Global Banking and Finance Review is an online platform offering news, analysis, and opinion on the latest trends, developments, and innovations in the banking and finance industry worldwide. The platform covers a diverse range of topics, including banking, insurance, investment, wealth management, fintech, and regulatory issues. The website publishes news, press releases, opinion and advertorials on various financial organizations, products and services which are commissioned from various Companies, Organizations, PR agencies, Bloggers etc. These commissioned articles are commercial in nature. This is not to be considered as financial advice and should be considered only for information purposes. It does not reflect the views or opinion of our website and is not to be considered an endorsement or a recommendation. We cannot guarantee the accuracy or applicability of any information provided with respect to your individual or personal circumstances. Please seek Professional advice from a qualified professional before making any financial decisions. We link to various third-party websites, affiliate sales networks, and to our advertising partners websites. When you view or click on certain links available on our articles, our partners may compensate us for displaying the content to you or make a purchase or fill a form. This will not incur any additional charges to you. To make things simpler for you to identity or distinguish advertised or sponsored articles or links, you may consider all articles or links hosted on our site as a commercial article placement. We will not be responsible for any loss you may suffer as a result of any omission or inaccuracy on the website. .

The Rise of Mobile Banking: Challenges and Opportunities

By Dima Kats, CEO, Clear Junction

Mobile banking use is rapidly increasing worldwide. In the first half of 2020 alone, there were 26% more mobile banking app sessions globally than in 2019. Relative to even a few years ago, the number of people using mobile banking has skyrocketed. While the acceleration of mobile banking has indeed brought opportunity for financial institutions; it has also resulted in challenges.

There are significant security risks that arise from using mobile applications, including mobile banking apps. As businesses expand mobile payment capabilities, ensuring that business and customer payment data is safe is crucial.

With the growth of mobile and digital banking set to continue after the pandemic, banks must work to develop a seamless and secure environment for the future. Customer behaviour concerning mobile banking is changing, and businesses need to change too. Companies that fail to recognise this change will fall behind their competitors, while those who do adapt need to ensure they are putting appropriate security measures in place to protect their customers’ data.

How to profit from the benefits while avoiding security pitfalls

Mobile banking offers unparalleled convenience, speed and accessibility to consumers – no more closures on bank holidays, tiresome queues, or inscrutable statements. It’s no wonder people are adopting mobile payments and banking in droves; the benefits are enormous. While businesses rightly follow their customers in facilitating smooth mobile banking and payments, they must remain constantly vigilant to the security threats that mobile banking presents.

76% of mobile banking apps can be accessed by hackers, and with anyone from the app developers to the banks themselves capable of leaving vulnerabilities, it is easy for security to fall short at any stage.

Security and reliability are of paramount importance to mobile banking users. A substantial 62% of mobile banking users claim they would switch providers after a negative experience. With increased adoption and security risks tied to scalability, institutions need to be agile enough to embrace and scale their customer base while remaining vigilant about a smooth and secure service. Customers may abandon those who don’t.

Increasingly, mobile customers bring a range of new security issues to businesses. Companies wishing to future-proof their payments structure and match the customer demand for frictionless online payments can ensure success by working with payment experts. Partnering with a specialist team can ensure financial institutions are able to provide their customers with the best mobile banking experience, while keeping data safe and secure.

Preparing for the future

Financial institutions have been on a digital transformation journey for several years, but now is the time to turn this into a competitive advantage. 24% of UK residents use some form of digital wallet and in some countries, like Russia, banking customers are extensively using their phones to withdraw money from cash machines. The need for cards, let alone cash, is likely to wane in favour of mobile phones over the next few years.

However, the ever-increasing variety of choices regarding mobile banking support can leave businesses at a loss when it comes to setting up the right system for them. In areas of the world that suffer from slow or limited internet capacity, mobile phone ownership is still skyrocketing despite poor infrastructure.

To grasp this opportunity, businesses and banks need to make sure they are working with payment experts who have experience managing online transfers across the world safely and securely.

Companies like Clear Junction connect financial institutions to a secure, regulated and optimised payment infrastructure to help them overcome the barriers of digital transformation and challenges relating to banking and payments. Getting the digital foundation right the first time is a definitive way to remain a step ahead of competitors, retain customer loyalty and ensure future success.

Global Banking & Finance Review

Why waste money on news and opinions when you can access them for free?

Take advantage of our newsletter subscription and stay informed on the go!

Email (required) *

Example: Yes, I would like to receive emails from Global Banking & Finance Review. (You can unsubscribe anytime)

Recent Post

VistaCreate – No. One Design Assisstant For Businesses

How reforms and innovation have turned Uzbekistan into a global investment opportunity

Nektar Network begins Epoch 1 of Nektar Drops – Rewards for ongoing participation

Why it’s essential that merchants use acquirer agnostic PSPs

Privacy Overview

- Search Search Please fill out this field.

Mobile Banking

James Chen, CMT is an expert trader, investment adviser, and global market strategist.

