PhD in Risk Management and Insurance

Program Overview

The PhD in Business Administration with a focus on Risk Management and Insurance (RMI) is designed to help students develop an understanding of both theoretical and applied aspects of insurance, risk management and employee benefits. The Terry College provides an excellent opportunity for those interested in pursuing a PhD in risk management and insurance. Some of the benefits of the Terry College include:

- Consistently highly ranked, the UGA RMI program is currently the top-ranked program in the country by U.S. News & World Report.

- A recent global study ranked the UGA RMI program among the top 10 universities in the world – and second among public universities — for the impact of its risk management and insurance research.

- Faculty members are among the top publishers in the premier risk management and insurance journal, the Journal of Risk and Insurance . View our departmental directory for a complete list of the faculty .

- RMI faculty have received numerous research awards from the Journal of Risk and Insurance , Risk Management and Insurance Review , Journal of Insurance Issues , the Journal of Insurance Regulation and others.

- Professor , Risk Management and Insurance Program

Preferred deadline: January 4

Applications after January 4 will also be considered until spots are filled

Prerequisites

Math courses.

- Calculus : Differential and integral

- Linear Algebra : A course elementary linear algebra is strongly recommended before taking doctoral level (8000 and 9000) courses.

Typical Course Sequence

- Years 2 and 3

- RMIN 7100 : Fundamentals of Risk Management

- RMIN 9450 / 9550 : Risk Management Seminar

- ECON 8000 : Math for Economics (taken in Summer leading to Fall Semester)

- ECON 8010 : Microeconomic Theory I

- ECON 8070 : Stats for Econometrics

- RMIN 7120 : Corporate Risk Management

- ECON 8080 : Intro to Econometrics

- ECON/STAT/FINA Elective

- RMIN 9000 : Doctoral Research

- ECON 8120 : Econometrics II

- FINA 9200 : Corporate Finance Theory

- ECON 8110 : Econometrics I

- Preliminary Exams

Graduates of the risk management and insurance program currently teach in leading risk management and insurance programs across the country including:

- Saul Adelman (1980 Graduate; Associate Professor of Finance at Miami University)

- David Cather (1985 Graduate; Clinical Professor of Risk Management at Penn State University)

- Robert Puelz (1990 Graduate; Dexter Trustee Professor of Risk Management at Southern Methodist University)

- Brenda Wells (1992 Graduate; Associate Professor and Director, Risk Management and Insurance Program at East Carolina University)

- Lee Colquitt (1995 Graduate; Professor and Chair, Department of Finance at Auburn University)

- William Ferguson (1995 Graduate; G. Frank Purvis, Jr./BORSF Eminent Scholar Endowed Chair in Insurance and Risk Management at the University of Louisiana at Lafayette)

- Randy Dumm (1998 Graduate; Professor of Research at Temple University)

- Tim Query (1999 Graduate; Mountain States Insurance Group Endowed Chair Holder and Associate Professor of Finance at New Mexico State University)

- Kathleen McCullough (2000 Graduate; State Farm Insurance Professor of Risk Management and Insurance and Associate Dean for Academic Affairs and Research at Florida State University)

- Lars Powell (2002 Graduate; Director of the Alabama Center for Insurance Information and Research at the University of Alabama)

- Ryan Lee (2001 Graduate; Initial Placement—University of Calgary)

- Cassandra Cole (2002 Graduate; Robert L. Atkins Professor in Risk Management and Insurance and Department Chair at Florida State University)

- Andre Liebenberg (2004 Graduate; Robertson Chair of Insurance and Associate Professor of Finance at the University of Mississippi)

- Enya He (2006 Graduate; Regional Director for Lloyd’s South Central U.S. Region)

- Joseph Ruhland (2006 Graduate; Chair and Associate Professor of Risk Management and Insurance at Georgia Southern University)

- Steve Miller (2010 Graduate; Associate Professor and Director, School of Risk Management and Insurance at University of South Florida)

- Leon Chen (2011 Graduate; Professor of Finance at Minnesota State University-Mankato)

- Jianren Xu (2014 Graduate; Assistant Professor of Finance at University of North Texas)

- In Jung Song (2016 Graduate; Hankuk University of Foreign Studies)

- Evan Eastman (2017 Graduate; Florida State University)

- Joshua Frederick (2019 Graduate; Ball State University)

- Jiyeon Yun (2019 Graduate; California State University-Northridge)

- Polin Wang (2020 Graduate; University of South Florida)

Departments and Program Offices

- PhD Program Office

- Risk Management and Insurance Program

UGA Resources

- Graduate School

- Financial Aid

Additional Information

- Current PhDs

- Faculty Research

Florida State University

FSU | College of Business

College of Business

Ph.d. in business administration with a major in risk management and insurance, request information, deadline to apply.

Begin your application today by entering the Graduate Admissions Portal .

Submit your application by: January 15 – Application review begins and will continue until positions are filled. March 1 – Application submission deadline. All supporting materials must be received by March 15.

Contact Us

- Contact Dr. Patricia Born , program director, for more information on the RMI major, its content and curriculum.

- Email Elizabeth Kistner , Ph.D. graduate advising director, for more information about the admissions process.

Graduate Programs Office 850-644-6458 877-587-5540 (toll free) [email protected]

Join us for a virtual info session at 5:30 p.m., Wednesday, April 3!

Risk Management and Insurance is one of seven majors offered through FSU’s College of Business’ Ph.D. in Business Administration. Housed in the Dr. William T. Hold/The National Alliance Program in Risk Management and Insurance , the RMI major admits one candidate each fall (on average), and the program takes four to five years to complete.

- Offers faculty with research expertise in insurer operations, insurance market performance and regulation, catastrophe risk management and the economics of risk and uncertainty

- Includes primary courses covering the fundamentals of risk management/insurance and research courses in mathematical economics and applied quantitative methods

- Encourages support area studies in finance econometrics, real estate and statistics

- Includes two to three years of coursework culminating in a comprehensive exam, followed by two years of research and teaching, culminating with a dissertation

For an overview of FSU’s Ph.D. in Business Administration and its seven majors, download the brochure .

Student Accomplishments

East Carolina University; University of Akron; University of Connecticut; Illinois State University; Troy University

Courtney Bass, 2013-14 Spencer Educational Foundation Pre-Dissertation Award Jill Bisco, Best Student Paper Award, Southern Risk and Insurance Association Annual Meeting Dana Telljohann , 2022 Spencer Scholarship award recipient

Defended Dissertation

- "Value and Strategy: An Analysis of the Surplus Line Insurance Market" by Courtney Bass Baggett ; Dr. Cassandra Cole, major professor

- “The Role of Asymmetric Information in the U.S. Health Insurance Market,” by E. Tice Sirmans ; Dr. Patricia Born, major professor

Program Requirements

The RMI doctoral program emphasizes current research topics in Risk Management, Insurance Operations and Performance, Insurance Regulation, and Risk Theory. In addition, students are taught a variety of theoretical and empirical research methods and tools using statistics, econometrics, and mathematical economics.

Prerequisites

All Risk Management and Insurance Doctoral students must have completed undergraduate level courses in Calculus I, Calculus II, and Linear Algebra.

Major Requirements

All RMI doctoral students must complete courses in three areas: Tools for Analytical Research (TAR), Primary RMI and Support.

