Alert Banner

Ncbiotech's move program wins federal grant to expand biopharma job opportunities for nc’s military community. .

Cary CRO Allucent wins $25.5 million Covid project award

An industry consortium funded by a federal agency has chosen Allucent, a Cary-based clinical research organization, for its initial project award for a decentralized clinical trial involving the next generation of Covid vaccines.

The Rapid Response Partnership Vehicle (RRPV) chose Allucent to lead a vaccine clinical trial where participants can remain at home instead of traveling to trial sites. RRPV is made up of 268 companies, nonprofits and universities and is funded primarily by the Biomedical Advanced Research and Development Authority, or BARDA, which is housed in the U.S. Department of Health and Human Services.

Allucent will use the $25.5 million award to conduct the Phase IV clinical trial with up to 4,000 participants. The study will assess vaccine correlates of protection against SARS-CoV-2, the virus that causes Covid, with a focus on how geographically diverse populations respond to the vaccine.

Allucent will employ its decentralized trial delivery model, which includes participants self-collecting specimens and using wearable devices, the company said.

“We are proud to apply our decentralized trial expertise as a partner to BARDA on this initiative,” Allucent chairman and CEO Mark A. Goldberg, MD, said in a statement. “The continuing emergence of new variants and subvariants underscores the need for ongoing optimization of COVID-19 vaccines to ensure their effectiveness in combating the virus. This study is a step forward in addressing the evolving challenges posed by COVID-19 and mitigating their impact on public health.”

The RRPV award is part of a broader effort aimed at advancing the nation’s response to Covid and improving preparedness for future public health threats. Called Project NextGen , the $5 billion initiative is designed to help develop new vaccines, therapeutics and technologies to address SARS-CoV-2 viral strains.

Allucent isn’t the only Triangle company involved in Project Next Gen. In September, Rho , a Durham CRO, was chosen to provide statistical and data coordinating services for Phase 2b clinical trials of new Covid vaccine candidates.

The Bezos Center for Sustainable Protein has launched at North Carolina State University.

The Bezos Earth Fund awarded NC State $30 million over five years to lead a center of excellence to create a biomanufacturing hub for dietary proteins that are environmentally friendly, healthy, tasty and affordable. The Earth Fund has committed $100 million to establish a network of open-access research and development centers focused on sustainable protein alternatives, expanding consumer choices.

CSL Seqirus, a global vaccine maker with a massive manufacturing plant in Holly Springs, has won a federal contract to produce a stockpile of vaccines in case of a pandemic of avian influenza, or bird flu.

Under terms of the $22 million contract, awarded by the Biomedical Advanced Research and Development Authority (BARDA), CSL Seqirus will complete the fill-and-finish process for about 4.8 million doses of pre-pandemic vaccine that is well-matched to H5N1, the currently circulating strain of bird flu virus.

- Conference Coverage

- CRO/Sponsor

- 2023 Salary Survey

- Publications

- Conferences

CRO Update: Where are Contract Research Organizations Headed?

How CROs have adapted to recent challenges—and how they’ll continue to evolve in the future.

Contract research organizations (CROs) have undergone significant changes in recent years, and even more changes are on the horizon. Some of the new and established trends in CROs are the result of technological advances, while others have arisen in response to market pressures or the COVID-19 pandemic. Experts say that spending on research and development has continued to grow over the last 15 years, even as the pandemic has caused biotech stocks to slump. However, CROs continue to face a variety of challenges, from competitive pressure to commoditization to evolving patient engagement models. Market stratification is placing pressure on smaller CROs to niche down or subcontract as larger organizations capture more of the market. As CROs navigate a post-pandemic future, there will be opportunities to implement lessons learned from COVID-19 and adopt emerging technologies that can improve data management, mitigate staffing shortages, or facilitate better patient monitoring and engagement.

Tips to Rescue a Clinical Trial Before It’s Too Late

Why constant communication and transparency are paramount to successful partnerships between pharmaceutical companies and CROs

Focus on Fundamentals for Better Collaboration Across Research Sites and Sponsors

Improving the site-sponsor relationship can get trials off on the right foot and on a path for success.

When FMVs Collide: Coming to Terms with Fair Market Value

With variation in costs between different stakeholders in clinical trials, there is often disagreement on fair market value.

Top 3 Most Read CRO/Sponsor Feature Articles of 2023

Authors highlighted outsourcing and the impact of the COVID-19 pandemic in these CRO/sponsor articles from 2023.

Anticipating Near-Term Structural Change in the Outsourcing Landscape

Can full-service outsourcing to CROs by large biopharma companies sustainably prosecute a clinical development portfolio?

Harmonizing Outsourcing to Keep Clinical Trials on Track

A shared partnership culture is critical in navigating today’s complex terrain.

2 Commerce Drive Cranbury, NJ 08512

609-716-7777

Switch language:

CRO consolidation: is the clinical trials industry reaching a tipping point?

The M&A trend among CROs and clinical service providers raises questions about sustainability and impact on their pharma clients.

- Share on Linkedin

- Share on Facebook

The news about global life sciences company Labcorp divesting its clinical development business only a few years after acquiring the contract research organisation (CRO) Covance, in order to leverage its capabilities in clinical trials and predictive analytics, has shaken up the healthcare space and raised a number of questions about the sector’s future outlook.

Recommended Buyer's Guides

Leading Guide to Services for the Clinical Trials Industry

Leading guide to contract research organisations for the clinical trials industry.

Some of these questions are about why the company has decided to spin-off its drug development and clinical trials arm, including speculation about the acquisition not being as successful as the company had originally hoped. Others have questioned what impact this will have on the CRO market in the future, including whether this spinoff is an indication that recent growth in merger and acquisition (M&A) activity among CROs will lead to more spinoffs in the future, as the ongoing consolidation may not be sustainable for the industry.

Go deeper with GlobalData

Panic Disorders Clinical Trial Analysis by Trial Phase, Trial Statu...

Malignant pleural effusion drugs in development by stages, target, ..., premium insights.

The gold standard of business intelligence.

Find out more

Related Company Profiles

Pra health sciences inc, inotiv, inc, bupa (asia) limited.

Labcorp announced the spinoff of its drug development and clinical trials arm in August 2022, called Clinical Development Business, which will now operate as a CRO offering Phase I–IV clinical trial management and technology to the biopharma industry. Labcorp will retain the laboratory business that is related to routine and esoteric labs, central labs, and early development research labs.

However, in 2014, Labcorp acquired the global CRO Covance for $5.6 billion. The combined company was intended to leverage technologies that improve patient recruitment for clinical trials; increase efficiency in the conduct of clinical trials; deliver data more quickly to drug sponsors, physicians, and patients; and leverage the increased scale of its central laboratory operations and collective data resources to drive greater R&D productivity for its clients.

Labcorp is not the only company that has undergone an M&A in the CRO space. Other key recent examples include Thermo Fisher acquiring Scientific Inc PPD Inc, ICON Plc buying PRA Health Sciences , CenExel purchasing ForCare Clinical Research, Inotiv acquiring Gateway Pharmacology Laboratories, and NAMSA buying Clinlogix.

Deep diving on M&A

Increased scale, geographic expansion, lower costs, and operational savings are a few of the reasons that companies opt for M&As instead of building the same offerings internally.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

Rodney Gollo, head of risk at Bupa Asia, explains that healthcare infrastructure can be a focus area for companies looking for an M&A, as having more control of healthcare infrastructure is increasingly important for building resilience. “There are some similarities between clinical trials and APIs [active pharmaceutical ingredients], and having access to APIs is key to the speed that clinical trials can be conducted. Thus, this is determinant of few things, as it can accelerate regulatory approval, but there is also a commercial driver element to this,” Gollo says.

Gaining capabilities in niche areas is another reason behind the increase in M&A activity among CROs, as a number of larger companies prefer to acquire smaller players or start-ups, especially in areas related to patient recruitment, patient monitoring, and digital tracking of outcome measures in clinical trials. Smaller software start-ups can often solve very specific challenges in clinical trials execution, as they focus on operational pain points.

