- Military & Veterans

- Transfer Students

- Education Partnerships

- COVID-19 Info

- 844-PURDUE-G

- Student Login

- Request Info

- Bachelor of Science

- Master of Science

- Associate of Applied Science

- Graduate Certificate

- Master of Business Administration

- ExcelTrack Master of Business Administration

- ExcelTrack Bachelor of Science

- Postbaccalaureate Certificate

- Certificate

- Associate of Applied Science (For Military Students)

- Programs and Courses

- Master of Public Administration

- Doctor of Education

- Postgraduate Certificate

- Bachelor of Science in Psychology

- Master of Health Care Administration

- Master of Health Informatics

- Doctor of Health Science

- Associate of Applied of Science (For Military Students)

- Associate of Science (For Military Students)

- Master of Public Health

- Executive Juris Doctor

- Juris Doctor

- Dual Master's Degrees

- ExcelTrack Master of Science

- Master of Science (DNP Path)

- Bachelor of Science (RN-to-BSN)

- ExcelTrack Bachelor of Science (RN-to-BSN)

- Associate of Science

- Doctor of Nursing Practice

- Master of Professional Studies

The average Purdue Global military student is awarded 54% of the credits needed for an associate's and 45% of the credits needed for a bachelor's.

- General Education Mobile (GEM) Program

- AAS in Health Science

- AS in Health Science

- BS in Organizational Management

- BS in Professional Studies

- AAS in Criminal Justice

- AAS in Small Group Management

- AAS Small Group Management

- Master's Degrees

- Bachelor's Degrees

- Associate's Degrees

- Certificate Programs

- Noncredit Courses

- Tuition and Financial Aid Overview

- Financial Aid Process

- Financial Aid Awards

- Financial Aid Resources

- Financial Aid Frequently Asked Questions

- Financial Aid Information Guide

- Tuition and Savings

- Aviation Degree Tuition and Fees

- Professional Studies Tuition and Fees

- Single Courses and Micro-Credentials

- Time and Tuition Calculator

- Net Price Calculator

- Military Benefits and Tuition Assistance

- Military Educational Resources

- Military Tuition Reductions

- Military Spouses

- Student Loans

- Student Grants

- Outside Scholarships

- Loan Management

- Financial Literacy Tools

- Academic Calendar

- General Requirements

- Technology Requirements

- Work and Life Experience Credit

- DREAMers Education Initiative

- Student Identity

- Student Experience

- Online Experience

- Student Life

- Alumni Engagement

- International Students

- Academic Support

- All Purdue Online Degrees

- Career Services

- COVID-19 FAQs

- Student Accessibility Services

- Student Resources

- Transcript Request

- About Purdue Global

- Accreditation

- Approach to Learning

Career Opportunities

- Diversity Initiatives

- Purdue Global Commitment

- Cybersecurity Center

- Chancellor's Corner

- Purdue Global Moves

- Leadership and Board

- Facts and Statistics

- Researcher Request Intake Form

Most Commonly Searched:

- All Degree Programs

- Communication

- Criminal Justice

- Fire Science

- Health Sciences

- Human Services

- Information Technology

- Legal Studies

- Professional Studies

- Psychology and ABA

- Public Policy

- Military and Veterans

- Tuition and Fee Finder

- Financial Aid FAQs

- Military Benefits and Aid

- Admissions Overview

- Student Experience Overview

- Academic Support Overview

- Degree Programs

- Online Bachelor Finance Degree

Online Bachelor's Degree in Finance

Admissions requirements.

- Ways to Save on Tuition

- Career Outcomes

Bachelor’s in Finance Overview

Employment in finance is growing faster than average. Come back stronger, ready to meet the demand, with an online finance degree from Purdue Global.

- Create real career opportunities. The growing range of financial products and the need for in-depth knowledge of emerging markets is expected to increase the demand for financial professionals.

- Gain technical knowledge in areas such as fiscal planning, corporate finance, banking, real estate, economic markets, and investment management.

- Get hands-on, rigorous training — through reports, presentations, group projects, and a final capstone project — to build the practical skills needed to solve to real-life financial challenges.

- General finance

- Real estate

- Wealth management and financial planning

Build the Core Skills That Employers Need:

- Perform financial analysis using quantitative concepts and techniques.

- Interpret financial statements and ratios.

- Examine investment and financial risk.

- Apply legislation, regulations, and principles of practice to financial scenarios.

- Communicate professionally with stakeholders.

Accelerated Master’s Degree Option

Interested in continuing on to a graduate degree? Gain entry into a shortened version of our Master of Science in Finance by earning a minimum course grade in select bachelor's courses. You can earn both your bachelor’s and master’s degrees in less time and at a lower cost than completing them separately. For details, speak to an Advisor.

Purdue Global’s business programs are accredited by the Accreditation Council for Business Schools and Programs (ACBSP) .

The human resources concentration aligns with the Society for Human Resource Management's HR Curriculum Guidebook and Templates .

Academic Quality

Learn the most recent developments in business and finance — the curriculum is reviewed and revised continually by our dedicated curriculum department and advisory board.

Purdue Global Is Accredited by the Higher Learning Commission

The HLC ( HLCommission.org ) is an institutional accreditation agency recognized by the U.S. Department of Education.

You must be a high school graduate or possess a General Educational Development (GED) certificate or other equivalency diploma. You are also encouraged to complete orientation before you start classes. Refer to the University Catalog or speak to an Advisor to learn more.

Purdue Global Career Outcomes 2020–2021

96% of graduates in Purdue Global’s Bachelor of Science in Finance program were employed or continued their education within 18 months of graduation.

Each year, our Center for Career Advancement sends a NACE First Destination survey to our graduating class to learn more about their career choices and potential income within 18 months of graduation. We’re proud of our recent Purdue Global alumni accomplishments.

“Career Outcomes Rate” is not the same as an “employment rate” — it includes graduates who are: (1) employed (whether full or part time); (2) participating in a program of voluntary service, (3) serving in the U.S. Armed Forces, or (4) enrolled in a program of continuing education. This rate may also include graduates employed in jobs unrelated to their degree or who were employed while attending Purdue Global. (9,106 graduates surveyed across associate's, bachelor's, master's, JD, EJD, and DNP programs from July 1, 2019, to December 31, 2020. 7,803 of 9,106 replied.)

What Courses Will I Take?

Courses within the online bachelor's in finance program help students develop the following skills:

- Attention to detail

- Critical thinking

- Clear communications at work

- High standards of integrity

- Computer literacy

Sample Courses

- Corporate Finance

- Financial Markets

- Financial Statement Analysis

- Investments

- Microeconomics

Program Requirements

Upcoming start dates.

We offer multiple start dates to give you flexibility in your education, life, and work schedules.

Online Finance Degree Concentrations

Concentrations allow you to personalize your finance education by focusing your electives on an area of study that best fits your desired career path. Choose from the following options:

Concentrate your degree in a fast-growing field. Develop innovations used to enhance and automate the delivery of financial services.

Concentration Outcomes:

- Develop and apply fintech as part of a businesses strategic plan

- Examine the impact laws and regulations have on the fintech industry.

- Explore the benefits of the Blockchain from a macro perspective

Take elective courses a la carte to get a taste of different finance areas.

- Examine the financial performance of a company using its financial statements.

- Examine the mechanics of buying and selling securities.

Develop skills relevant to real estate sales and the real estate industry and apply them to various financial situations.