I. Tools for Analytical Research (TAR) Area

Students must take the following three courses:

- ECO 5403 Static Optimization

- ECO 5416 Econometrics I

- ECO 5423 Econometric Theory

Students must also take three additional quantitative courses in Statistics, or Economics numbered 5000 and above with the approval of the doctoral program adviser. Examples include:

- ECO 5424 Econometrics/Panel Data

- ECO 5427 Limited Dependent Variables

- STA 5440 Probability Theory

- STA 5206 Analysis of Variance

- STA 5207 Applied Regression Methods

RMI doctoral students are expected to have or acquire computer literacy through coursework or self-study

II. Primary RMI Coursework

The primary area courses and seminars provide opportunities for in-depth study. RMI doctoral students must take the following doctoral seminars and courses:

- RMI 6195 Seminar in Life and Health Insurance

- RMI 6296 Seminar in Property and Liability Insurance

- RMI 6395 Seminar in the Theory of Risk and Insurance

Students must take an additional three RMI elective courses approved by the doctoral adviser. Examples include RMI 5136 (Employee Benefit Plans), RMI 5345 (Risk Management in the Business Enterprise).

Students will take at least two additional doctoral-level economics courses that are not included in the Tools and Research area above. The two economics courses will be chosen in consultation with the program director. RMI doctoral students also are expected to have or acquire computer literacy through course work or self-study.

In addition to these courses, first-year and second-year students will participate in a professional development series that will be an additional registered course in each semester of the first two years of the program. The development series is designed to introduce doctoral students to the roles and responsibilities of faculty, including research ethics, communication with faculty at other universities, the research review process, balancing research, teaching and service, among other topics.

In addition to the regularly scheduled seminars, the RMI faculty and doctoral students meet periodically to share the results of recent research conducted by FSU faculty and doctoral students and by invited scholars from other universities. RMI doctoral students are required to attend these RMI brown bag seminars and invited lectures.

III. Support Area Coursework

RMI doctoral students typically choose a support area in Finance. The courses for this support area include:

- FIN 6804 Foundations of Financial Theory

- FIN 6809 Markets and Institutions

- FIN 6842 Empirical Methods

- FIN 6527 Seminar: Corporate Finance/Investments

Normally, three or four courses are required in the support area. In addition, at least two of the courses required in the support area cannot be used to satisfy other requirements. The support area is chosen in consultation with the RMI doctoral program adviser.

There is also a required research paper that must be completed by the end of the second year. The paper is directed by the RMI faculty and is designed to prepare the student for the dissertation and subsequent research.

Sample Course Sequence*

*Actual schedule subject to course offerings and availability.

Application Process

Admission decisions are made by the college’s Doctoral Admissions Committee and are based on a combination of factors, including prior academic record from accepted universities; GRE or Graduate Management Admission Test (GMAT) scores taken within the past five years; letters of recommendation; experience; record of accomplishments. Admission is competitive and focused on students with grade-point averages of 3.5 or higher and GMAT scores of at least 600 or GRE scores of at least 155 on each section of the revised GRE.

Application Checklist

- Login to admissions.fsu.edu/gradapp (applications will only be accepted through this portal).

- Begin your application by logging in with your FSUID or clicking the link to register to get one.

- Complete your online application form and submit.

- This will generate automated email sent to your references by our system to request that they submit a recommendation for you and answer a series of standardized questions.

- Submit your Statement of Purpose (2-3 pages).

- Submit a current resume or C.V.

- Pay the nonrefundable $30 application fee.

- Request that each college or university you have attended submit an official transcript to FSU (see below for email/address).

- Transcripts are considered official if they are sent directly to FSU (either through the U.S. mail or electronically) by your undergraduate or graduate institution.

- Request that official GMAT or GRE scores (and TOEFL/IELTS/PTE/DuoLingo/Cambridge C1 Advanced/Michigan Language, if applicable) be submitted to FSU (see below for email/address)

- Test scores will only be considered official if sent directly from the testing service. The code for ETS to send (GRE and TOEFL) scores to FSU is 5219. The code to send GMAT scores to FSU is PN8K567.

- An English proficiency exam score (TOEFL/IELTS/PTE) must be submitted for international applicants whose native language is not English or who have not received a college degree from an institution where the instruction is primarily in English.

Have transcripts and test scores sent to [email protected] or:

Graduate Admissions Office 222 S. Copeland St. 314 Westcott Building Florida State University Tallahassee, FL 32306-1410 USA

International Applicants

International applicants should visit gradschool.fsu.edu/admissions/international-admissions for information concerning financial responsibilities, degree equivalency, etc.

English Language Proficiency Exam International applicants whose native language is not English or who have not completed an undergraduate or graduate degree in an English-speaking country are required to take either the Test of English as a Foreign Language (TOEFL,) the International English Language Testing System (IELTS,) the Pearson Test of English (PTE,) Duolingo, Cambridge C1 Advanced Level, or Michigan Language Assessment and submit official test results in order to be admitted to Florida State University. The College of Business requires a minimum TOEFL score of 100 on the internet-based test, a minimum of 7.0 on the IELTS exam , or a minimum of 66 on the PTE , a minimum score of 120 on Duolingo , a minimum score of 180 on Cambridge C1 Advanced Level , or a minimum score of 55 on the Michigan Language Assessment taken within the past two (2) years.

Program Costs

Ph.D. students typically take 27-33 credit hours each year. Here are the estimated program costs for the 2023-2024 academic year:

- Florida residents: $479.32 (tuition plus fees) per credit hour. Total estimated program cost is $12,941.64 - $15,817.56 per year.

- Non-Florida residents: $1,110.72 (tuition plus fees) per credit hour. Total estimated program cost is $29,989.44 - $36,653.76 per year.

Note: These costs do not include required books, supplies for courses, or required health insurance. Costs are subject to change. Fees above do not include some per-term flat fees for FSUCard and facilities use. For a breakdown of on-campus student fees and their explanations, visit the university’s Tuition Rates page.

Residency Information

The doctoral program is a full-time program that lasts four to five years. Students should plan to live in the Tallahassee area year-round, including summers. Our program is not set up for individuals who wish to take courses part time or online.

Financial Assistance

The College of Business awards financial assistance to applicants based on academic criteria and performance. The goal of the college is to provide assistantships and/or fellowships to all of our admitted doctoral students, subject to overall enrollment and fiscal limitations. Most doctoral students who request funding, who maintain a satisfactory level of academic and work performance, and who are in residence receive financial assistance from the college. Annual stipends and supplementary assistance such as travel expenses for conference attendance will vary among cohorts and programs. Students who are not Florida residents should note that tuition waivers associated with assistantships only cover the out-of-state portion of their tuition for year one of the program. Out-of-state tuition waivers are generally not available for years two through five. Doctoral students on assistantship are supported for four full academic years, contingent upon satisfactory performance in the program. Eligibility for fifth-year support is considered for a student having made substantial progress toward placement at a research-oriented university. For a full list of Florida State University funding and awards, visit gradschool.fsu.edu . Applicants are strongly encouraged to submit all completed application materials before January 15 to be eligible for additional funding opportunities at the university level.

Awards/Scholarships

The College of Business awards financial assistance to applicants based on academic criteria and performance. There are various scholarships available for graduate students. Visit our graduate scholarships page to learn more.

(Applicants are strongly encouraged to submit all completed application materials before January 15 to be eligible for additional funding opportunities at the university level.)

- For a full list of Florida State University funding and awards, visit gradschool.fsu.edu

- For more information on Florida State University's research and research funding, visit research.fsu.edu

- For more information on Florida State University's graduate fellowships and awards, visit ogfa.fsu.edu

Risk Management Faculty

Directory College Calendar

For Faculty & Staff

Undergraduate Programs

Graduate programs .

