- Find a Branch

- Schwab Brokerage 800-435-4000

- Schwab Password Reset 800-780-2755

- Schwab Bank 888-403-9000

- Schwab Intelligent Portfolios® 855-694-5208

- Schwab Trading Services 888-245-6864

- Workplace Retirement Plans 800-724-7526

... More ways to contact Schwab

Chat

- Schwab International

- Schwab Advisor Services™

- Schwab Intelligent Portfolios®

- Schwab Alliance

- Schwab Charitable™

- Retirement Plan Center

- Equity Awards Center®

- Learning Quest® 529

- Mortgage & HELOC

- Charles Schwab Investment Management (CSIM)

- Portfolio Management Services

- Open an Account

Options Exercise, Assignment, and More: A Beginner's Guide

So your trading account has gotten options approval, and you recently made that first trade—say, a long call in XYZ with a strike price of $105. Then expiration day approaches and, at the time, XYZ is trading at $105.30.

Wait. The stock's above the strike. Is that in the money 1 (ITM) or out of the money 2 (OTM)? Do I need to do something? Do I have enough money in my account? Help!

Don't be that trader. The time to learn the mechanics of options expiration is before you make your first trade.

Here's a guide to help you navigate options exercise 3 and assignment 4 —along with a few other basics.

In the money or out of the money?

The buyer ("owner") of an option has the right, but not the obligation, to exercise the option on or before expiration. A call option 5 gives the owner the right to buy the underlying security; a put option 6 gives the owner the right to sell the underlying security.

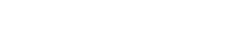

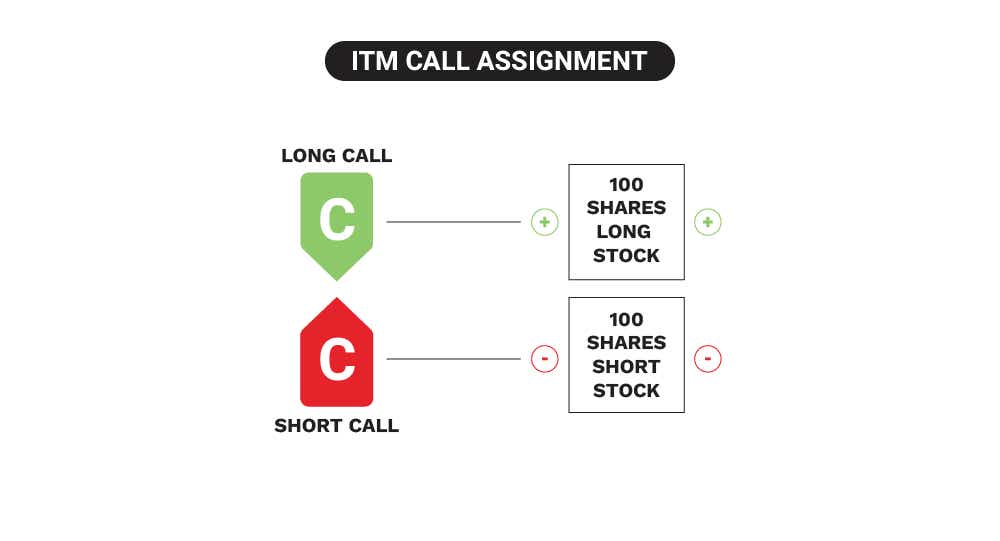

Conversely, when you sell an option, you may be assigned—at any time regardless of the ITM amount—if the option owner chooses to exercise. The option seller has no control over assignment and no certainty as to when it could happen. Once the assignment notice is delivered, it's too late to close the position and the option seller must fulfill the terms of the options contract:

- A long call exercise results in buying the underlying stock at the strike price.

- A short call assignment results in selling the underlying stock at the strike price.

- A long put exercise results in selling the underlying stock at the strike price.

- A short put assignment results in buying the underlying stock at the strike price.

An option will likely be exercised if it's in the option owner's best interest to do so, meaning it's optimal to take or to close a position in the underlying security at the strike price rather than at the current market price. After the market close on expiration day, ITM options may be automatically exercised, whereas OTM options are not and typically expire worthless (often referred to as being "abandoned"). The table below spells it out.

- If the underlying stock price is...

- ...higher than the strike price

- ...lower than the strike price

- If the underlying stock price is... A long call is... -->

- ...higher than the strike price ...ITM and typically exercised -->

- ...lower than the strike price ...OTM and typically abandoned -->

- If the underlying stock price is... A short call is... -->

- ...higher than the strike price ...ITM and typically assigned -->

- If the underlying stock price is... A long put is... -->

- ...higher than the strike price ...OTM and typically abandoned -->

- ...lower than the strike price ...ITM and typically exercised -->

- If the underlying stock price is... A short put is... -->

- ...lower than the strike price ...ITM and typically assigned -->

The guidelines in the table assume a position is held all the way through expiration. Of course, you typically don't need to do that. And in many cases, the usual strategy is to close out a position ahead of the expiration date. We'll revisit the close-or-hold decision in the next section and look at ways to do that. But assuming you do carry the options position until the end, there are a few things you need to consider:

- Know your specs . Each standard equity options contract controls 100 shares of the underlying stock. That's pretty straightforward. Non-standard options may have different deliverables. Non-standard options can represent a different number of shares, shares of more than one company stock, or underlying shares and cash. Other products—such as index options or options on futures—have different contract specs.

- Stock and options positions will match and close . Suppose you're long 300 shares of XYZ and short one ITM call that's assigned. Because the call is deliverable into 100 shares, you'll be left with 200 shares of XYZ if the option is assigned, plus the cash from selling 100 shares at the strike price.

- It's automatic, for the most part . If an option is ITM by as little as $0.01 at expiration, it will automatically be exercised for the buyer and assigned to a seller. However, there's something called a do not exercise (DNE) request that a long option holder can submit if they want to abandon an option. In such a case, it's possible that a short ITM position might not be assigned. For more, see the note below on pin risk 7 ?

- You'd better have enough cash . If an option on XYZ is exercised or assigned and you are "uncovered" (you don't have an existing long or short position in the underlying security), a long or short position in the underlying stock will replace the options. A long call or short put will result in a long position in XYZ; a short call or long put will result in a short position in XYZ. For long stock positions, you need to have enough cash to cover the purchase or else you'll be issued a margin 8 call, which you must meet by adding funds to your account. But that timeline may be short, and the broker, at its discretion, has the right to liquidate positions in your account to meet a margin call 9 . If exercise or assignment involves taking a short stock position, you need a margin account and sufficient funds in the account to cover the margin requirement.

- Short equity positions are risky business . An uncovered short call or long put, if assigned or exercised, will result in a short stock position. If you're short a stock, you have potentially unlimited risk because there's theoretically no limit to the potential price increase of the underlying stock. There's also no guarantee the brokerage firm can continue to maintain that short position for an unlimited time period. So, if you're a newbie, it's generally inadvisable to carry an options position into expiration if there's a chance you might end up with a short stock position.

A note on pin risk : It's not common, but occasionally a stock settles right on a strike price at expiration. So, if you were short the 105-strike calls and XYZ settled at exactly $105, there would be no automatic assignment, but depending on the actions taken by the option holder, you may or may not be assigned—and you may not be able to trade out of any unwanted positions until the next business day.

But it goes beyond the exact price issue. What if an option is ITM as of the market close, but news comes out after the close (but before the exercise decision deadline) that sends the stock price up or down through the strike price? Remember: The owner of the option could submit a DNE request.

The uncertainty and potential exposure when a stock price and the strike price are the same at expiration is called pin risk. The best way to avoid it is to close the position before expiration.

The decision tree: How to approach expiration

As expiration approaches, you have three choices. Depending on the circumstances—and your objectives and risk tolerance—any of these might be the best decision for you.

1. Let the chips fall where they may. Some positions may not require as much maintenance. An options position that's deeply OTM will likely go away on its own, but occasionally an option that's been left for dead springs back to life. If it's a long option, the unexpected turn of events might feel like a windfall; if it's a short option that could've been closed out for a penny or two, you might be kicking yourself for not doing so.