:max_bytes(150000):strip_icc():format(webp)/photo__james_chen-5bfc26144cedfd0026c00af8.jpeg)

What Is Mobile Banking?

Mobile banking is the act of making financial transactions on a mobile device (cell phone, tablet, etc.). This activity can be as simple as a bank sending fraud or usage activity to a client’s cell phone or as complex as a client paying bills or sending money abroad. Advantages to mobile banking include the ability to bank anywhere and at any time. Disadvantages include security concerns and a limited range of capabilities when compared to banking in person or on a computer.

Understanding Mobile Banking

Mobile banking is very convenient in today’s digital age with many banks offering impressive apps. The ability to deposit a check, to pay for merchandise, to transfer money to a friend or to find an ATM instantly are reasons why people choose to use mobile banking. However, establishing a secure connection before logging into a mobile banking app is important or else a client might risk personal information being compromised.

Mobile Banking and Cybersecurity

Cybersecurity has become increasingly important in many mobile banking operations. Cybersecurity encompasses a wide range of measures taken to keep electronic information private and avoid damage or theft. It is also used to make data is not misused, extending from personal information to complex government systems.

Three main types of cyber attacks can occur. These are:

- Backdoor attacks, in which thieves exploit alternate methods of accessing a system that doesn't require the usual means of authentication. Some systems have backdoors by design; others result from an error.

- Denial-of-service attacks prevent the rightful user from accessing the system. For example, thieves might enter a wrong password enough times that the account is locked.

- The direct-access attack includes bugs and viruses, which gain access to a system and copy its information and/or modify it.

Steps financial advisors can take to protect their clients against cyber attacks include:

- Helping educate clients about the importance of strong, unique passwords (e.g, not reusing the same one for every password-protected site), along with how a password manager like Valt or LastPass can add an extra layer of security.

- Never accessing client data from a public location, and being sure the connection is always private and secure.

Mobile Banking and Remittances

Remittances are funds that an expatriate sends to their country of origin via wire, mail, or mobile banking (online transfer). These peer-to-peer transfers of funds across borders have enormous economic significance for many of the countries that receive them – so much so that the World Bank and the Gates Foundation have set up complex tracking mechanisms. They estimate that remittances to developing countries amounted to $529 billion in 2018, up 9.6% from the previous record high $486 billion recorded in 2017.

:max_bytes(150000):strip_icc():format(webp)/young-woman-using-smartphone-in-shopping-mall-981469094-28bcb62027334fd5848218d161bcc972.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

7 key benefits of mobile banking

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Personal finance

- • Savings accounts

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Here is a list of our banking partners .

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Mobile banking has become the norm in many consumers’ daily lives. A report from the American Bankers’ Association found that 81 percent of consumers had managed their bank account from a mobile device at least once in the past month.

The allure, of course, is the convenience mobile banking offers: Consumers tote their smartphones virtually everywhere, so a mobile banking app can help them quickly take care of a range of financial needs whenever they wish. It’s essentially a bank in your pocket.

Having tools that make it easier to manage your finances is especially valuable at a time when most consumers are struggling to save. To put it in perspective, Bankrate’s 2024 emergency savings report found that 56 percent of Americans wouldn’t be able to pay for a $1,000 emergency expense with their savings. Mobile banking offers expense tracking, automated savings, account access for those who might not have a branch nearby and more to aid in your finances.

Key takeaways

- Expense tracking, automated savings and easy access to account information are a few features that make mobile banking an essential tool for managing finances in the modern world.

- Mobile banking apps also provide added security measures, such as encryption and biometric authentication, to protect sensitive financial information and prevent unauthorized access.

- Mobile banking can be especially helpful for underbanked or marginalized communities, as it offers tailored options and a sense of safety and convenience that traditional banks may not provide.

Advantages of mobile banking

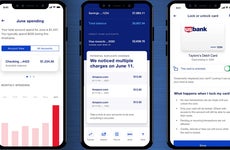

Mobile banking apps can warn you when you spend more than you have in your account, automatically move money into savings on your payday and let you set controls on your cards to restrict spending. Banking apps can also make it easy to send money to friends and to reach a customer service representative with the tap of a button.

1. Accessing the bank 24/7

Unlike a bank branch, mobile banking conveniently gives you access to your account anytime you like — with some exceptions, such as planned maintenance updates and unexpected outages .

This ease of accessibility saves you time. Mobile check deposit, for example, a feature most banking apps offer, allows you to deposit a check on the go or from the comfort of your couch.

Mobile banking apps can also make it easy for users to schedule and pay bills at their convenience with features like bill pay and upcoming payment alerts. Customers can ensure bills are settled on time, regardless of whether it’s on the go or late at night.

2. Making it easier to save

The best mobile banking apps have evolved to help you manage your money with less effort. For example, the Ally Bank app offers several savings features, including automatic transfers to a savings account and round-ups that move rounded up change into your savings. The U.S. Bank app alerts customers when its algorithms spot money-saving opportunities or situations when an account is at risk of being overdrawn.

