How to Create a Profit and Loss Forecast

Angelique O'Rourke

7 min. read

Updated October 27, 2023

An income statement, also called a profit and loss statement (or P&L), is a fundamental tool for understanding how the revenue and expenses of your business stack up.

Simply put, it tells anyone at-a-glance if your business is profitable or not. Typically, an income statement is a list of revenue and expenses, with the company’s net profit listed at the end (check out the section on income statement examples below to see what it looks like).

Have you ever heard someone refer to a company’s “bottom line”? They’re talking about the last line in an income statement, the one that tells a reader the net profit of a company, or how profitable the company is over a given period of time (usually quarterly or annually) after all expenses have been accounted for.

This is the “profit” referred to when people say “profit and loss statement,” or what the “p” stands for in “P & L.” The “loss” is what happens when your expenses exceed your revenue; when a company is not profitable and therefore running at a loss.

As you read on, keep in mind that cash and profits aren’t the same thing. For more on how they’re different, check out this article .

What’s included in an income statement?

The top line of your profit and loss statement will be the money that you have coming in, or your revenue from sales. This number should be your initial revenue from sales without any deductions.

The top line of your income statement is really just as important as the bottom line; all of the direct costs and expenses will be taken out of this beginning number. The smaller it is, the smaller the expenses have to be if you’re going to stay in the black.

If you’re writing a business plan document and don’t yet have money coming in, you might be wondering how you would arrive at a sales number for a financial forecast. It’s normal for the financials of a business plan to be your best educated guess at what the next few years of numbers will be. No one can predict the future, but you can make a reasonable plan.

Check out this article about forecasting sales for more information.

Direct costs

Direct costs, also referred to as the cost of goods sold, or COGS, is just what it sounds like: How much does it cost you to make the product or deliver the service related to that sale? You wouldn’t include items such as rent for an office space in this area, but the things that directly contribute to the product you sell.

For example, to a bookstore, the direct cost of sales is what the store paid for the books it sold; but to a publisher, its direct costs include authors’ royalties, printing, paper, and ink. A manufacturer’s direct costs include materials and labor. A reseller’s direct costs are what the reseller paid to purchase the products it’s selling.

If you only sell services, it’s possible that you have no direct costs or very low direct costs as a percentage of sales; but even accountants and attorneys have subcontractors, research, and photocopying that can be included in direct costs.

Here’s a simple rule of thumb to distinguish between direct costs and regular expenses: If you pay for something, regardless of whether you make 1 sale or 100 sales, that’s a regular expense. Think salaries, utilities, insurance, and rent. If you only pay for something when you make a sale, that’s a direct cost. Think inventory and paper reports you deliver to clients.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

Gross margin

Gross margin is also referred to as gross profit. This number refers to the difference between the revenue and direct costs on your income statement.

Revenue – Direct Costs = Gross Margin

This number is very important because it conveys two critical pieces of information: 1.) how much of your revenue is being funneled into direct costs (the smaller the number, the better), and 2.) how much you have left over for all of the company’s other expenses. If the number after direct costs is smaller than the total of your operating expenses, you’ll know immediately that you’re not profitable.

Operating expenses

Operating expenses are where you list all of your regular expenses as line items, excluding your costs of goods sold.

So, you have to take stock of everything else your company pays for to keep the doors open: rent, payroll, utilities, marketing—include all of those fixed expenses here.

Remember that each individual purchase doesn’t need its own line item. For ease of reading, it’s better to group things together into categories of expenses—for example, office supplies, or advertising costs.

Operating income

Operating income is also referred to as EBITDA, or earnings before interest, taxes, depreciation, and amortization. You calculate your operating income by subtracting your total operating expenses from your gross margin.

Gross Margin – Operating Expenses = Operating Income

Operating income is considered the most reliable number reflecting a company’s profitability. As such, this is a line item to keep your eye on, especially if you’re presenting to investors . Is it a number that inspires confidence?

This is fairly straightforward—here you would include any interest payments that the company is making on its loans. If this doesn’t apply to you, skip it.

Depreciation and amortization

These are non-cash expenses associated with your assets, both tangible and intangible. Depreciation is an accounting concept based on the idea that over time, a tangible asset, like a car or piece of machinery, loses its value, or depreciates. After several years, the asset will be worth less and you record that change in value as an expense on your P&L.

With intangible assets, you’ll use a concept called amortization to write off their cost over time. An example here would be a copyright or patent that your business might purchase from another company. If the patent lasts for 20 years and it cost your company $1 million to purchase the patent, you would then expense 1/20th of the cost every year for the life of the patent. This expense for an intangible asset would be included in the amortization row of the income statement.

This will reflect the income tax amount that has been paid, or the amount that you expect to pay, depending on whether you are recording planned or actual values. Some companies set aside an estimated amount of money to cover this expected expense.

Total expenses

Total expenses is exactly what it sounds like: it’s the total of all of your expenses, including interest, taxes, depreciation, and amortization.

The simplest way to calculate your total expenses is to just take your direct costs, add operating expenses, and then add the additional expenses of interest, taxes, depreciation, and amortization:

Total Expenses = Direct Costs + Operating Expenses + Interest + Taxes + Depreciation + Amortization

Net profit, also referred to as net income or net earnings, is the proverbial bottom line. This is the at-a-glance factor that will determine the answer to the question, are you in the red? You calculate net profit by subtracting total expenses from revenue:

Net Profit = Revenue – Total Expenses

Remember that this number started at the top line, with your revenue from sales. Then everything else was taken out of that initial sum. If this number is negative, you’ll know that you’re running at a loss. Either your expenses are too high, you’re revenue is in a slump, or both—and it might be time to reevaluate strategy.

- Income statement examples

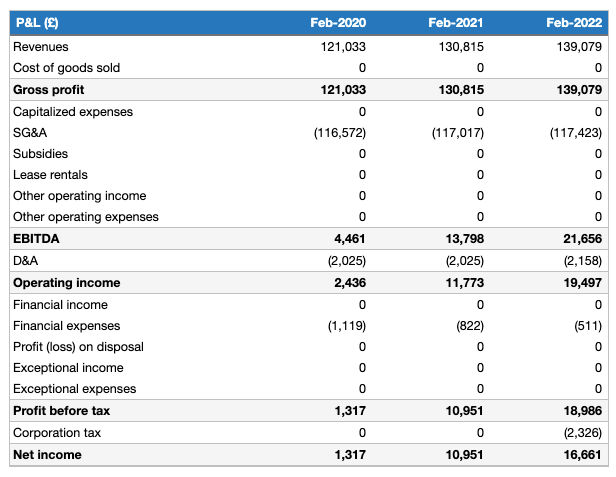

Because the terminology surrounding income statements is variable and all businesses are different, not all of them will look exactly the same, but the core information of revenue minus all expenses (including direct costs) equals profit will be present in each one.

Here is an income statement from Nike, to give you a general idea:

An income statement from Nike .

As you can see, while Nike uses a variety of terms to explain what their expenses are and name each line item as clearly as possible, the takeaway is still the bottom line, their net income.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Angelique is a skilled writer, editor, and social media specialist, as well as an actor and model with a demonstrated history of theater, film, commercial and print work.

Table of Contents

- What’s included in an income statement?

Related Articles

3 Min. Read

What Is a Break-Even Analysis?

2 Min. Read

How to Use These Common Business Ratios

4 Min. Read

How to Create an Expense Budget

9 Min. Read

What Is a Balance Sheet? Definition, Formulas, and Example

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Profit and loss statements explained (+ templates and examples)

Wouldn’t it be great if you could know what the future holds for your business?

Well, you kind of can, and we aren’t talking about magic here!

What we’re referring to is the profit and loss statement (P&L), which gives you insight into how well your business is doing. Or how badly , for that matter.

In fact, experts consider a profit and loss statement one of the most common financial documents in any sector and business plan. You may even call it mission-critical.

In this in-depth guide, we’ll cover the essential elements of profit and loss statements, including:

- Profit and loss statements most common types,

- Examples of profit and loss statements,

- Profit and loss statement templates,

- Tested tips for making better P&L statements, and more.

Let’s start with a few general remarks that you need to know first!

Table of Contents

What is a profit and loss statement?

A profit and loss statement is a financial statement that typically covers the following items:

- Revenues,

- Costs, and

Moreover, a profit and loss statement usually consists of company revenues, costs, and expenses within a specific period, like a month, a quarter, a fiscal year — or even a week.

When done properly, a P&L can help protect the financial bottom line of a company by offering deeper insights into how a business can reduce costs and increase revenue.

In other words, a profit and loss statement is a handy tool that allows you to scrutinize the financial health (or lack thereof) of your company.

Interestingly, a P&L statement goes by many names, depending on the experts you talk to. Here’s a quick list of some of the terms:

- Expense statement,

- Statement of profit and loss,

- Income statement, etc.

In any case, P&L statements summarize a company’s revenues, expenses, and costs in one form or another and are typically performed by in-house or outsourced accountants. But, if you’re a finance-savvy manager, you can even perform one yourself — at least the less detailed P&L statements.

Sidenote: Public companies are required by law to make their P&L statements publicly available — specifically, on their web page’s investor relations section.

Because of the insight they offer, profit and loss statements allow managers, leaders, and investors to make better investing decisions or spot underperforming business areas.

To get you on the same page with creating your P&L statements the right way, let’s take a quick look at 2 universal methods for creating profit and loss statements.

FREE FOREVER • UNLIMITED USERS

Free time tracking software

Track time and calculate payroll with Clockify, time tracker used by millions.

2 Universal methods for creating a P&L statement

A profit and loss statement comes into existence thanks to 2 types of accounting methods — either the accrual method or the cash method. In simple terms, these universal accounting methods are tools for tracking and recording expenses in certain ways.

Still, the method you choose can make all the difference.

For illustration, investors often inspect corresponding types of P&L statements published by same-sector companies of similar size. After crunching the numbers, they spot trends in managing expenses and decide to invest in one company rather than another.

For clarity’s sake, suppose a company decides to use the cash method, although using the accrual method would have provided more insight into the company’s financial performance. In this case, the investors may disapprove of the inappropriate use of accounting methods, leading to the investor deciding not to invest in the company.

To explore further, we’ll next discuss the accrual and cash method in more detail.

Accounting method #1: Cash method

Accountants often call this “the cash accounting method.” Companies use the cash method only when they need to record instances of cash changing hands — that is, when cash actually enters or leaves the business.

An example of this would be if a business counts their cash on hand and the money they paid for expenses.

Accountant Francis Fabrizi of Keirstone Limited explained that smaller companies typically prefer the cash method of accounting:

“Some small businesses may choose to use the cash method for accounting purposes, as the accrual method can be more complex and time-consuming to use.”

Yet, this approach comes with a major downside, as it accounts for cash only when it is either paid or received.

Accounting method #2: Accrual method

Unlike the cash method, the accrual method records profit only when it’s earned. In a nutshell, this means that a company records expenses or revenue after the service has been provided, regardless of the fact that it hasn’t received the cash for offering the service.

Simply put, companies typically use the accrual method for funds that they expect to receive at a future date.

In the subscription age, the accrual method is a much-loved method for recording revenue and sales.

For example, picture an on-demand streaming service like HBO GO or Netflix. These companies use the accrual method to record revenue on their P&L statements, although they haven’t collected the payment for the service — but expect to receive it at a given subscription renewal period.

In fact, the accountant we mentioned previously, Francis Fabrizi, clarified that the accrual-based method is the preferred method for financial accounting:

“The reason is that the accrual method provides a more accurate picture of a company’s financial performance. This is because it recognizes revenue and expenses in the period in which they are actually incurred, rather than when cash is exchanged. The accrual method helps to ensure that revenues and expenses are matched in the same accounting period.”

As we have seen, the cash and accrual methods of accounting come with their pros and cons. So, choose the one that fits your needs, your company’s reporting, and your client’s requirements.

🎓 Clockify Pro Tip

Whichever accounting method you pick, bear in mind that the process of collecting data for your profit and loss statement is best done using accounting software. Take a look at some of the best on the market:

- 15 best free accounting software tools

What is the structure of a profit and loss statement?

By now, you might wonder what is in a profit and loss statement . To answer your question, the structure of a typical P&L statement looks something like this:

- Revenue: the total amount of money that the business has earned during a given accounting period (a week, month, quarter, calendar year, or fiscal year).

- Cost of goods sold (COGS): the cost of the services or products sold by the company; includes items like materials and direct labor.

- Gross profit : the difference between revenue and cost of goods sold; also known as gross margin and gross income.

- Operating expenses: the cost of operating the company, including rent, utilities, payroll, general and administrative costs; includes anything not covered by the cost of goods sold.

- Operating income: the difference between gross profit and operating expenses; shows how much profit a business makes from its activities prior to deducting interest and taxes.

- Non-operating items: interest expenses, interest income, gains or losses from selling assets, and other non-operating expenses or non-operating income.

- Net income, net profit, or bottom line: the profit after the company has deducted all expenses; represents the company’s final figure or overall loss or profit for the corresponding period.

Sure, with all this information in mind, a P&L statement may not infuse you with enthusiasm, but it’s critical that you still prepare it regularly.