- Prepare a competitive market analysis for a real estate client.

- Analyze the legal and ethical considerations in a real estate transaction.

- Synthesize the real estate sales process and compliance issues.

Explore wealth management, portfolio management, and financial planning.

- Explain the key concepts of personal financial statements and the impact of tax implications.

- Formulate an insurance coverage strategy.

- Evaluate investment options such as mutual funds, stocks and bonds.

Earn Credit for Prior Coursework and Experience

The average bachelor's degree student pays $15k and takes 2.3 years to complete their degree.

Ways to Save on Time and Tuition

Purdue Global works with students to find ways to reduce costs and make education more accessible. Contact us to learn about opportunities to save on your educational costs.

Earn credit for prior coursework completed at eligible institutions.

Learn about federal financial aid programs available for many of our degree programs.

Employees of Purdue Global partner organizations may be eligible for special tuition reductions .

Graduate tuition savings for military include a 17–30% reduction per credit for current servicemembers and, 14% per credit for veterans for graduate programs.

Earn credit for your military training . We offer credit for ACE-evaluated training and CLEP and DANTES examinations.

International students living outside of the United States are eligible for a 25% international student tuition reduction .

View the total cost of attendance for your program.

Calculate Your Time and Cost

Estimate how much your prior learning credits can reduce your tuition and time to graduation.

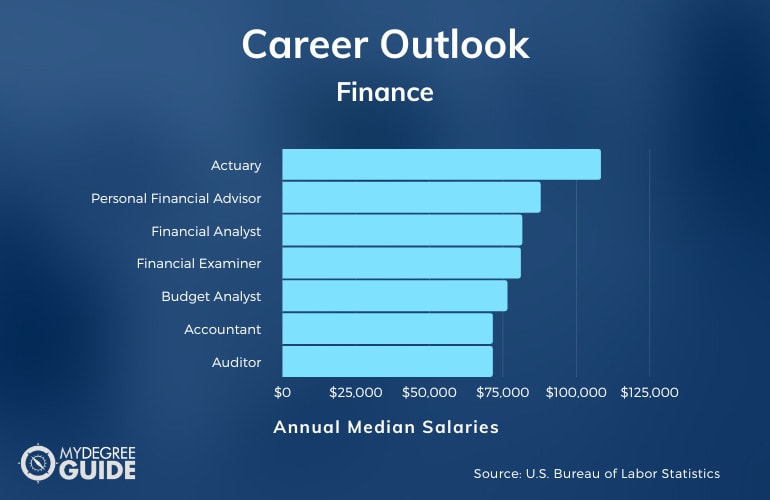

As technology continues to evolve at a rapid pace, it stimulates business growth and generates new opportunities. Earning your online bachelor’s degree in finance at Purdue Global can help you develop valuable skills that could be applied to a broad range of financial positions. You could pursue careers in fields such as corporate and government financial management, investments, portfolio analysis and management, financial analysis, financial planning, banking, and risk management.

Average Salary

In Your State

General labor market and salary data are provided by Lightcast and may not represent the outcomes experienced by Purdue Global graduates in these programs. Purdue Global graduates in these programs may earn salaries substantially different or less than the amounts listed above. Salary and employment outcomes vary by geographic area, previous work experience, education, and opportunities for employment that are outside of Purdue Global's control.

Purdue Global does not guarantee employment placement, salary level, or career advancement.

See Notes and Conditions below for important information.

Take 3 Weeks to Get to Know Us

Not sure if Purdue Global is right for you? Experience a Purdue Global undergraduate program for an introductory 3-week period.

There’s no financial obligation and no cost to apply.

That’s the Purdue Global Commitment.

Download the Program Brochure

Download our brochure to learn more about the Online Bachelor of Science in Finance and the benefits of earning your degree at Purdue Global.

Prepare yourself for success with a bachelor's degree in finance.

Choosing a Bachelor’s Degree in Finance

Discover tools and additional resources on the value of an undergraduate degree in finance and potential career pathways to pursue.

Propel your career in a growing, in-demand field. Learn the skills you need to help people reach their financial goals.

Boost your offerings in the finance field. Learn why a specialty certification could be your secret sauce to success.

Get to Know Our Faculty

Purdue Global faculty members are real-world practitioners who bring knowledge gained through the powerful combination of higher learning and industry experience.

Faculty members who have advanced degrees

Faculty members who hold a doctorate

Faculty publications in 2022–2023

Professional development hours logged by faculty in 2022–2023

Statistics include all Purdue Global faculty members and are not school- or program-specific calculations. Source: Purdue Global Office of Reporting and Analysis, July 2023. 2022–2023 academic year.

Your Path to Success Begins Here

Connect with an Advisor to explore program requirements, curriculum, credit for prior learning process, and financial aid options.

* Estimated Graduation Date and Average Completion: Estimated graduation date is based on the assumption that you will enroll in time to begin classes on the next upcoming start date, will remain enrolled for each consecutive term, and will maintain satisfactory academic standing in each term to progress toward completion of your program. Completion time is based on a full-time schedule. Programs will take longer for part-time students to complete.

Degree Completion Time and Average Net Price: Cost and completion times for individual programs may vary. Average institutional completion time for Purdue Global degree students who graduated in the 2022–2023 academic year. Average net price reflects all institutional-level charges for all graduates, including those who transferred to Purdue Global, after application of scholarships, tuition reductions, grants (including federal Pell grants for undergraduate students), employer tuition assistance, and/or military tuition assistance. Source: Purdue Global Office of Reporting and Analysis, July 2023.

Employment and Licensure—Finance and Investments: Purdue Global doe not guarantee employment or career advancement. Certain finance positions may require further certification and/or licensing by individual states, and certain investment positions and portfolio management positions may require securities licensing and successful completion of a securities exam. This program was not designed to meet any specific state’s requirements for licensure or certification, and Purdue Global makes no representations or warranties as to whether the degree or any individual courses meet such requirements. Refer to Purdue Global's State Licensure and Certifications page for state-specific requirements.

Job Growth—Financial Analysts: Source is BLS: U.S. Department of Labor, Bureau of Labor Statistics, Occupational Outlook Handbook, Financial Analysts, https://www.bls.gov/ooh/business-and-financial/financial-analysts.htm National long-term projections may not reflect local and/or short-term economic or job conditions, and do not guarantee actual job growth.

Best Online Bachelor's in Finance

Staff Writers

Contributing Writer

Learn about our editorial process .

Updated May 1, 2024

Reviewed by

TBS Rankings Team

Contributing Reviewer

Our Integrity Network

TheBestSchools.org is committed to delivering content that is objective and actionable. To that end, we have built a network of industry professionals across higher education to review our content and ensure we are providing the most helpful information to our readers.

Drawing on their firsthand industry expertise, our Integrity Network members serve as an additional step in our editing process, helping us confirm our content is accurate and up to date. These contributors:

- Suggest changes to inaccurate or misleading information.

- Provide specific, corrective feedback.

- Identify critical information that writers may have missed.

Integrity Network members typically work full time in their industry profession and review content for TheBestSchools.org as a side project. All Integrity Network members are paid members of the Red Ventures Education Integrity Network.

Explore our full list of Integrity Network members.

TheBestSchools.org is an advertising-supported site. Featured or trusted partner programs and all school search, finder, or match results are for schools that compensate us. This compensation does not influence our school rankings, resource guides, or other editorially-independent information published on this site.

