AWS Quantum Technologies Blog

A detailed, end-to-end assessment of a quantum algorithm for portfolio optimization, released by goldman sachs and aws.

To date, the financial services industry has been a pioneer in quantum technology, owing to its plethora of computationally hard use cases and the potential for significant impact from quantum solutions. Daily operations at financial firms such as banks, insurance companies, and hedge funds require solving well-defined computational problems on underlying data that is constantly changing. If quantum computers can perform the same calculations faster or with better accuracy than existing solutions, these customers stand to reap significant benefit.

In this post we’ll walk you through some key takeaways from a body of work by scientists from Goldman Sachs and AWS that was published today in the journal PRX Quantum [1].

A commonly studied use case in quantitative finance is the task of portfolio optimization — consequently, customers are eager to learn what impacts quantum computing can have on this task, if any. Several distinct quantum algorithms have been proposed for portfolio optimization, each of which leverage quantum effects to provide a theoretical speedup over comparable classical algorithms.

However, it has been difficult to assess whether these theoretical speedups can be realized in practice. Such an assessment requires an end-to-end resource estimation of the quantum algorithm — that is, a calculation of the total number of qubits and quantum gates (or other relevant metrics) required to solve the actual problem of interest, without sweeping any costs or caveats under the rug.

End-to-end assessments are challenging because certain elements of the quantum algorithm are heuristic, and there are caveats related to the way the quantum computer accesses the data. Thus, it can be difficult to make apples-to-apples comparisons with existing methods

Despite the challenges, scientists from Goldman Sachs and AWS took on the task of performing an end-to-end resource estimate for a leading quantum approach to portfolio optimization — the quantum interior point method (QIPM), which we will discuss in this post. You can read the full paper in the journal PRX Quantum, but let’s walk through some of the main takeaways of that work [1].

How do we determine if a quantum algorithm is practical?

For quantum computers to provide value over classical algorithms, we need to develop practical, end-to-end quantum algorithms, for which we identify the following criteria:

- The quantum algorithm produces a classical output that allows for benchmarking against classical methods . This requirement rules out some quantum “algorithms” that efficiently produce quantum states as output, but are much less efficient when forced to turn that quantum state into an answer to the original (classical) computational problem.

- The quantum algorithm relies on a reasonable input model . In particular, it does not utilize any unspecified black-box subroutines (often called “oracles”) for which the costs are not counted, nor does it assume fast data access without accounting for the true cost of quantum access to the classical data . For example, several quantum algorithms for Machine Learning were thought to offer exponential advantages over classical methods until it was pointed out that this was primarily an artifact of unreasonable assumptions about the input model [2].

- The quantum algorithm has a plausible case for asymptotic quantum speedup — that is, for sufficiently large instance sizes, the quantum algorithm requires substantially fewer elementary operations than the classical algorithm. Since classical computers can perform elementary operations at a much faster rate than quantum computers, without an asymptotic speedup, the quantum computer will always lose.

- For classically challenging problem sizes, the quantum algorithm can solve the same end-to-end problem in a reasonable run-time . Asymptotic speedups are of no value if the crossover point where quantum computers outperform classical computers occurs at instance sizes that are too large to be useful to customers.

Portfolio optimization

Portfolio optimization is a well-defined computational task that appears in many fields, but its utility is particularly clear for financial operations. Suppose you have a fixed budget to invest in the stock market. You’d like your investments to provide predictable growth; in particular, you’d like to construct a portfolio that maximizes the expected return of the portfolio, while minimizing the risk , that is, the amount by which the return might deviate from its expectation.

Part of the problem is thus determining which stocks are expected to perform well in a given timeframe, based on historical data — we assume this has already been done. If there are n stocks to invest in, we are provided as input with a length- n vector containing the expected return for each of the stocks, as well as an n x n matrix 𝛴 containing the historical volatilities of each stock and the covariance of each pair of stocks — the performance of different stocks is correlated, and the optimal portfolio will exploit these correlations to minimize portfolio risk.

Let w be the length- n vector representing the fraction of our budget we allocate to each stock. In general, entries of w can be negative, which represents a short sale. Here, though, we will require that the portfolio contain only “long” assets — i.e., no short sales: w i ≥ 0 . The portfolio optimization problem is then formulated as a convex optimization problem:

The parameter q is called the “risk-aversion parameter”, and it is set by the user according to how much risk they are willing to take on to gain additional return.

The first constraint is a total budget constraint. We’ve normalized w so that the total budget available is just 1, but without normalizing this sum would equal the total amount of money available to invest.

The second constraint enforces the “long-only” condition above; if we allow short selling, this can be relaxed. Additional constraints, such as minimum or maximum investments in certain stock sectors, cardinality constraints (i.e., the maximum allowed number of assets), or transaction costs, can also be incorporated into this framework (see [3]).

The set of portfolios that obey all the constraints is known as the feasible region. The feasible region can be divided into the boundary, where at least one of the inequality constraints holds as an equality (e.g. w i = 0 ), and the interior , where all inequality constraints are strict ( w i > 0 for all i ).

One widely used classical approach for solving portfolio optimization is to map the convex optimization problem above to a type of optimization problem known as a second-order cone program (SOCP), and then solve it with an interior point method (IPM). The basic idea of an IPM is to start at some portfolio in the interior of the feasible region and iteratively update it in a way that is guaranteed to eventually approach the optimal portfolio, which lies on the boundary of the feasible region, as depicted in Figure 1.

Figure 1: A toy example depicting how an Interior Point Method (IPM) solves portfolio optimization. The hexagonal region represents the feasible set of portfolios. The IPM generates a sequence of points (known as the central path) that follows a path from the interior of the region to the optimal point, which lies on the boundary. The color represents the value of the objective function, including barrier functions that implement constraints (darker is better). The black dots represent the central path, which is defined to be the optimal point of the objective function, including the barrier. As the barrier functions are relaxed, the objective function approaches the true objective function, and the central path approaches the optimal solution to the problem on the boundary of the feasible space.

Performing a single iteration of the IPM requires solving a linear system of equations of size L x L , where (in our formulation), L ≈ 14n and n is the number of stocks in which we could invest. The output of the IPM is a portfolio w that obeys all the constraints and for which the objective function is within 𝜖 of the optimal value. Many flavors of IPM exist, and developing better classical IPMs is an active area of research.

Here we focus on the IPMs that are most comparable with quantum algorithms. These classical IPMs solve the PO problem in time scaling as n 3.5 log(1/𝜖). This runtime is efficient in theory (i.e., it scales polynomially with n ) and also in practice (IPMs are a leading method underlying many open-source and commercial solvers). Using IPM-based, off-the-shelf solvers, one can solve the PO problem on portfolios with thousands of stocks reasonably quickly on standard compute resources. However, the n 3.5 scaling is steep, and pushing the number of assets into the tens of thousands presents an opportunity for alternative solutions (such as quantum computing) to provide value. In the next section, we explore a proposal to do exactly that.

Quantum interior point methods

Quantum interior point methods (QIPMs) aim to accelerate classical IPMs by replacing certain algorithmic steps with quantum subroutines. The fact that IPMs are efficient both in theory and in practice gives hope that, if indeed these subroutines can be completed more quickly, QIPMs could satisfy the four criteria of a practical quantum algorithm and deliver practical utility in customer use cases.

QIPMs preserve the main loop of the IPM (which iteratively generates a sequence of better and better portfolios), and replaces a subroutine in the IPM that solves linear systems of equations with a quantum algorithm for completing this task. To do this, QIPMs leverage three quantum ingredients — Quantum Random Access Memory, quantum linear system solvers, and quantum state tomography — in each iteration of the main loop. These ingredients perform the following roles:

- Quantum Random Access Memory (QRAM) allows the quantum algorithm to access the data that defines the instance, namely u and 𝛴, in an efficient and quantum mechanical way. Theoretical analyses of QRAM-based algorithms often merely report the number of queries to the QRAM data structure and assume the query time is very fast. To account for criterion 2 (reasonable input model), a full end-to-end analysis must go further and compute the exact resources required to perform the QRAM queries. Specifically, our resource analysis for the QIPM utilizes the resource estimates for implementing a block-encoding of an arbitrary matrix — a primitive that is in some sense equivalent to QRAM — that we developed in separate, parallel work [4].

- Quantum linear system solvers (QLSSs), as their name suggests, are quantum subroutines for solving linear systems of the form Ax = b , where A is an invertible L x L matrix, and x and b are length- L vectors. In the PO problem, L ≈ 14n . The catch is that, unlike classical linear system solvers, QLSSs do not output the vector x ; rather, they output a quantum state |x ⟩ whose amplitudes are proportional to the entries of x .

- Quantum state tomography is precisely the subroutine that turns the quantum state |x ⟩ into a classical description of the vector x , which is then used to iterate the IPM. In essence, tomography is performed just by preparing many copies of |x ⟩ , measuring them, and gathering statistics on the frequency of each measurement outcome to estimate the entries of x . The need for tomography is related to criterion 1, above; the QLSS is efficient, but it outputs a quantum state rather than classical data, and this quantum state is not the object that is immediately useful to the rest of the algorithm.

The full end-to-end analysis takes care to account for errors incurred by each of these primitive ingredients. The largest of these errors is incurred by tomography, due to the statistical noise of estimating an entry of x from measurement outcomes of |x ⟩ . An additional caveat is that these small errors prevent the QIPM from exactly following the same path as the classical IPM, and they also cause the QIPM to leave the feasible region. Luckily, the IPM is designed to be self-correcting, in the sense that it partially fixes any errors it makes in future iterations.

