- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

How To Write the Management Section of a Business Plan

Susan Ward wrote about small businesses for The Balance for 18 years. She has run an IT consulting firm and designed and presented courses on how to promote small businesses.

:max_bytes(150000):strip_icc():format(webp)/SusanWardLaptop2crop1-57aa62eb5f9b58974a12bac9.jpg)

Ownership Structure

Internal management team, external management resources, human resources, frequently asked questions (faqs).

When developing a business plan , the 'management section' describes your management team, staff, resources, and how your business ownership is structured. This section should not only describe who's on your management team but how each person's skill set will contribute to your bottom line. In this article, we will detail exactly how to compose and best highlight your management team.

Key Takeaways

- The management section of a business plan helps show how your management team and company are structured.

- The first section shows the ownership structure, which might be a sole proprietorship, partnership, or corporation.

- The internal management section shows the department heads, including sales, marketing, administration, and production.

- The external management resources help back up your internal management and include an advisory board and consultants.

- The human resources section contains staffing requirements—part-time or full-time—skills needed for employees and the costs.

This section outlines the legal structure of your business. It may only be a single sentence if your business is a sole proprietorship. If your business is a partnership or a corporation, it can be longer. You want to be sure you explain who holds what percentage of ownership in the company.

The internal management section should describe the business management categories relevant to your business, identify who will have responsibility for each category, and then include a short profile highlighting each person's skills.

The primary business categories of sales, marketing , administration, and production usually work for many small businesses. If your business has employees, you will also need a human resources section. You may also find that your company needs additional management categories to fit your unique circumstances.

It's not necessary to have a different person in charge of each category; some key management people often fill more than one role. Identify the key managers in your business and explain what functions and experience each team member will serve. You may wish to present this as an organizational chart in your business plan, although the list format is also appropriate.

Along with this section, you should include the complete resumés of each management team member (including your own). Follow this with an explanation of how each member will be compensated and their benefits package, and describe any profit-sharing plans that may apply.

If there are any contracts that relate directly to your management team members, such as work contracts or non-competition agreements, you should include them in an Appendix to your business plan.

While external management resources are often overlooked when writing a business plan , using these resources effectively can make the difference between the success or failure of your managers. Think of these external resources as your internal management team's backup. They give your business credibility and an additional pool of expertise.

Advisory Board

An Advisory Board can increase consumer and investor confidence, attract talented employees by showing a commitment to company growth and bring a diversity of contributions. If you choose to have an Advisory Board , list all the board members in this section, and include a bio and all relevant specializations. If you choose your board members carefully, the group can compensate for the niche forms of expertise that your internal managers lack.

When selecting your board members, look for people who are genuinely interested in seeing your business do well and have the patience and time to provide sound advice.

Recently retired executives or managers, other successful entrepreneurs, and/or vendors would be good choices for an Advisory Board.

Professional Services

Professional Services should also be highlighted in the external management resources section. Describe all the external professional advisors that your business will use, such as accountants, bankers, lawyers, IT consultants, business consultants, and/or business coaches. These professionals provide a web of advice and support outside your internal management team that can be invaluable in making management decisions and your new business a success .

The last point you should address in the management section of your business plan is your human resources needs. The trick to writing about human resources is to be specific. To simply write, "We'll need more people once we get up and running," isn't sufficient. Follow this list:

- Detail how many employees your business will need at each stage and what they will cost.

- Describe exactly how your business's human resources needs can be met. Will it be best to have employees, or should you operate with contract workers or freelancers ? Do you need full-time or part-time staff or a mix of both?

- Outline your staffing requirements, including a description of the specific skills that the people working for you will need to possess.

- Calculate your labor costs. Decide the number of employees you will need and how many customers each employee can serve. For example, if it takes one employee to serve 150 customers, and you forecast 1,500 customers in your first year, your business will need 10 employees.

- Determine how much each employee will receive and total the salary cost for all your employees.

- Add to this the cost of Workers' Compensation Insurance (mandatory for most businesses) and the cost of any other employee benefits, such as company-sponsored medical and dental plans.

