Bank Business Plan Template

Written by Dave Lavinsky

Bank Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their banks.

If you’re unfamiliar with creating a bank business plan, you may think creating one will be a time-consuming and frustrating process. For most entrepreneurs it is, but for you, it won’t be since we’re here to help. We have the experience, resources, and knowledge to help you create a great business plan.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write a bank business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What Is a Bank Business Plan?

A business plan provides a snapshot of your bank as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for Your Bank Business

If you’re looking to start a bank or grow your existing bank, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your bank to improve your chances of success. Your bank business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Banks

With regards to funding, the main sources of funding for a bank are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for banks.

Finish Your Business Plan Today!

How to write a business plan for a bank.

If you want to start a bank or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your bank business plan.

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of bank you are running and the status. For example, are you a startup, do you have a bank that you would like to grow, or are you operating a chain of banks?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overview of the bank industry.

- Discuss the type of bank you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail the type of bank you are operating.

For example, you might specialize in one of the following types of banks:

- Commercial bank : this type of bank tends to concentrate on supporting businesses. Both large corporations and small businesses can turn to commercial banks if they need to open a checking or savings account, borrow money, obtain access to credit or transfer funds to companies in foreign markets.

- Credit union: this type of bank operates much like a traditional bank (issues loans, provides checking and savings accounts, etc.) but banks are for-profit whereas credit unions are not. Credit unions fall under the direction of their own members. They tend to serve people affiliated with a particular group, such as people living in the same area, low-income members of a community or armed service members. They also tend to charge lower fees and offer lower loan rates.

- Retail bank: retail banks can be traditional, brick-and-mortar brands that customers can access in-person, online, or through their mobile phones. They also offer general public financial products and services such as bank accounts, loans, credit cards, and insurance.

- Investment bank: this type of bank manages the trading of stocks, bonds, and other securities between companies and investors. They also advise individuals and corporations who need financial guidance, reorganize companies through mergers and acquisitions, manage investment portfolios or raise money for certain businesses and the federal government.

In addition to explaining the type of bank you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of clients served, the number of clients with positive reviews, reaching X number of clients served, etc.

- Your legal business Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the bank industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the bank industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your bank business plan:

- How big is the bank industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your bank? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your bank business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, small businesses, families, and corporations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of bank you operate. Clearly, corporations would respond to different marketing promotions than individuals, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Bank Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other banks.

Indirect competitors are other options that customers have to purchase from that aren’t directly competing with your product or service. This includes trust accounts, investment companies, or the stock market. You need to mention such competition as well.

For each such competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as

- What types of customers do they serve?

- What type of bank are they?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide loans and retirement savings accounts?

- Will you offer products or services that your competition doesn’t?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a bank business plan, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type of bank company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you provide savings accounts, auto loans, mortgage loans, or financial advice?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your plan, you are presenting the products and/or services you offer and their prices.

Place : Place refers to the site of your bank. Document where your company is situated and mention how the site will impact your success. For example, is your bank located in a busy retail district, a business district, a standalone office, or purely online? Discuss how your site might be the ideal location for your customers.

Promotions : The final part of your bank marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Reach out to websites

- Distribute flyers

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your bank, including reconciling accounts, customer service, accounting, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to sign up your Xth customer, or when you hope to reach $X in revenue. It could also be when you expect to expand your bank to a new city.

Management Team

To demonstrate your bank’s potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing banks. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing a bank or successfully running a small financial advisory firm.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you see 5 clients per day, and/or offer sign up bonuses? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your bank, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a bank:

- Cost of furniture and office supplies

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your bank location lease or a list of accounts and loans you plan to offer.

Writing a business plan for your bank is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will understand the bank industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful bank.

Bank Business Plan Template FAQs

What is the easiest way to complete my bank business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily write your bank business plan.

How Do You Start a Bank Business?

Starting a bank business is easy with these 14 steps:

- Choose the Name for Your Bank Business

- Create Your Bank Business Plan

- Choose the Legal Structure for Your Bank Business

- Secure Startup Funding for Your Bank Business (If Needed)

- Secure a Location for Your Business

- Register Your Bank Business with the IRS

- Open a Business Bank Account

- Get a Business Credit Card

- Get the Required Business Licenses and Permits

- Get Business Insurance for Your Bank Business

- Buy or Lease the Right Bank Business Equipment

- Develop Your Bank Business Marketing Materials

- Purchase and Setup the Software Needed to Run Your Bank Business

- Open for Business

Don’t you wish there was a faster, easier way to finish your Bank business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how a Growthink business plan consultant can create your business plan for you.

Other Helpful Business Plan Articles & Templates

Need a business plan? Call now:

Talk to our experts:

- Business Plan for Investors

- Bank/SBA Business Plan

- Operational/Strategic Planning

- L1 Visa Business Plan

- E1 Treaty Trader Visa Business Plan

- E2 Treaty Investor Visa Business Plan

- EB1 Business Plan

- EB2 Visa Business Plan

- EB5 Business Plan

- Innovator Founder Visa Business Plan

- UK Start-Up Visa Business Plan

- UK Expansion Worker Visa Business Plan

- Manitoba MPNP Visa Business Plan

- Start-Up Visa Business Plan

- Nova Scotia NSNP Visa Business Plan

- British Columbia BC PNP Visa Business Plan

- Self-Employed Visa Business Plan

- OINP Entrepreneur Stream Business Plan

- LMIA Owner Operator Business Plan

- ICT Work Permit Business Plan

- LMIA Mobility Program – C11 Entrepreneur Business Plan

- USMCA (ex-NAFTA) Business Plan

- Franchise Business Planning

- Landlord Business Plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Cannabis business plan

- eCommerce business plan

- Online Boutique Business Plan

- Mobile Application Business Plan

- Daycare business plan

- Restaurant business plan

- Food Delivery Business Plan

- Real Estate Business Plan

- Business Continuity Plan

- Buy Side Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Examples

How to Write a Business Plan to Start a Bank

Published Feb.29, 2024

Updated Apr.23, 2024

By: Alex Silensky

Average rating 5 / 5. Vote count: 3

No votes so far! Be the first to rate this post.

Table of Content

Bank Business Plan Checklist

A bank business plan is a document that describes the bank’s goals, strategies, operations, and financial projections. It communicates the bank’s vision and value proposition to potential investors, regulators, and stakeholders. A SBA business plan should be clear, concise, and realistic. It should also cover all the essential aspects of the bank’s business model.

Here is a checklist of the main sections that you should keep in mind while building a bank business plan:

- Executive summary

- Company description

- Industry analysis

- Competitive analysis

- Service or product list

- Marketing and sales plan

- Operations plan

- Management team

- Funding request

- Financial plan

Sample Business Plan for Bank

The following is a bank business plan template that operates in the USA. This bank business plan example is regarding ABC Bank, and it includes the following sections:

Executive Summary

ABC Bank is a new bank for California’s SMBs and individuals. We offer convenient banking services tailored to our customers’ needs and preferences. We have a large target market with over 500,000 SMBs spending billions on banking services annually. We have the licenses and approvals to operate our bank and raised $20 million in seed funding. We are looking for another $30 million in debt financing.

Our goal is to launch our bank by the end of 2024 and achieve the following objectives in the first five years of operation:

- Acquire 100,000 customers and 10% market share

- Generate $100 million in annual revenue and $20 million in net profit

- Achieve a return on equity (ROE) of 15% and a return on assets (ROA) of 1.5%

- Expand our network to 10 branches and 50 ATMs

- Increase our brand awareness and customer loyalty

Our bank has great potential to succeed and grow in the banking industry. We invite you to read the rest of our microfinance business plan to learn about how to set up a business plan for the bank and how we will achieve our goals.

Industry Analysis

California has one of the biggest and most active banking industries in the US and the world. According to the Federal Deposit Insurance Corp , California has 128 financial institutions, with total assets exceeding $560 billion.

The California banking industry is regulated and supervised by various federal and state authorities. However, they also face several risks and challenges, such as:

- High competition and consolidation

- Increasing regulation and compliance

- Rising customer demand for digital and mobile banking

- Cyberattacks and data breaches

- Environmental and social issues

The banking industry in California is highly competitive and fragmented. According to the FDIC, the top 10 banks and thrifts in California by total deposits as of June 30, 2023, were:

Customer Analysis

We serve SMBs who need local, easy, and cheap banking. We divide our customers into four segments by size, industry, location, and needs:

SMB Segment 1 – Tech SMBs in big cities of California. These are fast-growing, banking-intensive customers. They account for a fifth of our market share and a third of our revenue and are loyal and referable.

SMB Segment 2 – Entertainment SMBs in California’s entertainment hubs. These are high-profile, banking-heavy customers. They make up a sixth of our market and a fourth of our revenue and are loyal and influential.

SMB Segment 3 – Tourism SMBs in California’s tourist spots. These are seasonal, banking-dependent customers. They represent a quarter of our market and a fifth of our revenue and are loyal and satisfied.

SMB Segment 4 – Other SMBs in various regions of California. These are slow-growing, banking-light customers. They constitute two-fifths of our market and a quarter of our revenue and are loyal and stable.

Competitive Analysis

We compete with other banks and financial institutions that offer similar or substitute products and services to our target customers in our target market. We group our competitors into four categories based on their size and scope:

1. National Banks

- Key Players – Bank of America, Wells Fargo, JPMorgan Chase, Citibank, U.S. Bank

- Strengths – Large customer base, strong brand, extensive branch/ATM network, innovation, robust operations, solid financial performance

- Weaknesses – High competition, regulatory costs, low customer satisfaction, high attrition

- Strategies – Maintain dominance through customer acquisition/retention, revenue growth, efficiency

2. Regional Banks

- Key Players – MUFG Union Bank, Bank of the West, First Republic Bank, Silicon Valley Bank, East West Bank

- Strengths – Loyal customer base, brand recognition, convenient branch/ATM network, flexible operations

- Weaknesses – Moderate competition, regulatory costs, customer attrition

- Strategies – Grow market presence through customer acquisition/retention, revenue optimization, efficiency

3. Community Banks

- Key Players – Mechanics Bank, Bank of Marin, Pacific Premier Bank, Tri Counties Bank, Luther Burbank Savings

- Strengths – Small loyal customer base, reputation, convenient branches, ability to adapt

- Weaknesses – Low innovation and technology adoption

- Strategies – Maintain niche identity through customer loyalty, revenue optimization, efficiency

4. Online Banks

- Key Players – Ally Bank, Capital One 360, Discover Bank, Chime Bank, Varo Bank

- Strengths – Large growing customer base, strong brand, no branches, lean operations, high efficiency

- Weaknesses – High competition, regulatory costs, low customer satisfaction and trust, high attrition

- Strategies – Disrupt the industry by acquiring/retaining customers, optimizing revenue, improving efficiency

Market Research

Our market research shows that:

- California has a large, competitive, growing banking market with 128 banks and $560 billion in assets.

- Our target customers are the SMBs in California, which is 99.8% of the businesses and employ 7.2-7.4 million employees.

- Our main competitors are national and regional banks in California that offer similar banking products and services.

We conclude that:

- Based on the information provided in our loan officer business plan , there is a promising business opportunity for us to venture into and establish a presence in the banking market in California.

- We should focus on the SMBs in California, as they have various unmet banking needs, preferences, behavior, and a high potential for growth and profitability.

Operations Plan

Our operational structure and processes form the basis of our operations plan, and they are as follows:

- Location and Layout – We have a network of 10 branches and 50 ATMs across our target area in California. We strategically place our branches and ATMs in convenient and high-traffic locations.

- Equipment and Technology – We use modern equipment and technology to provide our products and services. We have computers and software for banking functions; security systems to protect branches and ATMs; communication systems to communicate with customers and staff; inventory and supplies to operate branches and ATMs.

- Suppliers and Vendors – We work with reliable suppliers and vendors that provide our inventory and supplies like cash, cards, paper, etc. We have supplier management systems to evaluate performance.

- Staff and Management – Our branches have staff like branch managers, customer service representatives, tellers, and ATM technicians with suitable qualifications and experience.

- Policies and Procedures – We have policies for customer service, cash handling, card handling, and paper handling to ensure quality, minimize losses, and comply with regulations. We use various tools and systems to implement these policies.

Management Team

The following individuals make up our management team:

- Earl Yao, CEO and Founder – Earl is responsible for establishing and guiding the bank’s vision, mission, strategy, and overall operations. He brings with him over 20 years of banking experience.

- Paula Wells, CFO and Co-Founder – Paula oversees financial planning, reporting, analysis, compliance, and risk management.

- Mark Hans, CTO – Mark leads our technology strategy, infrastructure, innovation, and digital transformation.

- Emma Smith, CMO – Emma is responsible for designing and implementing our marketing strategy and campaigns.

- David O’kane, COO – David manages the daily operations and processes of the bank ensuring our products and services meet the highest standards of quality and efficiency.

Financial Projections

Our assumptions and drivers form the basis of our financial projections, which are as follows:

Assumptions: We have made the following assumptions for our collection agency business plan :

- Start with 10 branches, 50 ATMs in January 2024

- Grow branches and ATMs 10% annually

- 10,000 customers per branch, 2,000 per ATM

- 5% average loan rate, 2% average deposit rate

- 80% average loan-to-deposit ratio

- $10 average fee per customer monthly

- $100,000 average operating expense per branch monthly

- $10,000 average operating expense per ATM monthly

- 25% average tax rate

Our financial projections are as per our:

- Projected Income Statement

- Projected Cash Flow Statement

- Projected Balance Sheet

- Projected Financial Ratios and Indicators

Select the Legal Framework for Your Bank

Our legal structure and requirements form the basis of our legal framework, which are as follows:

Legal Structure and Entity – We have chosen to incorporate our bank as a limited liability company (LLC) under the laws of California.

Members – We have two members who own and control our bank: Earl Yao and Paula Wells, the founders and co-founders of our bank.

