- Search Search Please fill out this field.

- Options and Derivatives

- Strategy & Education

Assignment: Definition in Finance, How It Works, and Examples

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate.

:max_bytes(150000):strip_icc():format(webp)/YariletPerez-d2289cb01c3c4f2aabf79ce6057e5078.jpg)

What Is an Assignment?

Assignment most often refers to one of two definitions in the financial world:

- The transfer of an individual's rights or property to another person or business. This concept exists in a variety of business transactions and is often spelled out contractually.

- In trading, assignment occurs when an option contract is exercised. The owner of the contract exercises the contract and assigns the option writer to an obligation to complete the requirements of the contract.

Key Takeaways

- Assignment is a transfer of rights or property from one party to another.

- Options assignments occur when option buyers exercise their rights to a position in a security.

- Other examples of assignments can be found in wages, mortgages, and leases.

Uses For Assignments

Assignment refers to the transfer of some or all property rights and obligations associated with an asset, property, contract, or other asset of value. to another entity through a written agreement.

Assignment rights happen every day in many different situations. A payee, like a utility or a merchant, assigns the right to collect payment from a written check to a bank. A merchant can assign the funds from a line of credit to a manufacturing third party that makes a product that the merchant will eventually sell. A trademark owner can transfer, sell, or give another person interest in the trademark or logo. A homeowner who sells their house assigns the deed to the new buyer.

To be effective, an assignment must involve parties with legal capacity, consideration, consent, and legality of the object.

A wage assignment is a forced payment of an obligation by automatic withholding from an employee’s pay. Courts issue wage assignments for people late with child or spousal support, taxes, loans, or other obligations. Money is automatically subtracted from a worker's paycheck without consent if they have a history of nonpayment. For example, a person delinquent on $100 monthly loan payments has a wage assignment deducting the money from their paycheck and sent to the lender. Wage assignments are helpful in paying back long-term debts.

Another instance can be found in a mortgage assignment. This is where a mortgage deed gives a lender interest in a mortgaged property in return for payments received. Lenders often sell mortgages to third parties, such as other lenders. A mortgage assignment document clarifies the assignment of contract and instructs the borrower in making future mortgage payments, and potentially modifies the mortgage terms.

A final example involves a lease assignment. This benefits a relocating tenant wanting to end a lease early or a landlord looking for rent payments to pay creditors. Once the new tenant signs the lease, taking over responsibility for rent payments and other obligations, the previous tenant is released from those responsibilities. In a separate lease assignment, a landlord agrees to pay a creditor through an assignment of rent due under rental property leases. The agreement is used to pay a mortgage lender if the landlord defaults on the loan or files for bankruptcy . Any rental income would then be paid directly to the lender.

Options Assignment

Options can be assigned when a buyer decides to exercise their right to buy (or sell) stock at a particular strike price . The corresponding seller of the option is not determined when a buyer opens an option trade, but only at the time that an option holder decides to exercise their right to buy stock. So an option seller with open positions is matched with the exercising buyer via automated lottery. The randomly selected seller is then assigned to fulfill the buyer's rights. This is known as an option assignment.

Once assigned, the writer (seller) of the option will have the obligation to sell (if a call option ) or buy (if a put option ) the designated number of shares of stock at the agreed-upon price (the strike price). For instance, if the writer sold calls they would be obligated to sell the stock, and the process is often referred to as having the stock called away . For puts, the buyer of the option sells stock (puts stock shares) to the writer in the form of a short-sold position.

Suppose a trader owns 100 call options on company ABC's stock with a strike price of $10 per share. The stock is now trading at $30 and ABC is due to pay a dividend shortly. As a result, the trader exercises the options early and receives 10,000 shares of ABC paid at $10. At the same time, the other side of the long call (the short call) is assigned the contract and must deliver the shares to the long.

:max_bytes(150000):strip_icc():format(webp)/novation.asp-final-f5904e1fe68047ba9d8b6feaf53c1736.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Understanding Share Transfer or Transfer of Shares

This article will help you understand all about share transfer and the procedure for the transfer of shares in a company.

With the economy changing, the ways of investing money have also changed. It was not long ago when we had many companies that were owned by just a single individual. Today, many companies are owned by a pool of individuals .

This article will help you understand all about share transfer and the procedure for the transfer of shares in a company .

Transfer of Shares

When a company is formed, the shares are allotted . After some time, shareholders will want to sell a part or all of their shares to someone else; this is called the transfer of shares in the company . But what exactly goes into this process?

What is transfer of shares?

There would be times where you would want to change the share structure of your company . This can be done by changing the existing proportion of shares between shareholders or adding a new shareholder. So, the transfer of shares in the company is the process of transferring existing shares from one person to another , either by selling or by gifting them.

When a person purchases or receives a company’s stock , they get a certificate that shares the details of the ownership of the shares, known as the stock certificate . So, when this person decides to transfer the shares to someone else, they would have to perform a transfer using a share transfer form.

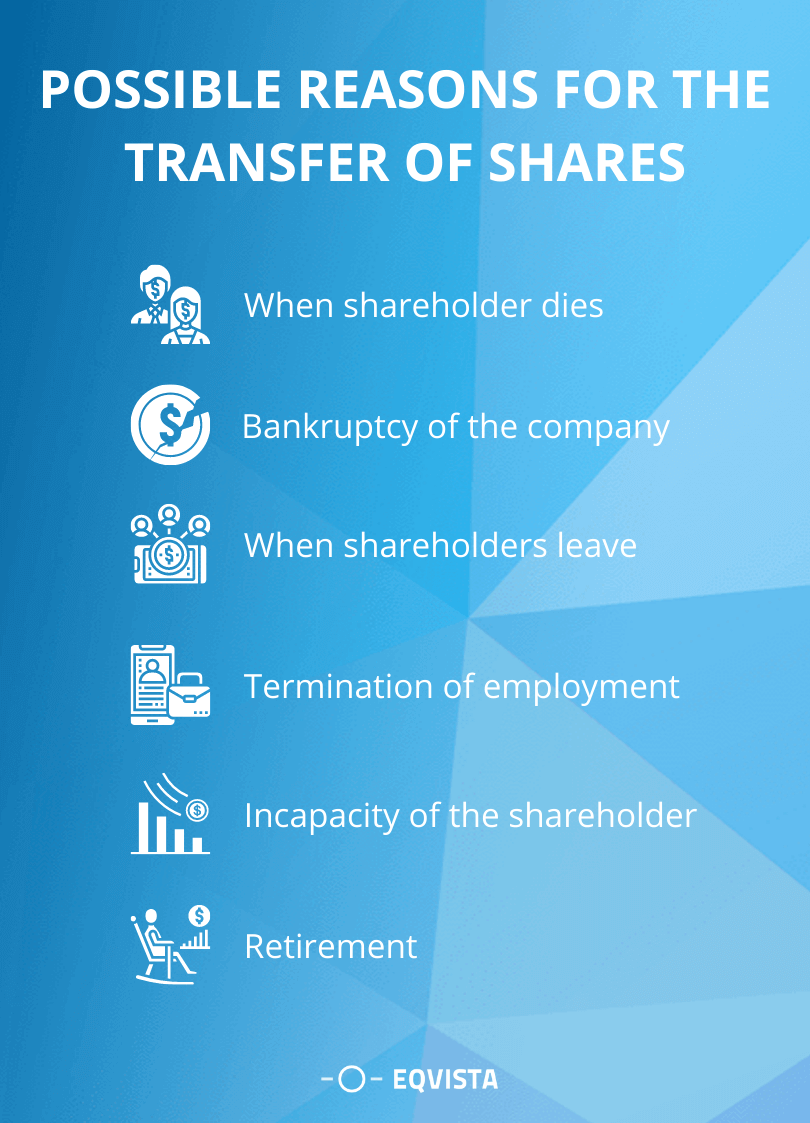

Possible reasons for the transfer of shares

A share transfer takes place under many different conditions. For instance, when a shareholder leaves the company , they would have to transfer the shares to another shareholder. The same happens when a shareholder dies or retires . With this, it is important to know the process of the transfer.

