Fixed Income Investor Presentation - May 7, 2019 - Goldman Sachs

- Download HTML

- Download PDF

- Uncategorized

- World Around

- Government & Politics

- Home & Garden

- Arts & Entertainment

- IT & Technique

- Health & Fitness

- Cars & Machinery

- Hobbies & Interests

- Current Events

- Style & Fashion

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

By clicking the "I Accept" button, you agree to abide by the terms and conditions listed below.

Select your country:

- Netherlands

- New Zealand

- South Africa

- Switzerland

- United Arab Emirates

- No services available for your region.

FOCUS ON FIXED INCOME

- Featured Content

- Our Solutions

What Makes Us Different

- Fixed Income

Private Credit

We invest across the global fixed income market and deliver a broad range of solutions across actively managed mutual funds, separately managed accounts, and exchange-traded funds.

Global Active Fixed Income Manager with $1tn+ AUS 1

Investment Professionals

Years Actively Managing Fixed Income Portfolios

People: Deep Expertise

We develop actionable insights through in-depth analysis and collaboration between investment teams. Our investors bring comprehensive experience across regions, sectors, and markets.

Technology: Dynamic Solutions

Our investment process is data-driven and technology-led to make smarter investment decisions faster. Our culture of innovation aims to deliver investment performance in rapidly changing markets.

Platform: A Holistic Approach

We combine our investment expertise with technology toolkits and data-driven insights to build resilient portfolios that can navigate complex challenges.

We combine deep expertise and long-standing relationships with sponsors and issuers. This allows our private credit platform to directly originate attractive risk-adjusted return opportunities.

Global Private Credit Manager 2

Years Investing in Private Credit

Benefits of Partnership

Our firm-wide network of relationships with financial sponsors and corporate issuers enables us to serve as a trusted partner across borrower types. Our track record of investing and relationships with clients enable deep insight into issuers and their needs.

Tailored Solutions

Our expertise in evaluating and structuring opportunities, enhanced by access to the full resources of Goldman Sachs enables us to tailor solutions to meet the needs of our clients.

Scale, at Deal Speed

Scale enables us to fully underwrite our transactions, eliminating syndication risk without compromising responsible portfolio construction for investors. Broad capabilities in private credit provide flexibility to invest across the capital structure and transaction types, to best respond in a rapidly-changing environment.

From Core to Credit: A New Fixed Income Playbook

Explore our solutions.

Learn more about our broad and flexible range of fixed income solutions helping our clients achieve their investment goals.

Discover how we invest globally and across the private credit capital structure to identify potentially attractive risk-adjusted return opportunities.

Related Insights

Fixed Income Outlook 1Q 2024: Balancing Act

Bear (Market) Necessities: The Case for Core Fixed Income

Balancing Act: Building Private Credit Portfolios

What's the Worst That Could Happen? Defaults and Recovery Rates in Private Credit

Extra Credit to Private Credit

Navigating Opportunities in Investment Grade Credit

Meet the team.

Whitney Watson

Global co-head of Fixed Income and Liquidity Solutions

Greg Olafson

Global Head of Private Credit

Ready to learn more about our Fixed Income capabilities?

Please reach out to your Goldman Sachs Asset Management relationship manager.

- Explore by Asset Class

- Liquidity Solutions

- Alternatives

- Multi-Asset

- Explore by Solution

- ESG & Impact Investing

- Fiduciary Management

- Pension Solutions

- Perspectives

- GSAM Connect

- All Insights

- Goldman Sachs Global Investment Research

- News and Media

- Stewardship

1 As of 3Q 2023. Per earnings releases (PIMCO, BlackRock, JPMorgan, Franklin Resources, T. Rowe Price, Morgan Stanley, Federated, State Street, BNY Mellon, Invesco, AllianceBernstein), per eVestment (PGIM Fixed Income, Amundi, Wellington, Capital Group, MFS, Dimensional), per Morningstar (Vanguard), per website (Fidelity). AUS numbers exclude Multi-Assets due to unavailability of break-up between various asset classes.

2 Private Debt Investor (PDI) 200 ranking based on a rolling five-year period. Amount of private debt investment capital raised by firms between January 1, 2018 and June 1, 2023.

Risk Considerations

All investing involves risk, including loss of principal.

Capital is at risk.

The risk of foreign currency exchange rate fluctuations may cause the value of securities denominated in such foreign currency to decline in value. Currency exchange rates may fluctuate significantly over short periods of time. These risks may be more pronounced for investments in securities of issuers located in, or otherwise economically tied to, emerging countries. If applicable, investment techniques used to attempt to reduce the risk of currency movements (hedging), may not be effective. Hedging also involves additional risks associated with derivatives.

Emerging markets investments may be less liquid and are subject to greater risk than developed market investments as a result of, but not limited to, the following: inadequate regulations, volatile securities markets, adverse exchange rates, and social, political, military, regulatory, economic or environmental developments, or natural disasters.

Investments in fixed income securities are subject to the risks associated with debt securities generally, including credit, liquidity, interest rate, prepayment and extension risk. Bond prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline in the bond’s price. The value of securities with variable and floating interest rates are generally less sensitive to interest rate changes than securities with fixed interest rates. Variable and floating rate securities may decline in value if interest rates do not move as expected. Conversely, variable and floating rate securities will not generally rise in value if market interest rates decline. Credit risk is the risk that an issuer will default on payments of interest and principal. Credit risk is higher when investing in high yield bonds, also known as junk bonds. Prepayment risk is the risk that the issuer of a security may pay off principal more quickly than originally anticipated. Extension risk is the risk that the issuer of a security may pay off principal more slowly than originally anticipated. All fixed income investments may be worth less than their original cost upon redemption or maturity.

High-yield, lower-rated securities involve greater price volatility and present greater credit risks than higher-rated fixed income securities.

Alternative investments are suitable only for sophisticated investors for whom such investments do not constitute a complete investment program and who fully understand and are willing to assume the risks involved in Alternative Investments. Alternative Investments by their nature, involve a substantial degree of risk, including the risk of total loss of an investor’s capital.