Are you ready to discover your college program?

An online bachelor's degree in finance prepares students for careers in the financial industry and for graduate study.

The Bureau of Labor Statistics projects that roles for financial advisors — a popular job for graduates with a bachelor of finance — will grow by 13% from 2022-2032. Financial advisors enjoy lucrative careers, earning a median annual salary of $95,390.

Featured Online Bachelor's in Finance Programs

Best online bachelor's in finance degree programs.

We use trusted sources like Peterson's Data and the National Center for Education Statistics to inform the data for these schools. TheBestSchools.org is an advertising-supported site. Featured or trusted partner programs and all school search, finder, or match results are for schools that compensate us. This compensation does not influence our school rankings, resource guides, or other editorially-independent information published on this site. from our partners appear among these rankings and are indicated as such.

#1 Best Online Bachelor’s in Finance

Southern New Hampshire University

- Manchester, NH

- Online + Campus

Programmatic Accreditation: Accreditation Council for Business Schools and Programs

Cost per Credit: In-State | $330 Out-of-State | $330

Credits to Graduate: 120

SNHU's online BS in finance degree accepts up to 90 transfer credits from past education. The 120-credit program offers a Certified Financial Planner Board-registered concentration in financial planning as the only degree to do so in New Hampshire.

The curriculum provides a foundation in business fundamentals while sharpening collaboration, entrepreneurial thinking, and communication skills. You can take classes like fundamentals of investments, investment portfolio analysis, and corporate finance. The program culminates with a capstone course that explores real-world financial case studies.

#2 Best Online Bachelor’s in Finance

Florida International University

Programmatic Accreditation: AACSB

Cost per Credit: In-State | $236 Out-of-State | $649

FIU's online bachelor of business administration in finance from the R. Kirk Landon Undergraduate School of Business can prepare you for careers in corporate finance, banking, investing, and general business. The program offers three start dates each year and pairs you with a success coach to keep you on track toward your degree.

You can explore topics like financial engineering, portfolio management, banking, and international finance. Major courses include commercial bank management, securities analysis, intermediate finance, and financial markets and institutions.

#3 Best Online Bachelor’s in Finance

Texas A&M University-Central Texas

- Killeen, TX

Cost per Credit: In-State | $260 Out-of-State | $668

A&M Central Texas' online BBA in finance degree focuses on financial planning and financial management. After graduation, you may qualify for jobs in commercial banking, financial planning, investment banking and management, and corporate finance.

While pursuing your degree, you can earn micro-credentials in areas like cybersecurity, supply chain management, and financial management. The curriculum includes major courses like international financial management, business ethics and corporate responsibility, fintech, and investments. You must complete a business capstone assessment to graduate.

#4 Best Online Bachelor’s in Finance

Thomas Edison State University

- Trenton, NJ

Cost per Credit: In-State | $419 Out-of-State | $545

TESU's online BSBA degree in finance from the School of Business and Management can prepare you to start or advance in a finance or banking career. The program emphasizes investments, organizational financial management, and financial markets and institutions.

Required major classes include small business finance, security analysis and portfolio management, fundraising for nonprofits, and risk management. To graduate, you must complete a strategic management capstone course, and the program strongly suggests including a business ethics class.

#5 Best Online Bachelor’s in Finance

National University

- San Diego, CA

Programmatic Accreditation: International Accreditation Council for Business Education

Cost per Credit: In-State | $370 Out-of-State | $370

Credits to Graduate: 180 quarter units

NU's online bachelor of science in financial management program covers corporate finance, financial management business skills, financial decision-making, and ethical and legal issues in financial management. Coursework provides methods of maximizing profits, with students receiving hands-on data analysis training.

Finance requirements include working capital management, analysis of financial statements, valuation of a corporation, and capital structure and financing. You must complete a financial project capstone at the end of the program. The financial management BS program offers year-round admission and four-week courses.

#6 Best Online Bachelor’s in Finance

Pennsylvania State University

- University Park, PA

Cost per Credit: In-State | $626 Out-of-State | $626

Penn State World Campus's online BS in finance degree , offered in partnership with Penn State Behrend, can help you prepare for the certified financial planner or chartered financial analyst exams. The program is part of the CFA® Institute University Affiliation Program.

The curriculum explores investment and portfolio management, personal finance, and capital management. You can participate in extracurricular activities like the investment research challenge team, the financial planning club, or the finance speakers series. Graduates can apply for jobs in corporate finance, banking, and personal financial planning.

#7 Best Online Bachelor’s in Finance

University of West Florida

- Pensacola, FL

Cost per Credit: In-State | $219 Out-of-State | $648

UWF's online finance BSBA degree can provide you with hands-on experience managing an investment portfolio. The program features small class sizes, one-on-one attention from instructors, and 15-week courses. Potential careers for graduates include financial analyst, financial manager, and personal financial advisor.

The finance specialization requires classes like security analysis and portfolio management, financial theory and practice, financial statement analysis, and investments. The program can prepare you to take the chartered financial analyst or the certified financial planner exams.

Out-of-state online learners can qualify for waivers to reduce their overall tuition costs.

#8 Best Online Bachelor’s in Finance

Johnson & Wales University

- Providence, RI

Programmatic Accreditation: AACSB ; Accreditation Council for Business Schools and Programs

Cost per Credit: In-State | $495 Out-of-State | $495

Credits to Graduate: 122

JWU's bachelor of science in finance degree can prepare you to pursue a career as a financial analyst or advisor. The fully online program includes experiential learning opportunities and instructors with years of experience in the financial field. You can choose from four start dates each year.

The curriculum covers financial institutions, financial management, and capital management. Classes include HR management, business analytics, financial markets and institutions, and organizational dynamics. You can develop business skills in communication, management, decision-making, and leadership.

#9 Best Online Bachelor’s in Finance

Fort Hays State University

Cost per Credit: In-State | $188 Out-of-State | $560

FHSU's online bachelor of business administration degree with a major in finance from the Department of Economics, Finance, and Accounting covers corporate finance, entrepreneurial finance, and financial planning. You can participate in extracurricular activities like FHSU's finance club or the financial planning national championship.

The finance curriculum requires major classes like money and banking, fundamentals of investments, financial markets and institutions, and intermediate finance. You also take business core courses that explore topics like accounting, strategic business communication, and business law.

#10 Best Online Bachelor’s in Finance

Oklahoma State University

- Stillwater, OK

Cost per Credit: In-State | $432 Out-of-State | $950

OSU's online BSBA in finance program from the Spears School of Business can prepare you to pursue careers in investment banking, portfolio and wealth management, and commercial banking. The program focuses on financial analysis and can help you develop decision-making and financial management skills.

The BSBA in finance curriculum includes major classes like advanced accounting tools and technologies, money and banking, financial management, and investments. Students also explore general business topics like strategic management, data analytics, entrepreneurship, and macroeconomic principles.

Online Bachelor's in Finance Degrees Programs Ranking Guidelines

We ranked these degree programs based on quality, curricula, school awards, rankings, and reputation.

Our Methodology

Here at TheBestSchools.org, we take the trust and welfare of our readers very seriously. When making our school and program rankings, our top priority is ensuring that our readers get accurate, unbiased information that can help them make informed decisions about online education. That's why we've developed a rigorous ranking methodology that keeps the needs of our readers front and center.