Anyway, don’t worry about it — we’ll provide you with a few examples and templates that’ll help you craft your own profit and loss statement. But before we get into that, let’s check out a few common types of P&L statements.

Explore the difference between gross salary and net salary in our blog post:

- Gross pay vs. net pay — Definition, calculation, key differences

What are the common types of profit and loss statements?

For your convenience, here’s a list of a few types of P&L statements you can use, depending on whether you’re a small, medium, or large company.

Regardless of the period for which you choose to implement your P&L statement — weekly, monthly, quarterly, or yearly — make sure to pick the right format from the list above that fits your company preferences and needs.

Speaking of time periods, we’ll next explore 2 criteria that you must not lose sight of when creating your profit and loss statement.

2 Criteria to consider before crafting a P&L statement

At this point, you need to know some types of P&L statements can be extraordinarily simple, and others can be incredibly complex. Certainly, some of them fall somewhere in between, and we’ll get to those.

For now, we can classify types of profit and loss statements based on 2 criteria:

- Period the statement covers, and

- Depth of data the statement provides.

In essence, we can refer to them as periodic and detailed P&L statements, but the actual format varies based on a company’s preferences and reporting standards.

Let’s go over each of those 2 criteria of profit and loss statements in more detail.

Criterion #1: Period the statement covers

In terms of timeframes, P&L statements are categorized into 4 types:

- Weekly P&L statements allow you to get a sneak preview of your company’s financial health for the past week,

- Monthly P&L statements deliver insight into a company’s profitability or losses in the course of a calendar month,

- Quarterly P&L statements illustrate financial performance (or lack thereof) over a 3-month period, and

- Yearly P&L statements provide a snapshot of a company’s financial performance over the span of a fiscal year.

Make sure you choose one or more for optimal business results — because, in contrast, a lack of periodic P&L statements can stifle your business growth.

For instance, even though people may be queueing up in front of your business to buy your product, that doesn’t necessarily mean that you’re making great profits. In fact, only after conducting a periodic P&L statement can you compare your profits with your costs.

Understandably, all P&L statements need to cover some period of time, whether a week, month, or year. So, let’s consider the depth of your profit and loss statement next.

Criterion #2: Depth of data the statement provides

You can divide the types of profit and loss statements in terms of the depth they go into to describe the financial status of a company.

Rule of thumb — the more depth you go into, the better your chances of spotting inconsistencies and issues.

In short, a smaller company can easily analyze its bottom line with the single-step profit and loss statement. In contrast, a large multinational corporation may need to turn to a comparative profit and loss statement for maximum benefits.

For example, elaborate P&L statements can benefit companies looking to cut their general expenses, like amortization and depreciation costs, when they conduct a profit and loss statement.

Depreciation and amortization refer to the practice of estimating the value of company assets over time. Yet, some businesses neglect to factor in these items, leading to failure in projecting long-term growth.

With these important criteria out of the way, let’s explore 3 examples to make the process of creating profit and loss statements more tangible.

Examples of a profit and loss statement

Now you’re familiar with the structure and types of P&L statements — kudos!

So, let’s dive into a few real-world scenarios where you can implement P&L reporting. For illustration, here are the 3 profit and loss statement examples we’ll cover:

- Small bakery P&L statement,

- Product/service company P&L statement, and

- Restaurant P&L statement.

Let’s up your financial game with a few real-life examples!

#1 Example of profit and loss statement: Small bakery

Suppose you want to start a business in Alabama , and you decide it’s going to be a small bakery. For a while, you successfully operate your company. After a few months, it’s high time you requested a profit and loss statement to be done to assess how well you’re doing.

In this case, you’ll use the single-step P&L statement because it neatly and simply analyzes the bottom line of a small business. For this example, it suffices to use the cash method of accounting, as this method records instances when cash actually enters or leaves the business.

To start things off in the right direction, begin by looking at baked goods and beverages — that’s the entire company revenue at this stage. How much the bakery makes and sells, i.e., your revenue, impacts the financial bottom line.

Next, you need to consider costs, like utilities, wages, and ingredients. Finally, you’ll get the net income that depicts the loss or profit of the business for the given period.

For practical purposes, we’ll offer a simplified version of the single-step P&L statement for your small bakery.

Note that the list of revenue items and costs listed below isn’t exhaustive, as you’ll probably have more things to add. Therefore, the overview below serves as an example.

#2 Example of profit and loss statement: Product/service company

A profit and loss statement isn’t confined to small businesses, like a bakery in Alabama. You can use it for complex organizations as well.

For this example, it’s recommended that you use the accrual method of accounting. The reason is that this method records expenses or revenue after they’ve provided the service — although the company hasn’t received the cash yet.

The accrual method is used for companies that need to get a more detailed overview of their financial performance. In other words — when the stakes are high.

To create a P&L statement for a software company, you first need to consider the revenue from subscriptions or product sales. After that, it’s appropriate to look into costs (COGS), like licensing, hosting, and customer support costs — all leading you to your gross profit. In short, you get the gross profit by deducting COGS from revenue.

Also, you need to consider the staff’s salaries, rent, and marketing expenses — all operating expenses. When you’re done with that, you need to evaluate the operating profit by deducting operating expenses from gross profit. The next step is to examine your taxes, interest on loans, and other necessary expenditures — your non-operating items.

Finally, you get the net profit — that is, the final figures showing you how well your business is performing.

To make it even more concrete, here’s a simplified breakdown of a multi-step P&L statement you could use for a software company — let’s call them InvincibleDevs .

#3 Example of profit and loss statement: Restaurant

With millions of restaurants spread throughout the world, it might be interesting to explore how a P&L statement can impact their profitability.

For illustration, we can take a single month’s worth of meals and pull it through a comparative P&L statement. In particular, let’s do a summary of the revenue and costs for January and February 2024. For this example, it’s best to use the cash method of accounting, as accountants typically record revenues and expenses only when the cash changes hands.

First, all the meals you typically sell during a month amount to your revenue. After you deduct the cost of goods sold — like ingredients — and labor costs from the revenue, you get a gross margin. Bear in mind that the cost of goods sold and labor costs are often jointly referred to as prime cost .

Second, you need to subtract the operating expenses, including wages of the entire kitchen and wait staff, plus the rent. These expenses are typically fixed.

Third, you have to cover the utilities, marketing expenses, and depreciation — all represented as general and administrative expenses (often also called non-operating expenses ).

In the end, our imaginary restaurant is left with the net income on that single month’s worth of meals for January and February 2024.

To make it more concrete, here’s what the restaurant budget for a single month’s worth of meals may look like in a comparative P&L statement:

Speaking of managing restaurants, here’s a list of the 10 of the best management software to operate any restaurant:

- 10 Best restaurant management software in 2022

3 Tested tips to make better P&L statements

As a business owner, it’s sometimes difficult to remember to do everything that needs to be done — from paying employees and contractors to recording and submitting all the required information to the authorities.

That’s why we’ve laid out 3 simple yet effective ways to make your profit and loss statements more akin to a walk in the park.

Tip #1: Track your time to better manage labor costs

You can’t possibly know everything that’s going on in your business if you don’t track what and when employees are doing. So, to improve your bottom line, you’ll have to keep tabs on the labor cost of people involved in your company.

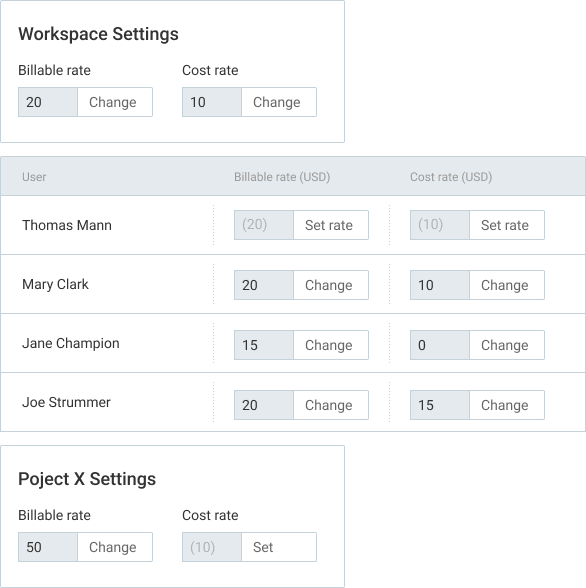

For example, a time-tracking system like Clockify lets you add billable rates for your clients — and define cost rates for your workforce. In Clockify reports, you get to compare your billable amounts (what you charge your clients) with your cost amounts (what you pay your employees).

As a result, you can better track profitability.

As soon as you enable cost rates in Workspace settings, you can apply billable rates and cost rates to any project, client, and employee. This allows you to create more detailed profit and loss statements because you’ll know exactly how much you charge your clients and pay your workforce.

So, the next time you want to make sure you’re meeting your financial goals, remember to start tracking your productivity and doing the same for your employees. Doing so will help you see where time is slipping through the cracks — and thereby ruining your business.

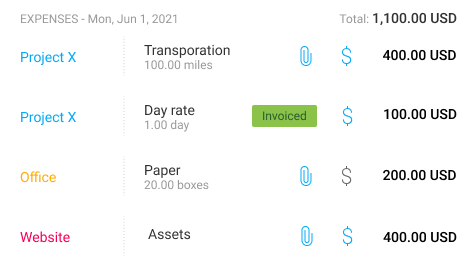

Tip #2: Keep tabs on expenses to protect your bottom line

A study that surveyed more than 200 Nordic organizations found that around 20% of receipts don’t make it into expense reports . That’s a sad reality for many companies nowadays. Yet, the cure to this problem is simple: Digitize your receipts!

For example, you can use an expense-tracking app like Clockify to track costs for project fixed fees by categories, like sum or unit. After inserting expenses, Clockify generates a fitting invoice that reflects all the expenses by category.

To tie it up with your P&L statement, you can track how much your team is spending on operating expenses, like marketing or purchasing office supplies.

In fact, you can organize your expenses per many items, including:

- Team member,

- Project,

- Category, and more.

Whether you work as an accountant or just want to get a head start on tracking your expenses, check out our informative article on this topic:

- How to keep track of expenses

Tip #3: Manage your time better to increase productivity

This point bears repeating in any sector — create an impenetrable time management system.

If your accountants and workforce are exhausted, they can make errors in their work, including what goes into your P&L statement.

But suppose you decide to make time management a priority. In this case, one of the intended consequences will be an improvement in your company’s bottom line.

Free time management app

Take control of your time and maximize productivity with effortless time tracking.

So, here are a few practical tips for managing your time well when crafting a P&L statement:

- Type in the title of your task in your time-tracking app,

- Click on the dollar sign to mark your time as billable,

- Start the timer to track your billable hours,

- Record expenses in your dedicated time billing software, and

- Create invoices for the services you provided.

As soon as you implement these techniques, you’ll be on your way to creating better financial statements and a work environment that drives stellar performance.

Get bite-sized advice on how to manage your time even better in our comprehensive guide:

- Everything you need to know about time management (+ tips)

Profit and loss statement templates

Now you have everything you need to grow your knowledge about P&L statements. But it’s prime time we get to a few useful templates you can use to craft your own profit and loss statement.

In this section, we’ll look into 3 templates of profit and loss statements:

- Single-step P&L statement template,

- Multi-step P&L statement template, and

- Comparative P&L statement template.

We hope you’re excited as we are — let’s dig in!

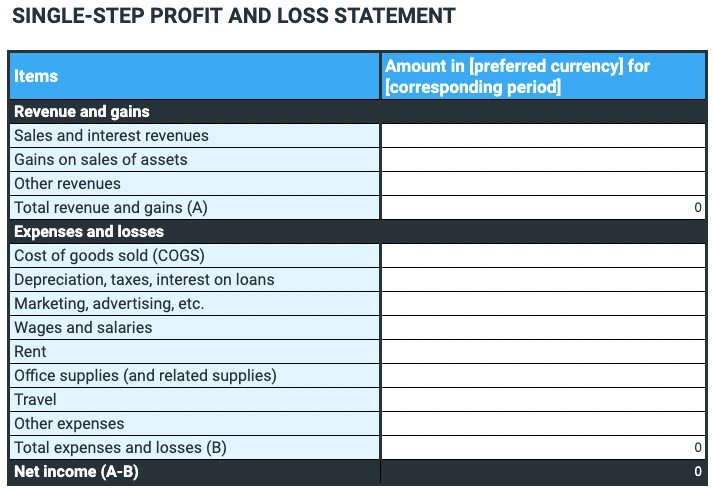

Profit and loss template #1: Single-step P&L statement

The single-step P&L statement is a simple financial tool that lets you get a bird’s-eye view of how much money your business is making or losing. Yet, its use doesn’t spread beyond small businesses — like our small bakery in Alabama. Larger companies typically avoid this when making long-term decisions.

The Single-step P&L statement template is useful if you’re just starting out and you’d like to calculate your total income without having to create a single-step P&L statement from scratch.

This template is also practical for getting a snapshot of your expenses and cost of goods sold. In fact, it’s called single-step because it gives you a picture of the loss or profit in a single step. Yet, it doesn’t list things like operating and non-operating costs — things that still impact the bottom line.

