingsmodulet

Optimér dine udenlandske betalinger

Cash flow forecasting

Forudse den fremtidige likviditet i din virksomhed

Integrer Business Online med dit økonomisystem

Likviditetsstyring

Få nemt overblik over cash pools, kreditmaksima og saldi

Giver dig overblik over virksomhedens leasingaftaler

Administration

Administrer selv brugernes adgange

Få alle fordelene i dag. Bliv kunde i Danske Bank.

Brug vores mobile business app.

eller log på vores selvbetjeningsløsninger

Danske banks brug af cookies og behandling af personoplysninger.

Bangor city centre building plan: Women's group seeks funding to make former bank into community and business centre

A North Down women’s group is seeking funding to turn a derelict Danske Bank in Bangor into a community and business centre.

Last year Kilcooley Women’s Centre acquired the iconic listed Victorian building on Main Street Bangor, and since then have been investigating sources of funding to revitalise the building and support a programme of interventions, while attracting more footfall into the centre of Bangor.

In July, an opportunity arose to apply for funding within a very short window, under the UK government’s Shared Prosperity Community Ownership Fund, with a closing date of 12 July.

Alison Blayney, Chief Executive of Kilcooley Women’s Centre contacted the Ards North Down Council Head of Economic Development seeking a letter of support for the application. The endorsement will also help with funding from sources such as the National Lottery Heritage Fund and Biffa Awards.

The council letter of support to the women’s centre states: “The building has been placed on the ‘Heritage at Risk’ list by the Department of Communities Historic Environment Division, and we are keen to assist and support the Women’s Centre’s reversal of this designation, through the refurbishment and innovative programmes it delivers to the community.

“This type of multi-function building, open to the community and businesses, will not only bring footfall to the Main Street and city centre, but will be a valuable contribution to the regeneration of Bangor.

“As you are aware, Ards and North Down Borough Council is currently working on and supporting projects to redevelop and transform Bangor waterfront and the surrounding area.

“Your project will enhance and complement all efforts being made to revitalise and renew the city centre and we would support your application, as the repurposing of this key city centre asset will be of benefit to the wider Bangor community. We hope and look forward to your application being successful and to work being able to start the building’s transformation as soon as possible.”

The former Northern Bank building, which dates back to the 1800s is at the junction of Hamilton Rd and Main Street. The building was originally a market place, then a courthouse, then around 1890 it was transformed into Ward Male, Female and Infant School.

In 1933 it became Bangor’s town hall, until 1952, was then sold to the Belfast Banking Company, and later became the Northern Bank, and finally the Danske Bank.

At the most recent meeting of the full Ards and North Down Borough Council, DUP Councillor Alistair Cathcart told the chamber: “This is terrific. I have recently been in the former Danske Bank, or Market House as it is again being called, and there are indeed workspaces upstairs where people can co-work.

“For self-employed people and people who are based in their own home but may not have the space, this provides an ideal location in the heart of Bangor. I am aware of a gentleman from Bangor who will be the first to set up there, and I wish everyone all the very best on the regeneration. It will be great to see this place active again, it is such an iconic building in Bangor.”

The results of the Kilcooley Women’s Centre’s application for the Shared Prosperity Community Ownership Fund is still pending.

07817949859

English (USA)

English (UK)

English (Canada)

English (India)

Deutsch (Deutschland)

Deutsch (Österreich)

Deutsch (Schweiz)

Français (France)

Français (Suisse)

Nederlands (Nederland)

Nederlands (België)

- Top Capitalization

- United States

- North America

- Middle East

- Sector Research

- Earnings Calendar

- Equities Analysis

- Most popular

- TESLA, INC.

- AMD (ADVANCED MICRO DEVICES)

- MICROSOFT CORPORATION

- NIPPON ACTIVE VALUE FUND PLC

- WALMART INC.

- Index Analysis

- Indexes News

- EURO STOXX 50

- Currency Cross Rate

- Currency Converter

- Forex Analysis

- Currencies News

- Precious metals

- Agriculture

- Industrial Metals

- Livestock and Cattle

- CRUDE OIL (WTI)

- CRUDE OIL (BRENT)

- Developed Nations

- Emerging Countries

- South America

- Analyst Reco.

