- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- *New* Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

What Is Risk Management & Why Is It Important?

- 24 Oct 2023

Businesses can’t operate without risk. Economic, technological, environmental, and competitive factors introduce obstacles that companies must not only manage but overcome.

According to PwC’s Global Risk Survey , organizations that embrace strategic risk management are five times more likely to deliver stakeholder confidence and better business outcomes and two times more likely to expect faster revenue growth.

If you want to enhance your job performance and identify and mitigate risk more effectively, here’s a breakdown of what risk management is and why it’s important.

Access your free e-book today.

What Is Risk Management?

Risk management is the systematic process of identifying, assessing, and mitigating threats or uncertainties that can affect your organization. It involves analyzing risks’ likelihood and impact, developing strategies to minimize harm, and monitoring measures’ effectiveness.

“Competing successfully in any industry involves some level of risk,” says Harvard Business School Professor Robert Simons, who teaches the online course Strategy Execution . “But high-performing businesses with high-pressure cultures are especially vulnerable. As a manager, you need to know how and why these risks arise and how to avoid them.”

According to Strategy Execution , strategic risk has three main causes:

- Pressures due to growth: This is often caused by an accelerated rate of expansion that makes staffing or industry knowledge gaps more harmful to your business.

- Pressures due to culture: While entrepreneurial risk-taking can come with rewards, executive resistance and internal competition can cause problems.

- Pressures due to information management: Since information is key to effective leadership , gaps in performance measures can result in decentralized decision-making.

These pressures can lead to several types of risk that you must manage or mitigate to avoid reputational, financial, or strategic failures. However, risks aren’t always obvious.

“I think one of the challenges firms face is the ability to properly identify their risks,” says HBS Professor Eugene Soltes in Strategy Execution .

Therefore, it’s crucial to pinpoint unexpected events or conditions that could significantly impede your organization’s business strategy .

Related: Business Strategy vs. Strategy Execution: Which Course Is Right for Me?

According to Strategy Execution , strategic risk comprises:

- Operations risk: This occurs when internal operational errors interrupt your products or services’ flow. For example, shipping tainted products can negatively affect food distribution companies.

- Asset impairment risk: When your company’s assets lose a significant portion of their current value because of a decreased likelihood of receiving future cash flows . For instance, losing property assets, like a manufacturing plant, due to a natural disaster.

- Competitive risk: Changes in the competitive environment can interrupt your organization’s ability to create value and differentiate its offerings—eventually leading to a significant loss in revenue.

- Franchise risk: When your organization’s value erodes because stakeholders lose confidence in its objectives. This primarily results from failing to control any of the strategic risk sources listed above.

Understanding these risks is essential to ensuring your organization’s long-term success. Here’s a deeper dive into why risk management is important.

4 Reasons Why Risk Management Is Important

1. protects organization’s reputation.

In many cases, effective risk management proactively protects your organization from incidents that can affect its reputation.

“Franchise risk is a concern for all businesses,“ Simons says in Strategy Execution . “However, it's especially pressing for businesses whose reputations depend on the trust of key constituents.”

For example, airlines are particularly susceptible to franchise risk because of unforeseen events, such as flight delays and cancellations caused by weather or mechanical failure. While such incidents are considered operational risks, they can be incredibly damaging.

In 2016, Delta Airlines experienced a national computer outage, resulting in over 2,000 flight cancellations. Delta not only lost an estimated $150 million but took a hit to its reputation as a reliable airline that prided itself on “canceling cancellations.”

While Delta bounced back, the incident illustrates how mitigating operational errors can make or break your organization.

2. Minimizes Losses

Most businesses create risk management teams to avoid major financial losses. Yet, various risks can still impact their bottom lines.

A Vault Platform study found that dealing with workplace misconduct cost U.S. businesses over $20 billion in 2021. In addition, Soltes says in Strategy Execution that corporate fines for misconduct have risen 40-fold in the U.S. over the last 20 years.

One way to mitigate financial losses related to employee misconduct is by implementing internal controls. According to Strategy Execution , internal controls are the policies and procedures designed to ensure reliable accounting information and safeguard company assets.

“Managers use internal controls to limit the opportunities employees have to expose the business to risk,” Simons says in the course.

One company that could have benefited from implementing internal controls is Volkswagen (VW). In 2015, VW whistle-blowers revealed that the company’s engineers deliberately manipulated diesel vehicles’ emissions data to make them appear more environmentally friendly.

This led to severe consequences, including regulatory penalties, expensive vehicle recalls, and legal settlements—all of which resulted in significant financial losses. By 2018, U.S. authorities had extracted $25 billion in fines, penalties, civil damages, and restitution from the company.

Had VW maintained more rigorous internal controls to ensure transparency, compliance, and proper oversight of its engineering practices, perhaps it could have detected—or even averted—the situation.

Related: What Are Business Ethics & Why Are They Important?

3. Encourages Innovation and Growth

Risk management isn’t just about avoiding negative outcomes. It can also be the catalyst that drives your organization’s innovation and growth.

“Risks may not be pleasant to think about, but they’re inevitable if you want to push your business to innovate and remain competitive,” Simons says in Strategy Execution .

According to PwC , 83 percent of companies’ business strategies focus on growth, despite risks and mixed economic signals. In Strategy Execution , Simons notes that competitive risk is a challenge you must constantly monitor and address.

“Any firm operating in a competitive market must focus its attention on changes in the external environment that could impair its ability to create value for its customers,” Simons says.

This requires incorporating boundary systems —explicit statements that define and communicate risks to avoid—to ensure internal controls don’t extinguish innovation.

“Boundary systems are essential levers in businesses to give people freedom,” Simons says. “In such circumstances, you don’t want to stifle innovation or entrepreneurial behavior by telling people how to do their jobs. And if you want to remain competitive, you’ll need to innovate and adapt.”

Netflix is an example of how risk management can inspire innovation. In the early 2000s, the company was primarily known for its DVD-by-mail rental service. With growing competition from video rental stores, Netflix went against the grain and introduced its streaming service. This changed the market, resulting in a booming industry nearly a decade later.

Netflix’s innovation didn’t stop there. Once the steaming services market became highly competitive, the company shifted once again to gain a competitive edge. It ventured into producing original content, which ultimately helped differentiate its platform and attract additional subscribers.

By offering more freedom within internal controls, you can encourage innovation and constant growth.

4. Enhances Decision-Making

Risk management also provides a structured framework for decision-making. This can be beneficial if your business is inclined toward risks that are difficult to manage.

By pulling data from existing control systems to develop hypothetical scenarios, you can discuss and debate strategies’ efficacy before executing them.

“Interactive control systems are the formal information systems managers use to personally involve themselves in the decision activities of subordinates,” Simons says in Strategy Execution . “Decision activities that relate to and impact strategic uncertainties.”

JPMorgan Chase, one of the most prominent financial institutions in the world, is particularly susceptible to cyber risks because it compiles vast amounts of sensitive customer data . According to PwC , cybersecurity is the number one business risk on managers’ minds, with 78 percent worried about more frequent or broader cyber attacks.

Using data science techniques like machine learning algorithms enables JPMorgan Chase’s leadership not only to detect and prevent cyber attacks but address and mitigate risk.