Ultimately, through this effect or other workarounds we explore in the full paper, the QIPM will solve the same problem as the classical IPM: it returns an ϵ-optimal solution in an amount of time that essentially scales as:

The appearance of new parameters ⲕ F and ξ represent additional technical complications, and need to be unpacked. The parameter ⲕ F is the “Frobenius condition number” — it represents the difficulty of inverting the relevant matrices with the QLSS. The parameter ξ is the maximum error on quantum state tomography that does not break the algorithm (i.e., how poorly we can estimate the state |x ⟩ ) — small errors are okay as long as subsequent iterations of the IPM find portfolios that are close enough to those of an ideal IPM.

These are instance-specific parameters, meaning that two different instances of the PO problem with stocks will have different values for ⲕ F and ξ , which makes the magnitude and scaling of these parameters difficult to study. This is an issue, because it is clear that the effectiveness of the algorithm critically hinges on how large they are! If ⲕ F and 1/ ξ are small and constant, one is tempted to declare that the quantum algorithm has a large n 3.5 → n 1.5 speedup over the classical IPM. However, it is expected that these parameters will also have an n dependence, cutting into this speedup. Work by Kerenidis, Prakash, and Szilágyi [5] studied one version of the QIPM for portfolio optimization and gave some preliminary numerical evidence that the QIPM still offers a speedup after accounting for the dependence on ⲕ F and ξ .

The expression above omits some additional logarithmic factors: we computed the full expression of the runtime to be proportional to:

These log factors are typically ignored in asymptotic analyses (such as that of Kerenidis, Prakash, and Szilágyi [5]), where the goal is to judge criterion 3 of a practical end-to-end algorithm, as these factors have a relatively small contribution in the limit where n and other parameters are large. However, to judge criterion 4, it is essential to keep track of all contributions, as they can make a big difference on the runtime estimate for specific choices of n .

Resource estimate for the QIPM

To judge criterion 4, we need to know how many quantum resources the QIPM consumes for values of n relevant to customers. We compute the number of logical qubits, the number of computationally expensive T gates (i.e., the “ T -count”), and the number of layers of T gates (i.e., “ T -depth”) required by the algorithm. A T gate is a commonly studied quantum gate that, when coupled with other easy-to-implement quantum gates, equips quantum computers with their expressive power. We only count the T gates because they are substantially more expensive than the other gates in popular approaches to fault-tolerant quantum computation, and they dominate the runtime of the algorithm. The number of logical qubits and the total number of T gates are then used to determine the overall physical footprint of the quantum algorithm — this will also depend on details of the physical hardware, such as the physical error rate.

Meanwhile, the T- depth determines the runtime in an architecture where T- gates on disjoint qubits can be implemented in parallel. These metrics have been computed for other quantum algorithms, allowing for reasonable comparisons.

For a version of the PO problem like the one above, with a couple of additional, common constraints, we find that optimizing an n -qubit portfolio to tolerance ϵ requires

where we omit subleading terms. Notably, the order- n 2 overhead for the T- count vs. the T- depth, and the order- n 2 logical qubit dependence reflects the fact that QRAM can be implemented at shallow depth albeit, with large qubit and gate cost.

Figure 2: Median value of the Frobenius condition number as a function of the number of stocks in the portfolio optimization instance, from numerical simulations. Error bars represent the 16th to 84th percentile of observed instances, and the dashed line is a power-law fit showing that the growth of the Frobenius condition number is nearly linear in n.

The above expressions are not particularly illuminating, as they still depend on instance-specific parameters ⲕ F and ξ . To probe these parameters, we simulated random instances of portfolio optimization with n varying from 10 to 120. For each instance, we chose a random set of n stocks from the Dow Jones U.S. Total Stock Market Index (DWCF) and constructed the expected daily return vector u and covariance matrix 𝛴 using historical stock data collected over 2 n time epochs. We found that both ⲕ F and ξ -2 appear to grow with n , on average, and were each typically on the order of 10 4 or 10 5 for n = 100 . Overall, we evaluated the average cost of the algorithm at n=100 to be:

- Number of logical qubits: 8 million

- T -depth: 2 x 10 24

- T -count: 7 x 10 29

Even if layers of T -gates are optimistically implemented at the GHz speeds of classical processors (in reality they are likely to be 2–4 orders of magnitude slower than that) these estimates suggest that the runtime of the quantum algorithm would still be millions of years, even for an instance size that is already classically tractable on a laptop.

This outcome allows us to confidently say that the QIPM, in its current form, does not satisfy criterion 4 of the end-to-end practical algorithm. The reason this occurred was due to a confluence of several independent factors: a large constant pre-factor coming mainly from the QLSS, a large condition number ⲕ F , a significant number of samples needed for tomography, and even a non-negligible contribution from logarithmic factors (about a factor of 100,000 for the T -depth) that are traditionally ignored in asymptotic analyses.

These estimates also incorporate a few improvements we made to the algorithm, including an adaptive approach to tomography, and preconditioning the linear systems. However, there are several ways one could try to improve the algorithm further, including using newer, more advanced versions of quantum state tomography [6] with ξ -1 rather than ξ -2 dependence, additional preconditioning, or improvements to the QLSS. Nonetheless, the resource estimate we arrive at is so far from practicality that multiple improvements to various parts of the algorithm would be needed to make the algorithm practical.

In retrospect, we can also consider whether the algorithm meets criterion 3, i.e., if it has an asymptotic speedup. The numerical simulations of Kerenidis, Prakash, and Szilágyi [5] suggested it does, but our numerical simulations fail to corroborate this, since we find that the scaling of the algorithmic runtime in the regime 10 ≤ n ≤ 120 is roughly the same as the classical algorithm. However, this scaling does not have a robust trend, and cannot confidently extrapolate to larger industrially relevant choices of n .

Conclusion and takeaways

Our end-to-end resource analysis of the QIPM for portfolio optimization is a revealing case study on the utility of quantum algorithms. Even when an algorithm presents signals of utility, closer inspection can reveal a drastically different picture when all factors are considered more fairly. This was the case for the QIPM—our analysis strongly suggests it will not be useful to customers, barring significant improvements to the underlying algorithm. However, the insights gleaned go beyond the QIPM; the core subroutines of the QIPM (QRAM, QLSS, tomography) are common to many other quantum algorithms as well. Parts of our detailed cost analysis could thus be re-utilized in those algorithms. Indeed, one specific lesson learned is the great cost of implementing quantum circuits for the data-access component of the quantum algorithm (QRAM).

The QRAM accounts for most of the logical qubits in our accounting, and contributes a considerable factor to the gate depth and gate count. To improve the QIPM to the point of practicality, one ingredient which would likely be necessary is a dedicated QRAM hardware element that can leverage the specialized, non-universal nature of the QRAM operation to perform the operation more efficiently than our general analysis accounts for. This hardware element would also improve the practicality of many other quantum algorithms in many domains such as quantum machine learning, quantum chemistry, and quantum optimization.

With our analysis revealing that QIPMs face significant challenges toward practicality, where does this leave portfolio optimization in the landscape of quantum computing applications? Fortunately, there are other proposed methods for solving portfolio optimization on quantum computers (e.g., [7]), and some of these are even amenable to near-term experimentation.

These approaches operate by reformulating the convex problem above as a binary optimization problem and attacking them with variational quantum algorithms, such as the quantum approximate optimization algorithm (QAOA), or using specialized hardware such as quantum annealers.

The upshot is that some of these variational approaches can already be run on near-term quantum devices through Amazon Braket, but one loses the theoretical asymptotic success guarantees afforded by the QIPM. As such, it is unclear whether these near-term solutions satisfy the third criterion above (asymptotic speedup), and determining whether this is the case will require further empirical investigation using current hardware and future generations of devices.

Finance remains a rich space for potential quantum algorithms, and perhaps some of the ideas in the QIPM will prove fruitful toward developing practical algorithms in the future. We hope that this example inspires researchers to search for the next generation of innovative, practical quantum algorithms in a systematic, end-to-end way.

[1] Alexander M. Dalzell, B. David Clader, Grant Salton, Mario Berta, Cedric Yen-Yu Lin, David A. Bader, Nikitas Stamatopoulos, Martin J. A. Schuetz, Fernando G. S. L. Brandão, Helmut G. Katzgraber, William J. Zeng. “End-to-end resource analysis for quantum interior point methods and portfolio optimization.” PRX Quantum 4, 040325 (2023). https://doi.org/10.1103/PRXQuantum.4.040325

[2] Ewin Tang. “Quantum Principal Component Analysis Only Achieves an Exponential Speedup Because of Its State Preparation Assumptions” Phys. Rev. Lett. 127, 06050 (2021). https://doi.org/10.1103/PhysRevLett.127.060503

[3] “MOSEK Portfolio Optimization Cookbook.“ Release 1.3.0 (2023) https://docs.mosek.com/MOSEKPortfolioCookbook-a4paper.pdf

[4] Blog: “Goldman Sachs and AWS examine efficient ways to load data into quantum computers“ Paper: B. David Clader, Alexander M. Dalzell, Nikitas Stamatopoulos, Grant Salton, Mario Berta, William J. Zeng. “Quantum Resources Required to Block-Encode a Matrix of Classical Data.” IEEE Transactions on Quantum Engineering (Volume: 3) (2022) https://doi.org/10.1109/TQE.2022.3231194 .