According to GlobalData’s database, there was an increase in the number of M&As among CROs in 2021. CROs have experienced difficulties during the pandemic due to a number of trials being disrupted. However, drug makers and governments are now looking to back investments in new treatments, which has boosted the demand for CRO services.

There were 50 completed M&A deals in 2021 , up from 21 the year before. More specifically, there were 20 completed M&A CRO deals in H1 2021, and 30 such deals in H2 2021.

The aftermath of consolidation

The ongoing consolidation within the CRO industry has led to the creation of mega “one-stop shop” global companies that offer several services. However, is the quality of the services that they offer to the pharmaceutical companies, which is their client, as good as it was before the M&A took place? Or as good as the service that the smaller players, which focus on niche areas, offer? Will mid and small biopharma sponsors get the same attention from a larger CRO as they get from a smaller one? Do the consolidated companies support the needs of all types of sponsors across all the stages of clinical drug development?

Big pharma companies prefer to invest heavily in new therapies when they have already given positive proof of concept results or when a biomarker has been discovered, as they invest when they believe a therapy will be successful and make it through clinical trials.

However, Eirini Schlosser, founder and CEO at the healthcare artificial intelligence (AI) research company Dyania Health, says that with certain rare diseases or diseases where there is no available biomarker, like pancreatic cancer, biotech and smaller companies are typically involved, often more than big pharma, because they have the risk appetite to focus on the moonshots. “These companies naturally have smaller budgets and often aren’t able to afford a large CRO. In these cases, I believe there has and will continue to be disease-specific niches for companies providing CRO services to excel in providing significant value,” Schlosser says.

Schlosser adds that within the value chain for clinical trials, the range in types of vendor services like patient engagement or electronic data capture is broad and complex.

“When a small vendor for specific type of service is acquired and ingested into a large CRO, it seems that the vendor’s services often get consumed into the CRO’s wider offering and ultimately fail to continue to exist. In these cases, I don’t think the consolidation is sustainable or will continue in this manner,” Schlosser notes.

To consolidate or not to consolidate?

There are several problems that may hinder progress when going through an M&A process, which might result in a number of risks for clinical trial sponsors. Some of these risks include different working cultures, company dynamics changing as the CRO goes through a restructure, and overlapping services between the two CROs, among others.

“The nature of clinical trials, drug manufacturing, and the pharmaceutical industry has traditionally been about taking long-term bets, and this does not always align well with M&As, where there might be a need to realise quick returns on investments,” says Gollo. He explains that clinical development is an expensive process and not all the drugs make it to the market, so some start-ups in the medical environment may find it hard to raise a lot of capital because the returns on investments can take a long time to materialise.

Crean notes that depending on integration activities and synergies due to the acquisition of buyer and seller, there are likely to be small issues along the way where the buyer does not offer the same quality and level of services that customers or clients may have been used to prior to an acquisition. “Not all M&A is successful,” he says.

So, what is next if an M&A is not successful? What if there is a fallout when it comes to integration activities and synergies? Will some companies fail to continue to exist or change their structure? Will there be more spinoffs or divestments?

Crean explains that CROs will continue to divest the lower profitability segments of their business, as it is good business practice to divest service segments that do not perform as well or have a lower demand or lower profit margins. “It is becoming increasingly difficult to offer unique, specialised services that are not seen as commodity services. The key to differentiation is to offer those services that are not offered by other CROs,” he says.

Healthcare data is the new oil

Consolidation might not be sustainable for all types of sponsors and pharma companies. However, it can still provide opportunities, especially when the focus is on data, automated software, and machine learning.

“What other industries have known for a while, but healthcare is just starting to realise, is that data is the new oil,” says Schlosser.

She explains that cleaned, structured, rich data can be used algorithmically in an effectively infinite number of ways to drive new therapies, improved patient outcomes, and run synthetic studies, among others. The use cases for the same data, and the machine that uses the data (AI, machine learning), can be pivoted and repurposed continuously into various business models. “I believe the spinoffs will not be complete spinoffs, but rather an advancement of the acquired companies’ technologies taken in different directions. It may result in lay-offs, hirings, or partial spinoffs of business models,” Schlosser says.

What does the future hold for the CRO market landscape?

There are several advantages and disadvantages when it comes to the current consolidation and M&A activity.

“I do expect M&A activity and consolidation in the sector to continue for the foreseeable future. The life sciences industry will continue to drive the CRO sector with increasing R&D budgets, increased venture funding, and greater outsourcing trends within the industry. The CRO industry must continue to expand through the buy model versus building it,” says Crean.

The ongoing consolidation and M&A activity is set to continue in the years to come, shaping a new landscape among CROs. The CRO industry will likely be fragmented with few large players and a number of smaller players that are either highly specialised, either by drug class or disease, or that offer specialised services or atomisation of clinical services, such as patient recruitment, feasibility, planning, and data collection and management, among others. However, in the long term, this ongoing consolidation may prove to be a successful strategy.

Schlosser believes that there will always be attempts at consolidation, but success is less about consolidating and more about finding truly synergetic fits between two companies. “For example, arguably the most successful CRO merger was that of IQVIA, with Quintiles bringing the CRO side and IMS bringing the data and IT side. Complementary offerings can be very value creative,” Schlosser notes.

Sign up for our daily news round-up!

Give your business an edge with our leading industry insights.

More Relevant

Hansa completes randomisation in Phase III trial of imlifidase

Caristo touts study showing accuracy of its cari-heart technology, sign up to the newsletter: in brief, your corporate email address, i would also like to subscribe to:.

I consent to Verdict Media Limited collecting my details provided via this form in accordance with Privacy Policy

Thank you for subscribing

View all newsletters from across the GlobalData Media network.

Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

- Explore content

- About the journal

- Publish with us

- Sign up for alerts

- NEWS IN BRIEF

- 08 March 2024

Shifts in the clinical trial landscape

- Asher Mullard

You can also search for this author in PubMed Google Scholar

Drug developers initiated nearly 4,900 clinical trials in 2023, down 15% from 2022 and down 32% from their highpoint in 2021, shows a report of R&D trends by the IQVIA Institute for Human Data Science. The decline is largely attributable to the decrease in COVID-19 trials, say the IQVIA analysts, but other areas are also affected. The annual number of clinical trial starts is now below pre-pandemic levels.

Access options

Access Nature and 54 other Nature Portfolio journals

Get Nature+, our best-value online-access subscription

24,99 € / 30 days

cancel any time

Subscribe to this journal

Receive 12 print issues and online access

195,33 € per year

only 16,28 € per issue

Rent or buy this article

Prices vary by article type

Prices may be subject to local taxes which are calculated during checkout

Nature Reviews Drug Discovery 23 , 239 (2024)

doi: https://doi.org/10.1038/d41573-024-00048-w

2024 Recruitment notice Shenzhen Institute of Synthetic Biology: Shenzhen, China

The wide-ranging expertise drawing from technical, engineering or science professions...

Shenzhen,China

Shenzhen Institute of Synthetic Biology

Multi-Disciplinary Studies of Biomolecular Condensates

Dallas, Texas (US)

The University of Texas Southwestern Medical Center (UT Southwestern Medical Center)

Research assistant (Postdoc) (m/f/d) - Department of Biology, Chemistry, Pharmacy - Institute of Bio

Department of Biology, Chemistry, Pharmacy - Institute of Biology Plant Physiology Research assistant (Postdoc) (m/f/d) full-time-job limited for u...

14195, Berlin Dahlem (DE)

Freie Universität Berlin

Global Faculty Recruitment of School of Life Sciences, Tsinghua University

The School of Life Sciences at Tsinghua University invites applications for tenure-track or tenured faculty positions at all ranks (Assistant/Ass...

Beijing, China

Tsinghua University (The School of Life Sciences)

Dr. Rolf M. Schwiete Professor (W2) of Translational Pediatric Oncology

The Faculty of Medicine of the Goethe University Frankfurt am Main and the University Hospital Frankfurt, in the Department of Pediatrics (Chairman...

Frankfurt am Main, Hessen (DE)

Johann Wolfgang Goethe-Universität Frankfurt

Sign up for the Nature Briefing newsletter — what matters in science, free to your inbox daily.