Private equity investments are speculative, highly illiquid, involve a high degree of risk, have high fees and expenses that could reduce returns, and subject to the possibility of partial or total loss of fund capital; they are, therefore, intended for experienced and sophisticated long-term investors who can accept such risks.

Alternative Investments often engage in leverage and other investment practices that are extremely speculative and involve a high degree of risk. Such practices may increase the volatility of performance and the risk of investment loss, including the loss of the entire amount that is invested. There may be conflicts of interest relating to the Alternative Investment and its service providers, including Goldman Sachs and its affiliates. Similarly, interests in an Alternative Investment are highly illiquid and generally are not transferable without the consent of the sponsor, and applicable securities and tax laws will limit transfers.

Investors should also consider some of the potential risks of alternative investments:

· Alternative Strategies. Alternative strategies often engage in leverage and other investment practices that are speculative and involve a high

degree of risk. Such practices may increase the volatility of performance and the risk of investment loss, including the entire amount that is invested.

· Manager experience. Manager risk includes those that exist within a manager’s organization, investment process or supporting systems and infrastructure. There is also a potential for fund-level risks that arise from the way in which a manager constructs and manages the fund.

· Leverage. Leverage increases a fund’s sensitivity to market movements. Funds that use leverage can be expected to be more “volatile” than other funds that do not use leverage. This means if the investments a fund buys decrease in market value, the value of the fund’s shares will decrease by even more.

· Counter-party risk. Alternative strategies often make significant use of over- the- counter (OTC) derivatives and therefore are subject to the risk that counter-parties will not perform their obligations under such contracts.

· Liquidity risk. Alternatives strategies may make investments that are illiquid or that may become less liquid in response to market developments. At times, a fund may be unable to sell certain of its illiquid investments without a substantial drop in price, if at all.

· Valuation risk. There is risk that the values used by alternative strategies to price investments may be different from those used by other investors to price the same investments.

Alternative Investments - Hedge funds and other private investment funds (collectively, “Alternative Investments”) are subject to less regulation than other types of pooled investment vehicles such as mutual funds. Alternative Investments may impose significant fees, including incentive fees that are based upon a percentage of the realized and unrealized gains and an individual’s net returns may differ significantly from actual returns. Such fees may offset all or a significant portion of such Alternative Investment’s trading profits. Alternative Investments are not required to provide periodic pricing or valuation information. Investors may have limited rights with respect to their investments, including limited voting rights and participation in the management of such Alternative Investments.

The above is not an exhaustive list of potential risks. There may be additional risks that are not currently foreseen or considered.

Conflicts of Interest

There may be conflicts of interest relating to the Alternative Investment and its service providers, including Goldman Sachs and its affiliates. These activities and interests include potential multiple advisory, transactional and other interests in securities and instruments that may be purchased or sold by the Alternative Investment. These are considerations of which investors should be aware and additional information relating to these conflicts is set forth in the offering materials for the Alternative Investment.

General Disclosures/ Important Information

Diversification does not protect an investor from market risk and does not ensure a profit.

This material is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities.

The views expressed herein are as of the date of the publication and subject to change in the future. Individual portfolio management teams for Goldman Sachs Asset Management may have views and opinions and/or make investment decisions that, in certain instances, may not always be consistent with the views and opinions expressed herein.

Prospective investors should inform themselves as to any applicable legal requirements and taxation and exchange control regulations in the countries of their citizenship, residence or domicile which might be relevant.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by Goldman Sachs Asset Management to buy, sell, or hold any security, they should not be construed as investment advice.

This material is provided for informational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. This material is not intended to be used as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client’s account should or would be handled, as appropriate investment strategies depend upon the client’s investment objectives.

THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR SOLICITATION IN ANY JURISDICTION WHERE OR TO ANY PERSON TO WHOM IT WOULD BE UNAUTHORIZED OR UNLAWFUL TO DO SO.

Assets Under Supervision (AUS) includes assets under management and other client assets for which Goldman Sachs does not have full discretion.

Examples are for illustrative purposes only and are not actual results. If any assumptions used do not prove to be true, results may vary substantially.

This material is provided at your request for informational purposes only. It is not an offer or solicitation to buy or sell any securities.

This material is provided at your request solely for your use.

There is no guarantee that objectives will be met.

Past performance does not guarantee future results, which may vary. The value of investments and the income derived from investments will fluctuate and can go down as well as up. A loss of principal may occur.

Economic and market forecasts presented herein reflect a series of assumptions and judgments as of the date of this presentation and are subject to change without notice. These forecasts do not take into account the specific investment objectives, restrictions, tax and financial situation or other needs of any specific client. Actual data will vary and may not be reflected here. These forecasts are subject to high levels of uncertainty that may affect actual performance. Accordingly, these forecasts should be viewed as merely representative of a broad range of possible outcomes. These forecasts are estimated, based on assumptions, and are subject to significant revision and may change materially as economic and market conditions change. Goldman Sachs has no obligation to provide updates or changes to these forecasts. Case studies and examples are for illustrative purposes only.

This information discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. This material has been prepared by Goldman Sachs Asset Management and is not financial research nor a product of Goldman Sachs Global Investment Research (GIR). It was not prepared in compliance with applicable provisions of law designed to promote the independence of financial analysis and is not subject to a prohibition on trading following the distribution of financial research. The views and opinions expressed may differ from those of Goldman Sachs Global Investment Research or other departments or divisions of Goldman Sachs and its affiliates. Investors are urged to consult with their financial advisors before buying or selling any securities. This information may not be current and Goldman Sachs Asset Management has no obligation to provide any updates or changes.

United Kingdom: In the United Kingdom, this material is a financial promotion and has been approved by Goldman Sachs Asset Management International, which is authorized and regulated in the United Kingdom by the Financial Conduct Authority.

