- How it works

Useful Links

How much will your dissertation cost?

Have an expert academic write your dissertation paper!

Dissertation Services

Get unlimited topic ideas and a dissertation plan for just £45.00

Order topics and plan

Get 1 free topic in your area of study with aim and justification

Yes I want the free topic

Banking and Finance Dissertation Topics – Selected for Business Students

Published by Owen Ingram at January 2nd, 2023 , Revised On August 16, 2023

Looking for an interesting banking and finance research idea for your dissertation? Your search for the best finance and banking dissertation topics ends right here because, a t ResearchProspect, we help students choose the most authentic and relevant topic for their dissertation projects.

Bank taxes, financial management, financial trading, credit management, market analysis for private investors, economic research methods, the economics of money and banking, international trade and multinational business, the wellbeing of people and society, principles and practices of banking, management and cost accounting, governance and ethics in banking, investment banking, introductory econometrics, and capital investment management are among the many topics covered in banking and finance.

Without further ado, here is our selection of the besting banking and finance thesis topics and ideas.

Other Useful Links:

- Law Dissertation Topics

- Human Rights Law Dissertation Topics

- Business Law Dissertation Topics

- Employmeny Law Dissertation Topics

- Contract Law Dissertation Topics

- Commercial Law Dissertation Topics

- EU Law Dissertation Ideas

- Sports Law Dissertation Topics

- Medical Law Dissertation Topics

- Maritime Law Dissertation Topics

The following dissertation topics for banking will assist students in achieving the highest possible grades in their dissertation on banking finance:

List of Banking and Finance Dissertation Topics

- A Comprehensive Analysis of the Economic Crisis as It Relates to Banking and Finance

- A Critical Review of Standard Deviation in Business

- The Political and Economic Risks Involving National Bank Transactions

- A Study of Corporate Developments in European Countries Regarding Banking and Finance

- Security Measures Implemented in Financial Institutions Around the World

- Banking and Finance Approaches from Around the World

- An in-depth study of the World Trade Organization’s role in banking and finance

- A Study of the Relationship Between Corporate Strategy and Capital Structures

- Contrasting global, multinational banks with regional businesses

- Preventing Repetitive Economic Collapse in National and Global Finances

- The Motivations for Becoming International Expats All Over the World

- The Difference Between Islamic Banking and Other Religious Denominations in Banking and Financial Habits

- How Can Small-Scale Industries Survive the Global Banking Demands?

- A Study of the Economic Crisis’s Impact on Banking and Finance

- The Impact of the International Stock Exchange on Domestic Bank Transactions

- A 2025 Projected Report on World Trade and Banking Statistics

- How Can We Address the Issue of the Government’s Financial Deficit in Banking?

- A Comparison of Contemporary and Classic Business Models and Companies’ Banking and Financial Habits

- Which of the following should be the principal area of money investment that has arrived at the bank in the form of deposits?

- How to strike a balance between investing money in various plans to generate a profit and managing depositor trust

- What are banks’ responsibilities to their depositors, and how may such liabilities be managed without jeopardising depositor trust?

- How the new banking financing laws enacted by governments throughout the world are better protecting depositors’ rights?

- What is the terminology related to banking finance, which oversees the investment of deposited funds as well as the banks’ responsibilities to depositors?

- Explain the most recent developments in research related to the topic of banking finance

- How research in the banking finance industry assists governments and banking authorities in properly managing their finances?

- What is the most recent credit rating software that assists in determining the rewards and dangers of investing bank funds in the stock market?

- How banking finance assists the world’s top banks in managing consumer expectations and profit?

- The negative impact of a manager’s poor management of a bank’s banking financing

- Is it feasible to conduct a banking firm without the assistance of banking finance management?

- What are the most significant aspects of banking financing that allow businesses to develop without constraints?

The importance of banking finance cannot be overstated. These are only a few of the most extensive subjects on which you may write a banking and finance dissertation. Remember that if you want to succeed in your studies, you must be able to offer reliable numbers and facts on the history and current state of banking and finance throughout the world. Otherwise, you will very certainly be unable to justify your study effectively. We hope you can take some inspiration and ideas from the above banking and finance dissertation topics .

Need professional dissertation help? Click here .

Free Dissertation Topic

Phone Number

Academic Level Select Academic Level Undergraduate Graduate PHD

Academic Subject

Area of Research

Frequently Asked Questions

How to find banking and finance dissertation topics.

To find banking and finance dissertation topics:

- Follow industry news and trends.

- Study regulatory changes.

- Explore emerging technologies.

- Analyze financial markets.

- Investigate risk management.

- Consider ethical and global aspects.

You May Also Like

Need interesting coronavirus (Covid-19) nursing dissertation topics? Here are the trending dissertation titles so you can choose the most suitable one.

Auditing dissertation study provides professionals and students with a variety of chances to improve quality in healthcare and commercial organizations.

Are you having trouble finding a good music dissertation topic? If so, don’t fret! We have compiled a list of the best music dissertation topics for your convenience.

USEFUL LINKS

LEARNING RESOURCES

COMPANY DETAILS

- How It Works

Research Topics & Ideas: Finance

120+ Finance Research Topic Ideas To Fast-Track Your Project

If you’re just starting out exploring potential research topics for your finance-related dissertation, thesis or research project, you’ve come to the right place. In this post, we’ll help kickstart your research topic ideation process by providing a hearty list of finance-centric research topics and ideas.

PS – This is just the start…

We know it’s exciting to run through a list of research topics, but please keep in mind that this list is just a starting point . To develop a suitable education-related research topic, you’ll need to identify a clear and convincing research gap , and a viable plan of action to fill that gap.

If this sounds foreign to you, check out our free research topic webinar that explores how to find and refine a high-quality research topic, from scratch. Alternatively, if you’d like hands-on help, consider our 1-on-1 coaching service .

Overview: Finance Research Topics

- Corporate finance topics

- Investment banking topics

- Private equity & VC

- Asset management

- Hedge funds

- Financial planning & advisory

- Quantitative finance

- Treasury management

- Financial technology (FinTech)

- Commercial banking

- International finance

Corporate Finance

These research topic ideas explore a breadth of issues ranging from the examination of capital structure to the exploration of financial strategies in mergers and acquisitions.

- Evaluating the impact of capital structure on firm performance across different industries

- Assessing the effectiveness of financial management practices in emerging markets

- A comparative analysis of the cost of capital and financial structure in multinational corporations across different regulatory environments

- Examining how integrating sustainability and CSR initiatives affect a corporation’s financial performance and brand reputation

- Analysing how rigorous financial analysis informs strategic decisions and contributes to corporate growth

- Examining the relationship between corporate governance structures and financial performance

- A comparative analysis of financing strategies among mergers and acquisitions

- Evaluating the importance of financial transparency and its impact on investor relations and trust

- Investigating the role of financial flexibility in strategic investment decisions during economic downturns

- Investigating how different dividend policies affect shareholder value and the firm’s financial performance

Investment Banking

The list below presents a series of research topics exploring the multifaceted dimensions of investment banking, with a particular focus on its evolution following the 2008 financial crisis.

- Analysing the evolution and impact of regulatory frameworks in investment banking post-2008 financial crisis

- Investigating the challenges and opportunities associated with cross-border M&As facilitated by investment banks.

- Evaluating the role of investment banks in facilitating mergers and acquisitions in emerging markets

- Analysing the transformation brought about by digital technologies in the delivery of investment banking services and its effects on efficiency and client satisfaction.

- Evaluating the role of investment banks in promoting sustainable finance and the integration of Environmental, Social, and Governance (ESG) criteria in investment decisions.

- Assessing the impact of technology on the efficiency and effectiveness of investment banking services

- Examining the effectiveness of investment banks in pricing and marketing IPOs, and the subsequent performance of these IPOs in the stock market.

- A comparative analysis of different risk management strategies employed by investment banks

- Examining the relationship between investment banking fees and corporate performance

- A comparative analysis of competitive strategies employed by leading investment banks and their impact on market share and profitability

Private Equity & Venture Capital (VC)

These research topic ideas are centred on venture capital and private equity investments, with a focus on their impact on technological startups, emerging technologies, and broader economic ecosystems.