Conversely, you might have a covered call (a short call against long stock), and the strike price was your exit target. For example, if you bought XYZ at $100 and sold the 110-strike call against it, and XYZ rallies to $113, you might be content selling the stock at the $110 strike price to monetize the $10 profit (plus the premium you took in when you sold the call but minus any transaction fees). In that case, you can let assignment happen. But remember, assignment is likely in this scenario, but it is not guaranteed.

2. Close it out . If you've met your objectives for a trade, then it might be time to close it out. Otherwise, you might be exposed to risks that aren't commensurate with any added return potential (like the short option that could've been closed out for next to nothing, then suddenly came back into play). Keep in mind, there is no guarantee that there will be an active market for an options contract, so it is possible to end up stuck and unable to close an options position.

The close-it-out category also includes ITM options that could result in an unwanted long or short stock position or the calling away of a stock you didn't want to part with. And remember to watch the dividend calendar. If you're short a call option near the ex-dividend date of a stock, the position might be a candidate for early exercise. If so, you may want to consider getting out of the option position well in advance—perhaps a week or more.

3. Roll it to something else . Rolling, which is essentially two trades executed as a spread, is the third choice. One leg closes out the existing option; the other leg initiates a new position. For example, suppose you're short a covered call on XYZ at the July 105 strike, the stock is at $103, and the call's about to expire. You could attempt to roll it to the August 105 strike. Or, if your strategy is to sell a call that's $5 OTM, you might roll to the August 108 call. Keep in mind that rolling strategies include multiple contract fees, which may impact any potential return.

The bottom line on options expiration

You don't enter an intersection and then check to see if it's clear. You don't jump out of an airplane and then test the rip cord. So do yourself a favor. Get comfortable with the mechanics of options expiration before making your first trade.

1 Describes an option with intrinsic value (not just time value). A call option is in the money (ITM) if the stock price is above the strike price. A put option is ITM if the stock price is below the strike price. For calls, it's any strike lower than the price of the underlying equity. For puts, it's any strike that's higher.

2 Describes an option with no intrinsic value. A call option is out of the money (OTM) if its strike price is above the price of the underlying stock. A put option is OTM if its strike price is below the price of the underlying stock.

3 An options contract gives the owner the right but not the obligation to buy (in the case of a call) or sell (in the case of a put) the underlying security at the strike price, on or before the option's expiration date. When the owner claims the right (i.e. takes a long or short position in the underlying security) that's known as exercising the option.

4 Assignment happens when someone who is short a call or put is forced to sell (in the case of the call) or buy (in the case of a put) the underlying stock. For every option trade there is a buyer and a seller; in other words, for anyone short an option, there is someone out there on the long side who could exercise.

5 A call option gives the owner the right, but not the obligation, to buy shares of stock or other underlying asset at the options contract's strike price within a specific time period. The seller of the call is obligated to deliver, or sell, the underlying stock at the strike price if the owner of the call exercises the option.

6 Gives the owner the right, but not the obligation, to sell shares of stock or other underlying assets at the options contract's strike price within a specific time period. The put seller is obligated to purchase the underlying security at the strike price if the owner of the put exercises the option.

7 When the stock settles right at the strike price at expiration.

8 Margin is borrowed money that's used to buy stocks or other securities. In margin trading, a brokerage firm lends an account owner a portion of the purchase price (typically 30% to 50% of the total price). The loan in the margin account is collateralized by the stock, and if the value of the stock drops below a certain level, the owner will be asked to deposit marginable securities and/or cash into the account or to sell/close out security positions in the account.

9 A margin call is issued when your account value drops below the maintenance requirements on a security or securities due to a drop in the market value of a security or when a customer exceeds their buying power. Margin calls may be met by depositing funds, selling stock, or depositing securities. Charles Schwab may forcibly liquidate all or part of your account without prior notice, regardless of your intent to satisfy a margin call, in the interests of both parties.

Just getting started with options?

More from charles schwab.

Today's Options Market Update

Weekly Trader's Outlook

Options Expiration: Definitions, a Checklist, & More

Related topics.

Options carry a high level of risk and are not suitable for all investors. Certain requirements must be met to trade options through Schwab. Please read the Options Disclosure Document titled " Characteristics and Risks of Standardized Options " before considering any options transaction. Supporting documentation for any claims or statistical information is available upon request.

With long options, investors may lose 100% of funds invested. Covered calls provide downside protection only to the extent of the premium received and limit upside potential to the strike price plus premium received.

Short options can be assigned at any time up to expiration regardless of the in-the-money amount.

Investing involves risks, including loss of principal. Hedging and protective strategies generally involve additional costs and do not assure a profit or guarantee against loss.

Commissions, taxes, and transaction costs are not included in this discussion but can affect final outcomes and should be considered. Please contact a tax advisor for the tax implications involved in these strategies.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

Short selling is an advanced trading strategy involving potentially unlimited risks and must be done in a margin account. Margin trading increases your level of market risk. For more information, please refer to your account agreement and the Margin Risk Disclosure Statement.

Options Assignment: Navigating the Rights and Obligations

By Tyler Corvin

Ever been blindsided by an unexpected traffic ticket in the mail?

You knew driving came with its set of potential consequences, yet you took to the road regardless. Suddenly, you’re left with a tangible obligation to pay. This unforeseen shift, where what was once a mere possibility becomes an immediate reality, captures the spirit of options assignment within the vast realm of options trading.

Diving into the details, option assignment serves as the bridge between the abstract realm of rights and the concrete world of duties in this field. It’s that unassuming piece in the machinery that can, without warning, change the entire game – often carrying notable financial repercussions. In a domain where every move has implications, truly grasping option assignment is foundational, ensuring not just survival but genuine success.

Join us in this comprehensive exploration of option assignment, arming traders of all experience levels with the knowledge to sail these intricate seas with assuredness and accuracy.

What you’ll learn

What is Options Assignment?

How options assignment works, identifying option assignment , examples of option assignment, managing and mitigating assignment risks, what option assignment means for individual traders.

- Conclusion

Dive into the realm of options trading and you’ll find a tapestry of processes and potential. “Options assignment” is one pivotal cog in this intricate machine. To a newcomer, this term might seem a tad daunting. But a step-by-step walk-through can demystify its core.

In its simplest form, options assignment means carrying out the rights specified in an option contract. Holding an option allows a trader the choice to buy or sell a particular asset, but there’s no compulsion. The moment they opt to use this right, that’s when options assignment kicks in.

Think of it this way: You’ve got a ticket (option) to a show (buy or sell an asset). You decide if and when to attend. When you make the move, that transition is the options assignment.

There are two main types of option assignments:

- Call Option Assignment : Triggered when a call option holder exercises their right. The seller of the option then steps into the spotlight, bound to sell the asset at the agreed-upon price.

- Put Option Assignment : Conversely, if a put option holder steps forward, the seller of the put takes the stage. Their role? To buy the asset at the specified rate.

To truly grasp options assignment, one must understand the dance between rights and obligations in options trading.

When a trader buys an option, they’re essentially reserving a right, a possible move. On the other hand, selling an option translates to accepting a duty if the option’s holder chooses to play their card.

Rights with Call Options: Buying a call option grants you a special privilege. You can procure the underlying asset at a set price before the option expires. If you choose to exercise this right, the one who sold you the call gets assigned. Their task? Handing over the asset at that set price.

Obligations with Put Options: Securing a put option empowers you to sell the underlying at a pre-decided rate. Should you exercise this, the put’s seller steps up, committed to buying the asset at the given rate.

Several factors steer the course of options assignment, including intrinsic value, looming expiration dates, and current market vibes. To stay ahead of these influences, many traders utilize option trade alerts for timely insights. And remember, while many options might find buyers, not all see execution. Hence, not every seller will get assigned. For traders, understanding this rhythm is vital, shaping many strategies in options trading.