[5] Iordanis Kerenidis, Anupam Prakash, Dániel Szilágyi. “Quantum Algorithms for Portfolio Optimization.” Proceedings of the 1st ACM Conference on Advances in Financial Technologies. (2019) https://doi.org/10.1145/3318041.3355465

[6] Joran van Apeldoorn, Arjan Cornelissen, András Gilyén, and Giacomo Nannicini. “Quantum tomography using state-preparation unitaries.” Proceedings of the 2023 Annual ACM-SIAM Symposium on Discrete Algorithms (SODA). https://doi.org/10.1137/1.9781611977554.ch47

[7] Sebastian Brandhofer, Daniel Braun, Vanessa Dehn, Gerhard Hellstern, Matthias Hüls, Yanjun Ji, Ilia Polian, Amandeep Singh Bhatia, Thomas Wellens. “Benchmarking the performance of portfolio optimization with QAOA.” Quantum Inf. Process 22, 25 (2023) https://doi.org/10.1007/s11128-022-03766-5

- No services available for your region.

- GS Dynamic Municipal Income Fund

- GS Core Fixed Income Fund

- GS GQG Partners International Opportunities Fund

- See All Mutual Funds

- GS S&P 500 Core Premium Income ETF (GPIX)

- GS Access Ultra Short Bond ETF (GSST)

- GS Small Cap Core Equity ETF (GSC)

- See All ETFs

- Liquidity Solutions

- Separately Managed Accounts

- Variable Insurance Trust

- Interval Fund

- Investment Centers

- Alternatives

- Buy-Write Strategy

- Emerging Markets

- Exchange-Traded Funds

- Fixed Income

- Model Portfolios

- Municipal Bonds

- Retirement (DCIO)

- Workplace Retirement Solution

In The Spotlight

Alternatives - Private Credit

- Macro & Market Views

- Investment Strategy

- ESG/Sustainable Investing

- ETF Investing

- Quantitative Investing

- By Asset Class

- Perspectives

- GSAM Connect

- All Insights

- Goldman Sachs Global Investment Research

- Product Collateral

- Product Brochures

- Investment Solutions

- Fund Commentaries

- Advisor Resources

- Strategic Advisory Solutions

- Asset Allocation PRISM

- Practice Management

- Client Service Account Access

- Documents and Forms

- Tax Information

- Forms & Applications

- Regulatory Documents

- All Documents

- Municipal Solutions Tool

- Diversified Investment Allocation Tool

- Floating Nav Vs. Stable Nav

Our In-Depth Commentary Could Help You Gain a Competitive Edge

Stay on top of the latest market developments, key themes, and investment ideas affecting your portfolio and practices.

- News and Media

- Company Sites

- Goldman Sachs

- Private Wealth Management

- Personal Financial Management

- Internal View

Explore how we can help you

Market Insights

Please log in to gain access to this feature.

Please enter a name to save your selection

Saved %% to your saved filters

Please note that you cannot undo this action.

Filter articles by topic.

Select one or more topic(s)

- Money Markets

Filter articles by date range.

Select date range(s)

- Past Quarter

Filter articles by publication type.

Select one or more perspective(s)

- All Macro Economic Views

- All Investment Strategy

- Market Monitor

- Market Pulse

- Macro Insights

- Market Know-How

Fixed Income Macro Views

- Money Market Views

- Corporate Credit Views

- Securitized Market Views

- Global Fixed Income Outlook

- Global Equity Outlook

Selections Made:

Evolution of Growth Investing in Europe

February 09, 2022

How is the growth equity landscape evolving in Europe? The heads of our Growth Equity team shared their views at a recent Alternative Investment Forum.

November 22, 2021

The US Department of Labor recently announced a proposed rule that would make it easier for retirement plan fiduciaries to consider climate change and other ESG factors when selecting investments. These proposed “rules of the road” are designed to guide Employee Retirement Income Security Act (ERISA) fiduciaries who are considering ESG incorporation within their investment process.

Read Full Report

Hear from our experts, what's latest in municipal bond market.

Goldman Sachs Research

Follow trends in the global economy, including policy issues and analysis of economic development from Goldman Sachs Global Investment Research.

CONTACT US See More

Products & investment centers.

- Mutual Funds

Tools & Resources

Note: Separate multiple email addresses with a comma or semicolon.

Your Email Address

Goldman Sachs Company’s Internal Environment Research Paper

Introduction, key internal factors, core competencies, resource-based view, value chain analysis.

Goldman Sachs has been in operation for the last 147 years and has become one of the leading financial institutions in the United States and global market. The success of this firm is partly attributed to a number of external environmental factors such as the growing economy in the United States, the increasing globalization, and the rising number of the middle class globally. However, its internal environment is largely responsible for the years of success that this firm has experienced, even at a time when its major market rivals such as Lehman Brothers were forced out of the market. The internal environmental factors, according to Williams (2016), are what make a firm unique compared to its competitors in the market. It makes a company have unique capabilities in terms of meeting market challenges. For Goldman Sachs, it has proven that it has a detailed understanding of the market forces not only in the home country in the United States, but also in other global markets where it operates. In this report, the focus is to conduct a comprehensive analysis of the internal environment of this firm.

According to Williams (2016), the competitiveness of a firm in the market is often determined by its key internal factors. In most of the cases, firms within a given industry often face similar environmental forces as long as they are operating in the same market. The success of a firm largely depends on the nature of its internal environment. For Goldman Sachs, the finance market where it operates is highly competitive. It has one of the top companies all competing for the same market. To achieve a greater market share, a firm needs to develop an internal structure that makes its operations more efficient and less straining to its employees. The management of this company has been keen on developing an enabling internal environment to help it achieve success in the market.

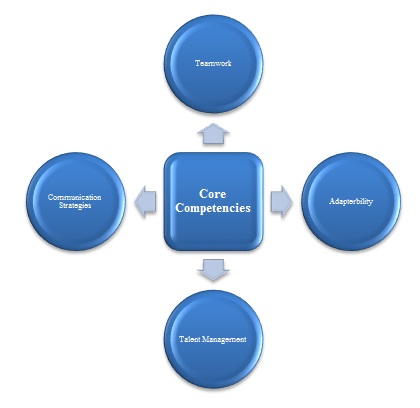

Looking at Goldman Sachs core competencies is one of the ways of analyzing its internal environment with a view of determining its uniqueness in the market. Mandis (2013) defines core competencies as “defining capability or advantage that distinguishes an enterprise from its competitors.” They may a company stand out among the rest as a firm that has unique capabilities uncommon in other rival companies. The figure below shows some of the key competencies of this company.

As shown in the above figure, one of the greatest core competencies of Goldman Sachs is the value it places on teamwork. According to Williams (2016), a firm that embraces teamwork is capable of achieving success because employees will cherish working as a unit instead of just completing the assignments given to them. Employees will be willing to help their colleagues to address tasks which are complex. It is also in such environments where employees will embrace positive competition among the departments. At Goldman Sachs, each department often treats its employees as part of a larger team. Members of every team are responsible for everything that happens within their department. For instance, all employees in the marketing department are responsible for the outcome of the activities of this department.

A mistake of an individual employee within the department is regarded as a mistake of all the members. As such, all the employees within the marketing department will do everything within their powers to eliminate such mistakes as much as possible. This approach in its operations has enabled this company to achieve success even after losing some of its talented employees. The employees are often willing to train newly recruited staff so that they can understand the concepts and culture of this company. Through teamwork, they are always able to come up with creative ways of solving problems in very unique ways. Although other firms in the industry also practice teamwork, Goldman Sachs has taken this strategy to the next level where it is the responsibility of everyone to ensure that success is achieved.

Communication is one of the most important factors that define the ability of a firm to achieve success in a highly competitive market. According to Williams (2016), different firms employ different communication strategies based on the organizational culture that it has embraced. At Goldman Sachs, maintains an open-door policy where employees are allowed to interact with the top managers without any restrictions. According to a study by Rumelt (2011), open-door policy is one of the most effective communication strategies that a firm needs to embrace to promote interaction between top managers and junior employees. The main problem that many firms often face is how to effectively employ this strategy.

Most firms often prefer using a structured communication system where employees communicate to their immediate supervisors as a way of creating a sense of order and ensuring that the top managers are allowed ample time to concentrate on strategic issues that affect the firm. However, Goldman Sachs has successfully created a communication system where junior employees can directly communicate with top managers without affecting their schedule on strategic matters of the firm. This communication strategy has enabled the top managers to understand forces that affect junior employees at their respective workplaces.

The relationship between those in top leadership and the junior employees has been good because of this effective environment for communication. Whenever there is an issue affecting an individual employee, he or she can visit the relevant manager and address the issue in an effective manner. The innovative nature of this firm is also partly attributed to the communication strategy that it has put in place. The employees have a rare opportunity of sharing their original ideas with the relevant managers without having to reach them through the middle managers.

Adaptability is another core competency that this firm has uniquely developed in a way that far exceed what other firms in the same industry are doing. Since its foundation about 147 years ago, this firm has been faced with numerous environmental challenges and changes that required it to adapt to new systems and structures. When the company was founded in 1869, computer technology that exists in the modern days had not been created. The firm relied on physical files and papers to tract the records of their clients. According to Scherf (2014), Goldman Sachs was one of the very first firms to adopt IBM computer systems as a way of keeping data. It realized that the new computer technology was critical for its success in the market. As time went by, internet emerged and technology kept on changing the operations in the banking sector.

When internet banking emerged, this company was one of the financial institutions that embraced this new product as a way of capturing more clients and making the banking process simpler. Internet banking was particularly critical for this firm because it allowed its clientele to operate their bank accounts irrespective of their location or time of the day. It named its online banking GS Bank and it mainly targeted clients in North America. It is important to note that other firms have similar products in the market, but not in the manner that Goldman Sachs did. What is unique about this firm is that it is quick in embracing emerging technologies and it understands how to overcome challenges that early adopters often face when using new technology. It has created a team of highly loyal and very effective workforce that is dynamic and embraces change. It explains why this firm often adapts to changes seamlessly and without any form of resistance from its employees.