Manager – We have appointed Mark Hans as our manager who oversees our bank’s day-to-day operations and activities.

Name – We have registered our bank’s name as ABC Bank LLC with the California Secretary of State. We have also obtained a trademark registration for our name and logo.

Registered Agent – We have designated XYZ Registered Agent Services LLC as our registered agent authorized to receive and handle legal notices and documents on behalf of our bank.

Licenses and Approvals – We have obtained the necessary licenses and approvals to operate our bank in California, including:

- Federal Deposit Insurance Corporation (FDIC) Insurance

- Federal Reserve System Membership

- California Department of Financial Protection and Innovation (DFPI) License

- Business License

- Employer Identification Number (EIN)

- Zoning and Building Permits

Legal Documents and Agreements – We have prepared and signed the necessary legal documents and agreements to form and operate our bank, including:

- Certificate of Formation

- Operating Agreement

- Membership Agreement

- Loan Agreement

- Card Agreement

- Paper Agreement

Keys to Success

We analyze our market, customers, competitors, and industry to determine our keys to success. We have identified the following keys to success for our bank.

Customer Satisfaction

Customer satisfaction is vital for any business, especially a bank relying on loyalty and referrals. It is the degree customers are happy with our products, services, and interactions. It is influenced by:

- Product and service quality – High-quality products and services that meet customer needs and preferences

- Customer service quality – Friendly, professional, and helpful customer service across channels

- Customer experience quality – Convenient, reliable, and secure customer access and transactions

We will measure satisfaction with surveys, feedback, mystery shopping, and net promoter scores. Our goal is a net promoter score of at least 8.

Operational Efficiency

Efficiency is key in a regulated, competitive environment. It is using resources and processes effectively to achieve goals and objectives. It is influenced by:

- Resource optimization – Effective and efficient use and control of capital, staff, and technology

- Process improvement – Streamlined, standardized processes measured for performance

- Performance management – Managing financial, operational, customer, and stakeholder performance

We will measure efficiency with KPIs, metrics, dashboards, and operational efficiency ratios. Our goal is an operational efficiency ratio below 50%.

Partner with OGSCapital for Your Bank Business Plan Success

Highly efficient service.

Highly Efficient Service! I am incredibly happy with the outcome; Alex and his team are highly efficient professionals with a diverse bank of knowledge.

Are you looking to hire business plan writers to start a bank business plan? At OGSCapital, we can help you create a customized and high-quality bank development business plan to meet your goals and exceed your expectations.

We have a team of senior business plan experts with extensive experience and expertise in various industries and markets. We will conduct thorough market research, develop a unique value proposition, design a compelling financial model, and craft a persuasive pitch deck for your business plan. We will also offer you strategic advice, guidance, and access to a network of investors and other crucial contacts.

We are not just a business plan writing service. We are a partner and a mentor who will support you throughout your entrepreneurial journey. We will help you achieve your business goals with smart solutions and professional advice. Contact us today and let us help you turn your business idea into a reality.

Frequently Asked Questions

How do I start a small bank business?

To start a small bank business in the US, you need to raise enough capital, understand how to make a business plan for the bank, apply for a federal or state charter, register your bank for taxes, open a business bank account, set up accounting, get the necessary permits and licenses, get bank insurance, define your brand, create your website, and set up your phone system.

Are banks profitable businesses?

Yes, banks are profitable businesses in the US. They earn money through interest on loans and fees for other services. The commercial banking industry in the US has grown 5.6% per year on average between 2018 and 2023.

Download Bank Business Plan Sample in pdf

OGSCapital’s team has assisted thousands of entrepreneurs with top-rate business plan development, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

How to Start a Plumbing Business in 2024: A Detailed Guide

Vegetable Farming Business Plan

Trading Business Plan

How To Write A Textile Manufacturing Business Plan

Start a Vending Machine Business in 2024: A Detailed Guide

Oil and Gas Business Plan

Any questions? Get in Touch!

We have been mentioned in the press:

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search the site:

Free PDF Business Plan Templates and Samples

By Joe Weller | September 9, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

We’ve gathered the most useful collection of business plan PDF templates and samples, including options for organizations of any size and type.

On this page, you’ll find free PDF templates for a simple business plan , small business plan , startup business plan , and more.

Simple Business Plan PDF Templates

These simple business plan PDF templates are ready to use and customizable to fit the needs of any organization.

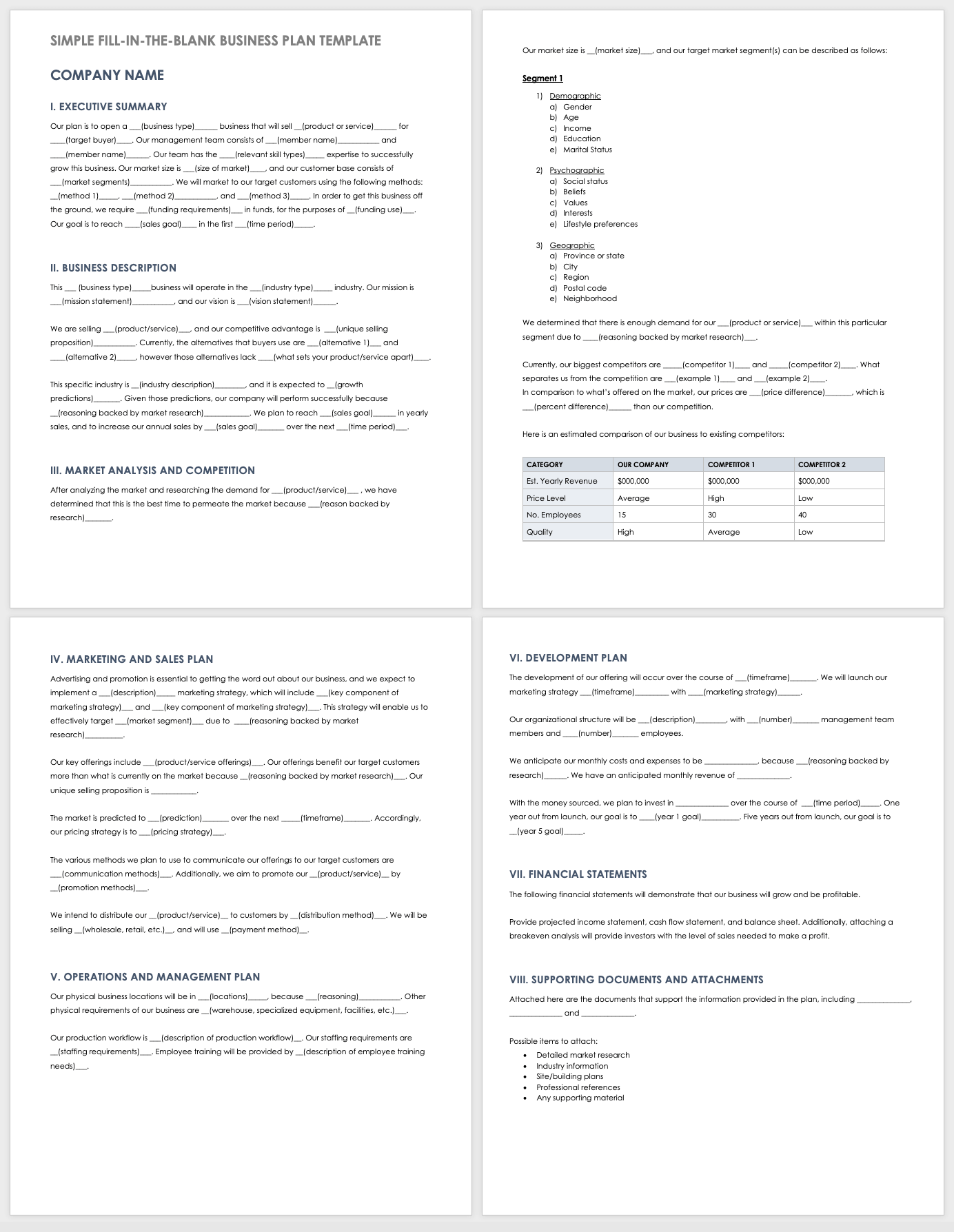

Simple Business Plan Template PDF

This template contains a traditional business plan layout to help you map out each aspect, from a company overview to sales projections and a marketing strategy. This template includes a table of contents, as well as space for financing details that startups looking for funding may need to provide.

Download Simple Business Plan Template - PDF

Lean Business Plan Template PDF

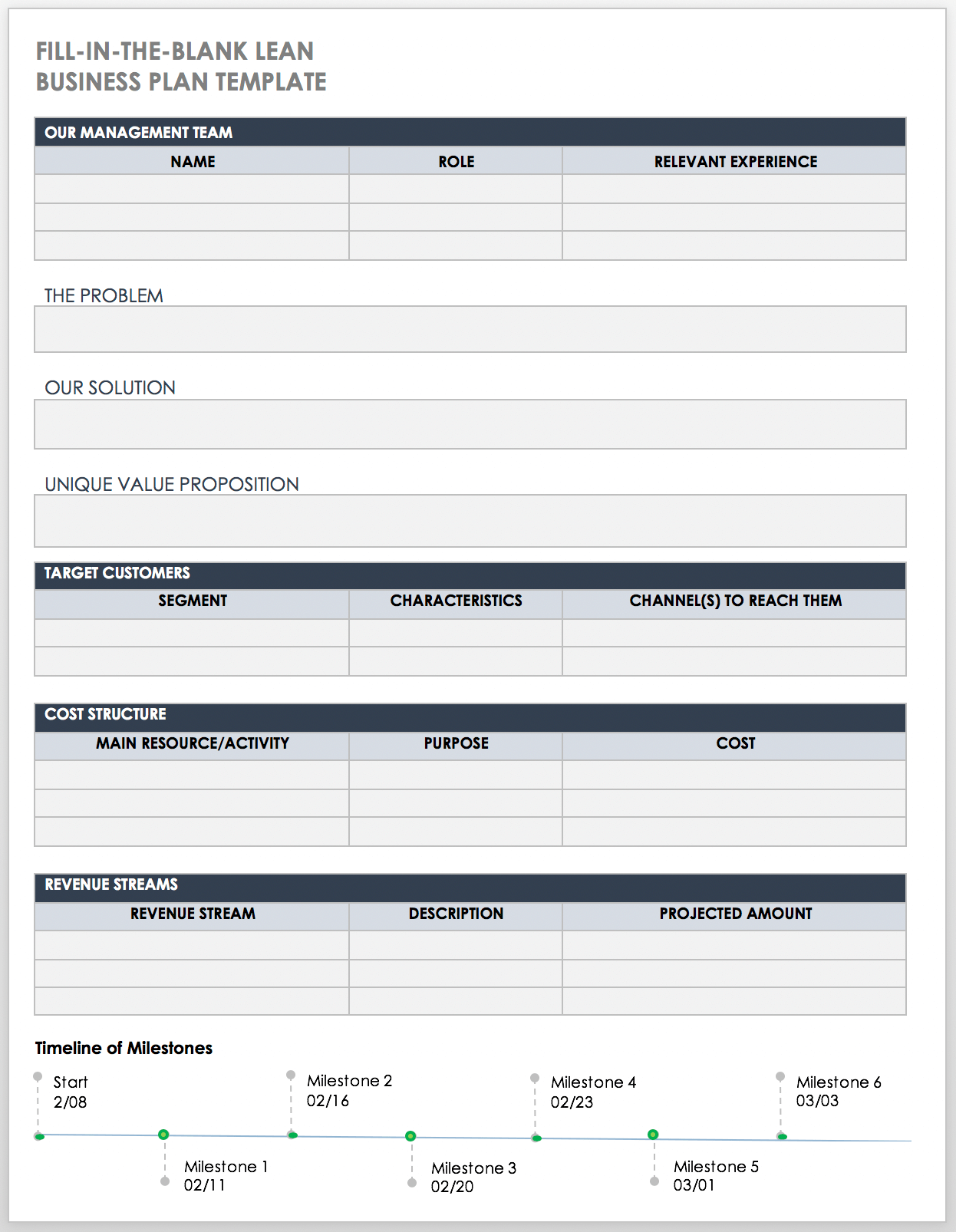

This scannable business plan template allows you to easily identify the most important elements of your plan. Use this template to outline key details pertaining to your business and industry, product or service offerings, target customer segments (and channels to reach them), and to identify sources of revenue. There is also space to include key performance metrics and a timeline of activities.

