- B2B Credit Application: The Ultimat...

B2B Credit Application: The Ultimate Guide to Strengthening Customer Onboarding

Table of Content

Key takeaways.

- A business credit application is a formal document that a company submits to a creditor when applying for a line of credit.

- In the past, business credit applications used to be sent in a physical form; however, today, businesses prefer online credit applications as they are more accessible.

- Manual credit applications can be time-consuming and lead to errors in information gathering.

- Automated credit applications can boost your credit management system, speed up customer onboarding, and reduce bad debt with real-time credit risk monitoring.

Introduction

In the B2B space, most businesses operate on credit; however, this system has its drawbacks. Granting credit without thoroughly assessing customers’ creditworthiness could be risky, especially for mid-sized companies. Just as a car requires fuel to run, a mid-sized business needs a healthy cash flow to survive. A single delinquent account can negatively impact your cash flow. Therefore, businesses must carefully evaluate credit applications from customers to reduce risk.

Credit applications have come a long way from paper applications to online applications, and today, many companies are choosing automated credit application processes to optimize their credit management.

Continue reading to explore the B2B credit application process, common challenges within it, steps to consider before granting credit, and more. Additionally, you can try out ready-made credit application templates to expedite the customer onboarding process and explore an automated credit application for your business.

What Is a Business Credit Application?

A business credit application is a formal document that a company submits to a creditor when applying for a line of credit. This application provides essential information about the business and its finances, helping the creditor evaluate the company’s creditworthiness and ability to repay the debt.

What is the purpose of a credit application?

The primary purpose of these credit applications is to compile necessary details from the customer, enabling an evaluation of their financials and gauging the inherent risk associated with extending credit to that particular business. Standard information included in a B2B credit application encompasses the business name, address, nature of operations, duration of business activity, financial specifics like revenue and cash flow, and credit references.

In some cases, the B2B credit application might outline credit terms and conditions, encompassing payment timelines, interest rates, and potential fees or penalties.

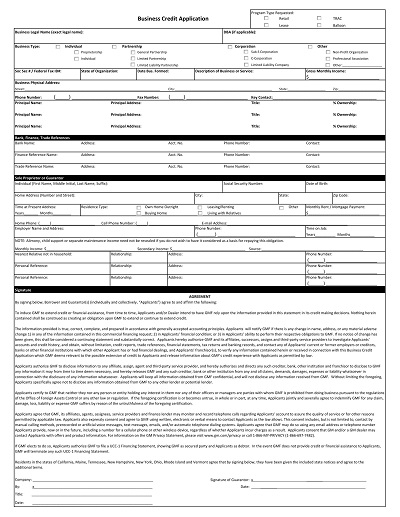

9 Key Elements to Create the Perfect B2B Credit Application

Creating the perfect credit application for businesses involves including crucial elements that gather comprehensive information while being user-friendly and efficient. Here are the key elements that you must have in your application:

Date of application: Specifying the date is essential to determine when the agreement begins.

Business information section: Provides basic identification details necessary to establish the identity and legal entity of the business.

Legal name of the business

Business address (headquarters and any additional locations)

Contact information (phone number, email address)

Industry or sector in which the business operates

Number of years in operation

Legal structure (corporation, LLC, partnership, etc.)

Ownership and management details: Helps understand the structure and leadership of the business, providing insight into decision-making and accountability.

Names and titles of key executives and decision-makers

Ownership structure (names of owners, percentage ownership)

Contact information for key personnel

Financial information: Assesses the financial health and stability of the business, including its ability to generate revenue, manage expenses, and meet financial obligations.

Annual revenue

Profit margins

Cash flow statements

Balance sheets

Income statements

Financial projections (if available)

Bank references

Trade references : Offers insights into the business’s payment history and relationship with other suppliers or vendors, indicating its creditworthiness and reliability.

Names and contact information of current or previous trade partners

Duration of the relationship

Payment history and credit terms

Credit request: Specifies the amount and purpose of the credit requested, guiding the creditor in assessing the appropriateness and feasibility of the credit arrangement.

Desired credit amount

Purpose of the credit (e.g., inventory purchase, equipment financing)

Proposed repayment terms (length of the credit period, interest rates)

Legal and authorization section: Ensures that the information provided is accurate and authorized by a responsible party within the business, mitigating the risk of fraud or misrepresentation.

Signature of an authorized representative of the business

Acknowledgment of terms and conditions

Authorization for credit checks and verification of information provided

Additional documentation requested: Supplements the application with supporting documents that provide further context and verification of the business’s identity, legality, and financial status.

Business licenses or permits

Tax identification number (TIN) or employer identification number (EIN)

Articles of incorporation or partnership agreements

Personal financial statements of key executives or owners

Instructions and guidance: Helps the applicant understand the purpose of each section and how to complete the application accurately, reducing errors and delays in processing.

Clear instructions on how to complete the application

Explanation of each section and the purpose of the information requested

Contact information for assistance or inquiries

4 Expert Tips To Create a Successful Credit Application

There is nothing better than first hand experience to solidify your business credit application. So, we have brought you some tips straight from our experts to ensure you have the best credit application process for your business.

Privacy and data security compliance : Ensure compliance with data protection regulations and assure the security of sensitive information provided by the business. This demonstrates the creditor’s commitment to protecting the confidentiality and security of the applicant’s sensitive information, building trust, and compliance with data protection regulations.

Ensure scalability and flexibility in credit application process : Design the application to accommodate potential growth or changes in the business’s needs over time. This allows the application to accommodate possible changes or growth in the business, ensuring that the credit arrangement remains suitable and sustainable over time.

Utilize a user-friendly format: Present the application in a clear, organized, and easy-to-understand format to facilitate completion by the applicant. This enhances the applicant’s experience by presenting information in a clear, organized manner, reducing confusion and streamlining the application process.

Have a robust review and approval process: Outline the steps involved in reviewing and approving the credit application, including estimated timelines and communication channels for updates or inquiries. This sets expectations regarding the steps involved in evaluating the application, providing transparency and accountability in the decision-making process.

Manual Credit Application Process Challenges

The world is moving rapidly today, and this means we have to keep evolving our processes to more efficient methods if we want to keep up.

Document management and verification are key challenges within the credit application process. The complexity of evaluating diverse financial documents and references can lead to delays and inaccuracies in the decision-making process. This challenge becomes particularly pronounced when handling a large number of credit applications. Here are some significant challenges:

Time-consuming – Manual credit application processes can be time-consuming, especially if companies have to manage a large volume of applications. This can lead to delays in credit decisions, which can impact business operations and customer relationships.

Inconsistent credit risk evaluation – Manual processes can lead to inconsistent assessment of credit applications, as different credit analysts may apply different criteria or weigh factors differently. This can lead to bias and result in inaccurate credit decisions.

Data entry errors – Manual data entry can result in errors, such as typos or transposed numbers, impacting credit decisions. These errors can also be time-consuming to correct and can delay credit decisions.

Limited data analysis – Manual processes can limit the amount of data analysis that can be performed, as analysts may not have access to all the information they need or may not have the tools or resources to analyze data effectively.

Inadequate credit monitoring – Manual application processes can make it challenging to monitor credit risk effectively, as analysts may not have timely access to information about changes in a customer’s credit profile or payment behavior. This can lead to missed opportunities to identify potential credit problems early on and take appropriate measures to mitigate risk.