Some online-only banks are also offering innovative savings features through their apps. Varo Bank , a popular online bank, offers a Save Your Pay feature that automatically stashes away a pre-set percentage of your paycheck each time it deposits.

Spending alerts are another way mobile banking apps can help you optimize your money.

“You are seeing a lot of people say, ‘Hey, I want to know every time there is a transaction over $150 or over $250 or whatever that threshold the consumer happens to care about is,’” says Zach Bruhnke, co-founder at HMBradley, a challenger bank. “A lot of people want to go and understand things like, ‘What are my daily limits?’ Things you’d probably ask your banker or call a branch for, now you are [the] one to do it. The push is for more and more information to be available at customers’ fingertips prints,” Brunhke adds.

3. Paying IOUs

When you are logged into your mobile banking app, it’s easy to pay back someone you know.

Banks across the country partner with Zelle so that you can send someone money in minutes through the bank’s mobile app rather than paying people with cash or a check.

You only need to know recipients’ email addresses or phone numbers to send them money. If your bank doesn’t offer Zelle, it usually lets you transfer funds to someone else’s bank account if you know their routing and account numbers.

4. Strengthening security

Banks are in the business of guarding your assets — including transactions made using their mobile apps. Though nothing is foolproof, there are ways you can step up security precautions if you’re concerned about mobile banking security .

Financial institutions often require a username and password to sign into a mobile app and offer additional safety features to further safeguard your account. Multi-factor authentication , for example, requires at least two kinds of verification to prove that it’s really you. The first are the account credentials (your username and password) followed by a text with numeric code sent to your phone that needs to be submitted to gain access to the account.

Further, some mobile devices — and some bank apps — let you log in by scanning your face or fingerprint as yet another way to protect your digital bank account without trading convenience.

A growing number of banks, such as Wells Fargo, Ally Bank, Chase and Bank of America let you use their mobile apps to turn your debit or credit card off if it goes missing or is stolen. It’s a nice feature to help you feel instantly secure in a moment of panic. Calling a toll-free number is not required if you want to turn your card back on, either.

5. Offering clarity about where your financial data is going

Many consumers share bank data to use services like Venmo. Depending on how many outside apps you use, it can be quite taxing to remember which company has what bank data. So a number of banks are trying to help customers understand where it’s going by changing the way data is shared behind the scenes.

“We are seeing a lot more banks offer that functionality that gives consumers proactive control over where their data is going,” says Rob Morgan, senior vice president of emerging technologies at the American Bankers Association. “It’s not just the added security … but it’s also the importance of transparency so you see where your data is going, how it is being used and [controlled], the ability to turn off this thing when you are no longer using the service,” Morgan adds.

At Wells Fargo, for example, customers are able to see recurring payments connected to payment cards.

6. Tracking expenses

When it comes to managing and sticking to a budget, tracking all of your expenses is the part that requires the most labor, and it may lead you to give up on budgeting altogether. Mobile banking apps can do much of that labor for you, by keeping track of your expenses tied to a particular account and organizing them into spending categories. You can see a breakdown of total expenses for things like utilities, dining, transportation and more.

By reviewing your spending patterns, you should gain a clearer understanding of where your money is going and can identify areas where you may need to make adjustments.

Some apps even come with built-in budget creation. Regions Bank , for example, offers a suite of budgeting tools through a feature in its app called My GreenInsights. Users have the ability to set up a budget in the app, sync multiple accounts to it and monitor their spending progress.

Other banking apps allow you to set financial goals, such as saving for a vacation or paying down a debt. Ally Bank and Capital One are two banks that come with features that let users establish and track progress toward different savings goals.

7. Giving you tailored options

Mobile banking can offer services to those who might historically have been overlooked or who are untrusting of traditional banks.

Bliss, for example, is a mobile banking platform designed for the transgender community. It allows users to put their chosen name on their debit cards, regardless of whether it’s been legally updated, and contains a database of financial goals related to transitioning.

Meanwhile, those who are unbanked or underbanked might find that mobile-only banking providers can help them access important financial services. Chime is a fintech that offers a fee-free checking account and no balance minimums, which can be managed entirely through a mobile device. The account could serve as an alternative banking option to those in geographically remote areas or who have a lack of trust in traditional financial institutions.

There are also startups building mobile financial tools for Black communities, young adults, women and other groups.

Disadvantages of mobile banking

Technical interruptions.

Mobile banking relies heavily on the user’s mobile device and internet connectivity. If you don’t have your device or the network is slow, it can hinder your ability to perform mobile banking activities. Plus, not all mobile banking apps work well, and even the best ones encounter outages every now and then.

Difficulty using the app

As banks layer in more features, navigating the apps can feel daunting. It’s not always obvious what features are available or where they’re located within the app. The good news is that banks are working to make their designs more intuitive.

Lack of personal interaction

Mobile banking eliminates face-to-face interactions with bank tellers. While this might not be an issue for many customers, it can be a disadvantage for those who prefer assistance or have complex financial inquiries that require more in-depth guidance. However, some mobile banking apps may allow you to contact a banker over live chat or the phone from the app.