Talent management is another critical tool that this firm is using to achieve a competitive edge over its market rivals. The top managers of this firm knows that the only way of managing stiff competition in this industry is to have a team of highly skilled, talented, and innovative employees. To achieve this, the firm has created an environment where its employees can come up with new ideas to address their current tasks or new challenges that they may encounter at work. Its highly competitive remuneration packages for its employees and other non-financial benefits have helped in retaining its highly qualified employees.

Strengths and competitive capabilities

It is clear from the above analysis of core competencies that this firm has a number of factors that give it competitive edge over its market rivals. One of the main strengths of this firm is its market experience of 147 years. It clearly understands the market forces, having encountered all the economic recessions in America’s modern history, and knows how to respond to these challenges. The strong financial base also gives it an edge over other emerging financial institutions. It is able to initiate major marketing or product development projects without straining. The team of highly skilled and dedicated employees also makes this firm to stand out among the rest as a dynamic company that is often ready to embrace change. The skilled and highly understanding top managers have also offered the vision needed to see this firm through some of the most significant challenges that it has often faced in the market. The loyalty it has gained among its clientele has also given it a competitive advantage against its top market rivals.

According to Hall and Yip (2016), even some of the most successful firms have a number of weaknesses that needs to be addressed in order to make them function effectively. Goldman Sachs is no exception. One of the main weaknesses of this company that was once almost forcing it into bankruptcy during the 2008 economic recession is its overreliance on subprime mortgages. The firm offered this product because of the high number of customers who were willing to take such loans. However, when these debtors were unable to repay their loans, the firm faced serious challenges in its operations. Its inability to offer mobile banking to its non-American clients has also been considered a weakness.

The core competencies of this, as discussed in this paper, were determined by the publications available in its websites, books, and other reliable sources. The focus was to identify core competencies that make it unique over its market rivals. The rationale of the analysis was to identify what makes Goldman Sachs more competitive compared to its market rivals.

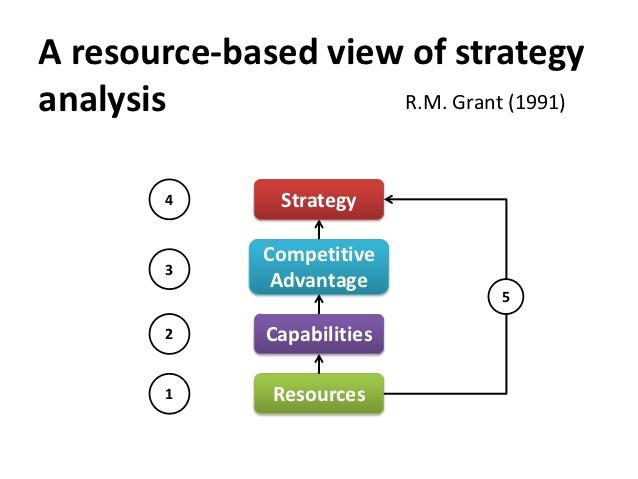

Successful firms have learnt how to use their resources to create competitive edge over their rivals and to develop market strategies that can help them overcome their market challenges. Using a resource-based view, it is possible to look at the path that firms take to turn their resources into competitive advantage and to develop market strategies. The figure below shows the RBV model.

As shown in the figure above, a firm uses its resources to create capabilities. Goldman Sachs has been using its financial resources to create new capabilities through various research projects that it often initiates, especially when faced with new challenges. These capabilities help in creating a competitive edge for the firm. It is able to overcome market challenges because of these unique capabilities. Most of the strategies that this firm develops are often based on competitive advantage it has over its market rivals.

Using value chain analysis may also help in understanding how this company generates value and effective strategies using its resources and capabilities. The figure below shows how primary and secondary activities work closely to generate margin for this firm.

As shown in the figure below, primary and supporting activities are used to generate the desired value. Inbound logistics, productions and operations, outbound logistics, sales and marketing, and services need human resources, technology, strategy, research, and development to enable a firm achieve the desired margin. As a financial institution, the supporting activities are very critical in enabling this firm achieve the desired success in the market. Human resources, technology, and strategy are of critical importance as discussed in the section above. Among the primary activities, marketing and quality services that this firm offers to its clients may help it make a difference in the market. Both the primary and supporting activities must be intertwined to achieve the level of success that is desired.

Goldman Sachs is one of the most successful financial companies not only in North America but also at global level. The firm has managed to overcome two main economic recessions that left many firms bankrupt. It has also weathered stiff competition in the global market. Its success is attributed to its internal environment. As discussed above, firms operating in the same industry within the same market largely rely on their internal environment to achieve competitive advantage over their market rivals. For Goldman Sachs, highly talented employees and a group of skilled and dedicated managers are some of the internal environmental factors that give it an edge over its market rivals. Its strong financial base and loyalty in the market has also enabled it to achieve success in the market.

Hall, D., & Yip, J. (2016). Discerning career cultures at work. Organizational Dynamics, 45 (3), 174–184. Web.

Mandis, S. G. (2013). What happened to Goldman Sachs? An insider’s story of organizational drift and its unintended consequences . New York: Cengage.

Rumelt, R. (2011). Good strategy, bad strategy: The difference and why it matters . London: Profile.

Scherf, G. (2014). Financial stability policy in the Euro zone: The political economy of national banking regulation in an integrating monetary union . Wiesbaden: Springer Gabler.

Sinn, H. (2014). Austerity, Growth and Inflation: Remarks on the Eurozone’s Unresolved Competitiveness Problem. The World Economy, 37 (1), 1–13.

Williams, E. F. (2016). Green giants: How smart companies turn sustainability into billion-dollar businesses . New York: Cengage.

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2024, January 23). Goldman Sachs Company's Internal Environment. https://ivypanda.com/essays/goldman-sachs-companys-internal-environment/

"Goldman Sachs Company's Internal Environment." IvyPanda , 23 Jan. 2024, ivypanda.com/essays/goldman-sachs-companys-internal-environment/.

IvyPanda . (2024) 'Goldman Sachs Company's Internal Environment'. 23 January.

IvyPanda . 2024. "Goldman Sachs Company's Internal Environment." January 23, 2024. https://ivypanda.com/essays/goldman-sachs-companys-internal-environment/.

1. IvyPanda . "Goldman Sachs Company's Internal Environment." January 23, 2024. https://ivypanda.com/essays/goldman-sachs-companys-internal-environment/.

Bibliography

IvyPanda . "Goldman Sachs Company's Internal Environment." January 23, 2024. https://ivypanda.com/essays/goldman-sachs-companys-internal-environment/.

- SEC Lawsuit Against Goldman Sachs

- Diversity Audit of Goldman Sachs

- Goldman Sachs Firm's Unethical Business Issue

- Goldman Sachs Bank in Economic Turmoil

- Goldman Sachs Group's Ethical Practices

- Goldman Sachs Company's Evolving Culture

- Goldman Sachs' Strategies, Global Role and Ethics

- Goldman Sachs' Generic Strategy and Diversification

- Goldman Sachs Company's Key External Factors

- High Ethical Standards in Business

- Larels Projects LLP Organisational Structure

- Careem Company's Analysis

- Google and Amcor Companies' Intrapreneurial Practices

- Amcor Limited: Legal Aspect of International Trade

- Navistar Company: Managing Change

How markets are responding to central bank moves Goldman Sachs The Markets

How are investors responding to central bank decisions across the globe? Vickie Chang, macro strategist in Goldman Sachs Research, discusses how the market has priced in this week’s Bank of Japan and US Federal Reserve outcomes.

- More Episodes

- © Copyright 2023 Goldman Sachs, all rights reserved.

Top Podcasts In Business

- Show more sharing options

- Copy Link URL Copied!

North America’s best for investment research: Goldman Sachs

Full results.

At a time when geopolitical and macroeconomic turmoil are more bewildering than ever, the need for the guiding hand of a thoughtful investment research and strategy operation is greater than ever for private-banking clients.

Through its well-respected investment strategy group (ISG), which has been in place for 22 years and numbers roughly 100 staff across the world, Goldman Sachs is able to deploy an array of resources in support of its own wealth advisers and the families and individuals they engage with.

Euromoney’s judges praised Goldman for its robust investment strategy platforms, which have a wide range of content and well-known reports.

The firm’s annual outlook is always a landmark deep-dive, for example, but Goldman has also now added an 'ISG in Brief' series that is able to tackle key issues more dynamically as they emerge, such as the meltdown of Credit Suisse.

Highlights of the series in relation to the US market over the period under review include a report steering clients away from a broad tactical overweight to non-US equities from US equities, in February 2023, and a detailed review of the likely impact of rising interest rates on corporate debt and US equities, published in October 2023.

To unlock this article

As a premium subscriber, you can gift this article for free

You have reached the limit for gifting for this month

There was an error processing the request. Please try again later.

Goldman Sachs Lifts STOXX 600 Annual Target to 540

The German share price index DAX graph is pictured at the stock exchange in Frankfurt, Germany, March 20, 2024. REUTERS/Staff/File Photo

(Reuters) - Goldman Sachs on Monday raised its 2024 year-end target for Europe's STOXX 600 index to 540 from 510, citing potential improvement in economic growth and monetary policy easing across central banks.

The brokerage's new target for the pan-European benchmark index implied a nearly 6% upside from Friday's close of 509.64.

"If economic growth modestly accelerates and central banks embark on a rate-cutting cycle in June, as our economists expect, valuations will rise further," Lilia Peytavin, portfolio strategist at Goldman Sachs said in a note.

Major central banks such as the U.S. Federal Reserve and the European Central Bank have hinted at probable interest rate cuts in June.

