- Search Search Please fill out this field.

What Are Operating Costs?

Understanding operating costs.

- Calculation

Fixed Costs

Variable costs, semi-variable costs.

- Real-World Example

- SG&A vs. Operating Costs

- Limitations

- Operating Cost FAQs

- Corporate Finance

Operating Costs Definition: Formula, Types, and Real-World Examples

:max_bytes(150000):strip_icc():format(webp)/me_jpeg__chris_murphy-5bfc262746e0fb0051bcea2f.jpg)

Operating costs are associated with the maintenance and administration of a business on a day-to-day basis. Operating costs include direct costs of goods sold (COGS) and other operating expenses—often called selling, general, and administrative (SG&A)—which include rent, payroll, and other overhead costs, as well as raw materials and maintenance expenses. Operating costs exclude non-operating expenses related to financing, such as interest, investments, or foreign currency translation.

The operating cost is deducted from revenue to arrive at operating income and is reflected on a company’s income statement .

Key Takeaways

- Operating costs are the ongoing expenses incurred from the normal day-to-day of running a business.

- Operating costs include both costs of goods sold (COGS) and other operating expenses—often called selling, general, and administrative (SG&A) expenses.

- Common operating costs in addition to COGS may include rent, equipment, inventory costs, marketing, payroll, insurance, and funds allocated for research and development.

- Operating costs can be found and analyzed by looking at a company's income statement.

Investopedia / Joules Garcia

Businesses have to keep track of operating costs as well as the costs associated with non-operating activities, such as interest expenses on a loan. Both costs are accounted for differently in a company's books, allowing analysts to determine how costs are associated with revenue-generating activities and whether the business can be run more efficiently.

Generally speaking, a company’s management will seek to maximize profits for the company. Because profits are determined both by the revenue that the company earns and the amount the company spends in order to operate, profit can be increased both by increasing revenue and by decreasing operating costs. Because cutting costs generally seems like an easier and more accessible way of increasing profits, managers will often be quick to choose this method.

Trimming operating costs too much can reduce a company’s productivity and, as a result, its profit as well. While reducing any particular operating cost will usually increase short-term profits, it can also hurt the company’s earnings in the long term.

For example, if a company cuts its advertising costs, its short-term profits will likely improve since it is spending less money on operating costs. However, by reducing its advertising, the company might also reduce its capacity to generate new business such that earnings in the future could suffer.

Ideally, companies look to keep operating costs as low as possible while still maintaining the ability to increase sales.

How to Calculate Operating Costs

The following formula and steps can be used to calculate the operating cost of a business. You will find the information needed from the firm's income statement that is used to report the financial performance for the accounting period.

Operating cost = Cost of goods sold + Operating expenses \text{Operating cost} = \text{Cost of goods sold} + \text{Operating expenses} Operating cost = Cost of goods sold + Operating expenses

- From a company's income statement, take the total cost of goods sold, or COGS, which can also be called cost of sales.

- Find total operating expenses, which should be further down the income statement.

- Add total operating expenses and COGS to arrive at the total operating costs for the period.

Types of Operating Costs

While operating costs generally do not include capital outlays, they can include many components of operating expenses , such as:

- Accounting and legal fees

- Bank charges

- Sales and marketing costs

- Travel expenses

- Entertainment costs

- Non-capitalized research and development expenses

- Office supply costs

- Repair and maintenance costs

- Utility expenses

- Salary and wage expenses

Operating costs will also include the cost of goods sold, which are the expenses directly tied to the production of goods and services. Some of the costs include:

- Direct material costs

- Direct labor

- Rent of the plant or production facility

- Benefits and wages for the production workers

- Repair costs of equipment

- Utility costs and taxes of the production facilities

A business’s operating costs are comprised of two components, fixed costs and variable costs , which differ in important ways.

A fixed cost is one that does not change with an increase or decrease in sales or productivity and must be paid regardless of the company’s activity or performance. For example, a manufacturing company must pay rent for factory space, regardless of how much it is producing or earning. While it can downsize and reduce the cost of its rent payments, it cannot eliminate these costs, and so they are considered to be fixed. Fixed costs generally include overhead costs, insurance, security, and equipment.

Fixed costs can help in achieving economies of scale , as when many of a company’s costs are fixed, the company can make more profit per unit as it produces more units. In this system, fixed costs are spread out over the number of units produced, making production more efficient as production increases by reducing the average per-unit cost of production. Economies of scale can allow large companies to sell the same goods as smaller companies for lower prices.

The economies of scale principle can be limited in that fixed costs generally need to increase with certain benchmarks in production growth. For example, a manufacturing company that increases its rate of production over a specified period will eventually reach a point where it needs to increase the size of its factory space in order to accommodate the increased production of its products.

Variable costs , like the name implies, are comprised of costs that vary with production. Unlike fixed costs, variable costs increase as production increases and decrease as production decreases. Examples of variable costs include raw material costs and the cost of electricity. In order for a fast-food restaurant chain that sells french fries to increase its fry sales, for instance, it will need to increase its purchase orders of potatoes from its supplier.

It's sometimes possible for a company to achieve a volume discount or "price break" when purchasing supplies in bulk, wherein the seller agrees to slightly reduce the per-unit cost in exchange for the buyer’s agreement to regularly buy the supplies in large amounts. As a result, the agreement might diminish the correlation somewhat between an increase or decrease in production and an increase or decrease in the company’s operating costs.

For example, the fast-food company may buy its potatoes at $0.50 per pound when it buys potatoes in amounts of less than 200 pounds. However, the potato supplier may offer the restaurant chain a price of $0.45 per pound when it buys potatoes in bulk amounts of 200 to 500 pounds. Volume discounts generally have a small impact on the correlation between production and variable costs, and the trend otherwise remains the same.

Typically, companies with a high proportion of variable costs relative to fixed costs are considered to be less volatile, as their profits are more dependent on the success of their sales. In the same way, the profitability and risk for the same companies are also easier to gauge.

In addition to fixed and variable costs, it is also possible for a company’s operating costs to be considered semi-variable (or “semi-fixed"). These costs represent a mixture of fixed and variable components and can be thought of as existing between fixed costs and variable costs. Semi-variable costs vary in part with increases or decreases in production, like variable costs, but still exist when production is zero, like fixed costs. This is what primarily differentiates semi-variable costs from fixed costs and variable costs.

An example of semi-variable costs is overtime labor. Regular wages for workers are generally considered to be fixed costs, as while a company’s management can reduce the number of workers and paid work hours, it will always need a workforce of some size to function. Overtime payments are often considered to be variable costs, as the number of overtime hours that a company pays its workers will generally rise with increased production and drop with reduced production. When wages are paid based on conditions of productivity allowing for overtime, the cost has both fixed and variable components and is considered to be a semi-variable cost.

Real-World Example of Operating Costs

Below is the income statement for Apple Inc. (AAPL) for the year ending Sept. 25, 2021, according to its annual 10-K report:

- Apple reported total revenue or net sales of $365.8 billion for the 12-month period.

- The total cost of sales (or cost of goods sold) was $213 billion, while total operating expenses were $43.9 billion.

- We calculate operating costs as $213 billion + $43.9 billion.

- Operating costs (cost of sales + operating expenses) were $256.9 billion for the period.

Apple's total operating costs must be examined over several quarters to get a sense of whether the company is managing its operating costs effectively. Also, investors can monitor operating expenses and cost of goods sold (or cost of sales) separately to determine whether costs are either increasing or decreasing over time.

SG&A vs. Operating Costs

Selling, general, and administrative expense (SG&A) is reported on the income statement as the sum of all direct and indirect selling expenses and all general and administrative expenses (G&A) of a company. It includes all the costs not directly tied to making a product or performing a service—that is, SG&A includes the costs to sell and deliver products or services, in addition to the costs to manage the company.

SG&A includes nearly everything that isn't in the cost of goods sold (COGS). Operating costs include COGS plus all operating expenses, including SG&A.

Limitations of Operating Costs

As with any financial metric, operating costs must be compared over multiple reporting periods to get a sense of any trend. Companies sometimes can cut costs for a particular quarter, which inflates their earnings temporarily. Investors must monitor costs to see if they're increasing or decreasing over time while also comparing those results to the performance of revenue and profit.

What Is the Total Cost Formula?

The total cost formula combines a firm's fixed and variable costs to produce a quantity of goods or services. To calculate the total cost, add the average fixed cost per unit to the average variable cost per unit. Multiply this by the total number of units to derive the total cost.

The total cost formula is important because it helps management calculate the profitability of their business. It helps managers pinpoint which fixed or variable costs could be reduced to increase profit margins . It also helps managers determine the price point for their products and compare the profitability of one product line versus another.

How Do Operating Costs Affect Profit?

Operating costs that are high or increasing can reduce a company's net profit . A company's management will look for ways to stabilize or decrease operating costs while still balancing the need to manufacture goods that meet consumer demands. If operating costs become too high, management may need to increase the price of their products in order to maintain profitability. They then risk losing customers to competitors who are able to produce similar goods at a lower price point.

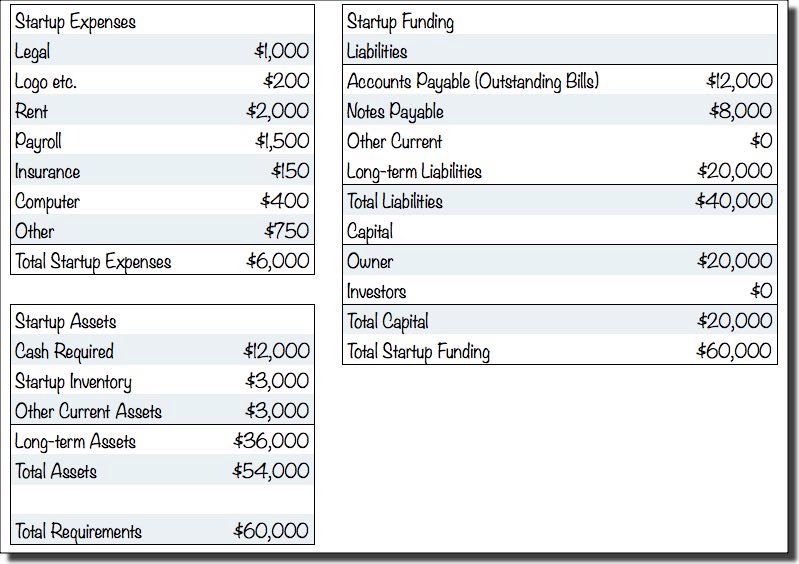

What Is the Difference Between Operating Costs and Startup Costs?