Quick links

- Explore articles by subject

- Guide to authors

- Editorial policies

Top Clinical Research Organisations (CRO) 2022

- Author Company: PharmiWeb.Jobs

- Author Name: Lucy Walters

- Author Email: [email protected]

- Author Website: https://www.pharmiweb.jobs/

In this article, we’ve rounded up some of the top Clinical Research Organisations (CROs) across the globe…

Headquartered in North Carolina, U.S., IQVIA is a leading global provider of clinical research services to the life sciences industry. With over 74,000 employees, IQVIA has been recognised as one of Fortune’s ‘World’s Most Admired Companies’ (2021), Flex Jobs’ ‘Top 100 Remote Work Companies to Watch’ (2021) and Forbes’ ‘World’s Best Employers’ (2020).

Browse current jobs with IQVIA here .

Also headquartered in North Carolina, U.S., Labcorp (formerly Covance) is a leading global life sciences company working to provide vital information to help doctors, hospitals, pharmaceutical companies, researchers, and patients make clear and confident decisions. Established in 1986, Labcorp’s Clinical Research Unit in Leeds, U.K., is where the organisation carries out clinical trials for some of the world’s leading pharmaceutical and biotechnology companies.

Browse current jobs with Labcorp here .

Syneos Health

Syneos Health is the only full-service biopharmaceutical solutions company in the world, bringing together the best clinical and commercial minds to improve patient access to medicine. With headquarters in North Carolina, U.S., Syneos Health has been recognised across the globe for its fit-for-purpose CRO solutions. The organisation has been awarded ‘Top CRO to Work With’ among top 10 global CROs in 2013, 2015 and 2017, and were the winner of the 2017 Society for Clinical Research Sites Eagle Award.

Browse current jobs with Syneos Health here .

ICON is a global, leading clinical research organisation providing services to pharmaceutical, biotechnology, medical device and government and public health organisations. ICON specialises in the planning, management, execution and analysis of Phase 2-3 clinical trials, with functional and therapeutic expertise including cardio-metabolic, oncology/hematology, infectious diseases, neurology/psychiatry, rare disease and more.

Browse current jobs with ICON Clinical Research here .

Headquartered in Massachusetts, U.S., Parexel is one of the largest clinical research organisations, providing services that help life science and biopharmaceutical organisations transform scientific discoveries into new treatments. With global study locations in Baltimore, Los Angeles, Berlin and London, Parexel offers comprehensive clinical development services from First-in-Human through Phase IV and post-marketing. They were named ‘Best Contract Research Organization’ in December 2020 and ‘Top CRO to Work With’ in 2022.

Browse current jobs with Parexel here .

Charles River Laboratories

Charles River is a leading provider of drug discovery services to the bioscience community, collaborating on projects from small, single discipline projects to fully integrated drug discovery projects. With more than 18,400 employees worldwide, Charles River currently operates in 100+ facilities in more than 20 countries and has supported the development of more than 80% of the drugs approved by the FDA for the past 3 years.

Browse current jobs with Charles River Laboratories here .

Medpace is a global, full-service clinical contract research organisation providing clinical development services (Phase I-IV) to the biotechnology, pharmaceutical and medical device industries. With headquarters in Ohio, U.S., Medpace has coverage across six continents and is the only global CRO to have a fully integrated Clinical Research Campus, with subsidiaries including central laboratories, a clinical pharmacology unit, a bioanalytical laboratory and other core laboratories.

Worldwide Clinical Trials

Worldwide Clinical Trials is a global, mid-sized, CRO that provides top-performing, preclinical, and Phase I-IV clinical development services to the biotechnology and pharmaceutical industries. The organisation has been recognised for excellence and honoured in five categories in the 2022 CRO Leadership Awards, marking the ninth consecutive year that Worldwide has been recognised as a high-performing CRO based on direct survey feedback from pharmaceutical and biotech professionals.

Browse current jobs with Worldwide Clinical Trials here .

Find more of the industry's top Clinical Research organisations currently advertising on PharmiWeb.Jobs here .

View the top CROs in 2023 here.

You are leaving PharmiWeb.com

Disclaimer: You are now leaving PharmiWeb.com website and are going to a website that is not operated by us. We are not responsible for the content or availability of linked sites.

ABOUT THIRD PARTY LINKS ON OUR SITE

PharmiWeb.com offers links to other third party websites that may be of interest to our website visitors. The links provided in our website are provided solely for your convenience and may assist you in locating other useful information on the Internet. When you click on these links you will leave the PharmiWeb.com website and will be redirected to another site. These sites are not under the control of PharmiWeb.com.

PharmiWeb.com is not responsible for the content of linked third party websites. We are not an agent for these third parties nor do we endorse or guarantee their products. We make no representation or warranty regarding the accuracy of the information contained in the linked sites. We suggest that you always verify the information obtained from linked websites before acting upon this information.

Also, please be aware that the security and privacy policies on these sites may be different than PharmiWeb.com policies, so please read third party privacy and security policies closely.

If you have any questions or concerns about the products and services offered on linked third party websites, please contact the third party directly.

- Latest News

- View Press Releases

- Post a Press Release

- Reprint Articles

- Digital Advertising

- Lead Generation

- Editorial Calendar

- Whitepapers

- Press Releases

- Post Press Releases

- Recorded Webinars

- Inside eBooks

- Industry Events

- Clinical Trainings

- Clinical Conferences

- Clinical Trial Innovation Summit

- Barnett International

- Editorial Profile

- Submit a Story

- SCOPE Summit – US

- SCOPE Summit – Europe

- European Innovations Awards

American Clinical Research Services Acquires Elixia, Oxford BioDynamics, King’s College London Collaborate, Recursion’s Supercomputer Ranked, More

Clinical Research News | American Clinical Research Services has acquired Elixia; Oxford BioDynamics and King's College London are teaming up in the immediate follow up of the APIPPRA trial, the largest RA prevention trial to date; Recursion’s BioHive-2 was dubbed No. 35 on the latest TOP500 list of the world’s fastest supercomputers; more.

Follow the Money: Blackstone Launches Portfolio Company, PCORI Approves Funds for CER Studies, Funds Gifted for Alzheimer’s Research, More

Clinical Research News | Blackstone launches the Blackstone Life Sciences portfolio company Uniquity Bio, a clinical-stage drug development company focused on immunology and inflammation; the Patient-Centered Outcomes Research Institute secures approval of funding awards to support new patient-centered comparative clinical effectiveness research studies; Laurence Belfer gifts funds to the University of Texas MD Anderson Cancer Center to strengthen neurodegeneration research through the Belfer Neurodegeneration Consortium, a transformative multi-institutional initiative to advance the study and treatment of Alzheimer’s disease; more.

The Risk-Based Data Management (RBDM) Revolution

Clinical Research News | The clinical trials landscape is evolving with more data, increased investment in personalized medicines and a shift toward decentralized and hybrid clinical trials. At the same time, the industry is attempting to become more efficient and harness new technologies and data science in operations.

Pan-RAS Inhibitor Offers Hope of Improved Pancreatic Cancer Prognosis

Clinical Research News | A consortium of pancreatic cancer researchers sharing information in real time has shown that an oral pan-RAS inhibitor known as RMC-7977, developed by Revolution Medicines, effectively targets the common cancer-causing RAS proteins while minimally impacting normal cells—and did so across a comprehensive range of preclinical models in a series of similar experiments.

Brain Stimulation Device Could Make Precision Mental Health A Reality

Clinical Research News | In the not-too-distant future, disorders of the brain could be treated with the same precision as heart disease and cancer. The means will be a therapeutic brain-computer interface (BCI) the size of a small blueberry for people suffering from treatment-resistant depression that uses a similar type of implant technology as Elon Musk’s Neuralink for helping paralyzed people speak.

- 1 (current)

Newsletter Archives

Clinical trials & pharma newsletters, clinical focus monthly newsletter - 2024.

