RBI – Things Must Know About RBI | Complete Case Study

RBI stands for (Reserve bank of India). It is a Central bank of India that handles the total banking department purpose considering from loans to accounts, credit to debits, and monetizing to reimbursement.

RBI has four zonal offices in Mumbai, Kolkata, Delhi, and Chennai and has nineteen regional offices at Thiruvananthapuram, Patna, Nagpur, Lucknow, Mumbai, Kochi, Kolkata, Jammu, Kanpur, Chennai, Delhi, Guwahati, Bhubaneshwar, Bhopal, Hyderabad, Ahmedabad, Chandigarh, Jaipur, and Bangalore.

Table of Contents

Historical Background

When RBI was formed as a Private Bank and it was Recommended by Hilton Young Commission or The Royal Commission on Indian Currency and Finance in 1926 which recommend the establishment of a central bank.

It was established on 1st April 1935 under the RBI Act of 1934 at Calcutta as the majority of trade of EIC (East India Company) was done from Calcutta which Later on shifted to then Bombay in 1937.

RBI was formed with an initial Paid Up capital of 5 Crore Rs. RBI was Nationalized in 1949.

Preamble of RBI

“To regulate the issue of Bank Notes and keeping of the reserves with a view of securing monetary stablilty in india and Generally to operate the currency and credit system of country to its advantage” RBI – Organisation and Functions

Governors of RBI

Rbi’s financial year start’s from 1st July to 30th June

Structure of RBI

Hierarchy in rbi.

- Deputy Governors

- Executive Directors

- Principal Chief General Managers

- Chief General Manager

- Deputy General Manager

- Assistant General Manager

- Assistant Manager

- Supporting Staff

Function of RBI

1. currency.

Currency Issuing, Forfeiting, Re-Issuing, and Printing functions are completely looked after by RBI

2. Development Role

Development of the Indian Banking System and Structure is another role of RBI where it looks at the functions such as Maintaining the Cash Flow, Development of Banks, Helping the Government in issuing Bonds and Securities

3. Banker To Government

Maintaining the Account of the Government by keeping the track of Savings, and Expenses, Tracking the Assets of the Government.

Monitors the integration of Central and State Government systems with Reserve Bank’s core banking solution – e-Kuber – for direct collection of their e-receipts and making e-payments.

4. Bankers To Banks

RBI is also Known as Bankers to Banks as it provides Loans to the banks on interest decided by RBI called Repo Rate or Bank Rate (Depending on the tenure) or Keeps the Surplus at the Rate called Reverse Repo Rate.

5. Monetary Policy

To understand the monetary policy we need to understand the Inflation Concept.

Definition : A General increase in rising and fall in the purchasing value of money is called Inflation

Inflation is considered by money supply and Demand. The amount of money supplied into the market for expense also increases the Demand for money in the economy so the Inflation is going to increase similarly if money supply and demand decrease Inflation will also be decreased

It is the role of RBI to maintain the Inflation in the Country between the range of 2% to 6% for which RBI uses the Monetary Policy Tools for maintaining price stability and sustainable growth.

The monetary policy includes the amount of currency inflow in an economy which can be directly or indirectly linked with macroeconomic factors like Inflation, liquidity, overall growth of an economy and etc.

RBI Act, 1934 also provides for an empowered six-member monetary policy committee (MPC) to be constituted by the Central Government by its notification in the Official Gazette. The first such MPC was constituted on September 29, 2016.

There are 3 types of Monetary policy Stance

1. Accommodative stances

An Accommodative stance means the Central Bank or RBI wants to increase the Inflation so there will be a reduction in the Interest Rate. The Loose money policy will be implemented.

2. Neutral stances

A Neutral Stance means the Central Bank or RBI won’t make any changes and keep the growth in the same phase.

3. Hawkish stances

A hawkish stance means the Central Bank or RBI wants to reduce the Inflation so there will be an increase in the Interest Rate. The tight money policy will be implemented.

Credit Control Measures or Instruments of Monetary Policy

• CRR (Cash Reserve ratio)

CRR is a policy asked banks to deposit a certain percentage (3% – 15%) of the total amount towards RBI as a reserve. This rule is for every bank. Cause RBI provides a license to them for all transactions. The amount percentage is kept in the form of Cash Only and the Bank didn’t receive any profit from it

• SLR (Statutory liquidity ratio)

SLR is the second layer of security. Here the reservation kept of that term which is more into liquid form (easily useable) asset such as gold, cash, government-approved security. SLR is a percentage of the total amount of deposit that banks need to keep for themself for security. But banks can generate profit or income through SLR, They can put that money as the government approves or paper gold approval which can get a refund through customer or investor.

• Liquidity Adjustment Facility

Recommended by Narasimhan Committee in 1998. LAF includes 2 types Repo Rate and Reverse Repo Rate. These Rates are been decided by the Monetary policy committee.

• Repo rate

The term repo represents reputation. The bank who have a high reputation in the market (which is RBI) provides a loan to other banks for a short-term period basically it is of 90 days was RBI charges a certain percentage on the total amount for that particular period keeping the G-Sec as collateral.

• Reverse repo rate

The term reverses repo rate is totally opposite from the Repo rate as its name. Here the bank provides a loan to RBI with a certain interest rate.

Why does RBI need to take a Loan?

To control the supply of money for economic causes RBI needs to control the inflation and maintain the economic growth which works on the simple Law of Demand and Supply .

• Marginal Standing Facility

To provide the Bank with Overnight Money due to the Cash Crunch RBI provides Overnight Loans to the Scheduled Commercial Banks at Intrest Rate known as MSF. Usually used to maintain SLR portfolio.

6. Fiscal Policy

RBI also plays an important role in deciding the Fiscal policy where its role is to decide the expenditure of the Government and Taxes

7. Foreign Reserve

RBI plays a crucial role in maintaining and Exchanging the Foreign Reserves.

8. Advisory Role

RBI is an Advisor not only to the Government but also to the Banks by advising them on Investments Avenues and Opportunities and also Cautions them.

“We are a democracy, we have the rule of law and India doesn’t have any expansionary ambitions. We don’t foresee sanctions but yes, it is something, going forward, now I think every country will start thinking about it.” WORDS BY “SHAKTI KANT DAS (RBI GOVERNOR)”

Reports Released by RBI

- Annual Report (Annual)

- Report on Trend and Progress of Banking in India (Annual)

- Financial Stability Report (Half-Yearly)

- Monetary Policy Report (Half-Yearly)

- Report on Foreign Exchange Reserves (Half-Yearly)

Legal Frameworks of RBI

I. acts administered by reserve bank of india.

- Reserve Bank of India Act, 1934

- Public Debt Act, 1944/ Government Securities Act, 2006

- Government Securities Regulations, 2007

- Banking Regulation Act, 1949

- Foreign Exchange Management Act, 1999

- Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (Chapter II)

- Credit Information Companies(Regulation) Act, 2005

- Payment and Settlement Systems Act, 2007 As Amended up to 2019

- Payment and Settlement Systems Regulations, 2008 As Amended up to 2022

- Factoring Regulation Act, 2011

II. Other relevant Acts

- Negotiable Instruments Act, 1881

- Bankers’ Books Evidence Act, 1891

- State Bank of India Act, 1955

- Companies Act, 1956/ Companies Act, 2013

- Securities Contract (Regulation) Act, 1956

- State Bank of India Subsidiary Banks) Act, 1959

- Deposit Insurance and Credit Guarantee Corporation Act, 1961

- Banking Companies (Acquisition and Transfer of Undertakings) Act, 1970

- Regional Rural Banks Act, 1976

- Banking Companies (Acquisition and Transfer of Undertakings) Act, 1980

- National Bank for Agriculture and Rural Development Act, 1981

- National Housing Bank Act, 1987

- Recovery of Debts Due to Banks and Financial Institutions Act, 1993

- Competition Act, 2002

- Indian Coinage Act, 2011 : Governs currency and coins

- Banking Secrecy Act

- The Industrial Development Bank (Transfer of Undertaking and Repeal) Act, 2003

- The Industrial Finance Corporation (Transfer of Undertaking and Repeal) Act, 1993

Departments in RBI

Rbi recently started buying gold let’s know why.

RBI started buying gold steadily over the few past years. RBI wants to diversify its assets to hold foreign exchange reserves in another country. As the world knows the all foreign transaction takes place in US Dollar but India is thinking now of divers the foreign exchange by gold because

-Foreign exchange reserves are assets denominated in a foreign currency that is held by a nation’s central bank

-These may include foreign currencies, bonds, treasury, bills, and other government securities.

