- Business Plan for Investors

Bank/SBA Business Plan

- Operational/Strategic Planning Services

- L1 Visa Business Plan

- E1 Treaty Trader Visa Business Plan

- E2 Treaty Investor Visa Business Plan

- EB-1 Business Plan

- EB-2 NIW Business Plan

- EB-5 Business Plan

- Innovator Founder Visa Business Plan

- Start-Up Visa Business Plan

- Expansion Worker Visa Business Plan

- Manitoba MPNP Visa Business Plan

- Nova Scotia NSNP Visa Business Plan

- British Columbia BC PNP Visa Business Plan

- Self-Employed Visa Business Plan

- OINP Entrepreneur Stream Business Plan

- LMIA Owner Operator Business Plan

- ICT Work Permit Business Plan

- LMIA Mobility Program – C11 Entrepreneur Business Plan

- USMCA (ex-NAFTA) Business Plan

- Franchise Business Plan

- Landlord business plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Cannabis business plan

- Ecommerce business plan

- Online boutique business plan

- Mobile application business plan

- Daycare business plan

- Restaurant business plan

- Food delivery business plan

- Real estate business plan

- Business Continuity Plan

- Pitch Deck Consulting Services

- Financial Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Examples

Trading Business Plan

MAR.12, 2024

According to a report, 13% of day traders maintain consistent profitability over six months, and a mere 1% succeed over five years. This is primarily due to inadequate planning and undercapitalization. A well-crafted trading business plan can help you avoid these pitfalls, and this article will guide you.

In this article, you’ll learn:

- The current trends and growth forecasts in the stock trading industry

- A breakdown of the costs involved in starting a trading company

- The key components of a trading business plan (with a trading business plan example)

- Strategies for securing funding and overcoming the barriers to entry

By the end of this article, you’ll understand what it takes to create a business plan for an investment company , positioning your trading business for long-term success in this lucrative but highly competitive industry.

Pros and Cons of Trading Company

Let’s explore the pros and cons associated with running a trading company before diving into the specifics of a trading site business plan. Understanding them will help you make informed decisions:

- Potential for significant profits.

- Flexibility in terms of time and location.

- Opportunity for continuous learning and skill development.

- High risk due to market volatility.

- Emotional stress and psychological pressure.

- Requirement for constant vigilance and discipline.

Trading Industry Trends

Industry size and growth forecast.

According to a report , the global stock trading and investing applications market size was at around $37.27 billion in 2022 and projects to grow at a CAGR of 18.3% from 2023 to 2030 (Source: Grand View Research). The following factors drive this growth:

- Increasing internet penetration

- Rising disposable income

- Growing awareness of investment opportunities.

(Image Source: Grand View Research)

The Services

As per our private equity firm business plan , a stock trading business offers various services, including:

- Facilitating Trades on behalf of clients

- Algorithmic trading services to automatically execute trades

- Market Insights (research reports, market analysis, and economic forecasts)

- Technical and Fundamental Analysis (price charts, historical data, and company fundamentals)

- Investment Recommendations

- Seminars and Webinars

- Online Courses

- Demo Accounts

- Portfolio Diversification

- Stop-Loss Orders

- Hedging Strategies

- Direct Market Access (DMA)

- Global Market Access

- Trading Platforms

- Mobile Apps

- High-Frequency Trading (HFT)

- Legal and Compliance Services

- Educate clients about Risk Disclosure

How Much Does It Cost to Start a Trading Company

According to Starter Story, you can expect to spend an average of $12,272 for a stock trading business. Some key startup costs include:

How Much Can You Earn from a Trading Business?

Earnings in the trading business can vary significantly and depend heavily on:

- Trading strategy and approach

- Market conditions and volatility

- Risk management techniques

- Capital allocation and leverage

While specific income figures are difficult to predict due to these factors. However, here are some statistics showing the earning potential of a stock trading business:

- According to Investopedia, only around 5% to 20% of day traders consistently make money.

- According to Indeed Salaries, the average base salary for a stock trader in the U.S. is $80,086 per year.

- 72% of day traders ended the year with financial losses, according to FINRA.

- Among proprietary traders, only 16% were profitable, with just 3% earning over $50,000. (Source: Quantified Strategies)

What Barriers to Entry Are There to Start a Trading Company

Barriers to entry into the stock trading business include:

- Regulatory Requirements: Obtaining necessary licenses and registrations from governing bodies like the SEC and FINRA is a complex and time-consuming process.

- Capital Requirements: Trading activities require significant capital to manage risks and leverage opportunities, which can be a substantial challenge for new or small firms.

- Technological Expertise: Developing or acquiring sophisticated trading platforms, algorithms, and data analysis tools is costly and requires specialized expertise.

- Market Knowledge and Experience: Gaining in-depth knowledge and practical experience in the complex and dynamic financial markets takes years of dedicated study.

- Competitive Landscape: Breaking into the highly competitive trading industry dominated by established firms and well-funded proprietary trading desks is challenging for new entrants.

You can overcome these barriers by developing unique strategies, leveraging innovative technologies, and offering competitive and specialized services to differentiate yourself in the market. Do check our financial advisor business plan to learn more.

Creating a Trading Business Plan

A well-researched stock trading business plan is crucial to start a trading business. A general trading company business plan is a comprehensive document that defines your goals, strategies, and the steps needed to achieve them. It helps you stay organized and focused and increases your chances of securing funding if you plan to seek investors or loans.

Steps to Write a Trading Business Plan

You can use a business plan template for a trading company or follow these steps to prepare a business plan for a personal trading business:

Step 1: Define Your Goals and Investment Objectives

Step 2: Conduct Market Research

Step 3: Develop Your Trading Strategy

Step 4: Establish Your Business Structure

Step 5: Develop a Financial Plan

Step 6: Outline Your Operational Procedures

Step 7: Create a Marketing and Growth Strategy

Step 8: Implement Risk Management

Step 9: Create an Exit Strategy

What to Include in Your Trading Business Plan

Executive summary, company overview.

- Market Analysis

- Trading Strategy and Risk Management

- Operations and Technology

- Financial Projections

- Management and Organization

- Appendices (e.g., research, charts, legal documents)

Here’s an online trading business plan sample of ABC Trading:

ABC Trading, a recently established stock trading firm, provides online trading services to individuals and institutional investors. Key highlights of our business include:

- Vision – Becoming a leading online trading platform with a wide range of trading products and services.

- Values – Our core focus is innovation, excellence, integrity, and customer satisfaction.

- Target market – Tech-savvy and risk-tolerant investors looking for alternative ways to invest their money and diversify their portfolios.

- Revenue model – Commissions and fees for each trade, as well as subscription fees for premium features and services.

- Financial goal – Break even in the second year of operation and generate a net profit of $1.2 million in the third year.

ABC Trading is seeking $500,000 seed funding to launch its platform, acquire customers, and expand its team.

