Price Discrimination

Definition – Price discrimination involves charging a different price to different groups of people for the same good. For example – student discounts, off peak fares cheaper than peak fares.

Different Types of Price Discrimination

1. First Degree Price Discrimination

This involves charging consumers the maximum price that they are willing to pay. There will be no consumer surplus.

2. Second Degree Price Discrimination

This involves charging different prices depending upon the choices of consumer. For example quantity, time period, collecting coupons

- After 10 minutes phone calls become cheaper.

- Electricity is more expensive for the first number of units. For a higher quantity of electricity consumed the marginal cost is lower.

- Loyalty cards reward frequent buyers with discounts on future products.

- If you collect coupons from a newspaper you can get a discount.

2nd-degree price discrimination is sometimes known as ‘indirect price discrimination’ because the firm allows consumers to choose which price they will pay. Some choices are offered cheaper because they impose costs on consumers (e.g. collecting coupons, buying in bulk or unsocial hours.

3. Third Degree Price Discrimination – ‘Group price discrimination’

This involves charging different prices to different groups of people. For example:

- Student discounts,

- Senior citizen railcard

- Peak travel/ off-peak travel

- Cheaper prices by the time of the day (e.g. happy hour’s in pubs – usually earlier on in evening where demand is lower.

More on third-degree price discrimination

3rd degree price-discrimination is sometimes known as direct price discrimination. Because a firm directly sets different prices depending on distinct groups of consumers (e.g. age)

Product versioning

One way firms practise price discrimination is to offer slightly different products as a way to discriminate between consumers ability to pay. For example:

- Priority boarding tickets. Same flight but for a premium, you get a shorter queue.

- Organic coffee / fair trade coffee

- Extra legroom on aeroplanes

- First-class/second class

This is a form of indirect segmentation. By offering slightly different choices, the firm is able to separate consumers who are willing to pay higher prices.

Conditions necessary for price discrimination

Firm is a price maker. The firm must operate in imperfect competition; it must be a price maker with a downwardly sloping demand curve.

Separate markets . The firm must be able to separate markets and prevent resale. E.g. stopping an adults using a child’s ticket. Prevent business travellers from buying discount tickets.

Different elasticities of demand . Different consumer groups must have elasticities of demand. E.g. students with low income will be more price elastic and sensitive to price. Business travellers will have more inelastic demand.

- Low admin costs . It must be relatively cheap to separate markets and implement price discrimination.

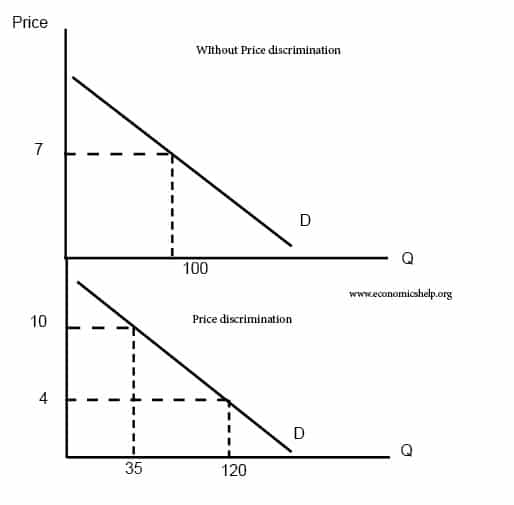

Simple diagram for Price Discrimination

WIth price discrimination, the firm can charge two different prices:

- £10 * 35 = £350

- £4 * 120 = £480

Total revenue = £830. Therefore, the firm makes more revenue under price discrimination.

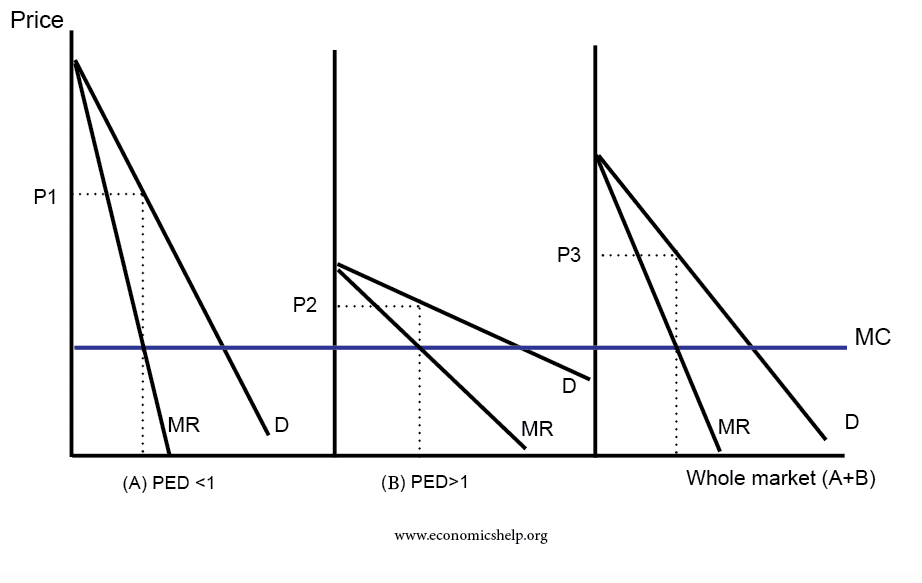

Profit maximisation under Price Discrimination

To maximise profits a firm sets output and price where MR=MC. If there are two sub markets with different elasticities of demand. The firm will increase profits by setting different prices depending upon the slope of the demand curve.

- Therefore for a group, such as adults, PED is inelastic – the price will be higher

- For groups like students, prices will be lower because their demand is elastic

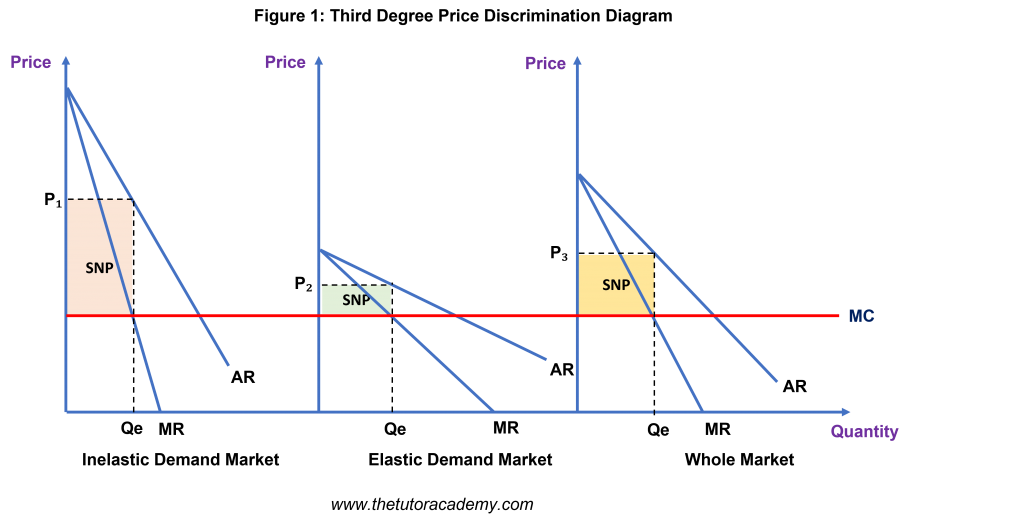

Diagram of Price Discrimination

Profit is maximised where MR=MC. WIthout price discrimination, there would just be one price set for the whole market (A+B). There would be a price of P3.