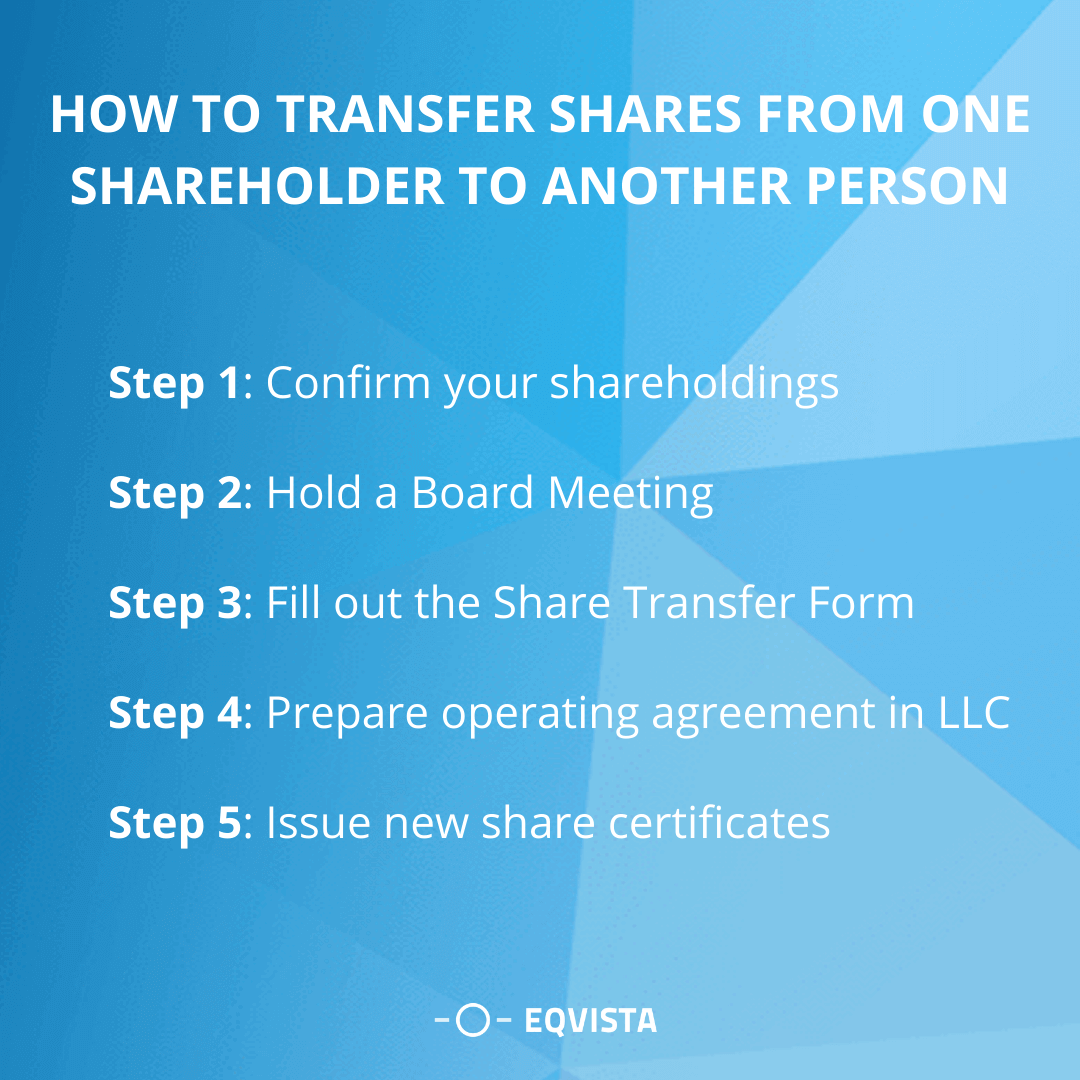

Here’s a short summary of the procedure for transfer of shares:

- Step 1 : Confirm your shareholdings: You need to confirm the number of shares you have, including the number of shares you want to give away and the number you want to keep.

- Step 2 : Hold a Board Meeting: As per the board agreement, the share transfer has to be approved by the board before it can be done. So, hold a board meeting and get the action approved.

- Step 3 : Fill the Share Transfer Form: It is the J30 form , a standard document used to transfer existing shares from one person to another. This form would hold the details of the seller or gifter of the shares, the receiver, number of shares, type of shares, and consideration paid. The shareholder selling the shares would then have to sign and date the form. If the shares are being transferred by the company and not an individual shareholder, then the director of the company would have to sign it.

- Step 4 : Issue new share certificates: With the confirmed share structure in place, the company’s next step is to issue new share certificates detailing the shareholdings. These will also render any previous share certificates as effectively canceled.

Share Transfer Form

The share transfer form , which is also known as a share transfer instrument , is a standard document that is needed for the transfer of shares in a company. This document is used when a shareholder or the company wants to sell or gift their company shares to another person or company.

The document is simple, where it outlines the particulars of the party selling the shares, the particulars of the person receiving it, the number of shares to be transferred, the company whose shares are transferred, the cost of each share, etc. As per the law, a private company cannot directly transfer shares to a person, but an existing shareholder can do so . When the form is filled, the transferor and the transferee will sign the document .

With this, the company can then affix its common seal on the document . Or, in place of this, either two directors, or one director and one secretary would need to sign on the document. If either party is an organization, then the authorized representative of the organization needs to sign the form. This will act as the seal for the transaction and is an integral part of confirming the transfer of shares in the company . Once this has been done, the document is kept in the company’s records.

How To Transfer Shares From One Shareholder to Another Person?

The transfer of shares in the company seems to be the same for all companies, but we know that there are different types of business entities, and each has its own kind of structures and processes. Keeping this in mind, we have shared the process of the transfer of shares for each main kind of company:

#1 Transfer of shares in a Corporation

The shares in a corporation are freely transferable . Nonetheless, the Articles of Incorporation, the agreement between the shareholder, or the bylaws might place some reasonable restrictions on the transfer of shares. For being about to transfer shares, the shareholder would require the board members’ approval and the approval of all the other shareholders in the company . Once this is done, the share transfer form is filled in, and the new share certificate is issued accordingly to the person getting the shares.

When the corporation sells its shares, the corporation would have to pay tax on the income and gain at the corporate level . And there is no preferential tax rate for capital gains recognized by a corporation. The money obtained from the sale of the shares is taxed as a dividend. And if it is sold as a plan of liquidation, it is taxed as a capital gain .

However, if an individual shareholder is selling the shares , they would have to pay tax on the capital gains at the preferential individual tax rate.

#2 Transfer of shares in S corporation

S corporations are corporations for all non-tax purposes. And that is why the steps needed for the transfer of shares are normally the same as those in the C corporation . Once the company or the individual shareholder decides to transfer the shares, they would need The Board’s approval, and then they need to fill the share transfer form. With this, the new share certificate is issued, and the shares are transferred. Ensure that all these transactions are noted in the company’s records and the cap table .

Since S corporations are pass-through entities , the tax implications are different from a C corp. When the shares in a company are sold, the S corporation would have to pay tax on the capital gains at the corporate level . This is then passed out to the shareholders. And if the shareholders are individuals, the amount is then taxed at the preferential capital gains tax rate. Shareholders get a step-up in tax basis in their shares as a result of corporate gain recognition.

#3 Transfer of shares in LLC

An LLC is governed by an Operating Agreement created when it is formed. This agreement provides the details on how the transfer of shares would be done in the company. If you are a shareholder in the LLC, you would have signed the operating agreement as well. And even though the operating agreement should have the rules that define the transfer of shares in the company, the LLC can also have a buy-sell agreement for it separately. It would share details taking into consideration every situation possible that can lead to the transfer of shares.

With this said, the transfer of shares in an LLC is not so different from that of a corporation. The only difference is that the transfer is governed by the rules in the operating agreement or by a buy-sell agreement . Once the board has approved the share transfer, and the conditions as per the agreement are met, the share transfer form must be filled and signed. As soon as it is signed, the shares are handed to the transferee, and the stock certificate is issued . With this, the company also needs to record the transaction in the company’s records and the cap table.

Taxation for Transfer of Shares

Selling stocks can have consequences on your tax bill. If your stock transaction resulted in you making a profit , you would owe the government capital gains tax . And if your transactions had a capital loss, you can use the loss to reduce your income for the year. You also get the option to carry the loss to the next year so that you can offset any capital gain that you make.

Let us understand what capital gains are a bit more before we can talk about the taxation of the transfer of shares.

What is a capital gain?

Capital gain is the difference in the amount you paid for the shares from the amount you sold the shares . In fact, capital gains aren’t just used for stocks, but it is for any asset you sell and get paid more than you paid for it.

There are two kinds of capital gains, namely, short-term and long-term capital gains. Short-term capital gains are when you own the stock or asset for less than a year before selling it off. In this case, you are taxed at the same rate as your income. This means that the short-term gain tax rate is equal to the income tax rate for your bracket.

If you own the stock for more than a year , it is considered a long-term capital gain . In this case, you are taxed at a much lower rate than your income tax. As a matter of fact, in 2020, single taxpayers get to pay:

- 0% on long-term capital gains if their taxable income is below $40,000 ,

- 15% – if their income is between $40,000 and $441,450 , and

- 20% – if their income is more than $441,450 .

Take the help of your accountant or lawyer to know more about your tax bracket.

Now, the tax you pay also depends on what you are doing with the shares . There are two situations, both have been explained below in detail:

#1 Selling Shares

In general, the capital gains tax will have to be paid for when you sell or give for free an asset, such as shares . The tax applied to it would depend on your income and the total capital gains you made from the shares in that year.

#2 Transfer as Gift

There are situations where a shareholder wishes to give their own shares as a gift to someone else. And the good news here is that there is no capital gains tax on the shares that are offered as gifts to your spouse or civil partner . But there is a general rule that when an individual gifts a chargeable asset like a company’s shares, it is considered disposal. This gives rise to a chargeable gain in the same way just it happens during the transfer of shares in exchange for money.

Nonetheless, when you gift shares, the shares’ market value at the time of disposal is taken into account for the capital gains tax and inheritance tax purposes. The logic behind this is that the tax is imposed on the increase in the value of the shares during the time the person owned them , that is if the value of the shares has increased from the time they acquired them to the time they gave them away for free.