In the multifaceted world of options trading, discerning option assignment straddles the line between art and science. While no technique guarantees surefire results, several pointers and signals can wave a flag, hinting at an impending assignment.

In-the-Money Options : A robust sign of a looming assignment is the option’s stance relative to its strike price. “In-the-money” refers to an option’s moneyness , and plays a pivotal role in the behavior of option holders. Deeply in-the-money (ITM) options amplify the odds of assignment. An ITM call option, where the market price of the asset towers above the strike price, encourages the holder to exercise and swiftly offload the asset on the market. Conversely, an ITM put option, where the market price trails significantly behind the strike price, incentivizes the holder to scoop up the asset in the market and then exercise the option to vend it at the loftier strike price.

Expiration’s Shadow: The ticking clock of an expiring option raises the assignment stakes, especially if it remains ITM. Many traders make their move just before the eleventh hour to capitalize on their gains.

Dividend Dates in Focus: Call options inching toward expiry ahead of a dividend date, especially if they’re ITM, stand at an elevated assignment crosshair. Option aficionados might play their call options to pocket the dividend, which they’d bag if they possess the core shares.

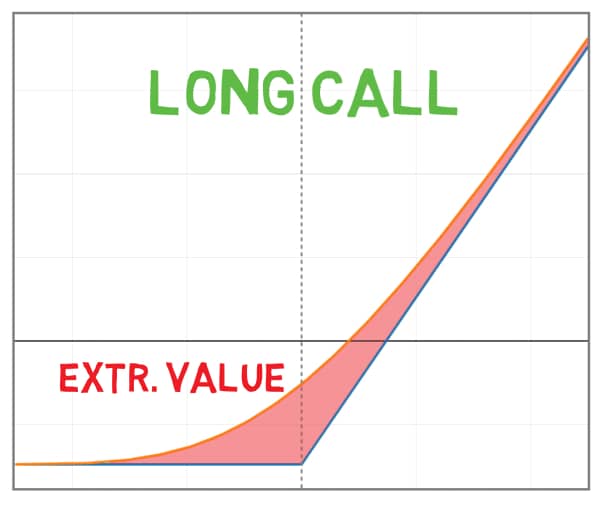

Extrinsic Value’s Decline : A diminishing time or extrinsic value of an option elevates its exercise odds. When intrinsic value dominates an option’s worth, a holder might be inclined to cash in on this value.

Volume & Open Interest Dynamics : A sudden surge in trading or a dip in open interest can be telltale signs. Understanding volume’s role is crucial as such fluctuations might hint at traders either hopping in or out, suggesting possible exercises and assignments.

Navigating the Post-Assignment Terrain

Grasping the ripple effects of option assignment is vital, highlighting the immediate responsibilities and potential paths for both the buyer and seller.

For the Option Seller:

- Call Option Assignment : For a trader who’s sold a call option, assignment means they’re on the hook to hand over the underlying shares at the strike price. If they’re short on shares, a market purchase is in order—potentially at a loss if market prices overshoot the strike.

- Put Option Assignment: Assignment on a peddled put option necessitates the trader to buy the shares at the strike price . If this price overshadows the market rate, losses loom.

For the Option Buyer:

- Call Option Play : Exercising a call lets the buyer snap up shares at the strike price. They can either nestle with them or trade them off.

- Put Option Play: Exercising a put gives the buyer the reins to sell their shares at the strike price. This play often pays off when the market rate is dwarfed by the strike, ensuring a tidy profit on the dispensed shares.

Post-assignment, all involved must be on their toes, knowing what triggers margin calls , especially if caught off-guard by the assignment. Tax implications may also hover, influenced by the trade’s nature and the tenure of the position.

Being savvy about these subtleties and gearing up for possible turns of events can drastically refine one’s journey through the options trading maze.

Call Option Assignment Scenario

Imagine an investor purchases an Nvidia ( NVDA ) call option at a strike price of $435, hoping that the price of the stock will ascend after finding out that they may be forced to move out of some countries . The option is set to expire in a month. Soon after, not only did NVDA rebound from the news, but they reported very strong quarterly earnings, propelling the stock to $455.

Spotting the favorable trend, the investor opts to wield their right to purchase the stock at the agreed strike price of $435, despite its $455 market value. This initiates the option assignment.

The other investor, having sold the option, must now part with their NVDA shares at $435 apiece. If they’re short on stocks, they’d have to fetch them at the going rate of $455 and let them go at a deficit. The first investor, however, stands at a crossroads: retain the shares in hopes of further gains or swiftly trade them at $455, reaping a neat sum.

Put Option Assignment Scenario

Let’s visualize an investor who speculates a dip in the share price of V.F. Corporation ( VFC ) after seeing news about an activist investor causing shares to jump almost 14% in a day . To hedge their bets, they secures a put option from another investor at a strike price of $18.50, set to lapse in a month.

Fast forward a week, let’s say VFC divulges lackluster quarterly figures, causing the stock to dive to $10. The first investor, seizing the moment, employs their put option, electing to sell their shares at the $18.50 strike price.

When the assignment bell tolls, the other investor finds himself bound to buy the shares from the first investor at the agreed $18.50, a rate that overshadows the current $10 market value. The first investor thus sidesteps the market slump, securing a favorable sale. The other investor, however, absorbs a loss, acquiring stocks at a premium to their market worth.

The realm of options trading is akin to navigating a dynamic river, demanding a sharp comprehension of the risks that lie beneath its surface. A predominant risk that traders often encounter is assignment risk. When one assumes the role of an option seller, they inherit the duty to honor the contract if the buyer opts to exercise. Grasping the gravity of this can make the difference, underscoring the necessity of adept risk management.

A savvy approach to temper assignment risk is by keeping a vigilant eye on the extrinsic value of options. Generally, options rich in extrinsic value tend to resist early assignment. This resistance emerges as the extrinsic value dwindles when the option dives deeper in-the-money, thereby tempting the holder to exercise.

Furthermore, economic currents, ranging from niche corporate updates to sweeping market tides, can be triggers for option assignments. Staying attuned to these economic ripples equips traders with the vision needed to either tweak or maintain their positions. For example, traders may opt to sidestep selling options that are deeply in-the-money, given their higher susceptibility to assignments due to their shrinking extrinsic value.

Incorporating spread tactics, like vertical spreads or iron condors, furnishes an added shield. These strategies can dampen the risk of assignment since one part of the spread frequently balances the risk of its counterpart. Should the specter of a short option assignment hover, traders might contemplate ‘rolling out’ their stance. This move entails repurchasing the short option and subsequently selling another, possibly at a varied strike rate or a more distant expiry.

Yet, despite these protective layers, it remains pivotal for traders to brace for possible assignments. Maintaining ample liquidity, be it in capital or necessary shares, can avert unfavorable scenarios like hasty liquidations or stiff margin charges. Engaging regularly with brokers can also shed light, occasionally offering a heads-up on looming assignments.

In conclusion, the bedrock of risk management in options trading is rooted in perpetual learning. As traders hone their craft, their adeptness at forecasting and navigating assignment risks sharpens.

In the intricate world of options trading, option assignments aren’t just nuanced details; they’re pivotal moments with deep-seated implications for individual traders and the health of their portfolios. Beyond the immediate financial aftermath, assignments can reshape trading plans, risk dynamics, and the overarching path of an investor’s journey.

At its core, option assignments can transform a trader’s asset landscape. Consider a trader who’s short on a call option. If they’re assigned, they might be compelled to supply the underlying stock. This can result in a rapid stock outflow from their portfolio or, if they don’t possess the stock, birth a short stock stance. On the flip side, a trader short on a put option who faces assignment may find themselves buying the stock at the strike price, thereby dipping into their cash reserves.

These immediate shifts can generate broader portfolio ripples. An unexpected gain or shedding of stocks can jostle a trader’s asset distribution, veering it off their envisioned path. If, for instance, a trader had charted a particular stock-to-cash distribution or a meticulous diversification blueprint, an option assignment might throw a spanner in the works.

