Starting a Business | Ultimate Guide

How to Create a Business Partnership Agreement [+ Free Template]

Published August 15, 2018

Published Aug 15, 2018

WRITTEN BY: Kiah Treece

This article is part of a larger series on Starting a Business .

A business partnership agreement is a contract between partners that contains terms like the business’s purpose, partner contributions and voting rights. A partnership agreement isn’t required to form a general partnership and doesn’t have to be filed with your state. However, have your partners sign one to create a legally enforceable document for resolving disputes.

Business Partnership Agreement Templates

Free general partnership agreement template.

We recommend hiring an attorney or online legal service, such as Rocket Lawyer , to prepare important legal documents for your partnership. However, if you’re comfortable drafting your own agreement and want to save on legal fees, download our free general partnership agreement template and follow the steps below to draft a simple partnership agreement for your business.

Get your free business partnership agreement template here:

- Free General Partnership Agreement Template (Google doc)

- Free General Partnership Agreement Template (.docx)

- Free General Partnership Agreement Template (PDF)

State-specific Business Partnership Agreement Template

The 11 steps to draft a business partnership agreement include:

Articles I-V: Organize Basic Partnership Details

Provide basic details about your business at the beginning of your partnership agreement. Articles I through V of your partnership agreement should include your partnership’s name, location, purpose and term. General partnerships don’t have to file this information with the state but include it in a signed partnership agreement to keep on file with your business.

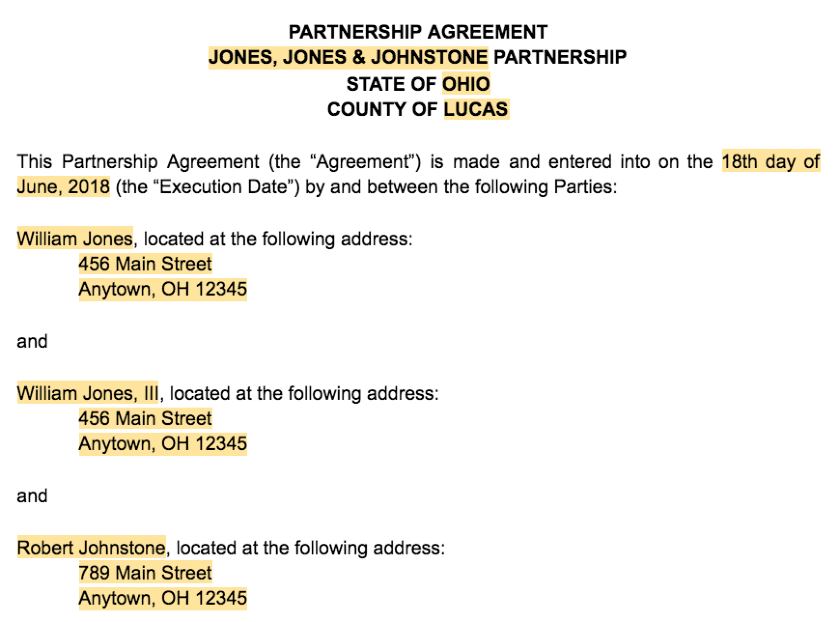

As a lead-in to Articles I through V, provide the names and addresses of your partners in the first paragraph of your partnership agreement. This information lets the public know that you and your partners are all engaged in business activities together as you fill out the articles together.

Screenshot of partnership agreement introductory information

Follow these steps to draft Articles I through V of your partnership agreement:

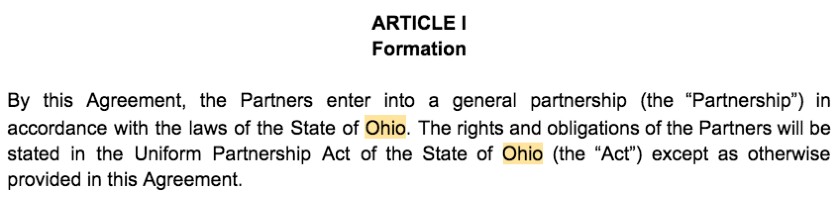

Identify Your Partnership State

Your partnership state is the state in which you’ll conduct business. The state you select determines the availability of a fictitious name for your partnership and determines the taxes and laws that will apply to your business. This information will be included in the title of your partnership agreement, in Article I and in various places throughout your agreement.

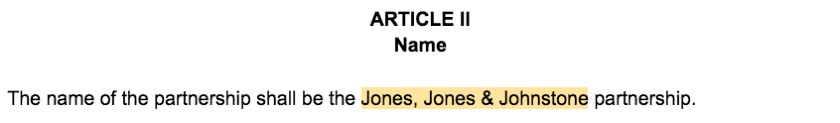

Name Your Partnership

A partnership can be named after its partners or operate under a fictitious business name. If you choose a fictitious name, confirm it isn’t already in use and fill out a fictitious business name statement to give notice that your partners are operating under the name. Once finalized, include the name in Article II of your partnership agreement.

Screenshot of partnership agreement Article I – Formation

If you wish to operate under the name of your partners, list each partner’s last name. However, if you want to operate under a fictitious business name, choose one that describes your business without limiting your geographic area or products. For example, instead of “Northwest Ohio Fishing Lures,” choose a name like “Midwest Outdoor & Fishing.”

Screenshot of partnership agreement Article II – Partnership Name

If you need some help choosing a business name, check out our business name generator .

Identify a Broad Purpose

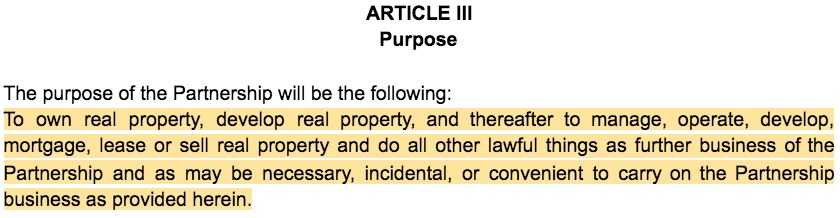

States don’t require general partnerships to have a partnership agreement, so your purpose statement doesn’t have to meet any state-specific requirements. However, it should describe the nature of your business and be broad enough to allow for future business growth. Include a general purpose statement in Article III that allows your partnership to evolve without revising the agreement every time your business changes.

For example, stating that the purpose of the partnership is to own and develop real property and do all other lawful things as may be necessary to carry on the partnership is general enough to encompass a variety of real estate services and allows for growth. Similarly, if your purpose is conducting the general business of operating a commercial farm and “such other businesses and purposes as the partners may from time to time determine,” you leave your partnership room to evolve.

Screenshot of partnership agreement Article III – Partnership Purpose

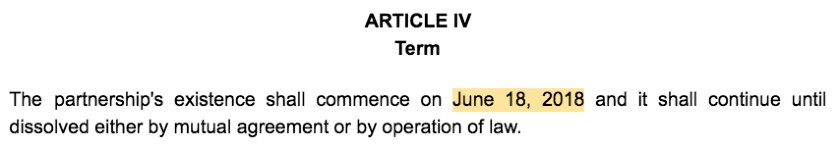

Define Your Partnership Term

The partnership term is the amount of time the partnership relationship will exist. This period begins when the partnership is formed and can end at any time. Include a starting date and describe when the partnership may end in Article IV of your business partnership agreement.

For example, if the partnership was created to handle a single task or project, provide a specific termination date for the partnership. Otherwise, state generally that the partnership will exist until the partners mutually agree to dissolve it, until the death of a partner or until any other circumstance agreed upon by the partners.

Screenshot of partnership agreement Article IV – Partnership Term

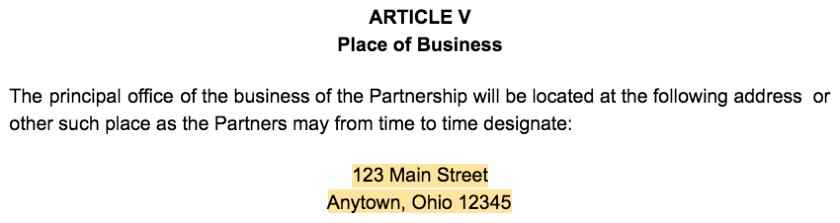

Locate Your Principal Place of Business

Your principal place of business is the address where you’ll perform the partnership’s business activities. This should be a street address and not a P.O. Box. Use Article V to set forth your place of business at the time the agreement is executed but allow partners to change the address as necessary during the partnership.