Imagine you get 5,000 shares at $0.10 per share . It is evident that the value of the shares would increase as the company grows. Let us say that the market value of the shares is now $2 per share . So, if you want to give away the complete 5,000 shares for free, they would be liable for capital gains tax. This would be calculated on the difference between the current market value of the shares ($2 * 5,000 = $10,000) and the acquisition value of the shares ($0.10 * 5,000 = $500) . This means that the remaining amount of $9,500 would be subject to tax .

Transfer Shares on Eqvista

With all the above explained and now that you have understood everything, it is essential to record every transaction you make. Recording it means documenting the transaction in your cap table. And Eqvista is an advanced cap table software to help you record and manage all your equity transactions .

Before you begin, you will need to make sure that you have an account on Eqvista and have created your company account .

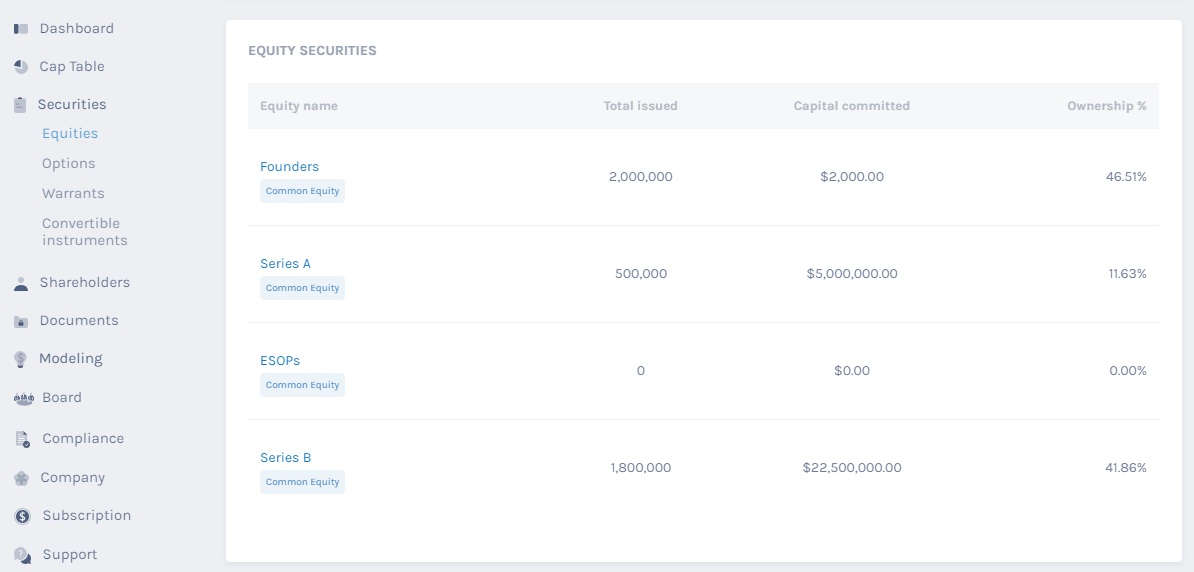

Step 1: Log into your account , select your company profile and from the dashboard, click on “Equities” under the “Securities” tab.

Here, click on the equity class from where the share transfer is about to take place. In this case, we select the option “Series B” .

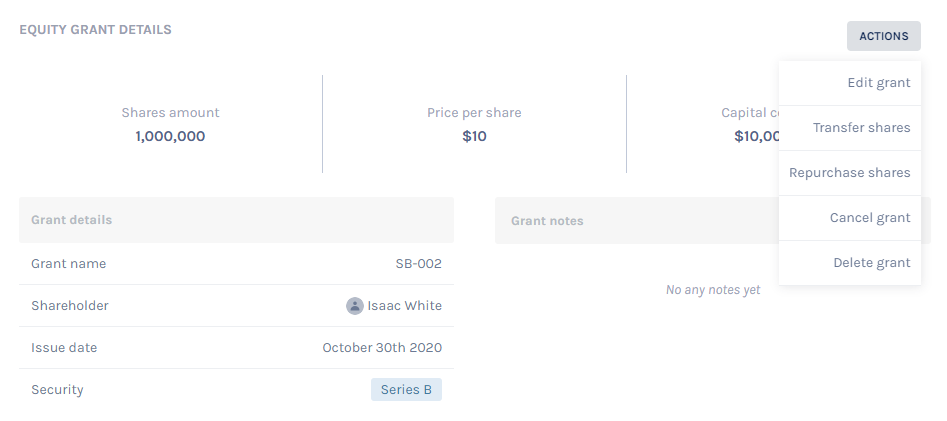

Step 2: Once you do this, you will reach the next page, as below:

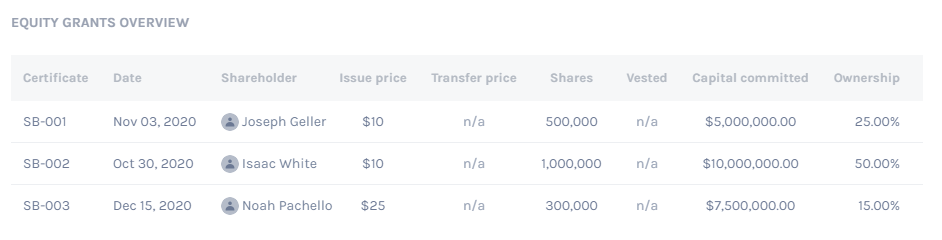

From here, select the certificate number of the shareholder whose shares are being transferred. In this case, we selected the option “SB-002” .

Step 3: This will take you to the page where you can see the details of this transaction. Next click on “Action” and then on “Transfer shares” .

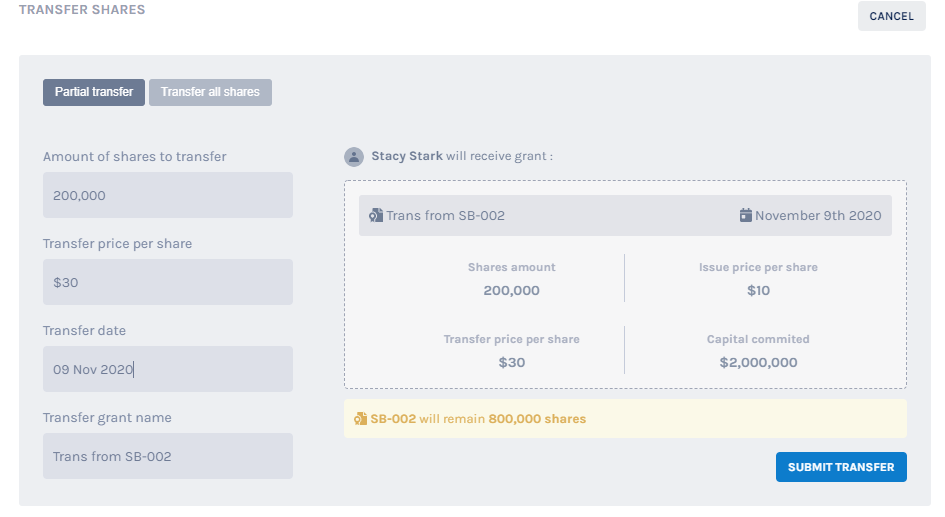

There are two kinds of transfers that you can make. One is the partial transfer and one is the transfer of all shares . Here we chose partial transfer, and type in the transferee’s name.

Step 4: You will reach the next step where you need to add the number of shares that you want to transfer. Since it is a partial transfer, and the shareholder who is making the transfer has about 1,000,000 shares, we choose to make a transfer of 200,000 shares here.

You will also have to add the price of the share at the time of the transfer . In this case we add in the share price of $30, and press on Submit .

With this, the transaction would be complete, and you will be redirected to the page of the transferor shareholder .

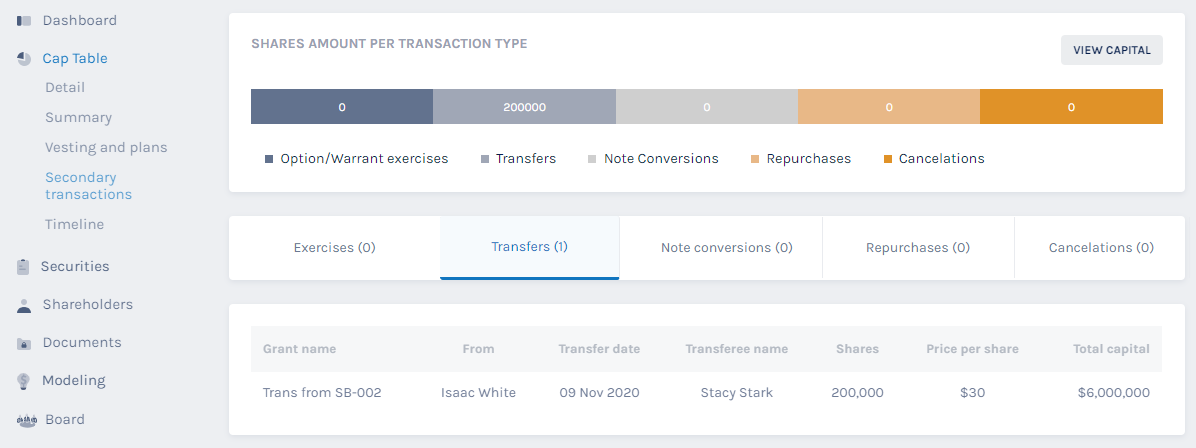

Step 5: To see the transfer and its effect on the secondary transactions of your cap table, you need to click on “Cap table” from the left side menu and then on “Secondary transactions” . This will take you to the following page.