Additionally, assignments can serve as a real-world litmus test for a trader’s risk-handling prowess . A surprise assignment might spark margin calls for those not sufficiently fortified with capital. It stands as a poignant nudge about the essence of ensuring liquidity and safeguarding against the unpredictable whims of the market.

Strategically speaking, recurrent assignments might signal it’s time for traders to recalibrate. Are the options they’re offloading too submerged in-the-money? Have they factored in pivotal market shifts that might heighten early exercise odds? Such reflective moments can pave the way for refining and elevating trading methods.

In the multifaceted world of options trading, option assignment stands out as both a potential boon and a challenge. Far from being a simple checkbox in the process, its ramifications can mold the contours of a trader’s portfolio and steer long-term tactics. The importance of comprehending and adeptly managing option assignment resonates, whether you’re dipping your toes into options for the first time or weaving through intricate trades with seasoned expertise.

Furthermore, mastering options trading is about integrating its myriad concepts into a cohesive playbook. Whether it’s differentiating trading strategies like the iron condor from the iron butterfly strategy or delving deep into the nuances of option assignments, each component enriches the narrative of a trader’s odyssey. As markets shift and new hurdles arise, a solid grasp of foundational principles remains an invaluable asset. In this perpetual dance of learning and evolution, may your trading maneuvers always be well-informed, proactive, and adept.

Understanding Options Assignment: FAQs

What factors influence the likelihood of an option being assigned.

Several factors come into play, including the option’s intrinsic value , the time remaining until expiration, and upcoming dividend announcements. Options that are deep in the money or nearing their expiration date are more likely to be assigned.

Are Some Option Styles More Prone to Assignment than Others?

Absolutely. When considering different option styles , it’s essential to note that American-style options can be exercised at any point before their expiration, which means they face a higher risk of early assignment. In contrast, European-style options can only be exercised at expiration.

How Do Current Market Trends Impact Assignment Risk?

Factors like market volatility, notable price shifts, and external economic happenings can amplify the chances of an option being assigned. For example, an option might be assigned before a company’s ex-dividend date if the expected dividend outweighs the weakening of theta decay .

Can Traders Reverse or Counter the Effects of an Option Assignment?

Once an option has been assigned, it’s set in stone. However, traders can maneuver within the market to balance out the implications of the assignment, such as procuring or selling the underlying asset.

Are There Any Fees Tied to Option Assignments?

Indeed, brokers usually impose a fee for both assignments and exercises. The specific fee can differ depending on the broker, making it essential for traders to understand their brokerage’s charging scheme.

Signal Lines Decoded

Linearly Weighted Moving Average Explained

What is Diffusion Index in Trading?

What is Guppy Multiple Moving Average (GMMA) in Trading?

What is an Advance Decline Line?

- Search Search Please fill out this field.

- Assets & Markets

What Is an Option Assignment?

:max_bytes(150000):strip_icc():format(webp)/image0-MichaelBoyle-30f78c37d3174fe298f9407f0b5413e2.jpeg)

Definition and Examples of Assignment

How does assignment work, what it means for individual investors.

Morsa Images / Getty Images

An option assignment represents the seller of an option’s obligation to fulfill the terms of the contract by either selling or purchasing the underlying security at the exercise price. Let’s explain what that means in more detail.

Key Takeaways

- An assignment represents the seller of an option’s obligation to fulfill the terms of the contract by either selling or purchasing the underlying security at the exercise price.

- If you sell an option and get assigned, you have to fulfill the transaction outlined in the option.

- You can only get assigned if you sell options, not if you buy them.

- Assignment is relatively rare, with only 7% of options ultimately getting assigned.

An assignment represents the seller of an option’s obligation to fulfill the terms of the contract by either selling or purchasing the underlying security at the exercise price. Let’s explain what that means in more detail.

When you sell an option to someone, you’re selling them the right to make you engage in a future transaction. For example, if you sell someone a put option , you’re promising to buy a stock at a set price any time between when the transaction happens and the expiration date of the option.

If the holder of the option doesn’t do anything with the option by the expiration date, the option expires. However, if they decide that they want to go through with the transaction, they will exercise the option.

If the holder of an option chooses to exercise it, the seller will receive a notification, called an assignment, letting them know that the option holder is exercising their right to complete the transaction. The seller is legally obligated to fulfill the terms of the options contract.

For example, if you sell a call option on XYZ with a strike price of $40 and the buyer chooses to exercise the option, you’ll be assigned the obligation to fulfill that contract. You’ll have to buy 100 shares of XYZ at whatever the market price is, or take the shares from your own portfolio and sell them to the option holder for $40 each.

Options traders only have to worry about assignment if they sell options contracts. Those who buy options don’t have to worry about assignment because in this case, they have the power to exercise a contract, or choose not to.

The options market is huge, in that options are traded on large exchanges and you likely do not know who you’re buying contracts from or selling them to. It’s not like you sell an option to someone you know and they send you an email if they choose to exercise the contract, rather it is an organized process.

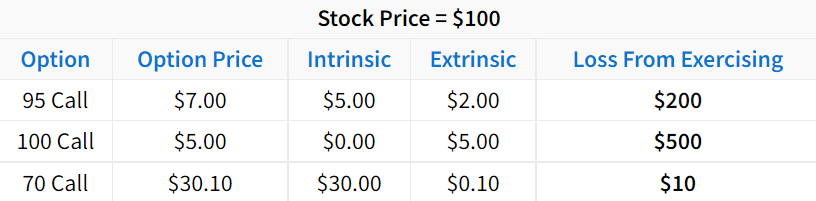

In the U.S., the Options Clearing Corporation (OCC), which is considered the options industry clearinghouse, helps to facilitate the exchange of options contracts. It guarantees a fair process of option assignments, ensuring that the obligations in the contract are fulfilled.

When an investor chooses to exercise a contract, the OCC randomly assigns the obligation to someone who sold the option being exercised. For example, if 100 people sold XYZ calls with a strike of $40, and one of those options gets exercised, the OCC will randomly assign that obligation to one of the 100 sellers.

In general, assignments are uncommon. About 7% of options get exercised, with the remaining 93% expiring. Assignment also tends to grow more common as the expiration date nears.

If you are assigned the obligation to fulfill an options contract you sold, it means you have to accept the related loss and fulfill the contract. Usually, your broker will handle the transaction on your behalf automatically.

If you’re an individual investor, you only have to worry about assignment if you’re involved in selling options. Even then, assignments aren't incredibly common. Less than 7% of options get assigned and they tend to get assigned as the option’s expiration date gets closer.

Having an option assigned does mean that you are forced to lock in a loss on an option, which can hurt. However, if you’re truly worried about assignment, you can plan to close your position at some point before the expiration date or use options strategies that don’t involve selling options that could get exercised.

The Options Industry Council. " Options Assignment FAQ: How Can I Tell When I Will Be Assigned? " Accessed Oct. 18, 2021.

- Options Income Mastery

- Accelerator Program

Option Assignment Process

Options trading 101 - the ultimate beginners guide to options.

Download The 12,000 Word Guide

One of the biggest fears that new options traders have is that they may get assigned. The option assignment process means that the option writer is obligated to deliver on the terms specified in a contract.

For example, if a put option is assigned, the options writer would need to buy the underlying security at the strike price dictated in the contract.

Likewise for a call option, the options write would need to sell the underlying security at the strike price dictated in the contract.

As an options trader you’re usually seeking to make a profit from directional bets or to hedge your portfolio.

You’re rarely, if ever, looking to actually buy or sell the underlying security so being assigned can sound like a scary prospect.

This article will explore the option assignment process so you can understand how it works and how you can prevent yourself getting stuck with buying or selling an underlying security.

When Assignment Occurs

Assignment occurs when an option holder exercises an option. Exercising an option simply means that the option holder executes the terms in the options contract.

So for example if you are holding a call option, you have the right, but not the obligation to buy the underlying security at the agreed strike price.

When you exercise the option, the option holder will need to sell the underlying security at the agreed strike price and for the agreed quantity.