- Investigating the determinants of successful venture capital investments in tech startups

- Analysing the trends and outcomes of venture capital funding in emerging technologies such as artificial intelligence, blockchain, or clean energy

- Assessing the performance and return on investment of different exit strategies employed by venture capital firms

- Assessing the impact of private equity investments on the financial performance of SMEs

- Analysing the role of venture capital in fostering innovation and entrepreneurship

- Evaluating the exit strategies of private equity firms: A comparative analysis

- Exploring the ethical considerations in private equity and venture capital financing

- Investigating how private equity ownership influences operational efficiency and overall business performance

- Evaluating the effectiveness of corporate governance structures in companies backed by private equity investments

- Examining how the regulatory environment in different regions affects the operations, investments and performance of private equity and venture capital firms

Asset Management

This list includes a range of research topic ideas focused on asset management, probing into the effectiveness of various strategies, the integration of technology, and the alignment with ethical principles among other key dimensions.

- Analysing the effectiveness of different asset allocation strategies in diverse economic environments

- Analysing the methodologies and effectiveness of performance attribution in asset management firms

- Assessing the impact of environmental, social, and governance (ESG) criteria on fund performance

- Examining the role of robo-advisors in modern asset management

- Evaluating how advancements in technology are reshaping portfolio management strategies within asset management firms

- Evaluating the performance persistence of mutual funds and hedge funds

- Investigating the long-term performance of portfolios managed with ethical or socially responsible investing principles

- Investigating the behavioural biases in individual and institutional investment decisions

- Examining the asset allocation strategies employed by pension funds and their impact on long-term fund performance

- Assessing the operational efficiency of asset management firms and its correlation with fund performance

Hedge Funds

Here we explore research topics related to hedge fund operations and strategies, including their implications on corporate governance, financial market stability, and regulatory compliance among other critical facets.

- Assessing the impact of hedge fund activism on corporate governance and financial performance

- Analysing the effectiveness and implications of market-neutral strategies employed by hedge funds

- Investigating how different fee structures impact the performance and investor attraction to hedge funds

- Evaluating the contribution of hedge funds to financial market liquidity and the implications for market stability

- Analysing the risk-return profile of hedge fund strategies during financial crises

- Evaluating the influence of regulatory changes on hedge fund operations and performance

- Examining the level of transparency and disclosure practices in the hedge fund industry and its impact on investor trust and regulatory compliance

- Assessing the contribution of hedge funds to systemic risk in financial markets, and the effectiveness of regulatory measures in mitigating such risks

- Examining the role of hedge funds in financial market stability

- Investigating the determinants of hedge fund success: A comparative analysis

Financial Planning and Advisory

This list explores various research topic ideas related to financial planning, focusing on the effects of financial literacy, the adoption of digital tools, taxation policies, and the role of financial advisors.

- Evaluating the impact of financial literacy on individual financial planning effectiveness

- Analysing how different taxation policies influence financial planning strategies among individuals and businesses

- Evaluating the effectiveness and user adoption of digital tools in modern financial planning practices

- Investigating the adequacy of long-term financial planning strategies in ensuring retirement security

- Assessing the role of financial education in shaping financial planning behaviour among different demographic groups

- Examining the impact of psychological biases on financial planning and decision-making, and strategies to mitigate these biases

- Assessing the behavioural factors influencing financial planning decisions

- Examining the role of financial advisors in managing retirement savings

- A comparative analysis of traditional versus robo-advisory in financial planning

- Investigating the ethics of financial advisory practices

The following list delves into research topics within the insurance sector, touching on the technological transformations, regulatory shifts, and evolving consumer behaviours among other pivotal aspects.

- Analysing the impact of technology adoption on insurance pricing and risk management

- Analysing the influence of Insurtech innovations on the competitive dynamics and consumer choices in insurance markets

- Investigating the factors affecting consumer behaviour in insurance product selection and the role of digital channels in influencing decisions

- Assessing the effect of regulatory changes on insurance product offerings

- Examining the determinants of insurance penetration in emerging markets

- Evaluating the operational efficiency of claims management processes in insurance companies and its impact on customer satisfaction

- Examining the evolution and effectiveness of risk assessment models used in insurance underwriting and their impact on pricing and coverage

- Evaluating the role of insurance in financial stability and economic development

- Investigating the impact of climate change on insurance models and products

- Exploring the challenges and opportunities in underwriting cyber insurance in the face of evolving cyber threats and regulations

Quantitative Finance

These topic ideas span the development of asset pricing models, evaluation of machine learning algorithms, and the exploration of ethical implications among other pivotal areas.

- Developing and testing new quantitative models for asset pricing

- Analysing the effectiveness and limitations of machine learning algorithms in predicting financial market movements

- Assessing the effectiveness of various risk management techniques in quantitative finance

- Evaluating the advancements in portfolio optimisation techniques and their impact on risk-adjusted returns

- Evaluating the impact of high-frequency trading on market efficiency and stability

- Investigating the influence of algorithmic trading strategies on market efficiency and liquidity

- Examining the risk parity approach in asset allocation and its effectiveness in different market conditions

- Examining the application of machine learning and artificial intelligence in quantitative financial analysis

- Investigating the ethical implications of quantitative financial innovations

- Assessing the profitability and market impact of statistical arbitrage strategies considering different market microstructures

Treasury Management

The following topic ideas explore treasury management, focusing on modernisation through technological advancements, the impact on firm liquidity, and the intertwined relationship with corporate governance among other crucial areas.

- Analysing the impact of treasury management practices on firm liquidity and profitability

- Analysing the role of automation in enhancing operational efficiency and strategic decision-making in treasury management

- Evaluating the effectiveness of various cash management strategies in multinational corporations

- Investigating the potential of blockchain technology in streamlining treasury operations and enhancing transparency

- Examining the role of treasury management in mitigating financial risks

- Evaluating the accuracy and effectiveness of various cash flow forecasting techniques employed in treasury management

- Assessing the impact of technological advancements on treasury management operations

- Examining the effectiveness of different foreign exchange risk management strategies employed by treasury managers in multinational corporations

- Assessing the impact of regulatory compliance requirements on the operational and strategic aspects of treasury management

- Investigating the relationship between treasury management and corporate governance

Financial Technology (FinTech)

The following research topic ideas explore the transformative potential of blockchain, the rise of open banking, and the burgeoning landscape of peer-to-peer lending among other focal areas.

- Evaluating the impact of blockchain technology on financial services

- Investigating the implications of open banking on consumer data privacy and financial services competition

- Assessing the role of FinTech in financial inclusion in emerging markets

- Analysing the role of peer-to-peer lending platforms in promoting financial inclusion and their impact on traditional banking systems

- Examining the cybersecurity challenges faced by FinTech firms and the regulatory measures to ensure data protection and financial stability

- Examining the regulatory challenges and opportunities in the FinTech ecosystem

- Assessing the impact of artificial intelligence on the delivery of financial services, customer experience, and operational efficiency within FinTech firms

- Analysing the adoption and impact of cryptocurrencies on traditional financial systems

- Investigating the determinants of success for FinTech startups

Commercial Banking

These topic ideas span commercial banking, encompassing digital transformation, support for small and medium-sized enterprises (SMEs), and the evolving regulatory and competitive landscape among other key themes.

- Assessing the impact of digital transformation on commercial banking services and competitiveness

- Analysing the impact of digital transformation on customer experience and operational efficiency in commercial banking

- Evaluating the role of commercial banks in supporting small and medium-sized enterprises (SMEs)

- Investigating the effectiveness of credit risk management practices and their impact on bank profitability and financial stability

- Examining the relationship between commercial banking practices and financial stability

- Evaluating the implications of open banking frameworks on the competitive landscape and service innovation in commercial banking

- Assessing how regulatory changes affect lending practices and risk appetite of commercial banks

- Examining how commercial banks are adapting their strategies in response to competition from FinTech firms and changing consumer preferences

- Analysing the impact of regulatory compliance on commercial banking operations

- Investigating the determinants of customer satisfaction and loyalty in commercial banking

International Finance

The folowing research topic ideas are centred around international finance and global economic dynamics, delving into aspects like exchange rate fluctuations, international financial regulations, and the role of international financial institutions among other pivotal areas.