Start Managing Your Organization's Risk

Risk management is essential to business. While some risk is inevitable, your ability to identify and mitigate it can benefit your organization.

But you can’t plan for everything. According to the Harvard Business Review , some risks are so remote that no one could have imagined them. Some result from a perfect storm of incidents, while others materialize rapidly and on enormous scales.

By taking an online strategy course , you can build the knowledge and skills to identify strategic risks and ensure they don’t undermine your business. For example, through an interactive learning experience, Strategy Execution enables you to draw insights from real-world business examples and better understand how to approach risk management.

Do you want to mitigate your organization’s risks? Explore Strategy Execution —one of our online strategy courses —and download our free strategy e-book to gain the insights to build a successful strategy.

About the Author

Risk Management 101: Process, Examples, Strategies

Emily Villanueva

August 16, 2023

Effective risk management takes a proactive and preventative stance to risk, aiming to identify and then determine the appropriate response to the business and facilitate better decision-making. Many approaches to risk management focus on risk reduction, but it’s important to remember that risk management practices can also be applied to opportunities, assisting the organization with determining if that possibility is right for it.

Risk management as a discipline has evolved to the point that there are now common subsets and branches of risk management programs, from enterprise risk management (ERM) , to cybersecurity risk management, to operational risk management (ORM) , to supply chain risk management (SCRM) . With this evolution, standards organizations around the world, like the US’s National Institute of Standards and Technology (NIST) and the International Standards Organization (ISO) have developed and released their own best practice frameworks and guidance for businesses to apply to their risk management plan.

Companies that adopt and continuously improve their risk management programs can reap the benefits of improved decision-making, a higher probability of reaching goals and business objectives, and an augmented security posture. But, with risks proliferating and the many types of risks that face businesses today, how can an organization establish and optimize its risk management processes? This article will walk you through the fundamentals of risk management and offer some thoughts on how you can apply it to your organization.

What Are Risks?

We’ve been talking about risk management and how it has evolved, but it’s important to clearly define the concept of risk. Simply put, risks are the things that could go wrong with a given initiative, function, process, project, and so on. There are potential risks everywhere — when you get out of bed, there’s a risk that you’ll stub your toe and fall over, potentially injuring yourself (and your pride). Traveling often involves taking on some risks, like the chance that your plane will be delayed or your car runs out of gas and leave you stranded. Nevertheless, we choose to take on those risks, and may benefit from doing so.

Companies should think about risk in a similar way, not seeking simply to avoid risks, but to integrate risk considerations into day-to-day decision-making.

- What are the opportunities available to us?

- What could be gained from those opportunities?

- What is the business’s risk tolerance or risk appetite – that is, how much risk is the company willing to take on?

- How will this relate to or affect the organization’s goals and objectives?

- Are these opportunities aligned with business goals and objectives?

With that in mind, conversations about risks can progress by asking, “What could go wrong?” or “What if?” Within the business environment, identifying risks starts with key stakeholders and management, who first define the organization’s objectives. Then, with a risk management program in place, those objectives can be scrutinized for the risks associated with achieving them. Although many organizations focus their risk analysis around financial risks and risks that can affect a business’s bottom line, there are many types of risks that can affect an organization’s operations, reputation, or other areas.

Remember that risks are hypotheticals — they haven’t occurred or been “realized” yet. When we talk about the impact of risks, we’re always discussing the potential impact. Once a risk has been realized, it usually turns into an incident, problem, or issue that the company must address through their contingency plans and policies. Therefore, many risk management activities focus on risk avoidance, risk mitigation, or risk prevention.

What Different Types of Risks Are There?

There’s a vast landscape of potential risks that face modern organizations. Targeted risk management practices like ORM and SCRM have risen to address emerging areas of risk, with those disciplines focused on mitigating risks associated with operations and the supply chain. Specific risk management strategies designed to address new risks and existing risks have emerged from these facets of risk management, providing organizations and risk professionals with action plans and contingency plans tailored to unique problems and issues.

Common types of risks include: strategic, compliance, financial, operational, reputational, security, and quality risks.

Strategic Risk

Strategic risks are those risks that could have a potential impact on a company’s strategic objectives, business plan, and/or strategy. Adjustments to business objectives and strategy have a trickle-down effect to almost every function in the organization. Some events that could cause strategic risks to be realized are: major technological changes in the company, like switching to a new tech stack; large layoffs or reductions-in-force (RIFs); changes in leadership; competitive pressure; and legal changes.

Compliance Risk

Compliance risks materialize from regulatory and compliance requirements that businesses are subject to, like Sarbanes-Oxley for publicly-traded US companies, or GDPR for companies that handle personal information from the EU. The consequence or impact of noncompliance is generally a fine from the governing body of that regulation. These types of risks are realized when the organization does not maintain compliance with regulatory requirements, whether those requirements are environmental, financial, security-specific, or related to labor and civil laws.

Financial Risk

Financial risks are fairly self-explanatory — they have the possibility of affecting an organization’s profits. These types of risks often receive significant attention due to the potential impact on a company’s bottom line. Financial risks can be realized in many circumstances, like performing a financial transaction, compiling financial statements, developing new partnerships, or making new deals.

Operational Risk

Risks to operations, or operational risks, have the potential to disrupt daily operations involved with running a business. Needless to say, this can be a problematic scenario for organizations with employees unable to do their jobs, and with product delivery possibly delayed. Operational risks can materialize from internal or external sources — employee conduct, retention, technology failures, natural disasters, supply chain breakdowns — and many more.

Reputational Risk

Reputational risks are an interesting category. These risks look at a company’s standing in the public and in the media and identify what could impact its reputation. The advent of social media changed the reputation game quite a bit, giving consumers direct access to brands and businesses. Consumers and investors too are becoming more conscious about the companies they do business with and their impact on the environment, society, and civil rights. Reputational risks are realized when a company receives bad press or experiences a successful cyber attack or security breach; or any situation that causes the public to lose trust in an organization.

Security Risk

Security risks have to do with possible threats to your organization’s physical premises, as well as information systems security. Security breaches, data leaks, and other successful types of cyber attacks threaten the majority of businesses operating today. Security risks have become an area of risk that companies can’t ignore, and must safeguard against.

Quality Risk

Quality risks are specifically associated with the products or services that a company provides. Producing low-quality goods or services can cause an organization to lose customers, ultimately affecting revenue. These risks are realized when product quality drops for any reason — whether that’s technology changes, outages, employee errors, or supply chain disruptions.

Steps in the Risk Management Process

The six risk management process steps that we’ve outlined below will give you and your organization a starting point to implement or improve your risk management practices. In order, the risk management steps are:

- Risk identification

- Risk analysis or assessment

- Controls implementation

- Resource and budget allocation

- Risk mitigation

- Risk monitoring, reviewing, and reporting

If this is your organization’s first time setting up a risk management program, consider having a formal risk assessment completed by an experienced third party, with the goal of producing a risk register and prioritized recommendations on what activities to focus on first. Annual (or more frequent) risk assessments are usually required when pursuing compliance and security certifications, making them a valuable investment.