If you’re dealing with European style options, you will know when expiration is possible because they can only be exercised on the expiration date itself.

For American style options, which is what most people trade, options can be exercised at any time before the expiration date.

This means that if you are an options writer of American style options, you could theoretically be asked at any time to comply with the terms of the contract.

Unfortunately, there is no knowing when an assignment will take place.

However, generally options are not exercised prior to expiration as it is usually much more profitable to sell the option instead.

It’s worth noting that this will only happen to you if you’re an options seller. Option buyers can never be assigned.

There are two key steps to assignment and to make it fair, the process of selecting who is assigned is random.

In the first step, the Options Clearing Corporation (OCC) will issue an exercise notice to a randomly selected Clearing Member who maintains an account with the OCC.

In the second step, the Clearing Member then assigns the exercise notice to an individual account.

When You Are Most At Risk

There are several situations that can dramatically increase the risk that you will be assigned:

Situation 1: Your option is In The Money (ITM)

When an option is ITM, an option holder would stand to profit if they exercised the option.

The deeper the option is ITM, the greater the profit for the option holder and therefore the higher risk they may exercise the option and you will be assigned.

Situation 2: The option has an upcoming dividend

An ITM call buyer can profit from exercising an option before its ex-dividend date if the extrinsic value of the call is less than the amount of the dividend.

Situation 3: There is no extrinsic value left

If there is no extrinsic value left, an option buyer could be tempted to exercise the option.

If there is extrinsic value, an option buyer would typically make a bigger profit by selling the option and buying/selling shares of the underlying asset.

How You Can Avoid The Risk Of Being Assigned

There are several steps you can take to avoid, or at the very least minimise, your risk of being assigned.

The first step to consider is avoiding selling any options that have an upcoming dividend.

Before selling any option, first check that the underlying security doesn’t have an upcoming dividend and if it does, consider waiting until after the dividend has occurred (i.e. the stock has gone ex-dividend).

If you do end up selling an option with an upcoming dividend, then the second step to protecting yourself is to close your position early as your risk begins to increase.

For example, if you are short an option with an extrinsic value less than the dividend amount and the ex-dividend of the underlying security is not too far away, close your position.

Otherwise you risk being assigned and being forced to pay the dividend as well!

To completely avoid early assignment risk, you could always sell only European style options which are cash settled at expiration. You can read more that here and here .

The final way to manage your risk is to close positions well before expiration date approaches.

As the time left to expiration decreases, so too does the extrinsic value. For option buyers, it means they could stand to benefit and so there is a risk they may exercise the option.

While this article deals with the process and risks behind being assigned, there will be times when this isn’t an issue for you.

Provided you have enough capital to meet the assignment, you may be fine with being assigned.

If this is the case, you would simply have a new stock position added which you could hold onto or immediately liquidate.

In the event that you don’t have enough capital, your broker will issue you with a margin call and the position should be automatically closed.

As the process of assignment can differ between brokers, its best you contact your broker to check the specific process they use when issuing assignments to individual accounts.

In general, provided you take a few key steps to mitigate your risks, particularly around dividend issuing securities, the chances of assignment are very low.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice . The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Like it? Share it!

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Closed my Oct BB (a few moments ago) for 34% profit…that is the best of the 3 BBs I traded since Gav taught us the strategy…so, the next coffee or beer on me, Gav 🙂

FEATURED ARTICLES

Small Account Option Strategies

The Ultimate Guide To Implied Volatility

What Is A Calendar Spread?

3,500 word guide.

Everything You Need To Know About Butterfly Spreads

Iron Condors: The Complete Guide With Examples and Strategies

Assignment in Options Trading

Introduction articles, what is an options assignment.

In options trading , an assignment occurs when an option is exercised.

As we know, a buyer of an option has the right but not the obligation to buy or sell an underlying asset depending on what option they have purchased. When the buyer exercises this right, the seller will be assigned and will have to deliver or take delivery of what they are contractually obliged to. For stock options, it is typically 1 , 000 shares per contract for the UK ; and 100 shares per contract in the US.

As you can see, a buyer will never be assigned, only the seller is at risk of assignment. The buyer, however, may be auto exercised if the option expires in-the-money .

The Mechanics of Assignment

Assignment of options isn’t a random process. It’s a methodical procedure that follows specific steps, typically beginning with the option holder’s decision to exercise their option. The decision then gets routed through various intermediaries like brokers and clearing +houses before the seller is notified.

- Exercise by Holder: The holder (buyer) of the option exercises their right to buy (for Call ) or sell (for Put ).

- Random Assignment by a Clearing House: A clearing house assigns the obligation randomly among all sellers of the option.

- Fulfilment by the Writer: The writer (seller) now must fulfill the obligation to sell (for Call) or buy (for Put) the underlying asset.

Option Assignments: Calls and Puts

Call option assignments.

When a call option holder chooses to exercise their right, the seller of the call option gets assigned. In such a situation, the seller is obligated to sell the underlying asset at the strike price to the call option holder.

Put Option Assignments

Similarly, if a put option holder decides to exercise their right, the put option seller gets assigned. The seller is then obligated to buy the underlying asset at the strike price from the put option holder.

The Implications of Assignments for Options Traders

Understanding assignment in options trading is crucial as it comes with potential risks and rewards for both parties involved.

For Option Sellers

Option sellers, or ‘writers,’ face the risk of unexpected assignments. The risk of being assigned early is especially present for options that are in the money or near their expiration date. We explain the difference between American and European assignments below.

For Option Holders

For option holders, deciding when to exercise an option (potentially leading to assignment) is a strategic decision. This decision must consider factors such as the intrinsic value of the option, the time value, and the dividend payment of the underlying asset.

Can Options be assigned before expiration?

In short, Yes, but it depends on the style of options you are trading.

American Style – Yes, this type of option can be assigned on or before expiry.

European Style – No, this type of option can only be assigned on the expiry date as defined in the contract specifications.

Options Assignment Example

For example, an investor buys XYZ PLC 400 call when the stock is trading at 385. The stock in the coming weeks rises to 425 after some good news, the buyer then decides to exercise their right early to buy the XYZ PLC stock at 400.

In this scenario, the call seller (writer) has been assigned and will have to deliver stock at 400 to the buyer (sell their stock at 400 when the prevailing market is 425).

An option typically would only be assigned if it is in the money, considering factors like dividends which do play an important role in exercise/assignments.

Can an Options Assignment be Prevented?

Assignment can sometimes come as a bit of a surprise but normally you should see it coming. You can only work to prevent assignment by closing the option before expiry or before any possible risk of assignment.

Managing Risks in Options Trading

While options trading can offer high returns, it is not devoid of risks. Therefore, understanding and managing these risks is key.

Buyers Risk: The premium paid for an option is at risk. If the option is not profitable at expiration, the premium is lost.

Writers Risk: The writer takes on a much larger risk. If a call option is assigned, they must sell the underlying asset at the strike price, even if its market price is higher.

Options Assignment Summary

The concept of ‘assignment’ in options trading, although complex, is a cornerstone of understanding options trading. It not only clarifies the responsibilities of an options seller but also helps the traders to gauge and manage their risks more effectively. Successful trading involves not just knowing your options but also understanding your obligations.

Options Assignment FAQs

What is options assignment.

Options assignment refers to the process by which the seller (writer) of an options contract is obligated to fulfill their contractual obligation to buy or sell the underlying asset, as specified by the terms of the options contract.

When does options assignment occur?

Options assignment can occur when the buyer of the options contract exercises their right to buy (in the case of a call option) or sell (in the case of a put option) the underlying asset before or at expiration .

How does options assignment work?

When a buyer exercises their options contract, a clearing house randomly assigns a seller who is short (has written) the same options contract to fulfill the obligations of the exercise.

What happens to the seller upon options assignment?

If assigned, the seller (writer) of the options contract is obligated to fulfill their contractual obligation by buying or selling the underlying asset at the specified price (strike price) per the terms of the options contract.

Can options be assigned before expiration?