Here, click on the “Transfers” tab to see the transfer transaction as shown below.

And just like this, you can easily make the transfer of shares in the company through Eqvista . To know more about the Eqvista app and how to use it, check out our knowledge center or contact us today!

More about Transfer of Shares

Interested in issuing & managing shares.

If you want to start issuing and managing shares, Try out our Eqvista App , it is free and all online!

- Legal GPS for Business

- All Contracts

- Member-Managed Operating Agreement

- Manager-Managed Operating Agreement

- S Corp LLC Operating Agreement

- Multi-Member LLC Operating Agreement

- Multi-Member LLC Operating Agreement (S Corp)

Assignment of Membership Interest: The Ultimate Guide for Your LLC

LegalGPS : November 30, 2023 at 8:16 AM

As a business owner, there may come a time when you need to transfer ownership of your company or acquire additional members. In these situations, an assignment of membership interest is a critical step in the process. This blog post aims to provide you with a comprehensive guide on everything you need to know about the assignment of membership interest and how to navigate the procedure efficiently. So, let's dive into the world of LLC membership interest transfers and learn how to secure your business!

What is an Assignment of Membership Interest?

An assignment of membership interest is a document that allows a member of an LLC to transfer their ownership share in the company to another person or entity. This can be done in the form of a sale or gift, which are two different scenarios that generally require different types of paperwork. An assignment is typically signed by the parties involved and delivered to the Secretary of State's office for filing. However, this process can vary depending on where you live and whether your LLC has members other than yourself as well as additional documents required by state law.

Necessary Approvals and Consent

Before initiating the assignment process, it's essential to review the operating agreement of your LLC, as it may contain specific guidelines on how to assign membership interests.

Often, these agreements require the express consent of the other LLC members before any assignment can take place. To avoid any potential disputes down the line, always seek the required approvals before moving forward with the assignment process.

Impact on Ownership, Voting, and Profit Rights

It's essential to understand that assigning membership interests can affect various aspects of the LLC, including ownership, voting rights, and profit distribution. A complete assignment transfers all ownership rights and obligations to the new member, effectively removing the original member from the LLC. For example, if a member assigns his or her interest, the new member inherits all ownership rights and obligations associated with that interest. This includes any contractual obligations that may be attached to the membership interest (e.g., a mortgage). If there is no assignment of interests clause in your operating agreement, then you will need to get approval from all other members for an assignment to take place.

On the other hand, a partial assignment permits the original member to retain some ownership rights while transferring a portion of their interest to another party. To avoid unintended consequences, it's crucial to clearly define the rights and responsibilities of each party during the assignment process.

Types of Membership Interest Transfers

Membership interest transfers can be either complete or partial, depending on the desired outcome. Understanding the differences between these two types of transfers is crucial in making informed decisions about your LLC.

Complete Assignment

A complete assignment occurs when a member transfers their entire interest in the LLC to another party, effectively relinquishing all ownership rights and obligations. This type of transfer is often used when a member exits the business or when a new individual or entity acquires the LLC.

For example, a member may sell their interest to another party that is interested in purchasing their share of the business. Complete assignment is also used when an individual or entity wants to purchase all of the interests in an LLC. In this case, the seller must receive unanimous approval from the other members before they can transfer their entire interest.

Partial Assignment

Unlike a complete assignment, a partial assignment involves transferring only a portion of a member's interest to another party. This type of assignment enables the member to retain some ownership in the business, sharing rights, and responsibilities proportionately with the new assignee. Partial assignments are often used when adding new members to an LLC or when existing members need to redistribute their interests.

A common real-world example is when a member receives an offer from another company to purchase their interest in the LLC. They might want to keep some ownership so that they can continue to receive profits from the business, but they also may want out of some of the responsibilities. By transferring only a partial interest in their membership share, both parties can benefit: The seller receives a lump sum payment for their share of the LLC and is no longer liable for certain financial obligations or other tasks.

How to Draft an Assignment of Membership Interest Agreement

A well-drafted assignment of membership interest agreement can help ensure a smooth and legally compliant transfer process. Here is a breakdown of the key elements to include in your agreement, followed by a step-by-step guide on drafting the document.

Key elements to include:

The names of the assignor (the person transferring their interest) and assignee (the person receiving the interest)

The name of your LLC and the state where it was formed

A description of the membership interest being transferred (percentage, rights, and obligations)

Any required approvals or consents from other LLC members

Effective date of the assignment

Signatures of all parties involved, including any relevant witnesses or notary public

Step 1: Gather Relevant Information

Before you begin drafting the agreement, gather all pertinent data about the parties involved and the membership interest being transferred. You'll need information such as:

The names and contact information of the assignor (the person transferring their interest) and assignee (the person receiving the interest)

The name and formation details of your LLC, including the state where it was registered

The percentage and value of the membership interest being transferred

Any specific rights and obligations associated with the membership interest

Step 2: Review the LLC's Operating Agreement

Examine your LLC's operating agreement to ensure you adhere to any predetermined guidelines on assigning membership interests. The operating agreement may outline specific procedures, required approvals, or additional documentation necessary to complete the assignment process.

If your LLC doesn't have an operating agreement or if it's silent on this matter, follow your state's default LLC rules and regulations.

Step 3: Obtain Necessary Approvals and Consents

Before drafting the assignment agreement, obtain any necessary approvals or consents from other LLC members as required by the operating agreement or state law. You may need to hold a members' meeting to discuss the proposed assignment and document members' consent in the form of a written resolution.

Step 4: Outline the Membership Interest Being Transferred

Detail the membership interest being transferred in the Assignment of Membership Interest Agreement. Specify whether the transfer is complete or partial, and include:

The percentage of ownership interest being assigned

Allocated profits and losses, if applicable

Voting rights associated with the transferred interest

The assignor's rights and obligations that are being transferred and retained

Any capital contribution requirements

Step 5: Determine the Effective Date of the Assignment

Set an effective date for the assignment, which is when the rights and obligations associated with the membership interest will transfer from the assignor to the assignee.

This date is crucial for legal and tax purposes and helps both parties plan for the transition. If you don’t specify an effective date in the assignment agreement, your state's law may determine when the transfer takes effect.

Step 6: Specify Conditions and Representations

In the agreement, outline any conditions that must be met before the assignment becomes effective. These could include obtaining certain regulatory approvals, fulfilling specific obligations, or making required capital contributions.

Additionally, you may include representations from the assignor attesting that they have the legal authority to execute the assignment. Doing this is important because it can prevent a third party from challenging the assignment on grounds of lack of authority. If the assignor is an LLC or corporation, be sure to specify that it must be in good standing with all necessary state and federal regulatory agencies.

Step 7: Address Tax and Liability Issues

Clearly state that the assignee will assume responsibility for any taxes, liabilities, and obligations attributable to the membership interest being transferred from the effective date of the assignment. You may also include indemnification provisions that protect each party from any potential claims arising from the other party's actions.

For example, you can include a provision that provides the assignor with protection against any claims arising from the transfer of membership interests. This is especially important if your LLC has been sued by a member, visitor, or third party while it was operating under its current management structure.

Step 8: Draft the Entire Agreement and Governing Law Clauses

In the closing sections of the assignment agreement, include clauses stating that the agreement represents the entire understanding between the parties concerning the assignment and supersedes any previous agreements or negotiations. Specify that any modifications to the agreement must be made in writing and signed by both parties. Finally, identify the governing law that will apply to the agreement, which is generally the state law where your LLC is registered.

This would look like this:

Step 9: Review and Sign the Assignment Agreement

Once you've drafted the Assignment of Membership Interest Agreement, ensure that all parties carefully review the document to verify its accuracy and completeness. Request a legal review by an attorney, if necessary. Gather the assignor, assignee, and any necessary witnesses or notary public to sign the agreement, making it legally binding.

Sometimes the assignor and assignee will sign the document at different times. If this is the case, then you should specify when each party must sign in your Assignment Agreement.

Importance of a Professionally-drafted Contract Template

To ensure a smooth and error-free assignment process, it's highly recommended to use a professionally-drafted contract template. While DIY options might seem tempting, utilizing an expertly-crafted template provides several distinct advantages.

Advantages of using a professionally-created template:

Accuracy and Compliance: Professionally-drafted templates are designed with state-specific regulations in mind, ensuring that your agreement complies with all necessary legal requirements.

Time and Cost Savings: With a pre-written template, you save valuable time and resources that can be better spent growing your business.

Reduced Legal Risk: Legal templates created by experienced professionals significantly reduce the likelihood of errors and omissions that could lead to disputes or litigations down the road.

How our contract templates stand out from the rest:

We understand the unique needs of entrepreneurs and business owners. Our contract templates are designed to provide a straightforward, user-friendly experience that empowers you with the knowledge and tools you need to navigate complex legal processes with ease. By choosing our Assignment of Membership Interest Agreement template, you can rest assured that your business is in safe hands. Click here to get started!

