How To Conduct a Budget Analysis

Updated: March 11, 2024

Published: April 26, 2023

As a business owner, you’re in charge of steering your company toward long-term growth and profitability. To achieve your goals, you need a clear outline of where you want to go and a solid understanding of where you are now.

Business budgets are essential financial planning tools that help you map out your company’s future. The budget process involves forecasting revenue and predicting upcoming expenses.

Budgets are also helpful for understanding your current performance. With a budget analysis, you can compare your actual performance to the predictions in your operating budget.

A budget analysis allows you to see if you’re on track or veering off course. Once you have that information, you can adjust your strategy and make decisions that help you maximize growth while keeping costs under control.

What is a budget analysis?

A budget analysis is the process of looking at your actual income and expenditures and comparing them to your budget to see if you’re on track. Conducting a budget analysis gives you a chance to correct overspending and update your forecasts.

Benefits of conducting a budget analysis

Conducting regular budget analyses helps you improve your company’s financial management.

Ben Walker, owner of transcription company Ditto Transcripts, explains, “A budget analysis can highlight areas of high spending, identify opportunities for cost savings, and help prioritize investment initiatives.”

Budget analysis is especially useful for startups that rely on a fixed amount of investment capital. Entrepreneurs need to be in touch with their company’s revenue and expenses to ensure they don’t run out of funds before they start generating profits.

You can also use your findings to inform future budget decisions and financial projections.

How to do a budget analysis

1. choose your analysis frequency.

You should conduct budget analyses regularly throughout the budget cycle, such as monthly, quarterly, or biannually.

Kamyar Shah, CEO of management consulting firm World Consulting Group, recommends startups analyze their budgets monthly. This lets you adapt to changes in your business and helps correct overspending before it grows into a serious issue.

Not to mention, startups and high-growth companies often experiment with tactics and strategies, so it’s harder to predict revenue and expenses.

Once your business starts earning steady profits and it’s easier to forecast sales or predict expenses, you can switch to a less frequent schedule.

2. Gather data and calculate budget variance

Once you know your schedule, you can gather the data you need to analyze.

Specifically, you want to gather:

- Master budget numbers : The overall projections outlined in your budget, including breakdowns for monthly or quarterly performance.

- Departmental budget numbers : Expense limits for each department and revenue projections, if they apply.

- Your current performance metrics : Year-to-date totals for your budget line items.

Next, it’s time to identify budget variances. A budget variance is the difference between your expected performance (budgeted number) and your actual performance.

For instance, say you predicted $20k in monthly expenses, but in January, you spent $23k. That’s an expense variance of $3k.

In the next step, you’ll use variance analysis to figure out if any of the discrepancies you found are cause for concern.

3. Analyze budget variances

Variance analysis means collecting more information about the differences between your expected and actual performance. The process of analyzing variance involves three steps:

- Qualify the variance . Is the difference favorable or unfavorable ?

- Quantify the variance . Is the variance significant?

- Identify the cause . Why is the variance happening?

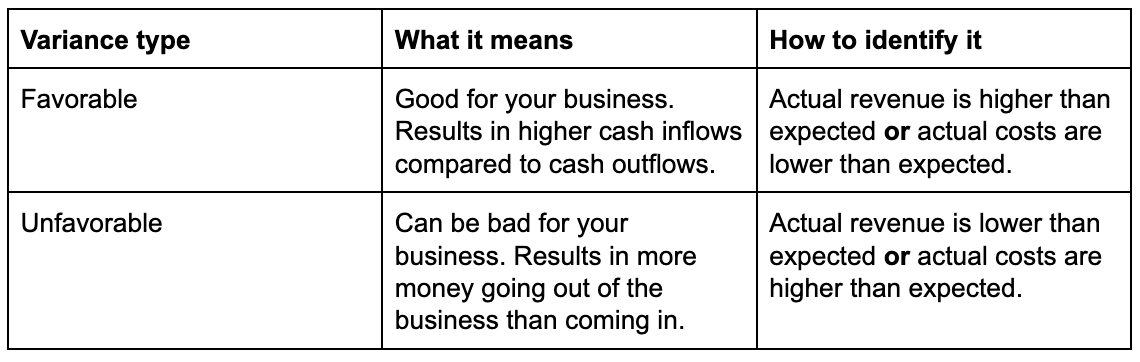

The first step is simple. You’re figuring out if the variance is good or bad for your business.

Here’s how to tell:

Using the previous example, you predicted $20k in expenses for January, but your actual expenses were $23k.

Since your actual expenses were higher than expected, this is an unfavorable variance.

Now that you’ve categorized it, the next question is, “Is this variance significant?” In other words, should you be concerned that your expenses were higher than expected?

As a general accounting guideline, variances of 10% or less are tolerable. That means you don’t have to start worrying about a variance until it goes over 10%.

However, you can set a lower budget variance threshold (like 5%) if you want to be stricter about sticking to your budget.

To calculate variance as a percentage, you can use the following formula.

Budget variance (percent) = (Total difference / Expected amount) x 100

Budget variance (percent) = ($3k / $20k) x 100 = 15%

Your actual expenses in January were 15% higher than expected. At this point, you’ve identified a significant unfavorable budget variance, which you’ll want to investigate further.

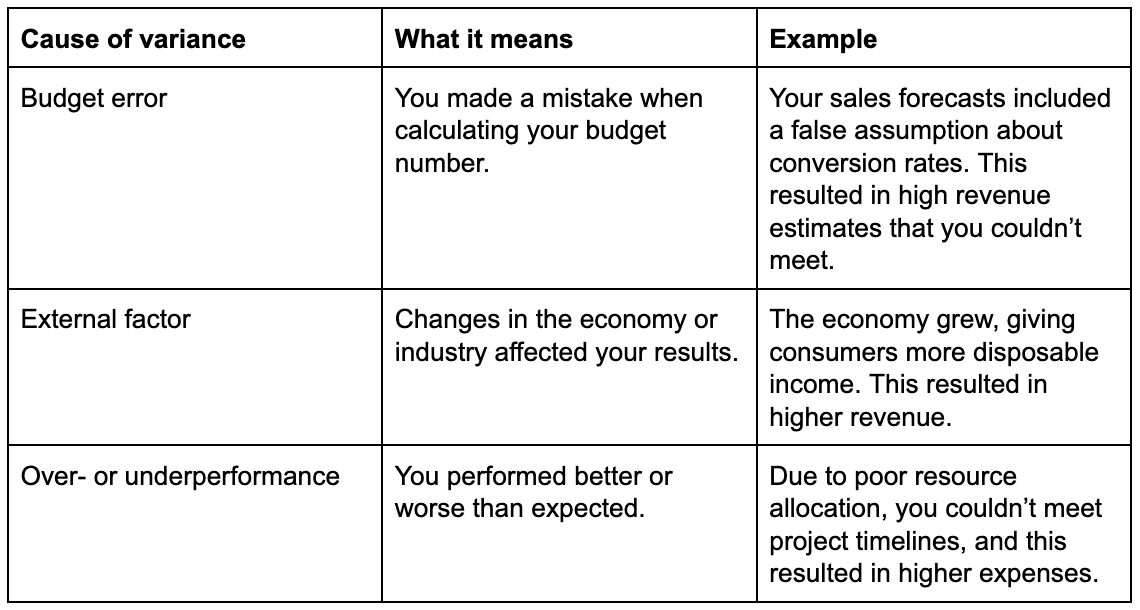

You need to identify the source of the variance to know how to fix it.

Budget variance often results from one of three causes:

4. Make necessary adjustments

The whole point of budget analysis is to make informed decisions that will improve your performance. There are two main types of changes: adjusting tactics and managing expectations.

Adjusting tactics can help improve your performance and adapt to changes in the external environment. For instance, if you’re overspending, you may look for possible cost reductions. You can also adjust to take advantage of new industry trends, like selling through social media.

Managing expectations refers to adjusting your budget forecasts based on new information. This works for businesses that use a flexible or rolling budget that lets them periodically update their forecasts. (You can skip this step if you use a static budget .)

Say your costs are significantly higher because of something out of your control, like inflation. You can’t reduce them, but you can adjust your budget forecasts to reflect the change.

Budget analysis example

Here’s an example to get a better idea of how this works. This example includes total revenue , total expenses, and net profit. However, you can break these numbers down into different categories, such as departments, when doing your own analysis.

Step 1: Choose a frequency

Say your business has started generating profits, and your expenses have become more predictable. You decide to do a quarterly budget analysis.

Step 2: Gather data and calculate variances

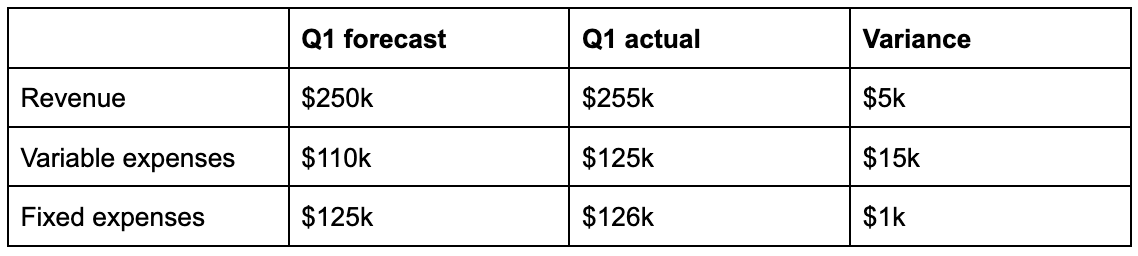

You’re reviewing your budget at the end of Q1, so you gather your Q1 forecasts and actual performance. From there, you calculate the variance for each line item.

Step 3: Variance analysis

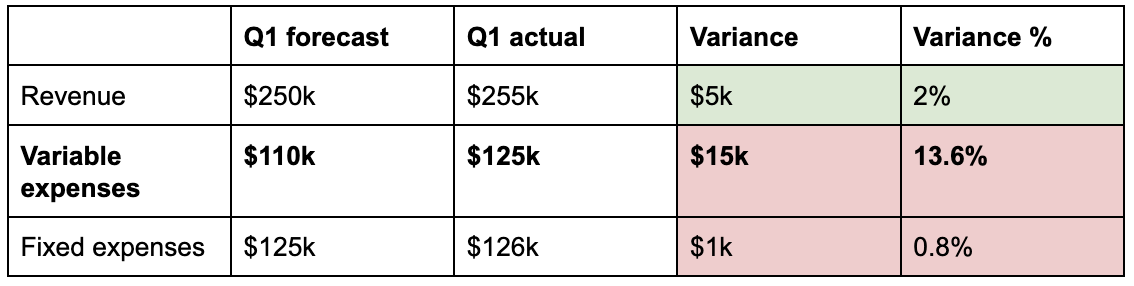

In the next step, you can use green to highlight favorable variance and red for unfavorable. Add a column for variance percent, which will help determine which variances are significant.

You can bold text to identify any variance over 10%.

From the analysis, you can see the unfavorable variance in variable expenses is significant and requires further investigation.

A root-cause analysis reveals two causes:

- Your packaging supplier increased prices, costing you $5k more.

- Rising gas prices increased the cost of shipping by $10k.

Step 4: Make adjustments

Based on your budget analysis insights, you can now make adjustments. First, you realize you can reduce costs by $5k if you switch to a different packaging material and smaller sizes.

Next, you research gas prices and see they’re likely to stay high. There’s not much you can do about shipping costs, so you update your budget to reflect higher variable expenses for the rest of the fiscal year.

hbspt.cta._relativeUrls=true;hbspt.cta.load(53, 'ad22bdd9-fd50-4b35-a4f5-7586f5a61a1e', {"useNewLoader":"true","region":"na1"});

What did you think of this article .

Give Feedback

Don't forget to share this post!

Outline your company's sales strategy in one simple, coherent plan.

Powerful and easy-to-use sales software that drives productivity, enables customer connection, and supports growing sales orgs

.css-s5s6ko{margin-right:42px;color:#F5F4F3;}@media (max-width: 1120px){.css-s5s6ko{margin-right:12px;}} Join us: Learn how to build a trusted AI strategy to support your company's intelligent transformation, featuring Forrester .css-1ixh9fn{display:inline-block;}@media (max-width: 480px){.css-1ixh9fn{display:block;margin-top:12px;}} .css-1uaoevr-heading-6{font-size:14px;line-height:24px;font-weight:500;-webkit-text-decoration:underline;text-decoration:underline;color:#F5F4F3;}.css-1uaoevr-heading-6:hover{color:#F5F4F3;} .css-ora5nu-heading-6{display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;-webkit-box-pack:start;-ms-flex-pack:start;-webkit-justify-content:flex-start;justify-content:flex-start;color:#0D0E10;-webkit-transition:all 0.3s;transition:all 0.3s;position:relative;font-size:16px;line-height:28px;padding:0;font-size:14px;line-height:24px;font-weight:500;-webkit-text-decoration:underline;text-decoration:underline;color:#F5F4F3;}.css-ora5nu-heading-6:hover{border-bottom:0;color:#CD4848;}.css-ora5nu-heading-6:hover path{fill:#CD4848;}.css-ora5nu-heading-6:hover div{border-color:#CD4848;}.css-ora5nu-heading-6:hover div:before{border-left-color:#CD4848;}.css-ora5nu-heading-6:active{border-bottom:0;background-color:#EBE8E8;color:#0D0E10;}.css-ora5nu-heading-6:active path{fill:#0D0E10;}.css-ora5nu-heading-6:active div{border-color:#0D0E10;}.css-ora5nu-heading-6:active div:before{border-left-color:#0D0E10;}.css-ora5nu-heading-6:hover{color:#F5F4F3;} Register now .css-1k6cidy{width:11px;height:11px;margin-left:8px;}.css-1k6cidy path{fill:currentColor;}

- Project planning |

- How to create (and stick with) a projec ...

How to create (and stick with) a project budget

A project budget is more than just money—it’s also a spending plan that guides you through the ideation, execution, and delivery of your project. When you master the art of budgeting, you can ensure your team has the resources they need to deliver quality results. In this article, we guide you through the budget creation process and offer tips to set your project up for success.

If your project was a car, a budget would be its fuel. Just like a truck needs gas in its tank, projects need money and resources to keep them going. And as a project manager, you have the power to plan and use those resources in the most effective way—so your project gets to its required destination on time, without running out of gas.

Because a project budget is essential to move work forward, knowing how to create and follow a solid budget plan is one of the most important project management skills you can develop over the course of your career.

What is a project budget?

Budgeting before you begin your project helps you scope work and control costs . It’s also a good way to pitch your project to stakeholders and get the funds you need, because a detailed spending plan helps approvers understand how costs contribute to your objectives. And as your project progresses, you can use your project budget as a baseline to compare actual spend to budgeted spend and mitigate extra costs as they arise.

9 steps to create a project budget

Creating a project budget may seem daunting, but you can do it by following a sequence of steps. We’ve laid out each part of the budgeting process below.

1. Set project objectives

Project objectives are what you plan to achieve by the end of your project. They’re a good place to start because they help you understand where work is headed, and act as a north star while you iron out the rest of your project plan .

The best objectives are clearly defined and falsifiable, so you can use them as a benchmark to measure success once your project is finished. To write clear objectives, use the SMART methodology. SMART stands for specific, measurable, achievable, realistic, and time-bound. For example, if you were trying to boost visitors to your website, you might set this objective: “By the end of this quarter, increase organic traffic to the website homepage by 10%.”

2. Define project scope

Once you’ve set your objectives, you can determine the scope of work you’ll need to achieve those goals. Your project scope sets boundaries for your project, such as what work you’ll do—or not do—and what deadlines and deliverables you’re working towards. When defining your project scope, consider the following:

Available resources: Before you determine the specific deliverables you want to target, take stock of the resources available to you. If you’re working with a hard budget cap or limited project team bandwidth, you may need to adjust your deliverables accordingly. As such, it’s useful to be aware of any limitations before you dive into the details of deliverables and required resources (which we’ll get to in later steps).