- Analysing the determinants of exchange rate fluctuations and their impact on international trade

- Analysing the influence of global trade agreements on international financial flows and foreign direct investments

- Evaluating the effectiveness of international portfolio diversification strategies in mitigating risks and enhancing returns

- Evaluating the role of international financial institutions in global financial stability

- Investigating the role and implications of offshore financial centres on international financial stability and regulatory harmonisation

- Examining the impact of global financial crises on emerging market economies

- Examining the challenges and regulatory frameworks associated with cross-border banking operations

- Assessing the effectiveness of international financial regulations

- Investigating the challenges and opportunities of cross-border mergers and acquisitions

Choosing A Research Topic

These finance-related research topic ideas are starting points to guide your thinking. They are intentionally very broad and open-ended. By engaging with the currently literature in your field of interest, you’ll be able to narrow down your focus to a specific research gap .

When choosing a topic , you’ll need to take into account its originality, relevance, feasibility, and the resources you have at your disposal. Make sure to align your interest and expertise in the subject with your university program’s specific requirements. Always consult your academic advisor to ensure that your chosen topic not only meets the academic criteria but also provides a valuable contribution to the field.

If you need a helping hand, feel free to check out our private coaching service here.

You Might Also Like:

thank you for suggest those topic, I want to ask you about the subjects related to the fintech, can i measure it and how?

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Print Friendly

25,000+ students realised their study abroad dream with us. Take the first step today

Here’s your new year gift, one app for all your, study abroad needs, start your journey, track your progress, grow with the community and so much more.

Verification Code

An OTP has been sent to your registered mobile no. Please verify

Thanks for your comment !

Our team will review it before it's shown to our readers.

Dissertation Topic in Finance

- Updated on

- Jan 11, 2024

Also known as the study of investments, Finance is a combination of two interrelated subjects – how money is handled and the process of obtaining money. One of the reasons why postgraduate students struggle with their Finance dissertation topics is that they do not spend enough time planning it. It is important for students to be extremely careful while writing a finance dissertation as it contributes a lot to their respective degrees. This blog provides you with the best topics, a dissertation structure, and more.

This Blog Includes:

What is a finance dissertation, why finance dissertation topics are important, tips to find excellent dissertation topics on finance, writing tips for finance dissertation, how to plan your work on a finance dissertation, how to structure a finance dissertation, finance dissertation general topics , topics related to india, mba dissertation topics, banking dissertation topics , accounting dissertation topics, research project example, final consideration and conclusion.

Finance dissertations, as the name implies, are pieces of writing that study a certain finance topic chosen by the student. The subjects covered include anything from the stock market to banking and risk management to healthcare finance. This dissertation gives the student academic self-assurance and personal happiness in the subject of finance. Finance writing necessitates substantial research in order to produce a compelling report.

The majority of students have no idea why finance dissertation themes are so crucial. However, put yourself in the shoes of your lecturer. You’ve already read hundreds of theses. The majority of them covered the same ground — issues that you’re already tired of hearing about. Then there’s a topic with a distinct, intriguing theme. Something that piques your interest and entices you to read more. Wouldn’t you give those pupils some extra credit? You’d do it! This is why there are so many fantastic finance dissertation topics. You can get extra points for your efforts. The topic of your paper might mean the difference between a good and a terrific grade.

It’s difficult to come up with anything unique and interesting. There are, nevertheless, ways to come up with interesting ideas. Here are a few pointers on how to locate them:

- Read a fantastic finance dissertation and find for areas where further study is needed.

- Go to the library and read a couple theses to get some ideas.

- Inquire with a writing agency about some ideas from one of their professional dissertation writers.

- In writing forums and blogs, ask for assistance. If you ask gently, people will give you some excellent suggestions.

- Look for ideas on the internet, but don’t use them exactly as they are. Make them distinctive by changing them.

- Talk to other students who are working on their dissertations and find out what other ideas they had before settling on the present topic.

- Narrow down your topic : Your financial topic should be narrowed down to a certain niche. It should concentrate on a single area, such as microfinance, microfinance, or online banking.

- Verify your facts: Finance is a topic that requires a great deal of logical analysis of statistical data. As a result, double-check facts and statistics using credible sources before using them in your paper.

- Write concisely: You should condense a financial paper into a tight, succinct work, unlike other papers with extended narrative narratives. At this length, the adage of ‘short is sweet’ theoretically applies.

- Arrange your data neatly: A report that is crammed with numbers and graphs may turn off a reader at first glance. Know how and when to utilise your data for a great financial thesis.

- Write simply: Avoid using jargon that might be confusing to a non-technical reader. When technical terminology are required, utilise accessible examples to convey them. In a finance dissertation, simplicity is king. So make good use of it.

Dissertation submission is very important to obtain a PG Degree. You are supposed to submit the work by the end of your study course, so by the last year of your degree, you may have got enough ideas and problems dealing with finance. While starting with a finance dissertation topic you should always remember that the purpose of a Finance Dissertation is to demonstrate your research ability, how you analyze specific data and come up with a conclusion. Mentioned below is a step to step guide for you to start working with:

Step 1 : Choose a relevant and interesting topic for your research

Step 2 : Discuss and receive feedback from your supervisor

Step 3 : Finalise the research methods to prove the significance of the selected topic

Step 4 : Gather the required data from relevant sources

Step 5 : Conduct the research and analyse the acquired results

Step 6 : Work on the outline of your dissertation

Step 7 : Make a draft and proofread it. Discuss with your advisors if any changes are to be made

Step 8 : Make the required corrections.

Step 9 : Draft the final dissertation

Also Read: Check out the Top Course in Finance

There are so many different ways you can structure your dissertation. But the most common and universally accepted way is as follows:

- Introduction

- Literature review

- Methodology

- Analysis of the data and Significance/Implications of the acquired results

Also Read: Executive MBA in Finance

Finance Dissertation Topics

Finance is an extensive field, you can explore a lot of areas related to finance to choose a dissertation topic. Here we’ve mentioned the best finance dissertation topics to make it easier for you:

Mentioned below are some of the topics related to the recent issues in the world:

- The negative impact of microfinance in developing countries.

- The effects of population growth on economic growth in China

- Cryptocurrency: Are we ready to digitalise the monetary world?

- Analyzing the financial statements of VISA and MasterCard

- Why do banks oppose digital currency?

- Risks and benefits associated with digital money transferring technology

Also Read: Top MBA course to pursue

- Investing in India’s technology sector – obstacles and opportunities

- Foreign investment and its effects on economic growth in India

- The effect of corporation investments in the economic development of the community

- Comparing financial development in Asia and Europe

- Did the banks help Small Medium Enterprises to grow in India in the last 5 years?

- The Indian Economic Crisis of 1991

Best MBA Dissertation Topics

Be careful while choosing an MBA Dissertation Topic as it involves more intense study. Make sure the topic you’ve chosen remains within your field of study. We’ve listed some of the best topics you can choose for an MBA Dissertation:

- Management skills an entrepreneur need

- The place of communication for effective management in the workplace

- How technology took over management

- The impact of good leadership in an organization

- How does a strong social media presence affect a company’s marketing strategies?

- Human resource management in non-profit organizations

- The importance of employee motivation programs on productivity

- Management’s socio-cultural background and how it influences leadership relationships

- How do employment benefits impact employee and company’s productivity?

- Business team performance in multinational corporations

Best Finance Universities in the USA

- Study on Future Options in Markets in India

- Gold as an Investable Commodity in India

- Study on Impact Of Corruption On FDI Inflows In India

- The Impact Of The Money Supply On Economic Growth In India

- Capital Structure Of The Business Enterprises In Delhi NCR

- GST And Its Effect on MNC Manufacturing Companies

- Analysis of the Insurance Industry in India

- Analysis of HDFC Bank Finance

- Comparative analysis of HDFC Bank with ICICI bank

- Comparison of Market Share in Public Sector Banks VS Private Sector Banks

- The impact of online banking on the world.

- Risk factors and security issues that are inherent in online banking.