Clinical Focus Monthly Newsletter – April 2024

Clinical Focus Monthly Newsletter – March 2024

Clinical Focus Monthly Newsletter – February 2024

Clinical Focus Monthly Newsletter – January 2024

Clinical Focus Monthly Newsletter - 2023

Clinical Focus Monthly Newsletter – November 2023

Clinical Focus Monthly Newsletter – October 2023

Clinical Focus Monthly Newsletter – September 2023

Clinical Focus Monthly Newsletter – August 2023

Clinical Focus Monthly Newsletter – July 2023

Clinical Focus Monthly Newsletter – May 2023

Clinical Focus Monthly Newsletter – April 2023

Clinical Focus Monthly Newsletter – March 2023

Clinical Focus Monthly Newsletter – February 2023

Clinical Focus Monthly Newsletter – January 2023

Clinical Focus Monthly Newsletter - 2022

Clinical Focus Monthly Newsletter – December 2022

Clinical Focus Monthly Newsletter – November 2022

Clinical Focus Monthly Newsletter – September 2022

Clinical Focus Monthly Newsletter – August 2022

Clinical Focus Monthly Newsletter – July 2022

Clinical Focus Monthly Newsletter – June 2022

Clinical Focus Monthly Newsletter – May 2022

Clinical Focus Monthly Newsletter – April 2022

Clinical Focus Monthly Newsletter – March 2022

Clinical Focus Monthly Newsletter – February 2022

Oncology & Translational Research Newsletter

Oncology consortia monthly newsletter - 2024.

Oncology Consortia Monthly Newsletter – May 2024

Oncology Consortia Monthly Newsletter – April 2024

Oncology Consortia Monthly Newsletter – March 2024

Oncology Consortia Monthly Newsletter – February 2024

Oncology Consortia Monthly Newsletter – January 2024

Oncology Consortia Monthly Newsletter - 2023

Oncology Consortia Monthly Newsletter – December 2023

Oncology Consortia Monthly Newsletter – November 2023

Oncology Consortia Monthly Newsletter – October 2023

Oncology Consortia Monthly Newsletter – September 2023

Oncology Consortia Monthly Newsletter – August 2023

Oncology Consortia Monthly Newsletter – July 2023

Oncology Consortia Monthly Newsletter – June 2023

Oncology Consortia Monthly Newsletter – May 2023

Oncology Consortia Monthly Newsletter – April 2023

Oncology Consortia Monthly Newsletter – March 2023

Oncology Consortia Monthly Newsletter – February 2023

Oncology Consortia Monthly Newsletter – January 2023

Oncology Consortia Monthly Newsletter - 2022

Oncology Consortia Monthly Newsletter – December 2022

Oncology Consortia Monthly Newsletter – November 2022

Oncology Consortia Monthly Newsletter – October 2022

Oncology Consortia Monthly Newsletter – September 2022

Oncology Consortia Monthly Newsletter – August 2022

Oncology Consortia Monthly Newsletter – July 2022

Oncology Consortia Monthly Newsletter – June 2022

Oncology Consortia Monthly Newsletter – May 2022

Oncology Consortia Monthly Newsletter – April 2022

Oncology Consortia Monthly Newsletter – March 2022

Oncology Consortia Monthly Newsletter – February 2022

Oncology Consortia Monthly Newsletter – January 2022

Subscribe to Our Newsletter

(We are GDPR compliant, as your info is for our internal use only. We never sell or share your info, ever.)

- Comments This field is for validation purposes and should be left unchanged.

Explore Resources

Welcome to Contract Pharma

Login join welcome to -->, subscribe free magazine enewsletter magazine enewsletter --> checkout.

- Breaking News

- Collaborations & Alliances

- Custom Sourcing News

- Financial Reports

- Industry News

- Packaging & Tracking

- Pharma Matters Q&A

- Promotions & Moves

- Reader Showcase

- Trials & Filings

Intego Clinical Expands into Latin America with New Office

Parexel, Palantir Expand AI Alliance

Veeda Clinical Research Acquires European CRO, Heads

WCG Expands Statistical Consulting Solutions

Celerion Obtains CLIA Certification for Its Bioanalytical Lab

Magnitude Biosciences CEO Acknowledged as a Game-Changing Industry Leader

Sai Life Sciences Expands DMPK Services

Biognosys Opens New Proteomics Facility in MA

EUROAPI, SpiroChem Partner on CRO-CDMO Services

Ichor Life Sciences Expands Clinical Trial Services

iuvo BioScience Acquires Promedica International

Fortrea, Veeva, Advarra Partner on Clinical Trial Experience

Emmes Group to Build Clinical Research Infrastructure

Medable Introduces Automation Technology for Clinical Trials Platform

Velocity Expands Clinical Sites Biz in Europe

ZyVersa Engages George Clinical for Phase 2a Trial

Applied StemCell Expands Leadership Team

Symbio & Dow Group Merge with Proinnovera

Odyssey Health Selects Syneos to Support Concussion Treatment Trial

Permira Advisors Acquires Ergomed for £703.1M

- Lilly Licenses QurAlis’ ALS Precision Therapy for $45M Upfront

- PhoreMost Achieves Second Boehringer Milestone in Target Discovery Alliance

- Navigate BioPharma Services Launches Assay for Radioligand Therapies

- Bionova Scientific to Open New Plasmid DNA GMP Facility in TX

- Thermo Fisher Opens New GMP Ultra-cold Facility in the EU

- CDMOs: The Cornerstone of Biopharmaceutical Innovation

- Pharma 4.0: CDMOs Digitalize to Enhance Customer Value

- CEO Spotlight: Gaston Salinas

- Parenteral Perspectives

- The Transformative Potential of Gene Therapy

- Cell & Gene Therapy Outsourcing

- Creating Solutions for CDMOs: An EPCMV Firm’s Perspective

- Single-use Fermenters for Microbial Biopharma Development & Manufacturing

Cookies help us to provide you with an excellent service. By using our website, you declare yourself in agreement with our use of cookies. You can obtain detailed information about the use of cookies on our website by clicking on "More information”. Got It

- Privacy Policy

- Terms And Conditions

Latest Breaking News From Nutraceuticals World

Latest Breaking News From Coatings World

Latest Breaking News From Medical Product Outsourcing

Latest Breaking News From Contract Pharma

Latest Breaking News From Beauty Packaging

Latest Breaking News From Happi

Latest Breaking News From Ink World

Latest Breaking News From Label & Narrow Web

Latest Breaking News From Nonwovens Industry

Latest Breaking News From Orthopedic Design & Technology

Latest Breaking News From Printed Electronics Now

Copyright © 2024 Rodman Media. All rights reserved. Use of this constitutes acceptance of our privacy policy The material on this site may not be reproduced, distributed, transmitted, or otherwise used, except with the prior written permission of Rodman Media.

AD BLOCKER DETECTED Our website is made possible by displaying online advertisements to our visitors. Please consider supporting us by disabling your ad blocker.

Making explorers dreams happen

We create value for the life science industry by rapidly identifying and delivering clinical development solutions.

Search our services by patient access or therapeutic areas

Alice Catherine Evans (1881 – 1975), American Microbiologist

News & Articles

We stay proactive and think big. Stay informed about our latest research news.

Clinical Trial Careers

From pharmacovigilance to clinical research specialists and everything in between, you’ll make an impact on the livelihood and wellbeing of people.

Investigative site network

We value your contribution to improving healthcare. Join our research organization in bringing lifechanging therapies directly to the ones who matter most.

Discover the real world of clinical trials.

From the patient perspective.

“For us, innovation is a development strategy that allows us to differentiate our FSP offerings by including the most advanced technology in a sensible and responsible manner.”

“Modern R&D is certainly continuing to push the bar for the application of innovative therapies. (…) Consulting options are readily available and provide access to like-minded teams that can facilitate commercialization at the right pace and an acceptable cost.”

“My ultimate hope working as a CTO for a growing and successful CRO is that we see a new DCT solution that builds from a core platform and then leverages this core in the development of component parts in order to achieve a true clinical trial lifecycle… for all stakeholders.”

- Applied Clinical Trials

This website collects only necessary cookies and analytical cookies; no personal identifiable information will be collected.

By clicking “Accept All Cookies,” you will allow us to gain valuable insights to enhance your user experience and our website.

