Smart. Open. Grounded. Inventive. Read our Ideas Made to Matter.

Which program is right for you?

Through intellectual rigor and experiential learning, this full-time, two-year MBA program develops leaders who make a difference in the world.

A rigorous, hands-on program that prepares adaptive problem solvers for premier finance careers.

A 12-month program focused on applying the tools of modern data science, optimization and machine learning to solve real-world business problems.

Earn your MBA and SM in engineering with this transformative two-year program.

Combine an international MBA with a deep dive into management science. A special opportunity for partner and affiliate schools only.

A doctoral program that produces outstanding scholars who are leading in their fields of research.

Bring a business perspective to your technical and quantitative expertise with a bachelor’s degree in management, business analytics, or finance.

A joint program for mid-career professionals that integrates engineering and systems thinking. Earn your master’s degree in engineering and management.

An interdisciplinary program that combines engineering, management, and design, leading to a master’s degree in engineering and management.

Executive Programs

A full-time MBA program for mid-career leaders eager to dedicate one year of discovery for a lifetime of impact.

This 20-month MBA program equips experienced executives to enhance their impact on their organizations and the world.

Non-degree programs for senior executives and high-potential managers.

A non-degree, customizable program for mid-career professionals.

PhD Program in Finance

2023-24 curriculum outline.

The MIT Sloan Finance Group offers a doctoral program specialization in Finance for students interested in research careers in academic finance. The requirements of the program may be loosely divided into five categories: coursework, the Finance Seminar, the general examination, the research paper, and the dissertation. Attendance at the weekly Finance Seminar is mandatory in the second year and beyond and is encouraged in the first year. During the first two years, students are engaged primarily in coursework, taking both required and elective courses in preparation for their general examination at the end of the second year. Students are required to complete a research paper by the end of their fifth semester, present it in front of the faculty committee and receive a passing grade. After that, students are required to find a formal thesis advisor and form a thesis committee by the end of their eighth semester. The Thesis Committee should consist of at least one tenured faculty from the MIT Sloan Finance Group.

Required Courses

The following set of required courses is designed to furnish each student with a sound and well-rounded understanding of the theoretical and empirical foundations of finance, as well as the tools necessary to make original contributions in each of these areas. Finance PhD courses (15.470, 15.471, 15.472, 15.473, 15.474) in which the student does not receive a grade of B or higher must be retaken.

First Year - Summer

Math Camp begins on the second Monday in August.

First Year - Fall Semester

14.121/14.122 Micro Theory I/II

14.451/14.452 Macro Theory I/II ( strongly recommended)

14.380/14.381 — Statistics/Applied Econometrics

15.470 — Asset Pricing

First Year - Spring Semester

14.123/14.124 Micro Theory III/IV

14.453/14.454 Macro Theory III/IV (strongly recommended)

14.382 – Econometrics

15.471 – Corporate Finance

Second Year - Fall Semester

15.472 — Advanced Asset Pricing

14.384 — Time-Series Analysis or 14.385 — Nonlinear Econometric Analysis (Enrolled students receive a one-semester waiver from attending the Finance Seminar due to a scheduling conflict)

15.475 — Current Research in Financial Economics

Second Year - Spring Semester

15.473 — Advanced Corporate Finance

15.474 — Current Topics in Finance (strongly encouraged to take multiple times)

15.475 — Current Research in Financial Economics

Recommended Elective Courses

Beyond these required courses, students are expected to enroll in elective courses determined by their primary area of interest. There are two informal “tracks” in Financial Economics: Corporate Finance and Asset Pricing. Recommended electives are designed to deepen the student's grasp of material that will be central to the writing of his/her dissertation. Students also have the opportunity to take courses at Harvard University. There is no formal requirement to select one track or another, and students are free to take any of the electives.

25,000+ students realised their study abroad dream with us. Take the first step today

Meet top uk universities from the comfort of your home, here’s your new year gift, one app for all your, study abroad needs, start your journey, track your progress, grow with the community and so much more.

Verification Code

An OTP has been sent to your registered mobile no. Please verify

Thanks for your comment !

Our team will review it before it's shown to our readers.

- Universities /

PhD in Finance from MIT: Admission Requirements, Application, and Acceptance Rate

- Updated on

- Feb 29, 2024

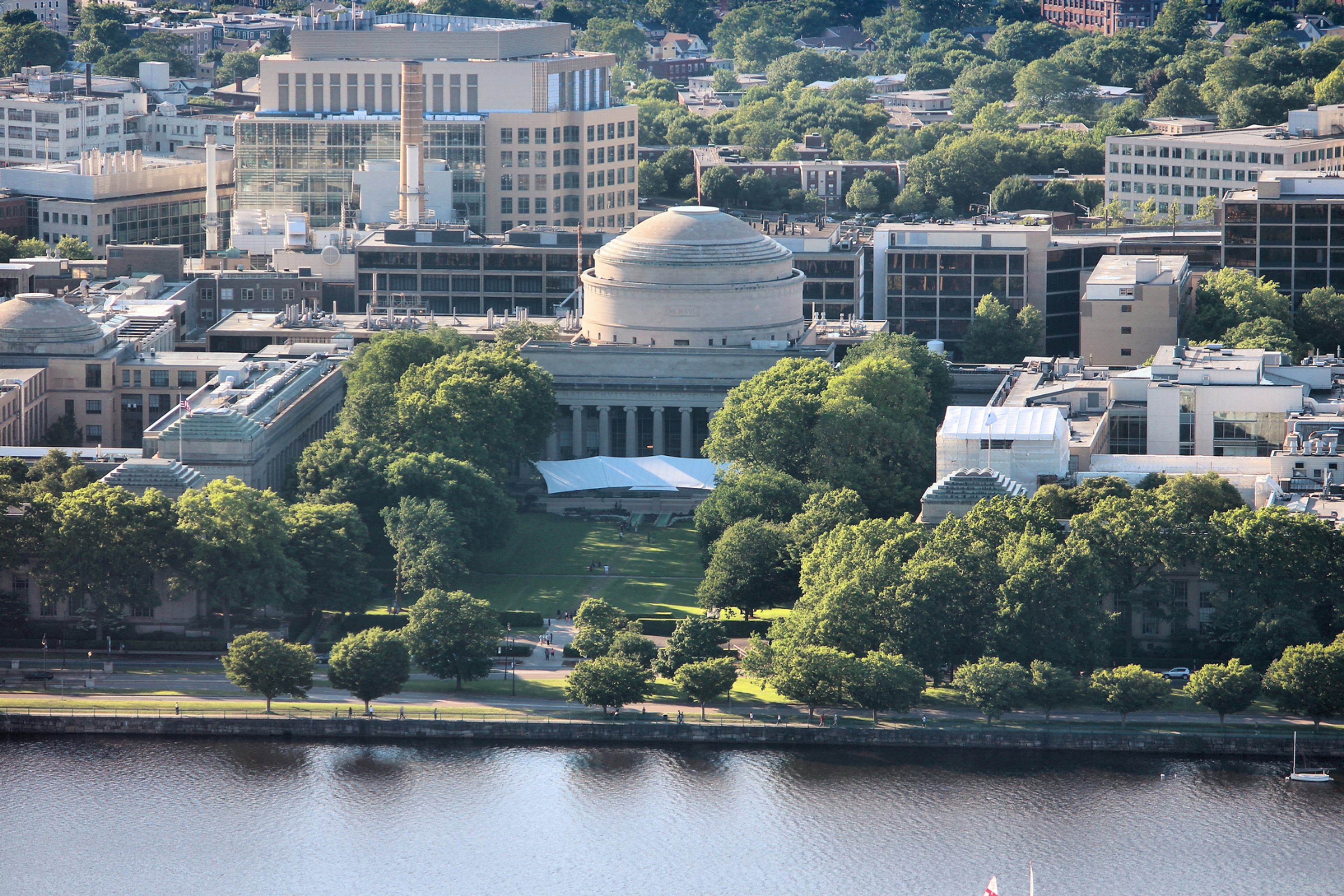

Finance graduates enjoy a high salary and immense career growth across the world. Moreover, pursuing a PhD in the field gives you an even greater boost. If you want to pursue a PhD in finance , then the Massachusetts Institute of Technology’s Sloan School of Management is ideal for you. Located in Cambridge, Massachusetts, United States, it is recognised as one of the most prestigious institutes in the world. Keep reading if you want to learn in detail about the pursuit of MIT PhD finance. You will learn about the program’s details, tuition fees, admission requirements, and more. So, let’s dive right into our discussion without wasting a second.