Time restrictions : Is there a time crunch for this project, or can you take as long as you need? A tight project schedule can influence the cost of resources. For example, you may need to pay freelancers a rush rate if you’re working with a tight deadline.

Non-goals : What’s outside the project scope? It can be helpful to identify what you’re not trying to achieve, so you can avoid scope creep and potential overspending.

Remember that your project scope is all about setting boundaries. It helps you understand what you want to achieve, what type of work you’ll do, and what deliverables you’re working towards.

3. Break deliverables into sub-dependencies

Next up, list out all the deliverables that fall within your project scope and break them down into sub-dependencies. For example, imagine that one of your project deliverables is to publish a blog post. You might break it down into the following line items:

Create design images

Stage in Wordpress

Share on social media

This method helps you include any hidden project expenses when you create your budget. For example, if you just tried to estimate the budget for publishing a blog post as a whole, you’d be more likely to omit extra costs—such as the hourly rate for a freelance editor, or the price of paid social posts.

If you prefer diagrams over lists, try creating a work breakdown structure (WBS) . This visual tool breaks down work into multiple levels, starting with your main objective at the top and branching out into deliverables and sub-dependencies below.

4. List required resources

Now that you’ve laid out all of your deliverables and sub-dependencies, it’s time to list the resources required for each item. Be as specific as possible, and remember that “resource” can mean more than just staff or equipment—it may also include indirect costs like training or a physical space to work in.

To get you started, here are some common project cost categories to consider:

Team members : Who are you relying on to do the work? Make a note if they’re salaried in-house staff, or if you need to hire additional hourly contractors.

Procurement : What do you need to do to acquire external resources? For example, you may need a team member to research the best products to use, communicate with sales reps, and purchase a tool.

Training : Do team members need time or resources to get up to speed? Think of the time needed for staff to train new employees or courses required to learn new skills.

Equipment : What tools are required? This can include things like extra computer monitors, design software, or even internet service.

Space : Where is your team going to work? For example, consider if you’ll require meeting rooms or desk space for new team members,

Research : What data do you need? Think if you’ll rely on information like user research studies, web analytics, or polling.

Professional services : Do you need to hire external experts, like legal or marketing consultants?

Travel : Does your team need transportation, lodging, or an allowance for on-the-go meals?

5. Estimate amounts

Ultimately, a budget is an estimate of costs. But while we can’t predict the future, there are a few methods to help you make the most accurate estimates possible. And you don’t have to stick to just one—you can use a combination of these approaches, depending on your unique project circumstances.

Here are a few of the estimation techniques you can use:

Estimate and sum the cost of each individual piece

Often called a bottom-up estimate, this is the best approach if you know exactly what deliverables and sub-dependencies will comprise your current project. If you’ve created a work breakdown structure , you’re already set up nicely to use this method.

To cover your bases, you can also compare your cost estimates with another one of these methods—for example, you could note how the budget was spent for a similar project in the past.

Work backwards from a fixed amount

In this approach, you start with a fixed budget amount and break it up into deliverables or project milestones . While working backwards can get a bit hairy—especially if you don’t already know how much project deliverables might cost—it can be helpful if you need to determine what objectives you’re able to achieve with a limited budget.

If you need to use this method, try combining it with another one of these options. For example, once you determine what you’re able to achieve, take a bottom-up approach to ensure you’re not missing any critical pieces.

Compare budgets from similar projects

Previous projects are a gold mine of historical data, because they’re a real-life record of where spend stayed on (or off) track. As such, they can help you see costs you might have overlooked, or how unexpected circumstances might influence spend. If possible, see if you can review lessons learned from a similar project in the past.

Consider different scenarios

Estimation can be hard for complex projects with a wide range of potential outcomes. For example, if you’re planning an outdoor event in April, costs may vary depending on the weather—you might need tents or fans to mitigate unexpected heat, heaters if it’s too cold, or an indoor venue if it rains.

In this case, it’s useful to estimate spend for each of these scenarios. Depending on your budget flexibility, you can play it safe and plan for the most expensive scenario. Or, you could calculate expected spend for the worst, best, and most likely outcome—then take the average of all three.

6. Set aside a contingency fund

Sometimes, the unexpected happens. Tools break, schedules change, and once-in-a-century pandemics make things a bit harder. Or, you might uncover an unexpected opportunity during your project—like the chance to purchase a business asset at a reduced cost. Contingency reserves give your budget extra padding when plans change. The typical recommendation is to set aside 5-10% of your total budget for contingencies.

Budgeting is a process of estimation, so you should always include a contingency fund. And if you’ve created a 100% accurate budget and don’t end up needing that extra padding, you can bolster your company’s bottom line with the leftover funds.

7. Build your budget

At this point you’ve identified all of your project’s deliverables, allocated resources , and estimated costs. Now, it’s time for the fun part—creating your actual budget document. Here are some key components to include:

Line items for each deliverable, sub-deliverable, and required resource—plus the expected cost of each.

A timeline of when you’ll need each resource, and when you expect to spend funds.

The person responsible for each budget component. For example, you might note that your assistant editor is responsible for tracking freelancer hours and invoices.

Clear documentation of which part of the company budget you’ll pull from for each line item. For example, you may use the marketing department budget to create video ads, and the IT department budget for computer upgrades.

A total of expenditures for your entire project. If applicable, include individual totals for each department budget you’ll be using.

A place to track actual costs vs. budgeted costs once your project kicks off.

Project budgeting tools

Selecting the right project budgeting tool is important, too. Make sure the program you choose has functionality to automatically total dollar amounts, so you don’t have to manually recalculate every time you need to adjust a line item. Also, your chosen tool should let you easily share and update your budget in real time, so you can make sure all team members are working with the most current version.

There are lots of options to choose from, including basic excel spreadsheets and more robust project management software . Not surprisingly, we’re partial to Asana because it lets you input and total line items, build custom fields, assign owners, and easily share information with teammates. And aside from your actual budget, you can iterate on past workflows , create process documents , and save project budget templates to ensure you’re not missing any steps.

8. Make a plan to monitor spend

A budget is only good as long as you stick to it. Plan in advance how often you’ll keep tabs on actual costs vs. budgeted costs, so you can mitigate potential issues before they get too big. You can also decide up-front what you’ll do if you go over (or under) budget.

The benefit of a tool like Asana is that it lets you share, manage, and track your budget in real time. For example, Asana’s Universal Reporting feature automatically pulls data from your projects and displays spend, task status, and completed milestones in one place—so you don’t have to dig to figure out if you’re on track or not.

9. Get approval from key stakeholders

Now that you have your project budget plan in hand, it’s time to share it with project stakeholders and ask for sign-off. Thankfully, the detailed plan you’ve made should give approvers a crystal clear picture of how each individual line item will contribute to your project objectives.

Example of a project budget

Let’s say you’re updating the checkout flow for your mobile app, and your project objective is to decrease average checkout time by 25% in Q3. To achieve that goal, you’ve scoped two priority deliverables and laid out the resources required.

Here’s a simple example of what your project budget might look like. Note that you’ve included the timeline, owner, and estimated cost for each. You’ve also indicated which department budget you’ll use for each line item, and added columns to track budget approval and actual spend.

![assignment on budget analysis [Old Product UI] Project budget example (lists)](https://assets.asana.biz/transform/f716071f-a7f5-4330-9588-08c73b6953d0/inline-project-planning-project-budget-2x?io=transform:fill,width:2560&format=webp)

Spend smart with project budgets

A well-crafted budget helps you through the entire project lifecycle—including planning, approval, and execution. Once you’ve mastered the skill of budgeting, you can ensure your project team has the resources they need to conquer key objectives and deliver quality results. And when you set up a process to stay on track with spend, you can tackle unexpected costs as they arise, build trust with budget approvers, and set a solid track record of successful projects.

Want to learn more about project management? Here are 25 essential project management skills you need to succeed .

Related resources

Unmanaged business goals don’t work. Here’s what does.

How Asana uses work management to drive product development

How Asana uses work management to streamline project intake processes

How Asana uses work management for smoother creative production

- Contact sales

Start free trial

Cost-Benefit Analysis: A Quick Guide with Examples and Templates

When managing a project, many key decisions are required. Project managers strive to control costs while getting the highest return on investment and other benefits for their business or organization. A cost-benefit analysis (CBA) is just what they need to help them do that. Before we explain how to do a cost-benefit analysis, let’s briefly define what it is.

What Is a Cost-Benefit Analysis?

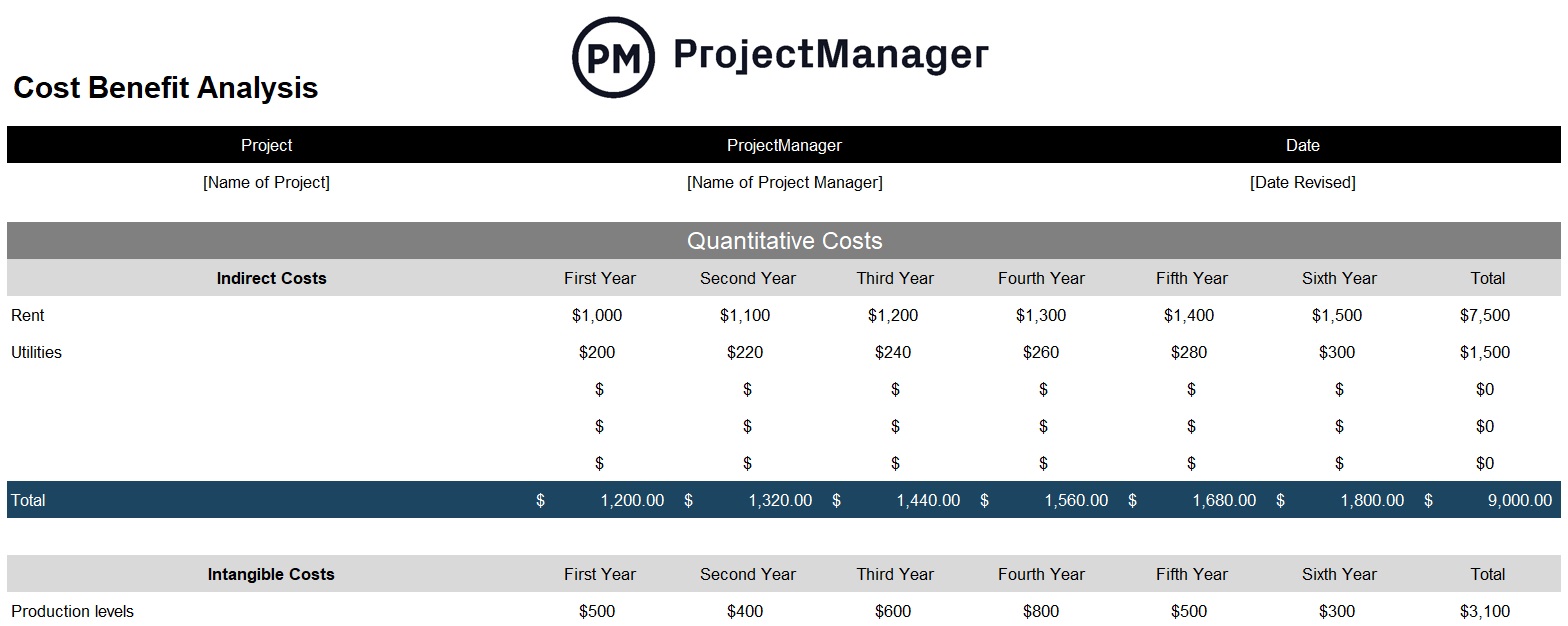

A cost-benefit analysis (CBA) is a process that’s used to estimate the costs and benefits of projects or investments to determine their profitability for an organization. A CBA is a versatile method that’s often used for business administration, project management and public policy decisions. An effective CBA evaluates the following costs and benefits:

- Direct costs

- Indirect costs

- Intangible costs

- Opportunity costs

- Costs of potential risks

- Total benefits

- Net benefits

These project costs and benefits are then assigned a monetary value and used to determine the cost-benefit ratio. However, a cost-benefit analysis might also involve other calculations such as return on investment (ROI), internal rate of return (IRR), net present value (NPV) and the payback period (PBP).

The Purpose of Cost-Benefit Analysis

The purpose of cost-benefit analysis is to have a systemic approach to figure out the pluses and minuses of various business or project proposals. The cost-benefit analysis gives you options and offers the best project budgeting approach to achieve your goal while saving on investment costs.

Get your free

Cost Benefit Analysis Template

Use this free Cost Benefit Analysis Template for Excel to manage your projects better.

When to Do a Cost-Benefit Analysis

Cost-benefit analysis is a technique that helps decision-makers choose the best investment opportunities in different scenarios. Here are some of the most common applications for a cost-benefit analysis in project management.

Cost Benefit Analysis & Feasibility Studies

A feasibility study determines whether a project or business initiative is feasible by determining whether it meets technical, economic, legal and market criteria.

Cost Benefit Analysis & Business Requirements Documents

A cost-benefit analysis should be included in a business requirements document , a document that explains what a project entails and what it requires for its successful completion.

Cost Benefit Analysis & Government Projects

Government projects also require conducting a cost-benefit analysis. However, in these types of projects, decision-makers must not only focus on financial gain, but rather think about the impact projects have on the communities and external stakeholders who might benefit from them.