After you've listed the points above, describe how you will find the staff your business needs and how you will train them. Your description of staff recruitment should explain whether or not sufficient local labor is available and how you will recruit staff.

When you're writing about staff training, you'll want to include as many specifics as possible. What specific training will your staff undergo? What ongoing training opportunities will you provide your employees?

Even if the plan for your business is to start as a sole proprietorship, you should include a section on potential human resources demands as a way to demonstrate that you've thought about the staffing your business may require as it grows.

Business plans are about the future and the hypothetical challenges and successes that await. It's worth visualizing and documenting the details of your business so that the materials and network around your dream can begin to take shape.

What is the management section of a business plan?

The 'management section' describes your management team, staff, resources, and how your business ownership is structured.

What are the 5 sections of a business plan?

A business plan provides a road map showing your company's goals and how you'll achieve them. The five sections of a business plan are as follows:

- The market analysis outlines the demand for your product or service.

- The competitive analysis section shows your competition's strengths and weaknesses and your strategy for gaining market share.

- The management plan outlines your ownership structure, the management team, and staffing requirements.

- The operating plan details your business location and the facilities, equipment, and supplies needed to operate.

- The financial plan shows the map to financial success and the sources of funding, such as bank loans or investors.

SCORE. " Why Small Businesses Should Consider Workers’ Comp Insurance ."

How to Write the Management Team Section of a Business Plan + Examples

Written by Dave Lavinsky

Over the last 20+ years, we’ve written business plans for over 4,000 companies and hundreds of thousands of others have used our business plan template and other business planning materials.

From this vast experience, we’ve gained valuable insights on how to write a business plan effectively , specifically in the management section.

What is a Management Team Business Plan?

A management team business plan is a section in a comprehensive business plan that introduces and highlights the key members of the company’s management team. This part provides essential details about the individuals responsible for leading and running the business, including their backgrounds, skills, and experience.

It’s crucial for potential investors and stakeholders to evaluate the management team’s competence and qualifications, as a strong team can instill confidence in the company’s ability to succeed.

Why is the Management Team Section of a Business Plan Important?

Your management team plan has 3 goals:

- To prove to you that you have the right team to execute on the opportunity you have defined, and if not, to identify who you must hire to round out your current team

- To convince lenders and investors (e.g., angel investors, venture capitalists) to fund your company (if needed)

- To document how your Board (if applicable) can best help your team succeed

What to Include in Your Management Team Section

There are two key elements to include in your management team business plan as follows:

Management Team Members

For each key member of your team, document their name, title, and background.

Their backgrounds are most important in telling you and investors they are qualified to execute. Describe what positions each member has held in the past and what they accomplished in those positions. For example, if your VP of Sales was formerly the VP of Sales for another company in which they grew sales from zero to $10 million, that would be an important and compelling accomplishment to document.

Importantly, try to relate your team members’ past job experience with what you need them to accomplish at your company. For example, if a former high school principal was on your team, you could state that their vast experience working with both teenagers and their parents will help them succeed in their current position (particularly if the current position required them to work with both customer segments).

This is true for a management team for a small business, a medium-sized or large business.

Management Team Gaps

In this section, detail if your management team currently has any gaps or missing individuals. Not having a complete team at the time you develop your business plan. But, you must show your plan to complete your team.

As such, describe what positions are missing and who will fill the positions. For example, if you know you need to hire a VP of Marketing, state this. Further, state the job description of this person. For example, you might say that this hire will have 10 years of experience managing a marketing team, establishing new accounts, working with social media marketing, have startup experience, etc.

To give you a “checklist” of the employees you might want to include in your Management Team Members and/or Gaps sections, below are the most common management titles at a growing startup (note that many are specific to tech startups):

- Founder, CEO, and/or President

- Chief Operating Officer

- Chief Financial Officer

- VP of Sales

- VP of Marketing

- VP of Web Development and/or Engineering

- UX Designer/Manager

- Product Manager

- Digital Marketing Manager

- Business Development Manager

- Account Management/Customer Service Manager

- Sales Managers/Sales Staff

- Board Members

If you have a Board of Directors or Board of Advisors, you would include the bios of the members of your board in this section.

