Environmental Accounting Degree

Jump to section.

- Why Environmental Accounting?

- Bachelor's Degrees in Environmental Accounting

- Certificates in Environmental Accounting

- Master's Environmental Accounting Degrees

- Doctoral Level Environmental Accounting Programs

- Job in Environmental Accounting

- Search For Schools

Why an Environmental Accounting Degree?

Environmental accountants calculate the environmental costs of business activity, as well as business costs incurred by environmental regulations and voluntary programs. By tracking a business's effects on the environment, they give managers opportunities to reduce or eliminate costs. Environmental accountants also suggest alternative supply chains, processes, and other options that may reduce business expenses and environmental damage at the same time. Some also account for “environmental assets” such as pollution allowances and revenue-generating waste streams. Environmental accounting is sometimes referred to as “total cost accounting” or “whole cost accounting.”

Environmental Accounting Areas of Specialty

Environmental Management Accounting (EMA) - EMA deals with internal reporting to company management. EMA tracks environmental assets, expenses, and liabilities, to help managers make better decisions about supply chains, capital investments, industrial processes, and more. Financial Accounting (FA) - Financial accounting deals with external reporting to investors, the government, and other stakeholders. Environmental financial accounting reports on environmental liabilities, assets, and programs to these stakeholders. For this reason, it is more formal than EMA. Financial accounting follows Generally Accepted Accounting Principles (GAAP). National Accounting (NA) - NA involves collecting and analyzing information on national income and health. Environmental national accounting reports on countries' environmental health and natural assets, and the activities and conditions that threaten them.

Environmental Accounting Undergraduate Programs

Most accounting jobs require at least a bachelor's degree in accounting. However, environmental accounting is a still-emerging, specialized field; the Association for the Advancement of Sustainability in Higher Education (AASHE) does not list any undergraduate degree programs in environmental accounting. Most students start out with generalized bachelor's degrees in accounting. Afterwards, they can choose to participate in a sustainable business program at the graduate level.

Alternatively, high school students interested in both business and the environment can choose from an increasing number of undergraduate degrees and concentrations in sustainable business, they may not cover accounting in as much depth.

School Spotlight

Texas A&M University offers a Certificate in Energy Accounting for undergraduate students seeking careers in the energy industry. To complete the certificate program, students must complete ACCT 327 (Intermediate Accounting), ACCT 403/603 (Energy Accounting), ACCT/FINC 484 (Internship), BUSN 302 (Energy Industry), and an approved energy-related elective in a non-business discipline, such as environmental science or geology. The certificate program offers opportunities for interdisciplinary study and real-world experience, and sets graduates apart. Aquinas College in Grand Rapids, Michigan offers a B.S. in Sustainable Business that integrates business courses and the natural sciences. Its Environmental Economics and Policy course covers environmental accounting, externalities, contingent valuation, and other environmental accounting concepts. It also offers courses on building social capital, sustainable business innovations, financial management, and industrial ecology.

Environmental Accounting Certification

New accounting and sustainable business graduates may need to earn professional certification. Any accountant filing a report with the U.S. Securities and Exchange Commission must be certified as a Certified Public Accountant (CPA). Many other accountants pursue certification to enhance their credentials, gain more clients, or improve their opportunities for advancement.

CPAs are licensed by their state Board of Accountancy. In most states, certification involves a minimum of a bachelor's degree, passing a national exam, and showing relevant work experience. Most states require CPAs to participate in professional development to keep their licenses.

An environmental accountant can also become a Certified Professional Environmental Auditor (CPEA) through the Board of Environmental, Health and Safety Auditors Certifications. A cer-tification specialty in environmental compliance is available. This certification is recognized by EPA and the Department of Energy. Like CPA certification, CPEA certification requires a bachelor's degree, passing an exam, and demonstrating relevant work experience.

Graduate Certificates in Environmental Accounting

There are currently no graduate certificate programs in environmental accounting. However, college graduates with general accounting degrees can opt to expand their “green” credentials with a graduate certificate in sustainable business.

Master's Degrees in Environmental Accounting

At the current time, environmental accounting mainly refers to a type of accounting or career path, rather than a degree program. Some universities offer Green MBAs, MBAs in Sustainability, and Masters of Environmental Management that include coursework in environmental accounting.

Doctoral Programs in Environmental Accounting

While there are currently no Ph.D. programs in environmental accounting in the United States, aspiring doctoral candidates can choose programs with faculty conducting research in this area. These faculty members can serve as advisors who guide independent student research.

The University of North Texas has one faculty member interested in research on environmental accounting. Applicants must be sure to communicate with potential advisors before selecting a program. RMIT University in Australia offers a Ph.D. of Accountancy. Its program specializes in business research in accounting, auditing, financial accounting, and social and environmental accountability.

Working as an Environmental Accountant

Most EMAs and FAs work for resource-intensive private companies such as mining, manufacturing, and energy firms. Government agencies and industry associations also employ accountants to tally the costs of regulations and pollution prevention measures. Others do national accounting for nonprofit organizations and federal agencies.

Accounting jobs are projected to grow at an average rate of 7% through 2030. Increasing focus on climate change, energy, and other environmental issues are likely to increase employment in environmental accounting.

2020 US Bureau of Labor Statistics salary figures and job growth projections for Accountants and Auditors reflect national data not school-specific information. Conditions in your area may vary. Data accessed September 2021.

- Browse All Articles

- Newsletter Sign-Up

EnvironmentalAccounting →

No results found in working knowledge.

- Were any results found in one of the other content buckets on the left?

- Try removing some search filters.

- Use different search filters.

Overview of the PhD Program

For specific information on the Environmental Science and Engineering PhD program, see the navigation links to the right.

What follows on this page is an overview of all Ph.D. programs at the School; additional information and guidance can be found on the Graduate Policies pages.

General Ph.D. Requirements

- 10 semester-long graduate courses, including at least 8 disciplinary. At least 5 of the 10 should be graduate-level SEAS "technical" courses (or FAS graduate-level technical courses taught by SEAS faculty), not including seminar/reading/project courses. Undergraduate-level courses cannot be used. For details on course requirements, see the school's overall PhD course requirements and the individual program pages linked therein.

- Program Plan (i.e., the set of courses to be used towards the degree) approval by the Committee on Higher Degrees (CHD).

- Minimum full-time academic residency of two years .

- Serve as a Teaching Fellow (TF) in one semester of the second year.

- Oral Qualifying Examination Preparation in the major field is evaluated in an oral examination by a qualifying committee. The examination has the dual purpose of verifying the adequacy of the student's preparation for undertaking research in a chosen field and of assessing the student's ability to synthesize knowledge already acquired. For details on arranging your Qualifying Exam, see the exam policies and the individual program pages linked therein.

- Committee Meetings : PhD students' research committees meet according to the guidelines in each area's "Committee Meetings" listing. For details see the "G3+ Committee Meetings" section of the Policies of the CHD and the individual program pages linked therein.

- Final Oral Examination (Defense) This public examination devoted to the field of the dissertation is conducted by the student's research committee. It includes, but is not restricted to, a defense of the dissertation itself. For details of arranging your final oral exam see the Ph.D. Timeline page.

- Dissertation Upon successful completion of the qualifying examination, a committee chaired by the research supervisor is constituted to oversee the dissertation research. The dissertation must, in the judgment of the research committee, meet the standards of significant and original research.

Optional additions to the Ph.D. program

Harvard PhD students may choose to pursue these additional aspects:

- a Secondary Field (which is similar to a "minor" subject area). SEAS offers PhD Secondary Field programs in Data Science and in Computational Science and Engineering . GSAS lists secondary fields offered by other programs.

- a Master of Science (S.M.) degree conferred en route to the Ph.D in one of several of SEAS's subject areas. For details see here .

- a Teaching Certificate awarded by the Derek Bok Center for Teaching and Learning .

SEAS PhD students may apply to participate in the Health Sciences and Technology graduate program with Harvard Medical School and MIT. Please check with the HST program for details on eligibility (e.g., only students in their G1 year may apply) and the application process.