For example, Russia had kept their foreign exchange in different banks worldwide but due to their sanctions Russia’s financial reserve got frizz that they are not able to pay their bills hence they have to face crises due to over-dependent on foreign currency and exchanges therefore India trying to diversify. In 2022 India added 65.11 tones of gold to their account The reason you purchase is India trying to diversify its Investment. The largest gold was brought in the fiscal year 2010 from the international monetary fund (IMF) which was 200 tonnes. Gold buying by the central bank surged in the first half of the year

- Thailand – Thailand purchase 90.2 tons of gold

- Hungary – Hungary purchase 62.0 tons of gold

- Brazil- Brazil purchased 53.7 tons of gold

- India- India purchase 29.0 tons of gold

- Uzbekistan-Uzbekistan purchased 25.5 tons of gold

- Turkey- Turkey purchased 13.5 tons of gold

- Cambodia- Cambodia purchased 5.0 tons of gold

- Poland- Poland purchased 3.1 tons of gold

- Mongolia- Mongolia purchased 1.8 tons of gold Central banks across the world have been loading up on gold over the past several years. Reason

There are main four reasons why countries started buying gold

- Dependency Decrease the dependency on dollars and Euros so the country becomes more stable because other assets in such by they are using gold

- Safety (value) To increase the safety of foreign exchange and gold is more secure and stable than liquid funds

- Liquidity Easily convertible into cash and easy for exchange.

- Inflation When Inflation increases the value of money decreases so, in such a case if there will be saving in terms of gold it will be more secure and much more average to its original base price.

What is the Function of RBI?

1. Currency 2. Development Role 3. Banker To Government 4. Bankers To Banks 5. Monetary Policy 6. Fiscal Policy 7. Foreign Reserve 8. Advisory Role

Departments in RBI ?

Consumer Education and Protection Department Corporate Strategy and Budget Department Department of Communication Department of Currency Management Department of Economic and Policy Research Department of External Investments and Operations Department of Government and Bank Accounts Department of Information Technology Department of Payment and Settlement Systems Department of Regulation Department of Statistics and Information Management Department of Supervision Enforcement Department Financial Inclusion and Development Department Financial Markets Operation Department Financial Markets Regulation Department Financial Stability Unit FinTech Department Foreign Exchange Department Human Resource Management Department Inspection Department Internal Debt Management Department International Department Legal Department Monetary Policy Department Premises Department Rajbhasha Department Risk Monitoring Department Secretary’s Department Central Vigilance Cell

There are How many types of Monetary policy Stance ?

There are 3 types of Monetary policy Stance 1. Accommodative stances An Accommodative stance means the Central Bank or RBI wants to increase the Inflation so there will be a reduction in the Interest Rate. The Loose money policy will be implemented. 2. Neutral stances A Neutral Stance means the Central Bank or RBI won’t make any changes and keep the growth in the same phase. 3. Hawkish stances A hawkish stance means the Central Bank or RBI wants to reduce the Inflation so there will be an increase in the Interest Rate. The tight money policy will be implemented.

Related Posts

Anil ambani case study, when will student loan forgiveness be applied and who qualifies, top 5 investment strategies – smartly invest your money.

[…] RBI – Things Must Know About RBI | Complete Case Study […]

Read More About RBI (Reserve Bank Of India)

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Case Details

- Case Intro 1

- Case Intro 2

In the first quarter (April-June) of the fiscal year 2013-14, India’s economy grew at its slowest in the previous four years and recorded a growth rate of 4.4%. In October 2013, the World Bank revised India’s economic growth forecast for the fiscal 2014 to 4.7 % against the earlier estimate of 6.1%. Experts pointed out that the Indian economic condition in 2013 was the worst since 1991. At a time when India was facing its worst financial and economic crisis in decades, with slowing economic growth, high inflation, a record high current account deficit, and the rupee hitting record lows, Raghuram Rajan was appointed as the 23rd governor of the RBI on September 04, 2013, for a period of three years. The day after he was appointed, the rupee strengthened, winning accolades for him from around the world. Raghuram Rajan was labeled as a rock star governor. The case analyzes the history of the RBI and the major monetary policy actions taken till date. It also studies the performance of the recent four governors of the RBI and the monetary policy stance adopted by them. Further, the case discusses Raghuram Rajan’s capacity to bring India out of its economic crisis, given that he had control over only the monetary policy. Economists and analysts kept a keen watch on his moves to see if he could contain the crisis in India and bring it back on the growth path. The biggest challenge before Raghuram Rajan was not to get labeled as India’s savior, because the country’s economic future was largely in the hands of its government, not its central bank.

The case has the following objectives »Analyze the history of the Reserve Bank of India (RBI) and its governors. »Study the monetary policy adopted by the RBI. »Examine the role of monetary policy and its governor in containing a crisis in a country like India. »Study the agenda for RBI governor Raghuram Rajan and the monetary policy stance adopted by him.

Monetary policy, Reserve Bank of India (RBI), Nationalization of the RBI, Cash Reserve Ratio, Inflation/ Average inflation, Chakarvarty Committee, Vaghul Committee, Narasimham Committee, Open Market Operations, RBI Governors, C. Rangarajan, Bimal Jalan, Y. V. Reddy, Duvvuri Subbarao, Raghuram Rajan, Inflation tageting monetary policy, Economic growth/ GDp growth, Food inflation, Banking sector reform, Current Account Deficit, Raghuram Rajan’s five pillars of financial reform

Introduction - Next Page>>

Case Studies Links:- Case Studies , Short Case Studies , Simplified Case Studies . Other Case Studies:- Multimedia Case Studies , Cases in Other Languages . Business Reports Link:- Business Reports . Books:- Textbooks , Work Books , Case Study Volumes .

- Terms & conditions

- Privacy policy

© 2023 Sorting Hat Technologies Pvt Ltd

- Introduction to the CSE

- Prelims Syllabus

- Essay Paper

- Annual Calender

- UPSC Booklists

- Previous Year paper analysis Analysis - Mains

- Free Content: Prelims : GS, CSAT

- Daily News Analysis: Date-wise

- Free Content: Mains

- Important Schemes

- One minute read

- Articulate Magazine

- IAS English Content

- UPSC Unstoppable content

- Free Special Classes

- UPSC Unstoppables

- Unacademy IAS: English

- Let's Crack UPSC CSE

- Let's Crack UPSC CSE Hindi

- World Affairs by Unacademy

- Agriculture

- Anthropology

- Civil Engineering

- Commerce & Accountancy

- Mathematics

- Political Science & International Relations

- Public Administration

- Foundation Program - UPSC CSE

- Online Classroom Program - UPSC CSE

- Mission IAS Program - UPSC CSE

- Lakshya Program - UPSC CSE

- Prelims Test Series and Printed Notes (English)

- Prelims Test Series and Digital Notes (English)

- Mains Test Series and Printed Notes (English)

- Mains Test Series and Digital Notes (English)

- Mains Test Series and Printed Notes (Hindi)

- Daily Current Affairs

- Topper's Notes

- 2022 Toppers

- 2021 Toppers

The Role of RBI in The Indian Economy

Are you willing to know about the role of RBI in the Indian economy? If yes, then you have come across the right article as this will provide you with all the necessary details that you need to know.

Table of Content

Reserve bank of india.

The Reserve Bank of India (RBI) is India’s central bank and regulatory organisation in charge of banking regulation. It belongs to the Indian government’s Ministry of Finance. The Indian rupee is issued and distributed by it. It also oversees the country’s major payment networks and aims to further the country’s economic growth. The RBI’s Bharatiya Reserve Bank Note Mudran division prints and mints Indian banknotes and coins. To regulate India’s payment and settlement systems, the RBI formed the National Payments Corporation of India as one of its specialised divisions. The Reserve Bank of India formed the Deposit Insurance and Credit Guarantee Corporation as a specialised division to provide deposit insurance and credit guarantee to all Indian banks.

Discover Unacademy UPSC Offline Centres in the following locations

- Mukherjee Nagar IAS Coaching in Delhi

- Best IAS Coaching in Karol Bagh

- Best UPSC Coaching in Prayagraj

It also had full control of monetary policy until the Monetary Policy Committee was constituted in 2016. According to the Reserve Bank of India Act, 1934, it began operations on 1 April 1935. The capital was divided into 100 fully paid shares at the outset. On 1 January 1949, the RBI was nationalised following India’s independence on 15 August 1947.

Also see:

- UPSC Preparation Books

Role of Reserve Bank of India (RBI)

It is in charge of deciding on the country’s monetary policy. The Reserve Bank of India’s (RBI) primary responsibility is to preserve financial stability and appropriate liquidity in the economy.

Some of the significant functions of the Reserve Bank of India are mentioned and explained below:

- Monetary Management – The formulation and seamless execution of monetary policy are one of the Reserve Bank of India’s main responsibilities. Various policy instruments are used by monetary policy to impact the cost and availability of money in the economy. The goal remains to encourage economic growth while maintaining price stability. It assures a steady supply of credit to the economy’s productive sectors.

- The issuer of Currency – Currency management and issuance are critical central banking functions. The Reserve Bank of India (RBI) is in charge of the country’s currency design, manufacture, distribution, and overall management. It aims to ensure that the state has a sufficient supply of clean and legitimate notes. Its goal is to lower the risk of counterfeiting. Counterfeit notes are frequently used for terrorist financing, which has a variety of negative consequences.

- Banker and debt manager of the Government – The Reserve Bank of India (RBI) is in charge of the government’s banking transactions. The Reserve Bank of India also holds the cash holdings of the Indian government. It can also serve as a lender to state governments. It appoints other banks to act as its agents in carrying out the government’s transactions. On behalf of the federal and state governments, it also manages public debt and offers new loans.

- Banker to Banks – The RBI is also responsible for the settlement of interbank transactions. This is normally accomplished through the employment of a “clearing house,” which allows banks to present cheques and other similar instruments for clearing. The central bank serves as a common banker for all of the banks.