For example, if you have a retail store, your principal place of business will be the address of the brick-and-mortar store. In contrast, if you have an e-commerce website, your principal place of business is the address from which your partners and employees are running the website.

Screenshot of partnership agreement Article V – Place of Business

Our template is a great place to start if your partnership is already formed or if this isn’t your first business. However, if you need extra guidance while you set up your business, let Rocket Lawyer help you compile the necessary information to get your partnership up and running. A Rocket Lawyer membership plan is $39.99 per month and its On Call attorneys can guide you through the process of creating your partnership.

Visit Rocket Lawyer

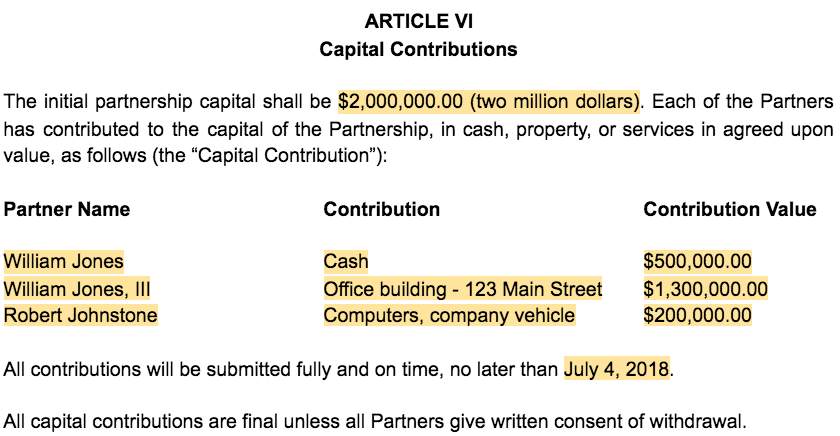

2. Article VI: List & Describe Each Partner’s Contribution

A partner’s capital contributions are cash investments, physical property, and other assets like intellectual property they commit to business operations at the outset of the partnership. Capital contributions establish each partner’s equity in the business. List and describe partner contributions in Article VI of the partnership agreement to establish a record of each partner’s capital account.

Capital contributions of partners can include:

- Cash : This is the most common type of contribution to partnerships and many of your partners will likely contribute cash as their initial capital contribution; denote this value in Article VI of the partnership agreement and specify whether it is earmarked for specific partnership expenses

- Personal property : Personal property contributions include things like equipment or furniture; for example, if you start a restaurant one of your partners may contribute kitchen equipment or furniture for the seating area. Include the value of this property in your partnership agreement

- Real estate : If your partnership will have a brick-and-mortar office or storefront, one of your partners may contribute real estate; include the appraised value, address and other identifying information for this property in the partnership agreement

- Client lists : In addition to industry knowledge, some partners also use their client lists as a capital contribution; it can be difficult to assign a monetary value to this kind of property so don’t undervalue this contribution when assigning ownership interests; you may encounter this kind of contribution if you have a real estate partnership or other business that relies heavily on sales

- Intellectual property : Depending on the type of business, a partner might contribute intellectual property like software code; if possible, estimate the value of the contribution based on similar intellectual property or its operational value to the partnership; this is not a common form of partnership contribution but may arise in a tech startup or software partnership

Screenshot of partnership agreement Article VI – Capital Contributions

About half of businesses with employees don’t survive past five years. One of the major causes of a business failing is undercapitalization — partners underestimate how much money they’ll need and how successful they’ll be early in business. Describing the contributions of each partner carefully in Article VI of your partnership agreement will help you better understand your business’ resources.

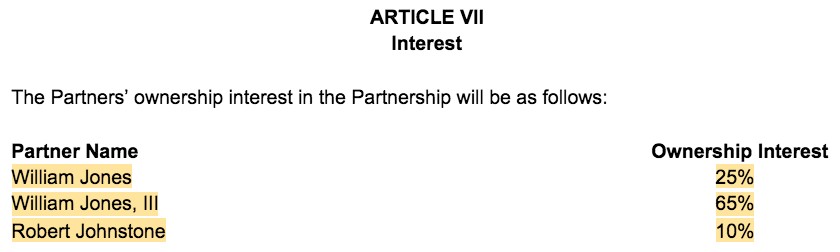

3. Article VII: Determine Ownership Interests

Business ownership can be shared between partners in a way agreed upon by the partners. Often, ownership reflects the size of a partner’s contribution. However, ownership is more complicated if partner contributions aren’t easily valued or where partner roles and responsibilities aren’t equal. Use your partnership agreement to describe how your business ownership will be divided.

Equal ownership isn’t appropriate where partners contribute things unevenly like:

- Property or cash : If one partner contributed a significantly larger amount of property or cash to the business, their greater risk should merit a greater ownership and returns

- Ideas : If one partner thought of the original business concept or otherwise completed the first steps toward creating the partnership, their ownership should be greater than their cash contributions

- Time : Conflicts can arise where one partner is working full-time and the other partners are working part-time; make sure this imbalance is reflected in that’s partner’s ownership

- Capital raises : Although venture capital raised by a partner is not a direct cash contribution, it should be recognized as part of his or her ownership interest

Screenshot of partnership agreement Article VII – Interest

If you don’t include partner contributions and ownership interests in your partnership agreement, you should list them elsewhere in your partnership’s records and provide them to each partner. An attorney can help identify partner contributions and determine the best ownership structure for your partnership. However, if your partnership contributions only include cash or other easily valued assets, use our template to draft a simple partnership agreement for free.

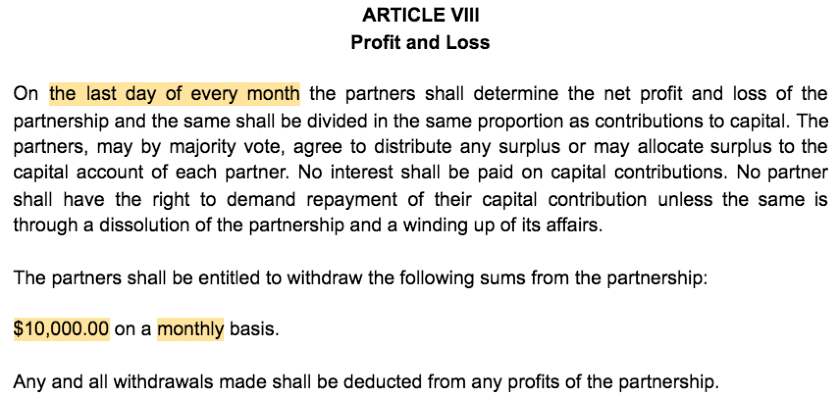

4. Article VIII: Determine Profit & Loss Distribution

Partners do not receive a salary for their role in a partnership. Instead, profits and losses are typically distributed among the partners in accordance with their ownership interests. Include details about how your business’s profits and losses will be distributed among members in Article VIII of your partnership agreement to avoid financial disputes between partners.

Generally, a partnership’s profits and losses are distributed among partners based on each partner’s ownership percentage. If you choose this method, indicate in your partnership agreement that the partners must share in profits and losses in the same proportion as their ownership or capital contributions.

