We're sorry for any inconvenience, but the site is currently unavailable.

- Kreyòl Ayisyen

What are title service fees?

Title service fees are part of the closing costs you pay when getting a mortgage. When you purchase a home, you receive a document most often called a deed, which shows the seller transferred their legal ownership, or “title,” to the home to you. Title service fees are costs associated with issuing a title insurance policy for the lender.

Title insurance can provide protection if someone later sues and says they have a claim against the home. Common claims come from a previous owner’s failure to pay taxes or from contractors who say they were not paid for work done on the home before you purchased it.

Lender’s title insurance is usually required to get a mortgage loan. Title service fees include the title search fee, the premium for the lender’s title insurance policy, and other costs and services associated with issuing title insurance. In most states, the fee for conducting your closing is also a part of the title service fees.

Title service fees are listed in section B or C of page 2 of your Loan Estimate (and in section B or C of page 2 of your Closing Disclosure ). If the title services are listed in Section C, you can shop for them separately .

If you choose to purchase owner’s title insurance , it will be listed in section H of your Loan Estimate.

See an interactive sample Loan Estimate form .

Note: You won’t receive a Loan Estimate or Closing Disclosure if you applied for a mortgage prior to October 3, 2015, or if you're applying for a reverse mortgage . For those loans , you will receive two forms – a Good Faith Estimate (GFE) and an initial Truth-in-Lending disclosure – instead of a Loan Estimate. Instead of a Closing Disclosure, you will receive a final Truth in Lending disclosure and a HUD -1 Settlement Statement . Title service fees are listed in Block 4 of your GFE (and Line 1101 of your HUD-1 settlement statement ). If you are applying for a HELOC , a manufactured housing loan that is not secured by real estate, or a loan through certain types of homebuyer assistance programs, you will not receive a GFE or a Loan Estimate, but you should receive a Truth-in-Lending disclosure .

Don't see what you're looking for?

Browse related questions.

- Can my final mortgage costs increase from what was on my Loan Estimate?

- What is owner's title insurance?

- What is lender's title insurance?

- Learn more about mortgages

Search for your question

Searches are limited to 75 characters.

A guide to understanding title fees

Whether you’re buying a home or refinancing, there are costs associated with insuring, reviewing, and modifying the title of that property. These costs are called “title fees,” because the “title” is a legal document that proves you own a property.

Title fees can cover a wide range of costs, so we’ve outlined a few of them below to help you know what to expect.

Where to find title fees

Title fees are listed as part of your Loan Estimate (LE) — a legally required document that summarizes the features, costs, and risks associated with your mortgage. Every lender is obligated to provide an official Loan Estimate within 3 days of receiving a new application. So if you haven’t seen one yet, be sure to ask about it.

What it all means

Next we’ll define each item, and explain why it’s required. The specific terms used may vary a bit from lender to lender, but if you understand the meaning of each, you should be able to navigate any Loan Estimate without too much trouble.

Attorney Fee

Depending on the state, an attorney might be required to review the title work, provide an attorney opinion letter, and hold and disburse funds. This fee covers that work.

Closing Protection Letter (CPL)

The CPL is an agreement written by the title company that protects the lender in case of losses caused by misconduct on the part of the closing agent. (Title companies charge this fee to draft the document.)

A Commitment is a document that discloses liens, defects, and burdens that affect the property and all the requirements that must be met before the title can be insured.

Owner’s Title Insurance

Owner’s Title Insurance protects the homeowner in case of any title claims made on the property. It's optional, but generally recommended for homeowners. An Owner’s policy lasts as long as the property is in your possession, so it won’t need to be repurchased if you refinance your home.

Lender’s Title Insurance

Lender’s Title Insurance is required in nearly all refinance and purchase transactions. As the name suggests, this policy protects the lender against losses incurred due to title disputes. In a refinance transaction, the lender’s premium is typically paid by the borrower, but in some purchase transactions, the borrower may be responsible for the cost. The lender’s premium is dependent on the loan amount or purchase amount. So if either increase, the premium will likely follow suit. The cost of Lender’s Title Insurance also varies by location, and is strictly regulated on a state by state basis.

Settlement Fee

Sometimes referred to the Closing Fee, the Settlement Fee covers costs associated with closing operations. Some title companies list out each cost, and some bucket them all in one place, so be sure you know exactly what you’re paying for. Costs bundled under the Settlement Fee may include the cost of escrow, survey fees, notary fees, deed prep fees, and search abstract fees.

Search Abstract Fee

This fee is paid to a third party vendor to disclose historical information about the ownership of the property. It may appear as an individual item, or be included as part of the Settlement Fee.

This fee is paid to a third party vendor to survey the property, and verify its boundaries, if needed. It may appear as an individual item, or be included as part of the Settlement Fee.

The cost to get a notary to meet at a specified location for the closing and for sending the scanned copy and mailing the physical copy to the title company.

Deed Prep Fee

A Deed Prep Fee is applicable when a title is transferred, or an existing deed has to be modified as part of a transaction. When a home is purchased, for example, the deed must be transferred title from the seller to the buyer. A deed may also be required when refinancing if marital status has changed, or people need to be added or removed from the title.

Endorsement Fee

An Endorsement is a specific addition to the coverage that a lender may require beyond a standard policy. For example, if a structure was built near the property line, the policy may be expanded to cover the cost of relocating or rebuilding it in the event of a dispute.

Recording Fee

Recording Fees are set by the county, not the title company, to cover the cost of entering deeds and mortgages into the land records.If a home is being purchased, these fees may also include transfer taxes and intangible taxes. It’s important to note that this is an estimate; if these fees end up being less than you were quoted, you will be reimbursed for the difference.

How to spot “junk fees”

While most of the fees listed on your Loan Estimate are necessary for closing, it’s wise to keep an eye out for any padding that may have been added in. If you see any of the following fees, be sure to ask your lender what they mean, and why they’re necessary; they may not be legit.

- Application Fee

- Rate Lock Fee

- Loan Processing Fee

- Underwriting Fee

- Courier Fee

- Overnight Fee

Still have questions about title insurance?

Better Settlement Services, an affiliate of Better Mortgage, has answers. Contact us at [email protected] and we’d be happy to provide you with any information you need.

How do I...

Schedule an office visit

- Renew my tabs

- Change my address

- Purchase a copy of my driving record

- Correct my name

- Renew my license or ID

- Apply for or renew a disability parking placard

- Apply for or renew a CDL

- Order a license plate

- Order a duplicate title

The web Browser you are currently using is unsupported, and some features of this site may not work as intended. Please update to a modern browser such as Chrome, Firefox or Edge to experience all features Michigan.gov has to offer.

- Google Chrome

- Microsoft Edge

Title transfer and vehicle registration

How can i title and register a vehicle.

Unavailable for this transaction

Unavailable

Self-service station

Office visit.

Complete your business in an average of 20 minutes

What do I need to title and register a vehicle? (Choose tab)

- Original title

- Title and registration fees

- Michigan No-Fault insurance

Present the original title (photocopies or titles that have been modified, such as crossing out a name, cannot be accepted) with:

- Your signature – All titled owners must sign when the title is transferred. Owners who can’t visit an office to sign the title may appoint an agent to sign on their behalf by completing an Appointment of Agent form.

- Seller’s signature – The seller must complete and sign the seller’s portion of the title if they don’t plan to visit a Secretary of State office with you.

- Odometer disclosure statement – Ensure the odometer reading is accurately recorded on the title. If space is not provided on the title, complete and submit an Odometer Mileage Statement.

- Statement from loan provider – If there was a loan against the vehicle, provide the lien termination statement or signed title from the financial institution that administered the loan. If there is an active loan on the title, a letter of authorization from the lienholder must be submitted with the title application.

- You also will need to bring your Michigan driver’s license or ID.