European Economic Area (EEA): This marketing communication is disseminated by Goldman Sachs Asset Management B.V., including through its branches (“GSAM BV”). GSAM BV is authorised and regulated by the Dutch Authority for the Financial Markets (Autoriteit Financiële Markten, Vijzelgracht 50, 1017 HS Amsterdam, The Netherlands) as an alternative investment fund manager (“AIFM”) as well as a manager of undertakings for collective investment in transferable securities (“UCITS”). Under its licence as an AIFM, the Manager is authorized to provide the investment services of ( i ) reception and transmission of orders in financial instruments; ( ii ) portfolio management; and (iii) investment advice. Under its licence as a manager of UCITS, the Manager is authorized to provide the investment services of ( i ) portfolio management; and ( ii ) investment advice. Information about investor rights and collective redress mechanisms are available on www.gsam.com/responsible-investing (section Policies & Governance). Capital is at risk. Any claims arising out of or in connection with the terms and conditions of this disclaimer are governed by Dutch law. In Denmark and Sweden this material is a financial promotion disseminated by Goldman Sachs Bank Europe SE, including through its authorised branches ("GSBE"). GSBE is a credit institution incorporated in Germany and, within the Single Supervisory Mechanism established between those Member States of the European Union whose official currency is the Euro, subject to direct prudential supervision by the European Central Bank and in other respects supervised by German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufischt, BaFin) and Deutsche Bundesbank.

Switzerland: For Qualified Investor use only – Not for distribution to general public. This is marketing material. This document is provided to you by Goldman Sachs Bank AG, Zürich. Any future contractual relationships will be entered into with affiliates of Goldman Sachs Bank AG, which are domiciled outside of Switzerland. We would like to remind you that foreign (Non-Swiss) legal and regulatory systems may not provide the same level of protection in relation to client confidentiality and data protection as offered to you by Swiss law.

Australia: This material is distributed by Goldman Sachs Asset Management Australia Pty Ltd ABN 41 006 099 681, AFSL 228948 (‘GSAMA’) and is intended for viewing only by wholesale clients for the purposes of section 761G of the Corporations Act 2001 (Cth). This document may not be distributed to retail clients in Australia (as that term is defined in the Corporations Act 2001 (Cth)) or to the general public. This document may not be reproduced or distributed to any person without the prior consent of GSAMA. To the extent that this document contains any statement which may be considered to be financial product advice in Australia under the Corporations Act 2001 (Cth), that advice is intended to be given to the intended recipient of this document only, being a wholesale client for the purposes of the Corporations Act 2001 (Cth). Any advice provided in this document is provided by either of the following entities. They are exempt from the requirement to hold an Australian financial services licence under the Corporations Act of Australia and therefore do not hold any Australian Financial Services Licences, and are regulated under their respective laws applicable to their jurisdictions, which differ from Australian laws. Any financial services given to any person by these entities by distributing this document in Australia are provided to such persons pursuant to the respective ASIC Class Orders and ASIC Instrument mentioned below.

• Goldman Sachs Asset Management, LP (GSAMLP), Goldman Sachs & Co. LLC (GSCo), pursuant ASIC Class Order 03/1100; regulated by the US Securities and Exchange Commission under US laws. • Goldman Sachs Asset Management International (GSAMI), Goldman Sachs International (GSI), pursuant to ASIC Class Order 03/1099; regulated by the Financial Conduct Authority; GSI is also authorized by the Prudential Regulation Authority, and both entities are under UK laws. • Goldman Sachs Asset Management (Singapore) Pte. Ltd. (GSAMS), pursuant to ASIC Class Order 03/1102; regulated by the Monetary Authority of Singapore under Singaporean laws • Goldman Sachs Asset Management (Hong Kong) Limited (GSAMHK), pursuant to ASIC Class Order 03/1103 and Goldman Sachs (Asia) LLC (GSALLC), pursuant to ASIC Instrument 04/0250; regulated by the Securities and Futures Commission of Hong Kong under Hong Kong laws

No offer to acquire any interest in a fund or a financial product is being made to you in this document. If the interests or financial products do become available in the future, the offer may be arranged by GSAMA in accordance with section 911A(2)(b) of the Corporations Act. GSAMA holds Australian Financial Services Licence No. 228948. Any offer will only be made in circumstances where disclosure is not required under Part 6D.2 of the Corporations Act or a product disclosure statement is not required to be given under Part 7.9 of the Corporations Act (as relevant).

New Zealand: This material is distributed in New Zealand by Goldman Sachs Asset Management Australia Pty Ltd ABN 41 006 099 681, AFSL 228948 (’GSAMA’) and is intended for viewing only by wholesale clients in Australia for the purposes of section 761G of the Corporations Act 2001 (Cth) and to clients who either fall within any or all of the categories of investors set out in section 3(2) or sub-section 5(2CC) of the Securities Act 1978, fall within the definition of a wholesale client for the purposes of the Financial Service Providers (Registration and Dispute Resolution) Act 2008 (FSPA) and the Financial Advisers Act 2008 (FAA),and fall within the definition of a wholesale investor under one of clause 37, clause 38, clause 39 or clause 40 of Schedule 1 of the Financial Markets Conduct Act 2013 (FMCA) of New Zealand (collectively, a “NZ Wholesale Investor”). GSAMA is not a registered financial service provider under the FSPA. GSAMA does not have a place of business in New Zealand. In New Zealand, this document, and any access to it, is intended only for a person who has first satisfied GSAMA that the person is a NZ Wholesale Investor. This document is intended for viewing only by the intended recipient. This document may not be reproduced or distributed to any person in whole or in part without the prior written consent of GSAMA.

Japan: This material has been issued or approved in Japan for the use of professional investors defined in Article 2 paragraph (31) of the Financial Instruments and Exchange Law (“FIEL”). Also, Any description regarding investment strategies on collective investment scheme under Article 2 paragraph (2) item 5 or item 6 of FIEL has been approved only for Qualified Institutional Investors defined in Article 10 of Cabinet Office Ordinance of Definitions under Article 2 of FIEL.