Step 1: Risk Identification

The first step in the risk management process is risk identification. This step takes into account the organization’s overarching goals and objectives, ideally through conversations with management and leadership. Identifying risks to company goals involves asking, “What could go wrong?” with the plans and activities aimed at meeting those goals. As an organization moves from macro-level risks to more specific function and process-related risks, risk teams should collaborate with critical stakeholders and process owners, gaining their insight into the risks that they foresee.

As risks are identified, they should be captured in formal documentation — most organizations do this through a risk register, which is a database of risks, risk owners, mitigation plans, and risk scores.

Step 2: Risk Analysis or Assessment

Analyzing risks, or assessing risks, involves looking at the likelihood that a risk will be realized, and the potential impact that risk would have on the organization if that risk were realized. By quantifying these on a three- or five-point scale, risk prioritization becomes simpler. Multiplying the risk’s likelihood score with the risk’s impact score generates the risk’s overall risk score. This value can then be compared to other risks for prioritization purposes.

The likelihood that a risk will be realized asks the risk assessor to consider how probable it would be for a risk to actually occur. Lower scores indicate less chances that the risk will materialize. Higher scores indicate more chances that the risk will occur.

Likelihood, on a 5×5 risk matrix, is broken out into:

- Highly Unlikely

- Highly Likely

The potential impact of a risk, should it be realized, asks the risk assessor to consider how the business would be affected if that risk occurred. Lower scores signal less impact to the organization, while higher scores indicate more significant impacts to the company.

Impact, on a 5×5 risk matrix, is broken out into:

- Negligible Impact

- Moderate Impact

- High Impact

- Catastrophic Impact

Risk assessment matrices help visualize the relationship between likelihood and impact, serving as a valuable tool in risk professionals’ arsenals.

Organizations can choose whether to employ a 5×5 risk matrix, as shown above, or a 3×3 risk matrix, which breaks likelihood, impact, and aggregate risk scores into low, moderate, and high categories.

Step 3: Controls Assessment and Implementation

Once risks have been identified and analyzed, controls that address or partially address those risks should be mapped. Any risks that don’t have associated controls, or that have controls that are inadequate to mitigate the risk, should have controls designed and implemented to do so.

Step 4: Resource and Budget Allocation

This step, the resource and budget allocation step, doesn’t get included in a lot of content about risk management. However, many businesses find themselves in a position where they have limited resources and funds to dedicate to risk management and remediation. Developing and implementing new controls and control processes is timely and costly; there’s usually a learning curve for employees to get used to changes in their workflow.

Using the risk register and corresponding risk scores, management can more easily allocate resources and budget to priority areas, with cost-effectiveness in mind. Each year, leadership should re-evaluate their resource allocation as part of annual risk lifecycle practices.

Step 5: Risk Mitigation

The risk mitigation step of risk management involves both coming up with the action plan for handling open risks, and then executing on that action plan. Mitigating risks successfully takes buy-in from various stakeholders. Due to the various types of risks that exist, each action plan may look vastly different between risks.

For example, vulnerabilities present in information systems pose a risk to data security and could result in a data breach. The action plan for mitigating this risk might involve automatically installing security patches for IT systems as soon as they are released and approved by the IT infrastructure manager. Another identified risk could be the possibility of cyber attacks resulting in data exfiltration or a security breach. The organization might decide that establishing security controls is not enough to mitigate that threat, and thus contract with an insurance company to cover off on cyber incidents. Two related security risks; two very different mitigation strategies.

One more note on risk mitigation — there are four generally accepted “treatment” strategies for risks. These four treatments are:

- Risk Acceptance: Risk thresholds are within acceptable tolerance, and the organization chooses to accept this risk.

- Risk Transfer : The organization chooses to transfer the risk or part of the risk to a third party provider or insurance company.

- Risk Avoidance : The organization chooses not to move forward with that risk and avoids incurring it.

- Risk Mitigation : The organization establishes an action plan for reducing or limiting risk to acceptable levels.

If an organization is not opting to mitigate a risk, and instead chooses to accept, transfer, or avoid the risk, these details should still be captured in the risk register, as they may need to be revisited in future risk management cycles.

Step 6: Risk Monitoring, Reviewing, and Reporting

The last step in the risk management lifecycle is monitoring risks, reviewing the organization’s risk posture, and reporting on risk management activities. Risks should be monitored on a regular basis to detect any changes to risk scoring, mitigation plans, or owners. Regular risk assessments can help organizations continue to monitor their risk posture. Having a risk committee or similar committee meet on a regular basis, such as quarterly, integrates risk management activities into scheduled operations, and ensures that risks undergo continuous monitoring. These committee meetings also provide a mechanism for reporting risk management matters to senior management and the board, as well as affected stakeholders.

As an organization reviews and monitors its risks and mitigation efforts, it should apply any lessons learned and use past experiences to improve future risk management plans.

Examples of Risk Management Strategies

Depending on your company’s industry, the types of risks it faces, and its objectives, you may need to employ many different risk management strategies to adequately handle the possibilities that your organization encounters.

Some examples of risk management strategies include leveraging existing frameworks and best practices, minimum viable product (MVP) development, contingency planning, root cause analysis and lessons learned, built-in buffers, risk-reward analysis, and third-party risk assessments.

Leverage Existing Frameworks and Best Practices

Risk management professionals need not go it alone. There are several standards organizations and committees that have developed risk management frameworks, guidance, and approaches that business teams can leverage and adapt for their own company.

Some of the more popular risk management frameworks out there include:

- ISO 31000 Family : The International Standards Organization’s guidance on risk management.

- NIST Risk Management Framework (RMF) : The National Institute of Standards and Technology has released risk management guidance compatible with their Cybersecurity Framework (CSF).

- COSO Enterprise Risk Management (ERM) : The Committee of Sponsoring Organizations’ enterprise risk management guidance.

Minimum Viable Product (MVP) Development

This approach to product development involves developing core features and delivering those to the customer, then assessing response and adjusting development accordingly. Taking an MVP path reduces the likelihood of financial and project risks, like excessive spend or project delays by simplifying the product and decreasing development time.

Contingency Planning

Developing contingency plans for significant incidents and disaster events are a great way for businesses to prepare for worst-case scenarios. These plans should account for response and recovery. Contingency plans specific to physical sites or systems help mitigate the risk of employee injury and outages.

Root Cause Analysis and Lessons Learned

Sometimes, experience is the best teacher. When an incident occurs or a risk is realized, risk management processes should include some kind of root cause analysis that provides insights into what can be done better next time. These lessons learned, integrated with risk management practices, can streamline and optimize response to similar risks or incidents.

Built-In Buffers

Applicable to discrete projects, building in buffers in the form of time, resources, and funds can be another viable strategy to mitigate risks. As you may know, projects can get derailed very easily, going out of scope, over budget, or past the timeline. Whether a project team can successfully navigate project risks spells the success or failure of the project. By building in some buffers, project teams can set expectations appropriately and account for the possibility that project risks may come to fruition.