When drafting Article VIII, address these issues regarding profits and losses:

- Division : Decide how you’ll divide profits and losses among owners; for example, it’s common to divide profits and losses based on each partner’s ownership percentage and/or relative capital contribution

- Calculation : Identify how distributions will be calculated; for example, you may calculate distributions based on a percentage of annual profits

- Timing : Indicate when you plan to distribute profits to the partners; this can be monthly, quarterly, annually and so on

- Reinvestment of profits : Have the partners determine whether a portion of the profits will be reinvested into the business each month or year

Screenshot of partnership agreement Article VIII – Profit and Loss

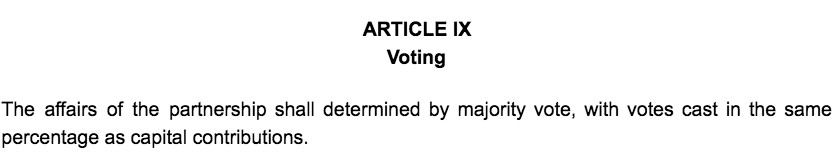

5. Article IX: Establish Voting Procedures

A partnership’s voting procedures detail the way partners must vote to make decisions for the partnership. Article IX of your partnership agreement should specifically mention whether there must be a unanimous or majority vote. This section should also describe how much weight each partner’s vote will have.

For example, Article IX of your partnership agreement can require that decisions of the partnership be determined by a majority vote with votes cast in the same percentage as capital contributions. Alternatively, you can require a unanimous vote of the partners, give each member’s vote equal weight regardless of their contribution or ownership percentage.

Screenshot of partnership agreement Article IX – Voting

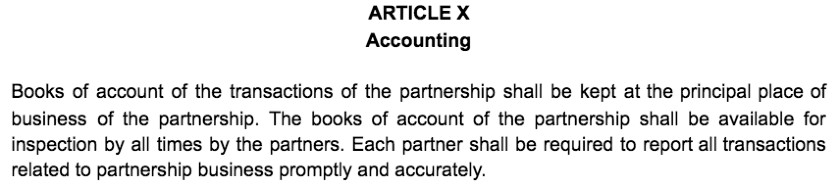

6. Article X: Describe Accounting Requirements

Keep an accurate accounting of your partnership’s day-to-day business to maintain a comprehensive understanding of business financials and meet tax requirements. Use Article X of your partnership agreement to describe where the partnership’s books should be kept, when partners should have access to the books and how to report transactions to the partnership.

This section should first state where the partnership’s books should be stored — usually at the principal place of business. Article X should also state that the accounting records should be available to all of the partners to inspect at any time. Finally, assert that partners have to report all partnership transactions accurately and as soon after the transaction as possible.

Screenshot of partnership agreement Article X – Accounting

7. Article XI: Prepare for New Partners

Businesses change and sometimes this includes adding partners. Because partnerships are structured around the partners, the addition of a partner changes the ownership structure of the business. Even if you don’t anticipate changes to your business, include procedures for adding new partners in Article XI of your agreement.

Important information regarding new partners to incorporate into Article XI includes who has the power to add new partners, how to adjust partner responsibilities and how voting will be impacted. If you want the flexibility to add partners later on, allow the agreement to be amended to include new partners pending a unanimous vote of all partners.

Screenshot of partnership agreement Article XI – New Partners

8. Article XII: Define the Partnership’s Management & Authority

Your partnership agreement should also describe your management structure and authority of partners to make business decisions. Describe how day-to-day partnership affairs will be managed and identify partner responsibilities and authority to borrow on credit, transfer assets and so on. Include this information in Article XII of your partnership agreement to avoid disputes regarding partners management and authority.

It is important to establish what kind of authority partners have to make decisions on behalf of the business at the outset. Describe the powers of partners to manage business activities at the beginning of Article XII. This prevents a partnership from being responsible for the unauthorized actions of its members and ensures that creditors and other third parties understand the authorities of each member to enter into contracts, borrow credit and transfer assets.

The day-to-day affairs of partnerships can be managed by a management committee made up of several partners. To form a committee, include terms in your partnership agreement describing how many partners should be on the committee, how they will be selected, and the scope of the committee’s authority. For example, you may choose to have three partners on the committee, chosen by a majority vote of the partners and who have authority to operate all partnership business.

Screenshot of partnership agreement Article XII – Management & Authority

Types of commitments the partnership agreement should address include:

- Partnership contracts : Generally, a partner with authority to sign contracts on behalf of the partnership can sign a contract that binds all of the partners. Make sure you limit contract authority to partners with knowledge of the businesses needs.

- Partnership debt : If your business will have a credit card, loan, line of credit or other debts, make sure you specify who may sign for new debts in your partnership agreement. Depending on the business structure that you choose, each partner may be personally liable for any unpaid business debt.

- Partnership expenditures : If you want to limit expenditures made by partners on behalf of the business, limit who may make purchases without consulting other partners. Alternatively, establish a spending limit on purchases made without permission from other partners.

Use Article XII of the partnership agreement to delineate each partner’s authority to sign contracts, open accounts and otherwise commit the partnership to avoid financial and contractual obligations that are not in the best interest of the partnership. For example, limit the amount of money a partner may spend for the business to $50,000 or less to make sure partners aren’t spending large sums of partnership assets on things the partnership doesn’t want or need.

9. Article XIII: Plan for Termination

If there is a partnership agreement in place, a partnership can terminate whenever the partners desire. Use Article XIII of your agreement to specify how your partnership can terminate and describe how partners and partnership assets should be treated upon termination. Include details about whether the business should survive after a partner exits voluntarily or otherwise.

In the absence of a partnership agreement, termination of a partnership occurs pursuant to state default rules. Under default rules, a partnership will terminate upon the death or bankruptcy of a partner or under other state-specific circumstances. Control how and when your partnership will terminate by explicitly listing termination events in your partnership agreement.

Screenshot of partnership agreement Article XIII – Termination

10. Article XIV: Decide How to Resolve Partner Disputes

Disputes are an inevitable part of owning a small business. Conflicts between partners are especially dangerous because, left unresolved, they can cause your business to implode from within. Protect your business from by including language in the partnership agreement describing how and where disputes should be resolved between partners.

One way to handle partnership disputes is requiring alternative dispute resolution (ADR). ADR uses a third party to reach an agreement between partners without litigation and includes practices like mediation and arbitration. Include terms requiring ADR in your partnership agreement to resolve disputes without the cost, hassle and public exposure that comes with litigation.

Other options for dispute resolution include giving the business’ CEO the final say, voting based on ownership percentages, requiring a majority vote for businesses with an odd number of partners or giving a particular partner final say on discrete areas of the business. If you prefer to handle disputes in-house without the help of an ADR specialist, include language in your partnership agreement describing your preferred dispute resolution procedures.

Screenshot of partnership agreement Article XIV – Dispute Resolution

11. Execute, File & Provide Copy to Partners

Partnership agreement filing requirements depend on your business and your secretary of state’s office. Familiarize yourself with your state’s requirements to determine whether a formal filing is necessary for your partnership. Either way, make sure the partnership agreement is signed by every partner and that each partner receives a copy of the document for their records.

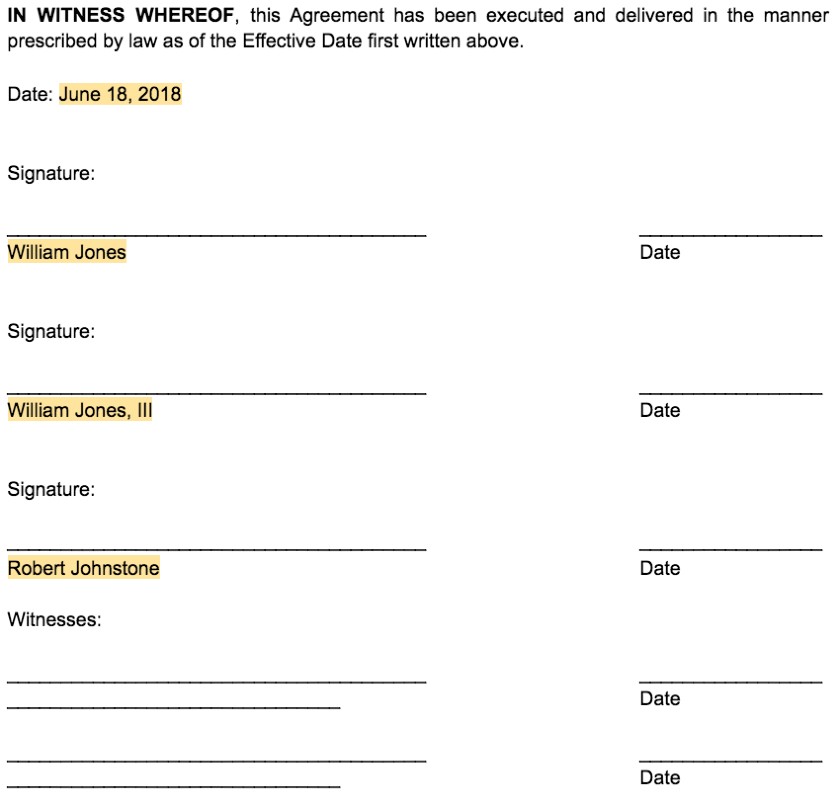

Screenshot of partnership agreement signature page

Other Things to Include in a Business Partnership Agreement

Depending on your partnership and business structure, you may need to include additional terms after Articles I through XIV of your partnership agreement. For example, describe partner responsibilities, how to handle new partners or what to expect during a partnership sale. If you have a complex partnership or anticipate changes to your business, include additional terms in your agreement.