Frequently Asked Questions (FAQs) about Assignment of Membership Interest

As you embark on the journey of assigning membership interest in your LLC, here are some frequently asked questions to help address any concerns you may have:

Is an assignment of membership interest the same as a sale of an LLC? No. While both processes involve transferring interests or assets, a sale of an LLC typically entails the sale of the entire business, whereas an assignment of membership interest relates to the transfer of some or all membership interests between parties.

Do I need an attorney to help draft my assignment of membership interest agreement? While not mandatory, seeking legal advice ensures that your agreement complies with all relevant regulations, minimizing potential legal risks. If you prefer a more cost-effective solution, consider using a professionally-drafted contract template like the ones we offer at [Your Company Name].

Can I assign my membership interest without the approval of other LLC members? This depends on your LLC's operating agreement and state laws. It's essential to review these regulations and obtain any necessary approvals or consents before proceeding with the assignment process.

Do you need a lawyer for this?

The biggest question now is, "Do you need to hire a lawyer for help?" Sometimes, yes ( especially if you have multiple owners ). But often for single-owner businesses, you don't need a lawyer to start your business .

Many business owners instead use tools like Legal GPS for Business , which includes a step-by-step, interactive platform and 100+ contract templates to help you start and grow your company.

We hope this guide provides valuable insight into the process of assigning membership interest in your LLC. By understanding the legal requirements, implications, and steps involved, you can navigate this essential task with confidence. Ready to secure your business with a professionally-drafted contract template? Visit our website to purchase the reliable and user-friendly Assignment of Membership Interest Agreement template that enables your business success.

Committed to offering clients expert, personalised legal advice

Assignment of shares in case of a limited company: required documents

In case of limited liability companies, shareholders may assign their shares. This assignment procedure may be performed by a Romanian lawyer .

A consequence of such a share assignment is that the assignor – the person assigning his shares, leaves the company and therefore loses his capacity of shareholder, while the assignee – the person who receives the shares – continues the activity of the company by acquiring the capacity of shareholder.

The share assignment procedure must be carried out at the Trade Registry. Lawyers appointed in this regard shall submit on behalf of the limited liability company (Ltd) all required documents.

Assigning shares is a procedure that may require two steps (if shares are assigned to persons outside the Ltd) or one single step (if shares are assigned to one or more of the Ltd’s existing shareholders). Shares may be assigned to individuals or companies (Romanian or foreign).

Two-step assignment of shares

Documents that need to be prepared as a first step:

- request for the assignment of shares;

- Decision of the General Assembly of Shareholders or, as the case may be, Decision of the sole shareholder (the assignment of shares must be expressly stipulated and all necessary information regarding the assignment);

- Assignment Agreement between the assignor and the assignee;

It is possible to be represented by a Romanian lawyer based on a special power of attorney.

Documents that need to be prepared during the second phase of the procedure:

- Registration request;

- Proof that the Decision of the General Assembly of Shareholders or the Decision of the sole shareholder was published in the Official Gazette;

- Decision of the General Assembly of Shareholders or, as the case may be, the Decision of the sole shareholder, which must include information about the assignment of shares;

- Copies of the individuals’ Identity Cards and, as the case may be, of the incorporation certificates in the case of companies, of those who shall acquire the capacity of shareholder;

- Statement given by the shareholder – company – that it complies with all required conditions for acting in the capacity of shareholder;

- Incorporation certificate, original or a copy bearing an Apostil, from the Trade Registry where the foreign company is registered, certifying its existence;

- Restated Articles of Incorporation – original copy.

Publisher: Budusan si Asociatii

Corporate legal services

Personal legal services, member directory, knowledge hub, legal information.

We use cookies to gather certain statistics and detect bots. These statistics will not be used for advertising purposes or similar by our organisation, they are only used to count page views using Google Analytics.

Understanding an assignment and assumption agreement

Need to assign your rights and duties under a contract? Learn more about the basics of an assignment and assumption agreement.

Get your assignment of agreement

by Belle Wong, J.D.

Belle Wong, is a freelance writer specializing in small business, personal finance, banking, and tech/SAAS. She ...

Read more...

Updated on: November 24, 2023 · 3 min read

The assignment and assumption agreement

The basics of assignment and assumption, filling in the assignment and assumption agreement.

While every business should try its best to meet its contractual obligations, changes in circumstance can happen that could necessitate transferring your rights and duties under a contract to another party who would be better able to meet those obligations.

If you find yourself in such a situation, and your contract provides for the possibility of assignment, an assignment and assumption agreement can be a good option for preserving your relationship with the party you initially contracted with, while at the same time enabling you to pass on your contractual rights and duties to a third party.

An assignment and assumption agreement is used after a contract is signed, in order to transfer one of the contracting party's rights and obligations to a third party who was not originally a party to the contract. The party making the assignment is called the assignor, while the third party accepting the assignment is known as the assignee.

In order for an assignment and assumption agreement to be valid, the following criteria need to be met:

- The initial contract must provide for the possibility of assignment by one of the initial contracting parties.

- The assignor must agree to assign their rights and duties under the contract to the assignee.

- The assignee must agree to accept, or "assume," those contractual rights and duties.

- The other party to the initial contract must consent to the transfer of rights and obligations to the assignee.

A standard assignment and assumption contract is often a good starting point if you need to enter into an assignment and assumption agreement. However, for more complex situations, such as an assignment and amendment agreement in which several of the initial contract terms will be modified, or where only some, but not all, rights and duties will be assigned, it's a good idea to retain the services of an attorney who can help you draft an agreement that will meet all your needs.

When you're ready to enter into an assignment and assumption agreement, it's a good idea to have a firm grasp of the basics of assignment:

- First, carefully read and understand the assignment and assumption provision in the initial contract. Contracts vary widely in their language on this topic, and each contract will have specific criteria that must be met in order for a valid assignment of rights to take place.

- All parties to the agreement should carefully review the document to make sure they each know what they're agreeing to, and to help ensure that all important terms and conditions have been addressed in the agreement.

- Until the agreement is signed by all the parties involved, the assignor will still be obligated for all responsibilities stated in the initial contract. If you are the assignor, you need to ensure that you continue with business as usual until the assignment and assumption agreement has been properly executed.

Unless you're dealing with a complex assignment situation, working with a template often is a good way to begin drafting an assignment and assumption agreement that will meet your needs. Generally speaking, your agreement should include the following information:

- Identification of the existing agreement, including details such as the date it was signed and the parties involved, and the parties' rights to assign under this initial agreement

- The effective date of the assignment and assumption agreement

- Identification of the party making the assignment (the assignor), and a statement of their desire to assign their rights under the initial contract

- Identification of the third party accepting the assignment (the assignee), and a statement of their acceptance of the assignment

- Identification of the other initial party to the contract, and a statement of their consent to the assignment and assumption agreement

- A section stating that the initial contract is continued; meaning, that, other than the change to the parties involved, all terms and conditions in the original contract stay the same

In addition to these sections that are specific to an assignment and assumption agreement, your contract should also include standard contract language, such as clauses about indemnification, future amendments, and governing law.

Sometimes circumstances change, and as a business owner you may find yourself needing to assign your rights and duties under a contract to another party. A properly drafted assignment and assumption agreement can help you make the transfer smoothly while, at the same time, preserving the cordiality of your initial business relationship under the original contract.

You may also like

What does 'inc.' mean in a company name?

'Inc.' in a company name means the business is incorporated, but what does that entail, exactly? Here's everything you need to know about incorporating your business.

October 9, 2023 · 10min read

How to write a will: A comprehensive guide to will writing

Writing a will is one of the most important things you can do for yourself and for your loved ones, and it can be done in just minutes. Are you ready to get started?

April 25, 2024 · 11min read

How to start an LLC in 7 steps: A complete guide for 2024

It's easy to create a new LLC by filing paperwork with the state. But to set yourself up for success, you'll also need to think about your business name, finances, an operating agreement, and licenses and permits. Here's a step-by-step guide.

March 21, 2024 · 20min read

Difference Between Assignment and Transfer

The difference between assignment and transfer is that assign means it's legal to transfer property or a legal right from one person to another. 3 min read updated on February 01, 2023

The difference between assignment and transfer is that assign means it's legal to transfer property or a legal right from one person to another, while transfer means it's legal to arrange for something to be controlled by or officially belong to another person.

When used as verbs, assign means to set apart or designate something for a purpose while transfer means to pass or move from one person, place, or thing to someone or someplace else. When used as nouns, assign means the assignee and transfer is the act of removing or conveying something from one person, thing, or place to another. Transfer generally refers to titles whereas assignment is used with obligations and rights.

Definitions of Assignment and Transfer

- Assignment: Assignment is used in real estate law and contracts law. It covers the transfer of rights held by the assignor to the assignee.

- Transfer: To remove or convey from one person or place to someone or somewhere else.

Distinction Between Assignment and Transfer

When distinguishing between assignment and transfer, take licenses, for example. Licenses are contracts that don't allow legal action for infringement. They fall under state law. Therefore, state law will decide whether the license is an obligation or right that can be transferred or assigned legally.

One way to distinguish this example is that an individual contract under an agreement cannot be assigned, like entitlement to grant back royalties . In addition, the contract cannot be transferred. You need to break it down and figure out what the actual issue is — the parties' intent. An additional distinction is when the contract holder is an entity and the business owners want to transfer a portion or all of their stock. This can be seen as an implied transfer of the whole contract. However, it would not likely be an assignment of the rights covered under this agreement.