Download Lean Business Plan Template - PDF

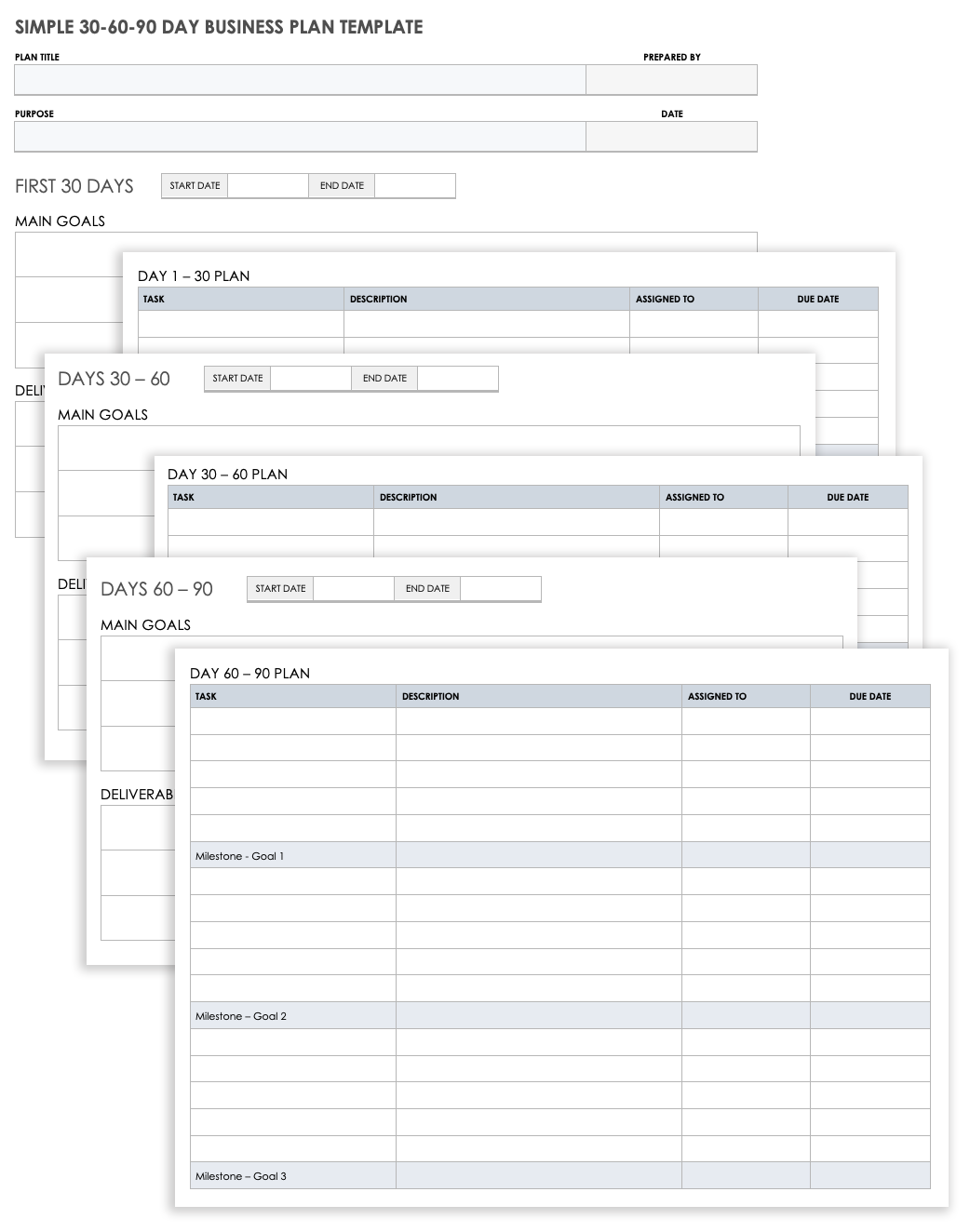

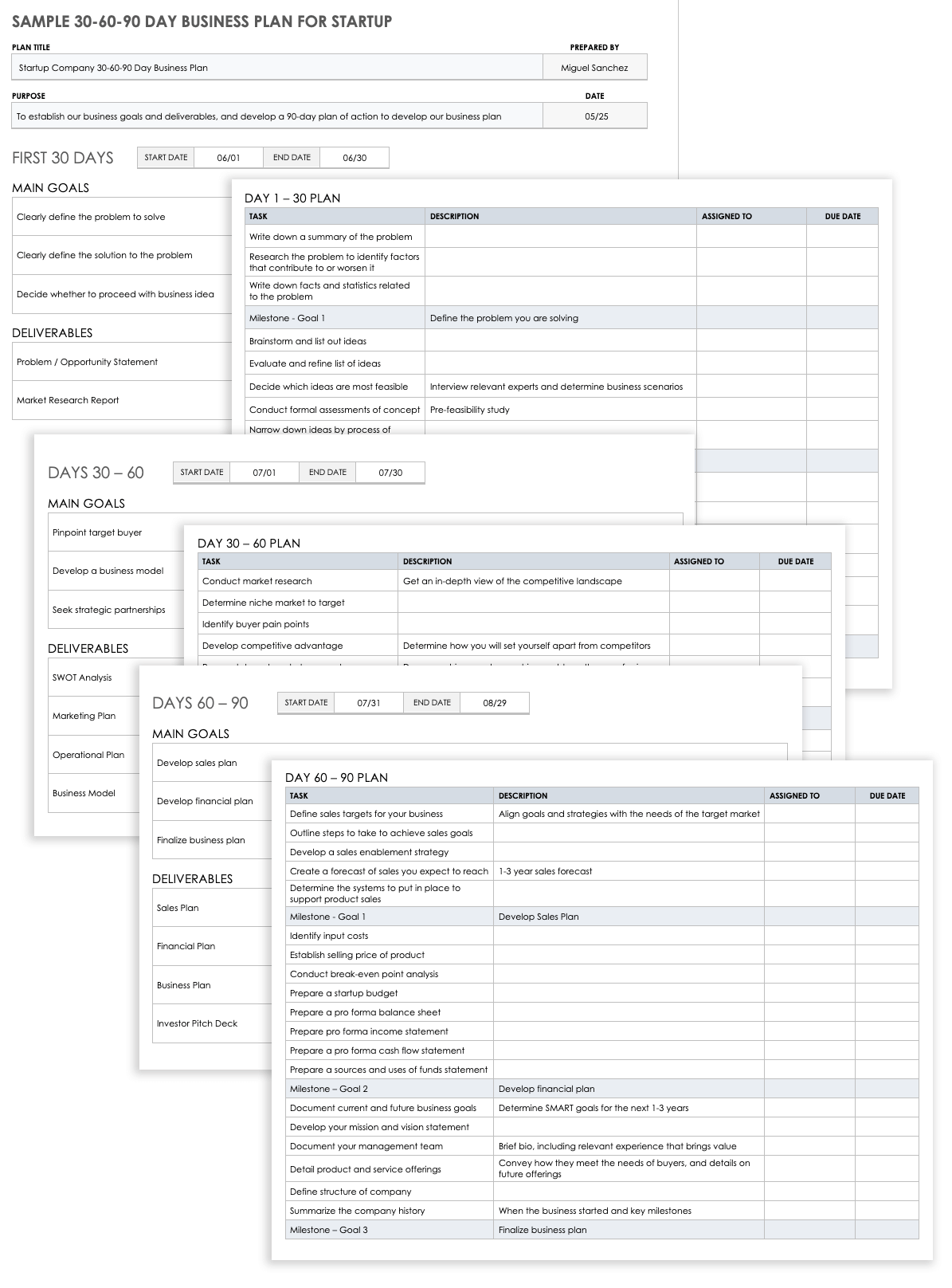

Simple 30-60-90 Day Business Plan Template PDF

This template is designed to help you develop and implement a 90-day business plan by breaking it down into manageable chunks of time. Use the space provided to detail your main goals and deliverables for each timeframe, and then add the steps necessary to achieve your objectives. Assign task ownership and enter deadlines to ensure your plan stays on track every step of the way.

Download Simple 30-60-90 Day Business Plan Template

PDF | Smartsheet

One-Page Business Plan PDF Templates

The following single page business plan templates are designed to help you download your key ideas on paper, and can be used to create a pitch document to gain buy-in from partners, investors, and stakeholders.

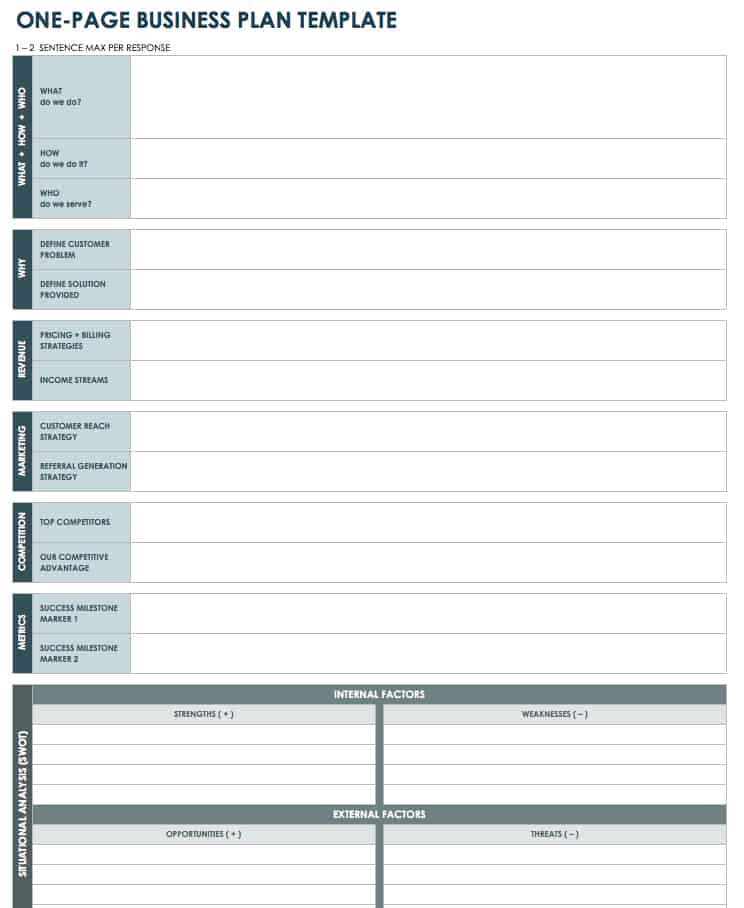

One-Page Business Plan Template PDF

Use this one-page template to summarize each aspect of your business concept in a clear and concise manner. Define the who, what, why, and how of your idea, and use the space at the bottom to create a SWOT analysis (strengths, weaknesses, opportunities, and threats) for your business.

Download One-Page Business Plan Template

If you’re looking for a specific type of analysis, check out our collection of SWOT templates .

One-Page Lean Business Plan PDF

This one-page business plan template employs the Lean management concept, and encourages you to focus on the key assumptions of your business idea. A Lean plan is not stagnant, so update it as goals and objectives change — the visual timeline at the bottom is ideal for detailing milestones.

Download One-Page Lean Business Plan Template - PDF

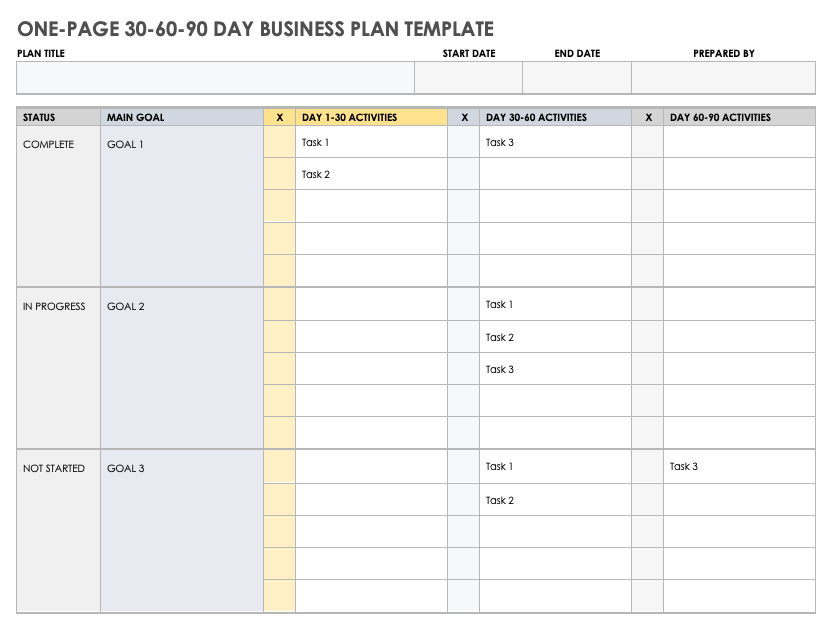

One-Page 30-60-90 Day Business Plan Template

Use this business plan template to identify main goals and outline the necessary activities to achieve those goals in 30, 60, and 90-day increments. Easily customize this template to fit your needs while you track the status of each task and goal to keep your business plan on target.

Download One-Page 30-60-90 Day Business Plan Template

For additional single page plans, including an example of a one-page business plan , visit " One-Page Business Plan Templates with a Quick How-To Guide ."

Small Business Plan PDF Templates

These business plan templates are useful for small businesses that want to map out a way to meet organizational objectives, including how to structure, operate, and expand their business.

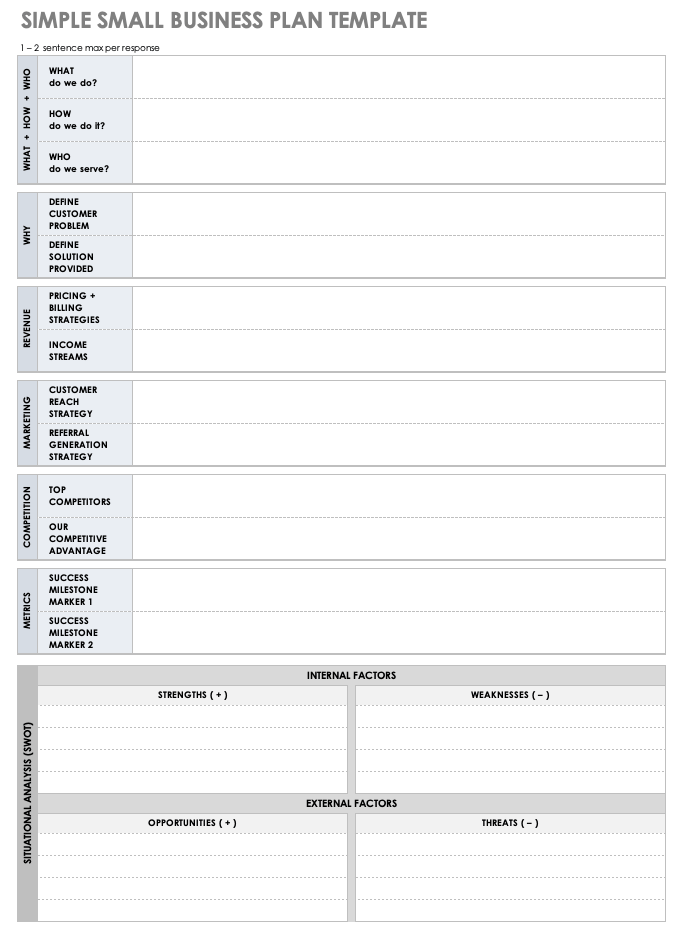

Simple Small Business Plan Template PDF

A small business can use this template to outline each critical component of a business plan. There is space to provide details about product or service offerings, target audience, customer reach strategy, competitive advantage, and more. Plus, there is space at the bottom of the document to include a SWOT analysis. Once complete, you can use the template as a basis to build out a more elaborate plan.