These challenges can result in inaccurate credit decisions, delays in credit decisions, and increased credit risk. Amidst these challenges, the need for a streamlined and automated credit application process becomes evident. Transitioning to an automated digital solution can help B2B companies mitigate these obstacles and enhance their credit risk management strategies.

The Power of Automation in Business Credit Application Processing

Automation in the credit application process refers to the use of technology and software systems to streamline and expedite the various stages involved in assessing, approving, and managing credit applications. This automation entails leveraging advanced algorithms, data analysis, and digital workflows to replace manual tasks and decision-making processes traditionally performed by humans. The adoption of automation in credit application processing offers numerous benefits for both creditors and applicants, revolutionizing the efficiency, accuracy, and overall effectiveness of the credit approval process.

Benefits of an Automated Credit Application

Automating the credit application process offers a wide range of benefits for both creditors and applicants. Let’s explore.

Enhanced efficiency : Automation streamlines the credit application process, reducing manual tasks, paperwork, and processing time.

Improved accuracy : Automated systems ensure consistent data collection, validation, and analysis, minimizing errors and discrepancies in applicant information. This leads to more accurate credit decisions and reduces the risk of fraudulent or incomplete applications.

Cost savings: By eliminating manual labor and reducing administrative overhead, automated credit application processes result in cost savings for creditors. They require fewer resources to manage and process applications, leading to increased operational efficiency and lower overhead costs.

Improved customer experience : Automation provides a smoother and more streamlined experience for applicants, with faster response times and more straightforward communication throughout the application process. This enhances customer satisfaction and loyalty, fostering positive relationships between creditors and applicants.

Increase in scalability: Automated systems are scalable and can handle a large volume of credit applications without sacrificing speed or accuracy. This scalability allows creditors to efficiently manage fluctuations in application volumes and accommodate business growth without additional strain on resources.

Improves regulatory compliance : Automated credit application systems can incorporate regulatory requirements and compliance checks into the application process, ensuring adherence to legal and industry standards. This reduces the risk of non-compliance penalties and enhances regulatory oversight and reporting capabilities.

Access to data analysis and insights: Automated systems generate valuable data and insights from credit application data, including trends, patterns, and performance metrics. This data can be used to optimize processes, identify opportunities for improvement, and make strategic decisions to drive business growth.

Effortless integration: Automated credit application systems can integrate with other enterprise systems, such as customer relationship management (CRM) software, accounting systems, and loan origination platforms. This integration enables seamless data exchange and workflow coordination, improving overall operational efficiency and collaboration.

By leveraging technology to streamline and optimize credit application processes, creditors can achieve greater productivity, profitability, and competitiveness in the marketplace.

Recommended reading: How Mosaic Accelerated Customer Onboarding by 56% & Saved 40% in FTE Costs with Automated Credit Management

How HighRadius Can Help to Automate Credit Application Processing

HighRadius offers innovative AI-powered credit management software designed to revolutionize the way businesses manage credit applications. With a specific focus on online credit applications , our software harnesses the power of artificial intelligence and machine learning to automate and optimize the entire credit application lifecycle.

With real-time credit risk monitoring , you can receive alerts for any changes in your customers’ credit profile and make data-driven credit decisions from unlimited credit reports. Our software integrates with your ERP system and can start monitoring your customers in just 30 days.

We offer configurable scoring models and approval workflows that can be customized based on geography, customer segments, business units, and other factors. You can fast-track credit approvals through complex corporate hierarchies, making the credit application process more efficient and streamlined.

Our highly configurable online credit application allows you to onboard customers across the globe with multi-language, customized credit applications embedded on your website. You can automatically capture financials, personal guarantees, and check bank references, reducing the need for manual data entry.

Our software also automatically extracts credit data from over 40+ global and local agencies, including credit ratings, financials, and credit insurance information. You can configure the auto-extracted data in your preferred currency, making it easier to analyze and interpret.

With AI-based blocked order management, you can auto-predict blocked orders based on the customers’ credit limit utilization and payment history. You can leverage AI-based release or partial payment recommendations for faster credit decisions, reducing the need for manual intervention.

Our software seamlessly integrates with collections, payments, and deductions, allowing you to share credit scores and risk analysis with collectors, review collectible amounts, calculate adjusted credit exposure, and dynamically update credit exposure leveraging payment and dispute information

HighRadius AI-based Credit Risk Management Software simplifies the credit application process, mitigates risk with real-time credit visibility, and manages global portfolios through comprehensive workflows.

By partnering with us, you can streamline your credit application process, reduce manual interventions, and ultimately provide a better customer experience.

Read about how Chevron Phillips achieved 61% faster customer onboarding by adopting our credit management software.

1. What are the types of credit application forms?

Types of credit application forms include consumer credit applications for personal loans or credit cards, commercial credit applications for businesses seeking trade credit, and mortgage loan applications for real estate purchases.

2. What are some tips for determining creditworthiness?

Assess factors like credit history, income stability, debt-to-income ratio, payment history and verify employment and review assets. Consider credit scores and past financial behavior to gauge creditworthiness accurately.

3. How can a business credit application form help mitigate risk?

A business credit application form helps mitigate risk by gathering essential information about potential clients, enabling thorough assessment of their creditworthiness. It allows businesses to evaluate factors like financial stability, payment history, and credit utilization, aiding in informed decision-making and reducing the likelihood of default or late payments.

4. What are the steps of the credit application process?

The steps of the credit application process typically include submission of application, verification of information, credit analysis, decision-making, approval or denial, and establishment of credit terms.

5. What are the red flags on a credit application?

Red flags on a credit application include inconsistent information, gaps in employment history, high debt-to-income ratio, recent delinquencies or bankruptcies, and frequent changes in residence or contact information.

6. Why do we need a credit application?

A credit application is essential for assessing the creditworthiness of potential customers or clients, mitigating risk, establishing credit terms, and ensuring responsible lending practices. It helps businesses make informed decisions about extending credit and managing cash flow effectively.

7. What happens when you submit a credit application?

When you submit a credit application, the lender will review your application to assess your creditworthiness and ability to repay the loan. They will typically check your credit report, income, employment history, and other financial information to make a decision. Once the lender has reviewed your application, they will either approve or deny your request for credit.

8. How long does it take for a credit application to be reviewed?

Generally, it can take anywhere from a few days to a few weeks for a credit application to be reviewed and a decision to be made. However, with the use of automated credit application processing systems, lenders can drastically reduce the time it takes to review credit applications and provide faster, more efficient service to customers.

9. What are quick steps to consider before granting credit?

Follow these structured steps to make an informed decision: Create a credit policy: Establish a clear policy to outline terms and agreements. Perform a credit check: Review the customer’s financial background for insights. Sign an agreement: Formalize the commitment to payment. Set credit limits: Align limits with credit scores for reduced risk

10. What is an example of business credit?

An example of business credit is a trade credit arrangement where a supplier allows a business to purchase goods or services on credit terms, such as net 30 days, allowing the business to pay for the purchases later after receiving the goods or services.

11. What is the difference between B2B credit applications vs. B2C credit applications?

B2B credit applications involve businesses extending credit to other businesses, focusing on trade credit terms and commercial financial information. B2C credit applications pertain to businesses offering credit to individual consumers, emphasizing personal credit history and consumer financial behavior.

12. What’s Included in a Business Credit Application?’

- Business Information: Company name, address, contact details, and legal structure.

