- How It Works

- All Projects

- Top-rated Pages

- Admission essay writing

- Book report writing

- Coursework writing

- Dissertation writing

- Essay editing

- MBA essay writing

- Scholarship essay writing

- Write my essay

- Free sample essays

- Writing blog

Best Education Essay Examples

Financial management: reflection on the course.

622 words | 3 page(s)

Each course is a particular challenge, a new summit to conquer. For me, taking the course of financial management was another valuable contribution to personal development and a chance to cope with inner uncertainty in addressing challenging tasks. The best thing about this course is that it helped realize that any situation could be dealt with regardless of the initial fear and the belief that it would be too complicated to handle. Because the course was both fun and challenging, I do believe that the time and effort spent for taking it were not vain because they were a gigantic investment into the future career and personal life development. What I loved the most is the ability to develop in both individual and team-related aspects.

As a result, I not only obtained new knowledge but also acquired new skills that would undoubtedly be beneficial in my future life. Still, regardless of the value of new skills, knowledge is the main motivation for taking courses and making effort to complete them successfully. The financial management course helped become familiar with a lot of important and helpful concepts and topics. For me, the most challenging and interesting ones were the topics related to financial planning and estimating risks related to making investment decisions. I found them most interesting because they were the areas of the most significant knowledge attainment.

Use your promo and get a custom paper on "Financial Management: Reflection on the Course".

In particular, I have learned that, except for the interest and exchange rate risks that I was aware of, other types of risks should as well be considered. They are market, liquidity, inflationary, and reinvestment risks as well as those deriving from the changes of political, social, and legal environment (Pandey, 2015). Also, I have found out that financial planning goes beyond the mere assessment of an individual’s current financial condition (Billingsley, Gitman, & Joehnk, 2017). Instead, the evaluation of the future financial status and forecasting future income is as well taking into consideration when creating and controlling the financial planning process.

The two topics mentioned above – financial planning and investment-related risks – are those that were of interest to me. Nevertheless, other concepts were as well covered by the course. In particular, significant attention was paid to financial performance assessment, developing cost-effective working capital strategy and understanding capital expenditure, and evaluating securities. Still, regardless of the value of the knowledge related to these themes, I had some background in them, so they were less challenging. Summing up the experience obtained during the course, I realize that I would like to apply the knowledge connected to planning and assessing investment-related risks in my personal life.

They could be valuable for understanding how to achieve one of my life goals – financial independence. In particular, I am interested in the opportunity to depend on investment-generated income instead of having to hope for the increase of wages. For this reason, adequate knowledge of the investment process and risks would be critical for choosing the right asset to invest in as well as create the most effective investment portfolio (Billingsley et al., 2017). More than that, applying financial planning knowledge would be of use for adequately assessing my financial status and allocating enough sources in the investment activities as well as considering those actions that would contribute to becoming financially independent.

Regardless of the interest in these two topics, all concepts learned during the course would be helpful for developing career in any sphere of business activities because financial management is the core of success. Still, I would like to acquire more knowledge on the two topics of interest as well as the assessment of financial performance. The latter would be a perfect supplementation for understanding whether my financial decisions are correct and helpful for a more effective and comprehensive financial planning process.

Have a team of vetted experts take you to the top, with professionally written papers in every area of study.

Financial Management Reflection

Introduction.

Financial management (2010, para.1) defines financial management as planning for the future of a person or a business enterprise to ensure a positive cash flow. It captures the administration and proper management of financial assets. It also entails processes of identification and management of risks whereby reflective activity means integrating whatever has been learned in financial management into practice either where one is attached, in an internship or in gainful employment (Reuters, n.d,p.5). This essay is going to illuminate aspects of financial management and the reflective activities involved.

A financial manager is supposed to be having diverse knowledge relating to provision and interpretation of financial information, monitoring and interpreting cash flows and predicting future trends, managing budgets, efficient supervision of staff, conducting reviews and evaluation for cost reduction opportunities, analyzing competitors and market trends, and finally developing financial management mechanisms that minimize risks (Ray &Noreen, 1999, para 4).

Financial manager and management of budgets

Dosset (2004, p.1) posits that the drawing of good budgets is very central in the smooth running of any business venture. Good budgets are used for planning, coordinating and controlling the financial issues of an organization. In the budget, the financial managers address the fiscal integrity of an organization and the ongoing processes. The budget helps in formulation, presentation, and execution of planned activities by ensuring adjusting programs, review of reports, preparation of reports and controlling of funds (UNESCO,2006,p.6).

Managers and accounting

Financial manager’s work involves planning programs, adapting accounting systems, undertaking day-to-day maintenance of ledger, classification and recording of financial transactions, managing total accounting program, application of accounting concepts. (Prudential,2009, p.5).

Managers and managerial financial reporting

Managerial financial reporting encompasses recurring budget, accounting, financial reports, program operation evaluation, statistical reports and work performance reports. Involve provision of data to officials at different levels of management to come up with the most effective program (U.S. office of personnel management, 1963, p.5).

Financial managers and advice to managers

Financial managers offer advice to management from a financial perspective. They act as technical officers on matters pertaining to finances in any organization (U.S. office of personnel management, 1963, para.6).

Financial managers and paperwork management

They handle correspondence, control directives and disposition of records. They manage administrative control systems, services and processes (Debora, 2003, p.5).

Financial Managers and auditing

Auditing involves putting in place and modification of audit policies, programs, methods and procedures and attainment of high standards of auditing (Leacy, 2009, P.8).

The aspects of financial management that I have learned have been of great help to me especially when I was doing my internship in a renowned soft drinks processing company. I was able to use my statistical ability to collect and interpret quantified information relating to market trends. My knowledge of cost accounting enabled me to know how the beverage food company’s past performance was perceived by the competitors in the market. I was able to prepare reports that touched on the performance of different departments of the company. Some were updates on orders received by the company, sales and capacity utilization. I also prepared many analytical reports that touched on the profitability of different brands of beverages that we manufactured. I did reports that analyzed different developing opportunities in different locations of the country. When our company acquired a new production line and had to remove the line that there was there initially, some corporate organizations developed an interest in this old line. The services of an appraiser were then needed. I took the challenge and estimated the value of the old line appropriately. The appraisal process was accurate and all the parties were happy with whatever they got. My knowledge in auditing helped me to carry out basic and advance auditing techniques in different departments of the company. My knowledge of budget-making enabled me to draw budgets for different departments like the quality control department, production department, human resource department and marketing department. With the drawn budget, I was able to keep track of how different departments use the resources that were disbursed by creating a conducive environment for planning and controlling organizations’ funds. I was also in opposition to come up with the paperwork of the estimated income and expenditure of the organization. Most of the decision-making processes were made depending on the budget. The budgets I drew were used by the management of the beverage company to adjust, analyze and evaluate programs and activities. Future plans were made depending on the subsequent budgets drawn. At the beverage company, I did managerial financial reporting where I consolidated and reported on the company’s results. I prepared consolidated financial statements. I assisted in coming up with accounting policies and procedures. I oversaw the smooth operation and cost-effectiveness of operating procedures, programs and systems. When the external and internal auditors wanted assistance I was always willing to furnish them with the information they wanted.