Highly rated mobile bank apps

In 2024, mobile banking apps with standout features let you automate money decisions, block your cards, quickly get answers to your questions and more. Here are some of Bankrate’s favorites.

- Ally Bank: The online-only bank offers the staples, such as finding nearby ATMs and transferring funds) and provides extra touches. You can use Ally Assist, a virtual assistant that can help initiate transfers and bill payments, as well as provide information on interest earned and patterns of spending and saving. You can also use the app to set up controls for your cards and create savings buckets to help organize your money.

- Bank of America: Among the standouts of the big bank’s app is Erica, a virtual assistant that can answer a wide range of financial questions. You can also use the mobile app to book an appointment with an in-person banker.

- Capital One: The Capital One app is easy to navigate, helps you save and includes Eno, a virtual assistant. Users can also add cash in store by getting a unique barcode through the app. They simply enter the amount of cash to deposit in the app, go to a nearby CVS and show the cashier the barcode to scan as confirmation.

- Chase: In addition to allowing you to send money to someone else and monitor your account, the Chase app shows you a simple daily snapshot of your spending and saving patterns. You can also set savings goals and track your progress.

- Chime: This challenger bank gives you daily balance alerts and allows you to block your card in-app. More impressively, it lets you set up rules to automatically save money and potentially get your payday up to two days early. You can also overdraw your account without paying a fee.

- Huntington : Rated the top regional bank for mobile banking in 2023 by J.D. Power , Huntington’s app is great for those who need to quickly check on their accounts. Users can view their account balance with one tap, without needing to log in. The app also offers bill pay, mobile check deposit, the ability to order checks and account alerts.

- Varo: This online-only bank’s app lets you track your spending with instant alerts, send money to friends and family, locate in-network ATMs and lock your debit card if it’s lost or stolen.

Is mobile banking safe?

A common concern among users is the safety of their financial information. Fortunately, banks have robust security measures in place to protect user data and money.

One of these measures is encryption technology. Encryption means that your sensitive information, such as login credentials and transaction details, remains confidential.

Mobile banking apps also incorporate multi-factor authentication (requiring users to provide multiple forms of identification to access accounts) or biometric authentication (requiring fingerprints or facial recognition to log in). Doing so adds an extra layer of protection against unauthorized access .

Still, there are some best practices to ensure you’re banking safely over a mobile device:

- Enable biometric authentication whenever possible.

- Regularly update your app. Developers often release updates that include security enhancements and bug fixes.

- Frequently check on your transaction history and account statements to quickly identify any unauthorized or suspicious activity.

- Avoid conducting mobile banking transactions on public Wi-Fi networks.

- Be cautious of phishing emails, messages or calls attempting to obtain your login information. Banks typically do not request sensitive information through these channels by reaching out to you first.

Bottom line

Mobile banking is designed to help you in all kinds of ways — some of which are fundamentally redefining the role of a bank. Thanks to 24/7 access to accounts and the ability to make transactions with the tap of a button, consumers have more control over their money management — making trips to the local bank — for many — a thing of the past.

— Mary Wisniewski wrote the original version of this story.

Related Articles

Best banks and credit unions for mobile banking

Worried about mobile banking security? Follow these best practices

Bank account alerts to help protect your money

Best mobile banking features of 2024

To read this content please select one of the options below:

Please note you do not have access to teaching notes, mobile banking adoption: a systematic review.

International Journal of Bank Marketing

ISSN : 0265-2323

Article publication date: 28 December 2020

Issue publication date: 19 March 2021

This study is a systematic review of mobile banking services. Its main objective is to provide a state-of-the-art review of this particular growing type of services. It inventories and assesses the most significant determinants of and barriers to consumers' adoption of mobile banking. Moreover, it identifies the most common consequences of this adoption.

Design/methodology/approach

By using three major academic databases (ABI/INFORM global, Web of Science and Business Source Premier), this paper selected 76 manuscripts and produced a systematic review that exposes the main theories, conceptual frameworks and models used to explain consumers' adoption of mobile banking.

The results show that the TAM (technology of acceptance model), followed by the UTAUT (unified theory of acceptance and usage of technology), are still the main conceptual frameworks and models adopted and adapted by scholars to explain consumers' use or intention of using mobile banking. Using the vote counting method, a myriad of antecedents and consequences that are frequently used in the literature of mobile banking are reported. These were categorized into five main perspectives: (1) m-banking attributes-based perspective, (2) customer-based perspective, (3) social influence-based perspective, (4) trust-based perspective and (5) barriers-based perspective.

Originality/value

An integrated model regrouping and relating the five perspectives is proposed, leading to intriguing implications for both academics and practitioners.