Company Name: ABC Trading

Founding Date: January 2024

Location: Delaware, USA

Registration: Limited Liability Company (LLC) in the state of New York

Regulated By: Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA)

Our team comprises seasoned professionals with diverse finance, mathematics, computer science, and engineering backgrounds.

Marketing Plan

Marketing Strategy: We aim to leverage online channels, such as social media, blogs, podcasts, webinars, and email newsletters, to create awareness, generate leads, and convert prospects into customers.

Marketing Objectives:

- Reach 100,000 potential customers in the first year of operation

- Achieve a 10% conversion rate from leads to customers

- Retain 80% of customers in the first year and increase customer lifetime value by 20% in the second year

The customer profile of ABC Trading includes the following characteristics:

- Age: 25-65 years old

- Gender: Male and female

- Income: Above $100,000 per year

- Education: Bachelor’s degree or higher

- Occupation: Professionals, entrepreneurs, executives, or retirees

- Location: US or international

- Trading experience: Intermediate to advanced

- Trading goals: Income generation, capital appreciation, risk diversification, or portfolio optimization

- Trading preferences: Stocks, options, or both

- Trading style: Technical, trend following, or volatility trading

- Trading frequency: Daily, weekly, or monthly

- Trading risk: Low, medium, or high

Marketing Tactics:

- Create and distribute engaging and informative content on social media platforms

- Offer free trials, discounts, referrals, and loyalty programs

- Collect and analyze customer feedback and data to improve and personalize the customer experience

- Partner with influencers, experts, and media outlets in the trading and finance niche

Marketing Budget:

We will allocate $10,000 for our marketing campaign, which we will use for the following purposes:

Operations Plan

ABC Trading’s operations plan ensures the smooth and efficient functioning of the company’s platform and services and compliance with the relevant laws and regulations.

Operation Objectives:

- Maintain a 99% uptime and availability of the company’s platform and services

- Ensure the security and privacy of the company’s and customers’ data and funds

- Provide timely and professional customer support and service

Operation Tactics:

- Use cloud-based servers and services

- Implement encryption, authentication, and backup systems

- Hire and train qualified and experienced customer service representatives and technicians

- Monitor and update the company’s platform and services regularly

- Follow the best practices and standards of the industry and adhere to the applicable laws and regulations

Operation Standards:

- Test and verify the quality and reliability of the company’s platform and services before launching and after updating

- Document and report any issues, errors, or incidents that occur on the company’s platform or services

- Resolve any customer complaints or disputes in a timely and fair manner

- Maintain a record of the company’s operations activities and performance

Financial Plan

ABC Trading’s financial plan is to provide a realistic and detailed projection of the company’s income, expenses, and cash flow for the next three years, as well as the key financial indicators and assumptions that support the projection.

Financial Objectives:

- Achieve a positive cash flow in the second year of operation.

- Reach a break-even point in the second year of operation.

- Generate a net profit of $1.2 million in the third year of operation.

- Maintain a healthy financial ratio of current assets to current liabilities of at least 2:1.

Financial Assumptions:

- Launch its platform and services in the first quarter of 2024

- Acquire 10,000 customers in the first year, 20,000 customers in the second year, and 30,000 customers in the third year

- Average revenue per customer will be $50 per month, based on the average number and size of trades and the subscription fees

- Average operating expense per customer will be $10 per month, based on the average cost of salaries, rent, utilities, marketing, and legal fees

- Pay a 25% tax rate on its net income

- Reinvest 50% of its net income into the company’s growth and development

Projected Income Statement:

Projected Cash Flow Statement

Projected Balance Sheet

Fund a Trading Company

To successfully establish and operate a trading company, raising funds to finance daily operations and business expansion is crucial. There are different ways with their advantages and disadvantages:

1. Self-funding (Bootstrapping)

Self-funding, also known as bootstrapping, is when the founder or owner of the trading company uses their own personal savings, family business ideas , assets, or income to finance the business. This is the most common and simplest way to fund a trading company, especially in the early stages.

- Complete ownership and control

- Flexibility in decision-making

- Potential for higher long-term returns

- Limited access to capital

- Personal financial risk

- Slower growth potential

2. Debt Financing

Debt financing involves borrowing money from lenders, such as banks, credit unions, or microfinance institutions, to fund the trading company’s operations. The borrowed funds must be repaid with interest over a specified period.

- Retain ownership and control

- Potential tax benefits from interest deductions

- Disciplined approach due to repayment obligations

- Debt burden and interest payments

- Collateral requirements and personal guarantees

- Difficulty in securing financing for startups

3. Angel Investors

Angel investors are wealthy individuals who invest their own money into early-stage or high-potential trading companies in exchange for equity or convertible debt. Angel investors typically provide smaller funding than venture capitalists and offer mentorship, guidance, and access to their network.

- Access to capital and industry expertise

- Potential for additional mentorship and guidance

- Lower risk compared to traditional investors

- Dilution of ownership and control

- Potential for conflicting visions and expectations

- Limited resources compared to larger investors

4. Venture Capital (VC) Funding

Venture capital firms are professional investment firms that provide capital to high-growth startups in exchange for equity ownership. They typically invest large sums of money and are active in the company’s management and strategic direction.

- Access to substantial capital for growth

- Expertise and industry connections from the VC firm

- Validation and credibility for the business

- Significant dilution of ownership and control

- Intense pressure for rapid growth and return on investment

Depending on your business model, goals, and needs, you may also consider other options, such as grants, subsidies, partnerships, etc. Ensure to check for relevant documents, like the hedge fund private placement memorandum . The best way to fund your trading company is the one that suits your situation and preferences.

OGSCapital: Your Strategic Partner for Business Success

At OGSCapital, we specialize in professional business plans that empower startups, established companies, and visionary entrepreneurs. With over 15 years of experience, our seasoned team combines financial acumen, industry insights, and strategic thinking to craft comprehensive plans tailored to your unique vision. Whether you’re seeking funding, launching a new venture, or optimizing your existing business, we’ve got you covered.

If you have any further questions regarding how to write a business plan for your trading business, feel free to contact us. Our team at OGSCapital is here to support you on your entrepreneurial journey. You can also check our hedge fund business plan sample here.

Download Trading Business Plan Template in PDF

Frequently Asked Questions

What does a trading business include?

A trading business involves trading stocks and other financial instruments under a legal business structure. It includes:

- Market analysis

- Trading strategy

- Risk management

How does a trading company work?

A stock trading company facilitates the buying and selling of stocks (shares) on behalf of investors. These companies operate within stock exchanges, executing trades based on specific trading strategies.

OGSCapital’s team has assisted thousands of entrepreneurs with top-rate business plan development, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

Add comment

E-mail is already registered on the site. Please use the Login form or enter another .

You entered an incorrect username or password

Comments (0)

mentioned in the press:

Search the site:

OGScapital website is not supported for your current browser. Please use:

Trading Plan Template & Examples: Step-by-Step Guide to Creating a Solid Trading Plan

Bonus Material:

Trading plans are an important part of any trader’s toolkit. The problem is, most traders don’t actively lay out a plan before they begin trading.