Pros of the Single-step P&L statement template :

- Makes record-keeping easy due to its simplicity, and

- Focuses on the company’s financial bottom line.

Cons of the Single-step P&L statement template :

- Doesn’t distinguish between operating costs and non-operating costs, and

- Makes it hard to determine the sources of many activities, which discourages investors from investing in the business.

How best to use the Single-step P&L statement template?

You have 2 formats to choose from for your template: a Google Sheets file and an Excel spreadsheet.

If you click on the Google Sheets link below, a new screen will appear with the prompt: Would you like to make a copy of the Single-step P&L statement template?

Click on Make a copy, and you’ll get an editable copy of the Single-step P&L statement template.

If you go with the Excel spreadsheet, clicking on the link will save the document to your device.

In any case, the document will be empty, with many zeroes. As soon as you begin inserting your digits, it will start to take shape.

After you’ve inserted your company’s details and the period you want to cover, start by filling in the Revenue and gains column by adding details such as:

- Sales and interest revenues,

- Gains on sales of assets, and other revenues.

Next, you need to populate data in the Expenses and losses column, including:

- Cost of goods sold,

- Depreciation,

- Office supplies,

- Rent, and other expenses.

To get the net income, you’ll need to subtract the Total of expenses and losses from the Total revenue and gains .

⬇️ Download the Single-step P&L statement template (Google Sheets)

⬇️ Download the Single-step P&L statement template (Excel)

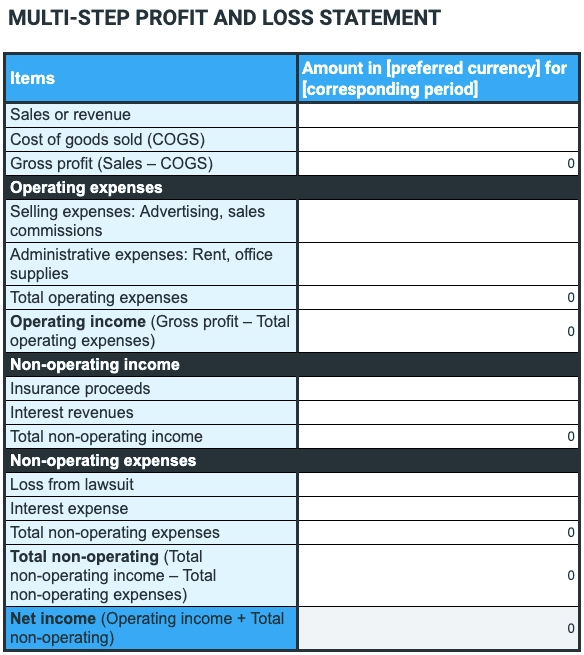

Profit and loss template #2: Multi-step P&L statement

The multi-step P&L statement is a more detailed type of profit and loss statement that includes multiple subtotals. For example, it separates the operating expenses and operating income from non-operating expenses and non-operating income. In turn, this helps a company find out which areas are performing as expected or poorly.

Suppose a budget item from your non-operating income — like insurance proceeds — is through the roof. In this case, the multi-step P&L statement provides you with details about this item. In contrast, the single-step P&L statement typically attaches this non-operating income to other budget items, which doesn’t give a proper explanation for the rise in insurance proceeds.

Filing out this template is time-consuming, but it helps you get more in-depth into your financial situation and is meant for mid-sized and large businesses.

Pros of the Multi-step P&L statement template:

- Calculates gross profit and operating income easily, and

- Offers deeper insight into operating trends and financial performance.

Cons of the Multi-step P&L statement template:

- Lacks simplicity, making it hard for non-finance persons to interpret, and

- Takes plenty of time and effort to create one.

How best to use the Multi-step P&L statement template?

If you click on the Google Sheets link below, a new screen will appear with the prompt: Would you like to make a copy of the Multi-step P&L statement template?

Click on Make a copy, and you’ll get an editable copy of the Multi-step P&L statement template.

After you’ve inserted your company’s details and the period you want to cover, start by filling in details such as:

- Sales or revenue, and

- Cost of goods sold.

Next, you need to populate data in the Operating expenses column, including:

- Selling expenses, and

- Administrative expenses.

This brings you to the Operating income , which you get when you subtract Total operating expenses from your Gross profit . The line item Operating income is critical, as it lets you see if your operating activities are generating profit or not. Depending on the industry, an operating activity can fall into many categories, like manufacturing, sales, marketing, and others.

Next, you need to fill in data for:

- Non-operating income, and

- Non-operating expenses.

To get the net income, you’ll need to add Operating income to the Total non-operating expenses . For simplicity’s sake, net income is the bottom line of a company. In other words, it represents the amount your business has made after deducting expenses, taxes, allowances, and other costs.

⬇️ Download the Multi-step P&L statement template (Google Sheets)

⬇️ Download the Multi-step P&L statement template (Excel)

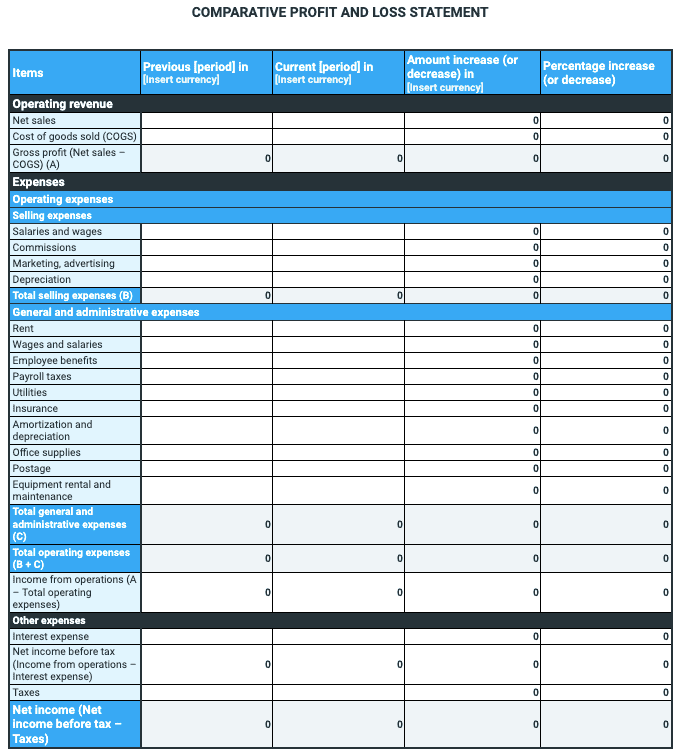

Profit and loss template #3: Comparative P&L statement

The comparative P&L statement is a complex type of a profit and loss statement that compares different accounting periods for one company — or multiple different-sized companies. Experts praise it as one of the most useful P&L statements, as it presents investors and managers with changes in percentage and numbers from one period to the next.

The Comparative P&L statement template presents figures of expenses and income on a single page without having to go back to previous P&L statements and compare them to current ones.

This template allows you to spot problems and trends over different accounting periods. In fact, since it’s digital, you can easily correct numbers and do necessary calculations online without having to print them out.

Pros of the Comparative P&L statement template:

- Provides a clear comparison between multiple accounting periods, and

- Simplifies analysis of sales and net income line items.

Cons of the Comparative P&L statement template:

- Benefits the company only if it uses identical accounting principles consistently to produce such P&L statements (like the accrual or cash method), and

- Fails to be practical when the company branches out into new lines of business.

How best to use the Comparative P&L statement template?

If you click on the Google Sheets link below, a new screen will appear with the prompt: Would you like to make a copy of the Comparative P&L statement template?

Click on Make a copy, and you’ll get an editable copy of the Comparative P&L statement template.

After you’ve inserted your company’s details and the period you want to cover, start by filling in details for the Operating revenue column, such as:

- Net sales, and

Next, you need to populate data in the Operating expenses and General and administrative expenses columns, including:

- Salaries and wages,

- Depreciation,

- Payroll taxes,

- Insurance, and others.

This brings you to the Total operating expenses column, which you get when you add Total selling expenses to the Total general and administrative expenses .

- Income from operations,

- Interest expenses,

- Taxes, and others.

To get the net income, you’ll need to subtract Net income before tax from Taxes .

⬇️ Download the Comparative P&L statement template (Google Sheets)

⬇️ Download the Comparative P&L statement template (Excel)

Note: Even though our P&L statement templates are pretty straightforward, it’s always best to consult with an accountant before making a profit and loss statement official. Clockify is not responsible for any losses or risks incurred should this example be used without further guidance from professionals.

FAQ about profit and loss statements

In this segment, we’ll take a look at a few frequently asked questions people face when they start working on a profit and loss statement.

What is the difference between a cash flow statement, balance sheet, and P&L?

Companies typically make 3 types of financial statements on their financial performance annually, quarterly, and monthly, including:

- Cash flow statement — a financial document that lists the sources of cash deriving from investment, operating, and financing activities,

- Balance sheet — a financial statement that looks into equity, liabilities, and assets that the company has in its possession, and

- Profit and loss statement or income statement — a financial document that details revenues, sales, expenses, and costs in one form or another, depending on the company’s reporting standards.

But when it comes to disclosing this information, not all companies have the same responsibilities toward authorities.

Which companies have to give away financial statements?

Public companies are required by law to file regular reports with the U.S. Securities and Exchange Commission. Yet, most private companies don’t have to disclose this information — at least the ones with less than $10,000,000 in assets and with more than 500 owners who hold securities (a financial instrument that provides individuals with a form of company ownership).

Private companies that aren’t subject to these criteria often still provide these financial statements to the authorities. The reason? Well, this information gives financial experts deeper insight into how they do business. As a result, investors can make informed decisions about investing, and buyers can decide whether they want to buy or sell a company.

Paired together, the cash flow statement, balance sheet , and profit and loss statement comprise 3 critical components that help managers and investors explore a company’s financial performance over a given accounting period.

Is a P&L the same as an income statement?

Yes, profit and loss statement and income statement are synonyms for the financial document that gives you insight into your company’s financial performance. They include expenses, revenue, and net profit for a given accounting period (a week, month, quarter, or year).

Is P&L the same as a balance sheet?

A profit and loss statement differs from a balance sheet by focusing on expenses and revenue. On the other hand, the balance sheet looks into:

- Liabilities,

- Assets, and

- Equity.

Yet, the balance sheet is a critical companion of the P&L statement in assessing the overall health of a business.

Does P&L include revenue?

Yes, a profit and loss statement always includes revenue and expenses. Line items on revenue, sales, expenses, and costs are the identifying marks of P&L statements.

Is a P&L a cash flow statement?

No, a profit and loss statement isn’t the same as a cash flow statement. Unlike the P&L statement, the cash flow statement lists the cash sources stemming from investment activities, operating activities, and financing activities. In other words, the cash flow statement doesn’t include information on expenses and revenue — as is the case with the P&L statement.

Wrap-up: Prepare regular P&L statements to learn if your business operations are profitable

To make your profits shine, you surely have to go through a strenuous process. And it’s so much more than mere cost management!

In fact, you need to be aware of what exactly happens with your company’s money — and this is where a profit and loss statement comes into play.

In a nutshell, P&L statements allow accountants and managers to make more informed decisions by giving them insight into which activities are a waste of money and which generate profit.

For this and a wealth of other reasons, we geared you up with everything that can help you make the best profit and loss statements, paired with examples and templates.

In summary, here are the main takeaways:

- Choose a simple or complex type of a P&L statement, depending on your needs,

- Harness the power of expense-tracking software to make the process effortless,

- Use templates to speed up the creation of a P&L statement,

- Implement a P&L statement regularly to keep tabs on sales and revenues, and

- Track and manage your time by using time and billing software.

If you follow just a few of these pieces of advice, you’ll be on your way to creating profit and loss statements that will amaze investors and managers alike.

Sources for the table:

- Khatabook, Comparative Income Statement: Examples, Analysis and Format

- Library of Congress, Research Guide on U.S. Private Companies

- Millie Atkinson, 2017, Income Statements Essentials

- Risks and benefits of handling digital receipts, Eurocard, 2021

- Sandy Baruffi, 2021, The Basics Of Understanding Financial Statements: A Guide To Understanding Financial Reports

- U.S. Securities and Exchange Commission, The Laws that Govern the Securities Industry

- U.S. Securities and Exchange Commission, What does it mean to be a public company?

- WallStreetMojo, Single-step Income Statement

Explore further

Business Regulations

Freelancers & Contractors

Free time tracker

Time tracking software used by millions. Clockify is a time tracker and timesheet app that lets you track work hours across projects.

How to Read and Analyze a Profit and Loss (P and L) Statement

Paula Kehoe

Reviewed by

January 25, 2022

This article is Tax Professional approved

A profit and loss statement (P&L) is an effective tool for managing your business. It gives you a financial snapshot of how much money you’re making (or losing) and can make accurate projections about your business’s future.

But, learning how to read one isn’t always intuitive.

I am the text that will be copied.

Here we show you how to break down a P&L statement—how each line item interacts and what they mean for your company’s financial performance. Knowing how it all works can help you to better troubleshoot, modify, and plan your daily operations.

What is a profit and loss statement?