In Environmental Science & Engineering

- Undergraduate Engineering at Harvard

- Concentration Requirements

- How to Declare

- Who are my Advisors?

- Sophomore Forum

- ABET Information

- Senior Thesis

- Research for Course Credit (ES 91R)

- AB/SM Information

- Peer Concentration Advisors (PCA) Program

- Student Organizations

- How to Apply

- PhD Timeline

- PhD Model Program (Course Guidelines)

- Qualifying Exam

- Committee Meetings

- Committee on Higher Degrees

- Guidelines for Advisor-Student Discussions

- Research Interest Comparison

- Collaborations

- Cross-Harvard Engagement

- Clubs & Organizations

- Centers & Initiatives

- Alumni Stories

About Stanford GSB

- The Leadership

- Dean’s Updates

- School News & History

- Commencement

- Business, Government & Society

- Centers & Institutes

- Center for Entrepreneurial Studies

- Center for Social Innovation

- Stanford Seed

About the Experience

- Learning at Stanford GSB

- Experiential Learning

- Guest Speakers

- Entrepreneurship

- Social Innovation

- Communication

- Life at Stanford GSB

- Collaborative Environment

- Activities & Organizations

- Student Services

- Housing Options

- International Students

Full-Time Degree Programs

- Why Stanford MBA

- Academic Experience

- Financial Aid

- Why Stanford MSx

- Research Fellows Program

- See All Programs

Non-Degree & Certificate Programs

- Executive Education

- Stanford Executive Program

- Programs for Organizations

- The Difference

- Online Programs

- Stanford LEAD

- Seed Transformation Program

- Aspire Program

- Seed Spark Program

- Faculty Profiles

- Academic Areas

- Awards & Honors

- Conferences

Faculty Research

- Publications

- Working Papers

- Case Studies

Research Hub

- Research Labs & Initiatives

- Business Library

- Data, Analytics & Research Computing

- Behavioral Lab

Research Labs

- Cities, Housing & Society Lab

- Golub Capital Social Impact Lab

Research Initiatives

- Corporate Governance Research Initiative

- Corporations and Society Initiative

- Policy and Innovation Initiative

- Rapid Decarbonization Initiative

- Stanford Latino Entrepreneurship Initiative

- Value Chain Innovation Initiative

- Venture Capital Initiative

- Career & Success

- Climate & Sustainability

- Corporate Governance

- Culture & Society

- Finance & Investing

- Government & Politics

- Leadership & Management

- Markets & Trade

- Operations & Logistics

- Opportunity & Access

- Organizational Behavior

- Political Economy

- Social Impact

- Technology & AI

- Opinion & Analysis

- Email Newsletter

Welcome, Alumni

- Communities

- Digital Communities & Tools

- Regional Chapters

- Women’s Programs

- Identity Chapters

- Find Your Reunion

- Career Resources

- Job Search Resources

- Career & Life Transitions

- Programs & Services

- Career Video Library

- Alumni Education

- Research Resources

- Volunteering

- Alumni News

- Class Notes

- Alumni Voices

- Contact Alumni Relations

- Upcoming Events

Admission Events & Information Sessions

- MBA Program

- MSx Program

- PhD Program

- Alumni Events

- All Other Events

- Requirements

- Requirements: Behavioral

- Requirements: Quantitative

- Requirements: Macro

- Requirements: Micro

- Annual Evaluations

- Field Examination

- Research Activities

- Research Papers

- Dissertation

- Oral Examination

- Current Students

- Entering Class Profile

- Education & CV

- GMAT & GRE

- International Applicants

- Statement of Purpose

- Letters of Recommendation

- Reapplicants

- Application Fee Waiver

- Deadline & Decisions

- Job Market Candidates

- Academic Placements

- Stay in Touch

- Fields of Study

- Student Life

Our doctoral program in the accounting field offers broadly based, interdisciplinary training that develops the student’s skills in conducting both analytical and empirical research.

Emphasis is placed on developing a conceptual framework and set of skills for addressing questions broadly related to accounting information. While issues of financial reporting, managerial accounting, corporate governance and taxation are the ultimate concern, special emphasis is given to applying basic knowledge of economics, decision theory, and statistical inference to accounting issues.

Spectrum of Interests and Research Methods

Faculty research represents a broad spectrum of interests and research methods:

- Empirical and analytical research on the relation between accounting information and capital market behavior examines the characteristics of accounting amounts, the effect of accounting disclosures on the capital market, the role of analysts as information intermediaries, and the effects of management discretion. Issues examined also include the impact of financial information on stock and option prices, earnings response coefficients, market microstructure, earnings management, voluntary disclosures, and the effect of changes in accounting standards and disclosure requirements.

- Problems of information asymmetries among management, investors, and others are currently under study. This research investigates, analytically and empirically, the structure of incentive systems and monitoring systems under conditions of information asymmetry. Research on moral hazard, adverse selection, risk sharing, and signaling is incorporated into this work.

- Other ongoing projects include research on the economic effects of auditing and regulation of accounting information, and analysis of tax-induced incentive problems in organizations.

- Additional topics of faculty interest include analytical and empirical research on productivity measurement, accounting for quality, activity-based costing for operations and marketing, and strategic costing and pricing.

Preparation and Qualifications

It is desirable for students to have a solid understanding of applied microeconomic theory, econometrics and mathematics (linear algebra, real analysis, optimization, probability theory) prior to the start of the program. Adequate computer programming skills (e.g. Matlab, SAS, STAT, Python) are necessary in coursework. A traditional accounting background such as CPA is not required.

Faculty in Accounting

Christopher s. armstrong, jung ho choi, george foster, brandon gipper, ron kasznik, john d. kepler, jinhwan kim, rebecca lester, iván marinovic, maureen mcnichols, joseph d. piotroski, kevin smith, emeriti faculty, mary e. barth, william h. beaver, david f. larcker, charles m. c. lee, stefan j. reichelstein, recent publications in accounting, diversity washing, buy now pay (pain) later, elpr: a new measure of capital adequacy for commercial banks, recent insights by stanford business, big investors say they use esg to reduce risk (but mostly focus on the e and g), more time to trade isn’t a good thing for many retail investors, nine stories to get you through tax season.