Yes, options can be assigned at any time (depending on contract type) before expiration if the buyer chooses to exercise their right. However, it is more common for options to be assigned closer to expiration as the time value diminishes.

What factors determine options assignment?

Options assignment is determined by the buyer’s decision to exercise their options contract. They may choose to exercise if the options contract is in-the- money and it is financially advantageous for them to do so.

How can I avoid options assignment?

As a seller (writer) of options contracts, you can avoid assignment by closing your position before expiration through a closing trade (buying back the options contract) or rolling it over to a future expiration date.

What happens if I am assigned on a short call option?

If assigned on a short call option, you are obligated to sell the underlying asset at the specified price (strike price). This means you would need to deliver the shares . To fulfill this obligation, you may need to buy the shares in the open market if you do not hold them .

What happens if I am assigned on a short put option?

If assigned on a short put option, you are obligated to buy the underlying asset at the specified price (strike price). This means you would need to purchase the shares .

How does options assignment affect my account?

Options assignment can impact your account by requiring you to fulfill the obligations of the assigned options contract, which may involve buying or selling the underlying asset. It is important to have sufficient funds or margin available to cover these obligations.

OptionsDesk Tips & Considerations

You should always have enough funds in your account to cover any assignment risk. If you have a short call position and it is in-the-money at the time of an ex-dividend be aware of extra assignment risk here as buyer/holder of the option may look to exercise to qualify for the dividend. Assignments can happen at any time!

Check out our other articles

Important information : Derivative products are considerably higher risk and more complex than more conventional investments, come with a high risk of losing money rapidly due to leverage and are not, therefore, suitable for everyone. Our website offers information about trading in derivative products, but not personal advice. If you’re not sure whether trading in derivative products is right for you, you should contact an independent financial adviser. For more information, please read our Important Derivative Product Trading Notes .

Mike Martin

Option exercise and assignment explained w/ visuals.

- Categories: Options Trading

Last updated on February 11th, 2022 , 06:38 am

Buyers of options have the right to exercise their option at or before the option’s expiration. When an option is exercised, the option holder will buy (for exercised calls) or sell (for exercised puts) 100 shares of stock per contract at the option’s strike price.

Conversely, when an option is exercised, a trader who is short the option will be assigned 100 long (for short puts) or short (for short calls) shares per contract.

- Long American style options can exercise their contract at any time.

- Long calls transfer to +100 shares of stock

- Long puts transfer to -100 shares of stock

- Short calls are assigned -100 shares of stock.

- Short puts are assigned +100 shares of stock.

- Options are typically only exercised and thus assigned when extrinsic value is very low.

- Approximately only 7% of options are exercised.

The following sequences summarize exercise and assignment for calls and puts (assuming one option contract ):

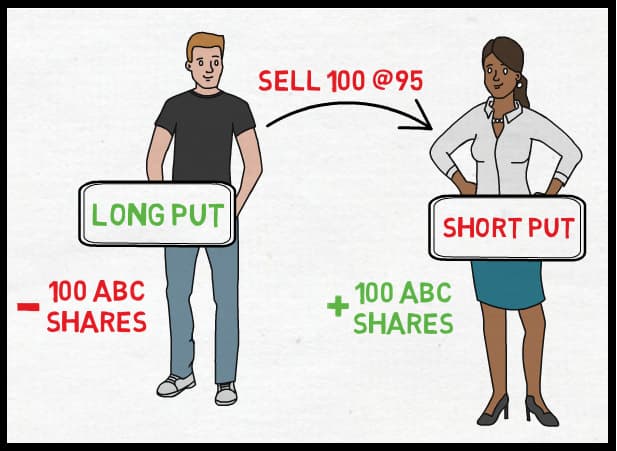

Call Buyer Exercises Option ➜ Purchases 100 shares at the call’s strike price.

Call Seller Assigned ➜ Sells/shorts 100 shares at the call’s strike price.

Put Buyer Exercises Option ➜ Sells/shorts 100 shares at the put’s strike price.

Put Seller Assigned ➜ Purchases 100 shares at the put’s strike price.

Let’s look at some specific examples to drill down on this concept.

New to options trading? Learn the essential concepts of options trading with our FREE 160+ page Options Trading for Beginners PDF.

Exercise and Assignment Examples

In the following table, we’ll examine how various options convert to stock positions for the option buyer and seller:

As you can see, exercise and assignment is pretty straightforward: when an option buyer exercises their option, they purchase (calls) or sell (puts) 100 shares of stock at the strike price . A trader who is short the assigned option is obligated to fulfill the opposite position as the option exerciser.

Automatic Exercise at Expiration

Another important thing to know about exercise and assignment is that standard in-the-money equity options are automatically exercised at expiration. So, traders may end up with stock positions by letting their options expire in-the-money.

An in-the-money option is defined as any option with at least $0.01 of intrinsic value at expiration . For example, a standard equity call option with a strike price of 100 would be automatically exercised into 100 shares of stock if the stock price is at $100.01 or higher at expiration.

What if You Don't Have Enough Available Capital?

Even if you don’t have enough capital in your account, you can still be assigned or automatically exercised into a stock position. For example, if you only have $10,000 in your account but you let one 500 call expire in-the-money, you’ll be long 100 shares of a $500 stock, which is a $50,000 position. Clearly, the $10,000 in your account isn’t enough to buy $50,000 worth of stock, even on 4:1 margin.

If you find yourself in a situation like this, your brokerage firm will come knocking almost instantaneously. In fact, your brokerage firm will close the position for you if you don’t close the position quickly enough.

Why Options are Rarely Exercised

At this point, you understand the basics of exercise and assignment. Now, let’s dive a little deeper and discuss what an option buyer forfeits when they exercise their option.

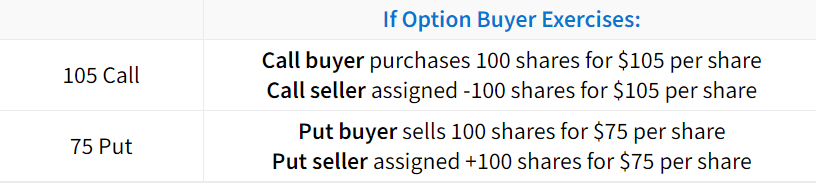

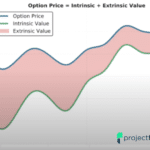

When an option is exercised, the option is converted into long or short shares of stock. However, it’s important to note that the option buyer will lose the extrinsic value of the option when they exercise the option. Because of this, options with lots of extrinsic value remaining are unlikely to be exercised. Conversely, options consisting of all intrinsic value and very little extrinsic value are more likely to be exercised.

The following table demonstrates the losses from exercising an option with various amounts of extrinsic value:

As we can see here, exercising options with lots of extrinsic value is not favorable.

Why? Consider the 95 call trading for $7. Exercising the call would result in an effective purchase price of $102 because shares are bought at $95, but $7 was paid for the right to buy shares at $95.

With an effective purchase price of $102 and the stock trading for $100, exercising the option results in a loss of $2 per share, or $200 on 100 shares.

Even if the 95 call was previously purchased for less than $7, exercising an option with $2 of extrinsic value will always result in a P/L that’s $200 lower (per contract) than the current P/L. F

or example, if the trader initially purchased the 95 call for $2, their P/L with the option at $7 would be $500 per contract. However, if the trader decided to exercise the 95 call with $2 of extrinsic value, their P/L would drop to +$300 because they just gave up $200 by exercising.

7% Of Options Are Exercised

Because of the fact that traders give up money by exercising an option with extrinsic value, most options are not exercised. In fact, according to the Options Clearing Corporation, only 7% of options were exercised in 2017 . Of course, this may not factor in all brokerage firms and customer accounts, but it still demonstrates a low exercise rate from a large sample size of trading accounts.

So, in almost all cases, it’s more beneficial to sell the long option and buy or sell shares instead of exercising. We like to call this approach a “synthetic exercise.”