Risk-Reward Analysis

In a risk-reward analysis, companies and project teams weigh the possibility of something going wrong with the potential benefits of an opportunity or initiative. This analysis can be done by looking at historical data, doing research about the opportunity, and drawing on lessons learned. Sometimes the risk of an initiative outweighs the reward; sometimes the potential reward outweighs the risk. At other times, it’s unclear whether the risk is worth the potential reward or not. Still, a simple risk-reward analysis can keep organizations from bad investments and bad deals.

Third-Party Risk Assessments

Another strategy teams can employ as part of their risk management plan is to conduct periodic third-party risk assessments. In this method, a company would contract with a third party experienced in conducting risk assessments, and have them perform one (or more) for the organization. Third-party risk assessments can be immensely helpful for the new risk management team or for a mature risk management team that wants a new perspective on their program.

Generally, third-party risk assessments result in a report of risks, findings, and recommendations. In some cases, a third-party provider may also be able to help draft or provide input into your risk register. As external resources, third-party risk assessors can bring their experience and opinions to your organization, leading to insights and discoveries that may not have been found without an independent set of eyes.

Components of an Effective Risk Management Plan

An effective risk management plan has buy-in from leadership and key stakeholders; applies the risk management steps; has good documentation; and is actionable. Buy-in from management often determines whether a risk management function is successful or not, since risk management requires resources to conduct risk assessments, risk identification, risk mitigation, and so on. Without leadership buy-in, risk management teams may end up just going through the motions without the ability to make an impact. Risk management plans should be integrated into organizational strategy, and without stakeholder buy-in, that typically does not happen.

Applying the risk management methodology is another key component of an effective plan. That means following the six steps outlined above should be incorporated into a company’s risk management lifecycle. Identifying and analyzing risks, establishing controls, allocating resources, conducting mitigation, and monitoring and reporting on findings form the foundations of good risk management.

Good documentation is another cornerstone of effective risk management. Without a risk register recording all of a company’s identified risks and accompanying scores and mitigation strategies, there would be little for a risk team to act on. Maintaining and updating the risk register should be a priority for the risk team — risk management software can help here, providing users with a dashboard and collaboration mechanism.

Last but not least, an effective risk management plan needs to be actionable. Any activities that need to be completed for mitigating risks or establishing controls, should be feasible for the organization and allocated resources. An organization can come up with the best possible, best practice risk management plan, but find it completely unactionable because they don’t have the capabilities, technology, funds, and/or personnel to do so. It’s all well and good to recommend that cybersecurity risks be mitigated by setting up a 24/7 continuous monitoring Security Operations Center (SOC), but if your company only has one IT person on staff, that may not be a feasible action plan.

Executing on an effective risk management plan necessitates having the right people, processes, and technology in place. Sometimes the challenges involved with running a good risk management program are mundane — such as disconnects in communication, poor version control, and multiple risk registers floating around. Risk management software can provide your organization with a unified view of the company’s risks, a repository for storing and updating key documentation like a risk register, and a space to collaborate virtually with colleagues to check on risk mitigation efforts or coordinate on risk assessments. Get started building your ideal risk management plan today!

Emily Villanueva, MBA, is a Senior Manager of Product Solutions at AuditBoard. Emily joined AuditBoard from Grant Thornton, where she provided consulting services specializing in SOX compliance, internal audit, and risk management. She also spent 5 years in the insurance industry specializing in SOX/ICFR, internal audits, and operational compliance. Connect with Emily on LinkedIn .

Related Articles

What Is Risk Management? [Definition & Guide]

Last Updated: September 19, 2023

Curiously enough, uncertainty is the most certain part of life. The world will always be filled with uncertainty and with uncertainty inevitably comes risk. Risk management, in its simplest form, is assessing the possibility of something bad happening; i.e. “If I take this action, will it result negatively?”

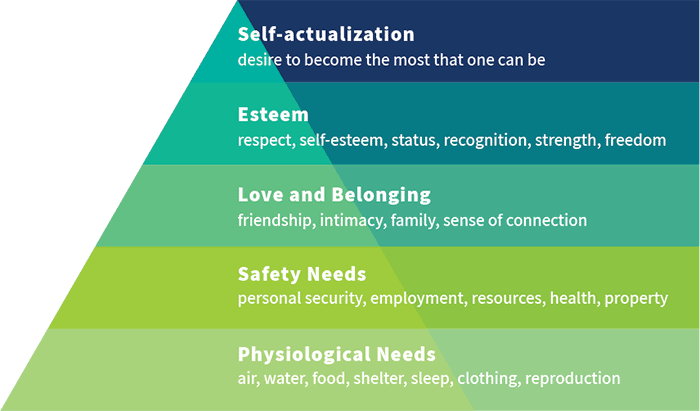

Negative outcomes are widely understood among humans because of our shared values. Maslow’s hierarchy of needs illustrates those values.

At the most basic level, Maslow’s hierarchy suggests that humans need to be secure physiologically. From there, we need safety. Higher level motivations are then driven by a need for belonging, self-esteem and self-actualization.

If at any point our needs are not being fulfilled, we view the situation as an undesirable consequence. It’s only inevitable that life becomes a series of avoiding these undesirable consequences. Here is an example of what that looks like:

There’s a chance it might rain today, so when you leave your house you bring an umbrella. On the most basic level, you did this to eliminate the risk of getting caught in the rain with no protection, resulting in soaking wet clothes that are physically uncomfortable. You also wanted to stay dry to keep your property safe; smartphones are still not 100% waterproof so you’re avoiding the risk of having to pay for a new phone. You also want to avoid the risk of being cut off from loved ones; ruining your phone ruins your sense of connection. Perhaps you’re heading to a client meeting. If you get absolutely drenched and need to find a change of clothes, you’ll be late and potentially lose the client’s respect. Losing their respect may cost you your job, which you may have worked towards achieving your entire life.

Whether you realize it consciously or not, bringing that umbrella just eliminated a risk that could have crumbled your entire hierarchy of needs.

Risk Management allows you to imagine tomorrow’s surprises today by managing risk.

While packing an umbrella is one of the most basic ways to stay prepared, risk is complex and life is unpredictable. The way humans manage risk is an undertone; we are always subconsciously thinking about the risk-reward tradeoff. Businesses, being powered by humans, naturally follow suit.

When we think about an organization, oftentimes risk-based decisions are made considering the consequences of inaction or taking a particular action. This is how people implicitly operate. However, implicit risk management is not enough to successfully operate a business.

Risk management should also involve a strategic and formalized process. With the right Enterprise Risk Management (ERM) software , your risk management efforts can help you imagine the unimaginable and prepare for what’s to come.

In this guide, we’ll answer what is risk management, detail the makings of a risk management plan, explain why risk management is important, and outline action items for enacting the risk management steps within your risk management plan.

Table of Contents

What Is Risk Management?

The risk management process involves identifying and assessing the likelihood of bad situations occurring. Once you have assessed these risks you will want to create a plan for risk mitigation and risk monitoring so that you are in control of potential threats.

Risk Management Definition

Risk Management Types

Now that you understand risk, understanding risk management seems fairly simple. It’s a concept that has been around for ages. However, risk management is an umbrella term that accounts for a number of more granular activities and encompasses the topic of GRC .