Difference Between Assign and License

The key difference between assign and license is that with a license, the person who grants permission, known as the licensor, keeps an interest in the product being licensed . In an assignment, the assignor will transfer his or her rights to the product or property being assigned.

Another difference is that assignments must be in writing and a license can be executed without being written. Consider, for example, intellectual property such as patents. Patents can be licensed verbally in some instances, but assignments for patents must be in writing and filed with the United States Patent and Trademark Office .

Assignments grant the assignee full ownership of a product or property. Therefore, an assignment will typically cost more to acquire than a license.

Frequently Asked Questions

Are there ever situations in which a license can be transferred but is not assignable?

- Yes, in the case of allowing an assignment to one of your affiliates, the assignor would still be liable for the performance of the agreement under general assignment law. In this situation, you would not typically permit a transfer, because in a transfer, the person transferring would not maintain any obligations related to performance. Don't rely solely on this general understanding, but still expressly detail your agreement on what a licensee can legally do.

How will transfer and assignment rights affect someone's ability to sublicense?

- In theory, if a licensee has the authority to assign license rights to someone else, you could argue that it also provides the right to sublicense it. The issue here is that with a sublicense, the person sublicensing it keeps a license right, therefore effectively creating two licensees. With an assignment, only one right is assigned, and the assignee is the one who has possession of the license. With well-drafted licenses, the right to sublicense is not typically implied, as the licensor is the one who reserves all rights that are not expressly granted.

What is the effect of poorly drafted licenses?

- A poorly drafted license could result in giving someone implied rights to also sublicense. An example is a software license that allows a licensee to access the software without clarifying any restrictions or clearly defining the word “use.” This means that, depending on what this software is supposed to do, someone could think the term “use” means the licensee has permission to grant a sublicense as part of their usage rights.

If you need help understanding the difference between assignment and transfer, you can post your legal need on UpCounsel's marketplace. UpCounsel only accepts the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

- Assignment Law

- Assignment and Novation Agreement: What You Need to Know

- Legal Assignment

- Assignment Legal Definition

- Assignment Of Contracts

- Assignment of Rights and Obligations Under a Contract

- Partial Assignment of Contract

- Assignment of Rights Example

- What Is the Definition of Assigns

- Transfer of Intellectual Property

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Deed of Assignment of Stock Subscription

Rating: 4.5 - 2 votes

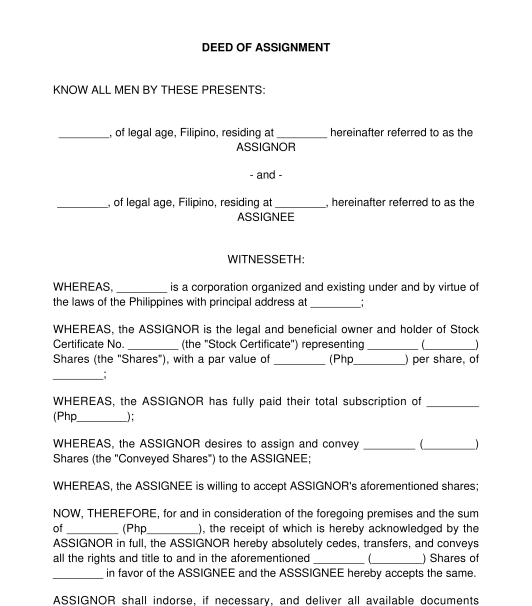

A Deed of Assignment of Stock Subscription is a written document used to transfer shares of stock of a corporation from the registered owner (the "assignor") to another person (the "assignee"). It should specify the names of the parties , the date of the transfer , the number of the stock certificate that represents the shares to be transferred, and the number of shares that will be transferred.

Only shares that have been fully paid are transferable. This means that if the assignor has not yet paid the full amount of the subscription, then the shares under the subscription cannot be transferred .

In order to transfer the shares, the stock certificate should be endorsed by the owner or any person legally authorized to make the transfer. Indorsement means signing the back of the stock certificate.

Finally, the transfer of shares will only be valid between the parties until it is recorded in the books of the corporation.

How to use this document

This document can be used by the registered owner of shares of stock of a corporation to transfer the shares (or part of the shares) to another person. It assumes that the purchase price for the shares has been fully paid .

The user should complete the document by entering the information required in the document. Once it is completed, the assignor and the assignee should sign the document .

This Deed of Assignment also includes an Acknowledgment. An Acknowledgment is an act of a person before a notary public stating that the signature on a document was voluntarily affixed by him and he executed the document as his free and voluntary act . Acknowledging a document before a notary public turns the document into a public document . Public documents are generally self-authenticating, meaning no other evidence will be needed to prove the execution of the document.

The Documentary Stamp Tax ("DST") and other applicable taxes, such as the Capital Gains Tax , should also be paid to the Bureau of Internal Revenue ("BIR") by the assignor or the assignee. The DST is required to be paid for any issuance or transfer of shares. The BIR shall issue a Certificate Authorizing Registration ("CAR") once the DST and other taxes are paid.

The assignor or assignee can then present the document, together with the endorsed stock certificate and the CAR , to the Corporate Secretary so the transfer can be recorded in the books of the corporation .

Applicable law

The Revised Corporation Code and the general laws of contracts and obligations found in the Civil Code govern the transfer of shares. However, other laws, their rules and regulations, and SEC rules may affect the conduct and transactions of the Corporation such as but not limited to the 1987 Constitution of the Philippines , the Securities Regulation Code, the Foreign Investment Act, the Republic Act 8179, specifically the Foreign Investment Negative List, the Anti-Money Laundering Act, and the Anti-Dummy Law may affect the ownership requirements of a corporation, depending on the business of the corporation. Tax laws may also affect the transfer of the shares.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

- What to do after Creating a Contract?

- When and how to Notarize a Document?

Other names for the document:

Deed of Assignment, Deed of Assignment of Shares, Deed of Assignment of Stock, Deed of Assignment of Shares of Stock, Deed of Transfer of Stock Subscription

Country: Philippines

General Business Documents - Other downloadable templates of legal documents

- Acknowledgement Receipt

- Minutes of the Meeting of the Stockholders

- Notice for Non-Renewal of Contract

- Loan Agreement

- Secretary's Certificate

- Minutes of the Meeting of the Board of Directors

- Monetary Demand Letter

- Notice of Meeting

- Letter of Consent of Nominee

- Business Name Change Letter

- Release, Waiver, and Quitclaim (One-Way)

- Notice of Dishonor for Bounced Check

- Withdrawal of Consent of Nominee

- Request to Alter Contract

- Subscription Agreement for Shares of Stock

- Breach of Contract Notice

- Affidavit of Closure of Business

- Debt Assignment and Assumption Agreement

- Notice of Death or Insolvency of a Partner

- Other downloadable templates of legal documents

- More from M-W

- To save this word, you'll need to log in. Log In

Definition of assignment

task , duty , job , chore , stint , assignment mean a piece of work to be done.

task implies work imposed by a person in authority or an employer or by circumstance.

duty implies an obligation to perform or responsibility for performance.

job applies to a piece of work voluntarily performed; it may sometimes suggest difficulty or importance.

chore implies a minor routine activity necessary for maintaining a household or farm.

stint implies a carefully allotted or measured quantity of assigned work or service.

assignment implies a definite limited task assigned by one in authority.

Examples of assignment in a Sentence

These examples are programmatically compiled from various online sources to illustrate current usage of the word 'assignment.' Any opinions expressed in the examples do not represent those of Merriam-Webster or its editors. Send us feedback about these examples.

Word History

see assign entry 1

14th century, in the meaning defined at sense 1

Phrases Containing assignment

- self - assignment

Dictionary Entries Near assignment

Cite this entry.

“Assignment.” Merriam-Webster.com Dictionary , Merriam-Webster, https://www.merriam-webster.com/dictionary/assignment. Accessed 3 May. 2024.

Legal Definition

Legal definition of assignment, more from merriam-webster on assignment.

Nglish: Translation of assignment for Spanish Speakers

Britannica English: Translation of assignment for Arabic Speakers

Subscribe to America's largest dictionary and get thousands more definitions and advanced search—ad free!

Can you solve 4 words at once?

Word of the day.

See Definitions and Examples »

Get Word of the Day daily email!

Popular in Grammar & Usage

What’s the difference between ‘hillbilly’ and ‘redneck’, more commonly misspelled words, commonly misspelled words, how to use em dashes (—), en dashes (–) , and hyphens (-), absent letters that are heard anyway, popular in wordplay, words of the week - may 3, 9 superb owl words, 'gaslighting,' 'woke,' 'democracy,' and other top lookups, 10 words for lesser-known games and sports, your favorite band is in the dictionary, games & quizzes.

We couldn’t find any results matching your search.

Please try using other words for your search or explore other sections of the website for relevant information.

We’re sorry, we are currently experiencing some issues, please try again later.

Our team is working diligently to resolve the issue. Thank you for your patience and understanding.

News & Insights

AMZN vs. META: Which Magnificent Seven Stock Is Better?

May 02, 2024 — 08:28 pm EDT

Written by Michelle deBoer-Jones for TipRanks ->

Of course, neither company needs an introduction, but Amazon is an e-commerce and cloud-computing giant, while Meta Platforms owns and operates several social networks, including Facebook, Instagram, WhatsApp, and others.