- Systematic review

- Mobile banking

- Antecedents and consequences

Souiden, N. , Ladhari, R. and Chaouali, W. (2021), "Mobile banking adoption: a systematic review", International Journal of Bank Marketing , Vol. 39 No. 2, pp. 214-241. https://doi.org/10.1108/IJBM-04-2020-0182

Emerald Publishing Limited

Copyright © 2020, Emerald Publishing Limited

Related articles

We’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

As mobile surges, what’s the role of web banking?

Consumers have embraced banking apps as their main banking channel, even choosing their primary institutions based on user experience. at the same time, customers say that their apps still lag banking websites for some transactions and needs. how can banking sites play to these strengths.

Digital banking solutions, specifically mobile and web-based platforms, have gained widespread adoption in the past ten years, as bank branches become less and less utilized. However, a pertinent question arises: Are consumers still actively utilizing web banking services, or has mobile banking emerged as the dominant preference, rendering web banking obsolete? Should banking institutions favor, innovate and push one platform over the other?

In research exclusive to The Financial Brand conducted by Rivel in March 2024, among a national sample of banking consumers, mobile banking usage is a clear favorite with 58% using their phone to bank most or all the time. The numbers are even more stark when Rivel looks at the results by generation: 33% of Millennials use their mobile app exclusively and Gen Z comes in at 38% mobile app primary usage.

A crazy stat:

A shocking 14% of Baby Boomers do not use their bank’s digital tools at all.

How are banks preparing for the slow decline of the web interface and how can they effectively position their mobile solutions?

Related Articles

Key insights from the 2024 Digital Banking Performance Metrics Report

Don’t just follow the latest (business book) fad

Innovative approach to savings benefits members and local charities

Navigating credit union challenges: Insights gained from core consulting

Stay connected to the credit union community with our free newsletter.

Delivered to the inboxes of thousands of credit union leaders daily.

You have Successfully Subscribed!

Impacts of Mobile Banking

Introduction.

As a result of the advent of mobile banking, which fundamentally revolutionized and redefined how banks previously conducted their business, technology is now considered the key contributor to the success of organizations and one of their core competencies. With the help of their mobile phones or personal digital assistants, customers of a financial institution can perform a wide range of financial operations (Kumar et al., 2020). Banking and financial services are available and accessed via mobile phones and other wireless devices. Services may include banking and trading capabilities, account management, and customized data displays based on user preferences. An example of an innovation that has spread across multiple economic and industrial sectors is the concept of mobile banking. To promote economic growth, healthy banking conditions are universally recognized as both a prerequisite and a key factor (Ho et al., 2020). This paper explores the impacts of mobile banking technology on the financial sector.

Ways in Which Mobile Banking Has Changed the Financial Industry

Mobile banking can improve bank performance by increasing market share, customer satisfaction, product variety, individualized goods, and responsiveness to customer demands. Mobile banking has been and will be used as a strategic tool to influence the revenue structures of banks ever since it was introduced (Garzaro et al., 2021). Over time, profitability can be traced back to a strategy that effectively maintained or grew the customer base. Banking institutions can benefit from mobile banking and mobile money by increasing their market share, fostering customer loyalty, reducing operational expenses, and fulfilling governmental service obligations.

Mobile banking provides financial institutions with numerous opportunities to develop new revenue streams. Among these are capitalizing on customer analytics, improving customers’ access to products and services in real-time, and using the data banks collect about their customers’ preferences to create more personalized marketing campaigns (Khoa, 2021). Previous research into the concept of branchless banking has identified the crucial role that mobile phones play in specific models. These match the expectations that electronic money will bring greater efficiencies and lower transaction costs. Theoretically, The provision of mobile banking services is expected to increase profits for banks in the form of commission incomes and to gradually reduce the costs of overhead operations, both of which positively impact financial performance as a whole.

Mobile banking has wholly revolutionized the money transfer industry and spawned additional innovations that have reduced transaction costs for customers and banks alike. As a result of this change, financial institutions are making more money and more profit from the money transfer market (Samsudeen et al., 2021). Worldwide, there has been a shift toward doing a growing share of retail business via mobile devices. Customers can move funds between their checking and savings accounts and electronic money accounts, and vice versa. The improvement of mobile money services has increased the velocity and circulation of money in the country, leading to higher commission incomes for banks.

Branchless banking, such as mobile banking and mobile payments, is a way to cut down on the expenses of catering to low-income customers. Financial institutions that have had difficulty serving customers with low incomes in a viable manner through more conventional distribution routes will find this an attractive proposition (Rajaobelina et al., 2021). Mobile banking has matured into its channel and is no longer seen as an add-on to online banking; it is now called the “fifth channel” of banking. Because of this, there is now tighter coordination between mobile banking and traditional bank servers. This has allowed financial institutions access to the tools necessary to increase their customer base and revenue by bringing previously unbanked individuals into the banking system.

Drawbacks of Mobile Banking

Specific smartphone devices can only use a subset of the available apps. It is also possible that your device is incompatible with the platform the app was made for (Samsudeen et al., 2022). Typically, financial services on the go are reserved for the more high-tech mobile devices. A stable internet connection is also essential for your program to run smoothly and effectively.