Recent data showed euro zone business activity was within a whisker of returning to growth in March, outperforming expectations, while the U.S. business activity held steady.

The Wall Street brokerage, which previously lifted its index target in mid-February, now estimates the STOXX 600's valuation can increase about 2.5% this year.

"Equities have probably reached the optimism phase, the last one of the equity cycle, in which multiples tend to rise while profit growth slows," Peytavin added.

Goldman argued that over the last six months, European equities climbed 12%, and all of this rally has been driven by an improvement in valuations rather than earnings growth.

The STOXX 600 currently trades at about 15 times its one-year forward price-to-earnings (PE) ratio, while the S&P 500 index trades at 26 times its one-year forward PE ratio, according to LSEG data. A lower PE multiple indicates a more attractive investment opportunity.

Goldman, however, warned that rising oil prices could pose a two-sided risk to its forecasts - while they could push back the timing of interest rate cuts, they also provide an 'upside risk' to earnings-per-share growth.

The brokerage also lifted on Monday its 2024 target for the UK's benchmark FTSE 100 index to 8,200 from 7,900.

(Reporting by Siddarth S and Kanchana Chakravarty in Bengaluru; Editing by Shounak Dasgupta and Sherry Jacob-Phillips)

Copyright 2024 Thomson Reuters .

Tags: Europe

The Best Financial Tools for You

Credit Cards

Personal Loans

Comparative assessments and other editorial opinions are those of U.S. News and have not been previously reviewed, approved or endorsed by any other entities, such as banks, credit card issuers or travel companies. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

Subscribe to our daily newsletter to get investing advice, rankings and stock market news.

See a newsletter example .

You May Also Like

Best semiconductor stocks.

Brian O'Connell March 25, 2024

Best Long Term Stocks to Buy and Hold

Glenn Fydenkevez March 25, 2024

Best Investing Apps for Beginners

Kate Stalter March 25, 2024

10 Best Growth Stocks to Buy for 2024

Wayne Duggan March 25, 2024

Best Renewable Energy Stocks to Buy

Matt Whittaker March 22, 2024

How to Invest in Startups

Coryanne Hicks March 22, 2024

How to Invest in TIPS

Kate Stalter March 22, 2024

7 Best High-Dividend Mutual Funds

Jeff Reeves March 22, 2024

The History of Bitcoin (BTC)

Julie Pinkerton March 21, 2024

Should You Buy Reddit (RDDT) Stock?

Brian O'Connell March 21, 2024

7 Best Thematic ETFs to Buy in 2024

Jeff Reeves March 21, 2024

Cheap Dividend Stocks to Buy Under $20

Wayne Duggan March 21, 2024

Best Residential REITs to Buy

Glenn Fydenkevez March 20, 2024

Pharma Stocks With Blockbuster Drugs

8 Top-Performing Fidelity Funds

Tony Dong March 20, 2024

7 Best Money Market Funds for 2024

Tony Dong March 19, 2024

7 Undervalued Stocks to Buy Now

Wayne Duggan March 19, 2024

9 Dividend Aristocrat Stocks to Buy Now

7 Best No-Minimum Funds

Marc Guberti March 19, 2024

Are Financial Advisors Worth It?

Kate Stalter March 18, 2024

GOLDMAN SACHS ASSET MANAGEMENT

A career with Goldman Sachs Asset Management is an opportunity to help clients across the globe realize their potential, while you discover your own. As part of one of the world’s leading asset managers with over $2 trillion in assets under supervision, you can expect to participate in exciting investment opportunities while collaborating with talented colleagues from all asset classes and regions and building meaningful relationships with your clients. Working in a culture that values integrity and transparency, you will be part of a diverse team that is passionate about our craft, our clients, and building sustainable success. Bringing together traditional and alternative investments, Goldman Sachs Asset Management provides clients around the world with a dedicated partnership and focus on long-term performance. As primary investment area within Goldman Sachs, we provide investment and advisory services for pension plans, sovereign wealth funds, insurance companies, endowments, foundations, financial advisors and individuals.

YOUR IMPACT

Are you passionate about asset management products? Can you see yourself in a global team researching market developments, coordinating product strategy and design across a diverse client base?

We are currently looking for a driven and detail-oriented Product Research professional who is seeking to use their creative and technical skills and ideas to join our Global Product Strategy team within our Asset Management business.

Within Asset and Wealth Management, we seek to provide innovative investment solutions to help our clients meet their financial goals. We work with specialists and groups from around the firm to help individuals and institutions across industries navigate changing markets and to provide them with a diverse offering of product solutions. We value self-starters with an entrepreneurial spirit, providing the support and resources to ensure your success.

Global Product Strategy, which reports to the Client Solutions Group and Public Investing within our asset management business, consists of specialized teams focused on Product Development, Strategy & Research for mutual funds, ETFs, collective investment trusts, and other pooled/registered vehicles across all public and public/private asset classes. The team evaluates and coordinates at all aspects of the strategy, research, analysis, design, management, and development of new and existing product vehicles for client distribution across third party wealth, institutional, consultant, insurance, and retirement channels. The team specializes in products mostly comprised of public securities, but also helps facilitate and support initiatives for separately managed accounts, private funds, and public/private products.

We are looking for an Associate to join the Product Strategy & Research-focused team in New York.

HOW YOU WILL FULFILL YOUR POTENTIAL

- Identify market and product trends in the industry to enable GSAM to make informed product decisions.

- Help with the curation of product priorities for various client segments by analyzing and distilling industry data, evaluating the relative strength of GSAM products vs. peers, understanding client feedback and preferences.

- Examine performance and structure of the existing fund lineup, helping to evolve the firm’s offering to stay relevant to the client base and market environment.

- Assist in the early-stage product design and development, ongoing oversight for pooled vehicles across asset classes including mutual funds, ETFs, collective investment trusts, interval funds, etc.

- Help the team to prioritize and efficiently execute on new product ideas that leverage the firm’s investment capabilities and best thinking, drive scale and address meaningful and measurable client demand.

- Develop product messaging, competitive research and actionable ideas for growth and change that would be presented to senior management, governance forums, distribution, and investment teams.

- Utilize multiple external data sources (i.e. Morningstar, Broadridge, Brightscope, eVestment) to identify addressable firm priorities by client type and region.

SKILLS & QUALIFICATIONS

- Bachelor’s degree, CFA preferred, 2-3 years of financial industry experience.

- SIE, Series 7, and Series 63 licenses are required (and will be sponsored by the firm if not already completed).

- In-depth knowledge of the asset management industry, client channels, and vehicle mechanics and requirements (mutual funds, ETFs, collective investment trusts, etc.) through previous experience in product development.

- Excellent written and verbal communication skills, especially the ability to explain complex technical concepts in simple terms.

- Strong project management and interpersonal skills and ability to work effectively with others across all levels and functions.

- Proactive problem solver with a strong work ethic, strategic mindset, and commercial perspective.

- Strong technical skills including high level of proficiency in Microsoft Excel and PowerPoint, and familiarity with industry data through such sources as Morningstar Direct, Simfund, Cerulli, Broadridge, Brightscope, etc.

ABOUT GOLDMAN SACHS At Goldman Sachs, we commit our people, capital and ideas to help our clients, shareholders and the communities we serve to grow. Founded in 1869, we are a leading global investment banking, securities and investment management firm. Headquartered in New York, we maintain offices around the world. We believe who you are makes you better at what you do. We're committed to fostering and advancing diversity and inclusion in our own workplace and beyond by ensuring every individual within our firm has a number of opportunities to grow professionally and personally, from our training and development opportunities and firmwide networks to benefits, wellness and personal finance offerings and mindfulness programs. Learn more about our culture, benefits, and people at GS.com/careers . We’re committed to finding reasonable accommodations for candidates with special needs or disabilities during our recruiting process. Learn more: https://www.goldmansachs.com/careers/footer/disability-statement.html

- MY CONTENT HOME

- YOUR PROFILE HOMEPAGE

- MACRO MARKETS

- PORTFOLIO STRATEGY

- COMMODITIES

- CREDIT STRATEGY

- EMERGING MARKETS

- MACRO FORECASTS

- PROPRIETARY INDICATORS

- STOCK SCREENER

- CONVICTION LISTS

- THEMES HOMEPAGE

- TOP OF MIND

- RECESSION RISK

- CHINA REOPENING

- INFLATION REDUCTION ACT

- ARTIFICIAL INTELLIGENCE

- MORE THEMES VIA THE THEMES TRACKER

- PUBLICATIONS

Global Equity Views

'fat & flat' strikes back.