Download Simple Small Business Plan Template

Fill-In-the-Blank Small Business Plan Template PDF

This fill-in-the-blank template walks you through each section of a business plan. Build upon the fill-in-the-blank content provided in each section to add information about your company, business idea, market analysis, implementation plan, timeline of milestones, and much more.

Download Fill-In-the-Blank Small Business Plan Template - PDF

One-Page Small Business Plan Template PDF

Use this one-page template to create a scannable business plan that highlights the most essential parts of your organization’s strategy. Provide your business overview and management team details at the top, and then outline the target market, market size, competitive offerings, key objectives and success metrics, financial plan, and more.

Download One-Page Business Plan for Small Business - PDF

Startup Business Plan PDF Templates

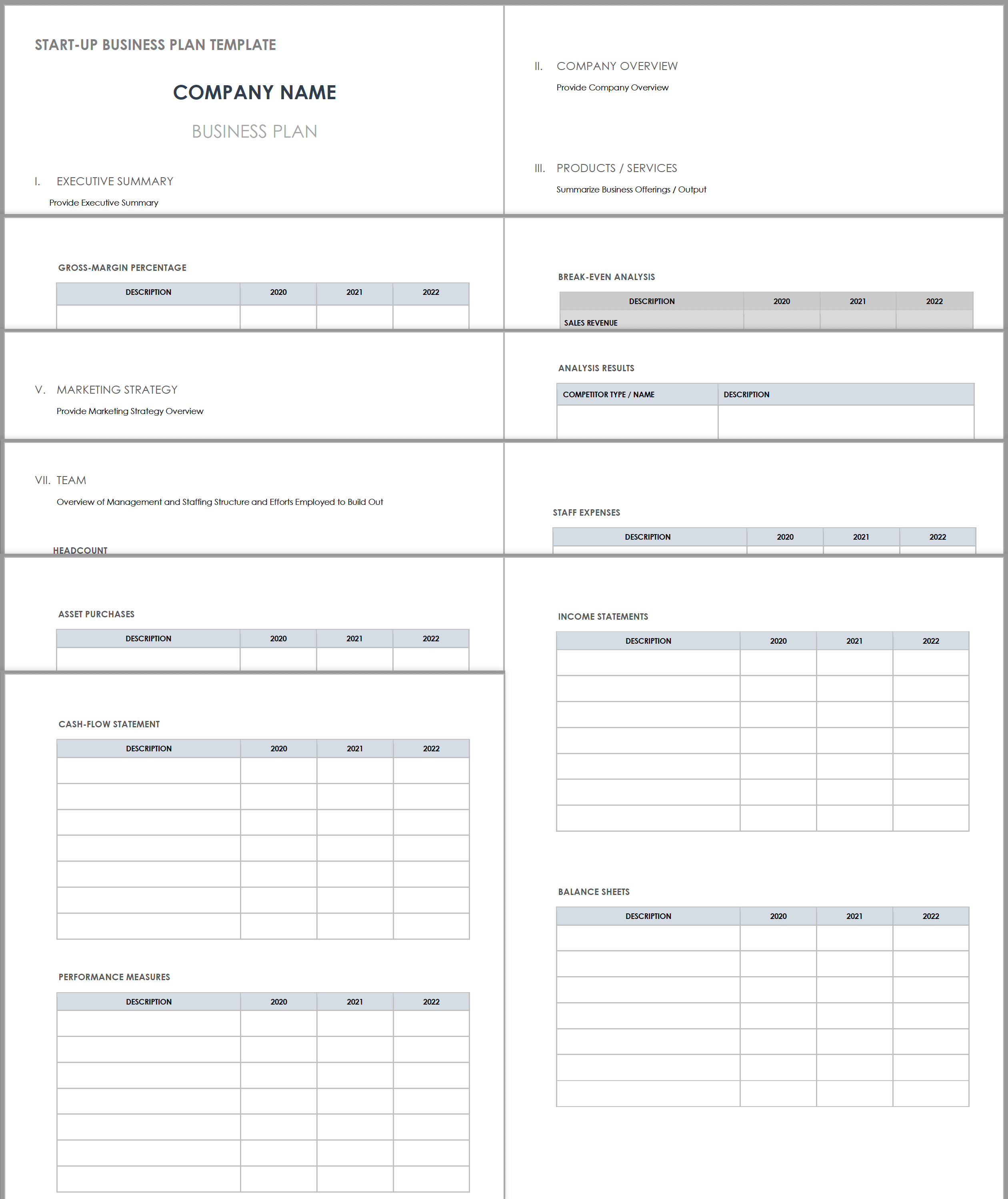

Startups can use these business plan templates to check the feasibility of their idea, and articulate their vision to potential investors.

Startup Business Plan Template

Use this business plan template to organize and prepare each essential component of your startup plan. Outline key details relevant to your concept and organization, including your mission and vision statement, product or services offered, pricing structure, marketing strategy, financial plan, and more.

Download Startup Business Plan Template

Sample 30-60-90 Day Business Plan for Startup

Startups can use this sample 30-60-90 day plan to establish main goals and deliverables spanning a 90-day period. Customize the sample goals, deliverables, and activities provided on this template according to the needs of your business. Then, assign task owners and set due dates to help ensure your 90-day plan stays on track.

Download Sample 30-60-90 Day Business Plan for Startup Template

For additional resources to create your plan, visit “ Free Startup Business Plan Templates and Examples .”

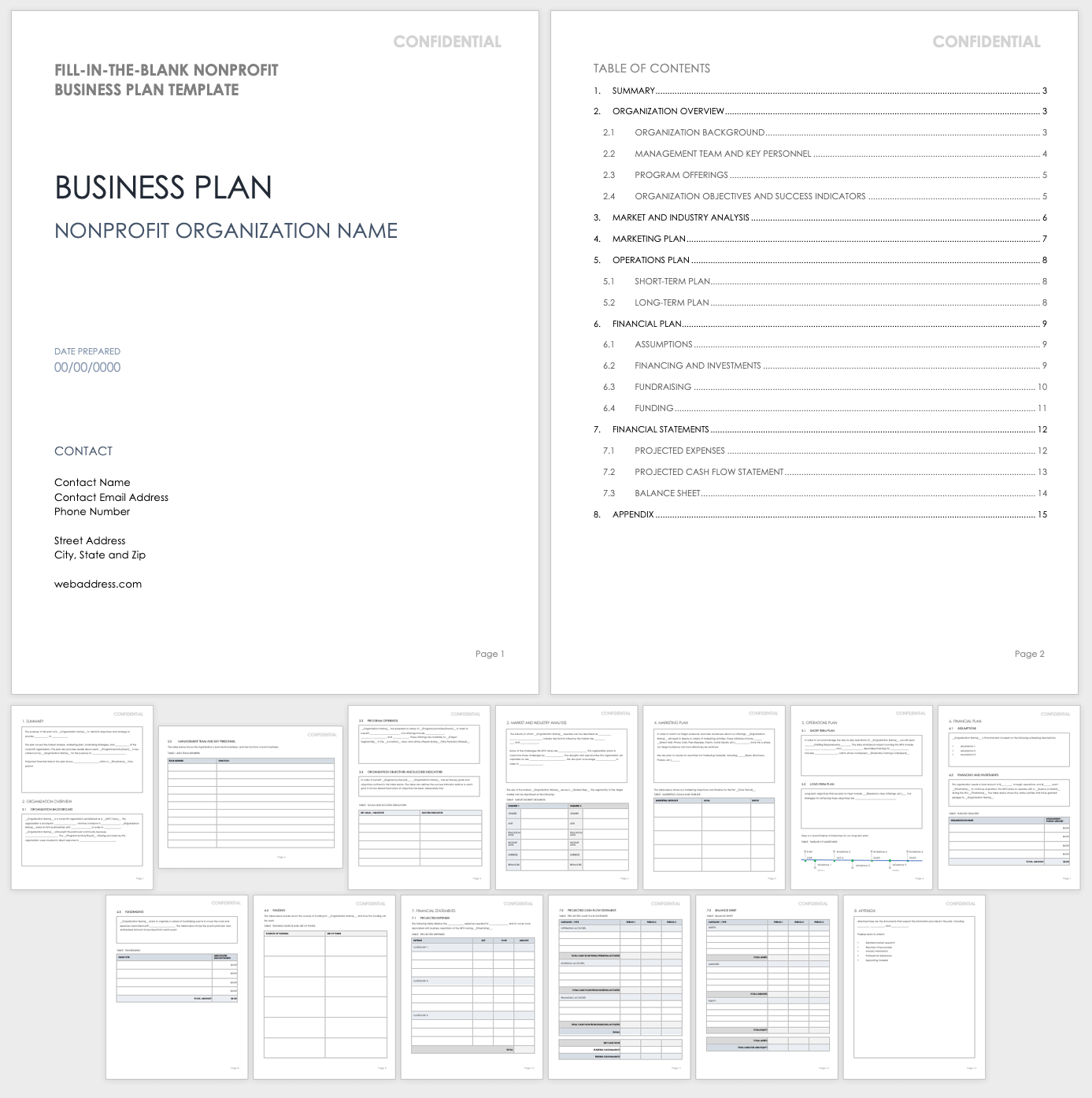

Nonprofit Business Plan PDF Templates

Use these business plan PDF templates to outline your organization’s mission, your plan to make a positive impact in your community, and the steps you will take to achieve your nonprofit’s goals.

Nonprofit Business Plan Template PDF

Use this customizable PDF template to develop a plan that details your organization’s purpose, objectives, and strategy. This template features a table of contents, with room to include your nonprofit’s mission and vision, key team and board members, program offerings, a market and industry analysis, promotional plan, financial plan, and more. This template also contains a visual timeline to display historic and future milestones.

Download Nonprofit Business Plan Template - PDF

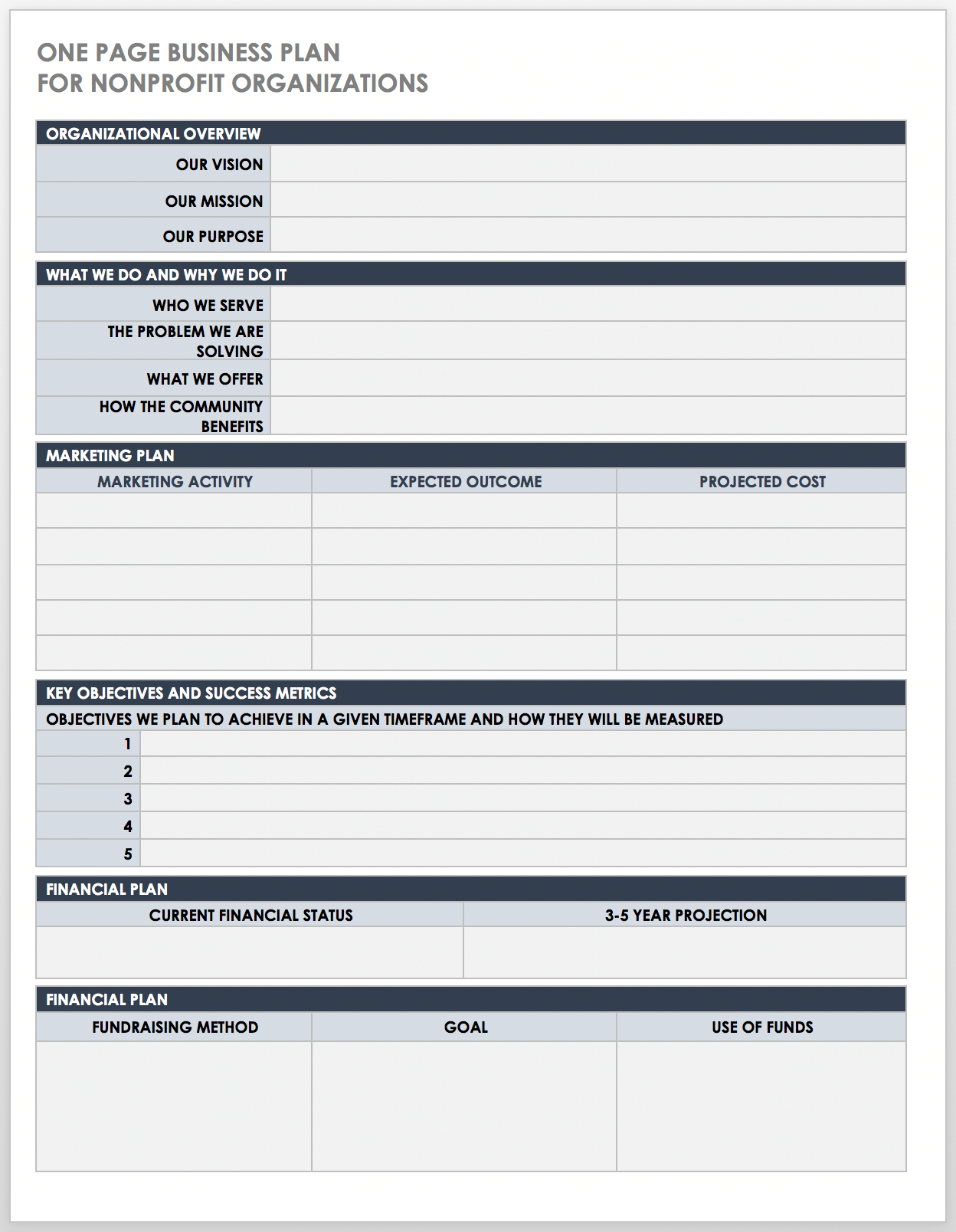

One-Page Business Plan for Nonprofit Organization PDF

This one-page plan serves as a good starting point for established and startup nonprofit organizations to jot down their fundamental goals and objectives. This template contains all the essential aspects of a business plan in a concise and scannable format, including the organizational overview, purpose, promotional plan, key objectives and success metrics, fundraising goals, and more.