- However, price discrimination allows the firm to set different prices for segment A (inelastic demand) and segment B (elastic demand)

- Because demand is price inelastic, segment (A) will have a higher profit maximising price (P1)

- In segment (B) demand is price elastic, so the profit maximising price is lower.

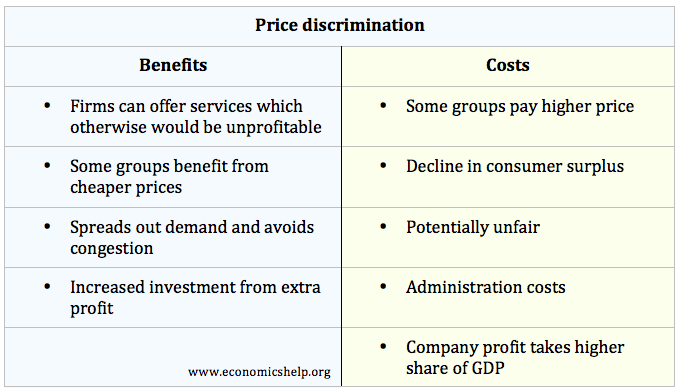

Advantages of price discrimination

Firms will be able to increase revenue . Price discrimination will enable some firms to stay in business who otherwise would have made a loss. For example price discrimination is important for train companies who offer different prices for peak and off-peak. Without price discrimination, they may go out of business or be unable to provide off-peak services.

Increased investment . These increased revenues can be used for research and development which benefit consumers

Lower prices for some . Some consumers will benefit from lower fares. For example, old people benefit from lower train companies; old people are more likely to be poor. Also, customers willing to spend time in researching ‘special offers’ and travelling at awkward times will be rewarded with lower prices.

- Manages demand . Airlines can use price discrimination to encourage people to travel at unpopular times (early in the morning) This helps avoid over-crowding and helps to spread out demand.

Disadvantages of Price Discrimination

Higher prices for some . Under price discrimination, some consumers will end up paying higher prices (e.g. people who have to travel at busy times). These higher prices are likely to be allocatively inefficient because P > MC.

Decline in consumer surplus . Price discrimination enables a transfer of money from consumers to firms – contributing to increased inequality.

Potentially unfair . Those who pay higher prices may not be the poorest. For example, adults paying full price could be unemployed, senior citizens can be very well off.

Administration costs. There will be administration costs in separating the markets, which could lead to higher prices.

Predatory pricing . Profits from price discrimination could be used to finance predatory pricing .

Importance of marginal cost in price discrimination

In markets where the marginal cost of an extra passenger is very low, the firm has an incentive to use price discrimination to sell all the tickets. This is why sometimes prices for airlines can be very low just before their date. Once the company is due to fly the MC of an extra passenger will be very low. Therefore this justifies selling the remaining tickets at a low price.

- Examples of price discrimination

- Student discounts on trains

- Discounts for buying train tickets in advance

- Discounts for travelling at off-peak time

- Lower unit cost price for buying high quantity.

- Phone deals which give 100 texts free.

- Initially, units of electricity are set at one tariff, but for higher quantity, price is lower.

Does price discrimination help the consumer?

Benefits and disadvantages of price discrimination

- Airline price discrimination

Price Discrimination Economics Essay

Price discrimination occurs when goods or services of identical nature retail at different prices from the same provider (Philips, 1983, p. 5). It can also be referred to as price differentiation. Price discrimination is characteristic of oligopolistic and monopolistic markets and it mainly makes use of market power.

Success of price discrimination depends on the separation of the markets, in this case, men and women and also young and senior citizens. There is likely to be minimal reselling between the two groups that are targeted by the grocery and the pub. Secondly, market demand must exhibit different elasticities.

For instance, the demand of beer among men and women and the demand of groceries among young and senior citizens must show different elasticities. Price discrimination has been used by retailers to attract a particular group of people that is likely to boost sales.

Its success is varied though there numerous cases of very high success. Theoretically, price discrimination is likely to succeed in a perfectly competitive market where there are perfect substitutes, perfect information and as well as minimal or no transactional costs (Keat & Young, 2006, p 307).

Price discrimination can be categorized into three levels; first degree price discrimination, second degree price discrimination and third degree price discrimination (Mankiw, 2008, p. 328). In first degree price discrimination, the seller or service provider has to identify the position of each customer on the demand curve and then use the information to impose a specific price.

In second degree price discrimination, blocks of goods and services attract different prices. The case above displays third degree price discrimination. Here, seller group customers to different markets and charge these respective markets different prices. Many demographic factors such as gender, age, and income are used in the segmentation. In the pub, the owners have grouped the market to men and women.

The grocery owner has grouped the market to young people and senior citizens. In some cases, third degree price discrimination exhibited in the cases above can be dependent on the location of the business. The business people that use price discrimination like the above case have more often than not differentiated the consumer base.

In the above case, the discrimination is effected to women and senior citizens’ advantage. The business owners recognize that men and young people will have varying willingness to pay for the goods than women and senior citizens.

Men and young people exhibit a more flexible price elasticity of demand compared to the groups that have the advantage because of budget constraints. The sellers in the above case realize that women and senior citizens can’t easily buy the goods without a lower price

It’s important to note that price discrimination does not always guarantee success. The sellers and service providers need quality market intelligence before embarking on such initiatives. While it can lead to surpluses, it can also easily make some groups of customers feel discriminated (Mankiw, 2008, p. 335). Fro that reason therefore, retailers must always ensure that the three most basic conditions are met.

The consumers that are targeted must exhibit considerable variance in their demand for the goods or services on offer. The firm or seller/provider of the goods and services must possess market power. Finally, the sellers or firm must be able to check or prevent arbitrage. When the above conditions are observed, it’s easier for any business or firm to successfully carry out price discrimination.

Keat, G.P. & Young, K.Y. (2006). Managerial economics: economic tools for today’s decision makers . New York: Pearson Prentice Hall.

Mankiw, N.G. (2008). Principles of economics . New York: Cengage Learning.