- Financial Regulation and Supervision- The regulatory and supervisory powers of the RBI are extensive. Through a variety of policy initiatives, it aims to ensure general financial stability. Its goal is to ensure the orderly development and conduct of banking activities, as well as bank liquidity and solvency.

- Developmental Role – The Reserve Bank of India (RBI) actively supports and enhances development efforts in the country. It guarantees that the productive sectors of the economy have access to sufficient credit and establishes organisations to support the development of financial infrastructure. It also tries to ensure that everyone has access to banking services.

- Oversees Market Operations – The Central Bank implements its monetary policy through government securities, foreign exchange, and money market operations. It also regulates and develops market instruments such as the term money market, repo market, and others.

- Foreign Exchange Management – The foreign exchange market is regulated by the Reserve Bank of India (RBI). It has also opened practically all areas to international investment.

Some of the major causes of inflation in India are an increase in money supply, deficit financing, increase in government expenditure, inadequate agricultural and industrial growth, rise in administered prices, rising import prices and rising taxes.

Important Pages

Conclusion:.

The RBI’s job could thus be to construct a multi-layered regulatory and supervisory environment that captures the industry’s heterogeneity and adopt policies that provide the sector with enough leeway to flourish without causing disruption.

Frequently asked questions

Get answers to the most common queries related to the UPSC Examination Preparation.

What is the full form of RBI?

Ans : The full form of RBI is the Reserve Bank of India.

When and where was the Reserved Bank of India established?

What are the three objectives of the reserved bank of india (rbi).

Ans : The Reserve Bank of India (RBI) was established on 1 April 1935 in Kolkata, India.

Ans : The three main objectives of the Reserved Bank of India (RBI) are as follows:

- To control inflation,

- To encourage growth, and

- Financial stability.

Get started with your UPSC preparation today

Over 8L learners preparing with Unacademy

- Fully organized study planner

- Exceptional educators to learn from

- Ask Mock tests, live quizzes & practice

Notifications

Get all the important information related to the UPSC Civil Services Exam including the process of application, important calendar dates, eligibility criteria, exam centers etc.

Previous Year Question Papers for Optional Subjects

Upsc 2022 prelims results, upsc calendar, upsc cse gs main test series 23.

- UPSC Cut Off Analysis

UPSC Dedicated Doubt Solving Sessions

Upsc eligibility criteria 2024, upsc exam pattern – check prelims and mains exam pattern, upsc free doubt solving sessions – doubt darbaar.

- UPSC Marking Scheme

UPSC Prelims Answer Key 2022

- UPSC Prelims Previous Year Question Paper

UPSC Prelims Results

Upsc preparation books – best books for ias prelims and mains, upsc syllabus 2024 pdf – ias prelims and mains syllabus.

- UPSC Toppers

Related articles

World trade organisation.

An overview of the World Trade Organisation: its origin, aims and objectives, ways of functioning, and various challenges faced by the organisation.

Understanding Top Market Borrower

Top market borrower is important to understand the financial state of a place. In this article, you can learn about Top Market borrowers in Tamil Nadu.

Understanding Reserve Bank of India

This article will discuss the impact of the important objectives and will further break down the functions of RBI. The topic of RBI and its overview is discussed briefly throughout the article.

The Action Plan to Make India Atmanirbhar in Rock Phosphate

Are you willing to learn more about the action plan to make India atmanirbhar in rock phosphate? Does India import rock phosphate? Where can we find phosphorus in India? Then this guide will help you to learn the answers to all these questions.

Start you preparation with Unacademy

Related links

- UPSC Syllabus

- UPSC PDF Notes

- UPSC Printed Notes

- UPSC Exam Pattern

- UPSC Eligibility Criteria

- UPSC Mains Exam

- UPSC Prelims Exam

- UPSC Question Paper

Latest UPSC Notifications

- UPSC Mains Paper Analysis

- UPSC Mains Result 2022

- UPSC Study Material

'Transformation of Indian Banking Sector A Case Study': PM Modi Attends RBI@90 Celebrations in Mumbai

Curated By : Sanstuti Nath

Last Updated: April 01, 2024, 12:31 IST

Mumbai, India

PM Modi released a commemorative coin on the 90th anniversary of RBI (Image: X/ANI)

Union Finance Minister Nirmala Sitharaman and RBI Governor Shaktikanta Das also attended the event

Congratulating the Reserve Bank of India on completing 90 years of service, Prime Minister Narendra Modi said the Central bank entered a historic phase today. Addressing a ceremony marking the anniversary celebrations in Mumbai, the Prime Minister said RBI is known in the world for its professionalism and commitment.

PM Modi said the banking sector has become profitable and credit growth has been increasing because of efforts taken by his government and the RBI in the last decade.

“In 2014, when I attended the program for the completion of 80 years of the RBI, the situation was very different. The entire banking sector of India was struggling with problems and challenges. Everyone was doubtful regarding the stability and future of India’s banking system. The situation was so bad that the Public Sector banks were not able to provide enough boost to the country’s economic progress… And today, India’s banking system is seen as a strong and sustainable banking system in the world,” he said

PM Modi said this changed because his government has clear policies, honesty, and commitment.

“Our efforts had stability and honesty. When the intentions are clear, then the policies are right. When policies are right, then the decisions are right. And when the decisions are right, the results are also right,” he stressed.

The Prime Minister stressed that India’s GDP is dependent on coordination between monetary and fiscal policies

“Transformation of the Indian banking sector is a case study, govt infused Rs 3.5 lakh crore capital in PSU banks for their revival. NPAs in banks have fallen to less than 3 pc in September 2023 from a record high of 11.25 pc in 2018; credit growth at 15 PC,” he noted.

He also stressed upon easy access to credit in India, which in turn promotes ease of doing banking. “UPI has become a globally recognised platform; RBI is also working on central bank digital currency,” he said.

The RBI has played a significant role in all these accomplishments, said PM Modi, adding that the central bank’s monetary policy committee has worked very well on inflation targeting.

“The last 10 years were just a trailer. We have to do a lot more to take forward our country. We gave inflation-targeting authority to RBI… Indian economy making new records when several economies are struggling to come out of the Covid pandemic impact… Inflation was at a moderate level even during the Covid pandemic, wars or any other external factor,” he said.

He further stressed that India needs to become economically self-reliant in the next 10 years so that the nation is not impacted much by global factors.

“A lot of work will be generated for everyone once the BJP-led NDA assumes office for the third term in June…We have to increase India’s economic self-reliance,” he said.

“I am busy with the elections for these 100 days, so you have a lot of time to think about (new policies). Because just a day after the swearing-in ceremony, you will have a lot of work,” PM Modi added.

PM Modi released a commemorative coin on the 90th anniversary of RBI. Union Finance Minister Nirmala Sitharaman and RBI Governor Shaktikanta Das also attended the event.

Established in 1935, RBI functions as the nation’s central bank, following the recommendations of the Hilton Young Commission and is governed by the Reserve Bank of India Act, of 1934.

The functioning of this central bank is governed by the Reserve Bank of India Act, 1934 (II of 1934), and it began operations on April 1, 1935, with Sir Osborne Smith as the first Governor, responsible for functions such as currency issuance, banking services for banks and the government, and the development of rural cooperatives and agricultural credit.

In 1937, the Central Office of the Reserve Bank was also shifted from Kolkata to Mumbai.

The RBI’s role has expanded to cover monetary management, regulation and supervision of the financial system, management of foreign exchange, currency issuance, regulation and supervision of payment and settlement systems, and developmental roles over the years.

- Narendra Modi

- Search Search Please fill out this field.

What Is the Reserve Bank of India (RBI)?

- How It Works

- Departments

- Communication

The Bottom Line

- Monetary Policy

- Federal Reserve

The Reserve Bank of India (RBI): What It Is and How It Works

James Chen, CMT is an expert trader, investment adviser, and global market strategist.

:max_bytes(150000):strip_icc():format(webp)/photo__james_chen-5bfc26144cedfd0026c00af8.jpeg)

Investopedia / Michela Buttignol

The Reserve Bank of India (RBI) is the central bank of India, which began operations on Apr. 1, 1935, under the Reserve Bank of India Act. The Reserve Bank of India uses monetary policy to create financial stability in India, and it is charged with regulating the country’s currency and credit systems.

Key Takeaways

- The Reserve Bank of India (RBI) is the central bank of India,

- The RBI was originally set up as a private entity in 1935, but it was nationalized in 1949.

- The main purpose of the RBI is to conduct consolidated supervision of the financial sector in India, which is made up of commercial banks, financial institutions, and non-banking finance firms.

Understanding the Reserve Bank of India (RBI)

Located in Mumbai, the RBI serves the financial market in many ways. The bank sets the overnight interbank lending rate. The Mumbai Interbank Offer Rate (MIBOR) serves as a benchmark for interest rate–related financial instruments in India.

The main purpose of the RBI is to conduct consolidated supervision of the financial sector in India , which is made up of commercial banks, financial institutions, and non-banking finance firms. Initiatives adopted by the RBI include restructuring bank inspections, introducing off-site surveillance of banks and financial institutions, and strengthening the role of auditors

First and foremost, the RBI formulates, implements, and monitors India’s monetary policy . The bank’s management objective is to maintain price stability and ensure that credit is flowing to productive economic sectors. The RBI also manages all foreign exchange under the Foreign Exchange Management Act of 1999. This act allows the RBI to facilitate external trade and payments to promote the development and health of the foreign exchange market in India .