Shares of Amazon are up 15% year-to-date and have soared 69% over the last year, while Meta Platforms stock is up 22% year-to-date and 80% over the last 12 months.

Although their year-to-date performances are somewhat similar, that’s where the similarities between these two companies end. While both are part of the so-called “Magnificent Seven” stocks, they operate in totally different businesses despite both having a technology bent.

However, a closer look at their latest earnings results and the market’s reactions to those reports reveals something very interesting. In short, investors initially rewarded one for spending more on artificial intelligence technology and punished the other for the same thing.

It seems clear that both Amazon and Meta Platforms could benefit from improved AI technology, but unfortunately, this sort of manic-depressive behavior is commonplace on Wall Street right now. Let’s see if those totally opposite reactions were warranted.

Amazon (NASDAQ:AMZN)

At a P/E of 50.9x, Amazon is trading at a discount to its five-year mean price-to-earnings (P/E) ratio of 72.2x. Its forward P/E of about 36.4x is also quite attractive and suggests analysts are projecting significant increases in earnings over the next 12 months. Thus, a bullish view seems appropriate, especially considering the cloud computing results in Amazon’s latest earnings report.

For the first quarter, Amazon reported adjusted earnings of 98 cents per share on $143.3 billion in revenue versus the consensus estimates of 84 cents per share on $142.5 billion in revenue. Sales in North America rose 12% year-over-year to $86.3 billion, while international sales grew 10% year-over-year to $31.9 billion. Revenues in the cloud computing segment, Amazon Web Services (AWS), surged 17% year-over-year to reach $25 billion.

Amazon’s management guided for second-quarter revenue of $144 billion to $149 billion, which came up short of the consensus estimate of $150.1 billion, and operating income to be between $10 billion and $14 billion. Analysts are also projecting adjusted earnings of $1.02 per share for the second quarter.

Although Amazon stock initially dropped after the April 30 earnings release, it recovered quickly, soaring from about $179 before the release to around $185 now. This action is particularly interesting in light of the company’s disappointing guidance, as the Street has typically been punishing companies that come up short of expectations in their outlooks.

However, the initial post-earnings drop could have been due to the press release with the disappointing guidance, with the rebound coming after the earnings call On that call, Amazon CEO Andy Jassy attributed the recently achieved $100 billion annual revenue run rate for AWS to their AI-related enhancements.

Evercore ISI analyst Mark Mahaney also told clients in a note on Tuesday that it was the first quarter since Q3 2022 in which AWS’s total-dollar revenue growth surpassed that of Microsoft’s ( NASDAQ:MSFT ) Azure. In fact, AWS is becoming more profitable as well, with its operating income jumping 84% to $9.4 billion and its operating margin expanding to 37.6% from 24% in the year-ago quarter.

All of this adds up to a bright future for Amazon, which suggests that it’s meaningfully undervalued at current multiples.

What Is the Price Target for AMZN Stock?

Amazon has a Strong Buy consensus rating based on 42 Buys, zero Holds, and zero Sell ratings assigned over the last three months. At $213.74, the average Amazon stock price target implies upside potential of 18.65%.

Meta Platforms (NASDAQ:META)

At its current P/E of about 25.1x, Meta Platforms is trading roughly in line with its five-year mean P/E of about 26.5 x. Its forward P/E of 21.6x suggests analysts are looking for a relatively small earnings increase over the next 12 months, but it’s not a significant drop between the current and forward P/E, suggesting a bit more stability rather than soaring earnings to come. Thus, a neutral view seems appropriate, especially considering a key piece of the latest earnings report.

Meta Platforms posted its latest earnings results on April 24, reporting adjusted earnings of $4.71 per share on $36.45 billion in revenue versus the consensus numbers of $4.32 per share on $36.15 billion in revenue . However, investors were displeased with the company’s revised outlook, which boosted its expected capital expenditures.

Meta now expects to spend between $35 billion and $40 billion on capital expenditures (capex) this year, up from the previous guidance of $30 billion to $37 billion. The company said those increased capex will enable it to speed up its infrastructure investments in support of its AI roadmap .

Meta stock plunged $50 following that release, as investors actually penalized the company for its increased AI spending. However, a key difference from Amazon is that Amazon is already showing results from its AI investments, while Meta is merely planning for future AI enhancements. Of course, Meta has already rolled out some AI enhancements, like its AI chatbot, but it clearly is planning much more with that sizable increase in capex.

Additionally, Meta’s Reality Labs division continues to report sizable losses, so investors may be concerned about the company’s ability to transform new technologies into profits. In the first quarter, Reality Labs posted a loss of $3.85 billion, bringing its losses to more than $45 billion since the end of 2020.

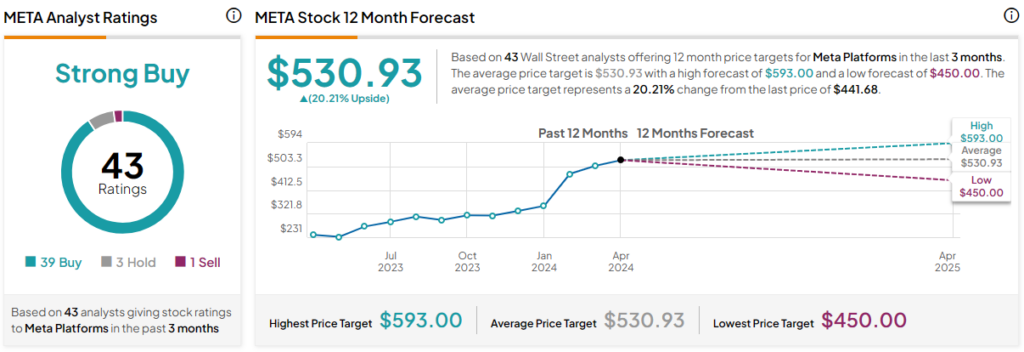

What Is the Price Target for META Stock?

Meta Platforms has a Strong Buy consensus rating based on 39 Buys, three Holds, and one Sell rating assigned over the last three months. At $530.93, the average Meta Platforms stock price target implies upside potential of 20.2%.

Conclusion: Bullish on AMZN, Neutral on META

While it’s hard to go wrong with Amazon or Meta Platforms, Amazon is the clear winner of this pairing due to its valuation, successful implementation of AI to boost demand, and results from its cloud computing division, AWS.

On the other hand, Meta’s AI ambitions are incomplete as it significantly boosts spending on AI. As a result, those AI efforts look like a bit of a show-me story, at least until the capital is spent and we see the results of those ambitions. It’s understandable that investors would be concerned about Meta’s ability to turn its new technologies into earnings based on the Reality Labs losses that are piling up.

Disclosure

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Stocks mentioned

More related articles.

This data feed is not available at this time.

Sign up for the TradeTalks newsletter to receive your weekly dose of trading news, trends and education. Delivered Wednesdays.

To add symbols:

- Type a symbol or company name. When the symbol you want to add appears, add it to My Quotes by selecting it and pressing Enter/Return.

- Copy and paste multiple symbols separated by spaces.

These symbols will be available throughout the site during your session.

Your symbols have been updated

Edit watchlist.

- Type a symbol or company name. When the symbol you want to add appears, add it to Watchlist by selecting it and pressing Enter/Return.

Opt in to Smart Portfolio

Smart Portfolio is supported by our partner TipRanks. By connecting my portfolio to TipRanks Smart Portfolio I agree to their Terms of Use .

- Live on Sky

- Get Sky Sports

- Sky Mobile Apps

- Kick It Out

- Black Lives Matter

- British South Asians in Football

Premier League spending cap rules explained: What might clubs be allowed to spend from the 2025/26 season?

Premier League clubs voted for new spending rules from the 2025/26 season; clubs may only be able to spend a maximum of 70 to 85 per cent amount of their revenue, there may also be 'anchoring' rules in place; Man Utd, Man City and Aston Villa voted against new rules, Chelsea abstained

Sky Sports News Chief Reporter

Tuesday 30 April 2024 14:08, UK

Please use Chrome browser for a more accessible video player

Premier League clubs have voted in principle for plans to introduce a spending cap from the 2025/26 season.

The rules, should they be approved in a final vote later this year, will replace the current Profit and Sustainability Rules (PSR) which have caused controversy in the Premier League this season.

Everton and Nottingham Forest were handed points deductions this season, which are still subject to appeal with a few weeks of the season to go, for breaching the current rules - causing top-flight clubs to reconsider the financial rules.

- Forest handed four-point deduction | Everton handed second points deduction

- Stream Sky Sports with NOW | Get Sky Sports

- Transfer Centre LIVE! | Papers - latest headlines

In a central London meeting on Monday, Premier League clubs discussed proposed new rules which included a spending cap on player wages, transfer fees and agent fees.

Sky Sports News chief reporter Kaveh Solhekol runs through the prospective new rules and what they mean for the Premier League clubs...