Conclusions

Aspects of financial management like accounting, budgeting, managerial financial reporting, management analysis, auditing and statistics if substantially reflected in various government departments can help curb the loss of resources (University of Waterloo School of Accounting and Financial Management, n.d, p.6)

Debora, N. (2003). What is an Appraisal? Wise GEEK . Spark: Conjecture Corporation. Web.

Dosset, J.C. (2004). Budgets and Financial Management in Special Libraries. Web.

Financial management. (2010). Economy Watch. Stanley: Stanley St Labs. Web.

Leacy, A. (2009). Financial manager . Prospects. Manchester: Manchester. Web.

Prudential. (2009). Manager Financial Reporting . New Jersey: Newark. Web.

Ray, H., Noreen, E. (1999). Introduction to Managerial Accounting. Accounting for management.com. Web.

Reuters, T. (n.d.). Internal Auditing and Financial Management Package . New York: Web.

UNESCO. (2006). Budget and Financial Management . Paris: International Institute for Educational Planning. Web.

University of Waterloo School of Accounting and Financial Management. (n.d) Work term/ Professional reflection requirements . Waterloo: Ontario. Web.

U.S. office of personnel management. (1963). Position Classification Standards for Financial management Series. Web.

Cite this paper

- Chicago (A-D)

- Chicago (N-B)

- Turabian (A-D)

- Turabian (N-B)

EduRaven. (2021, December 13). Financial Management Reflection. https://eduraven.com/financial-management-reflection/

"Financial Management Reflection." EduRaven , 13 Dec. 2021, eduraven.com/financial-management-reflection/.

EduRaven . (2021) 'Financial Management Reflection'. 13 December.

EduRaven . 2021. "Financial Management Reflection." December 13, 2021. https://eduraven.com/financial-management-reflection/.

1. EduRaven . "Financial Management Reflection." December 13, 2021. https://eduraven.com/financial-management-reflection/.

Bibliography

EduRaven . "Financial Management Reflection." December 13, 2021. https://eduraven.com/financial-management-reflection/.

Financial Management Explained: Scope, Objectives & Importance

In business, financial management is the practice of handling a company’s finances in a way that allows it to be successful and compliant with regulations. That takes both a high-level plan and boots-on-the-ground execution.

What Is Financial Management?

At its core, financial management is the practice of making a business plan and then ensuring all departments stay on track. Solid financial management enables the CFO or VP of finance to provide data that supports creation of a long-range vision, informs decisions on where to invest, and yields insights on how to fund those investments, liquidity, profitability, cash runway and more.

ERP software can help finance teams achieve these goals: A financial management system combines several financial functions, such as accounting, fixed-asset management, revenue recognition and payment processing. By integrating these key components, a financial management system ensures real-time visibility into the financial state of a company while facilitating day-to-day operations, like period-end close processes.

Video: What Is Financial Management?

Objectives of Financial Management

Building on those pillars, financial managers help their companies in a variety of ways, including but not limited to:

- Maximizing profits: Provide insights on, for example, rising costs of raw materials that might trigger an increase in the cost of goods sold.

- Tracking liquidity and cash flow: Ensure the company has enough money on hand to meet its obligations.

- Ensuring compliance: Keep up with state, federal and industry-specific regulations.

- Developing financial scenarios: These are based on the business’ current state and forecasts that assume a wide range of outcomes based on possible market conditions.

- Manage relationships: Dealing effectively with investors and the boards of directors .

Ultimately, it’s about applying effective management principles to the company’s financial structure.

Scope of Financial Management

Financial management encompasses four major areas:

The financial manager projects how much money the company will need in order to maintain positive cash flow, allocate funds to grow or add new products or services and cope with unexpected events, and shares that information with business colleagues.

Planning may be broken down into categories including capital expenses, T&E and workforce and indirect and operational expenses.

The financial manager allocates the company’s available funds to meet costs, such as mortgages or rents, salaries, raw materials, employee T&E and other obligations. Ideally there will be some left to put aside for emergencies and to fund new business opportunities.

Companies generally have a master budget and may have separate sub documents covering, for example, cash flow and operations; budgets may be static or flexible .

Static vs. Flexible Budgeting

Managing and assessing risk.

Line-of-business executives look to their financial managers to assess and provide compensating controls for a variety of risks, including:

Affects the business’ investments as well as, for public companies, reporting and stock performance. May also reflect financial risk particular to the industry, such as a pandemic affecting restaurants or the shift of retail to a direct-to-consumer model .

The effects of, for example, customers not paying their invoices on time and thus the business not having funds to meet obligations, which may adversely affect creditworthiness and valuation, which dictates ability to borrow at favorable rates .

Finance teams must track current cash flow, estimate future cash needs and be prepared to free up working capital as needed.

This is a catch-all category, and one new to some finance teams. It may include, for example, the risk of a cyber-attack and whether to purchase cybersecurity insurance , what disaster recovery and business continuity plans are in place and what crisis management practices are triggered if a senior executive is accused of fraud or misconduct.

The financial manager sets procedures regarding how the finance team will process and distribute financial data, like invoices, payments and reports, with security and accuracy. These written procedures also outline who is responsible for making financial decisions at the company — and who signs off on those decisions.

Companies don’t need to start from scratch; there are policy and procedure templates available for a variety of organization types, such as this one for nonprofits.

Functions of Financial Management

More practically, a financial manager’s activities in the above areas revolve around planning and forecasting and controlling expenditures.

The FP&A function includes issuing P&L statements, analyzing which product lines or services have the highest profit margin or contribute the most to net profitability, maintaining the budget and forecasting the company’s future financial performance and scenario planning.

Managing cash flow is also key. The financial manager must make sure there’s enough cash on hand for day-to-day operations, like paying workers and purchasing raw materials for production. This involves overseeing cash as it flows both in and out of the business, a practice called cash management.

Along with cash management, financial management includes revenue recognition, or reporting the company’s revenue according to standard accounting principles. Balancing accounts receivable turnover ratios is a key part of strategic cash conservation and management. This may sound simple, but it isn’t always: At some companies, customers might pay months after receiving your service. At what point do you consider that money “yours” — and report the good news to investors?

Finally, managing financial controls involves analyzing how the company is performing financially compared with its plans and budgets. Methods for doing this include financial ratio analysis, in which the financial manager compares line items on the company’s financial statements.

Strategic vs. Tactical Financial Management

On a tactical level, financial management procedures govern how you process daily transactions, perform the monthly financial close, compare actual spending to what’s budgeted and ensure you meet auditor and tax requirements.

On a more strategic level, financial management feeds into vital FP&A (financial planning and analysis) and visioning activities, where finance leaders use data to help line-of-business colleagues plan future investments, spot opportunities and build resilient companies.

Importance of Financial Management

Solid financial management provides the foundation for three pillars of sound fiscal governance:

Strategizing

Identifying what needs to happen financially for the company to achieve its short- and long-term goals. Leaders need insights into current performance for scenario planning , for example.

Decision-making

Helping business leaders decide the best way to execute on plans by providing up-to-date financial reports and data on relevant KPIs.

Controlling

Ensuring each department is contributing to the vision and operating within budget and in alignment with strategy.

With effective financial management, all employees know where the company is headed, and they have visibility into progress.

What Are the Three Types of Financial Management?

The functions above can be grouped into three broader types of financial management:

Capital budgeting

Relates to identifying what needs to happen financially for the company to achieve its short- and long-term goals. Where should capital funds be expended to support growth ?