Download One-Page Business Plan for Nonprofit Organization Template - PDF

Fill-In-the-Blank Business Plan PDF Templates

Use these fill-in-the-blank templates as a foundation for creating a comprehensive roadmap that aligns your business strategy with your marketing, sales, and financial goals.

Simple Fill-In-the-Blank Business Plan PDF

The fill-in-the-blank template contains all the vital parts of a business plan, with sample content that you can customize to fit your needs. There is room to include an executive summary, business description, market analysis, marketing plan, operations plan, financial statements, and more.

Download Simple Fill-In-the-Blank Business Plan Template - PDF

Lean Fill-In-the-Blank Business Plan PDF

This business plan is designed with a Lean approach that encourages you to clarify and communicate your business idea in a clear and concise manner. This single page fill-in-the-blank template includes space to provide details about your management team, the problem you're solving, the solution, target customers, cost structure, and revenue streams. Use the timeline at the bottom to produce a visual illustration of key milestones.

Download Fill-In-the-Blank Lean Business Plan Template - PDF

For additional resources, take a look at " Free Fill-In-the-Blank Business Plan Templates ."

Sample Business Plan PDF Templates

These sample business plan PDF templates can help you to develop an organized, thorough, and professional business plan.

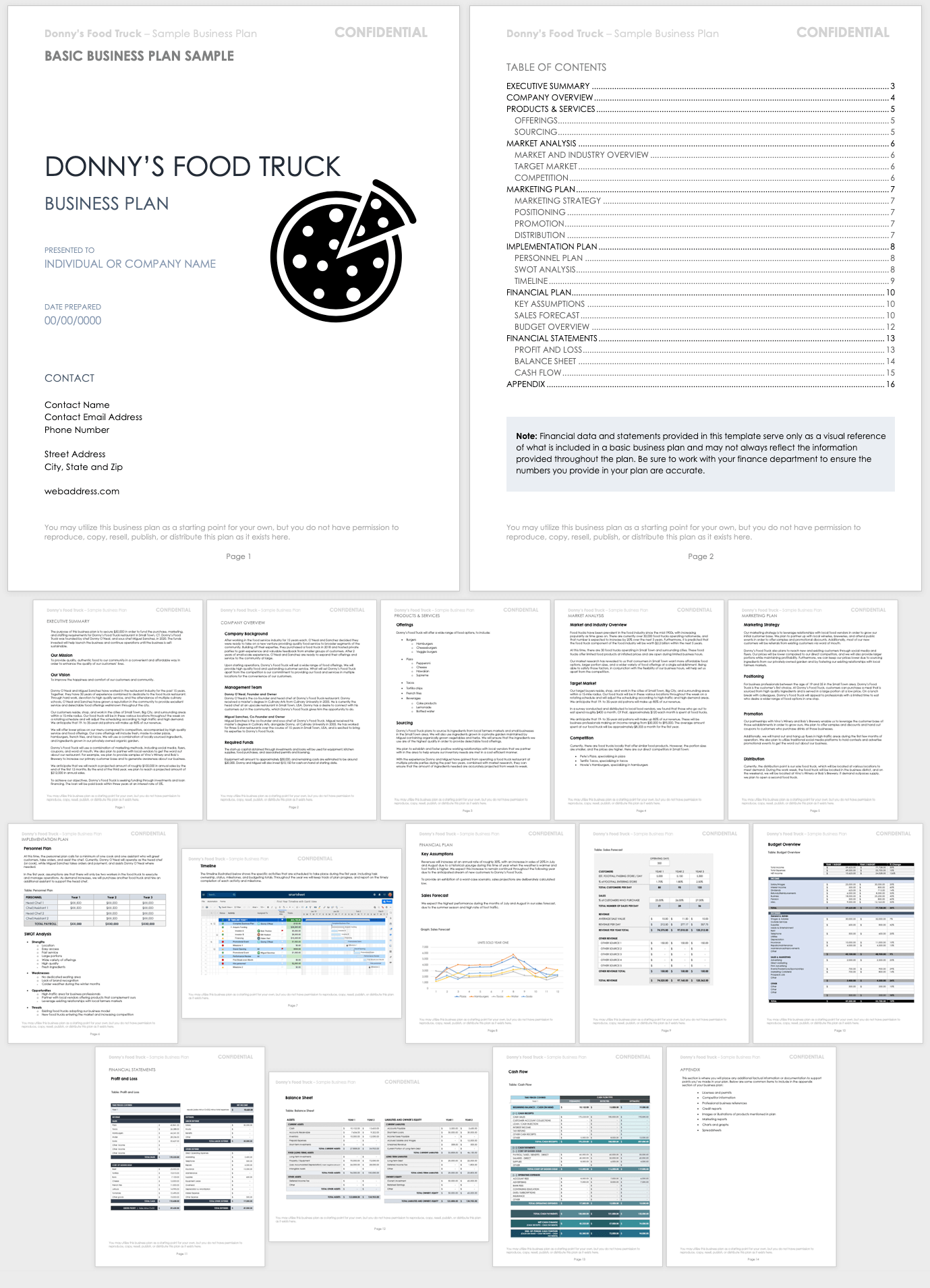

Business Plan Sample

This business plan example demonstrates a plan for a fictional food truck company. The sample includes all of the elements in a traditional business plan, which makes it a useful starting point for developing a plan specific to your business needs.

Download Basic Business Plan Sample - PDF

Sample Business Plan Outline Template

Use this sample outline as a starting point for your business plan. Shorten or expand the outline depending on your organization’s needs, and use it to develop a table of contents for your finalized plan.

Download Sample Business Plan Outline Template - PDF

Sample Business Financial Plan Template

Use this sample template to develop the financial portion of your business plan. The template provides space to include a financial overview, key assumptions, financial indicators, and business ratios. Complete the break-even analysis and add your financial statements to help prove the viability of your organization’s business plan.

Download Business Financial Plan Template

PDF | Smartsheet

For more free, downloadable templates for all aspects of your business, check out “ Free Business Templates for Organizations of All Sizes .”

Improve Business Planning with Real-Time Work Management in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

Researched by Consultants from Top-Tier Management Companies

Powerpoint Templates

Icon Bundle

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

How to Create a Fruitful Bank Business Plan- Free PDF Included

Tamana Gupta

A bank is a type of financial institution that accepts deposits and extracts money from customers' accounts. The banking industry, like other businesses, needed a large capital expenditure to get off the ground.

A business plan for the banking sector is essential for starting and growing banks. Financial institutions need a business plan for banks because their regulations are based on similar ones. So, it should be designed to grab the interest of lenders, stakeholders, and investors.

Business plans for the banking sector must include clear and attainable goals for the future, marketing strategies, timeliness, ways to use the investments and information about the organization. For the company to achieve its objectives, it must project the estimations of the commercial operations that have been planned during the previous three fiscal years and evaluate their viability.

Guidelines for Writing a Business Plan for the Banking Sector

Prepare a thorough banking business plan by going through all the relevant topics in depth. Provide the reasons for starting the firm and the goals that demonstrate the entrepreneur's skill and pique the interest of venture capitalists. Before creating a business plan for the banking industry, there are a few questions that should be adequately addressed. As follows:

What kind of market do you have, and where?

What is the likely range of your industrial expansion?

Who are your intended customers?

What types of regulations will you put in place to lure consumers?

How will you carry out your carefully thought-out policies and take the appropriate measures in response?

So, here are a few of the essential slides that you must incorporate into your business plan to make it stand out.

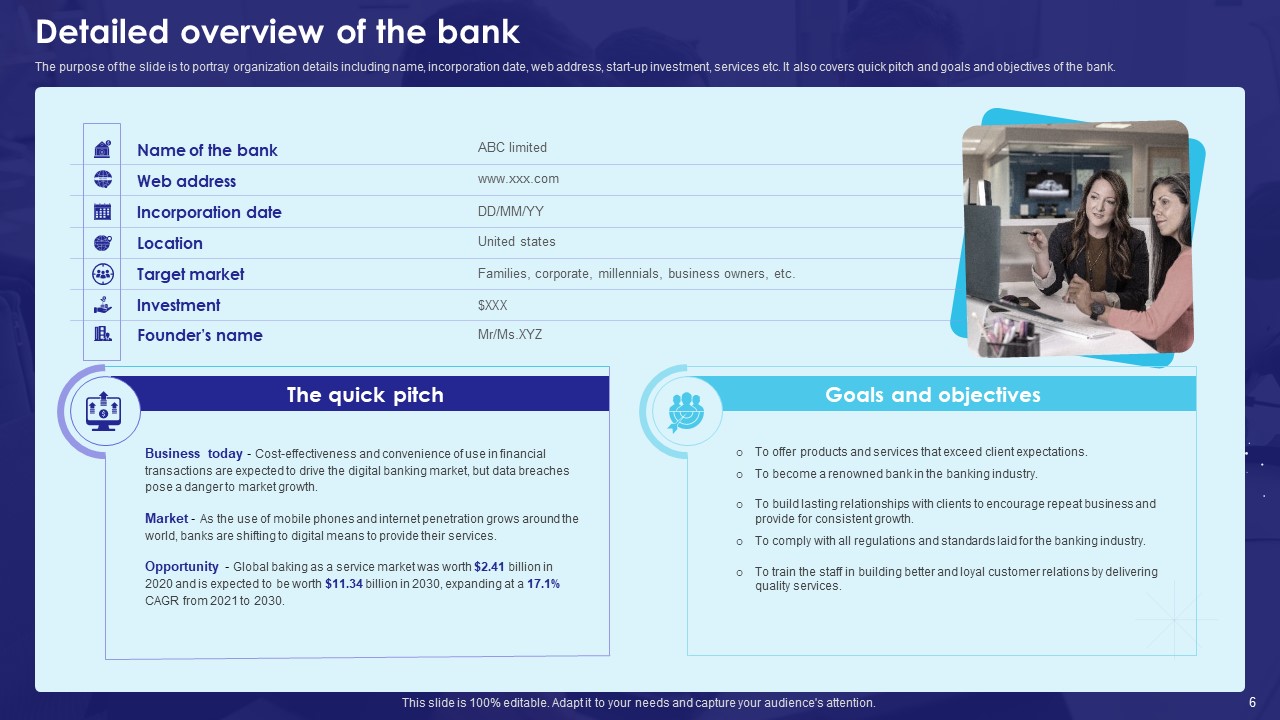

# Detailed overview of the bank

This slide is to portray organization details including name, incorporation date, web address, start-up investment, services, etc. It also covers the quick pitch and goals and objectives of the bank.

The company overview is part of your business plan that gives the basics and background of your business. It's the foundation on which you will build the rest of your business plan. You need the reader to be well-informed about your business to entice investors or future customers.

This slide is 100% editable, so download it right now.

Download this Template Now

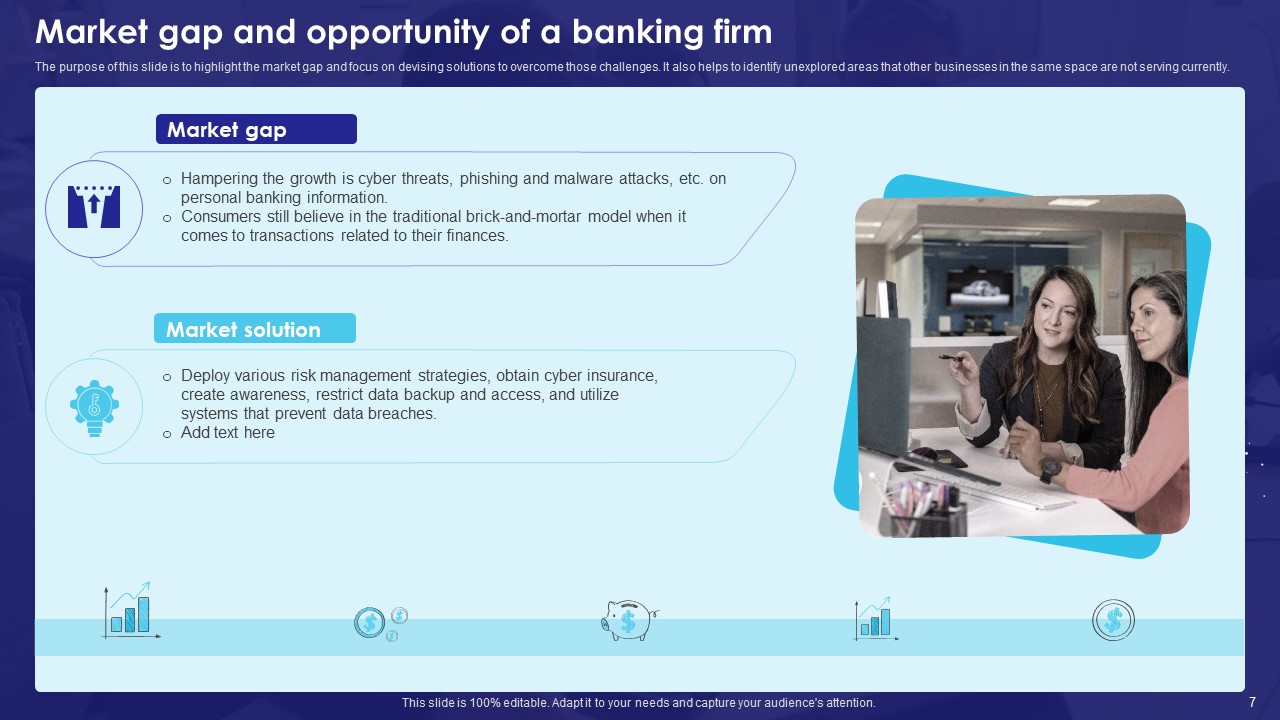

# Market gap and opportunity of a banking firm

The purpose of this slide is to highlight the market gap and focus on devising solutions to overcome those challenges. It also helps to identify unexplored areas that other businesses in the same space are not serving currently.