A Board of Directors is a paid group of individuals who help guide your company. Typically startups do not have such a board until they raise VC funding.

If your company is not at this stage, consider forming a Board of Advisors. Such a board is ideal particularly if your team is missing expertise and/or experience in certain areas. An advisory board includes 2 to 8 individuals who act as mentors to your business. Usually, you meet with them monthly or quarterly and they help answer questions and provide strategic guidance. You typically do not pay advisory board members with cash, but offering them options in your company is a best practice as it allows you to attract better board members and better motivate them.

Management Team Business Plan Example

Below are examples of how to include your management section in your business plan.

Key Team Members

Jim Smith, Founder & CEO

Jim has 15 years of experience in online software development, having co-founded two previous successful online businesses. His first company specialized in developing workflow automation software for government agencies and was sold to a public company in 2003. Jim’s second company developed a mobile app for parents to manage their children’s activities, which was sold to a large public company in 2014. Jim has a B.S. in computer science from MIT and an M.B.A from the University of Chicago

Bill Jones, COO

Bill has 20 years of sales and business development experience from working with several startups that he helped grow into large businesses. He has a B.S. in mechanical engineering from M.I.T., where he also played Division I lacrosse for four years.

We currently have no gaps in our management team, but we plan to expand our team by hiring a Vice President of Marketing to be responsible for all digital marketing efforts.

Vance Williamson, Founder & CEO

Prior to founding GoDoIt, Vance was the CIO of a major corporation with more than 100 retail locations. He oversaw all IT initiatives including software development, sales technology, mobile apps for customers and employees, security systems, customer databases/CRM platforms, etc. He has a B.S in computer science and an MBA in operations management from UCLA.

We currently have two gaps in our Management Team:

A VP of Sales with 10 years of experience managing sales teams, overseeing sales processes, working with manufacturers, establishing new accounts, working with digital marketing/advertising agencies to build brand awareness, etc.

In addition, we need to hire a VP of Marketing with experience creating online marketing campaigns that attract new customers to our site.

How to Finish Your Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Click here to finish your business plan today.

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success.

Click here to see how Growthink’s professional business plan consulting services can create your business plan for you.

Other Resources for Writing Your Business Plan

- How to Write an Executive Summary

- How to Expertly Write the Company Description in Your Business Plan

- How to Write the Market Analysis Section of a Business Plan

- The Customer Analysis Section of Your Business Plan

- Completing the Competitive Analysis Section of Your Business Plan

- Financial Assumptions and Your Business Plan

- How to Create Financial Projections for Your Business Plan

- Everything You Need to Know about the Business Plan Appendix

- Business Plan Conclusion: Summary & Recap

Other Helpful Business Plan Articles & Templates

How to write the structure and ownership section of your business plan?

Business planning is vital to the success of any entrepreneur because it helps them secure funding and find competent business partners. The document itself contains a variety of key sections, including the presentation of the legal structure and ownership of the business.

This section details the legal structure of your business and helps interested parties such as lenders and investors understand who they will be doing business with if they decide to go ahead and finance your company.

In this guide, we’ll look at the objective of the structure and ownership section, deepdive into the information you should include, and cover the ideal length. We’ll also assess the tools that can help you write your business plan.

Ready? Let’s get started!

In this guide:

What is the objective of the structure and ownership section of your business plan?

What information should i include when presenting the legal structure and ownership of my company in my business plan.

- How long should the structure and ownership section of your business plan be?

- Example of structure and ownership in a business plan

What tools should I use to write my business plan?

The objective of this section is to provide potential investors, lenders, and strategic partners with a clear and transparent view of your business's legal form, ownership distribution, and registration details.

It aims to build credibility and trust by showcasing your commitment to openness and compliance with regulations. Let's take a look at some of the key objectives:

Communicate the legal form and registration details

- You should explicitly state your business's legal form. For example, your business might be corporation, sole proprietorship, or limited liability company (LLC).

- Clearly explaining your chosen legal form helps stakeholders understand your entity's liability, taxation, and management implications.