Appointment of Agent form

Odometer Mileage Statement

- $15 – Title transfer fee

- $10 to $15 – Plate transfer fee (varies depending on whether the vehicle receiving the plate was bought in a private sale or sold to a family member)

- 6 percent sales tax (not collected for vehicle sales to immediate family members)

- Recreation Passport (optional) - $14 for a one-year vehicle registration; $28 for a two-year vehicle registration; $8 for motorcycle registration

A $15 late fee will be charged if the title isn’t transferred within 15 days of the sale.

Secretary of State offices accept payment by cash, check, money order, or credit or debit card (additional fees apply).

Registration fee calculator

Plate transfer

You must provide proof of a valid Michigan No-Fault insurance policy to register your vehicle in Michigan.

Michigan.gov/AutoInsurance

Frequently asked questions (FAQs)

Most dealerships will handle the title transfer and vehicle registration process for you.

Yes but only if you drive the vehicle directly to the first place of storage (usually your home) within three days of the sale. You must have the properly assigned title and proof of insurance with you as temporary registration. At the time of the sale, remove the seller’s plate from the vehicle and return it to them.

Anyone whose name will be listed as an owner on the title must be present. It is advised that the seller also accompany the buyer to transfer the title. Those who cannot visit a Secretary of State office to transfer the vehicle title may appoint a designated agent or power of attorney to attend the office visit and sign the title on their behalf.

Title transfer and registration fees are set by state law and cannot be amended without legislative action.

You need to transfer the title within 15 days of purchasing the vehicle. A $15 late fee is charged if you don’t transfer the title in time.

If possible, the seller should join you at a Secretary of State office to complete the title transfer. Dealerships typically manage title transfers for vehicles purchased through the dealership.

Under Michigan law, title transfers between the following relatives aren’t subject to sales tax:

- Parent (or stepparent or mother/father-in-law)

- Child (or stepchild or daughter/son-in-law)

- Sibling (or stepsibling, half-sibling, or sister/brother-in-law)

- Grandparent

- Grandchild (or grandchild-in-law)

- Legally appointed guardian

No other relationships are tax exempt.

If the deceased owner's estate isn’t probated, the surviving spouse or legal next-of-kin may transfer the vehicle into their name by presenting the following at a Secretary of State office:

- The original vehicle title

- A certified copy of the death certificate

- Certification from the Heir to a Vehicle form (TR-29) completed by the next-of-kin

- License or ID for the next-of-kin

- Proof of Michigan No-Fault insurance, if the vehicle will be registered

If the estate is being probated, the personal representative appointed by Probate Court must assign the title to the surviving spouse. The spouse presents the assigned title and a copy of the personal representative's Letter of Authority document to apply for a title in their name at a Secretary of State office.

If the current title is in both your name and the deceased's name with the legend "Full Rights To Survivor" printed on it, then all that is needed to transfer the vehicle into just your name is the title and a copy of the death certificate.

Certification from the Heir to a Vehicle form (TR-29)

A title with a lien on it may be transferred only if the loan is paid off and a statement or letter of termination is provided by the lienholder, or if a letter of authorization from the lienholder approving the transfer is submitted with the title application.

Yes. A person who cannot prove they sold their vehicle as required by Section 257.240 is responsible for a civil infraction and subject to a civil fine of $15. The person is also presumed to be the last titled owner and is liable for towing fees and daily storage fees if the vehicle is abandoned.

Still have questions?

Calculate My Fees

Vehicle License Fee (VLF) paid for tax purposes

Select a Calculator to Begin

- Registration renewal fees

- Registration fees for new vehicles that will be purchased in California from a licensed California dealer

- Registration fees for new resident vehicles registered outside the state of California

- Registration fees for used vehicles that will be purchased in California

Disregard transportation improvement fee (TIF) generated for commercial vehicles with Unladen Weight of 10,001 pounds or greater. These vehicles are exempt from paying the TIF. The vehicle registration fee calculator will be corrected soon.

Renew Registration

Skip the line and renew your vehicle registration online.

Title Transfer

When a vehicle/vessel is bought or sold, or there’s any change to the registered owner or lienholder (legal owner), the California Certificate of Title needs to be transferred to the new owner.

Online Services

DMV offers many services that can be handled online.

General Disclaimer

When interacting with the Department of Motor Vehicles (DMV) Virtual Assistant, please do not include any personal information.

When your chat is over, you can save the transcript. Use caution when using a public computer or device.

The DMV chatbot and live chat services use third-party vendors to provide machine translation. Machine translation is provided for purposes of information and convenience only. The DMV is unable to guarantee the accuracy of any translation provided by the third-party vendors and is therefore not liable for any inaccurate information or changes in the formatting of the content resulting from the use of the translation service.

The content currently in English is the official and accurate source for the program information and services DMV provides. Any discrepancies or differences created in the translation are not binding and have no legal effect for compliance or enforcement purposes. If any questions arise related to the information contained in the translated content, please refer to the English version.

Google™ Translate Disclaimer

The Department of Motor Vehicles (DMV) website uses Google™ Translate to provide automatic translation of its web pages. This translation application tool is provided for purposes of information and convenience only. Google™ Translate is a free third-party service, which is not controlled by the DMV. The DMV is unable to guarantee the accuracy of any translation provided by Google™ Translate and is therefore not liable for any inaccurate information or changes in the formatting of the pages resulting from the use of the translation application tool.

The web pages currently in English on the DMV website are the official and accurate source for the program information and services the DMV provides. Any discrepancies or differences created in the translation are not binding and have no legal effect for compliance or enforcement purposes. If any questions arise related to the information contained in the translated website, please refer to the English version.

The following pages provided on the DMV website cannot be translated using Google™ Translate:

- Publications

- Field Office Locations

- Online Applications

Please install the Google Toolbar

Google Translate is not support in your browser. To translate this page, please install the Google Toolbar (opens in new window) .

- Coaching Team

- Investor Tools

- Student Success

Real Estate Investing Strategies

- Real Estate Business

- Real Estate Markets

- Real Estate Financing

- REITs & Stock Investing

How To Navigate The Real Estate Assignment Contract

What is assignment of contract?

Assignment of contract vs double close

How to assign a contract

Assignment of contract pros and cons

Even the most left-brained, technical real estate practitioners may find themselves overwhelmed by the legal forms that have become synonymous with the investing industry. The assignment of contract strategy, in particular, has developed a confusing reputation for those unfamiliar with the concept of wholesaling. At the very least, there’s a good chance the “assignment of contract real estate” exit strategy sounds more like a foreign language to new investors than a viable means to an end.

A real estate assignment contract isn’t as complicated as many make it out to be, nor is it something to shy away from because of a lack of understanding. Instead, new investors need to learn how to assign a real estate contract as this particular exit strategy represents one of the best ways to break into the industry.

In this article, we will break down the elements of a real estate assignment contract, or a real estate wholesale contract, and provide strategies for how it can help investors further their careers. [ It's time to escape the rat race. Register to attend a free one-day investing event , where you'll learn how one secret strategy can help you create cash flow from the stock market. ]

What Is A Real Estate Assignment Contract?

A real estate assignment contract is a wholesale strategy used by real estate investors to facilitate the sale of a property between an owner and an end buyer. As its name suggests, contract assignment strategies will witness a subject property owner sign a contract with an investor that gives them the rights to buy the home. That’s an important distinction to make, as the contract only gives the investor the right to buy the home; they don’t actually follow through on a purchase. Once under contract, however, the investor retains the sole right to buy the home. That means they may then sell their rights to buy the house to another buyer. Therefore, when a wholesaler executes a contact assignment, they aren’t selling a house but rather their rights to buy a house. The end buyer will pay the wholesale a small assignment fee and buy the house from the original buyer.

The real estate assignment contract strategy is only as strong as the contracts used in the agreement. The language used in the respective contract is of the utmost importance and should clearly define what the investors and sellers expect out of the deal.

There are a couple of caveats to keep in mind when considering using sales contracts for real estate:

Contract prohibitions: Make sure the contract you have with the property seller does not have prohibitions for future assignments. This can create serious issues down the road. Make sure the contract is drafted by a lawyer that specializes in real estate assignment contract law.