Israel: This document has not been, and will not be, registered with or reviewed or approved by the Israel Securities Authority (ISA”). It is not for general circulation in Israel and may not be reproduced or used for any other purpose. Goldman Sachs Asset Management International is not licensed to provide investment advisory or management services in Israel.

Oman: The Capital Market Authority of the Sultanate of Oman (the "CMA") is not liable for the correctness or adequacy of information provided in this document or for identifying whether or not the services contemplated within this document are appropriate investment for a potential investor. The CMA shall also not be liable for any damage or loss resulting from reliance placed on the document.

Qatar This document has not been, and will not be, registered with or reviewed or approved by the Qatar Financial Markets Authority, the Qatar Financial Centre Regulatory Authority or Qatar Central Bank and may not be publicly distributed. It is not for general circulation in the State of Qatar and may not be reproduced or used for any other purpose.

Date of first use: February 26, 2024. 355778-OTU-1963907.

- See our Privacy Policy

- Learn More About Security

- Terms of Use

© 2024 Goldman Sachs. All rights reserved.

Please enter your email address to continue reading.

Confirm your access.

An email has been sent to you to verify ownership of your email address. Please verify the link in the email by clicking the confirmation button. Once completed, you will gain instant access to our insights. If you did not receive the email from us please check your spam folder or try again .

Improving your experience

We noticed that you have not opted into the Cookies that improve your experience. If you would like to receive insights and information which are more relevant to you, you can click the link below and opt-in to Cookies that improve your experience. Set your preferences here We use these cookies to understand website behaviour and to tailor the information we share with you.

- Get 7 Days Free

Goldman Sachs Core Fixed Income Instl GSFIX Portfolio

Sponsor center.

We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here . By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service .

New to Zacks? Get started here.

Member Sign In

Don't Know Your Password?

- Zacks #1 Rank

- Zacks Industry Rank

- Zacks Sector Rank

- Equity Research

- Mutual Funds

- Mutual Fund Screener

- ETF Screener

- Earnings Calendar

- Earnings Releases

- Earnings ESP

- Earnings ESP Filter

- Stock Screener

- Premium Screens

- Basic Screens

- Research Wizard

- Personal Finance

- Money Managing

- Real Estate

- Retirement Planning

- Tax Information

- My Portfolio

- Create Portfolio

- Style Scores

- Testimonials

- Zacks.com Tutorial

Services Overview

- Zacks Ultimate

- Zacks Investor Collection

- Zacks Premium

Investor Services

- ETF Investor

- Home Run Investor

- Income Investor

- Stocks Under $10

- Value Investor

- Top 10 Stocks

Other Services

- Method for Trading

- Zacks Confidential

Trading Services

- Black Box Trader

- Counterstrike

- Headline Trader

- Insider Trader

- Large-Cap Trader

- Options Trader

- Short Sell List

- Surprise Trader

- Alternative Energy

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK . If you do not, click Cancel.

Image: Bigstock

3 Goldman Sachs Mutual Funds for Great Returns

Goldman Sachs Asset Management ("GSAM") has been offering financial services — including investment and advisory solutions, and risk-management expertise — to institutional and individual investors throughout the world since 1988. With more than $2.6 trillion in assets under management, GSAM is considered one of the world’s leading financial management companies.

The fund has more than 2,000 professionals across 31 offices worldwide. Its teams have more than 700 investment professionals who capitalize on Goldman Sachs’ technology, risk-management skills and market insights. The fund family develops investment strategies with respect to geographical regions, industries and asset classes.

Below, we share with you three top-ranked Goldman Sachs mutual funds, viz., Goldman Sachs Large Cap Gr Insghts Fund ( GLCGX Quick Quote GLCGX - Free Report ) , Goldman Sachs Commodity Strategy Fund ( GSCAX Quick Quote GSCAX - Free Report ) and Goldman Sachs US Eq Div and Premium Inv Fund ( GVIRX Quick Quote GVIRX - Free Report ) . Each has a Zacks Mutual Fund Rank #1 (Strong Buy) and is expected to outperform its peers in the future. Investors can click here to see the complete list of Goldman Sachs mutual funds .

Goldman Sachs Large Cap Gr Insghts Fund invests most of its assets along with borrowings, if any, in a diversified portfolio of equity securities in large-cap domestic and foreign companies traded in the United States. GLCGX advisors may also invest in fixed-income securities.

Goldman Sachs Large Cap Gr Insghts Fund has three-year annualized returns of 10.3%. As of the end of October 2023, GLCGX held 88 issues, with 12.6% of its assets invested in Microsoft Corp.

Goldman Sachs Commodity Strategy Fund seeks long-term growth of capital. GSCAX invests in equity securities of global companies, both foreign and domestic, with relatively small market capitalizations.

Goldman Sachs Commodity Strategy Fund has three-year annualized returns of 6.8%. GSCAX has an expense ratio of 0.93%.

Goldman Sachs US Eq Div and Premium Inv Fund invests most of its assets, along with borrowings, in dividend-paying equity investments in large-cap U.S. issuers. GVIRX aims to build a diversified portfolio primarily consisting of common stocks from large-cap U.S. issuers represented on the S&P 500 Index.

Goldman Sachs US Eq Div and Premium Inv Fund has three-year annualized returns of 9.4%. Monali Vora has been one of the fund managers of GVIRX since 2010.

To view the Zacks Rank and the past performance of all Goldman Sachs mutual funds, investors can click here to see the complete list of Goldman Sachs mutual funds .

Want key mutual fund info delivered straight to your inbox?

Zacks’ free Fund Newsletter will brief you on top news and analysis, as well as top-performing mutual funds, each week. Get it free >>

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report free:.