Our proprietary, multi-criteria ranking algorithm analyzes key data indicators — as collected by the federal government — for each school or program. What data we use depends on the focus of each specific ranking, but in all cases, our ranking methodology is impartial: Schools cannot buy better rankings at TBS.

While specific criteria under consideration can vary by ranking, there are a few data points that we value most highly. They are affordability, academic quality, and online enrollment. Below, we break down our algorithm to help you understand what you're getting when you use one of our rankings.

- Affordability

- Online Enrollment

Data Sources

The data used in TBS rankings comes primarily from the federal government, and much of it is provided by the schools themselves. We aggregate and analyze this data to build our rankings.

The Integrated Postsecondary Education Data System (IPEDS) is our primary source. Its data comes from annual surveys conducted by the U.S. Department of Education's National Center for Education Statistics (NCES). Every college, university, or technical school with access to federal financial aid must participate in these surveys, which include questions about enrollment, graduation rates, finances, and faculty qualifications. This is publicly available data, which you can access yourself through the College Navigator .

Additionally, because we value a personal touch and the professional experience of our staff and Academic Advisory Board, we vet all results and adjust rankings as necessary based on our collected knowledge of schools and degree programs. Depending on the ranking, we may obtain additional input from AcademicInfluence.com , subject matter experts, prior TBS ranking lists, or other sources we deem relevant to a particular ranking.

Breakdown of Our Rankings Methodology

About our ranking factors.

Here at TBS, we value what you value: quality education, affordability, and the accessibility of online education. These factors guide all of our program rankings.

Each of these factors are further broken down into weighted subfactors. For example, retention rates are weighted more heavily than availability of program options because they are a better indicator of student success.

We chose the following factors for our rankings because of their influence on learning experiences and graduate outcomes. However, students should always balance our rankings against their personal priorities. For instance, a learner who needs a fully online program may prioritize online flexibility more than our rankings do. Our rankings are designed to help you make a decision — not to make a decision for you.

- Collapse All

Academics - 75%

Affordability - 15%, online enrollment - 10%.

In all our school rankings and recommendations, we work for objectivity and balance. We carefully research and compile each ranking list, and as stated in our advertising disclosure, we do NOT permit financial incentives to influence rankings. Our articles never promote or disregard a school for financial gain.

If you have questions about our ranking methodology, please feel free to connect with our staff through contact page .

We thank you for your readership and trust.

Choosing an Online Bachelor of Finance Degree Program

When researching the best finance schools , students should consider several factors, such as cost, transfer policies, and on-campus requirements. We cover several important program considerations for prospective bachelor of finance students below.

Program Cost

Students can typically save money by attending a public institution rather than a private institution. Additionally, some online programs offer tuition discounts to in-state students, while others charge all distance students the same tuition rate, regardless of residency.

Transfer Policies

Transfer policies vary by school. Students who already hold some college credits should look for schools with generous transfer policies to ensure they can receive credit for prior academic work. Some schools also offer transfer credit for professional, military, and volunteer experience.

School Size and Type

Some students prefer to attend larger schools, which typically provide more diverse course offerings and programs than small schools. Alternatively, some learners prefer the more individualized attention often found at smaller schools.

Program Length

A bachelor of finance program typically takes four years of full-time study to complete, but some programs offer accelerated timelines that may allow students to graduate in less time.

On-campus Requirements

Some online programs may offer or require on-campus requirements. Students should ensure they can meet all of a program's requirements before committing to a school.

Thesis, Fellowship, and Work Requirements

Students planning to pursue graduate school benefit from attending a program with a thesis requirement, while students planning to work immediately after graduation may benefit more from a program with a fellowship or internship requirement.

Accreditation for Online Finance Degrees

Accreditation indicates that a school meets high academic standards with respect to faculty qualifications, student learning outcomes, and academic rigor. Attending an accredited school expands a student's employment, education, and financial aid opportunities. Schools may hold national or regional accreditation, with regional accreditation generally considered the more prestigious of the two. The Council for Higher Education Accreditation and the U.S. Department of Education oversee six independent regional accrediting bodies that accredit schools based on where a school is located.

Certain programs within a school may also receive specialized accreditation. Students pursuing a bachelor's degree in finance should look for programs accredited by the Association to Advance Collegiate Schools of Business and the Accreditation Council for Business Schools and Programs.

How Long Does It Take to Get a Bachelor's Degree in Finance?

An online bachelor's degree in finance typically takes four years of full-time study to earn. However, some programs offer accelerated timelines, allowing students to expedite graduation. Additionally, students seeking to balance their studies with work and family obligations may prefer to study part time, which extends the length of a program.

Online Finance Degree Curriculum

Courses vary by program, but online bachelor's degree in finance programs typically cover topics like investments, bank management, and financial statements. We cover several common courses for bachelor of finance students below.

Investments

Bank management, introduction to financial management, applications for managerial finance, finance jobs.

Graduates of top finance schools can pursue many positions in corporate and personal finance, such as financial advisor, budget analyst, and financial analyst. We cover several common jobs for graduates below.

Financial Advisor

Financial advisors provide professional money management advice to clients. They meet with clients to assess financial goals and help clients make informed decisions about their finances. Financial advisors may offer information and recommendations on topics such as estate planning, taxes, retirement savings, and investments. They also regularly monitor clients' financial accounts and make adjustments as needed.

Median Annual Salary

Projected Growth Rate

Financial Analyst

Financial analysts help individuals and businesses make important investment decisions. They assess financial records, create investment portfolios aligned with clients' goals, and monitor the economy to predict investment performance. These professionals typically form long-term relationships with clients, working with them to meet investment goals and advising them on proper risk management. They frequently provide written reports on investment activities and recommend changes as needed.

Budget Analyst

Budget analysts work with corporations, nonprofits, government agencies, and other types of organizations to assist with budget management. They often work with other finance professionals to develop comprehensive budgets and review proposed departmental budgets to ensure they meet regulations and compliance standards. These professionals also ensure a budget is followed throughout the calendar year, make recommendations for adjustments, and use various budgeting tools and methodologies to project spending needs and goals.

Top Executive

Chief financial officers (CFOs) are top company executives that manage other financial professionals, develop organizational policies, and set strategic company goals around income and losses. They may negotiate with vendors, contractors, and other providers to lower spending while liaising with sales and marketing staff to set goals for increased earnings. CFOs often need to make high-level decisions in the face of budgetary constraints, including cutting costs associated with staffing when necessary.

Common Questions About Bachelor's in Finance Degrees

What can you do with a major in finance.

Graduates with a bachelor's degree in finance can work in roles such as financial planner, financial analyst, and actuary.

What is the best degree in finance?

The best bachelor's degree in finance is one that aligns with a student's academic abilities, career aspirations, and financial needs.

How long does it take to get a bachelor's degree in finance?

Full-time students can typically earn an online bachelor's degree in finance in four years.

Is a degree in finance a BS or a BA?

Typically, schools offer a bachelor of business administration in finance or a BS in finance.

What types of finance degrees exist?

Aside from generalist finance studies, some programs offer concentrations in areas such as financial accounting, risk management, and corporate finance.

Popular with our students.

Highly informative resources to keep your education journey on track.

Take the next step toward your future with online learning.

Discover schools with the programs and courses you’re interested in, and start learning today.

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Online Business Certificate Courses

- Business Strategy

- Leadership, Ethics, and Corporate Accountability

- Finance & Accounting →

Develop an intuitive knowledge of financial principles and statements to unlock critical insights into performance and potential.