Operating costs are the expenses a business incurs in its normal day-to-day operations. Startup costs, on the other hand, are expenses a startup must pay as part of the process of starting its new business. Even before a business opens its doors for the first time or begins production of a new product, it will have to spend money just to get started.

For example, the business may need to spend money on research and development, equipment purchases, a lease on office space, and employee wages. A startup often pays for these costs through business loans or money from private investors. This contrasts with operating costs, which are paid for through revenue generated from sales.

Apple. " Form 10-K, Apple Inc. ," Page 29.

- Accounting History and Terminology 1 of 35

- Absorption Costing Explained, With Pros and Cons and Example 2 of 35

- What Is an Amortization Schedule? How to Calculate with Formula 3 of 35

- Average Collection Period Formula, How It Works, Example 4 of 35

- Bill of Lading: Meaning, Types, Example, and Purpose 5 of 35

- What Is a Cash Book? How Cash Books Work, With Examples 6 of 35

- Cost of Debt: What It Means and Formulas 7 of 35

- Cost of Equity Definition, Formula, and Example 8 of 35

- Cost-Volume-Profit (CVP) Analysis: What It Is and the Formula for Calculating It 9 of 35

- Current Account: Definition and What Influences It 10 of 35

- Days Payable Outstanding (DPO) Defined and How It's Calculated 11 of 35

- Depreciation: Definition and Types, With Calculation Examples 12 of 35

- Double-Declining Balance (DDB) Depreciation Method Definition With Formula 13 of 35

- EBITDA: Definition, Calculation Formulas, History, and Criticisms 14 of 35

- Economic Order Quantity: What Does It Mean and Who Is It Important For? 15 of 35

- 4 Factors of Production Explained With Examples 16 of 35

- Fiscal Year: What It Is and Advantages Over Calendar Year 17 of 35

- How a General Ledger Works With Double-Entry Accounting Along With Examples 18 of 35

- Just-in-Time (JIT): Definition, Example, and Pros & Cons 19 of 35

- Net Operating Loss (NOL): Definition and Carryforward Rules 20 of 35

- NRV: What Net Realizable Value Is and a Formula To Calculate It 21 of 35

- No-Shop Clause: Meaning, Examples and Exceptions 22 of 35

- Operating Costs Definition: Formula, Types, and Real-World Examples 23 of 35

- Operating Profit: How to Calculate, What It Tells You, and Example 24 of 35

- Production Costs: What They Are and How to Calculate Them 25 of 35

- What Is a Pro Forma Invoice? Required Information and Example 26 of 35

- Retained Earnings in Accounting and What They Can Tell You 27 of 35

- Revenue Recognition: What It Means in Accounting and the 5 Steps 28 of 35

- What Is a Sunk Cost—and the Sunk Cost Fallacy? 29 of 35

- Triple Bottom Line 30 of 35

- Variable Cost: What It Is and How to Calculate It 31 of 35

- Work-in-Progress (WIP) Definition With Examples 32 of 35

- Write-Offs: Understanding Different Types To Save on Taxes 33 of 35

- Year-Over-Year (YOY): What It Means, How It's Used in Finance 34 of 35

- Zero-Based Budgeting: What It Is and How to Use It 35 of 35

:max_bytes(150000):strip_icc():format(webp)/TermDefinitions_Fixedcost-262ceb69354340e7a8bbd1c05adb3771.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

How To Write the Operations Plan Section of the Business Plan

Susan Ward wrote about small businesses for The Balance for 18 years. She has run an IT consulting firm and designed and presented courses on how to promote small businesses.

:max_bytes(150000):strip_icc():format(webp)/SusanWardLaptop2crop1-57aa62eb5f9b58974a12bac9.jpg)

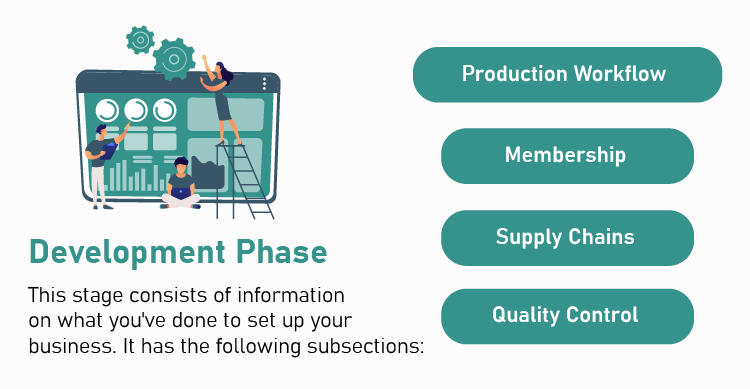

Stage of Development Section

Production process section, the bottom line, frequently asked questions (faqs).

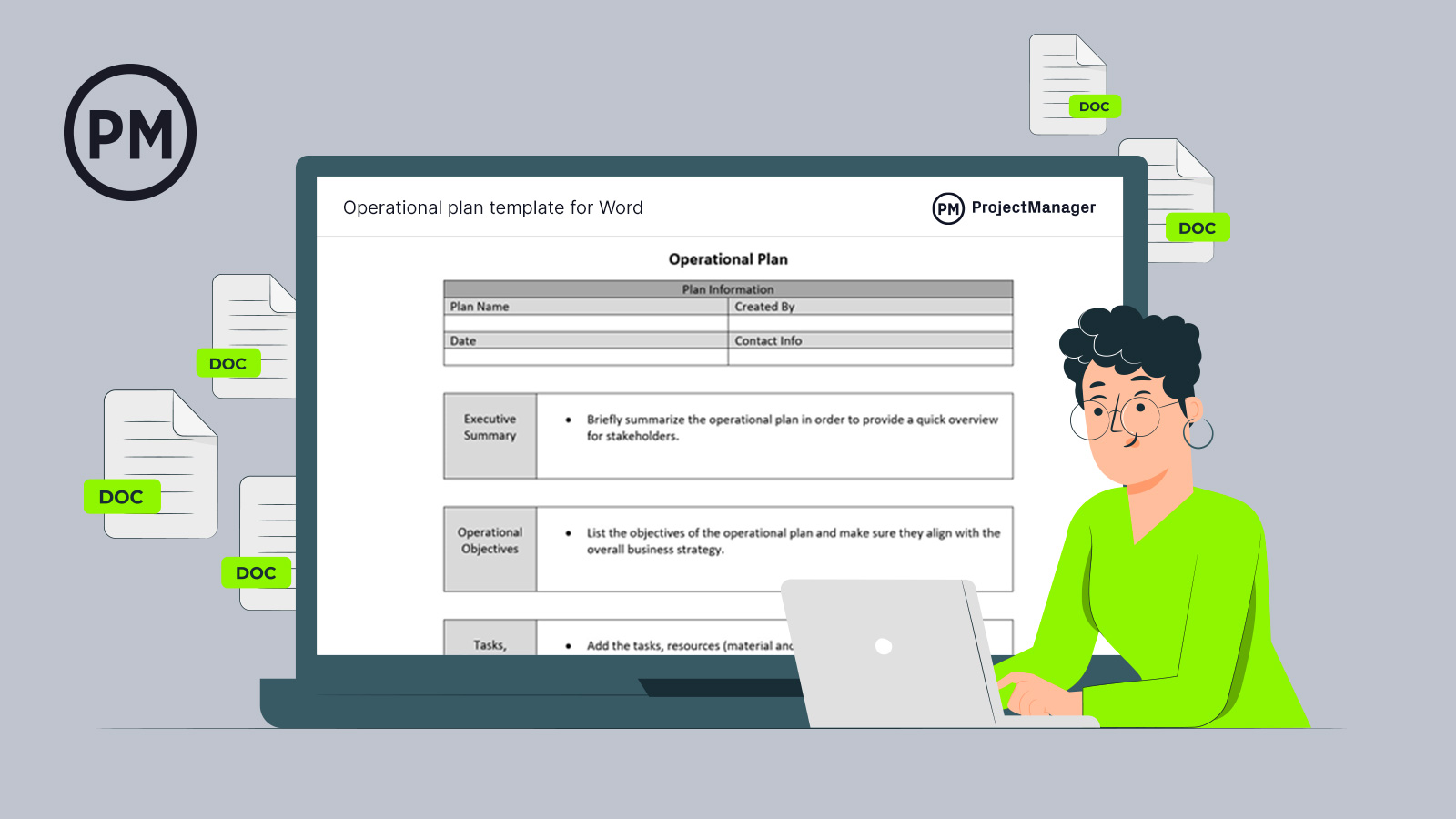

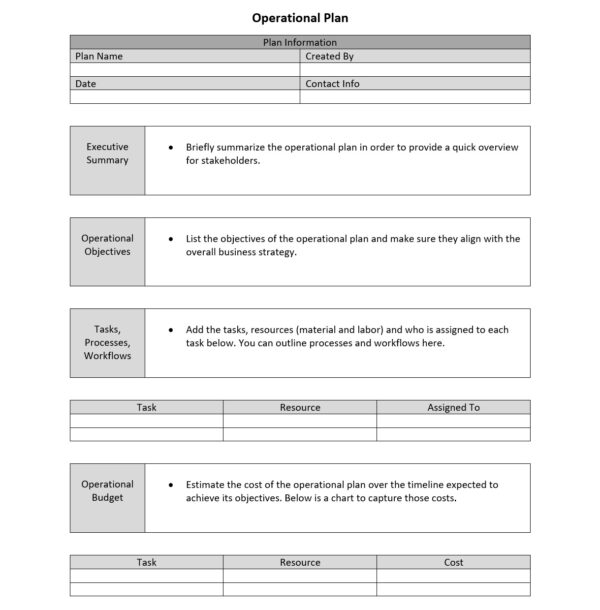

The operations plan is the section of your business plan that gives an overview of your workflow, supply chains, and similar aspects of your business. Any key details of how your business physically produces goods or services will be included in this section.

You need an operations plan to help others understand how you'll deliver on your promise to turn a profit. Keep reading to learn what to include in your operations plan.

Key Takeaways

- The operations plan section should include general operational details that help investors understand the physical details of your vision.