The result? They lose money and wonder why . Furthermore, many traders don’t know how to create a trading plan , or what to include.

Successful traders understand that trading plans are crucial to profiting consistently. In this article, I’ll walk you through creating your own plan, step-by-step, plus you can get a head start by using my free trading plan template, download below :

What is a trading plan?

A trading plan is an integral part of a trader’s strategy, outlining how trades are executed. It establishes rules for buying and selling securities, position sizing, risk management, and tradable securities. By following this plan, traders maintain discipline, consistency, and leverage proven strategies.

Why you should create a trading plan

Ask a new trader what they intend to do before the trading day and then ask them what they did at the end of the day. They almost certainly didn’t follow their plan.

Trading plans are there for us to follow. Trading plans mean we take trades that are consistent with our rules and risk, and it means we remove a lot of emotion and discretion . This is important because humans are not rational agents and outsourcing this work means we can achieve a better P&L and make more money.

A trading plan should resemble a business plan. A trader’s capital is their business and so we need to include everything that might be useful, but it should always cover the below.

What to include in your trading plan

- The time required to spend on your trading

Your trading goals and targets

- Your risk tolerance and risk management rules

Available capital for trading

Specific markets you wish to trade, the trading strategies you’ll use, your motivation for trading.

Read more information on what to include in your trading plan (with examples) below, and download your free template here:

The time required for trading

We need to define the time we need in order to trade successfully. For example, if you’re in full-time employment, then it’s unrealistic to spend six hours a day trading the market.

For example: Here is a part of my trading plan…

“To trade the UK stock market on a full-time basis I realistically need to spend at least 8-10 hours per day in order to take advantage of intraday opportunities and manage open positions in real time”.

It’s important to set realistic targets in trading. Once you have a target, you can reverse engineer how to achieve it.

For example: A target of increasing a trading account by 20% is an achievable target. To do that, we need to look at our trading capital and work out which trading strategies we’ll use.

Using breakouts to trend follow is a strategy I have had much success with, and I explain how I do this in my guide to breakouts.

There are several trading styles:

- Swing trading: This is a common strategy that attempts to capture moves over several days or weeks. Swing traders look for shorter term trends and then move onto the next trade.

- Momentum trading: This is a trend-following strategy based on upward movement and momentum. It can be a successful strategy over months and years as the stock continues to move higher. This is often coupled with increasing fundamental strength and accelerating earnings.

- Scalping or intraday trading (also known as ‘day trading’): Intraday strategies refer to trades placed and closed within the same trading session.

Your risk tolerance and risk management rules

Risk management is the most important part of trading. Position sizing is the first and last line of defence in our trading accounts.

If you take position sizes with 20% of your account, then that means you are risking 100% of that position every time it is risked in the market. Even if the chances are 99%, then eventually that 1 in 100 chance of the stock going to 0p and losing 100% of the position will happen.

Whilst a 20% drawdown on the trading account isn’t fatal, the law of compounding means that we will now need to gain 25% of our account just to get back to where we started.

Never underestimate the numbers here – a 33% drawdown requires a near 50% gain just to get back to where we started.

It’s important to put in place risk management rules that will protect the account and prevent us from taking on too much risk.

Only you will know how much risk you’re willing to take, but if you put yourself in a position where you could do yourself material damage, then eventually that outcome will be presented.

If taking a loss hurts, then it means you are trading too large. Most traders blow their accounts due to overexposure. I’ve never heard of a single trader who blew their account due to continuously taking small losses. Position sizing and risk management is covered in detail in my trading handbook.

Download the free ebook now

Enter your email to receive my free UK stock trading handbook, packed with professional techniques to manage risk and consistently profit on AIM stocks.

Traders should always be clear about what money should be used for trading and what money should stay in their bank accounts.

Far too many traders have drawdowns in their trading accounts and decide to top up their account with a bank transfer.

Unfortunately, they end up putting far too much money into their account and do not keep track of their losses.

You should never trade with money you can’t afford to lose. I’ve had emails from people asking me what to do because they’ve lost the deposit for their house and they haven’t told their partner. Sadly, there is little that can be done at that point because the money is already lost.

In your trading plan you should be clear about how much is going into your trading account and how much you will top this up each month if that is going to be your strategy to grow your account further.

However, the best way of growing your trading account is by making money trading successfully in the market. Once you can consistently do this, then it makes sense to increase your funds and scale up.

A trading plan should also include the specific markets you wish to trade. Do you plan on trading UK stocks, US stocks, foreign exchange (forex), or cryptocurrencies? Once you’ve picked a market, you still need to drill deeper.

For example: If you pick UK stocks will you trade all of these, or just AIM, or just the Main Market? Will you trade only small cap stocks? Will you trade both SETS and the SETSqx platforms ?

In my case, I trade all UK stocks, and don’t discriminate between any of them. However, my focus is on smaller stocks under £500 million market cap.

Your trading strategies are the ways you are going to make money. This part of the trading plan is important because by defining your strategies it will be clear to follow.

For example: I want to trade small-cap stocks that have momentum behind them, and I will find this momentum through technical breakouts and positive RNS announcements.

I will trade gaps and also place orders into the auctions in order to get better fills. I will use various brokers for different types of execution. I will take secondary raises that have news catalysts that can potentially drive the shares higher.

What is your why? What are your goals, and what is your motivation? Trading is hard and there are ups and downs – it’s easy to motivate yourself when the going is good and you’re making lots of money. But it can be harder when you’re suffered several losses in a row, and you keep seeing your account grind lower or flat for weeks on end.

Writing down your why will make it easier to stay focused and commit to the long-term process and improvement.

For example:

- I want to trade because I enjoy the challenge and I also want to be my own boss.

- I want the freedom that comes with the lifestyle of a full time trader and I want to be around my wife and future children as they grow up.

- I want to offer my family a better life, and by continuing to work on my skillset is putting me closing towards my goals.

Good trading plan example

How do you write a trading plan?

- Know your trading playbook

- Manage your risk

- Have a realistic profit target

1. Know your trading playbook

You should have a playbook of trades that you know how to execute in the market. A playbook is a list of trades, each with step-by-step instructions on how to trade the pattern.

If you don’t know what you should trade in your trading plan then building a playbook of trades is a good place to start.

2. Manage your risk

Risk management is a crucial skill for any trader. I’ve written an in-depth article on trading risk management for further information.

The reason risk management is so important is that without it we would blow up our accounts. Nobody would think about driving a car with no brakes because it would obviously crash – risk management is the brakes and safety system for our trading accounts.

Everyone has different risk profiles. Some are happy to take on high amounts of risk accepting that they may take hefty losses in order for the possibility of excess return.

Full-time traders like myself tend to be more cautious knowing that if they lose too much capital, they may have to go back to work.