Strengthened analytical skills

Return on investment with an average $17,000 salary increase

Are more self-assured at work

Certificate Courses (4)

Leading with Finance

Build an intuitive understanding of finance to better communicate with key stakeholders and grow your career.

Financial Accounting

In this accounting fundamentals course, discover what's behind the numbers in financial statements, such as balance sheets and income statements.

Sustainable Investing

Evaluate environmental, social, and governance (ESG) factors, and measure and manage impact investments.

Alternative Investments

Take your finance knowledge to the next level by learning how to maximize investment portfolio value with alternative investments, including private equity and real estate.

Why Should You Learn Finance and Accounting?

What you earn.

Certificate

Boost your resume by completing an HBS Online course.

Certificate of Specialization

Complete any three courses within this subject area to earn a Certificate of Specialization and signify your deep expertise in finance and accounting.

What Learners are Saying

Operating in general management, I need to make decisions utilizing the principles we learned on a daily basis. The course empowers me to do so with confidence.

I'd never experienced such an immersive platform online. It was more effective at building and solidifying knowledge than some in-person courses I've taken.

What sets HBS Online apart?

Real-world cases, hbs online vs. other top business schools with online, asynchronous courses, related content.

A Manager's Guide to Finance & Accounting

Which HBS Online Finance and Accounting Course Is Right for You?

The Importance of Financial Literacy in Business

What is Sustainable Investing?

You may also be interested in, finance and accounting faqs, what will i learn in a finance and accounting course.

Finance is often referred to as the "language of business." It affects every business function and can be used to assess, evaluate, and strategize your organization's financial health.

A finance course will teach you the key levers that drive your company's performance and cover topics such as cash flow , value creation , and the cost of capital . An accounting course will equip you with skills to report and communicate information through financial statements, including income statements , balance sheets , and cash flow statements .

Because finance is an ever-evolving field, you might consider taking a more specialized course covering a topic like alternative investments or sustainable investing . An alternative investments course can help you assess investment opportunities beyond traditional stocks and bonds, while a sustainable investing program can teach you how to incorporate environmental, social, and governance (ESG) factors into investment decisions.

Which finance and accounting course is right for me?

Finance and accounting are essential in any business. All industries require accountants and finance professionals for financial reporting , revenue management , and financial forecasting .

While a finance and accounting course is incredibly useful regardless of the industry, there are several courses to choose from. It is important to know which finance and accounting course is right for your professional goals .

While a finance and accounting course is incredibly useful regardless of your industry, there are several to choose from. It’s important to know which finance and accounting course is right for your goals . Download our free course flowchart to determine which HBS Online course is the best fit.

What's the difference between finance and accounting?

Finance focuses on how an organization generates and uses capital, while accounting refers to the process of reporting and communicating financial information. Accounting leverages past and present transactional data to determine a company's health, while finance is inherently forward-looking. Each can help you assess your firm's position and performance and develop your financial literacy , but it’s vital to learn the differences between finance and accounting to pick the right course for you.

- Academics /

Finance Master’s Degree Program

Build the skills and network you need to advance your career in finance.

Online Courses

11 out of 12 total courses

On-Campus Experience

2 weekends or a 3-week summer course

$3,220 per course

Program Overview

Ready to deepen your financial expertise and enhance your career potential? Develop the advanced knowledge and practical skills you need to take on greater professional responsibilities or make a career pivot.

Our Finance Master’s Degree Program offers a wide range of courses that cover essential financial topics — from microeconomics to investment theory to business valuation. Under the instruction of expert faculty, you’ll learn to make complex financial decisions. And you’ll examine issues in finance through a local, regional, and global lens.

Program Benefits

Customizable path, stackable certificates, & experiential learning

Instructors who are academics and professionals at the top of their fields

Personalized academic & career advising

Entrepreneurial opportunities through the Harvard Innovation Labs

Paid research options

Harvard Alumni Association membership upon graduation

Customizable Course Curriculum

Our curriculum is flexible in pace and customizable by design. You can study part time, choosing courses that fit your schedule and align with your career goals. In the program, you’ll experience the convenience of online learning and the immersive benefits of learning in person.

In core finance courses, you’ll deepen your knowledge of essential finance concepts, tools, and strategies. Through elective coursework, you’ll build upon that foundation — focusing on the specialized areas that are most important to you, such as corporate finance, investments, or financial accounting.

11 Online Courses

- Synchronous and asynchronous

- Fall, spring, January, and summer options

You’ll complete 1 degree requirement in person at Harvard, at an accelerated or standard pace:

- 2 weekends in fall or spring

- 3 weeks in the summer

The path to your degree begins before you apply to the program.

First, you’ll register for and complete 3 required courses, earning at least a B in each. These foundational courses are investments in your studies and count toward your degree, helping ensure success in the program.

As an alternative, you may choose to earn one of the following credentials as part of your admissions path: HBS Online CORe Admissions Pathway or the MITx MicroMasters® Program Pathway .

Getting Started

We invite you to explore degree requirements, confirm your initial eligibility, and learn more about our unique “earn your way in” admissions process.

Earn a Stackable Certificate

As you work your way toward your master’s degree, you can take courses that also count — or “stack” — toward a graduate or microcertificate . It’s a cost-effective, time-saving opportunity to build specialized skills and earn a professional credential along the way to your degree.

Here are a few examples of stackable certificates and courses.

Business Economics View More

Through courses taken for this graduate certificate, you’ll learn how to integrate economic principles and business concepts.

Sample Stackable Courses

- Microeconomic Theory

- Behavioral Economics and Decision Making

- The Economics of Financial Markets

- Strategy, Conflict, and Cooperation

Learn more about the Business Economics Graduate Certificate .

Corporate Finance View More

Gain the knowledge and tools needed for corporate financial analysis and decision-making in this graduate certificate.

- Managerial Finance

- Emerging Markets: Investment Theories and Practice

- Mergers, Acquisitions, and Restructurings

Learn more about the Corporate Finance Graduate Certificate .

Data Analytics View More

Deepen your analytics knowledge to inform strategic business decisions with this graduate certificate.

- Introduction to Computer Science with Python

- Data Mining for Business

- Introduction to Quantitative Methods for Economics and Finance

- Introduction to Statistical Modeling

Learn more about the Data Analytics Graduate Certificate .

Principles of Finance View More

Learn to use financial information to make business decisions through this graduate certificate.

- Foundations of Real-World Economics

- Monetary Policy After the Financial Crisis

- Financial Technologies, Artificial Intelligence, Blockchain, and Cryptocurrencies

- Private Equity

Learn more about the Principles of Finance Graduate Certificate .

Real Estate Investment View More

Develop practical, real-world knowledge and skills for investing in real estate with this graduate certificate.

- Financing Community and Economic Development

- Urban Development Policy

- Principles of Real Estate

- Real Estate Finance and Investment

Learn more about the Real Estate Investment Graduate Certificate .

A Faculty of Finance Experts

Studying at Harvard Extension School means learning from the world’s best. Our finance instructors are renowned experts in their field and bring a genuine passion for teaching, with students giving our faculty an average rating of 4.6 out of 5.

Peter Marber

Chief Investment Officer for Emerging Markets, Aperture Investors

Gregory Sabin

Instructor in Accounting and Finance; Preceptor, Harvard Extension School

Teaches Managerial Accounting, Principles of Finance, Corporate Finance

Zinnia Mukherjee

Associate Professor of Economics, Simmons University

Teaches courses on a variety of topics, including microeconomic theory and the economics of climate change

Our Community at a Glance

Students in our Finance Master’s Degree program are experienced financial professionals seeking to advance their careers at their current companies, level up at different organizations, and even make total career changes.