Capital structure

Determine how to pay for operations and/or growth. If interest rates are low, taking on debt might be the best answer. A company might also seek funding from a private equity firm , consider selling assets like real estate or, where applicable, selling equity.

Working capital management

As discussed above, is making sure there’s enough cash on hand for day-to-day operations, like paying workers and purchasing raw materials for production.

#1 Cloud ERP Software

What Is an Example of Financial Management?

We’ve covered some examples of financial management in the “functions” section above. Now, let’s cover how they all work together:

Say the CEO of a toothpaste company wants to introduce a new product: toothbrushes. She’ll call on her team to estimate the cost of producing the toothbrushes and the financial manager to determine where those funds should come from — for example, a bank loan.

The financial manager will acquire those funds and ensure they’re allocated to manufacture toothbrushes in the most cost-effective way possible. Assuming the toothbrushes sell well, the financial manager will gather data to help the management team decide whether to put the profits toward producing more toothbrushes, start a line of mouthwashes, pay a dividend to shareholders or take some other action.

Throughout the process, the financial manager will ensure the company has enough cash on hand to pay the new workers producing the toothbrushes. She’ll also analyze whether the company is spending and generating as much money as she estimated when she budgeted for the project.

NetSuite: Financial Management for Startups and Beyond

At the outset, financial management responsibilities within a startup include making and sticking to a budget that aligns with the business plan, evaluating what to do with profits and making sure your bills get paid and that customers pay you.

Financial management gets more complicated as the company grows and adds finance and accounting contractors or staffers. You must ensure your employees get paid with accurate deductions, properly file taxes and financial statements, and watch for errors and fraud.

This all circles back to our opening discussion of balancing strategic and tactical. By building a plan, you can answer the big questions: Are our goods and services profitable? Can we afford to launch a new product or make that hire? What might the coming 12 to 18 months bring for the business? Solid financial management provides the systems and processes to answer those questions.

Financial management challenges can be daunting for both startups and growing businesses. This is where NetSuite's financial management software comes into play. With its comprehensive, cloud-based solutions, NetSuite ensures that your financial data is accurate, up-to-date, and accessible anytime, anywhere.

From automating complex financial processes to offering real-time visibility into performance, NetSuite is the go-to solution for businesses aiming for seamless integration and efficient financial operations. As your company expands, NetSuite scales with you, ensuring you have the right tools to make informed strategic decisions at every stage. Make the smart choice for your business's financial future with NetSuite.

Financial Management

What is Financial Contingency Plan? A Step-by-Step Guide to Creating One

Creating a financial contingency plan is a wise move for any business. Crises and setbacks can strike suddenly, from natural disasters to economic downturns, technical failures, partner bankruptcies and customer…

Trending Articles

Learn How NetSuite Can Streamline Your Business

NetSuite has packaged the experience gained from tens of thousands of worldwide deployments over two decades into a set of leading practices that pave a clear path to success and are proven to deliver rapid business value. With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support.

Before you go...

Discover the products that 37,000+ customers depend on to fuel their growth.

Before you go. Talk with our team or check out these resources.

Want to set up a chat later? Let us do the lifting.

NetSuite ERP

Explore what NetSuite ERP can do for you.

Business Guide

Complete Guide to Cloud ERP Implementation

Essay on Financial Management

After reading this essay you will learn about:- 1. Introduction to Financial Management 2. Definition of Financial Management 3. Scope 4. Role in a Business 5. Financial Goals and Objectives 6. Functions.

Essay Contents:

- Essay on the Functions of Financial Management

Essay # 1. Introduction to Financial Management:

A business organisation seek to achieve their objectives by obtaining funds from various sources and then investing them in different types of assets, such as plant, buildings, machinery, vehicles etc. Financial management is managing the finances through scientific decision-making.

For making right decisions, financial management needs to understand financial environment within which these decisions operate. Financial management will then be able to analyse these financial information’s to predict likely future results and to plan more carefully their proposed course of action.

ADVERTISEMENTS:

Financial management is concerned with the acquisition (investment), financing (arranging funds), and management of assets with some overall goal in mind. Investment decisions begin with a determination of the total amount of assets required by the firm and to determine the money value of the same. Assets that cannot be economically justified, may be reduced, eliminated or replaced.

Financing decisions include decisions regarding mix of financing, type of financing employed, dividend policy and method of acquiring funds i.e., getting a short term loan, or a long term lease arrangement, sale of bonds or stock.

Asset management decisions means managing the assets efficiently after their acquisition.

Success of a firm depends on the ability to raise funds, invest in assets and manage wisely.

Essay # 2. Definition of Financial Management:

Financial management is an internal part of overall management and not a staff function of the organization. It is not only restricted to fund raising process but also covers utilization of funds and monitoring its uses. The finance function is concerned with the process of acquiring an efficient utilization of funds of a business system, in order to maximize the value of the enterprise.

Financial management involves the application of principles of general management to the finance function. These functions influence the operations of other crucial functional areas of the enterprise or firm such as marketing production and personnel. Thus the overall survival of the firm is effected by it financial operations.

“The financial management deals with how the corporation obtains the funds and how it uses them.” —Hoagland

“The financial management refers to the application of skills in the manipulation, use and control of funds.” —Mock, Schultz and Schuckectat

Financial management can also be defined as that part of management, which is related mainly with raising or acquiring the funds for the enterprise or firm in the most economical way, utilizing those funds as profitably as possible, for a given risk level, planning the future investment of those funds and controlling the current performance plus future development by adopting budgeting, cost accounting and financial accounting.

Essay # 3. Scope and Functions of Financial Management :

The main objectives of financial management are to arrange the sufficient funds for meeting short term long term requirements of the enterprise. These finances are procured at minimum cost in order to maximize the profitability.

In view of these factors the financial management scope concentrates on the following areas of finance function.

(i) Estimating the Financial Requirements :

The first job of the finance manager of an enterprise is to estimate short term and long term financial requirements of his business. He will prepare a financial plan for present as well as future for this purpose.

The finance required for procuring fixed assets as well as the working capital needs will have to be ascertained. The estimations should be based on sound financial principles so that funds available with the firm are neither inadequate nor excess.

(ii) Determining the Capital Structure :

After estimating the financial requirements, the finance executives have to decide about the composition of capital. The capital structure refers to the type and proportion of different securities for raising funds. After deciding the quantum of funds needed it should be decided which type of securities should be raised.

The finance executives have to determine the relative proportions of owner’s risk capital and borrowed capital along with short term and long term debt equity ratio.

A decision regarding various sources of funds should be linked with the cost of raising funds. A decision about the kind of securities to be employed and the proportion in which these should be utilized is an important decision which affects the short term and long term financial planning of an enterprise.

(iii) Choice of Sources of Finance :

After preparing a capital structure an appropriate source of finance is chosen. Various sources from which finance may be raised include: shareholders’ debenture holders, banks and other financial institutions and public deposits etc. Finance executive has to evaluate each source or method of finance and select the best source keeping in view the various factors.

The need, purpose, objective, cost involved may be the factors affecting the selection of a suitable source of financing, for instance, if the finances are required for short periods then banks, public deposits and financial institutions may be appropriate, and for long term financial requirements, the share capital and debentures may be useful.

(iv) Investment Decisions :

When the funds have been poured then a decision regarding pattern of investment has to be taken. The funds raised are to be intelligently invested in various assets so as to optimize the returns on investment. The funds will have to be used first for the purchase of fixed assets and then an appropriate part will be retained as working capital.