- Priorities for the GSB's Future

- See the Current DEI Report

- Supporting Data

- Research & Insights

- Share Your Thoughts

- Search Fund Primer

- Teaching & Curriculum

- Affiliated Faculty

- Faculty Advisors

- Louis W. Foster Resource Center

- Defining Social Innovation

- Impact Compass

- Global Health Innovation Insights

- Faculty Affiliates

- Student Awards & Certificates

- Changemakers

- Dean Jonathan Levin

- Dean Garth Saloner

- Dean Robert Joss

- Dean Michael Spence

- Dean Robert Jaedicke

- Dean Rene McPherson

- Dean Arjay Miller

- Dean Ernest Arbuckle

- Dean Jacob Hugh Jackson

- Dean Willard Hotchkiss

- Faculty in Memoriam

- Stanford GSB Firsts

- Certificate & Award Recipients

- Teaching Approach

- Analysis and Measurement of Impact

- The Corporate Entrepreneur: Startup in a Grown-Up Enterprise

- Data-Driven Impact

- Designing Experiments for Impact

- Digital Business Transformation

- The Founder’s Right Hand

- Marketing for Measurable Change

- Product Management

- Public Policy Lab: Financial Challenges Facing US Cities

- Public Policy Lab: Homelessness in California

- Lab Features

- Curricular Integration

- View From The Top

- Formation of New Ventures

- Managing Growing Enterprises

- Startup Garage

- Explore Beyond the Classroom

- Stanford Venture Studio

- Summer Program

- Workshops & Events

- The Five Lenses of Entrepreneurship

- Leadership Labs

- Executive Challenge

- Arbuckle Leadership Fellows Program

- Selection Process

- Training Schedule

- Time Commitment

- Learning Expectations

- Post-Training Opportunities

- Who Should Apply

- Introductory T-Groups

- Leadership for Society Program

- Certificate

- 2023 Awardees

- 2022 Awardees

- 2021 Awardees

- 2020 Awardees

- 2019 Awardees

- 2018 Awardees

- Social Management Immersion Fund

- Stanford Impact Founder Fellowships and Prizes

- Stanford Impact Leader Prizes

- Social Entrepreneurship

- Stanford GSB Impact Fund

- Economic Development

- Energy & Environment

- Stanford GSB Residences

- Environmental Leadership

- Stanford GSB Artwork

- A Closer Look

- California & the Bay Area

- Voices of Stanford GSB

- Business & Beneficial Technology

- Business & Sustainability

- Business & Free Markets

- Business, Government, and Society Forum

- Get Involved

- Second Year

- Global Experiences

- JD/MBA Joint Degree

- MA Education/MBA Joint Degree

- MD/MBA Dual Degree

- MPP/MBA Joint Degree

- MS Computer Science/MBA Joint Degree

- MS Electrical Engineering/MBA Joint Degree

- MS Environment and Resources (E-IPER)/MBA Joint Degree

- Academic Calendar

- Clubs & Activities

- LGBTQ+ Students

- Military Veterans

- Minorities & People of Color

- Partners & Families

- Students with Disabilities

- Student Support

- Residential Life

- Student Voices

- MBA Alumni Voices

- A Week in the Life

- Career Support

- Employment Outcomes

- Cost of Attendance

- Knight-Hennessy Scholars Program

- Yellow Ribbon Program

- BOLD Fellows Fund

- Application Process

- Loan Forgiveness

- Contact the Financial Aid Office

- Evaluation Criteria

- English Language Proficiency

- Personal Information, Activities & Awards

- Professional Experience

- Optional Short Answer Questions

- Application Fee

- Reapplication

- Deferred Enrollment

- Joint & Dual Degrees

- Event Schedule

- Ambassadors

- New & Noteworthy

- Ask a Question

- See Why Stanford MSx

- Is MSx Right for You?

- MSx Stories

- Leadership Development

- Career Advancement

- Career Change

- How You Will Learn

- Admission Events

- Personal Information

- Information for Recommenders

- GMAT, GRE & EA

- English Proficiency Tests

- After You’re Admitted

- Daycare, Schools & Camps

- U.S. Citizens and Permanent Residents

- Faculty Mentors

- Current Fellows

- Standard Track

- Fellowship & Benefits

- Group Enrollment

- Program Formats

- Developing a Program

- Diversity & Inclusion

- Strategic Transformation

- Program Experience

- Contact Client Services

- Campus Experience

- Live Online Experience

- Silicon Valley & Bay Area

- Digital Credentials

- Faculty Spotlights

- Participant Spotlights

- Eligibility

- International Participants

- Stanford Ignite

- Frequently Asked Questions

- Operations, Information & Technology

- Classical Liberalism

- The Eddie Lunch

- Accounting Summer Camp

- Videos, Code & Data

- California Econometrics Conference

- California Quantitative Marketing PhD Conference

- California School Conference

- China India Insights Conference

- Homo economicus, Evolving

- Political Economics (2023–24)

- Scaling Geologic Storage of CO2 (2023–24)

- A Resilient Pacific: Building Connections, Envisioning Solutions

- Adaptation and Innovation

- Changing Climate

- Civil Society

- Climate Impact Summit

- Climate Science

- Corporate Carbon Disclosures

- Earth’s Seafloor

- Environmental Justice

- Operations and Information Technology

- Organizations

- Sustainability Reporting and Control

- Taking the Pulse of the Planet

- Urban Infrastructure

- Watershed Restoration

- Junior Faculty Workshop on Financial Regulation and Banking

- Ken Singleton Celebration

- Marketing Camp

- Quantitative Marketing PhD Alumni Conference

- Presentations

- Theory and Inference in Accounting Research

- Stanford Closer Look Series

- Quick Guides

- Core Concepts

- Journal Articles

- Glossary of Terms

- Faculty & Staff

- Researchers & Students

- Research Approach

- Charitable Giving

- Financial Health

- Government Services

- Workers & Careers

- Short Course

- Adaptive & Iterative Experimentation

- Incentive Design

- Social Sciences & Behavioral Nudges

- Bandit Experiment Application

- Conferences & Events

- Reading Materials

- Energy Entrepreneurship

- Faculty & Affiliates

- SOLE Report

- Responsible Supply Chains

- Current Study Usage

- Pre-Registration Information

- Participate in a Study

- Founding Donors

- Location Information

- Participant Profile

- Network Membership

- Program Impact

- Collaborators

- Entrepreneur Profiles

- Company Spotlights

- Seed Transformation Network

- Responsibilities

- Current Coaches

- How to Apply

- Meet the Consultants

- Meet the Interns

- Intern Profiles

- Collaborate

- Research Library

- News & Insights

- Program Contacts

- Databases & Datasets

- Research Guides

- Consultations

- Research Workshops

- Career Research

- Research Data Services

- Course Reserves

- Course Research Guides

- Material Loan Periods

- Fines & Other Charges

- Document Delivery

- Interlibrary Loan

- Equipment Checkout

- Print & Scan

- MBA & MSx Students

- PhD Students

- Other Stanford Students

- Faculty Assistants

- Research Assistants

- Stanford GSB Alumni

- Telling Our Story

- Staff Directory

- Site Registration

- Alumni Directory

- Alumni Email

- Privacy Settings & My Profile

- Success Stories

- The Story of Circles

- Support Women’s Circles

- Stanford Women on Boards Initiative

- Alumnae Spotlights

- Insights & Research

- Industry & Professional

- Entrepreneurial Commitment Group

- Recent Alumni

- Half-Century Club

- Fall Reunions

- Spring Reunions

- MBA 25th Reunion

- Half-Century Club Reunion

- Faculty Lectures

- Ernest C. Arbuckle Award

- Alison Elliott Exceptional Achievement Award

- ENCORE Award

- Excellence in Leadership Award

- John W. Gardner Volunteer Leadership Award

- Robert K. Jaedicke Faculty Award

- Jack McDonald Military Service Appreciation Award

- Jerry I. Porras Latino Leadership Award

- Tapestry Award

- Student & Alumni Events

- Executive Recruiters

- Interviewing

- Land the Perfect Job with LinkedIn

- Negotiating

- Elevator Pitch

- Email Best Practices

- Resumes & Cover Letters

- Self-Assessment

- Whitney Birdwell Ball

- Margaret Brooks

- Bryn Panee Burkhart

- Margaret Chan

- Ricki Frankel

- Peter Gandolfo

- Cindy W. Greig

- Natalie Guillen

- Carly Janson

- Sloan Klein

- Sherri Appel Lassila

- Stuart Meyer

- Tanisha Parrish

- Virginia Roberson

- Philippe Taieb

- Michael Takagawa

- Terra Winston

- Johanna Wise

- Debbie Wolter

- Rebecca Zucker

- Complimentary Coaching

- Changing Careers

- Work-Life Integration

- Career Breaks

- Flexible Work

- Encore Careers

- Join a Board

- D&B Hoovers

- Data Axle (ReferenceUSA)