Property-specific prohibitions: HUD homes (property obtained by the Department of Housing and Urban Development), real estate owned or REOs (foreclosed-upon property), and listed properties are not open to assignment contracts. REO properties, for example, have a 90-day period before being allowed to be resold.

What Is An Assignment Fee In Real Estate?

An assignment fee in real estate is the money a wholesaler can expect to receive from an end buyer when they sell them their rights to buy the subject property. In other words, the assignment fee serves as the monetary compensation awarded to the wholesaler for connecting the original seller with the end buyer.

Again, any contract used to disclose a wholesale deal should be completely transparent, and including the assignment fee is no exception. The terms of how an investor will be paid upon assigning a contract should, nonetheless, be spelled out in the contract itself.

The standard assignment fee is $5,000. However, every deal is different. Buyers differ on their needs and criteria for spending their money (e.g., rehabbing vs. buy-and-hold buyers). As with any negotiations , proper information is vital. Take the time to find out how much the property would realistically cost before and after repairs. Then, add your preferred assignment fee on top of it.

Traditionally, investors will receive a deposit when they sign the Assignment of Real Estate Purchase and Sale Agreement . The rest of the assignment fee will be paid out upon the deal closing.

Assignment Contract Vs Double Close

The real estate assignment contract strategy is just one of the two methods investors may use to wholesale a deal. In addition to assigning contracts, investors may also choose to double close. While both strategies are essentially variations of a wholesale deal, several differences must be noted.

A double closing, otherwise known as a back-to-back closing, will have investors actually purchase the home. However, instead of holding onto it, they will immediately sell the asset without rehabbing it. Double closings aren’t as traditional as fast as contract assignment, but they can be in the right situation. Double closings can also take as long as a few weeks. In the end, double closings aren’t all that different from a traditional buy and sell; they transpire over a meeter of weeks instead of months.

Assignment real estate strategies are usually the first option investors will want to consider, as they are slightly easier and less involved. That said, real estate assignment contract methods aren’t necessarily better; they are just different. The wholesale strategy an investor chooses is entirely dependent on their situation. For example, if a buyer cannot line up funding fast enough, they may need to initiate a double closing because they don’t have the capital to pay the acquisition costs and assignment fee. Meanwhile, select institutional lenders incorporate language against lending money in an assignment of contract scenario. Therefore, any subsequent wholesale will need to be an assignment of contract.

Double closings and contract assignments are simply two means of obtaining the same end. Neither is better than the other; they are meant to be used in different scenarios.

Flipping Real Estate Contracts

Those unfamiliar with the real estate contract assignment concept may know it as something else: flipping real estate contracts; if for nothing else, the two are one-in-the-same. Flipping real estate contracts is simply another way to refer to assigning a contract.

Is An Assignment Of Contract Legal?

Yes, an assignment of contract is legal when executed correctly. Wholesalers must follow local laws regulating the language of contracts, as some jurisdictions have more regulations than others. It is also becoming increasingly common to assign contracts to a legal entity or LLC rather than an individual, to prevent objections from the bank. Note that you will need written consent from all parties listed on the contract, and there cannot be any clauses present that violate the law. If you have any questions about the specific language to include in a contract, it’s always a good idea to consult a qualified real estate attorney.

When Will Assignments Not Be Enforced?

In certain cases, an assignment of contract will not be enforced. Most notably, if the contract violates the law or any local regulations it cannot be enforced. This is why it is always encouraged to understand real estate laws and policy as soon as you enter the industry. Further, working with a qualified attorney when crafting contracts can be beneficial.

It may seem obvious, but assignment contracts will not be enforced if the language is used incorrectly. If the language in a contract contradicts itself, or if the contract is not legally binding it cannot be enforced. Essentially if there is any anti-assignment language, this can void the contract. Finally, if the assignment violates what is included under the contract, for example by devaluing the item, the contract will likely not be enforced.

How To Assign A Real Estate Contract

A wholesaling investment strategy that utilizes assignment contracts has many advantages, one of them being a low barrier-to-entry for investors. However, despite its inherent profitability, there are a lot of investors that underestimate the process. While probably the easiest exit strategy in all of real estate investing, there are a number of steps that must be taken to ensure a timely and profitable contract assignment, not the least of which include:

Find the right property

Acquire a real estate contract template

Submit the contract

Assign the contract

Collect the fee

1. Find The Right Property

You need to prune your leads, whether from newspaper ads, online marketing, or direct mail marketing. Remember, you aren’t just looking for any seller: you need a motivated seller who will sell their property at a price that works with your investing strategy.

The difference between a regular seller and a motivated seller is the latter’s sense of urgency. A motivated seller wants their property sold now. Pick a seller who wants to be rid of their property in the quickest time possible. It could be because they’re moving out of state, or they want to buy another house in a different area ASAP. Or, they don’t want to live in that house anymore for personal reasons. The key is to know their motivation for selling and determine if that intent is enough to sell immediately.

With a better idea of who to buy from, wholesalers will have an easier time exercising one of several marketing strategies:

Direct Mail

Real Estate Meetings

Local Marketing

2. Acquire A Real Estate Contract Template

Real estate assignment contract templates are readily available online. Although it’s tempting to go the DIY route, it’s generally advisable to let a lawyer see it first. This way, you will have the comfort of knowing you are doing it right, and that you have counsel in case of any legal problems along the way.

One of the things proper wholesale real estate contracts add is the phrase “and/or assigns” next to your name. This clause will give you the authority to sell the property or assign the property to another buyer.

You do need to disclose this to the seller and explain the clause if needed. Assure them that they will still get the amount you both agreed upon, but it gives you deal flexibility down the road.

3. Submit The Contract

Depending on your state’s laws, you need to submit your real estate assignment contract to a title company, or a closing attorney, for a title search. These are independent parties that look into the history of a property, seeing that there are no liens attached to the title. They then sign off on the validity of the contract.

4. Assign The Contract

Finding your buyer, similar to finding a seller, requires proper segmentation. When searching for buyers, investors should exercise several avenues, including online marketing, listing websites, or networking groups. In the real estate industry, this process is called building a buyer’s list, and it is a crucial step to finding success in assigning contracts.

Once you have found a buyer (hopefully from your ever-growing buyer’s list), ensure your contract includes language that covers earnest money to be paid upfront. This grants you protection against a possible breach of contract. This also assures you that you will profit, whether the transaction closes or not, as earnest money is non-refundable. How much it is depends on you, as long as it is properly justified.

5. Collect The Fee

Your profit from a deal of this kind comes from both your assignment fee, as well as the difference between the agreed-upon value and how much you sell it to the buyer. If you and the seller decide you will buy the property for $75,000 and sell it for $80,000 to the buyer, you profit $5,000. The deal is closed once the buyer pays the full $80,000.

Assignment of Contract Pros

For many investors, the most attractive benefit of an assignment of contract is the ability to profit without ever purchasing a property. This is often what attracts people to start wholesaling, as it allows many to learn the ropes of real estate with relatively low stakes. An assignment fee can either be determined as a percentage of the purchase price or as a set amount determined by the wholesaler. A standard fee is around $5,000 per contract.

The profit potential is not the only positive associated with an assignment of contract. Investors also benefit from not being added to the title chain, which can greatly reduce the costs and timeline associated with a deal. This benefit can even transfer to the seller and end buyer, as they get to avoid paying a real estate agent fee by opting for an assignment of contract. Compared to a double close (another popular wholesaling strategy), investors can avoid two sets of closing costs. All of these pros can positively impact an investor’s bottom line, making this a highly desirable exit strategy.

Assignment of Contract Cons

Although there are numerous perks to an assignment of contract, there are a few downsides to be aware of before searching for your first wholesale deal. Namely, working with buyers and sellers who may not be familiar with wholesaling can be challenging. Investors need to be prepared to familiarize newcomers with the process and be ready to answer any questions. Occasionally, sellers will purposely not accept an assignment of contract situation. Investors should occasionally expect this, as to not get discouraged.