Many security issues plague today’s bank-specific software, beginning with inadequate data encryption and ending with data leakage. If this is the case, hackers and other online peril can easily compromise these programs (Shankar et al., 2020). If hackers determine that your account has sensitive data, they may attempt to gain access to it. In order to avoid falling victim to scammers, you should never give out your password or any other financial details. If you lose your device, criminals may be able to access your financial information.

Mobile banking apps are not a good fit for corporations because they can only process small deposits simultaneously. When your account reaches the maximum amount, you must visit the branch to make a new deposit (Çera et al., 2020). The computer scanning software may be unable to identify some types of checks. As a result, you should set aside a considerable amount of time for this procedure.

While it may be possible to keep tabs on your accounts and investments even when you are on the go, getting your hands on that cash will still take some time. Experts scrutinize each deposit and transfer of funds before being granted (Zhang and Kim, 2020). It follows that you must keep waiting till the approval is granted. The ramifications of this technique affect virtually all financial institutions.

A mobile banking application’s numerous advantages and functions make it a helpful tool. You have total flexibility and freedom to manage your money and access banking services whenever and wherever you like. While using a mobile banking app, it is essential to prevent it from illegal use by taking measures such as protecting your login information and password security. Though mobile banking eliminates several inconvenient steps, it still has its challenges. Carefully consider an app’s potential drawbacks and advantages before installing it on your device. Do not let yourself become a victim of cybercriminals by forgetting to take precautions. Keeping up standards requires that service providers manage issues such as network oscillations, the impact of lost or stolen mobile phones, unauthorized access, and the possibility of improper transfers.

Reference List

Çera, G., Pagria, I., Khan, K.A. and Muaremi, L., 2020. Mobile banking usage and gamification: the moderating effect of generational cohorts. Journal of Systems and Information Technology .

Ho, J.C., Wu, C.G., Lee, C.S. and Pham, T.T.T., 2020. Factors affecting the behavioural intention to adopt mobile banking: An international comparison. Technology in Society , 63 , p.101360.

Rajaobelina, L., Brun, I., Line, R. and Cloutier-Bilodeau, C., 2021. Not all elderly are the same: fostering trust through mobile banking service experience. International Journal of Bank Marketing , 39 (1), pp.85-106.

Samsudeen, S.N., Hilmy, M.H.A. and Gunapalan, S., 2020. Islamic banking customers’ intention to use mobile banking services: A Sri Lankan study.

Samsudeen, S.N., Selvaratnam, G. and Hayathu Mohamed, A.H., 2022. Intention to use mobile banking services: An Islamic banking customers’ perspective from Sri Lanka. Journal of Islamic Marketing , 13 (2), pp.410-433.

Shankar, A., Jebarajakirthy, C. and Ashaduzzaman, M., 2020. How do electronic word-of-mouth practices contribute to mobile banking adoption? Journal of Retailing and Consumer Services , 52 , p.101920.

Zhang, L.L. and Kim, H., 2020. The influence of financial service characteristics on use intention through customer satisfaction with mobile fintech. Journal of System and Management Sciences , 10 (2), pp.82-94.

Khoa, B.T., 2020. The impact of the personal data disclosure’s tradeoff on the trust and attitude loyalty in mobile banking services. Journal of Promotion Management , 27 (4), pp.585-608.

Garzaro, D.M., Varotto, L.F. and Pedro, S.D.C., 2021. Internet and mobile banking: the role of engagement and experience on satisfaction and loyalty. International Journal of Bank Marketing , 39 (1), pp.1-23.

Kumar, A., Dhingra, S., Batra, V. and Purohit, H., 2020. A framework of mobile banking adoption in India. Journal of Open Innovation: Technology, Market, and Complexity , 6 (2), p.40.

Cite This Work

To export a reference to this article please select a referencing style below:

Related Essays

Organisations and systems, leveraging big data and analytics for improved logistics and supply chain management: a case study, leadership failure in an organization, brand loyalty among millennials (generation y) and generation z, ethical leadership: the case of dennis kozlowski – the ceo of tyco international, technology and innovation in banking/finance, popular essay topics.

- American Dream

- Artificial Intelligence

- Black Lives Matter

- Bullying Essay

- Career Goals Essay

- Causes of the Civil War

- Child Abusing

- Civil Rights Movement

- Community Service

- Cultural Identity

- Cyber Bullying

- Death Penalty

- Depression Essay

- Domestic Violence

- Freedom of Speech

- Global Warming

- Gun Control

- Human Trafficking

- I Believe Essay

- Immigration

- Importance of Education

- Israel and Palestine Conflict

- Leadership Essay

- Legalizing Marijuanas

- Mental Health

- National Honor Society

- Police Brutality

- Pollution Essay

- Racism Essay

- Romeo and Juliet

- Same Sex Marriages

- Social Media

- The Great Gatsby

- The Yellow Wallpaper

- Time Management

- To Kill a Mockingbird

- Violent Video Games

- What Makes You Unique

- Why I Want to Be a Nurse

- Send us an e-mail

A Marketing Research on Mobile Banking Essay

Research problem, research objective, research hypothesis, research plan, data collection, data analysis, conclusion and recommendations.