- Details in the operations plan include information about any physical plants, equipment, assets, and more.

- The operations plan can also serve as a checklist for startups; it includes a list of everything that must be done to start turning a profit.

In your business plan , the operations plan section describes the physical necessities of your business's operation, such as your physical location, facilities, and equipment. Depending on what kind of business you'll be operating, it may also include information about inventory requirements, suppliers, and a description of the manufacturing process.

Keeping focused on the bottom line will help you organize this part of the business plan.

Think of the operating plan as an outline of the capital and expense requirements your business will need to operate from day to day.

You need to do two things for the reader of your business plan in the operations section: show what you've done so far to get your business off the ground and demonstrate that you understand the manufacturing or delivery process of producing your product or service.

When you're writing this section of the operations plan, start by explaining what you've done to date to get the business operational, then follow up with an explanation of what still needs to be done. The following should be included:

Production Workflow

A high-level, step-by-step description of how your product or service will be made, identifying the problems that may occur in the production process. Follow this with a subsection titled "Risks," which outlines the potential problems that may interfere with the production process and what you're going to do to negate these risks. If any part of the production process can expose employees to hazards, describe how employees will be trained in dealing with safety issues. If hazardous materials will be used, describe how these will be safely stored, handled, and disposed.

Industry Association Memberships

Show your awareness of your industry's local, regional, or national standards and regulations by telling which industry organizations you are already a member of and which ones you plan to join. This is also an opportunity to outline what steps you've taken to comply with the laws and regulations that apply to your industry.

Supply Chains

An explanation of who your suppliers are and their prices, terms, and conditions. Describe what alternative arrangements you have made or will make if these suppliers let you down.

Quality Control

An explanation of the quality control measures that you've set up or are going to establish. For example, if you intend to pursue some form of quality control certification such as ISO 9000, describe how you will accomplish this.

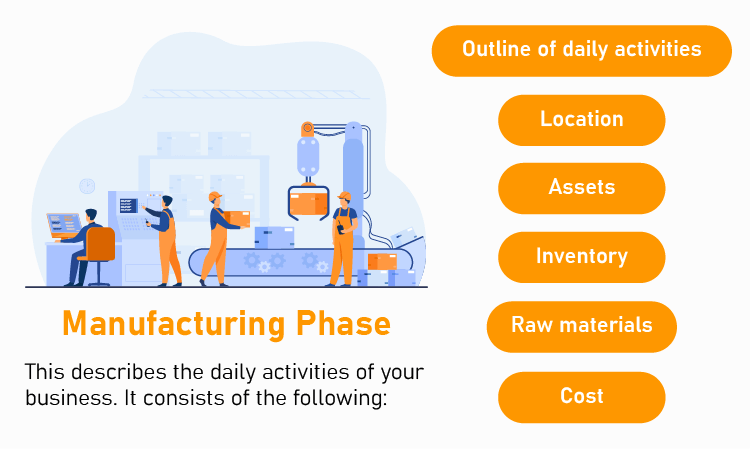

While you can think of the stage of the development part of the operations plan as an overview, the production process section lays out the details of your business's day-to-day operations. Remember, your goal for writing this business plan section is to demonstrate your understanding of your product or service's manufacturing or delivery process.

When writing this section, you can use the headings below as subheadings and then provide the details in paragraph format. Leave out any topic that does not apply to your particular business.

Do an outline of your business's day-to-day operations, including your hours of operation and the days the business will be open. If the business is seasonal, be sure to say so.

The Physical Plant

Describe the type, site, and location of premises for your business. If applicable, include drawings of the building, copies of lease agreements, and recent real estate appraisals. You need to show how much the land or buildings required for your business operations are worth and tell why they're important to your proposed business.

The same goes for equipment. Besides describing the equipment necessary and how much of it you need, you also need to include its worth and cost and explain any financing arrangements.

Make a list of your assets , such as land, buildings, inventory, furniture, equipment, and vehicles. Include legal descriptions and the worth of each asset.

Special Requirements

If your business has any special requirements, such as water or power needs, ventilation, drainage, etc., provide the details in your operating plan, as well as what you've done to secure the necessary permissions.

State where you're going to get the materials you need to produce your product or service and explain what terms you've negotiated with suppliers.

Explain how long it takes to produce a unit and when you'll be able to start producing your product or service. Include factors that may affect the time frame of production and describe how you'll deal with potential challenges such as rush orders.

Explain how you'll keep track of inventory .

Feasibility

Describe any product testing, price testing, or prototype testing that you've done on your product or service.

Give details of product cost estimates.

Once you've worked through this business plan section, you'll not only have a detailed operations plan to show your readers, but you'll also have a convenient list of what needs to be done next to make your business a reality. Writing this document gives you a chance to crystalize your business ideas into a clear checklist that you can reference. As you check items off the list, use it to explain your vision to investors, partners, and others within your organization.

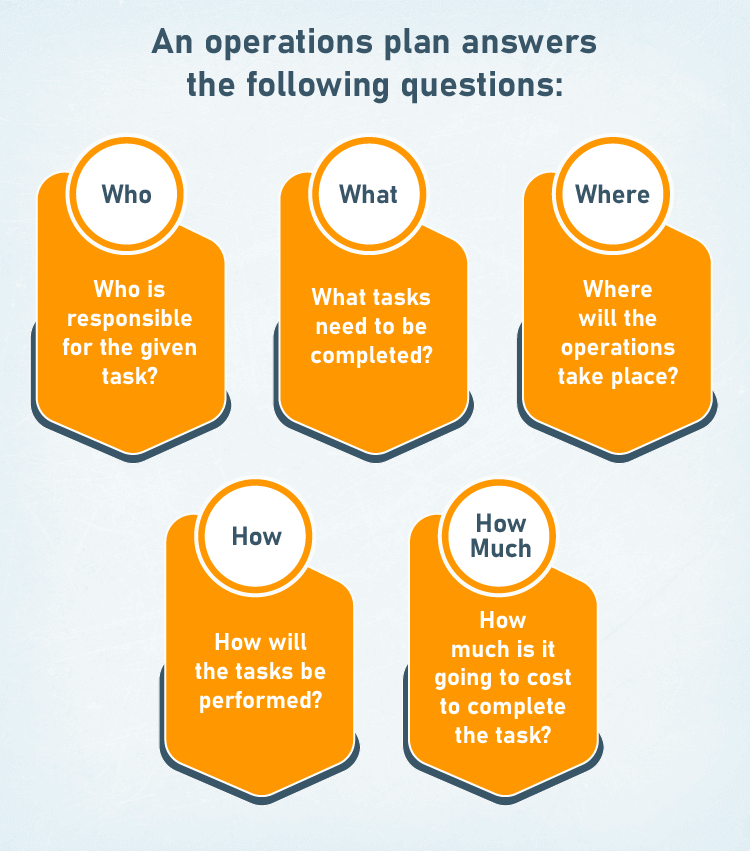

What is an operations plan?

An operations plan is one section of a company's business plan. This section conveys the physical requirements for your business's operations, including supply chains, workflow , and quality control processes.

What is the main difference between the operations plan and the financial plan?

The operations plan and financial plan tackle similar issues, in that they seek to explain how the business will turn a profit. The operations plan approaches this issue from a physical perspective, such as property, routes, and locations. The financial plan explains how revenue and expenses will ultimately lead to the business's success.

Want to read more content like this? Sign up for The Balance's newsletter for daily insights, analysis, and financial tips, all delivered straight to your inbox every morning!