The utilisation of long term funds requires a proper assessment of different alternatives through capital budgeting and opportunity cost analysis. While spending on various assets, management should be guided by three important principles of safety, liquidity and profitability. A balance should be struck even in these principles for the purpose of optimum returns on investment.

(v) Management of Profits :

The utilisation of surpluses or earnings is also an important factor in financial management. A judicious utilisation of earnings is essential for expansion and diversification plans of the enterprise.

A certain amount out of the total profit may be kept as reserve voluntarily, a portion of surplus may be distributed among the ordinary and preference shareholders, yet another portion may be reinvested. The finance executive must take into consideration the merits and demerits of the alternative scheme of utilizing the funds generated from the enterprise’s own earnings.

(vi) Management of Cash Flow :

Cash flow management is also an important task of finance executive. He has to assess the various cash requirements at different times and then make arrangements for cash needed. Cash may be required to (i) make payments to creditors (ii) for purchase of materials (iii) to meet wage bill (iv) to meet everyday expenses.

The cash management should be such that neither there is shortage of it and nor it is idle. Any shortage of cash will damage the credit worthiness of the firm. The idle cash with the enterprise will mean that it is not properly utilized. In order to know the cash requirements during different periods, the management should arrange for the preparation of cash flow statement in advance.

(vii) Implementation of Financial Controls :

An efficient system of financial management needs the use of various control of devices. Financial control devices generally adopted are (i) Return on Investment (ii) Budgetrary Control (iii) Cost control (iv) Break Even analysis (v) Ratio analysis. The use of various control techniques by the Finance Manager will help him in evaluating the performance in different areas and take corrective action whenever needed.

Essay # 4. Role of Financial Management in a Business:

An effective financial management plays a dynamic role in a modern company’s development.

In earlier days, financial managers were primarily engaged in:

(a) Raising funds, and

(b) Managing the firms cash flow.

But now-a-days with the developments and increasing complexities in the business, responsibility of the financial managers have increased and they are now concerned with the decision-making process involving finance, i.e., capital investment.

Today external factors, like competition, technological change, economic uncertainty, inflation problem etc., create financial managers problem more complicated. He must have flexibility to adopt to the changing external environment for the survival of his firm.

Thus in addition to the job of acquisition, financing and managing the assets, the financial manager is supposed to contribute to the fortunes of the firm and to the optimal growth of the economy as a whole.

He is required to take decisions on:

(i) Investing funds in assets, and

(ii) Obtaining best mix of financing and dividends.

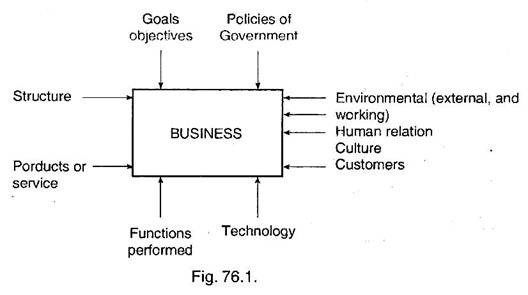

In order to understand the environment in which a finance manager is required to take decision, a sketch indicating business system is given hereunder:

The Financial Management’s main role is therefore to create profit on the capital invested (fixed as well as working capital). Each and every decision related to finance/economy must be optimal. Every business enterprise is set up to earn profit, and no one is interested in taking risk unless he is assured of fair return on the investment. However government organisations have no profit motive but are created to serve the public.

The profit earned by a firm is used for:

(a) Future expansion.

(b) Distributing profit as rewards to owners/shareholders.

Profit earned also serves as an indicator of efficiency and performance of the firm. So as to enable to perform the role of financial management, financial managers must be given proper authority, autonomy, freedom of actions, supporting staff, system for providing necessary information. He should be accountable also for his role.

Essay # 5. Financial Goals and Objectives :

There may be various objectives of a firm, but the goal of a firm is to maximise the wealth of the firm’s owners. Thus we can say that, “the improvement of shareholders value is the one mission that continually guides all corporate decisions and actions” or “the goal of a firm is maximizing the shareholders’ value”. This maximisation of value should be achieved from long term point of view.

The financial goal can be expressed as:

(a) Required profit levels,

(b) Earnings per shares, and

(c) Required rate of return on investment.

For a large firm, where shareholders do not have direct say and the firm is managed by the management, an ordinary shareholder can judge the performance by the market price of the firm’s share. Market price serves as a gauge for business performance, it indicates how well management is doing on behalf of its shareholders.

Management is the agents of the owners or shareholders, and financial management acts for achieving the goal of profit maximization in the shareholders’ best interests.

Social Goals :

While profit maximisation is the primary goal for any business organisation, social responsibility is also important for them. In case of Government organisations and public sector organisations, social responsibility is the primary goal and profit is secondary.

Social responsibility includes service to the people, protecting the consumer, paying fare wages to the employees, upliftment of the weaker sections, welfare facilities like medical education, environment improvement programmes etc.

Financial Objectives :

In making financial decisions, it is important to set out clear objectives.

Following are the basic financial objectives:

(a) Profit maximisation.

(b) Maximisation of shareholders’ owners’ wealth.

(c) Reduction in cost.

(d) Minimising risks.

(e) Sustained increase in the value of firm

(f) Wealth maximisation.

Essay # 6. Functions of Financial Management :

Financial manager is concerned with the following aspects:

1. Identifying the present strengths and weaknesses of the organisation, and the scope for improvement, by conducting the financial analysis.

2. Planning the financial strategies. This involves the consideration of methods and levels of funds raising, profitability and the financing of expansion plan of the organisation.

3. Arranging the funds when required, in the form needed in the most economical way.

4. Conducting financial appraisal of the possible courses of action. The appraisals are needed in respect of possible take overs and mergers, analysis of capital projects, or alternative methods of funding.

5. Advising about capital structure.

6. Consideration of an appropriate level for drawings by dividends to the owners/ shareholders.

7. Ensuring that assets are controlled and used in an efficient manner.

8. Cash management. Preparation of detailed cash budgets and/or forecast funds flow statement so that future problems can be foreseen and remedial measures taken in advance. These take care of both shortage and excess of cash. Finance managers must find ways of raising more funds needed, or investing excess funds for an appropriate length of time.

9. Finance managers are likely to draw attention on other disciplines also, like accounting and budgeting.

In order to enable financial managers to perform above functions satisfactorily, he must have good knowledge of accounting, economics, mathematics, statistics, law especially taxation, financial market etc.

The functions of finance thus involve three major decisions the firm must make:

(a) The investment decisions,

(b) The financing decisions, and

(c) The dividend decisions.

Each of these decisions are taken in relation to the objective of the firm, an optimal combination of these three will maximise the value of the firm to its shareholders. Since the decisions are interrelated, their joint impact on the market price of the firm’s stock must be considered.

(a) Investment Decisions:

This is the most important decision. Capital investment, i.e., allocation of capital to investment proposals is the most important aspect, whose benefits are to be realised in future. As future benefits are not known with certainty, the investment proposals involve risk.

These should, therefore, be evaluated in relation to expected return and risk. Considerable attention is paid to determine the appropriate required rate of return on the investment.