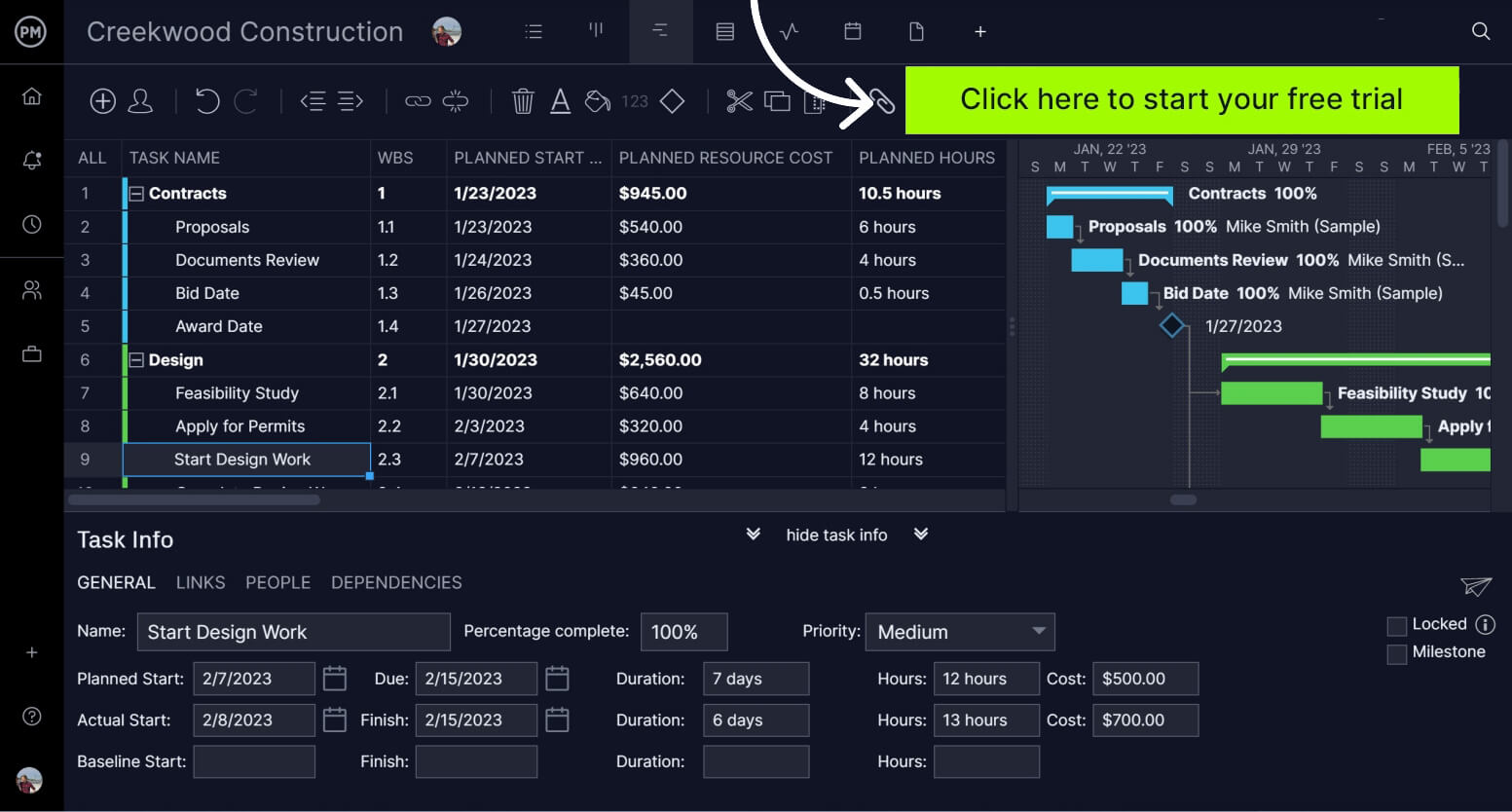

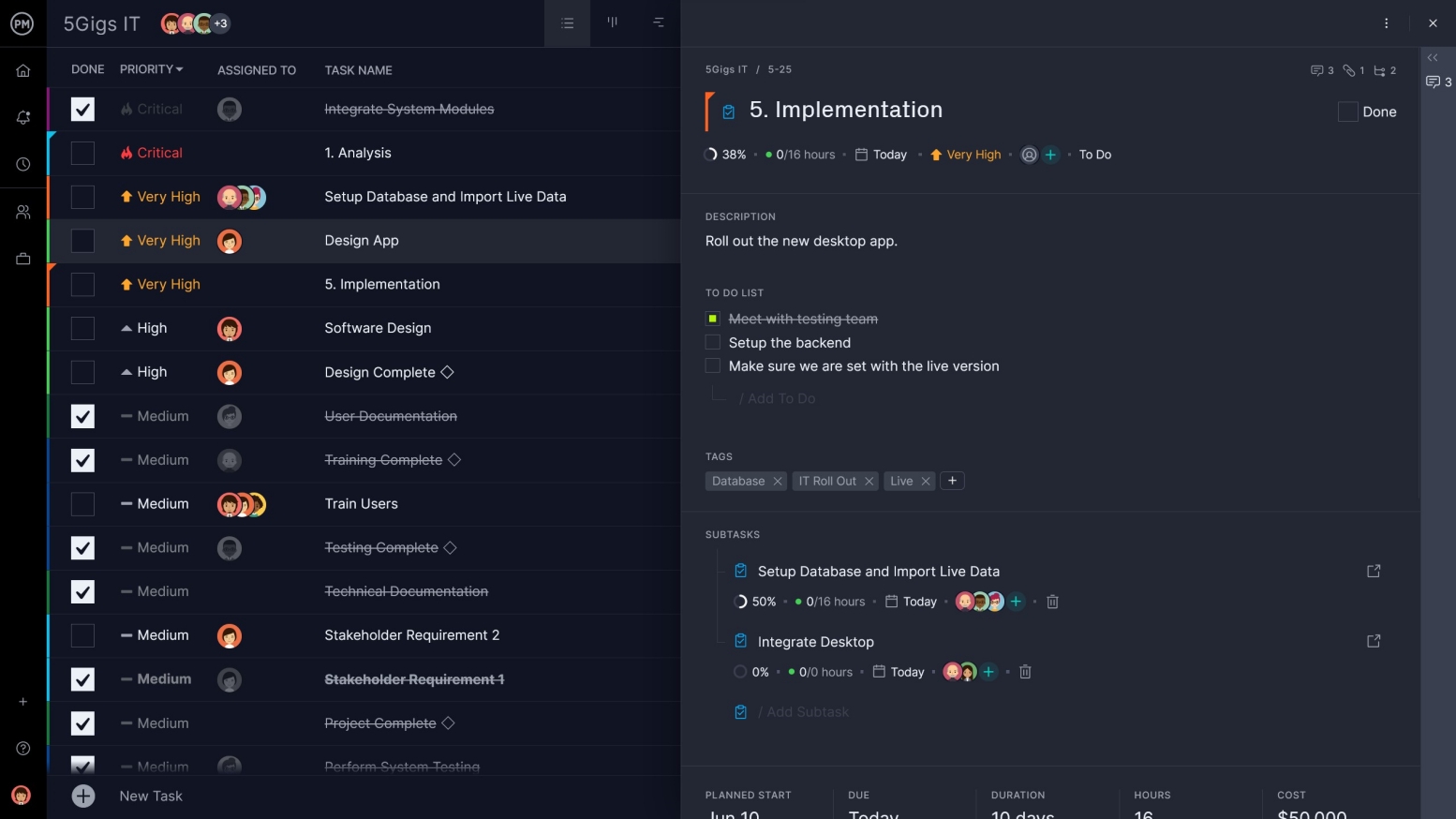

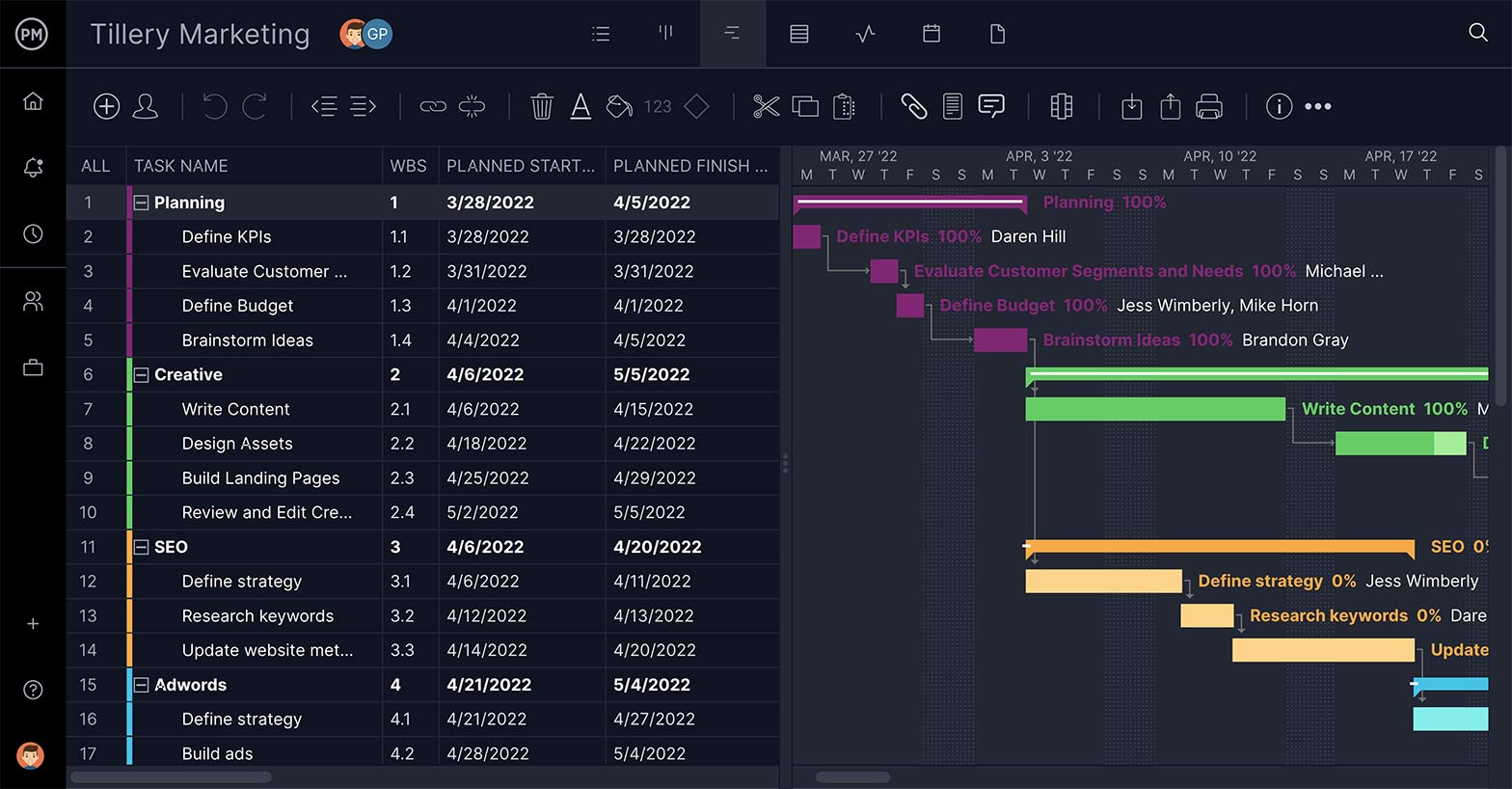

Keeping track of project costs is easier with project management software. For example, ProjectManager has a sheet view, which is exactly like a Gantt but without a visual timeline. You can switch back and forth from the Gantt to the sheet view when you want to just look at your costs in a spreadsheet. You can add as many columns as you like and filter the sheet to capture only the relevant data. Keeping track of your costs and benefits is what makes a successful project. Get started for free today.

How to Do a Cost-Benefit Analysis

According to the Economist , CBA has been around for a long time. In 1772, Benjamin Franklin wrote of its use. But the concept of CBA as we know it dates to Jules Dupuit, a French engineer, who outlined the process in an article in 1848.

Since then, the CBA process has greatly evolved. Let’s go through this checklist to learn how to do a basic cost-benefit analysis using the cost-benefit ratio and present value formulas:

1. What Are the Project Goals and Objectives?

Create a business case for your project and state its goals and objectives.

2. Review Historical Data

Before you can know if a project proposal might be valuable, you need to compare it to similar past projects to see which is the best path forward. Check their success metrics such as their return on investment, internal rate of return, payback period and benefit-cost ratio.

3. Who Are the Stakeholders?

List all stakeholders in the project. They’re the ones affected by the costs and benefits. Describe which of them are decision-makers.

4. What Are the Project Costs and Benefits?

Estimate the future value of your project costs and benefits and think about all the non-financial benefits that a project proposal might bring

The process can be greatly improved with project management software. ProjectManager has one-click reporting that lets you can create eight different project reports. Get data on project status, variance and more. Reports can be easily shared as PDFs or printed out for stakeholders. Filter any report to display only the data you need at the time.

5. Define a Project Timeframe

Look over the costs and benefits of the project, assign them a monetary value and map them over a relevant time period. It’s important to understand that the cost-benefit ratio formula factors in the number of periods in which the project is expected to generate benefits.

6. What Is the Rate of Return?

As explained above, the rate of return is used to calculate the present values of your project’s costs and benefits, which are needed to find the cost-benefit ratio.

Free Cost-Benefit Analysis Template

Use this Excel template to put what you’ve learned into practice. This free cost-benefit analysis template helps you identify quanitative costs and benefits, as well as qualitative costs and benefits, so you can appreciate the full impact of your project. Download yours today.

What Is the Cost-Benefit Ratio?

The cost-benefit ratio, or benefit-cost ratio, is the mathematical relation between the costs and financial benefits of a project. The cost-benefit ratio compares the present value of the estimated costs and benefits of a project or investment.

Cost-Benefit Ratio Formula

This is a simplified version of the cost-benefit ratio formula.

Cost-Benefit Ratio= Sum of Present Value Benefits / Sum of Present Value Costs

Here’s how you should interpret the result of the cost-benefit ratio formula.

- If the result is less than 1: The benefit-cost ratio is negative, therefore the project isn’t a good investment as its expected costs exceed the benefits.

- If the result is greater than 1: The cost-benefit ratio is positive, which means the project will generate financial benefits for the organization and it’s a good investment. The larger the number, the most benefits it’ll generate.

Present Value Formula

The present value of a project’s benefits and costs is calculated with the present value formula (PV).

PV = FV/(1+r)^n

- FV: Future value

- r= Rate of return

- n= Number of periods

We’ll apply these formulas in the cost-benefit analysis example below. Our free cost-benefit analysis template can help you gather the information you need for the cost-benefit ratio analysis.

Cost-Benefit Analysis Example

Now let’s put the formulas reviewed above into practice. For our cost-benefit analysis example, we’ll think about a residential construction project, the renovation of an apartment complex. After using project cost estimation methods and evaluating past-project data, the apartment management company concludes that:

- The project costs are $65,000. They’re paid upfront, so it’s not necessary to calculate their present value

- The project is expected to generate $100,000 in profit for the next 3 years

- The rate of return based on inflation data is 2%

Next, we’ll need to calculate the present value of the benefits expected to be earned in the future using the present value formula:

PV= ($100,000 / (1 + 0.02)^1) + ($100,000 / (1 + 0.02)^2) + ($100,000 / (1 + 0.02)^3)=$288,000

Now we need to use this cost value to find the cost-benefit ratio. Here’s how it would be calculated in this case:

Cost-Benefit Ratio: 288,000/65,000= 4.43

Since we obtained a positive benefit-cost ratio, we can conclude that the project will be profitable for this company. This result implies that the project will generate about $4,43 dollars per each $1 spent to cover expenses .

This is a simple cost-benefit analysis that relies on the cost-benefit ratio to establish the profitability of this project. In other scenarios, you might also need to calculate the return on investment (ROI), internal rate of return (IRR), net present value (NPV) and the payback period (PBP). In addition, it’s advisable to conduct a sensitivity analysis to evaluate different scenarios and how those affect your cost-benefit analysis.

Capture all the costs and benefits with project management software. But unlike many apps with inferior to-do lists, ProjectManager has a list view that is dynamic. It adds priority and customized tags you can assign team members to own each item. Our online tool automatically tracks the percentage complete for each item in real time. All the data you collect in our list view is visible throughout the tool. Regardless of the view, they all update live and they’re ready for you to utilize.

How Accurate Is Cost-Benefit Analysis?

How accurate is CBA? The short answer is it’s as accurate as the data you put into the process. The more accurate your estimates, the more accurate your results.

Some inaccuracies are caused by the following:

- Relying too heavily on data collected from past projects, especially when those projects differ in function, size, etc., from the one you’re working on

- Using subjective impressions when you’re making your assessment

- Improperly using heuristics (problem-solving employing a practical method that is not guaranteed) to get the cost of intangibles

- Confirmation bias or only using data that backs up what you want to find

Cost-Benefit Analysis Limitations

Cost-benefit analysis is best suited to smaller to mid-sized projects that don’t take too long to complete. In these cases, the analysis can help decision-makers optimize the benefit-cost ratio of their projects.

However, large projects that go on for a long time can be problematic in terms of CBA. There are outside factors, such as inflation, interest rates, etc., that impact the accuracy of the analysis. In those cases, calculating the net present value, time value of money, discount rates and other metrics can be complicated for most project managers .

There are other methods that complement CBA in assessing larger projects, such as NPV and IRR. Overall, though, the use of CBA is a crucial step in determining if any project is worth pursuing.

Templates to Help With Your Cost-Benefit Analysis

As you work to calculate the cost-benefit analysis of your project, you can get help from some of the free project management templates we offer on our site. We have dozens of free templates that assist every phase of the project life cycle. For cost-benefit analysis, use these three.

RACI Matrix Template

One of the steps when executing a cost-benefit analysis includes identifying project stakeholders. You need to list those stakeholders, but our free RACI matrix template takes that one step further by outlining who needs to know what. RACI is an acronym for responsible, accountable, consulted and informed. By filling out this template, you’ll organize your team and stakeholders and keep everyone on the same page.

Project Budget Template

You can’t do a cost-benefit analysis without outlining all your expenses first. That’s where our free project budget template comes in. It helps you capture all the expenses related to your project from labor costs, consultant fees, the price of raw materials, software licenses and travel. There’s even space to capture other line items, such as telephone charges, rental space, office equipment, admin and insurance. A thorough budget makes for a more accurate cost analysis.