Leading Change in Cancer Clinical Research, Because Our Patients Can’t Wait

May 31, 2024 , by W. Kimryn Rathmell, M.D., Ph.D., and Shaalan Beg, M.D.

Greater use of technologies that can increase participation in cancer clinical trials is just one of the innovations that can help overcome some of the bottlenecks holding up progress in clinical research.

Thanks to advances in technology, data science, and infrastructure, the pace of discovery and innovation in cancer research has accelerated, producing an impressive range of potential new treatments and other interventions that are being tested in clinical studies . The extent of the innovative ideas that might help people live longer, improve our ability to detect cancer early, or otherwise transform care is staggering.

Our understanding of tumor biology is also evolving, and those gains in knowledge are being translated into the continued discovery of targets for potential interventions and the development of novel types of treatments. Some of these therapies are producing unprecedented clinical responses in studies, including in traditionally difficult-to-treat cancers.

These advances have contributed to a record number of Food and Drug Administration (FDA) approvals in recent years with, arguably, the most notable approvals being those for drugs that can be used for any cancer, regardless of where it is in the body .

In some instances, the activity of new agents has been so profound that clinical investigators are having to rethink their criteria for implementation in patient care and their definitions of treatment response.

For example, although HER2 has been a known therapeutic target in breast cancer for many decades, the new antibody-drug conjugates (ADCs) that target HER2 have proven to be vastly more effective than the original HER2-targeted therapies. This has forced researchers to rethink fundamental questions about how these ADCs are used in patient care: Can they be effective in people whose tumors have lower expression of HER2 than we previously thought was needed ? And, if so, do we need to redefine how we classify HER2-positive cancer?

As more innovative therapies like ADCs hit the clinic at a far more rapid cadence than ever before, the research community is being inundated with such fundamentally important questions.

However, the remarkable progress we're experiencing with novel new therapies is tempered by a critical bottleneck: the clinical research infrastructure can’t be expected to keep pace in this new landscape.

Currently, many studies struggle to enroll enough participants. At the same time, there are patients who don’t have ready access to studies from which they might benefit. Furthermore, ideas researchers have today for studies of innovative new interventions might not come to fruition for 2 or 3 years, or even longer—years that people with cancer don’t have.

The key to overcoming this bottleneck is to invite innovation to help reshape our clinical trials infrastructure. And here’s how we plan to accomplish that.

Testing Innovation in Cancer Clinical Trials

A transformation in cancer clinical research is already underway. That transformation has been led in part by the success of novel precision oncology approaches, such as those tested in the NCI-MATCH trial .

This innovative study ushered in novel ways of recruiting participants and involving oncologists at centers big and small. And NCI-MATCH has spawned several successor studies that are incorporating and building on its innovations and achievements.

An innovation that emerged from the COVID pandemic was the increase of remote work, even in the clinical trials domain. Indeed, staffing shortages have caused participation in NCI-funded trials to decline. In response, NCI is piloting a Virtual Clinical Trials Office to offer remote support staff to participating study sites. This support staff includes research nurses, clinical research associates, and data specialists, all of whom will help NCI-Designated Cancer Centers and community practices engaged in clinical research activities.

Such technology-enabled services can allow us to reimagine how clinical trials are designed and run. This includes developing technologies and processes for remotely identifying clinical trial participants, shipping medications to participants at home, having imaging performed in the health care settings where our patients live, and empowering local physicians to participate in clinical trials.

We also need mechanisms to test and implement innovations in designing and conducting clinical studies.

For example, NCI recently established the Clinical Trials Innovation Unit (CTIU) to pressure test a variety of innovations. One of the first trials to emerge from the CTIU’s initial efforts was the Pragmatica-Lung Cancer Treatment Trial , a phase 3 study designed to be easy to launch, enroll, and interpret its results.

The CTIU, which includes leadership from FDA and NCI’s National Clinical Trials Network , is already working on future innovations, including those that will streamline data collection and apply innovative approaches for other cancers, all with the goal of making cancer clinical studies less burdensome to run and easier for patients to participate.

Data-Driven Solutions

The era of data-driven health care is here, providing still more opportunities to transform cancer clinical research.

The emergence of artificial intelligence (AI) solutions, large language models, and informatics brings real potential for wholesale changes in how we match patients to clinical studies, assess side effects, and monitor events like disease progression.

Recognizing this potential, NCI is offering funding opportunities and other resources that will fuel the development of AI tools for clinical research, allow us to carefully test their usefulness, and ultimately deploy them across the oncology community.

Creating Partnerships and Expanding Health Equity

To be sure, none of this will be, or can be, done by NCI alone. All these innovations require partnerships. We will increase our engagement with partners in the public- and private-sectors, including other government agencies and nonprofits.

That includes high-level engagement with the Office of the National Coordinator for Health Information Technology (ONC), with input from FDA, Centers for Medicare & Medicaid Services, and Centers for Disease Control and Prevention.

Dr. W. Kimryn Rathmell, M.D., Ph.D.

NCI Director

One example of such a partnership is the USCDI+ Cancer program . Conducted under the auspices of the ONC, this program will further the aims of the White House's reignited Cancer Moonshot SM by encouraging the adoption and utilization of interoperable cancer health IT standards, providing resources to support cancer-specific use cases, and promoting alignment between federal partners.

And just as importantly, the new partnerships we create must include those with patients, advocates, and communities in ways we have never considered before.

A central feature of this community engagement must involve intentional efforts to expand health equity, to create study designs that are inclusive and culturally appropriate. Far too many marginalized communities and populations today are further harmed by studies that fail to provide findings that apply to their unique situations and needs.

Very importantly, the future will require educating our next generation of clinical investigators and empowering them with the tools that enable new ways of managing clinical studies. By supporting initiatives spearheaded by FDA and professional groups like the American Society of Clinical Oncology, NCI is making it easier for community oncologists to participate in clinical trials and helping clarify previously misunderstood regulatory requirements.

These efforts must also ensure that we have a clinical research workforce that is representative of the people it is intended to serve. Far too many structural barriers have prevented this from taking place in the past, and it’s time for that to change.

Expanding our capacity doesn’t mean doing more of the same, it means challenging ourselves to work differently. This will let us move forward to a new state, one in which clinical research is integrated in everyday practice. It is only with more strategic partnerships and increased inclusivity that we can open the doors to seeing clinical investigation in new ways, with new standards for success.

A Collaborative Effort

Shaalan Beg, M.D.

Senior Advisor for Clinical Research

To make the kind of progress we all desire, we have to recognize that our clinical studies system needs to evolve.

There was a time when taking years to design, launch, and complete a clinical trial was acceptable. It isn’t acceptable anymore. We are in an era where we have the tools and the research talent to make far more rapid progress than we have in the past.

And we can do that by engaging with many different communities and stakeholders in unique and dynamic ways—making them partners in our effort to end cancer as we know it.

Together, our task is to capitalize on this work so we can move faster and enable cutting-edge research that benefits as many people as possible.

We also know that there are more good ideas in this space, and part of this transformation includes grass roots efforts to drive systemic change. So, we encourage you to share your ideas on how we can transform clinical research. Because achieving this goal can’t be done by any one group alone. We are all in this together.

Featured Posts

March 27, 2024, by Edward Winstead

March 21, 2024, by Elia Ben-Ari

March 5, 2024, by Carmen Phillips

- Biology of Cancer

- Cancer Risk

- Childhood Cancer

- Clinical Trial Results

- Disparities

- FDA Approvals

- Global Health

- Leadership & Expert Views

- Screening & Early Detection

- Survivorship & Supportive Care

- February (6)

- January (6)

- December (7)

- November (6)

- October (7)

- September (7)

- February (7)

- November (7)

- October (5)

- September (6)

- November (4)

- September (9)

- February (5)

- October (8)

- January (7)

- December (6)

- September (8)

- February (9)

- December (9)

- November (9)

- October (9)

- September (11)

- February (11)

- January (10)

- News & Events

- Press releases

ICON acquisition creates world-leading healthcare intelligence and clinical research organisation

Dublin, Ireland, 1st July 2021 – ICON plc , (NASDAQ: ICLR) today announced the completion of its acquisition of PRA Health Sciences. The combined company will retain the name ICON and will bring together 38,000 employees across 47 countries, creating the world’s most advanced healthcare intelligence and clinical research organisation.