Philips, L.(1983). The economics of price discrimination . Cambridge: Cambridge University Press.

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2022, April 19). Price Discrimination Economics. https://ivypanda.com/essays/price-discrimination-essay/

"Price Discrimination Economics." IvyPanda , 19 Apr. 2022, ivypanda.com/essays/price-discrimination-essay/.

IvyPanda . (2022) 'Price Discrimination Economics'. 19 April.

IvyPanda . 2022. "Price Discrimination Economics." April 19, 2022. https://ivypanda.com/essays/price-discrimination-essay/.

1. IvyPanda . "Price Discrimination Economics." April 19, 2022. https://ivypanda.com/essays/price-discrimination-essay/.

Bibliography

IvyPanda . "Price Discrimination Economics." April 19, 2022. https://ivypanda.com/essays/price-discrimination-essay/.

- Cultural Field Trip Experiences at an Irish Pub

- Fork and Dagger Pub and Its Future Strategy

- Bread & Roses Pub's Social & Technological Factors

- The Shoe Inn Pub Analysis

- The Demand for Food in South Africa

- Organizational Behaviour: Teamwork in a Canadian Pub

- Managerial Economics Conceptions

- Elasticity and Its Importance for Business

- Torts Practice: Dwarf-Tossing Pub

- House Price Mosaic: Demand Elasticity in the Market

- Clear Hear Manufacturing: Fixed and Variable Costs

- Future of Islamic Finance

- The Fiscal and Monetary Policy and Economic Fluctuations

- Federal Open Market Committee (FOMC) Meeting

- Price Discrimination and Monopolistic Competition

Price Discrimination Notes & Questions (A-Level, IB)

Relevant Exam Boards: A-Level (Edexcel, OCR, AQA, Eduqas, WJEC), IB, IAL, CIE Edexcel Economics Notes Directory | AQA Economics Notes Directory | IB Economics Notes Directory

Price discrimination Definition: Price discrimination is defined as firms charging their consumers different prices for the same good.

Price discrimination Examples & Explanation: If you once took an Uber, you may have seen their surge pricing before. When that happens, you are taking the same taxi journey for double or even triple the price. This would be an example of price discrimination where producers charge consumers more, when they have a higher willingness to pay, despite the same good is being offered. This helps them maximise profits and results in a loss of consumer surplus . Another common example is charging different prices for child vs adult cinema tickets, so that cinemas can more fully monetise their capital/production (empty cinema seats). However, companies can only do so under a few conditions, such as having some degree of market power to set prices, and have consumers they can separate into groups with different price elasticities .

Price Discrimination Notes with Diagrams

You may not have realised but more online e-commerce sites are using algorithms to price discriminate, like Amazon or Google . As they understand your purchasing patterns by what you bought/viewed in the past, they know the highest price you are willing to pay for the product and charges you that! What’s even more troubling is if more sites operate these algorithms, they are likely to charge you a similarly price by colluding like an oligopoly and erase competition in the market to maximise their profits. Finally there are three main types of piece discrimination in theory: the first degree can be done by charging each consumer at different prices; adjusting prices according to the quantity purchased by consumers will be the second degree; where the third degree means to change prices depending on different consumer groups.

Price Discrimination Video Explanation – EconPlusDal

Price Discrimination Multiple-Choice & Essay Questions (A-Level)

Price discrimination in the news, related a-level, ib economics resources.

Follow us on Facebook , TES and SlideShare for resource updates.

You may also like

AQA A-Level Economics Syllabus

Please see the AQA A-Level Economics syllabus and curriculum below, extracted directly from the AQA A-Level specification for 2015 onwards. You can […]

Positive and Negative Externalities Notes & Questions (A-Level, IB)

Relevant Exam Boards: A-Level (Edexcel, OCR, AQA, Eduqas, WJEC), IB, IAL, CIE Edexcel Economics Notes Directory | AQA Economics Notes Directory | […]

Employment Notes (A-Level, IB)

Related Exam Boards: GCE A-Level, IB (HL), Edexcel (A2), OCR, AQA, Eduqas, WJEC Looking for revision notes, past exam questions and teaching […]

Consumer & Producer Surplus Notes (A-Level, IB)

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

COPYRIGHT © THE TUTOR ACADEMY LTD. www.thetutoracademy.com

Price Discrimination

- Revision Notes

Level: AS Levels, A Level, GCSE – Exam Boards: Edexcel, AQA, OCR, WJEC, IB, Eduqas – Economics Revision Notes

This is when firms are able to use their market power to charge consumers a higher price for the same good / service being provided.

Conditions necessary for Price Discrimination

- Price Maker – the firm engaging in price discrimination must be a Price Maker and should therefore possess a degree of market power

- Different Elasticities of Demand – there should also be different submarkets consisting of consumer groups with different price elasticities of demand

- Separate Markets – the cost of keeping markets separate should be less than the increased profit gained from doing so. Consumers must also be unable to move from one submarket to another

First Degree Price Discrimination

This occurs when a firm is able to charge the maximum price that consumers are willing to pay; hence resulting in no consumer surplus

Second Degree Price Discrimination

This occurs when consumers are charged different prices depending on the choices available to them. Some of these choice may include factors such as: quantity, time, positive customer loyalty.

Effectively, the consumers are in control of the price they pay as they pick the choice most preferable to them.

Third Degree Price Discrimination

This occurs when different prices are charged to different consumer groups for the same good / service. Examples of this include: student discounts, peak & off-peak travel, cheaper prices depending on the time of day – ‘happy hours at pubs / bars’.

Firms engage in Third Degree Price Discrimination when their demand is price elastic. They are likely to charge consumers higher prices when their demand is price inelastic to increase their sales and revenue.

Equilibrium occurs when MC = MR.

We can see the price is higher in the inelastic demand market. Firms will charger prices as they know consumers will continue to purchase their goods / services.

Price is lower in an Elastic Demand Market as the demand for products will decrease if prices were to rise.

Profit is also much higher in the inelastic demand market than in the elastic demand market and for the firm.