Research Unplugged: Cross Asset Views for the Second Half

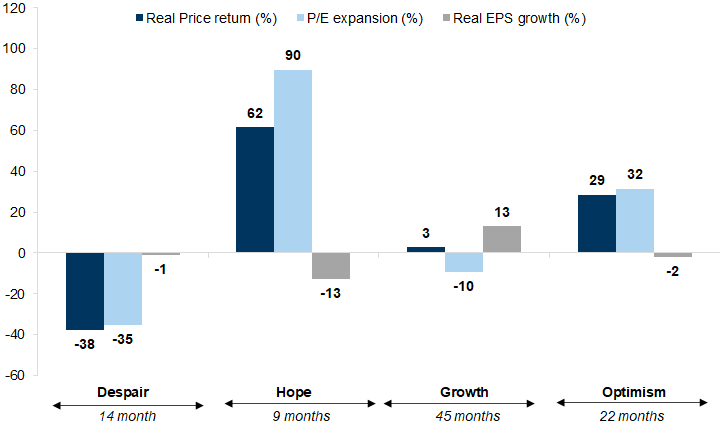

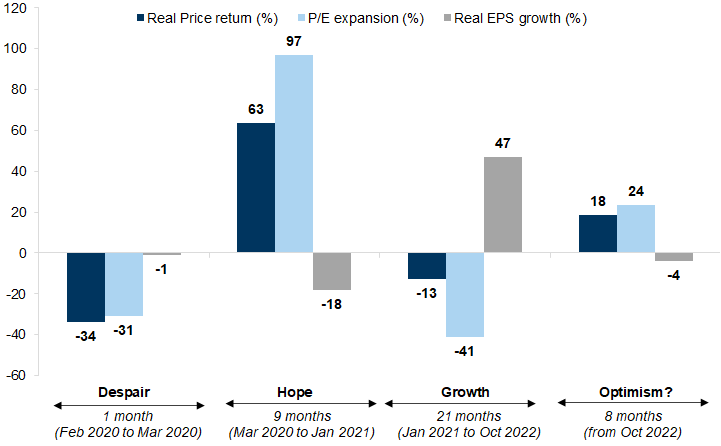

1) One of the questions we hear most frequently from clients is 'where are we in the cycle'? Of course, no two cycles are the same given that their drivers, and the structural factors that influence them, can vary significantly between one cycle and another. That said, we find that most cycles go through four phases, starting with ‘Despair’ (a bear market) and followed by ‘Hope’ – the strongest and shortest phase, where markets and valuations rise in anticipation of a future profit growth recovery. Next, there is usually a ‘Growth’ phase, where profits recover and grow but valuations fall back and returns moderate. The final phase, which we describe as ‘Optimism’, is generally associated with increasing valuations even as interest rates rise ( Exhibit 1 ). It is generally easier to identify these phases well after they have happened rather than in real time, but we do find that, so far, this cycle has followed this classic pattern ( Exhibit 2 ). Although the Despair phase at the start of the pandemic was shorter than normal (only around one month), it was similar in magnitude to the average cycle. The Hope phase was in line with the average in terms of time (9 months) and annualized returns (at over 60%). The growth phase, despite its name, is typically associated with lower returns. This is because, while EPS are rising, it has often already been paid for in the Hope phase. This has been the case in the current cycle, between January 2021 and October 2022 which was also weaker than average because of the speed of interest rate rises. The optimism phase which started in late 2022 has largely been in line with history, driven by higher valuations.

Exhibit 1 : The 4 phases of an equity cycle

Annualized data for historical phases (S&P 500)

Source: Datastream, Haver Analytics, Goldman Sachs Global Investment Research

Exhibit 2 : The 4 phases of the current cycle

Cumulative data for current phase (S&P 500)

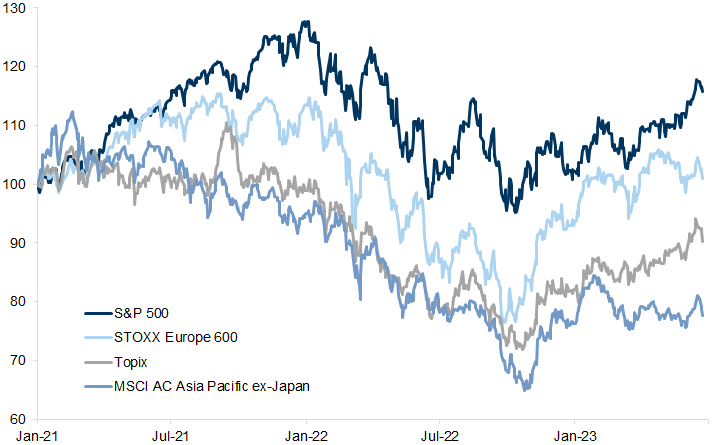

2) While the pattern of returns has been similar to the past, particularly in the Despair and Hope phases, we have argued that the scale of the returns would be relatively 'Fat & Flat', with returns constrained by the ongoing tug of war between rates and growth fears, the higher than average valuations, particularly in the US, and a backdrop of weak earnings growth despite a likely soft landing. The S&P 500, for example, is at more or less the same level as in the summer of last year. Japan and Europe are a little higher, but Asia is a little lower. Overall, the global equity index is broadly unchanged.

Exhibit 3 : The Growth phase in the current cycle has been ‘Fat & Flat’ – with relatively low returns in a wide trading range

World equity indices (indexed price performance, USD)

Source: Datastream, Goldman Sachs Global Investment Research

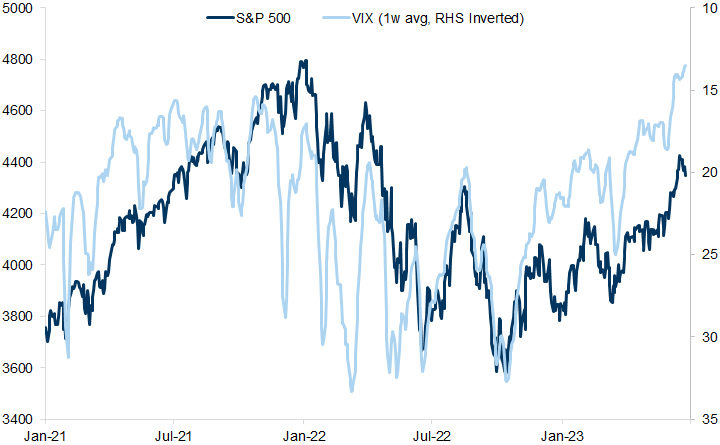

3) In recent weeks, however, the equity markets have enjoyed a rally, which led to optimism that indexes would decisively break out of the range. This shift higher, since June in particular, has come alongside falling volatility triggered by the fading of left-tail risks, and by large equity dispersion: the resolution of the US debt ceiling and slowing of deposit flight from US regional banks have both helped, while lower commodity prices have reduced the risks of inflation becoming more entrenched. The more recent intense focus on AI and its impact has also provided a narrative to fuel renewed enthusiasm for growth. In combination, equity markets were rising despite pedestrian profit growth in most regions and valuations have increased despite higher interest rates, even (and in some cases in particular) in the long-duration technology areas of the markets. These are all characteristics of the typical late-cycle Optimism phase.

Exhibit 4 : Equities have enjoyed a rally, which came alongside falling volatility

S&P 500 and VIX (1-week average)

Source: Bloomberg, Goldman Sachs Global Investment Research

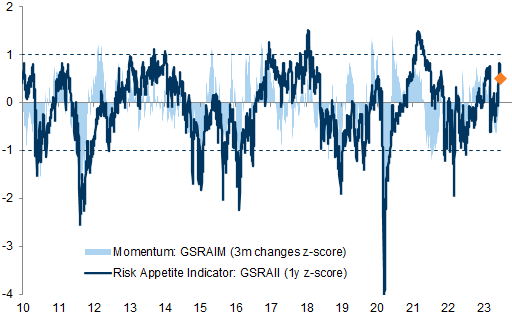

4) Another important driver of equities in recent weeks has been that the market-implied probability of recession has moved towards our economists ' more positive view on economic growth. Our GOAL Team flagged that the increase in our Risk Appetite Indicator has been mostly driven by a sharp pro-cyclical repricing across assets, pushing our PC1 'Global Growth factor' to the highest level since early 2021. Markets have moved ahead of macro data, and the current gap between PC1 and macro surprises as captured by the global MAP score is large, suggesting that a soft landing is being priced.

Exhibit 5 : The increase in our Risk Appetite Indicator has been mostly driven by a sharp pro-cyclical repricing across assets

Exhibit 6 : markets have moved ahead of macro data.

Risk Appetite Indicator level and momentum factors

PC1: Global growth factor and Global MAP Score

Source: Goldman Sachs Global Investment Research

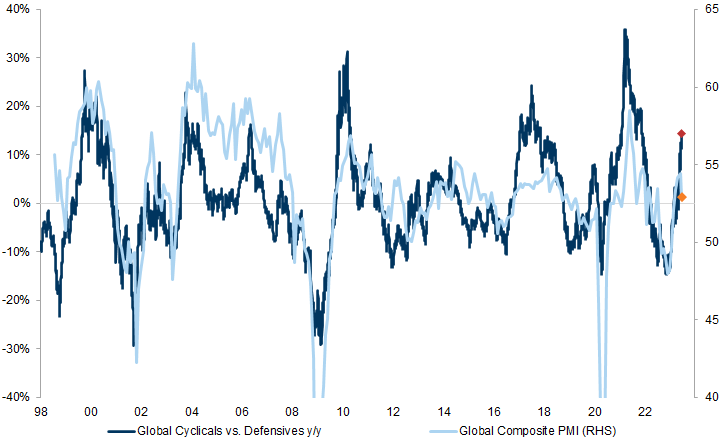

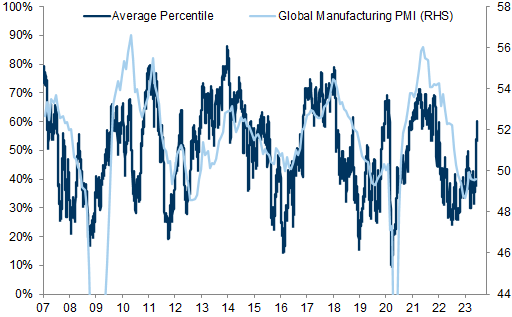

A similar observation can be made looking at global cyclicals versus defensives and plotting this against the global PMI. Despite the most recent softening of survey data, market pricing appears to be consistent with stronger growth moving forward.