The RBI acts as a regulator and supervisor of the overall financial system. This injects public confidence into the national financial system, protects interest rates, and provides positive banking alternatives to the public. Finally, the RBI acts as the issuer of national currency. For India, this means that currency is either issued or destroyed depending on its fit for current circulation. This provides the Indian public with a supply of currency in the form of dependable notes and coins, a lingering issue in India.

The current Governor is Shri Shaktikanta Das, and he has four Deputy Governors that report to him directly.

Reserve Bank of India Departments

The Reserve Bank of India has a number of departments, each of which have a very specific purpose. An entire list of departments can be found on the Reserve Bank of India's site. Some of the key departments within the Reserve Bank of India along with what that department does includes but isn't limited to:

- Department of Monetary Policy: Responsible for formulating and implementing monetary policy to achieve price stability and economic growth.

- Department of Banking Regulation: Regulates and supervises banks and financial institutions to ensure the stability and efficiency of the banking system.

- Department of Currency Management: Manages the issuance and circulation of currency notes and coins.

- Department of Payment and Settlement Systems: Regulates and supervises payment and settlement systems to ensure safety, efficiency, and reliability of payment systems in the country.

- Department of Economic and Policy Research: Conducts economic research and analysis to provide inputs for policymaking and to monitor economic indicators.

- Department of Information Technology: Manages and develops IT infrastructure, systems, and applications to support the operations of the Reserve Bank of India.

Reserve Bank of India Operations

The RBI was originally set up as a private entity, but it was nationalized in 1949. The reserve bank is governed by a central board of directors appointed by the national government. The government has always appointed the RBI’s directors, and this has been the case since the bank became fully owned by the government of India as outlined by the Reserve Bank of India Act. Directors are appointed for a period of four years.

According to its website, the current focus of the RBI is to continue its increased supervision of financial institutions, while dealing with legal issues related to bank fraud and consolidated accounting and attempting to create a supervisory rating model for its banks.

Reserve Bank of India and Communication

The Reserve Bank of India acknowledges the pivotal role that communication plays in modern central banking. On its website, it emphasizes a collegial approach to monetary policy decision-making. The Reserve Bank of India's communication policy adheres to guiding principles of relevance, transparency, clarity, comprehensiveness, and timeliness with the aim of enhancing public understanding of developments across its various domains.

In its medium-term vision statement titled "Utkarsh 2022", the RBI delineates objectives including excellence in statutory functions, enhanced public trust, increased relevance nationally and globally, transparent governance, modern infrastructure, and a skilled workforce. Strategies to achieve these objectives involve consolidating past gains, leveraging emerging opportunities, and addressing future challenges through tangible, time-bound milestones.

The RBI commits to reviewing its communication policy every three years, reflecting its recognition of communication as a dynamic process crucial for effective central banking operations.

How Does the RBI Regulate Banks and Financial Institutions in India?

The RBI regulates banks and financial institutions in India through various measures such as licensing and supervision, setting capital adequacy norms, and conducting inspections and audits. The RBI is also the governing body responsible for issuing regulatory guidelines and directives.

What Are the Primary Objectives of the RBI as Outlined in the Reserve Bank of India Act of 1934?

The primary objectives of the RBI, as outlined in the Reserve Bank of India Act, 1934, include regulating the issuance of banknotes, maintaining monetary stability, operating the currency and credit system to the country's advantage, and fostering economic growth.

What Are the Key Initiatives and Strategies Outlined in the RBI's Medium-Term Vision Statement?

The RBI's medium-term vision statement outlines key initiatives and strategies aimed at achieving excellence in statutory functions, strengthening public trust, and enhancing relevance nationally and globally. It also is currently aiming to ensure transparent governance, modernize infrastructure, and foster a skilled workforce.

The Reserve Bank of India is the central banking institution in India responsible for formulating and implementing monetary policy, regulating and supervising the banking and financial system, and managing the issuance and circulation of currency. It plays a crucial role in maintaining financial stability not just for the country for the broader, global economy.

Reserve Bank of India. " Chronology of Events ."

Legislative Department of India. " The Foreign Exchange Management Act, 1999 ," Page 3.

Reserve Bank of India. " Organisation Structure ."

Reserve Bank of India. " Departments ."

Reserve Bank of India. " About Us ."

Reserve Bank of India. " Communication Policy of RBI ."

- U.S. COVID-19 Stimulus and Relief 1 of 26

- American Rescue Plan (Biden’s $1.9 Trillion Stimulus Package) 2 of 26

- The Consolidated Appropriations Act of 2021: What's in It, What's Not 3 of 26

- The Paycheck Protection Program and Health Care Enhancement Act 4 of 26

- What Is the CARES Act? 5 of 26

- Families First Coronavirus Response Act (FFCRA) Overview 6 of 26

- Main Street Lending Program: What It is, How It Works 7 of 26

- Municipal Liquidity Facility (MLF): What It is, How It Works 8 of 26

- Money Market Mutual Fund Liquidity Facility: Overview 9 of 26

- Primary Market Corporate Credit Facility (PMCCF): Overview 10 of 26

- Secondary Market Corporate Credit Facility (SMCCF): Overview 11 of 26

- Paycheck Protection Program Liquidity Facility (PPPLF): Overview 12 of 26

- Term Asset-Backed Securities Loan Facility (Talf) Overview 13 of 26

- Primary Dealer Credit Facility (PDCF): What It Is, How It Works 14 of 26

- Commercial Paper Funding Facility (CPFF): Meaning, How It Works 15 of 26

- What Is a Special Purpose Vehicle (SPV) and Why Companies Form Them 16 of 26

- Exchange Stabilization Fund (ESF): Meaning, Creation, In Action 17 of 26

- Repurchase Agreement (Repo): Definition, Examples, and Risks 18 of 26

- International COVID-19 Stimulus and Relief 19 of 26

- European Central Bank (ECB): Definition, Structure, and Functions 20 of 26

- People's Bank of China (PBoC): What It Is and Responsibilities 21 of 26

- Bank of Japan (BOJ): Organization, Monetary Policy, Transparency 22 of 26

- Bank of England (BoE): Role in Monetary Policy 23 of 26

- The Reserve Bank of India (RBI): What It Is and How It Works 24 of 26

- What Is the World Bank, and What Does It Do? 25 of 26

- What Is the International Monetary Fund (IMF)? 26 of 26

:max_bytes(150000):strip_icc():format(webp)/32190943222_d2f38af525_k-a26a5d1ea4b84606a0291832861cd61d.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Publications

- Monetary and Credit Information Review

publications

I. Regulation

Domestic Systemically Important Banks (D-SIBs)

The Reserve Bank on January 2, 2023 released the list of Domestic Systemically Important Banks (D-SIBs). State Bank of India, ICICI Bank, and HDFC Bank continue to be identified as D-SIBs, under the same bucketing structure as in the 2021 list of D-SIBs. The additional Common Equity Tier 1 (CET1) requirement for D-SIBs was phased-in from April 1, 2016 and became fully effective from April 1, 2019. The additional CET1 requirement as a percentage of Risk Weighted Assets (RWAs) for State Bank of India is 0.60 per cent while for ICICI Bank and HDFC Bank, the RWA is 0.20 per cent each. To read more, please click here .

‘On tap’ Licensing of Universal Banks

The Reserve Bank on January 4, 2023 released that during the quarter ended December 31, 2022, it has received one application under the guidelines for ‘on tap’ Licensing of Universal Banks in the Private Sector from Annapurna Finance Private Limited, Bhubaneswar. To read more, please click here .

Periodic Updation of KYC

The Reserve Bank on January 5, 2023 rationalised KYC related instructions taking into account the available technological options for enhancing customers’ convenience within the framework prescribed under the Prevention of Money Laundering Act, 2002 (PMLA) and rules framed thereunder.

As per the present guidelines, a self-declaration to that effect from an individual customer is sufficient to complete the re-KYC process, if there is no change in KYC information. The banks have been advised to provide facility of such self-declaration to the individual customers through various non-face-to-face channels such as registered email-id, registered mobile number, ATMs, digital channels (such as online banking/internet banking, mobile application), letter, etc., without need for a visit to bank branch. Further, if there is only a change in address, customers can furnish revised/updated address through any of these channels after which, the bank would undertake verification of the declared address within two months. To read more, please click here .

Basel III Capital Regulations

The Reserve Bank on January 9, 2023 advised the banks to use the ratings of the below mentioned credit rating agencies for risk weighting their claims for capital adequacy purposes;

i) Acuite Ratings and Research Limited (Acuite);

ii) Credit Analysis and Research Limited (CARE);

iii) CRISIL Ratings Limited;

iv) ICRA Limited;

v) India Ratings and Research Private Limited (India Ratings); and

vi) INFOMERICS Valuation and Rating Private Limited (INFOMERICS).

Regulated Entities/Market Participants were advised that in respect of ratings/credit evaluations required in terms of any guidelines issued by the Reserve Bank, no fresh ratings/evaluations shall be obtained from Brickwork Ratings India Private Limited. To read more, please click here .