Advantages of Price Discrimination

- If consumers receive a lower price, they can benefit from a net welfare gain

- Positive externalities can be yielded as consumers which were previously excluded from accessing the good / service due to high prices, can now benefit from it at a lower price

- Firms making supernormal profit can use this to invest into innovation, R&D, and better quality goods / services

- Spare capacity can be used in a more efficient manner

Disadvantages of Price Discrimination

- Usually, consumers will experience a loss of consumer surplus as they may be faced with higher prices in the long run if the monopoly power of firms strengthen

- Since P > MC, there will also be a loss of allocative efficiency

- There may be a divide in the market which could limit the benefits they gain

Quick Fire Quiz – Knowledge Check

1. Define ‘Price Discrimination’ (2 marks)

2. Identify and explain the three conditions necessary for Price Discrimination to occur (6 marks)

3. Explain when First Degree Price Discrimination occurs (2 marks)

4. Explain when Second Degree Price Discrimination occurs (2 marks)

5. Explain when Third Degree Price Discrimination occurs (4 marks)

6. Identify two examples of Third Degree Price Discrimination (2 marks)

7. Using diagrams, explain the differences in price, quantity and profit for an inelastic demand market and an elastic demand market (10 marks)

8. Explain why the profit generated is greater in the inelastic demand market. (4 marks)

Next Revision Topics

- Perfect Competition

- Monopolistic Competition

- Natural Monopoly

- Contestability

A Level Economics Past Papers

Author: Tushar Depala

Economics Tutor

Price discrimination

Price discrimination is a common business strategy which attempts to increase (or maximise) profits by charging different prices for the same product. As well as help generate additional profits, price discrimination can help a firm achieve other business objectives, including gaining revenue and helping ensure survival.

There are various 'degrees' of price discrimination, including:

First degree discrimination

First degree discrimination means charging a different price for every good sold. If the firm discriminates with new prices it gains consumer surplus which it converts into producer surplus.

In this way producer surplus can be increased as more prices are added. But it is very difficult to apply in practice as it would involve a very complex calculation for price and it would be relatively easy for a consumer who pays a higher price to find ways round the strategy.

Information failure means that this policy is unlikely to work in practice.

Second degree discrimination

Second degree discrimination means charging different prices for different quantities – so, unit prices for single products will be higher than those contained in multi-packs.

Third degree discrimination

Third-degree discrimination is the most common type and occurs when different sub-markets can be identified.

Once identified, each sub-market must have a different PED. When PED is low and inelastic, profit maximising price is high.

But when PED is high and elastic, profit maximising price is much lower.

When sub-markets can be kept apart, say through time or place, discrimination is possible, as with peak-time travel tickets which are sold at higher prices than off-peak tickets.

In this example, profits from separating a market into an inelastic submarket and an elastic one - are greater than from combining the market. For convenience, MC is assumed constant, and equal to AC – profit maximisation in each market is where the MR for each sub-market equals the ‘common’ MC.

Here, super-normal profits ‘X’ plus ‘Y’ are greater than ‘Z’ – so price discrimination is beneficial.

Criteria for successful discrimination - summary

Price discrimination can be a successful profit maximising strategy when the following conditions are met:

- Sub-markets can be clearly identified .

- Each sub-market must exhibit different price elasticity of demand.

- The must be an information gap - where those consumers paying the higher price are not aware that they could buy in a cheaper market, or if they are aware, cannot benefit from cheaper options.

- The costs of separating the sub-markets is small.

- Consumers cannot move from one sub-market to another.

- Firms have power as price makers - which means some monopoly (or monopsony) power.

Price discrimination is a very common strategy, and can be employed whenever the above criteria can be met. Public transport and energy supply are two common examples.

Rail and air operators can charge different prices according to date and time of travel, whether child or adult, and whether business or tourist 'class'.

However, not all of the price differences are pure discrimination - business and tourist class travellers are likely to experience a different quality of service, even though the travel aspect might be identical.

Energy suppliers can also differentiate according to time (peak and off-peak) an whether domestic or business users.

Try a quiz on price discrimination.

Perfect competition

More on perfect competition.

What are the disadvantages of oligopoly?

Game theory

How does game theory explain oligopoly?

Price Discrimination – A-level Economics Notes

Price discrimination means charging different consumers different prices for the same good.

First-degree price discrimination means every consumer faces a different price.

Second-degree price discrimination means consumers may get discounts for buying different amounts of the good; in other words, bulk-buying.

Third-degree price discrimination means different consumer groups face different prices for the same good. This could include discounts for students or pensioners for example or peak versus off-peak pricing.

Cinemas charge different prices for example Cineworld charges lower price to seniors, students and children compared to the price for adults.

Rail tickets – Student Railcards can offer a discount on trains.

Uber – at different times of day, there are different prices for Uber rides. There are also different prices for different qualities of vehicle (e.g. Uber Lux).

Apple – offers slightly different prices on some goods e.g. Macbooks to consumers in different countries.

Conditions necessary for price discrimination

To be able to conduct price discrimination, the following conditions need to be met:

- There are at least two groups with different price elasticities of demand.

- These groups can be separated. The firm can tell which consumers belong to which group and can prevent consumers pretending to be part of another group.

- The firm is a price maker, so they are able to charge different prices to different groups.

- Low administration and enforcement costs. Otherwise if these costs are high, then price discrimination could harm the firm’s profit overall.

This diagram below shows the case of third-degree price discrimination.

The left diagram shows the whole market. We assume the firm is a price maker, so marginal revenue and average revenue are downward sloping. We also assume constant marginal costs for simplicitly.

The left diagram shows the whole market. The firm maximises profit and sets quantity where MR=MC and so produces at price p1. This gives the price if the firm did not price-discriminate and is drawn over the other diagrams in red for comparison.

The middle diagram shows the group with the more elastic price elasticity of demand, so MR and AR are flatter. For example this could be the peak travel group in the case of on-peak, off-peak train tickets. These people could be more flexible about when they travel. In this case to maximise profits, the firm produces quantity q2 and price p2. This price is below the original price p1 when there is no price discrimination. So the elastic group is better off under price discrimination – they face a lower price and higher consumer surplus.

The right diagram shows the group with the more inelastic price elasticity of demand, so MR and AR are steeper. This could be the off-peak travel group in the case of train tickets. These people may be commuters and may be less flexible about when they can travel – they may need to get to work. Again to maximise profits, the firm produces quantity q3 at price p3. The new price with price discrimination is above the original price p1 under no price discrimination. This group is worse off under price discrimination, with a higher price and lower consumer surplus.

- Higher profits for firms. For the elastic group, lowering the price leads to higher revenues and profits (given constant marginal costs). For the inelastic group, raising the price will increase profits.

- More price-elastic group benefits from lower prices and sees higher consumer surplus.

- Higher profits could be reinvested into company to improve research and development and quality of product, benefitting consumers.

- The profits may also be used to support (“cross-subsidise”) loss-making parts of your company e.g. rural bus routes, benefitting even more people.

- If the poorer group has the more elastic PED, then price discrimination could reduce inequality.

- May help manage capacity. For example charging more for peak train use may lead to less overcrowding in trains at peak times, as some consumers switch to other off-peak travel times.

Disadvantages

- More price-inelastic group sees higher prices and reduced consumer surplus.

- The firm incurs costs from price discrimination from adminstration. Price discrimination may lower firms’ profits if administrative costs are too high.