- It is also essential to disclose where your company is registered. This information is vital as it provides clarity on the jurisdiction under which your business operates.

- It also helps investors and lenders assess any legal and regulatory implications specific to the location of registration.

Identify shareholders

- Potential investors and lenders need to know who owns the company and the percentage of ownership each party holds.

- By providing this information, you instill confidence in your business and help identify what needs to be verified as part of Know Your Customer (KYC) and Anti-Money Laundering (ALM) checks down the line.

Transparency is the cornerstone of credibility for businesses. By openly presenting the legal structure and ownership, you signal to potential investors that your business operates with integrity and adherence to regulations.

Notably, anti-money laundering regulations require investors to verify the identity of all shareholders before committing funds. By providing a clear picture of the parties involved, you can facilitate this process and build trust with investors.

Venture capitalists (VC) firms and angel investors in particular, may have specific criteria such as location and ownership mandates governing the companies they can finance. Being transparent about your company's structure and ownership enables potential investors to assess whether your business aligns with their investment preferences and requirements.

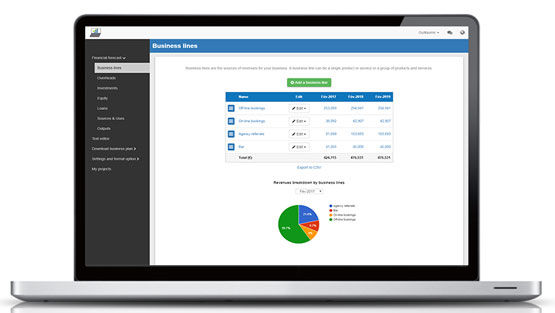

Need a convincing business plan?

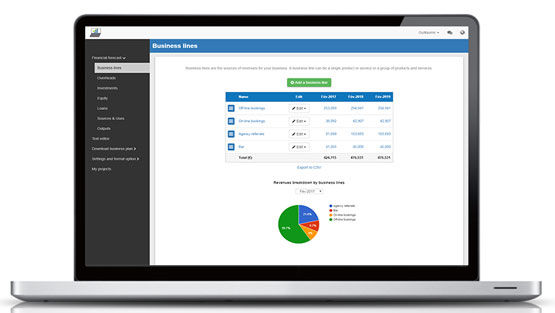

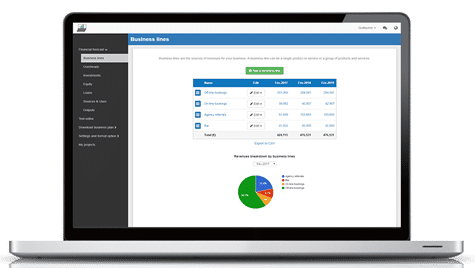

The Business Plan Shop makes it easy to create a financial forecast to assess the potential profitability of your projects, and write a business plan that’ll wow investors.

The structure and ownership subsection arrives quite early in your business plan as it is the first part of the company section which is the second section of the document (after the executive summary) if you are following a standard business plan outline .

At this stage, the reader is still in the process of getting familiar with your business, and this section serves as a crucial foundation for potential investors and partners and helps them understand the core aspects of your business’s structure.

Here's what you should include:

Company registration details and registered office address

Provide information about when and where your company was registered and its registration number. This enables readers to understand the jurisdiction under which your business is operating and helps verify its legal existence.

Also, mention the registration date to showcase the company's longevity or recent establishment.

Include the registered office address of your company. This is the official address where the company can be contacted, and legal notices can be served. Providing this address demonstrates your commitment to compliance and transparency.

The information above needs to repeated for each subsidiary or joint venture owned by your business in order to provide a clear map of the coporate structure.

Overview of ownership

Offer a concise overview of the ownership structure of the company. Identify the shareholders, and specify their ownership percentages or shares.

If there are numerous shareholders, list individuals or entities owning 5% or more, and highlight those with a controlling interest in the company or on the board.

If the business is controlled by another business, such as a holding company for example, it is also useful to explain who controls that business as well.