How to Write the Operations Section of Your Business Plan

2 min. read

Updated January 3, 2024

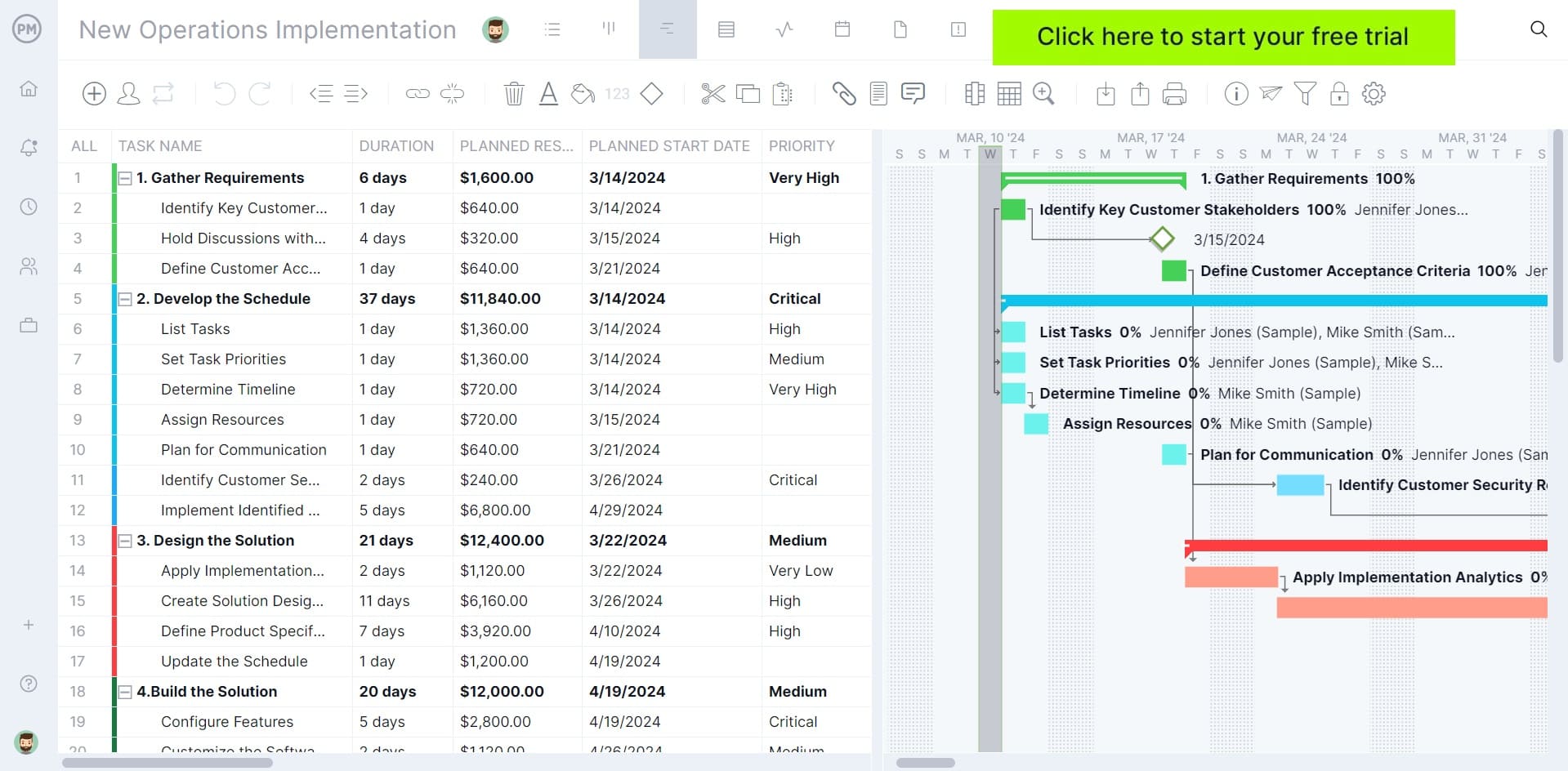

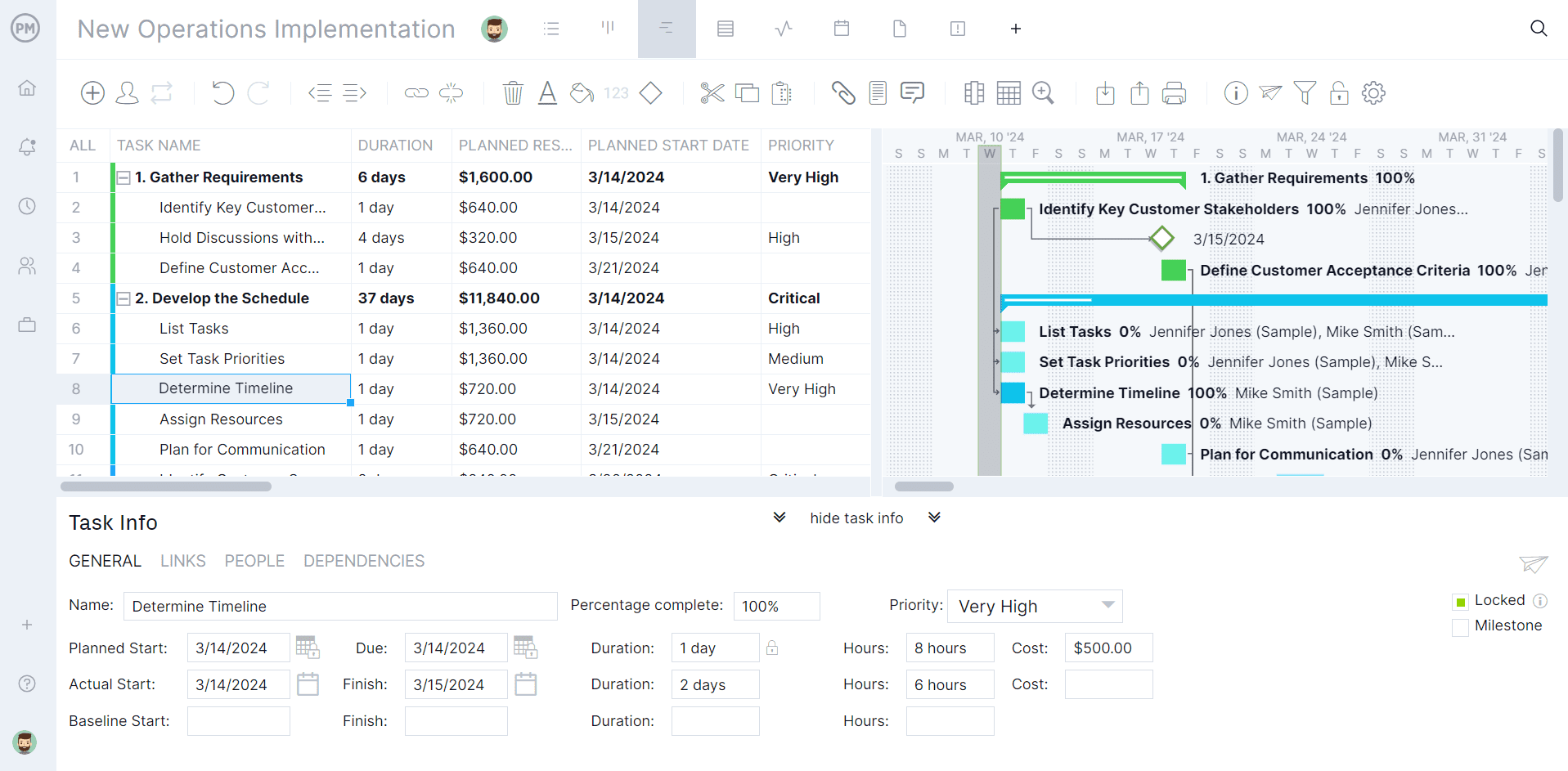

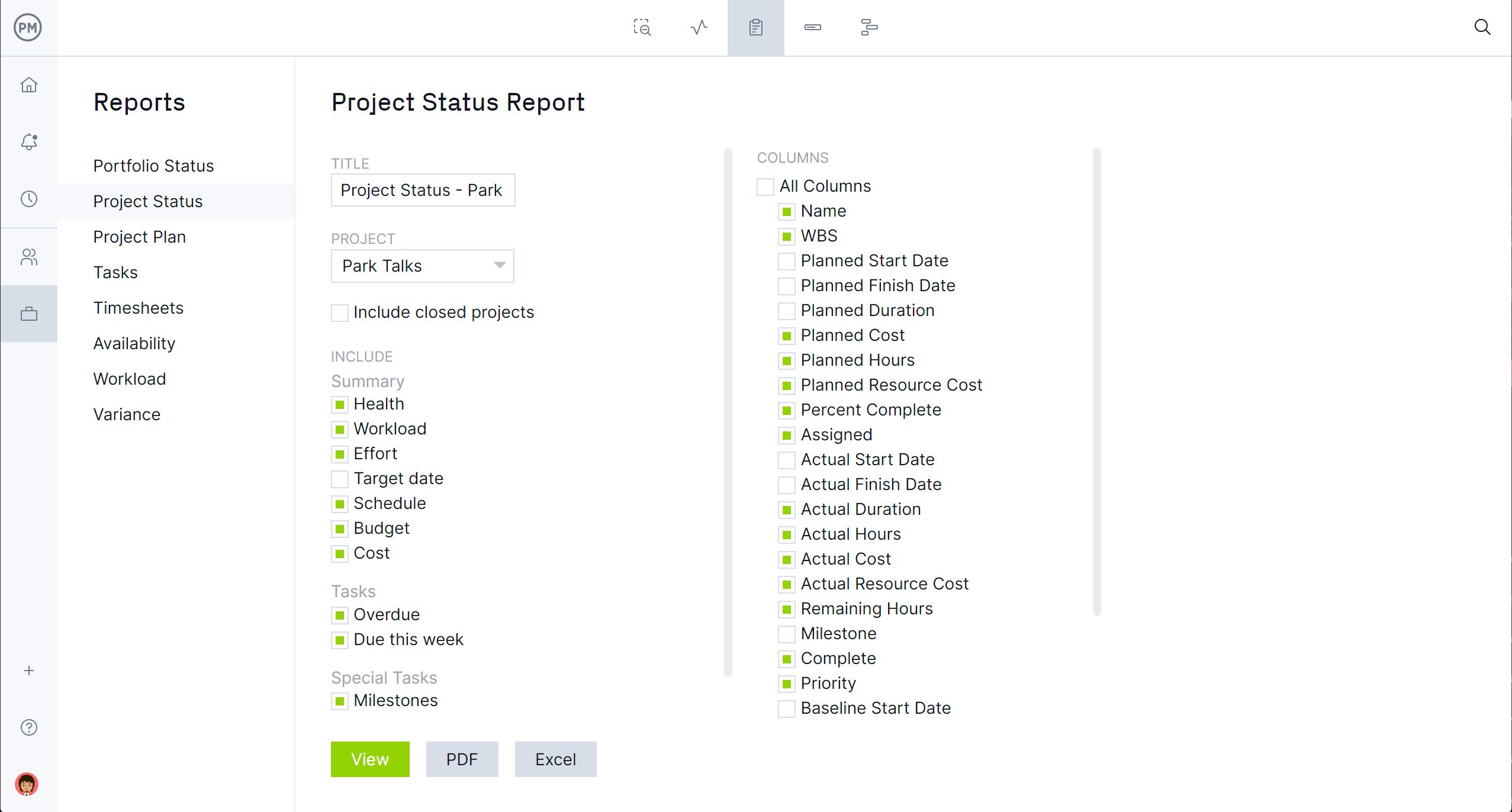

The operations plan covers what makes your business run. It explains the day-to-day workflows for your business and how you will deliver the product or service that you offer. As part of your plan, it’s your chance to describe what you’ve set up so far and that you understand what is still left to make your business fully operational.

- How to write about business operations

Like some of the other sections in your plan, the information you include fully depends on your type of business. If you run a subscription box service you’ll need to cover how you source and fulfill each order. If it’s a service-oriented business (like a mechanic or coffee shop) you’ll need to go into more detail about your location as well as the tools and technology you use.

The important thing is that the information here fully addresses how your business runs.

What to include in your operations plan

The components of your operations plan fully depend on what’s necessary to produce your product or service. For most, you’ll be adding details about your location and facilities, the technology being used, and any equipment or tools.

Location and facilities

The information you include about your business location fully depends on the state, city, and neighborhood you’ve chosen. This will determine the specific taxes, registration, licenses, permits, zoning laws, and other regulations you’ll be subjected to.

Once you’ve legally established your business be sure to reference the relevant paperwork and legal documentation in this section. You may also want to point to mockups of the building, copies of legal agreements, and any other supporting documentation for how valuable the property is and how it helps your business function.

Sourcing and fulfillment

How will you create your product/service and what will it cost? You’ll include detailed breakdowns in your financial plan, but here you’ll talk about what it will take, who you will work with, and any alternatives.

How and when to write about technology

Is your product or service driven by a specific technology or process? Let investors, banks, or other necessary parties know why it’s a valuable part of your business.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- Why you need an operational plan

Understanding your business operations makes your processes real. It ensures that you have organized steps in place to produce a product or service.