In addition to taking capital investment decisions, finance managers are concerned with the management of current assets efficiently in order to maximise profitability relative to the amount of funds tied up in asset. Investment decisions also include the decisions about mergers and acquisition of another company.

(b) Financing Decisions:

Finance manager is required to determine the best financing mix or capital structure. An optimal financing mix is one in which market price per share could be maximised. Financing decision are taken in relation to the overall valuation of the firm.

Various methods of obtaining short, intermediate, and long term financing are also explored, examined, analysed and a decision is taken. While taking financing decisions, the influence of inflammation on financial markets and on the cost of funds to the firm is also considered.

(c) Dividend Decision:

The dividend decision includes the percentage of earnings paid to stockholders in cash dividends, stock dividends and splits, and the repurchase of stock.

To Meet Funds Requirement of a Firm :

Funds requirement is assessed for different purposes, namely for feasibility study of a project, detailed planning of a project, and for operation and expansion of the business.

For feasibility study, only broad estimates are sufficient and are generally obtained from the past experience of the similar works by interpolating the present trends and the condition of the proposed project in comparison to the one whose figures are being adopted. While during detailed planning, estimated requirement is comparatively more realistic, and prepared after going into details more thoroughly.

Here we are discussing the funds requirement for a running business including its long term planning for expansion.

The main function of financial management is to ensure that the firm must have sufficient funds to meet financial obligations when they are needed and to take advantage of investment opportunities. To achieve this objective, a thorough study is conducted about ‘flow of funds’ i.e., statement of funds requirement indicating the amount of fund needed and at what time.

This ‘statement of funds’ is a summary of a firm’s changes in financial position from one period to another. This indicates that how the funds will be used and how it will be financed over specific period of time. This includes the cash as well as non-cash transactions.

Forecast, financial statements are prepared for selected future dates, generally for middle term and long term plans of the firm. Budgets are used for one year, and are prepared only to fulfill the firms’ objectives envisaged in the forecast for that particular year.

These forecast financial statements are based on the sales forecast and future strategies for expanding the business, and includes, forecast income statements, forecast assets, liabilities, shareholders, equity etc.

Related Articles:

- Essay on Financial Management: Objectives, Scope and Functions

- Essay on Financial Management: Top 5 Essays | Branches | Management

- Top 3 Types of Financial Decisions

- Shareholder Value Analysis (SVA) | Firm | Financial Management

We use cookies

Privacy overview.

Essay on Financial Literacy for Students and Children

Importance of financial literacy, an introduction to financial literacy.

We go to schools, colleges, universities to complete our educated and start earning our livelihood. We take up jobs, practise professions or start our own businesses so that we can earn money to make our living. But which of these institutions make us capable of managing our own hard-earned money? Probably a very few of them.

Our ability to effectively manage our money by drawing systematic budgets, paying off our debts, making buying and selling decisions and ultimately becoming financially self-sustainable is known as financial literacy.

Financial literacy is knowing the basic financial management principles and applying them in our day-to-day life.

Financial Literacy – What does it Involve?

From simple practices like keeping a track of our expenses and understanding the need to spend money if we like a product to striking a balance between the value of time saved and money lost, paying our taxes and filing of tax returns, finalizing the property deals, etc – everything becomes a part of financial literacy.

Get the huge list of 500+ Essay Topics here

As human beings, we are not expected to know the nitty-gritty of financial management. But managing our own money in a way that it does not affect us and our family in a negative way is important. We certainly do not want to end up having a day with no money at hand and hunger in our stomach.

Why is Financial Literacy so Important?

Financial literacy can enable an individual to build up a budgetary guide to distinguish what he buys, what he spends, and what he owes. This subject additionally influences entrepreneurs, who incredibly add to financial development and strength of our economy.

Financial literacy helps people in becoming independent and self-sufficient. It empowers you with basic knowledge of investment options, financial markets, capital budgeting, etc.

Understanding your money mitigates the danger of facing a fraud-like situation. A few strategies are anything but difficult to accept, particularly when they’re originating from somebody who is by all accounts learned and planned. Basic knowledge of financial literacy will help people with foreseeing the risks and argue/justify with anyone learned and well-informed.

What should you read on / get informed about in Financial Literacy?

- Budgeting and techniques of budgeting

- Direct and indirect taxation system

- Direct tax slabs

- Income and expense tracking

- Loans and debt – EMI management

- Interest rate systems: fixed versus floating

- Business and organisational transaction studies

- Elementary Book-keeping and Accountancy

- Cash in-flow and out-flow Statements

- Investment & personal finance management

- Asset management:

- Business negotiation skills and techniques

- Make or buy decision-making

- Financial markets

- Capital structure – owner’s funds and borrowed funds

- Fundamentals of Risk Management

- Microeconomics and Macroeconomics fundamentals

While there are various media to learn about financial literacy, we recommend that you join a short-term, weekend programme which helps you get financially literate.

Customize your course in 30 seconds

Which class are you in.

- Travelling Essay

- Picnic Essay

- Our Country Essay

- My Parents Essay

- Essay on Favourite Personality

- Essay on Memorable Day of My Life

- Essay on Knowledge is Power

- Essay on Gurpurab

- Essay on My Favourite Season

- Essay on Types of Sports

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Download the App

116 Financial Management Essay Topics

🏆 best essay topics on financial management, ✍️ financial management essay topics for college, 👍 good financial management research topics & essay examples, 🎓 most interesting financial management research titles, 💡 simple financial management essay ideas.

- Coca-Cola Company’s International Financial Management

- Strategic Financial Management: The Link Between Valuation and Financial Decisions

- Amazon Company: Financial Management

- BP and Royal Dutch Shell Companies’ Financial Management

- Financial Operation Exposure Management Principles

- IBM’s Management Accounting & Financial Practices

- Puma SE: Financial Management

- Financial Management Role in Healthcare With the introduction of the Affordable Care Act, electronic health records, and the Medicare billing system, the financial aspect of healthcare requires extra attention.

- Financial Management of Aldar Properties UAE UAE has seen a massive growth in all business sectors and promises more to the investors, but recent financial scam has cast many things under doubts.

- BMW: Global Financial Management and Summary In the case study, the foreign exchange risk management strategy of BMW, discussed in order to identify the effectiveness of the strategies followed by it to get the optimum results.

- Euroland Foods S.A. Strategic Financial Management In the Euroland Foods S.A. company, there are many constraints, among them is capital rationing where the budget for all projects is Euro 120 million.

- Alibaba Corporation’s Financial Management This report offers an examination of Alibaba’s major financial ratios and performance indicators, assessing the firm’s cash flow, liquidity, solvency, and profitability ratios.

- Financial Planning. Money Management Skill Financial literacy can be defined as knowledge about financial planning and management that allows making reasonable choices about money spending and saving.

- Personal Financial Management and Financial Literacy By understanding the basic principles and minor aspects of money management such as the compound interest method, people can avoid bankruptcy and enhance their chances for the side income.

- Southwest Airlines’ Financial Management This paper analyzes the financial and trend ratios of Southwest Airlines, predicts future financial performance, and determines the return on equity.

- Nokia Company’s Financial Analysis and Management Nokia is part of the mobile communications industry which is now one of the most rapidly growing industries in the world. The industry includes multinational companies.

- EasyJet: Financial Management To ensure its survival during lockdowns and travel bans, EasyJet could take every step necessary to reduce costs, conserve cash burn, and enhance liquidity.