Goldman Sachs LrgCp Gr Insights A (GLCGX) - free report >>

Goldman Sachs Commody Strategy A (GSCAX) - free report >>

Goldman Sachs US Eq Div & Prem Inv (GVIRX) - free report >>

Published in

This file is used for Yahoo remarketing pixel add

Due to inactivity, you will be signed out in approximately:

- Dividend Stocks News

Goldman Sachs Access Emerging Markets USD Bond ETF declares monthly distribution of $0.1794

- Goldman Sachs Access Emerging Markets USD Bond ETF ( BATS: GEMD ) - $0.1794 .

- Payable Apr 05; for shareholders of record Apr 02; ex-div Apr 01.

More on Goldman Sachs Access Emerging Markets USD Bond ETF

- Seeking Alpha’s Quant Rating on Goldman Sachs Access Emerging Markets USD Bond ETF

- Dividend scorecard for Goldman Sachs Access Emerging Markets USD Bond ETF

Recommended For You

More trending news, about gemd etf, related stocks, trending analysis, trending news.

1 hr 12 min

55. Women on Wall Street: Is There a Problem with Female Managers? The Wall Street Skinny

The Wall Street Journal recently published an article titled "Women Aren't Getting the Big Jobs at Goldman Sachs, and They're Heading for the Exits" (linked below). That same day, we were asked by our social media community whether our best managers were male or female when we were working at investment banks. Our answer? Male. We received HUNDREDS of messages from our community --- from mostly women --- saying their experience with female managers on Wall Street was overwhelmingly negative. So we wanted to have a frank, open discussion of these two distinct but very related topics in a public forum to discern what the nature of the problem is and to try and suggest possible solutions. We are joined by two amazing women for this conversation: Carissa Jordan and Nikki Boulukos, currently the co-founders of Benjamin Talks, a company on a mission to facilitate financial literacy for people of all ages starting with children. Carissa and Nikki started their careers in Fixed Income and Equities Sales & Trading at Goldman Sachs, and rose through the ranks before exiting for individual reasons we will discuss. This will be the first of many conversations with women ranging from the junior most levels all the way to the C-suite. Anyone working on Wall Street or planning on a career in the industry needs to listen to this episode. https://www.wsj.com/finance/investing/goldman-sachs-women-big-jobs-leaving-09112f6a Nikki Boulukos is Co-Founder and Co-CEO of Benjamin Talks BA in Psychology & Economics from Harvard. Additionally, cross-registered and completed coursework in Accounting & Finance at Massachusetts Institute of Technology and London School of Economics. Captained the Varsity Women's Soccer team for three years at Harvard, first three-year captain in school history. All Ivy selection and Academic All American nominee. Financial analyst at Goldman Sachs on Equity Research Sales desk. Member of Women's Steering Committee. Later served as COO & Vice President of San Francisco-based beverage start-up, Wanu Water (fka FLUROwater) and later founded Seirén, an on-demand app company in the beauty space. Nikki now lives in Cold Spring Harbor, NY with her husband and their three small, financially-savvy kids.Carissa Jordan is Co-Founder and Co-CEO of Benjamin Talks BBA in Finance from Hofstra University. Member of Honors College. Carissa also held internships at Ivy Asset Management, MF Global and Goldman Sachs throughout college. Associate at Goldman Sachs in FICC on the credit trading desk. Carissa later joined J.P. Morgan Private Bank where she worked as an investor associate. Carissa currently resides in Lloyd Harbor, NY with her husband and the three young children whose innate curiosity about money sparked her passiSign up to attend MISS EXCEL’S FREE MASTERCLASS LIVE Wednesday, April 17 at 3pm ESTFriday, April 19 at 12pm ESTOR to get the replay:Register Here!https://links.miss-excel.com/exclusive?ref=thewallstreetskinny The Funds4Teachers event is happening the dates below:Locations/DatesAtlanta - Apr 25Boston - June 6Chicago - June 18New York - Sep 26 To learn more about how to support this initiative and register click here: https://iconnections.io/funds4teachers/ Follow us on Instagram and Tik Tok at @thewallstreetskinny https://www.instagram.com/thewallstreetskinny/

- More Episodes

- © 2024 The Wall Street Skinny

3 Goldman Sachs Mutual Funds to Build a Solid Portfolio

G oldman Sachs Asset Management (GSAM) is a world-renowned investment management company. GSAM has provided portfolio management, design and advisory services to individual and institutional investors worldwide since 1988. As of Dec 31, 2022, GSAM had $2 trillion in assets under supervision.

GSAM strategies cover various asset classes, industries and geographies. The company offers investment solutions, including fixed income, money markets, public equity, commodities, hedge funds, private equity and real estate, through proprietary strategies, strategic partnerships and open architecture programs.

GSAM has more than 2,000 employees across 31 offices all over the world. The company has a team of more than 800 investment professionals who capitalize on Goldman Sachs’ technology, risk-management skills and market insights. The fund house provides opportunities to individuals who wish to increase their wealth through various strategic investment funds.

The fund house has a reputation as a trusted partner and has long-term financial success. Uncertainties over the Federal Reserve’s interest decision could impact corporate performance. Investors who wish to diversify in various asset classes but lack professional expertise in managing funds can consider Goldman Sachs mutual funds.

The Federal Reserve, in its last policy meeting, has kept the overnight interest rate unchanged in the range of 5.25-5.5%. Fed Chair Jerome Powell expects inflation to gradually decline to the Fed’s target inflation of 2% irrespective of the spike in recent months. Though, the central bank hinted three rate cuts in 2024 despite sticky inflation, the time line for the same is still unclear.

Amid such uncertainties, we have selected three Goldman Sachs mutual funds that have not only preserved investors’ wealth but also generated excellent returns amid market uncertainties. These funds have the majority of their investments in sectors such as energy, technology, finance, retail trade, utilities and industrial cyclical, which will help in long-term growth and preservation of wealth.

These funds boast a Zacks Mutual Fund Rank #1 (Strong Buy), have positive three-year and five-year annualized returns, minimum initial investments within $5000 and carry a low expense ratio. Notably, mutual funds, in general, reduce transaction costs and diversify portfolios without an array of commission charges mostly associated with stock purchases (read more: Mutual Funds: Advantages, Disadvantages, and How They Make Investors Money).