A P and L statement is a go-to financial statement that shows how much your business has spent and earned over a specific period of time. Your P&L statement shows your revenue, minus expenses and losses. The outcome is either your final profit or loss.

Small business owners have two reporting options when preparing an income statement: a single-step or a multi-step P&L statement.

A single-step profit and loss statement is pretty straightforward. It adds up your total revenue, then subtracts your total expenses, and gives you your net income. A multi-step P&L, on the other hand, requires you to perform multiple calculations in order to arrive at your final net income. The format you choose depends on the type of business you own and the purpose of the P&L you’re creating.

You’ll sometimes see a P&L statement called statement of operations, income statement , statement of earnings, or more simply, “the bottom line.”

You can use a P and L alongside other key financial reports, like the balance sheet and cash flow statement , to check up on and improve the health of your business.

A P&L is typically prepared around tax time. But business owners can run a P&L statement monthly, quarterly, or annually to verify profits and compare certain periods of time to show growth. These comparisons can be helpful for investors and banks who want to see a company’s risk level before they will invest or loan to a business.

A note on vocabulary: profit and loss statements are called income statements when they’re meant to be shared outside a business. The statement is called a P&L when it’s for internal use only. Other than that, though, the two statements are essentially the same.

Profit and loss statement sample

We’ve created a single-step profit and loss statement for an imaginary business—Bench Bakery, a small pastry shop.

Bench Bakery P&L Statement For Year End: December 31, 2021

We read profit and loss statements top to bottom, so we’ll go through this one line by line.

The components of a profit and loss statement

Here’s a quick run-down of what each section in a P and L statement means and where the numbers come from.

Knowing how much revenue your business brings in is a key factor in knowing whether it has been profitable. You can measure this either through a cash basis or accrual accounting . The revenue line will be at the top of your P&L and will mark the total revenue accrued during the timeframe you’ve set out (i.e., quarter or year-end, as in this case).

Cost of goods sold

Cost of goods sold, or COGS , represents what it costs your company to deliver the goods or services. This includes direct expenses such as materials, labor, and shipping but doesn’t include indirect expenses such as rent or utilities.

Gross profit

To find out your gross profit , deduct the COGS from your total revenue. This doesn’t include overhead costs like rent or upkeep, so it’s not a full indication of your profits.

Expenditures

General expenses fall into two categories.

- Direct : In the case of Bench Bakery, that might be employee wages, flour, butter, sugar, ovens—any items directly related to producing bread.

- Indirect : These expenses aren’t traceable to the production of a product (in this case, bread). For the bakery, that can include overhead costs like rent, maintenance, electricity bills, or gas for delivery vans. You don’t include these in COGS.

Operating earnings

Operating earnings measure how profitable your business is, without taking into account external costs, like interest payments, taxes, depreciation, and amortization.

Operating earnings are also called “Earnings Before Interest, Taxes, Depreciation, and Amortization” (EBITDA). Don’t worry; it’s not as scary as it sounds. Because you have more control over your internal costs than your external costs, many accountants believe EBITDA is the best way to gauge how a business is performing.

Interest expense

Typically, interest expenses arise from a company borrowing money, for example, through a business loan, line of credit, or credit card. Interest expense is the total interest payment you make to creditors for a specific period on your P&L statement.

Earnings before income tax

This is your business’s profitability before it pays its income taxes.

Income tax expense

This line shows how much tax you paid on your income.

Your net profit deducts all expenses (direct and indirect) from your total revenue. This reveals the total profit your company has made.

A loss indicates your expenses were higher than the revenue your business brought in. Basically, this shows your business didn’t make a profit during this time period and by how much.

A DIY approach to profit and loss statements

Interested in generating your own P&L statement to track cash flow and expenses for your small business? Try our profit and loss statement Excel template . It’s free to download, and you can customize it using your business numbers to make examining your company’s performance easier.

How to analyze a profit and loss statement

While it can seem like a daunting pile of numbers, knowing how to review a P and L statement can show you how your business is evolving over time and when it has been most profitable. It can also help you uncover any potential issues with your cash flow.

Here are a few things to keep in mind when reviewing a P&L.

1. Check your bottom line

Curious how your business is doing? Check your bottom line.

The last line of your P&L indicates whether you’re “in the black” (earnings were greater than expenses) or “in the red” (expenses were greater than earnings).

While a net profit is always something to celebrate, a net loss doesn’t always mean your business is in trouble, especially when first starting out. However, it can indicate any areas that might need attention to ensure losses don’t become a pattern.

2. Check your income streams and expenses

Once you know whether your business has made money or not, it’s a good idea to take a closer look at your income streams and expenses.

Are your revenue sources in line with your business goals? Are they a one-time or continuous increase? It’s good to know if a surge in profit came from gradual growth or a specific event or promotion.

On the other hand, do your expenses make sense for the time period examined? Some costs like rent and utilities might be fixed, while others like supplies or wages could vary.

If your business had a net loss, it’s good to see if you can reduce any ongoing costs or if they were necessary for that time period (i.e., increased inventory for the holidays, planned expansion, etc.).

3. Compare your numbers

It’s important to compare your P&L statement to previous periods to see if your profit or loss is a trend or an anomaly.

Examining the percentage of change in each category can help you determine if you’re on track to meet your goals. Even though a large percentage jump in earnings may seem positive at first glance, if the same period the year prior had very low income, the growth might not be as significant. The same might also be true for expenses.

Once you’ve made your comparisons, you will have a better idea of what’s working or not for your business and if you need to make any changes moving forward.

4. Double-check your math

If you’re working in an Excel spreadsheet to build and review your P&L statement, be sure to double-check your numbers to make sure you didn’t miss anything or accidentally change a formula. Sometimes, manual data entry can lead to mistakes that affect your bottom line. Reviewing your previous statements can also help in this process.

How Bench can help

Updating your profit and loss statement helps you check in on the health of your business. Your Bench account offers an at-a-glance P&L statement, allowing you to review your profitability, identify any cash flow issues, and stay on top of your main expenses month to month.

Spend less time struggling with profitability and more time optimizing it with Bench. Learn more about how Bench works .

Get the full picture of your business’s financial health

Having a solid grasp of your P&L statement analysis is extremely useful. It helps answer key questions about your business’s financial health and how you can keep building revenue to fuel your growth. When your numbers are reliable and up to date, it leaves you more time to focus on the big picture.

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

Get a regular dose of educational guides and resources curated from the experts at Bench to help you confidently make the right decisions to grow your business. No spam. Unsubscribe at any time.

Profit and Loss Statement (P&L) Definitions & Examples

A profit and loss (P&L) statement is a report that details a company’s revenue and expenses over a period of time (usually a quarter or fiscal year). The profit & loss statement, also called the income statement, shows whether a company lost money or made a profit during the reporting period.

Let’s explore what a P&L statement means for your business, why you need one, a profit and loss statement example, and three free templates you can use to create yours today in this article from Nav’s experts.

When Your Business Needs a Profit and Loss Statement

As a small business owner, you probably already have a number of responsibilities on your to-do list. Depending on your situation, you may have to manage taxes, apply for business credit cards or small business loans , monitor your business credit scores , and perhaps even oversee daily sales or operations.

It’s understandable that you might feel worried about adding more duties to the ever-growing pile. But once you get used to filling out your income statement template , you’ll get faster at the process over time. Your accounting software may help you complete this task as well.

The good news is you don’t need a business accounting degree to learn how to use these statements. Your accounting software can often help you create a P&L, or your accountant can help as well.

Pro forma P&L

The first time your business should create a P&L statement is right at the beginning. You probably won’t have any actual income or expenses to report at that point. Still, you can create a pro forma P&L to project these figures for the future. Pro forma income statements may be helpful when you apply for business loans or other types of financing.

Periodic P&L

All established businesses should prepare a P&L statement from time to time. Ideally, your company should create a new report at least once a quarter. Monthly income statements are even better.

A periodic P&L statement can help you manage your business finances. You can compare your current statement to previous ones and see if your net income is improving or declining. A P&L statement can also help you when it’s time to prepare your business tax return.

Other types of P&L/income statements

Other types of P&L statements include:

- Single-step P&L statements are the simplest format for a P&L statement with subtotals for revenue and expenses.

- Multi-step P&L statements further break down revenues and expenses into operating and non-operating revenues and expenses.

- Comparative income statements compare different periods (such as quarterly or annual reporting periods).

- Common size analysis P&L statements present line items as a percentage of revenue.

- Profit & loss variance statements show the difference between amounts budgeted versus actual income or expenses.

- Contribution margin P&L statements show net profit by first deducting variable expenses from sales to determine the contribution margin, then subtracting fixed expenses.

- Driver-based P&L statements are used to create forecasts, often for executive planning.

Compare Your Financing Options With Confidence

Spend more time crushing goals than crunching numbers. Instantly, compare your best financial options based on your unique business data. Know what business financing you can qualify for before you apply, with Nav.

What Information Goes on a P&L Statement?

Before you prepare a statement of profit and loss, you’ll need to gather information about that money that flowed into and out of your business during the time period in question. Make sure your bookkeeping is up to date so you’re working with current information. If you already have a company cash flow statement , it may contain many of the details you need.

In addition to your statement of cash flows, you may also gather information from the following sources:

Your business bank statements

Search your bank statements for all sources of income deposited during the reporting period. Your company’s income categories may include:

- Sales revenue – Total sales earned when your company sells goods or services.

- Affiliate commissions – Commissions received when your business promotes or sells another company’s products or services.

- Rent and lease payments – Income earned from leasing equipment or property to others.

- Royalties – Money earned when you create a product, and someone else sells it on your business’ behalf.

- Non-operating income – May include interest earned on investments or savings.

- Gains – Profits made from the sales of the company’s assets, like equipment, property, etc.

Your accounting software

Next, assemble a list of the funds that flowed out of your business during the time period featured in the report. The transactions list in your accounting software or checkbook ledger should contain these details. Alternatively, you can review your bank statement for the data you need.

Group all expenses incurred into categories, such as:

- Operating costs (or administrative expenses) – Rent, salary, wages, marketing, insurance, legal fees, and other overhead costs.

- Costs of goods sold (COGS, or cost of sales) – Inventory, shipping, storage, raw materials, and other expenses involved in selling products.

- Depreciation and amortization – May apply to equipment, machinery, buildings, or other property your business owns.

- Taxes – Income tax paid.

- Interest paid on debt – Interest expenses incurred on business credit cards , small business loans , lines of credit, and other debt.

Cash receipts

Be sure to include cash transactions in your P&L as well — both income and expenses. Cash deposits should be detailed in your business checking account and your accounting software, if you recorded them previously. It’s also wise to save your receipts to make reporting cash expenses easier.

Simple Profit and Loss Statement Example

The table below shows an example of a simple profit and loss statement.

3 Excellent P&L Statement Templates You Can Download for Free

Rather than starting with a blank page, turn to a profit and loss statement template. These templates can provide the backbone of your business’s profit and loss statement. Most templates are in Excel and are fully editable to suit your business needs.

Here are some great options:

- Nav : Get Nav’s profit and loss template here.

- FreshBooks : Download FreshBooks’s free P&L template here.

- Corporate Finance Institute : Get the free template from the Corporate Finance Institute here.

You can also reach out to an accounting professional to get advice on how to complete a profit and loss statement if you have questions.

How to Analyze a Profit and Loss Statement

A profit and loss statement can give you insight into a company’s profitability, but you need to know how to read it first.

A one-step profit and loss statement is relatively straightforward. First, you’ll decide what you want the given period to be, which can be monthly, quarterly, or annually. Then you’ll subtract your total expenses from your business income (any business expenses) to find your net income.

Once you have completed the calculations, a P&L statement can show you where you’re overspending or not grabbing onto opportunities to increase profits. It will allow you to look at changes that happen over time to see if there are up seasons you can plan ahead for, or if you’re growing. You can also compare your business to the competition to see if there’s a way to increase profits. Overall, you can become more efficient and effective at running your business using a P&L statement.

Profit and loss statements can be useful tools, but you need to understand how they work first. Don’t hesitate to contact an accounting professional with any questions.

Why You Need a P&L Statement

We’ve covered when your business needs a P&L statement and some basics about how to create a simple one. But why is a profit and loss statement useful for a business? Below are a few reasons why your business needs an income statement in the first place.

- You can use a P&L statement to improve your bottom line. By periodically taking stock of your company’s income and expenses, you can get a better idea of how it’s performing financially. You may discover how to boost your net income, and ultimately business profits, by increasing revenue, cutting expenses, or some combination of the two.

- Put your business in a better position to borrow. When you apply for business funding, lenders will often review your financial statements , including the P&L statement, as part of the application process. Of course, your business credit scores and reports are often among the key factors considered when you apply for a loan. Yet a P&L statement that shows your company is in the black can be a big plus.

- A P&L statement might be required. Is your company publicly traded? If so, you’re likely required to file annual reports (and other reports) with the Securities and Exchange Commission (SEC) . An income statement is part of the financial information your business must disclose in these reports.