- Financial Data: Revenue, profit margins, assets, liabilities, and credit history.

- Trade References: Details of previous credit relationships with suppliers or vendors.

- Ownership Details: Names, titles, and ownership percentages of company principals.

- Industry Sector: Description of the company’s industry, market position, and competitive landscape.

- Bank Information: Bank account details and references.

- Tax ID: Business tax identification number.

- Purpose of Credit: Intended use of credit and desired credit limit.

- Guarantees: Personal guarantees or collateral provided to secure credit.

- Signature: Authorization and consent for credit checks and terms acceptance.

Related Resources

What Is a Transferable Letter of Credit? Everything You Need to Know

The Fundamentals of Credit Management & Control: What is It & How Does it Work

13 Must-Ask Interview Questions for Hiring Top Credit Analysts

Streamline your order-to-cash operations with highradius.

Automate invoicing, collections, deduction, and credit risk management with our AI-powered AR suite and experience enhanced cash flow and lower DSO & bad debt

Please fill in the details below

Get the hottest Accounts Receivable stories

Delivered straight to your inbox.

- Order To Cash

- Collections Management

- Cash Application Management

- Deductions Management

- Credit Management

- Electronic Invoicing

- B2B Payments

- Payment Gateway

- Surcharge Management

- Interchange Fee Optimizer

- Payment Gateway For SAP

- Record To Report

- Financial Close Management

- Account Reconciliation

- Anomaly Management

- Accounts Payable Automation

- Treasury & Risk

- Cash Management

- Cash Forecasting

- Treasury Payments

- Learn & Transform

- Whitepapers

- Courses & Certifications

- Why Choose Us

- Data Sheets

- Case Studies

- Analyst Reports

- Integration Capabilities

- Partner Ecosystem

- Speed to Value

- Company Overview

- Leadership Team

- Upcoming Events

- Schedule a Demo

- Privacy Policy

HighRadius Corporation 2107 CityWest Blvd, Suite 1100, Houston, TX 77042

We have seen financial services costs decline by $2.5M while the volume, quality, and productivity increase.

Colleen Zdrojewski

Trusted By 800+ Global Businesses

Sample Credit Request Letter To Supplier: Free & Effective

In this article, I’ll share a step-by-step guide on how to write a persuasive credit request letter, including tips from my personal experience and a customizable template to get you started.

Key Takeaways

- Understand the Purpose : Learn why and when to write a credit request letter to a supplier.

- Personal Experience Tips : Gain insights from real-life examples and personal advice.

- Step-by-Step Guide : Follow a detailed guide to craft your letter effectively.

- Customizable Template : Use a provided template to easily create your own letter.

- Engagement Request : Share your experiences and tips in the comments section.

Understanding the Purpose

A credit request letter to a supplier is a formal way of asking for payment terms that allow you to purchase goods or services now and pay for them later.

This can help you manage your cash flow more effectively, especially if you’re dealing with seasonal fluctuations or waiting on receivables.

Step-by-Step Guide to Writing a Credit Request Letter

Step 1: prepare your information.

Before you start writing, gather all necessary information about your business and the supplier. This includes your business name, contact details, the history of your transactions, and any other relevant details.

Step 2: Start with a Professional Greeting

Address the letter to a specific person if possible. Use a formal salutation like “Dear [Name]” to start your letter on a professional note.

Step 3: Introduce Your Business and Intent

Trending now: find out why.

Begin with a brief introduction of your business and the purpose of your letter. Clearly state that you are requesting credit terms.

Step 4: Provide Justification

Explain why you are seeking credit terms. Be honest and transparent about your reasons, whether it’s for managing cash flow, expanding your business, or other reasons.

Step 5: Reference Past Transactions

If you have a history with the supplier, mention it. Highlight your timely payments and reliability to strengthen your request.

Step 6: Detail Your Request

Specify the credit terms you are seeking, such as the payment period or credit limit. Be realistic and fair in your request.

Step 7: Assure of Future Business

Emphasize your commitment to maintaining a long-term relationship with the supplier. Assure them of your future business and timely payments under the new credit terms.

Step 8: Provide Financial Information

If necessary, include relevant financial information that supports your creditworthiness, like recent financial statements or references.

Step 9: Close Professionally

Conclude the letter by thanking the supplier for considering your request. Include a call to action, inviting them to discuss the request further.

Step 10: Include Your Contact Information

End with your name, position, company, and contact details. Offer to provide additional information if needed.

Personal Experience Tips

- Be Concise : Keep your letter succinct yet informative. Avoid unnecessary details that might detract from your main points.

- Maintain Professionalism : Even if you have a casual relationship with the supplier, keep the tone professional and respectful.

- Follow Up : Don’t hesitate to follow up with a phone call or email if you haven’t received a response within a reasonable time frame.

Sample Credit Request Letter To Supplier Template

[Your Name] [Your Position] [Your Company Name] [Your Company Address] [Date]

[Recipient’s Name] [Recipient’s Position] [Supplier’s Company Name] [Supplier’s Company Address]

Dear [Recipient’s Name],

I am writing to express our interest in establishing credit terms with [Supplier’s Company Name].

As [Your Position] at [Your Company Name], I have had the pleasure of doing business with you for [duration], and we are keen to continue and deepen this relationship.

Our request for credit terms is driven by our desire to manage our cash flow more efficiently and to align our payment cycle with our revenue stream.

We believe that a credit arrangement would be mutually beneficial, enabling us to maintain our purchasing volume, even in our off-peak season.

We have always valued the quality and reliability of your products/services and have consistently met our payment obligations on time.

We are interested in discussing a credit term of [specific credit terms], which we believe reflects our history and future potential as your client.

We are committed to maintaining a strong and reliable partnership with [Supplier’s Company Name] and are confident in our continued business dealings.

Please feel free to contact me directly at [Your Phone Number] or [Your Email] to discuss this request further.

Thank you for considering our request. We look forward to your positive response and to continuing our successful partnership.

[Your Name] [Your Position] [Your Company Name]

Engage with Us

Share your experiences and tips in the comments below. We’d love to hear how you’ve navigated credit requests and any lessons you’ve learned along the way!

Related Posts

- Request Credit Term from Supplier Email Sample

- Simple Payment Request Letter: Free & Effective

- Sample Letter to Reduce Payments: Free & Effective

Frequently Asked Questions (FAQs)

Q: How do I effectively request a credit term extension from a supplier?

Answer: In my experience, it’s crucial to be upfront and honest. I always start by expressing appreciation for our ongoing business relationship. Then, I clearly explain why the extension is needed, providing specific details.

It’s important to reassure them of your commitment to honoring the new terms and propose a realistic timeline. For example, I once requested a 30-day extension due to unexpected cash flow issues and offered a detailed payment plan to demonstrate my reliability.

Q: What should I include in a credit request letter to a new supplier?

Answer: When I approached a new supplier for credit, I made sure to include essential details. I introduced my business, provided financial statements, and references from other suppliers to establish credibility.

I clearly stated the credit terms I was seeking and how it would benefit our mutual business relationship. Also, I emphasized our potential for long-term collaboration, which helped in securing favorable terms.

Q: How can I negotiate better credit terms with a long-term supplier?

Answer: Negotiating better terms requires a blend of diplomacy and assertiveness. I always start by reviewing our payment history to highlight our reliability.