Another obstacle wholesalers may face when working with an assignment of contract is in cases where the end buyer wants to back out. This can happen if the buyer is not comfortable paying the assignment fee, or if they don’t have owner’s rights until the contract is fully assigned. The best way to protect yourself from situations like this is to form a reliable buyer’s list and be upfront with all of the information. It is always recommended to develop a solid contract as well.

Know that not all properties can be wholesaled, for example HUD houses. In these cases, there are often anti-assigned clauses preventing wholesalers from getting involved. Make sure you know how to identify these properties so you don’t waste your time. Keep in mind that while there are cons to this real estate exit strategy, the right preparation can help investors avoid any big challenges.

Assignment of Contract Template

If you decide to pursue a career wholesaling real estate, then you’ll want the tools that will make your life as easy as possible. The good news is that there are plenty of real estate tools and templates at your disposal so that you don’t have to reinvent the wheel! For instance, here is an assignment of contract template that you can use when you strike your first deal.

As with any part of the real estate investing trade, no single aspect will lead to success. However, understanding how a real estate assignment of contract works is vital for this business. When you comprehend the many layers of how contracts are assigned—and how wholesaling works from beginning to end—you’ll be a more informed, educated, and successful investor.

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!

What is an STR in Real Estate?

Wholetailing: a guide for real estate investors, what is chain of title in real estate investing, what is a real estate fund of funds (fof), reits vs real estate: which is the better investment, multi-family vs. single-family property investments: a comprehensive guide.

An official website of the Washington state government

The .gov means it’s official. A .gov website belongs to an official government organization in the United States.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

Transfer title: Buying from private party

Learn how to transfer a vehicle purchased from a private party into your name.

Before you get started

When to transfer a vehicle title into your name.

After you buy or receive a vehicle as a gift, you have 15 days to transfer the ownership into your name. If you don't transfer within 15 days you'll have to pay penalties:

- $50 on the 16th day, or

- $2 per day after the 16th day (up to $125)

If you buy from an out-of-state dealer, you may need to take care of the transfer. If you buy from a Washington State (WA) dealer, they will take care of the transfer. Learn more about buying from a WA dealer .

Contact a vehicle licensing office to learn how much it will cost to transfer ownership of your new vehicle into your name.

Gather the information and forms you need

Odometer disclosure form.

- If the vehicle model year is 2011 or newer, you should fill out the Odometer Disclosure section on the title.

- If the vehicle model year is 2010 or older, you don't have to report the Odometer miles.

If you don't have the title, you can get an Odometer Disclosure form at your local vehicle licensing office. You cannot download this form. We will provide it for you in the office on tamper-proof paper.

- Vehicle/Vessel Bill of Sale

You and the seller need to complete the Vehicle/Vessel Bill of Sale form.

- Enter the sale price (this is used to calculate the use tax on the vehicle), or

- Enter zero if the vehicle was a gift or inheritance

Notarized Vehicle Title Application

Signatures on the Vehicle Title Application form must be notarized. Don't sign this form until you are in front of either:

- a notary public, or

- a licensing agent at a vehicle licensing office

Submit your forms and payment

Submit the following to a vehicle licensing office:

- Vehicle Certificate of Ownership (Title) Application form

- The current vehicle title

- Payment (contact a vehicle licensing office for the exact amount)

You may also need to submit:

- Affidavit of Loss/Release of Interest

- Affidavit of Inheritance/Litigation

- Odometer Disclosure Statement

Get your title

There are 2 ways to get your title. You can submit your forms to:

- A vehicle licensing office and get your title in 6-8 weeks

- A Quick Title office * and get your title immediately in person or within a few business days by mail. Quick Titles have an additional $50 fee.

* Note: Quick Titles aren't available for snowmobiles, vehicles or boats reported as stolen, insurance or wrecker-destroyed vehicles and boats, or vehicles with "WA Rebuilt" on the title.

Get new license plates

Since the vehicle has changed ownership, you'll need to get new license plates.

Plates don't need to be replaced (unless the vehicle has out-of-state plates) if:

- You're removing a deceased spouse or domestic partner from the title.

- your spouse or domestic partner

- a family member as a gift or inheritance

- a trust in which the registered owner or their immediate family members are the beneficiaries of the trust

Learn more about plate replacement requirements

Add the vehicle to your License eXpress account

Once the ownership has been transferred into your name, you can add it to your License eXpress account . With License eXpress, you can manage all your vehicles:

- See when your vehicle's tabs are due

- Make sure your address is up to date

- Sign up for email renewal notices and more

Need additional help? Here's how to contact us:

Related information, report of sale.

Learn when and why to report if you sell, gift, or donate your vehicle.

Vehicle licensing office locations

Find an office location.

Register a new vehicle

Learn how to transfer ownership of a vehicle, transfer a title, and get tabs on your new vehicle.

5. Is it ethical

Now that we got the “ legal ” question out of the way…

What about “How ethical is it to wholesale”.

Type that into the web and you’ll get thrown into a black hole of comments and forums chatter you won’t ever be able to get out of.

Here’s the bottom line of why it gets so much controversy and what it has to do with assignment fees…

Wholesalers are going around marketing “We buy houses CASH” when in reality, they aren’t buying it cash… they’re assigning the contract for a fee.

This is where everyone gets their tights all tied up in a bunch (did I just make up a word?! Yes! I did). Because if you say you’re going to close it with cash, but you have to walk away from the seller because you can’t find a buyer… how would you feel leaving a seller (who seriously needed to close yesterday), hanging)?

Some with a conscious would feel pretty bad… others don’t care.

So it’s up to you how you feel about the ethics side of things.

Can you close the deal yourself if you can’t find a cash buyer , via a hard money lender or partner? Or will you feel comfortable walking away from the deal? Or will you be confident enough to go up to the seller and tell her the truth, that you intended on selling the contract to a cash buyer but it seems that your priced it too high, can we renegotiate?

The underlying problem with “walking away” from a buyer is not pricing it right.

If you have a good deal, cash buyers will be all over it and be HAPPY to pay you an assignment fee.

Here’s a video on ethical wholesaling:

6. How much should a fee be?

New wholesalers typically aren’t sure what they should charge. But it’s going to vary from deal-to-deal, and market to market.

A decent wholesaling fee can range from $10,000 to $30,000.

There are occasions when you hear about $100,000 assignment fees. And they do happen. It’s just a matter of negotiating a good deal.

While there isn’t a “set fee” that wholesalers should charge, it all depends on how good of a deal you can negotiate, and how high you can mark up the contract for an end buyer.

So there are two components that determine how much you can get paid for an assignment fee:

- Seller’s price.

- End buyers price.

Later, in another section, I talk about how you can increase your assignment fee… for now, let’s just cover how much your can charge.

Earlier I mentioned that your market might have an influence on how much you can charge. And that has more to do with how low of a discount, sellers are willing to take AND how competitive it is in your market.

Here’s an example:

If a seller talks to three wholesalers, one offers $200,000 while the others offer $180,000, she most likely will go with the higher offer. Well, now those wholesalers might enter into bidding wars in the market, by creeping up their MAOP (Max allowable offer price).

When wholesalers start raising their Max offers (because the market is demanding it), AND if the end buying price (what cash buyers are willing to pay for that deal) does move up with it…

Then you start seeing wholesalers’ assignment fees start shrinking down. We’ll go over later some techniques for helping with this natural occurrence in the market.