Cancellation of Certificate of Registration

The Reserve Bank on January 11, 2023 in exercise of powers conferred on it under Section 45-IA (6) of the Reserve Bank of India Act, 1934, has cancelled the Certificate of Registration (CoR) of 10 Non-Banking Financial Companies (NBFCs) as these companies have surrendered the CoR granted to them by the Reserve Bank.

Further, one Asset Reconstruction Company (ARC) surrendered the CoR granted to them by the Reserve Bank. The RBI, in exercise of powers conferred on it under Section 4(1) of the SARFAESI Act, 2002, therefore cancelled the CoR. To read more, please click here .

Liberalised Remittance Scheme

The Reserve Bank on January 23, 2023 directed SBM Bank India Ltd. (a subsidiary of the State Bank of Mauritius) to stop, with immediate effect, all transactions under Liberalised Remittance Scheme (LRS) till further orders. The order was based on certain material supervisory concerns observed in the bank.

However, the bank has initiated corrective actions and made submission for relaxation of the restrictions. Based on the submission and also to provide relief to the affected customers of the bank, the Reserve Bank on January 31, 2023 decided to partially relax the restrictions by allowing ATM/POS transactions under LRS through KYC compliant internationally active debit cards issued by the bank up to March 15, 2023 or until further orders, whichever is earlier. To read more, please click here .

Safe Deposit Locker/Safe Custody Article Facility

The Reserve Bank on January 23, 2023 has decided to extend the deadline for banks to complete the process of renewal of agreements for the existing safe deposit locker/safe custody article facility in a phased manner by December 31, 2023, with intermediate milestones of 50 per cent by June 30, 2023, and 75 per cent by September 30, 2023. The earlier deadline was January 1, 2023. The Reserve Bank further advised the banks to make necessary arrangements to facilitate execution of the revised agreements by ensuring the availability of stamp papers. To read more, please click here .

Securitisation of Stressed Assets Framework

The Reserve Bank on January 25, 2023 as part of ‘Statement on Developmental and Regulatory Policies dated September 30, 2022’ released a discussion paper on Securitisation of Stressed Assets Framework (SSAF) inviting comments from stakeholders.

The Discussion paper broadly covers nine relevant areas of the framework including asset universe, asset eligibility, minimum risk retention, regulatory framework for special purpose entity and resolution manager, access to finance for resolution manager, capital treatment, due diligence, credit enhancement, and valuation. It draws upon similar frameworks introduced in other jurisdictions, while trying to keep it structurally aligned with the framework for securitisation of standard assets. To read more, please click here .

Appointment

The Reserve Bank on January 31, 2023 appointed Shri V. Ramachandra as a member in the Advisory Committee of Srei Infrastructure Finance Limited (SIFL) and Srei Equipment Finance Limited (SEFL) to advise the Administrator in the operations of the financial service providers during the corporate insolvency resolution process. To read more, please click here .

II. Payment and Settlement System

Regulatory Sandbox

The Reserve Bank on January 5, 2023 announced the opening of the fourth cohort under Regulatory Sandbox for theme ‘Prevention and Mitigation of Financial Frauds’. Out of the nine applications received, the Bank selected applications for the ‘Test Phase’. The entities, viz., i) Bahwan Cybertek Private Limited; ii) Crediwatch Information Analytics Private Limited; iii) enStage Software Private Limited (Wibmo); iv) HSBC in collaboration with enStage Software Private Limited (Wibmo); v) napID Cybersec Private Limited; and vi) Trusting Social Private Limited shall commence testing of their products from February 2023. To read more, please click here .

Digital Payments Index

The Reserve Bank on January 31, 2023 announced Reserve Bank of India – Digital Payments Index (RBI-DPI) for the month of September, 2022. The index for September 2022 stands at 377.46 as against 349.30 for March 2022. To read more, please click here .

III. Financial Markets

Fully Accessible Route

The Reserve Bank on January 23, 2023 issued the issuance calendar for Sovereign Green Bonds for the fiscal year 2022-23. Attention is also invited to the Fully Accessible Route (FAR) introduced by the Reserve Bank, wherein certain specified categories of Central Government securities were opened fully for non-resident investors without any restrictions, apart from being available to domestic investors as well. It has now been decided to also designate all Sovereign Green Bonds issued by the Government in the fiscal year 2022-23 as ‘specified securities’ under the FAR. To read more, please click here .

IV. Banker to Government

Calendar for Sovereign Green Bonds

The Reserve Bank on January 6, 2023 notified that, Government of India, as part of its overall market borrowings, will be issuing Sovereign Green Bonds (SGrBs), for mobilising resources for green infrastructure. Further, the Reserve Bank, in consultation with GoI, notified an indicative calendar for issuance of SGrBs for the fiscal year 2022-23.

To read more, please click here .

Price/Yield Range Setting in e-Kuber

The Reserve Bank on January 11, 2023 advised the participants in the government securities market to utilise the ‘Price/Yield range setting’ facility on the e-Kuber platform before placing bids in the primary market auctions. This facility is provided to the market participants as a risk management measure. This allows a market participant to define a range for the bids. The range can be set in either price or yield terms, for each security in every auction, which can be set before the auction and can also be modified during the auction. To read more, please click here .

V. Foreign Exchange Management

Rationalisation of Reporting

The Reserve Bank on January 4, 2023 advised all Category-I Authorised Dealer (AD) banks about the following changes with respect to the reporting of foreign investment in ‘Single Master Form (SMF)’ on FIRMS Portal;

i) The forms submitted on the portal will be auto-acknowledged. The AD banks shall verify the same within five working days based on the uploaded documents, as specified.

ii) In cases of delayed reporting, the AD banks shall either advise the Late Submission Fee (LSF) to the applicants, which will be computed by the system or advise for compounding of contravention, as the case may be. To read more, please click here .

VI. Research

Financial Literacy and Financial Inclusion: A Case Study of Mizoram

The Reserve Bank on January 17, 2023 released the Development Research Group (DRG) study titled, ‘Determinants of Financial Literacy and Financial Inclusion in North-Eastern Region of India: A Case Study of Mizoram’.

The study evaluates the determinants of financial inclusion and financial literacy in the under-banked North-Eastern region of India based on primary data collected through a survey in the State of Mizoram. A total of 523 respondents were selected from eight blocks covering four districts of Mizoram. To read more, please click here .

Services and Infrastructure Outlook Survey

The Reserve Bank on January 18, 2023 launched the 36th round of quarterly Services and Infrastructure Outlook Survey (SIOS) for the reference period January-March 2023. The survey assesses the business situation for the current quarter (Q4:2022-23) from selected companies in the services and infrastructure sectors in India and their expectations for the ensuing quarter (Q1:2023-24) based on qualitative responses on a set of indicators pertaining to demand conditions, financial conditions, employment conditions and the price situation. An additional block on key parameters captures the outlook of the services and infrastructure companies for two subsequent quarters (Q2:2023-24 and Q3:2023-24). To read more, please click here .

Industrial Outlook Survey

The Reserve Bank on January 18, 2023 has launched the 101st round of the quarterly Industrial Outlook Survey (IOS) of the Indian manufacturing sector for the reference period January-March 2023. The survey assesses business sentiment for the current quarter (Q4:2022-23) and expectations for the ensuing quarter (Q1:2023-24), based on qualitative responses on a set of indicators pertaining to demand conditions, financial conditions, employment conditions and the price situation. The survey provides useful insight into the performance of the manufacturing sector. To read more, please click here .

VII. RBI Publications

State Finances: A Study of Budgets

The Reserve Bank on January 16, 2023 released a report titled ‘State Finances: A Study of Budgets of 2022-23’, an annual publication that provides information, analysis and an assessment of the finances of State governments for 2022-23 against the backdrop of actual and revised/provisional accounts for 2020-21 and 2021-22, respectively. The theme of this year’s Report is ‘Capital Formation in India - The Role of States’.

Highlights:

i) The fiscal health of the States has improved from a sharp pandemic-induced deterioration in 2020-21 on the back of a broad-based economic recovery and resulting high revenue collections - States’ gross fiscal deficit (GFD) is budgeted to decline from 4.1 per cent of gross domestic product (GDP) in 2020-21 to 3.4 per cent in 2022-23.

ii) While States’ debt is budgeted to ease to 29.5 per cent of GDP in 2022-23 as against 31.1 per cent in 2020-21, it is still higher than 20 per cent recommended by FRBM Review Committee, 2018 (Chairman: Shri N. K. Singh), warranting prioritisation of debt consolidation.

iii) In 2022-23, States have budgeted higher capital outlay than in 2019-20, 2020-21 and 2021-22. Going forward, increased allocations for sectors like health, education, infrastructure and green energy transition can help expand productive capacities if States mainstream capital planning rather than treating them as residuals and first stops for cutbacks in order to meet budgetary targets.

iv) It is worthwhile to consider creating a capex buffer fund during good times when revenue flows are strong so as to smoothen and maintain expenditure quality and flows through the economic cycle.

v) To crowd in private investment, the State governments may continue to focus on creating a congenial ecosystem for the private sector to thrive. States also need to encourage and facilitate higher inter-state trade and businesses to realise the full benefit of spillover effects of State capex across the country. To read more, please click here .