For investors, this helps prove that you know what you’re doing and can back up the rest of your plan with actual work that makes it happen. For you as a business owner, it’s a starting point for optimization. You have a blueprint for how things work. And as you run your business, can begin to identify opportunities for improvement.

If you don’t cover operations as part of your business plan, then you’re flying blindly. There’s no documented process for how things should work and no connection to the other strategic elements of your business.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Kody Wirth is a content writer and SEO specialist for Palo Alto Software—the creator's of Bplans and LivePlan. He has 3+ years experience covering small business topics and runs a part-time content writing service in his spare time.

.png?format=auto)

Table of Contents

- What to include

Related Articles

10 Min. Read

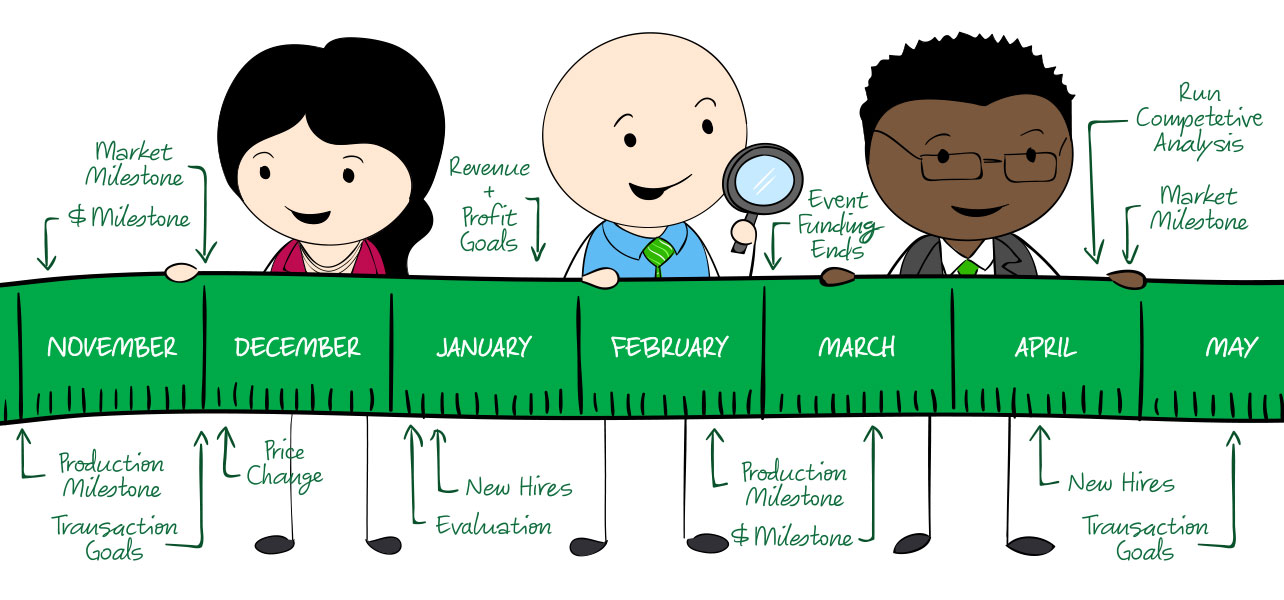

How to Set and Use Milestones in Your Business Plan

6 Min. Read

How to Write Your Business Plan Cover Page + Template

3 Min. Read

What to Include in Your Business Plan Appendix

How to Write a Competitive Analysis for Your Business Plan

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Business Plan Operational Plan - Everything You Need to Know

Welcome to our comprehensive guide on the business plan operational plan. A fundamental component of any effective business plan and a key component of growth As a business owner, executive, or manager, you understand that a well-articulated strategy is crucial for the success and growth of your venture. But have you ever stopped to ponder how this strategy is executed on a day-to-day basis? How do we transform those lofty goals into tangible, everyday actions? This is where an operational plan comes into play. An operational plan outlines the practical details of how your business will operate and deliver on its strategic goals. It describes the inner workings of your business, detailing everything from your daily operations and production processes to your team's roles and responsibilities. In this guide we will delve into the purpose and scope of an operational plan, its essential elements, and how to develop one effectively. We'll also share valuable tips, best practices, and common pitfalls to avoid.

Table of Contents

- Operational Plan - The Purpose

- The Essential Elements

- Description of Operations

- Steps for Creating Operational Plan

- Tips & Best Practices

Real-Life Case Study

- Common Pitfalls

- Final Thoughts

Business Plan Operational Plan - The Purpose

The role of an operational plan in a business cannot be overstated. This fundamental document is a strategic guide that outlines the direction, timelines, and resources necessary to achieve specific objectives within an organisation. An operational plan is the driving force behind the execution of your business strategy. It allows you to map out clear and attainable operational goals that align with your overall strategic objectives, breaking them down into manageable, actionable steps. Whilst acting as a map for your business you can also use to track performance via measurable objectives.

Scope of an Operational Plan in Day-to-Day Operations

The business plan operational plan should detail key elements such as the operational processes, resource allocation, tasks, and timelines. From personnel and location to inventory, suppliers, and operating hours - the operational plan touches every aspect of your business. It's a living document, evolving and changing as your business grows and adapts to market dynamics and industry trends.

Remember, the opening of your Executive Summary sets the tone for the entire document. Make it memorable and compelling to encourage the reader to continue exploring.

Business Plan Operational Plan - The Essential Elements

Creating an operational plan requires thoughtful consideration of several vital components that collectively represent the full breadth of your company's operations. Each one plays a crucial role in defining the day-to-day activities that will lead to the fulfilment of your strategic objectives.

Description of the Business Operations

Every operational plan starts with a comprehensive description of the business operations. This includes outlining your production process, operations workflow, and supply chain management. Defining these processes in clear terms provides a concrete vision of how products or services will be created and delivered, identifying the necessary resources and potential bottlenecks along the way.

People are the lifeblood of your business, and it's essential to define their roles and responsibilities within the operational plan. This involves outlining the team's structure, detailing who is responsible for what, and defining key performance indicators (KPIs) for each role. By assigning clear responsibilities, you ensure the efficient use of human resources and promote accountability.

Your business location and the physical resources at your disposal play a crucial role in your operational plan. Detail the premises your business will operate from, the equipment required, and any associated costs. Whether you're operating from a single office, managing multiple retail outlets, or running a home-based online business, defining your operational space is crucial.

Effective inventory management is crucial for maintaining smooth operations, particularly for businesses dealing with physical products. Your operational plan should outline how you will manage your supplies, including how often you'll restock, which vendors you'll use, and how you'll handle storage and distribution. Remember, balancing supply with demand is key to avoiding unnecessary costs or stockouts.

Your operational plan needs to address your suppliers - who they are, what terms and agreements you have with them, and how you will manage these relationships. The reliability and quality of your suppliers can greatly affect your operations, making this a critical consideration in your planning process.

When constructed effectively, these elements come together to form an operational plan that is clear, comprehensive, and actionable. In the next section, we'll explore the steps to develop such a plan, and later, we'll offer some tips and best practices for bringing your operational plan to life. Stay tuned! Looking an industry specific guide to business plans, then check out our business plan guides homepage .

Steps for Developing an Operational Plan

Creating a comprehensive and effective operational plan involves careful planning, clear communication, and continuous monitoring and evaluation. Let's explore these steps in detail:

- 1. Setting Clear Operational Goals and Objectives: The first step towards developing an operational plan is defining what you want to achieve operationally within a given period. These goals should align with your strategic business objectives and be specific, measurable, attainable, relevant, and time-bound (SMART).For instance, if your strategic goal is to increase market share, your operational objective might be to ramp up production by a certain percentage within the next quarter. Or, if you aim to improve customer satisfaction, you might focus on improving the quality and durability of the product.

- Regular Monitoring and Evaluation: With your operational goals in place, the next step is to monitor progress and evaluate performance regularly. Key Performance Indicators (KPIs) and metrics should be set for each operational goal. These could range from production volumes and delivery times to quality measures and cost efficiency.Consistently monitoring these metrics allows you to measure progress, identify any potential issues or bottlenecks early on, and adjust your operational plan as necessary.

- Communication: This is a crucial when implementing your operational plan. Ensure all stakeholders, including team members, suppliers, and partners, are aware of the plan and understand their roles within it.Hold regular meetings to update everyone on progress and address any challenges or changes in the plan. Remember, your operational plan should be a living document, flexible enough to adapt to changes and updates as required.

Business Plan Operational Plan - Tips and Best Practices

Creating an operational plan that works requires more than just defining goals and setting performance metrics. There are nuances and best practices that can significantly enhance the effectiveness of your operational plan. Here are a few tips to guide you:

- Involve Your Team : The people responsible for executing the operational plan should also contribute to its creation. Encourage your team to share their ideas, challenges, and insights. Their first-hand experience can lead to more practical, achievable operational plans. Besides, team involvement promotes ownership and commitment to the plan's execution.

- Keep It Flexible : Operational plans need to be adaptable to accommodate changes in the business environment, such as market dynamics, customer preferences, or new regulations. Regularly review and update your plan to ensure it remains relevant and effective. Remember, the operational plan is a guide, not a set-in-stone document.

- Be Specific : Avoid ambiguity in your operational plan. Use clear, concise language and provide detailed action plans, including what needs to be done, by whom, when, and with what resources. This clarity reduces misunderstanding and keeps everyone on the same page.

- Use Technology : Leverage the power of technology to enhance your operational efficiency. There are numerous tools and software available that can help with project management, process automation, data analysis, and more. Use these tools to streamline your operations, track performance, and improve communication.

- Consistency with the Business Plan : Ensure your operational plan aligns with your broader business strategy. This alignment ensures that your day-to-day operations contribute effectively to achieving your long-term business objectives.

By applying these tips and best practices, you can create an operational plan that's not only effective but also fosters a culture of continuous improvement and strategic alignment in your organisation.

To further illustrate the importance of a well-executed operational plan, let's look at a real-life case study - the global tech giant, Apple Inc. Apple's operational plan is a testament to the company's relentless focus on precision, quality, and groundbreaking innovation. One key operational strategy that Apple uses is its tight control over its supply chain.

- Description of Business Operations: Apple's business operations are highly integrated and efficient. They manufacture and market a variety of products, including iPhones, iPads, Macs, and services like iCloud and Apple Music. Their production process is complex, involving design, prototyping, manufacturing, and distribution, often happening across different continents.