A market gap is an area where there is a need from customers but where businesses do not already fill the void. A market gap opportunity is a chance to create and offer something currently unavailable.

So, highlight the market gap along with its solution in the slide to give a glimpse to the investor.

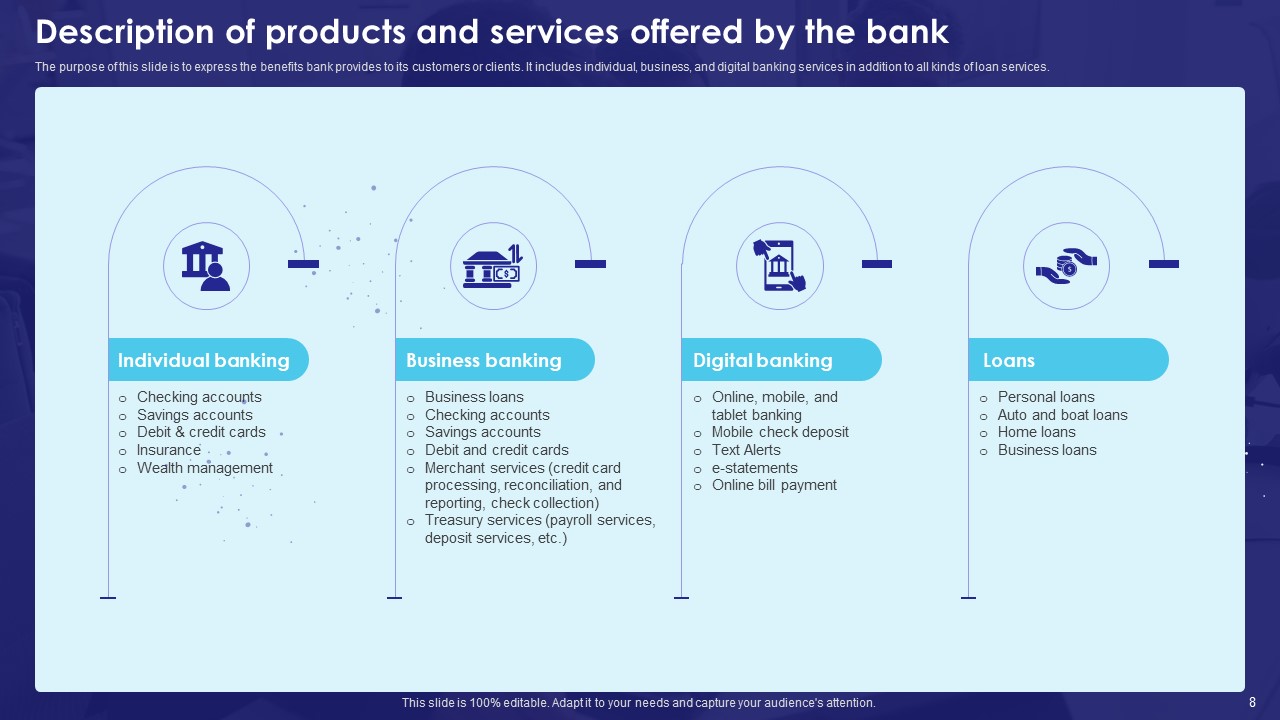

# Description of products and services offered by the bank

This slide is to express the benefits the bank provides to its customers or clients. It includes individual, business, and digital banking services in addition to all kinds of loan services.

Your business plan's section on products and services helps the reader understand why you're in business, what you sell, how you compete with existing options, or how you fill a market gap that no one else is filling.

So, highlight the different services your bank is offering to you.

# Choosing an ideal business location for the bank

This slide portrays an ideal business location for the bank that minimizes the risk of failure. It covers gathering and analyzing data in order to select the optimal location in terms of feasibility, economy, and future sustainability.

Choosing an apt location for your business not only helps you in retaining employees but also makes you more accessible in attracting target customers.

So, highlight the few things you are considering while choosing the location to make the users of the business plan aware.

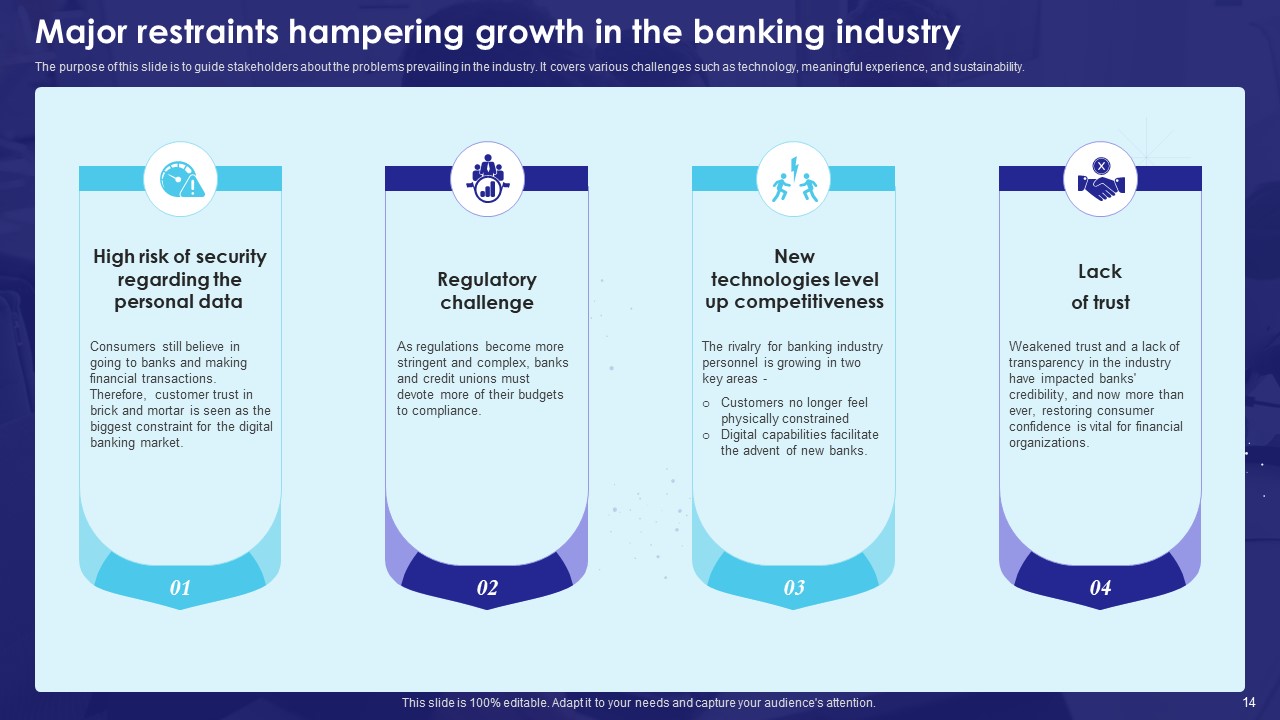

# Major restraints hampering growth in the banking industry

The idea behind this slide is to guide stakeholders about the problems prevailing in the industry. It covers various challenges such as technology, meaningful experience, and sustainability.

However, highlighting the major restraints in a business plan will make you understand the clear-cut challenges that they have to overcome.

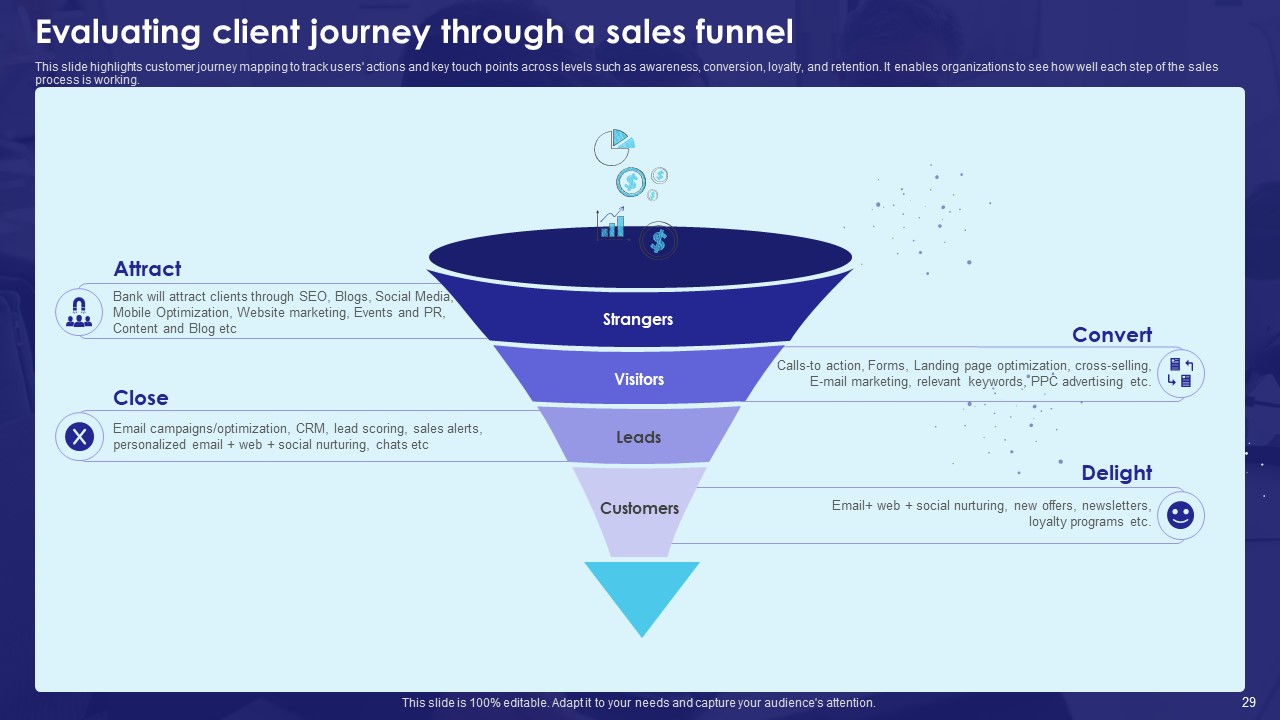

# Evaluating client journey through a sales funnel

This slide highlights customer journey mapping to track users' actions and key touch points across levels such as awareness, conversion, loyalty, and retention. It enables organizations to see how well each step of the sales process is working.

A sales funnel is a word used in marketing, to sum up and define the path taken by potential clients from prospecting to purchase.

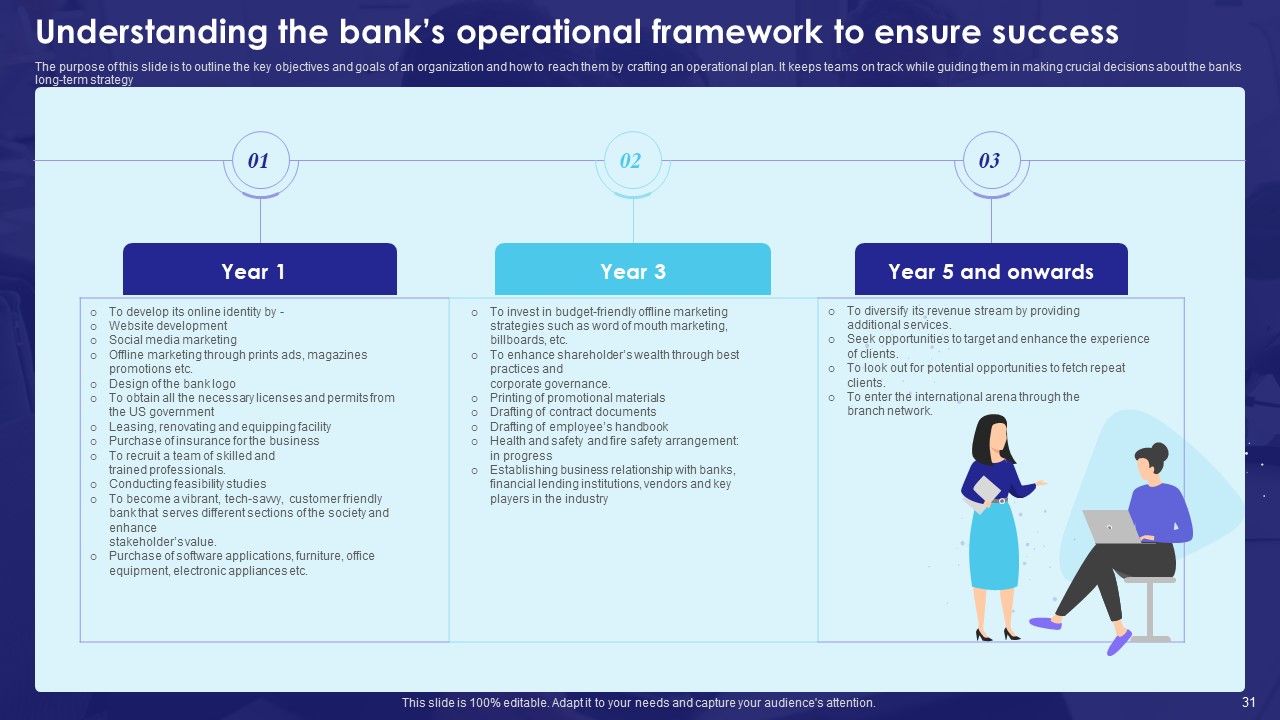

# Understanding the bank’s operational framework to ensure success

The purpose of this slide is to outline the key objectives and goals of an organization and how to reach them by crafting an operational plan. It keeps teams on track while guiding them in making crucial decisions about the banks’ long-term strategy.

In this slide, you can highlight the 1-YEAR plan, 3-YEAR plan, and 5-YEAR onwards plan to achieve the goals and objectives.