Primary (Urban) Co-operative Banks’ Outlook

The Reserve Bank on January 18, 2023 released the 9th volume of the annual publication titled ‘Primary (Urban) Co-operative Banks’ Outlook 2021-22’. The publication has been brought out by the Department of Supervision.

The publication covers the financial accounts of Scheduled and Non-Scheduled Primary (Urban) Co-operative Banks for the financial year 2021-22. The publication provides aggregate information on major items of balance sheet, profit and loss account, non-performing assets, financial ratios, state-wise distribution of offices and details of priority sector advances. Besides, the publication also provides bank-wise information of Scheduled Primary (Urban) Co-operative Banks on select financial ratios on Capital Adequacy, Profitability, and Employee Productivity. The publication is being brought out in only electronic form on an annual basis on the Reserve Bank’s website through the link https://dbie.rbi.org.in/ of Database on Indian Economy.

Annual Report of OBO

The Reserve Bank on January 4, 2023 released the Annual Report of the Ombudsman Schemes for the period April 1, 2021–March 31, 2022. With the year also marking the launch of Reserve Bank–Integrated Ombudsman Scheme (RB-IOS) on November 12, 2021, the Annual Report covers the activities under the erstwhile Ombudsman Schemes, i.e., Banking Ombudsman Scheme, 2006 (BOS), the Ombudsman Scheme for Non-Banking Financial Companies, 2018 (OSNBFC), and the Ombudsman Scheme for Digital Transactions, 2019 (OSDT) up to November 11, 2021, along with the activities under RB-IOS, 2021 since November 12, 2021. The report also captures major developments during the year and the way forward in the area of consumer protection. Some highlights from the Annual Report are as follows:

• Activities under the Ombudsman Schemes

i) The volume of complaints received under the Ombudsman Schemes/Consumer Education and Protection Cells during the year 2021-22 increased by 9.39 per cent over the previous year and stood at 4,18,184 during the reported period;

ii) 3,04,496 complaints out of the total reported complaints were handled by the 22 Offices of RBI Ombudsman (ORBIOs), including the complaints received under the three erstwhile Ombudsman Schemes till November 11, 2021.

iii) Since establishment of Centralised Receipt and Processing Center (CRPC) under the RB-IOS, 2021, of the 1,49,419 complaints handled at the CRPC, 1,43,552 complaints had been disposed as at the end of March 31, 2022.

iv) Complaints relating to the digital modes of payment and transactions were the highest in number, constituting 42.12 per cent of the total complaints received during the year.

v) The rate of disposal of complaints by RBIOs improved to 97.97 per cent in 2021-22 from 96.59 per cent in 2020-21.

vi) Majority (63.63 per cent) of the maintainable complaints were resolved through mutual settlement /conciliation /mediation.

• Important developments during the year 2021-22

During the year, Consumer Education and Protection Department (CEPD) undertook the following initiatives for strengthening the grievance redress system:

i) The RB-IOS, 2021 was launched on November 12, 2021, by the Prime Minister. The ambit of RB-IOS, 2021 was extended to include non-scheduled Urban Cooperative Banks with deposits of ₹50 Crore and above.

ii) Under the RB-IOS, 2021, a CRPC was established at RBI, Chandigarh to receive complaints through email or physical mode from across the country and handle the initial scrutiny and processing of these complaints before assigning the maintainable ones to ORBIOs for further redressal. A contact center to assist complainants in lodging their complaints, providing them information regarding redressal mechanism at RBI and awareness messages related to safe banking practices in ten regional languages (Assamese, Bengali, Gujarati, Kannada, Oriya, Punjabi, Malayalam, Marathi, Tamil and Telugu) apart from Hindi and English, was also setup.

iii) A Nationwide Intensive Awareness programme was launched on the World Consumer Rights Day on March 15, 2022 by the department and ombudsman offices. The RBIOs also conducted 29 town-hall events and 175 awareness programmes during the year.

• Way forward

During the period April 1, 2022 to March 31, 2023, CEPD will work towards the following action plans:

i) Review of the guidelines on ‘Strengthening of grievance redress framework for banks’ issued in January 2021.

ii) Extension of the RB-IOS, 2021 and Internal Ombudsman Scheme to more REs that are not covered presently.

iii) Enhance the efficiency and ease of usage of CMS and

iv) Upgrade and expand the Contact Centre. To read more, please click here .

RBI Bulletin, January 2023

The Reserve Bank on January 19, 2023 released the January 2023 issue of its monthly Bulletin. The Bulletin includes three speeches, five articles and current statistics. The five articles included in the bulletin are;

i) State of the Economy;

ii) Productivity Growth in India: An Empirical Assessment;

iii) What Drives Start-up Fundraising in India?

iv) Open Market Operations in India–An Appraisal; and

v) Supply of Banking Services and Credit Offtake: Evidence from Aspirational District Programme in the Eastern Area. To read more, please click here .

VIII. Data Release

Important data released by the Reserve Bank during the month of January 2023 are as follows:

Edited and published by Yogesh Dayal for Reserve Bank of India, Department of Communication, Central Office, Shahid Bhagat Singh Marg, Mumbai - 400 001. MCIR can be also accessed at https://mcir.rbi.org.in .

Impact of RBI’s monetary policy announcements on government bond yields: evidence from the pandemic

- Published: 20 May 2023

- Volume 58 , pages 261–291, ( 2023 )

Cite this article

- Aeimit Lakdawala 1 ,

- Bhanu Pratap ORCID: orcid.org/0000-0003-2047-0715 2 &

- Rajeswari Sengupta 3

1790 Accesses

3 Altmetric

Explore all metrics

We investigate how the bond market responded to the Reserve Bank of India’s (RBI) monetary policy actions undertaken since the start of the pandemic. Our approach involves combining a narrative analysis of the media coverage together with an event-study framework around RBI’s monetary policy announcements. We find that the RBI’s actions early in the pandemic were helpful in providing an expansionary impulse to the bond market. Specifically, long-term bond interest rates would have been meaningfully higher in the early months of the pandemic if not for the actions undertaken by the RBI. These actions involved unconventional policies providing liquidity support and asset purchases. We find that some of the unconventional monetary policy actions had a substantial signaling channel component where the market perceived the announcement of an unconventional monetary policy action as representing a lower future path for the short-term policy rate. We also find that the RBI’s forward guidance was more effective in the pandemic than it had been in the couple of years preceding the pandemic.

Similar content being viewed by others

Unconventional monetary policy in the euro zone.

John Driffill

The impact of monetary policy interventions on banking sector stocks: an empirical investigation of the COVID-19 crisis

Niall O’Donnell, Darren Shannon & Barry Sheehan

The European Monetary Policy Responses During the Pandemic Crisis

Pierpaolo Benigno, Paolo Canofari, … Marcello Messori

Avoid common mistakes on your manuscript.

1 Introduction

Major central banks all over the world resorted to a wide variety of policy actions to provide much-needed support to their respective economies that were severely impacted by the Covid-19 pandemic. These ranged from conventional monetary policy (CMP) actions such as reductions in the short-term interest rates to unconventional announcements such as extended lending programmes, asset purchases and forward guidance. The primary objective of these actions was to inject liquidity into the system and maintain the orderly flow of credit from financial intermediaries to the real economy. With the pandemic having subsided and the same central banks trying to exit the policies of abundant liquidity injection, it is now worthwhile to investigate the impact of these monetary policy actions on the financial markets. Against this background, in this paper, we empirically analyze the bond market impact of the conventional and unconventional monetary policy actions announced by the Reserve Bank of India (RBI) since the beginning of the pandemic. We focus on the bond market as it is one of the most important links in the overall monetary transmission mechanism. Footnote 1

India offers an interesting case study to examine this issue for two main reasons. While in the developed countries, governments announced massive fiscal stimulus packages in the wake of the pandemic to stimulate demand, in India, much of the heavy lifting was done by the RBI. Given the limited fiscal space (fiscal deficit of the central and state governments in the pre-pandemic period was close to 10 percent of GDP), the fiscal responses of the government were mostly restricted to providing relief measures to the disadvantaged sections of the Indian population. This led to considerable expectations in the financial markets that the RBI would provide the necessary support to the formal sector of the economy including both financial and non-financial firms.

Second, the RBI which had formally adopted inflation targeting in 2016, had not resorted to unconventional monetary policy (UMP) actions in as big a way as for example the US Federal Reserve or the European Central Bank at any point of time in the pre-pandemic period. Footnote 2 This makes a study of the RBI’s pandemic-time actions even more interesting. Footnote 3 Not only did the RBI undertake different types of UMP actions they also provided explicit forward guidance during the pandemic to anchor the expectations of the market participants. The objective of the conventional as well UMP actions was manifold including, aiming to improve monetary policy transmission, facilitating credit flow from banks to the rest of the economy, easing liquidity constraints in specific sectors, reducing financial stress in markets and maintaining financial stability (Patra & Bhattacharya, 2022 ).