- P&L statements can help you prepare your taxes. Unless you’re an accountant or a big fan of numbers, you likely don’t enjoy preparing your business tax return. Many business owners don’t consider this particular obligation to be much fun. Yet if you prepare regular P&L statements, filling out your tax returns could be less painful. Through your P&L, you’ll already have access to much of the information you need.

P&L Statement vs. Balance Sheet

A balance sheet and a P&L statement are both financial reports, but they provide different information to a business. As mentioned, a profit and loss statement shows a business’s profitability over a certain period of time. It can give insights into how to increase profits by boosting revenue or reducing expenses, or both.

On the other hand, a balance sheet looks at a business’s assets, liabilities, and shareholder equity (if applicable) at a specific time. Assets include accounts receivable, inventory, and cash, while liabilities are debt, overhead, and accounts payable. It shows how well the management is using the business’s resources and how it can be improved. Calculating the rates of return using your balance sheet for different products and services shows what’s giving you the most bang for your buck, and if there is anything you should cut.

Businesses use both of these financial statements in tandem. When used together, they give you an overall view of your business’s efficiency, consistency, changes you should make to your business plan, and the direction you should take as a business as a whole.

The Difference Between a P&L Statement and a Statement of Revenue

A statement of revenue and a P&L are the same financial report. There are actually four different terms used to describe the report that helps you calculate your company’s net income:

- Profit and loss statement

- P&L statement

- Statement of revenue

- Income statement

It can be easy to confuse these terms, but know that they refer to the same report.

Is Profit And Loss Statement and Income Statement the Same?

Yes, you will often see the terms P&L and income statement used interchangeably. They are the same report and perform the same function, but they’re sometimes referred to using two different names.

Final Word: Profit and Loss Statements

Keeping track of your company’s financial performance is critical to its long-term success. That’s why a P&L statement can be such a valuable tool for a business owner to use.

By creating regular profit and loss statements, you can track your company’s financial health over time. This knowledge can provide you with opportunities to either double down on smart business strategies that are working for you or make course corrections when needed.

If the idea of creating regular P&L statements or other financial documents feels overwhelming, you don’t have to create these statements on your own. You can hire a professional accountant to help. Even if you’re comfortable creating your own financial reports, a professional accountant can save you time and free you up to focus on other areas of your business.

Accelerate your path to better funding

Build business credit history, see your business credit-building impact, and secure new funding options — only with Nav Prime.

This article was originally written on January 8, 2020 and updated on January 17, 2024.

Rate This Article

This article currently has 7 ratings with an average of 5 stars.

Michelle Black

Michelle Lambright Black, Founder of CreditWriter.com and HerCreditMatters.com, is a leading credit expert with over a decade and a half of experience in the credit industry. She’s an expert on credit reporting, credit scoring, identity theft, budgeting, and debt eradication. Michelle is also an experienced personal finance and travel writer. You can connect with Michelle on Twitter (@MichelleLBlack) and Instagram (@CreditWriter).

Have at it! We'd love to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and protect yourself. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers. Reviews Disclosure: The responses below are not provided or commissioned by the credit card, financing and service companies that appear on this site. Responses have not been reviewed, approved or otherwise endorsed by the credit card, financing and service companies and it is not their responsibility to ensure all posts and/or questions are answered.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name and email in this browser for the next time I comment.

Free Profit and Loss Templates

By Andy Marker | March 26, 2018

- Share on Facebook

- Share on LinkedIn

Link copied

We’ve compiled the most useful collection of free profit and loss (P&L) templates for company owners, corporate officers, accountants, and shareholders. Plan and track your organization’s P&L with these free, easy-to-use templates.

Included on this page, you’ll find a simple profit and loss template , a small business profit and loss template , a self-employed profit and loss template , a printable profit and loss template , and a restaurant profit and loss template , among others. Plus, find tips for using these P&L templates .

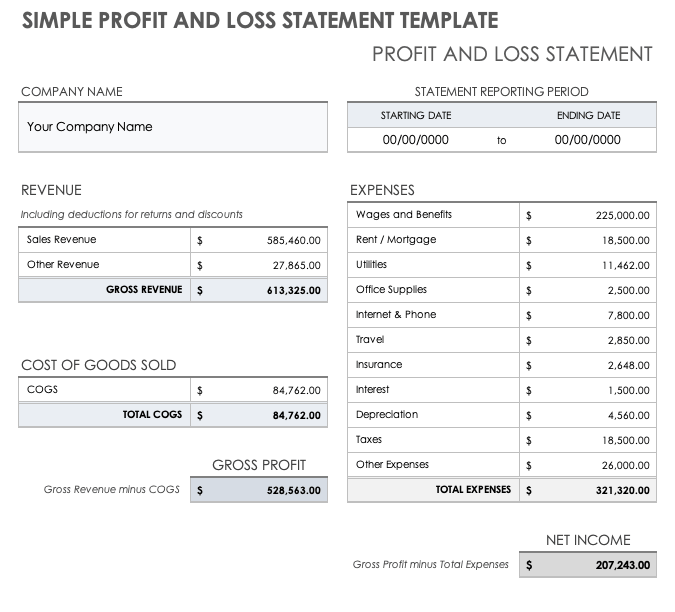

Simple Profit and Loss Statement Template

Download Simple Profit and Loss Statement Microsoft Excel | Microsoft Word | Adobe PDF

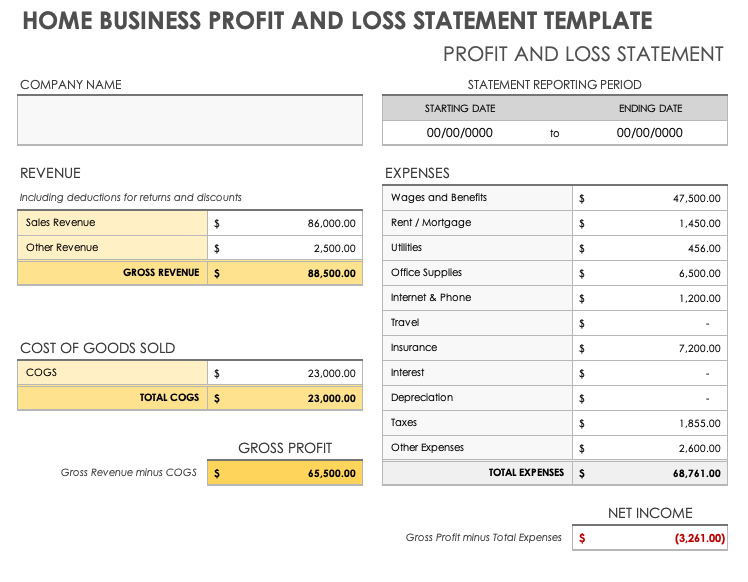

Use this simple P&L statement template to calculate your organization’s total revenue compared to your costs and expenses. This fully customizable template prompts you to note your Statement Reporting Period date range, enter revenues (including any deductions for returns and discounts) and cost of goods sold (COGS), to determine your gross profit. Enter your expenses to calculate your total expenses, and to reach your net income figure.

For more finance-reporting resources and templates, read our article on business plan financial templates .

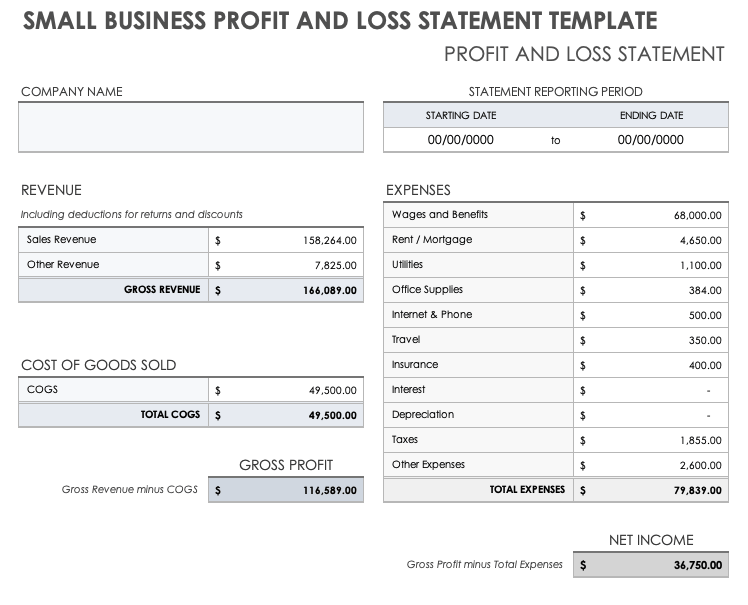

Small Business Profit and Loss Statement Template

Download Small Business Profit and Loss Template Microsoft Excel | Adobe PDF | Google Sheets

Use this simple template if the categories under income and expenses don’t need to be broken out. This template can be used by service, retail, and B2B organizations. The income section includes space to show income and to deduct the cost of goods sold. The expenses section includes common categories, such as wages and benefits, insurance, and taxes. To use this template for multiple periods (e.g., six months or three years), save a copy for each time period.

Read our article on free small business profit and loss templates to find additional resources and get the most out of your P&L statements.

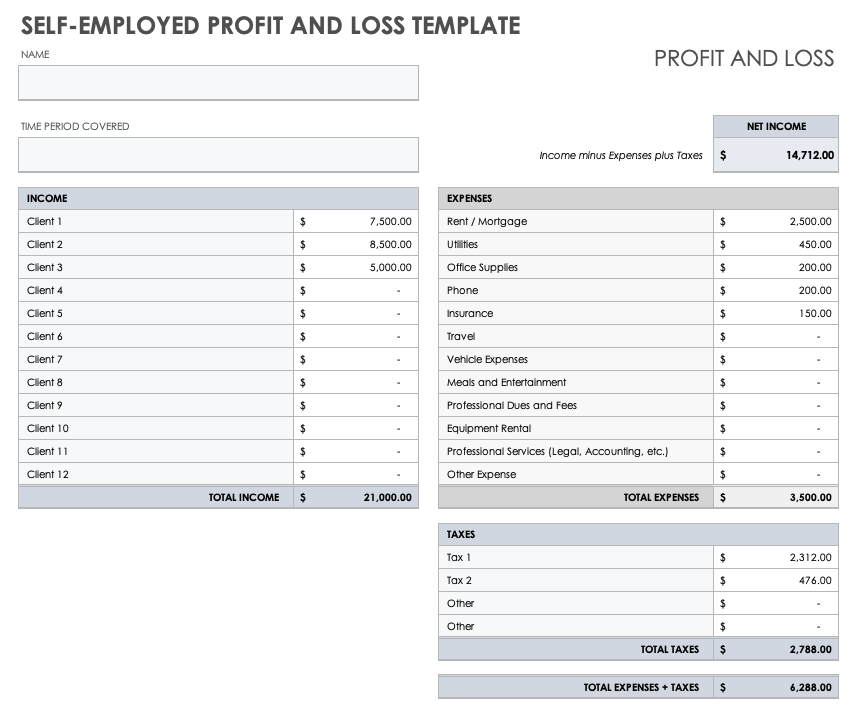

Self-Employed Profit and Loss Template

Download Self-Employed Profit and Loss Template Microsoft Excel | Adobe PDF | Google Sheets

Self-employed people and freelancers have unique needs. This self-employed profit and loss template takes these requirements into account by breaking out income by client and by using expense categories that apply to people who work for themselves.

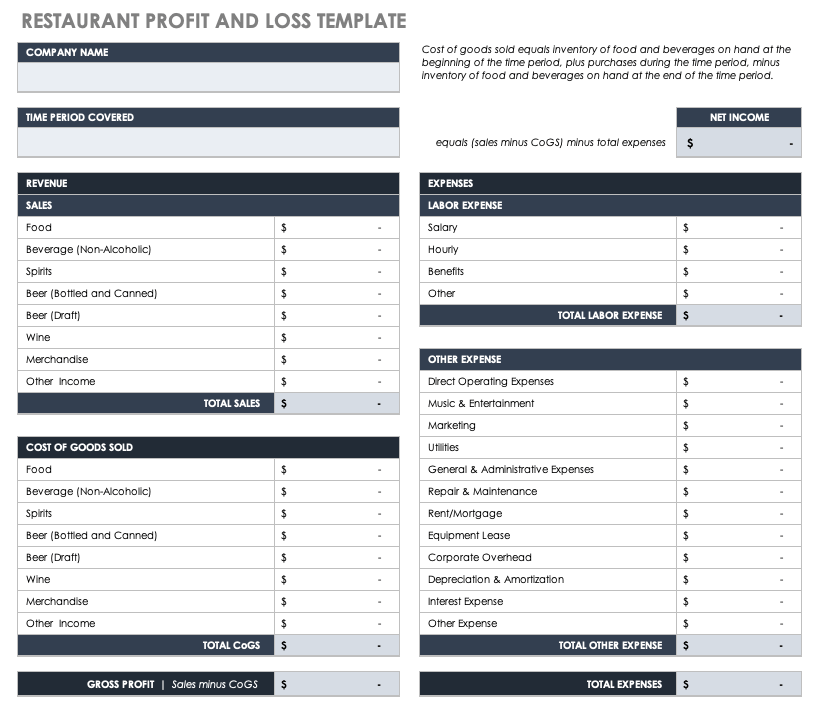

Restaurant Profit and Loss Template

Download Restaurant Profit and Loss Template — Microsoft Excel

Food service businesses have to keep track of their food and beverage inventories. This template has entries for different types of inventory — including multiple beverage categories, such as draft beer, canned and bottled beer, wine, spirits, and non-alcoholic beer — in both the sales and cost of goods sold sections.