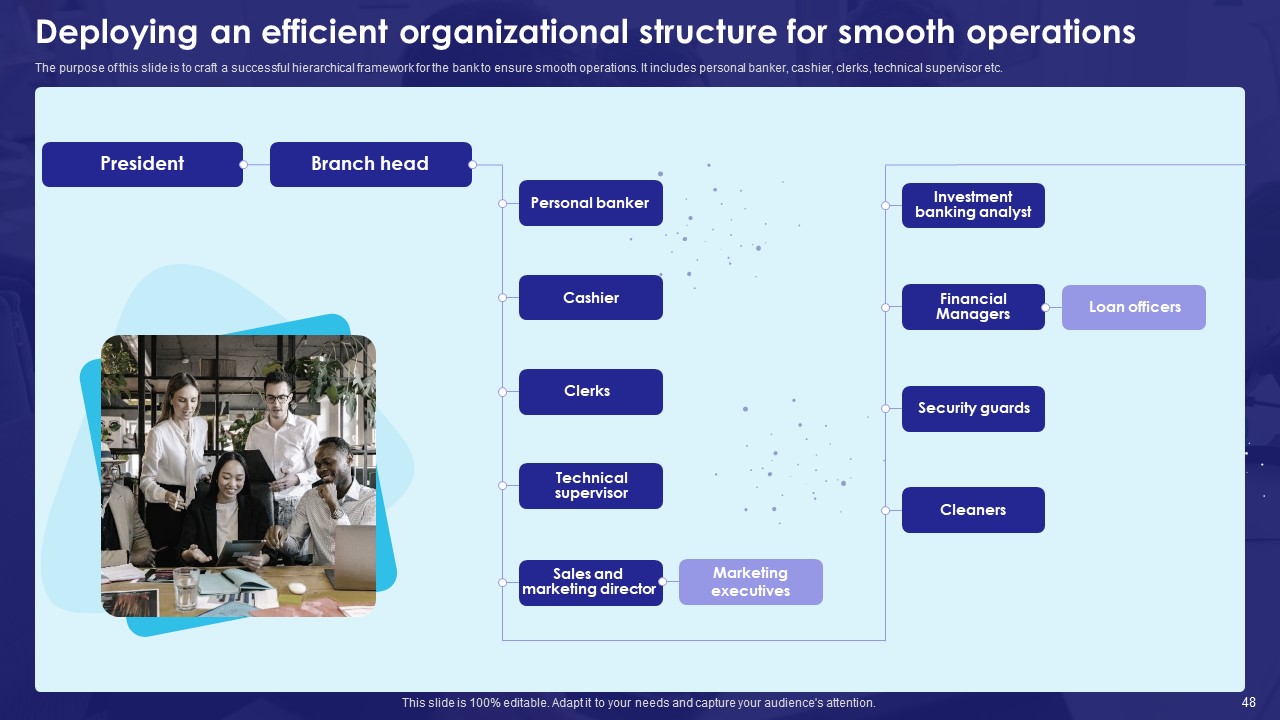

# Deploying an efficient organizational structure for smooth operations

The purpose of this slide is to craft a successful hierarchical framework for the bank to ensure smooth operations. It includes personal bankers, cashiers, clerks, technical supervisors, etc.

An organizational structure is a system that defines how specific tasks are directed in order to fulfill the goals of an organization.

So, highlight the organizational chart in the slide to make it clear to the audience, how the pattern is being followed in the organization.

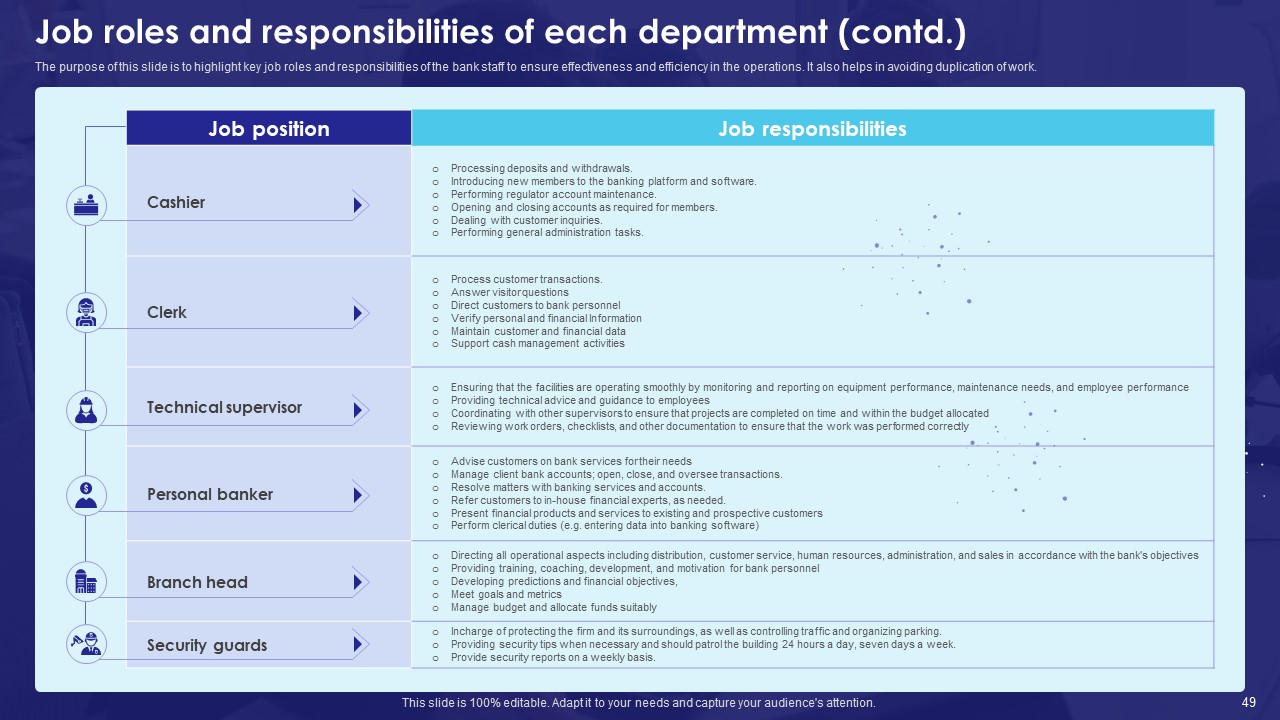

# Job roles and responsibilities of each department (contd.)

This slide aims to highlight key job roles and responsibilities of the bank staff to ensure effectiveness and efficiency in the operations. It also helps in avoiding duplication of work. Job responsibilities refer to the duties and tasks of their particular roles.

Companies that identify roles and responsibilities can streamline their hiring processes. It may encourage their employees to perform better and pay closer attention at work. It also helps enhance operational efficiency by removing confusion and redundancy.

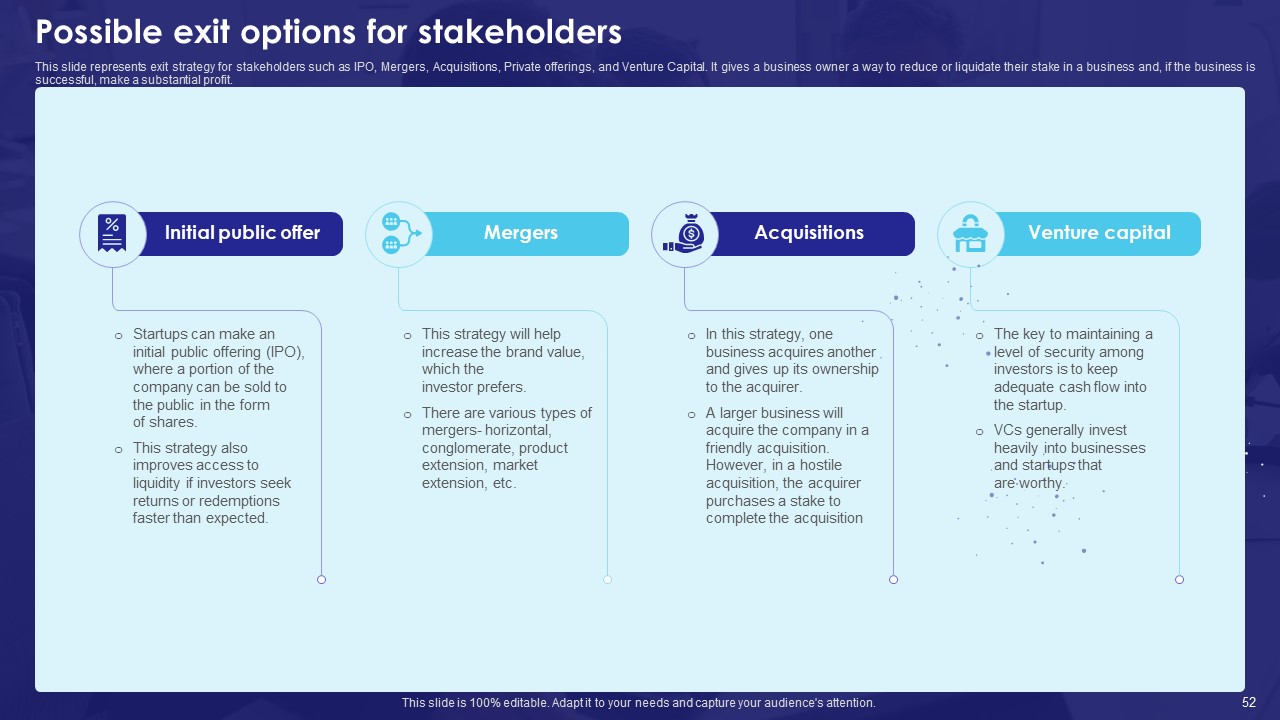

# Possible exit options for stakeholders

This bank business plan slide represents exit strategy for stakeholders such as IPO, Mergers, Acquisitions, Private offerings, and Venture Capital. It gives a business owner a way to reduce or liquidate their stake in a business and make a substantial profit if the business is successful.

An exit option is a clause in a business plan or project that enables a corporation to abandon the venture with only minor financial repercussions.

So download this ready-to-use PowerPoint presentation and edit the text as per your requirement.

Wrapping up

You can get all the information you need to understand the market, the industry, and both at once for the bank business plan in this PowerPoint.

At SlideTeam, a group of researchers and designers work together on projects to create material that satisfies customer requirements. You alter our business plan ppt to suit a person's unique professional needs.

What is the purpose of a business plan for a bank?

A business plan outlines your growth strategy for the next five years and gives a current picture of your bank. It outlines your company's objectives and your plans for achieving them. Market research is also included to help you with your plans.

Which three business models do banks typically use?

A commercial bank with retail funding, a commercial bank with wholesale funding, and a bank focused on the capital markets are the three business models we identify. While the third type stands out principally due to banks' growing involvement in trading activities, the first two models differ primarily in how banks choose to fund their operations.

Related posts:

- How to Design the Perfect Service Launch Presentation [Custom Launch Deck Included]

- Quarterly Business Review Presentation: All the Essential Slides You Need in Your Deck

- [Updated 2023] How to Design The Perfect Product Launch Presentation [Best Templates Included]

- 99% of the Pitches Fail! Find Out What Makes Any Startup a Success

Liked this blog? Please recommend us

2 thoughts on “How to Create a Fruitful Bank Business Plan- Free PDF Included”

This form is protected by reCAPTCHA - the Google Privacy Policy and Terms of Service apply.

Digital revolution powerpoint presentation slides

Sales funnel results presentation layouts

3d men joinning circular jigsaw puzzles ppt graphics icons

Business Strategic Planning Template For Organizations Powerpoint Presentation Slides

Future plan powerpoint template slide

Project Management Team Powerpoint Presentation Slides

Brand marketing powerpoint presentation slides

Launching a new service powerpoint presentation with slides go to market

Agenda powerpoint slide show

Four key metrics donut chart with percentage

Engineering and technology ppt inspiration example introduction continuous process improvement

Meet our team representing in circular format

Internet-Banking

Bank business plan

- Bank Business Plan

pdf (958 Kb)

pdf (197 Kb)

pdf (182 Kb)

doc (55 Kb)

How to use a screen reader

Firstly, enable a screen reader mode. Then highlight necessary text and click on the emerging icon. * The screen reader isn't compatible with Windows Vista and other older versions of Windows.

Which version of Internet Banking do you want to use?

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

Online account for individuals

More in file.

- Who Should File

- Tax Record (Transcript)

- Income Verification Express Service

- Life Events

- Seniors & Retirees

- Businesses and Self-Employed

- Governmental Liaisons

- Federal State Local Governments

Access your individual account information including balance, payments, tax records and more.

Sign in to your online account

If you're a new user, have your photo identification ready. More information about identity verification is available on the sign-in page.

Access tax records

- View key data from your most recently filed tax return, including your adjusted gross income, and access transcripts

- View digital copies of certain notices from the IRS

- View information about your Economic Impact payments

- View information about your advance Child Tax Credit payments

Make and view payments

- You can also make a guest payment without logging in

- View 5 years of payment history, including your estimated tax payments

- Schedule and cancel future payments

- View pending and scheduled payments

View or create payment plans

- Learn about payment plan options and apply for a new payment plan

- View and revise details of your existing payment plan

View your balance

- View the amount you owe and a breakdown by tax year

Manage your profile preferences

- Go paperless for certain notices

- Get email notifications for new account information or activity

View Tax Pro authorizations

- View any authorization requests from tax professionals

- Approve and electronically sign Power of Attorney and tax information authorization from your tax professional

Accessibility

There are compatibility issues with some assistive technologies. Refer to the accessibility guide for help if you use a screen reader, screen magnifier or voice command software.

Other ways to find your account information

- You can request an account transcript by mail . Note that each account transcript only covers a single tax year, and may not show the most recent penalties, interest, changes or pending actions.

- If you're a business, or an individual who filed a form other than 1040, you can obtain a transcript by submitting Form 4506-T, Request for Transcript of Tax Return .

- Find more assistance .

Related information

Need to pay.

See your payment options.

What if I don't pay?