Request Graduate Programs Info Contact the Webmaster

Address 821 Academic Way, Tallahassee, FL 32306-1110 | Phone 850-644-3090 | Fax 850-644-0915 Copyright © 2023, Florida State University - College of Business , All Rights Reserved. Accredited by AACSB International.

2024 Best Online PhD in Risk Management [Doctorate Guide]

Analytical individuals with a passion for research might consider pursuing a PhD in Risk Management.

Risk management professionals can shape the way a company handles risk assessment and manages threats to their operation. A doctoral degree can set you apart from the crowd, signaling that you have research skills and expert knowledge of the industry.

Editorial Listing ShortCode:

Many people who obtain their Ph.D. in Risk Management choose to work in a variety of business or finance roles.

Universities Offering Online Doctorate in Risk Management Degree Program

Methodology: The following school list is in alphabetical order. To be included, a college or university must be regionally accredited and offer degree programs online or in a hybrid format.

Capella University

At Capella University, the online Doctor of Information Technology program is designed to help students acquire the knowledge and skills needed to excel as leaders in the IT industry. The program’s 13 courses and 2 virtual residencies can be completed at a student’s own pace. The curriculum covers topics like complex adaptive systems, system security, and project and risk management.

Capella University is accredited by the Higher Learning Commission.

Capitol Technology University

The courses for the Doctor of Philosophy in Occupational Risk Management at Capitol Technology University are taught by industry leaders and academic experts. The curriculum is built on key concepts in the growing safety and occupational construction field and the direct application of these concepts. The program consists of 60 credits and can be completed fully online.

Capitol Technology University is accredited by the Commission on Higher Education of the Middle States Association of Universities and Schools.

Liberty University

Liberty University offers a PhD in Organization and Management with an emphasis in Entrepreneurship. The curriculum is designed to teach strategic business concepts focused on organizational growth and advanced entrepreneurship. The program aims to help students step into dynamic leadership roles after graduation. Students can typically complete the 60 credit, online program in about 3 academic years.

Liberty University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

St. Thomas University

St. Thomas University offers a Doctor of Business Administration in Cyber Security Management. Graduates of the program often secure positions as chief information security officers, directors of financial systems, and high-level IT managers. This online, 60 credit program culminates in a final project. Students can choose between a traditional dissertation, an article dissertation, or action-based research.

St. Thomas University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

University of the Cumberlands

The University of the Cumberlands offers a Doctor of Philosophy in Information Technology. Students in the program can specialize in one of four specialties: Information Systems Security, Information Technology, Digital Forensics, or Blockchain. The program requires the completion of 60 credits. The curriculum covers topics like robotics, programming, machine learning, network technology, and information security.

The University of the Cumberlands is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Online PhD in Risk Management Programs

All organizations face risks to their operations, such as security breaches, theft, or a fluctuating market. Risk management plays a key part in protecting business by recognizing, addressing, and controlling potential threats.

Doctoral programs in risk management cover subjects in a range of fields, including finance, law, and economics. It’s also beneficial to have a strong understanding of advanced econometrics concepts, as these are used to create and analyze risk models.

A risk management doctoral program will likely include courses topics similar to those listed below:

- Regulatory and legal risk

- Organizational risk

- Econometrics

- Probability theory

- Applied regression methods

- Limited dependent variables

- Doctoral research

You can also choose to specialize in a particular area of risk management. This can be the topic that you choose to focus your research on as well. Risk management specialties can include:

- Financial intermediaries

- Risk and crisis management

A doctorate in risk management can help prepare you for leadership or research roles in the field. Risk management positions include:

- Risk management director

- Market research analyst

- Quantitative risk analyst

- Business analyst

- Claims adjuster

There are many benefits to a career in risk management, including the opportunity to work for a variety of companies. Some professionals also travel for work.

While pursuing your PhD in Risk Management, you can learn how to quantify risks and can enhance your financial knowledge and analytical skills. With experience, these abilities may help you qualify you for career advancements in the risk management industry.

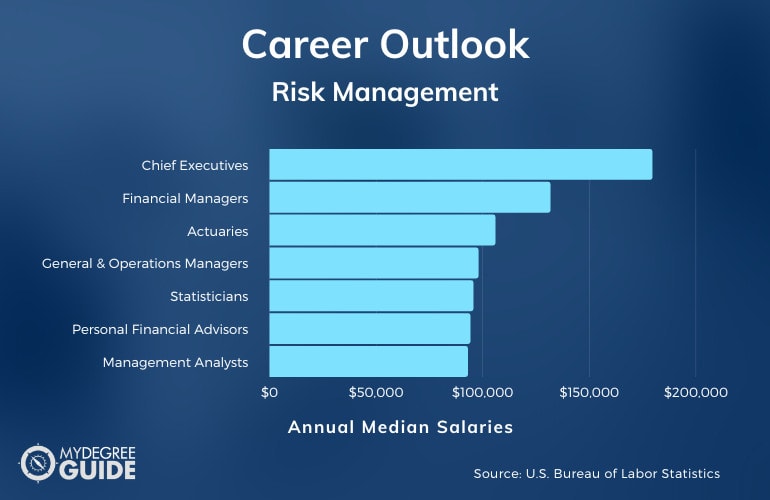

Risk Management Careers & Salaries

Much like with a masters in risk management , earning a PhD in Risk Management can open up professional opportunities in finance, economics, and education.

A typical curriculum in a risk management program consists of courses in finance theory, econometrics, and research. Having a firm foundation in these areas can help you qualify for positions at a variety of companies. According to the Bureau of Labor Statistics , experts in risk management may pursue the following career paths.

Many of the careers connected to risk management and insurance offer higher than average median salaries. Earning a doctorate may also increase your earning potential, though a certain pay range is not guaranteed to graduates.

When it comes to finding a job, there are a number of determining factors, such as your prior work experience, your specialized skill sets, and your geographic location.

Risk Management PhD Curriculum & Courses

The curriculum for a risk management doctoral program can change based on several factors, such as specialization or school, but you’ll likely take some courses similar to the following:

- Regulatory and Legal Risk : This course focuses on managing risk in a business setting, covering topics like managing operational and legal risks.

- Operational Risk : In this class, you’ll develop an understanding of the concepts included in a risk framework, exploring subjects such as fraud and security breaches.

- Econometrics : Designed to ready students for empiric economic work, this course explores a range of topics, including data analysis, testing, and forecasting.

- Probability Theory : This course is concerned with modeling events with uncertain results, spanning topics from conditional probability to distribution theory.

- Applied Regression Methods : This course is a study of regression models, and your lessons will include analysis of variance and covariance, along with case studies and examples.

- Limited Dependent Variables : This course focuses on specific regression models that involve dependent variables.

- Doctoral Research : You’ll have the opportunity to develop and strengthen your research skills as well as begin the process of putting together your dissertation.

- Corporate Finance Theory : In this course, you’ll study key topics in corporate finance theory, including asset pricing models and capital budgeting.

- Market Microstructure : This course explores the ways in which the interactions of traders impact pricing, and it focuses on areas such as strategic trading, market fragmentation, and liquidity.

- Risk Management Fundamentals : You’ll learn the fundamentals of risk management, including risk maturity and action, monitoring, and identification techniques.

As you apply to doctoral programs, you can read through each curriculum to ensure that it provides learning opportunities that match your interests and career goals.

Admissions Requirements

As you begin applying to doctoral risk management programs, you’ll likely notice some similarities in the application materials between schools.