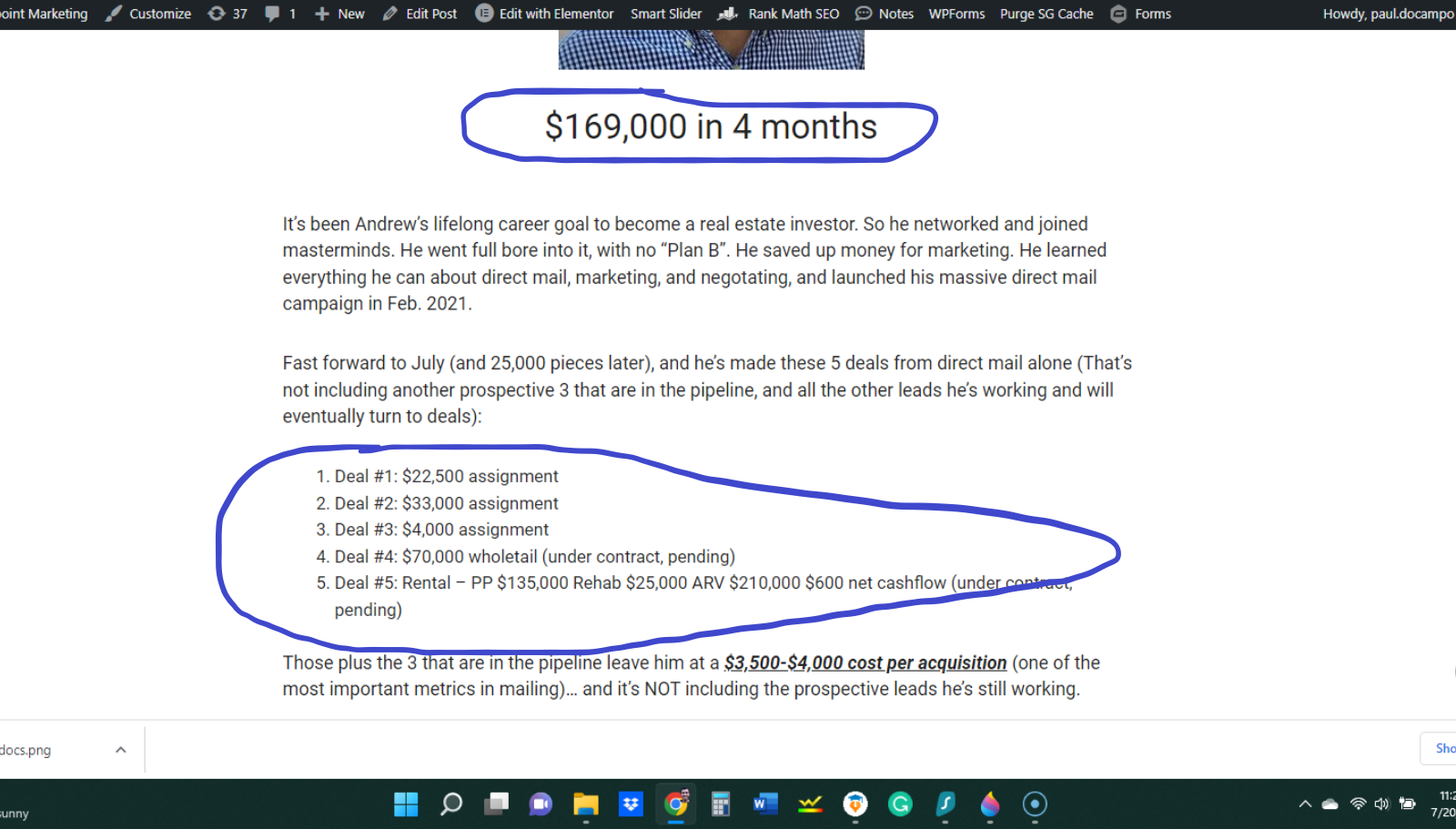

Here’s an example of a real wholesaler using our handwritten mailers, in a case study where he made anywhere from $4k fees to $22,500

7. Who pays for it?

Typically, in a traditional real estate wholesaling model, the end buyer (the cash buyer) is paying for your assignment fee.

For example: You negotiate with the seller to buy the property for $100,000. And the end buyer agrees to buy this deal for $120,000. He enters into escrow and pays the $120,000. You get the difference between the seller price and the end buyer price.

8. Does the seller or buyer see the fee?

In a typical assignment transfer, yes your assignment fee will be inside the closing statements.

After a property closes escrow, every party involved will get “closing statements” that look might look like this (depending on your state and the companies you use):

One of the line items may show up as “Assignment Fee” (or something similar), and show the amount.

Buyers will see these, as well as sellers.

However, a cash buyer (usually) understands that wholesaling is A LOT of work and that you should get paid for it. A good cash buyer understands that.

Sellers, most likely, won’t understand what an “assignment fee” is when they see this doc (they most likely won’t even read it).

On the rare occasion that they actually do ask what that line item is, you can tell the truth like this: “We work with partners and lenders all the time, and sometimes we end up selling the property during escrow to these partners, instead of keeping it ourselves. In this case we ended up selling to them”.

There’s a way to circumvent this potential problem of an assignment fee showing up on the closing documents…

And that’s by doing a double close instead of an assignment.

Let me explain in the next section…

9. Alternatives to an assignment?

As mentioned in the previous section, an assignment fee can have some cons to it. The primary being that sellers AND buyers can see how much you’re getting paid.

However, there is another “tool” you can use that hides this from both parties, and that’s called the “double close” (sometimes referred to as a “simultaneous closing” or “back to back” closing. As the name implies, there are 2 separate closings, not 1 (like our assignment fee transaction).

Here’s an explanation:

- The homeowner (party A) agrees to sell to a wholesaler (Party B) for $100,000

- They enter escrow

- While in escrow, Party B finds a cash buyer (Party C)

- Party C agrees to buy that property for $150,000

- They enter a second escrow agreement (different from the first)

- Party C funds the escrow account to buy the property at $150,000

- Party B uses those funds (minus his “assignment fee”) to pay the purchase from Party A

A little confusing?

Maybe this infographic helps:

We won’t go into too much detail about this as this is an article on the assignment fee… But just know that there is an alternative to hiding your fee but using a double close.

The con to this is that you pay a little more because you’re in fact doing 2 closes, not 1. So the times you might want to a double close vs an assignment fee is when you negotiated a very good deal and want to conceal the big check you’ll be getting.

10. Assignment fees and agents?

Anyone can get paid an assignment fee for this kind of “wholesaling” transaction. There’s no law that says agents can’t. However, that agent/broker needs to pay careful attention to their State RE commission laws as they’re put under serious scrutiny if they walk any fine lines.

For instance, if you’re buying the property and wholesaling it AND you’re licensed… in most states, you have to express to the seller that you are a licensed real estate agent but you are NOT representing them, and instead the principle of the transaction.

If you’re an agent wondering if you can (or should) do this, first contact your broker or RE Commission office to find out more.

Secondly, you might want to reconsider doing this as in some markets agent commission fees are higher than typical wholesaling fees. This is rare, but there are some hot markets where wholesalers have to keep raising their prices to win the deal, and therefore lower their assignment fee.

11. How to increase your assignment fees?

As mentioned in a previous section, your fee is greatly dependent on the kind of deal you negotiate.

So if you get a deal at $100,000 and another investor (cash buyer) is willing to pay $150,000 for it, you walk with a $50,000 assignment fee (assuming no closing costs are removed from this).

There are 4 factors to increasing your assignment fees…

- Become a better marketer If you improve your knowledge and skill set in marketing, you can essentially get to motivated sellers before anyone else.In the next section, we cover how to find these properties, which has everything to do with marketing, but one way (that we specialize in) is using handwritten mail to gain the best response rates from sellers.

- Become a better negotiator If you study and practice good salesmanship you can effectively win deals even if you’re offer is “low” . If you have no experience in sales, this will take time, but there are loads of resources available online (free and paid) that you can take advantage of. But, if you’re planning to stay in this entrepreneurship game for the long haul I HIGHLY suggest you study sales on a regular basis.

- Know you numbers Getting better and better at knowing what your market demands in terms of prices, rehab costs , etc… will help determine a more accurate price at a faster rate. Why does this matter to getting paid a higher assignment fee? It’s 2 reasons: First, if you know that cash buyers are willing to pay X, you can raise your asking price from end buyers, or on the flip side of that if, you know that a house needs some major repairs you can use that negotiated a lower price with the seller…Secondly, if you are really good with numbers, you can give an offer faster than your competition who has to take 1-2 days to send an offer in. In competitive markets “ Speed to lead ” wins and the person who can act fastest is usually the one who takes the trophy.