- Fraud and identity theft is accomplished via internet banking.

- Advantages and disadvantages of internet banking for consumers.

- Risk management in investment banking

- The rise of growing banking sectors in developing nations.

- Issues surrounding banking in China’s growing economy.

- The impact of the Federal Reserve on the United States and global economy

- Banking and asset-liability in management.

- The strategies to use online banking technology to attract customers.

All you need to know about a Banking Course

- Case study of the impact of industry and public knowledge on the market share index’s fluctuation

- Significance of auditing for large corporations

- Examining India’s country’s tax scheme

- What to consider when investing in financial markets?

- From an accounting perspective, risk-taking in companies and its effects

- Evaluate the differences and similarities between external and internal auditors

- Can taxation be considered a human rights policy? Analyse the problem

- What are the consequences of India’s current tax structure on individuals with a lower income?

Accounting courses

We’ve included a Finance Dissertation Research Example with reference to a Finance Dissertation Structure:

- The Indian Economic Crisis of 1991 – The title of your Finance Dissertation must focus on your research objective.

- Abstract – The 1991 Indian economic crisis was…………….. imports and other external factors. The abstract part must include a summary of the research problem or objective of the research, the research design and a summary of the results.

- Introduction – The introduction must reflect your research on the Indian Economic Crisis of 1991 in a way that the audience already gets to know what the research is going to include.

3.1 Background (background of the study)

3.2 Problem Statement (significance of the problem in context)

3.3 Purpose/Research Questions (What caused the Crisis, how was the crisis revived etc.)

- Review of Literature – The Review of Literature Section must include a theoretical rationale of the problem, the importance of the study, and the significance of the results.

- Methodology – The Methodology Section must include the description of the subjects, research methods used in the data collection and any limitations issues involved.

- Significance/Implications (Results of the Discussion)

*Please note that the above-mentioned structure is only for your reference to get an idea of writing a Finance Dissertation.

Choosing the right topic for your Finance dissertation to plan the work, all the above-mentioned aspects must be given equal importance. This blog has included the best dissertation topic in finance in MBA, accounting, and banking you can choose while writing a dissertation.

Finance research papers and dissertations should be prepared in a way that answers the core question while also being relevant to the remainder of the study. For example, if the dissertation’s major question is “what is the link between foreign exchange rates and the interest rates of a specific country,” the dissertation should provide suitable illustrations to help illustrate the topic. It should also go through the major and minor concerns that are relevant to this topic. Furthermore, utilise proper language to ensure that the article is readily understood by readers. The overall purpose of the project is to produce a well-written, well-researched, and well-supported dissertation.

It takes around 2 years to complete an MBA in India while 1 year to complete a full-time MBA in other countries.

A finance dissertation must be 100-300 pages long.

It takes around 5 years to obtain a Doctorate in Finance.

Hopefully, this blog assisted you in finding out your finance dissertation topics and structure for your course. If you require any assistance regarding your application process while enrolling for your further studies, our experts at Leverage Edu are just one click away. Call us anytime at 1800 572 000 for a free counselling session!

Damanpreet Kaur Vohra

Daman is an author with profound expertise in writing engaging and informative content focused on EdTech and Study Abroad. With a keen understanding of these domains, Daman excels at creating complex concepts into accessible, reader-friendly material. With a proven track record of insightful articles, Daman stands as a reliable source for providing content for EdTech and Study Abroad.

Leave a Reply Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Contact no. *

Leaving already?

8 Universities with higher ROI than IITs and IIMs

Grab this one-time opportunity to download this ebook

Connect With Us

25,000+ students realised their study abroad dream with us. take the first step today..

Resend OTP in

Need help with?

Study abroad.

UK, Canada, US & More

IELTS, GRE, GMAT & More

Scholarship, Loans & Forex

Country Preference

New Zealand

Which English test are you planning to take?

Which academic test are you planning to take.

Not Sure yet

When are you planning to take the exam?

Already booked my exam slot

Within 2 Months

Want to learn about the test

Which Degree do you wish to pursue?

When do you want to start studying abroad.

September 2024

January 2025

What is your budget to study abroad?

How would you describe this article ?

Please rate this article

We would like to hear more.

- How It Works

- PhD thesis writing

- Master thesis writing

- Bachelor thesis writing

- Dissertation writing service

- Dissertation abstract writing

- Thesis proposal writing

- Thesis editing service

- Thesis proofreading service

- Thesis formatting service

- Coursework writing service

- Research paper writing service

- Architecture thesis writing

- Computer science thesis writing

- Engineering thesis writing

- History thesis writing

- MBA thesis writing

- Nursing dissertation writing

- Psychology dissertation writing

- Sociology thesis writing

- Statistics dissertation writing

- Buy dissertation online

- Write my dissertation

- Cheap thesis

- Cheap dissertation

- Custom dissertation

- Dissertation help

- Pay for thesis

- Pay for dissertation

- Senior thesis

- Write my thesis

200 Finance Dissertation Topics: Quick Ideas For Students

Finance dissertation topics are on-demand in the 21st century. But why is this so? It may perplex you how everyone is up and down looking for interesting, quality finance topics. However, the answer is simple: because fascinating finance dissertation topics can earn students bonus points.

We will delve into that in just a second. Your finance topic dictates the difficulty of the assignment you are going to handle. Landing on the right topic means that you will not have to toil as much as when you pick a highly complex topic. Does it make sense?

Let’s explore the nitty-gritty of finance dissertation papers before we get into mentioning the top-rated finance research topics list.

What Is A Finance Dissertation?

As the name goes, finance dissertation is a kind of writing that investigates a particular finance topic selected by the student. The topics range from the stock market, banking, and risk management to healthcare finance topics.

This dissertation provides the student with a degree of academic self-confidence and personal satisfaction in the finance field. Finance writing requires extensive research to create a persuasive paper in the end.

Writing Tips For Finance Dissertations

Are you uncertain concerning what you need to do to compose a top-notch finance dissertation? Worry no more! Our professional writers have put together some essential suggestions to kick you off. In the next few minutes, you will be in a position to create a perfect finance dissertation painstakingly:

- Narrow down your topic : Trim down your finance topic to a specific niche. It should focus on one region; either micro-finance, macro-finance, or internet banking.

- Verify your facts : Finance is a field that includes a lot of statistical data to be followed logically. Therefore, verify facts and figures with reliable sources before opting to use them in your paper.

- Write concisely : Unlike other papers with long narrative tales, you should encapsulate a finance paper into a tight, concise paper. The rule of ‘short is sweet’ technically applies here at great length.

- Arrange your data neatly : A paper that is stuffed with numerals and charts all over may turn down a reader at first sight. For an impressive finance thesis, know-how and when to use your data.

- Write simply : Avoid jargon that may confuse an ordinary reader. Where a need is for technical terms to be used, illustrate them with relatable examples. Simplicity is gold in a finance dissertation. So, use it well.

With these tips and tricks, you are all set to start writing your finance paper. We now advance to another crucial part that will make sure your finance paper is refined and at per with your institution’s academic standards.

General Structure of a Finance Dissertation

It is crucial to consult your supervisor regarding your dissertation’s research methodology, structure, style, and reasonable length. Depending on the guidance of your supervisor, the structure may vary. Nonetheless, as a general guide, ensure the following sections are part and parcel of your dissertation:

- Introduction: State the problem that you intend to address in your dissertation. It also includes a definition of key terms, the relevance of the topic and a summary of hypotheses.

- Theoretical and empirical literature, hypotheses development and contribution: It provides the theoretical framework of your study. The hypotheses are based on the literature review.

- Data and methodology: State the model (i.e. dependent and key independent variables) that you want to use the drawing on theoretical framework or economic argument that you may employ for your analysis. Define all control variables and describe the data used to test the hypothesis.

- Empirical results: Describe the results and mention whether they are consistent with the hypotheses and relate them with the existing evidence in the literature. You will also describe the statistical and practical/economic significance of your findings.

- Summary and conclusion: Summarize your research and state the general conclusion with relevant implications.

It is important to have all the dataset you want to use readily available before finalizing the topic. The dataset is essential for testing your hypotheses.