Many colleges and universities will ask for the following:

- GRE or GMAT test scores (only some schools require them)

- Personal statement

- Letters of recommendation

- Official college transcripts

Because a doctorate is the highest-level degree, it is beneficial for your transcripts to reflect a strong academic performance during your undergraduate and graduate school years.

Accreditation

Have you ever wondered how employers and the general public know whether a college program is up to standard? The answer lies in the accreditation process .

Regional accreditation is a process that schools can elect to undergo in order to prove that they offer high-quality educational programs and student services. Accrediting agencies ensure that a school’s faculty is experienced and that its curriculum covers the necessary information for each subject area. Colleges and universities are also motivated to continuously improve their programs in order to maintain their accreditation status.

Financial Aid and Scholarships

Financial aid generally operates on an as-needed basis, providing monetary support for the families and individuals that need it most. There are a number of scholarships opportunities, though, that are based on other criteria, such as academic merit, field of study, and more.

To see how much financial aid you can receive from the government, you can fill out the Free Application for Federal Student Aid (FAFSA) . In addition to federal aid, you can apply for grants, loans, tuition reimbursement programs, or scholarships. These options will all look different depending on your location, personal financial history, and employer.

There are also financial aid options that are specific to certain family situations, such as aid for military families or international students.

What Can You Do with a Doctorate Degree in Risk Management?

A doctorate in risk management can lead to a number of lucrative and growing careers. Many risk management graduates go on to accept roles as financial managers, actuaries, or market research analysts.

Professionals in this sector combine their financial and regulation knowledge with their management and communication skills to help companies identify and manage potential risks. A doctoral program can also help you become well-versed in current research methods and tools. Professionals with a PhD often work in academia, typically as postsecondary teachers or researchers.

How Long Does It Take to Get a PhD in Risk Management Online?

A PhD is considered the highest degree one can earn, and a doctorate generally takes 3 to 5 years to complete with full-time enrollment.

How long it takes you to complete your online management degree can depend on the number of credit hours required by your program and the time it takes you to finish your dissertation. If there is no dissertation requirement in a doctoral program, it can generally be completed in 3 years with full-time study.

What’s the Difference Between a DBA vs. PhD in Risk Management?

A Doctor of Business Administration (DBA) and a Doctor of Philosophy (PhD) in Risk Management are both advanced degrees. A DBA is a professional doctorate, though, while a PhD is a research-based degree.

The doctoral path that’s right for you will likely depend on your professional goals.

Is a PhD in Risk Management Degree Worth It?

Yes, a PhD in Risk Management is worth it for many students. Many risk management careers are experiencing employment growth at a rate higher than the national average. For instance, postsecondary teachers, financial managers, and actuaries are expected to see 12%, 17%, and 24% job growth, respectively, over the next ten years (Bureau of Labor Statistics).

Additionally, risk management professionals have an impact on the security of the companies they work for, making them an essential part of an organization’s team. Not only do they identify potential risks, but they can work to eliminate future risks as well.

Getting Your PhD in Risk Management Online

Strong communication, financial acumen, and analytical skills are all essential for success in the field of risk management.

Earning your doctoral degree in risk management can help you improve and hone these skills while you study industry-specific knowledge and conduct original research. A doctoral degree can also help you advance your professional qualifications.

Just as they do with online masters in negotiation , a growing number of regionally accredited universities now offer risk management PhD programs both on campus and online. If you’re ready to enhance your expertise in this lucrative field, you can start exploring risk management doctoral programs today!

Print Options

Bulletin 2023-2024, business administration/risk management and insurance phd.

FOX SCHOOL OF BUSINESS AND MANAGEMENT

Learn more about the Doctor of Philosophy in Business Administration .

About the Program

The PhD in Business Administration program, with a concentration in Risk Management and Insurance, prepares individuals for advanced research and scholarship. The primary emphasis of the program is to prepare future faculty members for successful academic careers.

Time Limit for Degree Completion: 7 years

Campus Location: Main

Full-Time/Part-Time Status: Full-time study is required.

Accreditation: The PhD in Business Administration program, with a concentration in Risk Management and Insurance, is accredited by the Association to Advance Collegiate Schools of Business (AACSB International).

Job Prospects: The program is primarily dedicated to producing well-trained researchers who will work in academic positions.

Non-Matriculated Student Policy: Non-matriculated students are not permitted to take doctoral courses.

Financing Opportunities: Typically, all PhD students receive financial assistantship in the form of full tuition remission and a stipend in return for offering services as a Research Assistant (RA) or Teaching Assistant (TA). The level of support is based on the concentration, the applicant’s qualifications, and other competitive considerations. Students may also receive remuneration for conference travel, publications and academic achievement.

Admission Requirements and Deadlines

Application Deadline:

Applications must be submitted AND complete (i.e., all required materials must be received and verified by Fox Staff) by Dec. 5 to be considered. Applications received after this deadline are reviewed on a case-by-case basis and dependent on availability.

APPLY ONLINE to this Fox graduate program .

Letters of Reference: Number Required: 2

From Whom: Letters of recommendation should be obtained from evaluators, typically college/university faculty or an immediate work supervisor, who can provide insight into your abilities and talents, as well as comment on your aptitude for graduate study.

Master's Degree in Discipline/Related Discipline: A master's degree is not required, but preferred.

Bachelor's Degree in Discipline/Related Discipline: The equivalent of a four-year U.S. baccalaureate degree from an accredited university or college is required. For three-year degrees, mark sheets must be evaluated by WES or another NACES organization.

Statement of Goals: In 500 to 1,000 words, describe your specific interest in Temple's program, research goals, career goals, and academic and research achievements.

Standardized Test Scores: GMAT/GRE: Required. GMAT scores are preferred. Test results cannot be more than five years old. Although the applicant’s test score is an important factor in the admissions process, other factors, such as the ability to conduct research as demonstrated by academic research publications and whether your indicated research interests match with those of our faculty, are also taken into consideration.

Applicants who earned their baccalaureate degree from an institution where the language of instruction was other than English, with the exception of those who subsequently earned a master’s degree in a country where the language of instruction is English, must report scores for a standardized test of English that meet these minimums:

- TOEFL iBT: 90

- IELTS Academic: 7.0

- Duolingo: 110

- PTE Academic: 68

Resume: Current resume or CV required.

Program Requirements

General Program Requirements: Number of Credits Required to Earn the Degree: 48

Required Courses: 1

Students require approval from their mentor and the Concentration Director for all course selections, including those dropped and/or added.

The program of study may be individualized to a significant degree for the student's best professional and scholarly development. With approval from the Concentration Director, students may take other electives to match their research interests. Suggested focus areas and courses may be chosen with approval from the Concentration Director.

This is a theory-focused course.

This is a finance-focused course.

This is an economics-focused course.

Of the 6 required research credits, a minimum of 2 credits of BA 9999 must be taken. The other 4 credits may be taken in any combination of BA 9994 , BA 9998 , and BA 9999 . Given that 6 credits constitute the minimum requirement, additional credits may be needed to fulfill the degree program's culminating experiences. Doctoral students must maintain continuous enrollment from matriculation to graduation.

Culminating Events: Preliminary Examination: The purpose of the preliminary examination is to demonstrate critical and interpretive knowledge of current research. The subject areas are determined, in advance, by the faculty of the department. The preliminary exam should be completed no more than one term after the student completes the coursework component of the program. Students who are preparing to write their preliminary examinations should confirm a time and date with their departmental advisor.