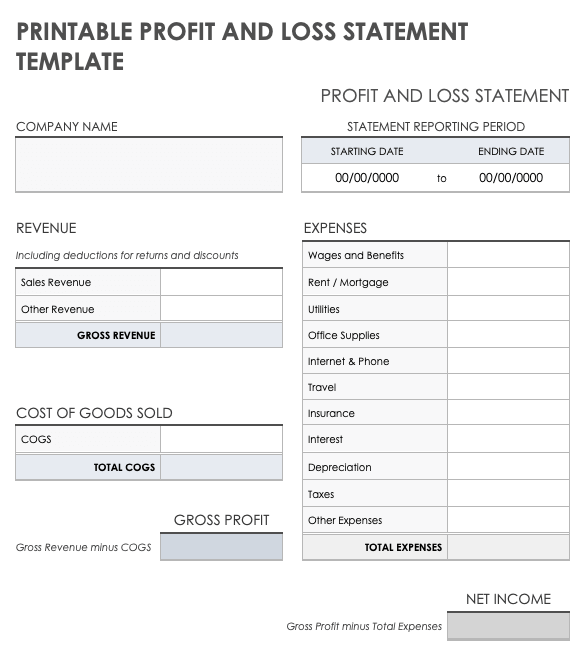

Printable Profit and Loss Statement Template

Download Printable Profit and Loss Statement Template Microsoft Word | Adobe PDF | Google Docs

This one-page P&L template provides a print-friendly solution for those looking to compare their total revenues to their total costs and expenses. Use his straightforward template to determine whether your net income puts you in the red or black, and whether you need to increase your profits by increasing your revenues or reducing expenses.

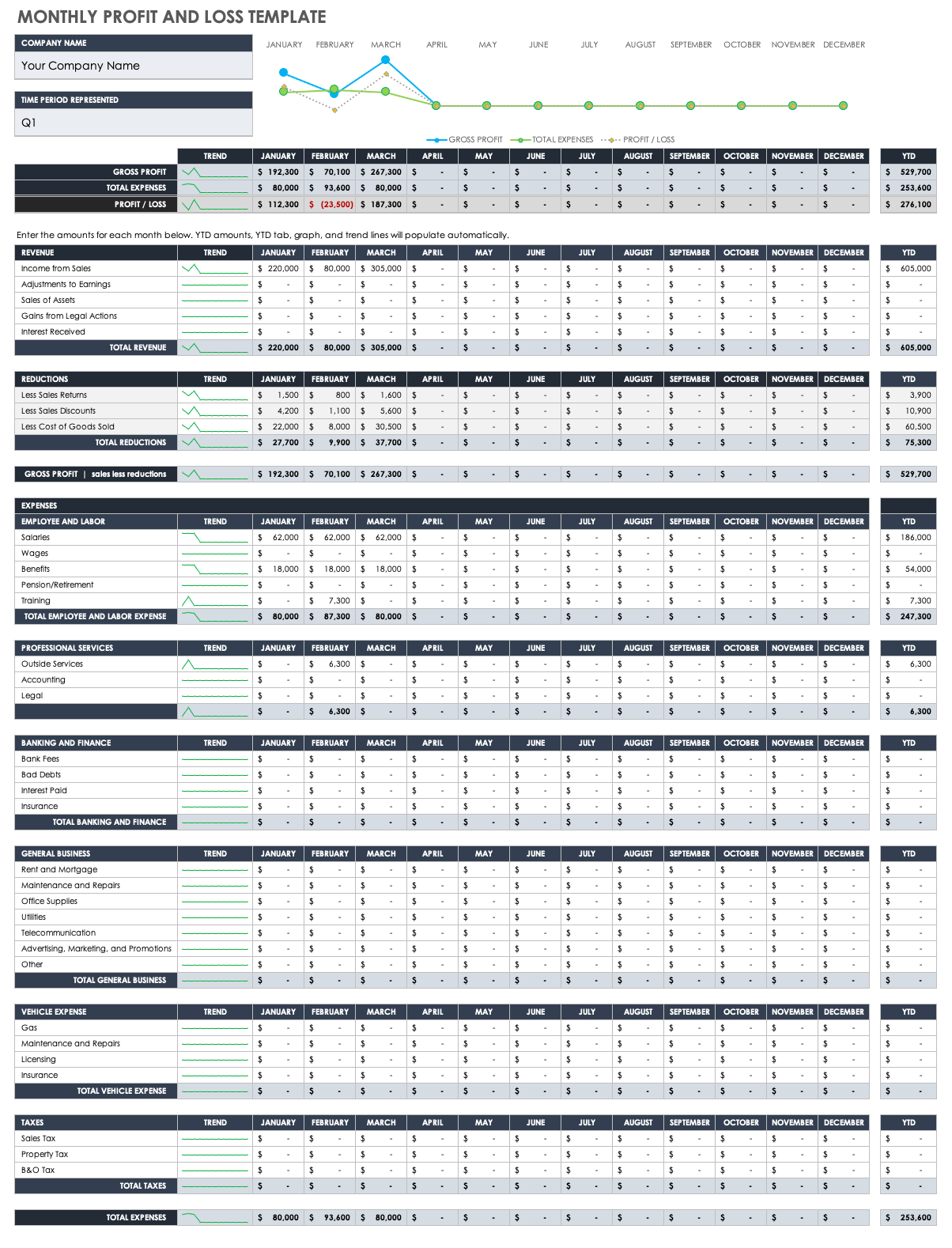

Monthly Profit and Loss Template

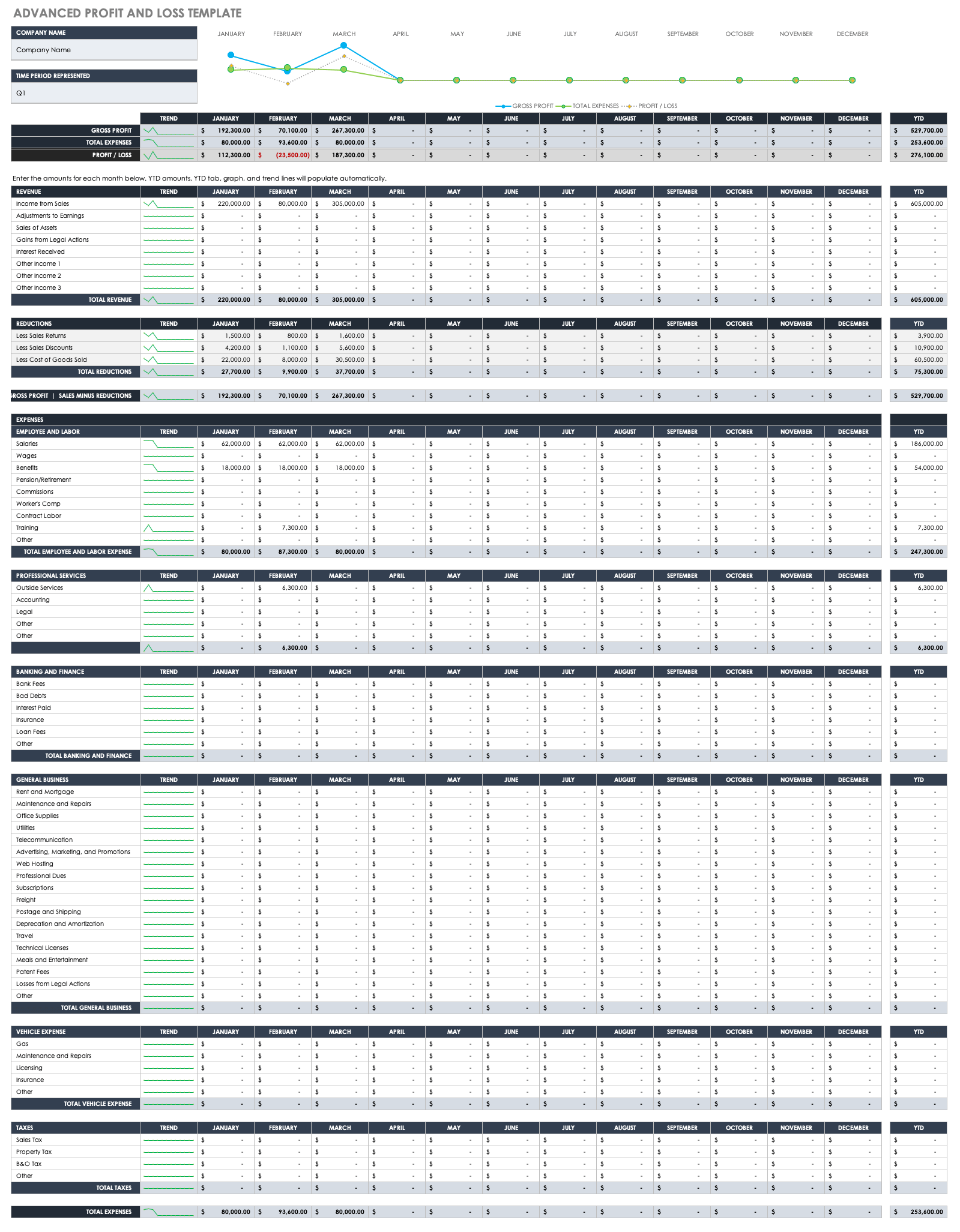

Download Monthly Profit and Loss Template — Microsoft Excel

Use this template to create a P&L statement that tracks your month-by-month and year-to-date (YTD) costs and expenses compared to your revenue. Enter your revenue figures, reductions, expenses, professional services (if applicable), banking and finance information, general business costs, and taxes to determine if your total revenue exceeds your costs and expenses. A month-by-month bar chart indicates your P&L trend by mapping how your gross profit relates to your total expenses over a series of months.

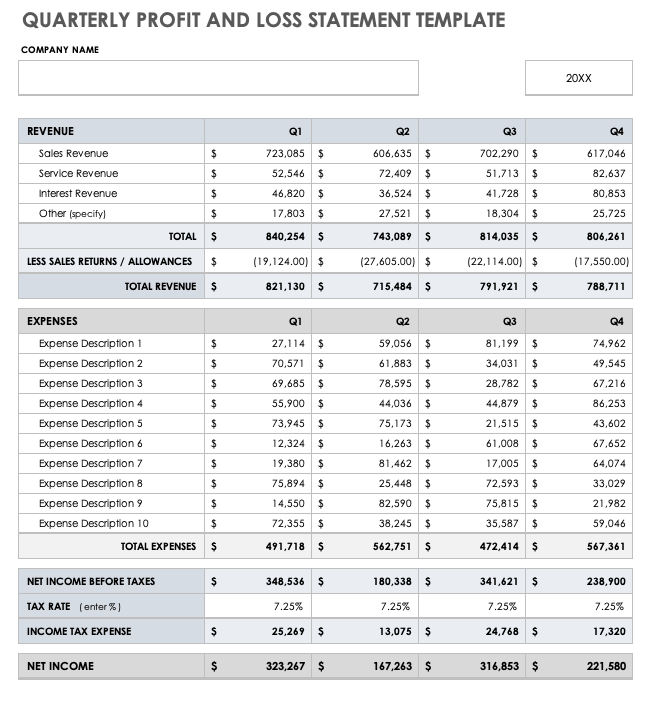

Quarterly Profit and Loss Statement Template

Download Quarterly Profit and Loss Statement — Microsoft Excel

Use this three-month P&L statement template to record your quarterly income and expenses. This template is a perfect solution for companies that need to provide quarterly P&L updates, and includes quarter-by-quarter columns, so that stakeholders can review your organization’s net income in smaller time increments.