You should include in your trading plan how much you’re prepared to risk on particular trades in your playbook and how much in your account overall.

3. Have a realistic profit target

Having an idea of a profit target will mean that you don’t end up falling into the trap of never selling. Far too many traders watch a stock rise, see it pullback, then immediately regret not nailing down profit into strength.

By setting out clear take profit targets this avoids indecisiveness and will ensure you execute ruthlessly.

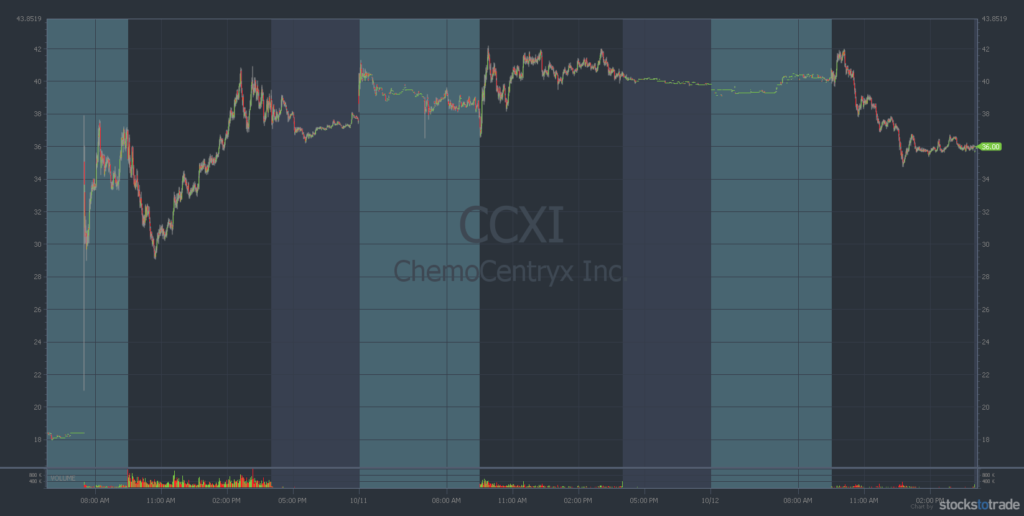

Bonus tip: Trade the stocks in play

Trading is about being in stocks that are moving. Volatility is the lifeblood of a trader, and a dead stock means dead money.

The stocks ‘in play’ are the stocks that have moved or are moving in recent sessions, and the stocks we should be immediately keeping tabs on. Stocks can cycle in and out being in play, and so we need to keep track of those that offer the greatest volatility to trade.

Download my free one-page trading plan template

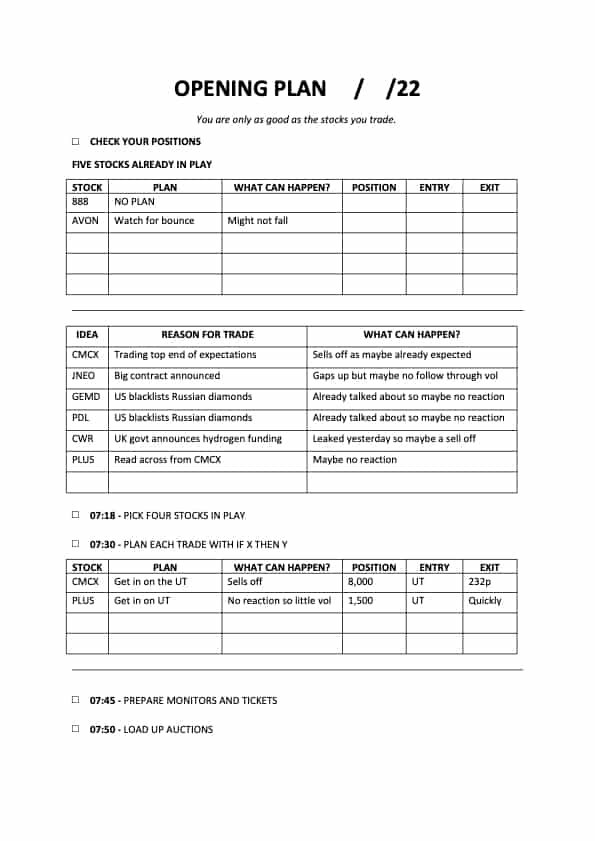

My opening plan trading template has everything you need to begin the trading day. It forces you to check and review your open positions, so you’re always knowing what to do.

It also suggests to list the current stocks in play, and how you can trade them, and in what size. Additionally, it asks “What can happen?” so a trader using this template will never be caught out.

By thinking ahead about potential scenarios and how to trade them, this gives the trader an advantage over others who do not put the work in. Traders who punt around their money without a clue or a plan are commonly referred to as “liquidity”.

To download the free template, click the button below and follow the instructions.

About The Author

Michael taylor.

Too soon to get the course ? Get my free UK stock trading ebooks

Start typing and press enter to search

Almost there.

Enter your email below to receive my four free stock trading ebooks with everything you need to start trading the UK stocks.

Enter your email to receive my free trading plan template, with everything you need to begin the trading day.

Get your free stock trading ebooks

Get four free UK stock market ebooks and my monthly trading newsletter with trade ideas and things learned from trading stocks

Don't miss out!

Trading Business Plan Template

Written by Dave Lavinsky

Trading Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their trading companies.

If you’re unfamiliar with creating a trading business plan, you may think creating one will be a time-consuming and frustrating process. For most entrepreneurs it is, but for you, it won’t be since we’re here to help. We have the experience, resources, and knowledge to help you create a great plan.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write a trading business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is a Trading Business Plan?

A business plan provides a snapshot of your trading company as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for a Trading Company

If you’re looking to start a trading company or grow your existing company, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your trading business to improve your chances of success. Your business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Trading Companies

With regards to funding, the main sources of funding for a trading company are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for trading companies.

Finish Your Business Plan Today!

How to write a business plan for a trading company.

If you want to start a trading business or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your trading business plan.

Executive Summary

Your executive summary provides an introduction to your trading business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of trading company you are running and the status. For example, are you a startup, do you have a trading business that you would like to grow, or are you operating a chain of trading companies?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overview of the trading industry.

- Discuss the type of trading business you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail what type of trading business you are operating.

For example, you might specialize in one of the following types of trading businesses:

- Retail trading business: This type of business sells merchandise directly to consumers.

- Wholesale trading business: This type of business sells merchandise to other businesses.

- General merchandise trading business: This type of business sells a wide variety of products.

- Specialized trading business: This type of business sells one specific type of product.

In addition to explaining the type of trading business you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of customers served, the number of products sold, and reaching $X amount in revenue, etc.

- Your legal business Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the trading industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the trading industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section:

- How big is the trading industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your trading business? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, schools, families, and corporations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of trading business you operate. Clearly, individuals would respond to different marketing promotions than corporations, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Trading Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other trading businesses.