The members of the student's department write the questions for the preliminary exam. The student must answer every question on the examination in order to be evaluated by the Department Committee. The evaluators look for a breadth and depth of understanding of specific research areas, a critical application of that knowledge to specific phenomena, and an ability to write technical prose. Each member votes to pass or fail the student. In order to pass, a majority of the committee members must agree that the exam has been satisfactorily completed.

Proposal: The dissertation proposal demonstrates the student's knowledge of and ability to conduct the proposed research. The proposal should consist of the following:

- the context and background surrounding a particular research problem;

- an exhaustive survey and review of literature related to the problem; and

- a detailed methodological plan for investigating the problem.

The proposal should be completed and approved no more than one year after completing coursework. Upon approval, a timeline for completing the investigation and writing process is established.

Dissertation: The doctoral dissertation is an original empirical study that makes a significant contribution to the field. It should expand the existing knowledge and demonstrate the student's knowledge of both research methods and a mastery of their primary area of interest. Dissertations should be rigorously investigated; uphold the ethics and standard of the field; demonstrate an understanding of the relationship between the primary area of interest and the broader field of business; and be prepared for publication in an academic journal.

The Doctoral Advisory Committee is formed to oversee the student's doctoral research and is comprised of at least three Graduate Faculty members. Two members, including the Chair, must be from the student's department. The Chair is responsible for overseeing and guiding the student's progress, coordinating the responses of the committee members, and informing the student of her/his academic progress.

The Dissertation Examining Committee evaluates the student's dissertation and oral defense, including the student's ability to express verbally their research question, methodological approach, primary findings and implications. The Dissertation Examining Committee votes to pass or fail the dissertation and the defense at the conclusion of the public presentation. This committee is comprised of the Doctoral Advisory Committee and at least one additional faculty member from outside the department.

If any member decides to withdraw from the committee, the student shall notify the Chair of the Dissertation Examining Committee and the PhD Managing Director. The student is responsible for finding a replacement, in consultation with the Chair. Inability to find a replacement shall constitute evidence that the student is unable to complete the dissertation. In such a case, the student may petition the PhD Managing Director for a review. Once review of the facts and circumstances is completed, the Director will rule on the student's progress. If the Director rules that the student is not capable of completing the dissertation, the student will be dismissed from the program. This decision may be appealed to the Senior Associate Dean. If dismissed, the student may appeal to the Graduate School.

Students who are preparing to defend their dissertation should confirm a time and date with their Dissertation Examining Committee and register with the Graduate Secretary at least 15 days before the defense is to be scheduled. The Graduate Secretary arranges the time, date and room within two working days, and forwards to the student the appropriate forms. After the Graduate Secretary has scheduled the defense, the student must send to the Graduate School a completed "Announcement of Dissertation Defense" form, found in TUportal under the Tools tab within "University Forms," at least 10 days before the defense. The department posts flyers announcing the defense, and the Graduate School announces the defense on its website.

Program Web Address:

https://www.temple.edu/academics/degree-programs/business-administration-phd-bu-ba-phd

Department Information:

Fox School of Business and Management

1801 Liacouras Walk

701 Alter Hall (006-22)

Philadelphia, PA 19122

215-204-5890

215-204-7678

Fax: 215-204-1632

Submission Address for Application Materials:

https://apply.temple.edu/FOX/Account/Login

Department Contacts:

Admissions:

Fox PhD Admissions

Concentration Director:

Benjamin Collier

215-204-8155

PhD Managing Director:

Vinod Venkatraman, PhD

Associate Professor, Marketing

215-204-1409

Send Page to Printer

Print this page.

Download Page (PDF)

The PDF will include all information unique to this page.

Download PDF of entire Undergraduate Bulletin

All pages in Undergraduate Bulletin

Download PDF of entire Graduate and Professional Bulletin

All pages in Graduate and Professional Bulletin

RMA/Wharton Advanced Risk Management Program

Program overview.

As the volatility and interdependencies of markets increase, senior executives must make organizational risk management a high priority. The RMA/Wharton Advanced Risk Management Program gives banking executives analytical frameworks, strategies, and resources to better measure, manage, and monitor risk at their organizations.

You also will use tools for modeling risk analysis, critical thinking, and risk scenario planning, while applying your knowledge to current issues facing your organization through risk evaluations to give you an enterprise view of risk. In between the two program weeks, you will examine a new area of risk in your organization, reporting findings to the class.

Academic Director Richard Herring describes the curriculum of the RMA/Wharton Advanced Risk Management Program .

Date, Location, & Fees

If you are unable to access the application form, please email Client Relations at [email protected] .

May 5 – 10, 2024 Philadelphia, PA and June 9 – 14, 2024 Philadelphia, PA $29,995

In Partnership With

Drag for more

Program Experience

Who should attend, testimonials, highlights and key outcomes.

In the RMA/Wharton Advanced Risk Management Program , you will:

- Network and interact with banking industry peers and renowned Wharton faculty

- Use tools for modeling risk analysis, critical thinking, and risk scenario planning

- Apply your knowledge to current issues facing your bank or financial institution through risk evaluations

Experience & Impact

In today’s global economy, the environment for risk has become much more complex. The RMA/Wharton Advanced Risk Management Program introduces the latest thinking around risk, including macroeconomic drivers, and equips you with the tools to evaluate your exposure.

Wharton faculty — led by Richard Herring, PhD, the author of more than 150 articles, monographs, and books on various topics in financial regulation, international banking, and international finance — apply their field-based research and the latest strategic insights to help you broaden your view the major drivers of risk, with a framework for measuring and monitoring it. Unique to the RMA/Wharton program is the integration of academic analytics, which provide the professional bankers who participate in the program with a theoretical foundation, along with the insights of star practitioners, who show how these ideas can be implemented.

Session topics include:

Risk management as a strategic competitive strength:

- Macroeconomic drivers of risk

- Distinctive features of regulated financial intermediaries and how the regulatory environment has evolved since the 2007–09 crisis

- The connection between corporate finance and managerial decision making and risk management

- The study of systemic risk and the unique challenges of being a financial intermediary in today’s interconnected world

The analytical framework for measuring, managing, and monitoring risk:

- Methods and issues in measuring risk exposure

- Modeling challenges and practices

- Scenario-based strategic planning

- Unique risk characteristics presented by derivatives and real estate assets

- Economic capital

The enterprise perspective, including culture, governance, and relationships with stakeholders:

- Peripheral vision and critical decision making

- Defining risk appetites

- Communicating risk profiles to both internal and external stakeholders

- Tension between economic capital and regulatory capital

- Enterprise risk management

Through highly interactive lectures, exercises, and case studies, both in the classroom and in smaller work groups, this deep dive into risk will help you be a more capable enterprise risk management leader within your financial institution.

Convince Your Supervisor

Here’s a justification letter you can edit and send to your supervisor to help you make the case for attending this Wharton program.

Due to our application review period, applications submitted after 12:00 p.m. ET on Friday for programs beginning the following Monday may not be processed in time to grant admission. Applicants will be contacted by a member of our Client Relations Team to discuss options for future programs and dates.

Participants are mid-level to senior executives in banking and banking-related industries with several years of experience, including:

- Chief Risk Officers

- Business-line Risk Managers

- Enterprise-wide and Operational Risk Managers

Firms that have sent executives to this program in the past include:

- BBVA Compass

- Capital One

- Discover Financial

- First Republic

- Morgan Stanley

- TD Ameritrade

Fluency in English, written and spoken, is required for participation in Wharton Executive Education programs unless otherwise indicated.