- Capital Markets Transactions

- New Contracts

- Profit Warnings

- Appointments

- Press Releases

- Security Transactions

- Earnings reports

- New markets

- New products

- Corporate strategies

- Legal risks

- Share buybacks

- Mergers and acquisitions

- Call Transcripts

- Currency / Forex

- Commodities

- Cryptocurrencies

- Interest Rates

- Asset Management

- Climate and ESG

- Cybersecurity

- Geopolitics

- Central Banks

- Private Equity

- Business Leaders

- All our articles

- Most Read News

- All Analysis

- Satirical Cartoon

- Today's Editorial

- Crypto Recap

- Behind the numbers

- All our investments

- Asia, Pacific

- Virtual Portfolios

- USA Portfolio

- European Portfolio

- Asian Portfolio

- My previous session

- My most visited

- Trend-Following Stocks

- Growth stocks

- Quality stocks at a reasonable price

- Quality stocks

- Yield stocks

- Dividend Kings

- Biotechnology

- Millennials

- Unusual volumes

- New Historical Highs

- New Historical Lows

- Top Fundamentals

- Sales growth

- Earnings Growth

- Profitability

- Rankings Valuation

- Enterprise value

- Top Consensus

- Analyst Opinion

- Target price

- Estimates Revisions

- Top ranking ESG

- Environment

- Visibility Ranking

- Stock Screener Home

- Gold and Silver

- Israeli innovation

- Bionic engineering

- Wind energy

- Oversold stocks

- Overbought stocks

- Close to resistance

- Close to support

- Accumulation Phases

- Most volatile stocks

- Top Investor Rating

- Top Trading Rating

- Top Dividends

- Low valuations

- All my stocks

- Stock Screener

- Stock Screener PRO

- Portfolio Creator

- Event Screener

- Dynamic Chart

- Economic Calendar

- Our subscriptions

- Our Stock Picks

- Thematic Investment Lists

Danske Bank A/S

Dk0010274414.

- Danske Bank A/S : Active Ownership Report 2023

Active Ownership Report 2023

Danske Bank Asset Management

Active Ownership Report

When customers entrust us with their assets and savings, it is our duty to serve their interests by providing investment solutions with the goal to deliver competitive and long-term performance. Our firm commitment to Responsible Investment is an integralpart of this duty. It is about making better- informed investment decisions - addressing issues of risk, problems, and dilemmas, and influencing portfolio companies through active ownership to contribute to a positive outcome. Furthermore, the exercise of Active Ownership activities is in line with our fiduciary duty , which is to consider what is in the best interests of our clients.

Active ownership - through direct dialogue, collaborative engagement and voting at the annual general meetings - is an important part of our ability to create long-term value to the companies we invest in and to our investors. We believe it is more responsible to address material sustainability matters as investors rather than refraining from investing when issues of concern arise, leaving the problem to someone else to solve. Our investment teams are the change agents who can impact companies to manage risks and opportunities.

The aim of our Active Ownership Report covering three parts ' Engagement Activities ', ' Collaborative Engagement Initiatives ' and ' Voting Activities ' is to demonstrate how our Active Ownership Policy / instruction has been implemented throughout the year, fulfilling our annual duty to report on our active ownership activities in accordance with Article 3g of the Shareholder Rights Directive II (as implemented under national laws, including the Danish Financial Business Act § 101a.

The 3 parts of the report

Engagement Activities

Voting Activities

Collaborative

Initiatives

Where to get additional information

Responsible Investment Policy click here

Active Ownership Instruction click here

Voting Guidelines click here

Proxy Voting Dashboard click here

Danske Bank Sustainability approach and priorities

Climate Action Plan Progress Report 2023 click here

Principal Adverse Impact Statement click here

Investment Restrictions click here

Our active ownership activities in numbers for 2023

43 200+ 500+

Active Ownership Report, Part 1 Engagement Activities

Engagement introduction

The Investment and Responsible Investment teams engage on a regular

basis with investee companies about material sustainability matters in

order to seek improvement in performance and processes with the aim of enhancing and protecting the value of Danske Bank's investments.