- Personnel: Apple's workforce is highly specialised. Each team and department has clearly defined roles and responsibilities, whether it's designing new products, managing supplier relationships, or ensuring quality control. Employees at Apple are encouraged to think differently, fostering a culture of innovation.

- Location: Apple operates in multiple locations worldwide, including its iconic headquarters, Apple Park, in Cupertino, California. The company also has a network of retail stores across the globe and contracts with manufacturing facilities, primarily in Asia.

- Inventory: Apple's inventory management is legendary for its efficiency. Through just-in-time inventory practices, Apple reduces storage costs and minimises the risk of stock obsolescence, contributing to its streamlined operations and impressive profit margins.

- Suppliers: Apple has a vast network of suppliers from around the world. It maintains strong relationships with these suppliers and holds them to strict standards of quality and ethical business practices, ensuring the integrity and excellence of its products.

Apple's operational plan aligns seamlessly with its business strategy, focusing on innovation, quality, and customer experience. This has allowed the company to maintain its status as a market leader and pioneer in the tech industry. This case study illustrates how an effective operational plan can turn a strategic vision into a successful reality. In the next section, we'll delve into common pitfalls to avoid when creating your operational plan.

Common Pitfalls to Avoid

As you embark on developing an operational plan for your business, it's crucial to be aware of some common pitfalls that can hinder your plan's effectiveness. Here, we outline these potential obstacles and provide advice on how to avoid them.

- Lack of Alignment with Strategic Goals: One of the most common mistakes is a disconnect between the operational plan and the company's strategic goals. Your operational plan should directly support and drive towards achieving these objectives. Ensure all operational goals, processes, and tasks align with your overarching business vision.

- Overly Complex or Unrealistic Plans: While an operational plan needs to be comprehensive, it also needs to be practical and achievable. Avoid creating overly complex plans that your team cannot implement or that require resources beyond your means. Strike a balance between thoroughness and simplicity for a more manageable plan.

- Neglecting to Involve the Team: Your team members are the ones who will execute the operational plan, and neglecting to involve them in its creation can lead to resistance or confusion. Make sure your team is part of the planning process, understands the plan, and is committed to its implementation.

- Ignoring Market Changes: A business doesn't operate in a vacuum. Failing to consider external factors such as market trends, customer behaviour, and economic conditions can derail your operational plan. Ensure your plan is flexible and adaptable to respond to changing circumstances.

- Insufficient Monitoring and Evaluation: An operational plan is not a set-and-forget document. Regular monitoring and evaluation are critical to assess progress, identify bottlenecks, and make necessary adjustments. Make sure you set measurable KPIs and allocate resources to track and review them.Avoiding these common pitfalls will significantly enhance the effectiveness of your business plan operational plan. With a solid operational plan in place, your business is well-positioned to achieve its strategic objectives, driving growth, and success.

Wrapping It All Up

Operational planning plays a vital role in any business, acting as a roadmap to direct daily operations and align them with the strategic goals of the company. As we have seen in this blog post, creating an operational plan involves several important components and steps, from defining clear goals to continuous monitoring and evaluation. Remember, the key to an effective operational plan is to keep it flexible, involve your team and maintain alignment with your business plan. If you implement those principles and regularly review and update you will have set a solid foundation for future business growth. We wish you all the best on your operational planning journey, and remember - every step you take towards detailed and thoughtful planning is a step towards long-term success and growth for your business. If you require any further help on other sections of your business plan, visit our Learning Zone for several in-depth guides.

Business Plan Operational Plan - Frequently Asked Questions (FAQs)

To wrap up this guide, let's address some frequently asked questions about operational plans in business.

- What is the difference between a strategic plan and an operational plan? A strategic plan outlines a company's long-term vision, objectives, and strategies for achieving those objectives. It's a high-level roadmap for the direction the company intends to go. On the other hand, an operational plan details the day-to-day activities and resources necessary to achieve the strategic goals. It's the 'action plan' that brings the strategic plan to life.

- How often should an operational plan be reviewed? The frequency of review may vary depending on your business size, type, and industry, but generally, it is a good idea to review your operational plan at least quarterly. The regular review ensures that the plan is still relevant and effective, allowing for adjustments as business conditions change.

- How long should an operational plan be? There is no set length for an operational plan, as it will depend on the complexity of the operations. It needs to be comprehensive enough to cover all operational aspects of the business but concise enough to be understandable and manageable.

- Who is responsible for creating an operational plan? While the business owner or top management usually leads the creation of an operational plan, it should involve input from all levels of the organisation. Each department or team can provide valuable insights into their operations, challenges, and opportunities, leading to a more realistic and effective plan.

- How can I measure the success of my operational plan? The success of an operational plan is measured by how effectively it helps achieve the strategic objectives. Regular monitoring of Key Performance Indicators (KPIs) related to your operational goals will provide a clear indication of your plan's success. If these KPIs are consistently met, your operational plan is likely successful. If not, adjustments may be needed.

- Travel & Expense Management Software

- Employee Tax Benefits

- Branch Petty Cash

- FleetXpress

- Prepaid cards

- World Travel Card

- Customer Speaks

- Press Release

- Partner with us

Operating Cost: What is it, How to Monitor, Adjust & Calculate It?

Table of Contents

Introduction

Operating cost is a company’s expense to keep its operations running smoothly.

Operating costs are a monetary representation of what it takes to run a business. Wages, daily expenses, and various other costs are a part of it. These costs impact profitability, pricing, and a company’s growth strategy.

This article will demystify operating costs and highlight why they’re more than just numbers on a spreadsheet. Dive in to grasp the heart of your business’s financial plan .

Read More: Variable Cost: Definition, Types, Formulas, Calculations and Examples

What are operating costs?

Operating costs are the expenses businesses face daily. They cover everything a company needs to function, from employee salaries to rent.

Think of them as the bills a business must pay to keep running. By managing these costs, a business can succeed. They differ from capital expenses and one-time purchases like machinery or real estate.

These costs are pivotal in helping organizations make informed decisions to thrive. From a higher level view, it’s somewhat the backbone of an effective financial strategy.

Read More: Prepaid Expenses: Definition, Importance, Types & Examples

Understanding operating costs in detail

Operating costs are the silent players in the backdrop, influencing profitability and sustainability. Every time a company pays for utilities, rents a space, or processes paychecks, it’s tapping into its operating costs. These aren’t one-off purchases; they recur month after month.

To effectively manage these expenses, one must categorize them. Some fixed costs, like rent, remain constant irrespective of the company’s output. Others vary with production, such as raw materials. These fluctuating costs can increase or decrease based on how much a company produces.

Then, there are tricky semi-variable costs. A good example is electricity. A factory might use a baseline amount for basic operations, but as production ramps up, more power is consumed. It’s a mix of fixed and variable.

Operating cost vs. operating expense

Simply put, operating expenses are one part of operating costs. Operating expenses refer to costs an organization generates that don’t relate to the production of its products. On the other hand, operating costs are every cost you incur to run your business or perform revenue-generating activities.

Operating costs provide a clearer picture of a business’s financial standing. Knowing which costs can be trimmed during lean times and which remain constant helps in budgeting and forecasting . And it’s not just about cutting costs; it’s about optimizing them.

Types of operating costs

When we talk about operating costs, it’s not a one-size-fits-all concept. Different types exist, and each has its unique characteristics. Let’s break them down.

- Fixed costs remain unchanged no matter how much a business produces. Think of monthly rent or salaries for permanent staff; they don’t fluctuate with production levels.

- Variable costs change based on production. If a company manufactures more products, the cost of raw materials, for example, will rise. When production decreases, so do these costs.

- Semi-variable costs stand in the middle. They contain elements of both fixed and variable costs. Consider an electricity bill at a factory. A base fee is always present, but the more machines you run, the higher the bill.

- Direct costs can be directly attributed to a specific product or service. If you make shoes, the leather and laces are direct costs.

- Indirect costs aren’t linked to a specific product. Office supplies, general utilities, and administrative salaries fall under this category. They support the overall business operations but can’t be pinned to one product.

Understanding these categories allows businesses to make smarter financial decisions. They can predict how costs will change with production shifts, leading to more accurate budgeting and planning.

Learn More About: Explicit Cost: Definition, Types, Calculations and Examples

Difference between operating costs and other types of business expenses

Read More: What is Prime Cost? Formulas, Calculations and Applications

Components of operating costs

Understanding the elements of operating costs makes companies aware of their financial health. They can optimize operations and boost profitability with a clear picture of where money flows.

- Salaries and wages : This is the money businesses pay to their employees. Whether hourly wages or monthly salaries, it’s a significant chunk of operating costs.

- Rent or lease payments : Many companies operate from rented spaces. This regular payment keeps the doors open for operation.

- Utilities : These include electricity, water, gas, and the internet. Like a household, businesses need these essentials to function smoothly.

- Raw materials and supplies : If you’re manufacturing a product, you need raw materials. For service industries, this could be office supplies or software subscriptions.

- Maintenance and repairs : Machines break, and spaces deteriorate. Keeping everything in working order is crucial.

- Marketing and advertising: Businesses invest in marketing campaigns, advertisements, and promotions to attract customers.

- Travel and transportation: This covers expenses related to business trips, vehicle maintenance, or delivery costs.

- Insurance : To safeguard against risks, businesses pay for various insurance policies, from property to liability.

- Taxes and licenses : Operating legally means paying taxes and securing necessary permits and licenses.

- Depreciation : While not a direct outlay of cash, accounting for the decrease in the value of assets is essential.

- Miscellaneous expenses: Every business faces unexpected costs. This category catches those unpredictable expenses that don’t neatly fit elsewhere.

Operating cost formula

The operating cost formula helps companies determine how much they spend to keep the wheels turning. At its core, the formula is straightforward.

Operating Cost = Cost of Goods Sold (COGS) + Operating Expenses

But, why is this formula crucial?

It provides clarity. A business can see where its money goes and how expenses shift with production changes. With these insights, strategies can be tweaked, costs minimized, and profits maximized.

How to calculate operating costs?

Let’s unpack the operating cost formula.

Operating Cost = Cost of Goods Sold (COGS) + Operating Expenses.