Project Risk Register Template

You have your stakeholders identified and your budget outlined, but there’s always the unknown to consider. You can’t leave that up to chance: you must manage risk, which is why our free project risk register is so essential. Use it to outline inherent project risks. There are places to list the description of the risk, its impact, the level of risk and who’s responsible for it. By maintaining a risk register, you can control the project variables and make a better cost-benefit analysis.

Make Any Project Profitable With ProjectManager

No matter how great your return on investment might be on paper, a lot of that value can evaporate with poor execution of your project. ProjectManager is award-winning project management software with the tools you need to realize the potential of your project. First, you need an airtight plan.

Planning on Gantt Charts

Our online Gantt charts have features to plan your projects and organize your tasks, so they lead to a successful final deliverable. If things change, and they will, the Gantt is easy to edit, so you can pivot quickly.

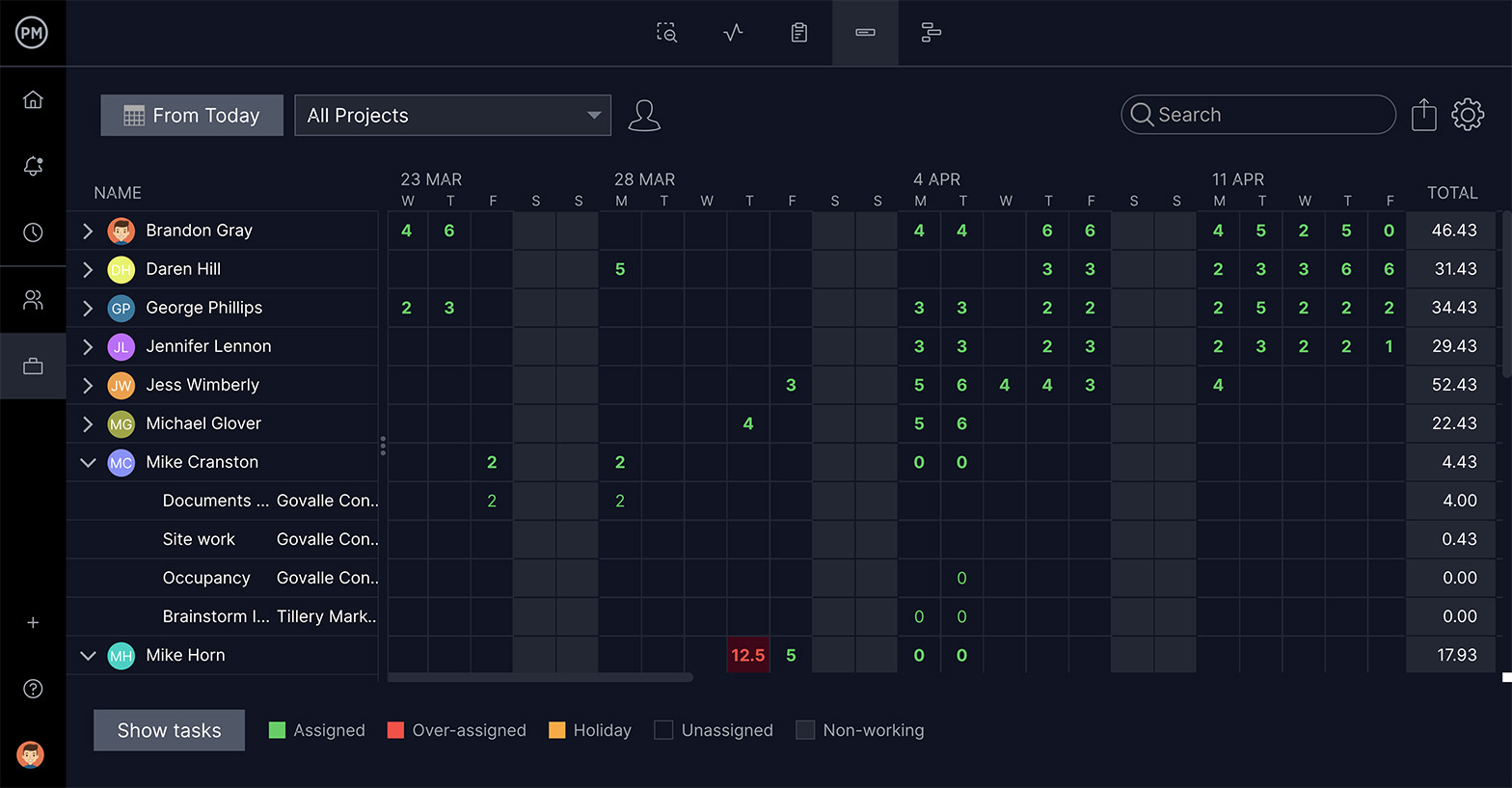

Resource Management Tools

Another snag that can waylay a project is your resources. ProjectManager has resource management tools that track your materials, supplies and your most valuable resource: the project team. If they’re overworked, morale erodes and production suffers.

The workload page on ProjectManager is color-coded to show who is working on what and gives you the tools to reassign to keep the workload balanced and the team productive.

Real-Time Cost Tracking

The surest way to kill any project is for it to bleed money. ProjectManager lets you set a budget for your project from the start. This figure is then reflected in reports and in the charts and graphs of the real-time dashboard , so you’re always aware of how costs are impacting your project. ProjectManager has the features you need to lead your project to profitability.

Cost benefits analysis is a data-driven process and requires project management software robust enough to digest and distribute the information. ProjectManager is online project management software with tools, such as a real-time dashboard, that can collect, filter and share your results in easy-to-understand graphs and charts. Try it today with this free 30-day trial.

Deliver your projects on time and under budget

Start planning your projects.

Researched by Consultants from Top-Tier Management Companies

Powerpoint Templates

Icon Bundle

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

Top 10 Budget Analysis Templates To Ace Your Financial Planning!

Naveen Kumar

"Follow the money trail," — a catchphrase popularized after All the President's Men , is now the fundamental tenet of investigating white-collar crimes. But did you know that it also holds immense significance in the world of business? Understanding your business's financial landscape, tracking every dollar, and predicting future outcomes are essential for sustainable growth and success. While it is a financial investigation for crimes, for businesses, its Budget Analysis.

What is Budget Analysis

Budget analysis is the systematic evaluation of your company's financial data to gain insights into its financial performance, identify trends, and make informed decisions. It involves dissecting revenue, expenses, and internal/industry financial metrics to determine areas of improvement, allocate resources in an effective manner, and plan for a sustainable future.

Budget Analysis Transforms Business Fortunes

Studies say that 9 of ten successful businesses attribute their growth to effective budget analysis practices. For businesses, budget analysis is crucial. The major reasons are:

- Did you know that companies that conduct budget analysis on a regular basis are 30% more likely to achieve their financial goals? It provides a clear picture of your financial health, allowing you to assess profitability and cash flow and identify potential risks or inefficiencies.

- It helps set data-based and realistic financial objectives, ensuring that your resource allocation is wise. In fact, a study found that businesses that actively engage in budget analysis experience 40% more positive growth.

- The budget analysis enables you to monitor and measure performance, comparing actual against projected figures and adjusting your strategies.

Budget Analysis Templates

Conducting budget analysis is challenging. Managing and organizing large volumes of financial data can be overwhelming, leading to errors and overlooked details during manual data entry or calculations. Analyzing financial metrics and understanding their relationships can be complex and challenging. Presenting budget analysis findings in a clear and concise manner is often difficult, especially when communicating complex financial information to stakeholders.

Our budget analysis templates resolve all these pain points. These presentation designs streamline data management by providing built-in tools for input and organization, reducing the chances of errors and saving time. They simplify analysis by breaking down complex financial concepts into manageable sections and offering predefined formulas and calculations for easy interpretation of data.

The 100% customizable nature of these templates provides you with the desired flexibility to conduct a comprehensive budget analysis. The content-ready slides give you the much-needed structure that saves your accounts team time and effort.

Lets’s explore these budget analysis templates together to get you the ideal virtual finance manager.

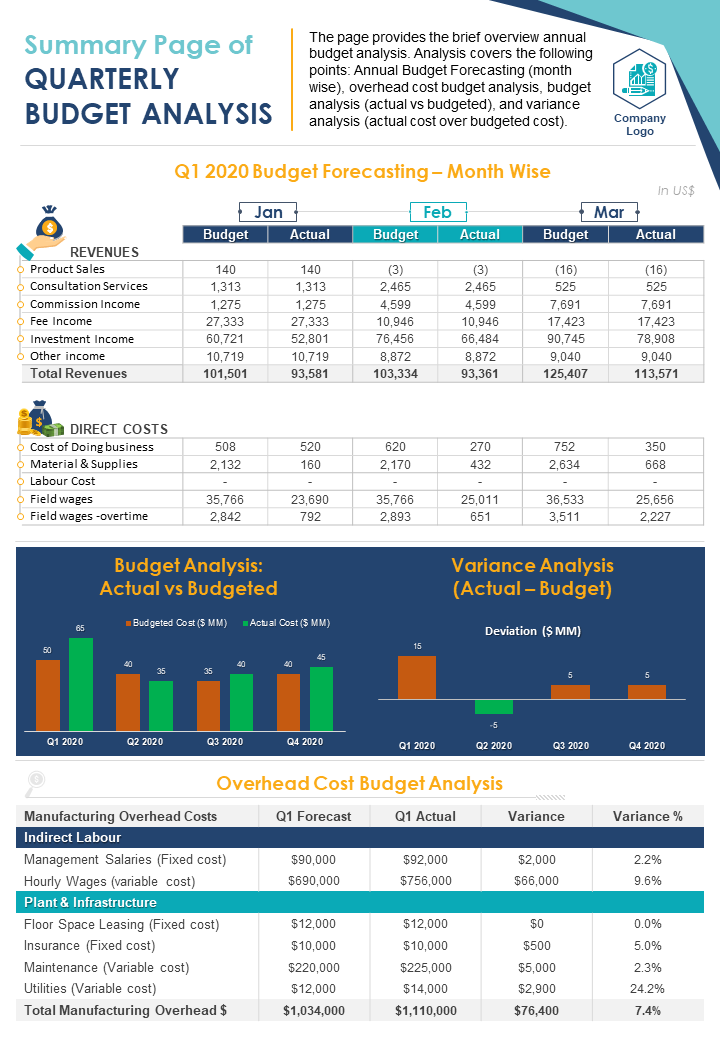

1. Budget Vs. Actual Variance Analysis Presentation Deck

Discover the reasons behind variances in finance as you explore this budget PPT presentation template. This comprehensive deck is packed with research-driven templates, including actual cost vs. budget, month-wise forecasting, overhead cost analysis, quarterly budget analysis, variance analysis, actual vs. target variance, budget vs. plan vs. forecast, and more. It will help you stay ahead of the game with periodic reviews of actual expenses compared to the budget. Use this slide to identify potential cost overruns and revenue shortfalls that impact your business's bottom line. Download it now!

Download this presentation deck

2. Quarterly Budget Analysis Presentation Template

Take your budget analysis to new heights with this content-ready PPT Template crafted to help you analyze and assess your financial performance over a quarter. Delve into the intricacies of your budget and explore quarter revenue trends, expense patterns, and budget variances. It contains a budget table that highlights variable expenses, total variable expenses, fixed expenses, and non-income statement items, along with other sub-elements. Gain insights into the financial health of your business and make data-driven decisions. Get it now!

Download this template

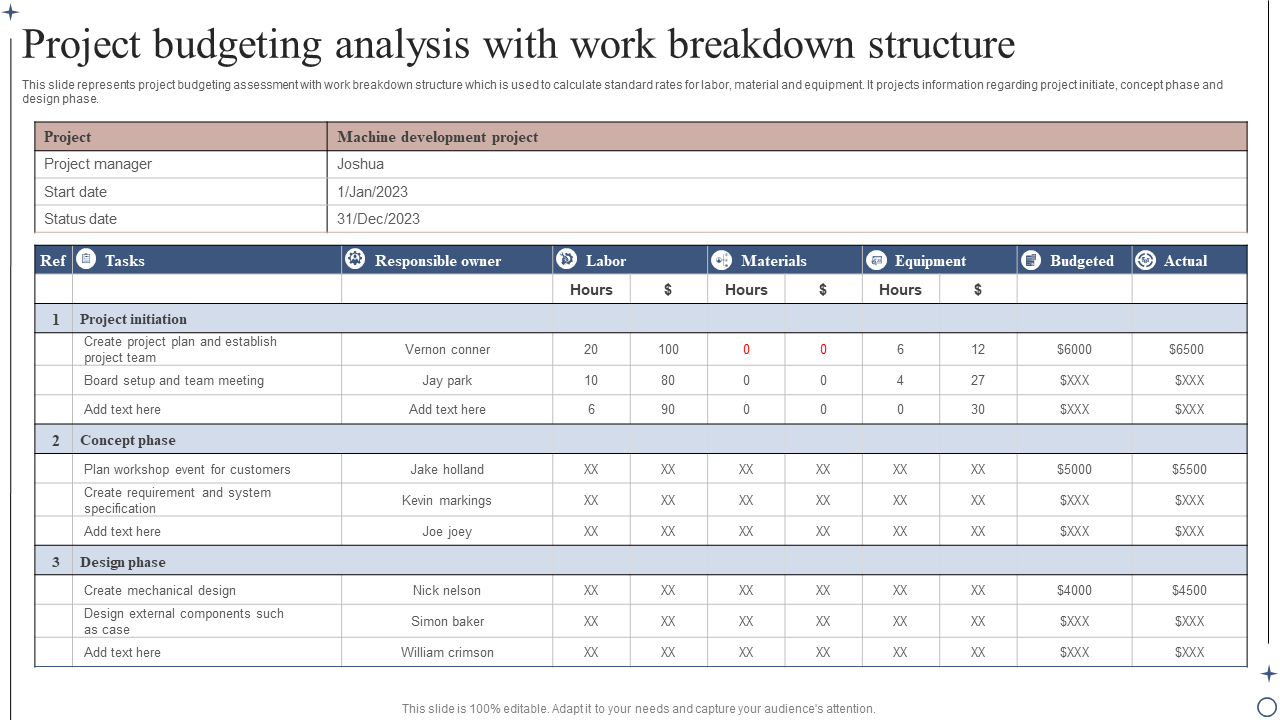

3. Project Budgeting Analysis With Work Breakdown Structure PPT Template

Analyze and manage project budgets using a structured approach with this structured presentation layout. It allows you to create a multi-phase Work Breakdown Structure (WBS) of your project with manageable components. Use this template to organize project tasks, resources, and costs with precision, allowing you to gain a holistic view of your budget allocation. You can assign a responsible person for each task and budget item in this PPT Design, which makes the project flow and financial implications easy to follow. Grab it today!