Exhibit 7 : Market pricing appears to be consistent with stronger growth moving forward

Global Cyclicals vs. Defensives y/y and Global Composite PMI

Source: Datastream, Worldscope, Haver Analytics, Goldman Sachs Global Investment Research

5) Despite these improvements, we think the absolute upside for equity markets is constrained by both high valuations and the prospects for interest rates to remain higher for longer than the market has been pricing. Post the June meeting, ECB commentary has turned more hawkish, with Board Member Schnabel arguing that the optimal risk management strategy was still to err on the hawkish side and Governor Wunsch calling for hikes this past November. Chair Powell emphasized the need for further tightening in his semi-annual testimony to Congress. Last week, the Bank of England and the Norges Bank surprised to the upside with a move of 50 bps. Meanwhile, on the activity front, PMIs continued to see weakening activity which has largely been concentrated in the manufacturing sector but more recently extended to services as well.

Exhibit 8 : Sentiment Indicators have sharply increased while Manufacturing PMIs remain weak

Exhibit 9 : elevated levels of sentiment do not, in themselves, represent a bearish signal.

Average percentile of sentiment indicators (data since 2007) and Global Manufacturing PMI

S&P 500 3m return distribution

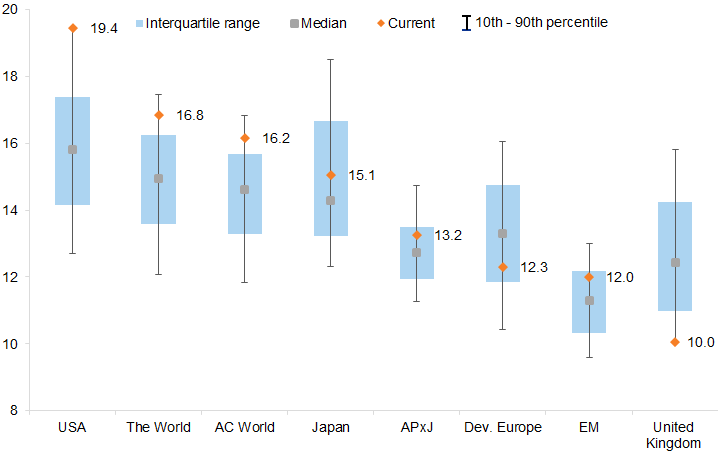

Elevated levels of sentiment point to a less favourable asymmetry for equity returns but do not, in themselves, represent a bearish signal – the distribution of subsequent 3-month S&P 500 returns from levels of our sentiment component above the 80th percentile shows that the right tail is more capped relative to the unconditional, but the left tail is not 'fatter' . In terms of valuation, the US equity market in particular is trading at valuations well above the historical averages ( Exhibit 10 ), and is now close to 20x forward consensus earnings (and even higher on our lower earnings assumptions). Other markets look cheaper, although in most cases they too have re-rated in recent weeks. The combination suggests that the Fat & Flat range remains intact.

Exhibit 10 : The US equity market is trading at valuations well above the historical averages

12m fwd P/E ranges (MSCI Regions) over a 20-year timeline

Source: FactSet, Goldman Sachs Global Investment Research

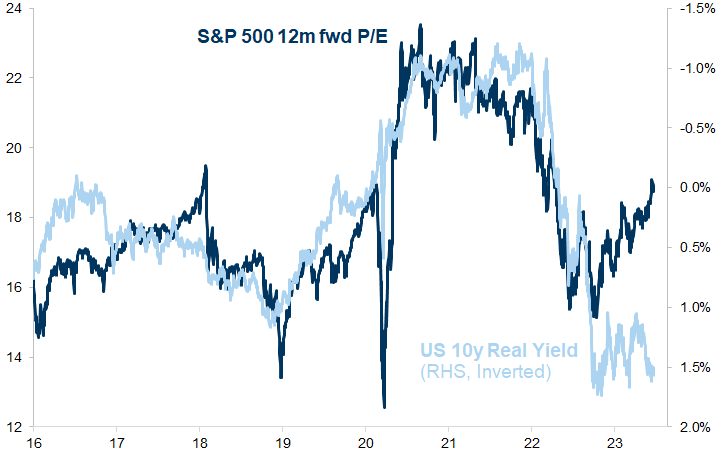

Valuations of equities have also increasingly de-coupled from real interest rates . As Exhibit 11 shows, the S&P 500 P/E has increased sharply in recent weeks despite a rise in real bond yields. This implies that either investors expect rapid rate cuts, or that long-term growth expectations have gone up, or a combination.

Exhibit 11 : Valuations of equities have increasingly de-coupled from real interest rates

S&P 500 12m fwd P/E and US 10y Real Yield

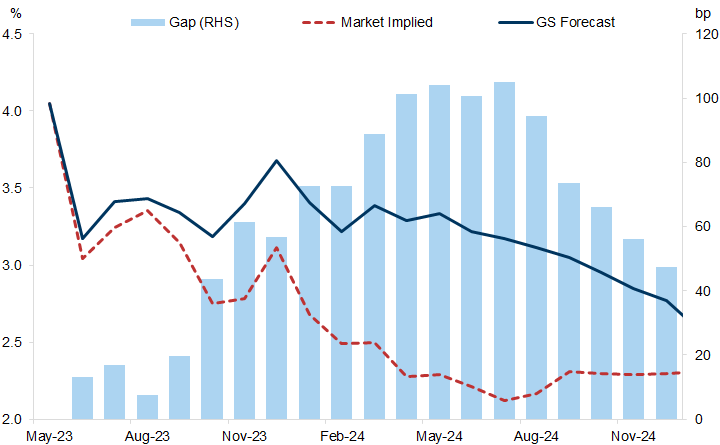

6) In our view, this optimism on interest rate relief is premature; our economists have argued that the market-implied path for inflation remains too optimistic and, by inference, the prospects for interest rate declines. In the US, the gap between our expected path for inflation and the market-implied path continues to rise into next year.

Exhibit 12 : The gap between our expected path for inflation and the market-implied path continues to rise into next year

Inflation, GS forecast and market-implied (United States)

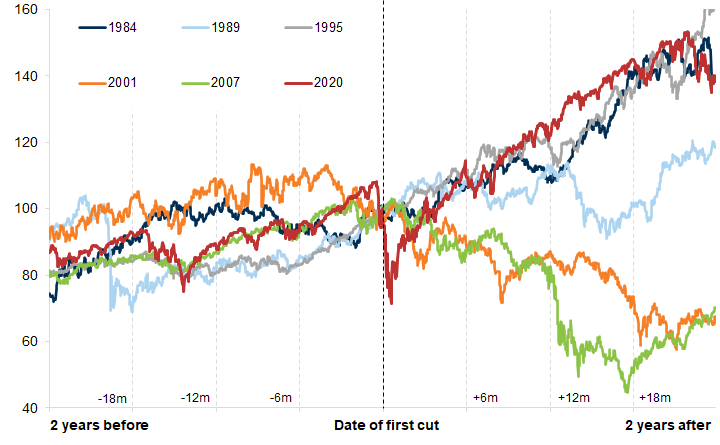

7) Even if the market happens to be right in expecting earlier rate cuts than we do, the reasons for these interest rate cuts would matter. Exhibit 13 shows that, in recent cycles, the path of returns on equities once interest rates cuts begin depends on the path for growth, as well as market valuations.

Exhibit 13 : The path of returns in equities once interest rates cuts begin depends on the path for growth as well as market valuations

S&P 500 price performance. Indexed to 100 the day of the Fed's first cut in a cutting cycle

A persistent deterioration in the economic environment, even after rate cuts, had continued to weigh on equity returns during the financial crisis. By contrast, interest rate cuts did not help the equity market in the aftermath of the collapse of the technology bubble at the turn of the century because valuations were so high. At the current time, in the absence of a recession, the urgency for central banks to cut interest rates is likely to be less than the market is pricing.

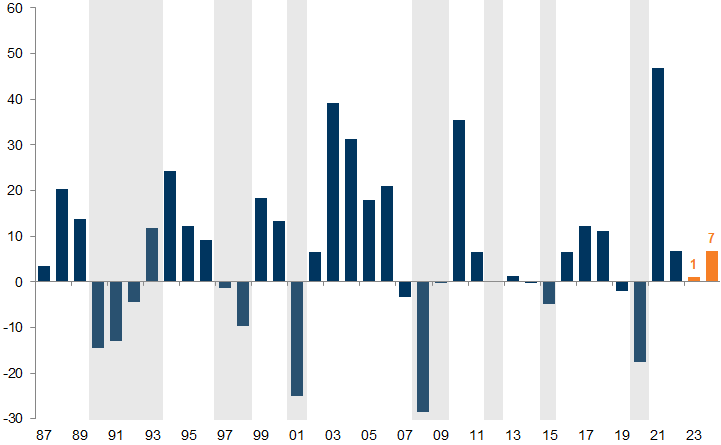

While we do not expect a recession, the outlook for profit growth remains subdued ( Exhibit 14 ). We expect virtually no profit growth (other than in Japan) this year, and mid-single-digit growth rates (other than in Asia, from a low base) next year.

The combination of high valuations and relatively slow profit growth implies a positive, albeit moderate, return for equities.