Why Pursue PhD Finance from MIT?

Let’s understand why you should pursue the MIT PhD Finance before learning about the various aspects of the program. So, here are the main reasons why you should go for this doctoral degree at MIT:

Acquire the Needed Knowledge: The program offers you an understanding of modern financial theory, whose practical implications are widely recognised and applied by Wall Street and corporations. You will be taught everything you need to conduct theoretical and applied research in the course.

World-Renowned Faculty: You will benefit from world-renowned faculty and hands-on learning experiences, allowing you to receive the best education possible.

Global Hub for Innovation: MIT is a renowned global hub of innovation in finance, management, entrepreneurship, analytics, and technology. Moreover, the degree earned from the institute will give you an edge over other professionals.

Also Read: PhD in Chemistry at Edinburgh University: Entry Requirements, Cost, Application Process

Program Details

The MIT Sloan Finance Group provides a PhD in Finance, catering to students aspiring to make a research career in academic finance. Students are engaged primarily in coursework during the initial two years, taking both required and elective courses in preparation for their general exam towards the end of the second year.

Students have to complete a research paper by the fifth semester’s end, present it to the faculty committee, and obtain a passing grade in the MIT PhD finance program. After this, they need to find a formal thesis advisor and create a thesis committee by the eighth semester’s end. The Thesis Committee must comprise at least one tenured faculty from the MIT Sloan Finance Group.

Tuition Fees

An MIT Sloan PhD Program charges an annual tuition fee of $57,575.98 . Moreover, the average monthly cost of living for an individual is $3,794 (with rent) in Cambridge, MA. So, keep these costs in mind to properly plan your educational budget.

Now that you have learnt about the details and tuition fees of MIT PhD finance, let’s look at the rankings of MIT. The institute receives a top rank every year in the global rankings, reaffirming its excellence.

See below the popular rankings of MIT:

MIT PhD Finance: Acceptance Rate

The acceptance rate for the MIT Sloan School of Management is 13-15%, making it a very competitive school to get into. However, don’t let the low acceptance rate discourage you from applying for admission. Pursuing a degree from here is very rewarding as far as your career is concerned, making all your efforts worthwhile.

MIT PhD Finance: Admission Requirements

Before applying for the MIT PhD finance program, make sure you meet its eligibility criteria. So, here are the admission requirements for the MIT Sloan PhD Program:

- You must have a bachelor’s degree or equivalent.

- Moreover, you are required to have a strong quantitative background.

- You also have to submit the following documents during your admission process:

- GMAT/GRE Scores

- Statement of Purpose

- Transcripts

- TOEFL/IELTS Scores

- Letters of Recommendation

- Video Essay

- Writing Sample(s)

- Valid Passport Copy (For International Students)

- Student Visa (For International Students)

Also Read: PhD at Columbia University: Courses Overview, Tuition Fees and Duration

MIT PhD Finance: Application Process

The application process for the MIT PhD finance can become daunting. Luckily, we can help you with your application and make the whole process easier for you.

Here is how we can help you in your application:

- You can use our Ai course finder to select the course you want to attend.

- Then Leverage Edu’s experts will commence your application on your behalf for your chosen institute and program.

- Your application must have some necessary documents like IELTS, TOEFL, LORs, SOPs, and essays.

- So, please prepare all the mandatory documents for your application beforehand.

- Our team will begin your application for housing, student loans, and scholarships once you have finished all the needed paperwork.

- Now, relax and wait for your offer letter, which you are usually granted within 4-6 weeks.

Relevant Reads:

Answer: Yes, students obtain full academic year tuition along with a monthly fellowship stipend (current rate $4,497 per month) and/or TA/RA salary for each of 12 months a year.

Answer: Yes, MIT is renowned and recognised for its finance degrees across the world.

Answer: The duration of a PhD course at MIT is 5-6 years.

So, this was all about the MIT PhD finance Many Indian students dream of pursuing education in foreign nations due to the exposure and career growth they offer. Consider joining a free counselling session with Leverage Edu if you plan to study abroad .

Abhishek Kumar Jha

Abhishek Kumar Jha is a professional content writer and marketer, having extensive experience in delivering content in journalism and marketing. He has written news content related to education for prominent media outlets, garnering expansive knowledge of the Indian education landscape throughout his experience. Moreover, he is a skilled content marketer, with experience in writing SEO-friendly blogs. His educational background includes a Postgraduate Diploma in English Journalism from the prestigious Indian Institute of Mass Communication (IIMC), Dhenkanal. By receiving an education from a top journalism school and working in the corporate world with complete devotion, he has honed the essential skills needed to excel in content writing.

Leave a Reply Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Contact no. *

Connect With Us

25,000+ students realised their study abroad dream with us. take the first step today..

Resend OTP in

Need help with?

Study abroad.

UK, Canada, US & More

IELTS, GRE, GMAT & More

Scholarship, Loans & Forex

Country Preference

New Zealand

Which English test are you planning to take?

Which academic test are you planning to take.

Not Sure yet

When are you planning to take the exam?

Already booked my exam slot

Within 2 Months

Want to learn about the test

Which Degree do you wish to pursue?

When do you want to start studying abroad.

January 2024

September 2024

What is your budget to study abroad?

How would you describe this article ?

Please rate this article

We would like to hear more.

Have something on your mind?

Make your study abroad dream a reality in January 2022 with

India's Biggest Virtual University Fair

Essex Direct Admission Day

Why attend .