Plan Your Stay

This program is held at the Steinberg Conference Center located on the University of Pennsylvania campus in Philadelphia. Meals and accommodations are included in the program fees. Learn more about planning your stay at Wharton’s Philadelphia campus .

Group Enrollment

Banks sending four participants will receive a 10% discount on each enrollment. Please note that all four participants must register for the program at the same time. Please contact the Wharton Client Relations Team at +1.215.898.1776 or [email protected] , for more details.

Richard Herring, PhD See Faculty Bio

Academic Director

Jacob Safra Professor of International Banking; Professor of Finance, The Wharton School

Research Interests: International banking, international finance, money and banking

Peter Conti-Brown, PhD See Faculty Bio

Class of 1965 Associate Professor of Financial Regulation, Associate Professor of Legal Studies & Business Ethics, The Wharton School

Research Interests: Central banking, financial history, financial regulation, fiscal crises, political history, public finance, the Federal Reserve

Mauro Guillén, PhD See Faculty Bio

William H. Wurster Professor of Multinational Management; Vice Dean, MBA Program for Executives, The Wharton School

Research Interests: Globalization, international political economy, multinational management

Ethan Mollick, PhD See Faculty Bio

Ralph J. Roberts Distinguished Faculty Scholar; Associate Professor of Management; Academic Director, Wharton Interactive, The Wharton School

Research Interests: Innovation, entrepreneurship, crowdfunding, games, AI

Todd Sinai, PhD See Faculty Bio

David B. Ford Professor; Professor of Real Estate; Professor of Business Economics and Public Policy; Chairperson, Real Estate Department, The Wharton School

Research Interests: Commercial real estate and real estate investment trusts, real estate and public economics, risk and pricing in housing markets, taxation of real estate and capital gains

Robert Stine, PhD See Faculty Bio

Professor Emeritus of Statistics, The Wharton School

Research Interests: Credit scoring, model selection, pattern recognition and classification, forecasting

What initially attracted me to the program was the breadth of topics covered together with the opportunity to learn from the experiences of other banks, especially in North America. Having completed the program, I could not recommend it more highly — it easily surpassed my expectations. The program content served not only as a timely reminder of core risk management fundamentals but was also rich with practical insights born out of the experiences of practitioners. The content was delivered by a superb mix of academic and C-suite executives which blended to create a wonderful learning experience in terms of how to apply what we were learning in practice. Another impressive element of the program was the engagement within the class, which resulted in many insightful conversations which continued long after the allotted time of the session! The dialogue drew not only on the theory but also, and more importantly, on the hands-on, lived experience from participants. It was this “compare and contrast’ that really produced enormous value and insights. If you are thinking about the Advanced Risk Management program, I would say you should have no hesitation. In my own case not only did I learn a lot but I have made very good friends and a network that I know will support me throughout my career. "

John Kelly Group Head of Risk Management, AIB (Ireland)

Antoine Avril Vice President and Chief Credit Officer, Desjardins Group

I was recommended to attend the RMA/Wharton Advanced Risk Management Program by Mr. Ed Schreiber. I met Ed when I was president and CEO of a small minority depository institution headquartered in Houston, Texas. My small community bank was undergoing an amazing transformation and he was assisting me in addressing my staffing and training challenges. At that time, he strongly suggested that I attend this RMA program because he believed it would round out my experience and provide me with the blueprint needed in leading a banking institution. And he was right! This RMA program has provided me with all the tools and access to resources I need to be successful. The staff, academic directors, and the program team made me feel welcomed and valued. But more important, they facilitated a program that addressed risk in a very comprehensive and strategic way. And all the instructors were outstanding! I came into the program feeling a bit insecure and out of my league with my class of highly experienced and seasoned chief risk officers and managers from many of the top 10 banks from around the world — but ended with a new network of amazing colleagues that will be my lasting friends. The highlight of this program for me was preparing and delivering our Bridge Project. Our differences became our strengths. It was amazing! As I embark on my new journey of creating a new de novo minority depository institution, I will use each risk model to guide how I manage my institution. This Advanced Risk Program is not limited to risk officers only. I highly recommend and strongly encourage bank executives leading small community and MDI banks attend this program. You will not be disappointed!"

Laurie Vignaud CEO, ViZ Bank

I head the team of credit adjudication and portfolio management at the National Bank of Canada. I took the RMA/Wharton Advanced Risk Management program to broaden my horizons. I had a strong credit background but not as much exposure to the entire suite of risks present in a large bank (operational, market, compliance, reputational, cyber, emerging risks, etc.) The program was excellent. It was really about opening your eyes on different practices and angles, to give you a more holistic view of risks. The length of time and the intensity of the course were perfect for an executive. The assignments between the sessions, and the relationships you could create with people, were just stellar. The learnings were actionable and I had a ton of ideas about things that I could really apply or improve upon at my bank. Another key takeaway was the quality of the faculty. I appreciated the mix of academia and real-life practitioners; it was the best of both worlds. I particularly enjoyed Professor Dick Herring’s presentation about what happened in 2007-2008, which gave a general understanding of the mechanics of what can go wrong. That’s what we have applied in our team to think about detecting patterns in our own bank. There can be “unknown unknowns,” questions I did not even know to ask. The program made me better at asking the right questions. The course gave me many industry contacts. It was a very diverse group geographically, in the types of risk in which people operate, and the types of financial institutions. This yielded really unique perspectives. The way you interact with the other participants, and the questions that they ask in class—especially deep domain experts in a certain risk that you’re not absolutely familiar with—to academia members who are also deep experts in that risk, brings you an exponential level of learning. I would give the program a ten out of ten. It was above expectations.”

Jean-Sébastien Grisé Vice President, Credit Risk, Commercial, Retail and Wealth Management, National Bank of Canada, Montreal, Canada

I enrolled in the RMA/Wharton Advanced Risk Management Program hoping to broaden and deepen my perspectives on the practice of risk management. I’d developed my career in a singular risk discipline and wanted to have some insights on the other risk types. The program was a great overall experience. The quality of the instruction was first-class and the facilities are outstanding. Some highlights for me were working with Professor Bob Stine, who simplified some pretty complex issues around model development, model risk, the statistics of risk management, and thinking about how we can employ those ideas in our businesses. Coming from my background that was still a new science for me, so it was great to get that perspective. I also enjoyed hearing from Professor Mauro Guillen on global macro trends. That was a great presentation with important insights about looking beyond today and thinking about emerging risks and evolving trends. The program elevated the practice of risk management in a way that I think positions me to help my organization deal with new challenges in the financial services industry. I can better serve my company’s stakeholders as we deal with the pace of change. I really appreciated the opportunity to engage with the other professionals. I’ve been to other seminars and discussions, but at Wharton we had a really candid and open group, all willing to share ideas and concerns. I think those relationships are of incalculable value over and above the education. For me it was one of the great takeaways from the experience. I would recommend the program highly. I definitely see an opportunity to identify the right kind of talent within our risk management organization and sponsor them into the program for the lessons that they could learn, contacts they could make in the industry, and to help them understand the broader practice of risk management.”