Other things you may want to include in your partnership agreement are:

Partner Responsibilities & Commitments

Generally, partners are involved in different departments of the business. To facilitate efficient organization of partnership roles and responsibilities, list expectations in the partnership agreement. If you want to establish work hours, vacation time allowances or a partner’s ability to work outside of the business, include these details in the partnership agreement as well.

Selling the Business

Selling a business can be one of the most difficult tasks partners face. Because the sale of a partnership is likely to cause disputes between partners, it’s important to establish transfer procedures. Use your partnership agreement to specify who’ll manage purchase offers, whether partners can force the sale of the business and the minimum business sale price.

How a Business Partnership Agreement Works

A partnership agreement is a legal document that formalizes business operations and creates a contract between partners. General partnership agreements also protect businesses from internal disputes, establish partner responsibilities and more. Your general partnership doesn’t have to file its agreement but keep a signed copy on file in case disputes arise.

The three types of partnerships include:

- General partnership : A general partnership is the most basic form of partnership and does not require state filings or other formalities like annual meetings or ongoing state fees. Instead, a general partnership is formed each time partners come together to engage in business activities. This article and free template focus on what you should include in a general partnership agreement.

- Limited partnership : Limited partnerships (LPs) are typically reserved for finite projects like estate planning. This structure requires filing documents with the state and offers liability protection for its limited partners only. General partners, who oversee day-to-day business activities, have unlimited liability for the acts and debts of the LP.

- Limited liability partnership : Limited liability partnerships (LLPs) are more complex and can only be formed by certain types of professional businesses that require licensing under state law, like doctors, architects and attorneys. LLPs don’t protect partners from their own malpractice but a partner’s personal assets can’t be used to satisfy the debts of the LLP.

Because partnerships are complex legal entities, we recommend hiring an attorney or using an online legal service to help choose a business structure and file it with the state. If you don’t want to spend money to hire an attorney, download our partnership agreement template to get started with a simple partnership agreement today.

Who a Business Partnership Agreement is Right For

Partnership agreements are legally binding contracts between business partners. Although not required by state law, even a simple partnership agreement will formalize your partnership’s management structure and protect it from internal disputes. If you have a partnership or an LLP, hire an attorney or use our free template to execute a partnership agreement.

Benefits of a Business Partnership Agreement

Having an enforceable partnership agreement for your business has several benefits. If drafted correctly and signed by all of the partners, a partnership agreement can protect your business from internal disputes and prepare partners for difficult management decisions. Familiarize yourself with the benefits of an enforceable partnership agreement before you start drafting one for your business.

The benefits of having a partnership agreement include:

Avoid State Default Rules

States impose default rules on partnerships that don’t have a partnership agreement on file. Under default rules, partnerships terminate under certain circumstances and internal disputes must be resolved using default procedures. Avoid default outcomes by drafting a business partnership agreement describing how profits will be distributed, how the partnership may be terminated and other important procedures.

Prevent & Resolve Disputes

Among other important terms, business partnership agreements describe how partners must vote and who has authority to make decisions for the business. Partnership agreements also include resolution procedures in the event of a conflict between partners. Have dispute avoidance and resolution terms in place to protect your business from failing due to the disagreements between partners.

Clarify Business Structure

Drafting a business partnership agreement will help you and your partners outline how the business will be structured. By detailing the responsibilities and authority of each partner, a partnership agreement provides clarity and allows the partnership to be operated more efficiently. Include partner responsibilities and expectations within the partnership agreement to lend structure to your business.

Facilitate Business Transition

Drawbacks of a business partnership agreement.

A business partnership agreement can protect your business from internal disputes and other management issues. However, hiring an attorney to draft your agreement can be expensive. A partnership agreement may also restrict partner authority and delay decisions. Use our free partnership agreement template and choose broad language that doesn’t limit your partners’ authority more than necessary.

The drawbacks of a business partnership agreement include:

Costly to Draft

Having an attorney draft legal documents for your business can get expensive. Use our free template to create a simple partnership agreement for your business.

Restrictive Language

Formalizing your management responsibilities, voting structure, profit distribution and other elements of your partnership can restrict how partners behave. Although this is generally an advantage of having a partnership agreement, it can reduce flexibility in business operations by limiting partner authority and slowing down the decision-making process.

The Bottom Line

General partnerships are formed when two or more partners agree to enter into business together. A formal filing isn’t required to create a simple partnership but you should execute a partnership agreement that formalizes the business structure. Include terms like partner contributions, dispute resolution methods and profit sharing in your agreement to protect you and your business.

About the Author

Find Kiah On LinkedIn

Kiah Treece

Kiah Treece is a staff writer at Fit Small Business specializing in real estate. Before joining the team here, she worked as an environmental scientist and attorney specializing in real estate development. She also researched climate change for The Climate Group . Kiah earned her MS from the University of Florida and a law degree from the University of Toledo . During law school, she served as an editor of the Law Review and edited manuscripts for faculty and students.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

Our Recommendations

- Best Small Business Loans for 2024

- Businessloans.com Review

- Biz2Credit Review

- SBG Funding Review

- Rapid Finance Review

- 26 Great Business Ideas for Entrepreneurs

- Startup Costs: How Much Cash Will You Need?

- How to Get a Bank Loan for Your Small Business

- Articles of Incorporation: What New Business Owners Should Know

- How to Choose the Best Legal Structure for Your Business

Small Business Resources

- Business Ideas

- Business Plans

- Startup Basics

- Startup Funding

- Franchising

- Success Stories

- Entrepreneurs

- The Best Credit Card Processors of 2024

- Clover Credit Card Processing Review

- Merchant One Review

- Stax Review

- How to Conduct a Market Analysis for Your Business

- Local Marketing Strategies for Success

- Tips for Hiring a Marketing Company

- Benefits of CRM Systems

- 10 Employee Recruitment Strategies for Success

- Sales & Marketing

- Social Media

- Best Business Phone Systems of 2024

- The Best PEOs of 2024

- RingCentral Review

- Nextiva Review

- Ooma Review

- Guide to Developing a Training Program for New Employees

- How Does 401(k) Matching Work for Employers?

- Why You Need to Create a Fantastic Workplace Culture

- 16 Cool Job Perks That Keep Employees Happy

- 7 Project Management Styles

- Women in Business

- Personal Growth

- Best Accounting Software and Invoice Generators of 2024

- Best Payroll Services for 2024

- Best POS Systems for 2024

- Best CRM Software of 2024

- Best Call Centers and Answering Services for Busineses for 2024

- Salesforce vs. HubSpot: Which CRM Is Right for Your Business?

- Rippling vs Gusto: An In-Depth Comparison

- RingCentral vs. Ooma Comparison

- Choosing a Business Phone System: A Buyer’s Guide

- Equipment Leasing: A Guide for Business Owners

- HR Solutions

- Financial Solutions

- Marketing Solutions

- Security Solutions

- Retail Solutions

- SMB Solutions

Online only. Expires 4/27/2024

Business Partnership Agreement Writing Guide

Table of Contents

Since joining Business News Daily in 2015, Adam Uzialko has become a trusted resource for small businesses. As our Small Business Insider and an entrepreneur, he has spent thousands of hours researching and writing about the software and services entrepreneurs need most.