Don't Miss Out

- Skip to Content

- Bulletin Home

- This Is MIT >

- Research and Study >

Laboratory for Financial Engineering

- Around Campus

- Academic Program

- Administration

- Arts at MIT

- Campus Media

- Fraternities, Sororities, and Independent Living Groups

- Medical Services

- Priscilla King Gray Public Service Center

- Religious Organizations

- Student Government

- Work/Life and Family Resources

- Advising and Support

- Digital Learning

- Disability and Access Services

- Information Systems and Technology

- Student Financial Services

- Writing and Communication Center

- Major Course of Study

- General Institute Requirements

- Independent Activites Period

- Undergraduate Research Opportunities Program

- First-Year Advising Seminars

- Interphase EDGE/x

- Edgerton Center

- Grading Options

- Study at Other Universities

- Internships Abroad

- Career Advising and Professional Development

- Teacher Licensure and Education

- ROTC Programs

- Financial Aid

- Medical Requirements

- Graduate Study at MIT

- General Degree Requirements

- Other Institutions

- Registration

- Term Regulations and Examination Policies

- Academic Performance and Grades

- Policies and Procedures

- Privacy of Student Records

- Abdul Latif Jameel Poverty Action Lab

- Art, Culture, and Technology Program

- Broad Institute of MIT and Harvard

- Center for Archaeological Materials

- Center for Bits and Atoms

- Center for Clinical and Translational Research

- Center for Collective Intelligence

- Center for Computational Science and Engineering

- Center for Constructive Communication

- Center for Energy and Environmental Policy Research

- Center for Environmental Health Sciences

- Center for Global Change Science

- Center for International Studies

- Center for Real Estate

- Center for Transportation & Logistics

- Computer Science and Artificial Intelligence Laboratory

- Concrete Sustainability Hub

- D-Lab

- Deshpande Center for Technological Innovation

- Division of Comparative Medicine

- Haystack Observatory

- Initiative on the Digital Economy

- Institute for Medical Engineering and Science

- Institute for Soldier Nanotechnologies

- Institute for Work and Employment Research

- Internet Policy Research Initiative

- Joint Program on the Science and Policy of Global Change

- Knight Science Journalism Program

- Koch Institute for Integrative Cancer Research

- Laboratory for Information and Decision Systems

- Laboratory for Manufacturing and Productivity

- Laboratory for Nuclear Science

- Legatum Center for Development and Entrepreneurship

- Lincoln Laboratory

- Martin Trust Center for MIT Entrepreneurship

- Materials Research Laboratory

- McGovern Institute for Brain Research

- Microsystems Technology Laboratories

- MIT Center for Art, Science & Technology

- MIT Energy Initiative

- MIT Environmental Solutions Initiative

- MIT Kavli Institute for Astrophysics and Space Research

- MIT Media Lab

- MIT Office of Innovation

- MIT Open Learning

- MIT Portugal Program

- MIT Professional Education

- MIT Sea Grant College Program

- Nuclear Reactor Laboratory

- Operations Research Center

- Picower Institute for Learning and Memory

- Plasma Science and Fusion Center

- Research Laboratory of Electronics

- Simons Center for the Social Brain

- Singapore-MIT Alliance for Research and Technology Centre

- Sociotechnical Systems Research Center

- Whitehead Institute for Biomedical Research

- Women's and Gender Studies Program

- Architecture (Course 4)

- Art and Design (Course 4-B)

- Art, Culture, and Technology (SM)

- Media Arts and Sciences

- Planning (Course 11)

- Urban Science and Planning with Computer Science (Course 11-6)

- Aerospace Engineering (Course 16)

- Engineering (Course 16-ENG)

- Biological Engineering (Course 20)

- Chemical Engineering (Course 10)

- Chemical-Biological Engineering (Course 10-B)

- Chemical Engineering (Course 10-C)

- Engineering (Course 10-ENG)

- Engineering (Course 1-ENG)

- Electrical Engineering and Computer Science (Course 6-2)

- Electrical Science and Engineering (Course 6-1)

- Computation and Cognition (Course 6-9)

- Computer Science and Engineering (Course 6-3)

- Computer Science and Molecular Biology (Course 6-7)

- Electrical Engineering and Computer Science (MEng)

- Computer Science and Molecular Biology (MEng)

- Health Sciences and Technology

- Archaeology and Materials (Course 3-C)

- Materials Science and Engineering (Course 3)

- Materials Science and Engineering (Course 3-A)

- Materials Science and Engineering (PhD)

- Mechanical Engineering (Course 2)

- Mechanical and Ocean Engineering (Course 2-OE)

- Engineering (Course 2-A)

- Nuclear Science and Engineering (Course 22)

- Engineering (Course 22-ENG)

- Anthropology (Course 21A)

- Comparative Media Studies (CMS)

- Writing (Course 21W)

- Economics (Course 14-1)

- Mathematical Economics (Course 14-2)

- Data, Economics, and Design of Policy (MASc)

- Economics (PhD)

- Global Studies and Languages (Course 21G)

- History (Course 21H)

- Linguistics and Philosophy (Course 24-2)

- Philosophy (Course 24-1)

- Linguistics (SM)

- Literature (Course 21L)

- Music (Course 21M-1)

- Theater Arts (Course 21M-2)

- Political Science (Course 17)

- Science, Technology, and Society/Second Major (STS)

- Business Analytics (Course 15-2)

- Finance (Course 15-3)

- Management (Course 15-1)

- Biology (Course 7)

- Chemistry and Biology (Course 5-7)

- Brain and Cognitive Sciences (Course 9)

- Chemistry (Course 5)

- Earth, Atmospheric and Planetary Sciences (Course 12)

- Mathematics (Course 18)

- Mathematics with Computer Science (Course 18-C)

- Physics (Course 8)

- Department of Electrical Engineering and Computer Science

- Institute for Data, Systems, and Society

- Chemistry and Biology

- Climate System Science and Engineering

- Computation and Cognition

- Computer Science and Molecular Biology

- Computer Science, Economics, and Data Science

- Humanities and Engineering

- Humanities and Science

- Urban Science and Planning with Computer Science

- African and African Diaspora Studies

- American Studies

- Ancient and Medieval Studies

- Applied International Studies

- Asian and Asian Diaspora Studies

- Biomedical Engineering

- Energy Studies

- Entrepreneurship and Innovation

- Environment and Sustainability

- Latin American and Latino/a Studies

- Middle Eastern Studies

- Polymers and Soft Matter

- Public Policy

- Russian and Eurasian Studies

- Statistics and Data Science

- Women's and Gender Studies

- Advanced Urbanism

- Computational and Systems Biology

- Computational Science and Engineering

- Design and Management (IDM & SDM)

- Joint Program with Woods Hole Oceanographic Institution

- Leaders for Global Operations

- Microbiology

- Music Technology and Computation

- Operations Research

- Real Estate Development

- Social and Engineering Systems

- Supply Chain Management

- Technology and Policy

- Transportation

- School of Architecture and Planning

- School of Engineering

- Aeronautics and Astronautics Fields (PhD)

- Artificial Intelligence and Decision Making (Course 6-4)

- Biological Engineering (PhD)

- Nuclear Science and Engineering (PhD)

- School of Humanities, Arts, and Social Sciences

- Humanities (Course 21)

- Humanities and Engineering (Course 21E)

- Humanities and Science (Course 21S)

- Sloan School of Management

- School of Science

- Brain and Cognitive Sciences (PhD)

- Earth, Atmospheric and Planetary Sciences Fields (PhD)

- Interdisciplinary Programs (SB)

- Climate System Science and Engineering (Course 1-12)

- Computer Science, Economics, and Data Science (Course 6-14)

- Interdisciplinary Programs (Graduate)

- Computation and Cognition (MEng)

- Computational Science and Engineering (SM)

- Computational Science and Engineering (PhD)

- Computer Science, Economics, and Data Science (MEng)

- Leaders for Global Operations (MBA/SM and SM)

- Music Technology and Computation (SM and MASc)

- Real Estate Development (SM)

- Statistics (PhD)

- Supply Chain Management (MEng and MASc)

- Technology and Policy (SM)

- Transportation (SM)

- Aeronautics and Astronautics (Course 16)

- Aerospace Studies (AS)

- Civil and Environmental Engineering (Course 1)

- Comparative Media Studies / Writing (CMS)

- Comparative Media Studies / Writing (Course 21W)

- Computational and Systems Biology (CSB)

- Computational Science and Engineering (CSE)

- Concourse (CC)

- Data, Systems, and Society (IDS)

- Earth, Atmospheric, and Planetary Sciences (Course 12)

- Economics (Course 14)

- Edgerton Center (EC)

- Electrical Engineering and Computer Science (Course 6)

- Engineering Management (EM)

- Experimental Study Group (ES)

- Global Languages (Course 21G)

- Health Sciences and Technology (HST)

- Linguistics and Philosophy (Course 24)

- Management (Course 15)

- Media Arts and Sciences (MAS)

- Military Science (MS)

- Music and Theater Arts (Course 21M)

- Naval Science (NS)

- Science, Technology, and Society (STS)

- Special Programs

- Supply Chain Management (SCM)

- Urban Studies and Planning (Course 11)

- Women's and Gender Studies (WGS)

The MIT Laboratory for Financial Engineering (LFE) is a research center focused on the quantitative analysis of financial markets and institutions using mathematical, statistical, and computational models and methods. The goal of the LFE is to support and promote academic advances in financial engineering and computational finance that can be directly applied for the betterment of the world. To do that, LFE faculty, students, and staff engage with industry professionals, regulators, policymakers, and other stakeholders to develop and apply new financial technologies to practical and socially important settings.