You’ll join a network of talented peers who are committed to developing deep expertise in banking, investments, and economics. By the time you’ve completed your studies, you’ll likely have lifelong friends and professional contacts.

Download: Finance Master's Degree Fact Sheet

Average Age

Work Full Time

Have Experience in the Finance Field

Average Years of Professional Experience

Would Recommend the Program

Career Opportunities & Alumni Outcomes

With a graduate degree in finance, you can prepare to advance in a variety of roles. Our finance graduates work in a range of finance-related industries, including accounting, banking, biotechnology, information technology, investment and asset management, and financial management consulting.

Roles held by recent graduates include:

- Hedge fund analyst

- Credit analyst

- Compliance analyst

- Corporate strategy manager

- Vice president of mergers and acquisitions

Alumni work at a variety of organizations, including:

- Bain Capital

- Bank of America

- Citizens Bank

Career Advising and Mentorship

Whatever your career goals, we’re here to support you. Harvard’s Mignone Center for Career Success offers career advising, employment opportunities, Harvard alumni mentor connections, and career fairs like the annual Finance and FinTech Fair on campus at Harvard.

Your Harvard University Degree

Upon successful completion of the required curriculum, you will receive your Harvard University degree — a Master of Liberal Arts (ALM) in Extension Studies, Field: Finance.

Expand Your Connections: the Harvard Alumni Network

As a graduate, you’ll become a member of the worldwide Harvard Alumni Association (400,000+ members) and Harvard Extension Alumni Association (29,000+ members).

From start to finish, Harvard has given me a lifetime of experience for a fraction of the cost of similar programs. I am forever grateful I made the move.

Tuition & Financial Aid

Affordability is core to our mission. When compared to our continuing education peers, it’s a fraction of the cost.

After admission, you may qualify for financial aid . Typically, eligible students receive grant funds to cover a portion of tuition costs each term, in addition to federal financial aid options.

Coffee Chat: All About Management Programs at HES

Are you interested in learning more about management graduate degree programs at Harvard Extension School? Attendees joined us for an informational webinar where they had the opportunity to connect with program directors, academic advisors, and current students.

What is a Master’s in Finance?

A master’s degree in finance can help financial professionals deepen their knowledge and technical skills in the financial field. Students who choose to get this degree are often already working in finance or a related field. Core courses can provide a solid foundation in the principles of finance, while electives can help you specialize your degree.

What Can You Do With a Master’s Degree in Finance?

A master’s degree in finance gives you foundational knowledge and practice skills to help your organization better manage its finances and investments. Whether you specialize in mergers and acquisitions, real estate investment, sustainable finance, or monetary policy, a master’s degree will give you the skills and tools you need to keep your career moving forward. It may even help you advance into mid- or even senior-level positions or start a new career in finance.

For more information on how a master’s degree in finance can help advance your career, read our blog Corporate Finance Career Path: How to Keep Your Growth on Track .

Is a Degree in Finance Useful?

A degree in finance is a great way to supplement and expand the real-world experience you’ve developed in the office.

Our curriculum offers the theoretical and academic knowledge you need to solve problems and develop solutions in creative and practical ways. You’ll find yourself applying the tools you learn in class right from the start.

Is a Career in Finance a Good Career?

The outlook for careers in finance is strong.

Careers in finance tend to be stable, even during economic downturns. And the job market for experienced finance professionals is likely to continue to grow over the next decade. The potential for a high-income career — especially for individuals with an advanced degree and several years’ of experience — is excellent.

How Long Does It Take to Complete the Finance Graduate Program?

Program length is ordinarily anywhere between 2 and 5 years. It depends on your preferred pace and the number of courses you want to take each semester.

For an accelerated journey, we offer year round study, where you can take courses in fall, January, spring, and summer.

While we don’t require you to register for a certain number of courses each semester, you cannot take longer than 5 years to complete the degree.

How Will This Finance Master’s Degree Program Help My Career?

A master’s degree in the field of finance demonstrates your mastery of the key knowledge and critical skills to build and advance a successful career in finance.

In the program at Harvard Extension School, you’ll gain an understanding of core elements of organizational finance decisions, including accounting and financial statement analysis, principles of finance, investments, corporate finance, and business valuations.

You’ll build advanced knowledge of economic theory, corporate finance, mergers and acquisitions, international markets, and risk management.

Whether you are seeking to advance your career in finance or taking the first step in a career change, you can gain the knowledge you need to prepare for roles such as account manager, cash manager, financial analyst, financial risk analyst, or financial auditor. You may also qualify for senior financial management positions such as controller, treasurer, or even chief financial officer.

Harvard Division of Continuing Education

The Division of Continuing Education (DCE) at Harvard University is dedicated to bringing rigorous academics and innovative teaching capabilities to those seeking to improve their lives through education. We make Harvard education accessible to lifelong learners from high school to retirement.

30 Best Online Finance Degree Programs [2024 Guide]

Explore Online Finance Degrees for 2024. Compare schools offering a bachelors in finance online ( 8 week classes available ).

Earning an online finance degree can prepare you for a career in the exciting world of business and finance.

Editorial Listing ShortCode:

This job sector is experiencing a 7% growth rate, and the U.S. Bureau of Labor Statistics predicts that the number of positions will grow by 591,800 in the next ten years.

List of Schools Offering Online Finance Degree Programs

Methodology: The following school list is in alphabetical order. To be included, a college or university must be regionally accredited and offer degree programs online or in a hybrid format.

1. Baker College

Baker College is Michigan’s largest university, and it is a private, not-for-profit institution with campuses across the state of Michigan and online. As a career college, it features more than 150 career programs within its system. Also, it maintains a right-to-try policy and couples this policy with an extensive financial aid office.

- Bachelor of Business Administration – Finance

- Master of Business Administration – Finance

Baker College is accredited by The Higher Learning Commission.

2. Colorado Technical University

Established in 1965, Colorado Technical College is a private university that offers undergraduate, graduate, and doctoral degrees primarily in business, management, and technology. Although the school has no public or official affiliation with the State of Colorado, it remains to have over 23,000 students and 2,500 postgraduates.

- Bachelor of Science in Business Administration – Finance

Colorado Technical University is regionally accredited by the Higher Learning Commission.

3. Columbia College

Founded in 1851, Columbia College has a traditional college with over 30 campuses all over the nation. The college has local centers and a residential campus in Columbia, Missouri, and it provides an evening program and online classes. The institution currently offers 10 associate degrees, more than 30 bachelor’s degrees, and eight master’s degrees.

- Bachelor of Arts in Finance

- Bachelor of Science in Finance

Columbia College has been accredited by the Higher Learning Commission.

4. Davenport University

Established in 1866 by Conrad Swensburg, Davenport University is a private, not-for-profit institution with campuses throughout Michigan as well as online.

The motto of Davenport University is “Get where the World is Going,” and this school offers an athletic program that allows students to participate in the National Collegiate Athletic Association (NCAA) under Division II.

Davenport University is accredited by the Higher Learning Commission.

5. Dickinson State University

Dickinson State University is a small public university in Dickinson, North Dakota. The institution was founded in 1918 as Dickinson State Normal Scholl, and it was only granted full university status in 1987. With only 1,350 students enrolled, Dickinson State University has a 10:1 student to faculty ratio.