Start with the cost of goods sold (COGS). It represents the total cost of producing the goods a business has sold. It includes material costs, direct labor, and other direct costs tied to production. For instance, if you’re making shirts, the fabric, buttons, and wages of the workers crafting those shirts contribute to the COGS.

Next, consider the operating expenses. These costs don’t directly tie into production but are essential to running the business. Think of them as the backdrop costs. Rent for the office space, salaries for administrative staff, marketing expenses, and utilities all fall here. They’re the backbone expenses that support a business in its daily operations.

Next, it is time for some simple math. Once you’ve identified and summed up your COGS and operating expenses, just add them. The result gives you the total operating cost.

For a clearer picture, imagine a bakery. The flour, sugar, and labor to bake the cakes and cookies from the COGS. The rent for the bakery space, the electricity bill, and the cashier’s salary represent the operating expenses. You’d add these two components together to get the total operating cost.

Quick Read: What are Business Expenses: A Complete Guide

Example of operating costs for digital businesses

Let’s look at the flip side. Software businesses may not have many physical costs, but they too have operating costs, as follows:

- Server costs: Hosting their website or app is a priority. They regularly pay for cloud services or data centers.

- Software licenses: Every software tool has a price tag, from project management platforms to graphic design tools.

- Employee benefits: Beyond just salaries, the startup offers health insurance, retirement contributions, and gym memberships.

- Digital marketing: To grow their user base, they invest in online ads, social media campaigns, and email marketing tools.

- Freelancers and consultants: A young startup might not have all the expertise in-house. So, they hire external professionals for specific projects.

- Co-working spaces: Initially, many startups opt for flexible co-working spaces over traditional offices to save costs and foster networking.

- Training and development: They fund courses and workshops to keep their team updated with the latest technology and industry practices.

- Transaction fees: If their app involves financial transactions, there are charges associated with payment gateways and bank services.

- Customer support tools: Engaging with users requires platforms for chat support, ticketing, and feedback collection.

- Research and development : Innovating means investing. The startup allocates funds to explore new technologies or improve their current services.

Importance of managing operating costs

Managing operating costs isn’t just a financial task; it’s pivotal to a business’s survival and growth. Here’s why it’s so crucial:

- Ensures profitability . Businesses can maximize profits when they reduce operating costs. It’s simple math: higher expenses eat into potential profit margins.

- Drives competitiveness. In a market teeming with rivals, cost-efficient operations can give businesses an edge. They can price products or services more competitively, luring in more customers.

- Prevents wastage. Regularly reviewing and managing costs brings wasteful expenditures to light. Be it excess inventory or an underutilized subscription, money saved is money earned.

- Fosters stability. Consistent monitoring of operating costs helps businesses weather financial storms. In lean times, a company that’s streamlined its costs stands a better chance at survival.

- Encourages growth. Reinvesting saved money into the business can drive expansion. Perhaps it’s opening a new branch, launching a product line, or entering a new market.

- Aids in decision-making. Businesses can make more informed strategic choices with a clear picture of their costs. It’s about knowing where to cut back and where to invest.

Quick Read: SG&A Selling, General and Administrative Expenses

Strategies for reducing operating costs

Reducing operating costs is an art that every successful business owner must master. Let’s explore some strategies to achieve this.

- Negotiate with suppliers. Building strong relationships with suppliers can lead to better deals. It’s a win-win: they retain a loyal customer, and you enjoy discounted rates.

- Embrace technology. Automation can replace manual tasks, speeding up processes and cutting labor costs. Software solutions can manage inventory, handle accounting, or streamline customer interactions more efficiently.

- Outsource when beneficial. Sometimes, outsourcing certain tasks is cheaper and more efficient than keeping them in-house. Think of customer support, content creation, or IT support.

- Review contracts regularly. Staying on top of contracts, like leases or service agreements, ensures you’re not overpaying. Look for renegotiation opportunities or consider switching providers.

- Implement energy-saving measures. Switch to LED lights, invest in energy-efficient appliances, or encourage remote work to reduce utility bills.

- Cross-train employees. When staff can handle multiple roles, it offers flexibility. It means during busy times or staff shortages, you won’t need to hire temporary help.

- Encourage remote work. Renting office space is expensive. By fostering a remote work culture, businesses can downsize physical offices and save on overheads.

- Bulk buy. Purchasing items in bulk usually comes at a discount. But it’s a balancing act – ensure you’re not overstocking perishable items.

- Regularly review expenses. Setting aside time each month to scrutinize expenses can highlight areas for potential savings. Sometimes, it’s the small, unnoticed costs that accumulate.

As the saying goes, “A penny saved is a penny earned.” These saved pennies can pave the way for a brighter financial future in the business world.

Quick Read: Incidental Expenses: What is it, Importance, Types and Examples

Technology’s role in managing operating costs

Embracing technology is about more than staying current. It’s a strategic move that can drastically cut operating costs, streamline processes, and offer better value to customers. For businesses eager to thrive in a modern marketplace, leveraging technology’s offerings is less of a choice and more of a necessity.

Technology can take over repetitive jobs. The software handles invoicing , data entry, and even customer communications, trimming labor costs. Advanced algorithms schedule staff or manage inventory more efficiently. It reduces idle time and ensures resources are used to their fullest.

Tools like video conferencing and project management software make remote work seamless. Businesses can save on office space, utilities, and commuting allowances. Moreover, data analytics tools provide insights into spending patterns. Companies can spot inefficiencies and address them promptly.

Below are some notable ways technology helps manage operating costs.

- Digital documents and signatures reduce the need for printing

- Technology-enabled supply chains track products from manufacture to delivery, reducing wastage and ensuring timely deliveries.

- Cloud storage and software-as-a-service (SaaS) models cut IT infrastructure and maintenance costs.

- Digital marketing tools analyze consumer behavior, helping businesses tailor their campaigns more effectively

Learn About: Selling Expenses: What is it, Types, Calculations, Examples & Tips

Monitoring and adjusting operating costs

Staying vigilant about operating costs isn’t a one-time effort. It’s an ongoing process of observation, analysis, and adjustment. By keeping their finger on the pulse, businesses ensure they’re always moving forward, making the most of every dollar spent.

Businesses should know their standard operating costs. Having clear benchmarks allows for easier tracking of any deviations. You can leverage accounting tools that can provide real-time insights. These tools flag unusual expenses or highlight patterns that might go unnoticed manually.

An in-depth review of finances, preferably monthly or quarterly, can unearth discrepancies. It’s a chance to delve deep and uncover hidden drains of resources. External factors like economic downturns or supply chain disruptions require swift adjustments. Proactively reducing costs in anticipation can prevent more significant financial setbacks.

As technology evolves, newer and more cost-effective solutions emerge. Staying updated on these developments helps organizations better monitor and adjust operating costs for more profitability.

What is the difference between operating costs and capital expenses?

Read More: Capital Expense (CapEx) vs. Operating Expense (OpEx)

Long-term vs. short-term operating costs

Remember, understanding both types of costs helps in effective financial planning. Adjusting one can sometimes offset the other. Balance is key.

Long-term operating costs

- These costs stretch over a long period.

- You can’t avoid them easily.

- Examples include building maintenance and long-term equipment leases.

- Planning for these is crucial.

- They provide insight into a business’s financial health over the years.

Short-term operating costs

- These costs come and go quickly.

- Paying them is often a monthly or quarterly obligation.

- Think about utility bills or short-term software subscriptions.

- Businesses need to manage them regularly.

- Short-term costs impact immediate cash flow.

Operating cost vs. non-operating cost

The difference between operating and non-operating costs is similar to what we discussed while comparing operating costs and other business expenses. Here’s a brief overview:

Operating cost on income statements

On an income statement , operating costs hold a spotlight. Starting with revenues at the top, the income statement deducts operating costs to arrive at the operating profit.

First, let’s talk about revenues. They’re the earnings generated from selling goods or services. Once the direct costs of producing these goods or services, like raw materials and direct labor (often termed “ cost of goods sold ” or COGS), get subtracted, we reach a figure called “gross profit.”

Following this, operating expenses come into play. These are the expenses involved in the day-to-day running of a business. Examples include rent, utilities, salaries (excluding those involved in production), and marketing expenses. These costs are essential for a business to keep its doors open and serve its customers.

We determine the operating profit after subtracting operating expenses from the gross profit. This figure is significant. It represents the core profitability of a business from its primary activities, excluding external factors like interest or taxes.

Lastly, it’s worth noting that the income statement will also list non-operating expenses or incomes. These arise from events or decisions outside the core operations.

Limitations of operating costs

Below are some notable limitations of operating costs.

- Short-term focus. Operating costs mainly focus on immediate expenses, potentially overshadowing a business’s long-term financial health.

- Misleading analysis. Solely evaluating a company based on operating costs might provide a skewed picture. Sometimes, high expenses arise from critical, long-term investments.

- Seasonal variations. Operating costs can fluctuate based on the time of year, and using them without context might not offer an accurate annual performance snapshot.

- Inconsistencies across businesses . Only some companies classify operating costs similarly, complicating direct comparisons within an industry.

- Vulnerability to external factors . Elements like inflation or sudden market shifts can artificially inflate these costs, potentially causing undue alarm without a broader context.

Read More: Accounting Principles: A Comprehensive Guide 2023 – 2024

Best practices for managing operating costs

Although calculating operating costs differ for organizations, there are a few best practices you can follow to increase profitability and your business’ bottom line.

- Monitor regularly. Keep a close eye on operating costs to identify unusual spikes or drops. Adjustments can be more effective when made proactively.

- Improve operational efficiency. Implement lean management principles to optimize processes, eliminate waste, and use resources effectively.

- Invest in technology. Adopting modern tools and systems can automate tasks, reduce manual errors, and streamline operations, ultimately reducing costs.

- Train employees. Train staff to enhance their skills, ensuring efficient performance and reducing costly mistakes.

- Create feedback loops. Encourage feedback from employees at all levels. Frontline staff often have firsthand insights into where costs can be minimized without compromising quality.

Read More: Payroll Expense: A Comprehensive Guide for 2023

Bottom line

Operating costs illuminate the health of daily operations, painting a vivid picture of a company’s efficiency. It’s not just about the numbers but their story regarding sustainability, adaptability, and profitability.

You can navigate challenges with agility and proficiency in managing operating costs. Cut down unnecessary expenses but ensure quality and growth don’t take a back seat while you’re at it.

Operating costs in business are the expenses related to the day-to-day operations.