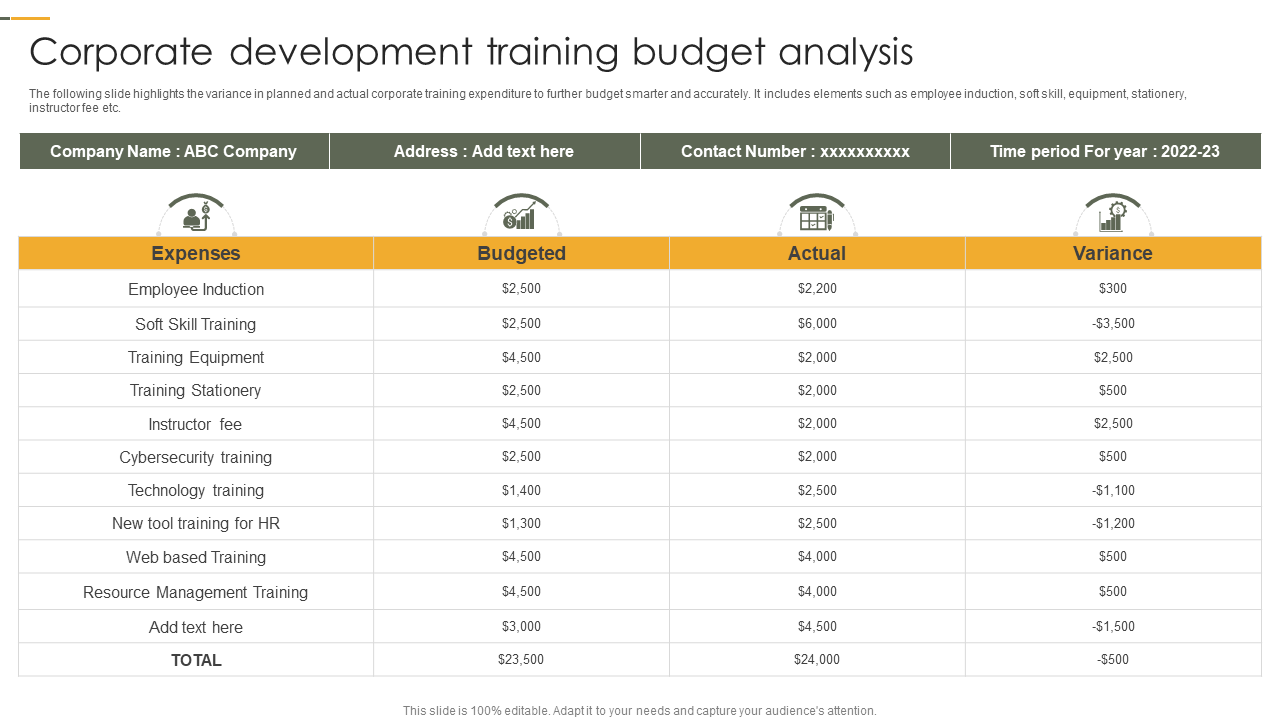

4. Corporate Development Training Budget Analysis PowerPoint Slide

Use this ready-to-use budget analysis PPT Design to maximize the impact of your training initiatives. The slide helps you analyze and manage training budgets, ensuring optimal utilization of resources. With this PowerPoint Set, you can track and evaluate training expenses, projected costs, actual expenditures, and variance. Evaluate and refine budget allocations for training programs like employee induction, soft skill training, and cybersecurity training, and make informed decisions to optimize this investment. Download it now!

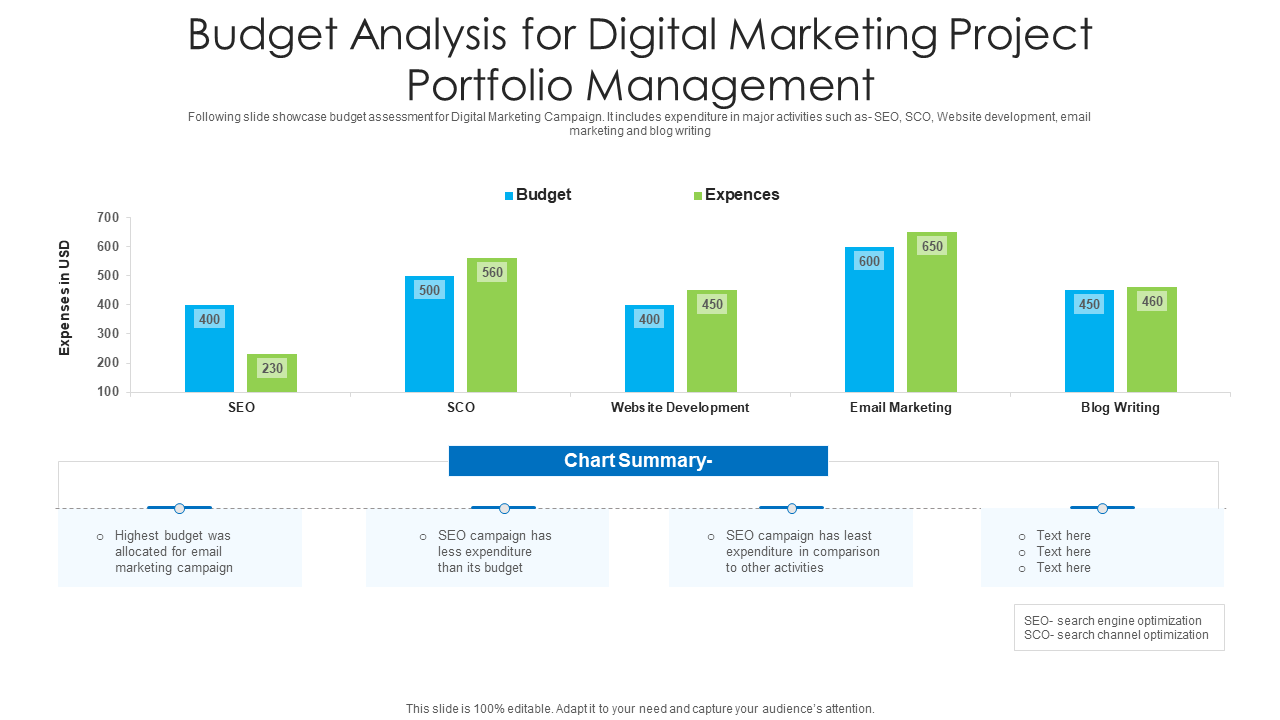

5. Budget Analysis Template for Digital Marketing Project

This easy-to-read presentation template is designed to help you analyze and compare expenses across five key digital marketing channels: SEO, SCO, Web Development, Email Marketing, and Blog Writing. The centerpiece of this PowerPoint Layout is a bar graph featuring blue bars that represent the allocated budget and green bars depicting the actual expenses for each channel. Use the spaces provided to present chart summaries or key insights derived from the bar graph. Highlight trends, cost-saving opportunities, and potential areas for improvement, fostering data-driven decision-making and enhanced budget optimization. Get this presentation template now!

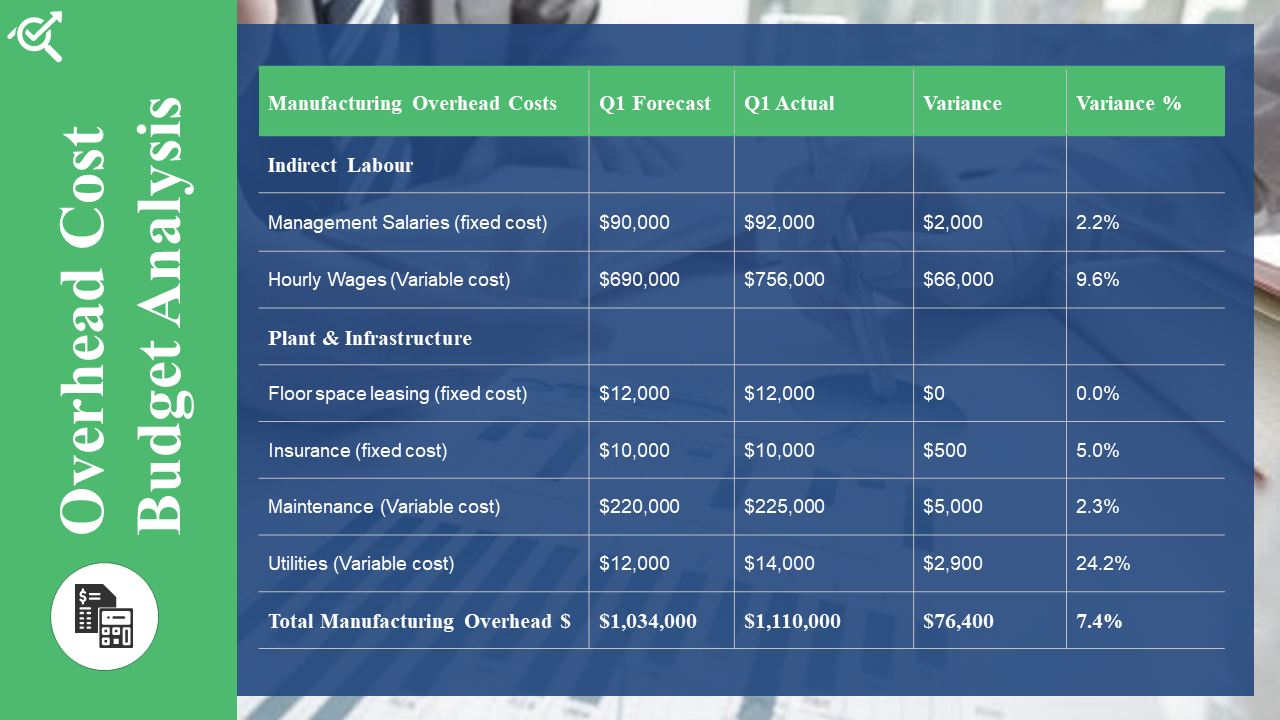

6. Overhead Cost Budget Analysis Presentation Template

Take advantage of this expert-designed PPT Slide to optimize your overhead cost management in an efficient way. It empowers you to analyze, assess, and control your overhead expenses, ensuring optimal financial performance for your organization. Our PowerPoint Set provides a structured framework to navigate overhead cost categories, such as indirect labor, plan & infrastructure, utilities, rent, salaries, maintenance, etc. It highlights each quarter's forecast, expense, variance, and variance percentage. Visualize the breakdown of your overhead costs with an easy-to-understand table and present the data in a clear and concise manner. Grab it today!

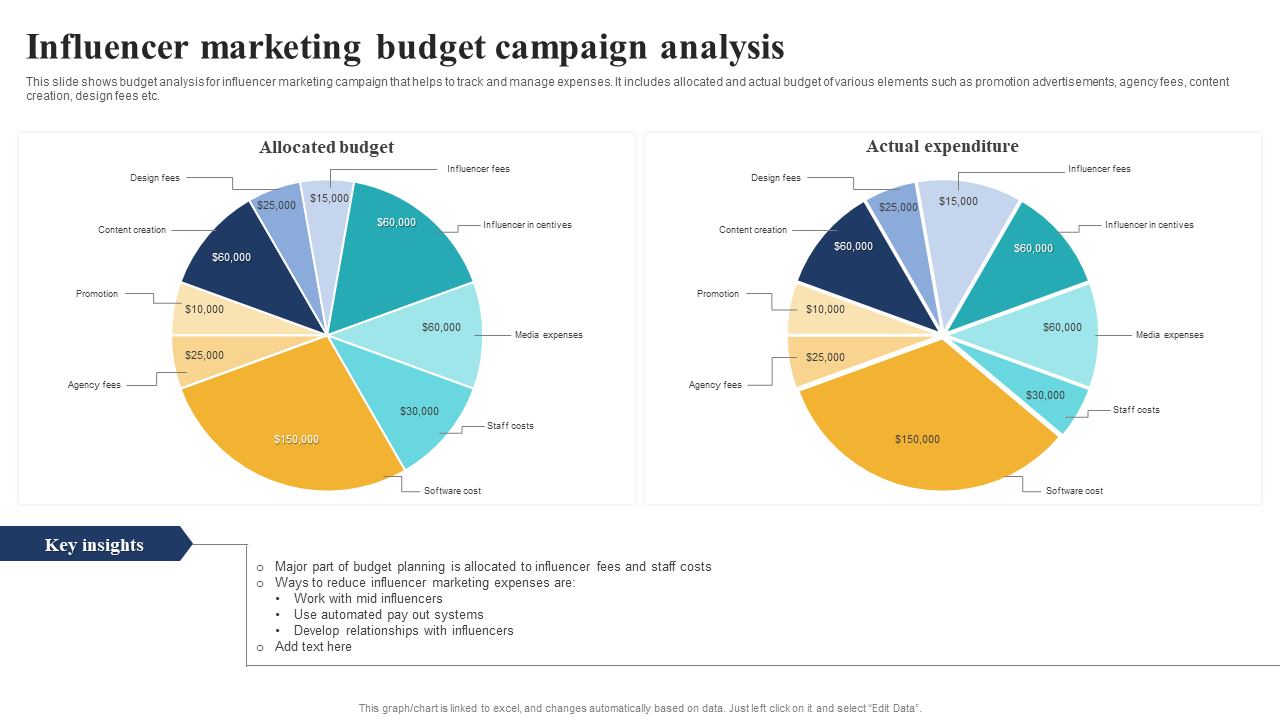

7. Influencer Marketing Campaign Budget Analysis PPT Template

Elevate your influencer marketing campaigns with this PPT Template, designed to help businesses analyze and optimize their budget allocations and expenditures. It features two vibrant and identical pie charts, showcasing a clear breakdown of the allocated budgets and actual expenditure for elements of influencer marketing campaigns. The left pie chart represents the allocated budgets or shares, while the right pie chart reflects the actual expenditure for influencer fees, influencer incentives, media expenses, staff costs, software costs, agency fees, promotion, content creation, and design fees. Navigate through the template to assess the variance between the allocated budgets and actual expenditures for each element. Take advantage of the dedicated section provided at the bottom of the template to share key insights from the comparison of the two pie charts. Highlight trends, pinpoint areas of improvement, and communicate the financial impact of your influencer marketing strategies. Download it now!

8. Budget Scenario Analysis PowerPoint Presentation Template

Make informed decisions and plan for the future with this detailed template that explores and evaluates three distinct scenarios — worst, average, and best — across key budget drivers, revenue impact, and overall budget. It helps you visualize the impact on budget drivers, revenue projections, and overall budget allocation for each scenario, enabling you to assess risk, identify opportunities, and make strategic decisions. The budget scenarios highlight the budget amount, base case variance, and percentage to enhance strategic planning and proactive decision-making. Get it now!

9. Post Corporate Event Budget Analysis Presentation Template

This PPT Template helps you assess and analyze your event expenses with ease and clarity. The PPT Layout features a colorful pie chart on the left, providing a visual representation of the percentage of the budget allocated to each category. From this pie chart, event managers can identify the distribution of funds across categories such as food and beverage, marketing , transportation, venue, decorations, and speakers. On the right side of the template, you'll find a comprehensive and easy-to-read table showcasing the detailed cost breakdown. The first row lists the expense categories, followed by the estimated budget and the actual expenses in the second and third rows. The top section of this event budget analysis template provides spaces to add the event title and date, ensuring a personalized touch for your presentation. Grab it today!

10. Annual Budget Analysis One-page Summary Template

This user-friendly template enables you to condense and present key financial insights. It features three tables and bar charts that provide a comprehensive overview of your annual budget analysis. The first table presents a month-wise breakdown of the revenue forecasted and generated from business sources. This allows you to compare and assess the financial performance of your business throughout the year. In the second table, you have estimated and levied costs for business components, including operations, materials & supplies, labor costs, field wages, overtime, and more. Below this, two bar charts showcase the budget and variance analysis for the four quarters of the year. Through this, you identify areas of over or under-spending and make informed adjustments. This one-page template provides a final table that offers detailed statistics on overhead cost budget analysis for a quarter. At the top, you'll find dedicated space to add an executive summary of the budget analysis report and your company logo, adding a personalized touch. Download it now!

From Chaos to Control

By leveraging budget analysis, you gain a competitive edge in the market, enhance financial stability, and maximize profitability. With our presentation templates enhance clarity and comprehension through charts, graphs, and infographics, making complex information more engaging and understandable.

With their polished and professional layouts, our budget analysis templates ensure that your presentations look impressive, maintaining consistent formatting, fonts, and design elements for a cohesive and professional appearance.

Download these budget analysis templates now and make the process more efficient by addressing data management, complexity, and communication challenges.

FAQs on Budget Analysis

1. what is a budget analysis.

A budget analysis is a systematic evaluation of financial data to assess the financial performance and effectiveness of a business or individual's budget . It involves reviewing income, expenses, and financial metrics to gain insights into the financial health and efficiency of budget allocation.

2. What are the stages of the budget analysis?

The stages of a budget analysis include:

- Data Collection: Gather relevant financial data, such as income statements, expense records, and cash flow statements, for the period under analysis.

- Data Organization: Arranging the collected data in a structured manner, categorizing income and expenses, and ensuring accuracy and completeness.

- Comparison and Evaluation: Comparing the actual financial performance with the budgeted or projected figures, assessing variances, and identifying areas where targets were met or missed.