Financial and sustainability information is reviewed from multiple data sources to mitigate investment risks and leverage opportunities, and to assess the potential positive and negative impact of material financial factors and sustainability factors on financial performance and society.

Reasons for dialogue can be, but are not limited to, the following

- Inform about voting decisions and guidelines

- Clarify publicly disclosed information from company

- Conduct research

- Identify and assess the quality of available data

- Understand performance and identify potential vulnerabilities

- Develop insights into risks and opportunities

- Identify potential regulatory developments and impacts

In order to ensure a structured engagement process, we log and monitor company dialogue and progress.

In 2023, we have had the following engagement activities

Split between engagement themes

Environmental

Top 7 engagement subjects discussed across themes

Top 10 industries most engaged with

Number of interactions with top 10 industries (Sector in bracket)

Banks (Financial) 85

Oil & Gas (Energy) 74

Chemicals (Basic Materials) 68

Food (Consumer, Non-cyclical) 66

Real Estate (Financial) 62

Electric (Utilities) 60

Transportation (Industrial) 58

Pharmaceuticals (Consumer, Non-cyclical) 49

Attachments

- Original Link

- Original Document

Danske Bank A/S published this content on 15 May 2024 and is solely responsible for the information contained therein. Distributed by Public , unedited and unaltered, on 15 May 2024 12:09:39 UTC .

Latest news about Danske Bank A/S

Chart danske bank a/s.

Company Profile

Income statement evolution, analysis / opinion.

DANSKE BANK : Q1: fading NII momentum shadows good progress on targets achievement

May 03, 2024 at 07:04 am EDT

Ratings for Danske Bank A/S

Analysts' consensus, eps revisions, quarterly earnings - rate of surprise, sector other banks.

- Stock Market

- DANSKE Stock

- News Danske Bank A/S

IMAGES

VIDEO

COMMENTS

Our strategy. With Forward '28, we take action to unleash our full potential to the benefit of all our stakeholders - customers, shareholders, employees and society. We set clear ambitions to continue our efforts to strengthen our position as a leading bank in the Nordic region and make significant investments in customer offerings.

Company announcement no. 4 2023. Danske Bank A/S. Holmens Kanal 2 - 12. DK-1092 København K. Tel. +45 45 14 00 00. 7 June 2023. Danske Bank announces its new Forward '28 strategy and ...

Policies. Our policies govern and guide our approach to and principles for conducting our business in a sustainable and responsible manner. 07. feb 2024 Responsible Investment Policy. 15. dec 2023 Stakeholder Policy. 17. okt 2023 Diversity & Inclusion Policy. 22. mar 2023 Tax Policy. 04. jan 2023 Sustainable Finance Policy.

Danske Bank A/S, Bernstorffsgade 40, 1577 København V. Tlf. +45 33 44 00 00, e-mail: [email protected], CVR-nr. 61 12 62 28, SWIFT: DABADKKK Phone conversations may be recorded and stored due to documentation and security purposes. Danske Bank reserves all rights. Danske Bank A/S is authorised by the Danish Financial Supervisory Authority.

The sustainability transition presents both major challenges and major opportunities. Our strategic focus areas provide the framework for how we aim to create lasting value for our customers, for our business and for society. In other words, they help us structure our efforts around sustainability-related opportunities, risks and impacts.

Contact us to learn more about how to become a customer and what we can do for you. Book meeting. Or call us:+45 45 14 00 00. If you are an international company looking for a banking solution outside of your domestic market, please contact us via [email protected].

Company announcement no. 4 2023. Danske Bank A/S. Holmens Kanal 2 - 12. DK-1092 København K. Tel. +45 45 14 00 00. 7 June 2023. Danske Bank announces its new Forward '28 strategy and ...

Our Climate Action Plan covers the activities of the Danske Bank Group. The report provides an overview of our targets, actions and initiatives in relation to our climate efforts. The developments towards our sector may not be linear as development in technologies and other fundamental circumstances may affect individual sectors year on year.