The LFE’s research projects fall into five areas, all focused on the interplay between financial markets and society.

- Healthcare finance. Driven by questions about how financial engineering can help cure cancer, LFE researchers are working to promote and develop new business models and financing structures for raising and deploying funds to support biomedical research and therapeutic development in a scalable and profitable manner. The work has grown beyond cancer to look at rare diseases, central nervous system disorders, vaccine programs, and other social challenges—like fusion energy and climate change—where transformative progress is only possible through public–private partnerships that combine fundamental scientific research with the right financial models and appropriate public policy.

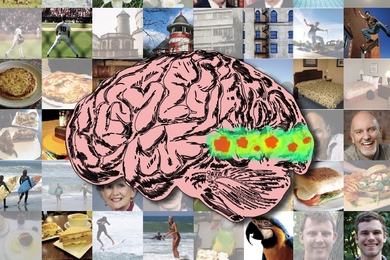

- Foundations of financial behavior and adaptive markets. The LFE is working to understand the impact of human behavior on financial markets and policy through research that explores the psychophysiology and behavioral biases of market participants. In taking an interdisciplinary approach to understanding financial markets, the LFE aims to reconcile human behavior with the Efficient Markets Hypothesis, which serves as the basis for much of modern investment theory and practice today.

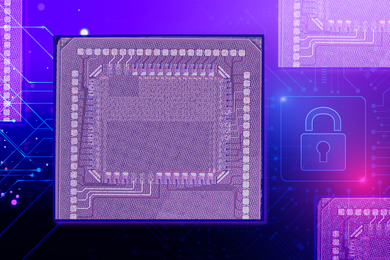

- Financial technology and artificial intelligence. Drawing upon computer science and artificial intelligence, research in this area applies techniques like machine learning and natural language processing to large datasets to develop real-world solutions to common industry challenges. As part of this research, the LFE also explores the positive and negative aspects of big data and financial technology, including privacy concerns and cybersecurity threats, and new technologies for addressing these issues.

- Asset-market dynamics. Explores quantitative models for portfolio management, trading, and asset allocation, including industry-level studies of the hedge fund industry, indexation and smart beta algorithms, and the impact of technology such as high-frequency trading on financial market dynamics.

- Risk management. Development of new methods for measuring and managing risks of various types, including systemic risk, in the financial system. A priority is to construct and test early warning signs for instabilities, and to understand the interplay between policy and the financial industry and its impact.

Students are encouraged to participate in current research projects, which include developing evolutionary and neurobiological models of individual risk preferences and financial-market dynamics; developing new approaches to financing biomedical innovation as well as analytics to better measure the risks and rewards of therapeutic development; developing models of investor behavior; measuring illiquidity risk in hedge-fund returns; and examining the public policy implications of this research.

The LFE is a research lab for MIT faculty and students and does not offer any degree programs.

Professor Andrew W. Lo is the director of the laboratory. For further information, please visit the LFE website or contact Jayna Cummings , 617-258-5727.

Print this page.

The PDF includes all information on this page and its related tabs. Subject (course) information includes any changes approved for the current academic year.

Christopher Palmer is the Albert and Jeanne Clear Career Development Professor and an Associate Professor of Finance at the MIT Sloan School of Management where he teaches corporate finance. His research focuses on how credit, real estate, and labor markets respond to periods of significant upheaval.

Palmer is also a Visiting Scholar at the Federal Reserve Bank of Boston, a Faculty Research Fellow at the National Bureau of Economic Research, and an Affiliate with the Jameel Poverty Action Lab. He previously taught real estate finance at the University of California Berkeley’s Haas School of Business and was a Visiting Scholar at the Federal Reserve Bank of San Francisco. Prior to graduate school, he consulted with Compass-Lexecon.

Palmer holds a BA in economics and mathematics from Brigham Young University and a PhD in economics from MIT.

Current Research Focus: Palmer's research focuses on how credit and real-estate markets respond to periods of significant upheaval. His current research projects evaluate policies designed to increase consumer attention to financial disclosures, improve retirement savings, reform the personal bankruptcy system, and improve federal housing vouchers.

Contact Information

Christopher j. palmer.

Albert and Jeanne Clear Career Development Professor

Associate Professor, Finance

MIT Sloan School of Management

100 Main St

Cambridge, MA 02142

Support Staff

Larissa walker, connect with christopher.

- April 23, 2024 | ALMA Uncovers the Building Blocks of Star Formation in Starburst Galaxy

- April 23, 2024 | New Harvard-Developed AI System Unlocks Biology’s Source Code

- April 23, 2024 | Antibiotic Breakthrough: Revolutionary Chinese Study Paves Way for Superbug Defeating Drugs

- April 23, 2024 | This Unusual Superfood Is Good for the Climate and Incredibly High in Protein

- April 23, 2024 | AI Efficiency Breakthrough: How Sound Waves Are Revolutionizing Optical Neural Networks

MIT Sloan Professor: A Deep Look at How Financial Markets Are Designed

By Peter Dizikes, Massachusetts Institute of Technology November 1, 2020

Financial markets, whether reformed or not, possess idiosyncrasies that attract scholars for thorough examination. That’s what MIT professor Haoxiang Zhu does.

Professor Haoxiang Zhu’s research has gained an audience beyond academia, reaching the finance industry and its regulators.

Financial markets are fast-moving, complex, and opaque. Even the U.S. stock market is fragmented into an array of competing exchanges and a set of proprietary “dark pools” run by financial firms. Meanwhile, high-frequency traders zoom around buying and selling stocks at speeds other investors cannot match.

Yet stocks represent a relatively transparent investment compared to many types of bonds, derivatives, and commodities. So when the financial sector melted down in 2007-08, it led to a wave of reforms as regulators sought to rationalize markets.

But every financial market, reformed or not, has its quirks, making them all ripe for scholars to scrutinize. That’s what Haoxiang Zhu does. The Gordon Y. Billard Professor of Management and Finance at the MIT Sloan School of Management is an expert on how market design and structure influence asset prices and investors. Over the last decade, his detailed theoretical and empirical studies have illuminated market behavior and gained an audience — scholars, traders, and policymakers — interested in how markets can be structured.

“When we need to reform markets, what should we do?” asks Zhu. “To the extent that something is not done perfectly, how can we refine it? These are very concrete problems and I want my research to shed light directly on them.”

One award-winning paper Zhu co-wrote in 2017 shows how transparent, reliable benchmark prices help investors efficiently identify acceptable costs and dealers in many large markets. For instance, in 2012, LIBOR, the interest-rate benchmark applied to hundreds of trillions of dollars in derivatives, was shown to have had price-manipulation problems. Zhu’s work emphasizes the value of having robust benchmarks (as post-2012 reforms have attempted to address) rather than scrapping them altogether.