There are thousands of research topics for finance students available all over the internet and academic books. You only have to browse and lookup for the latest research or refer to past readings or course lectures.

Even though this exercise may look simple enough on the surface, it takes a lot of time to consider what makes for interesting finance topics adequately. Not all ideas you find will achieve the academic requirements that your supervisor expects from you.

Here is a list of freshly mint topics to use for numerous finance situations:

Impressive Healthcare Finance Topics

Healthcare involves more than just treating patients and administering injections. There are finance aspects that also come into play, including:

- Strategies for marketplace achievement in turbulent times: Medical staff marketing

- Effects of the employer executive compensation and benefits plan after the Tax Reform Act of 1986

- Improving profitability through accelerating philanthropic giving to healthcare systems

- Acceleration and effective information strategies for cash management in hospitals

- Finding the system’s solution to health care cost accounting

- How hospitals spend money from charitable organizations and donor funding

- Models of enhancing cost accounting efforts by improving existing information sources

- Strategies of increasing cash flow with a patient accounting review

- A systematic review of productivity, cost accounting, and information systems

- A study of the cost accounting strategies under the prospective payment system

- How to manage bad debt and charity care accounts in hospitals

- Achieving more value from managed care efforts in healthcare systems

- Strategies of achieving economies of scale through shared ancillary and support services

- Profitable ways of financing the acquisition of a health care enterprise

- Effects of mergers and acquisitions on private hospitals

- Measuring nursing costs with patient acuity data in hospitals

- Affordable treatment and care for long-term and terminal diseases

- Survey of the organization and structure of a hospital’s administration concerning financing

- Impact of culture and globalization on healthcare financing

- Discuss the necessity for universal health coverage in the United States

Finance Management Project Topics

If you are a finance management enthusiast, this section will impress you the most:

- The impact of corrupt bank managers on its sustainability

- How banks finance small and medium-scale enterprises

- Loan granting and its recovery problems on commercial banks

- An evaluation of credit management in the banking industry

- The role of microfinance banks in the alleviation of poverty in the US

- Comparative evaluation strategies in mergers and acquisitions

- How to plan and invest in the insurance sector and tax planning

- Impact of shareholders on decision-making processes on banks

- How diversity in banks affects management and leadership practices

- Credit management techniques that work for small scale enterprises

- Appraisal on the impact of effective credit management on the profitability of commercial banks

- The impact of quantitative tools of monetary policy on the performance of deposit of commercial banks

- Financial management practices in the insurance industry and risk management

- The role of the capital market in economic development

- Problems facing financial institutions to the growth of small scale business in the USA

- Why training and development of human resources is a critical factor in bank operations

- The impact of universal banking financial system on the credibility

- Security threats to effective management in banks

- The effect of fiscal and monetary policy in controlling unemployment

- The effects of financial leverage on company performance

Topics in Mathematics With Applications in Finance

Mathematics and finance correlate in several ways in that they borrow concepts from each other. Here are some of the mathematics concepts that apply to finance paper topics:

- Linear algebra

- Probability theory

- Stochastic processes

- Regression analysis

- Value at risk models

- Time series analysis

- Volatility modelling

- Regularized pricing and risk models

- Commodity models

- Portfolio theory

- Factor modelling

- Stochastic differential equations

- Ross recovery theorem

- Option, price, and probability duality

- Black-Scholes formula, Risk-neutral valuation

- Introduction to counterparty credit risk

- HJM model for interest rates and credit

- Quanto credit hedging

- Calculus in finance and its application

International Finance Topics

International finance research topics deal with a range of monetary exchanges between two or more nations. Below is a list of international research topics in finance for you to browse through and pick a relevant one:

- A study of the most important concepts in international finance

- How internal auditing enhances good corporate governance practice in an organization

- Factors that affect the capital structure of Go Public manufacturing companies

- A financial engineering perspective on the causes of large price changes

- Corporate governance and board of directors responsibilities

- An exploratory study on the management of support services in international organizations

- An accounting perspective of the need for theorizing corporation

- Impact of coronavirus on international trade relations

- Is business ethics attainable in the global market arena

- How exchange rates affect international trading

- The role of currency derivatives in shaping the global market

- How to improve international capital structure

- How to forecast exchange rates

- Ways of measuring exposure to exchange rates fluctuations

- How to hedge exposure to exchange rates fluctuations globally

- How foreign direct investment puts individual countries at risk

- How to stabilize international capital markets

- A study of shadow banking in the global environment

- A comparative analysis of Western markets and African markets

- Exploring the monetary funding opportunities by the International Monetary Fund

Corporate Finance Research Topics

These 20 topics have the potential to help you write an amazing corporate finance paper, provided you have the will to work hard on your paper:

- Short- and long-term investment needs for working capital trends

- Identifying proper capital structure models for a company

- How capital structure and an organization’s funding of its operations relate

- Corporate finance decision making in unstable stock markets

- The effect of firm size on financial decision making incorporates

- Compare and contrast the different internationally recognized corporate financial reporting standards

- Evaluate the emerging concept integrated reporting in corporate finance

- Managing transparency in corporate financial decisions

- How technological connectivity has helped in integrated financial management

- How different investment models contribute to the success of a corporate

- The essence of valuation of cash flows in financial and non-financial corporates

- Identify the prevalent financial innovations in the USA

- Ways in which governance influences corporate financial activities

- Impact of taxes on dividend policies in developed nations

- How corporate strategies related to corporate finance

- Implications of the global economic crisis in the backdrop of corporate finance concepts

- How information technology impact corporate relations among companies

- Evaluate the effectiveness of corporate financing tools and techniques

- How do FDI strategies compare in Europe and Asia?

- The role of transparency and liquidity in alternative corporate investments

Finance Debate Topics

These finance debate topics are formulated in keeping with emerging financial issues globally:

- Is China’s economy on the verge of ousting that of the US?

- Does the dynamic nature of the global market affect the financial alienations of countries?

- Is Foreign Direct Investment in retail sector good for the US?

- Is it possible to maintain stable oil prices in the world?

- Are multinational corporations good for the global economy?

- Does the country of origin matter in selling a product?

- Are financial companies misusing ethics in marketing?

- Why should consumer always be king in marketing messages?

- Does commercialization serve in the best interest of the consumer?

- Why should companies bother having a mission statement?

- Why should hospitals receive tax subsidies and levies on drugs?

- Is television the best medium for advertisement?

- Is the guarantor principle security or a myth?

- Compare and contrast market trends in capitalism versus Marxism states

- Does the name of a business have an impact on its development record?

- Is it the responsibility of the government to finance small-scale business enterprises?

- Does budgeting truly serve its purpose in a company?

- Why should agricultural imports be banned?

- Is advertising a waste of company resources?

- Why privatization will lead to less corruption in companies

Finance Topics For Presentation

Is your group or individual finance presentation giving you sleepless nights just because you do not have a topic? Worry no more!

- The role of diplomatic ties in enhancing financial relations between countries

- Should banks use force when recovering loans from long-term defaulters?

- Why mortgages are becoming difficult to repay among the middle class

- Ways of improving the skilled workforce in developing

- How technology creates income disparities among social classes

- The role of rational thinking in making financial decisions

- How much capital is necessary for a start-up?

- Are investments in betting firms good for young people?

- How co-operatives are important in promoting communism in a society

- Why should countries stop receiving foreign aids and depend on themselves?

- Compare and contrast the performance of private sectors over public sectors

- How frequent should reforms be conducted in companies?

- How globalization affects nationalism

- Theories of financial development that is still applicable today

- Should business people head the finance ministry of countries?

- The impact of the transport sector on revenue and tax collection

- The impact of space exploration on the country’s economy

- How regional blocs are impacting developing nations

- Factors contributing to the growth of online scams

- What is the impact of trade unions in promoting businesses?

Finance Research Topics For MBA

Here is our best list of top-rated MBA financial topics to write about in 2023, which will generate more passion for a debate:

- Evaluate the effect of the Global crisis to use the line of credit in maintaining cash flow

- Discuss options for investment in the shipping industry in the US

- Financial risk management in the maritime industry: A case study of the blue economy

- Analyze the various financial risk indicators

- Financial laws that prevent volatility in the financial market

- How the global recession has impacted domestic banking industries

- Discuss IMF’s initiatives in tackling internal inefficiency of new projects

- How the WTO is essential in the global financial market

- The link between corporate and capital structures

- Why is it important to have an individual investment?