Then, I set up a meeting to discuss our continued partnership and future plans. I propose new terms that would benefit both parties, like extended payment periods or increased credit limits, backed with data on how it can improve our order volume and regularity.

Q: Is it appropriate to use email for a credit request letter?

Answer: Yes, email can be an effective medium. I’ve used it successfully, ensuring my message is professional and concise.

However, I always follow up with a phone call or a face-to-face meeting to add a personal touch and discuss any concerns they might have. This approach has often helped me in getting a positive response more quickly.

Q: How do I handle rejection of a credit request from a supplier?

Answer: Rejection can be a learning opportunity. I always ask for specific reasons and if there’s room for negotiation. Understanding their concerns helps me to adjust my request or improve certain aspects of my business. Sometimes,

I’ve even offered alternative solutions like partial credit or shorter payment terms as a stepping stone to build trust.

Related Articles

Personal loan request letter sample: free & effective, request letter for working capital loan: the simple way, personal loan paid in full letter sample: free & effective, sample letter to bank requesting extension of time for loan payment: free & effective, ask someone for money in a letter sample: free & effective, business loan request letter sample: free & customizable, 2 thoughts on “sample credit request letter to supplier: free & effective”.

I found your page very helpful. Thank you for your guidance

Thank you so much for your kind words! I’m thrilled to hear that you found the page helpful.

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

A Guide to Credit Applications for Business Owners

A guide to credit applications for business owners that includes what lenders ask for, what to do if you are denied, and how these impact your credit score. Learn more now.

Download Template

Fill the form below to download this template

Thank for you submitting the information.

Click below to download template.

Calculating Stripe fees for customer payments is easy with our calculator. Enter the payment amount to calculate Stripe's transaction fees and what you should charge to receive the full amount.

Our calculations are based on Stripe's per-transaction fees of 2.9% plus $0.30.

Calculate how much you’ll pay in Square fees for online, in-person, and manually-entered payments.

Enter your loan information to get an estimated breakdown of how much you'll pay over the lifetime of your loan.

PayPal fees can be confusing. Our calculator helps you understand how much you’ll pay in fees for common transaction methods.

rowing your business requires capital. While you can rely on self-funding to get your organization started, at some point, you'll likely need financing to purchase equipment, hire new staff, or build up inventory. When that time comes, you might decide to apply for business credit.

Various funding options are available for growing organizations, including loans and credit cards. To access them, you must complete a credit application for business with your chosen financial institution. The credit application details information about you and your company, which the lender will review when deciding to approve or deny credit.

What is a business credit application?

A credit application for a business account is a form used to initiate a request for financing from a financial institution. It's one tool that lenders use to evaluate a company's fitness for financing.

Completing a credit application form for business financing tells the bank you need money to support your company's operations. Typically, the application asks for key details about you and the business, such as contact information, industry sector, and how much money you want to borrow. The lender will use the details you provide to pull a business credit report and possibly a personal one, depending on your company's entity type.

Some lenders allow you to submit an online application, but you can also schedule an appointment at a local banking branch if you prefer one-on-one assistance. Typically, you'll receive a credit decision within a few business days — and sometimes even immediately, depending on the financial institution.

Depending on the lender's policies, loan type, and amount borrowed, you may need to submit additional information to support your business credit application. Examples of additional information a lender may request include your business plan, recent financial statements, tax returns, and financial forecasts.

If you receive approval for your loan, you'll get access to your new funds quickly via a designated bank account or a business credit card. However, if the financial institution denies funding, it will explain why in a written letter you'll receive after their evaluation.

What do lenders ask for in a business credit application?

Credit applications for businesses aren't standardized, so the questions you encounter will vary from lender to lender. The extent of the application will also differ based on the amount you apply for and the loan type. It stands to reason that the application process for a $5,000 vendor line of credit will likely be less complex than a request for $5 million to renovate your business office.

That said, here are a few questions you'll probably encounter when you apply for business credit.

Contact information

A lender will want to know the name of your company and where it's located. Identification details help them request business and personal credit reports, and it also tells them where to send the monthly bill if they approve your application.

Contact information you may provide includes:

- Business name

- Owner name and address

- Entity structure

- Employer identification number (EIN) or owner's Social Security number

- Business and personal phone number

- Email address

You likely know your company's basic details by heart, so providing them shouldn't be too hard.

Market sector and industry details

The lender will want to know what your business sells and what market sector you're in. Learning the basics about your company helps them understand why you need financing and how it will benefit your organization.

Expect questions about the length of time your company has been in business and your target customer base. A lender may also ask about vendor relationships, inventory (if you have any), and the number of employees you have.

Typically, details about your company operations and market sector are included in your business plan. The bank may request to review your business plan, so preparing it before starting a credit application is a good idea. Your business plan doesn't need to be the next great American novel—a few pages will usually suffice for a growing organization.

Trade references

Some lenders will include a field requesting the name and contact information of any suppliers or vendors your company does business with. If you have an existing relationship with a supplier—especially one that involves a credit line—including it in your credit application can demonstrate your company's ability to stay on top of payments.

Expect the financial institution to request the name of your suppliers, their address, a point of contact, and phone numbers. Keep in mind that not every vendor reports their client's payment history to credit reporting agencies, so the lender may need to reach out directly for a reference.

Company financial statements

A lender is unlikely to approve a request for credit if they don't believe your business can stay on top of payments. So, they'll want to review your company's financial statements to see how much revenue you earn and whether there's enough income to support ongoing debt repayments. They'll also evaluate your business's outstanding debt, such as loans and credit cards, to determine if the company is overextended.

Some lenders may request audited financial statements depending on the size and complexity of your loan request. Other financial institutions may be happy with statements a local accounting firm reviews. You may also need to provide financial projections and copies of your recent business tax returns.

How a lender uses a credit report and score in business loan applications

Once you finalize your application and submit all the required documents, the lender will start the evaluation process. It will ensure all the details in your application are accurate and may request additional details if necessary.

The lender will pull your business credit report (if there is one) and may request a copy of your personal credit report. A business credit report is similar to a consumer credit report. It will list identifying information about your company, as well as open and closed credit accounts for recent years and payment history.

Along with your credit report, the lender may check your business credit score. The credit score it uses may be the FICO Score model or a different scoring model of its choosing. Typically, the higher your company's credit score is, the more likely you'll receive an approval and the more favorable your credit terms will be.

A high credit score may result in an automatic approval with some lenders. If your application requires additional review, it will pass to the financial institution's underwriting team, who will perform a more detailed assessment. The underwriter's objective is to determine whether the risk of issuing a loan is worth the potential return to the lender. If the underwriter decides the loan is too risky, they may provide you with a lesser loan amount or deny the application altogether.

How to handle a business credit denial

A denial of business credit can be very frustrating. However, you may still be able to obtain a loan through another lender or apply for a different financing option that's more suitable for your organization.

Start by understanding the reasons for the denial. You'll likely receive a short letter stating basic reasons for the denial, such as a high debt-to-income ratio. If the rationale doesn't make sense to you, schedule an appointment with a lending specialist for clarification.

Next, address any issues that are problematic for lenders. For instance, if customers aren't paying you quickly enough to meet the lender's standards, tighten up your company's account receivable policies.

If a low credit score is the problem, take action to improve it. Learn the factors that impact your credit score, such as too much debt or missed payments, and correct them.

How applying for credit impacts your credit score

The short answer: It can.