- Neville meets Ten Hag: Kane, Hojlund & Man Utd's style of play

- Angry Ange: Chelsea defeat on me | Redknapp: He looks a beaten man

- Papers: Chelsea send Conte 'lucrative offer' for return

- Transfer Centre LIVE! 'Man Utd 'favourites' to land Olise'

- Premier League build-up LIVE! Howe, Ange, Klopp & more

- PL Predictions: Everton to send Luton packing

- 'Stop passing it backwards!' Ange loses cool in explosive touchline rant

- Max: I don't blame Newey for leaving Red Bull

- Chelsea 2-0 Tottenham - highlights and recap

- Poch: I don't know if I'll get time | Nev: Sacking him would be madness

- Latest News

What will Premier League clubs be allowed to spend from 2025/26?

The details still need to be worked on but clubs not in Europe would be allowed to spend 85 per cent of their club revenue on squad costs. That involves wages for their players, amortised transfer fees and also agent fees.

The clubs that are in Europe would be allowed to spend a maximum of 70 per cent on squad costs. That is also in line with UEFA rules.

Stream Sky Sports on NOW

Live Premier League table

Get Sky Sports on WhatsApp!

But what a lot of people have noticed is if you can only spend a maximum of 85 per cent of your revenue on your squad and you are a rich club, then you will always be able to spend more on your squad than the poorer clubs.

So what is the solution? There may also be 'anchoring' rules.

What is anchoring?

It's going to be something you're going to hear a lot about.

In its purest and simple form, it means all clubs would only be able to spend a maximum of the multiple of what the bottom club earns in TV revenue.

At the moment, the bottom club gets £103.6m. If the anchoring multiple, and this has been discussed, is going to be 4.5, then you would do £103.6m x 4.5, which results in £466m.

So £466m would be the spending cap in that instance. That is the maximum cap on what clubs would be allowed to spend on wages, amortised transfer fees and also agent fees.

The details are still to be ironed out, so the multiple may not necessarily be 4.5. This is what is being worked on at the moment.

Will these new rules definitely be approved?

These rules are in principle, so we haven't had the final vote yet.

What is happening now is Premier League executives, having had the green light from the clubs to do some more work on these proposals, will go away and draw up the legal rulebook, update that and then present it at the Premier League AGM next month, when there will be a final vote.

But it looks all but certain that we will have the 'anchoring' rules and the spending cap from the season after next because when an informal vote was taken on Monday, only three clubs voted against the spending cap: Manchester United, Manchester City and Aston Villa . Chelsea abstained from voting.

Why did those clubs vote against it?

This whole concept of 'anchoring' is controversial. The Premier League has become the biggest, most exciting league in the world because clubs have been allowed to spend a lot of money on their squads, wages, agents fees and the infrastructure on their stadiums. Critics will say it will move in a different direction if you restrain how much clubs can spend on their squads.

If you tell Man City: 'you can only spend £466m on your squad', they can come back on you and say: 'Our turnover is £800m to £900m, who are you to tell us how much money we can spend on our squad?' If you've earned the money, you feel you should have the right to spend the money.

As for Manchester United, there's obviously new money there and Sir Jim Ratcliffe has bought 25 per cent of the club. They want to invest and turn things around and they feel having a spending cap in place might mean they have to operate with one hand tied behind their back.

There are also concerns it will affect how competitive the big clubs are in Europe. Other countries have their own spending rules as well, but for the Premier League to maintain its position as the most watched and most exciting football league in the world, a lot of people would say that Premier League clubs should be allowed to spend what their owners want to spend as long as there isn't the threat of clubs going out of business.

How is this different from PSR?

There's a general acceptance that the current PSR rules are not fit for purpose - that is why clubs want to change the rules.

The issue with these PSR rules is that clubs are allowed to lose a maximum of £105m over three seasons.

We have seen clubs such as Everton and Nottingham Forest lose war with that and that has led to a lot of trouble - the situations with points deductions, appeals and it affects the league table. All the independent tribunals and appeals have been a distraction and it has, I think, affected the image and integrity of the Premier League.

That is why the Premier League clubs have got together and said: 'we need to have new rules and we need them quickly.'

We are going to have the PSR rules for next season. These new financial regulations would come in the season after next.

Analysis: Winners could be Brighton, Brentford & Bournemouth

Football finance expert Kieran Maguire speaking to Sky Sports:

"It's a bit like having a credit card, just because you've got the limit to spend a huge amount of money, it doesn't mean it's a good thing. The biggest winners potentially would be clubs like Brentford, Brighton and Bournemouth who have modest wage bills - they're probably paying on average £45,000 per week.

"They could double or treble that and still be within the rules. Clubs like that who have used the transfer market well, they could spend a lot more. Villa and Newcastle would love it if these rules were purely adopted and no other rules were alongside them. But I don't see an overall impact as it's the UEFA rules that will drag the clubs back."

Ad content | Stream Sky Sports on NOW

Stream Sky Sports live with no contract on a Month or Day membership on NOW. Instant access to live action from the Premier League, EFL, F1, England Cricket and so much more.

You can now start receiving messages and alerts for the latest breaking sports news, analysis, in-depth features and videos from our dedicated WhatsApp channel!

Find out more here...

Correctly predict six scorelines for a chance to win £250,000 for free. Entries by 3pm Saturday.

How to watch Premier League, EFL, WSL, Scottish Premiership, F1 and more

- Stream with NOW

- Upgrade Now

What is Tesla's Full Self-Driving and why its China rollout matters

- Medium Text

WHAT IS FSD?

Why is fsd available only on a limited basis in china, what would an fsd rollout in china mean for tesla, what might an fsd rollout mean for china.

Sign up here.

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Thomson Reuters

Brenda Goh is Reuters’ Shanghai bureau chief and oversees coverage of corporates in China. Brenda joined Reuters as a trainee in London in 2010 and has reported stories from over a dozen countries.

Business Chevron

Germany's Henkel raises 2024 outlook on strong Q1

German consumer goods company Henkel slightly raised its guidance for 2024 on Friday, saying strong performance in the first quarter had boosted its sales and earnings outlook.

India's MRF reported a surprise drop in its fourth-quarter profit on Friday, as the tyre maker faced pressure from a spike in rubber prices.

Transfer Guard Atin Wright Signs With UNT

4/29/2024 11:06:00 AM | Men's Basketball

For more information on UNT men's basketball tickets, contact the Mean Green Ticket Office at 940-565-2527 or at [email protected]. Fans can visit the UNT Athletics Ticket Office located at Gate 2 of DATCU Stadium between 9 a.m. and 5 p.m. Monday through Friday.

IMAGES

VIDEO

COMMENTS

An option assignment represents the seller's obligation to fulfill the terms of the contract by either selling or buying the underlying security at the exercise price. This obligation is triggered when the buyer of an option contract exercises their right to buy or sell the underlying security. To ensure fairness in the distribution of American ...

Assignment: An assignment is the transfer of an individual's rights or property to another person or business. For example, when an option contract is assigned, an option writer has an obligation ...

Assignment of Shares means the Assignment of Shares in substantially the form set forth on Schedule E. Sample 1. Based on 1 documents. Assignment of Shares means the assignment by the Guarantor to the Lender, dated as of the 5th day of June, 2003, of the interest of the Guarantor in the shares of the Borrower; Sample 1.

The share transfer form, which is also known as a share transfer instrument, is a standard document that is needed for the transfer of shares in a company. This document is used when a shareholder or the company wants to sell or gift their company shares to another person or company. The document is simple, where it outlines the particulars of ...

Updated November 2, 2020: A stock assignment agreement is the transfer of ownership of stock shares. It occurs when one party legally transfers their shares of stock property to another party or to a business. It's like the type of assignment agreement that happens when one person sells a car to another, which can also be referred to as ...

An assignment of membership interest is a document that allows a member of an LLC to transfer their ownership share in the company to another person or entity. This can be done in the form of a sale or gift, which are two different scenarios that generally require different types of paperwork. An assignment is typically signed by the parties ...

Transfer of shares is the voluntary act of passing on the ownership of shares to another individual. It can occur for various reasons, such as the need for capital for the transferor or a gift for the transferor's dear ones. The transfer completion is subject to approval from the company's board of directors.

The share assignment procedure must be carried out at the Trade Registry. Lawyers appointed in this regard shall submit on behalf of the limited liability company (Ltd) all required documents. Assigning shares is a procedure that may require two steps (if shares are assigned to persons outside the Ltd) or one single step (if shares are assigned ...

The assignment and assumption agreement. An assignment and assumption agreement is used after a contract is signed, in order to transfer one of the contracting party's rights and obligations to a third party who was not originally a party to the contract. The party making the assignment is called the assignor, while the third party accepting ...

Signing. An assignment of a UK patent (or application) must be in writing and signed by the assignor. It used to be the case that an assignment of a UK patent (or application) would need to be ...

The difference between assignment and transfer is that assign means it's legal to transfer property or a legal right from one person to another, while transfer means it's legal to arrange for something to be controlled by or officially belong to another person. When used as verbs, assign means to set apart or designate something for a purpose ...

from acquiring any Shares that would cause such future transferee to own, directly or indirectly, either: (a) in excess of 9.9% (in value or number of shares) of the Company's outstanding common stock; or (b) a number of Shares that would cause 50.0% or more of the Company's outstanding common stock to be held by five or fewer individuals. 6.

Inter vivos Assignment of Shares: Inter vivos assignment refers to the transfer of shares during the owner's lifetime. This can be a voluntary or involuntary assignment and is often seen during estate planning, where an individual decides to gift their shares to a family member, friend, or beneficiary. 4.