Another recent Zhu paper, published this past September, looks at the way the Dodd-Frank banking legislation of 2010 has changed the trading of some credit default swaps in the U.S. — by using centralized mechanisms to connect investors and dealers, instead of the one-on-one “over-the-counter” market. The new design has been working well, the paper finds, but still has room to improve; investors still have no easy ways to trade among themselves without dealer intermediation. Additional market-design changes could address these issues.

Many of Zhu’s results are nuanced: One 2014 paper he wrote about the stock market suggests that privately-run dark pools may unexpectedly help price discovery by siphoning off lower-information traders, while better-informed traders help determine prices on the bigger exchanges. And a 2017 study he co-authored about the optimal trading frequency of stocks finds that when it comes to setting new prices, smaller-cap companies should likely be traded less frequently than bigger firms. Such findings suggest subtle ways to think about structuring stock markets — and indeed Zhu maintains ongoing dialogues with policy experts.

“I think this sort of analysis does inform policymaking,” Zhu says. “It’s not easy to do evidence-based rulemaking. It’s costly to discover evidence, it takes time.”

Solving one problem at a time

Zhu did not fully develop his interest in finance and markets until after his college days. As an undergraduate at Oxford University, he studied mathematics and computer science, graduating in 2006. Then Zhu got a job for a year at Lehman Brothers, the once-flourishing investment bank. He departed in 2007, a year before Lehman imploded; it had become overleveraged, borrowing massively to fund an array of bad bets.

“Fortunately, I left early,” says Zhu. Still, his short time working in finance revealed a couple of important things to him. Zhu found the daily routine of finance to be “very repetitive.” But he also became convinced there were compelling problems to be addressed in the area of market structures.

“I think part of my interest in the details of market design has to do with my industry experience,” Zhu says. “I came into finance and economics viewing it somewhat from the outside. I looked at it more as an engineer would. That’s why I think MIT’s a perfect fit, because of the engineering way of looking at things. We solve one problem at a time.”

Which is also to say that Zhu’s research is not necessarily intended to produce overarching conclusions about the nature of all markets; he investigates the mechanics of separate markets first and foremost.

“It’s hard to get very deep if you start too broad,” says Zhu, who earned tenure at MIT last year. “I would argue we should start with depth. Once you get to the bottom of something, you see there are connections between many different issues.”

Zhu received his PhD in 2012 from Stanford University’s Graduate School of Business, and joined the MIT faculty that same year. Along with his appointment in Sloan, Zhu is a faculty affiliate in the MIT Laboratory for Financial Engineering and the MIT Golub Center for Finance and Policy.

Among the honors Zhu has received, his research papers have won several awards. The paper on benchmarks, for one, was granted the Amundi Smith Breeden First Prize by the Journal of Finance ; the paper on optimal trading frequency won the Kepos Capital Award for Best Paper on Investments, from the Western Finance Association; and Zhu’s dark pools paper won the Morgan Stanley Prize for Excellence in Financial Markets.

Like a start-up

Much of Zhu’s time and energy is also devoted to teaching, and he is quick to praise the students he works with at MIT Sloan.

“They are smart, they are hard-working,” Zhu says. Of his PhD students, he adds, “It is always a challenge to go from being a good student getting good grades to producing research. Producing research is almost like starting up a company. It’s not easy. We do our best to help them, and I enjoy interacting with them.”

And while continuing to study financial market design, Zhu is expanding his research portfolio. Among other projects, he is currently looking at the impact of new payment systems on the traditional banking industry.

“I think that’s really a fantastic area for research,” Zhu says. “Once you have a [new] payment system, people’s payments get diverted away from the banks. … So we basically look at how financial technology, in this case payment providers, siphons off customers and information away from banks, and how banks will cope.”

At the same time, Zhu’s work on market structures continues to have an audience in the finance industry and among its regulators, both of which he welcomes. Indeed, Zhu has written several comment letters to regulators about proposed rules that could have material impact on the market. For example, he has argued against certain proposals that would reduce the transparency of the corporate bond market, the swaps market, and investment managers’ portfolio holdings. But he is in favor of the U.S. Treasury’s innovation in issuing debt linked to the new U.S. benchmark interest rate that is set to replace LIBOR.

“In market design, the message is often nuanced: There are advantages, there are disadvantages,” Zhu says. “But figuring out the tradeoff is what I find very rewarding, in doing this kind of work.”

More on SciTechDaily

Closing “Wet Markets” Is Not an Effective Policy Solution for Safeguarding Human Health, Biodiversity

Small Investors Bilked Out of Billions? Tiny Price Gaps Exploited by Fast Information Systems

Extreme Weather Could Bring Next Recession – Risk Unaccounted for in Financial Markets

Prescription Drug Prices in the U.S. Are 2.56x Higher Than Other Nations – Brand-Named Drugs 3.44x Higher

MIT Startup Exchange Program: Creating Powerful Synergies

Researchers Hot Stock Tip: Avoid This Type of Investment Fund

MIT Launches Intelligence Quest To Advance Human and Machine Intelligence Research

A Threat to Business and Financial Markets: Misuse of Climate Data

1 comment on "mit sloan professor: a deep look at how financial markets are designed".

To be honest, the financial market and its development trends are too complicated for me. In addition, it is not very interesting for me to sit and figure out for hours how it all works. I’d rather use one like BitcodeAI , which is automated and works without my participation. I just get money and I’m more than happy with it.

Leave a comment Cancel reply

Email address is optional. If provided, your email will not be published or shared.

Save my name, email, and website in this browser for the next time I comment.

Suggestions or feedback?

MIT News | Massachusetts Institute of Technology

- Machine learning

- Social justice

- Black holes

- Classes and programs

Departments

- Aeronautics and Astronautics

- Brain and Cognitive Sciences

- Architecture

- Political Science

- Mechanical Engineering

Centers, Labs, & Programs

- Abdul Latif Jameel Poverty Action Lab (J-PAL)

- Picower Institute for Learning and Memory

- Lincoln Laboratory

- School of Architecture + Planning

- School of Engineering

- School of Humanities, Arts, and Social Sciences

- Sloan School of Management

- School of Science

- MIT Schwarzman College of Computing

From MIT to Singapore and back: Delivering knowledge and advancing careers in finance

Press contact :.

Previous image Next image

Both sections of MIT class 15.433 (Financial Markets), taught this fall by visiting associate professor of finance Hong Ru MFin ’10, PhD ’15 at the MIT Sloan School of Management, include over 100 students from the master of finance program . However, when he joined the program’s inaugural class just over a decade ago, this number was much smaller.

“I started in the program in 2009 and graduated in 2010, and there were only 26 students then. Not like today,” says Ru, who is an associate professor of banking and finance at Nanyang Business School. Along with his wife, Juno Wei Chen MFin ’10, Ru returned to Boston after eight years in Singapore to teach the next generation of MFin students at MIT Sloan.

Chen, a senior portfolio manager of the Global Asset Allocation team at Columbia Threadneedle Investments, says their return to Boston and MIT Sloan has been a “great pleasure.” It’s where they first met, where they started their careers in academia and finance, and where they got married.

Ru is especially grateful for the chance to give back to the program that introduced him to Chen and set the pair on their respective career paths, going as far as to describe it as the duty of alumni.

“It’s not just my obligation to deliver my knowledge as a lecturer but, as an MFin alumnus, to help students with their career development and to figure out what to do at this stage of their life and career. We have been there,” he says.

The place to be

Even without a major marketing push by the school in 2009, the pilot program for the master of finance degree garnered 179 applications.

Ru and Chen, who both attended universities in Shanghai but met for the first time when they matriculated at MIT Sloan, independently discovered the new program as they began researching potential graduate schools.