- Build a thriving buyers list The second component of the assignment fee and wholesaling business is selling the contract to a cash buyer.And, if you can build a list of buyers who will pay more for a good deal than most of the other “bottom of the barrel” buyers who demand very steep prices.Where do find buyers willing to pay more? It’s usually among high w-2 earners (doctors, lawyers, etc) who like to flip houses on the side. Or high-income business owners looking to park their cash somewhere to earn 15%+ annual ROI by doing so occasional flips.If you can find them, network with them, and add them to your list you can essentially raise your property raise to increase your assignment fee

12. How to find discounted properties to wholesale?

Finally our last section in this article which is probably at the top of some people’s minds:

“ Assignments sound great, but how do you FIND discounted properties!?!?”

Wholesaling is probably one of the toughest occupations in real estate.

You have to be well-rounded in almost every aspect of the industry. And you have to be top-notch in your selling and marketing capabilities.

But with that, there are foundational techniques to help you find these properties on your own. I’m going to give you 2 resources to start below.

First, is our article “ 8 ways to find 100 sellers for under $500”

Second is our eBook on Direct mail

You can get the Ebook for free by subscribing below to our newsletter, where we give lessons, stories, and value every week to real estate investors like you…

Spread the Word. Share this post!

Subscribe to our Newsletter

Sign up for news, updates, and more from BPM. It’s time to ZAG!

What is an Assignment Fee? The Ultimate Wholesaler’s Guide

In real estate investing, an assignment fee is the fee paid by the end buyer to the real estate wholesaler at the time of closing.

What is an assignment fee?

How do you assign a real estate contract?

How can you increase your assignment fee as a real estate wholesaler?

Those are just some of the questions we're going to answer in this ultimate assignment fee guide.

Let's dive in!

Part 1. Answering Common Questions About Assignment Fees

To start, we're going to answer some of the most commonly asked questions about assignment fees.

In real estate investing, an assignment fee is the fee paid by the end buyer to the real estate wholesaler at the time of closing.

This is the part of the process where the real estate wholesaler makes their money -- after finding a great deal and getting the property under contract, they then flip (i.e. assign) that contract to a cash buyer for a profit.

How are assignment fees calculated?

Assignment fees are calculated by taking the difference between what the seller was promised and what the buyer is paying.

For example, if a wholesaler has a contract to purchase a property for $100,000 and they assign that contract to a cash buyer for $120,000, then their assignment fee would be $20,000.

Who pays the assignment fee?

The assignment fee is paid by the cash buyer at closing.

And, critically, you -- the wholesaler -- are the person who gets to decide what that assignment fee is... it's only a matter of getting the cash buyer to agree (assuming you're not doing a double closing; more on that later).

What is the average wholesaler’s assignment fee?

The average assignment fee for a real estate wholesaler is between $2000 and $7000.

Of course, this number will depend on the market you're in as well as the level of experience that you have.

Many wholesalers charge upwards of $10,000 or even $20,000 for their assignment fee. Later in this guide, we'll show you how to systematically increase your assignment fee.

REISift users, on average, pull more money per deal than non-members. Here are some testimonials from our members and Sift Dojo attendees.

Are assignment fees taxable?

Yes, assignment fees are considered taxable income.

Be sure to speak with your accountant or tax advisor about the specific rules in your state.

What is a real estate assignment contract?

A real estate assignment contract is the contract between the wholesaler and the cash buyer that assigns (or transfers) the rights of the original purchase agreement to the cash buyer.

This contract will include all of the terms of the original purchase agreement, including:

- The price that was agreed to between the wholesaler and seller

- The property address

- The closing date

- Any contingencies that were in the original contract (i.e. financing, inspections, etc.)

Once the assignment contract is signed by both parties, the cash buyer will take over all responsibilities under the original purchase agreement and will be responsible for closing on the property.

What is a double close?

A double close is a type of real estate transaction where the wholesaler sells the property to the cash buyer and then immediately purchases the property from the seller.

In other words, there are two closings -- one for the sale of the property from wholesaler to cash buyer and another for the purchase of the property from seller to wholesaler.

In terms of assignment fees, double closings are often used when the wholesaler wants to keep their assignment fee confidential.

Download Assignment Fee Template

Part 2. how to assign a real estate contract .

Next, we're going to discuss the process for assigning a real estate contract -- from finding a great deal and building your buyers list to acquiring an assignment contract and collecting your assignment fee.

Step 1. Find a Great Deal

The first step in wholesaling real estate -- and thus assigning property contracts -- is finding a great real estate deal.

This is where your marketing efforts will come into play. You'll need to generate a steady stream of leads in order to find the best possible deals on properties that fit your criteria.

There are a number of ways to generate leads, but the most effective method is to use a combination of online and offline marketing.

This could include everything from direct mail campaigns and cold calling to driving for dollars and door knocking.

Check out our complete real estate investor marketing plan to learn more about this part of the process.

Step 2. Build Your Buyers List

A fundamental part of wholesaling real estate is flipping property contracts to cash buyers who have the funds to purchase your deals within just a couple of weeks.

A buyers list is a database of cash buyers (other real estate investors) who are interested in buying your deals.

You can find cash buyers by networking with other investors, attending real estate meetups and seminars, or searching online.

Here are 10 more ways to find cash buyers .

Step 3. Acquire an Assignment Contract

Once you've found a great real estate deal and got under contract with the seller, it's time to acquire an assignment contract.

You can do this by searching online for assignment contract templates or hiring a local lawyer to put the contract together for you. The assignment contract will pass the purchasing power and obligations from you to the new buyer.

Step 4. Collect Your Assignment Fee

After the new buyer has closed on the property, it's time for you to collect your assignment fee. This is typically done by wire transfer or check at the closing table via a title company.

And that's it! You've now successfully assigned a real estate contract and collected your assignment fee.

Part 3. The Pros & Cons of Assignment Contracts

Now let's take a moment to look at the pros and cons of assignment contracts.

- It's Cheaper Than Double Closing: Double closings can be more expensive (in terms of both time and money) than assignment contracts.

- It's Simple: Assignment contracts are relatively simple compared to other types of real estate transactions.

- It's Fast: Assignment contracts can be completed in as little as a week or two.

- It's Transparent: Unlike double closings, there is no need for two sets of escrow accounts, two sets of title insurance policies, or two sets of closing costs.

- Your Assignment Fee is Visible: Because your assignment fee is paid at closing, it will be visible to everyone involved in the transaction.

- It's Not Always Allowed: Some states have laws that prohibit or restrict the use of assignment contracts.

Part 4. 10 Ideas For Increasing Your Assignment Fee as a Wholesaler

To close out this guide, we're going to share 10 different ways that you -- the real estate wholesaler -- can increase your assignment fee.

1. Start With Great Deals

The better the deal, the higher your assignment fee will be.

This is why finding great deals -- and double-checking your math as well as your due diligence -- is absolutely critical to increasing your assignment fee.

So how do you find great real estate deals?

We have a detailed guide on finding great real estate deals over here .

2. Learn to Negotiate (With Sellers)

If you want to increase your assignment fee, you need to be able to negotiate with sellers.

The better you are at negotiating and sales — which in large part, just depends upon being an empathetic and helpful person — the better deals you’ll be able to get and the higher your assignment fee will be.

After all, if the seller agrees to a lower price, then that means you make a bigger profit.

The caveat here would be that you should always do right by your sellers. Don’t be afraid to negotiate (start lower than your max offer)... but also don’t try to screw anyone over.

3. Follow Up

It’s very rare that you’re going to turn someone from a lead into a deal with just a single phone call.

The nature of wholesaling real estate is that it requires a consistent and systematic follow-up process with seller leads to be successful.

Following up will help you close more deals… and closing more deals will give you the confidence, experience, and volume you need to increase your assignment fee.

4. Find Your Offer Min & Max

Good real estate deals are just a result of good due diligence and good math.

Determine how much money your cash buyer is going to want to pull, factor in your assignment fee, consider repair costs and holding costs… and calculate your max offer on the property.