Let’s examine risk management as the sum of the following parts:

Enterprise Risk Management (ERM)

Effectively as se ssing risks , mitigating and monitoring activities as you uncover critical risks across your entire enterprise. Ultimately, it helps the company allocate resources effectively to protect its reputation, employees, investors and community.

Incident Management

Reporting, resolving, remediating and preventing incidents — from small hiccups to disasters — in order to protect your workplace by managing risk. An equally important aspect of incident management is giving employees a voice to speak up about any issue.

IT Governance & Security

Protecting your company’s assets, data and reputation by assessing risk and responding to incidents. This involves tracking your company’s technological resources, making sure their vulnerabilities are under control, and creating policies and procedures that are compliant with today’s evolving regulations.

Compliance Management

Tracking regulations that you must adhere to, proving compliance, and staying on top of an ever-changing landscape. Doing so helps you maintain an exemplary reputation and empowers your company to operate under the highest standards of honesty and integrity.

Vendor Management

Ensuring that you’re working with top-notch vendors by managing who your third parties are, what services they provide, what sensitive information they have access to, which internal policies apply to them and so much more.

You can view our complete What is Vendor Management Guide here.

Financial Reporting

Tracking operational activities, attestations, and accountability to improve reporting efficiency and accuracy. This entails identifying risks of non-compliance, designing controls to address vulnerabilities, mapping controls to key objectives, testing controls for effectiveness, and reporting to regulators.

Audit Management

Making sure that every business area within your organization is stacking up and improving accordingly. This means monitoring controls to make sure they are as effective as possible. Internal process, compliance, IT, and facility-driven audits are essential to reduce threats and ineffectiveness and keep your business thriving.

Business Continuity & Disaster Recovery

Knowing which areas of your business are most critical, identifying resources for employees to keep crucial processes functioning and outlining recovery steps should havoc arise. Learn more in this business continuity guide .

Policy Management

Keeping track of the multitudes of policies your company has and creating the basis for which each one is implemented. This also means knowing every person associated with every policy and what their responsibilities are every time one of those processes kicks off.

Risk management should involve all of the areas discussed above. You can look at risk management as a way to proactively catalog organizational concerns and develop plans for how to address them. Once you’ve developed a thoughtful strategy, you enable better performance across your organization.

Why is Risk Management Important?

Realizing the importance of having a strong risk management function can save you money and drastically improve operational performance.

Asking, “What do we need in order to be prepared?” rather than planning a reaction pays dividends in the long run and is a key part of risk analysis.

Not only does having a strong risk management program save you money, but it also enhances performance. In fact, organizations that have a formalized enterprise risk management program tend to have higher evaluations thanks to their risk analysis. An independent research study, “ The Valuation Implications for Enterprise Risk Management Maturity ,” was published in the prestigious Journal of Risk and Insurance. This peer-reviewed and rigorous study conducted by Queens University MBA program definitively quantifies a 25% market valuation premium for organizations that have reached mature levels of ERM.

The connection between an organization’s risk management maturity level and market evaluation can be better understood by finding out your risk maturity score. The RMM Assessment allows you to score your ERM program on a five-level scale. Immediately after completing the assessment, you’ll receive an immediate benchmarking report that explains your current maturity level and offers actionable ideas for improvement.

For a complimentary copy of the RMM report “Why a Mature ERM Effort is Worth the Investment,” complete a free online RMM assessment here .

Risk Management Examples

Chipotle: Poor Risk Management

Since 2015, Chipotle has maintained notoriety for their repeated cases of food-borne illnesses. As they experienced one E-coli outbreak after another, the company disclosed to investors that its profits had plummeted by 95% in 2016 compared to the year prior. The stock price of company shares also plummeted by 45% the year following the outbreaks.

It turns out that the root cause of the outbreaks could be linked to the company’s decision to shift the process of prepping produce from central commissary kitchens to individual locations. While the initial decision to innovate could may have seemed smart at the time, Chipotle did not do their due diligence and monitor the vendor management risks, which led to significant losses.

Wimbledon: Good Risk Management

The most timely demonstration of risk management’s ROI is Wimbledon’s pandemic insurance plan . Over 17 years ago, following the SARS outbreak, Wimbledon purchased pandemic insurance at a rate of around $2 million per year. Fast forward to 2020 and the Wimbledon tennis tournament has been canceled as a result of the COVID-19 pandemic. Instead of suffering tremendous financial losses, Wimbledon is expected to receive an insurance payout of roughly $142 million.

It would be an understatement to say that Wimbledon was a step ahead of the rest of the world in terms of undertaking risk analysis. This was tremendous foresight that could have only been realized through detailed analysis and thoughtful planning; planning that did not happen implicitly.

What is a Risk Management Plan?

Having a clear, formalized risk management plan brings additional visibility into consideration. Standardizing risk management makes identifying systemic issues that affect your entire organization simple. The ideal risk management plan serves as a roadmap for improving performance by helping you understand key dependencies, risk analysis, and control effectiveness. With proper implementation of your plan, you ultimately should be able to better allocate time and resources towards what matters most.

Since every business has its own unique set of risks, it’s important to create a customized risk management plan for your organization. Profit motive, brand, size, industry, market share and many more characteristics all will prescribe your risk management program. That being said, all plans should be standardized, meaningful and actionable. The same framework for defining the steps within your risk management plan can be applied across the board.

Risk Management Steps

Step #1: Identify

Implementing risk identification techniques across your organization should be the first step to developing your risk management program. Note that it’s not enough to simply identify what happened; the most effective risk identification techniques focus on root cause. This allows you to identify systemic issues so that you can design controls that eliminate the cost and time of duplicate effort.

Step #2: Assess

Assessing risk in a uniform fashion is the hallmark of a healthy risk management system. Collect and analyze data so that you can determine the likelihood of any given risk and subsequently your remediation efforts with risk prioritization best practices .

It is also imperative to calculate your own risk appetite levels so that you can determine how much risk your organization is willing to accept.

Step #3: Mitigate

Risk mitigation is defined as the process of reducing risk exposure and minimizing the likelihood of an incident. Your top risks and concerns need to be continually addressed to ensure your business is fully protected.

Step #4: Monitor

Monitoring risk should be an ongoing and proactive process. It involves testing, metric collection, and incidents remediation to certify that your controls are effective. It also allows you to identify and address emerging trends to determine whether or not you’re making progress on your initiatives.

Step #5: Connect

Create relationships between risks, business units, mitigation activities, and more to create a cohesive picture of your organization. This allows you to recognize upstream and downstream dependencies, identify systemic risks and design centralized controls. When you eliminate silos, you eliminate the chances of missing critical pieces of information.

Step #6: Report

Presenting information about your risk management program in an engaging way demonstrates effectiveness and can rally the support of various stakeholders. Develop a r isk metric s key risk indicators repor t that centralizes your information and gives a dynamic view of your company’s risk profile.

The ultimate goal of your risk management plan is to be as accessible and intuitive as possible. Even the most intentional and holistic plan will not be effective unless it is transparent and efficient. The best way to ensure a successful risk management program is by investing in smart software.

Frequently Asked Questions

What is the first step in the risk management process.