- May be difficult in practice to prevent “seepage” – consumers can pretend to be part of another group to get a discount e.g. a student discount.

Other evaluation points

- The benefits of price discrimination depend on whether the necessary conditions hold.

- The impact on inequality depends on whether the group with more elastic PED is the poorer or the richer group.

- The benefit of higher profits depends on how those profits are used. Profits could go to dividends instead of investment. For Apple for example, roughly 25% of their profits go out as dividends.

Return to microeconomics notes

Latest Posts

- The economics of why people give gifts

- What economic theory says about immigration

- Why governments save some firms but not others

- 3 Economic Fallacies Explained

- How Did Amazon Grow So Big? 4 Key Economic Factors

Essay on Price Discrimination | Products | Economics

Here is an essay on ‘Price Discrimination’ for class 9, 10, 11 and 12. Find paragraphs, long and short essays on ‘Price Discrimination’ especially written for school and college students.

Essay on Price Discrimination

Essay Contents:

- Essay on the Desirability of Price Discrimination

Essay # 1. Meaning of Price Discrimination:

Generally a manufacturer charges one price for one product from all the customers but sometimes it happens that different prices are charged for the same product (or service) from different customers. This policy is commonly known as price differential or price discrimination policy.

ADVERTISEMENTS:

Mrs. John Robinson has defined price discrimination as follows. “The act of selling the same article, produced under a single control at different prices to different buyers is known as price discrimination”. According Prof. J.S. Bain, “Price discrimination refers strictly to the practice by a seller of simultaneously charging different prices to different buyers for the same goods.”

According to Spencer and Siegleman, “Differential pricing may be defined as the practice by a seller or charging different prices to the same or to different buyers for the same goods without corresponding difference in cost.”

Thus, price discrimination may be of various types such as individual price discrimination, geographical price discrimination use discrimination etc.

Essay # 2. Motives behind Price Discrimination:

From the seller’s standpoint, the differential price that result from the application of various discount structures and from product- line pricing may serve several purpose, it is, therefore (desirable to look first at the company’s structure of price discriminations in terms of its motives, which may be grouped follows:

1. Market Expansion:

Differential pricing that is designed encourage new users or new customers is a common goal product- line pricing, but it also extends over various phases of discount structure, depending upon the circumstances of a purchase by a new user.

2. Market Segmentation:

A major objective of price discrimination is to achieve profitable market segmentation when legal and competitive considerations permit discrimination. It permits the appropriation of the consumer’s surplus so that it accrues to the producer rather than to the consumer.

3. Implementation or Marketing Strategy:

The patterns of price differentials should implement the company’s overall marketing strategy. These price differentials should efficiently geared with other elements in the marketing programme to reach of the sectors the market selected by strategy. In doing so the job of a particular structure of discounts may be quite specific.

4. Reduction of Production Costs:

Differential prices can sometimes help solve problems of production. Seasonal or other forms of time-period discounts may be allowed partly for the purpose of regularising Output changing the timing of sale. For example, since electricity cannot be stored, classification of electric rates is designed to encourage off season users and penalizing users that contributed to peak.

5. Competitive Adaptation:

Differential prices are a major device for selective adjustment to the competitive environment. Discounts are often designed to match what competitors charge under comparable, conditions of purchase, in terms of net price to each customer class. When products are homogeneous, competitive parity is a compelling consideration.

Essay # 3. Conditions of Price Discrimination:

Price discrimination needs some conditions in the market.

They are as follows:

1. Existence or Monopoly:

Discrimination is possible only if monopoly exists and there is no competitor in the market or when the producers enter into agreement among themselves to sell the products at agreed prices.

2. Division or the Markets into Sub-Markets:

The market is distinctly divisible into various parts among which the product cannot be exchanged; examples are a home and a foreign market separated by governmental restrictions or by a tariff wall and the market for hair-cuts or a surgeon’s fees- in the former case domestic buyers cannot import the product at the low price and in the latter services are rendered to individuals personally.

3. Expenditure in Sub-Dividing the Market should not be More than the Expected Profit Increase from Price Discrimination:

Sometimes a monopolist has to incur some expenditure on keeping the sub-markets separate so that he can fix different prices in different sub-markets and the consumers are restrained from transferring the product from one sub-market to the other.

4. Consumer’s Ignorance:

When the consumers of one market are ignorant of the prices prevailing in the other markets, price discrimination can be successful.

5. Difference in Consumer’s Purchasing Power:

Variance in the purchasing power of the customers also helps in price discrimination. Non-price factors in such a situation pay to the producers.

6. Purchaser’s Irrational Feeling:

Some purchasers judge the quality of goods only by the high or low prices. There the policy of price discrimination can successfully be launched.

7. Geographical Distance and Tariff Walls:

Between two distant markets where the transportation charges make differences in the cost of the product, price discrimination can be practised easily.

8. Nature or Goods and Service:

Goods and services which are not transferable among buyers e.g., charging more from rich and less from poor by a doctor can be easily subjected to price discrimination.

9. Sale on Orders:

When the goods are produced on the specific instructions of the customers, price discrimination is possible. One customer does not know what is being charged from the other.

10. Product Differentiation:

Sometimes a monopolist’s market consists of rich and poor consumers. He takes advantage of the whims of the rich and offers the same production in a deluxe packing. Thereby he is able to charge a higher price from the richer section of consumers.

11. Govt. Sanction:

Sometimes government also permits the public utility services like the railway to charge different prices from different consumers, and different prices for the use of electricity by Individual and domestic purposes.

Essay # 4. Degrees of Price Discrimination:

Price discrimination is done only when elasticity of demand for the product is different for different buyers, the amounts demanded of the product differs at the same price i.e., the demand prices differ. Discrimination is designed to gain revenue by varying the price in term of the demand prices of the customers. On the basis of the limit to which a monopolist can go on charging different prices for his product from his customers, various degrees of discrimination were discussed by Professor A.C. Pigou.

(1) First Degree Discrimination:

In discrimination of the first degree the monopolist is supposed to know the maximum amount of money each consumer will pay for any quality. He then sets his prices accordingly and extracts from each consumer the entire amount of the consumer’s surplus. Such a monopolist, in Mrs. Robinson’s phrase, is a ‘perfect’ discriminator.

This is ‘perfect’ price discrimination because it is an extreme limiting case of the same. In practice, few monopolists can and actually do that. An example of limited discrimination of the type is to be found in the practice of doctors of varying the charges on their customers according to their income status.

A breeder of horses dealing individually with various buyers in different parts of the country, with a highly imperfect market and absence of knowledge on the part of each buyer of the prices being charged from other buyers, may be able to carry on perfect discrimination to a limited extent. Obviously, perfect discrimination is useful only in theory as a concept.