Goldman Sachs MLP Energy Infrastructure Fund GMNPX fund invests most of its assets, along with borrowings, if any, in equity or fixed-income securities issued by domestic and foreign energy infrastructure companies. GMNPX advisors may also invest a small portion of the fund’s net assets in non-energy sectors.

Christopher A Schiesser has been the lead manager of GMNPX since Jan 10, 2023. Most of the fund’s exposure was in companies like Energy Transfer (14.6%), Enterprise Products Partners (12.2%) and MPLX (11.5%) as of Nov 30, 2023.

GMNPX’s three-year and five-year annualized returns are almost 27.1% and 8.3%, respectively. GMNPX has an annual expense ratio of 1.06%.

To see how this fund performed compared to its category and other 1, 2, and 3 Ranked Mutual Funds, please click here.

Goldman Sachs Large Cap Growth Insights Fund GMZPX fund invests most of its assets, along with borrowings, if any, ina broadly diversified portfolio of large-cap domestic and foreign equity investments that are traded in the United States. GMZPX advisors may also invest in fixed-income securities.

Sharanya Srinivasan has been one of the lead managers of GMZPX since Feb 28, 2024. Most of the fund’s exposure was in companies like Microsoft (12.6%), Apple (11%) and Amazon.com (6.8%) as of Oct 31, 2023.

GMZPX’s three-year and five-year annualized returns are almost 11% and 15.9%, respectively. GMZPX has an annual expense ratio of 0.58%.

Goldman Sachs Focused Value GGYPX fund invests most of its assets along with borrowings, if any, in a diversified portfolio of common stocks, preferred stocks and other instruments with equity characteristics. GGYPX advisors choose to invest in quality companies that are undervalued with competitive advantages over the industry peers and have sustainable growth potential.

Kevin Martens has been the lead manager of GGYPX since Dec 26, 2019. Most of the fund’s exposure was in companies like Exxon Mobil (5.6%), Salesforce (5.3%) and Ameren (4.8%) as of Nov 30, 2023.

GGYPX’s three-year and five-year annualized returns are almost 10.8% and 12.5%, respectively. GGYPX has an annual expense ratio of 0.70%.

Want key mutual fund info delivered straight to your inbox?

Zacks' free Fund Newsletter will brief you on top news and analysis, as well as top-performing mutual funds, each week. Get it free >>

To read this article on Zacks.com click here.

We couldn’t find any results matching your search.

Please try using other words for your search or explore other sections of the website for relevant information.

We’re sorry, we are currently experiencing some issues, please try again later.

Our team is working diligently to resolve the issue. Thank you for your patience and understanding.

News & Insights

- Bitcoin ETFs: BlackRock adds Citi, Goldman Sachs and others as Authorized Participants

April 06, 2024 — 03:39 pm EDT

Written by Ibrahim Ajibade for FX Empire ->

BlackRock has added four more Wall Street firms as authorized participants (APs) for its spot Bitcoin ETF. With this addition, the asset manager’s Bitcoin-based fund now boasts a total of nine APs.

This announcement follows BlackRock and several other firms submitting amended forms for their Bitcoin ETF applications to the SEC.

Blackrock issues Bitcoin ETFs Update

BlackRock, touted as the world’s largest asset manager, now counts Citi, Citadel, Goldman Sachs, and UBS among its APs for its spot Bitcoin ETF offering.

The information was disclosed through an amendment attached to the ETF’s Form S-1 submitted to the Securities and Exchange Commission (SEC) on April 5,

On Jan. 8, several key players in the financial industry, including BlackRock, Ark Invest/21Shares, VanEck, WisdomTree, Invesco, Fidelity, and Valkyrie, filed amended S-1 forms for their spot Bitcoin ETFs with the U.S. SEC. This was considered the final step in the approval process.

The submission of amended S-1 forms revealed sponsor fees and strategic adjustments, providing insight into the financial structures supporting these potential spot Bitcoin ETFs.

BlackRock, for instance, set its sponsor fee at 0.3%, with a reduced rate of 0.2% for the first year or until the ETF reaches $5 billion in assets. VanEck chose one of the lowest permanent fees among issuers at 0.25%, while WisdomTree opted for a higher 0.5% fee.

Additionally, ARK Invest and 21Shares announced they would waive their 0.25% fee for the first $1 billion in transactions.

An AP is typically a large bank or investment firm designated by an ETF issuer to issue and redeem shares of exchange-traded funds (ETFs).

APs are pivotal in the ETF market, ensuring liquidity by creating and redeeming ETF shares according to market demand.

This process helps maintain ETF prices closely aligned with the net asset value of the underlying assets. These entities procure the required underlying assets to create ETF shares and receive a package of shares in return, referred to as a creation unit.

BlackRock’s selection of authorized participants for its spot Bitcoin ETF, alongside the surge of amendments to existing spot BTC ETF applications, indicates a notable advancement in the U.S. Bitcoin ETF journey.

The forthcoming weeks and months will carry substantial weight in determining the fate of these applications and their potential ramifications on the cryptocurrency market.