Indirect competitors are other options that customers have to purchase from that aren’t directly competing with your product or service. This includes other types of retailers or wholesalers, re-sellers, and dropshippers. You need to mention such competition as well.

For each such competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as

- What types of customers do they serve?

- What type of trading business are they?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you make it easier for customers to acquire your product or service?

- Will you offer products or services that your competition doesn’t?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a trading company, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type of trading company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you sell jewelry, clothing, or household goods?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your plan, you are presenting the products and/or services you offer and their prices.

Place : Place refers to the site of your trading company. Document where your company is situated and mention how the site will impact your success. For example, is your trading business located in a busy retail district, a business district, a standalone facility, or purely online? Discuss how your site might be the ideal location for your customers.

Promotions : The final part of your trading marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Reach out to websites

- Distribute flyers

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections of your plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your trading business, including answering calls, scheduling shipments, ordering inventory, and collecting payments, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to acquire your Xth customer, or when you hope to reach $X in revenue. It could also be when you expect to expand your trading business to a new city.

Management Team

To demonstrate your trading business’ potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing trading businesses. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing a trading business.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you charge per item or per pound and will you offer discounts for bulk orders? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your trading business, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and traders don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a trading business:

- Cost of equipment and supplies

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your facility location lease or a list of your suppliers.

Writing a business plan for your trading business is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will understand the trading industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful trading business.

Trading Business Plan Template FAQs

What is the easiest way to complete my trading business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily write your trading business plan.

How Do You Start a Trading Business?

Starting a trading business is easy with these 14 steps:

- Choose the Name for Your Trading Business

- Create Your Trading Business Plan (use a trading business plan template or a forex trading plan template)

- Choose the Legal Structure for Your Trading Business

- Secure Startup Funding for Trading Business (If Needed)

- Secure a Location for Your Business

- Register Your Trading Business with the IRS

- Open a Business Bank Account

- Get a Business Credit Card

- Get the Required Business Licenses and Permits

- Get Business Insurance for Your Trading Business

- Buy or Lease the Right Trading Business Equipment

- Develop Your Trading Business Marketing Materials

- Purchase and Setup the Software Needed to Run Your Trading Business

- Open for Business

What is a Trading Business?

There are several types of trading businesses:

- Retail trading business- sells merchandise directly to consumers

- Wholesale trading business- sells merchandise to other businesses

- General merchandise trading business- sells a wide variety of products

- Specialized trading business- sells one specific type of product

Don’t you wish there was a faster, easier way to finish your Trading business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how Growthink’s business plan advisors can give you a winning business plan.

Other Helpful Business Plan Articles & Templates

- Uncategorized

How to Create an Excellent and Performing Day Trading Plan

- Real Trading™ Staff

- May 13, 2022

Trading Up Blog >

Simply put, a trading plan is an all-inclusive setup that makes it easy for you to make concrete decisions regarding your trading activities.

Such a plan is crucial in deciding when, what, and how much you will trade. In fact, even the thriving traders on Wall Street rely on this concept for effective trading.

The key principle in creating successful trading plan is to personalize its content . While you can refer to another trader’s plan, it is important to remember that their capital and willingness to risk is different from yours.

It is important to note that a trading plan is different from a trading strategy . The latter concept focuses on how and when you need to enter or exit a trade .

Benefits of a Trading Plan

Making logical decisions.

Successful traders are those that have mastered the art of making decisions based on logic rather than emotions.

While following your instincts can sometimes bring good results, doing this in the long term relying on emotions can ruin your account .

With an apt trading plan, you will be aware of the point at which you need to stop losses or take profit .

Enhanced discipline

Discipline is one of the principles of successful trading . Sticking to your trading plan will deter you from taking up more risk than you can handle.

Studies show that traders and investors who have a trading plan are more disciplined compared to those who lack it. For example, these traders open trades only when certain market conditions are met .

Ease of trading

You will have planned everything before the actual trading. As such, it will be easy to trade of the pre-determined considerations .

If you have a good plan, you will be at a good position to know when to enter or exit a trade. You will also know when to stay away from the market. In other words, when you have a good plan, your trading approach will be much easier .

Related » Trader’s Journey: Set Up the Next Day Trading Week

Ability to improve

A trading plan encompasses a record of your past trading activities . With the embedded information, you will be in a position to learn from previous mistakes and improve on your trading. When you have a good plan, it becomes substantially easier for you to improve and become a better trader.

Avoid huge losses

Another benefit of having a good trading plan is that it will help you avoid making substantial losses . There are several reasons for this. First, a good trading plan will ensure that you only enter trades that meet your criteria .

Second, a plan ensures that you have all risk management strategies when you open a trade. Examples of these strategies are position sizing , having a stop-loss and a take-profit, and looking at correlations.

It makes trading fun

Further, having a good plan will make your trading fun. Ideally, when you have a plan, you know what to look for in a chart and the catalysts . Most importantly, you know when to be active in the market and when to be aggressive.

How to Create an Apt Trading Plan

Define your driving force.

Why do you want to trade? What do you intend to gain from trading? These questions form the basis of a fruitful trading journey.

The answers you write down will give you the drive needed to execute trading activities consistently .

Specify the amount of time you wish to put into trading

Do you intend to be a full-time trader or do you have other commitments that require your attention on a daily basis?

Based on your occupation, will you be able to trade while at work or will you have to trade late at night or early in the morning?

Related » How to Trade Part-Time When You Have a Full-Time Job

These questions will guide you in creating a schedule that works for you as a trader while still leaving time to deal with your other commitments.

Additionally, the nature of your trading activities will determine the amount of time you should commit to the profession.

For instance, opening several trades in a day will require a substantial amount of time. It is also crucial to note that the time you set aside shouldn’t be used on the actual trading alone.

You need to prepare for trading by reading relevant content , analyzing the markets, and practicing your strategies.

Stipulate your goals

Use the SMART model to define your goals . It is also important to identify your preferred trading style based on the amount of time you intend to input into the profession as well as your attitude towards risk.

The key trading styles are:

- swing trading

- day trading

- position trading

Mental preparedness

Another important aspect that is often overlooked is on psychology and mental preparedness . In this, you should always assess whether your mental state is fine to trade.

For example, you will be able to handle a big loss or not . While strategy plays an important role in the market, the reality is that psychology plays a bigger role .

Related » 5 Trading Psychology Stages to Consider

Select a Risk-Reward Ratio

Before you trade, determine the level of risk you are willing to take on. This evaluation should be on your individual trades as well as the entire trading strategy.

It is possible to lose more times than your wins and still record substantial returns. To calculate your risk-reward ratio , weigh the amount of funds you intend to risk against your potential gains.

Decide on the Amount of Funds You Intend to Input into Trading

One of the principles of successful trading is that you shouldn’t risk more funds than you can manage to lose.

For better risk management, start with a demo account and acquire the skills and experience needed to trade on a live account.