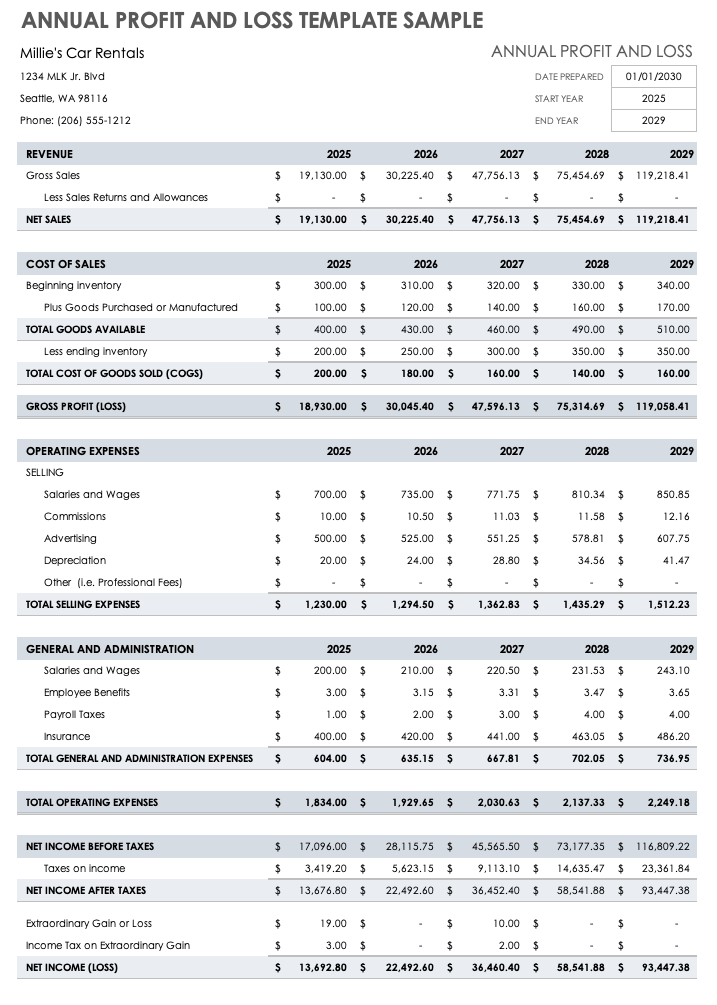

Annual Profit and Loss Sample Template

Download Annual Profit and Loss Template Sample — Microsoft Excel

Measure your YTD and year-over-year profits and losses by comparing your total revenue to your total expenses and costs. Enter annual revenue, cost of sales, operating expenses, general and administrative costs, and taxes to determine your net income. The template provides annual insight into your P&L, as well as a five-year outlook on your profit and loss trends.

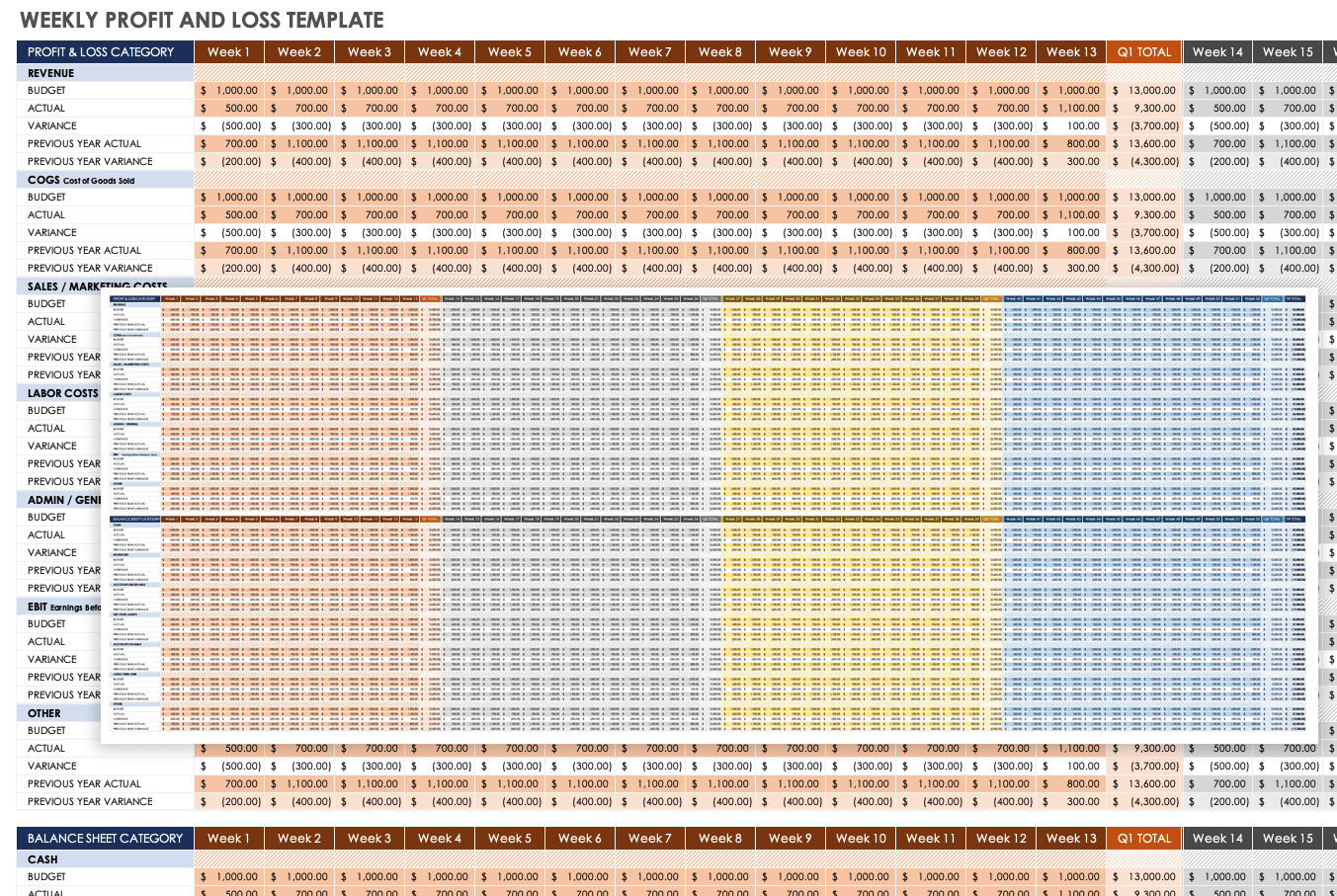

Weekly Profit and Loss Template

Download Weekly Profit and Loss Template Microsoft Excel | Google Sheets

Track your week-by-week budgeted revenue versus your actual revenue with this weekly profit and loss template. The template’s detailed Profit and Loss Category sections include revenue, COGS, sales and marketing costs, labor and administrative costs, and earnings before interest and taxes (EBIT). The template’s Balance Sheet Category sections includes cash, inventory, accounts receivable, net fixed assets, accounts payable, long-term debt, and other factors. Week-by-week columns provide you with more detailed insight into your P&L, and whether you need to reduce costs or increase revenue to boost your profits.

Read our article on free small business budget templates to find additional budgeting resources and to improve financial tracking and management.

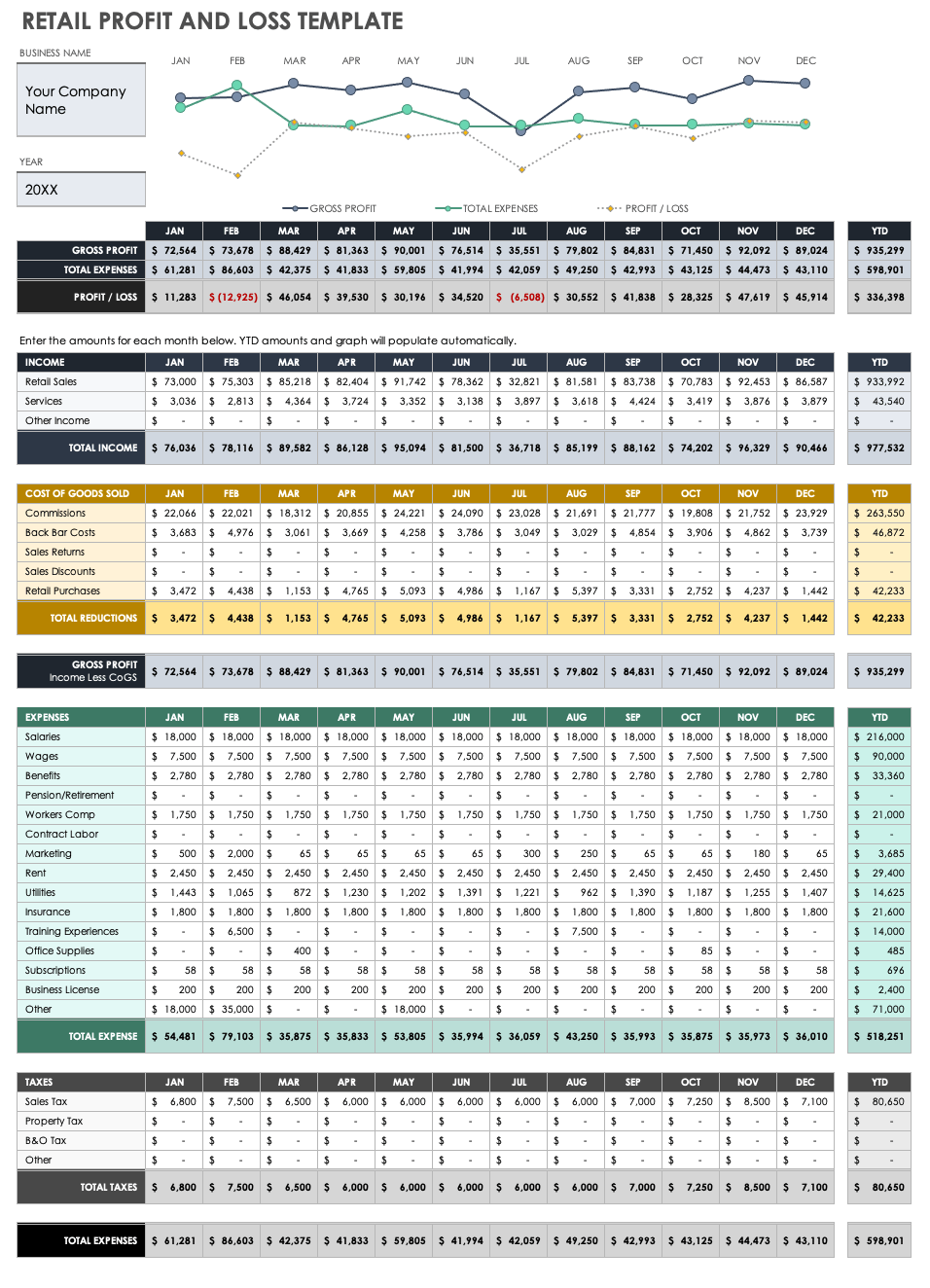

Retail Profit and Loss Template

Download Retail Profit and Loss Template Microsoft Excel | Google Sheets

Use this visually dynamic retail P&L template to determine your store’s profits or losses over any customized period of time. Enter income and expense figures, and the dashboard-style bar chart will illustrate your gross profit, total expenses, and actual P&L, while comparing your profits versus expenses. Use the detailed Costs of Goods Sold and Taxes sections to further account for every figure related to your P&L, as well as the overall fiscal health of your organization.

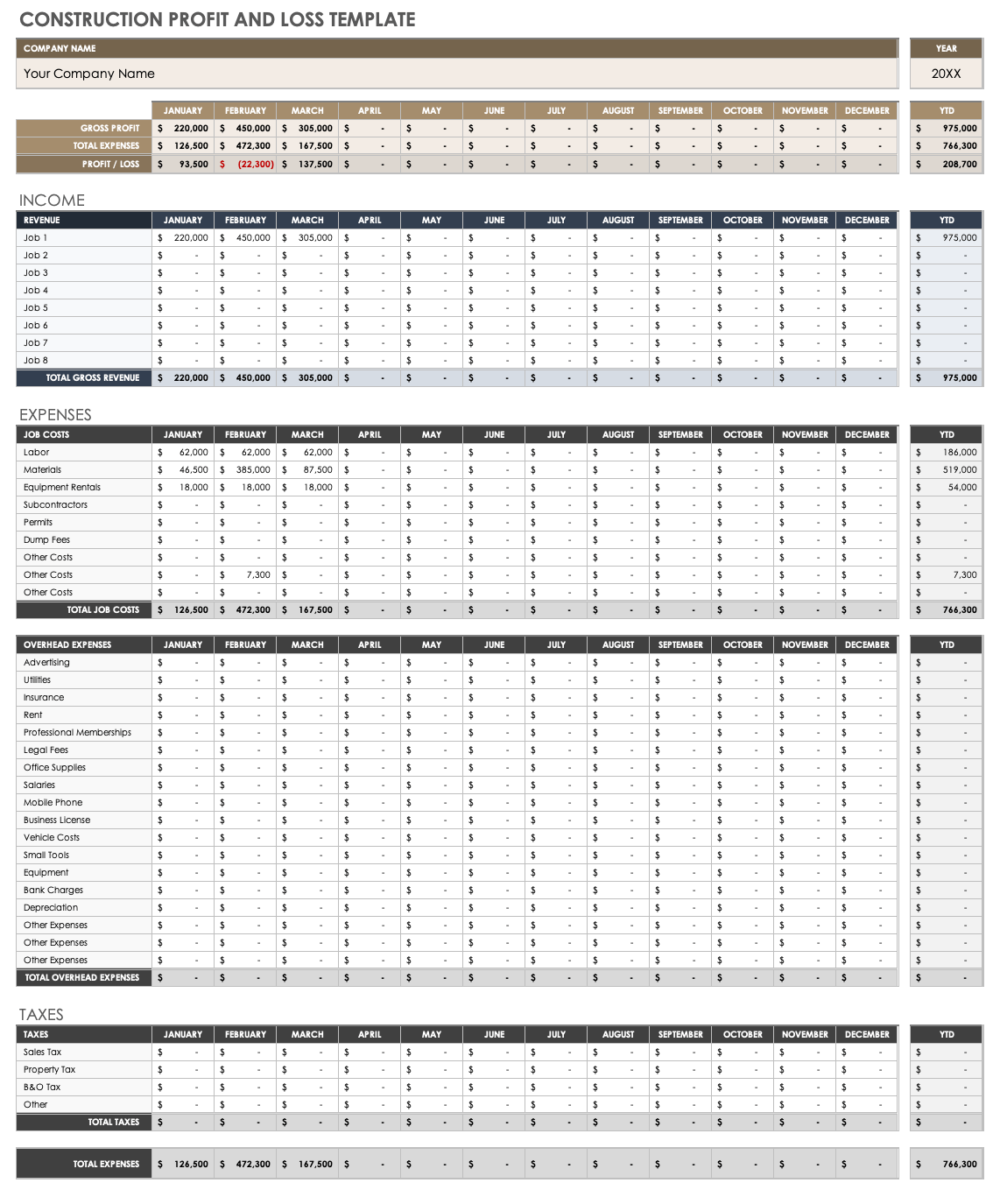

Construction Profit and Loss Template

Download Construction Profit and Loss Template Microsoft Excel | Google Sheets

Accurately assess your construction company’s P&L with this comprehensive construction-specific template. The template comes pre-filled with numbered jobs in the Revenue section and construction-specific costs in its Expenses section (e.g., labor, materials, equipment rentals, subcontractors, permits, dump fees, etc.). The template also provides sections for overhead expenses and taxes, so that you can provide owners, construction financial managers, or other stakeholders with an accurate, month-by-month financial picture of your construction company’s total profits.