- Bachelor of Business Administration with a major in Finance

Dickinson State University is accredited by the Higher Learning Commission.

6. Florida International University

Florida International University is a public research university in Greater Miami, Florida. It is classified among the “R1: Doctoral Universities – Very High Research Activity” and considered a “research university” by the Florida State University.

Florida International University participates in Division I of the National Collegiate Athletic Association, and its students are nicknamed the “Panthers.”

- Online Bachelor of Business Administration – Finance

Florida International University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

7. Florida State College at Jacksonville

Located in Jacksonville, Florida, FSCJ is a public school with four campuses in the area. Though still a college versus a university, it qualifies as a state college rather than a junior college for its number of degree offerings. The school was founded in 1966 and now enrolls between 50,000 and 55,000 students per year.

- Bachelor of Science in Financial Services

FSCJ is accredited by the Commission on Colleges of the Southern Association of Colleges and Schools.

8. Granite State College

Established in 1972, Granite State College is a public college located in Concord, New Hampshire, and it is a member of the University System of New Hampshire.

As of the moment, this institution is headed by Dr. Mark Rubinstein, and it has seven locations across the state.

- Accounting and Finance (B.S.)

Granite State College is accredited by the New England Commission of Higher Education.

9. Liberty University

Liberty University is a private evangelical Christian university in Lynchburg, Virginia. It is one of the largest Christian universities in the world and one of the largest private non-profit universities in the United States. It also consists of 17 colleges, which includes a School of Medicine and a School of Law.

- Online Bachelor of Science in Business Administration — Finance

- Master of Science in Finance

Liberty University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

10. Metropolitan State University

Metropolitan State University is a public university in Minneapolis-St. Paul, Minnesota that offers high-quality, flexible, and affordable tuition fees for undergraduate and graduate students. The university was established in 1971, and it is a member of the Minnesota State College and University System.

- Finance (BS)

Metropolitan State University is accredited by the Higher Learning Commission.

11. Missouri State University

Missouri State University is a public university established in 1905. The school features a campus of over 200 acres in Springfield, Missouri. Additionally, it has an academic staff of over 1,100 members. Also, it has sporting affiliations with Division I of the National Collegiate Athletic Association.

- Online Bachelor of Science in Finance

Missouri State University’s regional accreditation is through the Higher Learning Commission.

12. National University

Established in 1971, National University is a private non-profit university that has 28 campuses, with its headquarters located in La Jolla, California. The school has over 23,000 students and over 170,000 alumni. The university’s motto is “Discendo Vivimus,” which means “We Live through Learning” in English.

- Bachelor of Science in Financial Management

National University has been accredited by the WASC Senior College and University Commission.

13. New England College of Business and Finance

Formerly called the “New England College of Finance,” the New England College of Business and Finance is a private, college located in Boston, Massachusetts.

Founded in 1909, the school offers associate, undergraduate, and graduate degrees in Business, Digital Marketing, and International Business. The school also provides online courses.

- Online Bachelor’s Business Degree – Banking & Finance

- Online MBA – Finance Concentration

NECB is accredited by the New England Association of Schools and Colleges.

14. Northeastern University

Northeastern, located in Boston, Massachusetts, is classified as an R1 – Highest Research – University. It’s a private institution with more than 27,000 students per year and also operates branch campuses in Charlotte, Seattle, San Jose, and Toronto.

The distinguishing feature of this university is its co-op program, in which students gain valuable working experience via 3,100 partner organizations and businesses.

If you’re a sports fan, you can root for the school’s Huskies as they compete in the NCAA – Division I in 18 sports.

- Bachelor of Science in Finance and Accounting Management

- MBA in Finance and Business Administration

- MS in Finance and Business Administration

Northeastern University is accredited by the New England Commission of Higher Education.

15. Northwood University

Northwood University offers 21 majors for their BBA degree, and it was ranked as one of the best online bachelor’s in business programs by U.S. News & World Report.

Established in 1959 in Midland, Michigan, Northwood University has over 57,000 graduates since its founding. It currently has 20 locations in eight states and international programs in Malaysia, Sri Lanka, and Switzerland.

- Master of Business Administration

NU is regionally accredited by the Higher Learning Commission.

16. Old Dominion University

Established in 1930, Old Dominion University is a public research institution located in Norfolk, Virginia. It is currently one of the largest universities in Virginia, with 24,176 enrolls in 2019. The school offers 168 undergraduate degrees, and it has an online platform that provides long-distance access to over 24,000 students.

- Finance BSBA Online

Old Dominion University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

17. Pennsylvania State University

Founded in 1855, Pennsylvania State University is a state-related doctoral university with campuses and facilities throughout the state. It offers various services, ranging from teaching, research, and public service.

The school’s annual enrollment exceeds 46,000 students, making it one of the largest universities in the United States. It currently has an online platform called World Campus and 24 campuses that offer over 160 majors.

- Master of Finance

The Pennsylvania State University has been accredited by the Middle States Commission on Higher Education.

18. Purdue University Global

Purdue University Global operates as a part of the Purdue University System, where content delivery is mostly online, with its focus geared towards career-oriented fields of study.

The university has eight physical locations and an online law school. It approximately has 29,000 students, and although it is mainly an online university, it still has campuses in Indiana, Iowa, Maryland, Nebraska, and Maine.

Purdue Global is accredited by The Higher Learning Commission.

19. Southern New Hampshire University

Located between Hooksett and Manchester, New Hampshire, the Southern New Hampshire University was established in 1932. The online Bachelor in Business Administration Project Management degree program consists of the normal 120 credit hours to achieve the degree.

The flexibility of online and on-campus elective courses helps students to customize their learning experiences.

- BS in Finance

Southern New Hampshire University is accredited by the New England Commission of Higher Education.

20. State University of New York – Canton

Located in the Town of Canton, New York, State University of New York – Canton is the public four-year college of SUNY Canton. It offers 29 bachelor’s degrees, 20 associate degrees, and five one-year certificate programs.

Established in 1906, the State University of New York – Canton was the first post-secondary, two-year college authorized by the New York State Legislature. Currently, it is among the first to launch an esports management degree, and it was awarded $1.3 million New York State Grant for Canton Midtown Plaza Revitalization.

SUNY Canton is accredited by the Middle States Commission on Higher Education.

21. Thomas Edison State University

Located in Trenton, New Jersey, Thomas Edison State University is a majority-online institution that mostly serves the state’s adult population. In fact, it is one of the first schools in the country specifically designed for adults.

Established in 1972, the school offers various programs, which include associate, bachelor’s, and master’s degrees in more than 100 areas of study. It also has a national reputation for academic excellence, and it is one of New Jersey’s 11 senior public institutions of higher education.

Thomas Edison State University is accredited by Middle States Commission on Higher Education.

22. University of Alabama – Birmingham

Located in Birmingham, Alabama, the University of Alabama at Birmingham or UAB was established in 1936. Back then, it was only an academic extension and later became fully autonomous in 1969. It currently offers 140 programs of study in 12 academic divisions. The school has a total enrollment of more than 22,000 students from over 110 countries.

The University of Alabama at Birmingham is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

23. University of Houston – Clear Lake

The University of Houston – Clear Lake (UHCL) is located in Pasadena and Houston, Texas, with branch campuses in Pearland. The university was founded in 1971, and it is part of the University of Houston System.