- Identification of Trends and Patterns: Analyzing the data to identify trends, patterns, and potential causes for variances, such as changes in market conditions, pricing, or operational efficiency.

- Recommendations and Action Planning: Based on the analysis, developing recommendations for improving financial performance, optimizing resource allocation, and setting realistic financial goals. This stage may involve creating action plans and implementing strategies to address identified issues or capitalize on opportunities.

- Monitoring and Review: Scrutinizing the financial performance and reviewing the budget analysis results on a periodic basis to track progress, make adjustments, and ensure financial stability.

3. What are the three main types of budgets?

The three main types of budgets are:

- Operating Budget: An operating budget focuses on day-to-day operations and includes revenue and expense projections for a specific period, often a year. It outlines the projected sales, costs, and expenses related to the core business activities, such as production , marketing, and administration.

- Capital Budget: A capital budget is used for planning and managing long-term investments and expenditures. It involves budgeting for significant purchases or projects that have a lasting impact on the business, such as acquiring new equipment, expanding facilities, or launching new product lines.

- Cash Flow Budget: A cash flow budget focuses on the inflows and outflows of cash within a time frame, usually a month or quarter. It helps monitor and manage the timing and availability of cash to ensure that the business has sufficient liquidity to meet its financial obligations, such as paying bills, loan repayments, and managing working capital.

Related posts:

- An All-Encompassing Guide to Business Management (Best Templates Included)

- How Financial Management Templates Can Make a Money Master Out of You

- Top 10 Budget Management Templates to Keep Your Finances in Order

- The Superfast Guide to Break-Even Analysis [PPT Templates Included] [Free PDF Attached]

Liked this blog? Please recommend us

Top 10 Financial Budget Examples With Templates and Examples

Top 10 Annual Budget Templates with Samples and Examples

Top 5 Budget Planner Templates with Examples and Samples

Top 10 Budget Breakdown Templates with Samples and Examples

Top 10 Digital Marketing Budget Templates With Samples and Examples

Top 5 Departmental Budget Templates with Examples and Samples

Top 10 Yearly Budget Templates With Samples and Examples

Must-Have Bi-Fold Weekly Budget Planner Templates with Samples and Examples

This form is protected by reCAPTCHA - the Google Privacy Policy and Terms of Service apply.

Digital revolution powerpoint presentation slides

Sales funnel results presentation layouts

3d men joinning circular jigsaw puzzles ppt graphics icons

Business Strategic Planning Template For Organizations Powerpoint Presentation Slides

Future plan powerpoint template slide

Project Management Team Powerpoint Presentation Slides

Brand marketing powerpoint presentation slides

Launching a new service powerpoint presentation with slides go to market

Agenda powerpoint slide show

Four key metrics donut chart with percentage

Engineering and technology ppt inspiration example introduction continuous process improvement

Meet our team representing in circular format

Budget Analysis for Your Business

Creating a budget plan for your business is a key factor in the company’s development. An insufficient budget may cause the company to take drastic measures with their operations, such as laying off a number of employees in order to cut down costs.

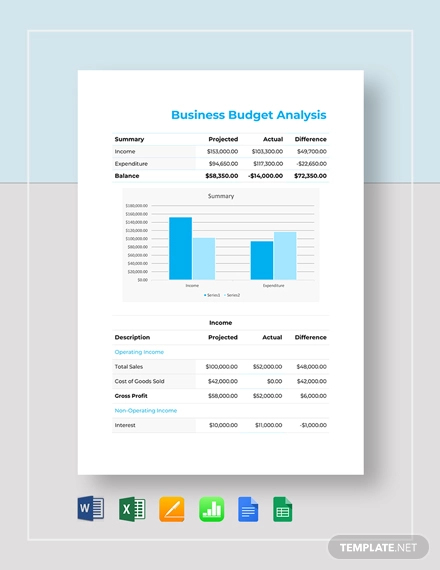

Business Budget Analysis Template

- Google Docs

- Google Sheets

Size: US, A4

But of course, it’s essential for a company to create a realistic budget. This would mean that a company should refrain from making investments that would not contribute to its growth.

A budget analysis example is a crucial process that is done to evaluate the budget plan made for the company. With a budget analysis, the company may thoroughly analyse existing or potential problems that may affect the company’s financial analysis sector.

What Is Needed for a Budget Analysis?

In making a budget analysis, you need to be aware of your company’s financial behaviour. This would include the company’s total sales analyis and expenses as well as its current cash balance. With this, the company would need to identify the amount of cash that they would need to support various sectors of the company.

To put it simply, the essential information needed for a budget analysis should include the adopted budget of the current year, the proposed budget for the succeeding year, the company’s total revenue and expenditure data, and its recent financial statement . With this, the team responsible for the analysis would need to determine whether the proposed budget is appropriate enough to be implemented.

Why Is Budgeting Important to Your Business?

When you think about it, your budget is actually a tool used for planning. The investment analysis you make may greatly impact various sectors of your company, but may simultaneously help you attain your goals as well. Having a budget will allow you to limit the money you spend on certain operations.

This would ensure that resources are not wasted on items that aren’t necessary to the company’s growth. This would mean that the company would need to be strict with their material resources in order to meet the budget limit. Furthermore, budgeting will also allow the company to closely monitor its financial department.

Tips to Writing a Budget Analysis for Your Business

Writing a budget analysis is a crucial step for any business analyiss . Any major, or even minor, mistake may cause the company its resources. The goal for any business is to maintain sufficient cash for their operations within a given period of time.

- Think of the future. Unforeseen circumstances may greatly affect the initial budget plan. Make assumptions based on possible issues that may take a toll on the set budget.

- Ask for help. Gaining input from financial professionals will help you with your analysis example . After all, a reliable analysis should be based on facts. Uncertainty may lead to negative outcomes.

- Make use of visuals. Graphs and charts may easily present statistical data that will provide a precise and clear view of your analysis.

- Review your calculations. Human error is a common, yet crucial, problem when dealing with numbers. Double check your calculations to ensure that everything is correct.

AI Generator

Text prompt

- Instructive

- Professional

10 Examples of Public speaking

20 Examples of Gas lighting

- Kreyòl Ayisyen

Analyzing budgets

Students analyze case studies and apply the 50-30-20 rule of budgeting.

Budgeting helps ensure that you’ll have enough money for the things you need and the things you want, while still building your savings for future goals.

Essential questions

- What are rules to live by for budgeting?

- How can they help inform spending decisions?

- Create a budget using the 50-30-20 rule

- Analyze a budget to see if it meets the 50-30-20 rule

What students will do

- Learn the 50-30-20 rule of budgeting.

- Use the “Analyzing budgets” worksheet to determine whether a scenario from the “Budget scenarios” handout meets the 50-30-20 rule.

- Give advice to help the characters in the scenario meet the 50-30-20 rule.

Download activity

Teacher guide.

cfpb_building_block_activities_analyzing-budgets_guide.pdf

Student materials

cfpb_building_block_activities_analyzing-budgets_worksheet.pdf

cfpb_building_block_activities_budget-scenarios_handout.pdf

Note: Please remember to consider your students’ accommodations and special needs to ensure that all students are able to participate in a meaningful way.

Explore related resources

- Search for related CFPB activities

- Find financial education lessons from FDIC

- View financial education resources from the Federal Reserve

Free Project Budget Templates: Simple to Advanced

By Andy Marker | February 25, 2022

- Share on Facebook

- Share on LinkedIn

Link copied

We’ve compiled the most useful free project budget templates for project managers, professional services teams, accountants, and other project budget stakeholders.

Included on this page, you’ll find a simple project budget template , a construction project budget template , a sample project proposal budget template , and a multiple project budget Gantt chart template , as well as a list of helpful tips for completing a project budget template.

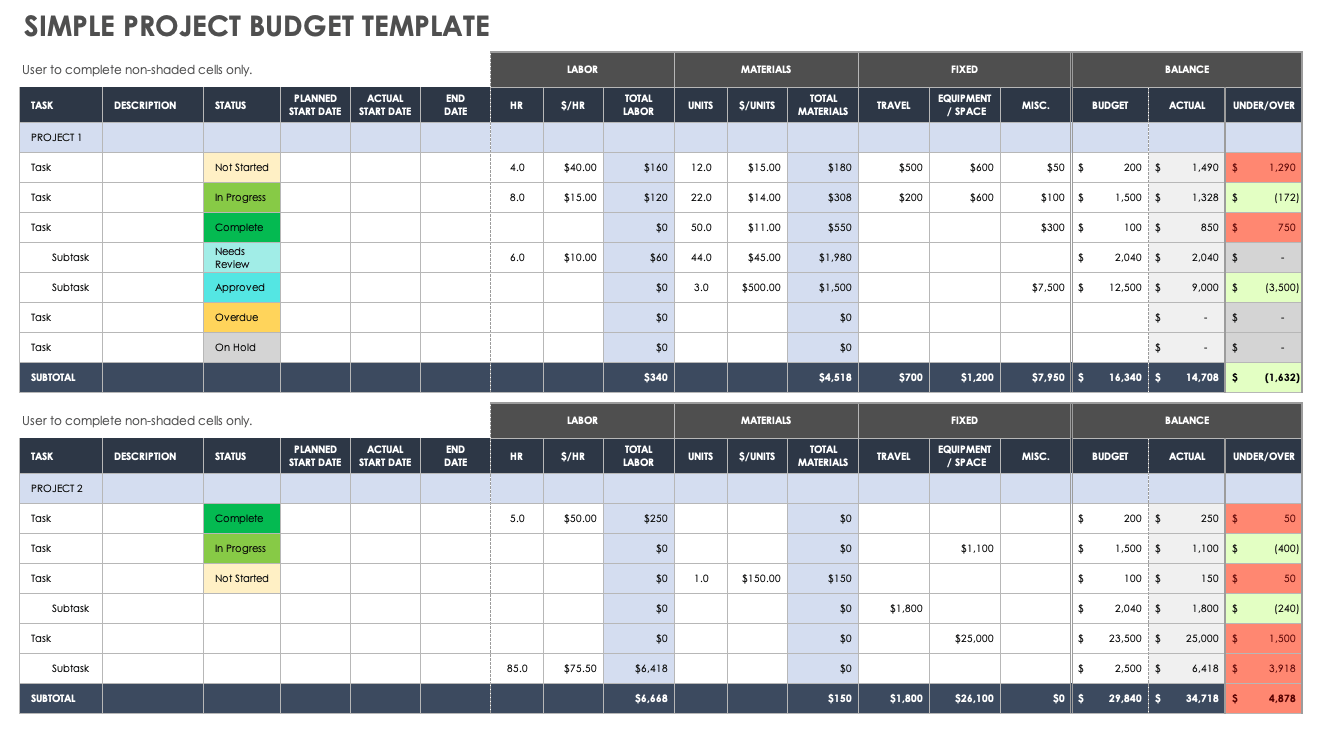

Simple Project Budget Template

Download Simple Project Budget Template Microsoft Excel | Microsoft Word | Google Sheets

Use this simple project budget template to plan and track all required tasks, resources, and the associated costs. Simply enter project tasks, subtasks, status, start and end dates, as well as labor and materials costs. You can enter fixed costs and compare budgeted and actual amounts.

The Balance column reflects each task’s under/over amount, and the built-in subtotal line tallies all task balances to give you the big picture of your project’s financial outlook. Use this customizable template to define and track any expenses your project incurs, and to ensure that you successfully complete your project within budget.

Find additional project proposal templates and learn more about getting the most out of your project-budget proposals.

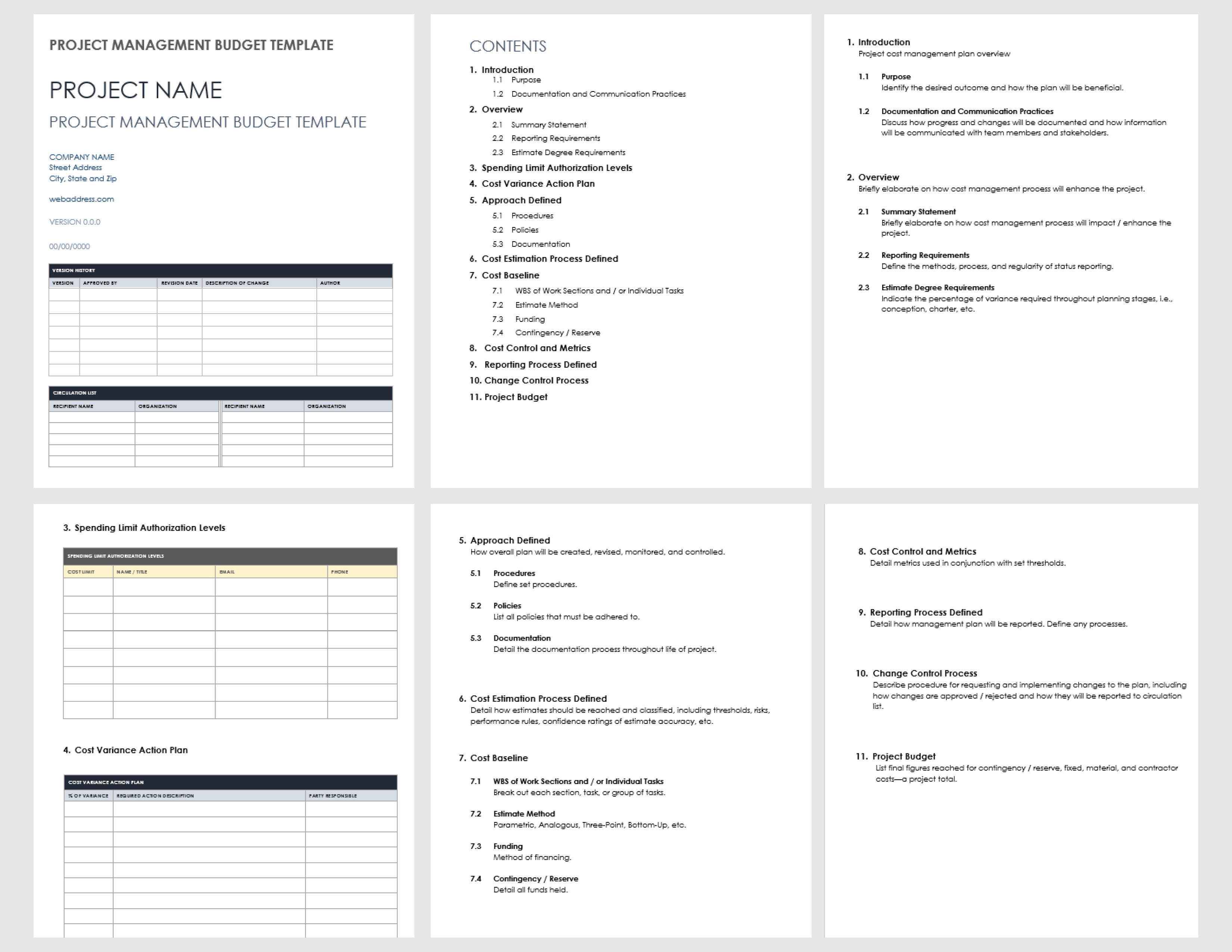

Project Management Budget Template

Download Project Management Budget Template Microsoft Word | Adobe PDF | Google Docs

Use this template to stay on top of your project budget and ensure that you, your team, and all other project stakeholders have easy access to the project’s financial details. This advanced project budgeting template offers space for you to define your project’s purpose, reporting requirements, spending limit authorization levels, cost variance action plan, cost estimation process, cost baseline, work breakdown structure (WBS), cost control and metrics, change control process, and total project budget. This detailed template helps you monitor your estimated and actual budget amounts in order to successfully launch and manage the project.