The combined company will leverage its enhanced operations to transform clinical trials and accelerate biopharma customer’s commercial success through the development of much needed medicines and medical devices. The new ICON will have a renewed focus on leveraging data, applying technology and accessing diverse patient populations to speed up drug development.

Transaction close details

Upon completion of the acquisition, pursuant to the terms of the merger agreement, PRA became a wholly owned subsidiary of ICON plc. Under the terms of the merger, PRA shareholders received per share $80 in cash and 0.4125 shares of ICON stock. The trading of PRA common stock on Nasdaq was suspended prior to market open on July 1, 2021.

Investor enquiries :

Brendan Brennan, CFO +35312912000

Jonathan Curtain, VP, Corporate Finance & Investor Relations +35312912000

Media enquiries :

Weber Shandwick (PR adviser) Lisa Henry (GMT timezone) +447785 458203

About ICON plc

ICON plc is a world-leading healthcare intelligence and clinical research organisation. From molecule to medicine, we advance clinical research providing outsourced services to pharmaceutical, biotechnology, medical device and government and public health organisations. We develop new innovations, drive emerging therapies forward and improve patient lives. With headquarters in Dublin, Ireland, ICON will operate from 150 locations in 47 countries and have approximately 38,000 employees as of July 1, 2021.

ICON and PRA Health Sciences

Cautionary note regarding forward-looking statements.

This press release contains forward-looking statements. These statements are based on management's current expectations and information currently available, including current economic and industry conditions. These statements are not guarantees of future performance or actual results, and actual results, developments and business decisions may differ from those stated in this press release. The forward-looking statements are subject to future events, risks, uncertainties and other factors that could cause actual results to differ materially from those projected in the statements, including, but not limited to, the ability to enter into new contracts, maintain client relationships, manage the opening of new offices and offering of new services, the integration of new business mergers and acquisitions, the impact of COVID-19 on our business, as well as other economic and global market conditions and other risks and uncertainties detailed from time to time in SEC reports filed by ICON, all of which are difficult to predict and some of which are beyond our control. For these reasons, you should not place undue reliance on these forward-looking statements when making investment decisions. The word "expected" and variations of such words and similar expressions are intended to identify forward-looking statements. Forward-looking statements are only as of the date they are made and we do not undertake any obligation to update publicly any forward-looking statement, either as a result of new information, future events or otherwise. More information about the risks and uncertainties relating to these forward-looking statements may be found in SEC reports filed by ICON, including its Form 20-F, F-1, F-4, S-8 and F-3, which are available on the SEC's website at http://www.sec.gov.

In this section

- In the News

- Facts and figures

- ICON spokespeople

- Financial Times US Pharma and Biotech Summit

- Social media

Connect with us

- Submit proposal request

- Update Email Preferences

- Global office locator

- ICON on social media

How can we help?

- Cell and Gene Therapies

- Early Clinical

- Medical Device

- Rare & Orphan Diseases

- Real World Evidence

- Site & Patient Recruitment

- Strategic Solutions

Guest Column | August 9, 2023

A shift toward trial site management organizations: trends and implications for sponsors.

By Matthew Wheeler, managing director and partner, L.E.K. Consulting

Clinical trial sponsors face a range of evolving dynamics today that are changing how trials are executed. Macro trends across biopharma include an expanding pipeline and trial volume (especially pronounced in certain therapeutic areas and modalities such as oncology and specialty drugs), increasingly complex trial designs, and evolving trial site and pharma service provider landscapes. Sponsors must acknowledge and consider implications arising from these trends and adjust their organizational strategies accordingly to position themselves for success going forward.

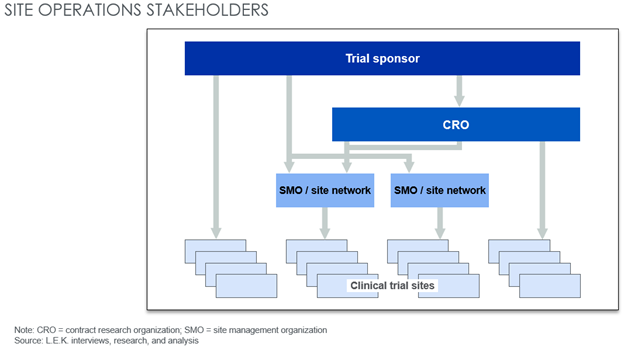

Within the trial site landscape, emerging site management organizations (SMOs) own multiple commercial clinical trial sites and offer dedicated site management services and a single touchpoint for sponsors conducting trials (see Figure 1). SMOs provide a range of value-added clinical services to sponsors, including:

- recruiting patients and facilitating longitudinal management/retention,

- identifying, selecting, and contracting with appropriate trial sites,

- handling regulatory documentation and monitoring ongoing compliance, and

- capturing and reporting trial data.

Although SMOs still account for a relatively small portion of total clinical trial patient volume at dedicated sites (estimated at 10%-20% in 2023), they play an important role in a landscape that has begun to experience consolidation as SMOs, often backed by private equity, look to achieve further scale through acquiring independent sites. In turn, sponsors are increasingly partnering with SMOs for trial execution as they recognize the value that SMOs can provide to trials and organizational success.

Underlying this partnering trend is the reality that sponsors are designing increasingly expensive and complex clinical trials, with more complicated therapies and niche patient populations, which has fundamentally enhanced the SMO value proposition. Through centralized and standardized functions, SMOs can enable faster trial start-up times and effective patient recruitment and retention, ensure timelines and data readout dates are met, and reduce overall costs.

Overall, a sponsor’s decision to partner with and select an SMO for trial execution brings new questions sponsors must consider. However, sponsors can prepare for tomorrow’s new normal through understanding key trends related to SMOs, the implications they have on sponsor trial execution, and incorporating this into organizational strategy going forward.

In this paper, we discuss the key trends shaping the SMO landscape and value proposition, what implications these trends have for trial sponsors, and how sponsors can adapt to these evolving conditions.

Figure 1: Potential stakeholders for clinical trial sponsors

Sponsor Use Of SMOs Is On The Rise

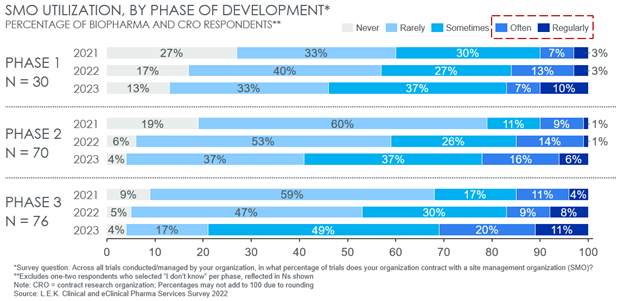

According to 2022 data from global strategy consulting firm L.E.K. Consulting’s inaugural Clinical and eClinical Pharma Services Survey 1 , biopharma sponsors and CROs have increased their utilization of SMOs since 2021 across phases, but particularly in later-stage trials. Overall, 31% of survey respondents expect to utilize SMOs “often” or “regularly” for Phase 3 trials in 2023, double that of just 15% in 2021. A similar twofold increase was expected in Phase 2 trials, from 10% to 22% (see Figure 2).

Beyond increasing overall use, a key trend from this data is an increased expectation by sponsors to utilize SMOs for later-stage trials. A total of 20% and 31% of respondents expect to use SMOs “often” or “regularly” for Phase 2 and Phase 3 trials, respectively, compared to only 17% for Phase 1. As assets progress to later-stage trials, protocols generally require higher patient counts, more sites, and more complex data collection and reporting for both safety and efficacy endpoints. Additionally, later-stage trials are more likely to be conducted over a dispersed range of geographies with varied regulatory dynamics. Together, these factors have introduced or emphasize common trial pain points that scaled SMOs look to address and work to amplify the potential SMO value proposition.