Applying for a business loan or credit card may result in a hard pull of your credit report—regardless of whether the lender approves you. The hard pull may decrease your credit score by a few points. If your credit score falls into the average or poor credit bucket, those few points can make a difference in whether other lenders will approve you for a loan.

To minimize the impact of credit inquiries on your personal or business credit report, understand the lender's requirements before you submit an application. Ask them what they require for approval and what credit score typically qualifies for a loan. You can then ask the consumer or business credit reporting agency for a copy of your credit report and score to assess the likelihood of obtaining credit. If you don't meet the lender's general requirements, shop around to see what other credit products you might qualify for.

Novo can help with your small business financing needs

Obtaining funding for your business can help you expand, support current operations, or provide an extra cushion if needed. At Novo, we offer up to $75,000 in merchant cash advances with a simple 10-minute application process. Learn more about our financing opportunities , and start your application today!

Novo Platform Inc. strives to provide accurate information but cannot guarantee that this content is correct, complete, or up-to-date. This page is for informational purposes only and is not financial or legal advice nor an endorsement of any third-party products or services. All products and services are presented without warranty. Novo Platform Inc. does not provide any financial or legal advice, and you should consult your own financial, legal, or tax advisors.

The Merchant Cash Advance is provided by Novo Funding LLC, PO Box 311092, Miami, FL 33231. Novo is the marketing name for Novo Platform Inc. and its subsidiaries and affiliates. Novo Funding LLC is a wholly owned subsidiary of Novo Platform Inc. Credit and Merchant Cash Advance products and services are offered by Novo Funding LLC. The information and materials contained on this website - and the terms and conditions of the access to and use of such information and materials - are subject to change without notice. Not all products and services are available in all geographic areas. Your eligibility for particular products and services is subject to final Novo determination and acceptance.

Novo is a fintech, not a bank. Banking services provided by Middlesex Federal Savings, F.A.: Member FDIC.

All-in-one money management

Take your business to new heights with faster cash flow and clear financial insights —all with a free Novo account. Apply in 10 minutes .

Sole Proprietorship vs. LLC

Do i need an ein for my llc, a complete overview of business structures, spend less time managing your finances.

Take your business to new heights with faster cash flow and clear financial insights—all with a free Novo account. Apply online in 10 minutes.

More Articles On

Starting a business, 5 benefits of hiring your first employee, sole proprietorship vs. llc: a complete overview, 4 business lines of credit for startups.

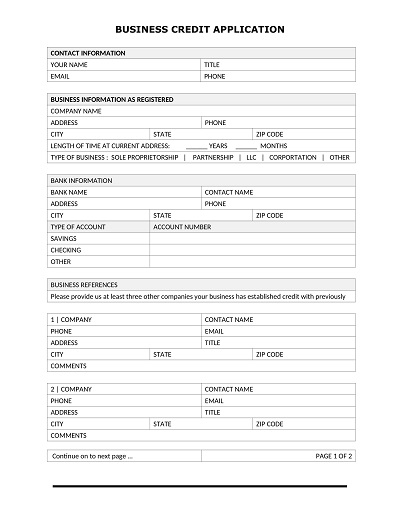

Free, Printable Business Credit Application Template (Plus, How to Use it Correctly)

Download your free, business credit application template.

*This template is intended for informational purposes. All legal documents should be reviewed by an attorney before use, and terms should be defined to protect you in the event of default.

Download your free, printable business credit application template so you can extend credit to your customers, or just find out what a business credit application looks like.

Business Credit Workshop coaching students get access to hundreds of actual business credit applications used by banks across the US.

Most of the time, we focus on ways to improve credit profiles and obtain business credit. But, many of our readers, members, and students run B2B operations that serve other businesses. So, it’s crucial that we understand the ins and outs of extending credit to our business clients and customers… when the opportunity arises.

If you offer your business customers the chance to buy now and pay later, you open a portal to attract more high-ticket sales from those that might not otherwise be able to afford a product or service in a single payment. Plus, by extending lines of credit or private tradelines, you can increase total profits by way of interest and fees.

Or, if you’re just curious about what to expect when you start applying for business credit yourself, this information (and the downloads above) can be helpful.

Here, I provide a breakdown of the essential elements of a business credit application. Finally, I’ll answer some frequently asked questions and provide guidance for new creditors, including options to create online business credit application forms.

Fundamentals of a Business Credit Application

I. use google forms, ii. use jotform, iii. use your website’s form builder.

- How Should You Ask a Customer to Fill Out a Credit Application?

How to Pull a Business Credit Report From D&B

How to pull a credit report from experian business, how to pull a credit report from equifax business, how to report on-time payments to d&b, how to report on-time payments to experian business, how to report on-time payments to equifax business, how to report on-time payments to creditsafe.

- 3. Enlist a Third-Party App or Platform to Manage Your Credit Program

Now, let’s get cracking.

What is a Business Credit Application?

A business credit application is a form that enables a registered entity to apply for a line of credit, term loan, revolving tradeline, or a private net 30 account. It collects identifiable information about the business to determine its creditworthiness.

A business credit application serves dual purposes:

- Gather personal, business, and financial data about the applicant

- Serve as a contract between the applicant and creditor

A credit application is considered a legal document, as it should ask for the applicant’s signature. Hence, once signed, and if all terms and conditions are properly outlined in the document, it is legally binding.

Any company that extends credit to their customers needs an application form to weed out those who would not be eligible for any type of financing.

To make an informed determination whether or not a company is worthy of business credit, you need specific identifying information.

- Professional Title

- % Ownership in Business (Most creditors require at least 50%)

- Company Name

- Tax ID or SSN

- Personal Address (Street, City, State, Zip)

- Business Phone Number

- Business Email Address

- Type of Business

- Years in Operation or Business Start Date

- Business Address (Street, City, State, Zip)

- Legal Entity Type (Proprietorship, Partnership, LLC, Corporation)

- State Registered in

- If DBA or Subsidiary, Parent Company Name & Business Start Date

- Name of Principal Responsible

- Principal’s Address (Street, City, State, Zip) & Phone Number

- Name of any Co-Principal Responsible (optional)

- Co-Principal’s Address (Street, City, State, Zip) & Phone Number

- Checking Account (Bank Name, Account No., Contact Info)

- Savings Account (Bank Name, Account No., Contact Info)

- Credit Line (Bank Name, Revolving/Term, Account No., Contact Info)

- Contact Name

- Company Address

- Company Phone Number

- Account Age or Account Open Since

- Credit Limit

- Current Balance

- Amount of Credit Requested

- Total Business Assets

- Total Business Liabilities

- Annual Net Income

- Yes or No: Have Any Officers Filed a Bankruptcy Petition?

- Yes or No: Is Your Company Subject to Any Litigation? (+Explanation)

- Terms of use

- Interest and Fees

- Penalties for Noncompliance

- Additional Forms Required (Articles of Organization, etc.)

- Disclosure of Credit Pull

- Applicant Full Name

- Legal Business Name

- Applicant Signature & Date Signed

- Company Seal & Date Stamped

Once the applicant has submitted their app– assuming it appears they have what it takes, and that you would extend them credit — you’ll need to verify their information and move through the rest of the process.

Here’s How to Create an Online Credit Application Form

In place of or in addition to a paper, pdf, spreadsheet, or doc application, you might want to offer your customers the option to fill out an online credit application form(this is super helpful, especially when applicants are not local).

So, here’s the scoop. There are multiple ways to create online forms, but here’s what I recommend.