Congrats! You’ve learned the basics of exercise and assignment. If you’d like to know how the exercise and assignment process actually works, continue to the next section!

Who Gets Assigned When an Option is Exercised?

With thousands of traders long and short options in the market, who actually gets assigned when one of the traders exercises their option?

In this section, we’ll run through the exercise and assignment process for options so you know how the assignment decision occurs.

If a trader is short a single option, how do they get assigned if one of a thousand other traders exercises that option?

The short answer is that the process is random. For example, if there are 5,000 traders who are long a call option and 5,000 traders who are short that call option, an account with the short option will be randomly assigned the exercise notice. The random process ensures that the option assignment system is fair

Visualizing Assignment and Exercise

The following visual describes the general process of exercise and assignment:

If you’d like, you can read the OCC’s detailed assignment procedure here (warning: it’s intense!).

Now you know how the assignment procedure works. In the final section, we’ll discuss how to quickly gauge the likelihood of early assignment on short options.

Assessing Early Option Assignment Risk

The final piece of understanding exercise and assignment is gauging the risk of early assignment on a short option.

As mentioned early, only 7% of options were exercised in 2017 (according to the OCC). So, being assigned on short options is rare, but it does happen. While a specific probability of getting assigned early can’t be determined, there are scenarios in which assignment is more or less likely.

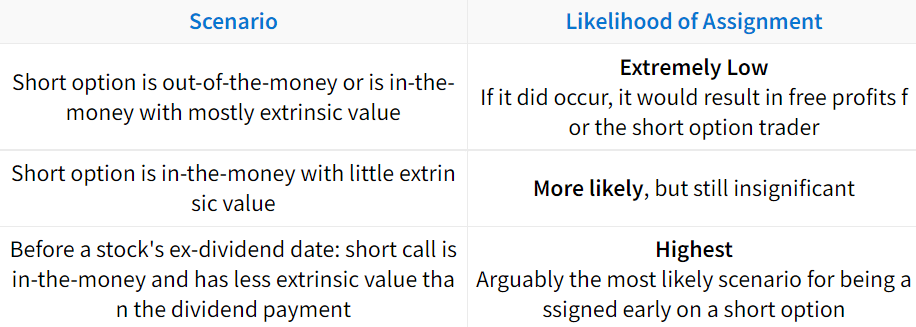

The following scenarios summarize broad generalizations of early assignment probabilities in various scenarios:

In regards to the dividend scenario, early assignment on in-the-money short calls with less extrinsic value than the dividend is more likely because the dividend payment covers the loss from the extrinsic value when exercising the option.

All in all, the risk of being assigned early on a short option is typically very low for the reasons discussed in this guide. However, it’s likely that you will be assigned on a short option at some point while trading options (unless you don’t sell options!), but at least now you’ll be prepared!

Next Lesson

Options Trading for Beginners

Intrinsic and Extrinsic Value in Options Trading Explained

Option Greeks Explained: Delta, Gamma, Theta & Vega

Projectfinance options tutorials.

➥ Bullish Strategies

➥ Bearish Strategies

➥ Neutral Strategies

➥ Vertical Spreads Guide

☆ Options Trading for Beginners ☆

➥ Basics of Calls and Puts

➥ What is a Strike Price?

➥ Option Expiration

➥ Intrinsic and Extrinsic Value

➥ Exercise and Assignment

➥ The Bid-Ask Spread

➥ Volume and Open Interest

➥ Option Chain Explained

➥ Option Greeks 101

➥ Delta Explained

➥ Gamma Explained

➥ Theta Explained

➥ Vega Explained

➥ Implied Volatility Basics

➥ What is the VIX Index?

➥ The Expected Move

➥ Trading VIX Options

➥ Trading VIX Futures

➥ The VIX Term Structure

➥ IV Rank vs. IV Percentile

➥ Option Order Types 101

➥ Stop-Loss Orders On Options Explained

➥ Stop Limit Order in Options: Examples W/ Visuals

➥ Limit Order in Option Trading Explained w/ Visuals

➥ Market Order in Options: Don’t Throw Away Money!

➥ TIF Orders Types Explained: DAY, GTC, GTD, EXT, GTC-EXT, MOC, LOC

Additional Resources

Exercise and Assignment – CME Group

Learn About Exercise and Assignment – CME Group

About the Author

Chris Butler received his Bachelor’s degree in Finance from DePaul University and has nine years of experience in the financial markets.

Chris started the projectfinance YouTube channel in 2016, which has accumulated over 25 million views from investors globally.

Our Authors

Share this post

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Quick Links

Other links.

- Terms & Conditions

- Privacy Policy

© 2024 projectfinance, All Rights Reserved.

Disclaimer: Neither projectfinance or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, registered investment adviser, registered broker-dealer or FINRA|SIPC|NFA-member firm. projectfinance does not provide investment or financial advice or make investment recommendations. projectfinance is not in the business of transacting trades, nor does projectfinance agree to direct your brokerage accounts or give trading advice tailored to your particular situation. Nothing contained in our content constitutes a solicitation, recommendation, promotion, or endorsement of any particular security, other investment product, transaction or investment. Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. Past Performance is not necessarily indicative of future results.

tastytrade, Inc. (“tastytrade”) has entered into a Marketing Agreement with Project Finance(Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’ brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade and/or any of its affiliated companies. Neither tastytrade nor any of its affiliated companies is responsible for the privacy practices of Marketing Agent or this website. tastytrade does not warrant the accuracy or content of the products or services offered by Marketing Agent or this website. Marketing Agent is independent and is not an affiliate of tastytrade.

Trade Options With Me

For Your Financial Freedom

What is Options Assignment & How to Avoid It

If you are learning about options, assignment might seem like a scary topic. In this article, you will learn why it really isn’t. I will break down the entire options assignment process step by step and show you when you might be assigned, how to minimize the risk of being assigned, and what to do if you are assigned.

Video Breakdown of Options Assignment

Check out the following video in which I explain everything you need to know about assignment:

What is Assignment?

To understand assignment, we must first remember what options allow you to do. So let’s start with a brief recap:

- A call option gives its buyer the right to buy 100 shares of the underlying at the strike price

- A put option gives its buyer the right to sell 100 shares of the underlying at the strike price

In other words, call options allow you to call away shares of the underlying from someone else, whereas a put option allows you to put shares in someone else’s account. Hence the name call and put option.

The assignment process is the selection of the other party of this transaction. So the person that has to buy from or sell to the option buyer that exercised their option.

Note that an option buyer has the right to exercise their option. It is not an obligation and therefore, a buyer of an option can never be assigned. Only option sellers can ever be get assigned since they agree to fulfill this obligation when they sell an option.

Let’s go through a specific example to clarify this:

- The underlying security is stock ABC and it is trading at $100.

- Peter decides to buy 1 put option with a strike price of 95 as a hedge for his long stock position in ABC

- Kate sells this exact same option at the same time.

Over the next few weeks, ABC’s price goes down to $90 and Peter decides to exercise his put option. This means that he uses his right to sell 100 shares of ABC for $95 per share. Now Kate is assigned these 100 shares of ABC which means she is obligated to buy them for $95 per share.

Peter now has 100 fewer shares of ABC in his portfolio, whereas Kate has 100 more.

This process is analog for a call option with the only difference being that Kate would be short 100 shares and Peter would have 100 additional shares of ABC in his portfolio.

Hopefully, this example clarifies what assignment is.

Who Can Be Assigned?

To answer this question, we must first ask ourselves who exercises their option? To do this, let’s quickly look at the different ways that you can close a long option position:

- Sell the option: Selling an option is probably the easiest way to close a long option position. Doing this will have no effect on the option seller.

- Let the option expire: If the option is Out of The Money , it would expire worthless and there would be no consequence for the option seller. If, on the other hand, the option is In The Money by more than $0.01, it would typically be automatically exercised . This would start the options assignment process.

- Exercise the option early: The last possibility would be to exercise the option before its expiration date. This, however, can only be done if the option is an American-style option. This would, once again, lead to an option assignment.