Operating costs directly affect a company’s profitability because higher costs decrease profit margins, whereas lower costs can enhance them.

Fixed operating costs can be reduced by renegotiating contracts, streamlining operations, or outsourcing services.

Variable operating costs change proportionately with business activity; as output or sales increase, these costs rise and vice versa.

Semi-variable operating costs contain fixed and variable components, changing in relation to business activity but not always at a constant rate.

Reducing operating costs can impact product quality or customer service if cuts compromise essential production or service delivery aspects.

Technology is pivotal in managing operating costs by automating processes, improving efficiency, and providing real-time data for better decision-making.

Businesses balance short-term cost-cutting with long-term growth by ensuring immediate savings don’t hinder future opportunities or damage brand reputation.

Operating costs should be monitored continuously and adjusted as necessary to respond to changes in the business environment and strategic goals. Monthly or quarterly review is a reasonable frequency.

Industries with high capital requirements, volatile raw material prices, or regulatory compliance demands, such as aviation, healthcare, and oil and gas, often find operating costs more challenging to control.

Operating costs directly impact a company’s financial health; high costs can erode profit margins, affecting liquidity and long-term viability, while well-managed costs can enhance profitability.

Energy-efficient practices can lower operating costs by reducing energy consumption, leading to savings on utility bills and potential tax incentives or rebates.

Cutting operating costs too aggressively can risk product quality, employee morale, and customer satisfaction and hamper future growth or innovation capacity.

Outsourcing certain services can help reduce operating costs by shifting labor, infrastructure, or other costs to third-party providers, often in locations with lower cost structures.

Companies like Southwest Airlines and Toyota have successfully managed their operating costs; Southwest kept its operations simple and standardized its fleet, while Toyota implemented the lean production system to increase efficiency and reduce waste.

Related Posts:

- Variable Cost: Definition, Types, Formulas,…

- What Is Cost Accounting? Types, Objectives, Methods…

- Financial Planning: What is it, Types, Objectives,…

- Financial Analysis: What is it, Types, Objectives,…

- Explicit Cost: Definition, Types, Calculations and Examples

- Unit Cost: What is it, Types Formula, Calculation…

Expense Ratio: What is it, Components, Formula and How to Calculate?

Discussion about this post, table of contents toggle table of content toggle, related articles, get started with happay now.

If you are looking to understand how our products will fit with your organisation needs, fill in the form to schedule a demo.

Schedule a demo

© 2023 Happay

Welcome Back!

Login to your account below

Remember Me

Retrieve your password

Please enter your username or email address to reset your password.

From Idea to Foundation

Master the Essentials: Laying the Groundwork for Lasting Business Success.

Funding and Approval Toolkit

Shape the future of your business, business moves fast. stay informed..

Discover the Best Tools for Business Plans

Learn from the business planning experts, resources to help you get ahead, startup & operational costs, table of contents, introduction.

Data from reputable organizations like the U.S. Chamber of Commerce and Kaufman Foundation reveal a sobering truth: a significant number of businesses falter and fail within their first few years. One of the critical reasons behind this high failure rate is an inadequate understanding of startup and operating costs. Businesses often stumble due to undercapitalization, inefficient budgeting, and unrealistic financial planning, directly linked to a lack of comprehensive startup and operational cost analysis.

By offering a detailed exploration of startup and operating costs, we aim to equip you with the knowledge and tools necessary for accurate financial assessment and planning. This step is about fostering a deep understanding of the financial framework your business operates within.

With this comprehensive guide, you’ll gain the insight needed to make informed decisions, set realistic budgets, and price your products or services appropriately. Ultimately, this understanding can be the difference between a business that merely survives and one that thrives. As we move forward on this detailed roadmap, prepare to arm yourself with knowledge that will crucially impact the longevity and success of your venture.

Pro Tip:

Review ‘Operations in Detail’: If you haven’t thoroughly examined the ‘Operations in Detail’ step or need a refresher, it’s essential to revisit this step. Understanding the operational aspects of your business is critical before you can accurately assess the financial implications.

Understanding Costs

Challenges in startup finance.

Navigating the financial aspects of starting a business is a complex task, often riddled with challenges that can significantly impact the success and sustainability of the venture. In this step, we address some of the most common financial hurdles entrepreneurs face and provide guidance on how to overcome them.

Key Takeaways: Financial Hurdles

- Undercapitalization: Many startups underestimate the capital required to launch and sustain their business until it becomes profitable. This oversight can lead to a cash flow crisis, with the business running out of money prematurely.

- Inadequate Budgeting: A clear understanding of cost structures and operating expenses is vital. Without it, creating an accurate budget is challenging, often leading to over or underspending in critical areas.

- Pricing Issues: Properly setting prices for products or services is crucial. Misjudging costs can result in uncompetitive pricing or, worse, selling at a loss.

- Poor Financial Planning: Comprehensive knowledge of startup and operating costs is essential for realistic financial projections, crucial for effective decision-making and strategic planning.

- Difficulty in Securing Funding: Detailed financial plans and cost analyses are typically required by investors and lenders. Inability to provide this information can make securing necessary funding challenging or, more likely, impossible.

- Operational Inefficiencies: Without a clear grasp of operating costs, identifying areas for cost reduction or efficiency improvements can be difficult, leading to wasteful practices.

- Risk of Business Failure: Ultimately, a lack of understanding of the full financial picture significantly raises the risk of business failure, particularly in the crucial early stages of operation.

Categories of Startup Costs

Your startup costs is the capital you spend before you open your doors to customers and can be broadly categorized into assets, expenses, and working capital, each with its own set of subcategories. It’s crucial to consider various aspects like lease vs. buy decisions, supply ordering strategies, and staffing choices. The following gives an overview of of startup assets, expenses, and working capital:

Startup assets for a pre-revenue startup are the tangible and intangible resources acquired to create a foundation for the business’s operations and growth. These assets include physical items like equipment and inventory, as well as intellectual properties and digital assets, which provide long-term value and contribute to the startup’s capability, unlike startup expenses that are consumed or depleted through the initial setup. Subcategories for startup assets often include:

Tangible Assets

- Real Estate: Land and buildings.

- Equipment: Machinery, computers, office equipment.

- Vehicles: Cars, trucks, or vans used for business purposes.

- Furniture and Fixtures: Desks, chairs, lighting, shelving.

- Inventory: Stock of products for sale.

- Equipment: Computers, tablets, servers, displays, phones, printers.

- Safety and Security Equipment: Surveillance cameras, alarms.

Intangible Assets

- Brand and Intellectual Property: Trademarks, patents, copyrights.

- Software and Technology: Custom software, tech tools, digital assets.

- Goodwill: Value attributed to acquiring a brand, its reputation, and its customer relationships.

- Non-Standard Licenses and Permits: Specific industry-related licenses where the license has a value if the business was sold (e.g., liquor license, cannabis license).

Other Assets

- Refundable Deposits: Security deposits for utilities or rent.

Expenses:

Startup expenses for a pre-revenue startup are the initial outlays necessary to establish and prepare the business for operation, including legal and administrative setup, securing a location, initial marketing, and workforce preparation. Unlike startup assets, which are tangible and intangible items of value the business owns, these expenses are one-time costs primarily aimed at setting up the business infrastructure and operational framework, without residual value or future liquidity. Examples of common startup expense subcategories include:

Legal and Administrative Expenses

- Legal Fees: Costs for legal advice, company registration, incorporation, patents, and trademarks.

- Licenses and Permits: Fees for obtaining necessary legal permissions to operate.

- Business Planning: Expenses for developing business strategy, model, and plans.

- Consultancy Fees: Expenses for professional services like business consultants, accountants.

Location and Infrastructure Setup

- Broker Fees: Initial payments and fees for securing a business location.

- Utility Set-Up Fees: Initial fees for setting up essential utilities like electricity, water, and internet.

Insurance and Risk Management

- Insurance Deposits: Initial deposits for various business insurance policies.

- Business Insurance Premiums for First Term: Initial premium payments for business-related insurance policies.

Marketing and Branding

- Branding: Costs for creating brand identity, including logo design.

- Initial Marketing and Public Relations: Costs for establishing initial market presence and public relations efforts.

- Website Development : Expenses for website creation, hosting, and pre-launch maintenance.

- Advertising for Launch: Pre-launch marketing and promotional activities.

Human Resources

- Training Period Salaries and Wages: Compensation for employees during training before business operation begins.

- Pre-Launch Employee Recruitment and Training Costs: Expenses related to hiring and training the initial workforce.

Research and Development

- Market Research: Costs for analyzing market trends, customer preferences, and competition.

- Prototype Development: Costs associated with creating prototypes or initial service models.

Miscellaneous Preparation Costs

- Software and Subscriptions: Pre-operational expenses for business software and service subscriptions.

- Travel and Survey Expenses: Costs associated with market surveys, business location visits, and other pre-operating travel.

Working Capital:

Working capital for a pre-revenue startup refers to the allocation of cash reserves to cover estimated monthly operating expenses (burn-rate components) and short-term liabilities, along with a buffer for contingencies. This capital is essential to support the startup’s operations through to the point of break-even or until it secures the next round of financing, such as moving from seed to Series A funding, with the amount and duration varying significantly based on the business type and strategy. Common examples of working capital allocations include:

Cash Reserves

- Initial Funding: Seed capital or initial investment funds obtained through investors, personal savings, loans, or grants.

- Emergency Fund: Additional reserve funds to cover unforeseen expenses or delays in reaching revenue-generating stages.

Monthly Operating Expenses (Burn Rate Components)

- Salaries and Wages: Monthly payroll for employees, including founders and early staff.

- Office Rent and Utilities: Monthly costs for office space, electricity, internet, and other utilities.

- Software and Subscription Services: Regular expenses for essential software, cloud services, and subscriptions necessary for operation.

- Marketing and Advertising: Monthly costs for marketing activities to build brand presence and customer awareness.

- Insurance Premiums: Regular payments for necessary business insurance policies.

- Professional Services: Fees for legal, accounting, and consulting services.

- Research and Development: Ongoing costs for product development, testing, and improvement.

Short-Term Liabilities

- Accounts Payable: Short-term debts or obligations to vendors and service providers.

- Accrued Expenses: Incurred expenses that are recorded but not yet paid.

Buffer for Contingencies

- Contingency Buffer: An additional percentage of the total working capital estimated to cover unexpected costs or delays.