Danske Bank A/S (pronounced [ˈtænˀskə ˈpɑŋˀk], lit. ' Danish Bank ') is a Danish multinational banking and financial services corporation. Headquartered in Copenhagen, it is the largest bank in Denmark and a major retail bank in the northern European region with over 5 million retail customers. Danske Bank was number 454 on the Fortune Global 500 list for 2011.

On 3 August 2023, the Bank of England announced an increase in the Bank of England bank rate from 5.00% to 5.25%. Economic analysis. Fresh insights and perspectives on the UK and Northern Ireland economies. Coronavirus: Business Customer support. We're here to support you, we've got many ways to access your money if you need to.

Danske Bank integrates sustainability disclosures into the Annual Report 2023. Danske Bank has for the first time integrated the statutory sustainability statement and EU Taxonomy disclosures into the Annual Report 2023. The sustainability statement provides an overview of progress on our 2023 Group Sustainability Strategy and targets, and it ...

Agile and cross functional work is fun and motivating for most of the development teams, so, focus should be on adopting the habits of middle management and the structures preventing Agile.". Interview with Danske Banks Kasper Uhd Jepsen, First Vice President and Head of customer experience, regulation and projects in the C&I Business ...

How to set up a Limited Company: Choose your company name by checking out the available names on the official Company House register. After selecting your name, input your Limited Company's registered address. Appoint the director (s) and/or shareholder (s) linked to your company.

Corporate Banking support team. Request a call from us. Or call 0345 266 1166. Opening hours Mon-Fri / 9am-5pm *. *Except Bank Holidays. Call charges may vary. Please contact your phone company for details. Calls may be recorded.

Get help from Danske Bank on business banking queries such as using District, making and receiving payments, adding additional mandates or card holders and more.

Apply for an account for your business. Apply now. If you have any questions, feel free to call us on +45 70 13 30 00. If you are an international company, looking for a banking solution outside your domestic market, please contact us via [email protected] before applying. We currently receive an extraordinary number of ...

Standard business accounts (including charities) We'll ask you to provide all the information listed in the UK Finance guide to opening a business account. The application form will also ask you to provide some additional details as set out in this guide, including: Details of your main customers and suppliers, both domestic and international;

With our Mobile Business app you can: • complete your first logon using your temporary PIN and eSafeID. • view accounts across Danske Bank Group (the Group) • view balance progress and balance graphs. • view account group overviews and graphs. • view and search transactions and pending transactions. • view payment details (including ...

When 3 employees change the behavior of 1500 colleagues. Danske Bank was founded back in 1871 in Copenhagen and is today the second largest bank in the Nordic region. They have offices in 8 countries and in total they have around 21.800 employees. The business unit in this case serving corporate clients in Danske Bank is a unit consisting of ...

Describe Your Services or Products. The business plan should have a section that explains the services or products that you're offering. This is the part where you can also describe how they fit ...

Business Online er Danske Banks professionelle onlineløsning, der giver virksomheder overblik og kontrol over økonomien. Gå til hovedindhold. Privat; Erhverv; Private Banking ... Danske Bank tilbyder ikke investeringsrådgivning ("Investeringsrådgivning") eller anden form for investeringsservice, herunder handel, udførelse og ...

A North Down women's group is seeking funding to turn a derelict Danske Bank in Bangor into a community and business centre. Last year Kilcooley Women's Centre acquired the iconic listed ...

Useful numbers. For all general business queries please contact 0345 850 9515, or if you have a specific query then please use the sections below. We may record or monitor calls to confirm details of our conversations, and for verification and quality purposes. You can read more about what personal information we hold, how we use it and your ...

Danske Bank A/S is Denmark's leading bank. The activity is organized around four areas: - retail banking; - market and investment banking: financial brokerage, merger-acquisition consulting, portfolio management, etc.; - insurance (Danica Pension): mainly life insurance and pension fund management; - other: primarily management of investment funds and asset management.

NIBE Industrier AB (publ) ( OTCPK:NDRBF) Q1 2024 Earnings Conference Call May 16, 2024 5:00 AM ET. Company Participants. Gerteric Lindquist - CEO. Hans Backman - CFO. Conference Call Participants.