“There has been a very strong appreciation for the American education system, especially since the United States is one of the centers of the financial world,” says Chen.

Given her double major in finance and mathematics, applying to a school like MIT made perfect sense to Chen. This was the same conclusion that Ru, also a finance major, came to.

Not only did the Institute boast one of the top management schools in the world, but it also housed a very influential economics department, whose faculty and alumni include many Nobel laureates — like the late Paul Samuelson, the first American to win the Nobel Memorial Prize in Economic Sciences, and School of Management Distinguished Professor of Finance Robert C. Merton PhD ’70, whose office, as Ru excitedly points out, is right next to his.

“MIT Sloan was definitely the place to be,” says Ru. Out of all the applicants vying for a spot in the inaugural class, he and Chen were both admitted.

“MIT brought us together, and I feel very fortunate to have met so many people from all over the world. It’s a very small class, but it’s very representative of many different countries, regions, and cultural backgrounds,” says Chen.

Two different, complementary paths

As their classes began in 2009, Ru, Chen, and their classmates were experiencing the first global recession of their adult lives. Ru pointed this out to his 15.433 students during a recent lecture, saying his peers faced a financial reality in which the S&P 500 had lost nearly 50 percent of its total value.

Even so, Ru and Chen appreciate everything they were able to learn, both in their coursework at MIT Sloan and off campus at various site visits and joint projects with industry firms. This context also informed the two different, but complimentary career paths they eventually took.

During her undergraduate studies, Chen interned with McKinsey & Co. and a few financial institutions in Shanghai, from which she decided to further explore the possibility of a career in finance. She was able to focus her path at MIT Sloan, where her courses taught her quantitative financial analysis and qualitative business skills, and networking events hosted by faculties like Senior Lecturer Mark P. Kritzman introduced her to firms like State Street, where she landed her first job after graduation.

“Where I ended up is a result of my personal interests and where I got my exposure, my knowledge, and where opportunities opened up for me,” says Chen.

The same can be said for Ru, who received offers for industry jobs in Boston and Hong Kong after graduation. Yet his interest in more advanced studies had been piqued when he enrolled in several doctoral-level classes to supplement his master’s coursework — including one taught by the late Stephen Ross, the inventor of arbitrage pricing theory.

“All the professors I had at MIT, like Stephen Ross, Jiang Wang, Leonid Kogan, and Antoinette Schoar, really cared about their students. Not all professors are like that,” Ru says of the faculty who influenced him. “They’re very passionate about what they do.”

The next 10 years

Ru and Chen are elated to be back in Boston, both because it was their first home together and because it is now the home of their growing family. They are also excited to reunite with their classmates after a long hiatus.

Like many Institute alumni, Ru and Chen missed out on getting back together with old friends and former teachers because of the Covid-19 pandemic, as 2020 marked the 10-year anniversary of the inaugural master of finance class. Yet they are hopeful for future gatherings at their next class reunion in 2025, as well as other school functions.

“We miss our friends, but the program also has 14 classes now, so let’s get together and have some fun,” says Ru. “Come sit in on 15.433 and see how I’m doing.”

Share this news article on:

Related links.

- Master of Finance Program

- MIT Sloan School of Management

Related Topics

- Business and management

Related Articles

Professor Stephen Ross, inventor of arbitrage pricing theory, dies at 73

Nobel-winning economist Paul A. Samuelson dies at age 94

For M.Fin. student, courses and travel offer opportunity

Previous item Next item

More MIT News

Mapping the brain pathways of visual memorability

Read full story →

Professor Emeritus Bernhardt Wuensch, crystallographer and esteemed educator, dies at 90

How light can vaporize water without the need for heat

This tiny chip can safeguard user data while enabling efficient computing on a smartphone

“No one can work in civil engineering alone”

Researchers detect a new molecule in space

- More news on MIT News homepage →

Massachusetts Institute of Technology 77 Massachusetts Avenue, Cambridge, MA, USA

- Map (opens in new window)

- Events (opens in new window)

- People (opens in new window)

- Careers (opens in new window)

- Accessibility

- Social Media Hub

- MIT on Facebook

- MIT on YouTube

- MIT on Instagram

Browse Course Material

Course info.

- Prof. Andrew Lo

Departments

- Sloan School of Management

As Taught In

- Financial Economics

Learning Resource Types

Finance theory i, course description.

You are leaving MIT OpenCourseWare

Egor Matveyev Executive Director

Dr. Egor Matveyev is the Executive Director of the MicroMasters Program in Finance and a Senior Lecturer in Finance at the MIT Sloan School of Management.

Dr. Matveyev joined MIT Sloan in 2017, and has led the MicroMasters Program in Finance since 2020. Prior to joining MIT Sloan, he was an Assistant Professor of Finance at the University of Alberta. His current research focuses on corporate finance, corporate governance, and asset management, with a particular focus on the non-profit sector. He teaches a variety of courses in the MBA, MFin, and Sloan Fellows programs. Dr. Matveyev also leads MIT Sloan’s action learning lab in Corporate Finance and Investment Banking.

He holds an MA in Economics from the New Economic School in Moscow and a PhD in Finance from the University of Rochester.

Alyssa Levy Program Manager

Alyssa Levy is the Program Manager for the MicroMasters Program in Finance. Alyssa is responsible for managing the launch, ongoing operations and strategy of MIT Sloan’s first MicroMasters Program, and is passionate about creating transformative educational programs and experiences for a global audience.

Peter Pham Program Coordinator

Peter Pham is the Program Coordinator for the MicroMasters Program in Finance. Among other things, he facilitates day-to-day operations for the program and manages program data analytics. He is passionate about providing equitable access to quality education for learners around the world.

Future Course Dates

MicroMasters Program in Finance Prerequisites and Resource Site

Finance at MIT

Master of Finance | MIT Sloan

A Justification Letter to send to your supervisor

Contact us: [email protected]

Courses delivered on

Instructors

MIT Sloan PhD Program: Application, Structure, and Specialties

Discover everything you need to know about the MIT Sloan PhD program, from the application process to the program structure and specialized areas of study.

Posted February 8, 2024

Featuring Geri T. and Andy P.

Applying to Top MBA Programs as a Consultant

Wednesday, april 24.

11:00 PM UTC · 60 minutes

Table of Contents

Are you considering pursuing a PhD in business administration? The MIT Sloan PhD Program is a distinguished option worth exploring. In this article, we will delve into the various aspects of this program, including its application process, structure, and specialties. Whether you are interested in the program overview, admission requirements, coursework, or career prospects, this comprehensive guide will provide you with the necessary information to make an informed decision.

Overview of the MIT Sloan PhD Program

The MIT Sloan PhD Program offers a rigorous and research-oriented curriculum designed to prepare students for careers in academia, research, or top-tier consulting firms. With a focus on interdisciplinary studies, this program emphasizes collaboration and innovation in addressing complex business challenges. Students have the opportunity to work closely with esteemed faculty members and engage in cutting-edge research projects.

At MIT Sloan, the PhD Program is known for its exceptional faculty and diverse student body. The program attracts students from all over the world who are passionate about advancing knowledge in business and management. With a strong emphasis on academic rigor and intellectual curiosity, the program provides a stimulating environment for students to thrive.

One of the unique aspects of the MIT Sloan PhD Program is its commitment to fostering a collaborative and supportive community. Students have the opportunity to collaborate with their peers on research projects, attend seminars and workshops, and engage in lively discussions that enhance their learning experience. The program also offers various networking events and conferences, providing students with opportunities to connect with industry professionals and scholars from different disciplines.