- Valero Energy and Chevron Corporations’ Financial Management Valero Energy and Chevron Corporations faced a drastic decline in total revenues in 2020, mainly due to economic upheaval and uncertainty caused by COVID-19.

- Financial Management in Nokia Nokia is part of the mobile communications industry which is now one of the most rapidly growing industries in the world.

- Accounting and Financial Management for Expo 2020 Dubai The use of technology is a fundamental aspect of the organizational development adopted in every aspect of the innovation exhibitions hosted by the association in Dubai.

- Jim’s Auto Body: Financial Management This paper examines the financial management of Jim’s Auto Body. Profitability is among the core elements considered in evaluating financial performance.

- British Airways Group: Financial Management In this report, a critical analysis is made of the financial statements of the British Airways Group for the period February 28, 2008 to March 31, 2009.

- Ramsay Health Care: Financial Management The results of this analysis reveal that Ramsay Health Care is engaging in desirable efforts and strategies that have led to considerable financial gains.

- Financial Management of Marks & Spencer vs. Next Marks and Spencer demonstrates higher profit and liquidity than Next does. However, Next has more capability to pay off its debts judging by its interest cover ratio.

- Project Cost and Finance Management Challenges The cost management functions are complex as projects come with different complexities. Many emerging projects pose different challenges in terms of their characteristics.

- Expo2020 Dubai’s Accounting and Financial Management This paper compares costs and revenues at two levels: state and organizational. Moreover, a comparison with other exhibitions that have been held in the last decade is presented.

- Strategic Financial Management: Diageo plc and SAB Miller plc Both Diageo and SAB Miller have strategic financial management that helps make complex decisions that increase their competitive advantages and eventually increase revenue.

- Public Budgeting Leadership and Financial Management To control the field of public budgeting correctly, one should have ideas about the practical methods of work and the theoretical aspects of this practice.

- JD Sports and Sports Direct Companies Financial Management This paper focuses on the financial analysis of two companies, JD Sports Fashion PLC and Sports Direct International PLC. Both are based in the UK but have a presence in other parts of the world.

- Children’s Programs: Financing and Management This research paper will examine the domains specific to the financial management and planning of children’s programs.

- Financial Management of Healthcare Organizations Healthcare is one of the salient aspects of human beings since it determines their ability to do their daily activities. Sick people cannot perform their roles.

- Financial Management in the Healthcare Industry In this essay, the author focuses on the significance of financial management and the most crucial data for overall management.

- The Neqi Firm’s Financial Management Due to the face mask sales during COVID-19, the Neqi firm, which creates and markets face masks, rose to the top of the list of profitable businesses.

- ABC Manufacturing: Financial Management In this research paper, it is required to evaluate the effectiveness of the financial management of ABC Manufacturing.

- Capital Investment and Financial Management A company’s capital investment is the money it spends on fixed assets like land, machinery, and buildings. Cash, assets, or loans may be used to fund the project.

- Rules of Financial Accounting: Economics and Management It is vital to describe control methods to show how an organization works to stop and curtail dishonest behavior and needless mistakes in its accounting records and data.

- Data Management and Financial Strategies By adopting comprehensive supply chain management, businesses can maximize the three main streams in the supply chain— information flow, product flow, and money flow.

- Possum Inc.’s Multinational Financial Management While Possum Inc. wants to become a multinational corporation, it is expected to know the nature of the local currency of the host currency and its conversion rates.

- Anne Arundel County: Public Finance and Management Analysis of revenue sources is extremely important to understand how the financial health of the county can be improved.

- Financial Management: Growth Financing Growth financing is an important topic of consideration for managers to continue the development of a business.

- Financial Management: Where Does the Money Go It is increasingly possible to hear about the importance of financial literacy in the modern world, which largely boils down to thoughtful money management.

- International Finance and Responsible Financial Management COVID-19 has a variety of ramifications for businesses in the future. Due diligence processes should focus on the target industry and the risks.

- Importance of Financial Management The implementation of non-monetary policies is proven to be useful as governments were able to overcome the financial recession.

- Financial Management During the Recession This paper shall set out to establish whether the recent financial crisis was in any way affected by global financial management or by other economic factors.

- Financial Management and Quality of Healthcare It is important for managers to understand how these facts are used to improve the financial position of the organisation.

- Financial Management: Annual Savings for Retirement The paper will focus on estimating the annual savings that the client needs to make in order to achieve the retirement plan.

- Sarbanes-Oxley Act and Financial Management The main concern regarding the Sarbanes-Oxley Act is whether it offers effective frameworks for preventing the falsification of a firm’s financial statements or not.

- Financial Management. Some Important Generalizations The article identifies several financial management approaches and perspectives, which when put in place are likely to hamper financial performance.

- Financial Management Competencies Discussion This article is about financial management: the author considers the most important competencies of a financial manager, liquidity risk, risk, and return scenarios.

- Healthcare Financial Management Association (HFMA) Healthcare Financial Management Association (HFMA) provides learning, analysis, and direction to its affiliates on the subjects relating to healthcare finance.

- Financial Management: Evaluation of the New Machine This report evaluates the viability of new trucks that are to be purchased by Southern Suburbs Transport by calculating the net present value.

- Stock Ticker Symbol: Financial Management of the Company The analysis of the company shows that the company has hardships with financial sustainability and adequate management of its assets and liabilities.

- Medical Centers Financial Management Factors that affect the financial performance of these hospitals include the indigent care load, case mix, payer mix, which also includes different levels of self-pay.

- Cyberchamp Inc.’s Ethics and Financial Management This paper aims at discussing the factors to consider while resolving ethical issues and making recommendations for the assistant finance manager in the Cyberchamp Inc. scenario.

- Clayton County Library’s Financial Management Study Limited funding has created financial constraints for Clayton County Library, Georgia. American Libraries experience the greatest threat to their financial stability.

- Terms Used in Financial Management It is important to be aware of some of the general terms the organization uses in its financial management system: a balance sheet, an income statement and the operating cash flow.

- Financial Management and the Secondary Market for Common Stocks This paper will focus on the changes that the secondary market for common stocks in the USA has faced since the 1960s as the reflections of the financial situation in the country.

- Financial Management and Investment Banking This paper will focus on the primary markets, analyze the functions that investment bankers perform in the traditional process for issuing new securities.

- Thai-Lay Fashion Company Ltd.’s Financial Management There are several methods that will help managers make capital investment decisions. These will be discussed here with reference to the Thai-Lay Fashion Company Ltd.

- Carnival Corporation’s Financial Management This paper details an account of the cost behavior of Carnival Corporation Inc. – a large multi-vessel cruise operator.

- A Company’s Value: Financial Management The current paper is aimed to discuss the aspects of financial management of an organization and its stakeholders.

- Financial Ratios: Management and Analysis A high price to earnings ratio suggests that the investors are expecting an enhanced earnings growth in the future as compared to other companies having a lower price to earnings ratio.

- Financial Institutions Management and Sources of Finance Finance is important to any business as it serves different functions which allow the business to run effectively. A company may need additional funds to expand its business operations or expenses.

- Management in Organizations: Financial Issues Creating the environment in which the staff delivers the performance of the finest quality is a necessity for managers in the contemporary business environment.

- Healthcare Organizations Financial Management The suggested paper describes the central components of the healthcare finance and lists phenomena that might impact decision-making regarding particular scenarios.