(2) Second Degree Discrimination:

It occurs where a monopolist sets different prices for different customers but does not fully exploit their potential demand prices; the monopolist captures only parts of his customer’s consumer’s surpluses. The schedules of rates typically charged by public utilities like railways can be regarded as form of second-degree discrimination.

(3) Third Degree Discrimination:

It means that the monopolist divides his customers into two or more classes or groups on the basis of the elasticity of their demand for the product, and charging a different price to each class of buyers. Each group is a separate market.

In discrimination, of the third degree, the monopolist makes some attempt to benefit from the differences in the elasticity of demand for the product on the part the different groups of buyers. This is the only type ordinarily possible and therefore we address ourselves to this type of discrimination in detail and study the price and output determination of such a monopolist.

Essay # 5. Desirability of Price Discrimination:

Price discrimination is generally hatred as an unpopular idea because justice is supposed to go with the concept of equality and similar treatment among all customers. Therefore, it is considered as anti-social, undesirable and unprofitable act.

But, now-a-days, it has become essential for the seller to create market for the goods taking into consideration the various factors such as economics, social, geographical location, availability of goods, available alternatives etc. Price discrimination is not anti-social, infact, it means charging reasonable prices from all sections of the buyers according to their capacity, status, elasticity of demand, etc.

Such differentiation helps the manufacturer in not only increasing the sale but serving the maximum members of the society.

In the following circumstances, price discrimination is very well justified:

(1) When Community’s Welfare is the Main Aim:

There are many public services which would not be available to the poor if there was no price discrimination. For example, electricity, water, doctor, education may be cited here.

(2) Operation of Public Utility Services: Such public utilities as railways, electric supply companies and water supply companies must be allowed to have price discrimination. This is because the price of the service has to be kept low.

For example, electric supply rates have to be low for industrial concerns and agricultural operations if we want to encourage industrialisation and agricultural development. This necessitates charging higher price from consumers who can pay, otherwise, costs will not be covered.

Related Articles:

- Price Discrimination: Definitions, Types, Conditions and Degrees

- Conditions under which Price Discrimination is Possible

- Price Discrimination: Kind, Effects and Evils | Monopoly

- Degrees of Price Discrimination | Monopoly

An Essay on Price Discrimination

Cite this chapter.

- Paul Milgrom

79 Accesses

1 Citations

The modern theory of price discrimination began with the work of Pigou (1920). Joan Robinson devoted two chapters of her book The Economics of Imperfect Competition (1969) to the problem of (‘third degree’) price discrimination. Her account examines the conditions that make price discrimination possible, presents a graphical analysis of the discriminating monopolist’s pricing decision which has become the standard textbook treatment, and ends with an inquiry into the consequences of price discrimination for both allocative efficiency and distributional equity. Although Pigou’s and Robinson’s contributions have proved of lasting value, the theory of price discrimination has by no means remained unaltered. 1

- Price Discrimination

- Participation Constraint

- Nash Bargaining Solution

- Incentive Constraint

- Business Traveller

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Unable to display preview. Download preview PDF.

You can also search for this author in PubMed Google Scholar

Editor information

Editors and affiliations.

University of Tennessee, USA

George R. Feiwel ( Alumni Distinguished Service Professor and Professor of Economics ) ( Alumni Distinguished Service Professor and Professor of Economics )

Copyright information

© 1989 George R. Feiwel

About this chapter

Milgrom, P. (1989). An Essay on Price Discrimination. In: Feiwel, G.R. (eds) The Economics of Imperfect Competition and Employment. Palgrave Macmillan, London. https://doi.org/10.1007/978-1-349-08630-6_10

Download citation

DOI : https://doi.org/10.1007/978-1-349-08630-6_10

Publisher Name : Palgrave Macmillan, London

Print ISBN : 978-1-349-08632-0

Online ISBN : 978-1-349-08630-6

eBook Packages : Palgrave Economics & Finance Collection Economics and Finance (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

- International

- Schools directory

- Resources Jobs Schools directory News Search

A-level Economics Price discrimination

Subject: Economics

Age range: 16+

Resource type: Lesson (complete)

Last updated

23 August 2020

- Share through email

- Share through twitter

- Share through linkedin

- Share through facebook

- Share through pinterest

A-level Economics lesson on price discrimination. Includes: Presentation on price discrimination Worksheet so students can see how a combined market can be divided into smaller markets (Price discrimination 10 people want to use the bus.pdf) Worksheet so students so students can see what the impact of price discrimination is on economic surplus (Price discrimination and economic surplus.pdf) Handout so students so students can identify different kinds of price discrimination, advatantages of price discrimination to producers and consumers and a case study to plan an essay response on the topic of price discrimination (Price discrimination.pdf)

Any suggestions/improvements/complaints please do comment and I will update it for future editions.

The font is OpenDyslexic - Free, OpenSource Dyslexia Typeface http://opendyslexic.org/

Creative Commons "Sharealike"

Your rating is required to reflect your happiness.

It's good to leave some feedback.

Something went wrong, please try again later.

clare_foster

Thank you so much for this!

Empty reply does not make any sense for the end user

Could you kindly link the answers to this?<br />

Which answers in particular are you looking for? All the answers you should need are in the slideshow, but I am happy to make a separate answer sheet if you let me know what you're looking for.

PAULEDWARDSMITH

What a thorough piece of work - plenty of effort clearly gone into this. It will certainly be of use for me. Many thanks for sharing this.

Report this resource to let us know if it violates our terms and conditions. Our customer service team will review your report and will be in touch.

Not quite what you were looking for? Search by keyword to find the right resource:

Final dates! Join the tutor2u subject teams in London for a day of exam technique and revision at the cinema. Learn more →

Reference Library

Collections

- See what's new

- All Resources

- Student Resources

- Assessment Resources

- Teaching Resources

- CPD Courses

- Livestreams

Study notes, videos, interactive activities and more!

Economics news, insights and enrichment

Currated collections of free resources

Browse resources by topic

- All Economics Resources

Resource Selections

Currated lists of resources

- Teaching PowerPoints

4.1.5.7 Price Discrimination (AQA A Level Economics Teaching Powerpoint)

Last updated 13 Sept 2023

- Share on Facebook

- Share on Twitter

- Share by Email

This editable and downloadable PowerPoint covers Price Discrimination which is most likely to happen in imperfectly competitive markets and especially monopoly.

Price discrimination is when a firm charges different prices to different customers for the same good or service. The firm will usually charge customers with different price sensitivities different amounts - customers who are less price-sensitive will be charged a higher price, while those who are more price-sensitive will be charged less. The goal of price discrimination is to maximize profits by extracting the most value from each customer. A common example is airline tickets, where business travelers might pay a higher price for tickets than leisure travelers. Another example is coupons - they're a way to offer discounts to price-sensitive customers while charging the full price to others.