The study plans to bridge the gap of knowledge in the acceptance and adoption of mobile banking among the consumers. The research will be an exploratory research. The reason for the choice of this methodology is due to its innovation of novel ideas that is required in the mobile banking market. Through exploratory study will provide new and clear concepts explaining the dynamics of mobile banking consumption.

The realization that the technology plays a critical role in the development of banking have adverse effects on the performance of the banking institutions and has led to reorganizations of the operation process and as well as the way banking processes are conducted. The most affected process is the customer services.

Technological developments have caused banks to move from the traditional queuing services to the modern day where customers can reach banks at any place and at any time. In fact technological development has revolutionized the banking industry. One of the areas that have been affected is the communication. Technology is utilized by banks to enhance connectivity and communication as well as in other business processes including customer services.

Mobile technology is one of the technological developments used by banks to increase the customer services. Currently, banks utilize mobile technology to allow their clients pay bills, receive updates in, plan payments as well as other aspects of consumer services while in their private life.

The major issue is whether the consumers have adopted the technological developments in banking. Banks have not established whether the consumers have adopted the new electronic payment services as in mobile banking. In addition, it has not been established what factors affect the mobile adoption. These are the problems and relations that will be examined in this research study.

The research study has the following objectives:

- To investigate the adoption of mobile banking by the consumers

- To establish specific factors affecting the mobile banking adoption by the consumers.

- To formulate appropriate recommendations to the banking institutions and the industry regarding strategies that may enhance the adoption of mobile banking.

This study will test the following hypothesis:

- H1: mobile banking is effectively adopted by the consumers and not influenced by many factors

- Ho: mobile banking is not effectively adopted by the consumers and influenced by many factors

For this research to meet its obligations, it will be an exploratory research. The reason for the choice of this methodology is due to its innovation of novel ideas that is required in the mobile banking market. Through exploratory, the research will come up with new and clear concepts explaining the dynamics of mobile banking consumption, set up main concerns, build up on operational explanations and improve on the final research design.

The study is both qualitative and quantitative. The qualitative part will be based on the literature review while the quantitative will be based on data collected through a survey. The survey will consist of a questionnaire that will be administered to the sampled population of both mobile banking users and non-users.

As a field survey, the information concerning mobile adoption and the factors afecting the adoption will be collected through administering properly designed research questionnaires, observation alongside conducting well-structured in-depth interviews to the unbiased selected users and non-users of mobile banking.

The well-designed research questionnaire will be administered to 60 users and 40 non-users. Each part of the questionnaire will constitute key items that suitably attend to the research questions. For instance, part one will constitute whether the consumer have embraced the mobile technology in banking services while part two will elicit factors that may have contributed their adoption or not of the mobile banking.

Other parts will generate insights amidst offering recommendations to the organization to adopt or abandon the employees training strategy to augment success. Some items in the questionnaire will throw light on the mobile banking services and its impact on the consumers along with the consumer knowledge of existence of such services.

The questionnaire will thus be made of both open and closed ended research questions and this is believed to be of great significance to the researcher since it will assist in performing data analysis. Minor research tools namely direct observations, personal in-depth interviews and occasional conversation will be used to collect primary data.

Conversely, secondary research data will be acquired from the banking institutions, industry records, and other documents, which contain mobile banking information as well as its successes. For this particular case, the researcher intends to trace the mobile banking history and its adoption successes over the past years from the research secondary sources. Different scales will however be applied in the survey questionnaire during data collection to ensure the scales reliability and validity of some research questions.

For example, ordinary scale will be applicable in various research questions given that most questions will measure knowledge, feelings and experience. In contrast, the scale reliability will be made certain via applying the repeatability and internal consistency concepts. This implies that, the questionnaire will comprise of different questions asking about the same thing yet in a very different way. Finally, split half technique will be applied to attain internal consistency.

In order to ensure logical completeness as well as response consistency, the acquired data will be edited by the researcher each day to be able to identify the ensuing data gaps or any mistakes that needs instant rectification.

When data editing is completed, the collected research information will definitely be analyzed qualitatively and quantitatively. For example, any data that will have been collected through in-depth interviews and secondary sources such as the mobile banking files and the banking organizations documents will be analyze by means of content analysis along with the logical analysis techniques.

Furthermore, from the acquired independent variables values such the number of customers using the mobile banking services and the institutional success measured in terms of total output or general productivity, regression analysis will be applied to establish the correlation that exist between mobile banking services and the success of those institutions.

To obtain the best correlation approximation values, the study quantitative data analysis will be carried out by utilizing the integrated approach. Further quantitative data analysis techniques including percentages, frequency distribution and deviations will be used to determine the research respondents’ proportions that chose various responses.

The method will be applied for each group of items available in the questionnaire that ideally corresponds to the formulated research question and objectives. Line graphs, tables as well as statistical bar charts will be used to maker sure quantitative data analysis is simply comprehensible.