Do this before you negotiate with the seller.

And make sure that when negotiations begin, you start well below your max offer so that you have room to adjust based on their response to your initial offer — this is your minimum offer.

You might find your max offer by using the popular 70% rule — which states that a real estate investor should pay no more than 70% of a property’s ARV (After Repair Value) — but you can find your starting offer by decreasing that to 50% or lower.

5. Qualify Your Cash Buyers

The amount of your assignment fee — as well as the efficiency with which your business operates — depends upon high-quality cash buyers.

Most wholesalers are a little over-eager to add email addresses to their cash buyer list.

But remember: quality over quantity.

You might have 500 cash buyers on your list… but only 20 or 30 of those are actually high-quality buyers.

Before adding buyers to your list, get proof of funds and make sure they’ve bought properties via assignment before.

Those buyers are going to move faster, pay the asking price for your properties, and return for more properties to buy.

6. Identify Cohorts of Cash Buyers

The instinct for most wholesalers is to send every deal to every cash buyer… but that actually wastes a lot of time.

It’s not in your interest to have to help every potential buyer determine whether or not they’re the right buyer for this deal.

It’s far more efficient to learn about your buyers upfront and determine what type of cash buyers they are — rehabbers, landlords, etc.

Using simple software, you can then create cohorts of cash buyers and send the right deal to the right people to get faster turn-around-times, less questions, and bigger assignment fees.

7. Text Your Buyers

Email is easy and popular… but it’s not necessarily the best channel when promoting deals to your list of cash buyers.

In fact, SMS or text messaging has some clear advantages.

Just consider these stats from ManyChat …

- 269 billion emails are sent every day with roughly 50% of them ending up in spam folders.

- SMS has a click-through rate of 19% and email has a click-through rate of 3.2%

The point is, if you want to get the attention of your high-quality buyers, then it’s probably worth sending both emails and text messages.

The faster you reach the right buyer, the easier it’ll be to get the assignment fee you want.

8. Don’t Negotiate (With Buyers)

As the wholesaler, realize that you determine your assignment fee.

No one else gets to decide what your assignment fee is going to be — now if you can’t get the buyer to agree to pay it, then that’s another problem… but you can always walk away and find another buyer.

If you’re going to raise your assignment fee, then it’s important to understand that all you have to do is… well, raise it. And see what happens.

High-quality buyers aren’t going to care about how much you’re making so long as they’re also making a good chunk of money.

9. Work With Real Estate Agents

Real estate agents control a huge part of every real estate market.

So if you exclude working with real estate agents to find cash buyers, then you’re ignoring a huge portion of the market’s revenue and potential.

Plain and simple.

Good real estate agents who work with cash buyers will understand your business model and be more than willing to coordinate the deal for you.

You will have to pay a bit of commission — or at least, the buyer will — but you’ll get to remove all the drama from the equation by working with agents. They understand how assignments work, and they negotiate on the behalf of the cash buyer.

It might not drastically increase your assignment fee, but it will help you dispose of deals far more efficiently.

10. Require a Nonrefundable Fee

When it comes to wholesaling, time really is money — the faster you can find a high-quality cash buyer, the more likely you are to get the assignment fee you want.

And one of the worst things that can happen is that your buyer will back out of the deal and you’ll have to restart the entire process.

That’s why you should make the buyer have skin in the game.

Require a nonrefundable fee from cash buyers who are ready to take action — this fee should be upwards of $3,000 and it can contribute to your total assignment fee.

If a buyer refuses to pay this to secure the deal as they’re own, then you probably want to find a different buyer anyway.

Final Thoughts on Real Estate Assignment Fees

We hope this guide has helped clear up any confusion you had about assignment fees and how they work in wholesaling real estate.

Remember: if you want to increase your assignment fee, focus on finding (and negotiating) great deals, following up with leads, qualifying cash buyers, and being systematic in your business.

Do those things, and you’ll be well on your way to making more money per deal.

Listen on other platforms

Join our ninja newsletter.

Subscription implies consent to our privacy policy

TRENDING POST

A2p / 10dlc: read this before you send real estate sms campaigns, wholesaling real estate contracts [template downloads], 7 mailing lists most real estate investors ignore, 5 top real estate wholesaling online courses in 2023, wholesaling real estate salary: how much can you make, visit our store to see all the courses available, popular tags, looking for more leads get it with reisift.

Related posts

Ready for more?

Subscription implies consent to our privacy policy.

Sales Tax and Title Transfer Fees

Vehicle Sales Tax and Title Transfer Fees

Be sure, when budgeting for a new car, to account for the possibility of sales tax and title transfer fees. In the excitement of the purchase, it's easy to overlook these two after-the-fact charges.

Car Sales Tax

Excuse yourself from reading this section if you reside in Delaware, Montana, New Hampshire, or Oregon. None of these purchase-friendly states charge sales tax. For everyone else, including Washington D.C. residents, read on. (Note: Though Alaska does not impose a state sales tax, state laws allow for municipalities to charge a local sales tax.)

The sales tax you'll pay on your new car is contingent on where you live. This includes not only your state, but also your county and city. Currently, out of the 45 states that charge a sales tax, 34 also allow for counties and municipalities to impose a local sales tax.

The exact sales tax rate varies by state and jurisdiction, but to give you an idea of what states are charging, Hawaii has the nation's lowest combined state and sales tax rate at 4.35%, while Tennessee charges the highest at 9.44%.

How to Calculate Your Auto Sales Tax Rate

If you're purchasing a new car from a dealership, the finance manager will calculate your sales tax rate for you. Your rate will be based on three scenarios:

- Total purchase price.

- Purchase price after trade-in is deducted.

- Purchase price after cash incentive is deducted.

If, however, you're buying a new car from an individual, you'll need to do the brain-work yourself. Fortunately, many states make this easy by providing online sales tax rate calculators . If you cannot locate an online sales tax rate calculator, check with your State Comptroller for your sales tax rate.

Keep in mind that the sales tax you pay on your new car is based on where you register it. For example, if you purchase a vehicle in New Hampshire, where there is no sales tax, but reside in Amherst, Massachusetts which charges sales tax, you will be taxed on the new car.

Title Transfer Fees

A car title serves as your proof of ownership. Whenever a used car transfers ownership, a title transfer fee comes into play. This applies to the following car-transfer scenarios:

- Inheritance

- Transferring to family

- Paying off a car loan

Title transfer fees vary by state. In most cases you pay this fee before registering the car. Some states, such as Oregon, that allow you to title and register at the same time. If in doubt, contact your local DMV .

DMV.ORG Article Categories

- Safety & Insurance

- Car & Driving Technology

- Quick Tips, Guides & DMV Basics

Recent Articles

JavaScript is required to use content on this page. Please enable JavaScript in your browser.

Maryland Department of Transportation Motor Vehicle Administration

Not sure if your transaction can be completed at home? Visit our Online Services tab below to see what services are available right now!

Maryland Vehicle Title and Registration Information

Titling information.

- Titling Used Vehicles

- Titling New Vehicles

- Titling - New MD Resident

Transfer of a Vehicle as a Gift

- Security Interest (LIEN)

Odometer Mileage Statement

Registration information.

- Certificate of Inspection

- Obtaining or Transferring Registration Plates

Insurance Requirements

- Fees for Registration Plates

- Do I Need to File a Heavy Vehicle Use Tax Form 2290 to Register My Vehicle?

- Apportioned Registration/International Registration Plan (I.R.P.)

- Maryland Income Tax Credit Certificate for Class ‘F’ Vehicle Registration

Other Information

- Application for Duplicate Certificate of Title

Returning to Maryland from Another State

- Issuance of a 24-Hour Registration

Trailers - Office Trailers and Mobile Homes

- Vehicle Beneficiary Designation

Titling used vehicles

To title and register your newly purchased used vehicle, you will need to submit the following documents, (along with payment for taxes and fees ):

- Proof of ownership - The vehicle's current title has to be properly assigned to you. If the title was issued in Maryland, it can be used as your application for titling and registering the vehicle. If the vehicle is from a state that does not issue a title as proof of ownership, a registration document and a bill of sale may be submitted as proof of ownership.