Download this PowerPoint

- Price Discrimination

- Perfect price discrimination

- Third degree price discrimination

- Hurdle Model of Price Discrimination

- Dynamic Pricing

You might also like

Economics of price gouging after a natural disaster.

17th May 2011

Price gouging in Edinburgh

11th August 2008

Competition & Monopoly Revision Quiz

Quizzes & Activities

Explaining Consumer Surplus

Study Notes

Uber and Surge Pricing

24th December 2014

Monopoly - Price Discrimination

Monopoly - 3rd degree price discrimination, monopoly - price discrimination and economic welfare, our subjects.

- › Criminology

- › Economics

- › Geography

- › Health & Social Care

- › Psychology

- › Sociology

- › Teaching & learning resources

- › Student revision workshops

- › Online student courses

- › CPD for teachers

- › Livestreams

- › Teaching jobs

Boston House, 214 High Street, Boston Spa, West Yorkshire, LS23 6AD Tel: 01937 848885

- › Contact us

- › Terms of use

- › Privacy & cookies

© 2002-2024 Tutor2u Limited. Company Reg no: 04489574. VAT reg no 816865400.

- Share full article

Advertisement

Supported by

For Women’s Basketball, Caitlin Clark’s Lasting Impact May Be Economic

People have flocked to watch the Iowa star on TV and in person at a time when her sport is more valuable than it ever was before.

By Santul Nerkar

Caitlin Clark, the University of Iowa basketball player who has dazzled crowds with her deep shooting range and preternatural scoring ability, is one of the biggest draws in sports.

Tickets to her games this season were nearly 200 percent more expensive than they were last year, according to Vivid Seats, a ticket exchange and resale company. Fans routinely traveled hundreds of miles to catch a glimpse of her, lining up for hours before tipoff and boosting local economies.

Nearly 10 million people, a record, watched her play in last year’s championship game, a loss to Louisiana State. More than three million tuned in this year when she set the career record for points scored by a Division I college basketball player.

Now, as Ms. Clark prepares for her final N.C.A.A. tournament — No. 1-seeded Iowa plays its first game on Saturday — excitement has reached a fever pitch. It has some wondering if Ms. Clark’s effect on the popularity of women’s sports, and their economics, will linger after her career at Iowa ends.

Viewership, juiced by media rights deals, and corporate sponsorships are the key drivers of revenue for college and professional sports. In women’s sports, those have long lagged behind what men’s sports receive. In 2019, for instance, women’s sports programming accounted for less than 6 percent of coverage on ESPN’s “SportsCenter,” according to a study .

But in recent years, women’s sports have had significant growth. A November report from Deloitte projected that women’s sports would generate more than $1 billion in global revenue this year, up roughly 300 percent from the company’s estimate in 2021. Globally, the number of sponsorships in women’s professional leagues increased 22 percent in 2023, compared with a 24 percent increase in men’s sports, according to SponsorUnited, which tracks company sponsorships and deals.

“You do need women like Caitlin Clark who are so great that you can’t miss them,” said Michael Pachter, a tech analyst for Wedbush Securities.

Stars do make sports. The men’s national title game in 1979 between Magic Johnson’s Michigan State and Larry Bird’s Indiana State remains the most-watched college basketball game of all time. Both stars then entered the National Basketball Association, making the league more popular than it had ever been.

Before the Johnson-Bird N.B.A. era, the league’s finals were broadcast on tape delay. Today, the N.B.A. earns billions of dollars from its television deals, and star players make more than $60 million per season.

And as TV networks have tried to give viewers reasons to tune in during the streaming era, the rights to broadcast popular men’s sports, like football, hockey and basketball, have become expensive. That has spurred networks to lock in deals to broadcast sports, like women’s basketball, that don’t cost as much and whose viewership is projected to grow.

“The networks have run into an economic problem where they’re paying too much for the sports that they need to fill up their network space,” said Andrew Barrett, a managing director of STS Capital Partners who works in sports management. “You start to look at female sports because people will watch those.”

In January, the N.C.A.A. signed a deal with ESPN that valued the annual rights to broadcast the women’s basketball tournament at more than $60 million, more than 10 times what the network paid in the previous deal, in 2011.

The network pays $25 million to $33 million per year to broadcast some Women’s National Basketball Association games, while Scripps reportedly pays $13 million per year. The W.N.B.A.’s previous deal, solely with ESPN, was signed in 2013 for $12 million per year, according to Sports Business Journal . Annual revenue nearly doubled from $100 million in 2019 to around $200 million in 2023, according to Bloomberg.

“We’re not a charity,” Cathy Engelbert, the W.N.B.A. commissioner, said during a recent panel discussion with the law firm Kramer Levin. “We’re a real sports media and entertainment property.”

When Ms. Clark said she would forgo her final year of college eligibility to enter this spring’s W.N.B.A. draft, it had an immediate effect. The Indiana Fever, who are expected to select her with the No. 1 overall pick in April, saw a more than 200 percent increase in the average listed price of their season opener, according to Vivid Seats.

Ms. Clark’s success follows decades of progress for women in sports, dating to the 1972 passage of Title IX, which prohibits sex-based discrimination in educational settings and led to skyrocketing funding of — and participation in — women’s sports. The World Cup that the U.S. women’s soccer team won in 1999 spurred interest and investment at the youth level. Serena Williams changed the audience for tennis, and athletes like the racecar driver Danica Patrick and the fighter Ronda Rousey brought new viewers to their sports.

Andrew Zimbalist, a professor of economics at Smith College, said Ms. Clark’s success was “another event in a long line of events” that had boosted the acceptance of all women’s sports.

“There’s been a positive evolution since Title IX was passed in 1972,” Mr. Zimbalist said.

Unlike previous generations, Ms. Clark has been able to immediately reap the rewards of her fame because of an N.C.A.A. rule change in 2021 that allows college athletes to profit off their own name, image and likeness, including through product endorsements and sponsorship deals. Ms. Clark’s sponsorship deals — valued at $3 million, according to On3 , a site that tracks N.I.L. deals — means she earns more than most W.N.B.A. players. (Her projected base salary for her rookie season is $76,000.)

Ms. Clark is hardly the first female basketball star to generate intense interest. The W.N.B.A. was founded in large part because of the popularity of women’s college basketball. Storied programs like the University of Tennessee and University of Connecticut collected multiple championships and featured stars like Tamika Catchings, Chamique Holdsclaw, Candace Parker, Rebecca Lobo, Sue Bird and Diana Taurasi.

But the progress has come in fits and starts. In 1997, the W.N.B.A.’s inaugural season, average attendance was around 10,000. Three years later, the league expanded to 16 teams. In 2023, there were only 12 teams, and average attendance was less than 7,000. The 2023 finals averaged 728,000 viewers, an improvement from 2022 but fewer than the 2003 finals, which were watched by an average of 848,000.