Roles and responsibilities of shareholders

In case of multiple shareholders, explain their respective roles and responsibilities within the organization.

Differentiate between passive investors, board members, and executive or non-executive directors.

Shareholders' agreement (if applicable)

If the business plan is presented for investment purposes, it is useful to clarify if a shareholders' agreement is in place between the existing investors.

This agreement outlines the rights and obligations of shareholders and adds an extra layer of legal protection for investors and shareholders.

Expertise of co-shareholders

Highlight any shareholders who contribute more than just financial capital to the company.

If, for instance, a shareholder is an industry expert and brings valuable advice, contacts, and credibility, emphasize this aspect.

Doing so demonstrates the added value these shareholders bring to the business.

Group or franchise structure

If your company operates as part of a group or franchise, provide this information for each individual company receiving funds.

Clarify the relationship between the main company and the individual entities within the group and their respective legal structures.

Addressing geographical restrictions

If some investors have geographical restrictions on their investments, clearly indicate whether your company meets their eligibility criteria.

This helps investors quickly assess whether your business aligns with their investment mandates or not.

How long should the structure and ownership section of your business plan be?

The length of your business plan's structure and ownership section requires a delicate balance.

While a general rule of thumb suggests that it should be about 2 to 3 paragraphs, the actual length depends on several factors, including the complexity of your corporate structure and the number of shareholders involved.

The complexity of your corporate structure

- A concise presentation may be sufficient if your company's legal structure is relatively straightforward, with a single owner or a small number of co-founders.

- In such cases, aim to provide the necessary information without overwhelming the reader with unnecessary details. A paragraph or two may convey the key points effectively, ensuring clarity and brevity.

- However, if you have a complex business structure, aim to provide details about members who play a key role in business continuity and profitability.

The number of shareholders involved

- If your business involves multiple shareholders, each with significant ownership percentages or unique roles, you may need to dedicate more space to this section.

- Do this by providing a comprehensive breakdown of ownership distribution and outlining each shareholder's contributions.

- This may take up more space as you need to add additional information. However, if you have a pretty straightforward ownership structure, a paragraph or two will be sufficient enough.

Regardless of the complexity, striking the right balance between providing sufficient detail and avoiding excessive technical jargon is crucial. The structure and ownership section should be reader-friendly, allowing potential investors and stakeholders to understand the core aspects of your company without feeling overwhelmed by intricate legalities.

Repetition can dilute the impact of your message and unnecessarily lengthen the section. Ensure that you don't reiterate information that has already been covered in other parts of the business plan. Instead, focus on providing unique insights and details that enhance the reader's understanding of your corporate structure and ownership.

When crafting this section, prioritize the most critical points that investors or partners need to know about your company's structure and ownership.

Focus on aspects that directly impact decision-making, such as the majority shareholder's influence, board composition, different classes of shares in issue, or any unique arrangements that set your business apart.

Need inspiration for your business plan?

The Business Plan Shop has dozens of business plan templates that you can use to get a clear idea of what a complete business plan looks like.

Example of structure and ownership section in a business plan

Below is an example of what the structure and ownership section of your business plan might look like. As you can see, it is part of the overall company section and precedes the location and management team subsections.

The structure and ownership section of a business plan provides a detailed overview of how your company is organized and who holds ownership stakes in the business.

This example was taken from one of our business plan templates .

In this section, we will review three solutions for creating a business plan for your business: using Word and Excel, hiring a consultant to write the business plan, and utilizing an online business plan software.

Create your business plan using Word and Excel

This is the old-fashioned way of creating a business plan (1990s style) and using Word and Excel has both pros and cons.

On the one hand, using either of these two programs is cheap and they are widely available.

However, creating an error-free financial forecast with Excel is only possible if you have expertise in accounting and financial modeling.

Because of that investors and lenders might not trust the accuracy of your forecast unless you have a degree in finance or accounting.

Also, writing a business plan using Word means starting from scratch and formatting the document yourself once written - a process that can be quite tedious - especially when the numbers change and you need to manually update all the tables and text.

Ultimately, it's up to the business owner to decide which program is right for them and whether they have the expertise or resources needed to make Excel work.