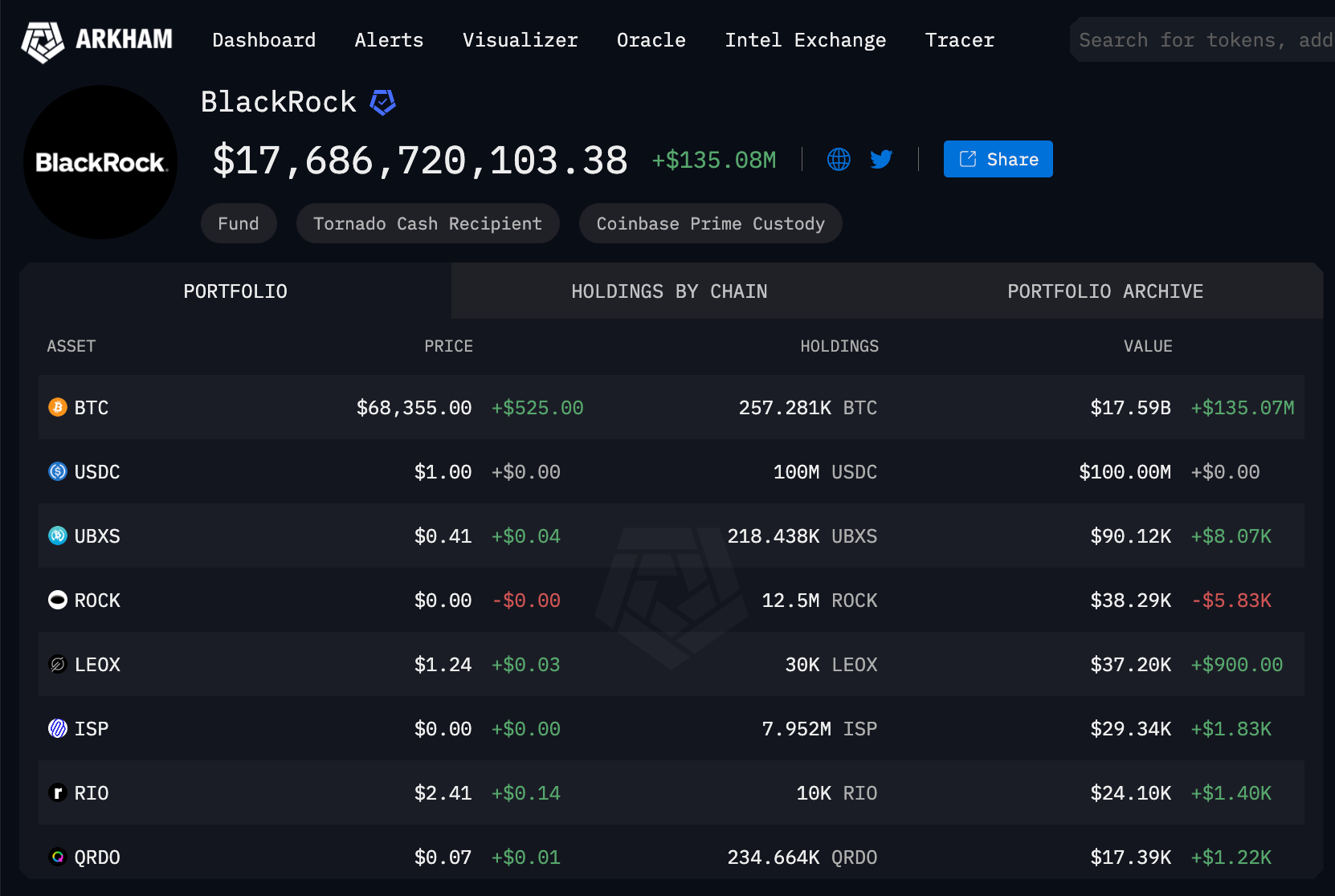

Blackrock Now Holds 257,281 BTC worth $17.7 billion

Bitcoin ETFs made a relatively flat start to April 2024, with Grayscale’s GBTC at the forefront of another week of significant outflows.

But unlike Grayscale, Blackrock recorded a week of positive net flows which saw its current balances soar above 257,281 BTC worth approximately $17.7 billion at the time of publication on April 6.

The $17.7 billion holdings now put Blackrock in first place as the publicly-traded US company with the largest Bitcoin portfolio, ahead of Michael Saylor’s MicroStrategy which currently holds BTC balances worth $14.6 billion, at press time.

This article was originally posted on FX Empire

More From FXEMPIRE:

- Apollo Shares Rise Powerfully

- Dogwifhat (WIF) Price Forecast: What Next for Solana’s top dog after 500% gains in March?

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Stocks mentioned

More related articles.

This data feed is not available at this time.

Sign up for the TradeTalks newsletter to receive your weekly dose of trading news, trends and education. Delivered Wednesdays.

To add symbols:

- Type a symbol or company name. When the symbol you want to add appears, add it to My Quotes by selecting it and pressing Enter/Return.

- Copy and paste multiple symbols separated by spaces.

These symbols will be available throughout the site during your session.

Your symbols have been updated

Edit watchlist.

- Type a symbol or company name. When the symbol you want to add appears, add it to Watchlist by selecting it and pressing Enter/Return.

Opt in to Smart Portfolio

Smart Portfolio is supported by our partner TipRanks. By connecting my portfolio to TipRanks Smart Portfolio I agree to their Terms of Use .

Unlock this Offer

IMAGES

COMMENTS

66% of our total US deposits are FDIC insured and 27% of our non-US deposits are insured by non-US programs as of. 3Q23. — 92% of US consumer deposits are insured. Deposits make up 58% of unsecured funding liabilities as of 3Q23, above the 50% target1, reducing reliance on higher-cost unsecured debt.

Potential outflows for 2021, 2022 and 2023 as of April 30, 2021. Potential outflows for 2021 include $11.0bn of contractual maturities (of which $1.1bn occurred YTD), $2.7bn of. preferred redemptions (including $675mm Series N Preferred Stock redemption settling on May 19, 2021), $8.6bn of debt par calls redeemed, and $8.3bn of additional debt.

Fixed Income Investor Presentation May 10, 2022 Brian Lee, Chief Risk Officer Philip Berlinski, Global Treasurer. End Notes ... Goldman Sachs Bank USA amounts prior to 2021 reflect the acquisition of Goldman Sachs Bank Europe, which was completed in 2021 Slide 11: 1. Unsecured funding includes Deposits, Unsecured short-term borrowings, and ...

These notes refer to the financial metrics and/or defined term presented on: Slide 1: Note: YTD refers to amounts through 3Q for each year represented. Slide 2: Annual revenue volatility calculated by dividing standard deviation of reported revenues by the average revenues over the period.