Home Business Profit and Loss Statement Template

Download Home Business Profit and Loss Statement Template Microsoft Excel | Google Sheets

Gain instant insight into your home business’s actual profits and losses with this straightforward template. Enter your desired reporting period, and then add figures to determine your gross revenue, COGS, and gross profit. Then, itemize your home business’s expenses (e.g., rent/mortgage, utilities, office supplies, internet & phone, etc.) to calculate your net income. This single-page template is the perfect fit for home businesses looking to gain quick insight into their financial position.

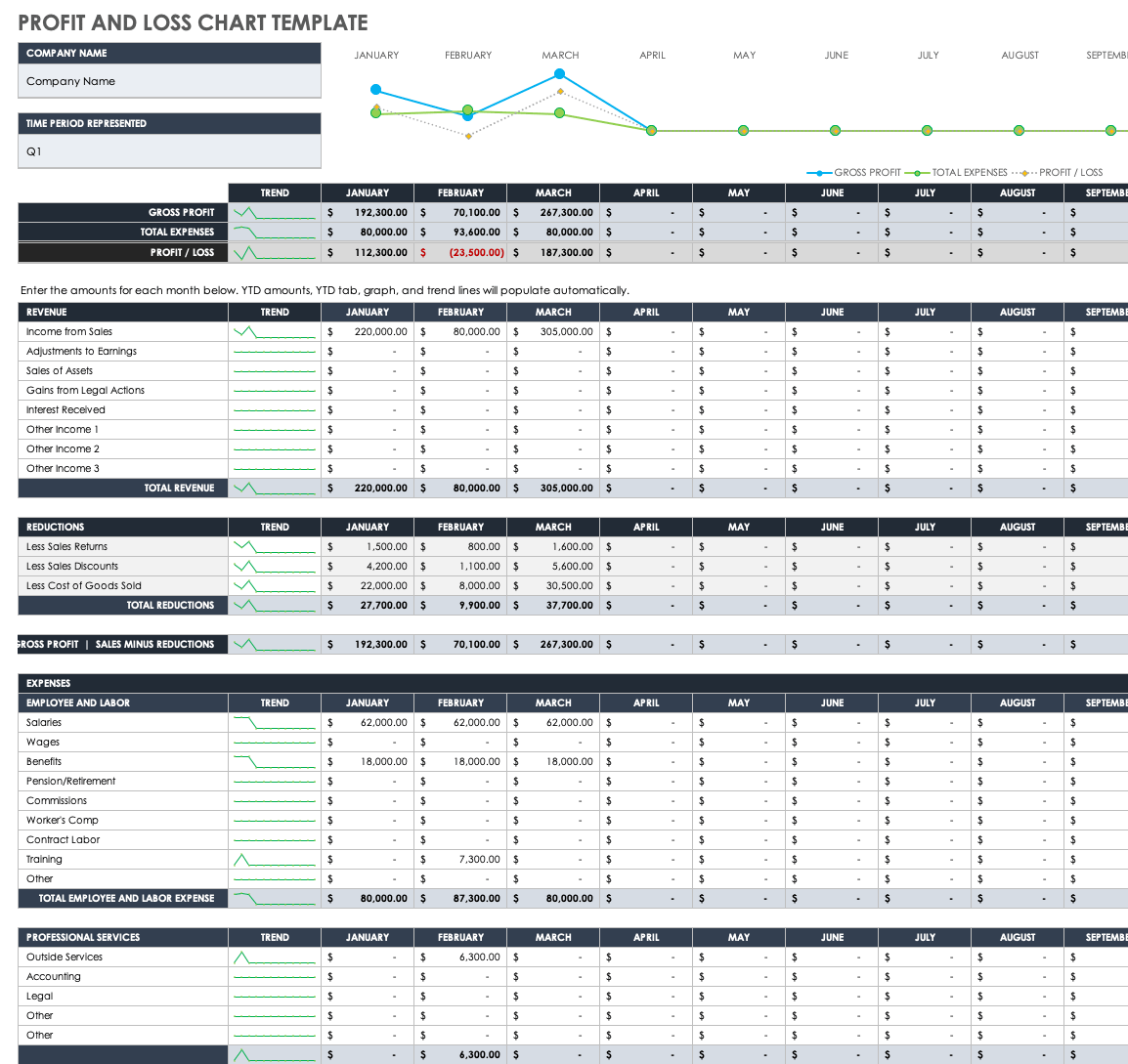

Profit and Loss Chart Template

Download Profit and Loss Chart Template Microsoft Excel | Google Sheets

Chart your company’s actual profits and losses for any period of time with this visually-rich profit and loss chart template. Enter total revenues and expenses, and the template will automatically calculate your profit/loss ratio. The Trend section of the template charts your gross profit and total expenses, and provides you with your current P&L.

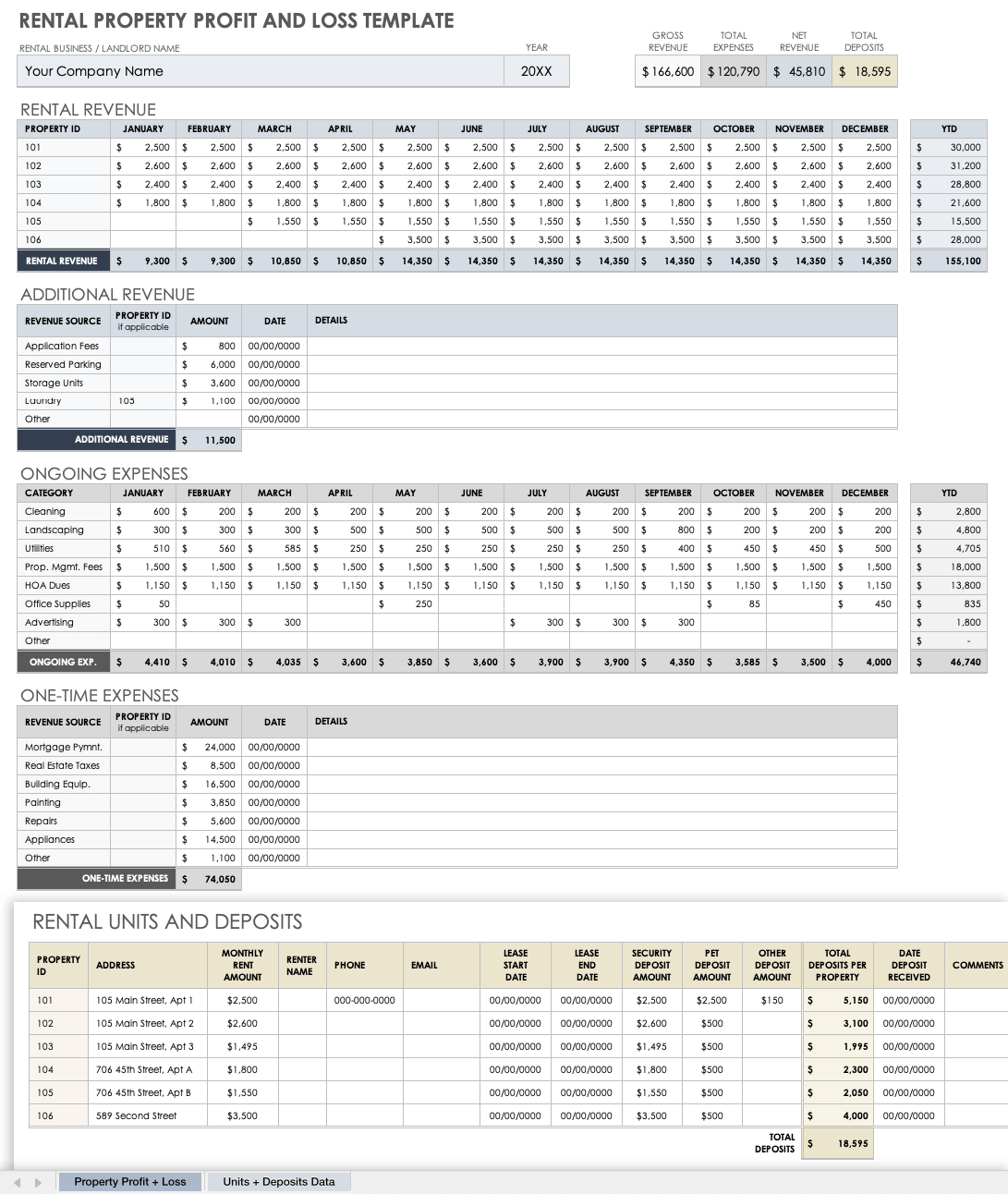

Rental Property Profit and Loss Statement Template

Download Rental Property Profit and Loss Template — Microsoft Excel

Determine whether your rental revenue is exceeding the cost of maintenance and other rental property-related expenses with this P&L template. List the revenues of each property, additional rental-related revenue (e.g., application fees, reserve parking, storage unit, laundry, etc.), and ongoing expenses (e.g., cleaning, landscaping, utilities, advertising, HOA fees, etc.).

Then, the dashboard-style tally will provide you with your properties’ gross revenue minus total expenses, to give you your net revenue. In the Deposits tab, list all renters’ deposits, and the template will calculate totals in the Total Deposits column. This template enables you to keep track of whether these deposits need to be returned or can be kept as compensation once renters vacate the space.

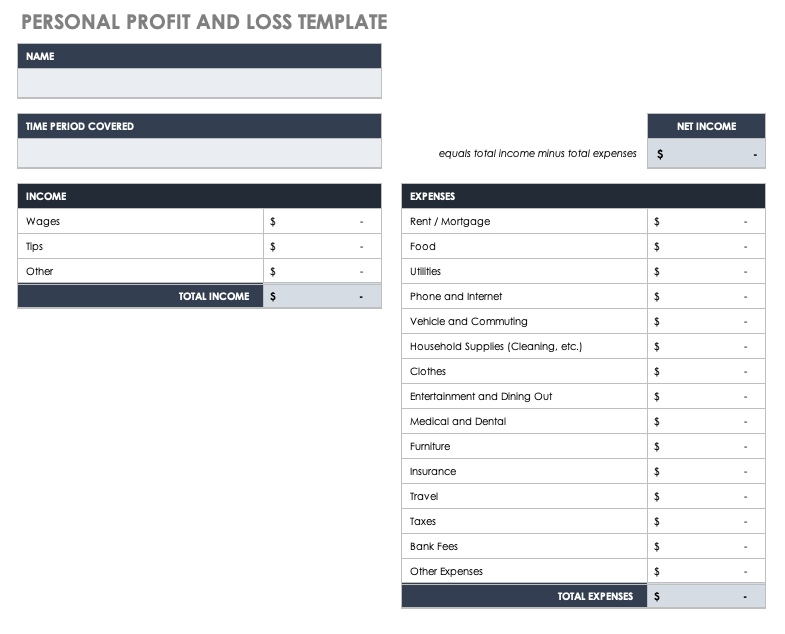

Personal Profit and Loss Template

Download Personal Profit and Loss Template — Microsoft Excel

Individuals and families can use the profit and loss model to track their income against their spending and see if they are spending more or less than they make. This template is customized to include personal expense categories, such as entertainment, food, and household supplies.

Advanced Profit and Loss Template

Download Advanced Profit and Loss Template — Microsoft Excel

This particular template contains many more categories than do the other templates in this article, and allows for a more detailed breakdown of expenses and revenue. The categories are grouped into sections. Enter data on the monthly tab, and see the year-to-date totals on the YTD tab. The monthly tab also has a chart that tracks month-to-month changes in total revenue and total expenses. This template can be used by service, retail, and B2B organizations. To use this template for multiple years, make a copy for each year.

See how Smartsheet can help you be more effective

Watch the demo to see how you can more effectively manage your team, projects, and processes with real-time work management in Smartsheet.