Key Features of the Program

The MIT Sloan PhD Program stands out for its commitment to excellence in research and teaching. The program provides students with a strong foundation in both theoretical and empirical research methods, allowing them to develop the necessary skills to make significant contributions to their respective fields. Moreover, the program's emphasis on interdisciplinary studies equips students with a unique perspective that enhances their problem-solving abilities.

As part of the program, students have access to state-of-the-art research facilities and resources. MIT Sloan is home to numerous research centers and initiatives, providing students with opportunities to collaborate on groundbreaking research projects. From the MIT Laboratory for Financial Engineering to the MIT Leadership Center, students have the chance to explore their research interests and contribute to cutting-edge knowledge in their chosen field.

In addition to the academic rigor, the MIT Sloan PhD Program also offers a range of professional development opportunities. Students have access to career services and workshops that help them navigate the job market and prepare for their future careers. The program also encourages students to present their research at conferences and publish their work in top-tier academic journals, providing them with valuable exposure and recognition within the academic community.

Furthermore, the program's faculty members are renowned experts in their respective fields, actively engaged in research and thought leadership. Students have the opportunity to work closely with these faculty members, benefiting from their expertise and mentorship. The faculty's diverse research interests and collaborations with industry leaders ensure that students receive a comprehensive and up-to-date education.

In conclusion, the MIT Sloan PhD Program offers a comprehensive and enriching experience for students who are passionate about advancing knowledge in business and management. With its rigorous curriculum, emphasis on interdisciplinary studies, and commitment to excellence in research and teaching, the program equips students with the skills and knowledge necessary for successful careers in academia, research, or top-tier consulting firms.

Delving into the Application Process

Gaining admission to the MIT Sloan PhD Program is a highly competitive process. Applicants are expected to demonstrate exceptional academic performance, strong analytical and quantitative skills, and a passion for research. The program seeks individuals who have a deep curiosity and a drive to push the boundaries of knowledge in their chosen field.

When applying to the program, there are several key components that applicants must carefully consider. Letters of recommendation play a crucial role in the evaluation process, as they provide insights into an applicant's potential for success in a rigorous academic environment. These letters should be written by professors or professionals who can speak to the applicant's intellectual capabilities, research potential, and personal qualities.

In addition to letters of recommendation, a statement of purpose is required. This is an opportunity for applicants to articulate their research interests, career goals, and how the MIT Sloan PhD Program aligns with their aspirations. It is important for applicants to customize their statement of purpose to demonstrate a clear understanding of the program's research areas and to convey their passion for contributing to the field.

Strong analytical and quantitative skills are highly valued in the program, and a strong GRE or GMAT score is an important component of a successful application. These standardized tests provide a measure of an applicant's ability to think critically, solve complex problems, and analyze data – skills that are essential for success in the program.

Application Timeline

To ensure a smooth application process , it is vital to be aware of the program's timeline. The application period typically opens in the fall, with specific deadlines for submitting all required materials. It is essential to start the application process early to allow ample time for gathering all necessary documents and crafting a compelling personal statement.

Once the application is submitted, a thorough review process takes place. The admissions committee carefully evaluates each application, considering factors such as academic performance, research experience, letters of recommendation, and the statement of purpose. The committee seeks to identify applicants who not only possess exceptional intellectual abilities but also demonstrate a strong fit with the program's values and research areas.

After the initial review, a select number of applicants are invited for an interview . This interview provides an opportunity for the admissions committee to further assess an applicant's fit with the program and to delve deeper into their research interests and motivations. It is important for applicants to prepare for these interviews by researching the program, identifying potential research interests, and practicing articulating their motivations and goals.

Tips for a Successful Application

Submitting a standout application requires careful preparation and attention to detail. Here are some tips to enhance your chances of being admitted to the MIT Sloan PhD Program:

- Highlight your research experience and any publications or presentations. This demonstrates your ability to contribute to the field and showcases your intellectual curiosity.

- Customize your statement of purpose to demonstrate your alignment with the program's research areas. Show how your research interests align with the ongoing work at MIT Sloan and how you can contribute to the program's intellectual community.

- Secure strong letters of recommendation from professors or professionals who can speak to your potential for academic success. These letters should highlight your intellectual abilities, research potential, and personal qualities.

- Schedule a visit to the MIT Sloan School of Management to demonstrate your interest and familiarize yourself with the campus and faculty. This shows your commitment to the program and allows you to gain a deeper understanding of the research opportunities available.

- Prepare for interviews by researching the program, identifying potential research interests, and practicing articulating your motivations and goals. Be prepared to discuss your research experience, academic background, and how the MIT Sloan PhD Program aligns with your long-term career goals.

By following these tips and carefully preparing your application, you can increase your chances of being admitted to the MIT Sloan PhD Program. Remember, the admissions process is highly competitive, so it is important to showcase your unique strengths and demonstrate how you can contribute to the program's intellectual community.

Read: How to Nail Your MIT Sloan MBA Interview: Overview, Questions, & Tips , Expert Guide to the MIT Sloan Short Answer Question,

Free trial!

From 92 top coaches

Access a library of videos, templates, and examples curated by Leland's top coaches.

Example essays.

Example Resumes

Application Prep

Video Courses

Structure of the MIT Sloan PhD Program

The MIT Sloan PhD Program is designed to provide students with a comprehensive curriculum that ensures a strong foundation in business administration. The program offers a wide range of coursework that covers various areas, including economics, statistics, research methods, and management theory. This diverse curriculum equips students with the knowledge and skills necessary to excel in their chosen field.

One of the unique aspects of the MIT Sloan PhD Program is the flexibility it offers. In addition to the core curriculum, students have the opportunity to choose elective courses that align with their research interests and career goals. This allows students to tailor their education to their specific needs and interests, ensuring that they receive a well-rounded and personalized education.

Duration and Schedule

Completing the MIT Sloan PhD Program typically takes around five years. During this time, students engage in a variety of activities, including coursework, research projects, and teaching assistantships. The program follows a cohort-based model, which fosters a collaborative learning environment. Students work closely with their peers, sharing ideas and insights, and supporting each other throughout their academic journey.

One of the advantages of the MIT Sloan PhD Program is its flexible scheduling options. The program understands that students may have unique research requirements or potential industry collaborations. As such, it offers flexible scheduling options to accommodate these needs. This ensures that students have the freedom to pursue their research interests while still meeting the program's requirements.

Research Opportunities

The MIT Sloan PhD Program offers ample research opportunities for students to explore their interests and make significant contributions to their fields. Students have access to state-of-the-art research facilities, which provide them with the resources they need to conduct groundbreaking research. Additionally, students have the opportunity to collaborate with renowned faculty members who are experts in their respective fields.

One of the key strengths of the MIT Sloan PhD Program is its emphasis on interdisciplinary research. The program recognizes that some of the most innovative and impactful research happens at the intersection of different disciplines. As such, it encourages students to explore interdisciplinary research projects, allowing them to draw insights from various fields and contribute to the advancement of knowledge in their chosen area of study.

Overall, the MIT Sloan PhD Program offers a comprehensive and flexible curriculum, a supportive learning environment, and ample research opportunities. It is designed to prepare students for successful careers in academia, research, and industry, and to equip them with the skills and knowledge they need to make a lasting impact in their chosen field.

Specialties within the MIT Sloan PhD Program

Available concentrations.

The program offers several concentrations that allow students to specialize in specific areas of business administration. These concentrations include finance, marketing, operations management, organizational behavior, and strategy. By choosing a concentration, students can develop expertise in their preferred field and conduct in-depth research.