Moreover, anecdotally another important goal seemed to be to keep the government’s borrowing costs in check. During the pandemic the Indian government’s debt-to-GDP ratio reached close to 90 percent of GDP implying unprecedented levels of borrowing by the government from the bond market. As a result, one of the main objectives of the RBI’s UMP announcements arguably was to lower the bond yields to support the government borrowing program. This was alluded to several times in the RBI’s official statements as well. Footnote 4

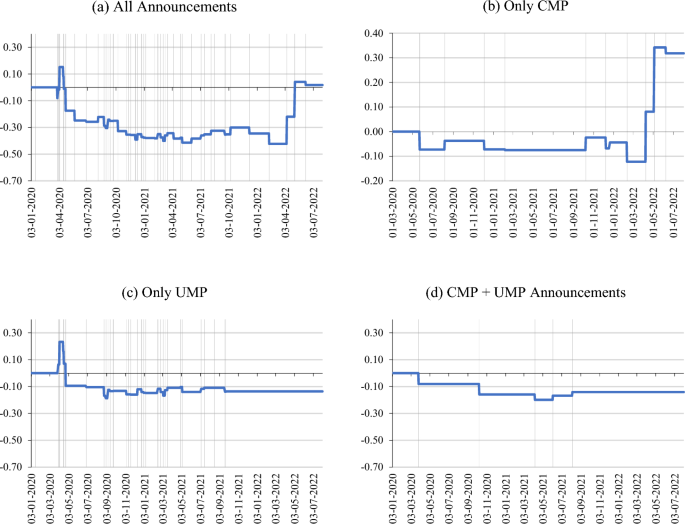

Our paper makes three main contributions in studying the bond market response to RBI’s pandemic-era monetary policy announcements. First, we study the media reactions to some of the major monetary policy announcements during our sample period which runs from March 2020 to June 2022. While using the change in financial market prices is a natural alternative to study the response to central bank announcements (and we also do this later in the paper), the narrative analysis using media articles allows us to provide more context in understanding the impact of these announcements. This is a novel aspect of our paper relative to the existing literature that analyzes the pandemic policy announcements of the RBI (see for example Patra & Bhattacharya, 2022 ; Talwar et al., 2021 ). Overall, we find that the narrative in the media is consistent with the financial market price changes. Both sources suggest that only a handful of the UMP actions and especially those in the early part of the pandemic took the markets by surprise. For instance, the market seems to have been more surprised by the first announcement of the Targeted Long-Term Repo Operations (TLTRO) (both in March and April) and the Operation Twist (OT) announcement in April. However, we do not find much of an effect of the GSAP (Government security acquisition program) announcements that happened more than a year into the pandemic in April and June 2021. For the conventional announcements, the markets seem to have been most surprised when the RBI began tightening monetary policy by raising the policy interest rates in the period from April to June 2022 in response to elevated inflation levels.

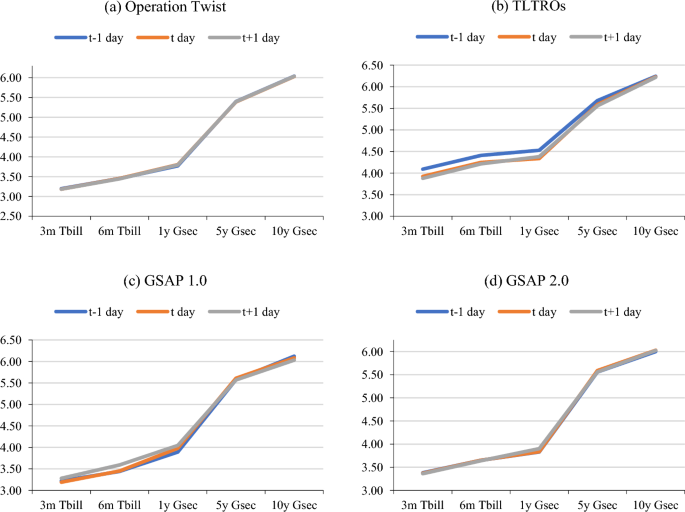

Second, we undertake a systematic investigation of how and why RBI announcements moved government bond yields since the start of the pandemic, focusing on both conventional and UMP announcements. Footnote 5 The total effect of the RBI’s surprise announcements in the first one and a half years of the pandemic was to reduce the yield on 10-year government securities (GSec) by at least 40 basis points. This accounts for the total fall in the 10-year GSec during that time. This effect was driven both by conventional and UMP actions. Consistent with the narrative analysis, we find that only 5 announcement dates, all in the first few months of the pandemic were responsible for the cumulative 40 bps fall in the 10-year yield. Four of these dates contained UMP announcements, such as TLTRO and Operation Twist (OT). Notably, the GSAP measures announced by the RBI in April and June 2021, during the second wave of the pandemic did not have any discernible impact on the bond yields. In other words, much of the impact of the RBI’s announcements was front-loaded in the first six months of the pandemic.

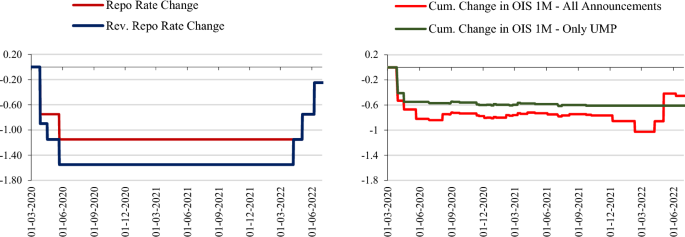

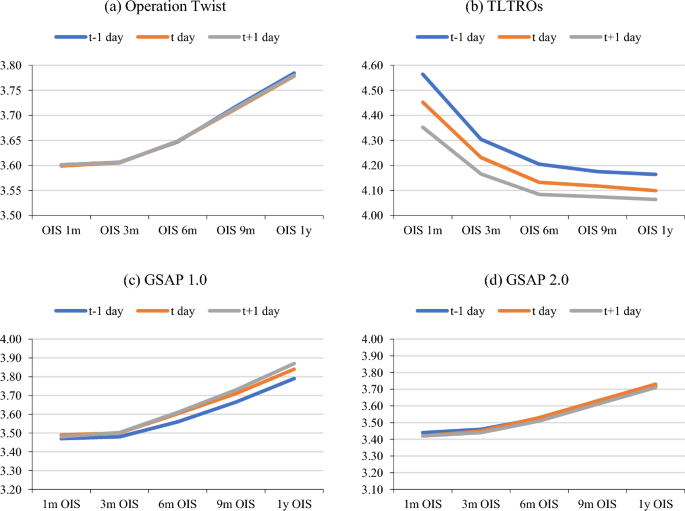

We also investigate if there are any indirect effects of the UMP announcements. We find evidence of the TLTRO announcements working through a signaling channel (see for eg., Bauer & Rudebusch, 2014 ). The idea behind this channel is that markets perceive the announcement of an unconventional monetary policy by the central banks as a signal to keep short-term interest rates lower in the future. We explore this channel using data from Overnight Indexed Swap (OIS) rates. While TLTRO announcements had a pronounced signaling channel effect of lowering short to medium-term interest rates, we do not find this for the other UMP actions.