Google Forms has a straightforward user interface and simple design. While it’s not super customizable, it will get the job done, and it’s free for Google Workspace users — both free, personal accounts and business accounts.

Jotform is another option — super easy to use — that is free for up to 5 forms and 100 monthly submissions. It’s more customizable than Google forms, with integrations with other platforms you might use like PayPal, Google Sheets, Adobe Sign, and HubSpot. It can cost up to $99 per month, depending on your usage

If you’re already collecting customer information via contact or subscribe forms on your website, you likely have a form builder that you use. You can probably get into your website dashboard and whip something up based on what you’ve learned here.

There are many other options out there to help you offer an online application — I’ve just found these to be the simplest to use and most reliable.

How Should You Ask a Customer to Fill Out a Credit Application?

If you’re eager to extend credit to customers — perhaps you want to use your credit offer as a highlight to make more sales — you can include your credit option at checkout (in-person or online) or during the sales process, depending on how your operations run.

Service businesses might want to mention their credit application in proposals or bids — at the point just before the sale is made or earlier.

I also recommend that you bookmark or download our trade reference request template and cover letter template (or create your own), because you can share them with your applicants to help them provide you with more information. Then, you can better determine if they meet your requirements for a credit account.

Recommended Reading: Trade References: Learn Everything You Need to Know

Don’t Forget to Do These 3 Things When You Offer Credit to Your Customers

Here are a few tasty reminders with a helping of details for you to munch on.

1. Do Your Due Diligence and Be Selective

The application form is only the first part of a credit application. If you are going to extend credit to your business customers, it’s so important to make sure that you verify everything that the applicant tells you.

Double-check credit report information with Dun & Bradstreet (D&B), Experian Business, and Equifax Business. Pull personal credit reports if you’re wary. Call the references applicants list on their app. Be 100% sure that someone is honest and qualified before you trust anyone in a buy now, pay later situation.

To get a full D&B credit report and PAYDEX Score, visit D&B’s website and select your plan. It will cost from $61.99 to $799 per year, depending on how many reports you will need.

To obtain an Experian Business credit report, go to Experian’s website , search for the business (be sure to select Other Business), and choose whether you would like a one-time report for $39.95 or $1,495 to $1,995 per year (for anyone who needs more than three reports monthly).

To receive an Equifax Business credit report, visit Equifax’s website and fill out the contact form on the Small Business Credit Report page to connect with the sales team — they can hook you up with the right plan.

2. Consider Reporting Payments to Business Credit Bureaus

As a courtesy to your customers and other creditors, consider reporting on-time payments to the business credit bureaus. Doing so will help your customers establish and grow their business credit profile, and can be a selling point that places you ahead of your competitors.

Furthermore, reporting slow, late, or missed payments help protect other businesses (like yours) from disreputable companies that tend to stiff their creditors on payments.

So, you might want to consider reporting on-time payments to D&B, Experian Business, Equifax Business, and Creditsafe — this typically requires that you join their trade exchange programs.

To report account activity to D&B, you must either be a part of their DNBi or PPP programs or join the trade Exchange Program. To sign up for D&B’s Trade Exchange Program, you need at least 300 active credit customers.

To apply, either visit D&B’s website or call 1-844-201-9144 to speak to your relationship manager.

Experian doesn’t charge creditors for reporting, but they have requirements such as, members must report a full portfolio monthly. To become an Experian reporting partner, shoot an email to [email protected] .

You can register to report payments to Equifax via the registration page on their website or by calling 1-800-831-5614 (Select option three to speak to the correct department).

Creditsafe is not the most popular business credit reporting solution, and will never hold more weight than one of the primary bureaus. Still, third-party data continues to become more and more desirable to creditors. So, after you pull an Experian Business or Equifax Business credit report, you might also pull from Creditsafe.

Why I mention them here , is because you can join their Trade Exchange Program a bit easier than the other bureaus… and they can automate reporting through your accounting software. Here’s how to leverage the program:

- Claim your company on Creditsafe’s directory

- Login to your Creditsafe account

- Authorize your accounting or ERP software

Many popular accounting tools will easily integrate (Xero, Quickbooks, and Freshbooks, to name a few). If the platform doesn’t integrate with your software, or if you don’t use accounting software, you can still manually report.

3. Enlist a Third-Party App or Platform to Manage Your Credit Program (At Least Think About it)

If the sole reason you want to offer business credit is to get more high-ticket sales, and you have no desire to earn income from fees and interest, explore your options for third-party credit offers, since they will make your job so much easier.

Your choices vary greatly and depend on your business offer. For example, check out Affirm , Klarna , and Afterpay to see if your business might qualify to offer customers their buy now pay later terms — if so, they will do everything for you.

If you do want to manage your credit program, it’s a good idea to explore debt collection offers so that you might outsource that portion of your work (I can almost guarantee you will have to collect on missed payments at some point).

To extend business credit to your customers, you can use the business credit application template at the top of this page to get started — note that all legal documents should be reviewed by an attorney. And, printable applications are great, but so are online applications.

If you’re just starting down the path to offering business credit to your customers, remember to do your due diligence and verify everything on the application. Think about reporting on-time payments to business credit bureaus. And, consider enlisting help from third parties (if you can find an offer that meets your needs).

Do you have a customer or client who didn’t quite meet the mark and got rejected for a line of credit through your program? Invite them to join Business Credit Workshop to learn how to boost their business credit score and obtain up to $100K in business credit in as few as 30 days.

Related posts:

- Business Credit Repair: How to Get Your Business Credit Back on Track

- The BRRRR Method: A Real Estate Portfolio-Building Blueprint

- Is Biz2Credit Legit? A Complete Review

- Business Car Leasing 101: How to Lease a Vehicle With Your EIN

Business Credit Blog

· Recommended Resources · Using 30 Day Net Vendors to Build Your Business Credit Score · How to Create a Business Credit “Entity” – Tutorial

Recent Posts

- Sidney Federal Credit Union: NY Business Financial Options

- Credit Repair Cloud Reviews Examined: Is This Offer Legit?

- Is Carputty Legit? A Complete Auto Financing Review

· Sign Up for Business Credit Workshop Online! · Login – Business Credit Workshop Online · Forgot Password?

· Affiliates

Financing | What is

What a Small Business Letter of Credit Is & How It Works

Published February 22, 2024

Published Feb 22, 2024

REVIEWED BY: Tricia Jones

WRITTEN BY: Andrew Wan

This article is part of a larger series on Business Financing .

- 1 How It Works

- 3 When It’s Required

- 4 Pros & Cons

- 5 How To Get It

- 7 Bottom Line

A letter of credit is issued by a bank or other financial institution as a way to guarantee payment in the event the customer does not pay. This can be especially useful when conducting business internationally or when making large complex purchases where failure to receive payment could result in cash flow issues. Companies that have concerns about receiving timely payments from customers and that want to ensure no interruptions to company operations as a result of nonpayment from customers can request a small business letter of credit.

We recommend considering Bluevine from our list of the best cash flow lenders. It offers a line of credit up to $250,000 that you can use to draw funds on an as-needed basis. You pay only when using the credit line as there are no fees to open, maintain, or close the account.

Visit Bluevine

Key takeaways

- With complex, high-risk, or large purchases, a letter of credit can facilitate a smooth transaction between a buyer and seller by providing the seller with a guarantee of payment.