Gain Ample Knowledge About the Market

The market you intend to trade is bound to affect your trading plan. For instance, a stock trading plan is different from one on currencies .

To begin with, get adequate information on the asset markets and classes you intend to trade. Evaluate the market’s volatility , potential gains or losses , and other relevant factors.

If you are unsatisfied with the prevailing conditions, consider a different market.

Have a trading diary

It is important to document the details of your trades to identify the aspects that are effective and those that you need to drop.

In addition to the technical details, include the logic that drove your trading decisions. A detailed trading diary will aid in improving your skills.

Stay up to date

Another way to build a good trading plan is to ensure that you are up to date on the market . Some of the top ways of doing this is to ensure that you have an economic calendar and you have the best sources of news.

Some of the top news sites to use are Bloomberg, Financial Times, and WSJ. Social platforms like Twitter and StockTwits are also vital sources of news.

Review your trading routine

Another part of your strategy is to review your trading routine . Having a routine is a good approach since it helps to simplify your trading process .

An example of a routine is to start by looking the calendar, top movers, and then doing individual analysis.

Final Thoughts

The key to successful trader is ample preparation . A Trading plan is one of the essential tools of preparing for a trade.

By following the steps included in this article, you will be in a position to improve your skills and identify the concepts that work for you as a trader.

External Useful Resources

- How to create a successful trading plan – IG

- The Difference Between A Trading Strategy And A Trading Plan – Rockwelltrading

Top Expert Guides

Recent articles, subscribe to the real trader newsletter.

Get our latest insights and announcements delivered straight to your inbox with The Real Trader newsletter. You’ll also hear from our trading experts and your favorite TraderTV.Live personalities.

Your ability to open a trading business with Real Trading™ or join one of our trading businesses is subject to the laws and regulations in force in your jurisdiction.

Due to current legal and regulatory requirements, United States citizens or residents are currently unable to open a trading business with us.

- Privacy Policy

Day Trade the World is now Real Trading

Trading Basics

- Order Types

- Money Management

- Day Trading Salary

- The Pattern Day Trading Rule

- Stock Earnings

- Trading Patterns

Chart Patterns

- Candlesticks Explained

- 6 Bullish Candlesticks

- 8 Bearish Candlesticks

- DOJI Candlestick

- Double Bottom W

- Symmetrical Triangle

- Ascending Triangle

- Descending Triangle

- The Bear Trap

- The Golden Cross

- Head and Shoulders

Trading Strategies

- How to use scans in Day Trading

- How to Trade The Head and Shoulders Strategy

- How to create a trading plan

- Options Trading Guide for Beginners

More Education

- Day Trading Blog

- The Simcast Podcast

- Stock Trading Indicators

- Trading as a business

- Trading Psychology

10 Elements of a Winning Trading Plan

Mar 18, 2019

Written by: Al Hill

Ask 100 traders if they can send you a copy of their sample trading plan and I guarantee you it will be the highest rejection level event of your life.

Unlike business owners who generally have a business plan in order to provide a strategic vision to employees and to stay focused on their primary line of business, most traders never take the time to create a business, a.k.a trading plan.

What is a Trading Plan?

A trading plan is your roadmap for what you are going to do in the markets. It’s something that you have to create and is not optional.

The trading plan can be whatever works for you, but it needs to be written down. For me, at times it has been illustrations, while other times it has been a technical manual of sorts.

You want the plan to be a page. Now, I’m not suggesting you over complicate your strategy, but you should have a detailed idea of what you are doing. This should go beyond the standard trading setup and needs to touch on items like money management, trading discipline and your overall purpose for trading.

Now, let’s dive into how to create a trading plan using the 10 elements of a winning trading plan you can create to help improve your performance.

#1: How Many Trades will You Use to Evaluate Your Performance?

How Many Trades?

In most lines of business, time is the main driver for evaluating performance. Companies report on a quarterly basis to the street, which fundamental analysts then feverishly work through the data to assess a company’s future growth potential.

Well, how long should you wait to evaluate your trading performance …yearly, monthly, daily?

The answer to this question is very simple. Base your evaluation period on the number of trades placed and not by the amount of time passed.

Time is irrelevant in the world of trading. Trading is one of the few areas in this realm, where the space-time continuum are of no relevance.

Those of us that have been trading for some time know that one-year’s stellar trading performance can lead to a 2-month binge of destruction, which can easily eradicate everything you’ve worked so hard to create.

The way to address the tracking of your performance is to create a set number of trades that you will evaluate against key performance metrics, which we will touch upon next.

You will need to identify the right number of trades for you to evaluate, but this number needs to be high enough that you have a decent sample set, but low enough where it prevents you from going on a destructive trading binge.

For me, that number is 10 trades. This applies to both my swing trading and day trading activities. On average, it will take me approximately 3 months to place 10 swing trades and about 4 days to place 10-day trades. I only mention the time element so you can see how long it takes me to place that number of trades based on my trading style , but you can easily perform the same math in your head.

So, what is the number of trades you will use when evaluating your trading activity?

#2: Identify Your Key Performance Metrics

Performance Metrics

I use the KISS method or Keep It Simple, Stupid (for those new to the term) for measuring my trading performance. To that aim, I only care about the following two metrics:

This is a ratio of your profitable trades divided by your losing trades. Over a 10 trade cycle, I would take, for example, $15,000 (winners)/$5,000 (losers), which would equal an R of 3. This essentially translates to the fact I profit three times more than I lose. You will want to measure R over every cycle. There is no set minimum or maximum R value; however, you will want to track your performance over time and quickly identify when you are below your historical average.

- This is the lowest intraday dollar value of your account within a trading cycle. Most max drawdowns require a new high to take place in order to mark the drawdown. I, however, feel this is not the right approach, because it could take you a series of trading cycles before you hit a new portfolio high. I recommend that you determine how low your account has gone from the starting point of the cycle in percentage terms. For example, if I have a starting portfolio value of $100k for a 10-sprint cycle and my account value hits $80k, then my max drawdown was 20%. Just like R, there is no hard and fast rule on maximum drawdown. Over time, you should aim to reduce your drawdowns, as this will ultimately lead to a portfolio balance that continues pointing up and to the left, with very little pullbacks.

#3: What Time of Day will You Trade?

For my day traders, I highly recommend you limit your trading activity.

For me, I trade from 9:50 am – 12:00 pm. Any trade activity occurring before or after this zone, I am purely a spectator on the sideline.

#4: Define Your Trading Edge

Similar to the times of day you will trade; keep your trading edge down to one or two setups when starting out. The more strategies you hope to master, the more difficult it will become to consistently make money in the market.