The findings indicate mobile bank services, in delivering the services to the clients, try to eliminate the impediments that the customers face from the conventional banking delivering of the services. The obstacles were identified to be from a diverse combination of items that are replicated from the obstacles in supply part of services. In addition, the hurdles are reflected from the obstacles associated with the purpose of cell phones as a means of conveying information from the part of the client in the delivery of services.

The study also indicated that mobile banking has achieved tremendous acceptance among consumers compared to other ways of banking such as internet banking that is still at its developing phase. Consequently, consumers have perceived mobile banking as the best way of carrying out banking transactions. According to the institutional studies, 80% agree that the mobile banking sector has made major strides in the delivery of services due to the rapid acceptance by majority of consumers.

However, the approval pace of mobile banking among consumers is not equivalent to the rate at which technology advances. Therefore, many factors were found to have a strong influence on the way consumers perceive and adopt mobile banking.

The impact of the increased technological advancement has compromised the proficiency of service superiority because services are initiated in the premature phases due competitiveness as well as outlay constraints. Consequently, the clients’ responses to the consumption of services are low because they think their needs are not considered. For instance, the customers feel that the adaptability of sustaining item services is inadequate.

Moreover, emphasis on expertise has an impact of overlooking basic requirements for approval in the provision of services. Technology has enabled mediums of creating new supply channels as well as communicating attributes of technology. Conversely, delivery involving technical knowledge comes with its own shortcomings. For example, there is lack of composition of service delivery and worth creation. In addition, customers have to know how to use technology-based electronics to achieve optimal usage.

An additional drawback in mobile banking is the functionality of cell phones in transacting banking services. Customers feel that the mobile phones are not effective in banking because for example, the cell phones have small keyboards leading to errors while accessing the services.

Further, studies show that consumers are dissatisfied by the confusing nature of the mobile phones while transacting banking services. Moreover, increasing concerns by consumers about transacting banking through wireless ways due to safety as well as significance of the services has had negative impacts acceptance of the service.

Results show that service providers must recognize the importance of client requirements when devising innovative services and products. Additionally, execution of information from familiarity of wireless banking should not be directed to the clients. As a result, banks have been able to make well-versed judgments in distributing assets as well as reduction of expenses.

It is evident that cell phones bear a huge ability of enabling success in accomplishing monetary operations and has led to the attainment of expansion in the financial sector with ease and less expenses. Therefore, it is essential for banks to expand their banking services to enable accessibility of their services.

As a result, government, supervisory bodies, service providers and all the stakeholders have easy access to the banking services from all regions. Further, implementing mobile banking services will bring on board non-bankers in the financial system. In addition, through creation of the understanding of mobile banking services among the people, they are able to embrace its use for personal gains.

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2020, January 13). A Marketing Research on Mobile Banking. https://ivypanda.com/essays/a-marketing-research-on-mobile-banking/

"A Marketing Research on Mobile Banking." IvyPanda , 13 Jan. 2020, ivypanda.com/essays/a-marketing-research-on-mobile-banking/.

IvyPanda . (2020) 'A Marketing Research on Mobile Banking'. 13 January.

IvyPanda . 2020. "A Marketing Research on Mobile Banking." January 13, 2020. https://ivypanda.com/essays/a-marketing-research-on-mobile-banking/.

1. IvyPanda . "A Marketing Research on Mobile Banking." January 13, 2020. https://ivypanda.com/essays/a-marketing-research-on-mobile-banking/.

Bibliography

IvyPanda . "A Marketing Research on Mobile Banking." January 13, 2020. https://ivypanda.com/essays/a-marketing-research-on-mobile-banking/.

- Exploratory Research in Organizational Leadership

- Leadership Preferences in Japan: an Exploratory Study

- Exploratory, Descriptive, and Causal Research Designs - Compare & Contrast

- Methods of Conducting Exploratory Marketing Research

- Visual Display of Data: Exploratory Data Analysis

- How to Become a Successful Athlete? Exploratory Essay

- Mobile Banking Adoption: Challenges and Solutions

- Applying a Gender Perspective to Corporate Social Responsibility (CSR): An Exploratory Study in the United Arab Emirates

- Exploratory Research Assignment: Sportsmanship

- Principal Components and Exploratory Factor Analysis

- What Are Some of the Product and Industry Characteristics Affecting EC Success?

- Keys to Be Successful Online

- Security and Privacy Issues in E-Commerce

- Mobile Commerce Technology

- Virtual Corporations: Article Analysis

ESSAY SAUCE

FOR STUDENTS : ALL THE INGREDIENTS OF A GOOD ESSAY

Essay: Mobile banking

Essay details and download:.

- Subject area(s): Finance essays

- Reading time: 26 minutes

- Price: Free download

- Published: 28 September 2015*

- File format: Text

- Words: 6,940 (approx)

- Number of pages: 28 (approx)

Text preview of this essay:

This page of the essay has 6,940 words. Download the full version above.