Figure 2: Sponsor current and expected SMO utilization across development phases

Implications For Clinical Trial Sponsors

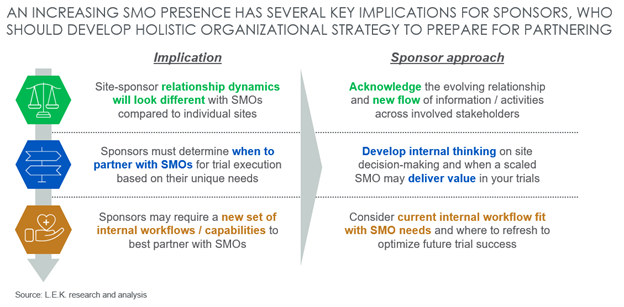

Given that sponsors expect SMO utilization to increase going forward, especially for later-stage trials, it is imperative that sponsors begin to develop organizational awareness and thinking on how this impacts strategy. Broader clinical trial trends (e.g., growing advanced modality pipeline requiring complex trial protocols, rise of personalized medicines targeting niche patient populations and introducing challenges to effective recruitment/retention, etc.) may serve to further drive the SMO value proposition and utilization for unique trial use cases. Biopharma sponsors can best prepare for tomorrow’s new normal by understanding and developing a holistic strategy around three key implications posed by an increasing SMO presence (see Figure 3):

- Sponsors will interface with SMOs differently than with individual sites and may expect that the “center of gravity” in the relationship could gradually shift from the historic norm.

- Sponsors must determine when SMOs are the right choice for them based on their unique trial needs and the degree to which their trials could benefit from the SMO value proposition.

- Sponsors that proactively review and refresh internal workflows/processes will be better prepared to partner with SMOs effectively and drive future trial success.

Figure 3: SMO implications for sponsors

Interfacing With SMOs Will Look Different

Sponsors should first acknowledge that the relationship with a scaled, central SMO can be fundamentally different than that with individual sites in carrying out clinical trials. Call-points may be different, there will be more coordination across sites required, etc. This makes it crucial for sponsors to understand an SMO’s organizational structure, responsibilities, and central policies/processes for trial oversight. Sponsors must ensure that the “right people” are in the room for important updates and discussions across the trial life cycle and that the SMO can effectively communicate key messages down to individual sites and coordinate activities across levels (and also communicate site-level messaging back to the center for distribution to other trial sites).

There is also potential for the center of gravity in site-sponsor relationships to evolve, as SMOs gain more scale and critical mass. Historically, sponsors have dealt with a site universe that is highly fragmented and disparate. As SMOs scale and drive consolidation, this dynamic evolves and implications for site-sponsor interactions have the potential to evolve, too.

Sponsors Must Identify Unique Trial Needs, Potential SMO Value

While SMOs are expected to play a larger role in the clinical trial landscape going forward, sponsors will still have flexibility of working with scaled partners vs. individual sites. Understanding the benefits that an SMO brings — and when those are most relevant — can help sponsors better choose when to proactively seek out the support of an SMO.

As previously shown, sponsors expect to partner with SMOs more often in later-stage clinical trials, where scale may enable SMOs to address common pain points (e.g., more challenging patient recruitment and retention, ensuring operational consistency/management across a wide range of geographies with varied regulatory landscapes, complex data collection and reporting, etc.).

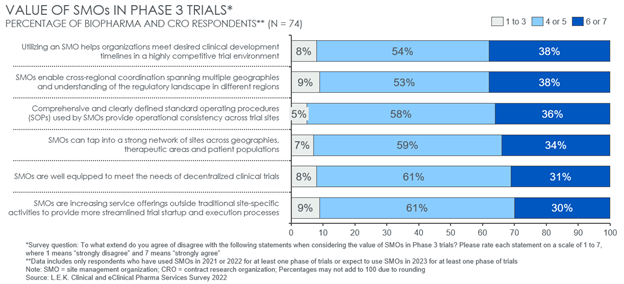

In examining the SMO value proposition further, L.E.K.’s survey found that sponsors value SMO partnerships in addressing several common challenges that often peak in late-stage trials. Specifically, respondents view SMO’s greatest potential value-add in Phase 3 is to (see Figure 4):

- Help meet desired clinical development timelines.

- Enable cross-regional coordination and understand regulatory dynamics across geographies.

- Leverage comprehensive and clearly defined standard operating procedures to ensure cross-site consistency.

For those trials where operations and success hinge on a tight development timeline or strong coordination of activities across a diverse range of geographies, partnering with an SMO may be an attractive option, and sponsors should be proactively considering doing so. These benefits may be more muted in trials requiring fewer total sites across a narrower regional footprint, for example.

Figure 4: SMO value proposition to sponsors in Phase 3 trials

Sponsors Should Review Internal Workflows Before SMO Partnership

Realizing that SMOs will likely play a larger role in the trial landscape going forward, sponsors should review their current internal workflows and site identification processes. Today, most site identification and start-up activity is geared around site-specific workflows. As SMOs allow for more centralized identification, contracting, and start-up, clinical operations workflows will need to adapt to better accommodate this new model. Many of the key pain points associated with clinical operations (i.e., site identification, contracting and budgeting, study start-up and training, patient recruitment coordination, payments and reimbursements) will require modified process flows moving forward. This provides an opportunity to create more seamless and streamlined operations — if dealt with proactively; otherwise, this could add complexity to already challenged operational steps.

The Time Is Now To Consider SMOs

As the complexity of drug development and trial execution continues to increase, the value created by top-performing sites (both operationally and scientifically) is more pronounced than ever before.

Now is the time for sponsors to develop organizational awareness of SMOs and their value proposition and start thinking about how to adapt and win in an evolving clinical trial landscape where scaled SMOs are expected to play an increasing role. Sponsors would first do well to keep a close eye on how the trends discussed in this article unfold in the near-term — whether and how fast SMOs capture a greater percentage of trial volume and that they establish a track record of delivering on the hypothesized value proposition through their scale and centralized operations. Beyond awareness and monitoring, sponsors should begin to think about how they will plan to leverage SMO relationships for their unique needs, and what internal investments/capabilities should be considered in working with them. If these trends materialize as expected, sponsors that have been proactive in preparing to work with and enable SMO success will in turn be well positioned for future trial and organizational success.

Read more coverage from L.E.K. Consulting on the site landscape in our white paper: Exploring the Risks and Opportunities within Clinical Site Management .

About The Author:

Acknowledgements:

The author would like to thank L.E.K. Consulting colleagues Arturo Garza-Gongora, Lee Miller, and Jenny Hammer for their support in developing this article.

References:

1. L.E.K. Consulting 2022 Clinical and eClinical Pharma Services Survey includes respondents employed in U.S., Canada, the U.K., and EU4

Like what you are reading?

Sign up for our free newsletter, newsletter signup.

Novotech Launches Dedicated Early Phase Unit for Biotechs Leveraging the Australian and New Zealand Clinical Environment

SAN DIEGO, June 03, 2024 (GLOBE NEWSWIRE) -- Novotech, the global full-service Contract Research Organization (CRO) that partners with biotech companies to accelerate the development of advanced and novel therapeutics at every phase, today announced the launch of a dedicated early phase unit focussed on leveraging the unique advantage of Australian and New Zealand (ANZ) for early phase clinical development.

This Early Phase Strategic Delivery Unit (EP SDU) is the first in a series of new Strategic Delivery Units (SDUs) to be launched by Novotech over the course of 2024, each one being a dedicated delivery unit with specialist teams and tailored processes, for different types of complex clinical trials.

Novotech has long been a partner of choice for biotechs wanting to conduct early phase trials in ANZ and benefit from the clinical and scientific excellence, attractive financial rebates, and rapid start-up with streamlined regulatory processes.

Novotech CEO Dr John Moller said: “Our Early Phase Strategic Delivery Unit ensures that, as our global operations continue to grow, our commitment to excellence in Phase I delivery across ANZ remains a core and integral part of Novotech's service offering. This continues to serve as a platform for our biotech clients to expedite their early phase work before expanding into later phase global development with Novotech.”

Lynda Bluck, Director of Early Phase Project Management, who brings over 20 years of clinical trial experience said: “The EP SDU consists of a multidisciplinary team of experts in early phase clinical trials who provide support, expertise, guidance, and oversight to all our early phase projects, ensuring consistent high quality operational delivery.”