UHCL has a total enrollment of over 6,000 students. It also offers 97 degree programs. Lastly, it ranked #18 among public universities in U.S. News & World Report’ s university rankings.

- Finance B.S.

- Finance M.S. Online

UHCL is accredited by the Commission on Colleges of the Southern Association of Colleges and Schools.

24. University of Houston – Downtown

UHD has a 40-acre campus in downtown Houston, Texas. There’s also a smaller campus in Harris County. It was established in 1974 and is still the second-largest college in the metropolitan Houston area. It is a public school with 52 possible degree programs and an enrollment of approximately 14,000 students per year.

University of Houston – Downtown officially accredited and/or recognized by the Southern Association of Colleges and Schools Commission on Colleges.

25. University of Houston – Victoria

The University of Houston-Victoria is part of the University of Houston System. The establishment of the university in 1971 was brought about by local efforts in Victoria to bring a higher learning institution in the community.

The institution is composed of four academic colleges where each school offers both undergraduate and master programs and degrees. Also, it has an enrollment reaching over 4,300 students.

- BBA Finance

The University of Houston-Victoria is accredited by the Southern Association of Colleges and Schools Commission on Colleges to award baccalaureate, masters, and specialist degrees.

26. University of Maryland Global Campus

The University of Maryland College is a public university focused primarily on online education. Its headquarters is located in Adelphi, Maryland, and it has satellite campuses across the Baltimore-Washington Metropolitan Area.

With its global range, the school currently serves over 90,000 students, making it one of the largest distance-learning institutions in the world. They also offer 120 academic programs, including bachelor’s, master’s, and doctoral degrees.

- Accounting and Financial Management Master’s Degree

- Management Master’s Degree with Financial Management Specialization

- Online Bachelor’s Degree: Finance

University of Maryland University College is regionally accredited by the Middle States Commission on Higher Education.

27. University of Massachusetts – Amherst

Located in Amherst, Massachusetts, UMass Amherst is a public research and land-grant university, and it is the flagship campus of the University of Massachusetts System.

The school has an annual enrollment of over 30,000 students. It also offers 109 undergraduate programs, 77 master’s degrees, and 48 doctoral degrees. Finally, it is classified among the “R1: Doctoral Universities – Very High Research Activity” by The Carnegie Classification of Institutions of Higher Education for its research expenditures exceeding $200 million (National Science Foundation).

- Master of Finance in Alternative Investments

The University of Massachusetts Amherst is accredited by the New England Commission of Higher Education.

28. University of Minnesota – Crookston

Crookston University is a public university located in Crookston, Minnesota, and it is one of the five universities in the University of Minnesota System. As of 2018, the schools had over 1,900 enrolled students coming from 20 different countries and 40 states.

In highlighting its significance, the university uses the slogan “Small Campus, Big Degrees” to show that the physical size of its campus does not affect the value of education it provides to its students.

- Bachelor of Science Finance

UMC has secured continued accreditation status from the Higher Learning Commission.

29. University of the Southwest

Located in Hobbs, New Mexico, the University of the Southwest is a private interdenominational four-year university. It was established in 1962 as a two-year Baptist educational institution.

Today, this school grants baccalaureate degrees in different fields. Also, it has three academic schools that offer over 50 undergraduate and 15 graduate programs.

- MBA in Finance

The University of the Southwest is an accredited member of the Higher Learning Commission.

30. Walsh College

Walsh College became Walsh University in 1993. It is a private, non-profit Roman Catholic university located in North Canton, Ohio. Currently, it offers 70 majors, seven graduate programs, and an online learning platform to approximately 2,700 students.

In line with the university’s ideals, they also offer study abroad programs that aim to foster global citizenship in different countries like Rome, Uganda, and Haiti.

- Bachelor of Business Administration in Finance

Walsh College is accredited by The Higher Learning Commission.

Online Finance Degree Courses

Programs for a bachelor of science in finance are a mix of business classes and finance-specific courses. The curriculums are designed to introduce students to theoretical concepts that influence financial decisions and policies as well as practical skills that can be applied to future employment settings. Here is a sample of common classes for this degree:

- Business Law: Many federal laws regulate the workings of the U.S. business and financial systems, and this class can give you an overview of them. The curriculum may also touch on local and international regulations. You may learn about contracts, employment law, torts, and other legal issues.

- Business Communication: This class can help you become more proficient at communicating with supervisors, coworkers, clients, shareholders, and others through memos, videoconferencing, email, and presentations. Your course may particularly focus on writing business reports. These skills can help you put your best foot forward, command attention, and persuade others with your words.

- Ethics in Finance: Unethical dealings have been the downfall of many business people and companies. To help you avoid that trap, this class covers ethical decision-making in business. You may discuss making above-board choices, cultivating an ethical workplace environment, operating within the boundaries of the law, and protecting the environment through sustainable practices.

- Economic Analysis: Understanding how to evaluate economic data can help you make solid business choices. Courses in economic analysis talk about both microeconomics and macroeconomics. You may get to explore various software applications that can be useful when performing financial analyses.

- Financial Accounting: This foundational class is designed to be an introduction to the basics of accounting. You and your classmates can study why careful accounting is important to the success of an organization. In addition to these theoretical ideas, you can also acquire practical skills for keeping track of financial records.

- Global Finance: Business dealings are often conducted across international markets. This course can help you prepare for working with people from other countries and performing transactions outside of your home country. In addition to learning about worldwide financial regulations, exchange rates, and international trade, you may also practice demonstrating cultural sensitivity when working in diverse settings.

- Introduction to Real Estate: Your online degree in finance may lead you to a career in real estate, so this course is designed to introduce you to some of the real estate concepts you may need to know. Topics covered may include appraisals, contracts, loans, and market analysis.

- Management of Investment Portfolios: Earning a financial advisor degree may lead to a job in managing financial assets and investments for others. This course addresses important topics that you’ll need to understand before taking on that responsibility, such as risk management, stocks, diversification, and asset selection.

Keep in mind that course selections can vary among finance schools. If your finance degree has a particular concentration or area of focus, you will take additional classes that are specific to that field of study.

Some online finance bachelor’s degree programs also require students to complete internships or other hands-on experiences in addition to the regular coursework.

What Can You Do with a Finance Degree?

Many career paths are available to people who have a bachelor’s degree in finance. With your bachelor’s degree, you may be able to get a finance job in a variety of areas including banking, insurance, taxation, accounting, and risk management.

Finance is a diverse field, so starting a finance program won’t lock you into any one job. You can explore several options and pursue the type of career that most appeals to you. According to the Bureau of Labor Statistics, some possible financial career paths and their correlating salaries include:

The above salaries are median figures for the entire country. Salaries can vary significantly based on geographic location, experience, and education. Having an online MBA in finance or even an online PhD in finance can likely cause a boost to the average annual salary.

Professional Organizations for Those with a Business Finance Degree

For those who love numbers and money matters, finance can be an exciting field. Connecting with others who have similar passions can help drive your professional growth. To learn from other financial experts through journals, conferences, classes and online forums, join an industry organization.

- American Finance Association : AFA is dedicated to conducting research on financial matters and disseminating information among finance professionals and the general public. The organization publishes a journal and holds an annual meeting.

- Association for Financial Professionals : AFP represents professionals who work in finance and treasury positions. In addition to putting out publications and holding events, the organization offers certification programs for treasury professionals, financial planners, and financial analysts.