Interdisciplinary Studies

The MIT Sloan PhD Program encourages interdisciplinary research, fostering collaboration between different departments and disciplines within the MIT community. Students have the opportunity to engage with scholars from various fields, broadening their perspectives and enhancing the impact of their research. This interdisciplinary approach empowers students to tackle multifaceted business challenges from diverse angles.

Career Prospects after MIT Sloan PhD

Job opportunities.

Graduates of the MIT Sloan PhD Program are highly sought after by academia, research institutions, and top consulting firms. With their exceptional research skills, deep knowledge in their respective fields, and interdisciplinary perspectives, these graduates are well-equipped for successful careers. The program's rigorous training and strong network also open up opportunities for students to pursue leadership roles in industry, government, and non-profit organizations.

Alumni Success Stories

The MIT Sloan PhD Program boasts an impressive list of alumni who have achieved remarkable success in their careers. From prominent academics to influential business leaders, these individuals have made significant contributions to their fields. The program's alumni network provides ongoing support and mentorship, ensuring that graduates continue to thrive long after completing their doctoral studies.

In conclusion, the MIT Sloan PhD Program offers a comprehensive and prestigious educational experience for those seeking a career in business administration. With its rigorous curriculum, interdisciplinary approach, research opportunities, and strong network, this program equips students with the knowledge and skills necessary to excel in academia, research, and consulting. Whether you are interested in finance, marketing, operations, or strategy, the MIT Sloan PhD Program provides the ideal platform to pursue your passion and make a lasting impact.

Browse hundreds of expert coaches

Leland coaches have helped thousands of people achieve their goals. A dedicated mentor can make all the difference.

Browse Related Articles

February 8, 2024

MIT Sloan Employment Report – Key Insights & Takeaways

Discover the latest insights and takeaways from the MIT Sloan Employment Report, providing valuable information on employment trends and opportunities.

MIT Sloan Values: What Does the School Care About?

Discover the core values that drive MIT Sloan School of Management and learn about what sets this prestigious institution apart.

February 9, 2024

MIT Sloan MBA Cost: Tuition & Fees Breakdown

Discover the breakdown of MIT Sloan MBA costs, including tuition and fees, in this comprehensive article.

MIT EMBA (Executive MBA) Degree – Program Overview

Looking to level up your career with an Executive MBA from MIT? This article provides a comprehensive overview of the prestigious MIT EMBA program, including insights into the curriculum, admissions process, and the unique benefits of earning an EMBA from one of the world's top institutions.

MIT Sloan Class Profile – Key Insights & Takeaways

Discover the essential insights and takeaways from the MIT Sloan class profile in this comprehensive article.

January 10, 2024

MIT Sloan Video Statement: Overview, Advice, & Common Mistakes

Learn all about the MIT Sloan video statement, including valuable advice and tips to help you stand out.

Expert Guide to the MIT Sloan Short Answer Question

Discover the essential tips and strategies for acing the MIT Sloan short answer question with our expert guide.

December 12, 2023

MIT Sloan – MBA Waitlist Strategy

Discover effective strategies and tips for navigating the MBA waitlist at MIT Sloan.

MIT Sloan MBA Acceptance Rates

Discover the latest MIT Sloan MBA acceptance rates and gain valuable insights into the competitive admissions process at one of the world's top business schools.

March 1, 2024

10 Notable Alumni of the MIT Sloan School of Management

Explore the remarkable careers and achievements of 10 outstanding MIT Sloan alumni who have made a significant impact in various industries.

5 MIT Sloan Faculty Members You Should Know

Discover the top 5 MIT Sloan faculty members who are making a significant impact in the business and academic world.

MIT Sloan MBA Letters of Recommendation Guide - Questions, Tips, & Examples

Looking for expert advice on securing stellar letters of recommendation for your MIT Sloan MBA application? Our comprehensive guide offers valuable insights, essential questions, helpful tips, and real-life examples to help you navigate this crucial aspect of your application process.

IMAGES

VIDEO

COMMENTS

2023-24 Curriculum Outline. The MIT Sloan Finance Group offers a doctoral program specialization in Finance for students interested in research careers in academic finance. The requirements of the program may be loosely divided into five categories: coursework, the Finance Seminar, the general examination, the research paper, and the dissertation.

The MIT Sloan Finance Group provides a PhD in Finance, catering to students aspiring to make a research career in academic finance. Students are engaged primarily in coursework during the initial two years, taking both required and elective courses in preparation for their general exam towards the end of the second year.

The MIT Laboratory for Financial Engineering (LFE) is a research center focused on the quantitative analysis of financial markets and institutions using mathematical, statistical, and computational models and methods. The goal of the LFE is to support and promote academic advances in financial engineering and computational finance that can be directly applied for the betterment of the world.

Christopher Palmer is the Albert and Jeanne Clear Career Development Professor and an Associate Professor of Finance at the MIT Sloan School of Management where he teaches corporate finance. His research focuses on how credit, real estate, and labor markets respond to periods of significant upheaval. Palmer is also a Visiting Scholar at the Federal Reserve Bank of Boston, a Faculty Research ...

MIT Sloan Professor Leonid Kogan, who teaches in the MITx MicroMasters Program in Finance, says, "Finance can fuel progress in the way people live, the health of our world, and the integrity of our global financial systems. MIT Sloan is a robust ecosystem of finance educators, research innovators, and industry practitioners with diverse and accomplished students and alumni working at the ...

Zhu received his PhD in 2012 from Stanford University's Graduate School of Business, and joined the MIT faculty that same year. Along with his appointment in Sloan, Zhu is a faculty affiliate in the MIT Laboratory for Financial Engineering and the MIT Golub Center for Finance and Policy.

Meet the complex demands of today's global finance markets with 5 courses developed and delivered by MIT Sloan faculty. Earn a MicroMasters program credential in finance to accelerate your career or fast-track your MIT Master of Finance degree. ... all five online courses in this program mirror on-campus graduate-level MIT coursework and ...

Both sections of MIT class 15.433 (Financial Markets), taught this fall by visiting associate professor of finance Hong Ru MFin '10, PhD '15 at the MIT Sloan School of Management, include over 100 students from the master of finance program.However, when he joined the program's inaugural class just over a decade ago, this number was much smaller.

This course introduces the core theory of modern financial economics and financial management, with a focus on capital markets and investments. Topics include functions of capital markets and financial intermediaries, asset valuation, fixed-income securities, common stocks, capital budgeting, diversification and portfolio selection, equilibrium pricing of risky assets, the theory of efficient ...

Dr. Matveyev joined MIT Sloan in 2017, and has led the MicroMasters Program in Finance since 2020. Prior to joining MIT Sloan, he was an Assistant Professor of Finance at the University of Alberta. His current research focuses on corporate finance, corporate governance, and asset management, with a particular focus on the non-profit sector.

PhD Candidate in Finance, MIT Sloan. Verified email at mit.edu. Corporate Finance Financial Institutions Technology and Productivity. Articles Cited by Co-authors. Title. Sort. Sort by citations Sort by year Sort by title. Cited by. Cited by. Year; Pay me now (and later): Pension benefit manipulation before plan freezes and executive retirement.

I am an Assistant Professor in Finance at the MIT Sloan School of Management. My research interests include credit markets, financial institutions, and monetary policy. Columbia University PhD in ...

The MIT Sloan PhD Program offers a rigorous and research-oriented curriculum designed to prepare students for careers in academia, research, or top-tier consulting firms. With a focus on interdisciplinary studies, this program emphasizes collaboration and innovation in addressing complex business challenges.

Finance PhD Candidate at MIT Sloan School of Management Cambridge, MA. Connect Hirotaka Miura PhD Candidate at MIT Sloan School of Management, Management Science, Information Technology Group ...