- EBSCO Business Source

- Global Newsstream

- Market Share Reporter

- ProQuest One Business

- Student Clubs

- Entrepreneurial Students

- Stanford GSB Trust

- Alumni Community

- How to Volunteer

- Springboard Sessions

- Consulting Projects

- 2020 – 2029

- 2010 – 2019

- 2000 – 2009

- 1990 – 1999

- 1980 – 1989

- 1970 – 1979

- 1960 – 1969

- 1950 – 1959

- 1940 – 1949

- Service Areas

- ACT History

- ACT Awards Celebration

- ACT Governance Structure

- Building Leadership for ACT

- Individual Leadership Positions

- Leadership Role Overview

- Purpose of the ACT Management Board

- Contact ACT

- Business & Nonprofit Communities

- Reunion Volunteers

- Ways to Give

- Fiscal Year Report

- Business School Fund Leadership Council

- Planned Giving Options

- Planned Giving Benefits

- Planned Gifts and Reunions

- Legacy Partners

- Giving News & Stories

- Giving Deadlines

- Development Staff

- Submit Class Notes

- Class Secretaries

- Board of Directors

- Health Care

- Sustainability

- Class Takeaways

- All Else Equal: Making Better Decisions

- If/Then: Business, Leadership, Society

- Grit & Growth

- Think Fast, Talk Smart

- Spring 2022

- Spring 2021

- Autumn 2020

- Summer 2020

- Winter 2020

- In the Media

- For Journalists

- DCI Fellows

- Other Auditors

- Academic Calendar & Deadlines

- Course Materials

- Entrepreneurial Resources

- Campus Drive Grove

- Campus Drive Lawn

- CEMEX Auditorium

- King Community Court

- Seawell Family Boardroom

- Stanford GSB Bowl

- Stanford Investors Common

- Town Square

- Vidalakis Courtyard

- Vidalakis Dining Hall

- Catering Services

- Policies & Guidelines

- Reservations

- Contact Faculty Recruiting

- Lecturer Positions

- Postdoctoral Positions

- Accommodations

- CMC-Managed Interviews

- Recruiter-Managed Interviews

- Virtual Interviews

- Campus & Virtual

- Search for Candidates

- Think Globally

- Recruiting Calendar

- Recruiting Policies

- Full-Time Employment

- Summer Employment

- Entrepreneurial Summer Program

- Global Management Immersion Experience

- Social-Purpose Summer Internships

- Process Overview

- Project Types

- Client Eligibility Criteria

- Client Screening

- ACT Leadership

- Social Innovation & Nonprofit Management Resources

- Develop Your Organization’s Talent

- Centers & Initiatives

- Student Fellowships

Putting the Focus on Environmental Management Accounting

1. what is environmental management accounting (ema).

EMA supports managers to make better decisions by informing them about environmental impacts of an organization beyond its boundaries and about environmental issues that influence the organization. This includes economic drivers and consequences of environmental issues. EMA can help identifying environmental problems caused, environmental improvements made and how they relate to the economic performance of the organization.

Apart from identifying problems and solutions to environmental problems, EMA helps identifying ‘win-win’ situations that improve both economic and environmental performance. In order to do this. EMA provides relevant monetary and physical information to managers to support decisions specific to their role in the organization. The information provided by EMA connects: short-run operational and long-run strategic concerns; repetitive routine and ad hoc decision settings; past and future performance; and the decision-making, planning and control, coordination, motivation and communication responsibilities of different types of managers.

2. How has EMA practice developed over the last 15 years?

From the late 1980’s early approaches to EMA were proposed and, by 2005, there was sufficient agreement amongst stakeholders for IFAC (2005) to offer guidance to members and to develop a common understanding of what EMA should cover. IFAC aimed to engage with professional bodies who were producing separate advice for the practitioners its members represented. To reduce some of the international confusion about EMA, IFAC provided a general framework and set of definitions. IFAC’s (2005) guidance to members referred to its Management Accounting Concepts definition:

“The management of environmental and economic performance via management accounting systems and practices that focus on both physical information on the flow of energy, water, materials, and wastes, as well as monetary information on related costs, earnings and savings.” (IFAC 2005, p. 16).

Since this guidance on EMA was issued over 15 years ago various developments have occurred in the profession. In this period there has been a significant increase in concern over the risks posed by environmental crisis, especially in relation to the existential threat from climate change, as included in the United Nations Sustainable Development Goals, and movement of the world beyond the safe-space of environmental planetary boundaries. For practitioners this has meant growing demand for their environmental accounting services, not only in relation to internal management advice, but also external reporting standards about the stewardship of environmental resources.

To meet these pressures, EMA research and practice has developed to provide granular accounting advice in relation to risk management of, amongst others, carbon emissions management and disclosure, water management and reporting, material flow and waste management within the context of a circular economy, and accounting for transformation of entities and governments towards zero impacts (or better) on the environment.

Practitioners and students of accounting now have access to a growing body of professional development courses and basic education about environmental issues and the tools that environmental management accounting offers.

3. How should EMA practice develop in the future?

As awareness of environmental crisis grows through international conventions, regional and national agreements, EMA practice should be mainstreamed in several roles.

First, it should build its attention-directing function to make environmental risks apparent to clients of accountancy firms and managers of organizations where accountants are employed.

Second, EMA should be integrated in the planning and control processes of organizations as a key set of tools, such as operational and capital environmental budgeting, environmental investment appraisal and environmental benchmarking based on science-based targets.

Third, EMA practice should be strongly linked with identifying opportunities that emerge from the continuously changing global and local stakeholder pressures to reduce environmental risks in line with international conventions, regional and national agreements. EMA practice should, in these ways, be viewed as support for both problem-solving and opportunity-seeking where organizations aim to transform their activities in operations, supply chains, and the product-service portfolio.

With these roles to the fore, EMA practice should be supported through: appropriate funding demonstrated to provide attractive ROCE; knowledgeable teams of specialised staff; and organizational responsibility structures in place to advise about accounting systems that identify, measure and communicate environmental risks and opportunities. To institutionalise these roles, EMA practice should also be embedded in the educational processes of students and practitioners through university degrees, professional accreditation courses, and ongoing professional development. Focus should be on the strength of EMA to demonstrate how it helps change behaviour to transform organizational activities and contribute to environmental solutions.

4. Where is EMA research today, and what are the future research opportunities in this area?

EMA research has developed substantially in recent years. Initial projects focussed on establishing and demonstrating the ways in which EMA could result in win-win outcomes and there are numerous case studies from multiple countries and industries that speak to this point. Nevertheless, despite this early success, the focus of EMA was largely inside the company while the external impacts with regard to planetary boundaries and society still need to be developed.

Further challenges exist in specific areas, especially with regard to access to and creation of certain types of environmental data (e.g. biodiversity) and the best way to link such data with monetary metrics. When set against the backdrop of increasing interest in new forms of advanced technology related to machine learning, big data, artificial intelligence and Industry 4.0 (the fourth industrial revolution), complementary opportunities exist to develop tools that increase the accuracy of EMA and improve decision making (Burritt and Christ, 2016). Advanced technology could also support EMA research to be undertaken along the supply chain improving environmental traceability to show the full environmental and economic benefits and costs associated with products and activities. Research is also needed into EMA and the changing perspective on globalization brought about by disasters such as the global pandemic.

There has also been movement towards expanding EMA towards a more complete form of sustainability management accounting, which encapsulates social and environmental as well as economic issues (Maas et al., 2016). Although under-researched a move towards sustainability management accounting could be a way to assist business in relation to various initiatives like the UN SDGs. Further research is needed into accounting support for managers to combine economically viable environmental and social opportunities.

5. What is the role of the accountancy profession in EMA?

EMA seeks to bring together physical and monetary information and, although opportunities and revenues are considerations, conventionally the profession’s focus has been on recognizing and reducing environmental costs. This can be seen in the development of EMA tools like material flow cost accounting which has been heavily promoted in Germany and Japan and was later standardised via an ISO standard; ISO 14051.

EMA is recognised by the profession as an interdisciplinary activity requiring commitment from different departments within organisations. Accountants engage with other professionals and development of working groups to address EMA issues has grown in importance. For example, support for decisions by managers through water management accounting requires joint expertise from environmental engineers, natural science-based experts such as meteorologists, logistics and transportation specialists, information technology and accounting experts. Yet notwithstanding this fact, as the gatekeepers to financial information within organisations, accountants are expected to play a key role in relation to the successful implementation of EMA.

Thus, the accountancy profession plays a leading role in EMA take-up. It builds awareness of managers in their different roles thereby promoting learning about the environmental contexts and capacity building scenarios for transformation of organizations through collaborative opportunity and cost sharing.