- How to handle credit crisis in financial marketing

- Financial planning for salaried employee and strategies for tax savings

- A study on Cost And Costing Models in Companies

- A critical study on investment patterns and preferences of retail investors

- Risk portfolio and perception management of equity investors

- Is there room for improvement in electronic payment systems?

- Risks and opportunities of investments versus savings

- Impact of investor awareness towards commodities in the market

- Is taxation a selling tool for life insurance

- Impact of earnings per share

Public Finance Topics

These interesting finance topics may augur well with university students majoring in public finance:

- Financial assistance for businesses and workers during Coronavirus lockdowns

- Debt sustainability in developing countries

- How we can use public money to leverage private funds

- Analyze the use of public funds in developed versus developing countries

- The reliability of sovereign credit ratings for investors in government securities

- Propose a method of analysis on the cost-benefit ratio of any government project

- The role of entities in charge of financial intermediation

- The reciprocity and impact of tariff barriers

- Impact of the exempted goods prices on the trade deficit

- Investor penalties and its impact in the form of taxes and penalties

- Public government projects that use private funds

- Ways of measuring the cost of sustainability

- Maintaining economic growth to avoid a strong recession

- The impact of the declining income and consumption rates

- Effects of quarantine and forced suspension of economic activity

- Innovative means of limiting the scale of pandemic development

- The growing scale of the public debt of the public finance system

- A critical analysis of the epidemiological safety instruments used in countries

- The growing debt crisis of the state finance system

- How to permanently improve and increase the scale of anti-crisis socio-economic policy planning

Business Finance Topics

You can address the following business finance research papers topics for your next assignment:

- How organizations are raising and managing funds

- Analyze the planning, analysis, and control operations and responsibilities of the financial manager

- Why business managers should take advantage of the federal stimulus package

- Economical ways of negotiating for lower monthly bills

- Evaluate the best retirement plans for entrepreneurs

- Tax reform changes needed to spearhead businesses to the next level

- How politicians can help small businesses make it to the top

- Setting up life insurance policies from which you can sidestep the banks and loan yourself money

- Why every business manager should know about profit and loss statements, revenue by customers and more.

- Advantages of creating multiple corporations to business entrepreneurs

- Why good liquidity is a vital weapon in the face of a crisis

- Reasons why many people are declaring bankruptcy during the coronavirus pandemic

- Why you should closely examine the numbers before making any financial decisions

- Benefits of corporations to small scale business ventures

- How to start a business without money at hand

- Strategies for improving your company’s online presence

- Discuss the challenge of debt versus equity for small-scale businesses

- The impact of financial decisions on the profitability and the risk of a firm’s operations

- Striking a balance between risk and profitability

- Why taking the ratio of current assets to current liabilities is important to any business

You can use any of the hot topics mentioned above for your finance dissertation paper or opt for our thesis writing services. We have competitive finance dissertation writing experts ready to tackle your paper to the core.

Try us today!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Comment * Error message

Name * Error message

Email * Error message

Save my name, email, and website in this browser for the next time I comment.

As Putin continues killing civilians, bombing kindergartens, and threatening WWIII, Ukraine fights for the world's peaceful future.

Ukraine Live Updates

- USF Research

- USF Libraries

Digital Commons @ USF > Muma College of Business > Finance > Theses and Dissertations

Finance Theses and Dissertations

Theses/dissertations from 2023 2023.

Do Industries' Political Profiles Affect Their Portfolio Return Performance? , Shaddy S. Douidar

Do Firms Overreact to the Enactment of Corporate Laws: Evidence from Anti-Price Gouging Laws , Mario Marshall

Theses/Dissertations from 2021 2021

Essays on CEO Personal Characteristics and Corporate Outcomes: Athlete CEOs and Foreign CEOs , Kirill Pervun

Theses/Dissertations from 2020 2020

Predictors of Economic Outlook in Stability Operations , Juan Carlos Garcia

The Warren Buffett Project: A Qualitative Study on Warren Buffett , Christian G. Koch

Theses/Dissertations from 2019 2019

Closing America’s Retirement Savings Gap: Nudging Small Business Owners to Adopt Workplace Retirement Plans , Peter W. Kirtland

Theses/Dissertations from 2018 2018

Growth Options and Corporate Goodness , Linh Thompson

Theses/Dissertations from 2017 2017

Essays on the Tax Policy and Insider Trading , Han Shi

Theses/Dissertations from 2016 2016

Two Essays on Lottery-type Stocks , Yun Meng

Theses/Dissertations from 2015 2015

Two Essays on IPOs and Asset Prices , Gaole Chen

Essays on the impact of CEO gender on corporate policies and outcomes , Nilesh Sah

Theses/Dissertations from 2014 2014

Essays on Corporate Finance , Hari Prasad Adhikari

Two Essays on Individuals, Information, and Asset Prices , Joseph Mohr

Two Essays on Investment , Bin Wang

Two Essays on Corporate Finance , Qiancheng Zheng

Theses/Dissertations from 2013 2013

Two Essays on Mergers and Acquisitions , Dongnyoung Kim

Two Essays on Politics and Finance , Incheol Kim

Two Essays on Stock Repurchases-The Post Repurchase Announcement Drift: An Anomaly in Disguise? and Intra Industry Effects of IPOs on Stock Repurchase Decisions , Thanh Thiet Nguyen

Two Essays on Investor Distraction , Erdem Ucar

Two Essays on Politics in Corporate Finance , Xiaojing Yuan

Theses/Dissertations from 2012 2012

On The Efficiency of US Equity Markets , Mikael Carl Erik Bergbrant

Two Essays on the Sell-side Financial Analysts , Xi Liu

Two essays on Corporate Restructuring , Dung Anh Pham

Two Essays on Corporate Governance , Yuwei Wang

Theses/Dissertations from 2011 2011

Capital Structure, Credit Ratings, and Sarbanes-Oxley , Kelly E. Carter

Institutional Investors and Corporate Financial Policies , Ricky William Scott

Advanced Search

- Email Notifications and RSS

- All Collections

- USF Faculty Publications

- Open Access Journals

- Conferences and Events

- Theses and Dissertations

- Textbooks Collection

Useful Links

- Rights Information

- SelectedWorks

- Submit Research

Home | About | Help | My Account | Accessibility Statement | Language and Diversity Statements

Privacy Copyright

Home » Blog » Dissertation » Topics » Finance » Banking and Finance » Banking and Finance Dissertation Topics (28 Examples) For Research

Banking and Finance Dissertation Topics (28 Examples) For Research

Mark May 26, 2020 Jun 5, 2020 Banking and Finance , Finance No Comments

Are you searching for banking and finance dissertation topics? We understand that selecting a dissertation topic is one of the biggest challenges. So, we offer a wide range of banking and finance dissertation topics and project topics on banking and finance. You can also visit our site for corporate finance dissertation topics and other business […]

Are you searching for banking and finance dissertation topics? We understand that selecting a dissertation topic is one of the biggest challenges. So, we offer a wide range of project topics on banking and finance.

Our team of writers can provide quality work on your selected banking and finance research topics. Once you select from the research topics on banking and finance, we will provide an outline, which can provide guidance on how the study should be carried out .

If you have come to this post after searching for corporate finance or finance topics, following are the seperate posts made on these topics.

- Finance Research Topics

- Corporate Finance Research Topics

Banking and finance dissertation topics

Role of micro-loans in the modern financial industry.

Online currencies like Bitcoin brought changes in the concept of fiat currencies.

Identifying the forces causing American retail banking centres to change.

Analysing the treatment of off-balance sheet activities.

Examining the role of internet banking in society.

Evaluating how the modern economy prevents a run on the banks from happening.

To find out whether the technology can replace the role of retail banking centre.

Relationship between housing loans and the 2008 recession.

Impact of foreign direct investment on the emerging economies.

Identifying the best capital structure for a retail bank.