A business partnership agreement is a document that establishes clear business operation rules and delineates each partner’s role. These agreements are enacted to resolve disputes, delineate responsibilities, and define how to allocate profits and losses .

Any business partnership in which two or more people own a stake in the company should have a business partnership agreement. This legal document provides critical guidance in a company’s operations.

We’ll explore what a business partnership should include, as well as share resources and best practices for creating this critical legal document.

What is a business partnership agreement?

A business partnership agreement is a legal document between two or more business partners that spells out the business’s legal structure and purpose. It outlines the following information:

- Individual partners’ responsibilities

- Capital contributions

- Partnership property

- Each partner’s ownership interest

- Decision-making conventions

The agreement also outlines what steps will be taken if one business partner decides to sell their interest or leave the company and how the remaining partner or partners would split profits and losses.

“I highly suggest formal partnership agreements are put in place as businesses evolve from solo practices into a partnership or ensembles,” said Rich Whitworth, former head of business consulting for Cetera Financial Group. “The biggest reason is that it establishes the ‘rules of engagement’ between the business and its owners … and lays out a road map on how to deal with entity-level issues.”

While businesses seldom begin with concerns about a future partnership dispute or how to dissolve the business, business partnership agreements are essential in situations in which emotions might otherwise take over. A written, legally binding agreement is an enforceable document instead of a spoken agreement between partners.

If you have an LLC , you’ll need articles of incorporation and an operating agreement to outline a business’s relationship with the state and the relationship between business owners.

How to write a business partnership agreement

A business partnership agreement must include all foreseeable issues regarding the business’s co-management. The easiest way to prepare a business partnership agreement is to hire an attorney or to find a customizable template. If you’re writing your own agreement, find a template for a company that’s similar to the business you’re starting .

A business partnership agreement should follow a logical process and include the following information:

- Business generalities. Start by stating the business’s name , its legal structure and the business’s location (i.e., which state’s laws will govern it).

- Business operations. State the partnership’s purpose, and explain the activities the business will and will not engage in.

- Ownership stake. Spell out the percentage of the business that each partner owns. Enumerate each partner’s rights and responsibilities.

- Decision-making process. Outline how decisions are made and the responsibility of each partner in the decision-making process . Include who has financial control of the company and who must approve the addition of new partners. Also include information on how profits and losses are distributed among the partners.

- Liability. If the business partnership is set up as an LLC, the agreement should limit the liability each partner faces in the event of a business lawsuit . To do so effectively, a partnership agreement should be paired with other documents, such as articles of incorporation . A business partnership agreement alone is likely not enough to fully protect the partners from liability.

- Dispute resolution. Any business partnership agreement should include a dispute-resolution process. Even if you’re working with family or best friends, disagreements are common in business.

- Business dissolution. If one or more partners choose to dissolve the business, a business partnership agreement should outline how that dissolution will occur. It should spell out the procedures for partners to join or leave the partnership. It should also outline continuity or succession planning for partners leaving the business.

- Explain how the partnership’s finances (including small business taxes ) will be managed.

Once you’ve spelled out everything in detail, each partner must sign the agreement for it to take effect.

To ensure your business partnership agreement adequately covers all business liabilities , closely involve your legal counsel while developing and reviewing the agreement, even if you’re working from a template.

The stages of a business partnership agreement

A business partnership agreement doesn’t have to be set in stone, especially as a business grows and develops. You’ll be able to add to the agreement, especially if unforeseen circumstances occur. According to Whitworth, there are four primary stages to consider.

- Initial partnership: This stage involves creating the initial business partnership agreement as described above. You’ll draft an agreement that governs the business’s general operations, decision-making process, ownership stakes and management responsibilities.

- Addition of limited partners: As a business grows, it might have the opportunity to add new partners. According to Whitworth, the original partners might agree to a “small carve-out of minor equity ownership” for the new partner, as well as limited voting rights that give the new partner partial influence over business decisions.

- Addition of full partners: Sometimes you’ll want to promote a limited partner to a full business partnership. A business partnership agreement should include the requirements and process for elevating a limited partner to full partner status, complete with full voting rights and influence equal to that of the original partners.

- Continuity and succession: At some point, founders may retire or leave the company without wanting to dissolve it. If you didn’t include continuity and succession planning initially, it’s crucial to outline your plan. Describe how ownership stake and responsibilities will be distributed among the remaining partners after the departing partners take their leave.

“Partnership agreements need to be well crafted for myriad reasons,” said Laurie Tannous, owner of law firm Tannous & Associates Inc. “One main driver is that the desires and expectations of partners change and vary over time. A well-written partnership agreement can manage these expectations and give each partner a clear map or blueprint of what the future holds.”

Succession planning is crucial to ensuring a business’s survival when a founder dies or an owner leaves the company.

Free business partnership agreement templates

Business partnership agreement templates are available for free online. These resources can help you draft your agreement, but you should have legal counsel review your draft and help you revise and finalize the document before you sign it.

Once a lawyer confirms that your business partnership agreement is thorough and legally binding, you and your partners can sign it to make it official.

When you’re searching for business partnership agreement templates, start with the following resources:

- LegalTemplates.net

- LegalContracts.com

- TemplateLab

Business partnership agreement mistakes to avoid

Partnership agreements are complex documents. Unfortunately, many people get bogged down in details and make crucial startup mistakes in their partnership agreement.

Here are some common mistakes to avoid:

- Skipping key details. Partnership agreements typically include some complex language around specific topics, and people may leave out this language if they don’t understand it. Don’t assume something isn’t necessary just because it reads like fine print.

- Trusting things will work out. People tend to go into business with people they like and trust, leading them to think there won’t be problems later. A partnership agreement exists to resolve these issues when they inevitably arise.

- Not having the agreement reviewed by counsel. Partnership agreements can vary by state and industry, and laws and best practices are constantly changing. If you choose not to have an attorney draft your agreement, at least have one review it before you sign the document.

- Not amending the agreement later. Partnerships evolve, and governing documents must be updated periodically to reflect the changing business. Otherwise, there may be issues that the document can’t resolve.

- Not forming separate partnerships for new ventures. Creating a business is expensive and time-intensive. Sometimes when a partner has an idea for a new business, their first thought is to make it part of their existing partnership. However, this keeps partners from compartmentalizing their liability. Often, their existing partnership agreement isn’t structured to govern new and different businesses.

Business partnership agreements formalize the relationship between partners and enumerate their rights and responsibilities. This limits partner liability and helps resolve disputes. Failing to draft an appropriate agreement can lead to problems later, including significant personal liability.

Why do you need a business partnership agreement?

A business partnership agreement establishes a set of agreed-upon rules and processes that owners sign and acknowledge before problems occur. If any challenges or controversies arise, the business partnership agreement defines how to address them.

“A business partnership is just like a marriage: No one goes into it thinking that it’s going to fail, but if it does fail, it can be nasty,” said Jessica LeMauk, marketing director at Voxtur. “With the right agreements in place, which I’d always recommend be written by a qualified attorney, it makes any potential problems of the business partnership much more easily solved and/or legally enforceable.”

In other words, a business partnership agreement protects all partners if things go sour. By agreeing to a clear set of rules and principles at the partnership’s outset, partners exist on a level playing field developed by consensus and backed by law.

Business partnership agreements level the playing field

A well-crafted, airtight business partnership agreement clarifies each partner’s expectations, duties and obligations. In business, things change constantly, so it’s crucial to establish a business partnership agreement that can serve as a grounding force in turbulent or uncertain times. A business partnership agreement also defines how the business should grow and governs the addition of new partners.

If you’re going into business with a partner, establish a business partnership agreement while incorporating as an entity. Even if it seems unnecessary today, when an issue arises, you’ll be glad you had an agreement in place.