- Government Budgeting and Financial Management The public budgeting leaders have the responsibility of fulfilling various roles including planning, reforming, and budgeting.

- What Is Financial Management and How to Do It Effectively

- The Role of Financial Management in Elaborating and Implementing Organization’s Strategies

- Effective and Ineffective Financial Management Practices in Health Care

- Innovation in Financial Management: The Impact of Technology

- Building Financial Management Capacity in Fragile and Conflict-Affected States

- Debt Elimination Through Financial Management

- How Financial Management and Corporate Strategy Affect a Firm’s Performance

- Profit vs. Wealth Maximization: A Financial Management Perspective

- Financial Statement and Ratio Analysis: Key Tools to Successful Financial Management

- Hierarchical Clustering Algorithms and Data Security in Financial Management

- Public Financial Management Intervention and Its Impact on Corruption

- Financial Management and Forecasting Using Business Intelligence and Big Data Analytics

- Economic Performance and Corporate Financial Management of Shipping Firms

- Microsoft’s International Financial Management: An Analysis

- Financial Management Practices and Their Impact on Organizational Performance

- Computer Applications for Financial Management

- Antecedent Factors of Financial Management Behavior Among Young Adults

- Financial Management Information Systems and Open Budget Data

- Household Financial Management: The Connection Between Knowledge and Behavior

- Modern System of International Financial Management in Multinational Corporations

- International Financial Management: Exchange Rate Exposure

- Fiscal Decentralization and Public Subnational Financial Management

- Best Practices for Non-Profit Financial Management

- Public Financial Management, Health Financing, and Under-Five Mortality: A Comparative Empirical Analysis

- Entrepreneurial Finance: Fundamentals of Financial Planning and Management for Small Business

- How Technological Evolution in Financial Management Implies a Company’s Success

- Challenges Facing Financial Management in Schools

- Time to Reboot: Rethinking Public Financial Management and Budgeting in Greece

- Financial Management of a Non- vs. For-Profit: Which Is Harder?

- Examining Financial Management in Promoting Sustainable Business Practices & Development

- Banking, Finance, and Financial Management: What’s the Difference

- Improving Public Financial Management in India: Opportunities to Move Forward

- Essential Instruments in the Financial Management of the Companies

- Short-Term Financial and Working Capital Management

- Examining Financial Management Practices in the Context of Smart ICT Use

- Family Financial Management: A Real-World Perspective

- Reforming Public Financial Management Systems in Developing Countries as a Contribution to the Improvement of Governance

- Accounting Use & Abuse in the Australian Public Sector Financial Management Reform Program

- Financial Management Explained: Scope, Objectives, and Importance

- Regional Financial Management Strategies to Improve the Community Welfare

- Financial Management for Public, Health, and Not-for-Profit Organizations

- Technical Efficiency and Financial Management in the Agriculture Industry

- Poor Financial Management Behavior as a Factor Why Students Are Facing Financial Difficulties

- Strengthening Public Financial Management: Exploring Drivers & Effects

- Balancing Long- and Short-Term Financial Management

- Financial Management and Control Procedures for the EU Structural Funds Programs

- The Environment of Public Financial Management: An Economic Perspective

- Introducing Financial Management Information Systems in Developing Countries

- Managing Post-Disaster Reconstruction Finance: International Experience in Public Financial Management

- Lessons From Australian and British Reforms in Results-Oriented Financial Management

Cite this post

- Chicago (N-B)

- Chicago (A-D)

StudyCorgi. (2023, May 7). 116 Financial Management Essay Topics. https://studycorgi.com/ideas/financial-management-essay-topics/

"116 Financial Management Essay Topics." StudyCorgi , 7 May 2023, studycorgi.com/ideas/financial-management-essay-topics/.

StudyCorgi . (2023) '116 Financial Management Essay Topics'. 7 May.

1. StudyCorgi . "116 Financial Management Essay Topics." May 7, 2023. https://studycorgi.com/ideas/financial-management-essay-topics/.

Bibliography

StudyCorgi . "116 Financial Management Essay Topics." May 7, 2023. https://studycorgi.com/ideas/financial-management-essay-topics/.

StudyCorgi . 2023. "116 Financial Management Essay Topics." May 7, 2023. https://studycorgi.com/ideas/financial-management-essay-topics/.

These essay examples and topics on Financial Management were carefully selected by the StudyCorgi editorial team. They meet our highest standards in terms of grammar, punctuation, style, and fact accuracy. Please ensure you properly reference the materials if you’re using them to write your assignment.

This essay topic collection was updated on January 8, 2024 .

To read this content please select one of the options below:

Please note you do not have access to teaching notes, reflections on public financial management in the covid-19 pandemic.

Journal of Accounting & Organizational Change

ISSN : 1832-5912

Article publication date: 3 December 2020

Issue publication date: 15 December 2020

The purpose of this paper is to reflect on competence in the management of government, with a focus on the management of public finances. I also reflect on the role public financial management (PFM) can play in addressing the impact of the coronavirus (COVID-19) pandemic.

Design/methodology/approach

The approach in this paper is to document my thoughts and opinions on PFM in the context of the COVID-19 pandemic.

Competent bureaucrats and sound finances are the key drivers of an effective PFM system that enables and encourages decisions leading to high standards of financial performance and position.

Practical implications

Although this is purely a personal reflection on the issue covered, it may encourage other academics and practitioners to explore the idea further in various settings across the globe.

Originality/value

Having devoted my academic and professional career to the field of PFM, this personal, reflective essay considers the role of PFM systems in generating information that leads to better decisions, better financial performance and position and ultimately a greater ability to absorb shocks such as the COVID-19 pandemic.

- New Zealand

- Accrual accounting

- Public financial management

- Governments

- Financial performance

Ball, I. (2020), "Reflections on public financial management in the Covid-19 pandemic", Journal of Accounting & Organizational Change , Vol. 16 No. 4, pp. 655-662. https://doi.org/10.1108/JAOC-10-2020-0160

Emerald Publishing Limited

Copyright © 2020, Emerald Publishing Limited

Related articles

We’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

155 Financial Crisis Essays & Examples

Looking for finance essay topics? You’re in the right place! The subject of financial economics is worth exploring.

💸 Top 10 Finance Essay Topics

🏆 top financial crisis essay examples, 💰 financial crisis essay topics, 👍 financial crisis research paper topics, 🏧 exciting financial essay topics, 📑 financial crisis topics for essays, ❓ research questions about financial crisis.

A financial crisis means massive depreciation of financial assets. It usually happens in the forms of banking, currency, and debt crises. Though the issue is studied well, financial crises still occur in various parts of the world.

In your finance crisis essay, you might want to focus on financial management in turbulent periods. Another idea is to discuss what it takes to survive a global financial crisis. One more option is to compare various types of financial crises. Whether you are assigned an argumentative essay, analytical paper, or research proposal, this article will be helpful. Here we’ve collected financial crisis research paper topics, current essay titles, writing tips, and financial crisis essay samples.

- The financial system and its components

- The role of investors in the financial system

- Personal, corporate, and public finance

- Financial risk management

- Quantitative finance and financial engineering

- Behavioral finance: the psychology of investors

- Early history of finance

- History and development of money

- Experimental finance and its goals

- Mathematical modeling in financial markets analysis

- Financial Crisis of 2007-2008 in ‘The Big Short’ Movie Michael predicted that it would devaluate mortgage bonds and, therefore, decided to short the housing market, that is, to bet on the market crash.