So as an option seller, you only have to worry about the last two possibilities in which the buyer’s option is exercised.

But before you worry too much, here is a quick fact about the distribution of these 3 alternatives:

Less than 10% of all options are exercised.

This means 90% of all options are either sold prior to the expiration date or expire worthless. So always remember this statistic before breaking your head over the risk of being assigned.

It is very easy to avoid the first case of being assigned. To avoid it, just close your short option positions before they expire (ITM). For the second case, however, things aren’t as straight forward.

Who Risks being Assigned Early?

Firstly, you have to be trading American-style options. European-style options can only be exercised on their expiration date. But most equity options are American-style anyway. So unless you are trading index options or other kinds of European-style options, this will be the case for you.

Secondly, you need to be an options seller. Option buyers can’t be assigned.

These two are necessary conditions for you to be assigned. Everyone who fulfills both of these conditions risks getting assigned early. The size of this risk, however, varies depending on your position. Here are a few things that can dramatically increase your assignment risk:

- ITM: If your option is ITM, the chance of being assigned is much higher than if it isn’t. From the standpoint of an option buyer, it does not make sense to exercise an option that isn’t ITM because this would lead to a loss. Nevertheless, it is possible. The deeper ITM the option is, the higher the assignment risk becomes.

- Dividends : Besides that, selling options on securities with upcoming dividends also increases your risk of assignment. More specifically, if the extrinsic value of an ITM call option is less than the amount of the dividend, option buyers can achieve a profit by exercising their option before the ex-dividend date.

- Extrinsic Value: Otherwise, keep an eye on the extrinsic value of your option. If the option has extrinsic value left, it doesn’t make sense for the option buyer to exercise their option because they would achieve a higher profit if they just sold the option and then bought or sold shares of the underlying asset. Typically, the less time an option has left, the lower its extrinsic value becomes. Implied volatility is another factor that influences extrinsic value.

- Puts vs Calls: This is more of an interesting side note than actual advice, but put options tend to get exercised more often than call options. This makes sense since put options give their buyer the right to sell the underlying asset and can, therefore, be a very useful hedge for long stock positions.

How can you Minimize Assignment Risk?

Since you now know what assignment is, and who risks being assigned, let’s shift our focus on how to minimize the assignment risk. Even though it isn’t possible to completely remove the risk of being assigned, there are things that you can do to dramatically decrease the chances of being assigned.

The first thing would be to avoid selling options on securities with upcoming dividend payments. Before putting on a position, simply check if the underlying security has any upcoming dividend payments. If so, look for a different trade.

If you ever are in the position that you are short an option and the ex-dividend of the underlying security is right around the corner, compare the size of the dividend to the extrinsic value of your option. If the extrinsic value is less than the dividend amount, you really should consider closing the position. Otherwise, the chances of being assigned are high. This is especially bad since being short during a dividend payment of a security will force you to pay the dividend.

Besides avoiding dividends, you should also close your option positions early. The less time an option has left, the lower its extrinsic value becomes and the more it makes sense for option buyers to exercise their options. Therefore, it is good practice to close your (ITM) short option positions at least one week before the expiration date.

The deeper an option is ITM, the higher the chances of assignment become. So the just-mentioned rule is even more important for deep ITM options.

If you don’t want to indefinitely close your position, it is also possible to roll it out to a later expiration cycle. This will give you more time and add extrinsic value to your position.

FAQs about Assignment

Last but not least, I want to answer some frequently asked questions about options exercise and assignment.

1. What happens if your account does not have enough buying power to cover the assigned position?

This is a common worry for beginning options traders. But don’t worry, if you don’t have enough capital to cover the new position, you will receive a margin call and usually, your broker will just automatically close the assigned shares immediately. This might lead to a minor assignment fee, but otherwise, it won’t significantly affect your account. Tatsyworks, for example, charges an assignment fee of only $5.

Check out my review of tastyworks

2. How does assignment affect your P&L?

When an option is exercised, the option holder gains the difference between the strike price and the price of the underlying asset. If the option is ITM, this is exactly the intrinsic value of the option. This means that the option holder loses the extrinsic value when he exercises his/her option. That’s also why it doesn’t make sense to exercise options with a lot of extrinsic value left.

This means that as soon as the option is exercised, it is only the intrinsic value that is relevant for the payoff. This is the same payoff as the option at its expiration date.

So as an options seller, your P&L isn’t negatively affected by an assignment. Either it stays the same or it becomes slightly better due to the extrinsic value being ignored.

As an example, if your option is ITM by $1, you will lose up to $100 per option or $1 per share that you are assigned. But this does not account for the extrinsic value that falls away with the exercise of the option. So this would be the same P&L as at expiration. Depending on how much premium you collected when selling the option, this might still be a profit or a minor loss.

With that being said, as soon as you are assigned, you will have some carrying risk. If you don’t or can’t close the position immediately, you will be exposed to the ongoing price fluctuations of that security. Sometimes, you might not be able to close the new position immediately because of trading halts, or because the market is closed.

If you weren’t planning on holding that security, it is a good idea to close the new position as soon as possible.

Option spreads such as vertical spreads, add protection to these price fluctuations since you can just exercise the long option to close the assigned share position at the strike price of the long option.

3. When an option holder exercises their option, how is the assignment partner chosen?

This is usually a random process. As soon as an option is exercised, the responsible brokerage firm sends a request to the Options Clearing Corporation (OCC). They send back the requested shares, whereafter they randomly choose another brokerage firm that currently has a client that is short the exercised option. Then the chosen broker has to decide which of their clients is assigned. This choice is, once again, random or a time-based priority system is used.

4. How does assignment work for index options?

As there aren’t any shares of indexes, you can’t directly be assigned any shares of the underlying asset. Therefore, index options are cash-settled. This means that instead of having to buy or sell shares of the underlying, you simply have to pay the difference between the strike price and the underlying trading price. This makes assignment easier and a lot less likely among index options.

Note that ETF options such as SPY options are not cash-settled. SPY is a normal security with openly traded shares, so exercise and assignment work just like they do among equity options.

I hope this article made you realize that assignment isn’t as bad as it might seem at first. It is just important to understand how the options assignment process works and what affects the likelihood of being assigned.

To recap, here’s what you should to do when you are assigned:

if you have enough capital in your account to cover the position, you could either treat the new position as a normal (stock) position and hold on to it or you could close it immediately. If you don’t have a clear trading plan for the new position, I recommend the latter.

If, on the other hand, you don’t have enough buying power, you will receive a margin call from your broker and the position should be closed automatically.

Assignment does not have any significant impact on your P&L, but it comes with some carrying risk. Options spreads can offer more protection against this than naked option positions.

To mitigate assignment risk, you should close option positions early, always keep an eye on the extrinsic value of your option positions, and avoid upcoming dividend securities.

And always remember, less than 10% of options are exercised, so assignment really doesn’t happen that often, especially not if you are actively trying to avoid it.

For the specifics of how assignment is handled, it is a good idea to contact your broker, as the procedures can vary from broker to broker.

Thank you for taking the time and reading this post. If you have any questions, comments, or feedback, please let me know in the comment section below.

22 Replies to “What is Options Assignment & How to Avoid It”

hi there well seems like finally there is one good honest place. seem like you are puting on the table the whole truth about bad positions. however my wuestion is when can one know where to put that line of limit. when do you recognise or understand that you are in a bad position? thanks and once again, a great site.

Well If you are trading a risk defined strategy the point would be at max loss and not too much time left until expiration. For undefined risk strategies however it can be very different. I would just say if you don’t have too much time until expiration and are far from making money you should use some common sense and admit that you are wrong.

What would happen in the event of a crash. Would brokers be assigning, options, cashing out these shares, and making others bankrupt. Well, I guessed I sort of answered my own question. Its not easy to understand, especially not knowing when this would come up. But seems like you hit the important aspects of the agreement.

Actually I wouldn’t imagine that too many people would want to exercise their options in case of a market ctash, because they probably wouldn’t want to hold stocks in this risky and volatile environment.