Dock Treece contributed to the writing and reporting in this article. Source interviews were conducted for a previous version of this article.

Building Better Businesses

Insights on business strategy and culture, right to your inbox. Part of the business.com network.

Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books.

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Start » strategy, how to write a business partnership agreement.

Deciding to go into business with a partner is an extremely important decision. Here are some tips for approaching and creating your partnership agreement.

Deciding to go into business for yourself is a major decision on its own — but deciding to join forces with a partner is a completely different ballpark. If you’re thinking about starting a business with a partner, consider structuring your business as a general partnership.

General partnerships are one of the most common legal business entities, granting ownership to two or more people who share all assets, profits and liabilities. In a general partnership, it’s important to understand that each person is responsible for the business and is liable for the actions of their partner(s). To help avoid any issues with your partners throughout your business journey, you’ll want to write a partnership agreement before moving forward.

[Read: What Is a General Partnership? ]

What is a partnership agreement, and why do you need one?

Nolo noted that, because you and your partners are equally responsible for the business, as well as the outcomes of one another’s decisions, creating a partnership agreement is a great way to structure your relationship with your partners to best suit your business.

Partnership agreements are a protective measure to ensure any and all disagreements can be resolved quickly and fairly, and to understand what to do in the event that the partners wish to dissolve the working relationship or business in its entirety.

What should be in a partnership agreement?

Your partnership agreement needs to cover a lot of ground. According to I nvestopedia , the document should include the following:

- Name of your partnership. While it may seem like common sense, one of the first things you and your partner(s) must agree on is the name of your business.

- Contributions to the partnership and percentage of ownership. Create a list of specific contributions you and your partner(s) will make to the business. In addition to contributions, you must decide on the percentage of ownership, which is typically dictated by each partner’s contributions to the business.

- Division of profits, losses and draws. You and your partner must decide how to divide the business’s profits, losses, and draws. Partners can agree to share the profits and losses in accordance with their percentage of ownership, or they can be distributed equally among the partners regardless of ownership stake.

- Partners’ authority. Partnership authority, also known as binding power, should be defined within the partnership agreement. The ability to bind the business to a debt or a contractual agreement can expose the business to unnecessary risk, which is why the partnership agreement should explicitly state which partner(s) have binding authority.

- Withdrawal or death of a partner. While no one wants to consider the possibility of a partner’s withdrawal or untimely death on the brink of launching a new business, this is something that needs to be clearly stated in the partnership agreement. The agreement should also outline the valuation process for the business and/or any requirements for maintaining a life insurance policy designating the other partner(s) as the beneficiaries.

To avoid conflict and maintain trust between you and your partner(s), be sure to discuss all business goals, the commitment level of each partner and salaries prior to signing the agreement.

How do you structure a 50/50 partnership?

- Discuss/agree on important details before drafting . Structuring a 50/50 partnership requires consent, input, and trust from all business partners. To avoid conflict and maintain trust between you and your partner(s), be sure to discuss all business goals, the commitment level of each partner, and salaries prior to signing the agreement.

- Consult with an attorney. Before you draft or sign a partnership agreement, consult with an experienced business attorney to ensure everyone’s investment in the partnership and business is protected.

- Provide both partners with equal access to all fixed assets. When running your business, you and your business partner will have separate roles and responsibilities but complete and equal access to all fixed assets, including any property and equipment you’ve invested in. Including this detail in your business partnership agreement will help ensure total transparency and trust between you and your partner.

- Include a dispute resolution process. With responsibility for the business split between two partners and the high cost of taking legal action, you should include an official dispute resolution process in your partnership agreement to help navigate arguments.

- Determine how you both will be paid. Your partnership agreement should outline reasonable salary expectations for yourself and your partner. Everyone, investors included, should agree to the terms before finalizing the partnership.

Advantages of a partnership

Some of the several advantages of a general partnership include the following:

Easy to establish

Establishing a partnership is simpler and more straightforward than other business structures. Once you’ve drafted a partnership agreement, all partners must agree to the terms listed and sign the document. And unlike other business entities, you don’t have to file federal paperwork — you simply need to file a few documents locally, like a trade name application and partnership authority.

Easy to dissolve

Partnerships can be as easy to dissolve as they are to establish. If all partners agree to dissolve the partnership amicably, refer to the dissolution clause in your partnership agreement and follow the terms outlined. Additionally, you must consult your state’s laws regarding partnership dissolutions, and you may need to file a statement of dissolution. If you and your partners don’t decide to dissolve the partnership amicably, that could complicate the process, especially if legal action is necessary.

Simplifies your taxes

With partnerships, you don’t have to file additional business entity taxes. Your taxes for the business will pass through to the business owners, which means you’ll need to include your share of the business profits and losses in your individual taxes. You’ll also be responsible for paying any additional taxes individually.

Involves extra help and knowledge

Business owners have to play multiple roles, but when you have a business partner to rely on, you can cover more ground than if you were trying to tackle everything alone. A business partner also brings their business expertise to the company, which could differ from your own knowledge and experience. Ideally, your partner has skills and expertise that complement and enhance your own.

Carries less of a financial burden

Rather than taking on the heavy financial responsibility of starting a business alone, your business partner can help ease some of the financial strain. Having a partner to help cover hefty startup costs can be a massive relief to business owners, with the added benefit of possibly being able to invest more upfront or avoid racking up large sums of debt since you’re splitting the responsibility of covering those costs.

Disadvantages of a partnership

Partnerships also come with a few disadvantages, including the following:

Doesn’t protect partners' personal assets and involves no separation from the business

Unlike other business structures, a partnership does not create a separate legal entity from you and the company or from you and your partner. You are liable for any legal or financial difficulties your business may face. Your personal assets could be at risk since they are not covered by the partnership agreement.

Mutual liability

When starting a partnership, you are legally and financially responsible for your partner and the business. If your partner creates legal trouble for the company, you become liable and open to legal prosecution as well. Not only can this strain your relationship with your business partner, but it also affects your personal finances because, as mentioned above, there’s no legal separation from the business unless you dissolve the partnership.

Provides less independence

Unless explicitly stated in your partnership agreement, your partner has an equal say in all business decisions. If you and your business partner disagree on some of the most fundamental decisions regarding your business, such as expansion opportunities, bringing on a management team, or selling the business, this could cause disagreements between you and your partner, hinder your professional growth, or jeopardize the company.

Requires you to split profits

Having a partner means there’s someone to help cover the business’s costs, but that also means you’ll need to split the profits with them. If you have multiple partners, you could be looking at a significantly smaller profit margin than if you started the business alone.

This story was updated by Julianna Lopez. CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Join us for our Small Business Day event!

Join us at our next event on Wednesday, May 1, at 12:00 p.m., where we’ll be kicking off Small Business Month alongside business experts and entrepreneurs. Register to attend in person at our Washington, D.C., headquarters, or join us virtually!

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

For more business structuring tips

How startups contribute to innovation in emerging industries, how entrepreneurs can find a business mentor, 5 business metrics you should analyze every year.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Partnership Agreement

Rating: 4.8 - 2,740 votes

A Partnership Agreement is a contract between two or more individuals who would like to manage and operate a business together in order to make a profit . Each Partner shares a portion of the partnership's profits and losses and each Partner is personally liable for the debt and obligations of the Partnership.

For more information about this form of business, please see the guide Frequently Asked Questions About Business Partnerships .

Note: One benefit of a Partnership is that Partnership income is only taxed once . Partnership income is distributed to the individual Partners who are then taxed on the partnership income. This contrasts with a corporation where income is taxed at two levels: first as a corporate entity and then at the shareholder level where shareholders are taxed on any dividends they receive.

The document is a critical foundational document for running a new business and serves to set the business up for success by ensuring clear communication and defined responsibilities for all of the Partners. This Agreement documents both contingency plans for when things go wrong as well as descriptions of the Partnership's day-to-day operations . A Partnership Agreement protects all of the Partners involved in the business and any individuals who plan to do business together should complete a Partnership Agreement.