- General Electric and the Financial Crisis of 2008 Although GE’s success is often attributed to the significant amount of financial assets that the company has, it owes its survival through the 2008 crisis to the careful and well-thought-out plan of investing in the […]

- Impact of World Financial Crisis on the UAE Economy The decline in economic growth was reflected in the significant reduction in the country’s GDP. However, the profitability and growth of the sector reduced substantially in 2009 due to the following factors.

- British Airways Performance and Global Financial Crisis This paper analyzes the performance of British Airways’ leadership in the wake of the global financial crisis. BA CityFlyer, which is a subsidiary of the British Airways, dominates operations in the London municipality airport.

- 2008 Financial Crisis in Dubai In order to address the collapse in the real estate market observed in Dubai in 2008, the Emirate’s authorities focused on elaborating stricter regulations on developers of the housing projects and on the buyers. 26 […]

- Global Financial Crisis Causes and Impacts After a number of years since the first occurrence of the crisis, it is still not possible to explain fully the impact of the global financial crisis because the economic emergency keeps on hindering and […]

- East Asian Financial Crisis of 1997-98 However, the quick actives responses by the states in the region helped in the quick aversion of the crisis and its impacts on the region’s economy.

- Apple and Hewlett Packard During 2008 Financial Crisis Though the general demand has not reached the level it was before the crisis, many companies have taken advantage of the rising demand and have made tremendous sales. However, the company has increased its spending […]

- Causes and Solutions of the 2008 Financial Crisis The current essay describes the causes of the Financial Crisis of 2008 and the solutions suggested by the Keynesian school of thought.

- Argentina’s Financial Crisis: A Critical Review of Causes and Effects The unprecedented expansion in the country’s markets and economy at large was attributed to the rise in agricultural exports. The country’s economy was heading in the right direction following the introduction of the convertibility system.

- 2008 Financial Crisis: Kuwait’s Economic Struggle At the year 2008, the intensity of the crisis was at the peak, causing oil prices which led to a decrease in production and drop in GDP of Kuwait.

- Social Distancing, Financial Crisis and Mental Health The lockdown leads to the inability of people to go to the hospital for mental health consultation and treatment due to the anti-COVID measures. It is possible to talk about the spread of mental health […]

- Aspects of the 2008 Financial Crisis According to Eisinger, none of the participants in the story in the film had any idea of the coming crisis. One of the connections between the film and the textbook is that of corporate social […]

- Essential Points From the Financial Crisis The first important point on slide 10 is the failure to penalize the originator for passing the mortgage to the provider.

- Argentina and Russia’s Financial Crisis Investors’ loss of faith in the Russian economy caused them to sell their Russian holdings, lowering the value of the Russian rouble and raising fears of a financial crisis.

- Ethical Questions in the 2008-2009 Financial Crisis What followed was an investigation of the genesis of the crisis, which revealed that catastrophic failure in oversight, the systemic weakening of usury laws, and outright thuggery by banks and mortgage salespeople were the major […]

- The 2008 Financial Crisis and Housing Policies Under the State Department of Housing and Urban Development, the government introduced the Section 8 Voucher. The function of this voucher was to meet the gap between what the renters would get and the actual […]

- 2008 Financial Crisis from a Neoliberal Perspective While such a position seems reasonable, the overall adherence of the financial system, including accounting and auditing, contributed to the crisis due to the unbearable level of loans and fictitious assets dominating the business.

- Corporate Social Capital During Financial Crisis The credit crisis related to the mortgage problem in 2008 has been one of the massive financial issues of the world since the times of the Great Depression.

- 2008 Global Financial Crisis in Andrew Sorkin’s “Too Big to Fail” The book Too Big to Fail: The Inside Story of How Wall Street and Washington Fought to Save the Financial System from Crisis and Themselves, written by Andrew Ross Sorkin, explores the events and consequences […]

- Financial Crisis in Greece It is doubtless that the value of money is essential in determining a number of factors like the stability of the economy and inflation.

- The Euro Financial Crisis Causes and Outcomes The involvement of the central banks of is an attempt to demonstrate that all the central bankers are collaborating. The Euro crisis has exarcebated the currency swap process as it is now more expensive to […]

- The 2007 Financial Crisis: Development of the Prices of Shares, Corporate Bonds and Loans The crippling of the financial system in the US and the UK in the period beginning late 2007 was a product of crippling loans.

- Challenges Facing College Sports After Financial Crisis When the housing bubble caused financial depression in the national economy, colleges and universities were some of the most affected institutions, especially because the state and federal legislatures were forced to cut funding, the major […]

- How Money Market Mutual Funds Contributed to the 2008 Financial Crisis While how the prices of shares fell below the set $1 per share was a complex process, it became one of the greatest systemic risks posed by the MMMF to the investors and the economy […]

- How Quantitative Models Contribute to the Financial Crisis The motivation behind this study lies in the desire to understand why and how the economies of many countries around the world, especially in the Middle East, have been shaken to the core by the […]

- South Africa’s Response to Global Financial Crisis Desire to the achieve objective that duly fulfils the needs of an individual while being disadvantageous to the majority of individuals led to the crisis.

- Manifestations of the Financial Crisis in Greece The bank which is also affected by the crisis will also exaggerate the cost of this operation and this leads to a loss on my side.

- Global Financial Crisis Impact on Multi-Nationals The credit crisis was linked to the sub-prime mortgage business. So as to encourage lending, the interest rates were also lowered credibly.

- Qantas’ Actions in the Financial Crisis Context The actions taken by Qantas in reducing their costs can be said to be influenced by the global financial crisis, where the decline of the number of passengers in September 2009 was 0.

- Prospects for Chindia After 2008 Global Financial Crisis According to the Australian business press, the recent economic growth achieved was a result of the relationship between itself and the two countries i.e. However, China experienced a hitch on its international markets especially in […]

- The Global Financial Crisis and Its Impact on Australia The collapse of key institutions in the US and other economies in the world has people scurrying back to the drawing board in a bid to rethink economic policy and regulation strategies.

- The Investment Industry in Kuwait Today (During Financial Crisis) One of the confessions was that the investment authority of Kuwait otherwise known as would not be in a position to provide financial support that would assist in the restoration of confidence that was already […]

- The Financial Crisis on the UK Economy Analyze the causes and the impact of the current financial crisis on the UK economy. Due to the above-trend growth in 2006 and 2007, activity needs to be slow.

- Financial Crisis Management in the United Nations A crisis can be defined as the perception of an abnormal situation that is beyond the capability of the business and its scope to deal with.

- Lehman Brothers and the 2008 Financial Crisis As a result, when the management of the bank expected assistance from other firms and the Bank of America, it did not receive the help it needed.

- Global Financial Crisis and Real Estate Issues The central point of the argument is that the real estate market in the US and the policy called “trailer park lending” was the main reason for the worldwide economic crisis.

- 2008 Global Financial Crisis: Crises of Capitalism? Although I had an idea of the possible catalysts of the 2008 global financial meltdown before watching the video, Harvey presented a clear report of the events that occurred before the crisis and put them […]

- Corporate Government During the World Financial Crisis The chairman is the leader of the board of directors while the CEO is the person who oversees the day to day activities of the company; each of them performs a distinct and critical role […]