Eric Ensmann Director of Enterprise Risk Management, BBVA Compass

As head of operational risk management for a U.S. bank, I’m responsible for making sure that our bank has implemented our operational risk management framework. We work with all of our respective business lines to make sure that they understand their key processes, risks, and controls, and that key controls are designed and operating effectively. The RMA/Wharton Advanced Risk Management Program broadened my knowledge beyond just operational risk. The course includes all the different risk disciplines, from operational risk, retail and commercial credit risk to market and liquidity risks. It was a great curriculum, and the Wharton faculty and the presenters were exceptional. I particularly enjoyed the enterprise risk management section. Also, the fact that this program brings in industry leaders is a big benefit. It’s not a 100% academic; we’re actually getting real perspectives from different business leaders coming in. The professors had great presentation styles. Even in an intensive program where it’s hard to sit still all day, I never found myself looking at my watch, because I was so engaged. The whole class was very engaged as well. The expertise of my classmates as well as the presenters made for an overall wonderful experience. Another benefit is the contacts that you make in the program. These are people I can reach out to now because we’ve built that relationship. I can say, I’m dealing with this type of issue; how have you dealt with it at your institution? What I really took away from the course is that operational risk is embedded in all the different disciplines that we talked about. So whether we’re talking about market risk, commercial credit, retail credit, third party, whatever it may be, it was all relevant to me. Having a better understanding of those areas allows me to be a better operational risk professional. I can now better interact with those areas at my own institution. I also appreciated the facilities and the amenities of the program, and enjoyed the vibe of being on Wharton’s campus in May when school was still in session. I would recommend the program 100 percent. I thought it was fantastic!”

Christopher Nestore Head of Operational Risk Management, TD Bank

The participants were a good mix of people from different types of institutions — I also liked that the program was held over two separate weeks so you have an opportunity to get to know people and reflect on course content at home before coming back to the classroom. There were two types of lectures that were really outstanding — one was star academic lectures on topics such as global risk the first week and ethics and strategic thinking the second week. The Wharton faculty really knew their subject matter and had applicable experience as well as being really engaging lecturers who connected with the audience. The other standout lectures were by colleagues from different financial institutions. Two that stick in my mind were the CRO from one of the major Canadian banks, covering risk appetite, and a board director of a major international bank who shared insight on the expectations and perspectives from the board and board risk committee. Since the financial crisis of 2007 and more recently Brexit in the UK, there is heightened uncertainty in how the economy might turn. Wharton’s program was very helpful in providing me with specific insights and an appreciation for common topics and current challenges in the industry, including how regulation works in different jurisdictions. Having that perspective means when I am talking to the chief executive or other directors in my organization, I’ve got a greater understanding of how a risk issue fits not only within our organization but also in a wider context. This is a premium program that I would recommend to the right person at the right stage in their career. It’s not often you get that time to really engage with the wide range of risk management issues this program addresses. I would absolutely recommend it to senior colleagues who are thinking about how to lift their career up a step and contribute more strategic insights to their organization.”

James Tebboth Chief Credit Officer, Nationwide, UK

Dennis Winkel Chief Risk Officer, Exchange Bank of Canada

With the cost of executive search fees reaching upwards of $300,000, effective retention tools represent a solid investment strategy. One of the most powerful tools for retaining top performers is to send them to the RMA/Wharton Advanced Risk Management Program . In fact, I’ve already sent 13 executives to the program. This program gives me a tremendous development and retention tool. By sending our executives through the program, we’re making a commitment to our employees about their personal and professional development. It also delivers impressive ROI in terms of building depth and experience on our team. We have realized significant savings by staffing senior positions from within the company. It is a world-class program that balances the quantitative with the qualitative, the theoretical with the practical.”

Tom Whitford Executive vice president, PNC Financial Services

Download the program schedule , including session details and format.

Hotel Information

This program consists of two non-consecutive sessions. Both sessions are required for completion.

Fees for the on-campus program include accommodations and meals. Prices are subject to change.

Read our COVID-19 Safety Policy »

International Travel Information »

Plan Your Stay »

Related Programs

- Mergers and Acquisitions

- The CFO: Becoming a Strategic Partner

For more information on The Risk Management Association , please contact Amanda Good, Senior Manager, Academic Programs: [email protected]

+1.215.898.1776

Still considering your options? View programs within Finance and Wealth Management , Industry Association Programs or:

Find a new program

Risk and Disaster Reduction MPhil/PhD

London, Bloomsbury

Reducing the impact of disasters globally and humanitarian crises presents a huge challenge that requires co-ordinated and collaborative action. This programme is designed for PhD students who wish to improve humanity's understanding of risk and to overcome the scientific, engineering, technical, social, health and political barriers to increasing resilience to disasters.

UK tuition fees (2024/25)

Overseas tuition fees (2024/25), programme starts, applications accepted.

- Entry requirements

Normally, a minimum of an upper second-class UK Bachelor's degree in a relevant discipline or an overseas qualification of an equivalent standard.

The English language level for this programme is: Level 1

UCL Pre-Master's and Pre-sessional English courses are for international students who are aiming to study for a postgraduate degree at UCL. The courses will develop your academic English and academic skills required to succeed at postgraduate level.

Further information can be found on our English language requirements page.

Equivalent qualifications

Country-specific information, including details of when UCL representatives are visiting your part of the world, can be obtained from the International Students website .

International applicants can find out the equivalent qualification for their country by selecting from the list below. Please note that the equivalency will correspond to the broad UK degree classification stated on this page (e.g. upper second-class). Where a specific overall percentage is required in the UK qualification, the international equivalency will be higher than that stated below. Please contact Graduate Admissions should you require further advice.

About this degree

Students learn how to conduct original, cross-disciplinary and international scientific research with significant, positive societal impact within an intellectually and globally diverse student body. There is a focus on multi-disciplinary research methods – in the laboratory, on site, talking to people, analysing documents, conceptual analysis, and others depending on the nature of the research – and employing theoretical, statistical, modelling, social survey and desk-based techniques. Students' skills in research, teaching, public engagement, communications, consultancy, and knowledge exchange are emphasised.

Who this course is for

The programme aims to train the next generation of innovative, creative and objectively critical researchers, thinkers, practitioners and decision-makers in risk and disaster resilience. Students earning their PhD from IRDR find jobs across sectors, including academia, government, the private sector, and the non-profit sector.

What this course will give you

In addition to world-class research facilities and information resources, PhD students will gain skills essential to employment, such as teaching, proposal writing, media and public engagement, organising events, and oral and written communications. IRDR holds an annual PhD Student Forum, Spring Academy, and conferences. The PhD offers research training alongside learning opportunities in all these other areas.

The foundation of your career

IRDR PhD graduates have gained employment in a wide variety of positions in London and around the world both within and outside of academia. The institute's extensive links and established credibility with the private sector, the non-profit sector, government, international organisations and academia provides graduates with a high-level network for winning positions, along with the skills and qualifications to apply for advertised posts and fellowships.

Employability

An IRDR PhD provides excellent networks and training for careers in research, research communication, public policy, (re)insurance, catastrophe modelling, risk management, international development, humanitarian assistance, engineering and many other fields. The IRDR provides dedicated careers support for students, including networking events often attended by recruiters from the financial sector to the public sector to disaster prevention and response organisations.

Teaching and learning

This MPhil/PhD programme, based in UCL's Institute for Risk and Disaster Reduction (IRDR), offers a unique opportunity to focus on a research topic of interest while learning from other disciplines across the social sciences, physical sciences, engineering, health and medicine, law, arts and humanities.

Leading international researchers in all aspects of risk and disaster are part of IRDR, and there are many opportunities to collaborate with internationally renowned scientists around UCL, elsewhere in the world, and in industry, government and non-profit organisations with whom we have close links. Further details of our research areas and academic expertise can be found at www.ucl.ac.uk/risk-disaster-reduction

In addition to regular supervision, each student must submit the full dissertation and complete an oral exam (Viva’ or ‘defence’). More details can be found on the department website, or by emailing the PhD administrator.