- Buyers can request a letter of credit from financial institutions, which usually charge a fee between 0.5% and 1.5% of the transaction amount.

- Different types of letters exist, and terms can often be customized to suit the unique needs of a transaction.

- If a letter of credit is not an option, consider getting financing from other sources, such as loans, to temporarily allow your company to continue operating until you receive payment.

How a Letter of Credit Works

A letter of credit typically may come up as a requirement when a buyer wishes to purchase a product or service from a seller. If the seller needs additional assurance that the buyer will make payment in a timely manner, a letter of credit could be requested. This letter of credit can be issued by a bank, and it will guarantee that the seller will get paid by either the buyer or the bank.

Below are the major steps that illustrate a typical transaction where a letter of credit is requested.

Step 1: Buyer and seller agree to a business transaction.

Before a letter of credit is deemed necessary, a buyer and seller typically must first come to an agreement on the details of a transaction. This can be for the purchase of goods or services. Having the details of the proposed transaction gives the seller more information on whether it might warrant a letter of credit.

Step 2: Seller requests a letter of credit from the buyer.

Once the details of the transaction are finalized, the seller can then determine whether it would want a letter of credit. Some possible factors could include the dollar amount of the transaction, potential impact on the seller in the event of nonpayment, and other risk factors. If the seller would like a letter of credit, it can inform the buyer, who can then take the next steps in obtaining it from a bank or other financial institution.

Step 3: Buyer obtains a letter of credit from a bank or other financial institution.

A letter of credit for small business transactions can be obtained from banks, credit unions, and other financial institutions. To get a letter of credit, these institutions usually go through a review process similar to that of a loan. This is done to ensure that the risk of the buyer defaulting on the payment to the seller will be low, so it must ensure the buyer can demonstrate the ability to afford the payment.

If approved, the bank will issue a letter of credit outlining the details of the transaction and any other terms and conditions.

Step 4: Purchase of services/goods is completed.

Depending on the type of letter of credit issued, funds can be sent directly to the seller to complete the transaction. Otherwise, once the buyer has obtained the letter of credit, it can be provided to the seller with payment to follow at a later date. If this is the case and the buyer subsequently fails to make payment in a timely manner, the seller would receive payment from the bank that issued the letter of credit.

Small Business Letter of Credit Types

Different types of letters of credit exist, and each has its own nuances. The details of your business transaction will determine the type of letter of credit best suited to your needs:

- Commercial letter of credit: As its name suggests, it is used in commercial transactions. This can include those conducted domestically and internationally. With a commercial letter of credit, the issuing bank makes payment directly to the seller.

- Standby letter of credit: The issuing bank will require the buyer to first make payment to the seller. Unlike a commercial letter of credit, the bank only pays the seller if the buyer fails to do so in a timely manner.

- Revolving letter of credit: It is typically used if the buyer and seller have agreed to conduct multiple transactions. This can save time and money from having to apply for a new letter of credit for each individual transaction.

- Traveler’s letter of credit: It is typically an ideal fit for those traveling overseas. This type guarantees that drafts will be honored at specified international banks.

- Confirmed letter of credit: Although unlikely, there’s always the chance that a bank issuing a letter of credit could also default or be unable to honor its agreement. A confirmed letter of credit significantly reduces this risk, as it guarantees that the seller can get paid by its own bank if the buyer and buyer’s bank default.

When a Letter of Credit Typically Is Required

The seller of a product or service can determine the circumstances in which they’d like to get a letter of credit from a buyer. This can be dependent on the characteristics of the buyer, the details of the transaction, or other factors. Below are common circumstances in which a letter of credit might usually be involved:

- The transaction is being conducted internationally: Conducting business overseas can be particularly challenging and complex, especially when factoring in differences in business law. A letter of credit can not only help provide a guarantee of payment, but it can also specify details of how the transaction must be completed to ensure it’s completed more efficiently. Details can include things like when goods must arrive and when payment must be made.

- The transaction is for a large dollar amount: If the transaction being conducted is for a large amount of money or is otherwise more complex, a letter of credit can give the seller peace of mind in knowing they’ll get paid. This can be beneficial to sellers if they must incur significant expenses to fulfill the order, where failure to receive payment could cause cash flow issues.

- The buyer and seller have never conducted business before: Without a track record of doing business, a seller may not know how reliable a buyer is with regard to making timely payments. A letter of credit can give sellers the guarantee of being paid.

Pros & Cons of a Small Business Letter of Credit

How to get a letter of credit.

Getting a letter of credit has many similarities to getting a traditional loan. You’ll need to find a bank that can issue one, submit an application, and provide any requested documentation.

We recommend checking out our guide on how to get a small business loan as we cover common eligibility criteria and documentation requirements. However, keep in mind that the exact criteria may vary slightly depending on the lender you choose.

Wells Fargo is one example of a lender that offers letters of credit. You can apply for a commercial or a standby letter of credit, both of which are secured by deposits you have with the bank. The provider also offers other lending and banking services that you can utilize as a small business owner.

Visit Wells Fargo

Frequently Asked Questions (FAQs)

How long does it take to get a small business letter of credit.

Most institutions can issue a letter of credit within 10 to 14 business days. During this time, the buyer’s qualifications must be reviewed by the issuing bank, which can include a review of its credit, income, and assets.

What does it cost to get a letter of credit?

Buyers must typically pay between 0.5% and 1.5% of the value of the transaction to get a letter of credit. The exact amount can vary depending on the amount and complexity of the transaction, as well as the requested terms and qualifications of the buyer.

Why should I use a letter of credit?

If a buyer ends up not paying for goods or services, a letter of credit ensures that the seller still gets paid by the bank that issued the document. Sellers can get added security with this guarantee, while buyers can secure an agreement on the purchase of a product or service that they might not otherwise have been able to get.

Bottom Line

Different types of letters of credit exist depending on the details of your transaction, but they all serve the primary purpose of ensuring the seller of a product or service will get paid. They are often used in international transactions and in large complex purchases. This can be helpful if receipt of funds is critical to continued business operations.

However, while letters of credit carry many benefits, also consider the downsides, such as the time needed to get one and the fees that may be charged by the issuing bank.

About the Author

Find Andrew On LinkedIn

Andrew Wan is a staff writer at Fit Small Business, specializing in Small Business Finance. He has over a decade of experience in mortgage lending, having held roles as a loan officer, processor, and underwriter. He is experienced with various types of mortgage loans, including Federal Housing Administration government mortgages as a Direct Endorsement (DE) underwriter. Andrew received an M.B.A. from the University of California at Irvine, a Master of Studies in Law from the University of Southern California, and holds a California real estate broker license.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

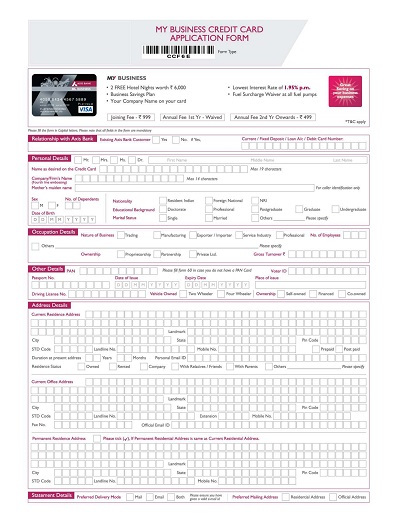

The 2023 Guide to Business Credit Applications [Free Templates]

What Is a Credit Application?