6. What could IFAC and its member organizations do more of to support the role of accountants in EMA?

For practitioners: Professional accountancy bodies can promote diffusion of EMA and its extension into sustainability management accounting through professional development activities which recognise that environmental risk is seen as the most critical issue facing business (World Economic Forum, 2020). With the increasing need to transform industries and companies towards operating in the safe space of planetary boundaries, EMA training and method development as well as industry agreements and policy recommendations for EMA adoption could be initiated and supported. Nevertheless, as highlighted by the COVID-19 pandemic, social issues are of joint concern and the profession needs to help build practitioner resilience and adaptation strategies in the context of developing opportunities. Accountants are first responders to socio-psychological issues when businesses are ordered to shut down, forced to lay-off staff, or move into bankruptcy and liquidation and professional bodies can prepare them to be well equipped to address societal and client needs for future scenarios.

For academia: Professional bodies can extend support to the development of research in EMA and sustainability management accounting to demonstrate increases in environmental benefits through EMA application, such as restoration of forested and grassland areas, as well as continue with the conventional concern over the reduction of environmental impacts and costs. They can also encourage research into geopolitical and technological risks and opportunities of sustainability transitions of organizations, industries and markets, edging their way into sustainability management accounting through review of globalization and the development of artificial intelligence-based robotics.

For education: The professional bodies can build EMA and sustainability management accounting developments into curricula for accountancy students and, via the accreditation process, encourage universities to mainstream EMA and its connections with global challenges.

7. What are some of the most useful guidance documents on EMA?

- Burritt, R., & Christ, K. (2016). Industry 4.0 and environmental accounting: a new revolution? Asian Journal of Sustainability and Social Responsibility, 1(1), 23-38.

- Burritt, R. L., Hahn, T., & Schaltegger, S. (2002). Towards a comprehensive framework for environmental management accounting—Links between business actors and environmental management accounting tools. Australian Accounting Review, 12(27), 39-50.International Federation of Accountants (IFAC) (2005). International guidance document: environmental management accounting. New York, NY: IFAC.

- Maas, K., Schaltegger, S., & Crutzen, N. (2016). Integrating corporate sustainability assessment, management accounting, control, and reporting. Journal of Cleaner Production, 136, 237-248.

- Schaltegger, S. (2018). Linking environmental management accounting: A reflection on (missing) links to sustainability and planetary boundaries. Social and Environmental Accountability Journal, 38(1), 19-29.

- World Economic Forum (2020). The global risks report 2020 - 15th Edition. World Economic Forum. Available at: http://www3.weforum.org/docs/WEF_Global_Risk_Report_2020.pdf.

Dr. Roger L. Burritt

Dr. Roger L. Burritt is Honorary Professor, Fenner School of Environment & Society, Australian National University, Canberra, Australia. He is a Fellow of CPA Australia and a CA member of Chartered Accountants Australia and New Zealand. His research focus is on environmental management accounting, and issues in sustainability accounting.

Stefan Schaltegger, PhD

Stefan Schaltegger, PhD, is professor for Sustainability Management and head of the Centre for Sustainability Management and the MBA Sustainability Management at Leuphana University Lüneburg. His research deals with corporate sustainability management and accounting with a special focus on performance measurement, sustainable entrepreneurship, business cases for sustainability, and stakeholder theory. Stefan has published more than 500 articles and books, including in leading management, sustainability, interdisciplinary and accounting journals. He serves as associate editor and member of editorial boards of various international journals.

Dr. Katherine Christ PhD, BCom(Hons), AdvDipAcct, CPA

Dr. Katherine Christ is a Senior Lecturer in Accounting at the University of South Australia and a member of CPA Australia. She has a PhD in Sustainability Accounting with interests in environmental accounting and accounting for and managing modern slavery risk in supply chains.

Enter a Search Term

Environmental Management, MS

- Program Overview

- Financing Your Education

- How to Apply

MSEM Program Office [email protected] (415) 422-4119

Program Director

Stephanie A. Siehr

Professor Siehr works on energy–based solutions to multiple environmental problems–from local air pollution to global climate change–combining engineering with tools from political economy and organizational analysis. With a geographical focus on China, Japan, and the US, her research and teaching examine energy and carbon saving strategies; emissions inventories; city climate action; environmental and energy policy analysis; urban sustainability, international cooperation; and environmental...

- PhD, MS, Environmental Engineering and Policy, Stanford University

- SB, Chemical Engineering, MIT

Full-Time Faculty

Tracy Benning

Professor Benning received her PhD from the University of Colorado, Boulder in Environmental, Population and Organismic Biology. Her research interests include landscape ecology, urban ecology and resource conservation and management. Her most recent research focuses on remote sensing and GIS technologies in the study of tropical rainforest dynamics in Hawaii and riparian corridors in southern African savannas.

- PhD, University of Colorado

John Callaway

John Callaway received his PhD in Oceanography and Coastal Sciences from Louisiana State University in 1994. Prior to his position at USF, John was the Associate Director of the Pacific Estuarine Research Laboratory (PERL) at San Diego State University.

At USF, Professor teaches undergraduate and graduate courses in introductory environmental science, applied ecology, wetlands, and restoration ecology. His research expertise is in wetland restoration, specifically wetland plant ecology and...

- PhD, Louisiana State University, 1994

- Wetland restoration

- Wetland plant ecology and sediment dynamics

Deneb Karentz

Professor Karentz is a marine biologist with expertise in plankton ecology and ultraviolet photobiology. Her work has focused on investigating the ecological implications of Antarctic ozone depletion, specifically identifying strategies for protection from UV exposure and understanding mechanisms for repair of UV–induced damage. She has over 30 years of field experience in Antarctica.

In addition to research, Deneb mentors early-career scientists through the US National Science Foundation...

- PhD, University of Rhode Island

- MS, Oregon State University

William Karney

William Karney received his BA from Haverford College and his PhD in organic chemistry from the University of California, Los Angeles. Prior to his position at USF he did postdoctoral work at the University of Washington and the University of California, Berkeley.

At USF, William teaches organic chemistry and environmental chemistry. His research, performed in collaboration with Professor Claire Castro, involves the use of computational chemistry to understand the structures, energetics, and...

- University of California, Los Angeles, PhD in Chemistry, 1994

- Haverford College, BA in Chemistry, 1986

Amalia Kokkinaki

An associate professor in the Department of Environmental Science since 2016, Dr. Amalia Kokkinaki holds a PhD degree from the University of Toronto in Canada and joined USF after completing her postdoctoral research at Stanford University. She is an environmental engineer with expertise in groundwater flow, fate and transport of contaminants, and biological treatment of organic pollutants. Her research is in the nexus of mathematical and statistical modeling of the physical, chemical and...

- University of Toronto, PhD, Civil and Environmental Engineering, 2013

- University of Toronto, MASc, Civil and Environmental Engineering, 2007

- Technical University of Crete, BS and MS, Environmental...

- Groundwater flow and transport

- Contaminant hydrogeology

- Environmental chemistry and microbiology

- Statistical modeling and data assimilation

- Bayesian inverse modeling

John M. Lendvay

John M. (Jack) Lendvay was born and raised near Cleveland, Ohio. Since an early age, he has been interested in environmental issues as one of his childhood memories is the Cuyahoga River Fire of 1969. This interest and his love of science led him to study Chemistry as an undergraduate student at Hiram College, where he graduated in 1983. After college, he joined the US Navy as a Nuclear Submarine Officer and served predominantly on USS Simon Bolivar until 1988. After working in industry for a...

- University of Michigan, Ph.D. in Environmental and Water Resources Engineering, 1999

- University of Michigan, M.S.E. in Environmental and Water Resources Engineering, 1994

- Hiram College, B.A. in...

- Assessment of Water Quality in Coastal California Streams

Allison Luengen

Allison Luengen received her MS in Marine Sciences from the University of California, Santa Cruz (UCSC). She then completed her PhD in Environmental Toxicology, also at UCSC. Following her PhD, she moved to the East Coast for postdoctoral research with Dr. Nicholas Fisher in the School of Marine and Atmospheric Sciences at Stony Brook University. As a postdoc, Professor Luengen worked with radioisotopes to look at how methylmercury bioavailability to phytoplankton was affected by dissolved...

- PhD, Environmental Toxicology, University of California, Santa Cruz

- MS, Marine Sciences, University of California, Santa Cruz

Thomas MacDonald

Tom MacDonald received his PhD from Stanford University. Professor MacDonald's research focuses on designing computer simulations of problems of pollution migration and using the results to engineer systems to contain pollutants and prevent further spreading. He has also published his research on the neural network application for bioremediation. Recently he has co-authored papers dealing with environmental risk and the precautionary principle.

- PhD, Stanford University

Paul Nesbit

Paul is from southern California and earned his PhD from the University of Calgary after completing an MA in Geography from Cal State University - Long Beach (CSULB). His research is at the intersection of modern digital geospatial technologies and geologic mapping, aimed at the assessment, documentation, and application of complete geospatial workflows to analyze and better understand fundamental environmental, geologic, and geomorphologic challenges. His current focus implements drone-based...

- University of Calgary, PhD in Geography, 2020

- CSU - Long Beach, MA in Geography, 2014

- CSU - Long Beach, BS in Geology, 2009

- CSU - Long Beach, BA in Geography, 2009

- Remote sensing and photogrammetry

- Geographic information systems (GIS)

- Geomorphology

- Geospatial analysis

- Drones/uninhabited aerial vehicles (UAV)

April M. Randle

April Randle's research is broadly focused on how ecological factors shape the behavioral and morphological traits of species and influence species' distributions and interactions. She has conducted research on a range of taxa including: tropical trees (forest restoration), primates (foraging behavior), temperate flora (plant ecology, mating system evolution, plant-pollinator interactions), marine mammals (population size estimation of large cetaceans), tropical freshwater fish (adaptations to...

- University of Pittsburgh, PhD in Ecology and Evolutionary Biology, 2009

- University of Florida, MS in Zoology, 2001

- The Evergreen State College, BS/BA, 1994

- Stream and Riparian Ecology

- Plant Mating-System Evolution

- General Ecology

- Wildlife Conservation

Diane Roberts

Diane Roberts, Professor of Accounting, is motivated by a deep concern for unethical financial reporting and non-transparent corporate accounting, considering the potential for catastrophic effects on the environment, community trust, and the global economy.

Having long been interested in environmental issues and professional accounting, Roberts engages her students in discussions that address both honorable and unlawful corporate practices, as well as historical cases that will naturally...

- PhD, Accounting from the University of California, Irvine

- MS, Accounting from California State University, Sacramento

- BA, Economics, University of California, Davis

Dr. Saah has been broadly trained as an environmental scientist with expertise in a number of areas including: landscape ecology, ecosystem ecology, hydrology, geomorphology, ecosystem modeling, natural hazard modeling, remote sensing, geographic information systems (GIS) and geospatial analysis. He has used these skills to conduct research primarily at the landscape level in a variety of systems. Dr. Saah has participated in research projects throughout the United States and Internationally...

- Ecosystem ecology

- Landscape ecology

- Ecosystem modeling

- Natural hazard modeling

- Remote sensing

Tanu Sankalia

Tanu Sankalia is a tenured full professor in the Department of Art + Architecture, and coordinates the Urban Studies Concentration within the Environmental Studies Program. He teaches courses in urban planning and design, architectural and urban history, and architectural design. He was trained in urban design at UC Berkeley, and in architecture at the School of Architecture, Ahmedabad, from where he graduated with a gold medal for the best diploma thesis.

Professor Sankalia's research and...

- UC Berkeley, Master of Urban Design, 1999

- School of Architecture, CEPT University, Ahmedabad, India, Bachelor of Architecture, 1994

Simon Scarpetta

Simon Scarpetta is an evolutionary biologist, paleontologist, and herpetologist with a particular appreciation for lizards and salamanders. He received a PhD in Geosciences from The University of Texas at Austin in 2021, and recently finished an NSF Postdoctoral Research Fellowship in Biology at UC Berkeley. His research incorporates molecular and paleontological data to determine evolutionary relationships and timescales of the lizards of North America, in the context of climatic changes...

- The University of Texas at Austin, PhD in Geosciences, 2021

- Stanford University, BS in Biology (Specialization in Ecology and Evolution), 2014

- Phylogenomics

- Computed tomography

Calla M. Schmidt

Calla Schmidt received a PhD in Earth Science from the University of California, Santa Cruz. Her research spans physical hydrology and biogeochemistry and aims to understand the connection between hydrology and the biogeochemical cycling of nutrients. She has done research on nutrient cycling during groundwater recharge, nitrogen pollution in highway runoff and presently she is working on a project investigating the transfer of nutrients discharged by wastewater treatment plants into the base of...

- PhD, Earth Science, University of California, Santa Cruz

Part-Time Faculty

Cam is a cartographer, spatial data scientist, and educator. In various roles, Cam has applied GIS in the public, private, non-profit, and academic sectors. He currently works in map production and leads international GIS training programs for the World Health Organization. Cam sits on the board of BayGeo, where he organizes and instructs educational workshops.

Cam enjoys using cartography to transform data into visual stories. He has published maps about a variety of topics including housing...

- University of California Davis, MA in Geography, 2018

- University of Illinois, BS in Environmental Engineering, 2011

- Geographic information systems

- Spatial data science

- Cartography

- Data visualization

Aaron Frank J.D.

Aaron Frank's areas of interest include Environmental Law, Environmental Ethics, and Wildlife Policy. He is the Founder and President of the California Wildlife Center and sits on the Board of the Arava Institute for Environmental Studies. In 2013, Aaron won a USF Distinguished Teaching Award.

Susan Hopp is a strategist, educator, and practitioner of sustainable and regenerative management. Since 2007, she has applied her years of experience with technology companies, both startups and multinationals, to building sustainability momentum in business. She spotlights the business case for sustainability as a key integrated strategy informing culture and organizational practices and has worked with organizations across industries to help them formalize their sustainability strategy and...

- MBA, Presidio Graduate School of Sustainable Management

- BA, Michigan State University

- Sustainability Strategy

- Sustainability Planning

- Stakeholder Engagement

- Regenerative Practices

- Facilitation

Gordon Johnson

Gordon Johnson is the manager of the environmental affairs regulatory department at the PBF Energy LLC Refinery in Martinez, California. Gordon has been teaching energy classes in the MSEM program since 1998 and is on the academic advisory board for the USF Energy Systems program.

He has extensive experience in wastewater treatment, groundwater and soil remediation, air regulatory compliance, hazardous waste minimization and elimination, new regulation advocacy, and environmental permitting...

- B.S. in Chemistry, Oregon State University

- M.S. in Environmental Management, University of San Francisco

Fernanda Lopez Ornelas

Fernanda Lopez Ornelas is a Mexican biologist and environmental manager who has always been passionate about nature and environmental phenomena. She earned her biology degree in Mexico and completed her Master of Science in Environmental Management at USF, where she developed a strong interest in geospatial technologies and GIS. She is proud to be part of the first group to obtain the GIS Certificate recently developed by USF’s Geospatial Analysis Lab (GsAL). Lopez Ornelas has a particular...

- University of San Francisco, MSc in Environmental Management, 2016

- Universidad Simon Bolivar (Mexico), BS in Biology, 2010

- LiDAR Technologies

Aviva Rossi

Aviva Rossi's research interests include biogeography, natural history, mammalogy, climate change, and conservation. Her current work focuses on quantifying the natural history of small mammals, including the niche space, resource selection, and modeled distributions. The ultimate goal of her work is to better understand how species are likely to respond to climate change in a way that can inform management.

In addition to her research, Ms. Rossi has over 20 years of experience working in the...

- PhD, University of California Davis, Ecology

- MS, University of San Francisco, Environmental Management

- Wildlife Ecology

Faculty Emeritus

Raymond James Brown

Raymond James (Jim) Brown joined the USF faculty in fall 1970 as an Assistant Professor in the Biology Department. Over his 37 years at USF, Jim taught General Biology, Organic Evolution, Comparative Anatomy, Vertebrate Embryology, and California Wildlife. Later in his career, he directed the Graduate Environmental Management Program and helped establish the Environmental Science Department. He was the first chair of the department and taught Environmental Science and Environmental Monitoring...

Advertisement

A framework for a green accounting system-exploratory study in a developing country context, Colombia

- Open access

- Published: 04 June 2022

- Volume 25 , pages 9517–9541, ( 2023 )

Cite this article

You have full access to this open access article

- Candy Chamorro Gonzalez 1 &

- Jesús Peña-Vinces ORCID: orcid.org/0000-0001-8962-7608 2

8275 Accesses

9 Citations

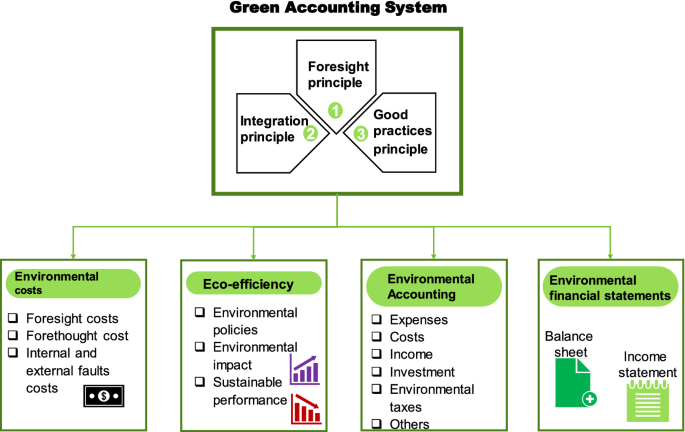

Explore all metrics

Current accounting systems assume a purely financial approach, without including environmental information, such as environmental costs and companies’ expenses. On the one hand, this study proposes a framework that considers the environmental impact of firms within their accounting system, the Green Accounting System (GAS). On the other hand, and in the context of developing countries, Colombia carried out an exploratory study. With a sample of 150 Colombian industrial and commercial companies, this research revealed that 100% of them had not yet implemented environmental practices within the accounting system. Therefore, this research would be useful not only for academia, but also for practitioners and governments. As GAS would contribute to traceability in the quantification of environmental accounting, it would simultaneously generate a movement toward cleaner production that would increase environmental quality.

Similar content being viewed by others

Environmental-, social-, and governance-related factors for business investment and sustainability: a scientometric review of global trends

Mandatory CSR and sustainability reporting: economic analysis and literature review

The Influence of Firm Size on the ESG Score: Corporate Sustainability Ratings Under Review

Avoid common mistakes on your manuscript.

1 Introduction

Few companies currently have a financial management system that not only focuses on the company’s economic aspects, but is also concerned about their environmental impact. Because of this, researchers constantly express the need to include new environmental processes and data in the General Accounting System (Aznar & Estruch, 2015 ; Van Thanh et al., 2016 ), constituting the basis for green or environmental accounting, therefore, enabling the identification and quantification of the use of natural resources. It also includes the costs of environmental management generated by cleanup of contaminated areas, environmental fines or taxes, green technology acquisitions, waste treatment, and the integration of environmental externalities, among other factors. With time, it will be recognized that environmental data must be a structural element in financial reports to provide information for third parties and as a basis for entrepreneurial decision-making.

Maunders and Burritt ( 1991 ) were pioneers in introducing the concept of green accounting. Lee et al. ( 2017 ) referred to the positive and negative interdependencies between economics and ecology, while Hens et al. ( 2018 ) advocated for the importance of implementing green accounting in the accounting system through the measurement of physical and monetary units.

Thus, building and applying green accounting models that lead to the incorporation of environmental processes, units, and activities is crucial as it impacts financial information. In turn, this will enable organizations to issue more complete and reliable financial information, based on both economic and environmental indicators that facilitate determining the evolution and current situation of organizations, which is useful for decision-making (Ojito et al., 2017 ).

In simpler terms, green accounting will translate into overall care for the environment, in particular helping to avoid pollution and deforestation (Schaltegger & Burritt, 2017 ; Zandi & Lee, 2019 ). The following will, therefore, utilize the term “green accounting” possessing the same definition as that of “environmental accounting” (El Serafy, 1997 ). Samaraweera et al. ( 2021 ) suggest including the term green because that color means loyalty and harmony, which, articulated with an accounting system, is understood as a subdiscipline designed to minimize the negative effects that organizations cause on the environment through measurement and assessment of processes to improve their eco-efficiency.

A series of definitions have been proposed for green accounting in the literature (Deegan, 2013 ; Gallhofer & Haslam, 1997 ; Greenham, 2010 ; Yang & Zhao, 2018 ; González & Herrera, 2020), however in the following research, the definition of Singh et al. ( 2019 ) will be used. They maintain that “Green accounting reflects the environmental impact generated by companies during all implemented productive and corporate activities.” (p. 482).

At a global level, there have been different proposals for green accounting (Aronsson et al., 1997 ; Mylonakis & Tahinakis, 2006 ; Nakasone, 2015 ; Vassallo et al., 2017 ). Some establish measurement units based on general equilibrium models that hinder quantifying environmental inefficiency and efficiency factors to enable the improvement of future actions (Aronsson et al., 1997 ). Researchers Mylonakis and Tahinakis ( 2006 ) propose the use of environmental accounting in the accounting information system of the cost-benefits sphere, without specifying other significant capital such as income or environmental assets.

Nakasone ( 2015 ) regards the green accounting model as a concern solely for mining, oil, and gas companies, leaving aside other industrial, commercial, and service sectors that also negatively impact environmental quality. Vassallo et al. ( 2017 ) propose robust methodologies and indicators in green accounting, but from the biophysical and trophodynamic perspective, without referring to the financial aspect.

In general, the proposals are diverse and use different green accounting methodologies that aim to measure and assess an organization’s environmental performance—these points of view do not aim to standardize all environmental activities or processes undertaken by organizations to be communicated in financial reports. Also, the grouping of environmental assessment and measurement methods are not coordinated with the general accounting plan, therefore are not communicated in comprehensive or independent financial reports. The main issue that green accounting models share is that they are conceived in developed countries and fail to consider the particularities of developing economies, such as that of Colombia. Some particularities are: (1) the economic is based on the primary sector, (2) low organizational culture related to the environment, (3) corrupt political regime, (4) lack of environmental and democratic institutions (5) these countries are laboratories in innovation of different ways because they do not have the levels of established infrastructures that are in the developed ones (6), little acceptance for the adaptation of new economic forms that reduce pollution.

In Latin America (LA), Colombia is one of the countries that promote the introduction of green accounting practices among its national companies (Galvis & Guevara, 2019 ; Martínez & Sánchez, 2019 ); Ceballos et al., 2020 . According to the goals of sustainable development, the previous government, and the current government of this country, want to reduce the level of CO 2 that comes from its national industry. Thus, promoting environmental practices by governments is a way to promote cleaner production (Chamorro, 2016 ). Therefore, it is appropriate to discuss green accounting in the context of the Colombian economy. Although it cannot represent all LA-economies, it can become a laboratory of innovation and practice in different ways because they do not have the established infrastructure levels that exist in developed ones (similar situation in all countries with developing economies.

Furthermore, it is relevant to build a new model for the adoption of green accounting in the accounting system. This is based on the models of Novillo and Hachi ( 2014 ), Higuera ( 2015 ), Urraca and Silvia ( 2017 ), who agreed on the essential points for including green accounting in the accounting discipline, taking into consideration important environmental parameters to be communicated in financial reports, such as prevention, integration and good practices.

Green accounting in Colombia dates back to 1990 with the publication by Araujo ( 1995 ) was relevant. The National Council for Economic and Social Policy [CONPES] developed in 1991 an environmental policy that sought to implement and quantify the national natural and environmental patrimony. The following year, the Institutional Committee for Environmental Accounts [CICA] presented an environmental program for Colombia. In 1994, the integrated environmental-economic accounting document for Colombia (Ortiz, 2017 ) was issued and in 1999, an International Environmental Accounts Forum was held, helping to establish the importance of implementing environmental accounts in the Colombian accounting system (Carvalho & Pozzetti, 2019 ).

Although Colombia has an interesting background in green accounting, there is no structure to support the integration of this type of accounting in financial reports (Chávez, 2020 ; Vélez et al., 2007 ; Yepes, 2008 ). This is due to the fact that most Colombian companies use financial accounting instead of green accounting. Therefore, this study attempts to fill the gap in the accounting and environmental literature from a double perspective, theoretical and exploratory. From a theoretical perspective, this study proposes a green accounting system that combines various categories of complete and reliable environmental information. As a result, companies could then identify areas of environmental inefficiency and efficiency, helping to improve decision-making in their productive and financial processes. And, from an exploratory perspective, we examine the degree of implementation of green accounting in firms in developing countries, by doing so; we have used a sample of 150 Colombian companies, allowing for the detection of formative problems and the development of essential bases from an academic approach. In turn, this will help those responsible for financial information and monitoring to integrate and communicate environmental damage along with investments made for ecological improvements through various ledger accounts that must demonstrate this.

The following research also contributes positively to Sustainable Development Goals [SDGs] because the study aims to establish the ninth goal (actions regarding climate) and thirteenth goal (industry, innovation, and infrastructure). Specifically, the main objective is to design a proposal for a Green Accounting System that allows companies to build administrative, commercial, and operational processes in an inclusive and sustainable manner and, consequently, to promote innovation in new forms of responsible production in the management of natural resources, an activity that will contribute to the environmental crisis.

More specifically, this research strengthens an academic circle with the methodological proposal that utilizes accounting knowledge and integrates environmental parameters in their financial records. Scientifically, it produces new methods and practices that reflect the convergence between the environment and accounting. This is an important initiative that organizations must implement globally.

In summary, this research will explore the following sections: a summary of the literature review referencing the main points associated with green accounting, a description of the methodology used to conduct the research and apply the data from the surveyed companies, an analysis of the results as they relate to the discussion, and finally the conclusions and implications of the research.

2 Green accounting system-literature review

Sustainability is one of the leading and most urgent new SDGs. In this context, tools and processes arise that aim to contribute to environmental care by organizations, offering various elements to combat competitive processes for companies’ social development. This is why productive environmental systems within organizations seek effective adaptation to climate change through their implementation of policies, processes, mechanisms, and tools, in order to develop and strengthen the companies' environmental productive activities (Fogarassy et al., 2018 ; Homan, 2016 ). This system also enables the possibility to undertake projects aimed at increasing resilience in communities in the area, achieving recovery and maintenance of the ecosystem (Cavalleti et al., 2020 ; Montagnini et al., 2015 ; Tiwari & Khan, 2020 ).

Alternatively, Moreno ( 2019 ) and Lehman ( 1995 ) mention that it has been axiomatic to incorporate environmental issues in research and education agendas that address evaluation mechanisms which would help companies and professionals implement systems or tools on behalf of the environment, such as green accounting (Angell & Klassen, 1999 ; Nilsson et al., 2017 ).

The nomenclature of green accounting (GA) is recognized as having begun with El Sefary ( 2000 ), who established the need to associate accounting with its green contribution; in other words, environmental protection and pollution prevention. In that regard, green accounting, in addition to being a social tool that enables reporting on qualitative and positive aspects of the environmental impact generated by organizations (Saleh & Jawabreh, 2020 ; Scarpellini et al., 2020 ), is also included in corporate sustainability and in the coordination of environmental and social processes. This ensures the responsible, ethical and continuous success of an enterprise (Hernádi, 2012 ; Ignat et al., 2016 ; Slawinski & Bansal, 2015 ).

The information provided by green accounting has four main objectives: (1) demonstrate environmental wealth, (2) represent temporary spaces for the existence and circulation of this type of wealth, (3) plan possible venues to monitor the behavior and circulation of environmental wealth using the quantitative and qualitative valuation, and (4) indicate a prospective aspect (Capusneanu, 2008 ; Geba et al., 2010 ; González, 2015 ; Zou et al., 2019 ). In short, green accounting is a technoscientific framework for a document that supports decision-making.

With this knowledge, companies must develop an internal environmental policy (Haque & Ntim, 2018 ; Evangelinos et al. 2015 ). In general, green accounting is considered an instrument that reduces a company’s environmental impact (Montemayor et al., 2019 ). Green accounting will support economic efficiency and promote an organizations' capacity for innovation and eco-efficiency (Islam & Managi, 2019 ; Rusell et al., 2017 ).

For this reason, it is important to communicate the processes, activities, strategies and practices that decrease an organization’s environmental impact. According to Rossi et al. ( 2016 ) and Higuera ( 2015 ), such communication must be presented through accounting recognition supported by a comprehensive or independent financial report. This would report on the monetary quantification of the main elements of green accounting: assets, liability, patrimony, expenses, costs, and provisions, among other accounts that categorize the environmental wealth of the organization which must be reflected in an independent environmental report (Bennett & James, 2017 ; Fleischman & Schuele, 2006 ; Gray & Laughlin, 2012 ).

According to the proposals presented in diverse models (Craig & Glasser, 1994 ; Cortes, 2016 ; Cairns, 2009 ; Mason & Simmons, 2014 ; Rodríguez, 2015 ), the characteristics that identify the integration of green accounting in a company are (A) implementation of environmental policy, (B) development of environmental strategies, (C) establishment of environmental financial reports, (D) introduction of environmental accounts, and (E) presentation of environmental reports that document the processes for reducing environmental impact.

Other models stress that green accounting must be established as a socioeconomic tool to facilitate company adaptation of principles and activities. This is vital to mitigate the environmental impact of their organizations through business processes and accounting recognition of the different environmental activities (Novillo & Hachi, 2014 ). According to Vasallo et al. ( 2017 ) and Zandi and Lee ( 2019 ), the implementation of environmental accounting is established as a competitive process that points towards new strategies such as the decrease of risks to environmental reputation, strategic innovation, entry into international markets, adaptation to the global market, among other benefits that contribute towards human and social development at companies.

In this scenario, organizations require accounting professionals with added knowledge in environmental matters since currently there are different standards that require measuring and evaluating environmental assets, liabilities, income, costs and expenses (Alvarado et al., 2016 ; Chamorro et al., 2019 ; Lieder & Rashid, 2016 ; Medina, 2019 ; Hernández, 2012 ).

3 Methodology

To develop the green accounting system, we carried out a thorough review of the literature on green accounting. Scopus and ISI web knowledge datasets were used mainly. The results revealed the scarcity of literature on the topic. To broaden the data to be evaluated, other databases such as Science Direct, Emerald, and Google Scholar (for Google, we used versions in both English and Spanish) were consulted. Astonishingly, the result was almost identical—little information was available. In fact, there was a proposal related to the context of developing economies that became part of this examination of gaps in the research. It also justifies the need for extensive research on green accounting topics.

The exploratory study is based on a sample of 150 Colombian companies. Thus, we first develop the green accounting system and then we continue with the exploratory analysis, which supports the idea that firms must count on an accounting system that can gather the environmental effects of corporative activities.

4 Green accounting system: an exploratory study in the colombian case

Our research identified that 6793 companies exist in the database maintained by the Chamber of Commerce in Colombia, but only 3771 are industrial and commercial companies (object of study). However, of 3771 companies, only 1000 were selected because the remaining did not count on financial managers.