To study the effect of mergers and acquisition on employee’s morale and performance in the case of banks.

Evaluating the credit management and issues of bad debts in commercial banks in the UAE.

To what extent the electronic banking has affected customer satisfaction.

Portfolio management and its impact on the profitability level of banks.

Impact of interest rate on loan repayment in microfinance banks.

An appraisal of operational problems facing micro-finance banks in delta state.

Studying the impact of risk management on the profitability of banks.

Evaluation of bank lending and credit management.

Role of automated teller machine on customer satisfaction and retention.

Examining the impact of bank consolidation on operational efficiency.

Competitive strategies and changes in the banking industry.

Development of rural banking in the case of developed countries.

The effect of electronic payment systems on the behaviour and satisfaction level of customers.

How does the organisational structure affect the commercial banks and their performance?

How can banks use ratio analysis as a bank lending tool?

Evaluating the relationship between e-banking and cybercrime.

Studying the importance of credit management in the banking industry.

Problems related to loan granting and recovery.

Topic With Mini-Proposal (Paid Service)

Along with a topic, you will also get;

- An explanation why we choose this topic.

- 2-3 research questions.

- Key literature resources identification.

- Suitable methodology with identification of raw sample size, and data collection method

- View a sample of topic consultation service

Get expert dissertation writing help to achieve good grades

- Writer consultation before payment to ensure your work is in safe hands.

- Free topic if you don't have one

- Draft submissions to check the quality of the work as per supervisor's feedback

- Free revisions

- Complete privacy

- Plagiarism Free work

- Guaranteed 2:1 (With help of your supervisor's feedback)

- 2 Instalments plan

- Special discounts

Other Posts

- Corporate Finance Dissertation Topics (29 Examples) For Your Research December 28, 2019 -->

- Finance Dissertation Topics Examples List (37 Ideas) For Research Students May 29, 2017 -->

Message Us On WhatsApp

Navigation auf uzh.ch

Department of Finance

Quicklinks und sprachwechsel, main navigation.

The preparation for the application as well as the writing of the Bachelor or Master's thesis at the Department of Finance entails different steps, whereby the application process is described in detail here.

- You find your own topic, write a Research Proposal and submit it via DF Thesis Market.

- Choose one of the provided Topic Proposals and apply for the corresponding topic on the DF Thesis Market including a letter of motivation.

- Supervisor: If your Research Proposal has been accepted or your application for an existing topic has been successful, you will be contacted by the person who will supervise you in your thesis. Based on your Research Proposal inputs, your supervisor will formulate the thesis assignment.

- Thesis assignment on OLAT: The task assignment includes your official thesis assignment for the written thesis. It can be collected on OLAT from the moment you have been informed by your supervisor. Once you collect the thesis assignment on OLAT, the time limit of six months starts.

- Time limit: Start working on your thesis early and discuss problems with your supervisor. Nevertheless, remember that a Bachelor or Master’s thesis is to be written independently.

- Submission: You must submit your thesis via OLAT i.e. you upload your thesis and any additional documents/attachments as a ZIP-file to OLAT.

- Grading of task: You receive your grade within a month after submission.

The following Video in German shows the recording of a presentation (PDF, 276 KB) in which the students were informed. It goes more into detail about the individual steps.

The prerequisite for writing a Bachelor and Master's thesis at the Department of Finance is relevant prior knowledge in the corresponding subject area. In particular, the relevant lectures must have been attended and passed. Provided Topic Proposals may contain further requirements, which you will find in the respective proposal.

It is also important that the rules and instructions of the Dean's Office ( study and graduation ) are generally to be noted. The responsibility regarding compliance with these regulations lies with you.

Application

In order to write a thesis at the Department of Finance, a digital application via the DF Thesis Market is required. You will need the following documents for the application:

- Curriculum Vitae (as PDF)

- Transcript of records (as PDF, current export from the Module Booking)

- Research Proposal (if you propose a topic of your own)

For the application via the Department of Finance Thesis Market, you also need your UZH login credentials (shortname and password).

There are two ways to apply for a thesis at the Department of Finance:

Option A: Own topic

Elaborate your own suggested topic and write a Research Proposal. On two to three pages, the Research Proposal summarises your motivation, the objectives, the planned procedure and the expected results. The following documents serve as a guide:

- Instructions for writing a Research Proposal (PDF, 114 KB)

- Example of a Research Proposal (PDF, 205 KB)

If you would like to write an empirical paper, check before submitting your application whether the data you need can be found in the available databases . It is advisable to check with a concrete example whether the data quality is sufficient (e.g., availability of time series).

It is important that you assign your Research Proposal to the correct research area so that it can be made available to appropriate supervisors. The research areas and fields of interest listed in the table below can serve as a decision-making aid. The links of the Professors lead to the Bachelor and Master's theses that they supervised so far. They can give an intuition on typical topics for writing a thesis.

Based on your Research Proposal, the final thesis assignment will be issued. However, the Department of Finance reserves the right to ask for improvements to the proposal, to make changes, to provide a different topic or to reject the application.

Option B: Provided topic

Apply for a topic provided by a supervisor via DF Thesis Market . Look at the topics on the marketplace, choose one and apply. Note that in addition to a CV and transcript of records, a short letter of motivation is also required for the application. Describe how the provided topic matches your skills and interests, and how the topic fits into your course of study.

Useful documents

As guidance to help you estimate the length of a thesis, we provide you with two sample theses:

- Bachelor’s thesis: The different theories of the 2010 Flash Crash with main focus on high-frequency trading (PDF, 1 MB)

- Master’s thesis: Strategic Allocation to Return Factors (PDF, 1 MB)

Additionally you can find a template for LaTeX (ZIP, 414 KB) .

Further notes

The Department of Finance strongly recommends that you start finding a topic for your Bachelor or Master's thesis at an early stage. The application must be submitted at least one month before the desired starting month. For example if you want to start writing your thesis at the beginning of May, you must apply by the end of March.

The matching process usually takes about a month, sometimes longer (especially for your own proposals), since all supervisors supervise several theses, and your own proposal must match the interests of your supervisor in terms of content. We will inform you as soon as the matching process is completed, or if we need further information or adjustments from you. If you want/need to start as soon as possible, you also have the option to apply to one of the posted proposals.

The DF endeavours to offer all applicants the opportunity to write a thesis at the Department of Finance, but we cannot guarantee a specific topic or a specific supervisor. Temporary bottlenecks may occur in the supervision. If you have any questions or problems in connection with your application, please contact the study coordinator and Managing Director of the DF, Dr. Benjamin Wilding, at [email protected] .

Research interest

Bereichs-navigation, unterseiten von theses.

- DF Thesis Market

- FAQ for Students

- Open access

- Published: 08 June 2020

Deep learning in finance and banking: A literature review and classification

- Jian Huang 1 ,

- Junyi Chai ORCID: orcid.org/0000-0003-1560-845X 2 &

- Stella Cho 2

Frontiers of Business Research in China volume 14 , Article number: 13 ( 2020 ) Cite this article