The first step in the risk management process is to identify the risks that are likely to occur. The company will need to identify the risks related to their business by conducting a risk assessment based on surrounding areas that could potentially affect them.

What Are Different Ways To Manage Risk?

Risk avoidance and risk mitigation are the two main ways companies try to manage their risks. Risk avoidance is when a company tries to avoid taking on certain risks that could have negative effects. Risk mitigation is when a company tries to reduce the impact of risks that they are taking on. These actions will help companies manage their risk level.

What Are Some Benefits Of Risk Management?

Some benefits of risk management are saved time and money, better customer service, improved decision making by employees, increased productivity, decreased turnover rates among employees and increased profits for the company.

Why Is Risk Management Important?

Risk management is important as it helps reduce the impact of risks on business operations. If a company were to not take any risk management measures, this could lead to serious consequences where the company may incur great losses or even go bankrupt.

Your ERM platform should enable you to bridge the gap between organizational silos. It should take a risk-based approach and allow you to manage all of your information with a common framework. This is the most clear-cut path to driving results.

LogicManager’s ERM software is built on the very idea that silos hinder success. It empowers organizations to anticipate what’s ahead, uphold their reputation and improve business performance through strong governance.

Now more than ever, risk and understanding both ERM and ESG should be top-of-mind for every organization. Social platforms like Twitter, Facebook, Glassdoor and Yelp have empowered consumers to monumentally impact a company’s reputation. Corporate mishaps can now be instantly shared, magnified and multiplied. With this unprecedented control of the market, it’s no wonder there are multitudes of corporate scandals dominating news headlines.

Unlike the undesirable outcomes that we try so hard to steer clear of in our daily lives, undesirable outcomes in business are avoidable as long as you’re equipped with the right tools and services. Gone are the days of corporate risk management being recognized as merely a part of compliance. If you’re truly aiming to realize the full potential of your business, it’s critical to keep risk management top-of-mind.

Want to see exactly how you can benefit from our risk-based approach ?

Free Risk Assessment Template

Our easy-to-use risk assessment template allows you to complete risk assessments in Excel to better mitigate risk, direct your business strategy and much more.

Share This Post

Stay informed, related content.

Your Content Goes [...]

Manage Tomorrow’s Risks Today Using LogicManager’s Enterprise Risk Management Software

Request a demo to see how our software can protect and reduce negative impacts against your business.

My Favorites List

Submit your Favorites List and our experts will reach out to you with more information. You will also receive this list as an e-mail which you can share with others. Here are the solutions you've added to your list so far:

Risk management is the process of identifying, assessing and controlling financial, legal, strategic and security risks to an organization’s capital and earnings. These threats , or risks, could stem from a wide variety of sources, including financial uncertainty, legal liabilities, strategic management errors, accidents and natural disasters.

If an unforeseen event catches your organization unaware, the impact could be minor, such as a small impact on your overhead costs. In a worst-case scenario, though, it could be catastrophic and have serious ramifications, such as a significant financial burden or even the closure of your business.

To reduce risk, an organization needs to apply resources to minimize, monitor and control the impact of negative events while maximizing positive events. A consistent, systemic and integrated approach to risk management can help determine how best to identify, manage and mitigate significant risks.

Get insights to better manage the risk of a data breach with the latest Cost of a Data Breach report.

Register for the X-Force Threat Intelligence Index

At the broadest level, risk management is a system of people, processes and technology that enables an organization to establish objectives in line with values and risks.

A successful risk assessment program must meet legal, contractual, internal, social and ethical goals, as well as monitor new technology-related regulations. By focusing attention on risk and committing the necessary resources to control and mitigate risk, a business protects itself from uncertainty, reduce costs and increase the likelihood of business continuity and success.

Three important steps of the risk management process are risk identification, risk analysis and assessment, and risk mitigation and monitoring.

Risk identification is the process of identifying and assessing threats to an organization, its operations and its workforce. For example, risk identification can include assessing IT security threats such as malware and ransomware, accidents, natural disasters and other potentially harmful events that could disrupt business operations.

Risk analysis involves establishing the probability that a risk event might occur and the potential outcome of each event. Risk evaluation compares the magnitude of each risk and ranks them according to prominence and consequence.

Risk mitigation refers to the process of planning and developing methods and options to reduce threats to project objectives. A project team might implement risk mitigation strategies to identify, monitor and evaluate risks and consequences inherent to completing a specific project, such as new product creation. Risk mitigation also includes the actions put into place to deal with issues and effects of those issues regarding a project.

Risk management is a nonstop process that adapts and changes over time. Repeating and continually monitoring the processes can help assure maximum coverage of known and unknown risks.

There are five commonly accepted strategies for addressing risk. The process begins with an initial consideration of risk avoidance then proceeds to 3 additional avenues of addressing risk (transfer, spreading and reduction). Ideally, these three avenues are employed in concert with one another as part of a comprehensive strategy. Some residual risk may remain.

Avoidance is a method for mitigating risk by not participating in activities that may negatively affect the organization. Not making an investment or starting a product line are examples of such activities as they avoid the risk of loss.

This method of risk management attempts to minimize the loss, rather than completely eliminate it. While accepting the risk, it stays focused on keeping the loss contained and preventing it from spreading. An example of this in health insurance is preventive care.

When risks are shared, the possibility of loss is transferred from the individual to the group. A corporation is a good example of risk sharing—several investors pool their capital and each only bears a portion of the risk that the enterprise may fail.

Contractually transferring a risk to a third-party, such as, insurance to cover possible property damage or injury shifts the risks associated with the property from the owner to the insurance company.

After all risk sharing, risk transfer and risk reduction measures have been implemented, some risk will remain since it is virtually impossible to eliminate all risk (except through risk avoidance). This is called residual risk.

Risk management standards set out a specific set of strategic processes that start with the objectives of an organization and intend to identify risks and promote the mitigation of risks through best practice.

Standards are often designed by agencies who are working together to promote common goals, to help to ensure high-quality risk management processes. For example, the ISO 31 000 standard on risk management is an international standard that provides principles and guidelines for effective risk management.

While adopting a risk management standard has its advantages, it is not without challenges. The new standard might not easily fit into what you are doing already, so you could have to introduce new ways of working. And the standards might need customizing to your industry or business.

Manage risk from changing market conditions, evolving regulations or encumbered operations while increasing effectiveness and efficiency.

Speed insights, cut infrastructure costs and increase efficiency for risk-aware decisions with IBM RegTech.

Simplify how you manage risk and regulatory compliance with a unified GRC platform fueled by AI and all your data.

Better manage your risks, compliance and governance by teaming with our security consultants.

Identify IT security vulnerabilities to help mitigate business risks.

Create a smarter security framework to manage the full threat lifecycle.

Understand your cybersecurity landscape and prioritize initiatives together with senior IBM security architects and consultants in a no-cost, virtual or in-person, 3-hour design thinking session.

Understand your cyberattack risks with a global view of the threat landscape.

Discover how a governance, risk, and compliance (GRC) framework helps an organization align its information technology with business objectives, while managing risk and meeting regulatory compliance requirements.

Find out how threat management is used by cybersecurity professionals to prevent cyber attacks, detect cyber threats and respond to security incidents.