Hire a consultant to write your business plan

Outsourcing your business plan to a consultant can be a viable option, but it also presents certain drawbacks.

On the plus side, consultants are experienced in writing business plans and adept at creating financial forecasts without errors. Furthermore, hiring a consultant can save you time and allow you to focus on the day-to-day operations of your business.

However, hiring consultants is expensive: budget at least £1.5k ($2.0k) for a complete business plan, more if you need to make changes after the initial version (which happens frequently after the first meetings with lenders).

For these reasons, outsourcing the plan to a consultant or accountant should be considered carefully, weighing both the advantages and disadvantages of hiring outside help.

Ultimately, it may be the right decision for some businesses, while others may find it beneficial to write their own business plan using an online software.

Use an online business plan software for your business plan

Another alternative is to use online business plan software .

There are several advantages to using specialized software:

- You are guided through the writing process by detailed instructions and examples for each part of the plan

- You can be inspired by already written business plan templates

- You can easily make your financial forecast by letting the software take care of the financial calculations for you without errors

- You get a professional document, formatted and ready to be sent to your bank

- The software will enable you to easily track your actual financial performance against your forecast and update your forecast as time goes by

If you're interested in using this type of solution, you can try our software for free by signing up here .

To sum it up, a well-written structure and ownership subsection is key to ensuring that the reader is clear on who controls the business, and whether or not it fits their investment criterias.

Also on The Business Plan Shop

- How to do a market analysis for a business plan

- How to present your management team in your business plan?

- Where to write the conclusion of your business plan?

Know someone who needs help writing-up their business plan? Share this article with them and help them out!

Founder & CEO at The Business Plan Shop Ltd

Guillaume Le Brouster is a seasoned entrepreneur and financier.

Guillaume has been an entrepreneur for more than a decade and has first-hand experience of starting, running, and growing a successful business.

Prior to being a business owner, Guillaume worked in investment banking and private equity, where he spent most of his time creating complex financial forecasts, writing business plans, and analysing financial statements to make financing and investment decisions.

Guillaume holds a Master's Degree in Finance from ESCP Business School and a Bachelor of Science in Business & Management from Paris Dauphine University.

Create a convincing business plan

Assess the profitability of your business idea and create a persuasive business plan to pitch to investors

500,000+ entrepreneurs have already tried our solution - why not join them?

Not ready to try our on-line tool ? Learn more about our solution here

Need some inspiration for your business plan?

Subscribe to The Business Plan Shop and gain access to our business plan template library.

Need a professional business plan? Discover our solution

Write your business plan with ease!

It's easy to create a professional business plan with The Business Plan Shop

Want to find out more before you try? Learn more about our solution here

IMAGES

VIDEO

COMMENTS

The management plan outlines your ownership structure, the management team, and staffing requirements. The operating plan details your business location and the facilities, equipment, and supplies needed to operate. The financial plan shows the map to financial success and the sources of funding, such as bank loans or investors.

The Management and Ownership section of a business plan features short (one to three paragraphs) biographies of the key personnel involved in forming and running the business. You should include key staff personnel and members of your Board of Directors. Additionally, describe the benefits that each member of the team brings to this business ...

Describe Your Services or Products. The business plan should have a section that explains the services or products that you’re offering. This is the part where you can also describe how they fit ...

Your management team plan has 3 goals: To prove to you that you have the right team to execute on the opportunity you have defined, and if not, to identify who you must hire to round out your current team. To convince lenders and investors (e.g., angel investors, venture capitalists) to fund your company (if needed)

The length of your business plan's structure and ownership section requires a delicate balance. While a general rule of thumb suggests that it should be about 2 to 3 paragraphs, the actual length depends on several factors, including the complexity of your corporate structure and the number of shareholders involved.

The following important ownership information should be incorporated into your business plan: Names of owners. Percentage ownership. Extent of involvement with the company. Forms of ownership (i.e., common stock, preferred stock, general partner, limited partner) Outstanding equity equivalents (i.e., options, warrants, convertible debt) Common ...