“ANZ is an attractive destination for early phase biotechs as it offers rapid, cost-effective, and high-quality clinical development solutions,” said Bluck.

“Novotech has more than 30 years of experience in conducting early phase clinical trials in ANZ with a reputation for consistently delivering high quality data that is accepted by international regulatory agencies.”

“Our team offers proven optimized processes for rapid and efficient execution of Phase I clinical trials and are committed to helping our sponsors navigate both the preclinical and clinical stages of drug development.”

Bluck said central to the EP SDU’s offering is integrated engagement with Novotech's world-class Drug Development Consulting (DDC) team.

“The DDC is a full-service global product development and strategic regulatory group that supports sponsors through every phase of clinical development. The expert team is particularly integral in providing guidance and support prior to entering Phase I and ensuring our sponsors are HREC (IRB equivalent) ready,” said Scott Schliebner, Novotech’s Vice President of Drug Development Consulting.

Novotech's DDC team provides comprehensive "lab to launch" program development services, including regulatory strategy and operations, CMC and product/analytical consulting, clinical oversight, toxicology and other nonclinical consulting, quality/GMP consulting, and electronic submissions. We have a proven track record of successful FDA meetings and approvals.

The teams have the expertise to support projects over their entire lifecycle, all the way from preclinical development through to approval and post-marketing.

About Novotech Novotech-CRO.com

Founded in 1997, Novotech is a global full-service clinical Contract Research Organization (CRO) focused on partnering with biotech companies to accelerate the development of advanced and novel therapeutics at every phase.

Recognized for its industry-leading contributions, Novotech has received numerous prestigious awards, including the CRO Leadership Award 2023, the Asia Pacific Cell & Gene Therapy Clinical Trials Excellence 2023, the Asia-Pacific Contract Research Organization Company of the Year Award since 2006.

The Company offers a comprehensive suite of services including laboratories, Phase I facilities, drug development consulting, regulatory expertise, and has experience with over 5,000 clinical projects, including Phase I to Phase IV clinical trials and bioequivalence studies. With a presence in 34 office locations and a dedicated team of 3,000+ professionals worldwide, Novotech is a trusted end-to-end strategic partner of choice.

For more information or to speak to an expert team member visit www.Novotech-CRO.com

Why Catalyst Clinical Research?

You need someone to listen to your needs. You need a catalyst for your drug development needs.

Catalyst provides highly customizable clinical trial and drug development solutions to the global biotechnology and biopharmaceutical industries through our Catalyst Oncology and Catalyst Flex. Through these two solutions, Catalyst offers a full-service oncology CRO and multi-therapeutic functional service provider services.

With Catalyst, you can always count on us. We are a catalyst.

Get the latest news and press releases from Catalyst Clinical Research

- Privacy Overview

- Strictly Necessary Cookies

- 3rd Party Cookies

- Additional Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

This website uses Google Analytics to collect anonymous information such as the number of visitors to the site, and the most popular pages.

Keeping this cookie enabled helps us to improve our website.

Please enable Strictly Necessary Cookies first so that we can save your preferences!

This website uses the following additional cookies:

(List the cookies that you are using on the website here.)

2024: An Endeavor into the Enigma - Uncovering the Substance of CROs

Reflecting on the complexities inherent in the acronyms CRO (Clinical Research Organization) and CRA (Clinical Research Associate) indeed reveals a multifaceted landscape within the realm of clinical research. For those deeply entrenched in the nuances of clinical inquiry, understanding the operational mechanisms of CROs emerges as a pivotal journey delving into the uncharted territories of healthcare advancement. Whether venturing into the realms of clinical research for the first time or seeking a renewed perspective, delving into the semantic intricacies of CROs and unlocking their transformative potential in healthcare becomes an essential exploration, propelling organizations towards unparalleled developmental heights.

The Essence of a CRO:

Clinical Research Organizations, abbreviated as CROs, epitomize entities entrusted with the management of clinical trials on behalf of pharmaceutical and biotechnological giants. Their mandates encompass the selection of patients, procurement of informed consent, aggregation of data, and the persistent oversight of safety protocols. CROs are broadly categorized into two overarching classifications: full-service CROs, offering a spectrum of services essential for clinical trials, and specialized CROs, focusing their expertise on specific areas such as patient enrollment or data management.

The Era of CRO Dominance:

A seismic shift characterizes the ascendancy of CROs in recent chronicles. The tally of clinical trials orchestrated by CROs surged from 9,000 in 2006 to a staggering 26,000 in 2016. This remarkable ascent fundamentally attributes itself to the accessible expertise and efficiency that CROs demonstrate, all at a cost-effective rate compared to traditional avenues of research. Moreover, the integration of CROs into the operational framework enables pharmaceutical and biotechnological entities to sharpen their core competencies while concurrently mitigating the looming specter of clinical setbacks.

Navigating the Intersection of Costs and Benefits:

However, amidst the commendable merits inherent in CRO engagement, a caveat looms ominously. Skepticism burgeons regarding the equivalence of expertise, with concerns revolving around the potential discrepancy in data quality vis-à-vis conventional research entities. A lingering unease surfaces, questioning the parity of commitment to patient safety between CROs and their traditional counterparts. Navigating through the intricate labyrinth of CRO utilization necessitates a judicious assessment, a meticulous weighing of the benefits against the potential pitfalls in the steadfast pursuit of advancing the uncharted territories of healthcare improvement.

Clinical investigate organizations, recognized as contract inquire about substances, expand outsourced administrations to the pharmaceutical and biotechnology divisions. These organizations organize clinical trials for inventive pharmaceuticals and restorative approaches. The engagement of CROs can be started either by the pharmaceutical companies themselves or by the scholastic teach initiating the trials. The CRO industry has been encountering exponential development in later a long time. In 2024, the worldwide CRO administrations showcase gathered an evaluated $25.1 billion in 2024, with projections showing a compound yearly development rate of 7.5% over the resulting five a long time. Clinical inquire about administrations constituted the most considerable share of this advertise, measuring to $19.8 billion in 2024. Multiple variables contribute to the thriving of the CRO industry. At first, there has been a essential surge in the around the world conduct of clinical trials. Hence, a move from minute, casual trials to sweeping, formal trials overseen by commercial CROs has been watched. Thirdly, there is a recognizable uptick in the outsourcing slant among pharmaceutical and biotechnology enterprises. The essential on-screen characters in the CRO division include major multinational substances such as QuintilesIMS, Covance, and Parexel. At the same time, an developing unexpected of littler CROs specializes in specific restorative spaces or particular trial categories, extending the industry's scope and diversity. So, what absolutely constitutes the modus operandi of a CRO in 2024? In pith, a CRO outfits a comprehensive cluster of administrations including consider conceptualization, ponder execution, watchfulness, information administration, and expository interests. Furthermore, they habitually apportion administrative backing administrations like creating entries and conducting administrative audits. The vital advantage of locks in a CRO dwells in its capacity to speed up the medicate advancement direction. By subcontracting select or whole clinical trial endeavors, pharmaceutical enterprises in 2024 stand to abridge consumptions and rescue time. CROs, blessed with capability in executing clinical trials, adeptly encourage effective and compelling trial executions, subsequently progressing the field of pharmaceutical investigate.

What are the benefits of Clinical Research Organizations?

There are many benefits to working with a Clinical Research Organization (CRO). Perhaps the most important benefit is that CROs can help you to move your clinical research program forward faster and more efficiently. They have the experience and expertise to help you manage all aspects of your study, from start to finish. This can save you a lot of time and money, as CROs know how to navigate the complex world of clinical research.

Another major benefit of using a CRO is that they can help you to reduce risk. By using their experience and knowledge, CROs can help you to select the right study participants, design the study correctly, and implement best practices throughout the study. This can help to minimize any potential risks involved in conducting your study.

Finally, CROs can also help sponsors save money. They have established relationships with vendors and suppliers, so they can often get better deals on study materials and services than you would be able to negotiate on your own. This can result in significant cost savings for your clinical research program.

What are the challenges of Clinical Research Organizations?