This document should be used for the creation of a general partnership. General partnerships are the most common form of partnerships and the easiest to create. A general partnership is different from a limited partnership in that all business partners in a general partnership have total liability, participate in managing the business, and have the ability to agree to business contracts and loans on behalf of the business. Ownership interests (i.e., how much of the business everyone owns) and profits in a general partnership are usually split unevenly, according to an agreement between the partners.

This document is used to create a new partnership. If one of the partners wishes to leave a partnership, they should use a Notice of Withdrawal from Partnership to inform the other members that they are leaving the arrangement. In order to dissolve the partnership entirely so it no longer exists, a Partnership Dissolution Agreeement document should be used.

How to use this document

A Partnership Agreement can be created either as a first step to outline Partner expectations and responsibilities before the Partners begin doing business together or after the Partnership has already been in business if a Partnership Agreement was never created and the Partners wish to codify or clarify how the Partnership operates.

No matter when in the life of a Partnership a Partnership Agreement is created, the Agreement will cover the following ground:

- Partnership name: the legal name under which the Partnership will do business

- Purpose of the Partnership: a brief description of the business that the Partnership will conduct

- Partner information: the legal names and addresses of all of the Partners currently involved in the Partnership

- Capital contributions: a description of the cash, property, services, and other resources initially contributed to the Partnership by each of the Partners

- Ownership interest: a description of the percent of the Partnership owned by each of the Partners

- Profit/Loss distribution: a description of how the profits and losses of the Partnership will be distributed between the Partners, often based on capital contributions and/or ownership interest, and how often distribution will take place

- Management and voting requirements: a description of how the Partnership will be managed , how voting weight will be determined, and whether unanimous or majority votes will be required to make important decisions about the finances and operations of the Partnership

- Partner addition and withdrawal: the guidelines for how the Partnership will handle the addition of Partners, the voluntary withdrawal of Partners, and the involuntary withdrawal of Partners

- Partnership dissolution: an outline of the circumstances under which the Partnership can be dissolved and a description of how the remaining assets of the Partnership will be divided between the Partnership if the Partnership is dissolved

Once the Partnership Agreement is completed, all of the Partners should sign and date the Agreement and keep copies of the Agreement for their records. If the Partners wish to change any of the terms of the Agreement, they should be sure to do so in writing .

Applicable law

Partnership Agreements are subject to the laws of individual states . There is no one federal law covering the requirements for a Partnership Agreement. This is because each individual state governs the businesses formed within that state.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

- How to Sell your Business

- How to Choose the Best Legal Structure for your Business

- How to Transfer Business Ownership

- Frequently Asked Questions about Business Partnerships

- Going out of Business: Ending or Dissolving a Partnership

Other names for the document:

Partnership Agreement - Updated, Articles of Partnership, Business Partnership Agreement, Creation of Partnership Agreement, Formation of Partnership Agreement

Country: United States

Business Structure - Other downloadable templates of legal documents

- Articles Of Organization

- Shareholder Agreement

- Articles Of Incorporation

- LLC Membership Interest Assignment

- Business Sale Agreement

- Corporate Bylaws

- Stock Sale and Purchase Agreement

- LLC Membership Purchase Agreement

- Founders' Agreement

- Business Merger Agreement

- Limited Partnership Agreement

- Other downloadable templates of legal documents

How to Create a Business Partnership Agreement

4 min. read

Updated October 25, 2023

If you plan on going into business with a business partner, a written partnership agreement is important. If you and your partners don’t spell out your rights and responsibilities in a written business partnership agreement, you’ll be ill-equipped to settle conflicts when they arise, and minor misunderstandings may erupt into full-blown disputes. In addition, without a written agreement saying otherwise, your state’s law will control many aspects of your business.

- How a partnership agreement helps your business

A partnership agreement allows you to structure your relationship with your partners in a way that suits your business. You and your partners can establish the shares of profits (or losses) each partner will take, the responsibilities of each partner, what will happen to the business if a partner leaves, and other important guidelines.

Uniform partnership act

Each state (with the exception of Louisiana) has its own laws governing partnerships, contained in what is usually called the “Uniform Partnership Act” or the “Revised Uniform Partnership Act”—or, sometimes, the “UPA” or the “Revised UPA.” These statutes establish the basic legal rules that apply to partnerships and will control many aspects of your partnership’s life, unless you set out different rules in a written partnership agreement.

Don’t be tempted to leave the terms of your partnership up to these state laws. Because they were designed as one-size-fits-all fallback rules, they may not be helpful in your particular situation. It’s much better to put your agreement into a document that specifically sets out the points you and your partners have agreed on.

- What to include in your partnership agreement

Here’s a list of the major areas that most partnership agreements cover. You and your partners-to-be should consider these issues before you put the terms in writing:

- Name of the partnership. One of the first things you must do is agree on a name for your partnership. You can use your own last names, such as Smith & Wesson, or you can adopt and register a fictitious business name, such as Westside Home Repairs. If you choose a fictitious name, you must make sure that the name isn’t already in use.

- Contributions to the partnership. It’s critical that you and your partners work out and record who’s going to contribute cash, property, or services to the business before it opens—and what ownership percentage each partner will have. Disagreements over contributions have doomed many promising businesses.

- Allocation of profits, losses, and draws. Will profits and losses be allocated in proportion to a partner’s percentage interest in the business? And will each partner be entitled to a regular draw (a withdrawal of allocated profits from the business) or will all profits be distributed at the end of each year? You and your partners may have different ideas about how the money should be divided up and distributed, and each of you will have different financial needs, so this is an area to which you should pay particular attention.

- Partners’ authority. Without an agreement to the contrary, any partner can bind the partnership without the consent of the other partners. If you want one or all of the partners to obtain the others’ consent before binding the partnership, you must make this clear in your partnership agreement.

- Partnership decision-making. Although there’s no magic formula or language for divvying up decisions among partners, you’ll head off a lot of trouble if you try to work it out beforehand. You may, for example, want to require a unanimous vote of all the partners for every business decision. If that seems like more than will be necessary, you can require a unanimous vote for major decisions and allow individual partners to make minor decisions on their own. In that case, your partnership agreement will have to describe what constitutes a major or minor decision. You should carefully think through issues like these when setting up the decision-making process for your business.

- Management duties. You might not want to make ironclad rules about every management detail, but you’d be wise to work out some guidelines in advance. For example, who will keep the books? Who will deal with customers? Supervise employees? Negotiate with suppliers? Think through the management needs of your partnership and be sure you’ve got everything covered.

- Admitting new partners. Eventually, you may want to expand the business and bring in new partners. Agreeing on a procedure for admitting new partners will make your lives a lot easier when this issue comes up.

- Withdrawal or death of a partner. At least as important as the rules for admitting new partners to the business are the rules for handling the departure of an owner. You should therefore set up a reasonable buyout scheme in your partnership agreement to deal with this eventuality.

- Resolving disputes. If you and your partners become deadlocked on an issue, do you want to go straight to court? It might benefit everyone involved if your partnership agreement provides for alternative dispute resolution, such as mediation or arbitration.

Have you gone into business with a partner, and did you write up an agreement beforehand? What would you have done differently? Share your stories or questions with us in the comments.

Clarify your ideas and understand how to start your business with LivePlan

Nolo's mission is to make the legal system work for everyone—not just lawyers. What we do: To help people handle their own everyday legal matters—or learn enough about them to make working with a lawyer a more satisfying experience—we publish reliable, plain-English books, software, forms and this website.

.png?format=auto)

Table of Contents

Related Articles

9 Min. Read

How to Legally Register for Your Business Name

3 Min. Read

How to Apply for an EIN: Federal Tax ID Number

3 Reasons Why You Shouldn’t Wait to Register for a DBA

17 Min. Read

The Legal Requirements to Start a Small Business in the UK Explained

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

Legal Templates

Home Business Partnership Agreement Small Business

Small Business Partnership Agreement Template

Use our small business partnership agreement to detail all the key information of a partnership for a small business.

Updated July 2, 2023 Reviewed by Brooke Davis

A small business partnership agreement is a written contract between partners in a small business, setting out each partner’s duties, rights, and profit sharing. It prevents misunderstandings and disputes and protects the company and its partners.