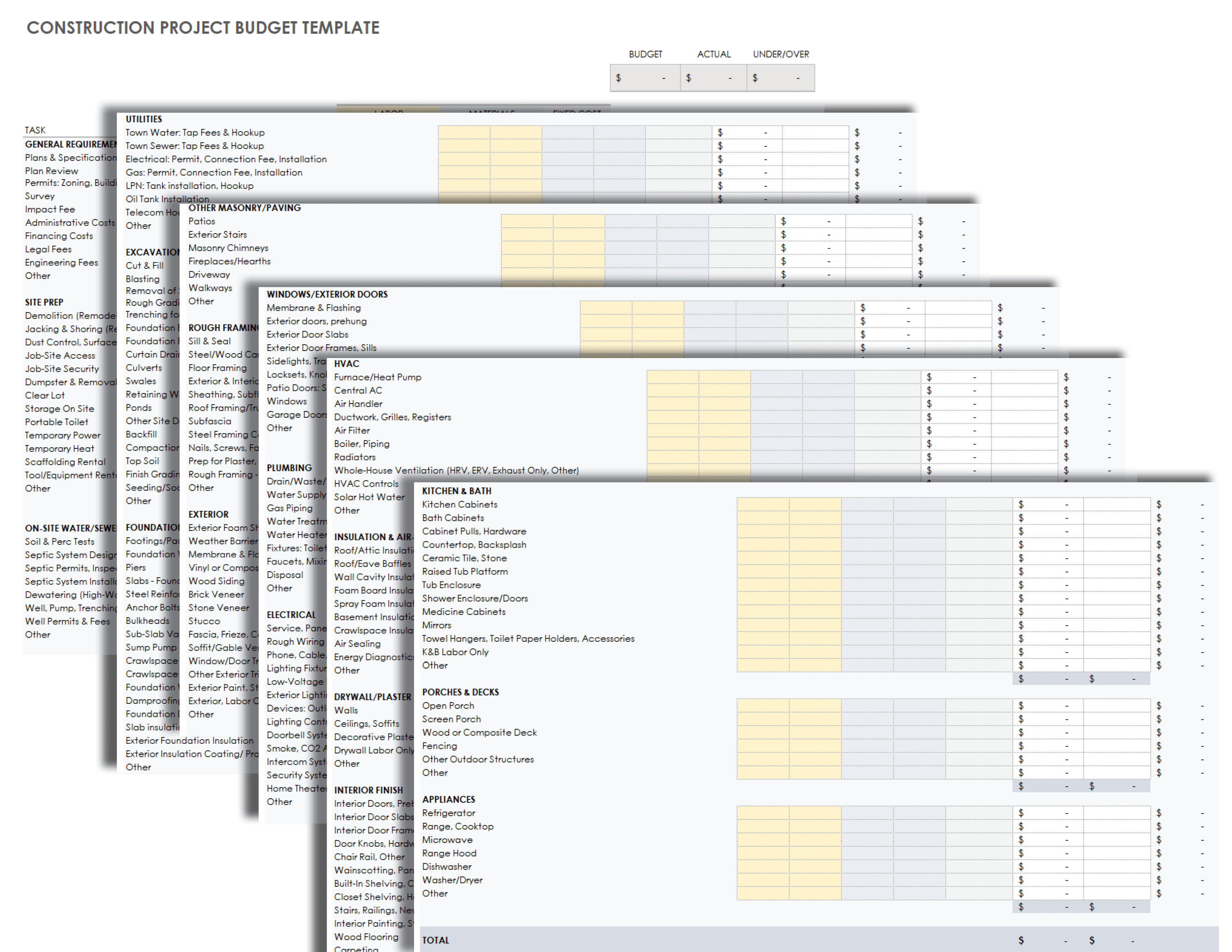

Construction Project Budget Template

Download Construction Project Budget Template Microsoft Excel | Google Sheets

Use this construction project budget template to break down construction task costs by general requirements, site prep, on-site water or sewer, utilities, excavation and earthwork, foundation, rough framing, electrical, and all the other construction stages. Enter labor costs for each task or subtask hours and rate) and materials (quantity and cost) to determine your project’s budgeted and actual amount, and by how much you’re over or under budget. Customize this template to reflect your unique construction project tasks and needs.

Read our guide on construction budgeting to find more construction-budgeting resources, and to ensure that you hit your budget goals.

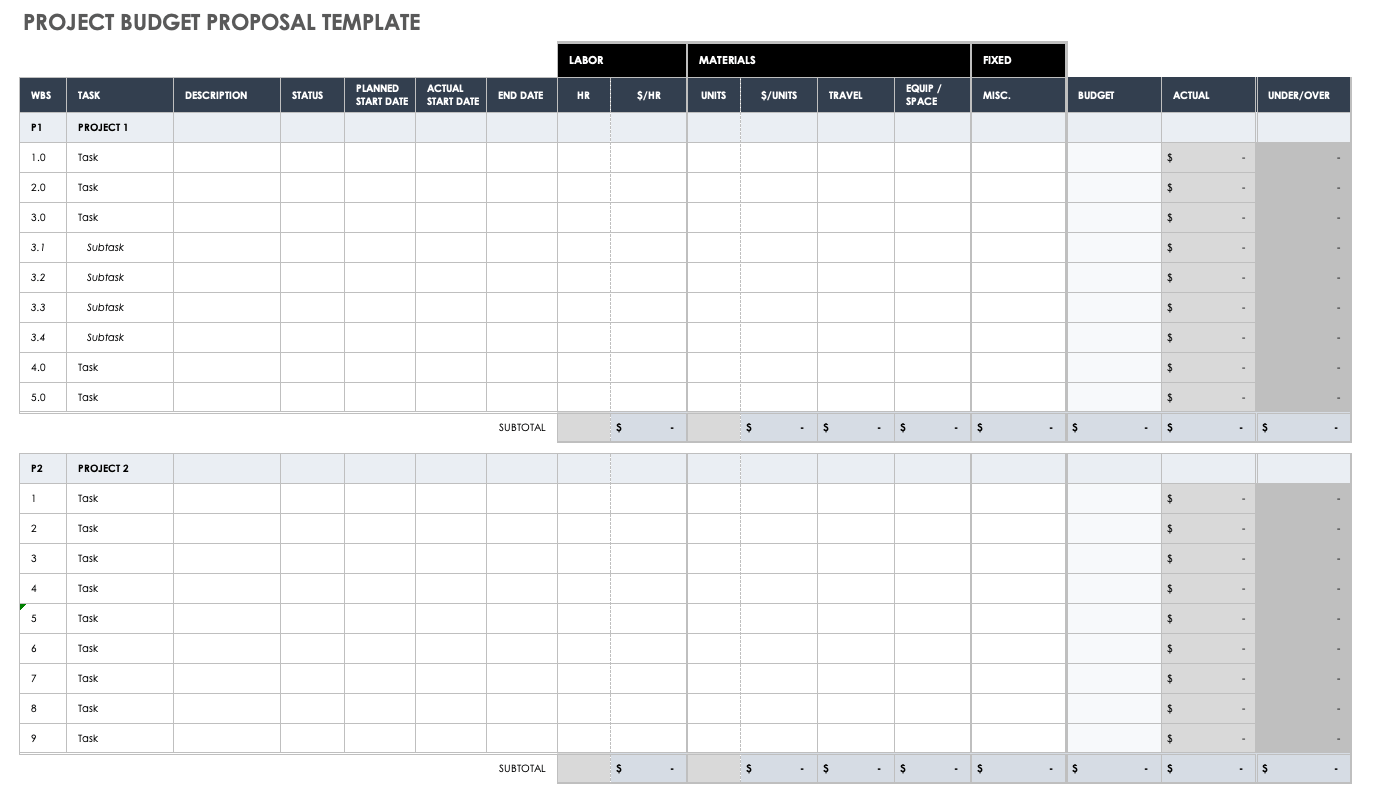

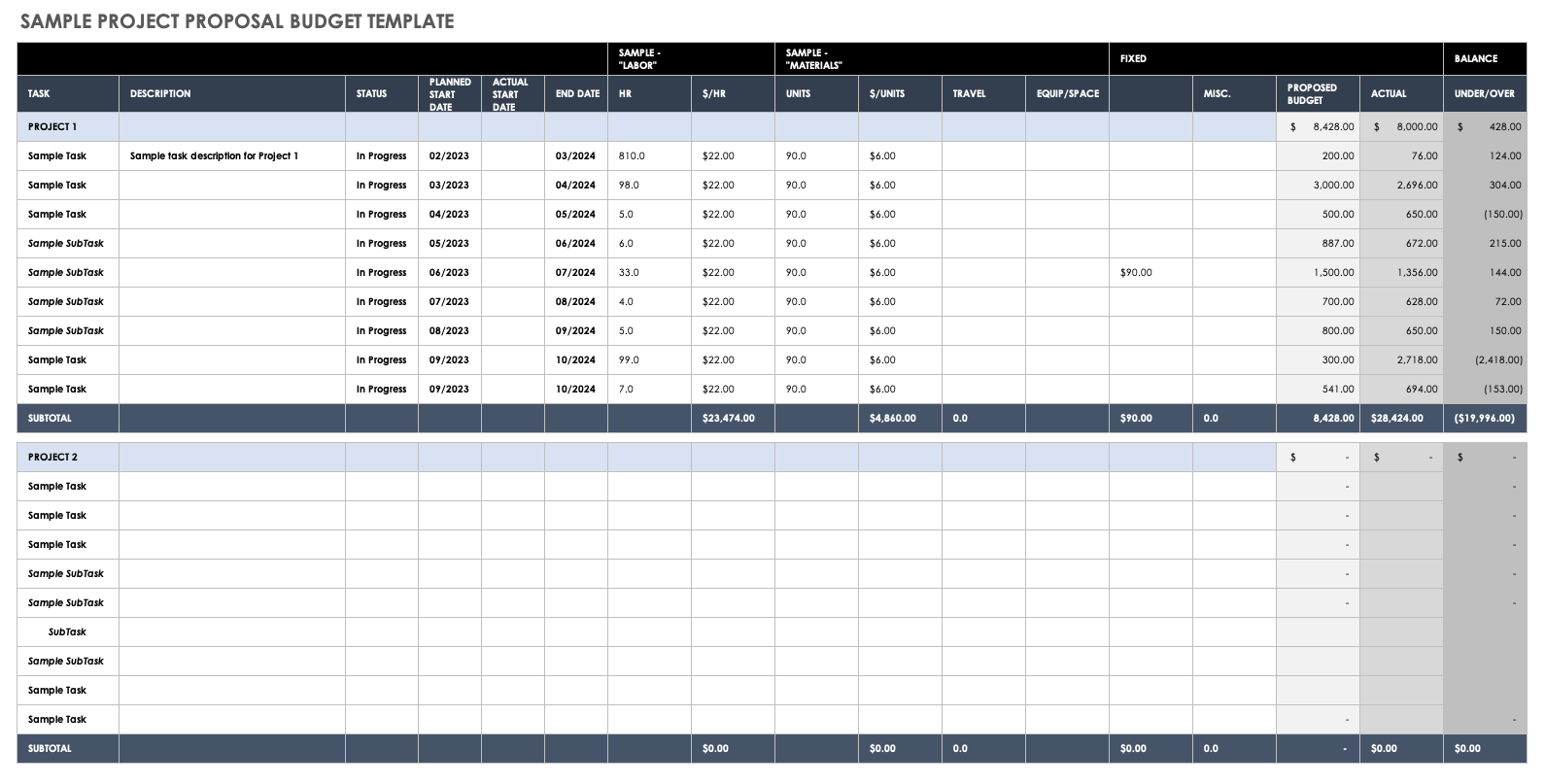

Project Proposal Budget Template

Download Project Proposal Budget Template Microsoft Excel | Google Sheets

Use this comprehensive project proposal budget to account for the costs of every task in your proposed budget. For each task, enter a unique WBS, a description, status, planned and actual start dates, targeted end date, labor and materials costs, and budgeted amount. Then, enter the actual amount spent to complete each task, and view the under/over amount and make any necessary adjustments. Use this tool to anticipate the differences between your proposed and actual budget, and to adapt accordingly.

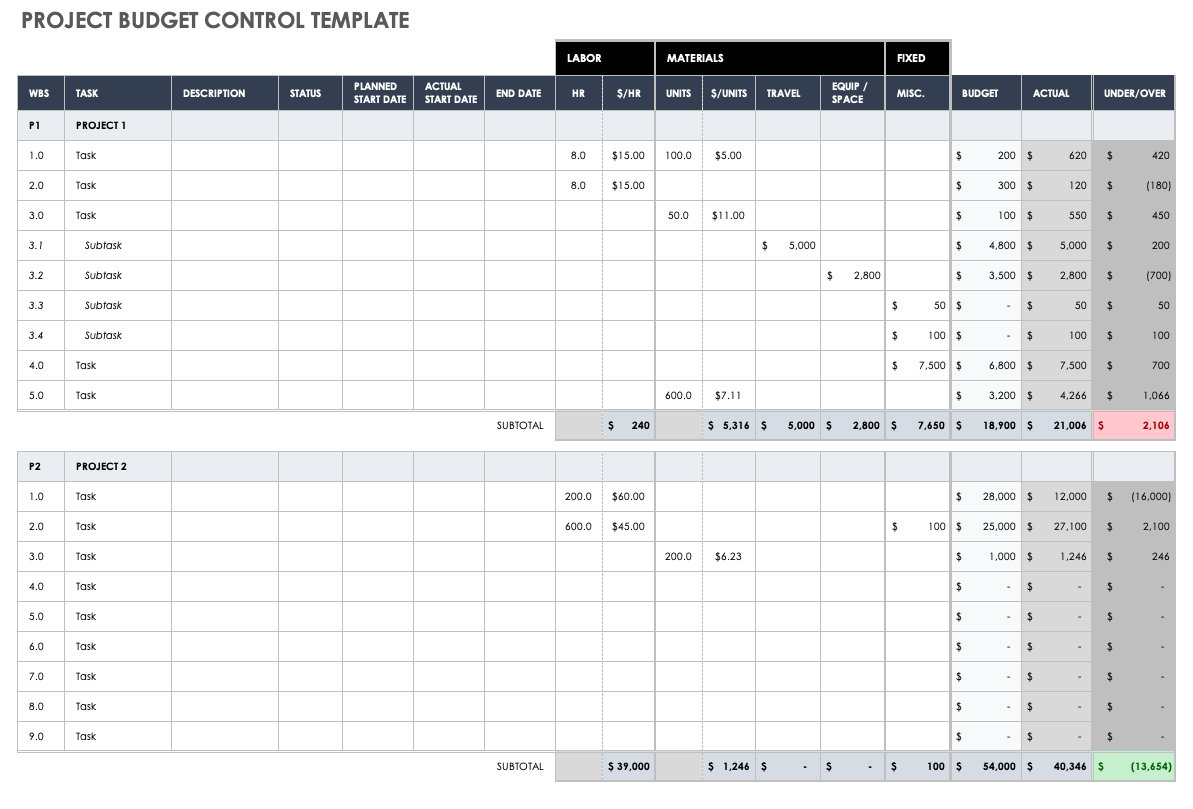

Project Budget Control Template

Download Project Budget Control Template — Microsoft Excel

Keep an accurate budgeting record and tight control of project-related spending with this unique project budget control template. Enter line-by-line tasks and subtask costs, and the template will automatically calculate subtotals to reflect whether your individual components — as well as the project as a whole — are over or under budget. You can use this simple project budget control template to control costs for a single project, related projects, original project budget figure comparison, or multiple projects.