62k Accesses

86 Citations

69 Altmetric

Metrics details

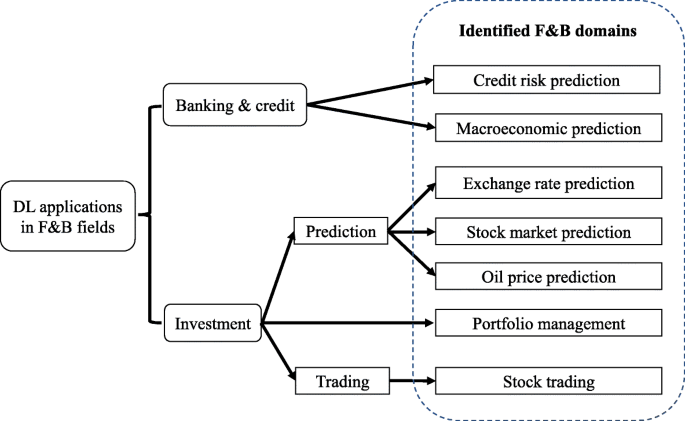

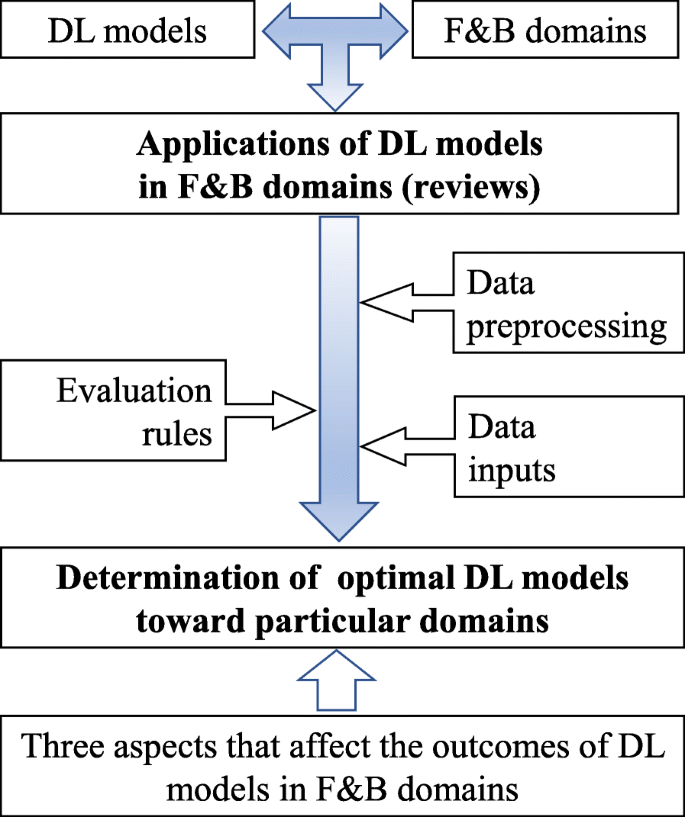

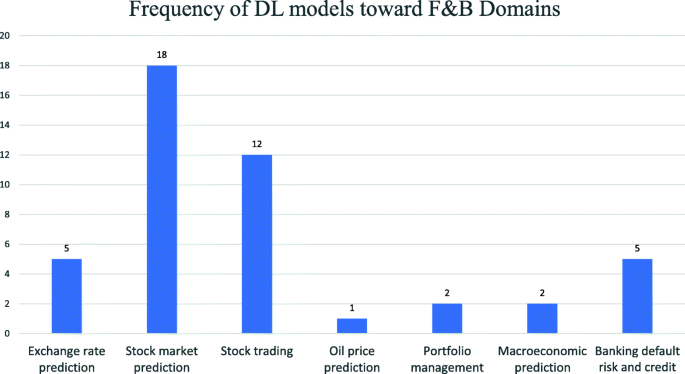

Deep learning has been widely applied in computer vision, natural language processing, and audio-visual recognition. The overwhelming success of deep learning as a data processing technique has sparked the interest of the research community. Given the proliferation of Fintech in recent years, the use of deep learning in finance and banking services has become prevalent. However, a detailed survey of the applications of deep learning in finance and banking is lacking in the existing literature. This study surveys and analyzes the literature on the application of deep learning models in the key finance and banking domains to provide a systematic evaluation of the model preprocessing, input data, and model evaluation. Finally, we discuss three aspects that could affect the outcomes of financial deep learning models. This study provides academics and practitioners with insight and direction on the state-of-the-art of the application of deep learning models in finance and banking.

Introduction

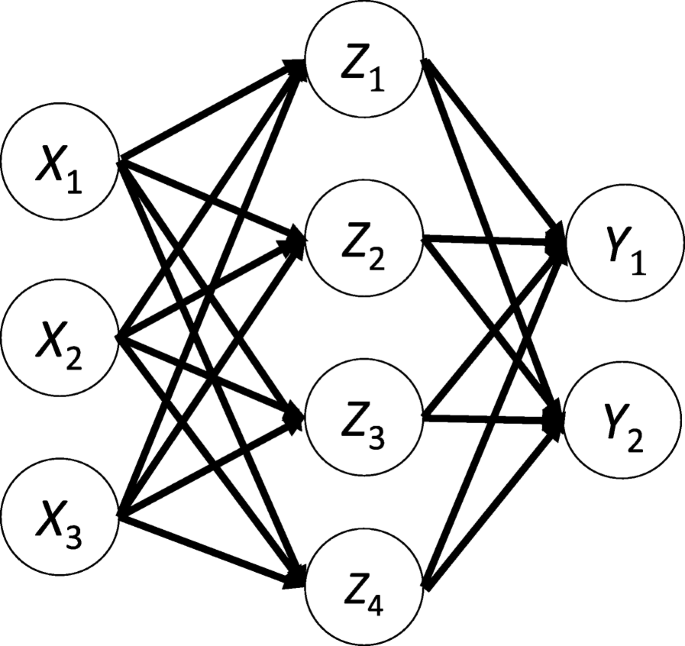

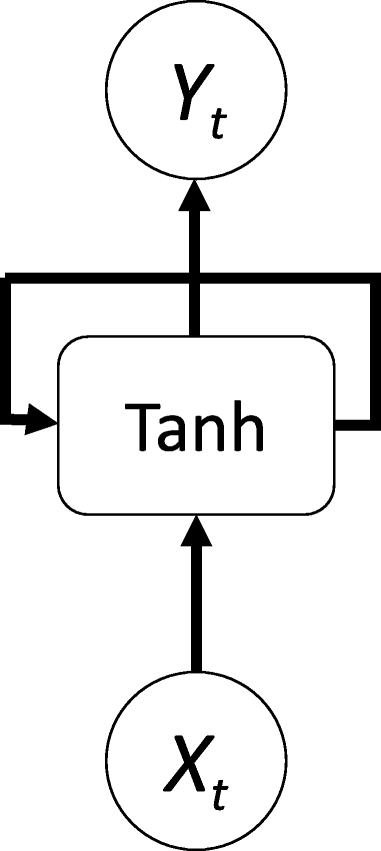

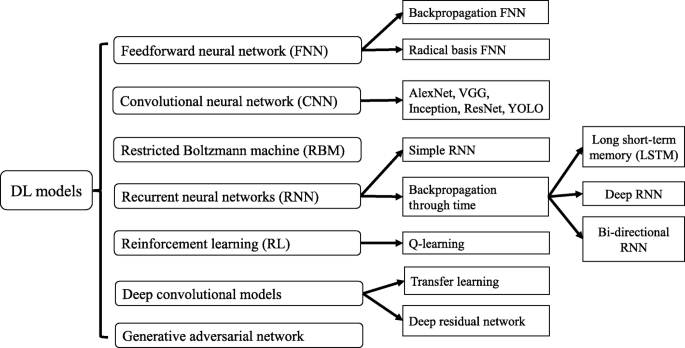

Deep learning (DL) is an advanced technique of machine learning (ML) based on artificial neural network (NN) algorithms. As a promising branch of artificial intelligence, DL has attracted great attention in recent years. Compared with conventional ML techniques such as support vector machine (SVM) and k-nearest neighbors (kNN), DL possesses advantages of the unsupervised feature learning, a strong capability of generalization, and a robust training power for big data. Currently, DL has been applied comprehensively in classification and prediction tasks, computer visions, image processing, and audio-visual recognition (Chai and Li 2019 ). Although DL was developed in the field of computer science, its applications have penetrated diversified fields such as medicine, neuroscience, physics and astronomy, finance and banking (F&B), and operations management (Chai et al. 2013 ; Chai and Ngai 2020 ). The existing literature lacks a good overview of DL applications in F&B fields. This study attempts to bridge this gap.

While DL is the focus of computer vision (e.g., Elad and Aharon 2006 ; Guo et al. 2016 ) and natural language processing (e.g., Collobert et al. 2011 ) in the mainstream, DL applications in F&B are developing rapidly. Shravan and Vadlamani (2016) investigated the tools of text mining for F&B domains. They examined the representative ML algorithms, including SVM, kNN, genetic algorithm (GA), and AdaBoost. Butaru et al. ( 2016 ) compared performances of DL algorithms, including random forests, decision trees, and regularized logistic regression. They found that random forests gained the highest classification accuracy in the delinquency status.