Mr. Pachter said he didn’t think the audience for women’s basketball would reach hundreds of millions overnight. But he sees interest continuing to steadily grow, and can envision a future where a streaming service may try to own the exclusive rights to a league like the W.N.B.A. For that to happen, other stars need to step up to Ms. Clark’s level.

“You need three or four more, but they’re coming,” Mr. Pachter said. “They’re going to emerge because now we’re paying attention.”

Santul Nerkar is a reporter covering business and sports. More about Santul Nerkar

IMAGES

VIDEO

COMMENTS

A-level Economics "DISCUSS THE EXTENT TO WHICH PRICE DISCRIMINATION IS BENEFICIAL TO PRODUCERS AND CONSUMERS" ESSAY PLAN 1) Define. Price discrimination occurs when a seller charges different prices to different customers for exactly the same product. 2) Explain the benefits to the producer.

It must be relatively cheap to separate markets and implement price discrimination. Simple diagram for Price Discrimination. Without price discrimination, the firm charges one price £7 * 100 = £700 revenue. WIth price discrimination, the firm can charge two different prices: £10 * 35 = £350; £4 * 120 = £480; Total revenue = £830.

In this video we walk through an answer to a question about whether price discrimination helps or harms consumer welfare. We hope this is useful in showing how to build clear chains of reasoning and well-supported evaluation. ... A-Level Economics Essay Walkthrough. Level: A-Level, IB Board: AQA, Edexcel, OCR, IB, Eduqas, WJEC Last updated 1 ...

Third degree price discrimination occurs when a firm charges different prices to different consumers for the same good/ service, e.g. rail fares are priced differently depending on the time of travel. Third degreee markets are often sub-divided based on time, age, income and geographic location. Some airline ticket portals charge higher prices ...

Exclusively available on IvyPanda. Price discrimination occurs when goods or services of identical nature retail at different prices from the same provider (Philips, 1983, p. 5). It can also be referred to as price differentiation. Price discrimination is characteristic of oligopolistic and monopolistic markets and it mainly makes use of market ...

In this video we walk through an answer to a question about whether price discrimination helps or harms consumer welfare. We hope this is useful in showing h...

Board: This is an updated revision presentation of the economics of price discrimination as a pricing strategy for businesses in imperfectly competitive markets. Explain and evaluate the potential costs and benefits of monopoly to both firms and consumers, including the conditions necessary for price discrimination to take place.

4.1.5.7 Price Discrimination (AQA A Level Economics Teaching Powerpoint) Teaching PowerPoints. Price Discrimination and Consumer Welfare - A-Level Economics Essay Walkthrough Practice Exam Questions. Price Discrimination and Economic Welfare 29th November 2022. Dynamic Pricing: Ticketmaster pricing system criticised ...

Price discrimination Definition: Price discrimination is defined as firms charging their consumers different prices for the same good. Price discrimination Examples & Explanation: If you once took an Uber, you may have seen their surge pricing before. When that happens, you are taking the same taxi journey for double or even triple the price.

This page is about 'Price Discrimination' taken from AQA Economics Syllabus Topic 4.1. Learn economics alongside the AQA A-level Economics specification. Revise exactly what you need to know for the exam.

Answers > Economics > A Level > Article This question is a 25 mark question, it requires a variety of different skills and a strong structure to recieve the highest marks possible. This is a 'discuss' question therefore different arguments should be presented.

Level: AS Levels, A Level, GCSE - Exam Boards: Edexcel, AQA, OCR, WJEC, IB, Eduqas - Economics Revision Notes . Price Discrimination. This is when firms are able to use their market power to charge consumers a higher price for the same good / service being provided.

Price discrimination is a very common strategy, and can be employed whenever the above criteria can be met. Public transport and energy supply are two common examples. Rail and air operators can charge different prices according to date and time of travel, whether child or adult, and whether business or tourist 'class'.

OCR A Level Economics P. Smith. Popular books for Environment and Biology. ... Evaluate the view that because price discrimination enables firms to make more profit, firms but not consumers benefit from price discrimination. The essay provides in depth detail with diagrams that are well explained, there is excellent application of relevant ...

Price discrimination means charging different consumers different prices for the same good. First-degree price discrimination means every consumer faces a different price. Second-degree price discrimination means consumers may get discounts for buying different amounts of the good; in other words, bulk-buying.

Essay # 4. Degrees of Price Discrimination: Price discrimination is done only when elasticity of demand for the product is different for different buyers, the amounts demanded of the product differs at the same price i.e., the demand prices differ. Discrimination is designed to gain revenue by varying the price in term of the demand prices of ...

4.1.5.7 Price Discrimination (AQA A Level Economics Teaching Powerpoint) Teaching PowerPoints Price Discrimination and Consumer Welfare - A-Level Economics Essay Walkthrough

Illustrating Third Degree Price Discrimination. In order to illustrate third degree price discrimination diagrammatically, the different sub-market diagrams are placed side by side; The total market diagram is a combination of the sub-market diagrams The total profit is a combination of profits from the sub-markets; The diagram below illustrates the market for rail travel in the UK where ...

Section 3: Essay Style Questions The essay-style questions section offers more extensive prompts that require students to synthesize information, analyze real-world examples, and demonstrate a comprehensive understanding of the economic principles surrounding price discrimination in monopoly markets.

The modern theory of price discrimination began with the work of Pigou (1920). Joan Robinson devoted two chapters of her book The Economics of Imperfect Competition (1969) to the problem of ('third degree') price discrimination. Her account examines the conditions that make price discrimination possible, presents a graphical analysis of the discriminating monopolist's pricing decision ...

pdf, 523.17 KB. A-level Economics lesson on price discrimination. Includes: Presentation on price discrimination. Worksheet so students can see how a combined market can be divided into smaller markets (Price discrimination 10 people want to use the bus.pdf) Worksheet so students so students can see what the impact of price discrimination is on ...

Price discrimination essay plan. Introduction part 1. Assess the view that price discrimination is always damaging. Click the card to flip 👆. Price discrimination is the selling strategy that charges customers different prices for the same product based on their elasticities, pure price discrimination would result in each customer paying ...

This editable and downloadable PowerPoint covers Price Discrimination which is most likely to happen in imperfectly competitive markets and especially monopoly. ... 4.1.5.7 Price Discrimination (AQA A Level Economics Teaching Powerpoint) Level: A-Level Board: AQA Last updated 13 Sept 2023. Share : ...

Ms. Clark's sponsorship deals — valued at $3 million, according to On3, a site that tracks N.I.L. deals — means she earns more than most W.N.B.A. players. (Her projected base salary for her ...