Below are the details of my trading edge:

- Early Range Breakouts

- High Volume

- Tight Spreads

- Consolidation prior to the breakout

- Only enter new positions between 9:50 am and 10:10 am

That’s it. If you feel your list bubbling up to 20+ criteria, you will drive yourself crazy trying to respect all of your rules

#5: Identify Stocks to Trade

Develop a standard methodology for identifying plays. You will have to first ask yourself the question, what is my time horizon for this trade? Day traders will want to focus on stocks in the news, while long-term traders will want to focus on stocks that are developing new business models that show the potential for multi-year growth. Whatever your trading style, make sure you identify the plays that have the highest odds of profitability.

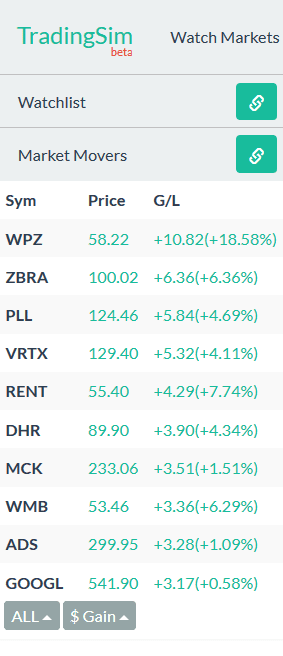

For day traders, you will want to focus on the market movers. This provides you with the greatest opportunity for locating stocks that are trending hard with high liquidity. Within TradingSim, our market movers component provides you the top list of gainers and losers in real-time. This way you don’t have to navigate through hundreds of charts manually.

TradingSim – Market Movers

Once you have found a stock you like, you will need to add the stock to your watchlist, so you can keep an eye on the security.

TradingSim – Watchlist

#6: Place Your Stop Loss

Stop losses are not a negative thing; they are what keep you in business over the long haul

My stop loss is once the position goes against me by 2%. The 2% threshold is based on the volatility of the stocks I trade and may not be suitable for your trading style. The point here is just to make sure you have a stop loss. If you find your stop is consistently being hit, then you need to take a deeper look into the volatility of the stocks you are trading .

#7: When to Exit

You have heard all the market wizards say, “Let your winners run”. Well, once you figure out what that means please let me know.

The greed in you will prevent you from closing your winning trades, even after you hear that little voice in your head tell you the run has come to an end. The way to avoid this scenario is to have a clear exit strategy.

Again, keep it simple. The exit strategy should be as simple as when the stock crosses below a moving average or the VWAP.

If you would like more insight into my own exit strategy for swing trading please take a look at the article I wrote titled ‘ How to Let Your Winners Run – 7 Tips for Success’ .

#8: How Much Money Can I Use per Trade?

Without money management, you will not stand a chance of making it in the business of trading. For me, the amount of money I can use per trade largely depends on how well I am performing. If I am going through a rough patch and my key performance indicators are down, then I use less money to minimize the damage to my account balance.

However, for keeping it simple in this article, I only use 10% of my available day trading buying power per trade. For example, if I have $250,000 cash, this would translate to $1,000,000 in day trading buying power; hence, I would use $100,000 per trade.

#9: When to Take Breaks

Take a Break from Trading+

This is something you will not see in other trading plans on the web. When will you take a break from trading? Sounds like a no-brainer, but you will be surprised how many traders I talk to that never take breaks. Whether the trader has just had the best series of trades or an all-out massacre of their account, the vast majority of traders just keep placing trades, day after day.

I take a break after I have placed 100 trades. I will take a day off just to give myself time to relax and reflect on my trading activity. You could be asking yourself; couldn’t I just take a break on the weekend or over federal holidays? Very true, but taking a self-imposed break goes back to discipline and exercising my control of the market. While the market is always there, I don’t always have to respond to her every move.

#10: Limit Up/Limit Down

The major exchanges and prop firms think in terms of limit up and limit down. This concept of curbs in was originally created after the 1987 crash and like everything else has become so complicated, it’s not worth trying to explain in less than 5,000 words.

For prop firms, their risk management rules will closely monitor how much a trader is up or down for the day. Once a trader reaches a particular extreme based on their past trading performance, this trader is not allowed to place any additional trades for the day.

Why do we as traders not think in terms of limit up or limit down?

For me, if I lose 2% of my trading capital at any point of the day, I need to exit all positions and go fishing. Conversely, if I make 7.5% of my trading portfolio in one day, it is time to go fishing.

Have you ever thought in terms of limit up/limit down? What are your limit up/limit down targets?

Sample Trading Plan

Now that we have covered the 10 inputs of a trading plan, below is a sample trading plan for your review. While this is a sample trading plan for day trading, you can simply change the parameters and apply them to any trading period for success.

Beach Photo by Trish Hartmann

Time Photo by Sean MacEntee

Performance Metrics by Alan O’Rourke

Tea Cups by Clyde Robinson

Tags: Day Trading Basics

Related Blogs

Trading days in a year – so how many are there really.

How to calculate the number of trading days in a year Trading Days in a Year Since you have posed the question of how many trading days in a year there are, let me first provide you an answer. On...

Day Trading Journal

A day trading journal is the only part of your trading arsenal required to succeed at active trading. Your journal contains each trading transaction and a brief summary of the trade. Much like a...

Tradingsim University

The Tradingsim University provides you a framework for how to use the Tradingsim Platform. Each module focuses on topics that are key to successful day trading. This is not a race! Take your team...

- Search Search Please fill out this field.

- 1. Knowledge Is Power

- 2. Set Aside Funds

- 3. Set Aside Time

- 4. Start Small

- 5. Avoid Penny Stocks

- 6. Time Those Trades

- 7. Cut Losses With Limit Orders

- 8. Be Realistic About Profits

- 9. Reflect on Investment Behavior

- 10. Stick to the Plan

How To Start Day Trading

What makes day trading difficult, deciding what and when to buy, deciding when to sell, day trading charts and patterns.

- How to Limit Losses

Day Trading Strategies for Beginners

How much do day traders make, is day trading worth it, how much money do i need to start day trading stocks, the bottom line.

- Trading Skills

10 Day Trading Tips and How To Get Started

Day trading involves buying and selling financial instruments at least once within the same day. If played correctly, taking advantage of small price moves can be a lucrative game. Yet, it can be dangerous for beginners and anyone else who doesn't have a well-thought-out strategy.

Not all brokers are suited for the high volume day trading generates. Meanwhile, some fit perfectly with day traders. Check out our list of the best brokers for day trading that accommodate individuals who would like to day trade.

The online brokers on our list, Interactive Brokers and Webull, have professional or advanced versions of their platforms with real-time streaming quotes, charting tools, and the ability to enter and modify complex orders in quick succession.

Below, we'll take a look at 10 day trading strategies for beginners. Then, we'll consider when to buy and sell, basic charts and patterns, and how to limit losses.

Key Takeaways

- Day trading is only profitable in the long run when traders take it seriously and do their research.

- Day traders must be diligent, focused, objective, and unemotional in their work.

- Interactive Brokers and Webull are two recommended online brokers for day traders.

- Day traders often look at liquidity, volatility, and volume when deciding what stocks to buy.