Credit applications act as a background check for businesses to determine the level of risk giving an advance to a customer might pose. If a business provides a customer with a product before performing a credit check or receiving payment, then they expose themselves to the possibility of severe interruptions to their cash flow if the customer breaks their agreement.

A business credit application can make it easy to collect all the information you need to properly gauge the risk a specific customer poses. It can also help you determine how much credit is appropriate at that time.

B2B Credit Applications vs. B2C Credit Applications

While granting a line of credit for a business-to-business (B2B) relationship is similar to business-to-consumer (B2C), what they’re looking for differs. Typically, when a consumer needs to buy something on credit, it’s for a single item that is slightly more costly than their typical expenses, like jewelry or workout equipment. Since B2C credit transactions are typically non-recurring for a high volume of customers, it makes sense to have a bank handle the requests.

Applying for business credit from a vendor is often done with the intention of building a long-term professional relationship. The customer often intends to use what they purchased on credit to help them make their own sale. They then use the profits from the sale to pay off the advanced credit. These purchases can quickly accrue to be worth hundreds of thousands of dollars. The stakes are much higher than B2C and, as a result, the credit check is more complicated.

Secured vs. Unsecured Credit

There are two approaches a business can take when approving business credit applications: secured and unsecured. A secured line of credit requires the customer to put up an asset as collateral. If the customer fails to honor the agreement, the vendor can seize the asset in lieu of payment.

An unsecured line of credit (ULOC) requires no form of collateral and is based on the customer’s credit history. If they are seen as low risk, then they are more likely to be approved for an unsecured line of credit. This is usually determined by the industry the business operates in and their own internal policies.

What’s Included on Business Credit Applications?

For business credit applications to accurately carry out their function, certain information should always be included:

- Applicant’s contact information: This includes the name of the business, billing/shipping addresses, email and phone numbers, and other relevant details.

- Ownership information: Knowing who the owners and principals of the company are can give added credibility to the company.

- Trade reference information: This includes contact information for someone the applicant has a working relationship with and who can provide insight into the customer’s credit history.

- Annual sales: This data is used to get an idea of the applicant’s income to help find a reasonable credit limit.

- Bank information: This includes account numbers and bank contact details to verify the applicant’s average balance.

- Amount of credit requested: The request is compared against their existing financial records to determine if it is reasonable.

- Date of application: The day the request was submitted can help determine when the term should begin.

A business credit application can be tailored to the specifics of any industry. Here are some business credit application templates you can use in your operations or as inspiration for creating your own:

Steps To Approve a Business Credit Application

After receiving a customer’s credit application form, you’ll need to analyze their information to determine if they qualify for a line of credit and how much that might be. For help with the approval process, apply the following steps.

1. Verify All Required Fields

The first step in reviewing your applicant’s business credit application is to ensure it has been filled out completely and correctly. If the credit application was not clear regarding which fields were optional and which were required, it’s possible the applicant left some blank. There’s also the possibility that the applicant entered their information incorrectly if they misunderstood what was being asked. To avoid this, clearly phrase all instructions on the form so the process won’t be unnecessarily prolonged.

2. Cross-check References

Following up with the applicant’s trade references is an important step in the vetting process. These are the people who are vouching for the applicant based on their past working relationship, helping you anticipate how they will act if given a line of credit. In some instances, an applicant may cite fake references with the hope that they won’t be contacted. Make a point to contact these people early on to avoid potential fraud.

3. Evaluate Credit History

An applicant’s credit report can generally be obtained from organizations like the National Association of Credit Management or Dun & Bradstreet . Use these results to inform your decision on whether or not the applicant is eligible for a line of credit and, if they are, for how much.

You may find that a credit report lacks details about a specific company’s financial history, sometimes only reporting on a small fraction of their spending history. To work around this issue, look for a service like Nuvo that offers instant digital bank references and credit reports on the principals of the company to get a better picture of their spending habits.

4 Tips for Determining Credit Worthiness

Knowing when to issue a line of credit and for how much can be a difficult task if left up to each individual’s judgment. Here are some tips for standardizing the process.

1. Establish a Company-wide Credit Policy

A credit policy defines the standards your company uses to vet an applicant as well as how you collect on overdue accounts. Setting a clear policy helps your employees evaluate applicants from an impartial perspective while giving customers a clear understanding of the criteria they must meet. This can help the credit approval process work more efficiently, reducing the number of questions that might arise along the way.

2. Sign a Contract

It’s important that every involved party is held accountable to their end of the agreement. Have the customer sign a contract to minimize the chances of a dispute in the event they default on their payments. The contract will make it clear what they agreed to and give you recourse for collecting what’s owed.

3. Set Realistic Limits

It can be tempting to give an applicant a greater line of credit than their financial history supports for the sake of earning more of their business. This can lead to problems down the line if they overextend themselves and can’t make payments, interrupting your own cash flow. Setting a realistic credit limit is beneficial for both parties in the long run, since this limit can always be increased down the line if the account remains in good standing.

4. Conduct Periodic Credit Reviews

A customer’s credit isn’t a permanent fixture in their financial history — it’s regularly changing. Just like a business can improve their credit, it can easily get worse. By periodically reviewing existing buyer accounts, you’ll stay updated on any increasing risks before the accounts start defaulting, allowing you to take proactive actions.

Advances in technology have automated many of these steps, removing some of the tedious aspects from the approval process. Nuvo eliminates much of the back and forth of traditional business credit application processes by taking it digital. By actively syncing information from banks and creditors, business suppliers can have the most up-to-date details with less work.

You may also like

Announcing nuvo.com, 31 accounts receivable statistics for cfos in 2023, what is credit control + 4 tips to tighten credit control measures, 🎉 thank you, please check your calendar for an invitation from our team..

This site uses cookies to deliver and enhance the quality of its services and to analyze traffic.

Business Credit Application Template

Understanding a credit application template.

View the key components of a Credit Application

For business owners, extending credit is a strategic decision that can drive sales and build customer loyalty.

However, doing so also comes with risks.

A Credit Application template serves as a vital tool in this process, providing a structured and thorough approach to assess the creditworthiness of potential clients. Implementing a standardized Credit Application process not only safeguards your business’s financial health but also streamlines your credit decision-making.

What is a Credit Application Template?

A Credit Application template is a crucial document used by businesses to gather essential financial and personal information from clients seeking credit.

This template serves as a formal request for credit, allowing businesses to evaluate the creditworthiness and financial stability of their clients. It outlines the necessary information and terms required for a business to make an informed decision about extending credit. This document is key to establishing clear credit terms and conditions and is instrumental in building a foundation for a healthy creditor-client relationship.

Key Elements in a Credit Application Template

- Client Information - Comprehensive details such as the client's name, address, contact information, and business structure.

- Financial Information - Bank details, financial statements, and credit references to assess the client's financial health.

- Credit Terms - Clearly defined credit terms, including payment deadlines, interest rates, and credit limits.

- Legal Clauses - Conditions that bind the client to the agreement, such as confidentiality and compliance with payment terms.

- Personal or Corporate Guarantee - A clause ensuring repayment, enhancing the security of the credit extended.

- Consent for Credit Checks - Authorization from the client to conduct credit checks and verify provided information.

- Signatures - Space for authorized signatures to validate the agreement.

Other Documents Related to Credit Applications

When drafting a Credit Application, consider including these related documents: