Pecking Order Theory and Innovativeness of Companies

- Conference paper

- First Online: 28 December 2016

- Cite this conference paper

- Katarzyna Prędkiewicz 2 &

- Paweł Prędkiewicz 3

Part of the book series: Springer Proceedings in Business and Economics ((SPBE))

2595 Accesses

1 Citations

The purpose of this paper is to explore whether the “pecking order hypothesis” applies to the capital finance preferences of innovative companies. The research is based on a survey of 409 companies. We asked them about attitude towards innovation—three answers were possible (neutral, innovation “on occasion” and pro-innovative attitude) and to indicate the financing hierarchy for five sources of capital (retained earnings, bank credit or loan, additional capital from the current owners, loan from the owners and new external equity capital). We found that in general, the hierarchy is consistent with the pecking order theory. On the first place with the higher frequency, retained earnings were pointed out, on the second place—bank credit or loan, and on the last (fifth)—new external equity. Innovativeness of companies changes the hierarchy of financing in the third and fourth place. Innovative companies after retained earnings and bank loans prefer loans from the owners, whereas companies with neutral attitude towards innovation, additional capital from the current owners. Moreover, the group that describes their attitude towards innovations as “innovation on occasion” is the most diverse in their preferences, whereas the group with “pro-innovative” strategy has consistent preferences.

- Capital structure

- Pecking order theory

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Aghion P, Bond S, Klemm A, Marinescu I (2004) Technology and financial structure: are innovative firms different? J Eur Econ Assoc 2:277–288. doi: 10.1162/154247604323067989

Article Google Scholar

Ang JS (1991) Small business uniqueness and the theory of financial management. J Entrep Finance 1:1–13

Google Scholar

Cassar G, Holmes S (2003) Capital structure and financing of SMEs: Australian evidence. Account Finance 43:123–147

Hall G, Hutchinson P, Michaelas N (2000) Industry effects on the determinants of unquoted SMEs’ capital structure. Int J Econ Bus 7:297–312. doi: 10.1080/13571510050197203

Hogan T, Hutson E (2005) Capital structure in new technology-based firms: evidence from the Irish software sector. Glob Finance J 15:369–387. doi: 10.1016/j.gfj.2004.12.001

Kubiak J (2013) Zjawisko asymetrii informacji a struktura kapitału przedsiębiorstw w Polsce. Wydawnictwo Uniwersytetu Ekonomicznego w Poznaniu, Poznań

Lopez-Gracia J, Aybar-Arias C (2000) An empirical approach to the financial behaviour of small and medium sized companies. Small Bus Econ 14:55–63. doi: 10.1023/A:1008139518709

Myers SC (1984) The capital structure puzzle. J Finance 39:574–592

Myers SC, Majluf NS (1984) Corporate financing and investment decisions when firms have information that investors do not have. J Financ Econ 13:187–221

Paul Stuart, Whittam Geoff, Wyper Janette (2007) The pecking order hypothesis: does it apply to start-up firms? J Small Bus Enterp Dev 14:8–21. doi: 10.1108/14626000710727854

Schäfer D, Werwatz A, Zimmermann V (2004) The determinants of debt and (private) equity financing: the case of young, innovative SMEs from Germany. Ind Innov 11:225–248. doi: 10.1080/1366271042000265393

Van Caneghem T, Van Campenhout G (2012) Quantity and quality of information and SME financial structure. Small Bus Econ 39:341–358

Zoppa A, McMahon RG (2002) Pecking order theory and the financial structure of manufacturing SMEs from Australia’s business longitudinal survey. Small Enterp Res 10:23–42

Download references

Acknowledgments

The project was funded by the National Science Centre allocated on the basis of the decision number DEC-2013/11/D/HS4/03941.

Author information

Authors and affiliations.

Department of Corporate Finance Management, Wrocław University of Economics, ul. Komandorska 118-120, 53-345, Wrocław, Poland

Katarzyna Prędkiewicz

Department of Finance, Wrocław University of Economics, ul. Komandorska 118-120, 53-345, Wrocław, Poland

Paweł Prędkiewicz

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Katarzyna Prędkiewicz .

Editor information

Editors and affiliations.

Faculty of Finance and Accounting, University of Economics, Prague, Czech Republic

David Procházka

Rights and permissions

Reprints and permissions

Copyright information

© 2017 Springer International Publishing AG

About this paper

Cite this paper.

Prędkiewicz, K., Prędkiewicz, P. (2017). Pecking Order Theory and Innovativeness of Companies. In: Procházka, D. (eds) New Trends in Finance and Accounting . Springer Proceedings in Business and Economics. Springer, Cham. https://doi.org/10.1007/978-3-319-49559-0_58

Download citation

DOI : https://doi.org/10.1007/978-3-319-49559-0_58

Published : 28 December 2016

Publisher Name : Springer, Cham

Print ISBN : 978-3-319-49558-3

Online ISBN : 978-3-319-49559-0

eBook Packages : Business and Management Business and Management (R0)

Share this paper

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

ROS Theses Repository

- ROS Home

- Management & Languages

- Doctoral Theses (Management & Languages)

Pecking order theory, trade-off theory and determinants of capital structure : empirical evidence from Jordan

Collections, ros administrator.

To read this content please select one of the options below:

Please note you do not have access to teaching notes, testing the pecking order theory: the importance of methodology.

Qualitative Research in Financial Markets

ISSN : 1755-4179

Article publication date: 5 June 2009

The purpose of this paper is to show that different methodologies may lead to different implications about the validity of the pecking order theory.

Design/methodology/approach

Using data from Greek firms as a starting‐point, the paper first investigates whether they follow the financing pattern implied by the pecking order theory and then illustrates that conclusions concerning the pecking order should be carefully shaped by researchers, as the methodology used can be misleading. Two different information sources are used; the first is data derived from the financial statements of the Greek firms listed in the Athens Exchange, while the second comprises the answers to a detailed questionnaire.

It is shown that a negative relationship between leverage and profitability does not necessarily mean that the pecking order financing hierarchy holds. Analysis should not rely solely on the mean‐oriented regression quantitative analysis to test the pecking order theory, as it refers to a distinct hierarchy.

Research limitations/implications

Further research should focus on investigating the reasons that underlie actual firm financing.

Practical implications

The fact that the pecking order is actually a hierarchy makes research in this field more complex. Analysts should consider this special feature of the pecking order approach when analyzing the existence of the pecking order financing pattern. The methodology followed is of crucial importance in the analysis of the existence of the pecking order financing pattern.

Originality/value

To the authors' knowledge, this is the first paper to test the pecking order pattern of financing using simultaneously quantitative and qualitative data, and to compare results and conclusions drawn from these two different types of methodology.

- Capital structure

- Research methods

Vasiliou, D. , Eriotis, N. and Daskalakis, N. (2009), "Testing the pecking order theory: the importance of methodology", Qualitative Research in Financial Markets , Vol. 1 No. 2, pp. 85-96. https://doi.org/10.1108/17554170910975900

Emerald Group Publishing Limited

Copyright © 2009, Emerald Group Publishing Limited

Related articles

We’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

Pecking Order Theory: Definitions, Concepts and Examples

Deciding how to finance a company’s operations and growth is a what corporate finance is all about! Companies must choose how to raise capital from various internal and external sources.

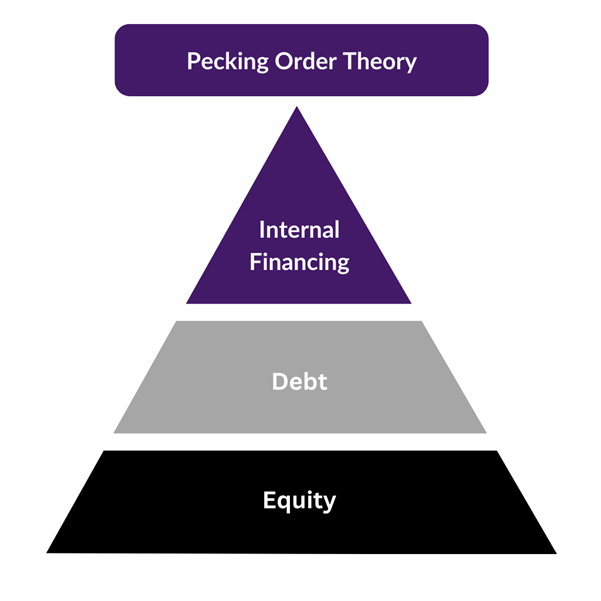

The pecking order theory provides an influential model for thinking about how companies make these financing decisions. Proposed by Stewart C. Myers and Nicolas Majluf in 1984, the theory suggests companies follow a defined hierarchy, prioritizing internal funds first, then debt, and finally equity as a last resort.

Understanding the pecking order theory gives insight into corporate capital structure choices and has important implications for financial modelling and analysis. While the theory has limitations, it remains a foundational framework for evaluating financing options.

What is the Pecking Order Theory?

The Pecking Order Theory, sometimes referred to as the capital structure pecking order, was first proposed by Stewart C. Myers and Nicolas Majluf in 1984. It aims to provide a model for how companies prioritise their financing sources and make capital structure decisions.

According to the pecking order theory, companies follow a hierarchy when making decisions about their capital structure:

- Internal Financing or Retained Earnings – Firms prefer to use internally generated funds to finance new projects and investments. This allows them to avoid the need for external financing which requires additional transaction costs.It’s also convenient as the company doesn’t need to go external investors (banks, institutions, shareholders) to get permission.

- Debt – If internal financing is insufficient, firms will issue debt in some form – utilising headroom on existing facilities, getting new loans from banks, or issuing bonds of some variety. Debt, as opposed to raising new equity capital, allows companies to obtain financing while avoiding giving up ownership or control.

- Equity – Issuing new equity is seen as a last resort in the pecking order. This can dilute ownership and requires sharing control with new shareholders.

The logic behind this pecking order is that internal funds have no associated costs while debt financing is cheaper than equity financing in most cases. Firms also wish to retain control and avoid ownership dilution.

Reasoning Behind the Pecking Order

The logic underpinning the pecking order theory extends beyond just the associated costs of each financing type. Several key reasons underlie this hierarchy:

- Information Asymmetry – Firms typically possess more information about their prospects and risks than external investors. When a company issues new equity, this is typically done when markets are buoyant and stock prices relatively high, so external investors may perceive it as a signal that the company believes its stock is over-valued. Just the announcement of a firm raising equity could actually damage the share price.

- Transaction Costs – Relying on internal financing avoids the transaction costs associated with issuing new debt or equity. Even between debt and equity, issuing debt typically has lower flotation costs.

- Control and Ownership Dilution – By using internal funds or debt, companies can prevent dilution of ownership. Issuing new equity can lead to a dilution of control of existing shareholders and may result in management having to answer to a broader group of shareholders. Family-controlled businesses are particularly sensitive to bringing in new shareholders.

- Cost of the finance – Debt is fundamentally cheaper than equity! It’s less risky for investors (with scheduled repayments of interest and principal) and has priority over equity on liquidation. It may also be secured over business assets making it even cheaper. In addition to all that, interest payments on debt are tax-deductible, making debt an attractive option from a tax perspective. Equity does not offer such tax advantages.

Real-World Examples

There are many real-world examples that illustrate the pecking order theory in action:

- Apple, for instance, has generated significant retained earnings in recent years. Instead of accumulating extensive external debt or issuing new equity, the tech giant has largely relied on these internal funds to finance ventures like R&D, capital expenditures, and acquisitions. However, it’s also worth noting that in certain circumstances, even major corporations like Apple may deviate from the pecking order, based on market conditions or strategic initiatives.

- Mature manufacturing firms rely heavily on corporate bonds and debt offerings to fund expansions. This allows them to maintain control and avoid issuing equity.These businesses also tend to be quite asset intensive, providing scope for debt to be secured over those tangible assets.

- High-growth startups exhaust their limited debt capacity quickly. When cheaper debt financing runs out, they turn to more expensive external equity investors like venture capitalists who command high returns (not necessarily in cash, but in seeing growth in their capital).

These examples show the pecking order theory largely holds when explaining corporate capital structure decisions across different contexts. Firms stick to the hierarchy when possible.

What are the Advantages of Using the Pecking Order Theory?

Using the pecking order theory to guide financing decisions has some benefits:

- Avoiding loss of control and dilution – Using internal funds allows firms to maintain existing ownership and control structures.

- Reduced financing costs – Internal funds and debt are typically cheaper sources than equity financing.

- Flexibility for future investments – Using less debt preserves borrowing capacity for future needs.

- Reduced information asymmetry – Debt requires sharing less private data than issuing equity.

Overall, the theory provides a model to manage the costs of external capital by utilizing cheaper internal funds first. This can lower a firm’s overall cost of capital, and lowering costs of any kind is always a good option if you aim to maximise shareholder value.

Limitations of the Pecking Order Theory

However, the pecking order theory also has some limitations:

- Oversimplifies complex decisions – A rigid hierarchy fails to capture real-world factors that affect capital structure.

- Applicable mainly to established public firms – less mature or private firms often lack access to cheaper internal and debt financing.

- Ignores benefits of equity – Firms may issue equity to strategically align with investors or when shares are overvalued.

- Static view – Changing market conditions affect the relative costs of debt and equity over time.

- Using internal funds may disturb the dividend pattern of a company. Many equity investors like dividend reliability, and if the pecking order theory is applied blindly it might mean lower dividends – leading to lower share price and damaging the share price.

While useful as a general framework, the pecking order theory oversimplifies nuanced financing decisions. In practice, multiple factors beyond just cost and control impact optimal capital structure. Companies weigh trade-offs based on their specific situation – How much do they need? What is it being used for? How leveraged is the business already? And so on.

Alternatives to the Pecking Order Theory

The Pecking Order Theory provides a hierarchical framework for financing decisions, but other theories offer contrasting views:

- Trade-off Theory – This theory suggests that firms balance the benefits and costs of debt financing to find an optimal capital structure. For instance, while debt can provide tax shields, it also increases the firm’s risk of bankruptcy.

- Agency Theory – This focuses on the conflicts of interest between shareholders and managers. Managers may prefer to finance operations without resorting to external financing to maintain job security, whereas shareholders might prefer riskier strategies that require external financing but offer higher returns.

- Market Timing Theory – Some researchers argue that the timing of equity markets influences financing decisions. Firms might issue equity when they believe their stock is overvalued and repurchase equity when they believe it’s undervalued.

Capital City Training offers face-to-face programs and online financial training courses covering Corporate Finance decision making and exploring the Capital Market financing options – from Syndicated Loans to Bonds and Equity. Contact us if you would like to discuss arranging or attending one of our programs.

Best Practice Financial Modelling

Gain essential skills needed to build robust forecast models for companies

Discount rate guide: definitions, formulas, examples.

Discount Rate Guide: Definitions, Formulas, Examples The discount rate is a crucial concept in corporate finance and investment

Is your firm paying the apprenticeship levy?

Claim it back through training! It has been over two years since the UK government announced it would introduce the

Working Capital: Definitions, Formulas, Examples

Working Capital: Definitions, Formulas, Examples Working capital is a vital concept in corporate finance and business management. It

Share This Story, Choose Your Platform!

About the author: mark.

IMAGES

VIDEO

COMMENTS

This thesis examines a variety of pecking order and trade-off asymmetric models and compares their performance with the symmetric alternative. Using data from 114 non-financial Jordanian firms (of which 62 are industrial firms and the remaining are services firms), we report evidence suggesting that firstly, equity ... 2.3.2 Empirical evidence ...

the pecking order hypothesis and the static tradeoff theory, under the UK setting. hus T the main research question of the thesis is:" Which theory can better explain the UK non-financial firms' capital structure, the pecking order hypothesis or the static tradeoff

We use the staggered introduction of a major financial-reporting regulation worldwide to study whether firms make financing decisions consistent with the pecking order theory. Exploiting cross-country and within country-year variation, we document that treated firms increase their issuance of external financing (and ultimately increase ...

Thesis for: Graduate Economics; Advisor: Dr. Vitor Trindade; ... One of the most popular models of firm's financing decisions under an asymmetry in the literature is the pecking order theory (POT ...

The pecking order theory relates to a company's capital structure in that it helps explain why companies prefer to finance investment projects with internal financing first, debt second, and equity last. The pecking order theory arises from information asymmetry and explains that equity financing is the costliest and should be used as a last ...

Later, Pecking Order theory is announced [33] which proposes the idea that firms initially emphasize more on internal funds then move for debt and then equity [34]. Technically, discussed capital ...

pecking order theory has little to very little support in any particular country in the European Union. There is little difference in pecking order behavior between firms of with various levels of ... This thesis is completely going to focus on the pecking-order hypotheses and will leave the competitive static tradeoff theory open for further ...

The pecking order theory suggests that firms have a particular preference order for capital used to finance their businesses (Myers and Majluf, 1984). Owing to the information asymmetries between the firm and potential investors, the firm will prefer retained earnings to debt, short-term debt over long-term debt and debt over equity. ...

The pecking order theory is one of the capital structure theories that have been tested in many different economies over the past thirty years. This theory predicts a hierarchy in funding and states in which firms will prefer an internal source of funds to external ones should there be a need for funding. This is the first stage of the pecking ...

Trade-off-theory vs. pecking order theory and the determinants of corporate leverage: Evidence from a panel data analysis upon French SMEs (2002-2010) ... Conversely, it refutes the prediction of POT and the thesis arguing that trade credit is a substitute for bank credit (Petersen & Rajan, Citation 1994), thereby rejecting the result of ...

This paper surveys 4 major capital structure theories: trade-off, pecking order, signaling and market timing. For each theory, a basic model and its major implications are presented. These implications are compared to the available evidence. This is followed by an overview of pros and cons for each theory. A discussion of major recent papers and suggestions for future research are provided.

This is consistent with the pecking order theory implied by Myers and Majluf (1984) since private debt will require better information about the firm than public debt. However, distinguishing these theories in empirical tests has proven difficult as variables describing one theory can also be classified for the other theory. For example, as ...

2.2 Tests of the pecking order theory Frank & Goyal (2003) state that in reality, company operations and the associated accounting structures are more complicated than the standard pecking order description. Aggregation of the accounting cash flows must be used in order to test the pecking order theory. The cash flows are defined as follows:

SMEs capital structure: trade-off or pecking order theory: a systematic review - Author: Lisana B. Martinez, Valeria Scherger, M. Belén Guercio The purpose of this paper is to organize and present the literature related to firm's capital structure across the years and find the most relevant publications and authors in the research area.

the corporate level, the signalling theory of capital structure predicts that high-quality corporations should signal their quality by issuing debt which is similar to the results in our paper. Myers and Majluf (1984) set forth the pecking order theory. The key element of the pecking order theory is asymmetric information between a

Preferences for selection order for five indicated sources of capital do not differ significantly from the pecking order theory, in general, in the whole sample (Table 58.2), but there were also companies in the sample that indicated a changed order in relation to POT.Retained earnings were pointed out as the first source of capital by 61% of the sample (250 companies), as the second source by ...

This thesis examines a variety of pecking order and trade-off asymmetric models and compares their performance with the symmetric alternative. Using data from 114 non-financial Jordanian firms (of which 62 are industrial firms and the remaining are services firms), we report evidence suggesting that firstly, equity issues track the financing ...

This master thesis aims to test two important theories in the field of capital structure, e.g. the pecking order hypothesis and the static tradeoff theory, under the UK setting. Thus the main research question of the thesis is:" Which theory can better explain the UK non-financial firms' capital structure, the pecking order hypothesis or the static tradeoff theory?" By using the sample ...

Analysis should not rely solely on the mean‐oriented regression quantitative analysis to test the pecking order theory, as it refers to a distinct hierarchy., - Further research should focus on investigating the reasons that underlie actual firm financing., - The fact that the pecking order is actually a hierarchy makes research in this ...

The Pecking Order Theory, sometimes referred to as the capital structure pecking order, was first proposed by Stewart C. Myers and Nicolas Majluf in 1984. It aims to provide a model for how companies prioritise their financing sources and make capital structure decisions. According to the pecking order theory, companies follow a hierarchy when ...

The pecking order theory is popularized by Myers and Majluf (1984) where they argue that equity is a less preferred means to raise capital because when managers (who are assumed to know better about true condition of the firm than investors) issue new equity, investors believe that managers think that the firm is overvalued and managers are ...

The pecking order theory of capital structure is among the most influential theories of corporate leverage. Originally developed by Myers-Majluf (1984), it considers the role of information asymmetries (with regard to presently held assets and investment opportunities) between firms and capital markets. According to

The pecking order theory explains that internal funding sources are more desirable than the use of external funds because the costs are cheaper; for example, business owners do not need to pay ...