Explore financial impacts and security measures that can help your organization avoid a data breach, or in the event of a breach, mitigate costs.

Keep up to date with the latest strategies from our expert writers.

Protect your business from potential risks and strive towards compliance with regulations as you explore the world of proper governance.

Cybersecurity threats are becoming more advanced and more persistent, and demanding more effort by security analysts to sift through countless alerts and incidents. IBM Security QRadar SIEM helps you remediate threats faster while maintaining your bottom line. QRadar SIEM prioritizes high-fidelity alerts to help you catch threats that others simply miss.

View or edit this activity in your CPD log.

What is risk management?

Risk analysis and risk management is a process that allows individual risk events and overall risk to be understood and managed proactively, optimising success by minimising threats and maximising opportunities and outcomes.

Definition from APM Body of Knowledge 7 th edition

Risk management

Risk management is focused on anticipating what might not go to plan and putting in place actions to reduce uncertainty to a tolerable level.

Risk can be perceived either positively (upside opportunities) or negatively (downside threats). A risk is the potential of a situation or event to impact on the achievement of specific objectives

Working with the risk owner, the project professional ensures that risks are clearly identified before moving on to the risk analysis step of the risk management process.

The project risk management process reflects the dynamic nature of projectwork, capturing and managing emerging risks and reflecting new knowledge in existing risk analyses.

A risk register is used to document risks, analysis and responses, and to assign clear ownership of actions.

The risk management process

Source: Project Risk Analysis and Management Guide 2 nd edition

Watch: What is risk?

What is risk analysis?

Risk analysis provides guidance on where the greatest vulnerabilities lie. Because risk analysis is fundamentally perception based, it is important for the project professional to engage stakeholders early to identify risks.

To make sense of differing perceptions, it is important to describe risk events clearly, separating causes (facts now), from risk events (situations that may occur), from effects (that have an impact on one or more of the project measures). This enables subsequent analysis and management of risks.

Effective risk analysis and contingency planning will see planned time and/or contingency used. Unused contingency is most likely caused by overestimation, luck or the efficient management of risk. Insufficient contingency is most likely caused by optimistic estimation, bad luck or inefficient management of risk.

Outputs from risk analysis help the project professional to:

- Understand the probability of achieving outturn dates, costs or

- Inform and influence decision-making about the chances of achieving the business case and

- Agree the level of contingency to provide the required level of confidence.

APM Learning

The following risk management resources are available on APM Learning. This is a member only resource.

- Information sheet - Risk management

- Mini guide - Project risk analysis and management

Find out more about APM Learning

The Asymmetry between Threats and Opportunities in Risk Management

Results from a Survey among APM Corporate Members

Our latest survey was conducted among our Corporate Members by our Risk Management SIG with the aim of assessing the state of risk management in projects, with an emphasis on definitions and processes around opportunity management.

This report revealed the differences between the application of risk management for larger and smaller projects.

Download the report

Related reading

APM Podcast

State of the art risk management projects: what you need to know.

Emma meets Peter Simon, a Director at Lucidus Consulting and a member of the APM Risk SIG Committee.

He is co-author of a new APM report looking into opportunity management as part of the overall project risk management process. The findings reveal notable areas where what is defined in textbooks and standards do not match what’s happening in practice.

APM Risk Specific Interest Group

The APM Risk SIG (Specific Interest Group) provides a forum in which to share knowledge and ideas, develop expertise and understanding and actively promote the adoption of project risk management.

Publications

APM Body of Knowledge 7 th edition

The APM Body of Knowledge 7 th edition is a foundational resource providing the concepts, functions and activities that make up professional project management. It reflects the developing profession, recognising project-based working at all levels, and across all sectors for influencers, decision makers, project professionals and their teams.

You may also be interested in

The APM Learning portal is an online resource which provides members with access to digital guides, modules and other digital learning resources as part of the membership benefit.

Project – APM's official journal – is circulated quarterly for members only, and online for regularly updated news, blogs, opinions and insights for those in the project community.

Essay on Risk Management

Students are often asked to write an essay on Risk Management in their schools and colleges. And if you’re also looking for the same, we have created 100-word, 250-word, and 500-word essays on the topic.

Let’s take a look…

100 Words Essay on Risk Management

What is risk management.

Risk Management is the process of identifying, assessing, and controlling threats to an organization’s capital and earnings. These threats or risks could stem from a wide variety of sources, including financial uncertainty, legal liabilities, strategic management errors, accidents, and natural disasters.

Importance of Risk Management

Risk Management is important because it prepares an organization to face uncertainties. It helps to understand potential risks and to make plans to minimize their impact. Proper risk management can reduce not only the likelihood of an event occurring, but also the magnitude of its impact.

Steps in Risk Management

Risk Management involves several steps. The first step is identifying the risks. The next step is analyzing the risk to understand its potential impact. The third step is evaluating or ranking the risk. The final step is treating or controlling the risk.

Risk Management Techniques

There are several techniques for managing risk. One is risk avoidance, where the aim is to eliminate all risks. Another technique is risk reduction, where steps are taken to reduce the severity of the loss. Risk retention and risk transfer are other techniques used in risk management.

In conclusion, Risk Management is a vital part of any organization. It helps to safeguard an organization’s future through the identification and treatment of risks. With proper risk management, an organization can reduce the negative impact of threats they may face.

250 Words Essay on Risk Management

Risk Management is a process that helps identify, assess, and control threats that could harm an organization. These threats or risks could be anything from financial problems, accidents, natural disasters, or even legal issues. The main goal of Risk Management is to lessen the impact of these risks.

Risk Management follows four main steps. First, we identify the risks. This means we look at what could possibly go wrong. Next, we assess the risks. We try to figure out how likely it is that these risks will happen and how much damage they could cause. Then, we work on ways to control these risks. This could mean coming up with a plan to prevent the risk or lessen its impact. Finally, we monitor the risks. We keep an eye on them to see if they change or if new risks come up.

Risk Management is very important because it helps organizations prepare for the unexpected. It helps them make plans that can prevent or lessen damage from risks. It also helps them save money that they might lose if these risks were to happen.

In conclusion, Risk Management is a necessary practice for all organizations. It helps them identify, assess, control, and monitor risks. By doing this, organizations can prevent or lessen the impact of these risks, saving them from potential damage and loss.

500 Words Essay on Risk Management

Risk Management is a process that helps you identify and control possible problems that might happen in the future. It’s like a safety net that prepares you for any unexpected events.

Why is Risk Management Important?

Imagine you are planning a picnic. But, what if it rains? Your picnic would be ruined. So, you check the weather forecast before planning. This is a simple example of risk management. In the same way, businesses also use risk management. They want to know about any problems that might happen. This way, they can make plans to avoid them or reduce their impact.

Risk Management includes four main steps:

1. Identifying the Risks: The first step is to find out what could go wrong. This could be anything from a machine breaking down to a sudden change in market trends. 2. Analyzing the Risks: Next, you need to understand how big the problem could be. This helps to decide which risks need the most attention. 3. Planning the Response: Once you know the risks, you can make plans to handle them. This could mean avoiding the risk, reducing its impact, or accepting it and making a plan to recover from it. 4. Monitoring the Risks: Finally, you need to keep an eye on the risks and how well your plans are working. This means you can make changes if needed.