- Some tools that day traders use to pinpoint buying points include candlestick chart patterns, trend lines and triangles, and volume.

1. Knowledge Is Power

In addition to knowledge of procedures, day traders need to keep up with the latest stock market news and events that affect stocks. This included the Federal Reserve System's interest rate plans, leading indicator announcements, and other economic, business, and financial news.

So, do your homework. Make a wish list of stocks you'd like to trade. Be informed about the selected companies, their stocks, and general markets. Scan business news and bookmark reliable online news outlets.

2. Set Aside Funds

Assess and commit to the amount of capital you're willing to risk on each trade. Many successful day traders risk less than 1% to 2% of their accounts per trade. If you have a $40,000 trading account and are willing to risk 0.5% of your capital on each trade, your maximum loss per trade is $200 (0.5% x $40,000). Moreover, only trade with suitable online brokers and trading platforms .

Earmark funds you can trade with and are prepared to lose.

3. Set Aside Time

Day trading requires your time and attention. In fact, you'll need to give up most of your day. Don’t consider it if you have limited time to spare.

Day trading requires a trader to track the markets and spot opportunities that can arise at any time during trading hours. Being aware and moving quickly are key.

4. Start Small

As a beginner, focus on a maximum of one to two stocks during a session. Tracking and finding prospects is easier with just a few stocks. It's now common to trade fractional shares . That lets you specify smaller dollar amounts that you wish to invest.

This means that if Amazon.com ( AMZN ) shares are trading at $170, many brokers will now let you buy a fractional share for as low as $5.

5. Avoid Penny Stocks

You're probably looking for deals and low prices but stay away from penny stocks . These stocks are often illiquid and the chances of hitting the jackpot with them are often bleak.

Many stocks trading under $5 a share become delisted from major stock exchanges and are only tradable over-the-counter (OTC). Unless you see a real opportunity and have done your research, steer clear of these. Finding real undervalued stocks can be demanding.

6. Time Those Trades

Many orders placed by investors and traders begin to execute as soon as the markets open in the morning , contributing to price volatility. A seasoned player may be able to recognize patterns at the open and time orders to make profits. For beginners, it may be better to read the market without making any moves for the first 15 to 20 minutes.

The middle hours are usually less volatile. Then, the movement begins to pick up again toward the closing bell. Though rush hours offer opportunities, it’s safer for beginners to avoid them at first.

7. Cut Losses With Limit Orders

Decide what type of orders you'll use to enter and exit trades. Will you use market orders or limit orders? A market order is executed at the best price available, with no price guarantee. It's useful when you want to enter or exit the market and don't care about getting filled at a specific price.

A limit order guarantees the price but not the execution. Limit orders can help you trade more precisely and confidently because you set the price at which your order should be executed. A limit order can cut your loss on reversals. However, if the market doesn't reach your price, your order won't be filled and you'll maintain your position.

More sophisticated and experienced day traders may also employ options strategies to hedge their positions.

8. Be Realistic About Profits

A strategy doesn't need to succeed all the time to be profitable. Traders can be successful by only profiting from 50% to 60% of their trades. However, they need to profit more on their winners than they lose on their losers. Ensure the financial risk on each trade is limited to a specific percentage of your account and that entry and exit methods are clearly defined.

9. Reflect on Investment Behavior

For day traders, frequent reflection on investment behavior is crucial. It helps them identify patterns, learn from past mistakes, and fine-tune their strategies. This fosters continuous learning and adapting to ever-changing market conditions. In addition, it encourages discipline and emotional control, which are key to successful trading.

10. Stick to the Plan

Successful traders have to move fast, but they don't have to think fast. Why? Because they've developed a trading strategy in advance, along with the discipline to stick to it. It is important to follow your formula closely rather than try to chase profits. Don't let your emotions get the best of you and make you abandon your strategy. Bear in mind a mantra of day traders: plan your trade and trade your plan.

Investopedia / Madelyn Goodnight

Getting underway in day trading involves putting your financial resources together, setting up with a broker who can handle day trading volume, and engaging in self-education and strategic planning. Here's how to start in five steps:

Step 1 : Educate yourself. Before you start trading, it's crucial to understand the trading principles and specific strategies used in day trading. Read books, take courses, and study financial markets. The major topic to study is technical analysis , which should include reading up on trading psychology and (this is a must) risk management.

Step 2 : Develop your trading plan. Outline your investment goals, risk tolerance, and specific trading strategies you've picked up from Step 1. Your plan should specify your entry and exit criteria, how much capital you are willing to risk on each trade, and your overall risk management strategy. Before investing real money, put your plan into practice with a real-time trading simulator. This helps you get familiarized with market behavior and the trading platform without financial risk.

Step 3 : Choose a trading platform and fund your account. You'll want a reputable broker that caters to day traders and has low transaction fees, quick order execution, and a reliable trading platform. Once you're ready, fund your account. It's advisable to begin with a relatively small amount in your trading account and only put in money you can afford to lose.

Step 4 : Begin trading with small positions. This reduces the risks of losing all your money on one or a series of bad trades while you're still learning. As you do so, continuously review your trades and check them against your learning resources to adjust your strategy. Day trading requires constantly adapting to changing situations.

Step 5 : Maintain discipline. Adjusting to changing circumstances does not mean shifting your stop-loss and stop-limit settings or other trading criteria as you take on more risk. Successful day trading relies very much on discipline and emotional control. Stick to your trading plan; don't let emotions drive your decisions. That's the way to quick ruin.

Day trading takes a lot of practice and know-how, and several factors can make it challenging .

First, know that you're competing against professionals whose careers revolve around trading. These people have access to the best technology and connections in the industry, which means they're set up to succeed. Jumping on the bandwagon usually means more profits for them.

Next, understand that Uncle Sam will want a cut of your profits, no matter how slim. You'll have to pay taxes on any short-term gains —investments you hold for one year or less—at the marginal rate. The upside is that your losses will offset any gains.

Also, as a beginning day trader, you may be prone to emotional and psychological biases that affect your trading—for instance, when your capital is involved and you're losing money on a trade. Experienced, skilled professional traders with deep pockets can usually surmount these challenges.

Day Traders Lose

An early popularizer of day trading, Toby Crabel, is also credited with a classic day trading strategy, the opening range breakout. Crabel has had some influence on technical analysis, and he often suggested that day traders are social psychologists with a computer program.

What To Buy

Day traders try to make money by exploiting minute price movements in individual assets (stocks, currencies, futures, and options). They usually leverage large amounts of capital to do so. In deciding what to buy—a stock, say—a typical day trader looks for three things:

- Liquidity . A security with this allows you to buy and sell it easily and, hopefully, at a reasonable price. Liquidity is an advantage with tight spreads, or the difference between the bid and ask price of a stock, and for low slippage, or the difference between the expected price of a trade and the actual price.

- Volatility. This measures the daily price range—the range in which a day trader operates. More volatility means greater potential for profit or loss.