Goldman Sachs Asset Management (GSAM) has the breadth and depth to cover every sector of the global fixed income market, combining an experienced team, rigorous fundamental analysis and risk management capabilities. We offer customized solutions across the fixed income spectrum, allowing clients to explore a focused or dynamic approach.

Fixed Income Investor Presentation. condition, see "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2017. You should also. the Investor Relations portion of our website: www.gs.com. See the appendix for more information about non-GAAP. financial measures in this presentation.

The Goldman Sachs Group, Inc. (NYSE:GS) Goldman Sachs Fixed Income Investor Conference Call November 9, 2023 9:00 AM ET Company Participants Philip Berlinski - Global Treasurer

FIXED INCOME WEEKLY: MUSINGS. March 22, 2024. In this weekly insight, we bring the global economy and fixed income markets to you. Macro at a Glance covers the latest developments in growth, inflation, and labor markets, while Policy Picture and Central Bank Snapshot details our outlook for monetary and fiscal policies.

The summary prospectus, if available, and the Prospectus contain this and other information about a Fund and may be obtained from your authorized dealer or from Goldman Sachs & Co. LLC by calling (retail—1-800-526-7384) (institutional—1-800-621-2550). Goldman Sachs & Co. LLC is the distributor of the Goldman Sachs Funds. - No Bank Guarantee.

Fund's average daily net assets.Additionally, Goldman Sachs & Co. LLC ("Goldman Sachs"), the Fund's transfer agent, has agreed to waive a portion of its transfer agency fee (a component of"Other Expenses") equal to 0.02% as an annual percentage of the average daily net assets attributable to ClassA, Class C and Investor Shares.These

May 7, 2019 Fixed Income Investor Presentation Cautionary Note on Forward-Looking Statements For a discussion of some of the risks and important factors that could affect the Firm's future results and financial condition, see "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2018.

February 29th, 2024, 7:27 PM GMT+0000. Lindsay Rosner, Goldman Sachs Asset Management Head of Multi-Sector Investing, discusses why fixed income is back as an attractive asset class and takes us ...

Newmark Group, Inc. (NMRK). May, 2023 . Fixed Income Investor Presentation for Goldman Sachs Annual Leveraged Finance & Credit Conference

New Zealand: This material is distributed in New Zealand by Goldman Sachs Asset Management Australia Pty Ltd ABN 41 006 099 681, AFSL 228948 ('GSAMA') and is intended for viewing only by wholesale clients in Australia for the purposes of section 761G of the Corporations Act 2001 (Cth) and to clients who either fall within any or all of the ...

Search through our curated library of Goldman Sachs slides to find inspiration for your next presentation on slidestart. Leave Feedback. GET STARTED. Go Back. View source. Details. Fixed Income Investor Presentation. Slide type. Pillar. Tags. Icon. Please submit your feedback here. Unlock this Offer. Learn to design and create effective ...

Search through our curated library of Goldman Sachs slides to find inspiration for your next presentation on slidestart ... Details. Fixed Income Investor Presentation. Slide type. Linear Flow. Tags. Process Flow. List. Bullet points. Please submit your feedback here. Unlock this Offer. Learn to design and create effective "consulting-style ...

PRESENTATION RICHARD RAMSDEN: Okay, so good morning, everybody. Welcome to day two of the Goldman Sachs Annual ... a mix of fixed income, obviously, and equities. When I think about Investment Banking, in Investment Banking, this is an area we've been investing in certain sectors like healthcare and the like. ... 2023 Goldman Sachs U.S ...

Sponsor Center. GSFIX Portfolio - Learn more about the Goldman Sachs Core Fixed Income Instl investment portfolio including asset allocation, stock style, stock holdings and more.

Goldman Sachs Large Cap Gr Insghts Fund has three-year annualized returns of 10.3%. As of the end of October 2023, GLCGX held 88 issues, with 12.6% of its assets invested in Microsoft Corp ...

Goldman Sachs Asset Management (GSAM) is a world-renowned investment management company. GSAM has provided portfolio management, design and advisory services to individual and institutional ...

Goldman Sachs' GEMD ETF offers a distribution of $0.1794 payable on April 5th for shareholders of record on April 2nd, with an ex-dividend date of April...

Carissa and Nikki started their careers in Fixed Income and Equities Sales & Trading at Goldman Sachs, and rose through the ranks before exiting for individual reasons we will discuss. This will be the first of many conversations with women ranging from the junior most levels all the way to the C-suite.

Search through our curated library of Goldman Sachs slides to find inspiration for your next presentation on slidestart. Leave Feedback. GET STARTED. Go Back. View source. Details. Fixed Income Investor Presentation. Slide type. Table. Tags. Table. Bullet points. Please submit your feedback here. Unlock this Offer. Learn to design and create ...

Goldman Sachs Asset Management (GSAM) is a world-renowned investment management company. GSAM has provided portfolio management, design and advisory services to individual and institutional ...

Search through our curated library of Goldman Sachs slides to find inspiration for your next presentation on slidestart. Leave Feedback. ... Details. Fixed Income Investor Presentation. Slide type. Mixed Chart. Tags. Column Chart. Bullet points. Please submit your feedback here. Unlock this Offer. Learn to design and create effective ...

Blackrock issues Bitcoin ETFs Update. BlackRock, touted as the world's largest asset manager, now counts Citi, Citadel, Goldman Sachs, and UBS among its APs for its spot Bitcoin ETF offering.

ABOUT GOLDMAN SACHS At Goldman Sachs, we commit our people, capital and ideas to help our clients, shareholders and the communities we serve to grow. Founded in 1869, we are a leading global investment banking, securities and investment management firm. Headquartered in New York, we maintain offices around the world.

Search through our curated library of Goldman Sachs slides to find inspiration for your next presentation on slidestart. Leave Feedback. ... Details. Fixed Income Investor Presentation. Slide type. Mixed Chart. Tags. Line Chart. List. Takeaway Box. Please submit your feedback here. Unlock this Offer. Learn to design and create effective ...