Benefits of Risk Management

Risk Management helps in many ways. It can save money by avoiding costly mistakes. It can also help a business to run smoothly, as they are prepared for any problems. Plus, it can help to build trust with customers and investors. They can see that the business is ready for any challenges.

Risk Management in Everyday Life

Risk Management is not just for businesses. We use it in our daily lives too. For example, wearing a helmet while riding a bike is a way of managing the risk of injury. Or, saving money for a rainy day helps to manage the risk of unexpected expenses.

So, Risk Management is a very helpful tool. It prepares us for the future and helps to avoid or reduce problems. It is used in businesses, but also in our everyday lives. By understanding and using Risk Management, we can make better decisions and be ready for whatever comes our way.

That’s it! I hope the essay helped you.

If you’re looking for more, here are essays on other interesting topics:

- Essay on Risk Assessment

- Essay on Robbery I Witnessed

- Essay on Rocket Ship

Apart from these, you can look at all the essays by clicking here .

Happy studying!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Your Article Library

Essay on risk management: meaning and approaches | foreign exchange.

ADVERTISEMENTS:

After reading this essay you will learn about:- 1. Meaning of Risk Management 2. Approaches to Risk Management 3. Approaches for Managing and Reducing Risks.

Essay on the Meaning of Risk Management:

Risk Management is developed during the twentieth century, on account of future uncertainties faced by businesses. It is the logical, consistent and disciplined approach to face the future’s uncertainties. Risk management provides platform to the business managers to work prudently and productively by having proper utilization of resources.

The management of future always depends on the capacity of the business managers to proactively frame the policy through the measurement of probability. As Peter Bernstein wrote, “If everything is a matter of luck, risk management is a meaningless exercise. Invoking luck obscures truth, because it separates an event from its cause.”

Risk Management supports the firm to decide the course of action in such a way so that risk and the consequential adverse effects of risk can be minimized or omitted to occur. To achieve the excellent performance and to have long term survival, it is must for firm to train the employees at all levels, so that can be provided insight to recognize risks and to take necessary steps to prevent it or to reduce the adverse effect of the same.

In short, risk management is a process of determination of risk components, and to re-organize the activities so that future losses can be reduced for the firm. For this purpose, the quantification of the risk is needed to be done carefully after identification of activities those lead to risk for the firm. Based on this, business manager has to design a strategy to reduce the proportion of risk.

Hence, the logical process of risk management may be outlined as:

1. Identification of risk or uncertainties;

2. Analysis of the implications (both individually and collectively);

3. Response to minimize risk; and

4. Allocation of appropriate contingencies based on plans and policies.

Risk management should be an essential part of the continuous and structured planning cycle within a firm.

Essay on Approaches to Risk Management :

Formalized procedures for the risk management in project or foreign exchange activities should be designed to suit the needs of the particular firm. The procedures to be structured in the systematic way and should also provide necessary guidelines to be followed. The framework should also suggest guidelines for selection of appropriate techniques.

Risk Management Model :

To work out the proper management of risk, the business managers have to parting with the total process in to three specific parts.

Those parts are as under:

1. Risk identification

2. Risk analysis and

3. Risk response.

1. Risk Identification :

Risk identification is a basic step needed to work out the financial, economic and societal impact on account of specific project or specific activity. The proper level of risk identification at appraisal stage supports to make proper choice of activities to be undertaken and the way it is to be performed considering the constraints of resources.

2. Risk Analysis :

The assessment of the risks associated with an activity is known as risk analysis. Risk analysis always looks for quantification of risk in terms of their effect on cost, time or revenue. Risk analysis can be done through the measurement of risk component and its effects on the economic and commercial feasibility of the project or activity.

3. Risk Response :

Once the risk analysis is done, it is needed to work out the strategy to cope up with the risk position. The response to the risk can be done through numerous ways.

Following is the illustrative list of risk response techniques:

i. Risk Avoidance or Reduction

ii. Risk Transfer and

iii. Risk Retention

i. Risk Avoidance or Reduction:

Risk avoidance is not considered as a wise technique, because in this technique, firm would like to take an action like not holding an asset or liability. In the case of risk reduction, firm adopts conservative course of action like application of hedging technique.

ii. Risk Transfer:

Under such technique, firm transfers the risky assets or liability to the party who is willing to take the risk. The counter party who is willing to take the risk will be paid upfront (at the time of entering in to contract) premium by the firm who wants to transfer the risk.

iii. Risk Retention:

Under this method, the firm is prepared to face the consequences of the risk situations with regards to assets or liabilities. The management of the firm has to develop the proper risk response strategy by considering the long-term corporate objectives of the firm.

Approaches for Managing and Reducing Risks :

After the different types of risk are identified; business managers are involved in the identification of the alternative approaches and ways to manage and reduce the risk.

Those available approaches are as under:

A. Avoidance :

A firm will try to avoid the risk by adopting a strategy like not to hold such asset or liability, which may results in to financial risk, exchange risk, volatility risk, or political risk, etc. The firm will not hold the foreign assets or liability in foreign currency those are prone to foreign exchange risk.

B. Loss Control :

Such type of approach is not acceptable by business managers, because such approach suggest to not to do any operating activities. Generally, the firm will should try to accept and find out the way through which the loss can be prevented or probability of loss can be reduced. For this purpose, generally firm takes the insurance policies or enters in to different types of hedging transactions.

C. Separation :

Under this approach, firm will not concentrate all their assets at one place or country. The loss can be reduced by firm by establishment of plants, and assets at different locations.

The core operating assets, those are needed for routine and regular business activities, are placed and located at multiple locations. In such situations any type of risk emerging situations will support to reduce or minimize the risk of business in case of economical slow down or political risk in a particular country.

Related Articles:

- Top 5 Measures for Reducing Foreign Exchange Risk

- 5 Aspects of Risk Management | Business Risk

Forex Management , Risk Management , Foreign Exchange Risks

Comments are closed.

- Thought Leadership

Principles of risk management explained

Following principles of risk management can help your organisation manage risk in the best possible way. This is important to ensure that your organization is protected from the various threats that it may face. It’s also important because, if done well, risk management can create opportunities for your business.

Applicable for all types of organisations, the ISO 31000 standard provides useful guidelines for managing risk. One way it does this is with the ISO 31000 risk management principles . This blog outlines what the ISO 31000 risk management principles are and the benefits of following principles of risk management

Let’s get into it.

What are the principles of risk management?

The ISO 31000 risk management principles aim to help your organization improve how it manages risk, so that you can create and protect value in your organization . The principles also intend to make your risk management processes more efficient and effective.

Below, we explain the 8 principles of risk management that are outlined in the international standard .

- Integrated - Ensure that all of your organization’s activities make risk management a focus. Integrate it throughout your organization.

- Structured and comprehensive – To achieve consistent results, your approach to risk management needs to be well-organised and thorough. It can’t be haphazard or sloppy; this only leads to failures down the line.

- Customised – Every organization is different. Make sure that your risk management framework and process is tailored to your organization, the context in which it operates, and its objectives.