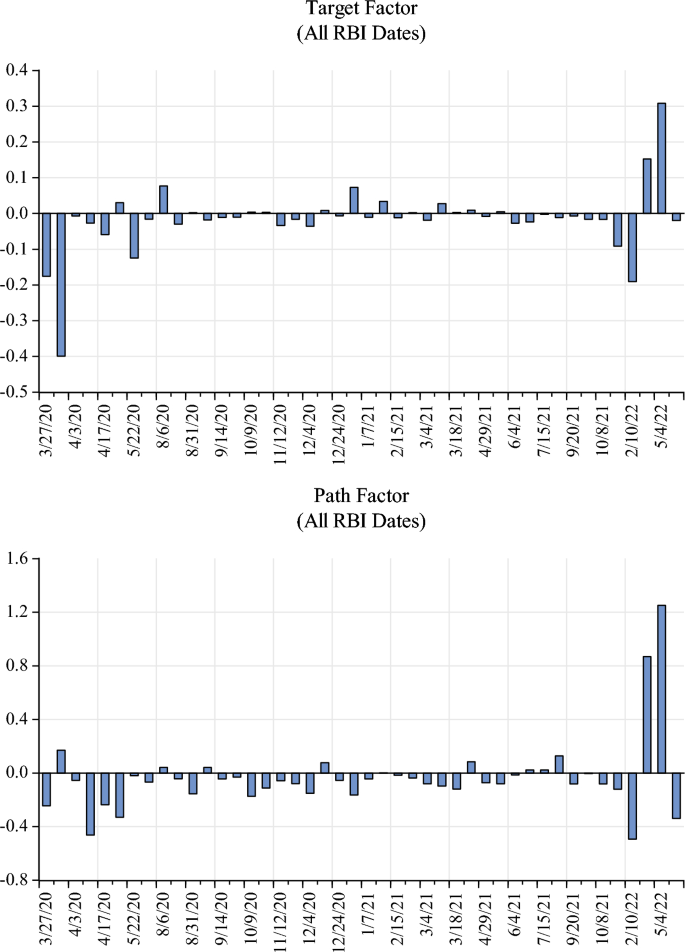

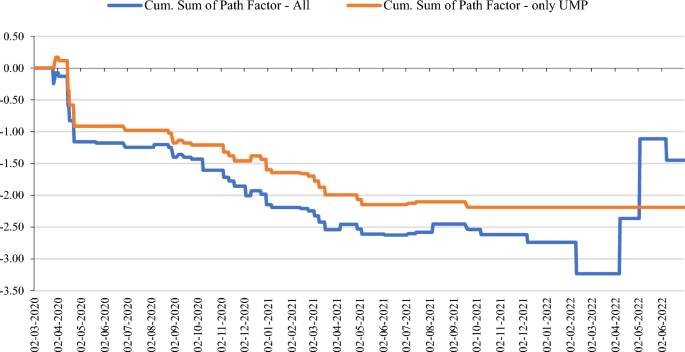

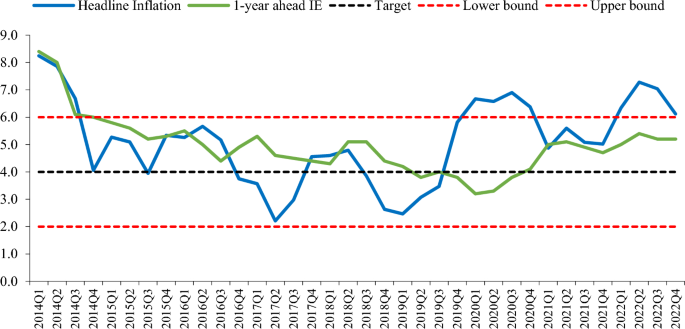

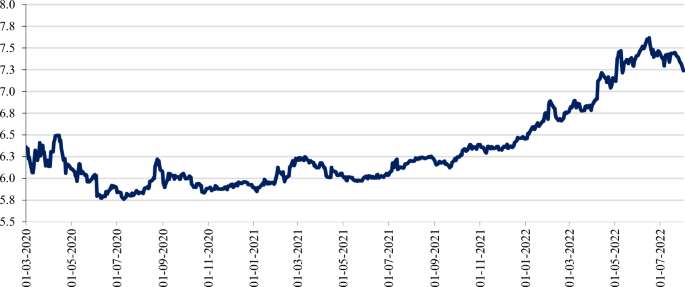

Finally, we assess the potential impact of the RBI’s forward guidance on the bond markets. The RBI traditionally did not offer forward guidance (Lakdawala & Sengupta, 2021 ; Mathur & Sengupta, 2019 ) as part of its monetary policy statements. However, during the pandemic forward guidance gained prominence in the RBI’s communication strategy (Talwar et al., 2021 ) primarily to reiterate the accommodative stance of monetary policy. We use OIS rates and the approach of Gürkaynak et al., ( 2005 ) to construct target and path factors which captures surprise changes to the short-term policy rate and surprise movements in the medium-term rates, respectively. Specifically, the path factor moves in response to surprise changes in the RBI’s forward guidance. We find that forward guidance shocks continued to have an expansionary effect on longer term rates not only in the first year of the pandemic but through early 2022. The biggest path factor movements however came about in 2022 when the RBI began tightening monetary policy to tackle high and rising inflation. Footnote 6 We also find that while in the pre-pandemic period, the target factor was the main driver for bond yields, in the pandemic period, the path factor was more important. This underscores the importance of the RBI’s forward guidance over the last two years.

While there exist by now several studies that analyze the impact of monetary policy actions particularly UMP announcements on bond markets (for e.g., Rebucci et al., 2022 ), to the best of our knowledge there is only a limited literature on this topic for emerging economies like India especially for the pandemic period (notable exceptions are Das et al., 2020a , Patra & Bhattacharya, 2022 and Talwar et al., 2021 ). We address this gap and contribute to this nascent literature by conducting a narrative analysis using media reports which enables us to study market’s reactions to the announcements and also by looking at both expansionary and contractionary announcements by the RBI. Our paper is also related to the broader strand of India-focused empirical literature that analyses the impact of the RBI’s announcements on financial markets. Footnote 7 The rest of the paper is organized as follows. In Sect. 2 , we describe various monetary policy actions undertaken by the RBI during the pandemic and discuss the media coverage around some of the major announcements. We analyze the bond market response to both unconventional and conventional monetary policy announcements in Sect. 3 followed by an analysis of RBI's forward guidance policies during the pandemic in Sect. 4 . We conclude the paper in Sect. 5 by drawing policy implications for the design and conduct of monetary policy in the future.

2 Monetary announcements during pandemic and market reactions

The RBI announced a slew of conventional and unconventional monetary policy (UMP) measures during the pandemic. Conventional measure refers to changes in the short-term policy rate (i.e., repo rate). According to the inflation targeting mandate of the RBI the monetary policy committee (MPC) is responsible for deciding the policy repo rate. As per the RBI’s liquidity management framework, the repo rate lies in a corridor (referred to as the Liquidity Adjustment Facility or LAF corridor) whose floor is decided by the reverse repo rate and the ceiling is decided by the marginal standing facility (MSF) rate (Dua, 2020 ). This corridor used to have a fixed width in the pre-pandemic period implying that once the MPC decided the repo rate, the other two rates were automatically determined. Till the pandemic, the reverse repo rate had never been changed in isolation by the RBI. However, during the pandemic, on April 17, 2020 the RBI cut the reverse repo rate by 25 basis points (bps) without changing the repo rate, as a result of which the LAF corridor became asymmetric with a downward bias. This was done predominantly to discourage the banks to park their excess liquidity with the RBI. However, this move would be considered an UMP action because it was not part of the conventional monetary policy statement of the MPC and did not entail a change in the policy rate.

In addition to this, the RBI announced several other UMP actions during the pandemic which we have described in the Appendix in Table 6 and Table 7 . The rationale and the nature of the policy actions, the transmission channels and the scale of operations are considered the main distinguishing features of UMP announcements (BIS, 2019 ; Patra & Bhattacharya, 2022 ). RBI undertook three main types of UMP actions, namely TLTRO, Operation Twist and G-SAP. TLTRO was introduced to provide liquidity to specific sectors and entities experiencing liquidity stress (Talwar et al, 2021 ). Operation Twist (OT) was aimed at compressing the term premium and flattening the yield curve. G-SAP was an upfront commitment by the RBI on the size of GSec purchases in contrast to the regular discretionary purchases through open market operations (Patra & Bhattacharya, 2022 ).

In this section, we describe a few of the major announcements and analyze the financial market’s reaction to these announcements as understood from articles published in the Economic Times (henceforth ET), a leading financial daily in India. We list some of the major announcement dates during our sample period in Table 1 .

The announcement of the nationwide lockdown on March 27, 2020 was followed by the Finance Minister announcing a fiscal package of Rs. 1.7 lakh crore on March 26, 2020. The market viewed this mostly as a relief package for the country’s poor in the wake of lockdown, without any demand stimulus per se, or any relief for the industry, including the hardest hit sectors such as aviation, and hospitality among others. This created some expectation that the RBI would announce some major policy actions to provide much needed support to the economy.

The RBI preponed its scheduled monetary policy meeting from April to March 2020. On March 27, 2020, in keeping with the expectations, in an unscheduled monetary policy announcement, the RBI announced a big expansion in monetary policy. This included a 75 basis points (bps) cut in the policy repo rate, a 90 bps cut in the reverse repo rate, and a 1 percent reduction in the cash reserve ratio (CRR). Simultaneously, the RBI announced an unconventional monetary policy in the form of the TLTRO (Targeted Long-Term Repo Operation or repurchase operation in government securities). While the RBI had been doing LTRO (Long-term repo operations) since February 2020 to improve monetary policy transmission, this was the first time it announced a targeted version of this program. The idea was that the banks would use the liquidity available under this scheme to invest in corporate bonds or commercial paper or debentures, and this would keep credit flowing in the economy. These announcements together were meant to inject Rs 3.74 lakh crore liquidity in the system, which amounted to about 1.8 percent of India’s GDP.

The RBI’s announcement came at a time when the market was already expecting a considerable monetary policy support given the shock of the pandemic and the lockdown. At the same time, in some quarters, the magnitude and variety of measures announced may have led to some element of surprise. For example, some analysts noted that “The RBI has surpassed expectations by delivering more than what the market anticipated, and its promise to 'do whatever it takes' has come good.” Footnote 8

Over the next couple of weeks, the RBI announced more TLTRO auctions. While these announcements were lauded by the analysts and markets in general, the overarching sentiment seemed to be that the government was not going to announce a sizeable fiscal stimulus because of constrained fiscal space, and hence the RBI would have to do much of the heavy lifting; however, the measures announced by the RBI did not seem adequate or appropriately targeted. For example, market expected the RBI to follow the footsteps of the US Federal Reserve, and directly start buying corporate bonds. The ET reported on April 15, 2020: “ RBI, which has been reluctant in following the sweeping actions of Federal Reserve, could use Sec 17 of the RBI Act to extend bond purchases to include corporate bonds with sufficient haircuts .” Footnote 9

There were also fears that given the high fiscal deficit of the government on account of reduction in tax revenues triggered by the lockdown, the government would need to significantly increase its borrowing from the market and this could push up bond yields. This led to expectations that the RBI would need to do more to keep the bond yields in check and support the government’s borrowing program. “ The RBI should consider another package of wide ranging measures…….The growth impact from Covid-19 due to required measures such as the lockdown, will require active support from the RBI to ensure that Government borrowing for the current financial year is conducted smoothly (ET, April 15, 2020)”.