We can take certain actions to collect your unpaid taxes.

Learn about tax collection & your rights

Business tax account

If you file with an EIN as a sole proprietor, view your information on file with a business tax account .

How to Write a Successful Digital Bank Business Plan (+ Template)

Creating a business plan is essential for any business, but it can be especially helpful for digital bank businesses that want to improve their strategy or raise funding.

A well-crafted business plan outlines the vision for your company, but also documents a step-by-step roadmap of how you will accomplish it. To create an effective business plan, you must first understand the components essential to its success.

This article provides an overview of the critical elements every digital bank business owner should include in their business plan.

Download the Ultimate Business Plan Template

What is a Digital Bank Business Plan?

A digital bank business plan is a formal written document describing your company’s business strategy and feasibility. It documents the reasons you will be successful, your areas of competitive advantage, and it includes information about your team members. Your business plan is a critical document that will convince investors and lenders (if needed) that you are positioned to become a successful venture.

Why Write a Digital Bank Business Plan?

A digital bank business plan is required for banks and investors. The document is a clear and concise guide to your business idea and the steps you will take to make it profitable.

Entrepreneurs can also use this as a roadmap when starting their new company or venture, especially if they are inexperienced in starting a business.

Writing an Effective Digital Bank Business Plan

The following are the critical components of a successful digital bank business plan:

Executive Summary

The executive summary of a digital bank business plan is a one- to two-page overview of your entire business plan. It should summarize the main points, which will be presented in full in the rest of your business plan.

- Start with a one-line description of your digital bank company

- Provide a summary of the key points in each section of your business plan, which includes information about your company’s management team, industry analysis, competitive analysis, and financial forecast, among others.

Company Description

This section should include a brief history of your company. Include a short description of how your company started and provide a timeline of milestones your company has achieved.

You may not have a long company history if you are just starting your digital bank business. Instead, you can include information about your professional experience in this industry and how and why you conceived your new venture. If you have worked for a similar company or been involved in an entrepreneurial venture before starting your digital bank firm, mention this.

You will also include information about your chosen digital bank business model and how, if applicable, it is different from other companies in your industry.

Industry Analysis

The industry or market analysis is an important component of a digital bank business plan. Conduct thorough market research to determine industry trends and document the size of your market.

Questions to answer include:

- What part of the digital bank industry are you targeting?

- How big is the market?

- What trends are happening in the industry right now (and if applicable, how do these trends support your company’s success)?

You should also include sources for your information, such as published research reports and expert opinions.

Customer Analysis

This section should include a list of your target audience(s) with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

For example, a digital bank business’ customers may include:

- Small businesses that need online banking solutions

- Start-ups and tech companies that are looking for innovative ways to manage their finances

- Freelancers and consultants who need a simple way to get paid and track expenses

You can include information about how your customers decide to buy from you and what keeps them buying from you.

Develop a strategy for targeting those customers who are most likely to buy from you, as well as those that might be influenced to buy your products or digital bank services with the right marketing.

Competitive Analysis

The competitive analysis helps you determine how your product or service will differ from competitors, and what your unique selling proposition (USP) might be that will set you apart in this industry.

For each competitor, list their strengths and weaknesses. Next, determine your areas of competitive advantage; that is, in what ways are you different from and ideally better than your competitors.

Below are sample competitive advantages your digital bank business may have:

- 24/7 customer service

- Higher deposit limits

- More locations

- Better mobile app

Marketing Plan

This part of the business plan is where you determine and document your marketing plan. . Your plan should be laid out, including the following 4 Ps.

- Product/Service : Detail your product/service offerings here. Document their features and benefits.

- Price : Document your pricing strategy here. In addition to stating the prices for your products/services, mention how your pricing compares to your competition.

- Place : Where will your customers find you? What channels of distribution (e.g., partnerships) will you use to reach them if applicable?

- Promotion : How will you reach your target customers? For example, you may use social media, write blog posts, create an email marketing campaign, use pay-per-click advertising, or launch a direct mail campaign. Or you may promote your digital bank business via a PR or influencer marketing campaign.

Operations Plan

This part of your digital bank business plan should include the following information:

- How will you deliver your product/service to customers? For example, will you do it in person or over the phone?

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

You also need to include your company’s business policies in the operations plan. You will want to establish policies related to everything from customer service to pricing, to the overall brand image you are trying to present.

Finally, and most importantly, your Operations Plan will outline the milestones your company hopes to achieve within the next five years. Create a chart that shows the key milestone(s) you hope to achieve each quarter for the next four quarters, and then each year for the following four years. Examples of milestones for a digital bank business include reaching $X in sales. Other examples include expanding to new markets, developing new products and services, and hiring new personnel.

Management Team

List your team members here, including their names and titles, as well as their expertise and experience relevant to your specific digital bank industry. Include brief biography sketches for each team member.

Particularly if you are seeking funding, the goal of this section is to convince investors and lenders that your team has the expertise and experience to execute on your plan. If you are missing key team members, document the roles and responsibilities, you plan to hire for in the future.

Financial Plan

Here, you will include a summary of your complete and detailed financial plan (your full financial projections go in the Appendix).

This includes the following three financial statements:

Income Statement

Your income statement should include:

- Revenue : how much revenue you generate.

- Cost of Goods Sold : These are your direct costs associated with generating revenue. This includes labor costs, as well as the cost of any equipment and supplies used to deliver the product/service offering.

- Net Income (or loss) : Once expenses and revenue are totaled and deducted from each other, this is the net income or loss.

Sample Income Statement for a Startup Digital Bank Firm

Balance sheet.

Include a balance sheet that shows your assets, liabilities, and equity. Your balance sheet should include:

- Assets : All of the things you own (including cash).

- Liabilities : This is what you owe against your company’s assets, such as accounts payable or loans.

- Equity : The worth of your business after all liabilities and assets are totaled and deducted from each other.

Sample Balance Sheet for a Startup Digital Bank Firm

Cash flow statement.

Include a cash flow statement showing how much cash comes in, how much cash goes out and a net cash flow for each year. The cash flow statement should include ash flow from:

- Investments

Below is a sample of a projected cash flow statement for a startup digital bank business.

Sample Cash Flow Statement for a Startup Digital Bank Firm

Finally, you will also want to include an appendix section which will include:

- Your complete financial projections

- A complete list of your company’s business policies and procedures related to the rest of the business plan (marketing, operations, etc.)

- Any other documentation which supports what you included in the body of your business plan.

Create Your Digital Bank Business Plan

Writing a good business plan gives you the advantage of being fully prepared to launch and/or grow your digital bank company. It not only outlines your business vision but also provides a step-by-step process of how you are going to accomplish it.

Now that you know how to write a business plan for your digital bank, you can get started on putting together your own.

Finish Your Business Plan in 1 Day!

Wish there was a faster, easier way to finish your business plan?

With our Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

- current affairs

- daily current affairs 21 may 2024

Daily Current Affairs 21 May 2024 | Latest News | Download Free PDF

May 21 2024

Dear Readers, get to know the daily current affairs today covering all the National & International Events provided here in this article. Current Affairs is an important topic in various competitive exams like IBPS/SBI/PO/Clerk and other competitive exams. To score better in this section, be updated with the daily happenings. Check the Daily Current Affairs February 2024 updates here. Revision is very important in remembering current affairs. Candidates after learning the Daily current affairs May 21 2024, can test their knowledge by attempting Current Affairs Quiz provided with answers. Daily current affairs May 21 2024 covers current affairs from International & National news, Important Days, State News, Banking & Economy, Business News, Appointments & Resignation, Awards & Honour, Books & Authors, Sports News, etc.,

Daily Current Affairs PDF of 21st May 2024

Get more: static gk pdfs, current affairs : banking & finance, new point of sale deployment slows to lowest growth rate since demonetisation: rbi data .

- The convenience of Unified Payments Interface (UPI) platforms is increasingly favoured by merchants and consumers, reducing the reliance on debit cards for cashless transactions.

Key Highlights :

- New PoS Terminal Deployment: The deployment of new point-of-sale (PoS) terminals grew at the slowest pace in fiscal 2023-24 since demonetisation, according to RBI data.

- New PoS terminal deployment rose by 14% between March 2023 and 2024, compared to 28% and 29% in the preceding two years.

- The highest growth rate in recent years was 82% in 2016-2017, following demonetisation when the base was 1.38 million machines.

- Impact of UPI on PoS Deployment: Despite ongoing deployment of PoS terminals due to merchants wanting to offer various payment options and increased credit card usage, QR code-based UPI transactions are becoming more popular.

- Growth of UPI QR Codes: Deployment of QR codes for UPI payments has doubled in the last two years.

- In March 2023, there were 346 million QR codes in use , compared to 172 million in March 2022.

- Merchant Discount Rate (MDR): The government mandate for zero merchant discount rate (MDR) on UPI transactions is encouraging merchants to prefer UPI payments over card swipes.

- Transaction Data :Debit card transactions at merchant outlets decreased by 32%, from 237 million in March 2022 to 160 million in March 2023.

- UPI merchant transactions increased by 72% , from 4.82 billion to 8.30 billion during the same period.

About UPI :

- Unified Payments Interface (UPI) is a system that powers multiple bank accounts into a single mobile application.

- It is developed by the National Payments Corporation of India (NPCI).

- It was introduced in April 2016.

IFC Provides $500 Million Financing to HDFC Bank to Boost Microloans

- The International Finance Corporation (IFC) has extended $500 million in financing to HDFC Bank to expand microloans for underserved women borrowers in India.

- Women, particularly microloan borrowers in semi-urban and rural areas, will benefit from increased access to finance due to IFC's financing of up to $500 million to HDFC Bank.

- HDFC Bank will utilize IFC's financing for on-lending as microloans to Self-Help Groups (SHGs) and Joint Liability Groups (JLGs) enrolled in the Sustainable Livelihoods Initiative (SLI).

- SLI is HDFC Bank's business line dedicated to microfinance lending programs exclusively for women borrowers.

About IFC :

- The International Finance Corporation is an international financial institution that offers investment, advisory, and asset-management services to encourage private-sector development in less developed countries.

- The IFC is a member of the World Bank Group and is headquartered in Washington, D.C. in the United States.

About HDFC Bank :

- Founded : 1st July 2023 (via the merger between HDFC-HDFC bank)

- Headquarters : Mumbai, Maharashtra, India

- MD & CEO : Sashidhar Jagdishan

- Tagline : We Understand Your World

SBI General Insurance Partners with CAMS to Launch Bima Central, a Groundbreaking Policyholder Servicing Platform

- SBI General Insurance Company Limited, one of India’s top general insurance carriers, has partnered with Bima Central , built by CAMS Insurance Repository, to launch the industry-first policyholder servicing platform, Bima Central.

- Functionality of Bima Central: The platform allows consumers to aggregate their insurance portfolios via an electronic Insurance Account (eIA).

- Users can manage their insurance policies effortlessly through a single digital portal, Bima Central.

- Unique Feature : For the first time in the market, SBI General Insurance customers with an eIA through CAMS Rep Bima Central will have immediate access to their insurance portfolio via the SBI General Insurance Mobile App.

- Consumer Benefit: The integration enables seamless management and access to insurance portfolios, enhancing convenience and efficiency for policyholders.

About SBI General Insurance Company Limited :

- Founded : 2009 (started operations in 2010)

- MD & CEO : Kishore Poludasu

- It is a joint venture between the State Bank of India (SBI) and the Insurance Australia Group (IAG).

CURRENT AFFAIRS: NATIONAL NEWS

Gail hires lng ship from coolco.

- State-owned gas utility GAIL (India) Ltd has hired a liquefied natural gas (LNG) carrier from NYSE-listed Cool Company for 14 years to augment its transportation capability to meet India's rising gas needs.

- The time charter for the LNG carrier will commence in early 2025 and GAIL will have the option to extend it by two additional years beyond the firm 14-year period.

- GAIL presently has four LNG carriers in its fleet and the one coming from CoolCo will be the fifth.

- Last year, GAIL hired an LNG carrier from Japanese shipping company Mitsui OSK Lines.

- This was the second MOL Group LNG carrier serving GAIL.

- The first vessel, named GAIL Bhuwan, was chartered in 2021.

- The second vessel, taken in December 2023, was named GAIL Urja.

- GAIL Limited Headquarters: New Delhi, Sandeep Kumar Gupta; (Chairman & MD).

Cabinet Approves Ambitious IndiaAI Mission to Strengthen the AI Innovation Ecosystem

- The Government of India launched the IndiaAI Mission with a budget outlay of Rs.10,371.92 crore , a comprehensive national-level program to democratize and catalyze the AI innovation ecosystem in the country and ensure the global competitiveness of India’s AI startups and researchers.

- The IndiaAI mission will establish a comprehensive ecosystem catalyzing AI innovation through strategic programs and partnerships across the public and private sectors.

- The Mission will be implemented by ‘ IndiaAI’ Independent Business Division (IBD) under Digital India Corporation (DIC).

- The government will fund up to 50 per cent of AI compute infrastructure that will be created in partnership with the private sector.

- The government is looking to set up at least 10,000 graphics processing unit (GPU) based compute capacity in the country soon.

- Meity has set a target to make available GPU-based servers approved under the IndiaAI Mission by March 2026.

- The rapid development of AI across the globe has led to an increase in demand for GPU-based servers as they can process data at a higher speed compared to CPU-based servers.

- The Cabinet has approved the India AI Mission with an outlay of Rs 10,372 crore for five years to encourage AI development in the country.

- The funding for the project could be done by the government either through a viability gap funding or voucher-based system.

CURRENT AFFAIRS : INTERNATIONAL NEWS

South african government urges faster visa issuance for indian tourists .

- The South African government is developing mechanisms for the speedy clearance of visa applications from India and is working on a proposal to introduce E-Visas for Indian tourists .

- In the first quarter of 2024, 16,000 Indian visitors travelled to South Africa.

- The initiative was announced during an event organised by South Africa Tourism.