PhDs are mainly self-directed study, with contact hours and supervisions to be agreed between each student and their supervisory team.

We ask students to participate in the intellectual community within the department, and that they also communicate their research ideas and results to a wide audience. Therefore, in addition to their research, there are a number of events and activities throughout the year in which students are expected to participate, such as the annual Spring Academy and PhD Forum.

Research areas and structure

This MPhil/PhD programme, based in UCL's Institute for Risk and Disaster Reduction (IRDR), offers a unique opportunity to focus on a research topic of interest while learning from other disciplines across the social sciences, physical sciences, engineering, health and medicine, arts and humanities. Leading international researchers in all aspects of risk and disaster are part of IRDR, and there are many opportunities to collaborate with internationally renowned scientists around UCL, in industry, government and non-profit organisations with whom we have close links. Further details of our research areas and academic expertise can be found at www.ucl.ac.uk/rdr

Research environment

UCL IRDR aims to build a thriving environment for research and research impact. Participation in research in the IRDR requires that students participate in the wider intellectual community, and that they also communicate their research ideas and results to a wide audience.

Students can expect to have excellent supervision in a stimulating intellectual environment, as well as dedicated skills training and career development support.

Students may study full time over three years and can be on-site or non-resident.

Students may also study part time over five years, either on-site or non-resident.

Accessibility

Details of the accessibility of UCL buildings can be obtained from AccessAble accessable.co.uk . Further information can also be obtained from the UCL Student Support and Wellbeing team .

Fees and funding

Fees for this course.

The tuition fees shown are for the year indicated above. Fees for subsequent years may increase or otherwise vary. Where the programme is offered on a flexible/modular basis, fees are charged pro-rata to the appropriate full-time Master's fee taken in an academic session. Further information on fee status, fee increases and the fee schedule can be viewed on the UCL Students website: ucl.ac.uk/students/fees .

Additional costs

T here are no programme-specific costs.

For more information on additional costs for prospective students please go to our estimated cost of essential expenditure at Accommodation and living costs .

Funding your studies

For a comprehensive list of the funding opportunities available at UCL, including funding relevant to your nationality, please visit the Scholarships and Funding website .

Please note that decisions whether to offer a place on our PhD programme are made primarily by the academic staff member who will take on the role of primary supervisor. They will make this decision on the basis of your project proposal, personal statement, other sections of your application including academic record and references, an interview and their availability to supervise. It is therefore important that your application identifies your proposed supervisor and includes well-prepared project proposal and personal statement sections. Applications are accepted at any time with start dates throughout the year, but typically start in September. Many scholarships have specific deadlines.

Please note that you may submit applications for a maximum of two graduate programmes (or one application for the Law LLM) in any application cycle.

Choose your programme

Please read the Application Guidance before proceeding with your application.

Year of entry: 2024-2025

Got questions get in touch.

Institute for Risk and Disaster Reduction

UCL is regulated by the Office for Students .

Prospective Students Graduate

- Graduate degrees

- Taught degrees

- Taught Degrees

- Applying for Graduate Taught Study at UCL

- Research degrees

- Research Degrees

- Funded Research Opportunities

- Doctoral School

- Funded Doctoral Training Programmes

- Applying for Graduate Research Study at UCL

- Teacher training

- Teacher Training

- Early Years PGCE programmes

- Primary PGCE programmes

- Secondary PGCE programmes

- Further Education PGCE programme

- How to apply

- The IOE approach

- Teacher training in the heart of London

- Why choose UCL?

- Entrepreneurship

- Inspiring facilities and resources

- Careers and employability

- Your global alumni community

- Your wellbeing

- Postgraduate Students' Association

- Your life in London

- Accommodation

- Funding your Master's

- How it works

Useful Links

How much will your dissertation cost?

Have an expert academic write your dissertation paper!

Dissertation Services

Get unlimited topic ideas and a dissertation plan for just £45.00

Order topics and plan

Get 1 free topic in your area of study with aim and justification

Yes I want the free topic

Risk Management Dissertation Ideas

Published by Owen Ingram at January 2nd, 2023 , Revised On August 18, 2023

Identifying and assessing risks in various life situations is the focus of risk management dissertation topics. The key focus of risk management research topics is on risk prevention and risk mitigation. This field is growing in popularity among students every day because of the need for businesses and organisations to prevent and manage risks as part of their damage control strategies.

The decision of what to write about for your dissertation can be difficult. But there is no need to panic yet because you’ve come to the right place if you’re looking for risk management dissertation topics .

For Your Consideration, Here Are Some Excellent Risk Management Dissertation Ideas.

- Investigating the relationship between risk management and organizational performance.

- A review of the literature on the effects of decision support on risk management strategies in business contexts.

- How do insurance companies approach risk management in their organizations? Is it fair, or do some changes need to be made to improve it?

- Earthquake risk management should concentrate on potential barriers and opportunities.

- A descriptive analysis of the relationship between earthquake risk management and earthquake insurance.

- How social and environmental factors relate to risk management, either directly or indirectly.

- A review of empirical evidence on long-term risk management.

- Geotechnical risk management: a comparison of developed and developing countries.

- Investigating the guidelines and principles related to the risk management domain.

- The impact of the relationship between key individuals and business concepts, as well as the degree to which risk management tools are related.

- Investigating the connection between consumer safety and risk management.

- A quantitative study focuses on the factors for optimizing risk management in services.

- A detailed review of empirical evidence for a futuristic analysis of the risk management domain.

- Which of the following factors is a business’s most important risk management?

- Smart grid security risk management is a new area to research.

- Investigating the risk management strategies used in organizations in the UK.

- A correlational study of risk management and population health.

- Investigating the relationship between supply chain risk management and performance measurement.

- International comparison of traditional versus modern risk management strategies.

- A review of the literature on an international disaster risk management system.

- A descriptive analysis of risk management strategies in the pharmaceutical development industry.

- A correlational analysis of the relationship between risk perception and risk management.

- Focus on potential challenges and interventions in enterprise risk management.

- Risk management and big data in engineering and science projects.

- A review of empirical evidence on community-based disaster risk management.

- Portfolio risk management should emphasize the significance of six sigma quality principles.

- Using financial tools and operational methods to integrate supply chain risk management.

- Discovering risk management’s practical applications in Third World countries. Risk Management in a Supply Chain: How Have Current Trends in Global Supply Chain Management Influenced the Evolution of Risk-Management Strategies?

- Critical Success Factors for Financial Services Organizations Implementing an Operational Management System.

Nothing is more critical to a business than managing risks, whether large or small and bringing positive results to their customers. There is no doubt that the course will be interesting, and you will be able to find topics to write about using research methods such as diversity. Get expert assistance with your dissertation topics by placing an order for our dissertation topic and outline service today. You can take inspiration from the above-mentioned risk management dissertation ideas as well.

Free Dissertation Topic

Phone Number

Academic Level Select Academic Level Undergraduate Graduate PHD

Academic Subject

Area of Research

Frequently Asked Questions

How to find dissertation topics about risk management.

To find risk management dissertation topics:

- Study industry challenges.

- Explore emerging risks.

- Analyze case studies.

- Review risk frameworks.

- Consider regulatory changes.

- Select a specific risk aspect or sector that intrigues you.

You May Also Like

Need interesting and manageable Economics dissertation topics? Here are the trending Economics dissertation titles so you can choose the most suitable one.

Portfolio management examines the projects and programs of an organization. There are three aspects involved here: selection, prioritization, and control. This is done by taking into account the strategic goals of the organization.