- Proof of purchase price - This should be a bill of sale signed by both the buyer(s) and seller(s). The bill of sale must be notarized if the following conditions apply:

- the vehicle is less than 7 years old; and

- the purchase price is at least $500 below the book value; and

- the new owner (buyer) wants to base the excise tax (more info below) calculation (6% of the vehicle's value) on the sale price rather than the book value.

Dealer A vehicle purchased from a licensed dealer, is assessed excise tax. The tax is based on the agreed upon price of the vehicle and includes any dealer processing charge, with an allowance for any trade-in consideration. Manufacturer rebates are taxable. However, dealer rebates and discounts are not. All rebate, trade-in, or discount information must be clearly marked on the bill of sale.

- Maryland Safety Inspection Certificate - The Maryland State Police form certifies that your vehicle meets Maryland safety standards. It is valid for up to 90 days from the date issued.

- If a vehicle is being transferred between spouses or between parents and children, an inspection is not generally required. All other transfers as gifts are subject to the state inspection laws. Gifts of vehicles that are titled out-of-state are not accepted.

- Lien release - If the existing title indicates that a lien was placed against it, you must submit a lien release. For a vehicle that was titled in Maryland, this could be a properly completed and signed Maryland Security Interest Filing or a signed letter from the lien holder specifically identifying the vehicle and stating that the lien has been released. If the vehicle is currently titled in another state, you may submit a signed letter of release from the lien holder or you may have the lien holder sign the title indicating that the lien has been released.

- Power of attorney ( VR-470 ) -– If someone other than you, the new owner, is signing the titling forms, this document is required. A copy of the registered owner(s) state issued identification must accompany the Power of Attorney and the person submitting must present their state issued identification.

- Certificate of origin - This is an ownership document produced by the vehicle's manufacturer.

- Bill of sale

- Title fee

- Lien fee

- Excise tax and tag fees .

Your title will be mailed to you. If you also register the vehicle, your registration card, license plates and expiration stickers can be provided immediately when you apply in person at the MVA; otherwise, they will also be mailed to you.

Maryland Excise Titling Tax

Dealer A vehicle purchased from a licensed dealer, is assessed excise tax. The tax is based on the agreed upon price of the vehicle and includes any dealer processing charge, with an allowance for any trade-in consideration. Manufacturer rebates are taxable. However, dealer rebates and discounts are not. All rebate, trade-in, or discount information must be clearly marked on the bill of sale.

Titling New Vehicles

Maryland dealers will usually handle the titling and registration of your vehicle for you. The dealer will provide you with a bill of sale and temporary (cardboard) or permanent (metal) license plates before you drive the vehicle off the lot. The Maryland Certificate of Title will be printed and mailed to you later. If a lien is placed against your title, a Maryland Security Interest Filing will be mailed to the lien holder at the same time.

If the dealer does not handle the titling and registration of your vehicle, perhaps because you purchased the vehicle from an out-of-state dealer, you will have to submit the application documents yourself.

To title and register your newly purchased vehicle, you will need to submit the following documents (along with payment for taxes and fees ):

Under certain circumstances, additional information and/or forms may be required:

Titling - New Maryland Resident

Please view the New to Maryland Titling and Registering page for more information.

If the last names do not agree, please submit proof of the relationship:

Security Interest Lien

If the vehicle is subject to a security interest lien, a recording fee will apply. A notice of security interest filing is mailed to the lending institution or person and the title is mailed to the owner. After the lien is satisfied, the security interest document must be mailed to the owner and kept with the title. Both documents are required to sell or trade the vehicle.

If there is a lien against your out-of-state title:

Federal regulations require that the vehicle's odometer mileage be stated by the seller when ownership of the vehicle is transferred. An inaccurate statement may make the seller liable for damages to the buyer or to the transferee. For more information click here .

Title Fees

There is a title fee for all vehicles.

Certificate of inspection

A safety inspection is required for all used cars, trucks, tractors, trailers, motorcycles, special equipment, and class "B" for hire vehicles being titled and registered in Maryland. They must be inspected by a licensed Maryland inspection station, such as an automobile dealer, service station and specialized automobile service center. A certificate of inspection, issued within 90 days of the vehicle to be titled, must accompany the application for a title. Please compare the vehicle identification number (VIN) on the inspection certificate with the one on the vehicle and the vehicle ownership documents to make certain they all agree. Altered inspection certificates will not be accepted.

Obtaining or Transferring License Plates

Obtaining New License Plates

Transfer of License Plates

License plates may be transferred if the vehicle is titled:

- In the joint names of a husband and wife and is being transferred to the name of either the husband or the wife;

- In the name of the husband or the wife and is being transferred to the joint names of both;

- In the joint names of a parent and a child and is transferred to the individual name of either party;

- In the name of an individual and is transferred to the parent and/or child of the individual.

License plates acquired by any person, firm, or corporation for any vehicle owned by them may be transferred to a newly acquired vehicle, providing the following requirements are met:

- The vehicle from which the plates are to be transferred must have been sold, traded, junked, or otherwise discarded.

- The ownership of the newly acquired vehicle has not changed from the name in which the license plates were originally purchased.

Fee For the Transfer of License Plates

If the annual registration fee is the same or less than the previously owned vehicle, the transfer fee will apply. If the annual registration fee is more than the previously owned vehicle, the transfer fee plus any difference in the two registration fees will apply.

If you are transferring license plates and less than 12 months remain before your registration expires, the registration will be renewed for an additional year.

Please check the MVA Insurance Compliance Information page for information on insurance requirements.

Fees for License Plates

Registration fees vary depending on the class and weight of the vehicle being registered. Please view the registration fee information page for more information.

Application for Duplicate Certificate of Title

- Apply online .

- Apply at a kiosk located at all MVA offices .

- Duplicate title fee .

If an owner of a vehicle originally titled in Maryland obtains a title for the vehicle in another state in the same name, and returns to Maryland, it may be registered by surrendering the foreign title and securing a duplicate Maryland title . There is a fee for a duplicate title.

Issuance of a 24-Hour Registration

The MDOT MVA may issue an electronic or digital registration valid for 24 hours, to allow a purchaser of a vehicle to operate the vehicle on a highway in Maryland. Only one 24-hour registration may be issued per vehicle sales transaction.

Office trailers and mobile homes in excess of 35 feet are not subject to the inspection, titling, or registration laws of Maryland. However, they may be titled. The MVA does not collect excise tax when it issues a title. Before the vehicle can be titled, though, the state retail sales tax must be paid, a receipt obtained and submitted with the application for title and other required documents. The state's sales tax division is located in the Maryland State Office Building, 301 West Preston Street, Baltimore, Maryland 21201.

Boat, Camping, Tent or Travel Trailers

All trailers are subject to the same motor vehicle laws as passenger vehicles. They must be titled and if registration is desired, they must be safety inspected (if they are used vehicles).

Homemade Trailers

Homemade trailers may be titled and registered by submitting an application for title to the MVA with two photographs of the vehicle taken from the side and the rear. If the application is approved, the vehicle is assigned a vehicle identification number and a serial plate is issued. The plate must be affixed to the vehicle and it becomes the identification number used in all future transactions.

Freight & Semi Freight Trailers

Freight and semi-freight trailers are subject to the same motor vehicle laws as passenger vehicles. They must be titled and if registration is desired, they must be safety inspected (if they are used vehicles). Freight and semi-freight trailers must also provide proof of motor vehicle liability insurance in the minimum amount required by law. All other trailers are covered by the insurance of the towing vehicle. If a commercial (freight) trailer is converted to an office trailer and the owner wishes to title the vehicle, a state retail sales tax must be paid and the sales tax receipt must accompany the application for title.

Please be certain to always carry the certificate of registration in the vehicle or on the person who is operating the vehicle.

Our Social Media Channels

We're available on the following channels.

The .gov means it's official