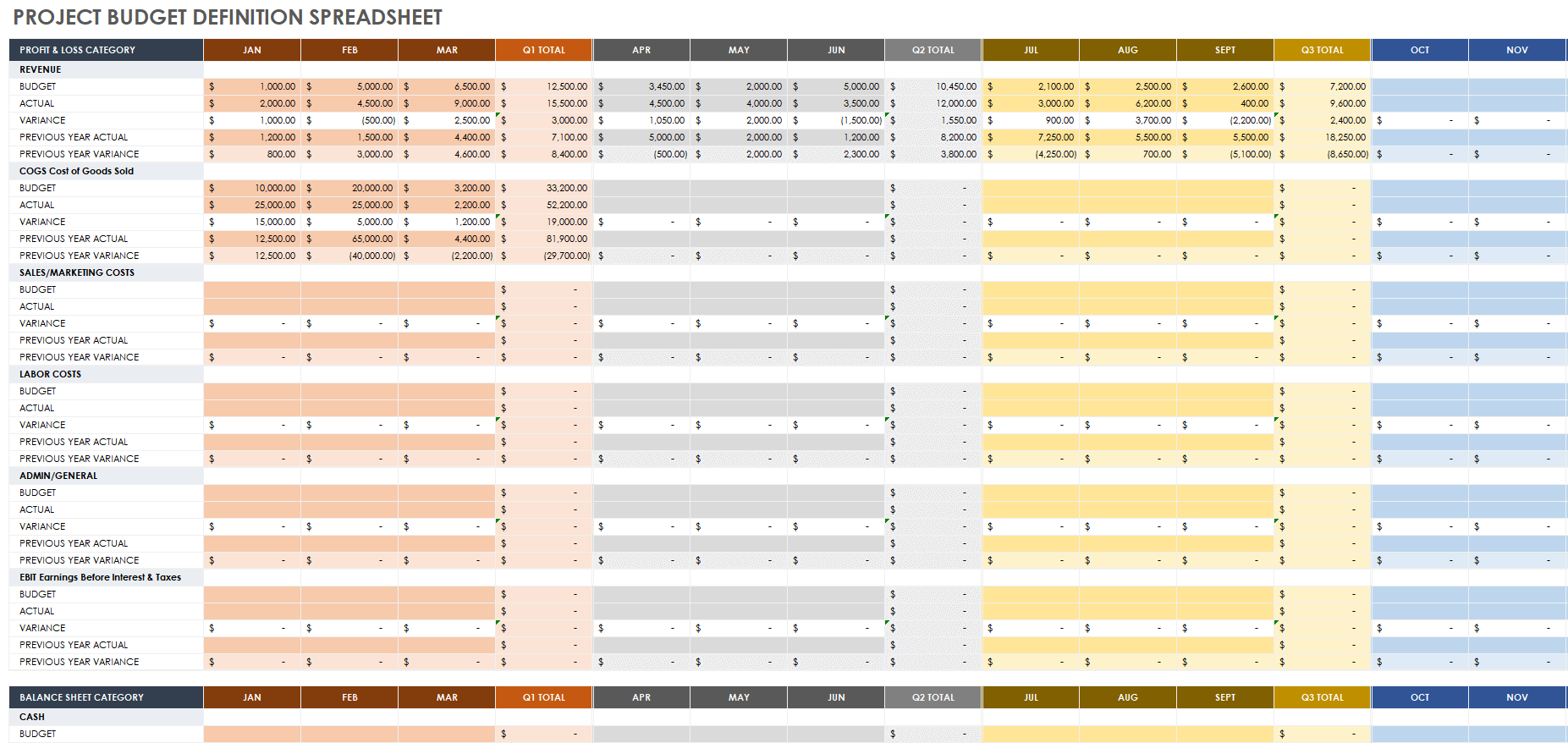

Project Budget Definition Spreadsheet

Download Project Budget Definition Spreadsheet Microsoft Excel | Google Sheets

In order to create a successful project-specific budget, you need a customizable blueprint to account for all of the components. Use this project budget definition template to list a project’s profit and loss (P&L) components, including revenue, cost of goods sold (COGS), labor costs, and more. Under Balance Sheet Category , list cash (budgeted, actual, and variance), inventory, net fixed assets, long-term debt, and other financial factors. The template provides you with a month-by-month, quarter-by-quarter, and annual insight into your project’s planned or implemented budget.

Sample Project Proposal Budget Template

Download Sample Project Proposal Budget Template Microsoft Excel | Google Sheets

Take the guesswork out of creating a project proposal budget with this sample template. The template includes sample text that guides you through the project budget creation process, along with sample labor, materials, and fixed costs; it also prompts you to assign individual task statuses, labor costs, proposed start and end dates. Use the pre-filled, editable task and subtask line-item amounts to determine whether you’re over or under your proposed budget, and how you might adjust to ensure that your proposed project comes in under budget.

Project Expense Tracking Template

Download Project Expense Tracking Template Microsoft Excel | Google Sheets | Smartsheet

Use this project expense tracking template to ensure that you proactively account for all of your project expenses, so that any shortfalls don’t risk your project’s success. This template includes customizable budget-component categories, auto-tallying materials and labor sections, space to note budgeted versus actual amount for each budget component, and the over/under amount. Propose and track the expenses for each individual task, and keep an eye on how each of these variables affect your project’s bottom line.

Read our project cost templates article to find additional templates and learn more about getting the most out of your project budgeting.

Multiple Project Budget Gantt Chart Template

Download Multiple Project Budget Tracking Template — Excel

Manage multiple projects at once with this Gantt chart template, which provides a project budget that’s unique for each individual. Guide team members and project sponsors through your financial details with this dynamic template, which includes example text and a visually rich Gantt chart that lists your projects’ over/under figures. Compare project-by-project budgets, or adjust figures for an individual project to ensure that you’ve adequately budgeted for your proposed project and are prepared for successful execution.

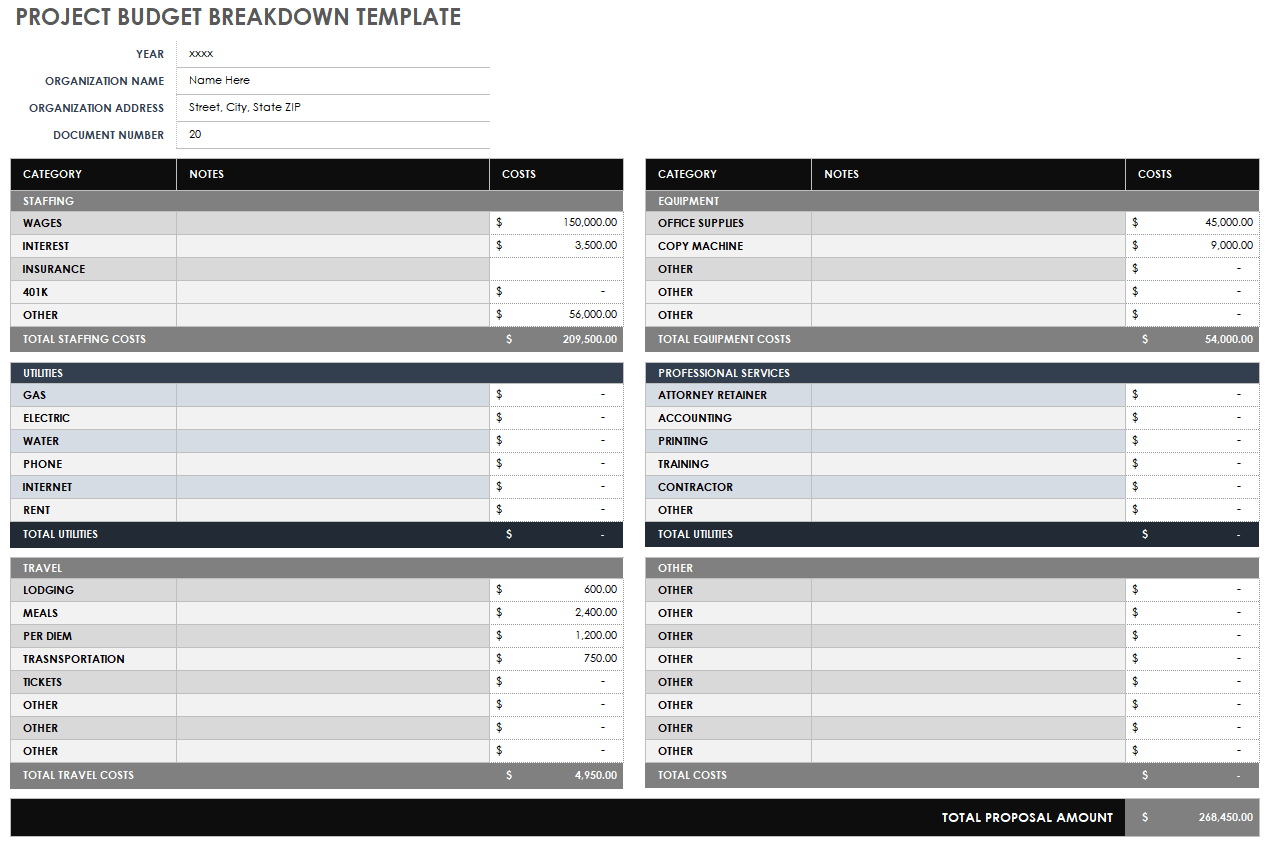

Project Budget Breakdown Template

Download Project Budget Breakdown Template Microsoft Excel | Adobe PDF | Google Sheets

Keep tabs on your project’s proposed versus actual budget with this easy-to-use project budget breakdown template. This fully customizable template enables you to accurately estimate the cost of each project category, review category subtotals, and then compare the total budgeted amount with your allotted budget.

What Is a Project Budget Template?

A project budget template is a tool that project managers use to estimate, implement, and gauge projected versus actual project costs. Use a template to track the project budget at the tasks level and identify your budget projections.

A project budget template takes the guesswork out of budgeting for projects, so that you have an accurate financial picture of all project-related costs and can identify how the costs of every project facet affect the big picture of your allotted budget. A project budget template can also alert you when tasks run over budget, so that you can adjust costs or other expenditures to stay within project budget.

A project budget template provides insight into the accuracy of anticipated expenditures and revenue sources so that you can use the template to justify any project-related cost adjustments to successfully execute the project.

A strong project proposal template will typically include the following sections to account for all of your proposed expenses:

- Actual: Enter the actual cost of each budgeted task.

- Budget: Review the budgeted amount for each individual task.

- Category: Enter category names for each task series or each subtask for your project’s budget.

- Fixed Amounts: Enter the fixed costs for each task.

- Labor: Enter each budgeted task’s projected hours and hourly rate.

- Materials: Enter task units, cost per unit, travel-related costs, and costs per piece of equipment or required office or work space.

- Project Title: Enter a title for the project and the projected and implemented tasks plan to track.

- Subtotal: Review the combined under/over amounts to determine your subtotal and assess whether your project is within budget.

- Task: Enter each budgeted task, a WBS number, a description, status (e.g., not started, in progress, completed), anticipated and actual start dates, and a proposed end date.

- Under/Over: Review each task’s under/over amount to determine any discrepancies between budgeted and actual task amount, and make adjustments accordingly.

Streamline Budgeting with Smartsheet for Project Management

From simple task management and project planning to complex resource and portfolio management, Smartsheet helps you improve collaboration and increase work velocity -- empowering you to get more done.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover a better way to streamline workflows and eliminate silos for good.

National Budget Analysis

Executive summary

A government budget is a legal document that is often passed by the legislature, & approved by the chief executive-or president. For example, only certain types of revenue may be imposed & collected. Property tax is frequently the basis for municipal & county revenues, while sales tax or income tax are the basis for state revenues, & income tax & corporate tax are the basis for national revenues.

The two basic elements of any budget are the revenues & expenses. In the case of the government, revenues are derived primarily from taxes. Government expenses include spending on current goods & services, which economists call government consumption; government investment expenditures such as infrastructure investment or research expenditure; & transfer payments like unemployment or retirement benefits.

Introduction

THE announcement of the budget is an important event in a country’s political and economic calendar. In Bangladesh, public focus on the budget is still confined to a few weeks in June. The incumbent politicians and allied pundits hail the document as visionary and pro-people, the opposition denounces it as anti-poor and anti-people, and then, after a few weeks, nothing more is heard of it.

This is not conducive to democratic policymaking. With little review of the previous year’s budget, there is little accountability for the government if it fails to implement what was announced, or change course if announced policies produce undesirable outcomes. By requiring the finance minister to regularly update the parliament on budget implementation, the Public Moneys and Budget Management Act, 2009 should improve both the economic policy and our democratic culture

Objective of the report

There are various objectives of report, so some important objectives are as follows:

1.To gather practical experience on the national budget used in our country.

2.To get involved in real projects related with our economy.

3.To obtain more knowledge about the budget influencing factors.

4.To findout the ways of making the budget more efficient.

Methodology

Data are collected from two sources.

- Primary data

- Secondary data

For doing the job, we took the help of the Financil ministry official website. Then we took the help of our text and analyzed the national budget for last three years. We also went to Bangladesh Bank and collected information from the library

National Budget

A government budget is a legal document that is often passed by the legislature, & approved by the chief executive-or president. For example, only certain types of revenue may be imposed & collected. Property tax is frequently the basis for municipal & county revenues, while sales tax &/or income tax are the basis for state revenues, & income tax & corporate tax are the basis for national revenues.

GOVERNMENT REVENUE

Government revenue includes all amounts of money received from sources outside the government entity. Large governments usually have an agency or department responsible for collecting government revenue from companies & individuals.

Government revenue may also include Reserve Bank currency which is printed. This is recorded as an advance to the retail bank together with a corresponding currency in circulation expense entry. The income derives from the Official Cash rate payable by the retail banks for instruments such as 90 day bills. There is a question as to whether using generic business based accounting standards can give a fair & accurate picture of government accounts in that with a monetary policy statement to the reserve bank directing a positive inflation rate the expense provision for the return of currency to the reserve bank is largely symbolic in that to totally cancel the currency in circulation provision all currency would have to be returned to the reserve bank & cancelled.

GOVERNMENT EXPENDITURE

Government spending or government expenditure is classified by economists into three main types. Government acquisition of goods & services for current use to directly satisfy individual or collective needs of the members of the community is classed as government final consumption expenditure. Government acquisition of goods & services intended to create future benefits, such as infrastructure investment or research spending, is classed as government investment (gross fixed capital formation), which usually is the largest part of the government gross capital formation. Acquisition of goods & services is made through own production by the government (using the government’s labor force, fixed assets & purchased goods & services for intermediate consumption) or through purchases of goods & services from market producers. Government expenditures that are not acquisition of goods & services, & instead just represent transfers of money, such as social security payments, are called transfer payments.

To ensure consistency between a national accounts logic expressed in the sequence of accounts (production, generation, distribution, redistribution & use of income, accumulation & financing) & a government budget perspective (government spending & receipts), two additional concepts are defined to national accounts categories:

AN OVERVIEW OF NATIONAL BUDGET IN BANGLADESH

Government forecast of a government’s expenditures & revenues for a specific period of time. The period covered by a budget of the government of Bangladesh is a financial year that starts on 1 July of a calendar year & ends on 30 June of the next calendar year. Government budget contains the strategies for mobilization, allocation & disbursement of public money by means of fiscal & monetary operations with due consideration of political, economic, & bureaucratic decision making process. It developed in Bangladesh on the basis of legal requirements, economy’s management needs, conventions, functional conveniences as well as accounting & auditing requirements, including transparency & accountability.

The Constitution of Bangladesh, however, does not use the term budget. Instead, it uses an equivalent term ‘Annual Financial Statement’, which is to show the estimated receipts & expenditures of the government for a particular financial year. Government budget in the country has two parts: Revenue & Development. The former is concerned with current revenues & expenditures ie, maintenance of normal priority & essential services, while the latter is prepared for development activities. Formulation of the two budgets follows different procedures. Their financing pattern & the delegated authorities of incurring expenditure in different tiers in them are also different. Receipts in revenue budget are: domestic receipts (tax & non-tax); foreign grants; capital receipts (foreign loans); domestic capital (net of current receipts & expenditures in public accounts); extra-budgetary resources (debenture of autonomous bodies, their self-financing & accumulated balance, & materials at stock); & domestic loans & advances (net).

Receipts in development budget are grouped as public & private receipts. Public receipts are the revenue surplus (revenue receipts minus revenue expenditures), incomes through new measures (such as new taxes), net domestic capital, & extra budgetary resources. A special form of public receipts is the foreign aid (project aid, counterpart fund from commodity aid & net food aid). Receipts under the private head for development budget are generated through direct private investment, borrowing from banking system & foreign private investment. Revenue budget is prepared by the Finance Division & the agency to prepare the development budget is the Planning Commission.