A successful small business partnership is akin to a strong relationship. Both entail not just short-term mutual benefits but long-term compatibility. You need to have the same business vision, mission, and goals. But under the pressure of starting a new business, problems arise and can turn into major setbacks.

Therefore, a small business partnership agreement template should govern the business.

What is a Small Business Partnership Agreement?

When to use a small business partnership agreement, what to include in a small business partnership agreement, small business partnership agreement sample.

A small business partnership agreement defines the precise guidelines for a small business partnership’s successful operations and the roles each partner will play.

The partnership agreement includes how profits and losses are shared amongst the partners, how the business will run in case of a partner withdrawal, and each partner’s rights and obligations.

You should use a small business partnership agreement to form a small business partnership. A partnership agreement is a vital document in the decision-making process of a business.

The absence of such an agreement can negatively affect the decision-making process of both business partners.

For instance, if a partner withdraws from the business, guidelines should be outlined on whether the partnership should be dissolved or reformed.

There will always be conflicts and tough decision-making in the lifespan of a business. A partnership agreement helps to reduce and solve disputes between you and your partner.

Before the formation of any successful business partnership, there are crucial factors that should be put into consideration.

The following factors form the bedrock of any successful joint business:

- Decision making

It is important to note that you and your partner will not agree on everything concerning the business. Therefore, you should develop long-term solutions to dilemmas within the business.

Who needs to make the final say? Which decisions require undivided votes by the partners? You will have a peaceful business by drafting down a non-biased decision-making structure.

- Distributions

The main intention of building the business is to maximize the profits received. Your small business partnership agreement should entail how you will divide business profits and how much each partner will receive.

Your agreement should clearly describe how ownership will change in various scenarios. What happens when a partner withdraws? What are the chances of buying out or absorbing a new partner? What happens if one partner dies, retires, or goes bankrupt?

- Dispute resolution

If things fall apart between partners, how will the disagreements be resolved? Deciding how you will handle disputes sets the foundation for a friction-free business.

- Critical developments

Sometimes, the unpredictable happens, and your small business partnership agreement should address possible concerns and circumstances, such as; what happens when a partner falls sick. What are the retirement provisions?

- Dissolution

A partnership agreement should entail the steps to be taken when legally terminating the partnership. You might opt to do this after you and your partners disapprove of the future of your business.

- Contributions

Ensure you outline each partner’s role in the business formation and running of finances. In your small business partnership agreement, define what each partner brings- monetary value, time, customers, efforts, liabilities, etc.

The below small business partnership agreement template allows you to quickly fill in the blanks and get your partnership up and running. Download in PDF or Word format.

Related Documents

- Business Plan : A plan that guides you through each stage of starting and growing your business.

- Partnership Agreement Amendment : A document detailing any changes to a Partnership Agreement.

- Assignment of Partnership Interest : A legal document that transfers the rights to receive benefits from an original business partner to a new business partner.

- Business Proposal : Use this document to form new relationships with other businesses and organizations.

- Legal Resources

- Partner With Us

- Terms of Use

- Privacy Policy

- Do Not Sell My Personal Information

The document above is a sample. Please note that the language you see here may change depending on your answers to the document questionnaire.

Thank you for downloading!

How would you rate your free template?

Click on a star to rate

End of the Year Sale: Get up to 35% Off on all our Plans.

Business Partnership Agreement Template

Navigating the modern business world is like setting sail in unpredictable waters; having a reliable compass can be a game-changer.

A business partnership agreement is that compass. It provides structure and security for all parties involved, allowing you to focus on what truly matters: the success of your business.

What is a Business Partnership Agreement?

A business partnership agreement is a legal document outlining each partner’s roles, responsibilities, and financial contributions within a business arrangement. This comprehensive contract is typically established between two or more business owners, forming a safeguard to ensure a harmonious, productive relationship.

The primary purpose of this agreement is to protect all parties involved. It clarifies matters ranging from dispute resolution and capital contributions to profit distribution and amendments. Detailing each partner’s role and expectations can prevent potential misunderstandings, fostering a healthier and more productive business partnership.

Without such an agreement, the business might fall under your state’s default rules, which may not be in the best interest of your partnership. This document serves as a tangible representation of each partner’s understanding, forming the bedrock of your collaborative business endeavor.

DISCLAIMER : We are not lawyers or a law firm and we do not provide legal, business or tax advice. We recommend you consult a lawyer or other appropriate professional before using any templates or agreements from this website.

When to Use a Business Partnership Agreement Template

A business partnership agreement template should be used when entering a business partnership. It’s not only for large corporations but also small businesses and startups. It’s relevant in various industries- technology, food service, or manufacturing. A partnership agreement is essential if two or more individuals collaborate to start or run a business.

One significant advantage of using a template is its simplicity and speed of the process. A template can be a lifesaver, especially when you’re not familiar with the ins and outs of legal language. It provides the basic framework, highlighting the essential elements in your agreement, ensuring you pay attention to important details.

For instance, imagine you’re opening a bakery with a friend. With a business partnership agreement template , you can clearly define your roles—who’ll manage supplies, who’ll handle the baking, how profits will be shared, etc. This transparency will help maintain harmony, facilitate growth, and mitigate potential disputes, ensuring your bakery thrives.

Perhaps you are an artist collaborating with a gallery owner. A partnership agreement can explicitly state the percentage of sales each party receives and detail responsibilities such as marketing and promotion, hosting exhibitions, and artwork transportation.

Similarly, for real estate developers planning a joint venture, a partnership agreement can clarify profit sharing, capital contributions, property acquisition, development duties, and how potential losses would be handled.

These scenarios illustrate the broad applicability of partnership agreements and the ease of a well-structured template.

Download our Partnership Agreement

The implications of not using a business partnership agreement with partners can be catastrophic to your business. That’s why we’ve created a simple template to help protect your business.

What to Include in a Partnership Agreement Template

When entering into business partnerships, having a clearly defined agreement is critical. Without a precise understanding of each partner’s role within the association and the expectations for both parties to fulfill, you may find yourself in a compromising and overwhelming situation down the line.

A partnership agreement template can provide this clarity by adhering to best practices for accountability and reliability between parties—but what should it include?

Below are some essential factors you should consider when creating your tailored partnership agreement template.

Business Information

The agreement should commence with the basic business information. It should clearly mention the legal name of the business, the type of business (e.g., limited liability company, limited liability partnership agreement, etc.), the business address, and any other significant details that identify the business.

For instance, if you’re establishing an innovative tech startup, your agreement should clearly state your company name, address, and the fact that you’re in the technology industry.

It’s vital to outline the primary purpose of your business as it helps delineate the boundaries of your operations, providing a clear focus for your partnership.

Partner Information

Understanding who you’re shaking hands with is equally important. Include comprehensive information about each partner, covering their full names, addresses, and contact details.

Beyond the basic partnership details, the agreement should also discuss why the partnership is being formed. Is it for specific expertise, financial contributions, or network access? Make this clear to underline the value each partner brings to the table. For example, if you’re partnering with an industry veteran for their experience and vast network, that should be highlighted here.

Your partnership is not a timeless saga; it needs a defined timeline. This section details the duration of the partnership—when it will start and the circumstances under which it will end.

In some cases, the partnership could be indefinite, continuing until a specific event occurs, such as the retirement or death of a partner or the achievement of a particular goal. Others might have a predetermined end date. Make sure to clarify this upfront to prevent future uncertainty.

Capital Contributions

Nothing can stir the pot of disagreement like money . Therefore, the partner capital contributions of each partner need to be explicitly outlined in your agreement.

This section should include the amount of money, property, or services each partner will contribute to start the business and any expected future contributions. Moreover, the document should clarify how these contributions affect the ownership percentages of each partner.

For example, suppose Partner A contributes $70,000, and Partner B contributes $30,000 to the business. In that case, the agreement might state that Partner A owns 70% of the company while Partner B owns 30%. This reflects their initial capital investments– which may fluctuate over time.