Exhibit 14 : The outlook for profit growth remains subdued

MSCI AC World EPS growth y/y (GS forecasts in orange)

Source: I/B/E/S, MSCI, Goldman Sachs Global Investment Research

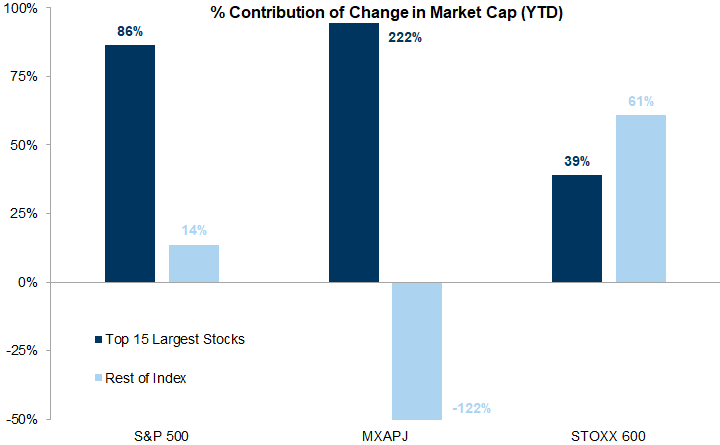

8) An additional concern is that the contributions of returns in most equity markets have been narrow. It is not uncommon to have a narrow market late in the cycle, during the Optimism phase, but it remains a concern for active investors (in Europe and US ). As shown in Exhibit 15 , the 15 biggest companies have driven 86% of the return in the US year to date and 100% in Asia (ex Japan). Europe’s market breadth has been somewhat healthier, with 39% coming from the biggest 15 companies, but the performance of the median company has been very modest.

Exhibit 15 : The 15 biggest companies have driven 86% of the return in the US year to date and 100% in Asia (ex Japan)

% Contribution to YTD change in market cap

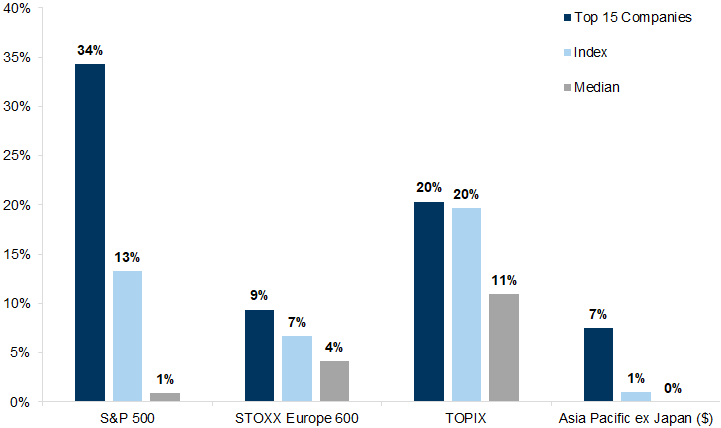

Year to date, the biggest 15 companies in the S&P have gone up 34%, while the median company is up just 1%. On this basis, Japan has had the most impressive returns, with the median company up 11% ( Exhibit 16 ).

Exhibit 16 : YTD, the biggest 15 companies in the S&P have gone up 34%, while the median company is up just 1%

YTD price return

9) A debate has now grown around this narrow leadership of the market: will it be resolved by a catching-up of the rest of the market or through a catching-down of the leading companies? We have found that in Europe, when the market is rallying with narrow leadership, subsequent 12m returns for the aggregate index are positive in 71% of instances (unconditional average following rallies = 62%). Over the past couple of weeks, market breadth has started to improve, suggesting that greater confidence in growth is leading to a widening of optimism about non-tech parts of the market. But the narrow contributions of returns remain very significant – particularly in the US, driven by technology. Also, equity/bond yield correlations have been positive, even for long duration Nasdaq, resulting in lower equity risk premia and equities turning more expensive relative to bonds .

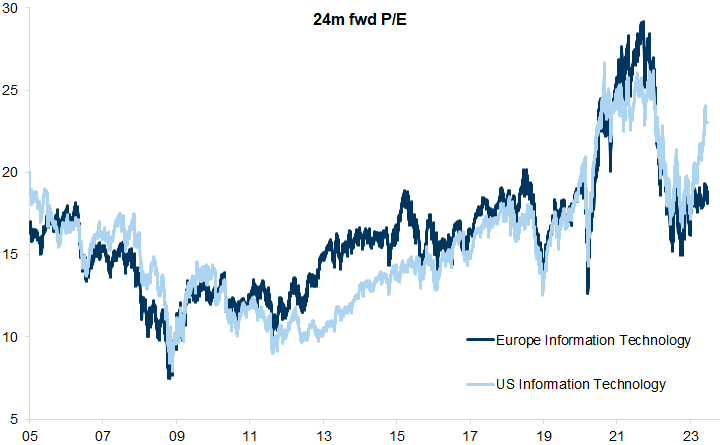

The dominance of the tech rally has come despite the rise in interest rates, suggesting that the drivers of the re-rating are not duration, but rather an increase in longer-term growth expectations, reflecting the perceived benefits accruing to these companies (from AI). This is also reflected in the way that US technology valuations are moving ahead of those in other markets. For example, their valuations have recently pulled away from the valuations of the tech sector in Europe ( Exhibit 17 ).

Exhibit 17 : The valuations of US tech have recently pulled away from those of the European tech sector

24m fwd P/E, S&P 500 and MSCI Europe Information Technology

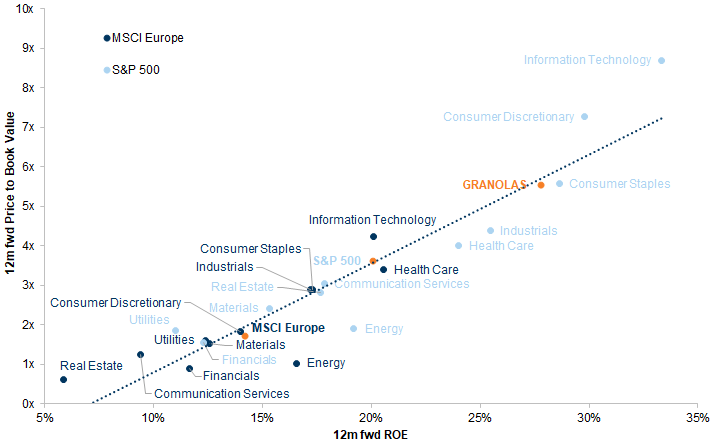

At the same time, comparing sectors across the US and Europe on a Price-to-Book basis with their Return On Equity shows that most sectors are valued in line with expected profitability. The S&P 500 and the STOXX 600 are trading in line with expected returns and so, too, are the ' healthy' GRANOLAS . Technology is maybe an exception, having moved above the curve. By contrast, European Energy remains well below the curve.

Exhibit 18 : Most sectors are valued in line with expected profitability

S&P 500 and MSCI Europe GICS level 1 sectors, 12m fwd Price to Book Value and ROE

We continue to like a barbell approach that includes a combination of quality growth, strong balance sheet and high margin businesses, with some deep value where valuation risks are skewed to the upside.

10) Overall, we expect most equity markets to remain in the 'Fat & Flat' range, while making a return close to their cost of capital over the next 12 months, reflecting the absence of recession. Nevertheless, poor earnings growth at the index level and high valuations, particularly in the US, suggest that the upside risks are limited over a 12-month view relative to cash on a risk-adjusted basis. Put-call skew indicates that upside positioning is now crowded and downside protection is attractively priced.

Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix , or go to www.gs.com/research/hedge.html .

Disclosure Appendix

We, Peter Oppenheimer, Sharon Bell, Lilia Peytavin, Guillaume Jaisson and Marcus von Scheele, hereby certify that all of the views expressed in this report accurately reflect our personal views, which have not been influenced by considerations of the firm's business or client relationships.

Unless otherwise stated, the individuals listed on the cover page of this report are analysts in Goldman Sachs' Global Investment Research division.

Disclosures

Msci disclosure.

All MSCI data used in this report is the exclusive property of MSCI, Inc. (MSCI). Without prior written permission of MSCI, this information and any other MSCI intellectual property may not be reproduced or redisseminated in any form and may not be used to create any financial instruments or products or any indices. This information is provided on an “as is” basis, and the user of this information assumes the entire risk of any use made of this information. Neither MSCI, any of its affiliates nor any third party involved in, or related to, computing or compiling the data makes any express or implied warranties or representations with respect to this information (or the results to be obtained by the use thereof), and MSCI, its affiliates and any such third party hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of this information. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in, or related to, computing or compiling the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. MSCI and the MSCI indexes are service marks of MSCI and its affiliates. The Global Industry Classification Standard (GICS) were developed by and is the exclusive property of MSCI and Standard & Poor’s. GICS is a service mark of MSCI and S&P and has been licensed for use by The Goldman Sachs Group.

Equity Basket Disclosure

The ability to trade the basket(s) discussed in this research will depend upon market conditions, including liquidity and borrow constraints at the time of trade.

Regulatory disclosures

Disclosures required by united states laws and regulations.

See company-specific regulatory disclosures above for any of the following disclosures required as to companies referred to in this report: manager or co-manager in a pending transaction; 1% or other ownership; compensation for certain services; types of client relationships; managed/co-managed public offerings in prior periods; directorships; for equity securities, market making and/or specialist role. Goldman Sachs trades or may trade as a principal in debt securities (or in related derivatives) of issuers discussed in this report.

The following are additional required disclosures: Ownership and material conflicts of interest: Goldman Sachs policy prohibits its analysts, professionals reporting to analysts and members of their households from owning securities of any company in the analyst's area of coverage. Analyst compensation: Analysts are paid in part based on the profitability of Goldman Sachs, which includes investment banking revenues. Analyst as officer or director: Goldman Sachs policy generally prohibits its analysts, persons reporting to analysts or members of their households from serving as an officer, director or advisor of any company in the analyst's area of coverage. Non-U.S. Analysts: Non-U.S. analysts may not be associated persons of Goldman Sachs & Co. LLC and therefore may not be subject to FINRA Rule 2241 or FINRA Rule 2242 restrictions on communications with subject company, public appearances and trading securities held by the analysts.

Additional disclosures required under the laws and regulations of jurisdictions other than the United States